ACTION BY UNAMOUS WRITTEN CONSENT OF

BOARD OF DIRECTORS OF TRIANGLE MULTI-MEDIA LIMITED, INC.

PURSUANT to the authority provided under the laws of the State of Washington, the undersigned, being all of the members of the Board of Directors of TRIANGLE MULTI-MEDIA LIMITED, INC. (the "Company") hereby adopt, consistent with the company's Bylaws, the following resolutions without a meeting.

1. Authority to Merge the Company with CINEMAX PICTURES AND PRODUCTION COMPANY INTERNATIONAL, INC., an Ontario, Canada corporation.

RESOLVED, that the Acquisition Agreement And Plan Of Merger made this 29th day of August, 2007 between TRIANGLE MULTIMEDIA LIMITED, INC., a Washington corporation and CINEMAX PICTURES AND PRODUCTION COMPANY INTERNATIONAL, INC., an Ontario, Canada corporation, is hereby approved and adopted;

RESOLVED FURTHER, that the officers of this company be, and each individually is, hereby authorized to do and perform any and all such acts, including execution of any and all documents and certificates, as said officers shall deem necessary or advisable, to carry out the purposes of the foregoing resolution; and

RESOLVED FURTHER, that all acts and deeds done by any officer or director of the Company intended to carry out the intent of the foregoing resolutions are hereby ratified and approved.

EXECUTED as of the 29th day of August, 2007.

MINUTES APPROVED:

Lloyd Fan, Director

ACQUISITION AGREEMENT

AND PLAN OF MERGER

THIS ACQUISITION AGREEMENT AND PLAN OF MERGER (the "Agreement"), is made and entered into this 29lh day of August 2007, by and among Triangle Multi-Media Limited, Inc. a Washington corporation, ('Triangle" or "Issuer"), Cinemax Pictures and Production Company International, Inc., an Ontario, Canada corporation ("Cinemax" or "Acquired Company") and the person executing this agreement (the "Shareholder") who owns all of the outstanding shares of Cinemax.

RECITALS

WHEREAS, Triangle, a public company, desires to acquire 100% of the total issued and outstanding capital stock of Cinemax in contemplation of combining the entities; and

WHEREAS, Triangle desires to acquire all of the issued and outstanding shares of common stock of Cinemax, u private company, in exchange for such number of shares of Triangle's common stock as shall equal an aggregate of 52% of the total issued and outstanding common stock (the 'Triangle Common Stock" or 'Triangle Shares"); and

WHEREAS, Cinemax and its Shareholder agree to enter into a business combination transaction which shall result in the combination of the two entities with the former Shareholder of Cinemax controlling a majority of the combined entity; and

WHEREAS, the Merger is intended to qualify as a tax-free reorganization under Sections 368 (a)(l)(A) and 36i5(a)(2)(E) of the Internal Revenue Code of 1986, as amended (the "Code"); and

NOW, THEREFORE, in consideration of the mutual promises, covenants, and representations contained herein, the parties hereto intending to be legally bound hereby, agree that Cinemax shall be merged into Triangle (the "Merger") upon the terms and conditions hereinafter set forth.

ARTICLE I

Merger

The following Plan of Merger was approved by the stockholders and directors of each of the undersigned corporations in the manner prescribed by law. It was agreed that Cinemax shall be merged into Triangle, the separate existence of Cinemax shall cease and Triangle shall continue to exist under the new name of "Cinemax Pictures and Production Company International, Inc." by virtue of, and shall be governed by, the laws of the State of Washington.

Page 2

ARTICLE II

Articles of Incorporation of Issuer

The Articles of Incorporation of Issuer as in effect on the date hereof shall be the Articles of Incorporation of Acquired Company on the Closing Date without change unless and until amended in accordance with applicable law.

ARTICLE III

Bylaws of Issuer

The Bylaws of Issuer as in effect on the date hereof shall be the Bylaws of the Acquired Company, without change, unless and until repealed or restated in accordance with applicable law.

ARTICLE IV

Effect of Merger on Stock of Constituent Corporation

4.01 All of the outstanding shares of Acquired Company common stock, ("Acquired Company Common Stock") shall be converted into such number of shares of Triangle Common Stock as shall equal an aggregate of 52% of the total issued and outstanding common stock. Acquired Company shall deliver all minutes and other books and records of Acquired Company that will satisfy Issuer or its representative.

