QuickLinks -- Click here to rapidly navigate through this documentAs Filed with the Securities and Exchange Commission on December 4, 2008.

Registration Statement No. 333-153850

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INTERVAL ACQUISITION CORP.

INTERVAL LEISURE GROUP, INC.

(See Table of Additional Registrants)

(Exact name of registrant as specified in its charter)

| | | | |

Interval Acquisition Corp.

Delaware

(State or other jurisdiction of incorporation

or organization) | |

8600

(Primary Standard Industrial

Classification Code Number) | | Interval Leisure Group, Inc.

Delaware

(State or other jurisdiction of incorporation

or organization) |

36-4189885

(I.R.S. Employer Identification No.) |

|

|

|

26-2590997

(I.R.S. Employer Identification No.)

|

6262 Sunset Drive

Miami, Florida 33143

(305) 666-1861

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Victoria J. Kincke

General Counsel

Interval Leisure Group, Inc.

6262 Sunset Drive

Miami, Florida 33143

(305) 666-1861

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

| | |

Suzanne K. Hanselman, Esq.

Baker & Hostetler LLP

3200 National City Center

1900 East 9th Street

Cleveland, Ohio 44114

(216) 621-0200 | | Michele L. Keusch, Esq.

AGC—Securities, Mergers & Acquisitions

Interval Leisure Group, Inc.

6262 Sunset Drive

Miami, Florida 33143

(305) 666-1861 |

Approximate date of commencement of proposed exchange offer:

As soon as practicable after this registration statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definition of "large accelerated filer," "accelerated filer" and "small reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

(Do not check if a smaller

reporting company) | | Smaller reporting company o

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

| | | | | | | | |

Exact Name of Registrant

as Specified in its Charter* | | Jurisdiction of

Incorporation or

Organization | | Primary Standard

Industrial Classification

Code Number | | IRS Employer

Identification

Number | |

|---|

IIC Holdings, Incorporated | | Delaware | | 8600 | | |

36-4197698 | |

Interval European Holdings Limited | | England and Wales and Delaware | | 8600 | | |

06-1427289 | |

Interval Holdings, Inc. | | Delaware | | 8600 | | |

06-1428126 | |

Interval International Holdings, Inc. | | Florida | | 8600 | | |

65-0575608 | |

Interval International, Inc. | | Florida | | 8600 | | |

59-2367254 | |

Interval International Overseas Holdings, Inc. | | Florida | | 8600 | | |

65-0575611 | |

Interval Resort & Financial Services, Inc. | | Florida | | 7380 | | |

65-0614258 | |

Interval Software Services, LLC | | Florida | | 8600 | | |

65-1133709 | |

Interval Vacation Exchange, Inc. | | Delaware | | 8600 | | |

06-1428446 | |

Meragon Financial Services, Inc. | | North Carolina | | 7320 | | |

56-2220495 | |

Meridian Financial Services, Inc. | | North Carolina | | 7320 | | |

56-1663191 | |

REP Holdings, LTD. | | Hawaii | | 6531 | | |

99-0335453 | |

RQI Holdings, LLC | | Hawaii | | 6531 | | |

03-0530842 | |

ResortQuest Hawaii, LLC | | Hawaii | | 6531 | | |

13-4207830 | |

ResortQuest Real Estate of Hawaii, LLC | | Hawaii | | 6531 | | |

99-0266391 | |

Vacation Holdings Hawaii, Inc. | | Delaware | | 8600 | | |

87-0799653 | |

Worldex Corporation | | Florida | | 8600 | | |

59-2229404 | |

Worldwide Vacation & Travel, Inc. | | Florida | | 4700 | | |

22-2362974 | |

XYZII, Inc. | | Washington | | 7320 | | |

91-1326725 | |

- *

- For each registrant listed in the table, the address and telephone number of such registrant's principal executive offices and the name, address and telephone number for the agent for service and persons to receive copies are the same as set forth above for Interval Acquisition Corp. and Interval Leisure Group, Inc.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated December 4, 2008

Prospectus

INTERVAL ACQUISITION CORP.

