James E. O'Connor

U.S. Securities and Exchange Commission

100 F Street, N.E.

Re: Keating Capital, Inc. (File Nos. 333-157217 and 814-00778)

Dear Mr. O’Connor:

James E. O’Connor

Division of Investment Management

Page 3

Statement of Assets and Liabilities

Please explain to us why, almost two years after the commencement of the offering, the Fund has invested only, approximately, 17% of its assets in equity securities according to its business purpose.

Response: In order to meet and maintain the requirements to be treated as a regulated investment company (“RIC”) for income tax purposes, the Company must, among other things, adhere to certain portfolio diversification requirements both at the time of each investment and as of each quarter end. The Company did satisfy the RIC requirements during 2010 and elected to be treated as a RIC effective for the 2010 tax year. During the offering period, while the Company is growing its asset base, it has been especially careful to balance the size of each portfolio company investment with the RIC portfolio diversification requirements.

As a result, in 2010, the Company invested an average of approximately 10% of its net assets in each new portfolio company investment measured at the time of the investment. The absolute dollar amount of these investments ranged from $500,000 to $1.1 million.

In January 2010, the Company raised the minimum $1 million amount and completed its first closing in the public offering. From January 2010 through the end of the third quarter, the Company raised a total of $11.9 million in gross proceeds. In the fourth quarter of 2010, the Company raised $10.9 million in gross proceeds, which nearly doubled the Fund’s net assets to a total of $22.4 million.

To assure compliance with RIC requirements, the Company uses the ending net assets of the most recent quarter end as the basis for determining the size of each new investment in the current quarter. As a result of the capital raised in the fourth quarter of 2010, the Company was able to increase the size of its target investment to approximately $2.5 million and, during the first quarter of 2011, made four additional portfolio company investments in the aggregate amount of $8.4 million, representing an additional 37% of 2010 year-end net assets. Through the end of the first quarter of 2011, the Company has made a total seven portfolio company investments in the aggregate amount of $12.0 million, representing approximately 53% of 2010 year-end net assets on a pro forma basis.

As a general guideline, in order to continue to satisfy the RIC diversification requirements, the Company will seek to size each of its future portfolio company investments at a level equal to 5% of the Fund’s assets as of each prior quarter end so that new investments will be classified as “good” assets for purposes of the diversification test. For example, if total net assets as of the end of any particular quarter end were anticipated to be $60 million, then the target investment size for the current quarter would be $3 million. Based on these parameters, and consistent with the Company’s disclosures in its Prospectus, the Company believes it will be able to invest the net proceeds from the public offering during the 12 to 24 month period following completion of the offering on June 30, 2011.

SUBJECT TO COMPLETION, DATED APRIL __, 2011

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Maximum Offering of 10,000,000 Shares of Common Stock

We are a closed-end, non-diversified investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended, or the 1940 Act. During 2010, we satisfied the requirements to qualify as a regulated investment company (“RIC”). We have elected to be treated as a RIC under Subchapter M of the Internal Revenue Code (the “Code”) effective for our 2010 taxable year.

Our investment objective is to maximize our portfolio’s capital appreciation while generating current income from our portfolio investments. We seek to invest principally in equity securities, including convertible preferred securities, and other debt securities convertible into equity securities, of primarily non-public U.S.-based companies. In accordance with our investment objective, we seek to provide capital principally to U.S.-based, private companies with an equity value of less than $250 million, which we refer to as “micro-cap companies” and US.-based, private companies with an equity value of between $250 million and $1 billion, which we refer to as “small-cap companies.” Our primary emphasis is to attempt to generate capital gains through our equity investments in micro-cap and small-cap companies, including through the conversion of the convertible debt or convertible preferred securities we may acquire in such companies. While a portion of our investments may, at any given time, include a component of interest or dividends, we do not expect to generate significant current yield on our portfolio company investments. As of the date of this prospectus, none of our portfolio company investments have generated, nor are they expected to generate, interest or dividend income. We expect that most, if not all, of our debt investments will be subordinated and unsecured and would be considered below investment grade if rated by a national rating agency, although we do not expect to receive such ratings on the debt securities we acquire.

