As filed with the Securities and Exchange Commission on October 14, 2008

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PHOSPHATE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 2870 | | 20-2055395 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

100 Webster Circle, Suite 4

Madison, MS 39110

(601) 898-9004

(Address, including zip code and telephone number, including

area code, of registrant’s principal executive offices)

Robert E. Jones

Chief Executive Officer

Phosphate Holdings, Inc.

100 Webster Circle, Suite 4

Madison, MS 39110

(601) 898-9004

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| | | | |

Alan J. Bogdanow Christine A. Hathaway Vinson & Elkins L.L.P. 2001 Ross Avenue, Suite 3700 Dallas, TX 75201 (214) 220-7700 | | Don B. Cannada Joseph E. Dudek M. Elizabeth Saxton Butler, Snow, O’Mara, Stevens & Cannada, PLLC 6075 Poplar Avenue, Suite 500 Memphis, TN 38119 (901) 680-7200 | | Andrew D. Soussloff Sullivan & Cromwell LLP 125 Broad Street New York, NY 10004 (212) 558-4000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

| Large accelerated filer ¨ | | Accelerated filer ¨ |

Non-accelerated filer x (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

| | | | |

| |

Title of Each Class of Securities to be Registered | | Proposed Maximum

Aggregate Offering

Price(1)(2) | | Amount of

Registration Fee |

Common stock, par value $0.01 per share | | $200,000,000.00 | | $7,860.00 |

| |

| |

| (1) | Includes the offering price of shares of common stock that the underwriters have the option to purchase. |

| (2) | Estimated pursuant to Rule 457(o). |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated October 14, 2008

Shares

Phosphate Holdings, Inc.

Common Stock

We are offering shares of our common stock. We anticipate that the offering price per share will be between $ and $ .

Currently, shares of our common stock are traded in the OTC markets under the symbol “PHOS.” As of October 10, 2008, the closing bid price of our common stock as reported by the OTC Bulletin Board was $18.00 per share. We plan to apply for approval for listing of our common stock on the under the symbol “ .”

See “Risk Factors” beginning on page 12 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | Per Share | | Total |

Initial public offering price | | $ | | | $ | |

Underwriting discount | | $ | | | $ | |

Proceeds, before expenses, to Phosphate Holdings, Inc. | | $ | | | $ | |

To the extent that the underwriters sell more than shares of our common stock, the underwriters have the option to purchase up to an additional shares of our common stock at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2008.

Goldman, Sachs & Co. | Merrill Lynch & Co. |

Prospectus dated , 2008.

TABLE OF CONTENTS

Prospectus

Through and including , 2008 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

PROSPECTUS SUMMARY

The following summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the matters discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus, before deciding to invest in our common stock.

References in this prospectus to “PHI,” “Phosphate Holdings,” “our,” “we” or “us” are to Phosphate Holdings, Inc. and its wholly owned subsidiary, Mississippi Phosphates Corporation, or MPC, unless the context otherwise requires. References to “tons” in this prospectus refer to short tons unless otherwise indicated. One short ton equals 2,000 pounds, one long ton equals 2,240 pounds and one metric ton equals 1,000 kilograms or approximately 2,200 pounds. References to “FOB, NOLA” mean free on board, New Orleans, Louisiana, and refer to domestic prices, and “FOB, U.S. GULF” mean free on board, U.S. gulf coast, and refer to export prices. References to “C&F, Tampa” mean cost and freight, Tampa, Florida.

Phosphate Holdings, Inc.

Overview

We are a major U.S. producer and marketer of diammonium phosphate, or DAP, the most widely used phosphate fertilizer. DAP serves an important role in global agriculture by providing two of the three primary nutrients essential for plant development and growth. In its chemical composition, DAP is composed of 46% phosphate and 18% nitrogen. Phosphate is essential for the photosynthesis process, seed germination, efficient water utilization by plants and protection of plants against diseases. Thus, phosphate fertilizers play an important role in improving crop quality, increasing crop yields and mitigating the effects of environmental stresses on plants.

In 2007, we sold 620,569 tons of DAP at an average price of $353.80 per ton, up from the 579,772 tons we sold in 2006 at an average price of $225.21 per ton. For the six months ended June 30, 2008, we sold 266,343 tons of DAP at an average price of $871.06 per ton. For the year ended December 31, 2007 and the six months ended June 30, 2008, we generated total net sales of $222.4 million and $238.5 million, EBITDA of $85.7 million and $71.9 million, and net income of $48.9 million and $42.0 million, respectively.

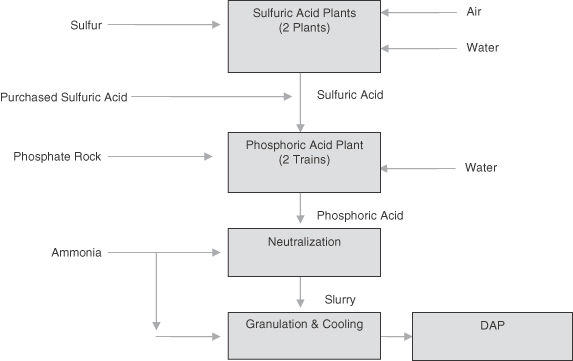

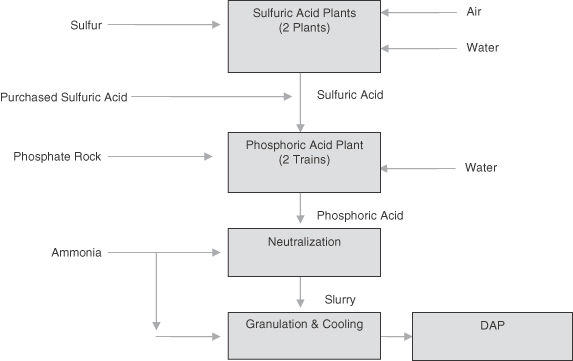

Our production facilities are strategically located on a deep water channel in Pascagoula, Mississippi with direct access to the Gulf of Mexico. Our manufacturing facilities consist of two sulfuric acid plants, a phosphoric acid plant and a DAP granulation plant. Our DAP granulation plant has a maximum annual DAP production capacity of approximately 870,000 tons. Our existing sulfuric acid plants currently produce sulfuric acid sufficient for annual DAP production of approximately 750,000 tons. When it is economical to do so, we can purchase additional quantities of sulfuric acid on the open market, allowing us to manufacture DAP at our full capacity. However, due to current high sulfuric acid prices, we do not expect to purchase supplemental sulfuric acid to increase our DAP production in 2008.

Historically, we have sold our DAP primarily into the U.S. domestic market where we have typically obtained better prices relative to export markets. During 2006 and 2007, we made 71% and 65%, respectively, of our DAP sales into the domestic market. In late 2007 and early 2008, however, prices in the export market exceeded those in the domestic market due to a significant increase in

1

international demand for phosphate fertilizers. As a result, we strategically directed our sales into the export market, and in the first half of 2008, we sold the substantial majority of our DAP into the export market. Latin America is the principal destination for our export sales. Our internal sales staff manages our domestic sales while Transammonia, Inc., or Transammonia, a major global trading company, markets our export volumes.

Industry Overview

Fertilizer Fundamentals. Fertilizers are crucial for the agricultural process because they replace the nutrients that crops remove from the soil, thereby sustaining the yield and quality of crops. Phosphate, nitrogen and potassium (potash) are the three primary nutrients essential to crop development. Each of these three key nutrients serves a different vital function in plant formation, and a proper balance of the three nutrients is necessary to maximize crop viability.

