Exhibit 99.1

Buy Privately, Sell Publicly, Capture the Difference™ Q4 2013 Investor Presentation Nasdaq: KIPO www.KeatingCapital.com

Disclaimer Keating Capital, Inc. (“Keating Capital”), a Maryland corporation, is a closed-end fund that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. Keating Investments, LLC (“Keating Investments”) is an SEC registered investment adviser and acts as the investment adviser to, and receives base management and/or incentive fees from, Keating Capital. Keating Investments and Keating Capital operate under the generic name of Keating. This presentation is a general communication of Keating and is not intended to be a solicitation to purchase or sell any security. This presentation may contain certain forward-looking statements, including statements with regard to the future performance of Keating Capital. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors that could cause actual results to differ materially are included in Keating Capital’s Form 10-K and Form 10-Q, and other SEC filings, and include uncertainties of economic, competitive, and market conditions, and future business decisions all of which are difficult or impossible to predict accurately, and many of which are beyond the control of Keating Capital. Although Keating Capital believes that the assumptions underlying the forward-looking statements included herein are reasonable, any of the assumptions could be inaccurate and therefore there can be no assurance that the forward-looking statements included herein will prove to be accurate. Except as required by the federal securities laws, Keating Capital undertakes no obligation to revise or update this presentation (including the slides presented) or any forward-looking statements contained herein, whether as a result of new information, future events or otherwise. Important Information about Structural Protections: In each of our investments, we may seek to negotiate structural protections such as conversion rights which would result in our receiving shares of common stock at a discount to the IPO price upon conversion at the time of the IPO, or warrants that would result in our receiving additional shares for a nominal exercise price at the time of an IPO. The ability to realize the potential value associated with these structural protections at the time of the IPO will depend on a number of factors including each portfolio company’s completion of an IPO, any adjustment to the special IPO conversion price that may be negotiated prior to or during the IPO process, the possible subsequent issuance of more senior securities that may impact the relative value of the structural protection, and fluctuation in the market price of each portfolio company’s common shares until such time as the common shares received upon conversion can be disposed of following the expiration of the 180-day post-IPO lockup period. Even if an IPO is completed, the potential value associated with these structural protections would not be realized unless the market price of each portfolio company’s common shares equals or exceeds the IPO price at the time such shares are disposed of following the post-IPO lockup period. Please see our periodic reports on Form 10-K and Form 10-Q for additional information on, and risks related to, our structural protections. Buy Privately, Sell Publicly, Capture the DifferenceTM 2