As a business development company, we are required to comply with certain regulatory requirements. For example, to the extent provided by the 1940 Act, we are required to invest at least 70% of our total assets in eligible portfolio companies (“Eligible Portfolio Companies”). Also, while we are permitted to finance investments using debt, our ability to use debt will be limited in certain significant respects, most notably that we are subject to a 200% asset coverage position. We do not anticipate financing the acquisition of investments using debt in the foreseeable future. See “Risk Factors – Risks Relating to Our Business and Structure.”

Through the dealer manager, we are offering up to 10,000,000 shares of common stock in this offering at an initial offering price of $10.00 per share. The dealer manager is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered. The minimum permitted purchase is $5,000 in shares of our common stock. We intend to conduct closings on at least a monthly basis until the conclusion of this offering. All subscription payments will be placed in an account held by the escrow agent, UMB Bank, N.A., in trust for our subscribers’ benefit, pending release to us at the next scheduled closing. As of April__, 2011, we have sold an aggregate of 4,363,011 shares of our common stock for gross proceeds of $43,460.613 in this offering.

We are offering our shares on a continuous basis at a price of $10.00; however, to the extent that our net asset value increases, we will sell at a price necessary to ensure that shares are not sold at a price, after deduction of selling commissions and dealer manager fees, that is below net asset value. Therefore, persons who tender subscriptions for shares of our common stock in this offering must submit subscriptions for a certain dollar amount, rather than a number of shares of common stock and, as a result, may receive fractional shares of our common stock. As of April___, 2011, all shares in this offering have been sold at a price of $10.00 per share, adjusted to the extent of any commissions waived by the dealer manager. This offering commenced on June 11, 2009 and will conclude on June 30, 2011. We anticipate that it will take us up to 12 to 24 months after conclusion of this offering to invest substantially all of the proceeds of this offering in accordance with our investment objective, during which time we may have insufficient investment income to meet our ongoing expenses, including payment of management fees to our investment adviser, Keating Investments.

