UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 2010.

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to __________________ to __________________

Commission File Number: 333-16052

CEDAR CREEK MINES LTD.

(Exact name of registrant as specified in its charter)

| Delaware | None |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

4170 Still Creek Drive, Suite 200 Burnaby, British Columbia (Address of principal executive offices) | V5C 6C6 (Zip Code) |

(604) 320-7877

(Registrant’s telephone number, including area code)

Securities registered under Section 12 (b) of the Exchange Act: None

Securities registered under Section 12 (g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

x Yes ¨ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. 969,000 shares X $0.00 per share = $0.00.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 51,297,026 shares of common stock as of August 31, 2010.

Table of Contents

| USE OF NAMES | | 3 |

| | | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | 3 |

| | | |

| Part I | | 4 |

| Item 1. Business | | 4 |

| Item 1A. Risk Factors | | 11 |

| Item 2. Properties | | 11 |

| Item 3. Legal Proceedings | | 14 |

| Item 4. [Removed and Reserved] | | 14 |

| | | |

| Part II | | 14 |

| Item 5. Market For Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 14 |

| Item 6. Selected Financial Data | | 17 |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 17 |

| Item 8. Financial Statements and Supplementary Data | | 20 |

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 21 |

| Item 9A. Controls and Procedures | | 21 |

| Item 9B. Other Information | | 23 |

| | | |

| Part III | | 23 |

| Item 10. Directors, Executive Officers, and Corporate Governance | | 23 |

| Item 11. Executive Compensation | | 26 |

| Item 12. Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters | | 27 |

| Item 13. Certain Relationships And Related Transactions, and Director independence | | 28 |

| Item 14. Principal Accountant Fees And Services | | 29 |

| | | |

| Part IV | | 30 |

| Item 15. Exhibits, Financial Statements | | 30 |

| | | |

| SIGNATURES | | 31 |

| Exhibit Index | | 32 |

USE OF NAMES

In this annual report, the terms “Cedar Creek Mines,” “Company,” “we,” or “our,” unless the context otherwise requires, mean Cedar Creek Mines Ltd. and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K and other reports that we file with the SEC contain statements that are considered forward-looking statements. Forward-looking statements give the Company’s current expectations, plans, objectives, assumptions or forecasts of future events. All statements other than statements of current or historical fact contained in this annual report, including statements regarding the Company’s future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plans,” “potential,” “projects,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” and similar expressions. These statements are based on the Company’s current plans and are subject to risks and uncertainties, and as such the Company’s actual future activities and results of operations may be materially different from those set forth in the forward looking statements. Any or all of the forward-looking statements in this annual report may turn out to be inaccurate and as such, you should not place undue reliance on these forward-looking statements. The Company has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. The forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and assumptions due to a number of factors, including:

| · | risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; |

| · | results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations; |

| · | mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in production; |

| · | the potential for delays in exploration or development activities or the completion of feasibility studies; |

| · | risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; |

| · | risks related to commodity price fluctuations; |

| · | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration and development projects; |

| · | risks related to environmental regulation and liability; |

| · | political and regulatory risks associated with mining development and exploration; |

| · | dependence on key personnel; |

| · | general economic conditions in the United States and Canada; and |

| · | other risks and uncertainties related to our prospects, properties and business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

These forward-looking statements speak only as of the date on which they are made, and except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained in this annual report.

PART I

ITEM 1. BUSINESS

Year of Organization

We were incorporated as a Delaware company on April 3, 2008. We have one wholly owned subsidiary, Cedar Creek Mines Inc. (“CCMI”), incorporated pursuant to the laws of Province of British Columbia, Canada, on April 27, 2007, which we acquired on May 16, 2008. On February 23, 2010, we changed the name of our subsidiary to Cedar Creek Mines (British Columbia) Inc.

Corporate Development and Business

We are an exploration stage corporation. An exploration stage corporation is one engaged in the search for mineral deposits or reserves which are not in either the development or production stage.

We intend to build our business by acquiring, exploring and developing mineral resource properties in the United States and Canada. We currently own, through our wholly owned subsidiary CCMI, an undivided 100% interest in the following three mineral claims located near the Similkameen Valley, 25 kilometers south of Keremeos, British Columbia (the “Leamington Property”):

| BC Tenure Number | | Tenure Type | | Claim Name | | Expiry Date | | Area (hectares) |

| 551027 | | Mineral | | Leamington | | February 2, 2011 | | 21.162 |

| 573730 | | Mineral | | SIS | | January 14, 2011 | | 42.318 |

| 585595 | | Mineral | | GUY | | June 2, 2011 | | 317.416 |

CCMI acquired our interest in the original four claims pursuant to a purchase agreement with Mr. Ron Schneider dated June 25, 2008. In consideration for this interest, we paid Mr. Schneider approximately $2,914. These claims require annual payments of approximately $2,200 to keep them in good standing. However, CCMI currently only has an interest in the three above mentioned claims as the mineral claim named “Sisters” having BC Tenure Number 573664 expired on January 13, 2010 as the annual payment was not made on such claim, and therefore, such claim has been automatically forfeited back to the Province of British Columbia.

Our project is at the exploration stage and there is no guarantee that any of our mineral claims contain a commercially viable ore body. We have not presently determined if our property contains mineral reserves that are economically recoverable, and we must complete an exploration program on the claims before we can make such a determination. We intend to explore primarily for precious metals, but we may explore for other minerals if our claims or any properties in which we acquire an interest displays signs that such minerals may be discoverable.

We will require additional financing to carry out any exploration program, and there is no guarantee that we will be able to secure the necessary funds to do so. Accordingly, there is uncertainty about our ability to continue to operate. If we cease our operations, you may lose your entire investment in our common stock. There are also many factors, described in detail elsewhere in this Annual Report under the heading "Risk Factors,” which may adversely affect our ability to begin and sustain profitable operations.

Over the next 12 months we intend to hire a geologist, land specialist and engineer, either on a part-time basis or as independent contractors, in order to meet the technical requirements associated with exploring and developing an exploration stage mineral property. We are searching for qualified and experienced personnel but we have not yet identified any particular individuals to fill these roles. There is no guarantee that we will be able to attract and retain qualified personnel, and our failure to do so may cause us to go out of business.