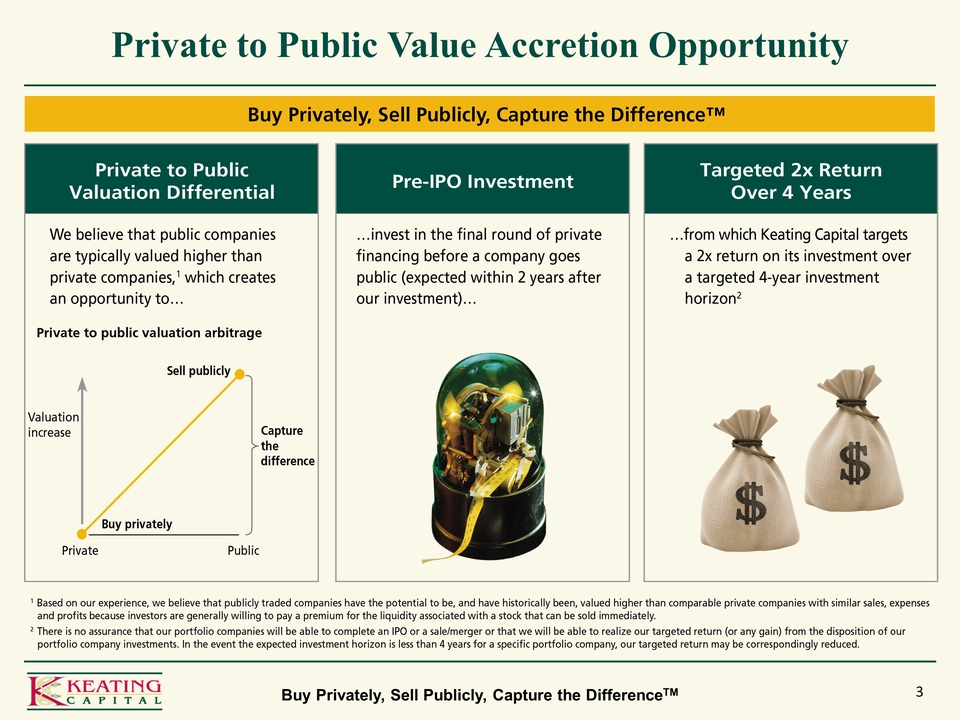

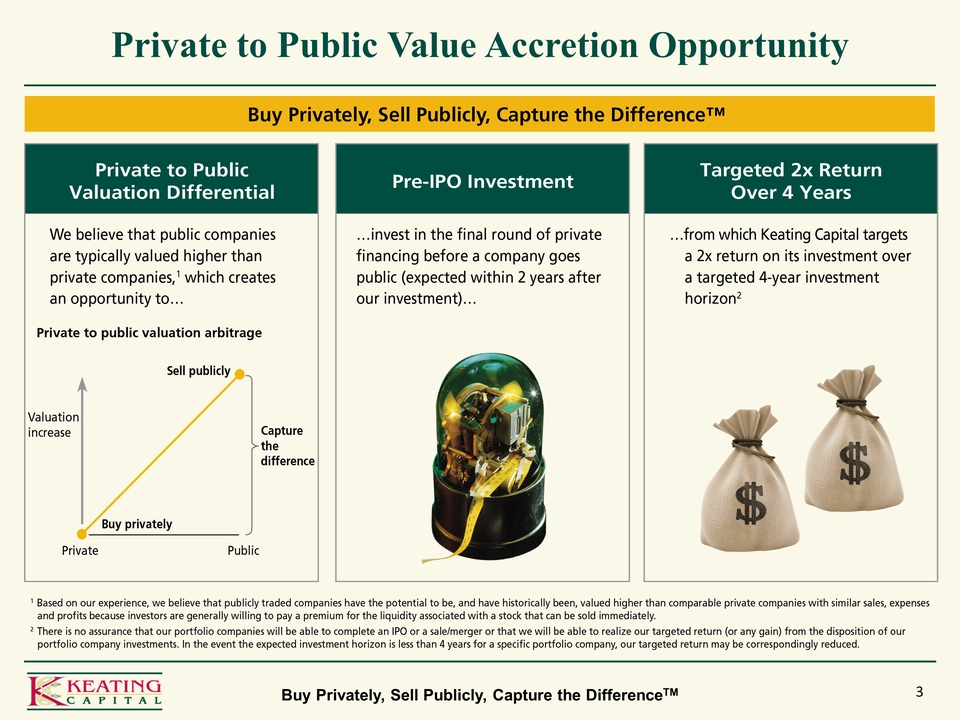

Private to Public Value Accretion Opportunity Buy Privately, Sell Publicly, Capture the DifferenceTM Buy Privately, Sell Publicly, Capture the DifferenceTM 3

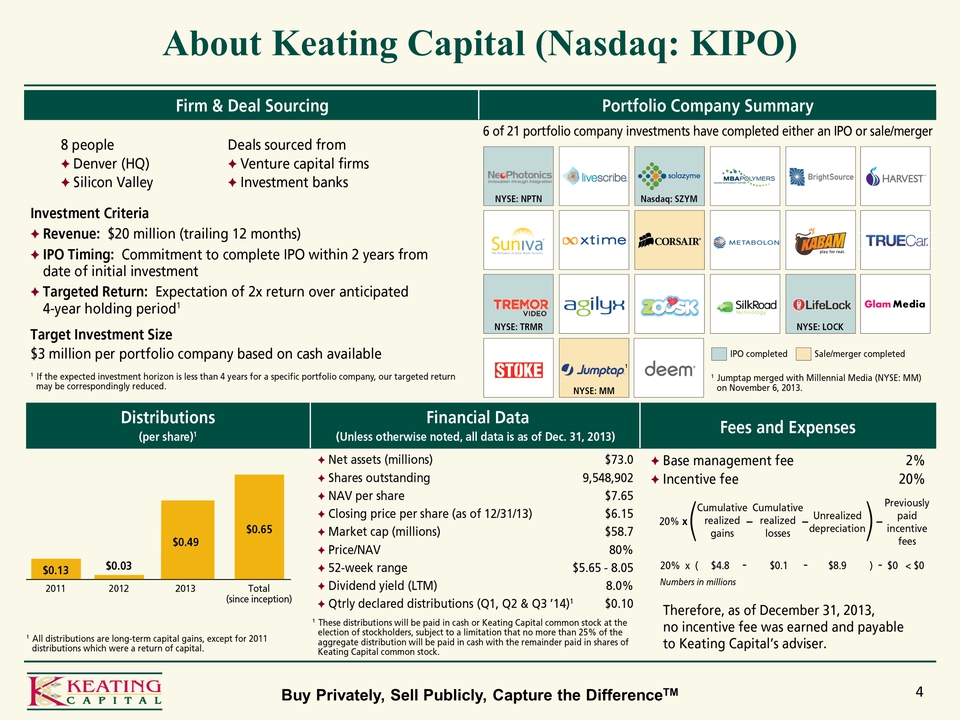

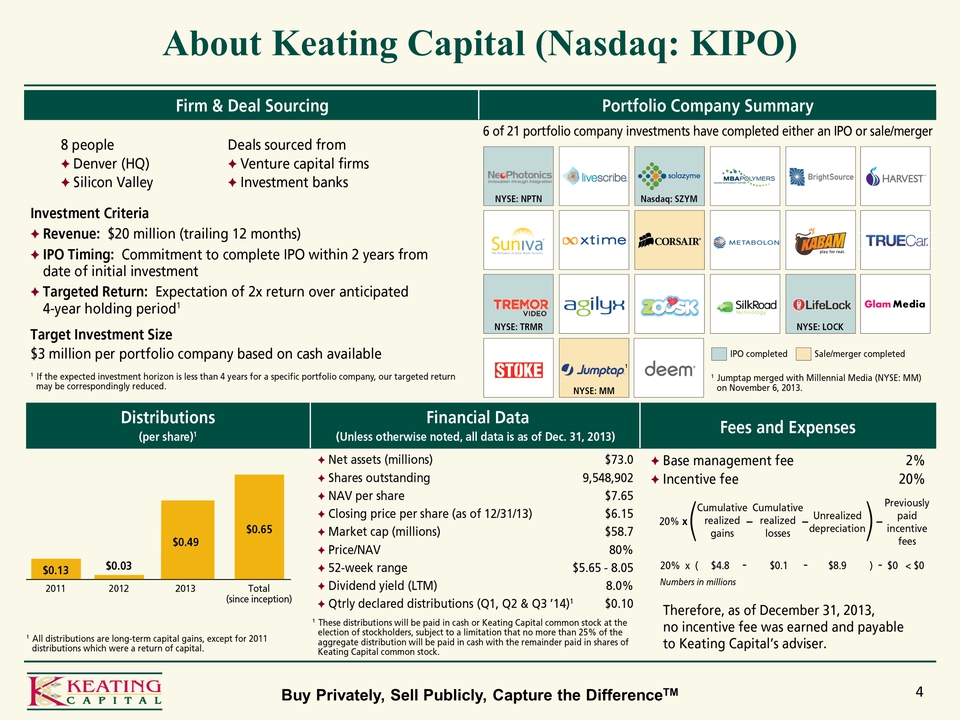

About Keating Capital (Nasdaq: KIPO) Buy Privately, Sell Publicly, Capture the DifferenceTM 4