Offer to Exchange

$300,000,000 principal amount of 9.5% Senior Notes due 2016, which have been registered under the Securities Act, for any and all of our outstanding 9.5% Senior Notes due 2016

Interval Acquisition Corp. is offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, all of its 9.5% Senior Notes due 2016, or the "old notes," for its registered 9.5% Senior Notes due 2016, or the "new notes." The new notes and the old notes are hereinafter referred to collectively as the "notes." The parent and domestic subsidiaries of Interval Acquisition Corp. are also offering the guarantees of the new notes, which are described in this prospectus. The terms of the new notes and the guarantees of the new notes are identical to the terms of the old notes and their guarantees except that the new notes have been registered under the Securities Act of 1933, as amended, and therefore are freely transferable. The new notes will represent the same debt as the old notes and will be issued under the same indenture as governs the old notes. Interest on the notes will be payable on March 1 and September 1 of each year. The notes will mature on September 1, 2016.

The principal features of the exchange offer are as follows:

- •

- We will exchange all old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for an equal principal amount of new notes that are freely tradable.

- •

- You may withdraw tendered old notes at any time prior to the expiration of the exchange offer.

- •

- The exchange offer expires at 5:00 p.m., New York City time, on • , 200 •, unless extended.

- •

- The exchange of old notes for new notes pursuant to the exchange offer will not be a taxable event for U.S. federal income tax purposes.

- •

- We will not receive any proceeds from the exchange offer. We will pay all expenses incurred by us in connection with the exchange offer and the issuance of the new notes.

- •

- We do not intend to apply for listing of the new notes on any securities exchange or automated quotation system.

Broker-dealers receiving new notes in exchange for old notes acquired for their own account through market-making or other trading activities must deliver a prospectus in any resale of the new notes.

All untendered old notes will continue to be subject to the restrictions on transfer set forth in the old notes and in the indenture. In general, the old notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the old notes under the Securities Act.

You should consider carefully the risk factors beginning on page 21 of this prospectus before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is • , 200 •

TABLE OF CONTENTS

| | |

| | Page |

|---|

AVAILABLE INFORMATION | | 1 |

INDUSTRY AND MARKET DATA | | 2 |

FORWARD-LOOKING STATEMENTS | | 2 |

SUMMARY | | 4 |

RISK FACTORS | | 21 |

THE TRANSACTIONS | | 37 |

USE OF PROCEEDS | | 39 |

CAPITALIZATION | | 40 |

RATIO OF EARNINGS TO FIXED CHARGES | | 41 |

INTERVAL LEISURE GROUP, INC. AND SUBSIDIARIES UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | | 42 |

SELECTED HISTORICAL FINANCIAL DATA | | 48 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 49 |

ILG'S PRINCIPLES OF FINANCIAL REPORTING | | 67 |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 70 |

OUR BUSINESS | | 71 |

MANAGEMENT | | 79 |

EXECUTIVE COMPENSATION | | 82 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 93 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 95 |

DESCRIPTION OF CERTAIN INDEBTEDNESS | | 103 |

THE EXCHANGE OFFER | | 105 |

DESCRIPTION OF NEW NOTES | | 116 |

BOOK-ENTRY, DELIVERY AND FORM | | 153 |

CERTAIN MATERIAL UNITED STATES FEDERAL TAX CONSEQUENCES | | 156 |

PLAN OF DISTRIBUTION AND SELLING RESTRICTIONS | | 162 |

LEGAL MATTERS | | 163 |

EXPERTS | | 163 |

INTERVAL LEISURE GROUP, INC. AND SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS | | F-1 |

i

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information. The exchange offer is not being made to, and we will not accept tenders for exchange from, holders of the restricted notes in any jurisdiction in which the exchange offer or the acceptance of the offers would not be in compliance with the securities or blue sky laws of that jurisdiction. You should not assume that the information contained or incorporated by reference in this prospectus is accurate as of any date other than the date on the front of this prospectus or the date indicated within the relevant document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of the notes. Our business, financial condition, results of operations and prospects may have changed since then.

