Filed pursuant to Rule 424(b)(3)

Registration Number 333-154629

1,132,000 shares of common stock

LIVEBUZZ, INC.

This prospectus covers the resale by our 26 selling stockholders of 1,132,000 shares of our common stock. The selling stockholders’ names and share amounts are set forth under “Selling Stockholders and Plan of Distribution” in this prospectus. The shares will be offered by our selling stockholders initially at $.50 per share until such time as the shares are quoted on the OTC Bulletin Board or listed on a national exchange at which time the shares may be sold at prevailing market prices. We intend to apply to list our common shares for quotation on the OTC Bulletin Board but cannot assure that our application will be accepted by the OTC Bulletin Board. The offering will terminate on the earlier of the date all of the shares are sold or one year from the date hereof. We will not receive any proceeds from the sale of shares offered by the selling stockholders.

There is no public market for our common stock and it is not quoted or listed on any exchange.

Investing in our common stock involves substantial risks. See “Risk Factors” beginning on page 3.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 11, 2009.

TABLE OF CONTENTS

| |

|---|

| About this Prospectus | | | | i | |

| | | |

| Summary | | | | 1 | |

| | | |

| Summary Financial Data | | | | 2 | |

| | | |

| Risk Factors | | | | 3 | |

| | | |

| Forward-Looking Statements | | | | 11 | |

| | | |

| Use of Proceeds | | | | 12 | |

| | | |

| Selected Financial Data | | | | 12 | |

| | | |

| Management's Discussion and Analysis of | | |

| Financial Conditions and Results of Operations | | | | 13 | |

| | | |

| Business | | | | 16 | |

| | | |

| Management | | | | 20 | |

| | | |

| Security Ownership of Executive Officers, Directors and | | |

| Beneficial Owners of Greater than 5% of Our Common Stock | | | | 21 | |

| | | |

| Selling Stockholders and Plan of Distribution | | | | 23 | |

| | | |

| Related Party and Other Material Transactions | | | | 25 | |

| | | |

| Description of Capital Stock | | | | 25 | |

| | | |

| Shares Eligible for Future Sale | | | | 26 | |

| | | |

| Experts | | | | 26 | |

| | | |

| Legal Matters | | | | 26 | |

| | | |

| Where You Can Find More Information | | | | 26 | |

| | | |

| Financial Statements | | | | F- | 1 |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus as we have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where such an offer or sale is not permitted.

SUMMARY

This summary highlights material information regarding our company and the offering contained in this prospectus. However, you should read the entire prospectus carefully, including the financial information and related notes, before making an investment decision.

Business

Since May 2008, we have been developing social and communicative networking via our website LiveBuzz.com and our mobile-based software application. As of November 2008, we have completed the initial portions of integrating the Apple iPhone Global Positioning Satellite (GPS) technology with the LiveBuzz iPhone application. However, our software is still in Alpha testing mode and has not been tested for commercial launch. In order for our application to be ready for a full commercial launch, we must move on to a Beta testing mode in which the software will be put through rigorous real-world testing situations. Both the Alpha test and Beta test may reveal issues with the software that will prevent us from launching a commercial release and we may not be able to overcome these testing issues.

We were incorporated in April 2008 as a Nevada corporation and commenced operations at that same time. Our corporate office is located at 8635 W. Sahara Avenue, Suite 576, Las Vegas, Nevada 89117, and our telephone number is (702) 370-8255. Our website address is www.LiveBuzz.com. Information on our website is not a part of this prospectus.

The Offering

| | |

|---|

| Securities offered by our selling stockholders: | | 1,132,000 shares of common stock |

| | | |

| Common stock outstanding prior to and after the offering: | | 2,982,000 shares of common stock |

| | | |

| Use of proceeds: | | We will not receive any proceeds from the sale of the common stock. |

Description of Selling Stockholders

Through this prospectus, we are registering for resale 250,000 shares of common stock issued to our founder at inception, and 750,000 shares of common stock which we sold to three investors in April and May 2008 and 132,000 shares of common stock which we sold to a group of 22 investors in June and July 2008.

The names and share amounts of the selling stockholders are set forth under “Selling Stockholders and Plan of Distribution” in this prospectus. None of the selling stockholders are officers, directors or 10% or greater stockholders of our company, except Tony Caporicci, our Chief Executive Officer and a director, nor are any affiliated or associated with any broker-dealers. Mr. Caporicci is offering 250,000 shares for sale.

1

SUMMARY FINANCIAL DATA

The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited financial statements and related notes for the period from inception (April 4, 2008) to April 30, 2008, and our unaudited financial statements and related notes for the six months ended October 31, 2008.

Statement of Operations Data

| Six months

Ended

October 31,

2008

(Unaudited)

| | Period From

Inception

(April 4,

2008)

to April 30,

2008

| |

|---|

| | |

|---|

| Revenue | | | $ | — | | $ | — | |

| Loss from operations | | | $ | (62,230 | ) | $ | (2,450 | ) |

| Net loss | | | $ | (62,230 | ) | $ | (2,450 | ) |

| Net loss per share of common stock | | | $ | (0.02 | ) | $ | (0.00 | ) |

Balance Sheet Data

| As of

October 31,

2008

(Unaudited)

| | As of

to April 30,

2008

| |

|---|

| | |

|---|

| Total assets | | | $ | 4,758 | | $ | 50,500 | |

| Total liabilities | | | $ | 5,838 | | $ | 350 | |

| Working capital (deficit) | | | $ | (4,411 | ) | $ | 50,150 | |

| Stockholders' equity (deficit) | | | $ | (1,080 | ) | $ | 50,150 | |

2

RISK FACTORS

The shares of common stock offered by this prospectus involve a high degree of risk and represent a highly speculative investment. You should not purchase these shares if you cannot afford the loss of your entire investment. In addition to the other information contained in this prospectus, you should carefully consider the following risk factors in evaluating our company, our business prospects and an investment in our shares of common stock.

Our auditors believe there is substantial doubt that we can continue as a going concern.

In their audit report dated August 5, 2008, our auditors indicated that there was substantial doubt that we could continue as a going concern. If we are unable to generate cash from earnings or from the sale of equity securities, we could be required to reduce our operations.

If we ware unable to attract users to our website, we will be unable to generate revenue, attain profitability, expand the range of our services or enter new markets.

We have not yet generated revenue, and we intend to generate future revenue by selling advertising space on our website. Therefore, to derive any significant revenues, we must attract users to our website. We will offer social networking services on our website, but we cannot guarantee that our product offering will attract users. Furthermore, to be able to maintain or increase our revenues, we will have to retain users and attract new ones. If we are unable to do so, future revenues could decrease.

There is substantial competition for social networking sites, and our current social network has no members. As many Internet users already belong to a social networking site, we cannot guarantee that they will want to join an additional site.