4.02 (a) Issuer shall act as exchange agent in the Merger.

(b) Issuer shall mail to each person who was, at the time of mailing, a holder of record of issued and outstanding Acquired Company Common Stock (i) a form letter of transmittal and (ii) instructions for effecting the surrender of the certificate or certificates, which represented issued and outstanding shares of Acquired Company Common Stock ("Acquired Company Certificates"), in exchange for certificates representing Triangle Common Stock. Upon surrender of an Acquired Company Certificate for cancellation to Issuer, together with a duly executed letter of transmittal, the holder of such Acquired Company Certificate(s) shall, subject to paragraph (f) of this section 4.02, be entitled to receive in exchange thereof a certificate representing that number of shares of Triangle Common Stock into which Acquired Company Common Stock theretofore represented by Acquired Company Certificate(s) so surrendered shall have been converted pursuant to the provisions of this Article IV; and Acquired Company Certificate(s) so surrendered shall forthwith be canceled.

(c) No dividends or other distributions declared after August 29, 2007 with respect to Triangle Common Stock and payable to holders of record thereof shall be paid to the holder of any unsurrendered Acquired Company Certificate's) with respect to Triangle Common Stock which by virtue of the Merger are represented thereby, nor shall such holder be entitled to exercise any right as a holder of Triangle Common Stock until such holder shall surrender such Acquired Company Certificate(s). Subject to the effect, if any, of applicable law and except as

Page 3

otherwise provided in paragraph (f) of this Section 4.02, after the subsequent surrender and exchange of an Acquired Company Certificate, the holder thereof shall be entitled to receive any such dividends or other distributions, without any interest thereon, which became payable prior to such surrender and exchange with respect to Triangle Common Stock represented by such Acquired Company Certificate.

(d) If any stock certificate representing Triangle Common Stock is to be issued in a name other than that in which Acquired Company Certificate surrendered with respect thereto is registered, it shall be a condition of such issuance that the Acquired Company Certificate so surrendered shall be properly endorsed or otherwise in proper form for transfer and that the person requesting such issuance shall pay any transfer or other taxes required by reason of the issuance to a person other than the registered holder of the Acquired Company Certificate surrendered or shall establish to the satisfaction of Issuer that such tax has been paid or it is not applicable.

(e) There shall be no further registration of transfers on the stock transfer books of Acquired Company of the shares of Acquired Company Common Stock, or of any other shares of stock of Acquired Company, which were outstanding immediately prior to August 29, 2007. If certificates representing such shares are presented to Acquired Company they shall be canceled and, in the case of Acquired Company Certificates, exchanged for certificates representing Triangle Common Stock as provided in this Article IV.

(f) No certificates or scrip representing fractional shares of Issuer shall be issued upon the surrender for exchange of Acquired Company Certificates. In lieu thereof, the Exchange Agent shall have issued to each holder of Acquired Company Common Stock a whole share of Triangle Common Stock.

ARTICLE V

Corporate Existence, Acquired Company and Liabilities of Acquired Company

On the Closing of this transaction, the separate existence of Acquired Company shall cease. Acquired Company shall be merged with and into Issuer in accordance with the provisions of this Agreement. Thereafter, Issuer shall possess all the rights, privileges, powers and franchises as well of a public as of a private nature, and shall be subject to all the restrictions, disabilities and duties of each of the parties to this Agreement and all and singular; the rights, privileges, powers and franchises of Acquired Company and Issuer, and all property, real, personal and mixed, and all debts due to each of them on whatever account, shall be vested in Issuer; and all property, rights, privileges, powers and franchises, and all and every other interest shall be thereafter and effectually the property of Issuer, as they were of the respective constituent entities, and the title to any real estate whether by deed or otherwise vested in Acquired Company and Issuer or cither of them, shall not revert to or be in any way impaired by reason of the Merger; but all rights of creditors and all liens upon any property of the parties hereto, shall be preserved unimpaired, and all debts, liabilities and duties of the respective constituent entities, shall thence forth attach to Issuer, and may be enforced against it to the same extent as if said debts, liabilities and duties had been incurred or contracted by it.

Officers and Directors of Issuer

The current officers and directors of Issuer shall tender their resignations as officers and directors contemporaneously with the Closing and then nominate as officers and directors persons whose names and positions will be supplied by the Acquired Company. The new officers and directors shall hold office in accordance with the Bylaws of Issuer or until their respective successors shall have been appointed or elected.