Unless otherwise indicated in this prospectus or the context otherwise requires:

- •

- the terms "ILG," "Company," "we," "us" and "our" refer to Interval Leisure Group, Inc., a Delaware corporation that was incorporated in May 2008 in connection with the spin-off of ILG to hold the businesses and subsidiaries of IAC/InterActiveCorp, the results of which were reported in the Interval reporting segment immediately prior to the completion of the spin-off;

- •

- all references to "Interval Acquisition Corp" or the "issuer" refer to Interval Acquisition Corp., a wholly-owned subsidiary of ILG and issuer of the notes;

- •

- all references to the "guarantors" refer to ILG and its domestic subsidiaries other than the issuer;

- •

- "Interval" refers to that group of companies operating our vacation ownership membership business;

- •

- "RQH" refers to that group of companies operating our vacation rental and property management business, including, without limitation, ResortQuest Hawaii, LLC and ResortQuest Real Estate of Hawaii, LLC;

- •

- the businesses operated by ILG following the spin-off are referred to herein as the "ILG Businesses";

- •

- "Spinco" refers to any of HSNi, ILG, Ticketmaster and Tree.com and their respective subsidiaries, and "Spincos" refers to all of the foregoing collectively;

- •

- "IAC/InterActiveCorp" and "IAC" refer to IAC/InterActiveCorp and its consolidated subsidiaries other than, for all periods following the spin-offs, the Spincos;

- •

- "HSNi" refers to HSN, Inc.;

- •

- "Tree.com" refers to Tree.com, Inc.;

- •

- "Spin-Off," "spin-off" or "distribution" refers to the distribution by IAC of the common stock of ILG and the "spin-offs," the "distributions" or the "separation" refers collectively to the distribution by IAC of the common stock of ILG and the other Spincos, as more fully described in this prospectus; and

- •

- "old notes" refers to the $300 million in aggregate principal amount of Interval Acquisition Corp.'s 9.5% Senior Notes due 2016 and the "new notes" refers to the $300 million in aggregate principal amount of Interval Acquisition Corp.'s 9.5% Senior Notes due 2016 offered hereby, which have been registered under the Securities Act of 1933, as amended.

AVAILABLE INFORMATION

In connection with the exchange offer, the issuer and the guarantors have filed with the Securities and Exchange Commission, or the SEC, a registration statement on Form S-4 under the Securities Act of 1933, as amended, or the Securities Act. This prospectus constitutes a part of the registration statement. As permitted under SEC rules, the prospectus does not include all of the information contained in the registration statement. We refer you to the registration statement, including all amendments, supplements, schedules and exhibits thereto, for further information about us and the new notes. References in this prospectus to any of our contracts or other documents are not necessarily

complete. If we have filed any documents as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of that document.

We are currently subject to the periodic reporting and other informational requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, the indenture governing the new notes requires that we file reports and other information called for by rules under the Exchange Act with the SEC and furnish information to the trustee and holders of the notes. See "Description of New Notes—Certain Covenants—Reports." You may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site athttp://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

This prospectus incorporates important business and financial information about Interval Leisure Group, Inc. that is not included in or delivered with this prospectus. This information is available without charge to holders of the old notes upon written or oral request to:

Interval Leisure Group, Inc.

6262 Sunset Drive

Miami, Florida 33143

Attention: General Counsel

Telephone number (305) 666-1861

To obtain timely delivery, note holders must request the information no later than five business days before the expiration date. The expiration date is • , 200 •.

INDUSTRY AND MARKET DATA

In this prospectus we rely on and refer to information and statistics regarding the travel and leisure industry and our market share in the sectors in which we compete. We obtained this information and statistics from sources other than us, such as The American Resort Development Association International Foundation, Ragatz Associates and Simmons, which we have supplemented where necessary with information from various third-party sources, discussions with our customers and our own internal estimates. We believe that these sources and estimates are reliable, but we have not independently verified them. We make no representation as to the accuracy or completeness of such information.

FORWARD-LOOKING STATEMENTS

Forward-looking statements in this prospectus, our public filings or other public statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or other public statements. Forward-looking statements include the information regarding future financial performance, business prospects and strategy, including the completion of the spin-offs and the realization of related anticipated benefits, anticipated financial position, liquidity and capital needs and other similar matters, in each case relating to ILG.