We have only recently begun operations. We have not generated any revenues from our business activities and we do not expect to generate revenues for the foreseeable future. Since our inception, we have incurred operational losses, and we have been issued a going concern opinion by our auditors.

For the next 12 months we intend to:

| · | carry out Phase I of our exploration program on the Leamington Property; |

| · | complete private and/or public financing to cover the cost of acquiring interests in additional mineral properties; and |

| · | retain a geologist, land specialist and engineer to assist us in developing our business. |

Our planned operation and exploration expenditures over the next 12 months are summarized as follows:

| Description | | Potential Completion Date | | Estimated Expenses ($) | |

| Complete Phase I of our exploration program on the Leamington Property | | July 2011 | | | 175,000 | |

| Annual fee to maintain the Leamington Property | | 12 months | | | 2,200 | |

| Retain a geologist, land specialist and engineer on a part-time basis or as independent contractors | | 12 months | | | 20,000 | |

| Management fees | | 12 months | | | 30,000 | |

| Professional fees (legal, accounting and auditing fees) | | 12 months | | | 100,000 | |

| Travel and promotional expenses | | 12 months | | | 10,000 | |

| General and administrative expenses | | 12 months | | | 10,000 | |

| Total | | | | | 347,200 | |

The second phase of our program is expected to consist of further mapping and sampling, a comprehensive drill program and the staking of new mineral claims. We expect this phase to cost approximately $200,000, however, we do not expect Phase II of our exploration program to occur over the next 12 months.

Our general and administrative expenses for the next twelve months will consist primarily of transfer agent fees, investor relations expenses and general office expenses. The professional fees are related to our regulatory filings throughout the year.

Based on our planned expenditures, we will require funds of approximately $347,200 to proceed with our business plan over the next 12 months. If we secure less than the full amount of financing that we require, we will not be able to carry out our complete business plan and we will be forced to proceed with a scaled back business plan tailored to our available financial resources.

We anticipate that we will incur substantial losses for the foreseeable future. Even if we carry out our planned exploration program on the Leamington Property, there is no guarantee that the property will contain commercially exploitable mineral resources. Our exploration activities will be directed by Guy Brusciano, our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer and a director of the Company, who will also supervise our planned acquisition activities and manage our operations.

We intend to raise our cash requirements for the next 12 months through the sale of our equity securities in private placements, through shareholder loans, or possibly through a registered public offering (either self-underwritten or through a broker-dealer). If we are unsuccessful in raising enough money through such capital-raising efforts, we may review other financing possibilities such as bank loans. At this time we do not have a commitment from any broker-dealer to provide us with financing. There is no assurance that any financing will be available to us or if available, on terms that will be acceptable to us. We intend to negotiate with our management and consultants to pay parts of their salaries and fees with stock and stock options instead of cash.

Even though we plan to raise capital through equity or debt financing, we believe that the latter may not be a viable alternative for funding our operations as we do not have tangible assets to secure any such financing. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock. However, we do not have any financing arranged and we cannot provide any assurance that we will be able to raise sufficient funds from the sale of our common stock to fund our operations or planned exploration activities. In the absence of such financing, we will not be able to acquire additional mineral properties or carry out a preliminary exploration program on an acquired property. Even if we are successful in obtaining equity financing to fund our operations and exploration activities, there is no assurance that we will obtain the funding necessary to pursue any advanced exploration of future properties following the completion of preliminary exploration. If we do not continue to obtain additional financing, we may be forced to abandon our business plan or any property interests in our possession.

Modifications to our plans will be based on many factors, including the results of our exploration activities, the assessment of data, weather conditions, exploration costs, the price of any minerals we discover and available capital. Further, the extent to which we carry out our exploration activities is dependent upon the amount of financing available to us.

We may consider entering into joint ventures or other strategic arrangements to provide the funding required to pursue the advanced exploration of our current and future properties. If we enter into a joint venture arrangement, we would likely have to assign a percentage of our interest in any project to our joint venture partner(s). The assignment of this interest would be conditional upon the contribution of capital by the joint venture partner(s) to enable the advanced exploration activities on the properties to proceed. There is no guarantee that any third party would enter into a joint venture agreement with us in order to fund the exploration component of any potential project.

Principal Products

At this time we do not have any product for sale as we are in the beginning stages of our exploration of the Leamington Property.

Market for Minerals

If we are able to extract minerals from the Leamington property or any other property we may acquire in the future, we will need to develop a marketing strategy to sell them. Available wholesale purchasers of minerals and precious metals exist in North America and throughout the world. Historically, the markets for minerals and precious metals are liquid and volatile. Wholesale purchase prices can be affected by a number of factors, all of which are beyond our control, including but not limited to:

| · | fluctuation in the supply of, demand and market price for minerals; |

| · | the mining activities of others; |

| · | the sale or purchase of certain precious metals by central banks and for investment purposes by individuals and financial institutions; |

| · | currency exchange rates; |

| · | inflation or deflation; and |

| · | the political and economic conditions in major mineral-producing countries. |

If we are able to locate minerals that are of economic grade in sufficient quantities to justify their removal, we may seek additional capital through equity or debt financing to build a mine and processing facility, find another entity to mine our claims on our behalf or as a joint venture, or sell our rights to mine the minerals. Any ore we mine would need to be processed through a series of steps to produce a rough concentrate. This rough concentrate must then be sold to refiners and smelters for the value of the minerals that it contains, less the cost of further concentrating, refining and smelting. Refiners and smelters then sell the refined minerals on the open market through brokers who work for wholesalers. Based upon the current demand for minerals, we believe that we will not have any difficulty selling any minerals that we may recover. However, we have not presently located any mineral reserves, and there is no assurance that we will find any economically viable reserves of minerals in the future.

Competition

We are a new and unestablished company and have a weak competitive position in the mineral exploration industry. We compete with other mineral exploration companies who are actively seeking to acquire mineral properties throughout the world together with the equipment, labor and materials required to operate on those properties.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of new mineral properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring properties of merit or exploring and developing their mineral properties. In addition, they may be able to afford increased geological expertise to more accurately target and explore potential mineral properties. These advantages could enable our competitors to acquire properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral properties or explore or develop our current or future mineral properties.