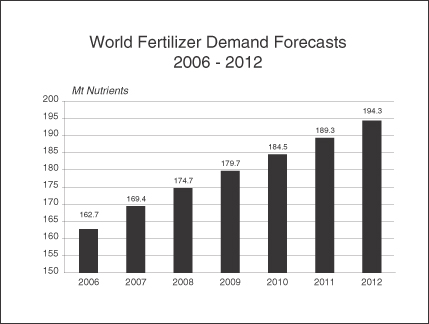

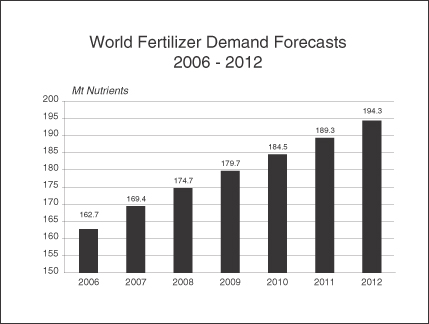

Global demand for food, which is a function of population growth and changes in dietary habits, is the primary driver of global fertilizer demand. Developed countries use fertilizers more intensively than developing countries, but sustained economic growth in the developing world is changing the patterns of fertilizer usage. Improvements in the standard of living in developing countries have produced a shift in dietary preferences towards more meat consumption. Producing meat from livestock requires large amounts of grain and, in turn, the fertilizer necessary to grow it. According to the International Fertilizer Industry Association, or the IFA, world fertilizer usage increased by 10% between 2005 and 2007, and world fertilizer demand is estimated to grow by approximately 15% from 2007 to 2012.

DAP Market Conditions and Outlook. Phosphate, the primary component of DAP, is essential for the photosynthesis process, which drives the production, transportation and accumulation of sugars in plants. Phosphate also aids seed germination, promotes efficient water utilization and protects plants against diseases. Thus, phosphate fertilizers play an important role in improving crop quality, increasing crop yields and mitigating the effects of environmental stresses on plants.

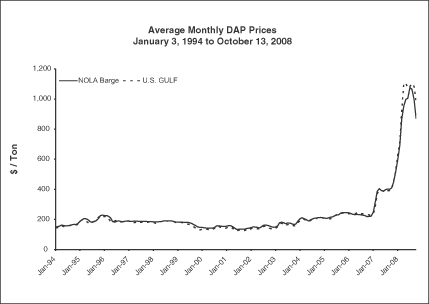

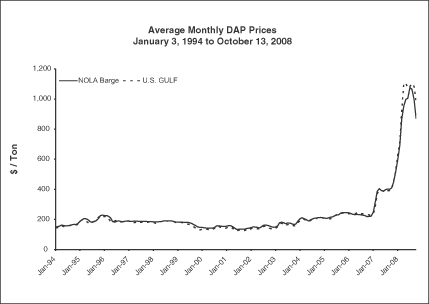

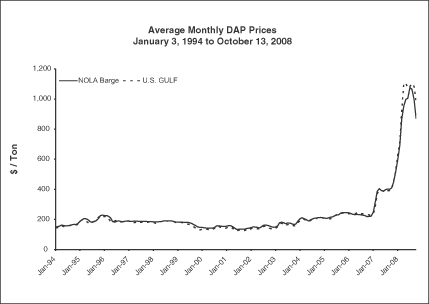

Over the last decade, DAP prices were relatively stable due to excess world capacity and static pricing for the key raw materials required to produce DAP, principally phosphate rock and sulfur. Since late 2006, global phosphate consumption has increased significantly, driven by growing demand for agricultural commodities for use as food and fuel. This surge in demand has dramatically altered the supply and demand balance for phosphate fertilizers. In the United States, producers’ inventory of DAP during 2007 fell significantly below five-year average levels. As a result of this supply and demand imbalance, DAP prices escalated rapidly in 2007. During 2007, DAP prices, FOB, NOLA, rose from $231 per ton on January 1, 2007 to $550 per ton on December 31, 2007.

As DAP production increased during 2007 to meet increased demand, raw material capacities tightened and shortages of sulfur and phosphate rock developed late in the year. Consequently, prices for both raw materials rose sharply, exerting further upward pressure on finished product prices. Between January 1, 2008 and July 1, 2008, posted prices, C&F, Tampa, for sulfur rose from $112 per ton to $625 per ton and reported ranges of merchant phosphate rock prices have increased from $68 to $75 per metric ton to $150 to $400 per metric ton. During that same period, DAP prices increased rapidly, with published prices for DAP, FOB, NOLA, increasing from $550 per ton to $1,070 per ton and prices for DAP, FOB, U.S. GULF, increasing from $544 per ton to $1,070 per ton.

Since the completion of the 2008 domestic planting season, we have experienced a customary decline in demand for DAP. Additionally, there has been a delay in the typical fall season DAP shipments to markets in the United States, Europe and Latin America. As a result, demand for DAP

2

has been sharply reduced, and DAP prices have declined to $834 per ton, FOB, NOLA, and $920 per ton, FOB, U.S. GULF, at October 13, 2008. This price decline has been partially offset by net reductions in the cost of raw materials. We expect that an increase in demand in late October and November, coupled with a reduction in available supply due to recent storms and announced production curtailments, will partially alleviate the current weakness in the DAP market.

The following table shows domestic and export DAP prices over the last 15 years:

Source: Green Markets

Looking forward, the following factors are expected to continue to support strong demand for agricultural commodities and fertilizers:

| | Ÿ | | growing population and improving diets; |

| | Ÿ | | declining grain stocks despite record crops; |

| | Ÿ | | current biofuel initiatives; and |

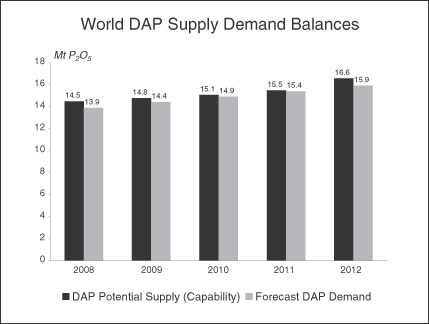

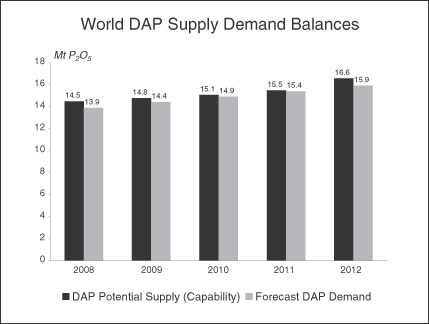

The IFA estimates that global DAP consumption will increase at an average annual growth rate of 3.5% from 2008 to 2012. Given the favorable industry dynamics, a large number of projects to increase phosphate fertilizer production capacity are under active consideration. However, due to the long lead-time typically required to complete these projects, significant additional phosphate fertilizer production capacity is not expected to be available before 2011. As a result, the supply and demand balance for phosphate fertilizers is expected to remain tight until at least that time.

Competitive Strengths

We believe the following competitive strengths have contributed to our recent success, differentiate us from our competitors and will drive our future growth:

Long-Term Strategic Supplier Relationship. We have a strong, long-term relationship with OCP S.A., or OCP, a corporation owned by the Kingdom of Morocco. A significant portion of the

3

world’s known phosphate rock reserves are located in Morocco, and OCP is the world’s leading exporter of phosphate rock, accounting for approximately 45% of world trade in phosphate rock. We are one of OCP’s largest buyers of phosphate rock, and we have purchased all of our phosphate rock requirements from OCP since 1991.

We believe the phosphate rock that OCP supplies to us is of a higher grade than the average phosphate rock mined in the United States. The higher grade lowers our conversion cost because we can more efficiently convert this phosphate rock into phosphoric acid. The higher grade also helps us meet the nitrogen content specification of our DAP without the need to add solid nitrogen products, such as urea, as supplements.

