Combination of Proteostasis Therapeutics and Yumanity Therapeutics August 24, 2020 Exhibit 99.2

Forward Looking Statements This presentation contains “forward-looking” statements that involve risks, uncertainties and assumptions. If the risks or uncertainties materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to: statements related to the anticipated consummation of the merger transaction between Proteostasis Therapeutics, Inc. (“Proteostasis”), Yumanity Holdings, LLC (“Holdings”) and Yumanity Therapeutics, Inc. (“Yumanity”), the financing to be completed immediately following the closing of the merger (the “Merger”), the expected benefits of the merger, milestones of the combined company following the closing of the merger, including the initiation and completion of clinical studies, clinical trials and the timing thereof; the timing and status of partnership discussions for Proteostasis’ CF program including any grant, sale or transfer of rights related to its proprietary CFTR modulators; and any statements of assumptions underlying any of the items mentioned. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. Actual results could differ materially from our current expectations. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, we undertake no obligation to update publicly any forward-looking statements for any reason to conform these statements to actual results or to changes in our expectations except as required by law. We refer you to the documents that we file from time to time with the Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These documents, including the sections therein titled “Risk Factors,” identify important factors that could cause the actual results to differ materially from those contained in forward-looking statements.

Important Information for Investors and Stockholders This communication may be deemed to be solicitation material in respect of the proposed transaction between Proteostasis Therapeutics, Inc. (“Proteostasis”), Yumanity Holdings, LLC (“Holdings”) and Yumanity Therapeutics, Inc. (“Yumanity”). In connection with the proposed transaction, Proteostasis will file relevant materials with the SEC, including a registration statement on Form S-4 that will contain a prospectus and a proxy statement. Proteostasis will mail the proxy statement/prospectus to Proteostasis stockholders, and the securities may not be sold or exchanged until the registration statement becomes effective. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Proteostasis may file with the SEC or send to stockholders in connection with the proposed transaction. Before making any voting decision, investors and securityholders are urged to read the proxy statement and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction and related matters. You may obtain free copies of the proxy statement and all other documents filed or that will be filed with the SEC regarding the proposed transaction at the website maintained by the SEC at www.sec.gov. Once filed, the proxy statement will be available free of charge on Proteostasis’ website at http://www.proteostasis.com, by contacting Proteostasis’ Investor Relations at (617) 225-0096 or the SEC’s website at www.sec.gov. Participants in the Solicitation Proteostasis and its directors and executive officers, Holdings and its directors and executive officers, and Yumanity and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Proteostasis in connection with the proposed transaction. Information about the executive officers and directors of Proteostasis is set forth in Proteostasis’ Definitive Proxy Statement on Schedule 14A relating to the 2020 Annual Meeting of Stockholders, filed with the SEC on April 29, 2020. Other information regarding the interests of such individuals, as well as information regarding Holdings’ directors and executive officers and Yumanity’s directors and executive officers, will be set forth in the proxy statement/prospectus, which will be included in Proteostasis’ registration on Form S-4 when it is filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph. Non-Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