ARTICLE VII

EXEMPTION KROM REGISTRATION; REORGANIZATION

The parties hereto intend that the Triangle Common Stock to be issued to the Shareholders shall be exempt from the registration requirements of the Securities Act of 1933, as amended (the "Act"), and pursuant to applicable state statutes. The parties hereto expect this transaction to qualify as a tax-free reorganization under Sections 368 (a)(l)(A) and 368(a)(2)(E) of the Internal Revenue Code of 1986, as amended (the "Code"), but no IRS ruling or opinion of counsel is being sought in connection therewith and such ruling or opinion is not a condition to closing the transactions herein contemplated.

ARTICLE VIII

REPRESENTATIONS AND WARRANTIES

OF CINEMAX PICTURES AND PRODUCTION COMPANY INTERNATIONAL. INC.

Cincmax hereby represents and warrants to Issuer that:

8.01 Organization. Cinemax is a corporation duly organized, validly existing, and in good standing under the laws of Ontario, Canada, has all necessary corporate powers to carry on its business as now owned and operated, and is duly qualified to do business and is in good standing in each of the states and other jurisdictions where its business requires qualification.

8.02 Capital. Cinemax's authorized capital presently consists of 28,000,000 common shares, $0.01 par value, and no preferred shares of capital stock, of which, as of the date hereof, 100 common shares are issued and outstanding and no shares, warrants or options have been reserved for issuance based upon certain specified contingencies. All issued and outstanding shares have been duly authored, validly issued and are fully paid and non-assessable, and subject to no preemptive rights of any shareholder.

8.03 Business Plan. The Business Plan of Cinemax delivered to Triangle accurately describes the business and operations of Cinemax. Cinemax has all right, title and interest in

trademarks, know-how, and otter intellectual property, e.g. foil length feature films in different stages of pre-production and production, reality television shows, discussed in such Business Plan and required to undertake the business and operations of a production company such as Cinemax that has three (3) distinct lines of business, more fully set forth in its business plan.

8.04 Directors and Officers. Exhibit B to this Agreement, the tract of which is hereby incorporated by reference, contains the names and titles of all of the directors and officers of Cinemax as of the date of this Agreement.

8.05 Compliance with Laws. Cinemax, to its actual knowledge, has substantially complied with, and is not in violation of, all applicable Canadian, province or local statutes, laws and regulations, including, without limitation, any applicable building, zoning, environmental, employment or other law, ordinance or regulation affecting its properties, products, services or the operation of its business except where such non-compliance would not have a materially adverse effect on the business or financial condition of Cinemax. Cinemax has all licenses and

permits required to conduct its business as now being conducted and as contemplated in its Business Plan heretofore delivered to Triangle except where such non-compliance would not have a materially adverse effect on the business or financial condition of Cinemax.

8.06 No Material Adverse Change. Prior to Closing, Cinemax shall not:

(i) issue any equity securities or rights to acquire such equity securities of Cinemax, except as authorized by the terms of this Agreement; or

(ii) adopt any pension, profit sharing, retirement, stock bonus, warrant, stock option or similar plan or arrangement.

8.07 Absence of Changes. Since the date of the most recent financial statements there has not been any change in the financial condition or operations of Cinemax, except for changes in the ordinary course of business, which changes have not in the aggregate been materially adverse.

8.08 Absence Of Undisclosed Liabilities. As of the date of its most recent balance sheet, Cinemax did not have any material debt, liability, or obligation of any nature, whether accrued, absolute, contingent or otherwise, and whether due or to become due, that is not reflected in such balance sheet or incurred in the ordinary course of business following the date of the last balance sheet included.

8.09 Investigation of Financial Condition. Without in any manner reducing or otherwise mitigating the representations contained herein, Triangle and/or its attorneys shall have the opportunity to meet with accountants and attorneys to discuss the financial condition of Cinemax. Cinemax shall make available to Triangle and/or its attorneys all books and records of Cinemax. If the transactions contemplated hereby are not completed, all documents received by Triangle and/or its attorneys shall be returned to Cinemax and all information so received shall be treated as confidential.