We believe that we have a strategic and mutually beneficial working relationship with OCP. During the 18 years that we have purchased phosphate rock from OCP, we have never experienced an interruption in our supply of phosphate rock caused by OCP. When Hurricane Katrina severely damaged our facilities in 2005, OCP’s prompt assurances that our supply of phosphate rock would be available when we were ready to resume operations facilitated our recovery from that disaster.

The price we pay OCP for phosphate rock is currently re-set each quarter. OCP has advised us that it is presently engaged in a comprehensive review of its existing customer contracts and contract terms, which it intends to update and standardize. OCP has stated that its objective is to execute new multi-year contracts with all of its global customers, rather than to extend current agreements. In connection with this objective, OCP has notified us that, rather than extend the term of our current contract, it plans to enter into a new agreement with us prior to the expiration of our current agreement on December 31, 2008. Accordingly, in June 2008, OCP provided us with written notice that it will not extend our current four-year agreement beyond December 31, 2008. OCP has advised us that it wishes to continue our long-standing relationship, and we currently anticipate entering into a new contract with OCP in advance of the expiration of our existing contract on December 31, 2008.

Strategically Located Facilities. Our production facilities are strategically located on a deep water channel with direct access to the Gulf of Mexico. We believe that our location provides the following important benefits:

Marketing Flexibility. We believe that our location provides us with maximum flexibility to direct our sales into markets that will yield the best price for our product. We are able to load our finished product either onto deep water vessels for shipment into the export market or onto barges for delivery along the Mississippi River and its tributaries for domestic consumption. Our export volumes are loaded directly onto ocean vessels from our Pascagoula plant without the extra expense that inland producers must incur for inland transport and terminal operations. Our Pascagoula location also permits us to directly access much of the U.S. corn belt by barge rather than higher cost rail transport. We also have rail and truck shipping capabilities, which maximize our delivery options.

Raw Material Access. Our deep water location also allows us to receive raw materials at a lower cost than our competitors with inland facilities. We can receive ammonia and sulfur directly at our dock while our competitors not located on a deep water channel must first move these materials through a deep water terminal and then transport them by rail or pipeline to their inland locations. Our Pascagoula plant is close to the major sulfur production regions in Texas and Louisiana. We believe this proximity lowers our sulfur delivery costs compared to our inland competitors. We also obtain a considerable portion of our molten sulfur requirement directly via pipeline from a large-scale oil refinery situated contiguous to our facility, which further strengthens our sulfur access advantage.

4

Established Valuable Infrastructure. Our Pascagoula plant has significant, well-maintained facilities and infrastructure in place. Based on current costs for similar assets, we estimate the replacement cost of our Pascagoula plant at approximately $900 million. In addition to the extensive capital investment, the construction of a similar facility in the United States could involve a complex, time-consuming and costly governmental and regulatory permitting process. We estimate that project development and execution would require approximately four years.

Our existing asset base provides a platform for cost-effective incremental expansion. We are currently unable to use a material portion of our phosphoric acid and DAP granulation capacity due to our limited sulfuric acid production capacity. We intend to use substantially all of the net proceeds from this offering to construct a new sulfuric acid plant, which will allow us to increase our sulfuric acid production and thereby utilize our full phosphoric acid and DAP production capacity. We believe this possibility is an attractive investment opportunity that will allow us to maximize our DAP production without the need to add additional phosphoric acid or granulation capacity.

We believe that our Pascagoula plant is well positioned to become an important terminal for fertilizer and related products and chemicals. Since 2005, we have provided ammonia terminaling services to Transammonia. Our Pascagoula plant has ample space for us to construct additional terminal facilities to handle more products and to provide terminaling services to additional third parties. We have commenced projects to add terminaling capabilities for sulfuric acid and liquid nitrogen fertilizer, which we expect to complete in 2009. Other projects to expand our terminaling business are under evaluation.

Environmental regulations require gypsum, a by-product of DAP production, to be stored in on-site permitted disposal facilities. Our active gypsum disposal facility is fully-permitted and has sufficient capacity to meet our operating requirements for approximately 18 additional years assuming we produce at our maximum annual DAP production rate of approximately 870,000 tons. The fully-permitted status and long remaining life of our active gypsum stack is a valuable resource that provides ongoing stability to our DAP operations. We believe that this stability provides us with a significant advantage over other companies whose gypsum disposal facilities have remaining lives that are significantly less than the remaining life of our active gypsum stack. Developing new gypsum disposal facilities has become increasingly difficult due to extensive capital investment requirements and a costly regulatory permitting process.

Key Strategic Alliances. In addition to our strategic relationship with OCP, we believe that our operating results benefit substantially from our broad-ranging alliances with two other strategic partners, Transammonia and International Commodities Export Corporation, or ICEC.

Transammonia, a major global trading company, supplies our ammonia requirements, priced competitively on a cost-plus basis, subject to an index-based maximum price. In addition, all of our DAP export sales and a significant portion of our domestic DAP sales are to Transammonia. Pursuant to our sales agreement with Transammonia, sales are made at a price composed of a market related “base price” plus an additional price related to the profitability of Transammonia’s ultimate sale. This framework allows us to achieve potentially higher profit margins on our sales. Under the Transammonia agreement, we maintain maximum flexibility and can react quickly to take advantage of changing price differentials in the domestic and export markets. In contrast, the agreement with our previous sole export customer, Phosphate Chemicals Export Association, Inc., or PhosChem, did not provide us this level of flexibility. Transammonia is also the exclusive user of our ammonia terminal, for which we receive ammonia throughput fees. Ammonia throughput fees consist of a base fee plus an additional fee related to the margins Transammonia achieves on sales through our terminal.

5

ICEC, the largest global marketer of sulfur, is our major supplier of sulfur. Pursuant to our sulfur supply contract with ICEC, ICEC supplies us with 7,000 to 12,000 long tons of sulfur per month. From time to time, at our request, ICEC sources additional sulfur and sulfuric acid to us. ICEC also purchases a significant portion of our DAP for resale into the U.S. domestic market.

Significant Management Experience. We benefit from the experience and long-standing industry relationships of our senior management team. On average, our senior management team has over 25 years of experience in the fertilizer industry. Our current senior leadership has successfully steered our business through the financial and operational challenges MPC faced during the bankruptcy of MPC and its former parent, Mississippi Chemical Corporation, or MCC, and, subsequently, Hurricane Katrina. We believe that our senior management team has the knowledge and experience to capitalize on business growth opportunities that will further enhance our reputation as well as our earnings and cash flow.

Business Strategy

Our objective is to increase long-term stockholder value. Key elements of our business strategy to accomplish our objective include:

Expand our manufacturing capacity to facilitate growth in revenues and cash flow. We plan to use substantially all of the net proceeds of this offering to build a new sulfuric acid plant and related cogeneration facility at our Pascagoula plant. Currently, our DAP production capacity is limited by our sulfuric acid production capacity, and the price of sulfuric acid in the open market makes the purchase of supplemental sulfuric acid economically unattractive. The new sulfuric acid plant will expand our sulfuric acid production capacity and will allow us to utilize our full DAP production capacity without relying on purchases of supplemental sulfuric acid. In addition, the new sulfuric acid plant will allow us to sell up to 95,000 tons of excess sulfuric acid per year into the merchant acid market. The new planned cogeneration operations will reduce our operating costs and provide additional revenue opportunities through the sale of excess electricity. We expect that the new sulfuric acid plant and related cogeneration unit will enable us to lower our DAP production cost per ton and increase our cash flow due to full utilization of our DAP production capacity, improved plant efficiency and reduced electricity costs.