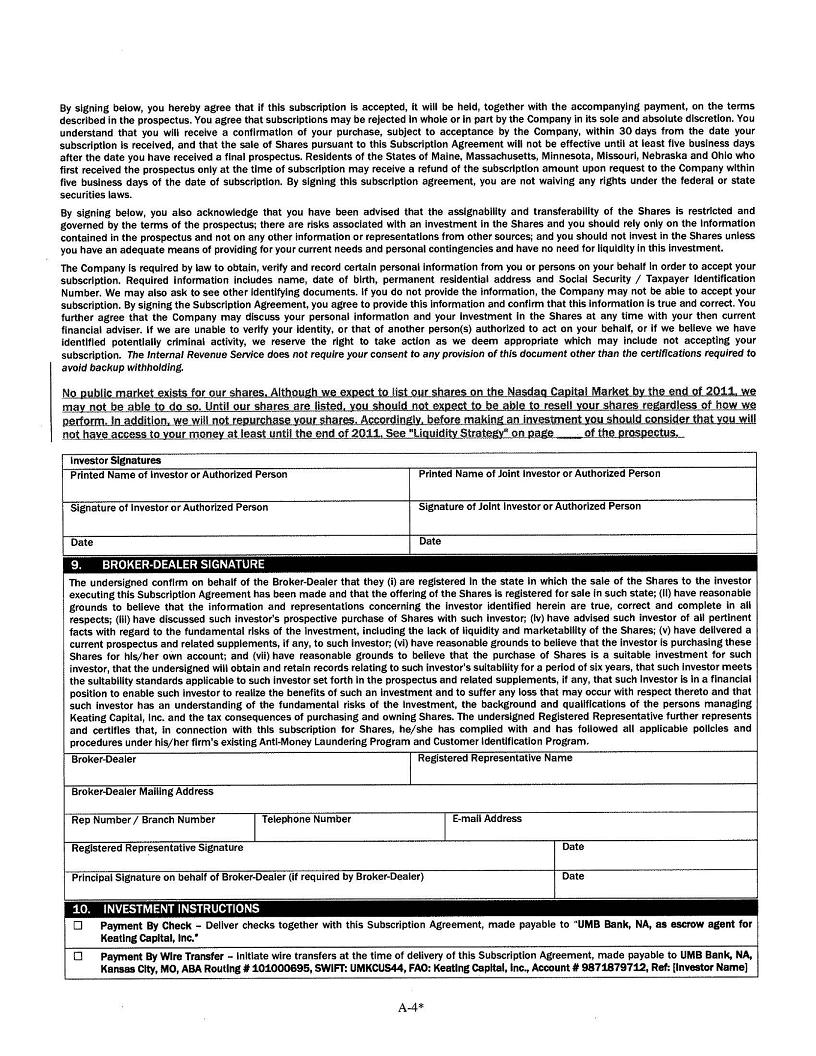

No public market exists for our shares. Although we expect to list our shares on the Nasdaq Capital Market by the end of 2011, we may not be able to do so. Until our shares are listed, you should not expect to be able to resell your shares regardless of how we perform. In addition, we will not repurchase your shares. Accordingly, before making an investment you should consider that you will not have access to your money at least until the end of 2011. See "Liquidity shares on page ___.

_____________________

Our common stock has no history of public trading. Shares of closed-end investment companies have in the past frequently traded at a discount to their net asset value. Given the public offering price of $10.00 per share, purchasers in this offering will experience immediate dilution in net asset value of approximately $2.15 per share, based upon our net asset value per share of $7.85 as of December 31, 2010. Once our shares of common stock become listed on Nasdaq Capital Market, they may trade at more or less than our net asset value of $7.85 as of December 31, 2010. Investing in our common stock should be considered highly speculative and involves a high degree of risk, including the risk of losing the entire investment. See “Risk Factors” beginning on page 28 to read about the risks you should consider before buying shares of our common stock.

An investment in our shares is not suitable for all investors. You should not invest in this offering if you do not have adequate financial means to economically bear the entire loss of your investment, if you are looking for a short-term investment, if you desire to receive a current yield on your investment, or if may need to liquidate your investment in the forseeable future. As a result, an investment in our shares is not suitable for investors that require short-term liquidity. See “Suitability Standards” on page ___ for information on the suitability standards that investors must meet in order to purchase shares of our common stock in this offering.

We intend to continue to issue shares of our common stock in this offering. As a result, your ownership in us is subject to dilution. See “Risk Factors—Risks Relating to this Offering and our Common Stock—Your interest in us will be diluted if we issue additional shares, which could reduce the overall value of your investment.”

This prospectus contains important information about us that a prospective investor should know before investing in our common stock. Please read this prospectus before investing and keep it for future reference. We are also required to file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission, or SEC. This information will be available free of charge through our website (www.keatingcapital.com), or by calling us at (720) 889-0139, as soon as reasonably practicable after filing with the SEC. Information contained on our website is not incorporated by reference into this prospectus and you should not consider that information to be part of this prospectus. The SEC also maintains a website at www.sec.gov that contains such information.

Neither the SEC, the Attorney General of the State of New York nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Except as specifically required by the 1940 Act and the rules and regulations thereunder, the use of forecasts is prohibited and any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence which may flow from an investment in this program is not permitted.

(1) Assumes all shares are sold at the initial offering price per share.

(2) Includes dealer manager fee and selling commissions.

(3) We estimate that we will incur approximately $1,250,000 of expenses if the maximum number of common shares is sold.

Because you will pay a sales load of up to 10% and offering expenses of up to 1.25% (assuming the maximum offering amount is raised) , if you invest $100 in the Company’s shares and pay the full sales load, between $88.75 and $90.00 will actually be used by us for investments. In addition, our shares would have to trade at a premium of 27% above our current net asset value of $7.85 for you to recover your purchase price if you could sell them currently. See “Estimated Use of Proceeds” on page___.

The date of this prospectus is April ___, 2011.

_____________________

Andrews Securities, LLC