8.10 Litigation. Cinemax is not a party to any suit, action, arbitration or legal, administrative or other proceeding, or governmental investigation pending or, to the best knowledge of Cinemax, threatened against or affecting Cinemax or its business, assets or financial condition, except for matters which would not have an adverse material affect on Cinemax or its properties. Cinemax is not in default with respect to any order, writ, injunction or decree of any Canadian, provincial, local or foreign court, department, agency or instrumentality applicable to it. Cinemax is not engaged in any lawsuits to recover any material amount of monies due to it.

8.11 Ability to Carry (3ut Obligations. The execution and delivery of this Agreement by the Shareholders and Cinemax and the performance by the Shareholders of the obligations hereunder in the time and manner contemplated will not cause, constitute or conflict with or result in: (a) any material breach or violation of any of the provisions of or constitute a material default under any license, indenture, mortgage, charter, instrument, articles of incorporation, by laws, or other agreement or instrument to which Cinemax is a party, or by which it may be bound, nor will any consents er authorizations of any party other than those hereto be required; (b) an event that would permit any party to any material agreement or instrument to terminate it or to accelerate the maturity of any indebtedness or other obligation of Cinemax, or; (c) an event that would result in the creation or imposition of any material lien, charge, or encumbrance on any asset of Cinemax.

8.12 Assets. Cinemax has good and marketable title to all of the properties and assets reflected on its latest balance sheet (except for property and assets disposed of in the ordinary course of business after the date thereof), free and clear of all liens and encumbrances, except as noted therein, and except for liens of taxes not delinquent.

8.13 Indemnification.. Cinemax agrees to defend and hold Triangle harmless against and in respect of any and all claims, demands, losses, costs, expenses, obligations, liabilities, damages, recoveries and deficiencies, including interest, penalties, and reasonable attorney fees, that it shall incur or suffer, which arise out of, result from or relate to any breach of, or failure by Cinemax to perform any of it's respective representations, warranties, covenants and agreements in this Agreement or in any exhibit or other instrument furnished or to be furnished by Shareholders under this Agreement.

ARTICLE IX

REPRESENTATIONS AND WARRANTIES OF TRIANGLE MULTI-MEDIA LIMITED. INC.

Triangle represents and warrants to Cinemax and the Shareholders that:

9.1 Organization. Triangle is a corporation duly organized, validly existing, and in good standing under the laws of Washington, has all necessary corporate powers to own its properties and to carry on its business as now owned and operated, and is duly qualified to do business in

Page 7

each of such states and other jurisdictions where its business requires such qualification. Triangle may change its domicile prior to Closing.

9.2 Capital. On the day of Closing, the total issued and outstanding capital stock of Triangle will consist of approximately 35,000,000 common shares with a $0.001 par value. No shares, warrants or options have been reserved for issuance based upon certain specified contingencies. All issued and outstanding shares have been duly authorized, validly issued and are fully paid and non-assessable, and subject to no preemptive rights of any shareholder.

9.3 Business. On or before the closing Triangle shall have no operations.

9.4 No Material Adverse Change. Prior to Closing, Triangle shall not:

| (i) | issue any equity securities or rights to acquire such equity securities of Triangle, except as authorized by the terms of this Agreement; or |

| (ii) | adopt any pension, profit sharing, retirement, stock bonus, warrant, stock option or similar plan or arrangement. |

9.5 Absence of Undisclosed Liabilities. As of the date of its most recent Balance Sheet, Triangle did not have any material debt, liability, or obligation of any nature, whether accrued, absolute, contingent or otherwise, and whether due or to become due, that is not reflected in such balance sheet or incurred in the ordinary course of business following the date of the last Balance Sheet included.

9.6 Tax Returns. Within the times and the manner prescribed by law, Triangle has filed all federal, state and local tax returns, as required by law, and has paid all taxes, assessments and penalties due and payable. There are no present disputes as to taxes of any nature payable by Triangle. Adequate provision has been made on the Balance Sheet for all taxes of Triangle as of the date thereof.

9.7 Investigation of Financial Condition. Without in any manner reducing or otherwise mitigating the representations contained herein, Shareholders shall have the opportunity to meet with Triangle's accountants to discuss the financial condition of Triangle. Triangle shall make available to Shareholders all books and records of Triangle in its possession and control.

9.8 Compliance with Laws. Triangle, to its actual knowledge, has complied with, and is not in violation of any, applicable federal, state or local statutes, laws and regulations (including, without limitation, any applicable building, zoning, environmental or other law, ordinance, or regulation) affecting its properties or the operation of its business, except where non-compliance would not have a materially adverse effect on the business or operations of Triangle.