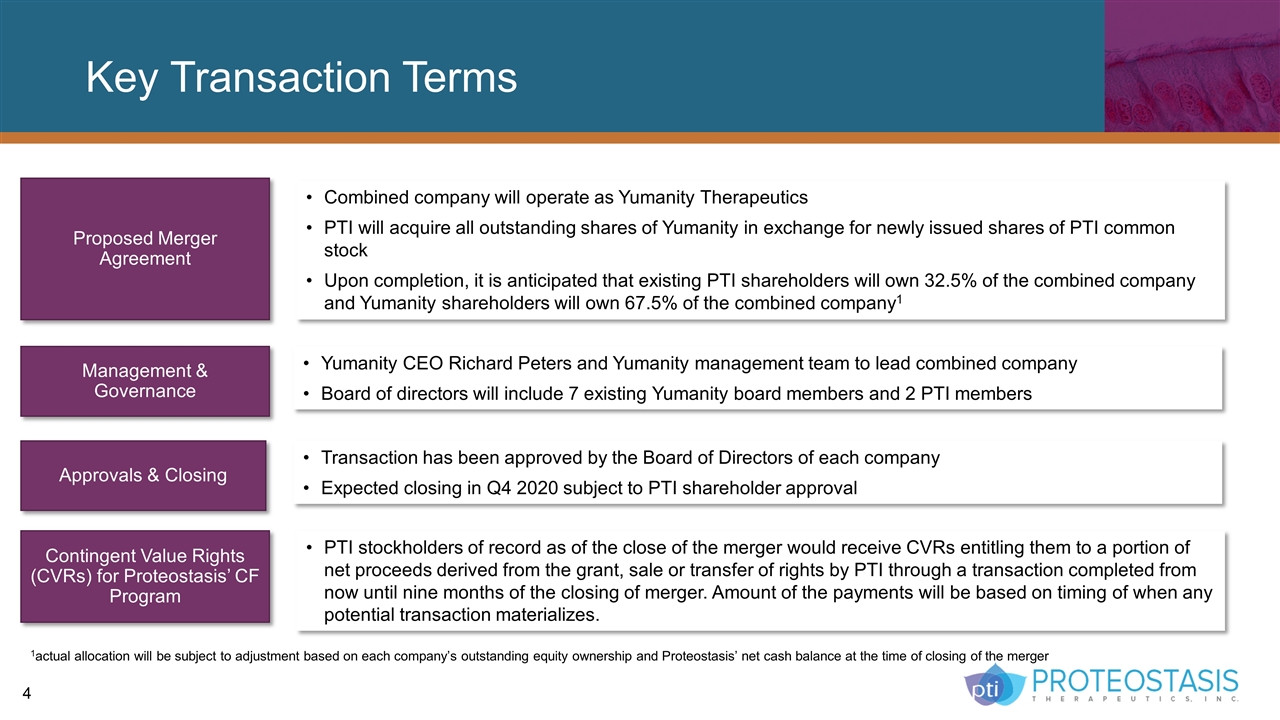

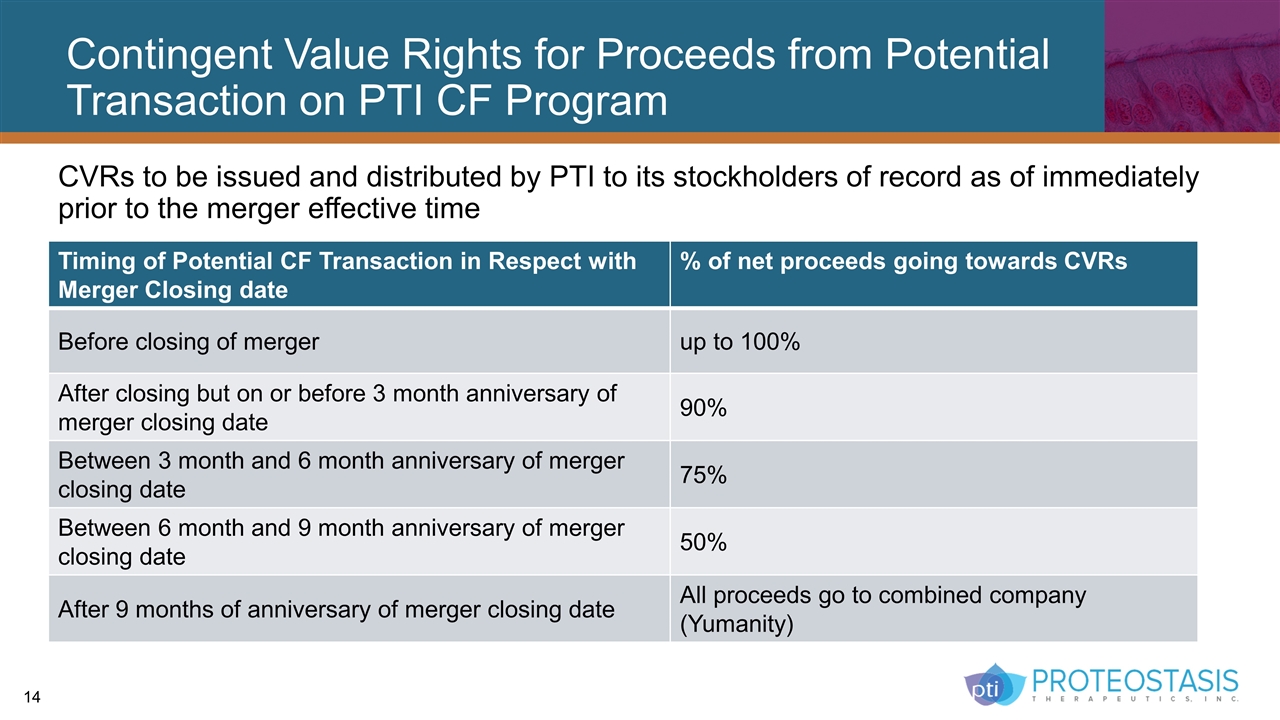

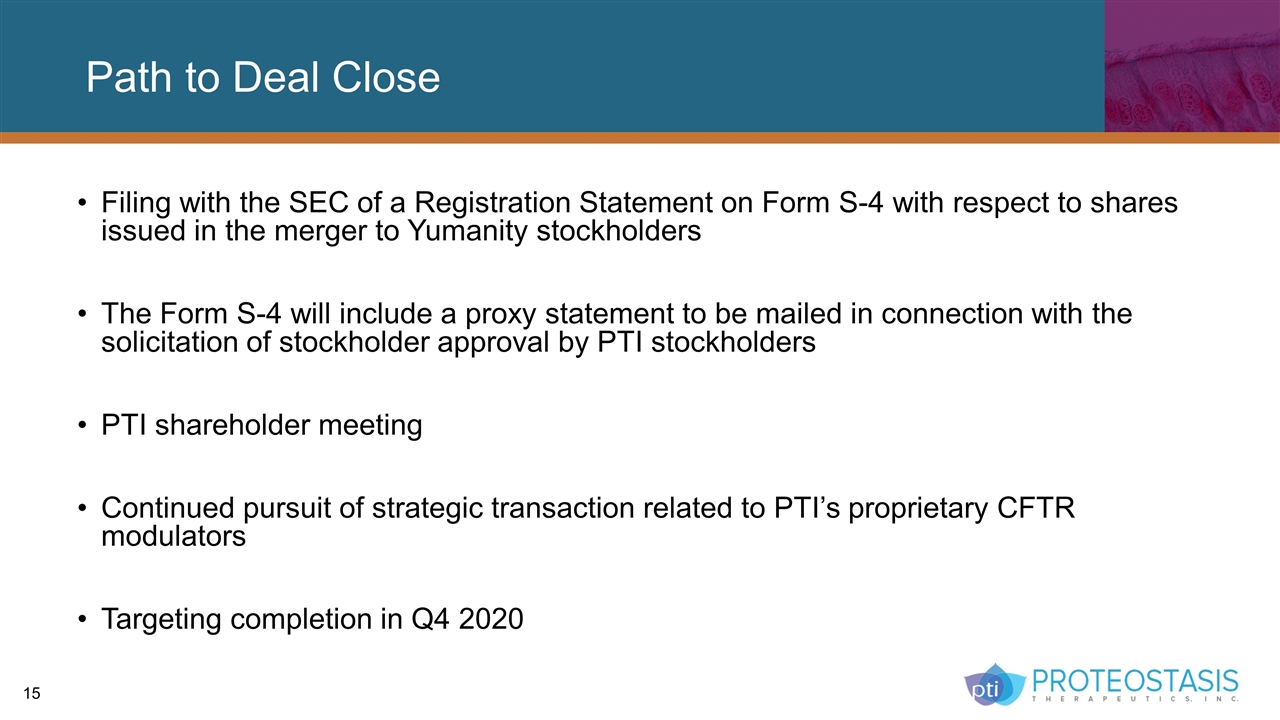

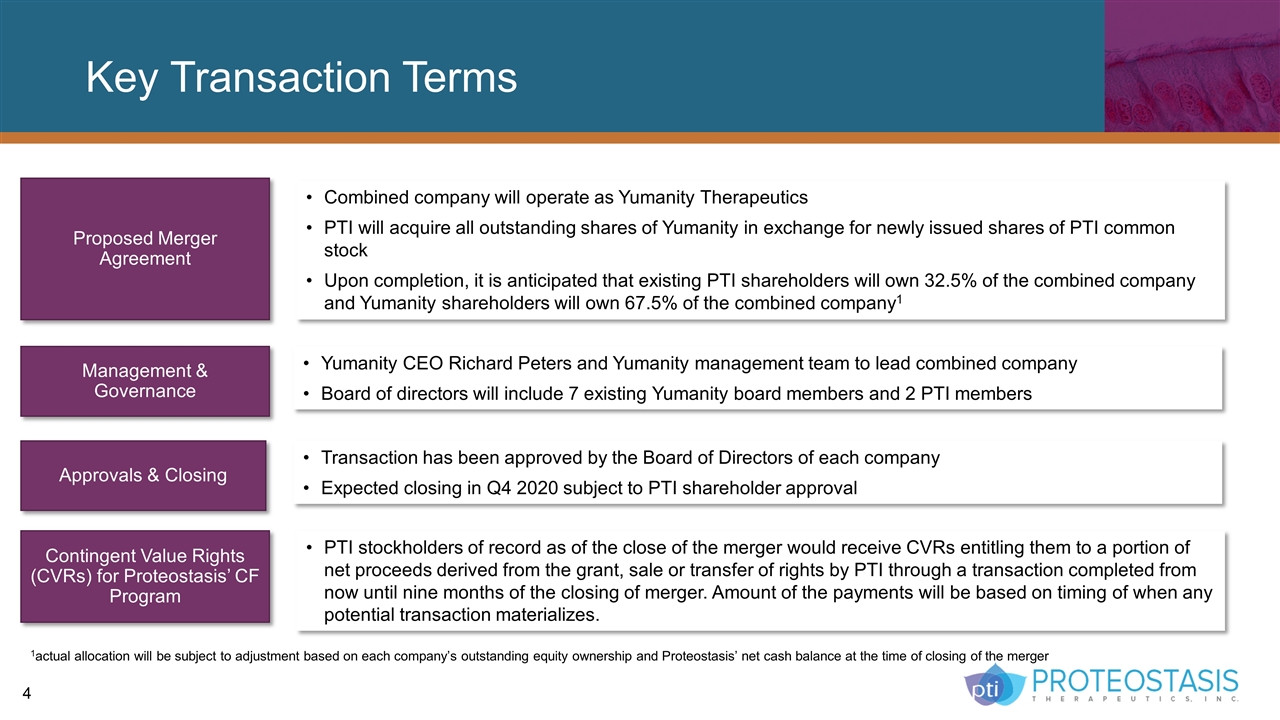

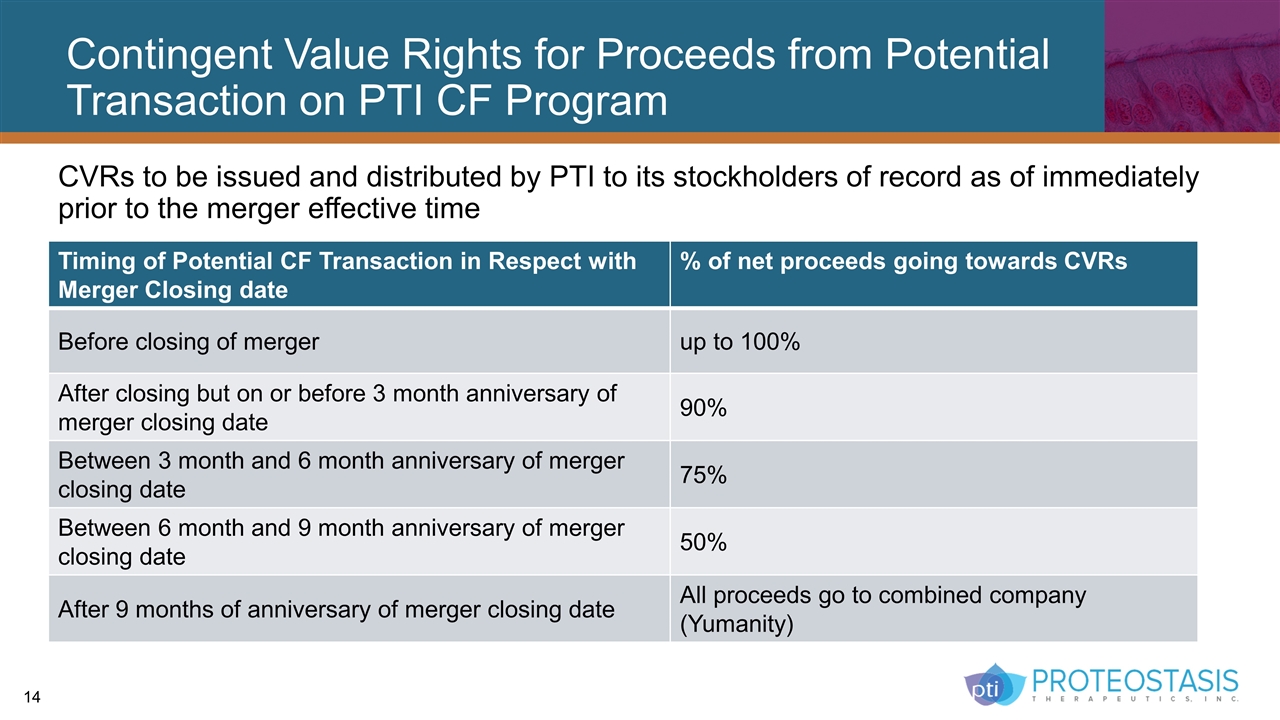

Key Transaction Terms Proposed Merger Agreement Contingent Value Rights (CVRs) for Proteostasis’ CF Program Management & Governance Approvals & Closing Combined company will operate as Yumanity Therapeutics PTI will acquire all outstanding shares of Yumanity in exchange for newly issued shares of PTI common stock Upon completion, it is anticipated that existing PTI shareholders will own 32.5% of the combined company and Yumanity shareholders will own 67.5% of the combined company1 PTI stockholders of record as of the close of the merger would receive CVRs entitling them to a portion of net proceeds derived from the grant, sale or transfer of rights by PTI through a transaction completed from now until nine months of the closing of merger. Amount of the payments will be based on timing of when any potential transaction materializes. Yumanity CEO Richard Peters and Yumanity management team to lead combined company Board of directors will include 7 existing Yumanity board members and 2 PTI members 1actual allocation will be subject to adjustment based on each company’s outstanding equity ownership and Proteostasis’ net cash balance at the time of closing of the merger Transaction has been approved by the Board of Directors of each company Expected closing in Q4 2020 subject to PTI shareholder approval

Yumanity – Proteostasis Combination Offers Strong Synergies for Value Creation Well-positioned to advance multiple programs into and through the clinic Yumanity’s lead program, YTX-7739, in Phase 1 for Parkinson’s disease; One new clinical program in neurodegeneration per year planned Common scientific expertise in protein misfolding to bring new transformative medicines in neurodegeneration Complementary disease relevant phenotypic assays, including patient derived organoids and neurospheres which can derisk path to clinic Strong validating partnerships with established biopharmaceutical companies Eligible to receive $600M+ in milestone payments plus royalties related to established collaborations including Merck Strong cash balance expected to fund operations into 2022