We compete with other mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration activities if investors perceive that investments in our competitors are more attractive based on the merit of their mineral properties or the price of the investment opportunity. We must also compete with other mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

In the face of such competition, we may not be successful in acquiring, exploring or developing profitable mineral properties, and we cannot give any assurance that suitable mineral properties will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

| · | keeping our costs low; and |

| · | using our size to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities. |

Legislation and Government Regulations

Different Canadian provinces use different procedures to regulate mining activities. For example, in British Columbia each potential mineral explorer must submit a permit application for all mechanized surface exploration that includes information about the mineral title, the operator, the program of work and the proposed reclamation plan. For minimal surface disturbance in a non-sensitive area, a letter permit may be issued by a district inspector of the Ministry of Energy, Mines and Petroleum Resources (the “Ministry”). If a mechanized work program is contemplated, the district inspector must participate in a consultation procedure with other government agencies, following which a permit may be issued. For exploration in highly sensitive areas, further referrals are made by the Ministry to, for example, an inter-agency management committee, other government agencies and public stakeholder groups.

Government Approvals and Recommendations

We must comply with the provisions of the Mineral Tenure Act (British Columbia) (the “Mineral Act”), which establishes rules for locating, posting and working claims, and for reporting work performed on claims. We must also comply with the Mineral Exploration Code (British Columbia) (the “MX Code”) which forms Part 9 of the larger Mine Health, Safety and Reclamation Code (British Columbia) (the “HSR Code”), which dictates how and where we can explore for minerals. As part of the HSR Code, the MX Code is enabled under Section 34 of the Mines Act (British Columbia) (the “Mines Act”). Compliance with these rules and regulations will not adversely affect our operations.

In order to explore for minerals on the Leamington Property we must submit our proposed exploration program for review. We believe that our exploration program will be successfully reviewed and that an exploration permit will be issued that allows us to undertake our planned activities. This exploration permit is the only permit or license we will require to explore for precious and base minerals on our mineral claims.

We will be required to obtain work permits from the Ministry for any exploration work which results in a physical disturbance to the land. Accordingly, we may be required to obtain work permits for any exploration work beyond that contemplated by our exploration program, depending on its complexity and effect on the environment. The time required to obtain a work permit is approximately four weeks. We will incur all necessary consultant expenses required to prepare the permit submissions to the Ministry. We will be required by the Mines Act to undertake remediation on any work that results in a physical disturbance to the land. The costs of such remediation will vary according to the degree of the physical disturbance. No remediation work is anticipated as a result of the completion of Phase I of our exploration program.

We have budgeted for regulatory compliance costs associated with our proposed exploration program. As mentioned above, we must sustain the costs of reclamation and environmental remediation for all exploration and other work we decide to undertake. We cannot estimate the amount of these costs at this time since we do not know if, or to what extent, any additional exploration will be required beyond our planned exploration program. Because we have not discovered any mineral deposits on our claims, it is impossible to assess the impact of any capital expenditures on our future earnings or competitive position.

If we commence any additional exploration, the costs of obtaining permits and complying with environmental laws will likely be greater than in our initial exploration program because the impact on the Leamington Property will likely be greater. We may be required to conduct an environmental review process under the Environmental Assessment Act (British Columbia) if we decide to proceed with any substantial exploration. An environmental review is not currently required under the Environmental Assessment Act to proceed with our initial exploration program on the Leamington Property.

We are also required to pay an annual fee of approximately $2,200 in order to keep the Leamington Property in good standing with the government of British Columbia.

Environmental Law

We are also subject to the larger HSR Code. This code deals with environmental matters relating to the exploration and development of mining properties. Its goals are to protect the environment through a series of regulations affecting health and safety, archaeological sites and exploration access. We are responsible for providing a safe working environment, not disrupting archaeological sites, and conducting our activities in a way that prevents unnecessary damage to the land.

We intend to secure all necessary exploration permits and, if we conclude that development is warranted on any claims, will file final plans of operation before we begin any mining operations. We do not anticipate discharging water into any active stream, creek, river, lake or any other body of water subject to any environmental laws or regulations, or disturbing the habitat of any endangered species. Restoration of any disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandoning the property. It is difficult to estimate the costs of compliance with environmental laws since the full nature and extent of our proposed activities cannot be determined until we begin our exploration program and assess it from an environmental standpoint.

We are currently in compliance with the HSR Code and plan to continue complying with this code. However, compliance with the HSR Code may adversely affect our business operations in the future.

Exploration stage companies are not required to comply with environmental matters, except as they relate to their exploration activities. The only “cost and effect” of compliance with environmental regulations in British Columbia is returning the surface of the land to its previous condition upon abandoning the property. We cannot speculate on those costs in light of our ongoing plans to explore our claims. When, and if, we are ready to begin drilling, we will notify the British Columbia Chief Inspector of Mines who will require us to put a bond in place to provide some assurance that the property will eventually be restored to its original condition.

Costs and Effects of Compliance with Environmental Laws

We currently have no costs to comply with environmental laws concerning our exploration program.

However, we would have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills.

Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the proposed two phases described above.

Research and Development

We have not spent any money on research and development activities since our inception. However, we anticipate that we will incur approximately $175,000 in exploration expenses over the next 12 months to carry out the first phase of our exploration program on the Leamington Property. Other than that, we have no current plans to spend any money on research and development, but that may change if we are successful in acquiring new property interests.

Employees

As of the date of this prospectus, we do not have any full-time or part-time employees. Guy Brusciano, our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer and a director of the Company, works as a part-time consultant in the areas of management and business development. Guy Brusciano currently contributes approximately 30 hours per week to us.

We currently engage independent contractors in the areas of accounting, legal, consulting, management and auditing services. We plan to engage independent contractors in the areas of geological services, marketing, bookkeeping, investment banking and other services.

Transfer Agent

We have engaged Island Stock Transfer of 100 Second Avenue South, Suite 705S, St. Petersburg, Florida 33701 as our stock transfer agent.