Statements preceded by, followed by or that otherwise include the words "believes," "expects," "anticipates," "intends," "projects," "estimates," "plans," "may increase," "may fluctuate," and similar expressions or future or conditional verbs such as "will," "should," "would," "may" and "could" are generally forward-looking in nature and not historical facts. You should understand that the following

2

important factors could affect future results and could cause actual results to differ materially from those expressed in such forward-looking statements:

- •

- adverse changes in economic conditions generally or in any of the markets or industries in which our businesses operate;

- •

- changes in relationships with third parties, including those with resort developers, members, and other vacation property owners;

- •

- the ability of resort developers and consumers to obtain financing and service existing debt;

- •

- changes in our senior management;

- •

- changes affecting our ability to efficiently maintain and grow the market share of our various brands, as well as to extend the reach of these brands through a variety of distribution channels and to attract new (and retain existing) customers;

- •

- consumer acceptance of new products and services offered by us;

- •

- changes adversely affecting our ability to adequately expand the reach of our businesses into various international markets, as well as to successfully manage risks specific to international operations and acquisitions, including the successful integration of acquired businesses;

- •

- future regulatory and legislative actions and conditions affecting us, including:

- •

- the promulgation of new, and/or the amendment of existing laws, rules and regulations applicable to us and our businesses; and

- •

- changes in the application or interpretation of existing laws, rules and regulations in the case of our businesses. In each case, laws, rules and regulations include, among others, those relating to sales, use, value-added and other taxes, software programs, consumer protection and privacy, intellectual property, the internet and e-commerce;

- •

- competition from other companies;

- •

- the rates of growth of the internet and the e-commerce industry;

- •

- changes adversely affecting our ability and our businesses' ability to adequately protect intellectual property rights, as well as to obtain licenses or other rights with respect to intellectual property in the future, which may or may not be available on favorable terms (if at all);

- •

- our substantial indebtedness and the possibility that we may incur additional indebtedness;

- •

- our ability to operate effectively as a public company following the spin-off from IAC;

- •

- third-party claims alleging infringement of intellectual property rights by us or our businesses, which could result in the expenditure of significant financial and managerial resources, injunctions or the imposition of damages, as well as the need to enter into formal licensing or other similar arrangements with such third parties, which may or may not be available on favorable terms (if at all); and

- •

- natural disasters, acts of terrorism, war or political instability.

Certain of these factors and other factors, risks and uncertainties are discussed in the "Risk Factors" section of this prospectus. Other unknown or unpredictable factors may also cause actual results to differ materially from those projected by the forward-looking statements. Most of these factors are difficult to anticipate and are generally beyond our control.

You should consider the areas of risk described above, as well as those set forth under the heading "Risk Factors," in connection with considering any forward-looking statements that may be made by us generally. Except for our ongoing obligations to disclose material information under the federal securities laws, we do not undertake any obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless required to do so by law.

3

SUMMARY

This summary highlights selected information from this prospectus and may not contain all the information that may be important to you. Accordingly, you are encouraged to read carefully the entire prospectus, including the risk factors, our financial statements and the related notes and the pro forma financial data appearing elsewhere in this prospectus before deciding whether to invest in the new notes.

Overview

Interval Leisure Group, Inc., or ILG, was incorporated in May 2008 in connection with the spin-off to hold the businesses of IAC/InterActiveCorp, or IAC, that were previously reported in its Interval reporting segment. The spin-off of ILG from IAC occurred on August 20, 2008. Interval Acquisition Corp., the issuer of the notes, is a wholly-owned subsidiary of ILG and also a holding company, which does not have any material assets or operations other than ownership interests in those entities and assets through which the businesses of ILG are conducted.