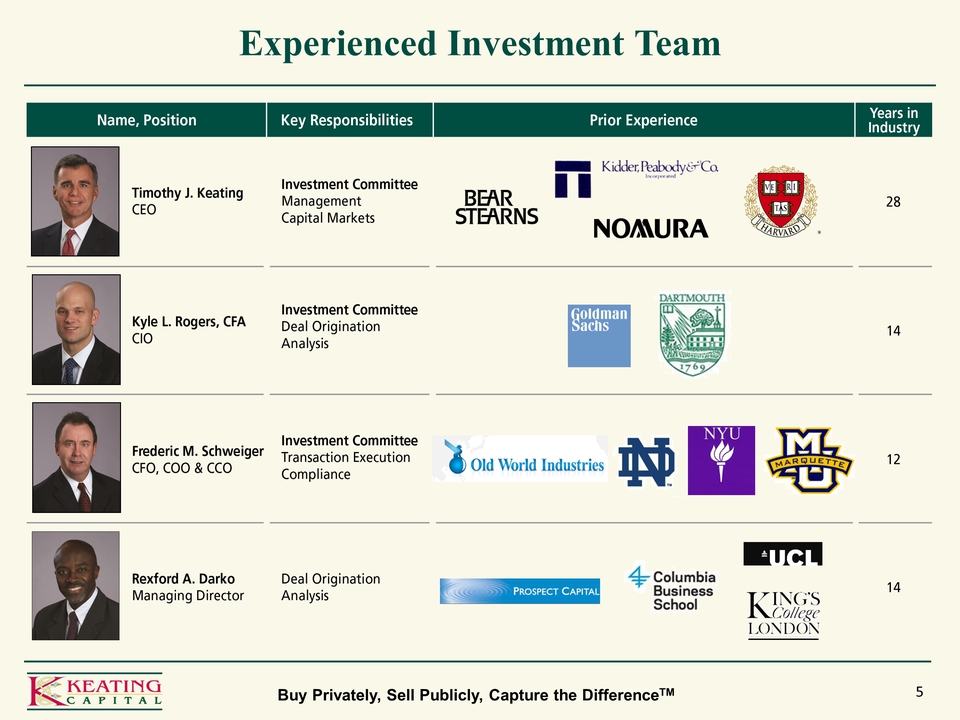

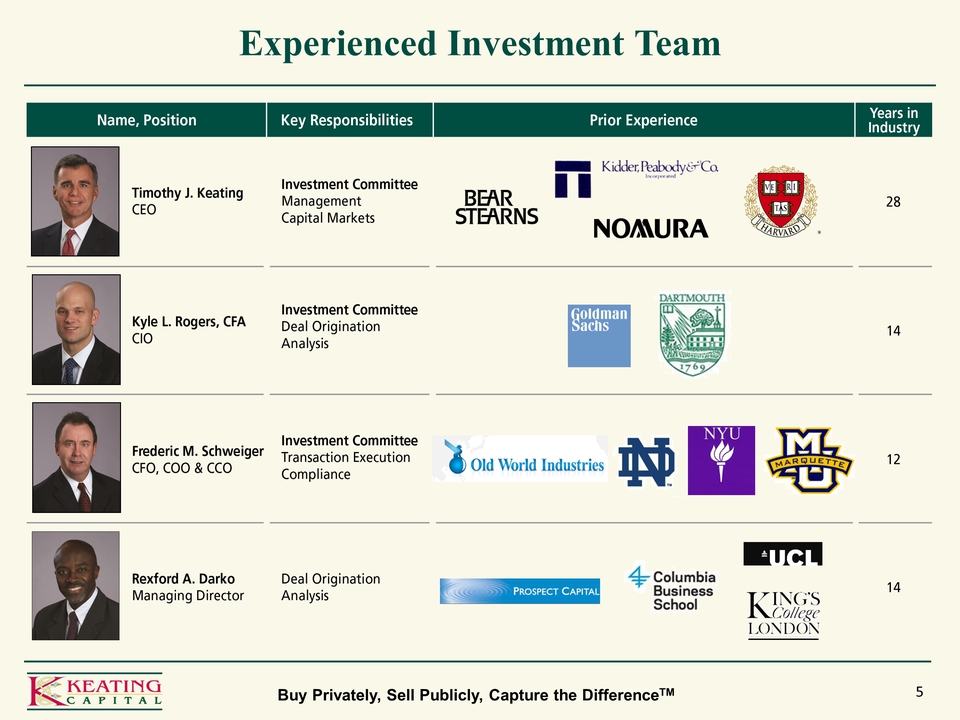

Experienced Investment Team Buy Privately, Sell Publicly, Capture the DifferenceTM 5