Capture opportunities for higher margins by strategically targeting our sales to more profitable markets. We constantly monitor domestic and export DAP market conditions. Unlike other domestic DAP producers, we can react quickly to take advantage of favorable regional conditions and strategically target our sales into higher yielding markets. Historically, we have delivered most of our DAP for sale into the U.S. domestic market. However, in late 2007, when pricing in the export market became more advantageous, we swiftly increased the amount of our DAP sold into the export markets. Pursuant to our sales agreement with Transammonia, we maintain maximum flexibility and can react quickly to take advantage of changing price differentials between domestic and export markets. Sales are made at a price composed of a market related “base price” plus an additional price related to the profitability of Transammonia’s ultimate sale. This framework allows us to achieve potentially higher profit margins on our export sales.

Diversify and grow our revenue stream primarily through investment in additional projects that capitalize on our strategic location and existing facilities. We continuously evaluate strategic investment opportunities, such as expanding our terminaling services, that will enable us to diversify our revenue stream beyond DAP sales. Currently, we offer ammonia terminaling services to Transammonia, our exclusive supplier of ammonia. In 2007, we expanded our terminal to

6

accommodate Transammonia’s increased requirements, and Transammonia increased its minimum throughput commitments under our terminaling contract. We have commenced projects that will expand our terminaling capacity to handle liquid nitrogen fertilizers and sulfuric acid. We are also evaluating a project that will increase our capacity to handle dry bulk goods. In addition, we are exploring other capital projects such as uranium recovery from phosphoric acid and solid sulfur prilling. We believe that these potential capital projects, which capitalize on our location in a heavily industrialized area on a deep water channel with access to the Gulf of Mexico, and our existing infrastructure can help us diversify and grow our revenue stream.

Maintain our financial strength to respond to changes in product prices and raw material costs and to withstand downturns in our industry. Recent increases in the price of raw materials, including phosphate rock, sulfur and ammonia, have highlighted the importance of being able to respond quickly to changes in market prices for DAP and raw materials. The degree of liquidity required to operate our business and respond to market conditions has increased significantly. During 2007, we dramatically improved our liquidity through the repayment of the $4.9 million outstanding balance under our revolving credit facility and by increasing cash on hand to $43.6 million at December 31, 2007. Our enhanced liquidity affords us the flexibility to capitalize on changing market conditions. During 2007, our financial strength permitted us to strategically accumulate DAP inventory in anticipation of the higher DAP sales prices that materialized in late 2007, to capture arbitrage opportunities created by price differentials between domestic and export markets and to build significant raw material inventories in advance of sharp raw material price increases. At June 30, 2008, our cash on hand had declined to $31.3 million principally due to our March 2008 special dividend payment and the buildup of raw material inventories. We intend to maintain a strong balance sheet and ample capital reserves to protect against any future downturn in the industry.

Continue to evaluate opportunities to expand our business. We are constantly analyzing opportunities to expand our core business through investments and acquisitions. We also will consider expanding into new businesses that are compatible with our core competencies and synergistic with our current operations.

Maintain our commitment to operate our facilities in an environmentally responsible and safe manner. We are firmly committed to protecting the environment in which we operate and take pride in the significant progress we have made in this area. Since our emergence from bankruptcy in December 2004, the number of reported environmental permit exceedances at our Pascagoula plant declined by more than 75%, compared to the three year period prior to our emergence from bankruptcy. We continually review our processes and practices to identify methods to reduce the environmental impact of our operations.

Our commitment to maintaining a strong safety record has resulted in significant improvements in our safety programs since our emergence from bankruptcy in December 2004. Our success in our safety efforts is reflected in our workers’ compensation insurance premium rates, which we believe are approximately one-third lower than the industry average.

Corporate History and Principal Executive Offices

We were incorporated in December 2004 as a Delaware corporation to act as a holding company for MPC, a subsidiary of MCC and owner of the phosphate fertilizer business of MCC, which was spun off as part of MCC’s emergence from bankruptcy under Chapter 11 of the U.S. Bankruptcy Code, or the Bankruptcy Code. Our principal executive offices are located at 100 Webster Circle, Suite 4, Madison, Mississippi 39110, and our telephone number is (601) 898-9004.

7

The Offering

Common stock offered by us | shares. |

Common stock to be outstanding after this offering | shares. |

Option to purchase additional shares | The underwriters have a 30-day option to purchase up to additional shares of our common stock at the initial public offering price less underwriting discounts and commissions. |

Use of proceeds | We estimate that the net proceeds to us from this offering will be approximately $ million (based on the midpoint of the price range set forth on the cover page of this prospectus). |

| | We intend to use substantially all of the net proceeds of this offering to fund the engineering, design and construction of a new sulfuric acid plant to replace our existing sulfuric acid plants, which will allow us to utilize our full DAP production capacity. We intend to use the balance of the net proceeds for general corporate purposes or for other capital projects. See “Use of Proceeds.” |

Dividend policy | We do not currently intend to pay a regular dividend on our common stock. |

Exchange listing | We plan to apply for approval for listing on the , or , under the symbol “ .” |

Risk factors | See “Risk Factors” beginning on page 12 and other information appearing elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding whether to invest in our common stock. |

The number of shares of our common stock to be outstanding after this offering is based on 7,654,290 shares outstanding as of October 10, 2008. Unless otherwise indicated, this number and all information presented in this prospectus:

| | Ÿ | | assumes no exercise of the underwriters’ option to purchase up to additional shares of our common stock from us; |

| | Ÿ | | excludes 757,018 shares of our common stock issuable upon the exercise of outstanding stock options, with an exercise price of $2.36 per share; |

| | Ÿ | | excludes 46,703 shares of our common stock reserved for issuance under outstanding stock appreciation right, or SAR, awards; and |

| | Ÿ | | excludes shares of our common stock reserved for future issuance under our equity incentive plans. |

8

Summary Historical Consolidated Financial and Operating Information

The following tables show summary historical consolidated financial and operating data of Phosphate Holdings and its wholly owned subsidiary, MPC. We derived the summary historical consolidated financial data for each of the years ended December 31, 2007, 2006 and 2005 and as of December 31, 2007 and 2006 from our audited consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus. We derived the summary consolidated statement of operations data for the six months ended June 30, 2008 and 2007 and the summary consolidated balance sheet data as of June 30, 2008 from our unaudited consolidated interim financial statements and the related notes thereto appearing elsewhere in this prospectus, which, in the opinion of our management, have been prepared on the same basis as the audited consolidated financial statements and reflect all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of our operating results and financial position for those periods and as of those dates. The summary unaudited financial data for the six months ended June 30, 2008 are not necessarily indicative of our results for the year ending December 31, 2008, and our historical results are not necessarily indicative of our results for any future period. The per share data in the table below have been retroactively adjusted to give effect to a 7,654.29-to-1 stock split in June 2007. The information provided below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto and other financial information appearing elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | |

| | | Six Months

Ended June 30, | | Years Ended

December 31, | |

| | | 2008(1) | | 2007(1) | | 2007(1) | | 2006(1) | | | 2005(1) | |

| | | (In thousands, except per share and per ton data) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | |

DAP sales | | $ | 232,001 | | $ | 109,208 | | $ | 219,569 | | $ | 130,579 | | | $ | 100,151 | |

Other | | | 6,453 | | | 689 | | | 2,805 | | | 985 | | | | 513 | |

| | | | | | | | | | | | | | | | | |

Total net sales | | | 238,454 | | | 109,897 | | | 222,374 | | | 131,564 | | | | 100,664 | |

Cost of sales | | | 164,461 | | | 88,141 | | | 169,952 | | | 128,684 | | | | 90,117 | |

| | | | | | | | | | | | | | | | | |

Gross profit | | | 73,993 | | | 21,756 | | | 52,422 | | | 2,880 | | | | 10,547 | |