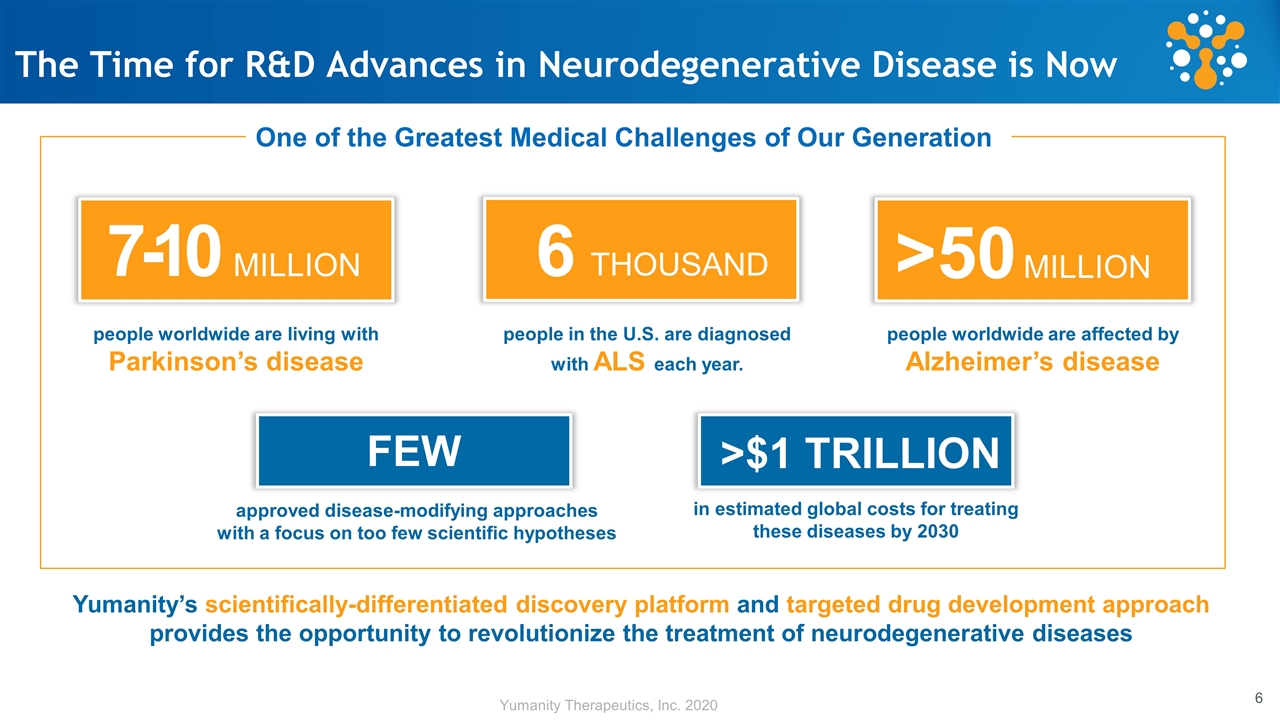

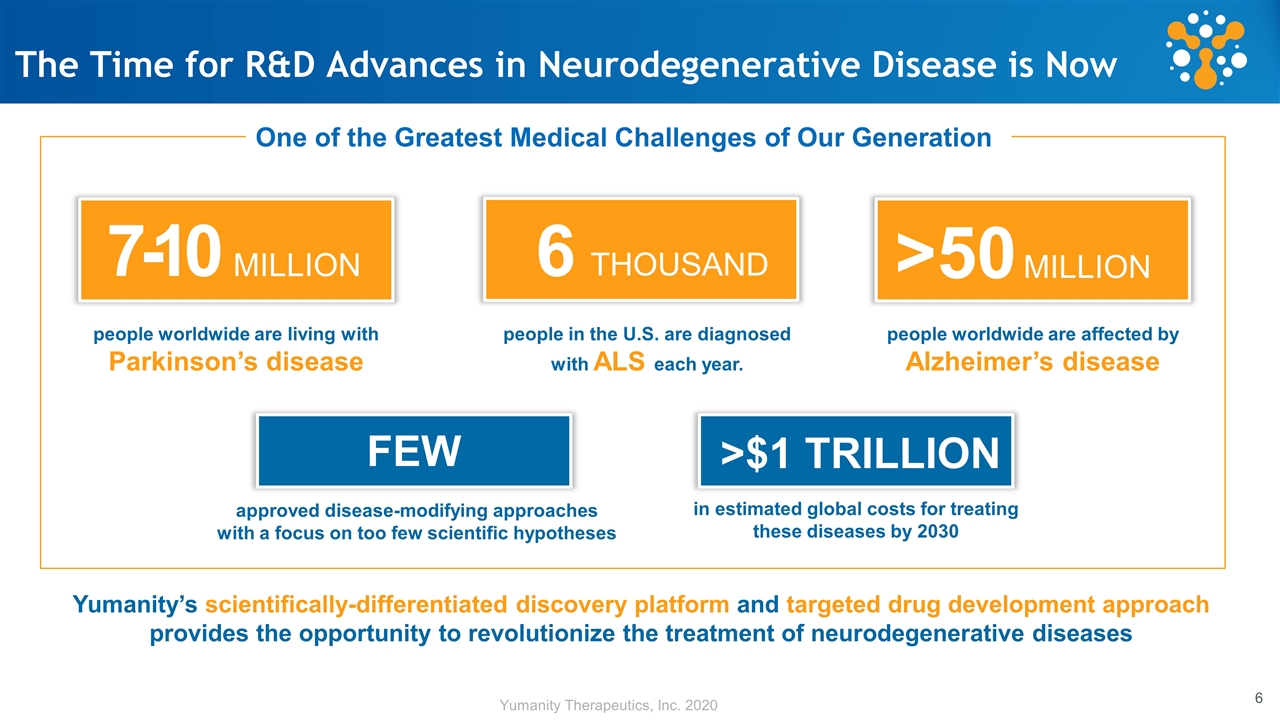

The Time for R&D Advances in Neurodegenerative Disease is Now 7 -1 0 MILLION people worldwide are living with Parkinson’s disease 6 > 5 0 MILLION THOUSAND people in the U.S. are diagnosed with ALS each year. people worldwide are affected by Alzheimer’s disease Yumanity’s scientifically-differentiated discovery platform and targeted drug development approach provides the opportunity to revolutionize the treatment of neurodegenerative diseases One of the Greatest Medical Challenges of Our Generation FEW approved disease-modifying approaches with a focus on too few scientific hypotheses >$1 TRILLION in estimated global costs for treating these diseases by 2030