Available Information

The Company’s filings with the Securities and Exchange Commission (“SEC”) may be accessed at the internet address of the SEC, which is http://www.sec.gov. Also, the public may read and copy any materials that the Company files with at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580 Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

ITEM 1A. RISK FACTORS

As a “smaller reporting company” (as defined by §229.10(f)(1)), we are not required to provide the information required by this Item.

ITEM 2. PROPERTIES

Our principal executive office space is located at 4170 Still Creek Drive, Suite 200, Burnaby, B.C., Canada, V5C 6C6. Our telephone number is (604) 320-7877. We started paying $2,000 per month (which amount is payable every six months) in June, 2009, for the use of our principal executive office space, which is approximately 1000 square feet in size.

At the present time, we do not have any real estate holdings and there are no plans to acquire any real property interests.

Leamington Property

Location and Access

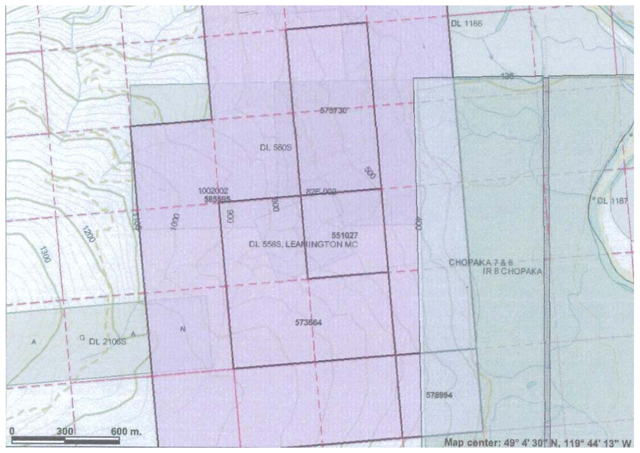

The Leamington Property is located near the Similkameen Valley, 25 kilometers south of Keremeos, British Columbia. It consists of approximately 381 hectares and can be accessed from Highway 3 via Chopaka Road from the west by travelling 1 kilometer up the Roberts Creek logging road. This logging road cuts through the property.

Title

Effective June 25, 2008, we purchased four unpatented mining claims collectively known as the Leamington Property from Ron Schneider through our wholly owned subsidiary Cedar Creek Mines (British Columbia) Inc. Pursuant to the purchase agreement with Mr. Schneider, we acquired an undivided 100% interest in the Leamington Property in exchange for $2,914 (CDN $3,000), which consisted of the purchase price of $2,428 (CDN $2,500) and a service fee of approximately $486 (CDN $500).

Currently, the Leamington Property consists of approximately 381 hectares and includes the following three mineral claims:

| BC Tenure Number | | Tenure Type | | Claim Name | | Expiry Date | | Area (hectares) |

| 551027 | | Mineral | | Leamington | | February 2, 2011 | | 21.162 |

| 573730 | | Mineral | | SIS | | January 14, 2011 | | 42.318 |

| 585595 | | Mineral | | GUY | | June 2, 2011 | | 317.416 |

The mineral claim named “Sisters” that formed part of the Leamington Property having BC Tenure Number 573664 expired on January 13, 2010 as the annual payment was not made on such claim, and therefore, such claim has been automatically forfeited back to the Province of British Columbia.

History of Operations

The previous owner of the Leamington Property completed some preliminary trenching and rock chip sampling on the claims. We are aware of significant activity in the geological region known as the “Similkameen granodiorite batholith” in which the Leamington Property is located. However, we do not have a record of any other previous operations on the Leamington Property. More details on the “Similkameen granodiorite batholith” are provided in the “Mineralization” section below.

Mineralization

The “Similkameen granodiorite batholith” rock formation, in which the Leamington Property is located, is situated in the Similkameen region located in the south central Okanagan area of British Columbia. The Similkameen region rock formations, largely made up of granite-like rock, stand along the U.S.-Canada border and were likely created about 300 million years ago during the Mesozoic Era. These formations have a radius of approximately 40 kilometers and have historically produced metal oxides and carbonates which have been shown to contain fairly substantial amounts of platinum group metals such as ruthenium, rhodium, palladium, osmium, iridium and platinum.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, active, or pending legal proceedings against our Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. In addition, there are no proceedings in which any of our Directors, officers, or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. [REMOVED AND RESERVED]

Not applicable.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

General

We are authorized to issue 150,000,000 shares of common stock, at a par value of $0.00001 per share and 50,000,000 shares of preferred stock with a par value of $0.00001 per share. As of August 31, 2010, there are 51,297,026 shares of Common Stock issued and outstanding and no preferred shares have been issued or are outstanding. The number of record holders of Common Stock as of August 31, 2010, is approximately 53.

Market Information

The Company’s Common Stock is listed on the Over-the-Counter Bulletin Board under the symbol “CEDA”. The Company’s Common Stock has been listed under this symbol since June 1, 2010.

The following historical quotations obtained from online sources reflects the high and low bids for our Common Stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions:

| Quarter Ended | | High ($) | | | Low ($) | |

| May 31, 2010 | | $ | 0.00 | | | $ | 0.00 | |

As of August 31, 2010, the Company’s Common Stock has not yet traded and there is no price listed for its shares.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system and certain other requirements are met. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgement of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

These disclosure requirements may have the effect of reducing the trading activity and price of our common stock. Therefore, stockholders may have difficulty selling those securities.

Dividend Policy

We have never paid any cash dividends and have no plans to do so in the foreseeable future. Our future dividend policy will be determined by our Board of Directors and will depend upon a number of factors, including our financial condition and performance, our cash needs and expansion plans, income tax consequences and the restrictions that applicable laws and other arrangements they impose.

Securities Authorized for Issuance Under Equity Compensation Plans

As of the end of the fiscal year ended May 31, 2010, we do not have any compensation plans under which equity securities are authorized for issuance.