Selling, general and administrative expenses | | | 6,529 | | | 5,436 | | | 12,301 | | | 4,472 | | | | 2,879 | |

Impairment of assets | | | 1,572 | | | — | | | — | | | — | | | | — | |

| | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 65,892 | | | 16,320 | | | 40,121 | | | (1,592 | ) | | | 7,668 | |

Other income (expenses): | | | | | | | | | | | | | | | | | |

Interest, net | | | 293 | | | 67 | | | 301 | | | (735 | ) | | | (73 | ) |

Hurricane-related gain | | | — | | | 37,830 | | | 37,830 | | | — | | | | — | |

Other, net | | | 213 | | | 232 | | | 176 | | | 533 | | | | (246 | ) |

| | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 66,398 | | | 54,449 | | | 78,428 | | | (1,794 | ) | | | 7,349 | |

Income tax expense | | | 24,407 | | | 20,793 | | | 29,539 | | | — | | | | 2,465 | |

| | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 41,991 | | $ | 33,656 | | $ | 48,889 | | $ | (1,794 | ) | | $ | 4,884 | |

| | | | | | | | | | | | | | | | | |

Earnings (loss) per share, basic | | $ | 5.49 | | $ | 4.40 | | $ | 6.39 | | $ | (0.24 | ) | | $ | 0.68 | |

| | | | | | | | | | | | | | | | | |

Earnings (loss) per share, diluted | | $ | 5.19 | | $ | 4.40 | | $ | 6.04 | | $ | (0.24 | ) | | $ | 0.66 | |

| | | | | | | | | | | | | | | | | |

Cash dividends per share | | $ | 1.50 | | $ | — | | $ | — | | $ | — | | | $ | 0.68 | |

| | | | | | | | | | | | | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | |

EBITDA(2) | | $ | 71,866 | | $ | 57,513 | | $ | 85,676 | | $ | 2,931 | | | $ | 8,945 | |

| | | | | | | | | | | | | | | | | |

9

| | | | | | | | | | | | | | | |

| | | Six Months

Ended June 30, | | Years Ended

December 31, |

| | | 2008(1) | | 2007(1) | | 2007(1) | | 2006(1) | | 2005(1) |

| | | (In thousands, except per share and per ton data) |

Selected Operating Data: | | | | | | | | | | | | | | | |

Tons of DAP produced | | | 258.1 | | | 341.4 | | | 631.1 | | | 597.8 | | | 485.6 |

Tons of DAP sold | | | 266.3 | | | 346.9 | | | 620.6 | | | 579.8 | | | 478.7 |

Average sales price per ton of DAP sold | | $ | 871.06 | | $ | 314.83 | | $ | 353.80 | | $ | 225.21 | | $ | 209.21 |

Average cost of sales per ton of DAP sold | | $ | 617.58 | | $ | 254.08 | | $ | 273.85 | | $ | 221.95 | | $ | 188.25 |

| | | | | | | | | | | | |

| | | June 30,

2008(1) | | December 31, |

| | | | 2007(1) | | 2006(1) | | 2005(1) |

| | | (In thousands) |

Balance Sheet Data: | | | | | | | | | | | | |

Current assets | | $ | 144,751 | | $ | 79,418 | | $ | 24,463 | | $ | 24,585 |

Property, plant and equipment, net | | | 47,286 | | | 41,417 | | | 35,219 | | | 13,658 |

Total assets | | | 195,684 | | | 124,303 | | | 63,478 | | | 40,688 |

Total current liabilities | | | 62,504 | | | 23,124 | | | 12,922 | | | 17,994 |

Total long-term debt | | | — | | | — | | | 4,875 | | | — |

Asset retirement obligations | | | 5,333 | | | 5,086 | | | 4,627 | | | 4,209 |

Stockholders’ equity | | | 115,740 | | | 85,230 | | | 17,570 | | | 18,485 |

| (1) | For substantial intervals during the period from December 31, 2005 to June 30, 2008, as a result of several factors, including Hurricane Katrina and significant equipment failures, our production facilities in Pascagoula were not operating or were operating significantly below expected capacity. For a discussion of these factors, see “—Hurricane Katrina” and “—Equipment Failures” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our financial and operating data in the tables above and below reflect the effects of such unplanned shutdowns and reduced production rates. |

| (2) | We define EBITDA as net income before interest; income taxes; depreciation, amortization and accretion; and asset impairment charges. EBITDA is used as a supplemental financial measure by our management and by external users of our financial statements to assess: |

| | Ÿ | | the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; |

| | Ÿ | | our operating performance and return on capital as compared to other companies in the fertilizer business, without regard to financing or capital structure; and |

| | Ÿ | | the viability of acquisitions and capital expenditure projects and the overall rates of return on alternative investment opportunities. |

We use EBITDA as a primary operating performance measure and an important indicator of our ability to provide cash flows to meet future debt service, if any, capital expenditures and working capital requirements and to fund future growth.

The U.S. Generally Accepted Accounting Principles, or GAAP, measure most directly comparable to EBITDA is net income. Our non-GAAP financial measure of EBITDA should not be considered as an alternative to GAAP net income. You should not consider EBITDA in isolation or as a substitute for analysis of our results as reported under GAAP. Because EBITDA excludes some, but not all, items that affect income from continuing operations and is defined differently by different companies in our industry, our definition of EBITDA may not be comparable to similarly titled measures of other companies.

10

We compensate for the limitations of EBITDA as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this information into our decision-making processes.

The following table shows the reconciliation of net income (loss) to EBITDA for the periods indicated:

| | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended June 30, | | | Years Ended

December 31, |

| | | 2008 | | | 2007 | | | 2007 | | | 2006 | | | 2005 |

| | | (In thousands) |

Net income (loss) | | $ | 41,991 | | | $ | 33,656 | (a) | | $ | 48,889 | (a) | | $ | (1,794 | ) | | $ | 4,884 |

Interest, net | | | (293 | ) | | | (67 | ) | | | (301 | ) | | | 735 | | | | 73 |

Income tax provision | | | 24,407 | | | | 20,793 | | | | 29,539 | | | | — | | | | 2,465 |

Depreciation, amortization and accretion | | | 4,189 | | | | 3,131 | | | | 7,549 | | | | 3,990 | | | | 1,523 |

Asset impairment charge(b) | | | 1,572 | | | | — | | | | — | | | | — | | | | — |

| | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 71,866 | | | $ | 57,513 | | | $ | 85,676 | | | $ | 2,931 | | | $ | 8,945 |

| | | | | | | | | | | | | | | | | | | |

| (a) | This amount includes $37,830 of Hurricane Katrina insurance related pre-tax gains. |

| (b) | During the six months ended June 30, 2008, we recorded an asset impairment charge of $1,572 related to the failure of certain internal components of the waste heat boiler in our No. 2 sulfuric acid plant. See Notes 1(d) and 13(f) to our unaudited consolidated interim financial statements appearing elsewhere in this prospectus. |

11

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors together with all of the other information included in this prospectus in evaluating an investment in our common stock. If any of the following risks were actually to occur, our business, financial condition or operating results could be materially and adversely affected. In that case, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

Our operating results are highly dependent upon, and fluctuate based on, the business and economic conditions and policies affecting fertilizer demand and prices as well as the agriculture industry in general. These factors are outside of our control and may significantly affect our profitability.