Social networking sites such as Myspace.com, Facebook.com, and Bebo.com currently have memberships exceeding one hundred million users. Many of our prospective members will already belong to an established social networking site, and it may be difficult to convince users to join an additional site.

The success of building a social network depends on building a critical mass of members. Without a significant member base, there will be limited interaction between our members. If we are unable to build a significant member base through our initial marketing efforts, it is unlikely that the social networking component of our business will be successful.

If we fail to deliver our applications to correspond with the commercial introduction of new mobile phone models, our sales may suffer.

Our business is tied, in part, to the commercial introduction of new mobile phone models with enhanced features, including color screens and greater processing power. Many new mobile phone models are released in the final quarter of the year to coincide with the holiday shopping season. We cannot control the timing of these mobile phone launches. Some of our customers download our applications soon after they purchase their new mobile phones in order to experience the new features of those phones. If we miss the opportunity to sell applications when our customers upgrade to a new mobile phone due to application launch delays, our sales may suffer. In addition, if we miss the key holiday selling period, either because the introduction of a new mobile phone model is delayed or we do not successfully deploy our applications in time for the holiday selling season, our sales may suffer.

3

Wireless communications technology is changing rapidly, and we may not be successful in working with these new technologies.

Wireless network and mobile phone technologies are undergoing rapid innovation. New mobile phones with more advanced processors and supporting advanced programming languages continue to be introduced in the market. We have no control over the demand for, or success of, these products. However, if we fail to anticipate and adapt to these and other technological changes, our market share and our operating results may suffer. Our future success will depend on our ability to adapt to rapidly changing technologies, develop applications to accommodate evolving industry standards and improve the performance and reliability of our applications. In addition, the widespread adoption of networking or telecommunications technologies or other technological changes could require substantial expenditures to modify or adapt our entertainment applications.

The markets for our applications, products and services are also characterized by frequent new mobile phone model introductions and shortening mobile phone model life cycles. The development of new, technologically advanced applications to match the advancements in mobile phone technology is a complex process requiring significant research and development expense, as well as the accurate anticipation of technological and market trends. As the life cycle of mobile phone models and other wireless devices shortens, we will be required to develop and adapt our existing applications and create new applications more quickly. These efforts may not be successful. Any failure or delay in anticipating technological advances or developing and marketing new applications that respond to any significant change in technology or customer demand could limit the available channels for our applications and limit or reduce our sales.

Actual or perceived security vulnerabilities in mobile phones could adversely affect our revenues.

Maintaining the security of mobile phones and wireless networks is critical for our business. There are individuals and groups who develop and deploy viruses, worms and other malicious software programs that may attack wireless networks and mobile phones. Recently, security experts identified what appears to be the first computer “worm” program targeted specifically at mobile phones. The worm, entitled “Cabir,” targets mobile phones running the Symbian(R) operating system. While the “Cabir” worm has not been widely released and presents little immediate risk to our business, we believe future threats could lead some customers to seek to return our applications, reduce or delay future purchases or reduce or delay the use of their mobile phones. Wireless carriers and mobile phone manufacturers may also increase their expenditures on protecting their wireless networks and mobile phone products from attack, which could delay adoption of new mobile phone models. Any of these activities could adversely affect our revenues.

Changes in government regulation of the media and wireless communications industries may adversely affect our business.

It is possible that a number of laws and regulations may be adopted in the United States and elsewhere which could restrict the media and wireless communications industries, including laws and regulations relating to customer privacy, taxation, content suitability, copyright, distribution and antitrust. Furthermore, the growth and development of the market for electronic commerce may prompt calls for more stringent consumer protection laws that may impose additional burdens on companies such as ours conducting business through wireless carriers. Changes in current laws or regulations or the imposition of new laws and regulations in the United States or elsewhere regarding the media and wireless communications industries may lessen the growth of wireless communications services and may materially reduce our ability to increase or maintain sales of our applications.

4

A decline in, or limitation on, the use of mobile phones would negatively impact our business.

A number of public and private entities have begun to restrict the use of mobile phones on their premises. For example, many places of worship, restaurants, hospitals, medical offices, libraries, museums, concert halls and other private and public businesses restrict the use of mobile phones due to privacy concerns, the inconvenience caused by mobile phone users to other patrons and the disruption mobile phones may cause to other electronic equipment at these locations.

Legislation has also been proposed in the U.S. Congress and by many states and municipalities to restrict or prohibit the use of mobile phones while driving motor vehicles. Some states and municipalities in the United States have already passed laws restricting the use of mobile phones while driving, and similar laws have been enacted in other countries. These laws and other potential laws prohibiting or restricting the use of mobile phones could reduce demand for mobile phones generally and, accordingly, the demand for our applications, which could reduce our ability to increase or maintain sales of our applications.

A number of studies have examined the health effects of mobile phone use and the results of some of the studies have been interpreted as evidence that mobile phone use causes adverse health effects. The establishment of a link between the use of mobile phone services and health problems, and any media reports suggesting such a link, could reduce demand for mobile phones and, accordingly, the demand for our applications.

Our business depends on the growth and maintenance of wireless communications infrastructure.

Our success will depend on the continued growth and maintenance of wireless communications infrastructure in the United States and around the world. This includes deployment and maintenance of reliable next-generation digital networks with the necessary speed, data capacity and security for providing reliable wireless communications services. Wireless communications infrastructure may be unable to support the demands placed on it if the number of customers continues to increase, or if existing or future customers increase their bandwidth requirements. In addition, viruses, worms and similar break-ins and disruptions from illicit code or unauthorized tampering may harm the performance of wireless communications. If a well-publicized breach of security were to occur, general mobile phone usage could decline, which could reduce the demand for and use of our applications. Wireless communications experience a variety of outages and other delays as a result of infrastructure and equipment failures, and could face outages and delays in the future. These outages and delays could reduce the level of wireless communications usage as well as our ability to distribute our applications successfully.

Our business may depend on third parties to resell our advertising space, and we cannot control the rates paid to us for our advertising space.

We do not have the resources to sell advertising space directly to advertisers, so we must rely on third parties such as Google or Yahoo to resell the advertising space on our website or through our mobile applications. Furthermore, it is possible that advertising rates may decline as more websites are added to the Internet thus creating more advertising space.

5

Our inability to obtain capital, use internally generated cash, or use shares of our capital stock or debt to finance future expansion efforts could impair the growth and expansion of our business.