Recent Sales of Unregistered Securities

| · | On April 4, 2008, we issued an aggregate of 50,000,000 shares of our common stock to West Point Capital Inc., a company controlled by Guy Brusciano, our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer and a director of the Company, at $0.00001 per share for cash proceeds of $500. These shares were issued without a prospectus pursuant to section 4(2) of the Securities Act. |

| · | On April 16, 2008, we issued an aggregate of 6,000 shares of our common stock to three non-U.S. investors at $0.25 per share in exchange for cash proceeds of $1,500. |

| · | On May 16, 2008, we issued an aggregate of 71,600 shares of our common stock to ten non-U.S. investors at $0.25 per share in exchange for cash proceeds of $17,900. |

| · | On May 16, 2008, we issued an aggregate of 498,400 shares of our common stock to ten non-U.S. investors in exchange for 498,400 shares of the common stock of Cedar Creek Mines Inc., our wholly owned subsidiary, pursuant to share exchange agreements. The 498,400 shares of Cedar Creek Mines Inc. were originally purchased for CDN $0.25 per share. |

| · | On May 28, 2008, we issued an aggregate of 152,000 shares of our common stock to six non-U.S. investors at $0.25 per share in exchange for cash proceeds of $38,000. Included in this issuance were 40,000 shares issued to Guy Brusciano, our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer and a director of the Company, at $0.25 per share in exchange for cash proceeds of $10,000. |

| · | On July 21, 2008, we issued an aggregate of 8,000 shares of our common stock to five non-U.S. investors at $0.25 per share in exchange for cash proceeds of $2,000. |

| · | On July 31, 2008, we issued an aggregate of 66,000 shares of our common stock to three non-U.S. investors at $0.25 per share in exchange for cash proceeds of $16,500. |

| · | On August 11, 2008, we issued 5,000 shares of our common stock to one non-U.S. investor at $0.25 per share in exchange for cash proceeds of $1,250. |

| · | On August 15, 2008, we issued 40,000 shares of our common stock to one non-U.S. investor at $0.25 per share in exchange for cash proceeds of $10,000. |

| · | On September 4, 2008, we issued 55,000 shares of our common stock to three non-U.S. investors at $0.25 per share in exchange for cash proceeds of $13,750. Included in this issuance were 20,000 shares issued to Guy Brusciano, our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer and a director of the Company, for cash proceeds of $5,000. |

| · | On June 12, 2009, we issued 14,000 shares or our common stock to three non-U.S. investors at $0.25 per share in exchange for cash proceeds of $3,500. |

| · | On June 22, 2009, we issued 93,000 shares of our common stock to ten non-U.S. investors at $0.25 per share in exchange for cash proceeds of $23,250. |

| · | On June 25, 2009, we issued 4,000 shares of our common stock to one non-U.S. investor at $0.25 per share in exchange for cash proceeds of $1,000. |

| · | On July 3, 2009, we issued 42,000 shares of our common stock to three non-U.S. investors at $0.25 per share in exchange for cash proceeds of $10,500. Included in this issuance were 20,000 shares issued to Guy Brusciano, our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer and director, for cash proceeds of $5,000 and 6,000 shares of common stock issued to Karen Brusciano, the spouse of Guy Brusciano, for proceeds of $1,500. |

| · | On July 7, 2010, we issued 242,026 shares of our common stock to three individuals due to the closing of our private placement at $0.25 per share for total gross proceeds of $60,506. |

Other than as described above, these shares were issued without a prospectus pursuant to Regulation S promulgated under the Securities Act of 1933, as amended.

Purchase of Equity Securities by the Company and Affiliated Purchasers

Not applicable.

ITEM 6. SELECTED FINANCIAL DATA

The Company, as a “smaller reporting company” (as defined by §229.10(f)(1)), is not required to provide the information required by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following plan of operation together with our financial statements and related notes appearing elsewhere in this annual report. This plan of operation contains forward-looking statements that involve risks, uncertainties, and assumptions. The actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors.

Overview

We intend to build our business by acquiring, exploring and developing mineral resource properties in the United States and Canada. We currently own, through our wholly owned subsidiary CCMI, an undivided 100% interest in four mineral claims located near the Similkameen Valley, 25 kilometers south of Keremeos, British Columbia (the “Leamington Property”). CCMI acquired our interest in the Leamington Property pursuant to a purchase agreement with Mr. Ron Schneider dated June 25, 2008. In consideration for this interest, we paid Mr. Schneider approximately $2,914. Our specific exploration plan for the Leamington Property, along with information regarding its location, accessibility, geology and history, is available under the headings “Item 1 - Business” and “Item 2 - Properties” hereinabove.

Our project is at the exploration stage and there is no guarantee that any of our mineral claims contain a commercially viable ore body. We have not presently determined if the Leamington Property contains mineral reserves that are economically recoverable, and we must complete an exploration program on the claims before we can make such a determination. We will require additional financing to carry out any exploration program, and there is no guarantee that we will be able to secure the necessary funds to do so.

We have only recently begun operations. We have not generated any revenues from our business activities and we do not expect to generate revenues for the foreseeable future. For the next 12 months we plan to spend approximately $347,200 to maintain our operations, carry out the first phase of an exploration program on the Leamington Property and acquire interests in other exploration stage properties in Canada and the United States. Since our inception, we have incurred operational losses, and we have been issued a going concern opinion by our auditors.

See “Item 1. Business” for details of our exploration programs.

Plan of Operations

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business operations.

Our registered independent auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next 12 months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we locate mineral deposits and begin removing and selling minerals. There is no assurance we will ever reach this point. Accordingly, we must raise cash from sources other than the sale of minerals found on the property and any other acquired properties. Thus, cash must be raised from other sources. Our only other source for cash at this time is investments by others in the Company. We must raise cash to implement our project and stay in business.

Our exploration target is to find mineral bodies containing precious metals. Our success depends upon finding mineralized material. This will require a determination by a geological consultant as to whether any of our mineral properties currently owned and intended to be acquired contains reserves. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of minerals to justify removal. If we don't find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and you will lose your investment.

In addition, we may not have enough money to complete our exploration of our Leamington Property in British Columbia, Canada, or any newly acquired properties. If it turns out that we have not raised enough money to complete our anticipated exploration program, we will try to raise additional funds from equity or debt financing. At the present time, we are in the process of attempting to raise additional money through equity financing and there is no assurance that we will raise additional money in the future. If we require additional money and are unable to raise it, we will have to suspend or cease operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our current or any newly acquired properties and if any minerals which are found can be economically extracted and profitably processed.