Fertilizers, including DAP, are global commodities and can be subject to intense price competition from domestic and foreign sources, often resulting in volatile changes in pricing from one growing season to the next and sometimes within one growing season. Historically, the majority of our sales have been made into the U.S. domestic market. As a result, our operating results are highly dependent upon conditions in the U.S. agricultural industry. A variety of factors beyond our control can materially affect domestic fertilizer demand and pricing. These factors include, but are not limited to, future prices for crops, U.S. planted acreage, government agricultural policies, government energy policies, particularly as they relate to the use of ethanol, fertilizer application rates and product selection, projected grain stocks, crop failures, weather, field conditions, changing or unpredictable crop choices by farmers, changes in agricultural production methods and seed technologies and general economic conditions. U.S. governmental policies may directly or indirectly influence the number of acres planted, the level of grain inventories, the mix of crops planted or crop prices.

The substantial majority of our sales in the first half of 2008 were made into the export market. Therefore, our operating results may also be significantly influenced by international market conditions. The export market for fertilizers is influenced by such factors as foreign agricultural policies, particularly in countries with high fertilizer consumption rates such as India, China, Pakistan and Brazil; the relative value of the U.S. dollar and its impact upon the cost of importing or exporting fertilizers; the existence of, or changes in, import or foreign currency exchange barriers in certain foreign markets; changes in the hard currency demands of certain countries and other regulatory policies of foreign governments; as well as the laws and policies of the United States affecting foreign trade and investment.

Adverse changes in one or more of these factors could have a materially adverse effect on our profitability, operating results and financial condition.

Our operating results are subject to price and demand volatility resulting from periodic imbalances of supply and demand, which may cause our operating results to fluctuate.

The market for fertilizer products tends to be cyclical as periods of high demand, increasing profits and high capacity utilization generally lead to investments in new plants and increased production. This growth increases the supply of fertilizer until the market is over-supplied, leading to declining fertilizer prices and declining capacity utilization until the cycle repeats. This cyclicality can result in supply and demand imbalances, which exert both positive and negative pressure on prices and profit margins. If market participants significantly increase their production capacities, demand may be insufficient to support prices at current levels, which could adversely affect our business, financial condition and operating results. As a result, our future DAP prices may be significantly lower than those currently prevailing.

12

High fertilizer prices may result in a decrease in phosphate fertilizer demand.

Fertilizer demand may decrease when the expected increase in crop yields and resulting economic returns attributable to fertilizer application do not offset the user’s fertilizer cost. When financial factors constrain fertilizer application rates, the ultimate user will usually reduce phosphate and potash fertilizer usage because these nutrients remain in the soil longer than nitrogen, which must be replenished each year. As a result, a decrease in phosphate fertilizer demand caused by high fertilizer prices could adversely affect our operating results and cash flows.

Phosphate rock production is highly concentrated, and we are dependent upon one source to supply us with phosphate rock, the primary raw material in DAP.

Phosphate rock is the primary raw material used in the production of DAP, and its production is highly concentrated. Although more than 30 countries produce phosphate rock, the four largest producers (China, the United States, Morocco and Russia) account for nearly 75% of world production. Since 1991, we have purchased all of our phosphate rock from OCP, a corporation owned by the Kingdom of Morocco. Obtaining alternate sources of supply for phosphate rock on reasonable terms would be very difficult.

Historically, the purchase price of our phosphate rock has been determined annually based on negotiations with OCP. For 2008, however, our phosphate rock price was set for the first six months of the year and then re-set for each of the third quarter and the fourth quarter of the year. The price adjustments for the first six months and the third quarter of 2008 each involved substantial increases in our phosphate rock price. However, the purchase price of our phosphate rock for the fourth quarter of 2008 was recently set at a level below our third quarter phosphate rock price. OCP has advised us that it is presently engaged in a comprehensive review of its existing customer contracts and contract terms, which it intends to update and standardize. OCP has stated that its objective is to execute new multi-year contracts with all of its global customers, rather than to extend current agreements. In connection with this objective, OCP has notified us that, rather than extend the term of our current contract, it plans to enter into a new agreement with us prior to the expiration of our current agreement on December 31, 2008. Accordingly, in June 2008, OCP provided us with written notice that it will not extend our current four-year agreement beyond December 31, 2008. Although no assurances can be given, based on our long-standing positive relationship with OCP, we expect to reach a new multi-year agreement with OCP in advance of the expiration of our existing contract on December 31, 2008.

Additional increases in the price we pay for phosphate rock could adversely affect our operating results by significantly increasing our production costs, and we may not be able to pass through phosphate rock price increases to our customers. If we are unable to reach a new agreement with OCP, or if a new agreement provides pricing that is unfavorable to us, our operating results would be adversely affected, and we ultimately could be forced to halt the production of DAP, which would have a material adverse effect on our business.

Our operating results could be adversely affected by increases in other raw material prices, which may be subject to volatile pricing or an interruption of supply.

In addition to phosphate rock, we use other raw materials in the production of DAP, including ammonia, sulfur and sulfuric acid. Most of these raw materials are supplied to us by either a single supplier or a small number of suppliers. Increases in the prices we pay for these raw materials could adversely affect our operating results by significantly increasing our production costs. In recent years, markets for our primary raw materials have been very volatile. The prices of sulfur and ammonia have substantially increased in recent periods. We may not be able to pass through raw material price increases to our customers. Interruptions in the availability of raw materials caused by accidents, labor disputes, transportation delays or other events could also have an adverse effect on our business.

13

An unplanned shutdown of our production facility could have an adverse effect on our operating results.

Our production facility has a recent history of significant shutdowns. In August 2005, our production facility in Pascagoula was severely damaged by Hurricane Katrina and did not resume operations until February 2006. Our No. 2 sulfuric acid plant, which has a nameplate capacity of 1,500 tons of sulfuric acid per day, was idled for four months in the third and fourth quarters of 2007 and the first quarter of 2008 due to the failure of a waste heat boiler in July 2007 and the subsequent inability of the retained contractor to repair the boiler. On February 20, 2008, the same sulfuric acid plant was shut down due to the failure of an original fabrication weld and did not resume operation until March 15, 2008. In addition, the maximum production rate of both of our sulfuric acid plants was negatively impacted by leaking heat exchangers beginning in the second quarter of 2007 and continuing into 2008. We installed a new heat exchanger in our No. 2 sulfuric acid plant during the January/February 2008 repairs and in our No. 3 sulfuric acid plant during the scheduled May 2008 turnaround. Since May 2008, both of our sulfuric acid plants have routinely achieved production rates in excess of nameplate capacity.

Our operations are also subject to hazards associated with the manufacturing, handling, storage, transportation and disposal of chemical materials and products, including pipeline leaks and ruptures, explosions, fires, inclement weather and natural disasters, terrorist attacks, mechanical failures, unscheduled downtime, transportation interruptions, remediation complications, chemical spills, discharges or releases of toxic or hazardous substances, storage tank leaks or other risks. Any unplanned shutdown at our facility for an extended period as a result of any of these risks could significantly affect our ability to meet the demand requirements of our customers, thereby resulting in lost sales and profitability in the short term or eventual loss of customers in the long term. Because we have a single production facility, any one of the events described above could significantly disrupt our production and distribution of DAP, and any sustained disruption could have a material adverse effect on our business, financial condition and operating results.

We plan to use substantially all of the net proceeds from this offering for the construction of a new sulfuric acid plant, which will enable us to utilize our full DAP production capacity. There is no guarantee that the new sulfuric acid plant will be constructed for its current estimated cost, that the construction will be completed on time or that the new plant will operate efficiently or at its nameplate capacity. Any construction delays or cost overruns could impact our future profitability.