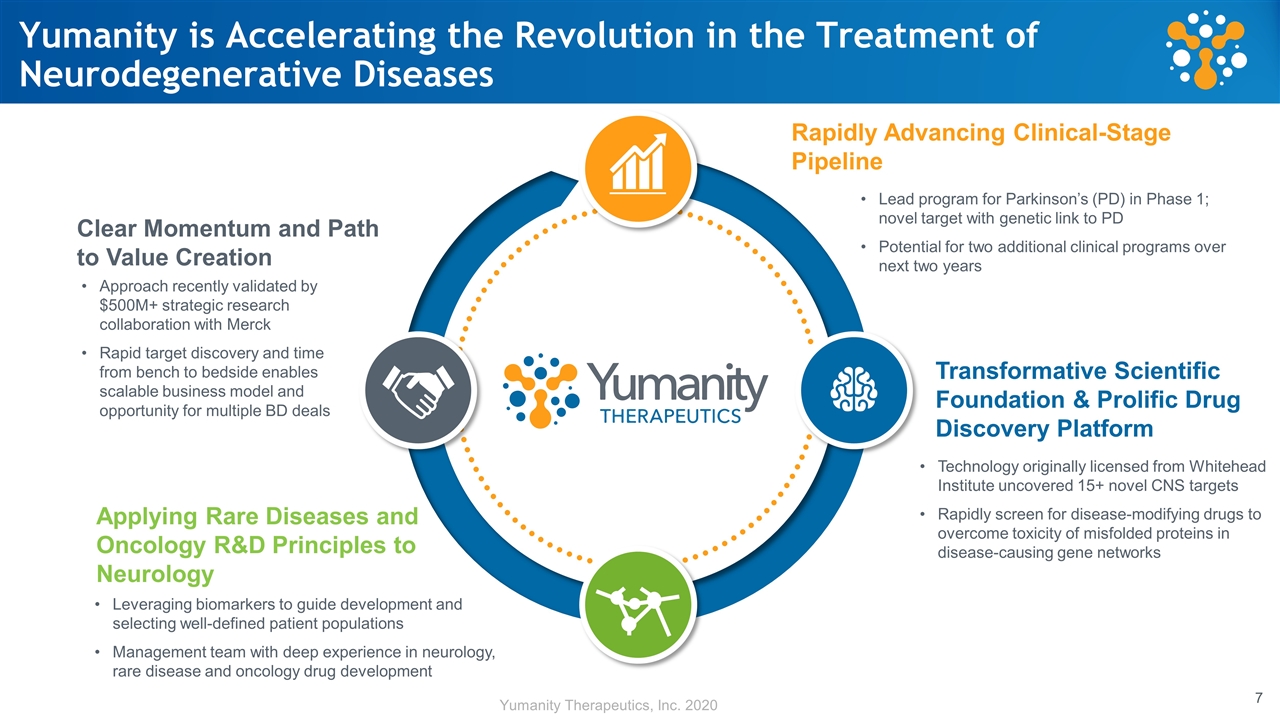

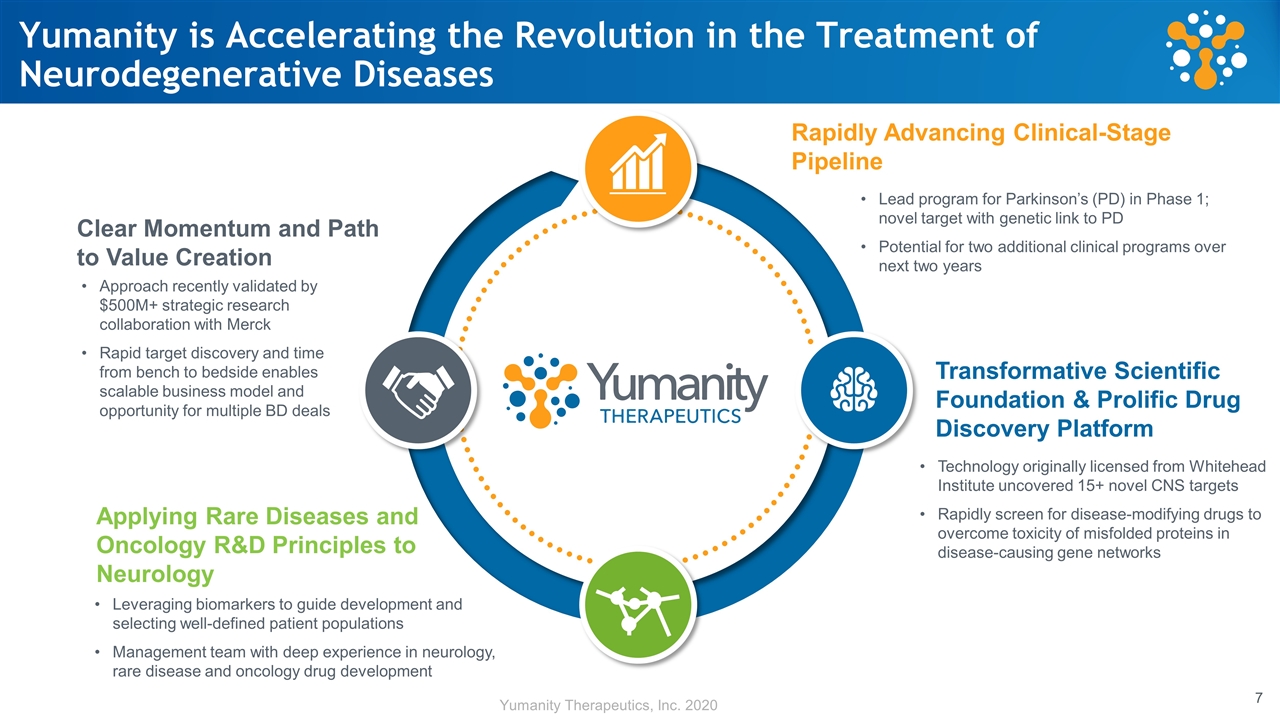

Yumanity is Accelerating the Revolution in the Treatment of Neurodegenerative Diseases Rapidly Advancing Clinical-Stage Pipeline Clear Momentum and Path to Value Creation Lead program for Parkinson’s (PD) in Phase 1; novel target with genetic link to PD Potential for two additional clinical programs over next two years Approach recently validated by $500M+ strategic research collaboration with Merck Rapid target discovery and time from bench to bedside enables scalable business model and opportunity for multiple BD deals Transformative Scientific Foundation & Prolific Drug Discovery Platform Technology originally licensed from Whitehead Institute uncovered 15+ novel CNS targets Rapidly screen for disease-modifying drugs to overcome toxicity of misfolded proteins in disease-causing gene networks Applying Rare Diseases and Oncology R&D Principles to Neurology Leveraging biomarkers to guide development and selecting well-defined patient populations Management team with deep experience in neurology, rare disease and oncology drug development