Before mineral retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We can't predict what that will be until we find mineralized material.

We do not claim to have any minerals or reserves whatsoever at this time on any of our current properties.

If we are unable to complete any phase of exploration because we do not have enough money, we will cease operations until we raise more money. If we cannot or do not raise more money, we will cease operations. If we are required to cease operations, we will investigate all other opportunities to maintain shareholder value.

We do not intend to hire additional employees at this time. All of the work to be conducted on any newly acquired properties will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we plan to conduct research and exploration of our properties before we start production of any minerals we may find. We are seeking equity financing to provide for the capital required to implement our research and exploration plans.

We have no assurance that future financings will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop, or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

As of May 31, 2010, we had total current assets of $13,776 and total assets of $14,200. Our total current assets as of May 31, 2010 are comprised of cash in the amount of $13,776. Our total current liabilities as of May 31, 2010 were $74,540 represented by accounts payable of $26,062, accrued liabilities of $17,811 and due to related party of $30,667. As a result, on May 31, 2010, we had a working capital deficiency of $60,764.

Operating activities used $297,377 in cash for the period from inception (April 3, 2008) to May 31, 2010. Our net loss of $347,679 was the primary component of our negative operating cash flow. Investing activities for the period from inception (April 3, 2008) to May 31, 2010, provided $80,830 from the acquisition of the subsidiary. Net cash flows provided by financing activities for the period from inception (April 3, 2008) to May 31, 2010 was $230,323 represented as proceeds from the sale of our common stock of $139,650, subscriptions received for the purchase of our common stock of $60,506 and advances from related party of $30,167.

As of the date of this annual report, we have yet to generate any revenues.

Results of Operation

Fiscal Year Ended May 31, 2010

Management fees: Management fees were $30,000 and $30,000 for the fiscal years ended May 31, 2010, and 2009, respectively.

Professional fees: Professional fees were $75,132 and $54,115 for the fiscal years ended May 31, 2010, and 2009, respectively. The increase in professional fees was related to the increase in activity and the filing of the Company’s registration statement as well as periodic reports during the fiscal year ended May 31, 2010.

General and administrative fees: General and administrative expenses were $25,419 and $49,087 for the fiscal years ended May 31, 2010, and 2009, respectively. The decrease in general and administrative expenses was a result of less travel expenses in 2010.

Mineral property expenses: Mineral property expenses were $2,100 and $2,914 for the fiscal years ended May 31, 2010, and 2009, respectively.

Net Loss: Net loss was $132,651 and $136,116 for the fiscal years ended May 31, 2010, and 2009, respectively. This decrease in net loss of $3,465 resulted primarily from a decrease in general and administrative expenses that was greater than the increase in professional fees by $2,651 during the fiscal year ended May 31, 2010.

Off-Balance Sheet Arrangements

There are no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Going Concern Statement

We have negative working capital, have not yet received revenues from sales of products or services, and have recurring losses from operations. Our continuation as a going concern is dependent upon us attaining and maintaining profitable operations and raising additional capital. The financial statements do not include any adjustment relating to the recovery and classification of recorded asset amounts or the amount and classification of liabilities that might be necessary should we discontinue operations.

Due to the uncertainty of our ability to meet our current operating expenses and the capital expenses noted above, in their report on the annual financial statements for the year ended May 31, 2010, our independent auditors included an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

The continuation of our business is dependent upon us raising additional financial support. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

Critical Accounting Policies

Our financial statements are impacted by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete summary of these policies is included in Note 2 of the notes to our financial statements. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

| CEDAR CREEK MINES LTD. |

| (AN EXPLORATION STAGE COMPANY) |

| CONSOLIDATED FINANCIAL STATEMENTS |

| |

| MAY 31, 2010 |

| CEDAR CREEK MINES LTD. |

| (AN EXPLORATION STAGE COMPANY) |

| INDEX |

| | PAGE |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-2 – F3 |

| | |

| CONSOLIDATED BALANCE SHEETS | F-4 |

| | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | F-5 |

| | |

| CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT) | F-6 |

| | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | F-7 |

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | F-8 – F-12 |

The accompanying notes are an integral part of these consolidated financial statements

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Cedar Creek Mines Ltd.

(A Development Stage Company)

We have audited the accompanying balance sheet of Cedar Creek Mines Ltd. as of May 31, 2010, and the related statements of expenses, cash flows and changes in stockholders’ deficit for the period from April 3, 2008 (inception) through May 31, 2010. These financial statements are the responsibility of Cedar Creek’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. Cedar Creek is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Cedar Creek’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Cedar Creek Mines Ltd., as of May 31, 2010, and the results of its operations and its cash flows for the period from April 3, 2008 (inception) through May 31, 2010, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Cedar Creek Mines Ltd. will continue as a going concern. As discussed in Note 3 to the financial statements, Cedar Creek has suffered losses from operations which raise substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MALONE BAILEY, LLP

www.malone-bailey.com

Houston, Texas

September 13, 2010

The accompanying notes are an integral part of these consolidated financial statements

KEMPISTY & COMPANY

CERTIFIED PUBLIC ACCOUNTANTS, P.C.

15 MAIDEN LANE - SUITE 1003 - NEW YORK, NY 10038 - TEL (212) 406-7272 - FAX (212) 513-1930

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Cedar Creek Mines Ltd.

(An exploration stage company)

We have audited the accompanying consolidated balance sheets of Cedar Creek Mines Ltd. (an exploration stage company) as of May 31, 2009 and May 31, 2008 and the related consolidated statements of operations, changes in stockholders' equity and cash flows for the year ended May 31, 2009, for the period April 3, 2008 (date of inception) through May 31, 2008 and for the period April 3, 2008 (date of inception) through May 31, 2009. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required at this time, to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Cedar Creek Mines Ltd. (an exploration stage company) as of May 31, 2009 and May 31, 2008 and the results of its operations and cash flows for the year ended May 31, 2009, for the period April 3, 2008 (date of inception) through May 31, 2008 and for the period April 3, 2008 (date of inception) through May 31, 2009, are in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has no established source of revenue and has incurred an accumulated loss of $215,028 since inception. This raises substantial doubt about its ability to continue as a going concern. Management's plans in regards to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from outcome of this uncertainty.

