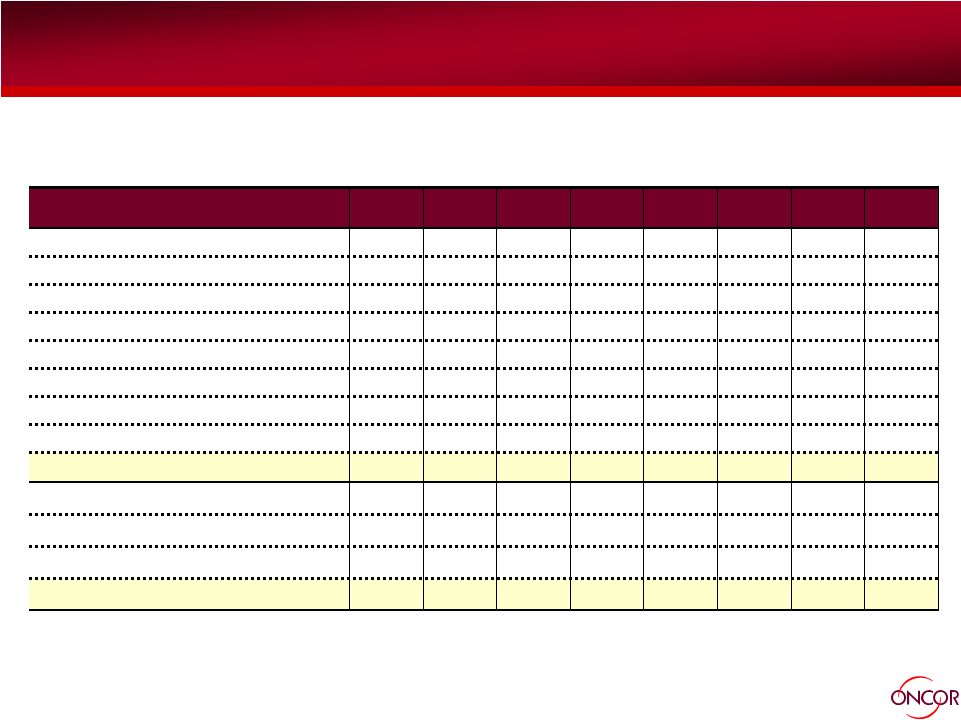

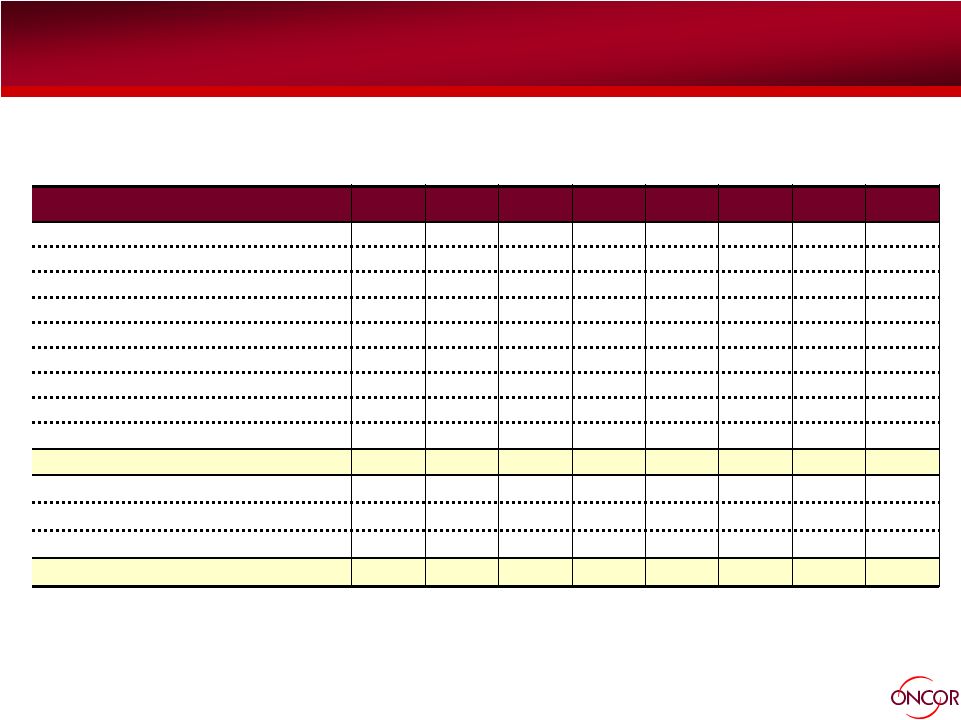

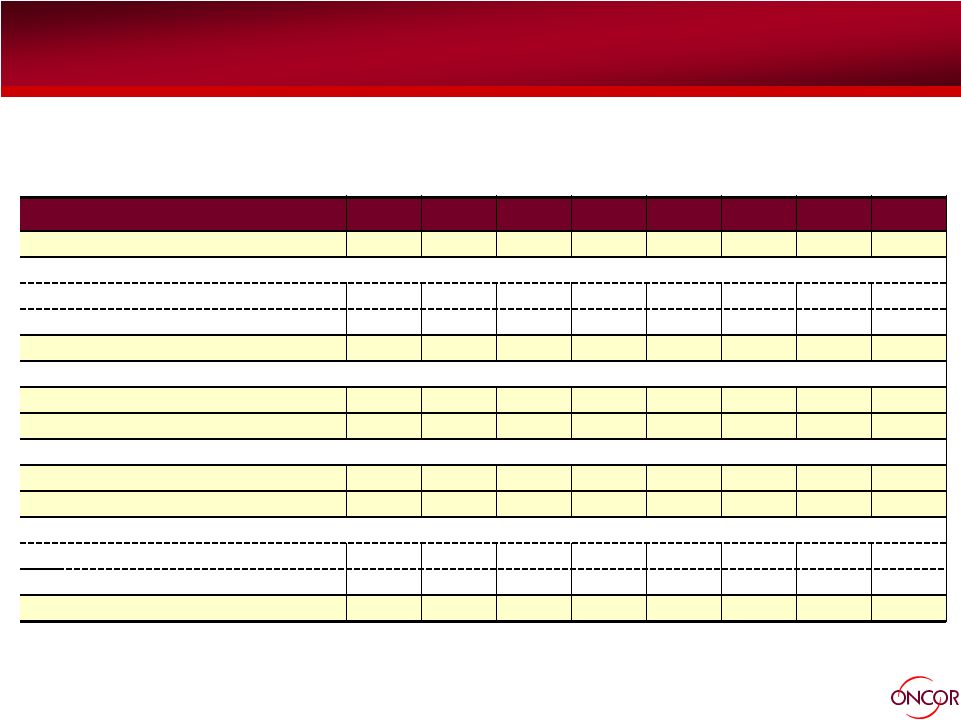

6 CONFIDENTIAL Endnotes Oncor Business Plan Summary (LRP) (1) EBITDA means net income (loss) before interest expense and related charges, income tax expense (benefit) and depreciation and amortization (including amortization of regulatory assets reported in operation and maintenance expense) and other income related to purchase accounting. EBITDA is also adjusted for certain noncash and unusual items, none of which is material in the years presented. EBITDA is a financial measure not calculated in accordance with GAAP. EBITDA is not intended to be an alternative to net income as a measure of operating performance, an alternative to cash flows from operating activities as a measure of liquidity or an alternative to any other measure of financial performance presented in accordance with GAAP, nor is it intended to be used as a measure of free cash flow available for discretionary use, because the measure excludes certain cash requirements such as interest payments, tax payments and other debt service requirements. EBITDA as presented in the table reflects EFH Corp.’s calculations of EBITDA for Oncor on a basis consistent with EFH Corp.’s prior public disclosures, except for the exclusion of amortization of regulatory assets reported in operation and maintenance expense. Accordingly, and because not all companies use identical calculations, EBITDA may not be comparable to EBITDA as calculated by Oncor or to similarly titled measures of other companies. (2) Capital expenditures include expenditures for transmission facilities, infrastructure maintenance, information technology initiatives, distribution facilities to serve new customers and other general investments. (3) Reflects 100% of distributions from Oncor (excluding tax sharing payments). EFIH’s wholly owned subsidiary Oncor Holdings owns approximately 80% of the equity interests of Oncor. Accordingly, distributions to EFIH will be approximately 80% of each distribution, excluding any portion of the distribution retained by Oncor Holdings to settle its obligations under its tax sharing agreement. |