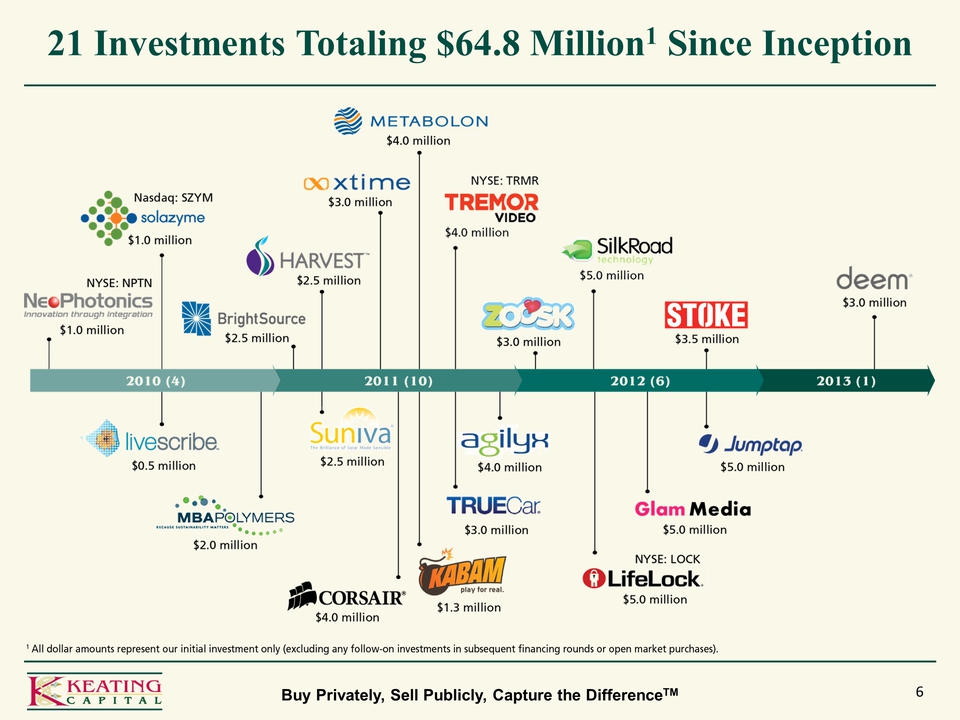

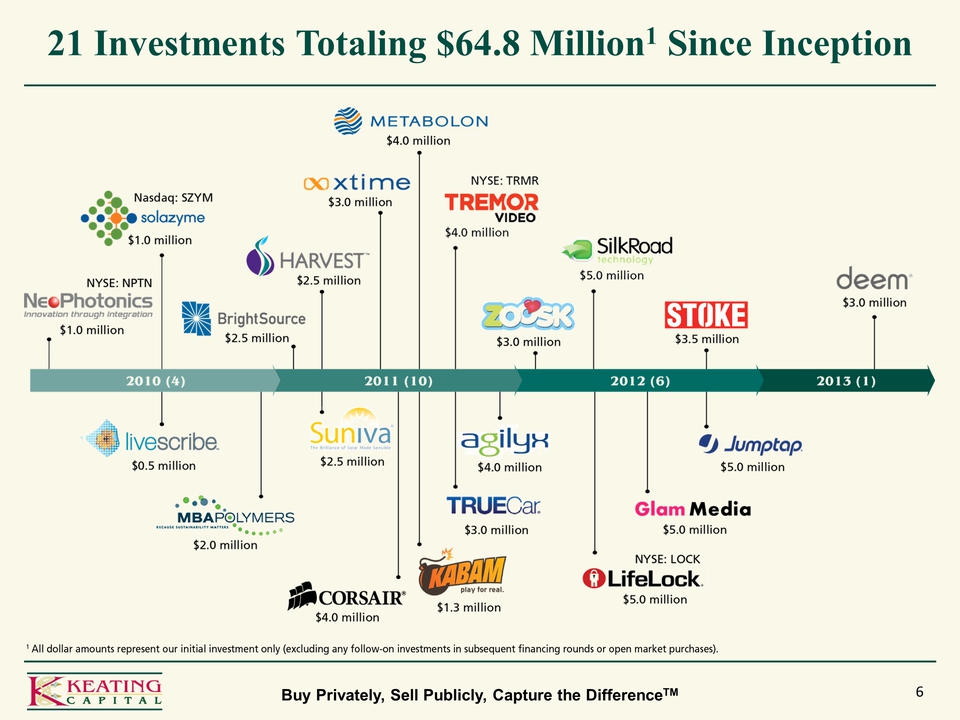

21 Investments Totaling $64.8 Million1 Since Inception Buy Privately, Sell Publicly, Capture the DifferenceTM 6

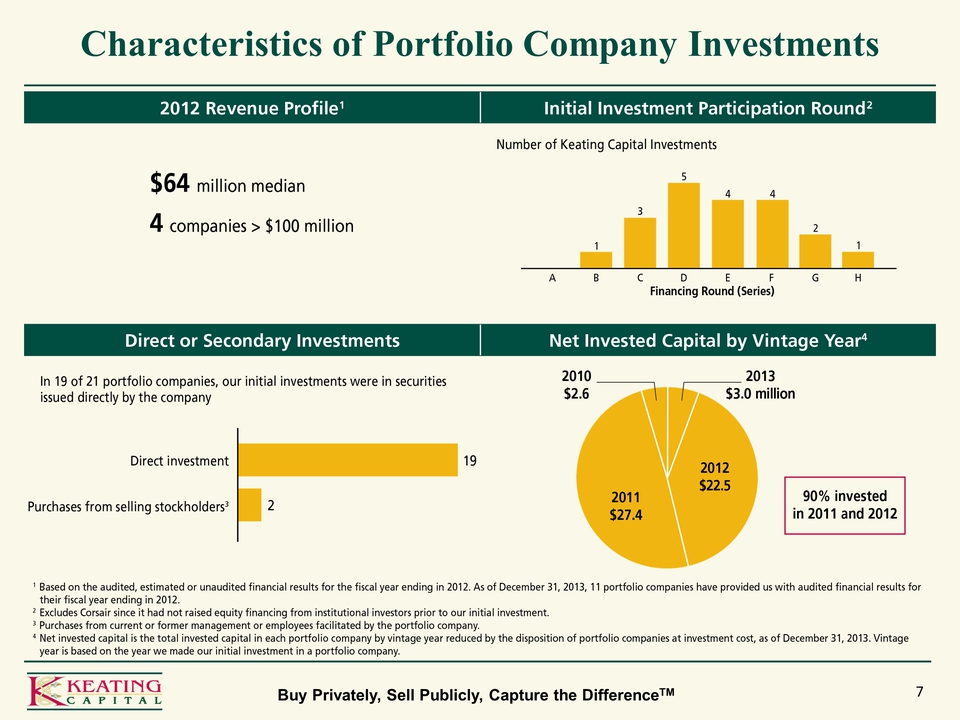

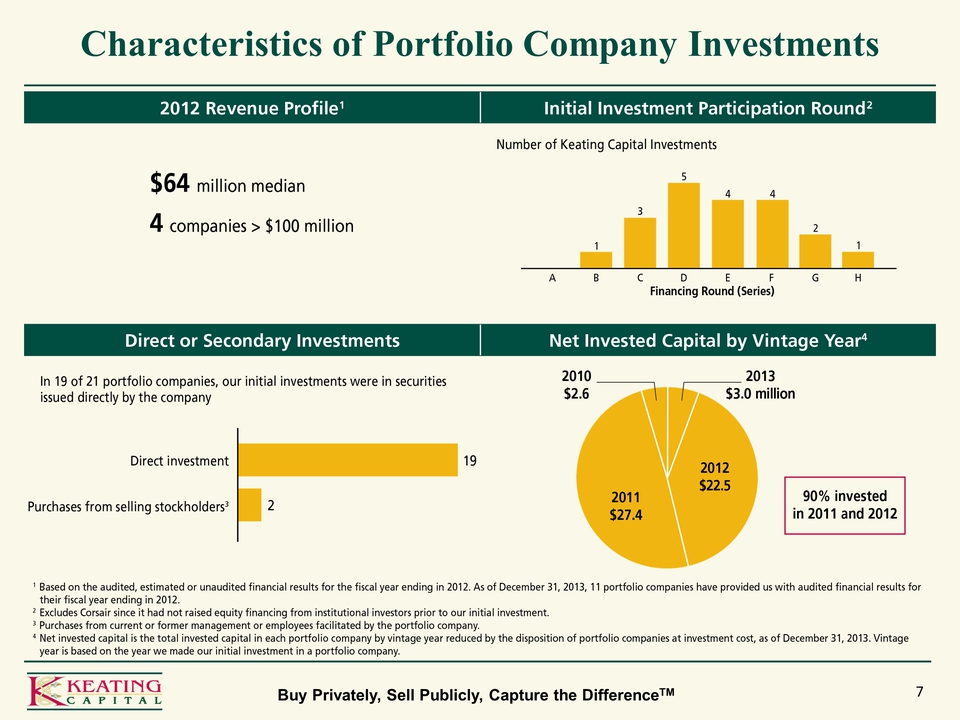