Kempisty & Company

Certified Public Accountants PC

New York, New York

October 5, 2009

The accompanying notes are an integral part of these consolidated financial statements

Cedar Creek Mines Ltd.

(An Exploration Stage Company)

Consolidated Balance Sheets

| | | May 31, | | | May 31, | |

| ASSETS | | 2010 | | | 2009 | |

| | | | | | | |

| Current Assets | | | | | | |

| Cash | | $ | 13,776 | | | $ | 26,406 | |

| Prepaid expenses | | | – | | | | 9,198 | |

| | | | | | | | | |

| Total Current Assets | | | 13,776 | | | | 35,604 | |

| | | | | | | | | |

| Property and Equipment | | | 424 | | | | 1,061 | |

| | | | | | | | | |

| Total Assets | | $ | 14,200 | | | $ | 36,665 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | |

| | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable | | $ | 26,062 | | | $ | 4,340 | |

| Accrued liabilities | | | 17,811 | | | | 17,381 | |

| Due to related party | | | 30,667 | | | | 14,639 | |

| | | | | | | | | |

| Total Current Liabilities | | | 74,540 | | | | 36,360 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Stockholders' Equity (Deficit) | | | | | | | | |

| Preferred Stock $0.00001 par value, 50,000,000 shares | | | | | | | | |

| Authorized; none issued & outstanding | | | – | | | | – | |

| Common stock, $0.00001 par value, 150,000,000 shares | | | | | | | | |

| authorized; 51,055,000 and 50,902,000 shares outstanding | | | | | | | | |

| at May 31, 2010 and 2009, respectively | | | 510 | | | | 509 | |

| Additional paid in capital | | | 226,323 | | | | 188,074 | |

| Common stock subscribed | | | 60,506 | | | | 26,750 | |

| Accumulated deficit during the exploration stage | | | (347,679 | ) | | | (215,028 | ) |

| | | | | | | | | |

| Total Stockholders' Equity (Deficit) | | | (60,340 | ) | | | 305 | |

| | | | | | | | | |

| Total Liabilities and Stockholders' Equity (Deficit) | | $ | 14,200 | | | $ | 36,665 | |

The accompanying notes are an integral part of these consolidated financial statements

Cedar Creek Mines Ltd.

(An Exploration Stage Company)

Consolidated Statements of Operations

| | | | | | | | | For the Period | |

| | | | | | | | | April 3, | |

| | | For the | | | For the | | | 2008 | |

| | | Year Ended | | | Year Ended | | | (Inception) to | |

| | | May 31, | | | May 31, | | | May 31, | |

| | | 2010 | | | 2009 | | | 2010 | |

| | | | | | | | | | |

| REVENUES | | $ | – | | | $ | – | | | $ | – | |

| | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | |

| Management fees | | | 30,000 | | | | 30,000 | | | | 71,315 | |

| Professional fees | | | 75,132 | | | | 54,115 | | | | 185,839 | |

| General and administrative | | | 25,419 | | | | 49,087 | | | | 84,840 | |

| Incorporation cost | | | – | | | | – | | | | 671 | |

| Mineral property costs | | | 2,100 | | | | 2,914 | | | | 5,014 | |

| | | | | | | | | | | | | |

| Total operating expenses | | | 132,651 | | | | 136,116 | | | | 347,679 | |

| | | | | | | | | | | | | |

| NET LOSS | | $ | (132,651 | ) | | $ | (136,116 | ) | | $ | (347,679 | ) |

| | | | | | | | | | | | | |

| NETLOSS PER COMMON SHARE | | | | | | | | | | | | |

| Basic and Diluted | | | (0.00 | ) | | | (0.00 | ) | | | | |

| | | | | | | | | | | | | |

| WEIGHTED AVERAGE NUMBER | | | | | | | | | | | | |

| OF SHARES OUTSTANDING | | | 51,045,000 | | | | 50,855,000 | | | | | |

The accompanying notes are an integral part of these consolidated financial statements

Cedar Creek Mines Ltd.

(An Exploration Stage Company)

Consolidated Statements of Changes in Stockholders' Equity (Deficit)

For the period from April 3, 2008 (Inception) to May 31, 2010

| | | | | | | | | | | | | | | Deficit | | | | |

| | | | | | | | | | | | | | | Accumulated | | | | |

| | | Common Stock | | | Additional | | | Common | | | During | | | | |

| | | $0.00001 Par Value | | | Paid in | | | Stock | | | Exploration | | | | |

| | | Shares | | | Amount | | | Capital | | | Subscribed | | | Stage | | | Total | |

| | | | | | | | | | | | | | | | | | | |

| Inception April 3, 2008 | | | 50,000,000 | | | $ | 500 | | | $ | – | | | $ | – | | | $ | – | | | $ | 500 | |

| April 16, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 6,000 | | | | – | | | | 1,500 | | | | – | | | | – | | | | 1,500 | |

| May 16, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 71,600 | | | | 1 | | | | 17,899 | | | | – | | | | – | | | | 17,900 | |

| May 16, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued to acquire subsidiary | | | 498,400 | | | | 5 | | | | 87,178 | | | | – | | | | – | | | | 87,183 | |

| May 28, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 152,000 | | | | 1 | | | | 37,999 | | | | – | | | | – | | | | 38,000 | |

| Net loss for period April 3, 2008 | | | | | | | | | | | | | | | | | | | | | | | | |

| (inception) to May 31, 2008 | | | – | | | | – | | | | – | | | | – | | | | (78,912 | ) | | | (78,912 | ) |

| Balance as of May 31, 2008 | | | 50,728,000 | | | | 507 | | | | 144,576 | | | | – | | | | (78,912 | ) | | | 66,171 | |

| July 21, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 8,000 | | | | – | | | | 2,000 | | | | – | | | | – | | | | 2,000 | |

| July 31, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 66,000 | | | | 1 | | | | 16,499 | | | | – | | | | – | | | | 16,500 | |

| August 11, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 5,000 | | | | – | | | | 1,250 | | | | – | | | | – | | | | 1,250 | |

| August 15, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 40,000 | | | | – | | | | 10,000 | | | | – | | | | – | | | | 10,000 | |