Reliance on internally generated cash or debt to finance our operations or complete business expansion efforts could substantially limit our operational and financial flexibility. The extent to which we will be able or willing to use shares of capital stock to consummate expansions will depend on the value of our capital stock from time to time and the willingness of potential investors, sellers or business partners to accept it as full or partial payment. Using shares of capital stock for this purpose also may result in significant dilution to our then existing shareholders. To the extent that we are unable to use capital stock to make future expansions, our ability to grow through expansions may be limited by the extent to which we are able to raise capital for this purpose through debt or equity financings. No assurance can be given that we will be able to obtain the necessary capital to finance a successful expansion program or our other cash needs. If we are unable to obtain additional capital on acceptable terms, we may be required to reduce the scope of any operations. In addition to requiring funding for expansions, we may need additional funds to implement our internal growth and operating strategies or to finance other aspects of our operations. Our failure to (i) obtain additional capital on acceptable terms, (ii) use internally generated cash or debt to complete expansions because it significantly limits our operational or financial flexibility, or (iii) use shares of capital stock to make future expansions may hinder our ability to actively pursue any expansion program we may decide to implement.

We do not currently maintain redundant capabilities and a catastrophic event could be costly and result in significant disruption of our services.

Our computer equipment and the telecommunications infrastructure of our third-party network provider are vulnerable to damage from fires, earthquakes, floods, power loss, telecommunications failures, terrorism and similar events. Our servers are also vulnerable to computer viruses, worms, physical and electronic break-ins, sabotage and similar disruptions from unauthorized tampering of our computer systems. We do not currently maintain redundant capabilities and a catastrophic event could result in a significant and extended disruption of our services. Currently, we do not have a disaster recovery plan to address these and other vulnerabilities. As a result, it would be difficult to operate our business in the event of a disaster. Any prolonged disruption of our services due to these, or other events, would severely impact or shut down our business.

Our business depends on continued and unimpeded access to the Internet and Internet service providers may be able to block, degrade or charge us or our users additional fees for our offerings.

Our users rely on access to the Internet to use our websites. Internet service providers may take measures that could degrade, disrupt or increase the cost of our websites by restricting or prohibiting the use of their lines for our websites, by filtering, blocking, delaying or degrading the packets containing the data associated with our websites, or by charging increased fees to us or our users for use of their lines for our websites. Some of these providers may contractually restrict their customers’ access to our offerings through their terms of service with their customers. These activities are technically feasible and may be permitted by applicable law. In addition, Internet service providers could attempt to charge us each time our users use our websites. Interference with our websites or higher charges for access to our websites, whether paid by us or by our users, could cause us to lose existing users, impair our ability to attract new users, and harm our revenues and growth.

6

Our Chief Executive Officer does not devote his full time to our operations, which could limit our operations and growth.

Tony Caporicci, our Chief Executive Officer, Treasurer and a director of our company, devotes only 50% of his time to our operations, thereby potentially limiting our operations and growth.

Our results of operations and key business metrics may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our results of operations and key business metrics may fluctuate as a result of a variety of factors, many of which are outside of our control. As a development company in a rapidly evolving industry, it may be difficult for us and others to accurately predict future performance. If our results of operations or key business metrics fall below the expectations of investors, the trading price of our common stock, if any, could decline. Fluctuations in our results of operations and key business metrics may be due to a number of factors, including:

| | • | the number of members accessing our services and the extent of their engagement with our services; |

| | • | variations in our advertising revenues and our ability to attract members to our social networking services; and |

| | • | the timing and success of new service introductions by us or our competitors. |

We believe that our results of operations and key business metrics may vary significantly in the future and that period-to-period comparisons of our results of operations and key business metrics may not be meaningful. You should not rely on the results of one period as an indication of our future performance. In addition, if our results of operations and key business metrics do not meet or exceed the expectations of securities analysts or investors, the price of our common stock could decline substantially.

If we are unable to develop new or enhanced features or fail to predict or respond to emerging trends, our revenue and any profitability will suffer.

Our future success will depend in part on our ability to modify or enhance our website features to meet users demands, add features and address technological advancements. If we are unable to predict preferences or industry changes, or if we are unable to modify our website features in a timely manner, we may lose members. New features may be dependent upon our obtaining needed technology or services from third parties, which we may not be able to obtain in a timely manner, upon terms acceptable to us, or at all. We spend significant resources developing and enhancing our features. However, new or enhanced features may have technological problems or may not be accepted by users. If we are unable to successfully develop, acquire or implement new features or enhance our existing features in a timely and cost-effective manner, our revenue and any profitability will suffer.

Our business is subject to online security risks, including security breaches and identity theft.

To succeed, online commerce and communications must provide a secure transmission of confidential information over public networks. Our security measures may not detect or prevent security breaches that could harm our business. We expect that our websites will process a significant amount of financial transactions between buyers and sellers. We rely on encryption and authentication technology licensed from third parties to provide the security and authentication to effect secure transmission of confidential information. Advances in computer capabilities, new discoveries in the field of cryptography or other developments may result in a compromise or breach of the technology we use to protect transaction data. In addition, any party who is able to illicitly obtain a user’s password could access the user’s transaction data. An increasing number of websites have reported breaches of their security. Any compromise of our security could harm our reputation and, therefore, our business. In addition, a party that is able to circumvent our security measures could misappropriate proprietary information, cause interruption in our operations, damage our computers or those of our users, or otherwise damage our reputation and business.

7

Our servers will be also vulnerable to computer viruses, physical or electronic break-ins, and similar disruptions, and we may experience “denial-of-service” type attacks on our system that may make all or portions of our websites unavailable for periods of time. We may need to expend significant resources to protect against security breaches or to address problems caused by breaches. These issues are likely to become more difficult as we expand the number of places where we operate. Security breaches could damage our reputation and expose us to a risk of loss or litigation and possible liability. Our insurance policies carry low coverage limits, which may not be adequate to reimburse us for losses caused by security breaches.

Our users may be targeted by parties using fraudulent “spoof” emails to misappropriate passwords, credit card numbers, or other personal information or to introduce viruses through “Trojan horse” programs to our users’ computers. These emails appear to be legitimate emails sent by us or one of our users, but direct recipients to fake websites operated by the sender of the email or request that the recipient send a password or other confidential information via email or download a program. We expect to attempt to mitigate “spoof” e-mails through product improvements and user education but if we are unsuccessful to eliminate the threat to a substantial degree, our brand may be damage, users may be discouraged to use our websites, and our costs may increase.

Assertions by a third party that we infringe its intellectual property could result in costly and time-consuming litigation, expensive licenses or the inability to operate as planned.

The software and technology industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property rights claims against us may grow. Our technologies may not be able to withstand third-party claims or rights restricting their use. Companies, organizations or individuals, including our competitors, may hold or obtain patents or other proprietary rights that would prevent, limit or interfere with our ability to provide our services or develop new services and features, which could make it more difficult for us to operate our business.

If we are determined to have infringed upon a third party’s intellectual property rights, we may be required to pay substantial damages, stop using technology found to be in violation of a third party’s rights or seek to obtain a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms, or at all, and may significantly increase our operating expenses or may require us to restrict our business activities in one or more respects. We may also be required to develop alternative non-infringing technology, that could require significant effort and expense or may not be feasible. In the event of a successful claim of infringement against us and our failure or inability to obtain a license to the infringed technology, our business and results of operations could be harmed.