9.9 Litigation. Triangle is not a party to any suit, action, arbitration or legal, administrative or other proceeding, or governmental investigation pending or, to the best knowledge of Triangle, threatened against or affecting Triangle or its business, assets or financial condition, except for matters which would not have a material affect on Triangle or its

Page 8

properties. Triangle is not in default with respect to any order, writ, injunction or decree of any federal, state, local or foreign court, department, agency or instrumentality applicable to it. Triangle is not engaged in any lawsuits to recover any material amount of monies due to it.

9.10 Authority. Triangle has duly and validly authorized this Agreement among Triangle, Cinemax and Shareholders, and the transactions contemplated herein. This Agreement when executed and delivered by Triangle will be valid and binding upon Triangle and enforceable against all parties in accordance with its respective terms, subject as to enforceability to general principles of equity and law.

9.11 Ability to Carry Out: Obligations. The execution and delivery of this Agreement by Triangle and the performance by Triangle will not conflict with or result in: (a) any material breach or violation of any of the provisions of or constitute a default under any license, indenture, mortgage, charter, instrument, articles of incorporation, bylaw, or other agreement or instrument to which Triangle is a party, or by which it may be bound, nor will any consents or authorizations of any party other than those hereto be required; (b) an event that would permit

any party to any material agreement or instrument to terminate it or to accelerate the maturity of any indebtedness or other obligation of Triangle, or; (c) an event that would result in the creation or imposition of any material lien, charge, or encumbrance on any asset of Triangle.

9.12 Title. The shares of Triangle Common Stock to be issued pursuant to this Agreement will be, at closing, free and clear of all liens, security interests, pledges, charges, claims, encumbrances and restrictions of any kind. None of such shares of Triangle Common Stock are or will be subject to voting trusts or agreements, no person holds or has the right to receive any proxy or similar instrument with respect to such shares, except as provided in this Agreement. Triangle is not a party to any agreement that offers or grants to any person the right to purchase or acquire any of the securities to be issued pursuant to this Agreement. There is no applicable local, state or federal law, rule, regulation or decree which would, as a result of the issuance of the shares of Triangle stock, impair, restrict or delay any voting rights with respect to the shares of Triangle Common Stock.

9.13 Issuance of Stock, whether Restricted or Free Trading. The issuance of Triangle Shares of common stock hereunder are not subject to contract provisions or subject to cancellation in the event of contingencies and the corporate resolution authorizing the issuance of said shares of common stock shall so state. Since subject issuance of stock is not subject to any conditions, an acknowledgement that such shares are fully paid and non-assessable shall be set forth in the cover letter of instruction to the Transfer Agent, which will accompany the

corporate resolution authorizing the issuance.

9.14 Indemnification. Triangle agrees to indemnify, defend and hold Cinemax harmless against and in respect of any and all claims, demands, losses, costs, expenses, obligations, liabilities, damages, recoveries and deficiencies, including interest, penalties, and reasonable attorney fees, that it shall incur or suffer, which arise out of, result from or relate to any breach of, or failure by Triangle to perform any of its representations, warranties, covenants and agreements in this Agreement or in any exhibit or other instrument famished or to be furnished

by Triangle under this Agreement.

ADDITIONAL REPRESENTATIONS AND WARRANTIES OF SHAREHOLDER

10.1 Share Ownership. The Shareholder holds shares of Cinemax Common Stock as set forth in Exhibit A attached hereto. The shares are owned of record and are held beneficially by the holder thereof, and such shares are not subject to any lien, encumbrance or pledge. The Shareholder has the authority to exchange such shares pursuant to this Agreement.

10.2 Investment Intent. The Shareholder understands and acknowledges that the shares of Triangle Common Stock are being offered for exchange in reliance upon the exemption provided in Section 4(2) of the Securities Act of 1933 (the "Securities Act") for non-public offerings; and the Shareholder makes the following representations and warranties with the intent that the same may be relied upon in determining the suitability of such Shareholder as a purchaser of securities.

(a) The Triangle Shares are being acquired solely for the account of the Shareholder, for investment purposes only, and not with a view to, or for sale in connection with, any distribution thereof and with no present intention of distributing or reselling any part of the Triangle Shares.