We currently intend to use substantially all of the net proceeds from this offering for the design and construction of a new sulfuric acid plant with a nameplate capacity of 3,600 tons of sulfuric acid per day, an increase of 600 tons per day over the nameplate capacity of our current sulfuric acid plants. The construction of a sulfuric acid plant involves complicated engineering, project management involving numerous contractors and subcontractors and complex governmental and regulatory permitting processes. Unforeseen circumstances frequently arise during the permitting and construction of such complex facilities, and such events may not be budgeted for or factored into the construction timeline. There is no guarantee that we will be able to complete this planned project or, if completed, that we will be able to complete the project on our anticipated schedule or for its current estimated cost of construction. Construction of a new sulfuric acid plant could divert management’s attention from other projects, and the construction itself will impact the day-to-day operations at our Pascagoula plant, which could adversely affect our operating results and cash flows.

14

We have identified a material weakness in our internal control over financial reporting. If we fail to remedy this material weakness or otherwise achieve and maintain effective internal control over financial reporting, we may not be able to accurately report our operating results or prevent fraud and, as a result, our business could be harmed and current and potential stockholders could lose confidence in us, which could cause our stock price to fall.

Prior to this offering, we were not subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and had limited accounting personnel and other resources with which to address our internal controls and procedures. As a public reporting company, we will be required, among other obligations, to maintain effective internal control over financial reporting suitable to prepare our publicly reported financial statements in a timely and accurate manner. In connection with this offering and in preparation for the re-audit of our financial statements for 2006 and 2007, we determined that a material weakness exists in our internal control over financial reporting. A material weakness is defined as a control deficiency, or combination of control deficiencies, that adversely affects an entity’s ability to initiate, authorize, record, process or report financial data reliably in accordance with GAAP such that there is more than a remote likelihood that a material misstatement of the entity’s financial statements will not be prevented or detected by the entity’s internal control over financial reporting. The material weakness we have identified relates to our lack of expertise to properly apply GAAP for non-routine and complex accounting issues. The material weakness resulted in a number of audit adjustments to our consolidated financial statements. This material weakness could result in a material misstatement of our financial statements or prevent us from identifying fraud. Moreover, we cannot assure you that we have identified all of our material weaknesses or that we will not have additional material weaknesses in the future. A material weakness may subject us to additional regulatory scrutiny or cause delays in filing our financial statements and periodic reports with the U.S. Securities and Exchange Commission, or the SEC, which might result in SEC penalties or a loss of public confidence in the reliability of our financial statements. This in turn could affect our ability to access the capital markets and cause the value of our stock to fall.

We hired a chief financial officer with extensive financial reporting experience and knowledge of GAAP in the second quarter of 2008. As his appointment alone will not be sufficient to overcome the material weakness, we intend to implement a number of additional measures, including: (i) hiring additional accounting personnel with experience in GAAP and SEC reporting requirements and (ii) engaging the use of a third party accounting service provider to further support and supplement our internal staff in accounting and related areas. There can be no assurance, however, that these steps will be implemented in a timely manner or that they will be sufficient to remediate our material weakness.

Upon completion of this offering, we will become subject to the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. Under Section 404 of the Sarbanes-Oxley Act and related SEC rules, we will be obligated, beginning with our Annual Report on Form 10-K for our fiscal year ending December 31, 2009, to assess the effectiveness of our internal control over financial reporting. Our independent registered public accounting firm will also be required to report on the effectiveness of our internal control over financial reporting. We have not yet begun our efforts to comply with these requirements, and it is possible that such efforts could result in the identification of additional material weaknesses or other reportable conditions.

A substantial majority of our total net sales are made to a few large customers.

During the first half of 2008, approximately 73% of our total net sales were made into international markets in order to capture higher prices. All of those sales were made to Transammonia, our sole export wholesaler. In 2007, we made 76% of our total net sales to three large customers. In 2006, we made 77% of our total net sales to four large customers. There can be no assurance that we will be able to maintain these customer relationships or that these customers will continue to purchase similar

15

quantities in the future. If we were to lose one or more of these customers, or if one or more of these customers were to change their demand, delays in replacing such customers, or a failure to meet such customers’ new demands, could have an adverse effect on our operating results.

As a DAP-only, single location producer, we are less diversified than our principal domestic competitors, and a decrease in the demand for DAP or increase in DAP supply could have a material adverse effect on our operating results.

We are dedicated exclusively to the production and marketing of DAP, while most of our domestic competitors are diversified, primarily into the nitrogen and potash-based fertilizer businesses and other chemical and industrial businesses. As a result of our DAP focus, we would likely be impacted more adversely by factors affecting our industry than we would if our business was more diversified. Decreases in the demand for or large increases in the supply of DAP could materially impact our operating results more than the operating results of our diversified competitors.

Some of our competitors have greater resources than we do, which may place us at a competitive disadvantage and adversely affect our sales and profitability. These competitors include domestic integrated producers and state-owned and government-subsidized entities in other countries.

We compete with a number of producers in the United States and globally, including state-owned and government-subsidized entities. Most of our primary domestic competitors have substantially greater operating and capital resources than we do. In addition, our primary domestic competitors have their own phosphate rock mines, which may allow them to have significantly lower production costs during periods of high phosphate rock prices, and some of our foreign competitors may have access to lower cost or government-subsidized raw materials, in each case placing us at a competitive disadvantage. Furthermore, some of our government-owned competitors may be willing to accept lower prices and profit on their products in order to support domestic employment or other political or social goals. To the extent that other fertilizer producers have competitive advantages or are willing to accept lower profit levels, the price of our products, our sales volumes and our profits may be adversely affected.

Loss of our key senior management personnel could adversely affect our business.

We believe that our continued success depends, in significant part, upon the collective abilities and continued service of our senior management personnel. On average, our senior managementteam has over 25 years of experience in the fertilizer industry. The loss of services of one or more of our key senior management personnel could adversely affect our future operating results.

Our inability to attract and retain skilled employees may result in significant increases in the cost of labor or a disruption in our operations.

As of June 30, 2008, we had 265 employees. Competition for skilled employees in the Pascagoula area, where our sole operating facility is located, is intense, and, as a result, we operate in a very competitive wage market. In addition, turnover of skilled employees has increased since Hurricane Katrina. Although we believe that our relations with our employees are good, we cannot give assurances that we will be successful in attracting and retaining needed skilled personnel in the future. Our business could be disrupted and our operating results could be adversely affected if we are unable to attract and retain skilled employees or if personnel costs increase substantially.

16

Our production facility is subject to extensive state and federal environmental, health and safety statutes and regulations, and our potential environmental liabilities may have an adverse effect on our business, financial condition or operating results.

Our operations involve the use, handling, processing, storage, transportation and disposal of hazardous materials, and we could incur substantial additional costs to comply with environmental, health and safety law requirements. We also could incur substantial costs for liabilities arising from past unknown releases of, or exposure to, hazardous substances. Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, or CERCLA, we could be held jointly and severally responsible for the removal or remediation of any hazardous substance contamination at our current facility, at neighboring properties to which such contamination may have migrated and at third-party waste disposal sites to which we have sent waste. We could also be held liable for natural resource damages. In addition, we are subject to liabilities for past operations at our current facilities and in some cases to liabilities for past operations by us and our predecessor companies and their subsidiaries. Liabilities under these and other environmental health and safety laws involve inherent uncertainties. Violations of environmental, health and safety laws are subject to civil, and, in some cases, criminal sanctions. As a result of liabilities under and violations of environmental, health and safety laws and related uncertainties, we may incur unexpected interruptions to operations, fines, penalties or other reductions in income, third-party claims for property damage or personal injury or remedial or other costs that would negatively impact our financial condition and operating results. Finally, we may discover currently unknown environmental problems or conditions. The discovery of currently unknown environmental problems may subject us to material capital expenditures or liabilities in the future.