8

If we fail to implement and maintain proper and effective internal controls and disclosure controls and procedures, our ability to produce accurate and timely financial statements and public reports could be impaired, which could adversely affect our operating results, our ability to operate our business and investors’ views of us.

We must ensure that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis. We will be required to spend considerable effort establishing and maintaining our internal controls, which will be costly and time-consuming and will need to be re-evaluated frequently. We are in the process of documenting, reviewing and, if appropriate, improving our internal controls and procedures in anticipation of being a reporting company and eventually being subject to Section 404 of the Sarbanes-Oxley Act of 2002, which will require annual management assessments of the effectiveness of our internal control over financial reporting. Both we and our independent auditors will be testing our internal controls in anticipation of being subject to these Section 404 requirements and, as part of that documentation and testing, may identify areas for further attention and improvement. We are in the process of developing disclosure controls and procedures designed to ensure that information required to be disclosed by us in our public reports and filings is recorded, processed, summarized and reported within the time periods specified by applicable SEC rules and forms.

Implementing any appropriate changes to our internal controls and disclosure controls and procedures may entail substantial costs to modify our existing financial and accounting systems and internal policies, take a significant period of time to complete, and distract our officers, directors and employees from the operation of our business. These changes may not, however, be effective in establishing or maintaining the adequacy of our internal controls or disclosure controls, and any failure to maintain that adequacy, or a consequent inability to produce accurate financial statements or public reports on a timely basis, could materially adversely affect our business. Further, investors’ perceptions that our internal controls or disclosure controls are inadequate or that we are unable to produce accurate financial statements may seriously affect the price of our common stock.

We may be required to seek additional funding, and such funding may not be available on acceptable terms or at all.

We may need to obtain additional funding due to a number of factors beyond our expectations or control, including a shortfall in revenue, increased expenses, increased investment in capital equipment or the acquisition of businesses, services or technologies. If we do need to obtain funding, it may not be available on acceptable terms or at all. If we are unable to obtain sufficient funding, our business would be harmed. Even if we were able to find outside funding sources, we might be required to issue securities in a transaction that could be highly dilutive to our investors or we may be required to issue securities with greater rights than the securities we have outstanding today. We may also be required to take other actions that could lessen the value of our common stock, including borrowing money on terms that are not favorable to us. If we are unable to generate or raise capital that is sufficient to fund our operations, we may be required to curtail operations, reduce our services, defer or cancel expansion or acquisition plans or cease operations in certain jurisdictions or completely.

9

We are a relatively new business in an emerging industry and need to manage the introduction of new products and services in order to avoid increased expenses without corresponding revenues.

We will be introducing new services to consumers in order to establish ourselves as a leader in the evolving market for social networking services. Introducing new or enhanced products and services requires us to increase expenditures before we generate revenues. For example, we may need to hire personnel to oversee the introduction of new services before we generate revenues from these services. Our inability to generate satisfactory revenues from such expanded services to offset costs could have a material adverse effect on our business, results of operations and financial condition.

Our success is dependent on keeping pace with advances in technology. If we are unable to keep pace with advances in technology, consumers may not use our services and our revenues will suffer. If we are required to invest substantial amounts in technology, our results of operations will suffer.

The Internet and electronic commerce markets are characterized by rapid technological change, changes in user and customer requirements, frequent new service and product introductions embodying new technologies and the emergence of new industry standards and practices that could render our existing Web sites and technology obsolete. These market characteristics are exacerbated by the emerging nature of the market and the fact that many companies are expected to introduce new Internet products and services in the near future. If we are unable to adapt to changing technologies, our business, results of operations and financial condition could be materially and adversely affected. Our performance will depend, in part, on our ability to continue to enhance our existing services, develop new technology that addresses the increasingly sophisticated and varied needs of our prospective customers, license leading technologies and respond to technological advances and emerging industry standards and practices on a timely and cost-effective basis. The development of our Web sites and other proprietary technology entails significant technical and business risks. We may not be successful in using new technologies effectively or adapting our Web sites, or other proprietary technology to customer requirements or to emerging industry standards. In addition, if we are required to invest substantial amounts in technology in order to keep pace with technological advances, our results of operations will suffer.

Because our common stock may be classified as “penny stock,” trading may be limited, and the share price could decline.

Because our common stock mayfall under the definition of “penny stock,” trading in the common stock, if any, may be limited because broker-dealers would be required to provide their customers with disclosure documents prior to allowing them to participate in transactions involving the common stock. These disclosure requirements are burdensome to broker-dealers and may discourage them from allowing their customers to participate in transactions involving the common stock.

“Penny stocks” are equity securities with a market price below $5.00 per share other than a security that is registered on a national exchange, included for quotation on the NASDAQ system or whose issuer has net tangible assets of more than $2,000,000 and has been in continuous operation for greater than three years. Issuers who have been in operation for less than three years must have net tangible assets of at least $5,000,000.

Rules promulgated by the Securities and Exchange Commission under Section 15(g) of the Exchange Act require broker-dealers engaging in transactions in penny stocks, to first provide to their customers a series of disclosures and documents including:

| | • | A standardized risk disclosure document identifying the risks inherent in investment in penny stocks; |

| | • | All compensation received by the broker-dealer in connection with the transaction; |

10

| | • | Current quotation prices and other relevant market data; and |

| | • | Monthly account statements reflecting the fair market value of the securities. |

These rules also require that a broker-dealer obtain financial and other information from a customer, determine that transactions in penny stocks are suitable for such customer and deliver a written statement to such customer setting forth the basis for this determination.

Our directors and executive officers will continue to exert significant control over our future direction, which could reduce the sale value of our company.

The sole member of our Board of Directors and our executive officer own 70.42% of our outstanding common stock. Accordingly, this stockholder will be able to control all matters requiring approval of our stockholders, including the election of directors and approval of significant corporate transactions. This concentration of ownership, which could result in a continued concentration of representation on our Board of Directors, may delay, prevent or deter a change in control and could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our assets.

Investors should not anticipate receiving cash dividends on our common stock.

We have never declared or paid any cash dividends or distributions on our common stock and intend to retain future earnings, if any, to support our operations and to finance expansion. Therefore, we do not anticipate paying any cash dividends on the common stock in the foreseeable future.

There is a reduced probability of a change of control or acquisition of us due to the possible issuance of additional preferred stock. This reduced probability could deprive our investors of the opportunity to otherwise sell our stock in an acquisition of us by others.