(b) The Shareholder agrees not to dispose of his Triangle Shares or any portion thereof unless and until special securities counsel for Triangle, Roger A. Kimmel, Jr., shall have determined that the intended disposition is permissible and does not violate the Securities Act of 1933 (the "1933 Act") or any applicable state securities laws, or the rules and regulations promulgated thereunder.

(c) The Shareholder acknowledges that Triangle has made all documentation pertaining to all aspects of Triangle and the transactions herein available to him and to his qualified representative(s), if any, and has offered such person or persons an opportunity to discuss Triangle and the transactions herein with the officers of Triangle.

10.3 Shareholder and Issued Stock. Exhibit A annexed hereto sets forth the name, shareholdings and consent of 100% of Cinemax Shareholders to this transaction.

10.4 Indemnification. The Shareholder recognizes that the offer of Triangle Shares to him is based upon his representations and warranties set forth and contained herein and hereby agrees to indemnify and hold harmless Triangle against all liability, costs or expenses (including reasonable attorney's fees) arising as a result of any misrepresentations made herein by such Shareholder.

ARTICLE XI

PRE-CLOSING COVENANTS

11.1 Conduct of Business. Prior to the Closing, Cinemax and Triangle shall each conduct its business in the normal course, and shall not sell, pledge, or assign any assets, without the prior written approval of the other party, except in the regular course of business. Neither Cinemax or Triangle shall amend its Articles of Incorporation or Bylaws, declare dividends, redeem or sell stock or other securities, incur additional or newly-funded liabilities, acquire or dispose of fixed assets, change employment terms, enter into any material or long-term contract, guarantee obligations of any third party, settle or discharge any Balance Sheet receivable for less than its stated amount, pay more on any liability than its stated amount, or enter into any other transaction other than in the regular course of business.

ARTICLE XII

POST-CLOSING COVENANTS

12.1 For one year following the Closing herein:

(a) Stock ..Dividends and Stock Splits. Triangle shall not for a period of one year following the Closing herein: (i) pay a stock dividend or otherwise make a distribution or distributions on shares of its common stock or any other equity or equity equivalent securities payable in shares of its common stock unless the Triangle shares issued to Shareholders and others participating in subject transactions receive their pro rata share of any such distribution; (ii) subdivide outstanding shares of its common stock into a larger number of shares; (iii) combine (including by way of reverse stock split) outstanding shares of common stock into a smaller number of shares or (iv) issue by rectification of shares of the common stock any shares of capital stock of Triangle.

(b) No Interference or Denial of Shares. Post closing, the management of Triangle will not challenge the ownership rights of any existing shareholder(s) at the time of Closing or in any manner interfere with their right to transfer the same so long as such shareholder's interest is set forth in the books and records delivered to the Transfer Agent, i.e. Capital Transfer Agency, Inc.

12.2 Benefit for the Cinemax Shareholder: The foregoing provisions of this Article 12 are expressly set forth for the benefit of the Shareholder of Cinemax and may not be amended or waived. If the Shareholder is damaged by a violation of these provisions he shall have the right to seek an injunction and/or damages, including reasonable attorneys' fees, for such violation.

conditions precedent to triangle's performance

13.1 Conditions. Triangle's obligations hereunder shall be subject to the satisfaction, at or before the Closing, of all the conditions set forth in this Article 13. Triangle may waive any or all of these conditions in whole or in part without prior notice; provided, however, that no such waiver of a condition shall constitute a waiver by Triangle of any other condition or any of Triangle's other rights or remedies, at law or in equity, if the Shareholder shall be in default of any of his representations, warranties, or covenants under this Agreement.

13.2 Accuracy of Representations. Except as otherwise permitted by this Agreement, all representations and warranties by Shareholder in this Agreement or in any written statement that shall be delivered to Triangle by Shareholder under this Agreement shall be true and accurate on and as of the Closing Date as though made at that time.

13.3 Performance. Shareholder shall have performed, satisfied, and complied with all covenants, agreements, and conditions required by this Agreement to be performed or complied with by him, on or before the Closing Date.

13.4 Absence of Litigation. No action, suit, or proceeding before any court or any governmental body or authority, pertaining to the transactions contemplated by this Agreement or to its consummation, shall have been instituted or threatened against Cinemax or Shareholder on or before the Closing Date.

13.5 Acceptance by Cinemax Shareholder. The holder of an aggregate of not less than 100% of the issued and outstanding shares of common stock of Cinemax shall have agreed to exchange his shares for shares of Triangle Common Stock.