Except as otherwise indicated or unless the context otherwise requires, in this prospectus "ILG," "the Company," "we," "our" or "us" refers to Interval Leisure Group, Inc. together with its subsidiaries. "Interval" refers to that group of companies operating our vacation ownership membership business. "RQH" refers to that group of companies operating our vacation rental and property management business, including, without limitation, ResortQuest Hawaii, LLC and ResortQuest Real Estate of Hawaii, LLC. The businesses operated by ILG are referred to herein as the "ILG Businesses."

We are a leading global provider of membership and leisure services to the vacation industry. We operate in two primary business segments: Interval and RQH. Our principal business, Interval, makes available vacation ownership membership services to the individual members of its exchange networks, as well as related services to resort developers participating in its programs worldwide. RQH was acquired in May 2007 and provides vacation rental and property management services to both vacationers and vacation property/hotel owners across Hawaii.

Vacation Ownership Membership Services (Interval)

Interval has been at the forefront of the vacation ownership membership exchange industry since its founding in 1976, and we operate one of the leading vacation ownership membership exchange networks, the Interval Network, and our recently launched Preferred Residences Program. As of September 30, 2008:

- •

- the large and diversified base of resorts participating in the Interval Network consisted of more than 2,400 resorts located in more than 75 countries and included both leading independent resort developers and branded hospitality companies;

- •

- nearly two million vacation ownership interest owners were enrolled as members of the Interval Network; and

- •

- the average tenure of the relationships with the top 25 resort developers (as determined by the number of new members enrolled during the year ended December 31, 2007) was approximately 16 years.

Interval typically enters into multi-year contracts with developers of vacation ownership resorts, pursuant to which the resort developers agree to enroll all purchasers of vacation interests at the applicable resort as members of an Interval exchange program. In return, Interval provides enrolled purchasers with the ability to exchange the use and occupancy of their vacation interest at the home resort (generally for periods of one week) for the right to occupy accommodations at a different resort participating in an Interval exchange network or at the same resort during a different period of

4

occupancy. Interval also provides travel-related services for members residing in the United States and United Kingdom directly and, in certain other servicing regions, through the use of third party travel providers. Through Interval's Getaway program, members may rent resort accommodations for a fee without relinquishing the use of their vacation interest. In addition, Interval offers support, consulting and back-office services, including reservation servicing, for certain resort developers participating in the Interval Network, upon their request and for additional consideration.

Interval earns most of its revenue from (i) fees paid for membership in the Interval Network and (ii) transactional and service fees paid for exchanges, getaways and reservation servicing, collectively referred to as transaction revenue.

Vacation Rental & Property Management Services (RQH)

Through RQH, we provide vacation rental and property management services for owners of vacation properties and hotel management services to owners of traditional hotels. Such vacation properties and hotels are not owned by us. As of September 30, 2008, RQH provided property management services to 26 resorts and hotels, as well as more limited management services to an additional 23 properties.

Revenue from RQH is derived principally from management fees for vacation rental services and property management services. Fees consist of a base management fee and, in some instances, an incentive fee. A majority of the property management agreements provide that owners receive either guaranteed dollar amounts or specified percentages of the revenue generated under RQH management. In these cases, the operating expenses for the rental operation are paid from the revenue generated by the rentals, the owners are then paid their contractual percentages or amounts, and RQH either retains the balance (if any) as its management fee or is required to make up the deficit.

Industry Overview/Market Opportunity

The hospitality industry is a major component of the travel industry, which is affected by the performance of the U.S. economy. In 2007, domestic and international travelers spent an estimated $740 billion in the United States for business and leisure travel of 50 miles or more, which represented a compounded annual growth rate of 6% since 2005.

The vacation ownership industry, which is also referred to as the timeshare industry, is a segment of the broader hospitality industry that encompasses the development, management and operation of vacation ownership resorts and the sale of vacation interests in related timeshare products, including traditional deeded week timeshare regimes, points systems or vacation clubs, fractional products, private residence clubs and other forms of shared ownership and, in some instances, whole ownership. The vacation ownership industry enables customers to share ownership of fully-furnished vacation accommodations.

Typically, a vacation interest purchaser acquires either a fee simple interest in a property, which gives the purchaser title to a fraction of a unit or a group of units, or a right to use accommodations for a specified period of time. A key benefit of vacation interests relative to traditional lodging is that vacation ownership units are, on average, larger and focus more on a "home away from home" experience.