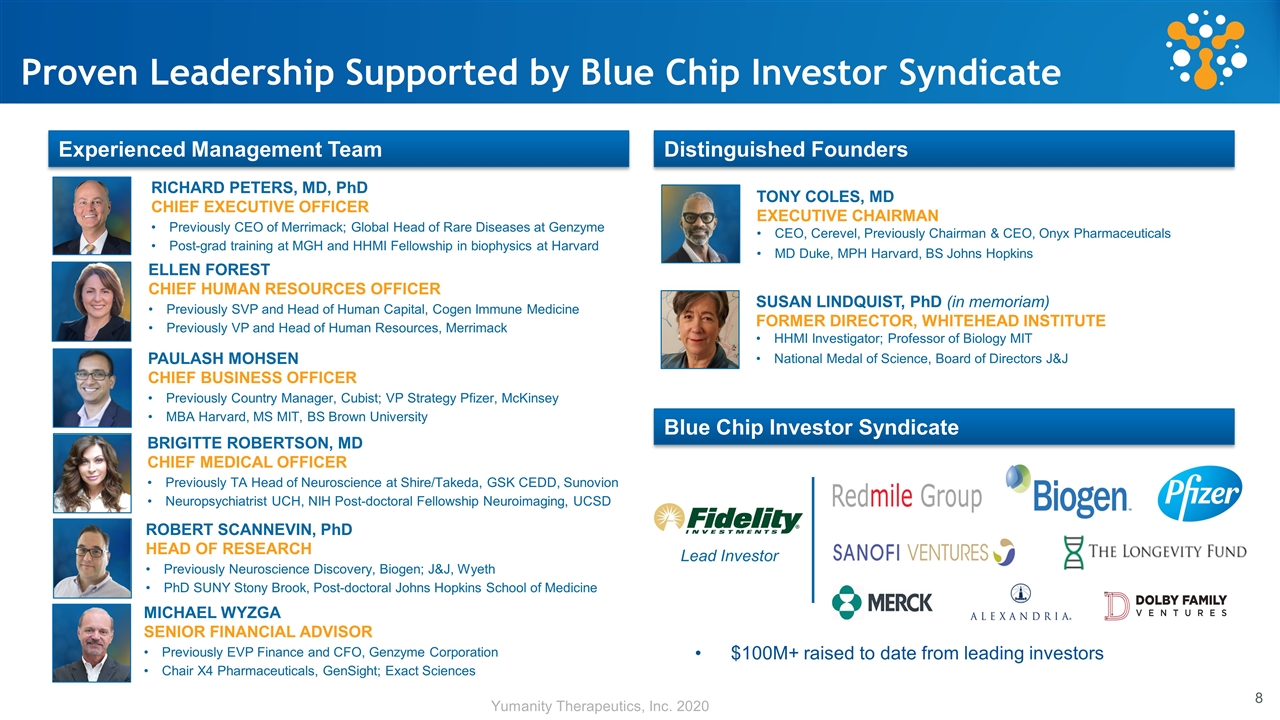

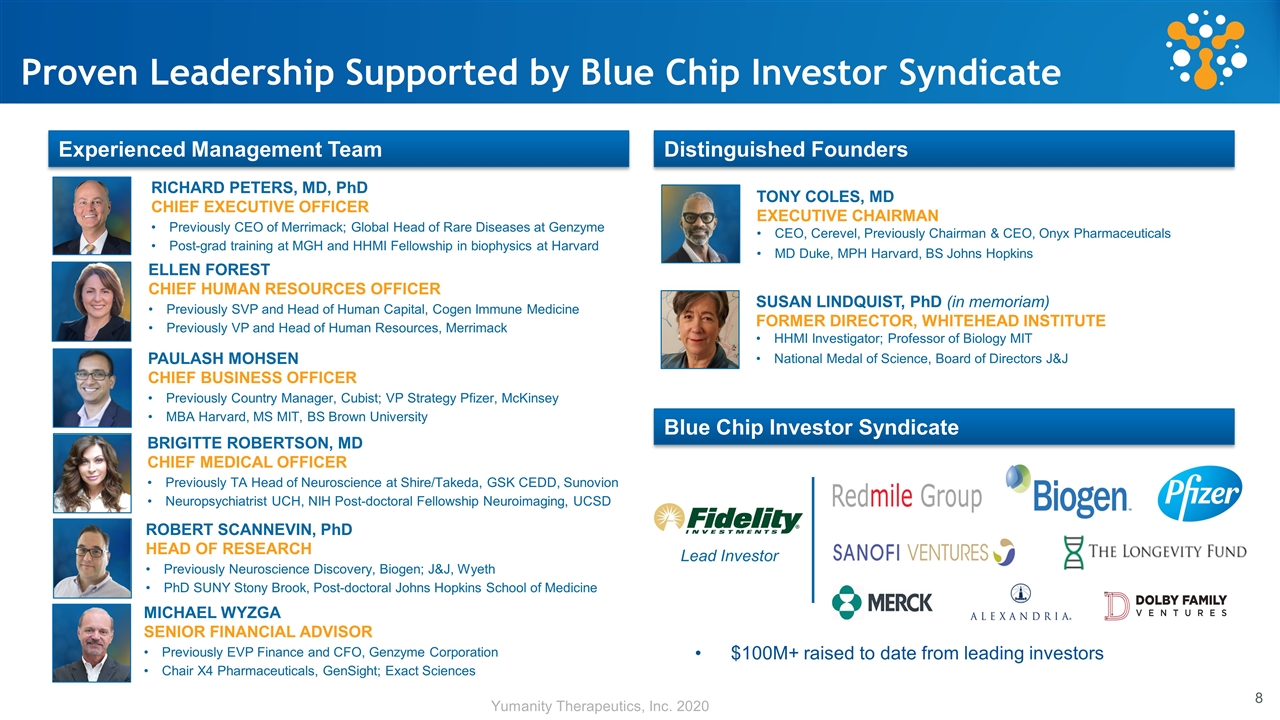

ROBERT SCANNEVIN, PhD HEAD OF RESEARCH Previously Neuroscience Discovery, Biogen; J&J, Wyeth PhD SUNY Stony Brook, Post-doctoral Johns Hopkins School of Medicine PAULASH MOHSEN CHIEF BUSINESS OFFICER Previously Country Manager, Cubist; VP Strategy Pfizer, McKinsey MBA Harvard, MS MIT, BS Brown University RICHARD PETERS, MD, PhD CHIEF EXECUTIVE OFFICER Previously CEO of Merrimack; Global Head of Rare Diseases at Genzyme Post-grad training at MGH and HHMI Fellowship in biophysics at Harvard Proven Leadership Supported by Blue Chip Investor Syndicate TONY COLES, MD EXECUTIVE CHAIRMAN CEO, Cerevel, Previously Chairman & CEO, Onyx Pharmaceuticals MD Duke, MPH Harvard, BS Johns Hopkins SUSAN LINDQUIST, PhD (in memoriam) FORMER DIRECTOR, WHITEHEAD INSTITUTE HHMI Investigator; Professor of Biology MIT National Medal of Science, Board of Directors J&J Distinguished Founders Experienced Management Team MICHAEL WYZGA SENIOR FINANCIAL ADVISOR Previously EVP Finance and CFO, Genzyme Corporation Chair X4 Pharmaceuticals, GenSight; Exact Sciences Blue Chip Investor Syndicate Lead Investor $100M+ raised to date from leading investors BRIGITTE ROBERTSON, MD CHIEF MEDICAL OFFICER Previously TA Head of Neuroscience at Shire/Takeda, GSK CEDD, Sunovion Neuropsychiatrist UCH, NIH Post-doctoral Fellowship Neuroimaging, UCSD Yumanity Therapeutics, Inc. 2020 ELLEN FOREST CHIEF HUMAN RESOURCES OFFICER Previously SVP and Head of Human Capital, Cogen Immune Medicine Previously VP and Head of Human Resources, Merrimack

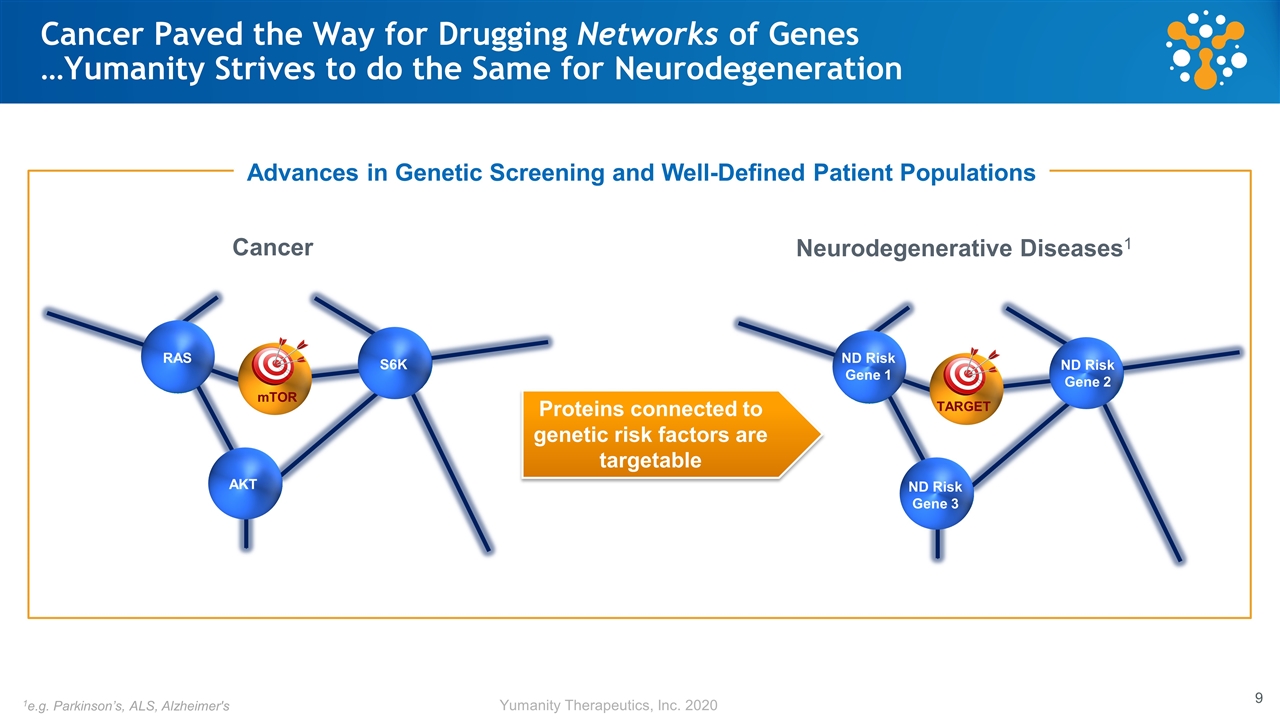

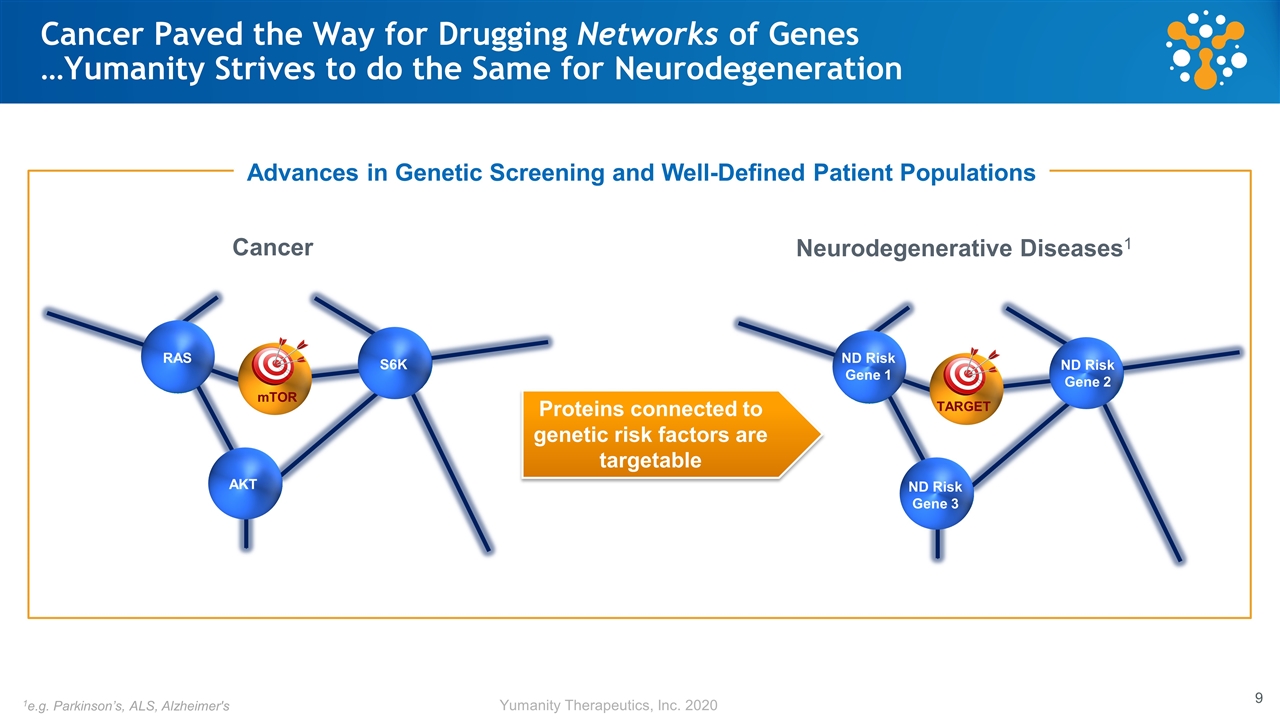

Cancer Paved the Way for Drugging Networks of Genes …Yumanity Strives to do the Same for Neurodegeneration 1e.g. Parkinson’s, ALS, Alzheimer's Proteins connected to genetic risk factors are targetable S6K mTOR RAS AKT ND Risk Gene ND Risk Gene Cancer Advances in Genetic Screening and Well-Defined Patient Populations ND Risk Gene 2 TARGET ND Risk Gene 1 Neurodegenerative Diseases1 ND Risk Gene 3 Yumanity Therapeutics, Inc. 2020