13.6 Certificate. Shareholder shall have delivered to Triangle a certificate, dated the Closing Date, certifying that each of the conditions specified in Sections 13.2 through 13.5 hereof have been fulfilled.

ARTICLE XIV

CONDITIONS PRECEDENT TO SHAREHOLDER'S PERFORMANCE

14.1 Conditions. Shareholder's obligations hereunder shall be subject to the satisfaction, at or before the Closing, of all the conditions set forth in this Article 14. Shareholder may waive any or all of these conditions hi, whole or in part without prior notice; provided, however, that no such waiver of a condition shall constitute a waiver by Shareholder of any other condition or any of Shareholder's rights or remedies, at law or in equity, if Triangle shall be in default of any of its representations, warranties, or covenants under this Agreement.

14.2 Accuracy of Representations. Except as otherwise permitted by this Agreement, all representations and warranties by Triangle in this Agreement or in any written statement that shall be delivered to Shareholder by Triangle under this Agreement shall be true and accurate on and as of the Closing Date as though made at that time.

14.3 Performance. Triangle shall have performed, satisfied, and complied with all covenants, agreements, and conditions required by this Agreement to be performed or complied with by it, on or before the Closing Date.

14.4 Absence Of Litigation No action, suit or proceeding before any court or any governmental body or authority, pertaining to the transactions contemplated by this Agreement or to its consummation, shall have been instituted or threatened against Triangle on or before the Closing Date.

14.5 Agreement concerning Liabilities. Triangle shall have no liabilities at the Closing that would have a materially adverse affect on the business or operations of Triangle.

14.6 Officer’s Certificate. Triangle shall have delivered to Shareholder a certificate, dated the Closing Date and signed by the President of Triangle certifying that each of the conditions specified in Sections 14.2 through 14.5 have been fulfilled.

ARTICLE XV

CLOSING

15.1 Closing. The Closing of this transaction shall be held at the offices of Roger A. Kimmel, Jr., or such other place as shall be mutually agreed upon, on such date as shall be mutually agreed upon by the parties. In the event the Closing herein has not been completed by the 31st day of September, 2007, any party hereto may terminate this Agreement and in such event this Agreement shall be null and void. At the Closing:

(a) The Shareholder shall present the certificate(s) representing his shares of Cinemax being exchanged to Triangle, and such certificate(s) must be duly endorsed.

(b) The Shareholder shall receive a certificate or certificates representing the number of shares of Triangle Common Stock for which the shares of Cinemax Common Stock shall have been exchanged.

(c) Triangle shall deliver an officer's certificate, as described in Section 14.6 hereof, dated the Closing Date, that all representations, warranties, covenants and conditions set forth in this Agreement on behalf of Triangle are true and correct as of, or have been fully performed and complied with by, the Closing Date.

(d) Triangle shall deliver a signed consent and/or Minutes of the Directors of Triangle approving this Agreement and each matter to be approved by the Directors of Triangle

under this Agreement (please reference the attached Resolutions of the Board of Directors of Triangle Multi-Media Limited, Inc.)

(e) Constantine A. Papadopoulos shall sign and deliver a certificate, covering the representations and warranties set forth in Article X, dated the Closing Date, that all representations, warranties, covenants and conditions set forth in this Agreement on behalf of Shareholder is true and correct as of, or have been fully performed and complied with by, the Closing Date.

(f) Contemporaneously with the Closing, the Directors of Triangle shall resign and new directors shall be appointed.

ARTICLE XVI

MISCELLANEOUS

16.1 Captions. The Article and paragraph headings throughout this Agreement are for convenience and reference only, and shall in no way be deemed to define, limit, or add to the meaning of any provision of this Agreement.

16.2 No Oral Change. This Agreement and any provision hereof, may not be waived, changed, modified, or discharged orally, but it can be changed by an agreement in writing signed by the party against whom enforcement of any waiver, change, modification, or discharge is sought.

16.3 Non-Waiver. Except as otherwise expressly provided herein, no waiver of any covenant, condition, or provision of this Agreement shall be deemed to have been made unless expressly in writing and signed by the party against whom such waiver is charged: and (i) the failure of any party to insist in any one or more cases upon the performance of any of the provisions, covenants, or conditions of this Agreement or to exercise any option herein contained shall not be construed as a waiver or relinquishment for the future of any such provisions, covenants, or conditions; (ii) the acceptance of performance of anything required by this Agreement to be performed with knowledge of the breach or failure of a covenant, condition, or provision hereof shall not be deemed a waiver of such breach or failure, and; (iii) no waiver by any party of one breach by another party shall be construed as a waiver with respect to any other or subsequent breach.