Characteristics of Portfolio Company Investments Buy Privately, Sell Publicly, Capture the DifferenceTM 7

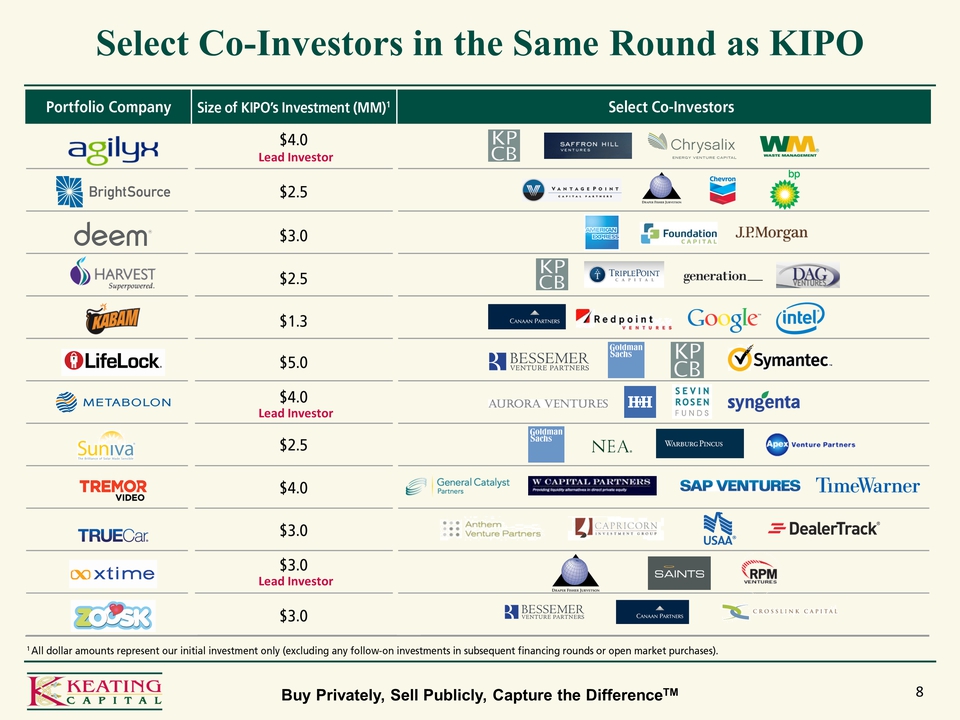

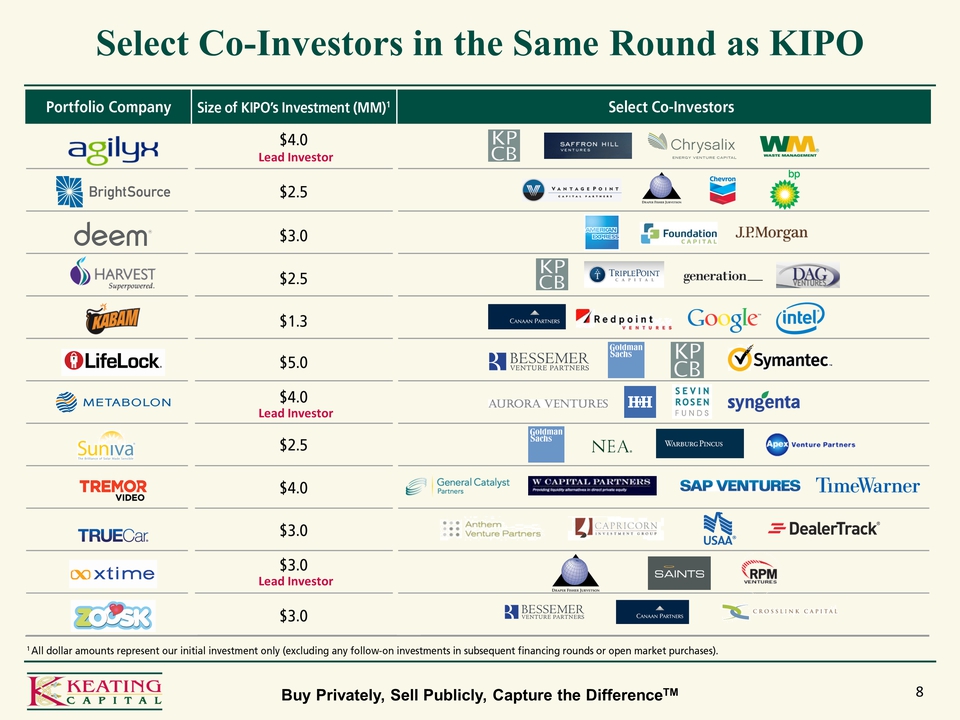

Select Co-Investors in the Same Round as KIPO Buy Privately, Sell Publicly, Capture the DifferenceTM 8

