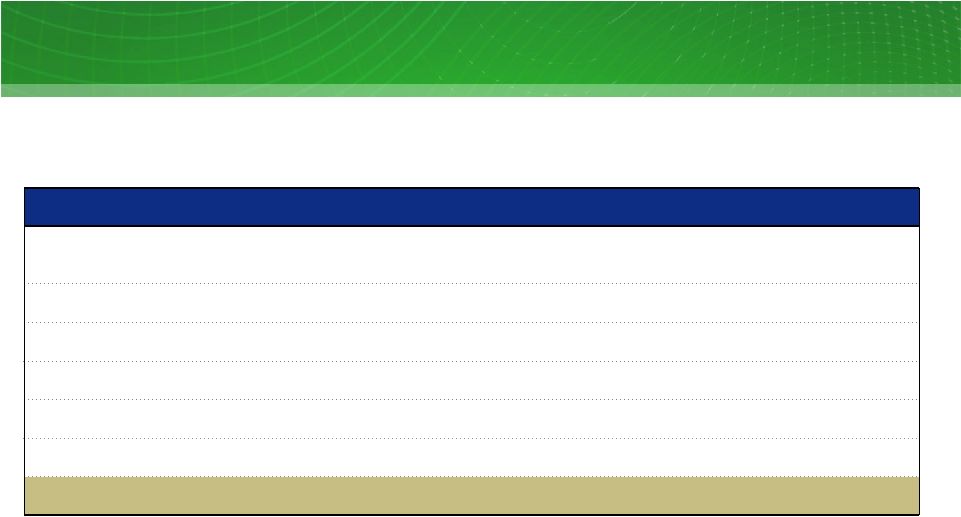

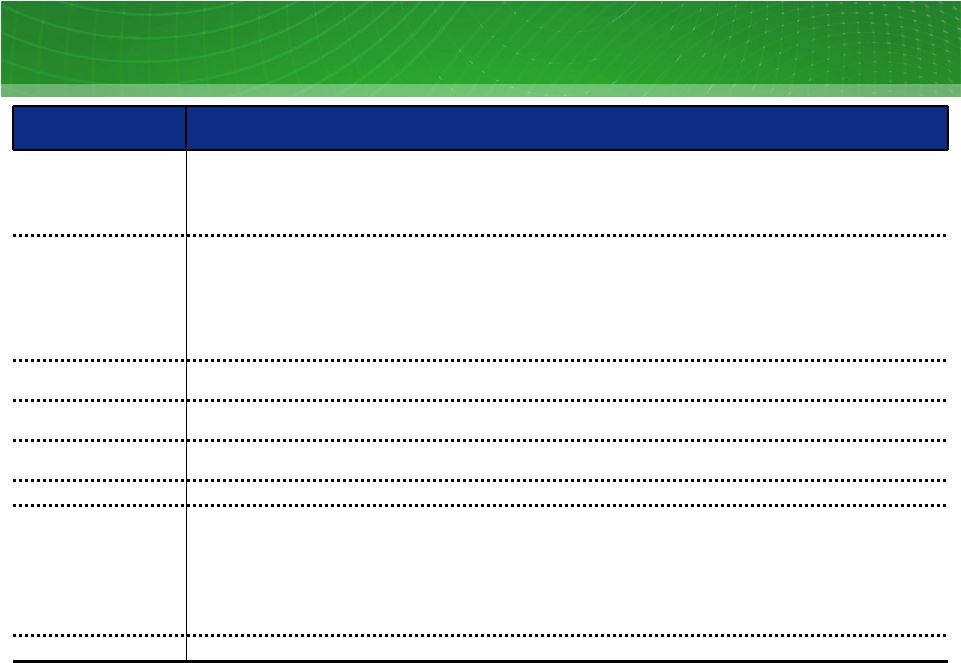

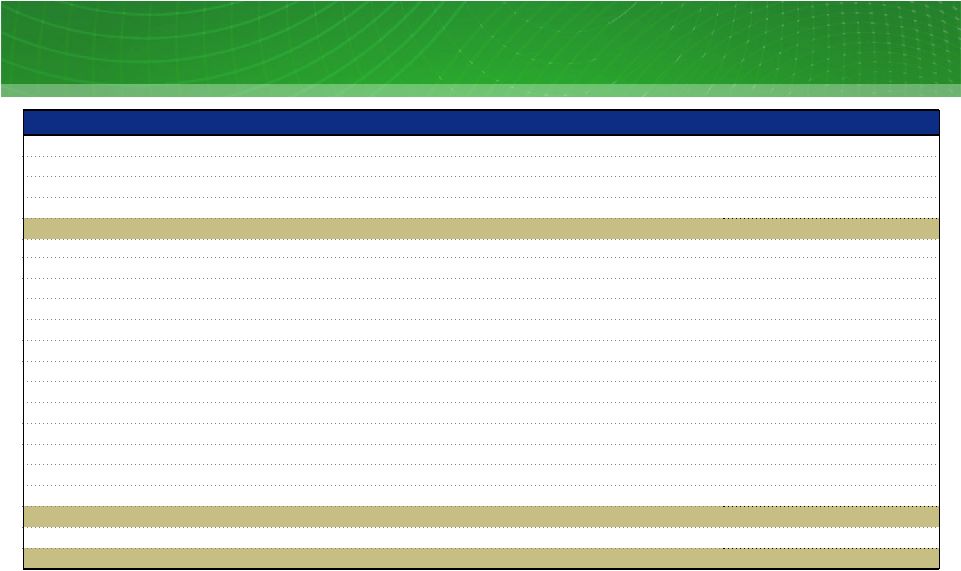

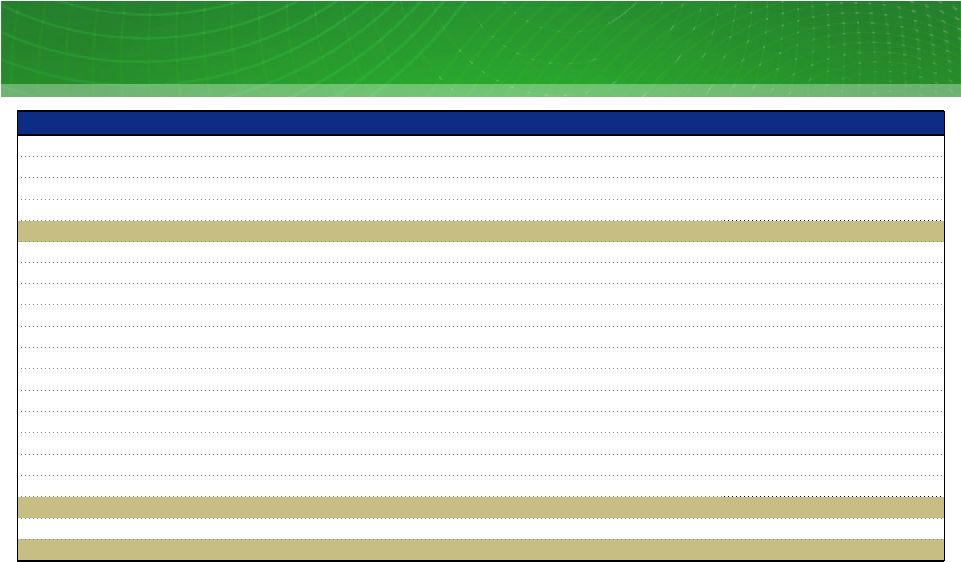

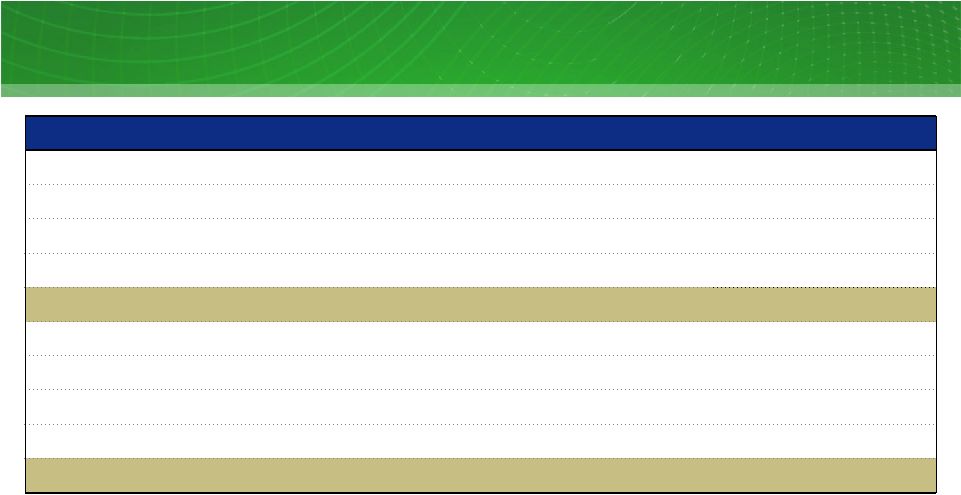

Table 2: TCEH Adjusted EBITDA Reconciliation Three Months Ended March 31, 2012 and 2013 $ millions Factor Q1 12 Q1 13 Net loss (238) (524) Income tax benefit (115) (378) Interest expense and related charges 622 586 Depreciation and amortization 330 344 EBITDA 599 28 Adjustments to EBITDA (pre-tax): Interest income (17) (4) Amortization of nuclear fuel 42 39 Purchase accounting adjustments 1 9 5 Unrealized net loss resulting from commodity hedging and trading transactions 152 487 EBITDA amount attributable to consolidated unrestricted subsidiaries (2) - Corporate depreciation, interest and income tax expenses included in SG&A expense 4 4 Noncash compensation expense 2 3 2 Transition and business optimization costs 3 9 5 Transaction and merger expenses 4 10 10 Restructuring and other 5 (1) 16 Expenses incurred to upgrade or expand a generation station 6 26 46 TCEH Adjusted EBITDA per Incurrence Covenant 834 638 Expenses related to unplanned generation station outages 26 10 TCEH Adjusted EBITDA per Maintenance Covenant 860 648 23 1 2 3 4 5 6 Includes amortization of the intangible net asset value of retail and wholesale power sales agreements, environmental credits, coal purchase contracts, nuclear fuel contracts and power purchase agreements and the stepped up value of nuclear fuel. Also includes certain credits and gains on asset sales not recognized in net income due to purchase accounting. Includes expenses recorded under stock-based compensation accounting standards and excludes capitalized amounts. Includes certain incentive compensation expenses as well as professional fees and other costs related to generation plant reliability and supply chain efficiency initiatives. Primarily represents Sponsor Group management fees. Includes costs associated with liability management program. Represents noncapital outage costs. |