Continued government and public emphasis on environmental issues can be expected to result in increased future investments for environmental controls at ongoing operations, which will be charged against income from future operations. Permit renewals and compliance with present and future environmental laws and regulations applicable to our operations may require substantial capital expenditures and may have a material adverse effect on our business, financial condition and operating results.

Our active gypsum disposal facility requires us to make quarterly contributions to a trust to fund the closure and post-closure care of the disposal facility. If we are unable to meet our current funding obligation, or any increased funding obligation, in violation of our permit, our business, financial condition and operating results would be adversely affected.

A by-product of DAP production is gypsum, a chemical with little commercial use or value, and we generate approximately 2.4 tons of gypsum per ton of DAP produced. The U.S. Environmental Protection Agency, or the EPA, requires us to dispose of our gypsum by storing it on the grounds of our production facility in Pascagoula. To dispose of our gypsum, we have two “stacks,” or gypsum disposal facilities. The older stack is no longer in use and is closed, although we remain obligated to maintain it in accordance with applicable environmental regulations. The Mississippi Department of Environmental Quality, or the MDEQ, regulates the newer, active gypsum stack as solid waste. The remaining capacity of the active stack is expected to support our operations for approximately 18 additional years assuming we produce at our maximum annual DAP production rate of approximately 870,000 tons. The MDEQ permit to operate the active stack is conditioned upon the requirement that we provide financial assurance for payment of the closure and post-closure care of the active stack, estimated to cost approximately $37.6 million in future, undiscounted dollars. We are fulfilling this obligation through a sinking fund arrangement whereby we make quarterly contributions of $0.2 million into an interest-bearing trust fund for closure and post-closure related costs to be incurred when the capacity of such stack is depleted. These payments will continue until funds in the trust, including earnings from trust assets, are sufficient to cover the estimated costs of closure at the

17

completion of the disposal site’s useful life and the post-closure costs for water treatment and leachate for 20 years after the closure. We must periodically review the adequacy of this fund and report any adjustments to the quarterly contributions (positive or negative) through an annual reporting requirement of the MDEQ permit. At June 30, 2008, the fair value of the trust assets available to fund this obligation was $3.5 million. Although we cannot give any assurances, we currently do not expect any increase in this funding requirement. If we are unable to meet this funding requirement, we may lose our permit to operate the active stack. The loss of this permit or the imposition of additional environmental requirements with respect to either stack could adversely affect our business, financial condition and operating results.

Our operating results could be adversely affected by disruption to our transportation or terminaling facilities for raw materials or by increased freight prices.

In the event of a disruption of existing transportation or terminaling facilities for raw materials, alternative transportation and terminaling facilities might not have sufficient capacity to fully serve our facilities. Freight is also an important factor in the total delivered cost of raw materials. Increases in the prices we pay for freight could adversely affect our operating results by significantly increasing production costs. We may not be able to pass through freight price increases to our customers. Freight also increases the delivered cost of our product to our customers, which tends to exert downward pressure on our prices.

Inadequate transportation and distribution infrastructure and capacity could limit our growth, and a shortage of bulk ships, barges and railcars and increased transit time could result in customer dissatisfaction, loss of sales and higher transportation costs.

Inadequate transportation and distribution infrastructure and capacity could limit our growth. We rely heavily upon barge and ocean freightliners and, to a much lesser degree, trucks, railcars and warehouse and port storage facilities to obtain raw materials and to deliver our product to our customers. Finding affordable and dependable transportation is important to our ability to obtain raw materials and to supply DAP to our customers. Higher costs for transportation services or an interruption or slowdown could result from labor disputes, derailments, adverse weather or other environmental events, short-term swings in demand for phosphate products and raw materials and changes to rail, barge or ocean freight systems. These disruptions and changes could interrupt or limit available transport services, which in turn could negatively affect our production or our ability to deliver our product to our customers. Any resulting customer dissatisfaction or loss of sales could negatively impact our financial performance.

Strong demand for grain and other bulk products can affect the availability of transportation and may lead to higher freight rates. The shipping industry currently has a shortage of ships, and the substantial time needed to build new ships prevents rapid market response. Delays and missed shipments resulting from transportation shortages, including ocean freightliners, barges, trucks and railcars for carrying product, and increased transit time may impact our ability to deliver our products on a timely basis, which could result in customer dissatisfaction and loss of sales and could negatively affect our financial performance.

Any future indebtedness could adversely affect our financial condition and impair our ability to operate our business.

At the time of this offering, we have no outstanding borrowings under our credit facility or other material indebtedness. Our credit facility allows us to borrow up to $30.0 million. Any indebtedness we incur in the future could have important consequences, including the following:

| | Ÿ | | it may limit our ability to borrow money to fund our working capital, capital expenditures and debt service requirements; |

18

| | Ÿ | | it may limit our flexibility in planning for, or reacting to, changes in our business; |

| | Ÿ | | it may make us more highly leveraged than some of our competitors, which may place us at a competitive disadvantage; |

| | Ÿ | | it may make us more vulnerable to a downturn in our business or the economy; |

| | Ÿ | | it may require us to dedicate a substantial portion of our cash flow from operations to the repayment of our indebtedness, thereby reducing the availability of our cash flow for other purposes; and |

| | Ÿ | | it may materially and adversely affect our business and financial condition if we are unable to service our indebtedness or obtain additional financing, as needed. |

In addition, our current credit facility contains financial and other restrictive covenants that may limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our debt. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Risks Related to This Offering

Our common stock price may be volatile, and you may lose all or part of your investment.

Securities markets worldwide experience significant price and volume fluctuations in response to general economic and market conditions and their effect on various industries. This market volatility could cause the price of our common stock to decline significantly without regard to our operating performance, and you may not be able to resell your shares at or above the price at which you purchased them. Any fluctuations could be based on various factors in addition to those otherwise described in this prospectus, including:

| | Ÿ | | our operating performance and the performance of our competitors; |

| | Ÿ | | the public’s reaction to our press releases, our other public announcements and our filings with the SEC; |

| | Ÿ | | changes in earnings estimates or recommendations by research analysts who follow us or other companies in our industry; |

| | Ÿ | | variations in general economic, market and political conditions; |

| | Ÿ | | the number of shares publicly traded; |

| | Ÿ | | actions of our current stockholders, including sales of our common stock by our directors and executive officers; |

| | Ÿ | | the arrival or departure of key personnel; and |

| | Ÿ | | other developments affecting us, our industry or our competitors. |

In addition, the stock market has recently experienced significant price and volume fluctuations. These fluctuations may be unrelated to the operating performance of particular companies. These broad market fluctuations may cause declines in the market price of our common stock. The price of our common stock could fluctuate based upon factors that have little or nothing to do with us or our performance, and those fluctuations could materially reduce our common stock price.

19

If securities or industry analysts do not publish research or reports about us, our industry or our market, or if they adversely change their recommendations regarding our common stock, then our stock price and trading volume could decline.

The trading market for our common stock is influenced by the research and reports that industry or securities analysts publish about us, our industry and our market. If no analyst elects to cover us and publish research or reports about us, the market for our common stock could be severely limited and our stock price could be adversely affected. In addition, if one or more analysts ceases coverage of us or fails to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline. If one or more analysts who elects to cover us adversely changes their recommendation regarding our common stock, our stock price could decline.

Future sales of our common stock or the perception that such sales may occur could depress our stock price.

Sales of a substantial number of shares of our common stock, either by us or by our stockholders, or the perception that such sales may occur, could depress the market price of our common stock and may impede our ability to raise additional capital in the future. Because we are currently not a reporting company under the Exchange Act, holders of our common stock are not required to file reports with the SEC disclosing their beneficial ownership of our common stock. As a result, there may be holders of our common stock who are unknown to us and who may control a substantial number of shares of our common stock and effect transactions that could depress the market price of our common stock.