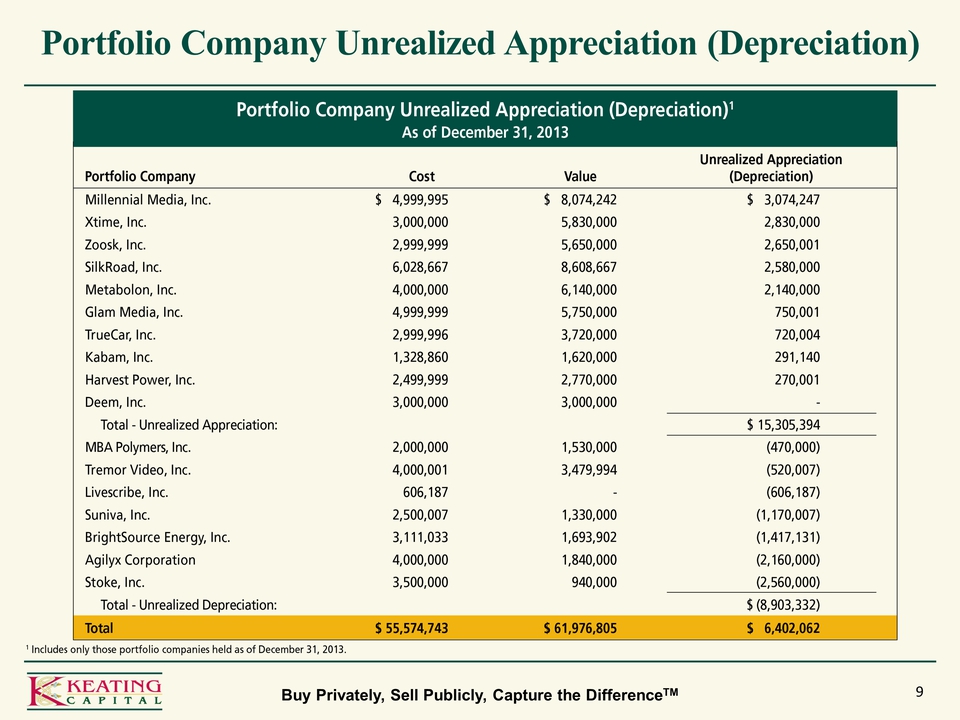

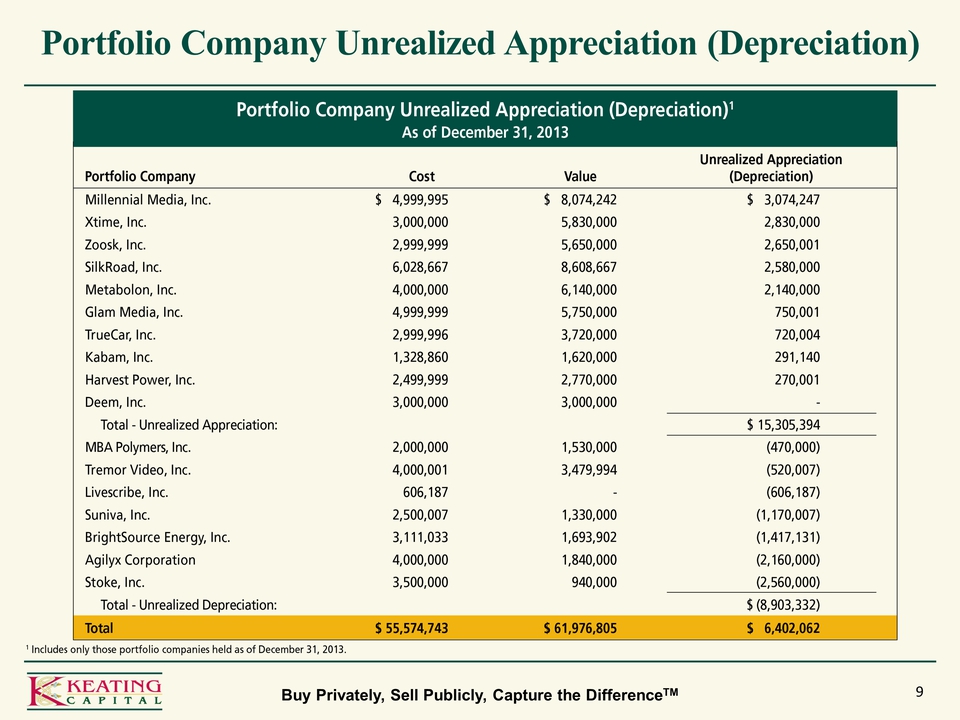

Portfolio Company Unrealized Appreciation (Depreciation) Buy Privately, Sell Publicly, Capture the DifferenceTM 9