Historically, the vacation ownership industry has been cited as one of the fastest growing segments of the hospitality industry in the United States, with a sales compounded annual growth rate of approximately 14% from 1990 through 2007. While current conditions are not favorable, we believe that in the long-term the following factors will be important to the growth of the industry:

- •

- increased consumer awareness and acceptance of the value and benefits of vacation interest;

5

- •

- adoption of constructive vacation ownership related legislation and regulations internationally that improve consumer protection and allow businesses to operate profitably; and

- •

- the entry of additional independent resort developers and branded hospitality companies into the vacation ownership industry, which we expect to increase the number of vacation interests available for sale.

Vacation exchange networks, such as the Interval Network, provide vacation interest owners the flexibility to trade their annual use rights for alternative accommodations based upon availability within these exchange networks. There are two principal providers of vacation ownership membership exchange services in the global vacation membership services industry, Interval and RCI, LLC, a subsidiary of Wyndham Worldwide Corp. In 2007, approximately 99% of all U.S.-based vacation ownership resorts were participants in an exchange network offered by Interval or RCI or both. Growth in the vacation ownership membership services industry is driven primarily by the number of vacation interests sold to new purchasers.

Competitive Strengths

As an industry leader, Interval is well-positioned to capitalize on the growth of the vacation ownership industry

As an industry leader, Interval is well-positioned to provide vacation exchange services to new and existing vacation interest owners that offer owners flexibility to select alternate vacation options, destinations and seasons in which to enjoy use of their vacation interests and experience other products and services through the membership in the Interval vacation exchange networks.

Meaningful value proposition to an affluent customer base of vacation interest owners

According to a 2006 study by Ragatz Associates, flexibility and ability to exchange were two of the top ten purchase motivations of recent U.S. vacation interest purchasers. The flexibility Interval membership provides, coupled with its relatively low cost as a percentage of the vacation interest purchase price (generally less than 1% of the sale price of a vacation interest), provides an attractive value proposition for Interval's members.

A 2006 study conducted by Simmons found that Interval's U.S. membership base is comprised of individuals and families, with an average primary home market value of approximately $440,000, median household income of approximately $108,000 and approximately 35% owning a second home in addition to their vacation interest. More than 45% of Interval's U.S. members own more than one week of vacation ownership per year, with 28% owning two weeks and 18% owning three weeks or more. Interval members travel 35 nights per year on average. By focusing on this high quality demographic, we are able to realize increased revenue per member, enhance our ability to cross-sell and deliver a wide array of supplemental products and services in addition to traditional exchange services.

Longstanding relationships with leading resort developers, a trusted exchange platform and a scalable infrastructure

Through Interval, we have developed strong relationships with quality-tier independent resort developers and branded hospitality companies, which in turn value the size and quality of the Interval Network and the value proposition it represents to vacation interest owners. Of the top 25 new member producing accounts in 2007, the average affiliation tenure is approximately 16 years. Interval has developed its service offering with the philosophy to complement rather than compete with its resort developer clients, which we believe has contributed to the long standing relationships it enjoys with its developer clients.

6

Global footprint

The Interval Network includes resorts in over 75 countries, and we maintain sales and service offices around the world. Our growing global footprint, coupled with our longstanding developer relationships, provides us with multiple opportunities to participate in the future growth of the global vacation ownership industry.

Recurring revenue streams and strong financial performance through economic downturns

Our recurring revenues from membership fees and transaction revenue (collectively, more than 87% of Interval's total revenues since 2003) have historically been predictable in nature, and have allowed us to display financial stability during two prior economic downturns. While in the past the vacation ownership industry has significantly outperformed traditional lodging segments during periods of slow economic growth, the current tightening of credit markets have negatively impacted the development, sales and marketing initiatives of resort developers in the vacation ownership industry.

Seasoned management team with demonstrated history of success

Our senior management team, led by Craig Nash, has over 110 years of combined experience with the Company. The senior management team has been responsible for many of our core strategies, including focusing on a higher income customer base, enhancing developer and branded hospitality company relationships, expanding into new international markets and entering the vacation rental and property management services business through the acquisition of Hawaii's second largest independent player in the market.