Our Articles of Incorporation authorize our Board of Directors to issue up to 5,000,000 shares of preferred stock, of which no shares have been issued. Our preferred stock is issuable in one or more series and our Board of Directors has the power to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, liquidation preferences and the number of shares constituting any series or designation of such series, without further vote or action by stockholders. As a result of the existence of this “blank check” preferred stock, potential acquirers of our company may find it more difficult to, or be discouraged from, attempting to effect an acquisition transaction with, or a change of control of, our company, thereby possibly depriving holders of our securities of certain opportunities to sell or otherwise dispose of such securities at above-market prices pursuant to such transactions.

Our general and administrative expenses will increase if and when we become a public reporting company.

General and administrative expenses associated with legal, accounting and financial compliance costs are expected to increase by approximately $25,000 annually at such time as this prospectus is declared effective by the Securities and Exchange Commission and we therefore become subject to the reporting requirements of the Securities Exchange Act of 1934, as amended. The costs will include annual audits of our financial statements, review of our quarterly unaudited financial statements, legal reviews of our filings and Edgar filing costs.

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. We have based these forward-looking statements on our current expectations about future events. These forward-looking statements are subject to risks, uncertainties and assumptions about us which are discussed in the “Risk Factors” section above and throughout this prospectus. In light of these risks, uncertainties and assumptions, any forward-looking events discussed in this prospectus might not occur.

11

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of our common stock being offered by the selling stockholders.

SELECTED FINANCIAL DATA

Statement of Operations Data

| Six months

Ended

October 31,

2008

(Unaudited)

| | Period From

Inception

(April 4,

2008)

to April 30,

2008

| |

|---|

| | |

|---|

| Revenue | | | $ | — | | $ | — | |

| Loss from operations | | | $ | (62,230 | ) | $ | (2,450 | ) |

| Net loss | | | $ | (62,230 | ) | $ | (2,450 | ) |

| Net loss per share of common stock | | | $ | (0.02 | ) | $ | (0.00 | ) |

Balance Sheet Data

| As of

October 31,

2008

(Unaudited)

| | As of

to April 30,

2008

| |

|---|

| | |

|---|

| Total assets | | | $ | 4,758 | | $ | 50,500 | |

| Total liabilities | | | $ | 5,838 | | $ | 350 | |

| Working capital (deficit) | | | $ | (4,411 | ) | $ | 50,150 | |

| Stockholders' equity (deficit) | | | $ | (1,080 | ) | $ | 50,150 | |

12

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

We and our representatives may from time to time make written or oral forward-looking statements, including statements included in or incorporated by reference into this prospectus and other filings made with the Securities and Exchange Commission. These forward-looking statements are based on management’s views and assumptions and involve risks, uncertainties and other important factors, some of which may be beyond our control, that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in this Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this prospectus. Readers should carefully review the risks described in this and other documents that we may file from time to time with the Securities and Exchange Commission. The forward-looking statements speak only as of the date that they are made, however, we are obligated in certain circumstances to update or revise the disclosures in this prospectus in accordance with Federal securities laws.

Overview of the Business

Since May 2008, we have been developing social networking services to be used on mobile devices and through our website, LiveBuzz.com.

Liquidity and Capital Resources

As of October 31, 2008, we had a working capital deficit of $(4,411), comprised of current assets of $1,427 and current liabilities of $5,838. We expect our working capital balance to fluctuate significantly as we develop our business.

All of our capital resources to date have been provided exclusively through the sale of equity securities. From inception to October 31, 2008, we received cash proceeds of $61,500 from the sale of our common stock. In addition, we issued 2,100,000 shares of common stock to a founder in exchange for certain website assets.

We expect to need additional funding to achieve our business development goals. We believe our existing cash resources will only satisfy our working capital needs through our year ending ending April 30, 2009. We expect to need approximately $75,000 to continue on operations for the next 12 months. Accordingly, our ability to continue as a going concern will be contingent upon our ability to obtain this capital through the sale of equity or issuance of debt, joint venture or sale of assets, and ultimately attaining profitable operations. There is no assurance that we will be able to successfully complete these activities and if we are unable to do so we may be required to terminate our operations.

The report of our registered independent public accountants on our financial statements at April 30, 2008 contains a qualification about our ability to continue as a going concern. This qualification is based on our lack of operating history, among other things.

We do not believe that we are a candidate for conventional debt financing and we have not made arrangements to borrow funds under a working capital line of credit. We believe that the most likely source of future funding, if any, will be the sale of equity or borrowings from related parties, however, we have no firm or written agreements regarding financing.

Net cash used in operating activities during the six months ended October 31, 2008 was $56,826, primarily consisting of our net loss for the period.

Net cash used in investing activities during the six months ended October 31, 2008 was $3,747, which consisted of capital expenditures for computer equipment and software.

Results of Operations – For the six months endedOctober 31, 2008

We are considered a development stage company for accounting purposes, since we have not commenced our planned principle operations. We are unable to predict with any degree of accuracy when this classification will change. We expect to incur losses until such time, if ever, as we begin generating revenue from operations.

For the six months ended October 31, 2008, we recorded a net loss of $(62,230), or $(0.02) per share.

We have never received revenue from our operations.

13

Operating expenses were $62,230 for the six months ended October 31, 2008. The expenses consisted primarily of $48,260 for website development, and general and administrative expenses of $13,970, including legal and accounting fees associated with being a public company of $6,211, travel expenses of $2,545, and other general and administrative expenses of $2,375.We expect operating expenses to increase substantially as we develop our business. General and administrative expenses associated with legal, accounting and financial compliance costs are expected to increase by approximately $25,000 annually at such time as this prospectus is declared effective by the Securities and Exchange Commission and we therefore become subject to the reporting requirements of the Securities Exchange Act of 1934, as amended. The costs will include annual audits of our financial statements, review of our quarterly unaudited financial statements, legal reviews of our filings and Edgar filing costs.

Development Stage Company

We are considered to be in the development stage as defined in Statement of Financial Accounting Standards (SFAS) No. 7, “Accounting and Reporting by Development Stage Enterprises”. We have devoted substantially all of our efforts to business planning and development. Additionally, we have allocated a substantial portion of our time and investment to bringing our product to the market, and to raising capital.

Use of Estimates

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates have been used by management in conjunction with the measurement of the valuation allowance relating to deferred tax assets and future cash flows associated with long-lived assets. Actual results could differ from those estimates.

Cash and Cash Equivalents

For financial statement presentation purposes, we consider short-term, highly liquid investments with original maturities of three months or less to be cash and cash equivalents.

We maintain cash and cash equivalent balances at financial institutions that are insured by the Federal Deposit Insurance Corporation up to $100,000. Deposits with banks in other countries are not insured. Deposits with these banks may exceed the amount of insurance provided on such deposits.

Contingencies

We are not currently a party to any pending or threatened legal proceedings. Based on information currently available, management is not aware of any matters that would have a material adverse effect on our financial condition, results of operations or cash flows.