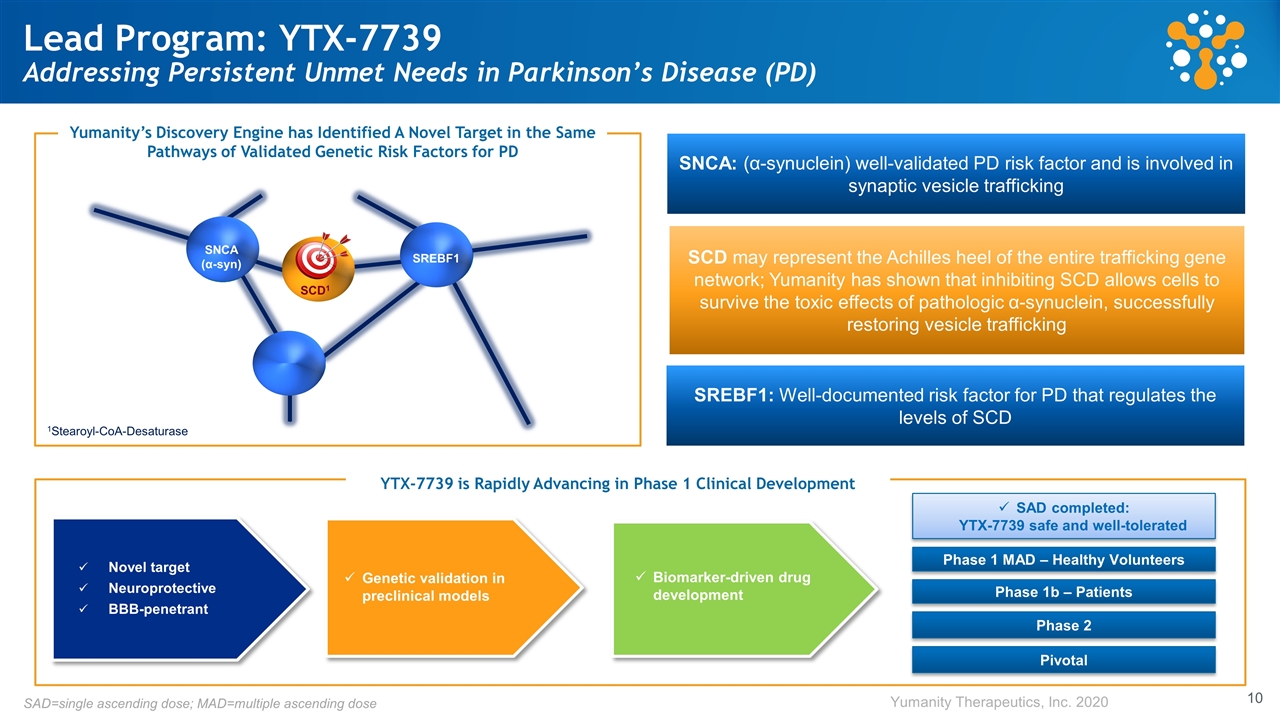

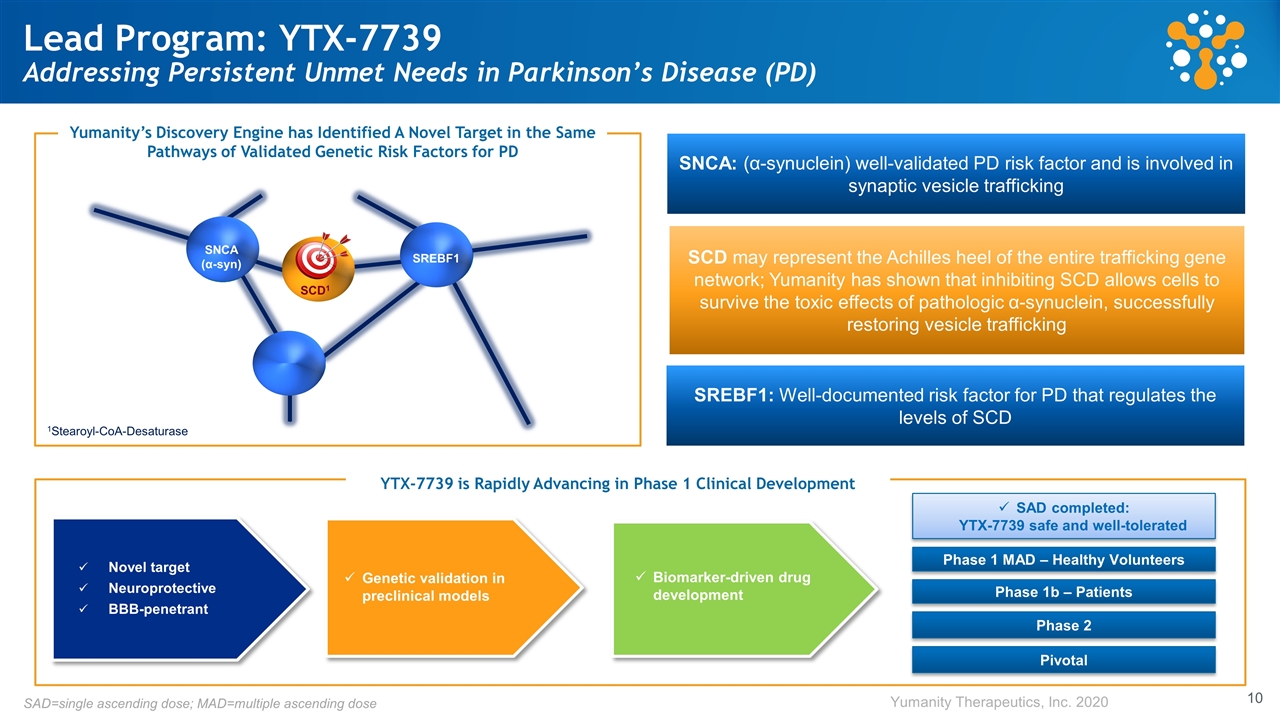

Lead Program: YTX-7739 Addressing Persistent Unmet Needs in Parkinson’s Disease (PD) SREBF1 SCD1 SNCA (α-syn) 1Stearoyl-CoA-Desaturase SNCA: (α-synuclein) well-validated PD risk factor and is involved in synaptic vesicle trafficking SREBF1: Well-documented risk factor for PD that regulates the levels of SCD Yumanity’s Discovery Engine has Identified A Novel Target in the Same Pathways of Validated Genetic Risk Factors for PD Novel target Neuroprotective BBB-penetrant Genetic validation in preclinical models Biomarker-driven drug development YTX-7739 is Rapidly Advancing in Phase 1 Clinical Development SAD=single ascending dose; MAD=multiple ascending dose Yumanity Therapeutics, Inc. 2020 SCD may represent the Achilles heel of the entire trafficking gene network; Yumanity has shown that inhibiting SCD allows cells to survive the toxic effects of pathologic α-synuclein, successfully restoring vesicle trafficking Pivotal Phase 2 Phase 1b – Patients SAD completed: YTX-7739 safe and well-tolerated Phase 1 MAD – Healthy Volunteers