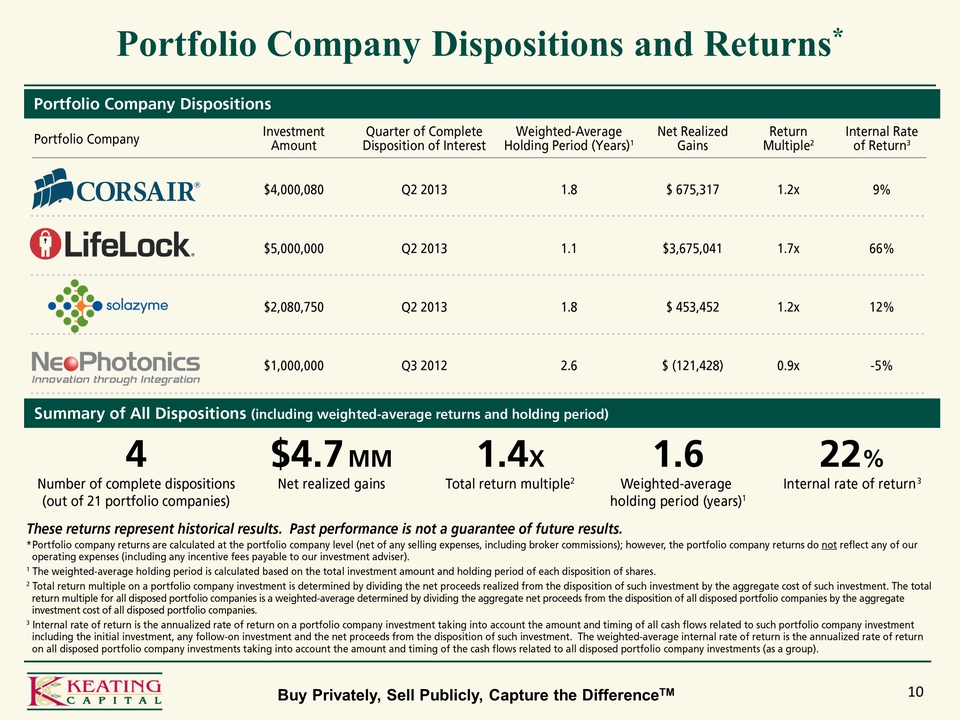

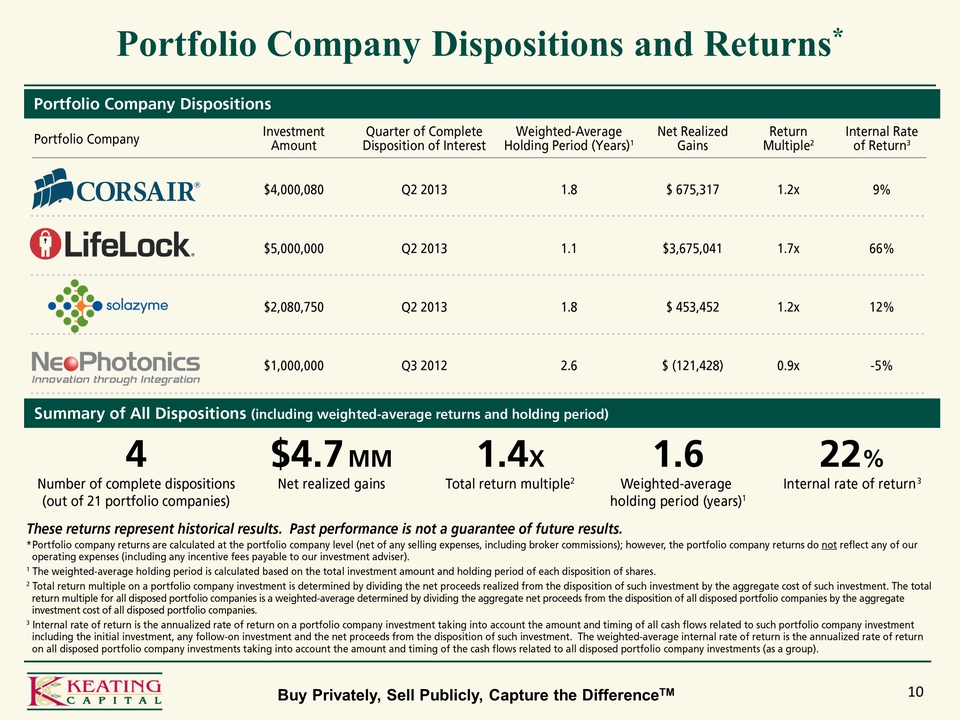

Portfolio Company Dispositions and Returns* Buy Privately, Sell Publicly, Capture the DifferenceTM 10