Fair Value of Financial Instruments

The carrying amounts of our financial instruments, including cash and cash equivalents, taxes receivable, accounts payable, and taxes payable approximate their fair values based on their short-term nature.

Income Taxes

We have adopted the provisions of SFAS No. 109,“Accounting for Income Taxes”which requires recognition of deferred tax liabilities and assets for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax liabilities and assets are determined based on the difference between the financial statement and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. A valuation allowance is provided for those deferred tax assets for which the related benefits will likely not be realized.

14

Loss per Common Share

Loss per common share has been computed using the weighted average number of common shares outstanding during each period. Except where the result would be anti-dilutive to income from continuing operations, diluted earnings per share has been computed assuming the conversion of the convertible long-term debt and the elimination of the related interest expense, and the exercise of stock warrants.

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS 157, “Fair Value Measurements”. SFAS 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. The provisions of SFAS 157 were adopted at inception.

In February 2007, the FASB issued SFAS 159, “The Fair Value Option for Financial Assets and Financial Liabilities – including an amendment of SFAS 115.” This Statement permits all entities to choose, at specified election dates, to measure eligible items at fair value (the “fair value option”). A business entity shall report unrealized gains and losses on items for which the fair value option has been elected in earnings (or another performance indicator if the business entity does not report earnings) at each subsequent reporting date. Upfront costs and fees related to items for which the fair value option is elected shall be recognized in earnings as incurred and not deferred. If an entity elects the fair value option for a held-to-maturity or available-for-sale security in conjunction with the adoption of this Statement, that security shall be reported as a trading security under SFAS 115, but the accounting for a transfer to the trading category under paragraph 15(b) of SFAS 115 does not apply. Electing the fair value option for an existing held-to-maturity security will not call into question the intention of an entity to hold other debt securities to maturity in the future. This statement was adopted at inception.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements (SFAS 160), which becomes effective for the company on May 1, 2009. This standard establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income attributable to the parent and to the noncontrolling interest, changes in a parent’s ownership interest and the valuation of retained non-controlling equity investments when a subsidiary is deconsolidated. The Statement also establishes reporting requirements that provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the non-controlling owners. The Company does not anticipate that this pronouncement will have a material impact on its results of operations or financial position.

15

In March 2008, the FASB issued FAS No. 161, Disclosures about Derivative Instruments and Hedging Activities – an Amendment of FASB Statement No. 133 (SFAS 161), which becomes effective on February 1, 2009. This standard changes the disclosure requirements for derivative instruments and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under SFAS 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. Management is currently evaluating the impact of adopting this statement.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” (SFAS 162), which becomes effective upon approval by the SEC. This standard sets forth the sources of accounting principles and provides entities with a framework for selecting the principles used in the preparation of financial statements that are presented in conformity with US GAAP. It is not expected to change any of our current accounting principles or practices and therefore, is not expected to have a material impact on our financial statements.

BUSINESS

Current Operations

Since May 2008, we have been developing social and communicative networking via our website LiveBuzz.com and our mobile-based software application. As of November 2008, we have completed the initial portions of integrating the Apple iPhone Global Positioning Satellite (GPS) technology with the LiveBuzz iPhone application. However, our software is still in Alpha testing mode and has not been tested for commercial launch. In order for our application to be ready for a full commercial launch, we must move on to a Beta testing mode in which the software will be put through rigorous real-world testing situations. Both the Alpha test and Beta test may reveal issues with the software that will prevent us from launching a commercial release and we may not be able to overcome these testing issues.

Business Strategy

Social networking sites allow users to communicate and interact with their peers. These sites have experienced popularity in the last few years, and many sites have grown to broad networks encompassing tens of millions of users. While social networking sites have become popular sites on the Internet, we believe there is an opportunity to provide social networking sites directly to mobile devices. There are several mobile-based social networks, however there is yet to be a provider to generate the traffic similar to that of online social networks like MySpace and Facebook. A report from ABI research in 2008 predicts that mobile-base social networks will generate $3.3 billion in revenue by 2013.

LiveBuzz will be a mobile-based social network that will mesh the popular aspects of social networking with tools geared directly for mobile users. In order to establish a mobile-based social network, we must integrate the popular aspects of online social networks with the application interface of mobile devices. Currently, we have a limited number of social networking functions integrated into a mobile device including messaging, chat, and picture posting. Our application is still in the early stages of development. Some limited functions of the application have been completed for the Apple iPhone, and we are currently in Alpha testing mode for these functions.

The initial mobile application that we have developed allows users to communicate with each other on the network directly from their mobile device, but these function have yet to be tested in a real-world environment. . We must continue to develop functions and complete testing of the application before we can begin a commercial launch. Our capital resources combined with the changing technology of mobile devices may keep us from developing a commercially viable application and fulfilling our business plan.

We have also completed integration of our Applie iPhone application to the Global Position Satellite (GPS) tools included in the Apple iPhone Software Development Kit (SDK) which allows the application to gather location-based information for our users. For example, a user can go on the LiveBuzz network and look for other users who are near them. Our iPhone-enabled GPS tools have had only limited testing within our controlled environment, and we must test the iPhone-enabled GPS tools in a real-world environment before we can start a commercial launch. This real-world test may produce errors that we may not be able to overcome.

Social Networking Sites

Social networking sites are generally free online sites that provide platforms for “peer-to-peer” communication; i.e., for friends to directly communicate with friends with updates on their personal lives. Each person has a profile, often with photos, on everything from their astrological sign to favorite drink. People may also post comments on each other’s profiles and bring other people into their network or personal page.

Four of the top 10 global Web sites on Alexa.com are social networking sites:

| | • | Myspace.com. With 955 million visitors per month as of February 2008, according to techcrunch.com) |

| | • | Facebook.com (#6 with 326.4 million) |

| | • | Hi5.com (#8 with 11.8 million) |

| | • | Orkut.com (#10 with 7 million) |

16

LiveBuzz Network

Upon commercial launch of our mobile software, LiveBuzz will be a free service allowing users to post and comment on the best, and worst, of any city across the globe. LiveBuzz will not be a shill for businesses to promote their wares. Rather, it will be grassroots reviews and commentary by the people, for the people. It will produce “pages with personality” where viewers can get an honest assessment and real feel for where to go and what to do within a specific city.

The mobile application allows for users to log on to the network, and presents information relating to their location,. Our current application allows for users to include their picture or an “avatar” (a graphic image that represents someone’s personality and could be anything from a dune buggy to a cartoon character). Pictures on social networks also help those seeking information to get a better feel for the reviewer, and locale, by looking at the person or avatar.