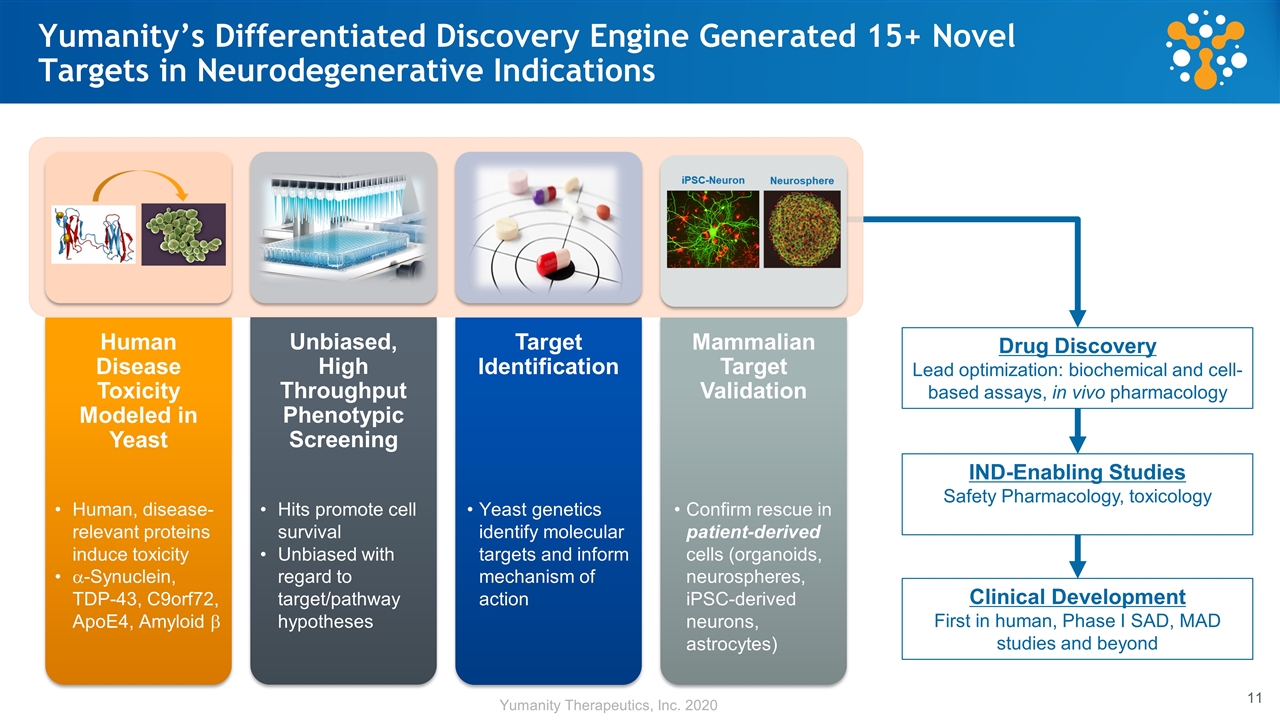

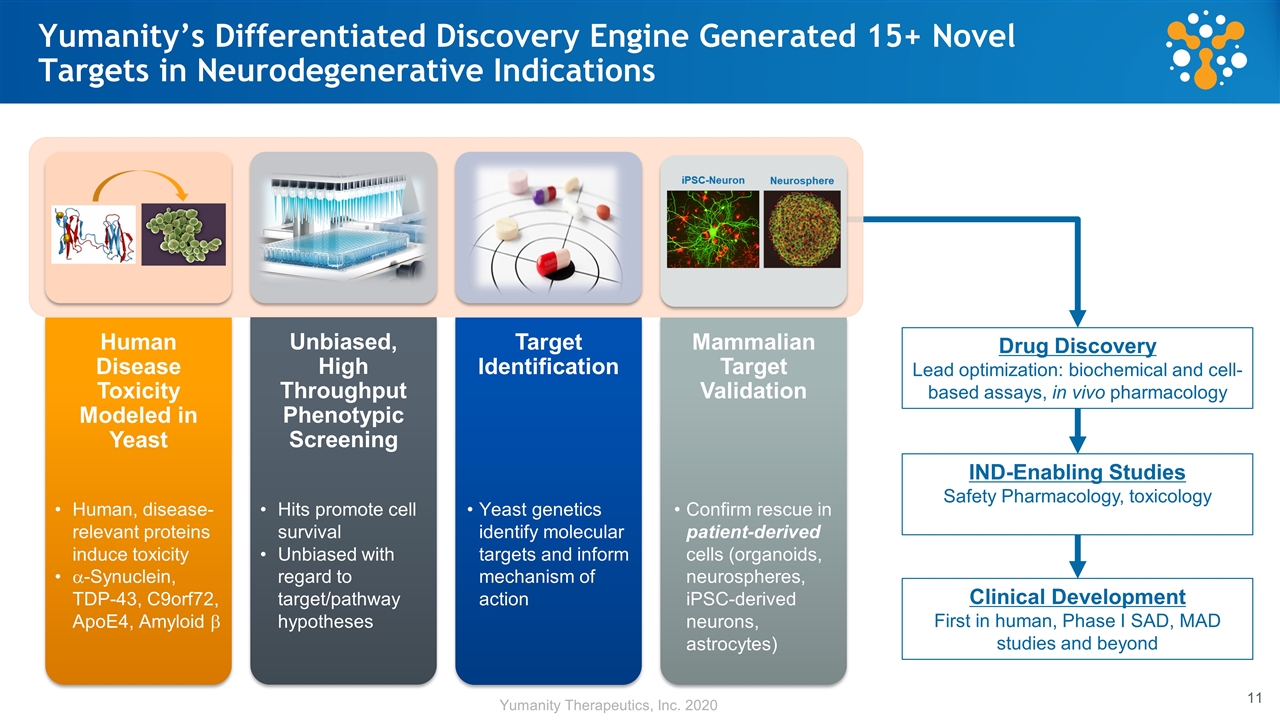

Human Disease Toxicity Modeled in Yeast Unbiased, High Throughput Phenotypic Screening Target Identification Mammalian Target Validation Hits promote cell survival Unbiased with regard to target/pathway hypotheses Confirm rescue in patient-derived cells (organoids, neurospheres, iPSC-derived neurons, astrocytes) Yeast genetics identify molecular targets and inform mechanism of action Human, disease-relevant proteins induce toxicity a-Synuclein, TDP-43, C9orf72, ApoE4, Amyloid b Drug Discovery Lead optimization: biochemical and cell-based assays, in vivo pharmacology IND-Enabling Studies Safety Pharmacology, toxicology Clinical Development First in human, Phase I SAD, MAD studies and beyond Yumanity’s Differentiated Discovery Engine Generated 15+ Novel Targets in Neurodegenerative Indications Yumanity Therapeutics, Inc. 2020

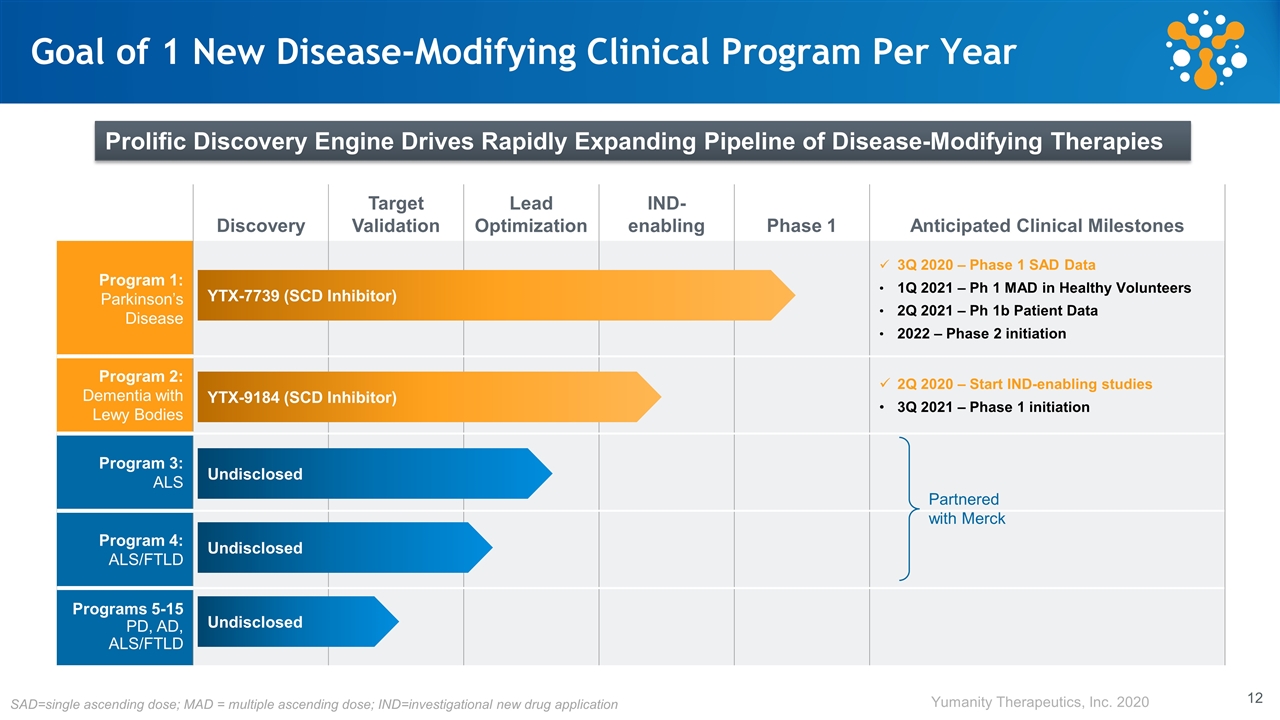

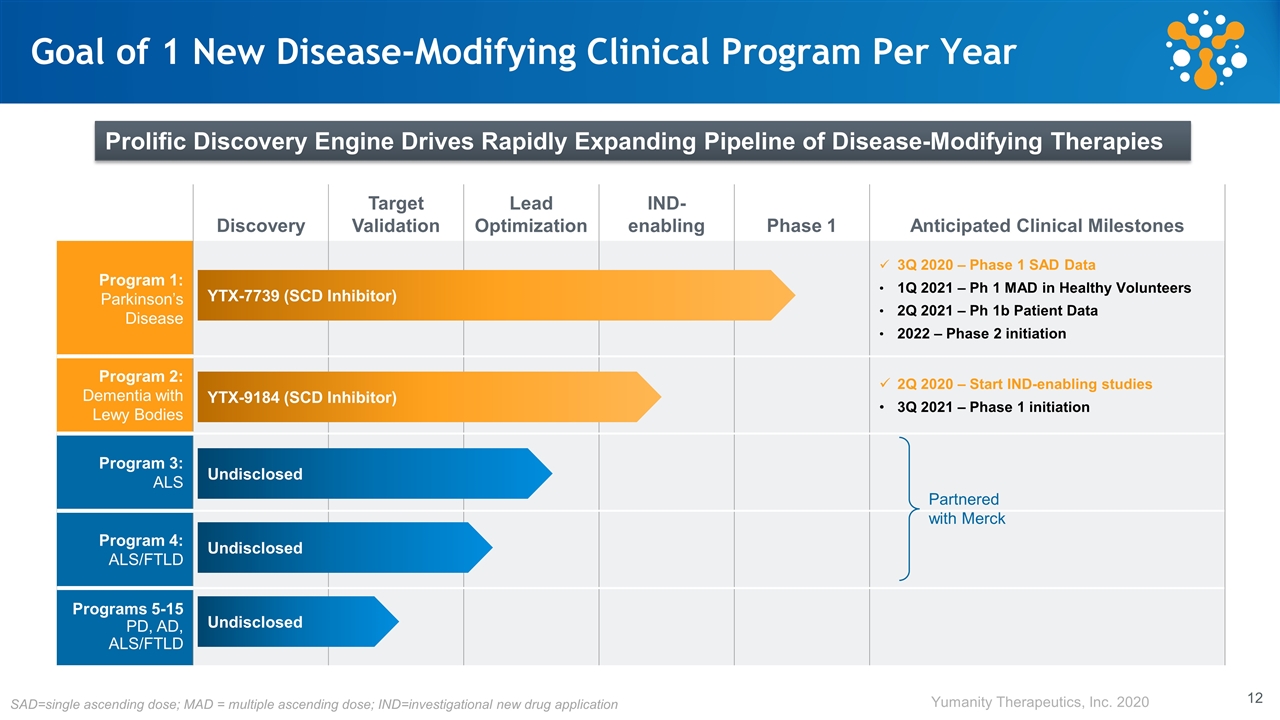

Discovery Target Validation Lead Optimization IND- enabling Phase 1 Anticipated Clinical Milestones Program 1: Parkinson’s Disease 3Q 2020 – Phase 1 SAD Data 1Q 2021 – Ph 1 MAD in Healthy Volunteers 2Q 2021 – Ph 1b Patient Data 2022 – Phase 2 initiation Program 2: Dementia with Lewy Bodies 2Q 2020 – Start IND-enabling studies 3Q 2021 – Phase 1 initiation Program 3: ALS Program 4: ALS/FTLD Programs 5-15 PD, AD, ALS/FTLD YTX-7739 (SCD Inhibitor) Undisclosed Undisclosed Undisclosed YTX-9184 (SCD Inhibitor) Goal of 1 New Disease-Modifying Clinical Program Per Year Partnered with Merck Prolific Discovery Engine Drives Rapidly Expanding Pipeline of Disease-Modifying Therapies Yumanity Therapeutics, Inc. 2020 SAD=single ascending dose; MAD = multiple ascending dose; IND=investigational new drug application