16.4 Time of Essence. Time is of the essence of this Agreement and of each and every provision hereof.

16.5 Entire Agreement. This Agreement contains the entire Agreement and understanding between the panties hereto, supersedes all prior agreements and understandings, and constitutes a complete and exclusive statement of the agreements, responsibilities, representations and warranties of the parties.

16.6 Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

16.7 Notices. All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given or delivered by facsimile or a national courier service, or on the third day after mailing if mailed to the party to whom notice is to be given, by first class mail, registered or certified, postage prepaid, and properly addressed as follows:

To Triangle: Lloyd Fan, President & CEO

22704 Ventura Blvd. #490

Woodlawn Hills, CA 91364

To Cinemax: Constantine A. Papadopoulos, President & CEO

271-2325 Hurontario Street

Mississauga, Ontario, Canada L5A 4K4

To Shareholder: Constantine A Papadopoulos, c/o Cinemax

16.8 Binding Effect. This Agreement shall inure to and be binding upon the heirs, executors, personal representatives, successors and assigns of each of the parties to this Agreement.

16.9 Mutual Operation. The parties hereto shall cooperate with each other to achieve the purpose of this Agreement, and shall execute such other and further documents and take such other and further actions as may be necessary or convenient to effect the transactions described herein.

16.10 Announcements, Triangle, Cinemax and Shareholder will consult and cooperate with each other as to the timing and content of any announcements of the transactions contemplated hereby to the general public or to employees, customers or suppliers.

16.11 Expenses. Each party will pay its own legal accounting and any other out-of-pocket expenses reasonably incurred in connection with these transactions, whether or not the transactions contemplated hereby are consummated.

16.12 Brokerage. Cinemax, Triangle and Shareholder each represent that no finder, broker, investment banker or cither similar person has been involved in this transaction. Each party agrees to indemnify and hold the other(s) harmless from the payment of any brokerage fee, finder's fee or commission claimed by any other person or entity who claims to have been involved in the transaction herein because of an association with such party.

16.13 Survival of Representations and Warranties. The representations and warranties of the parties set forth in this Agreement or in any instrument, certificate, opinion, or

Page 15

other writing, shall survive the Closing irrespective of any investigation made by or on behalf of any party for a period of one year unless otherwise specified.

16.14 Exhibits. As of the execution hereof, the parties hereto have provided each other with the Exhibits provided for hereinabove, including any items referenced therein or required to be attached thereto. Any material changes to the Exhibits shall be immediately disclosed to the other party.

16.15 Arbitration of Disputes Any dispute or controversy arising out of or relating to this Agreement, any document or instrument delivered pursuant to, in connection with, or simultaneously with this Agreement, or any breach of this Agreement or any such document or instrument shall be settled by arbitration in accordance with the rules then in effect of the American Arbitration Association or any successor thereto. The arbitrator may grant injunctions or other relief in such dispute or controversy. The decision of the arbitration shall be final, conclusive and binding on the parties to the arbitration. Judgment may be entered on the arbitrator's decision in any court having competent jurisdiction. Each party in such arbitration shall pay their respective costs and expenses of such arbitration and all the reasonable attorneys' fees and expenses of their respective counsel.

16.16 Choice of Law This Agreement and its application shall be governed by the laws of the State of Washington.

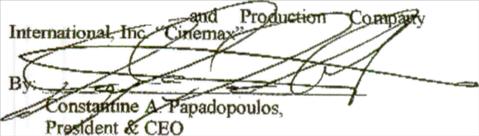

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed by their authorized representatives, all as of the date first written above.

Cinemax Pictures

Triangle Multi-Media Limited, Inc. "Triangle"

By:

Lloyd Fan, President & CEO

EXHIBIT A

CINEMAX PICTURES AND PRODUCTION COMPANY INTERNATIONAL, INC.

SHAREHOLDER

Constantino A. Papadopoulos 100 Shares

EXHIBIT B

CINEMAX PICTURES AND PRODUCTION COMPANY INTERNATIONAL, INC.

OFFICERS AND DIRECTORS

Constantino A. Papadopoulos President, CEO & Director