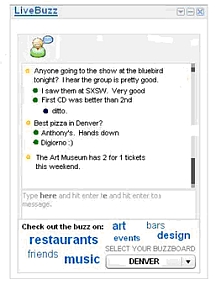

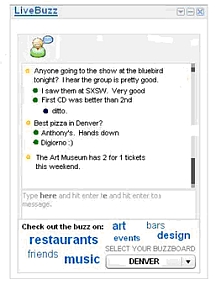

Like many popular social networking sites, our application contains a chat and messaging functionality. In addition, we have begun development of a public message board that will allow users to post anonymously. The initial public message board widget, termed the Buzzboard, is an open forum for users to discuss topics specific to a particular city. Like many of the other functions in our application, we are still in the development of the public message board and must complete rigorous testing before we can begin a commercial launch. This testing may produce errors or results which we are unable to overcome.

Initial design for the LiveBuzz message board

17

Non-voice mobile services

Originally, mobile services were exclusively voice oriented. In the infancy of the wireless industry, wireless carriers’ revenue models were based on the models of traditional phone companies. Carriers charged for usage (minutes), long distance, and premium services such as voicemail. As the industry evolved, mobile users began paying for non-voice services such as text messaging, emails, and Internet connectivity.

It is estimated that non-voice revenues will continue to grow as the phone evolves from just a cellular telephone to a mobile computer. Mobile devices continue to make significant technological advances, and many devices are capable of running software comparable to today’s desktop computers. Emarketer.com estimates that non-voice revenues from mobile phones will grow to $40 billion by 2010 in the US alone.

Revenue Model

We anticipate that our revenue model will come from target advertisements placed within the application and on the LiveBuzz.com website. However, we must obtain a substantial amount of traffic in order to realize any significant advertising revenue. The commercial acceptance of our application is unknown, and we cannot predict whether we will be able to generate the required traffic to generate significant revenue. We intend to sell our advertising space to third-party providers such as Google, Yahoo, or Admob. Advertising programs are widely available from these providers, but without substantial traffic, we will not generate significant advertising revenue. As our location-based services are developed, further location-specific advertising models will be explored. For instance, rather than providing a user with an advertisement for a restaurant in their city, the application may provide the user with a coupon for a restaurant located around the corner. However, we must attract local advertisers in order for location-based advertising to be effective. Since mobile advertising is a new advertising space, we may find that local advertisers will be unwilling to spend money in this medium.

In addition to generating revenue from advertising, we intend to .sell our application on third-party sites like Apple’s App store and Handango.com. These distributions sites generally are open to all new applications, but our application may be subject to quality tests from our distributor. Since we have limited resources to check our application for quality assurance, we cannot guarantee that it will pass a distributor’s quality tests. Also, these distributors’ sites will allow for users to provide reviews regarding our application. We have no assurance that users will review our application positively, and negative comments will have a dramatic and negative effect on our business.

Marketing

We will initial market our LiveBuzz application as a free application through Apple Computer’s App store. In order to distribute our application on App store, we must ensure that our application has passed necessary Alpha and Beta tests along with standards published by Apple Computer. The App store was launched by Apple on conjunction with the release of the 3G version of the Iphone. In its first weekend alone, the App store reported that over ten million applications were downloaded. By initially developing an application catered for the Iphone, we believe that we can get acceptance from a broad range of mobile users. As further mobile devices are launched, we will develop new versions of the application for other mobile platforms. However, our limited capital resources may keep us from porting our application to other mobile platforms.

Competition

There is a significant competition for mobile-based social networking tools and services. As mobile device penetration continues to grow, many companies are seeking to profit from this sector. We believe that our main competition will come from two sectors:

| | • | Traditional, Internet-based social networks. Social networking sites like MySpace.com, Facebook.com, and Orkut.com have a significant hold on social networking and maintain millions of members in their respective networks. While these sites are focused primarily on an Internet-based social network, most of the major sites provide mobile applications to interface with their Internet site. |

18

| | • | Mobile-based social networking sites. As social networking and mobile device usage have collectively evolved, many companies have developed social networking tools geared towards mobile devices. These sites included networks that allow for full-featured social networking to applications tailored for a specific purpose like locating one’s friends. An online article entitled “The State of Location-Based Social Networking on the iPhone”(http://www.techcrunch.com/2008/09/28/the-state-of-location-based-social-networking-on-the-iphone/) detailed a list of competitors who offer location-based social networking via the iPhone application. We believe that the list of companies in the article represents our main competition, but new competitors will continue to enter the location-based social networking market. The companies listed in the article include: Loopt, Pelago (Whrll), Limbo, zintin, Moximity, uLocate. In addition to the companies listed in the article, we believe that we will face competition from Brightkite and Google’s location-based services named Dodgeball. |

Employees

At December 1, 2008, we had one employee, our Chief Executive Officer.

Facilities

We are provided rent-free office space by our Chief Executive Officer at 8635 W. Sahara Avenue, Suite 576, Las Vegas, Nevada 89117.

19

MANAGEMENT

Directors, Executive Officers, Promoters and Control Persons

Directors hold office until the next annual meeting of the shareholders or until their successors have been elected and qualified. Our officers are appointed by our Board of Directors and hold office until their death, resignation or removal from office. Our sole director and executive officer’s age, positions held and date first appointed are as follows:

Name

| | Position Held with the Company

| | Age

| | Dated First Elected

or Appointed

| |

|---|

| Tony Caporicci | | | Chief Executive Officer, Chief Financial Officer and Sole Director | | | | 48 | | 2008 | | |

| | | |

Business Experience

The following is a brief account of the education and business experience of our sole director and executive officer during at least the past five years.

Since 2005, Tony Caporicci has been an independent technology consultant for Oil Flow USA, Inc. where he implements web applications, develops new office infrastructure, creates administration and management tools, and assists with product innovation, patent advancements and intellectual property. He is a writer on casino gaming technology for trade magazines such as Casino Enterprise Management and IGWB (International Gaming and Wagering Business). His articles and quotes have been featured in Business 2.0, Entrepreneur Magazine, Fortune Magazine. From 1993 to 2005, he was CEO/President at NetBooth Corporation.

Committees of the Board

Our company currently does not have nominating, compensation or audit committees or committees performing similar functions nor does our company have a written nominating, compensation or audit committee charter.

Executive Compensation

We have not paid any compensation to executive officers and directors since our incorporation in April 2008. We do not have key person life insurance on our sole executive officer’s life.

Director Compensation

Our sole director does not receive compensation for his services as a director.

Liability and Indemnification of Officers and Directors

Our Articles of Incorporation provide that liability of directors to us for monetary damages is eliminated to the full extent provided by Nevada law. Under Nevada law, a director is not personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director except for liability (i) for any breach of the director’s duty of loyalty to us or our stockholders; (ii) for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; (iii) for authorizing the unlawful payment of a dividend or other distribution on our capital stock or the unlawful purchases of our capital stock; (iv) a violation of Nevada law with respect to conflicts of interest by directors; or (v) for any transaction from which the director derived any improper personal benefit.