Business Strategy

To serve our clients and profitably grow our business, we are pursuing the following strategic initiatives:

Expand services to and leverage our strategic developer relationships

Interval believes it can leverage its existing strategic developer relationships to capitalize on the future expansion of currently participating resort developers, to establish relationships with additional resort developers building new resorts and to pursue strategic partnerships with other high quality companies. Interval strengthens these relationships by offering select resort developers, for additional consideration, back-office and operational support services including reservation services, loan servicing and maintenance fee billing. Also, Interval seeks to bring additional value to its developer clients and potentially add to its revenues through several lead generation initiatives, each aimed at driving new vacation ownership purchasers (and new Interval members) into the vacation ownership market.

Increase non-vacation exchange related revenue

We believe that our Interval Network membership base of approximately 2 million vacation owners provides an opportunity to continue to cross-sell existing value-added services and non-vacation exchange products as well as to offer new services and products. As an example, for an incremental annual fee, our Interval Gold program offers benefits such as discounts on Interval's Getaway program, a concierge service, a hotel discount program and Interval Options, a service that allows members to relinquish the use of their vacation interest annually towards the booking of a cruise, golf or spa vacation. Approximately 40% of our members were enrolled in Interval Gold as of September 30, 2008. We seek to grow the non-exchange related revenue from existing offerings, and intend to continue to develop new service and product offerings that serve the needs of our membership base in order to profitably grow our business.

7

Support continued growth of online transactions

IntervalWorld.com provides Interval's members with access to transact virtually all member services. Through this website, customers may easily exchange properties around the globe and purchase Gateways, renew their memberships and, in the United States, make travel arrangements. Interval's online confirmations have grown from approximately 14% of total bookings in 2003 to approximately 26% in 2007. Interval continues to support and encourage member usage ofIntervalWorld.com, through online-only promotions, expansion of online product offerings and improvement of site usability.

Continue international expansion

We continue to make strategic investments to capitalize on growing international demand for upscale vacation ownership resort development. In 2007, Interval expanded its operational presence in Asia. We believe that our continued expansion of our exchange networks internationally will appeal to our members and enhance our relationships with resort developers.

Pursue strategic acquisitions opportunistically

We plan to selectively evaluate potential acquisitions, joint ventures and other business arrangements that focus on the vacation rental and membership services sectors, and may use such activities to expand our membership base, provide cross-selling opportunities, or otherwise enhance or complement our existing operations and strategy.

Overview of the Spin-off and Related Financing Transactions

The separation

On August 20, 2008, IAC completed its separation into five separate, publicly traded companies via the distribution of all of the outstanding shares of common stock of the Spincos, each previously a wholly-owned subsidiary of IAC. At the time of the spin-offs, the Spincos held directly or indirectly the assets and liabilities associated with the following businesses:

- •

- HSNi;

- •

- ILG;

- •

- Ticketmaster; and

- •

- Tree.com.

Prior to the spin-offs, we entered into a Separation and Distribution Agreement and several other agreements with IAC and the other Spincos to effect the separation of the Spincos and provide a framework for the relationships of the Spincos with IAC and each other. Immediately following the spin-offs, IAC stockholders owned 100% of the outstanding common stock of each of the Spincos.

In connection with certain internal restructuring steps implemented in contemplation of and in order for IAC to complete the Spin-Off of ILG and the other Spincos, on August 20, 2008, IAC transferred to ILG all of the outstanding stock of Interval Acquisition Corp., which, directly and through its subsidiaries, holds ownership interests in those entities and assets through which the businesses of ILG are conducted, and the assets of ILG are held. See "The Transactions."