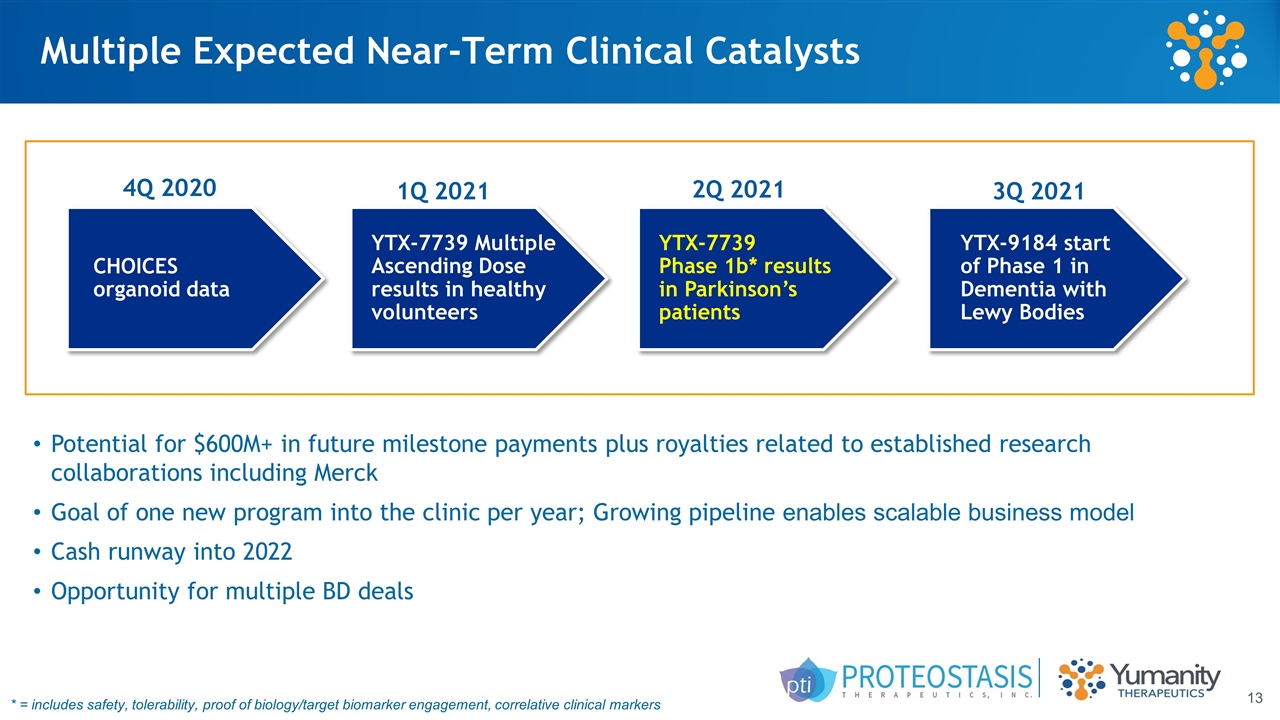

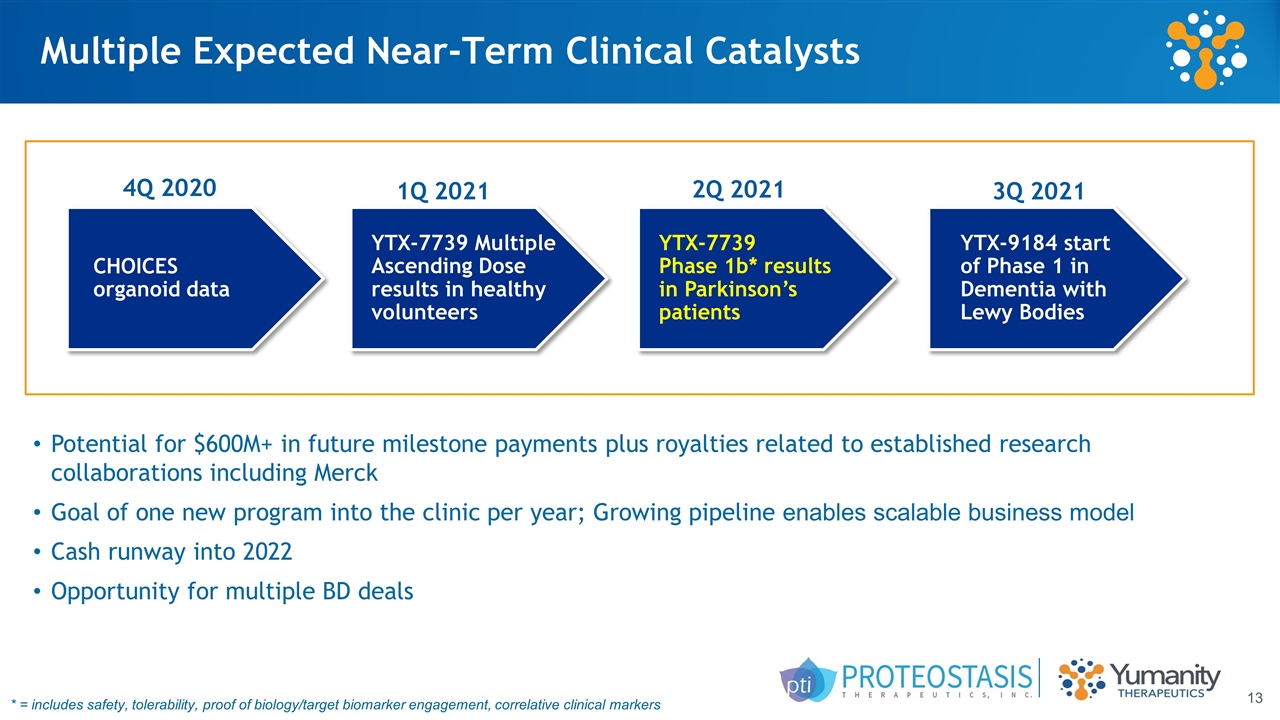

Multiple Expected Near-Term Clinical Catalysts CHOICES organoid data YTX-7739 Multiple Ascending Dose results in healthy volunteers YTX-7739 Phase 1b* results in Parkinson’s patients YTX-9184 start of Phase 1 in Dementia with Lewy Bodies 4Q 2020 1Q 2021 2Q 2021 3Q 2021 Potential for $600M+ in future milestone payments plus royalties related to established research collaborations including Merck Goal of one new program into the clinic per year; Growing pipeline enables scalable business model Cash runway into 2022 Opportunity for multiple BD deals * = includes safety, tolerability, proof of biology/target biomarker engagement, correlative clinical markers

Contingent Value Rights for Proceeds from Potential Transaction on PTI CF Program CVRs to be issued and distributed by PTI to its stockholders of record as of immediately prior to the merger effective time Timing of Potential CF Transaction in Respect with Merger Closing date % of net proceeds going towards CVRs Before closing of merger up to 100% After closing but on or before 3 month anniversary of merger closing date 90% Between 3 month and 6 month anniversary of merger closing date 75% Between 6 month and 9 month anniversary of merger closing date 50% After 9 months of anniversary of merger closing date All proceeds go to combined company (Yumanity)

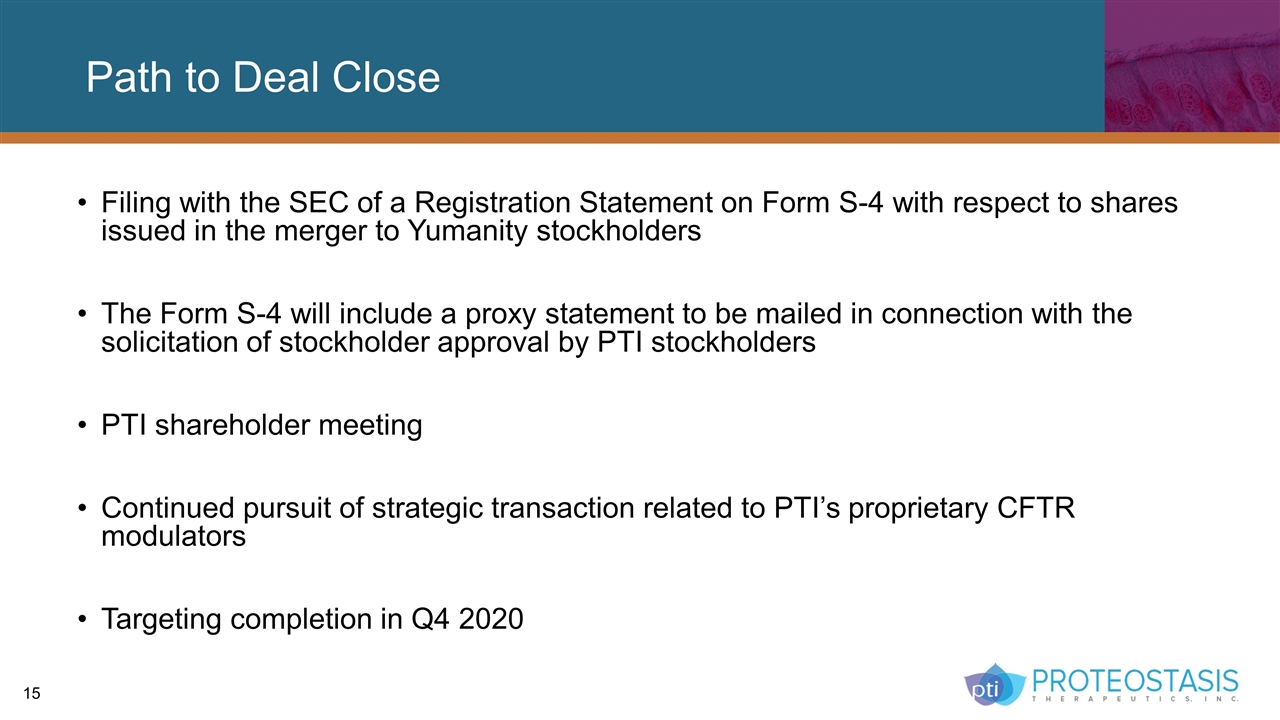

Path to Deal Close Filing with the SEC of a Registration Statement on Form S-4 with respect to shares issued in the merger to Yumanity stockholders The Form S-4 will include a proxy statement to be mailed in connection with the solicitation of stockholder approval by PTI stockholders PTI shareholder meeting Continued pursuit of strategic transaction related to PTI’s proprietary CFTR modulators Targeting completion in Q4 2020

Q&A