20

The effect of this provision in our Articles of Incorporation is to eliminate our rights and our stockholders’ rights (through stockholders’ derivative suits) to recover monetary damages from a director for breach of the fiduciary duty of care as a director (including any breach resulting from negligent or grossly negligent behavior) except in the situations described in clauses (i) through (v) above. This provision does not limit or eliminate our rights or the rights of our security holders to seek non-monetary relief, such as an injunction or rescission, in the event of a breach of a director’s duty of care or any liability for violation of the federal securities laws.

Insofar as indemnification for liabilities arising under the Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

SECURITY OWNERSHIP OF EXECUTIVE OFFICERS, DIRECTORS ANDBENEFICIAL

OWNERS OF GREATER THAN 5% OF OUR COMMON STOCK

As of the date of this prospectus, there are 2,982,000 shares of common stock outstanding. The following table sets forth certain information regarding the beneficial ownership of the outstanding shares as of the date of this prospectus by (i) each person who is known by us to own beneficially more than 5% of our outstanding common stock; (ii) each of our executive officers and directors; and (iii) all of our executive officers and directors as a group. Except as otherwise indicated, each such person has investment and voting power with respect to such shares, subject to community property laws where applicable. The address of our executive officers and directors is in care of us at 8635 W. Sahara Avenue, Suite 576, Las Vegas, Nevada 89117.

Name of Shareholder

| | Title of Class(1)

| | Amount

and Nature

of Beneficial

Ownership

| | Percent of Class

| |

|---|

| Tony Caporicci | | | | | | | | | | | |

| 8635 W. Sahara Avenue, Suite 576 | | |

| Las Vegas, NV 89117 | | | Common Stock | | | | 2,100,000 | | | 70.4% | |

| | | |

| Gary A. Agron | | |

| 5445 DTC Pkwy., Suite 520 | | |

| Greenwood Village, CO 80111 | | | Common Stock | | | | 250,000 | | | 8.4% | |

| | | |

| JLP Capital, LLC | | |

| Jennifer Frenkel, Manager | | |

| 2340 S. Columbine | | |

| Denver, CO 80210 | | | Common Stock | | | | 250,000 | | | 8.4% | |

21

Name of Shareholder

| | Title of Class(1)

| | Amount

and Nature

of Beneficial

Ownership

| | Percent of Class

| |

|---|

| Growth Ventures Inc. Personal Plan and Trust | | | | | | | | | | | |

| Gary McAdam, Trustee | | |

| 14 Red Tail Drive | | |

| Highlands Ranch, CO 80126 | | | Common Stock | | | | 250,000 | | | 8.4% | |

| | | |

| All directors and officers as | | |

| a group (1) | | | Common Stock | | | | 2,100,000 | | | 70.4% | |

(1) Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. Shares of common stock subject to options, warrants and convertible preferred stock currently exercisable or convertible, or exercisable or convertible within sixty (60) days, would be counted as outstanding for computing the percentage of the person holding such options or warrants but not counted as outstanding for computing the percentage of any other person.

SELLING STOCKHOLDERS AND PLAN OF DISTRIBUTION

We have outstanding 2,982,000 shares of common stock. We are registering by this prospectus an aggregate of 1,132,000 shares of common stock comprised of 250,000 shares of common stock issued to our Chief Executive and director, 500,000 shares of common stock which we sold to two investors in April 2008, 250,000 shares of common stock which we sold to an investor in May 2008 for $0.20 per share and 132,000 shares of common stock which we sold to a group of investors in June and July of 2008 for $0.083 per share. The following table sets forth the names of the selling stockholders, the number of shares of our common stock held by each selling stockholder and certain other information. The selling stockholders listed below are offering for sale all shares listed following their names. None of the selling stockholders is required to sell any of their shares at any time.

The shares may be offered from time to time by the selling stockholders initially at $.50 per share until such time as the shares are quoted on the OTC Bulletin Board or listed on a national exchange at which time the shares may be sold at prevailing market prices. Since the selling stockholders may sell all or part of the shares of common stock offered in this prospectus, we cannot estimate the number of shares of our common stock that will be held by the selling stockholders upon termination of this offering.

None of our selling stockholders are officers, directors or 10% or greater stockholders of the Company except Tony Caporicci, our Chief Executive Officer and a director who is offering 250,000 shares for sale. None of our selling stockholders are broker-dealers or affiliates of broker-dealers, and none of the selling stockholders has or had any material relationship with us except as stockholders.

Name of Stockholder

| | Shares of Common

Stock Owned

| | Percentage of

Outstanding

Common Stock Owned

| | Shares of

Common Stock

Offered For Sale

| | Percentage Of

Outstanding

Common Stock

Owned

After Sale

| |

|---|

| Tony Caporicci | | | | 2,100,000 | | 70.4% | | | | 250,000 | | | 62.0% | |

| | | |

| Growth Ventures Inc. | | | | 250,000 | | 8.4% | | | | 250,000 | | | 0 | |

| Personal Plan and Trust, | | |

| Gary McAdam, Trustee | | |

| | | |

| Gary A. Agron | | | | 250,000 | | 8.4% | | | | 250,000 | | | 0 | |

| | | |

| JLP Capital, LLC | | | | 250,000 | | 8.4% | | | | 250,000 | | | 0 | |

| Jennifer Frenkel, Manager | | |

| | | |

| 1st Zamora Corp | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| Laura Lee Madsen, President | | |

| | | |

| Brian M. McAdam | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Cary Walko | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Charlene Frenkel | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Chester Schwartz | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Claudia A. McAdam | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| David Lippa | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| G.A.S. Investments, LLP | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| Steve Walko, Manager | | |

| | | |

| Jason B. Walko | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Joey Mosko | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Kevin C. McAdam | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Kurt Lockmiller | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Laura S. Madsen | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Louise S. Schwartz | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Mark Frenkel | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Nemelka Family Investments | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| Dave Nemelka, Trustee | | |

| | | |

| Phil D. Greenblatt | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| | | |

| Rolling Dice Productions, Inc. | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| Nick Koustas, President | | |

| | | |

| Ruth Frenkel | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

23

| | | | |

|---|

| Stanford Ventures, Inc. | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| Gary Mosko, President | | |

| | | |

| Traum-Urlaub, Inc. | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

| Joseph Nemelka, President | | |

| | | |

| Travis Reid | | | | 6,000 | | * | | | | 6,000 | | | 0 | |

*less than 1%

In the event that we permit or cause this prospectus to lapse, the selling stockholders may only sell shares of our common stock pursuant to Rule 144 under the Securities Act of 1933. The selling stockholders will have the sole and absolute discretion not to accept any purchase offer or make any sale of these shares of our common stock if they deem the purchase price to be unsatisfactory at any particular time.