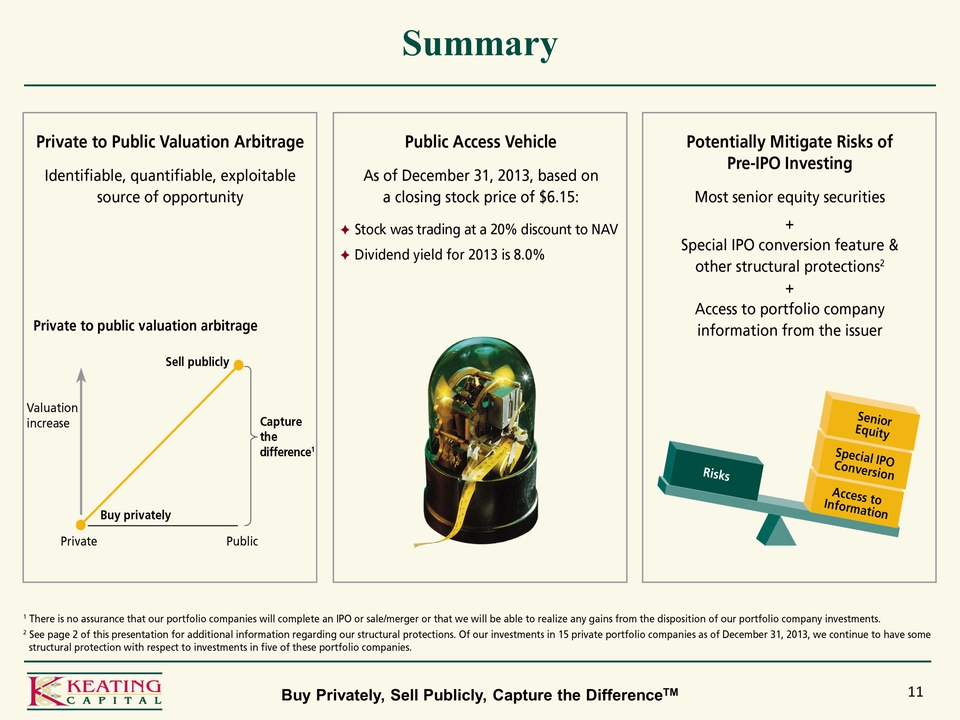

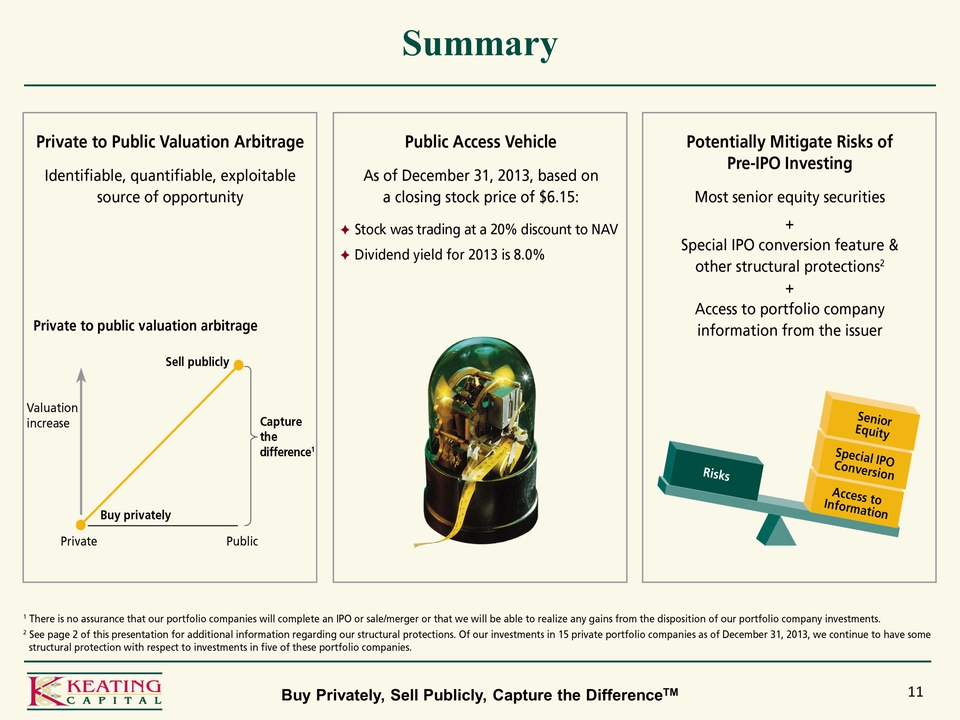

Summary Buy Privately, Sell Publicly, Capture the DifferenceTM 11

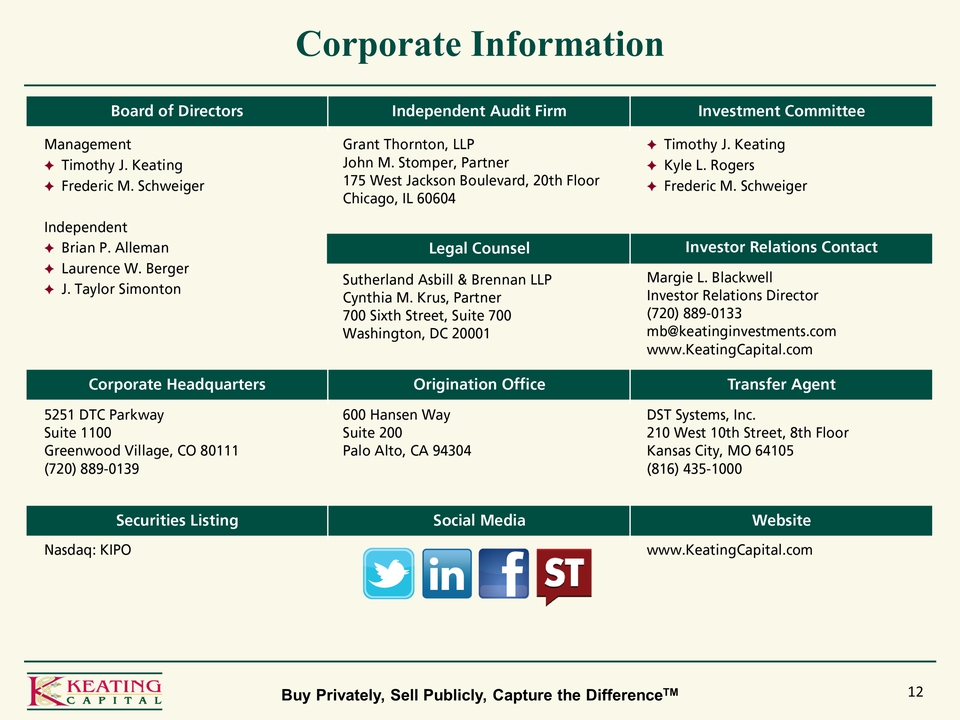

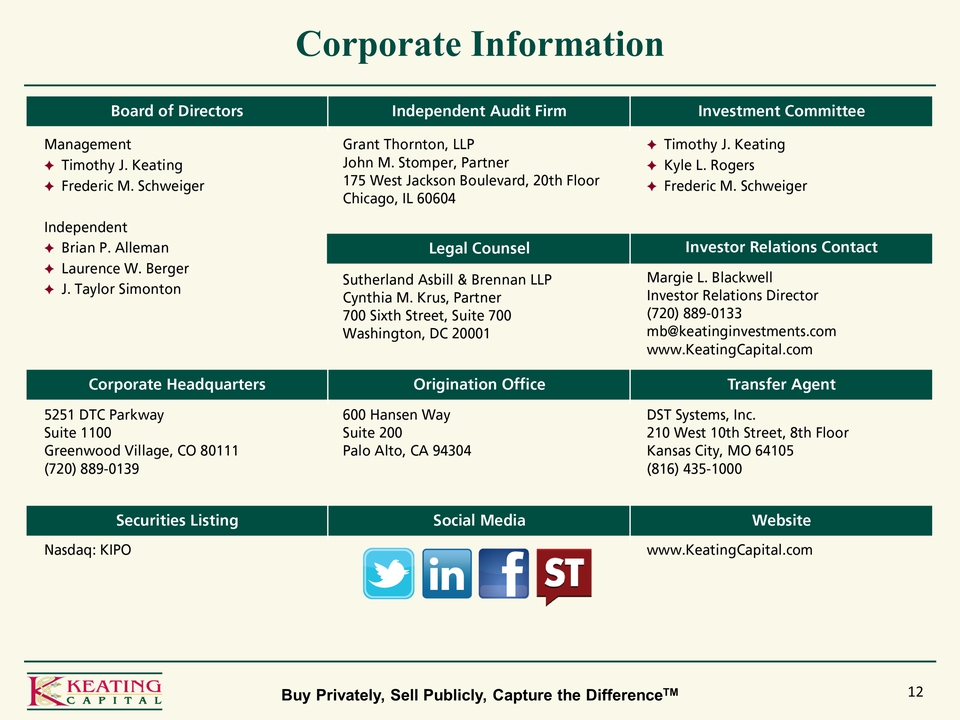

Corporate Information Buy Privately, Sell Publicly, Capture the DifferenceTM 12