| September 4, 2008 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 55,000 | | | | 1 | | | | 13,749 | | | | – | | | | – | | | | 13,750 | |

| Common stock subscribed | | | – | | | | – | | | | – | | | | 26,750 | | | | – | | | | 26,750 | |

| Net loss for year | | | – | | | | – | | | | – | | | | – | | | | (136,116 | ) | | | (136,116 | ) |

| Balance as of May 31, 2009 | | | 50,902,000 | | | $ | 509 | | | $ | 188,074 | | | $ | 26,750 | | | $ | (215,028 | ) | | $ | 305 | |

| June 12, 2009 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issuance of subscribed stock at $0.25 per share | | | 14,000 | | | | – | | | | 3,500 | | | | (3,500 | ) | | | – | | | | – | |

| June 22, 2009 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of subscribed stock at $0.25 per share | | | 93,000 | | | | 1 | | | | 23,249 | | | | (23,250 | ) | | | – | | | | – | |

| June 25, 2009 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 4,000 | | | | – | | | | 1,000 | | | | – | | | | – | | | | 1,000 | |

| July 3, 2009 – common shares | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cash at $0.25 per share | | | 42,000 | | | | – | | | | 10,500 | | | | – | | | | – | | | | 10,500 | |

| Common stock subscribed | | | – | | | | – | | | | – | | | | 60,506 | | | | – | | | | 60,506 | |

| Net loss for year | | | – | | | | – | | | | – | | | | – | | | | (132,651 | ) | | | (132,651 | ) |

| Balance as of May 31, 2010 | | | 51,055,000 | | | $ | 510 | | | $ | 226,323 | | | $ | 60,506 | | | $ | (347,679 | ) | | $ | (60,340 | ) |

The accompanying notes are an integral part of these consolidated financial statements

Cedar Creek Mines Ltd.

(An Exploration Stage Company)

Consolidated Statements of Cash Flows

| | | | | | | | | For the Period | |

| | | | | | | | | April 3, | |

| | | For the | | | For the | | | 2008 | |

| | | Year Ended | | | Year Ended | | | (Inception) to | |

| | | May 31, | | | May 31, | | | May 31, | |

| | | 2010 | | | 2009 | | | 2010 | |

| | | | | | | | | | |

| Cash flows from operating activities | | | | | | | | | |

| Net loss | | $ | (132,651 | ) | | $ | (136,116 | ) | | $ | (347,679 | ) |

| Adjustments to reconcile net loss to | | | | | | | | | | | | |

| cash used by operating activities: | | | | | | | | | | | | |

| Depreciation | | | 637 | | | | 637 | | | | 1,300 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Prepaid expenses | | | 9,198 | | | | (6,698 | ) | | | – | |

| Accounts payable | | | 21,722 | | | | (8,394 | ) | | | 25,591 | |

| Accrued liabilities | | | 430 | | | | 2,381 | | | | 17,811 | |

| Employee advances | | | – | | | | 3,000 | | | | 5,600 | |

| | | | | | | | | | | | | |

| Net cash used by operating activities | | | (100,664 | ) | | | (145,190 | ) | | | (297,377 | ) |

| | | | | | | | | | | | | |

| Cash flows from investing activities | | | | | | | | | | | | |

| Acquisition of subsidiary | | | – | | | | – | | | | 80,830 | |

| | | | | | | | | | | | | |

| Net cash provided by investing activities | | | – | | | | – | | | | 80,830 | |

| | | | | | | | | | | | | |

| Cash flows from financing activities | | | | | | | | | | | | |

| Issuance of shares | | | 11,500 | | | | 43,500 | | | | 112,900 | |

| Common stock subscribed | | | 60,506 | | | | 26,750 | | | | 87,256 | |

| Advances from related party | | | 16,028 | | | | 14,139 | | | | 30,167 | |

| | | | | | | | | | | | | |

| Net cash provided by financing activities | | | 88,034 | | | | 84,389 | | | | 230,323 | |

| | | | | | | | | | | | | |

| Net increase (decrease) in cash | | | (12,630 | ) | | | (60,801 | ) | | | 13,776 | |

| | | | | | | | | | | | | |

| Cash and cash equivalents, beginning of period | | | 26,406 | | | | 87,207 | | | | – | |

| | | | | | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 13,776 | | | $ | 26,406 | | | $ | 13,776 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Supplemental Disclosures | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Interest paid | | $ | – | | | $ | – | | | $ | – | |

| Income tax paid | | $ | – | | | $ | – | | | $ | – | |

The accompanying notes are an integral part of these consolidated financial statements

Cedar Creek Mines Ltd.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

■ NOTE 1 – NATURE OF BUSINESS

CEDAR CREEK MINES LTD. (the “Company”) was incorporated in the State of Delaware on April 3, 2008. Effective May 16, 2008, the Company acquired all the outstanding common stock CEDAR CREEK MINES INC. (a British Columbia, Canada Corporation). On February 23, 2010 the subsidiary changed its name to Cedar Creek Mines (British Columbia) Inc. The acquisition was accounted for pursuant to Accounting Standards Codification (“ASC”) 805, Business Combinations.

The Company is an Exploration Stage Company, as defined by ASC 915, Development Stage Entities. The Company’s principal business is the acquisition and exploration of mineral resources. The Company has not presently determined whether its properties contain mineral reserves that are economically recoverable.

Reclassifications

Certain reclassifications have been made to the prior period’s financial statements to conform to the current period’s presentation.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

These consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in US dollars. The Company’s fiscal year-end is May 31.

| b) | Principal of Consolidation |

The consolidated financial statements include the accounts of Cedar Creek Mines Ltd. and Cedar Creek Mines (British Columbia) Inc., its 100% owned subsidiary. All significant intercompany balances and transactions have been eliminated in consolidation.

| c) | Cash and Cash Equivalents |

The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents.

ASC 220, Comprehensive Income, establishes standards for the reporting and display of comprehensive income (loss) and its components in the consolidated financial statements. As at May 31, 2010 and 2009, the Company has no items that represent a comprehensive loss and, therefore, has not included a schedule of comprehensive loss in the consolidated financial statements.