Financing transactions

On August 19, 2008, Interval Acquisition Corp. entered into an indenture, which was supplemented on August 20, 2008, pursuant to which it issued the old notes to IAC. Interval Acquisition Corp.'s obligations under the indenture and the old notes are guaranteed by Interval Acquisition Corp.'s domestic subsidiaries and ILG. IAC exchanged the old notes on August 20, 2008

8

for certain of IAC's 7% Senior Notes due 2013 (the "IAC Notes") pursuant to a Notes Exchange and Consent Agreement, dated as of July 17, 2008, by and among IAC, Interval Acquisition Corp. and certain institutional holders (the "Noteholders") of IAC Notes (the "Exchange Agreement"). On August 20, 2008, Interval Acquisition Corp. and the guarantors entered into a Registration Rights Agreement with the Noteholders that exchanged certain of their IAC Notes for Interval Notes pursuant to the Exchange Agreement (the "Registration Rights Agreement").

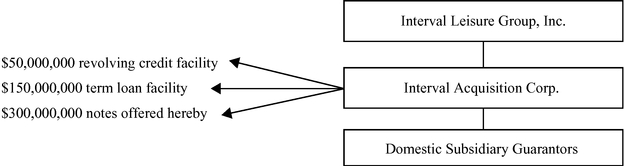

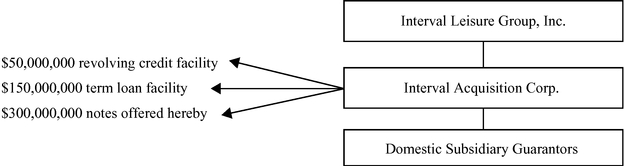

In connection with the spin-off, Interval Acquisition Corp. also entered into new senior secured credit facilities, consisting of a $150 million term loan and a $50 million revolving credit facility, which provided funding for a cash distribution to IAC at the time of the spin-off of approximately $89.4 million.

The issuance of the old notes and entering into of the senior secured credit facility are collectively referred to in this prospectus as the "financing." See "The Transactions" and "Description of Certain Indebtedness."

Organizational chart

The figure below illustrates our organizational and borrowing structure:

Corporate Information

Interval Acquisition Corp. was incorporated in Delaware in September 1997. ILG was incorporated in Delaware in May 2008. Interval Acquisition Corp.'s and ILG's principal office is located at 6262 Sunset Drive, Miami, Florida 33143 and their phone number is (305) 666-1861.

9

THE EXCHANGE OFFER

On August 19, 2008, $300,000,000 principal amount of 9.5% Senior Notes due 2016, the old notes to which the exchange offer applies, were issued by Interval Acquisition Corp. to IAC in reliance on exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. IAC exchanged the old notes on August 20, 2008 for the IAC Notes pursuant to the Exchange Agreement. The old notes have been fully and unconditionally guaranteed, jointly and severally, by all of the issuer's domestic subsidiaries and by the issuer's parent, ILG. In connection with the offering of the old notes, the issuer and the guarantors agreed to conduct the exchange offer pursuant to the Registration Rights Agreement with the Noteholders that exchanged certain of their IAC Notes for Interval Notes pursuant to the Exchange Agreement.

| | | | |

The Exchange Offer | | The issuer is offering new 9.5% Senior Notes due 2016, fully and unconditionally guaranteed by the guarantors, jointly and severally, which new notes and guarantees will be registered under the Securities Act, in exchange for the old notes. |

| | To exchange your old notes, you must properly tender them, and the issuer must accept them. The issuer will exchange all old notes that you validly tender and do not validly withdraw. The issuer will cancel all old notes accepted for exchange and issue registered new notes promptly after the expiration of the exchange offer. |

Resale of New Notes | | We believe that, if you are not a broker-dealer, you may offer the new notes (together with the guarantees thereof) for resale, resell and otherwise transfer the new notes and the related guarantees without complying with the registration and prospectus delivery requirements of the Securities Act if you: |

| | • | | are acquiring the new notes in your ordinary course of business; |

| | • | | are not engaged in, do not intend to engage in and have no arrangement or understanding with any person to participate in a "distribution," as defined under the Securities Act, of the new notes; and |

| | • | | are not an "affiliate," as defined under the Securities Act, of the issuer or any guarantor. |

| | Our belief that resales and other transfers of new notes would be permitted without registration or prospectus delivery under the conditions described above is based on SEC interpretations given to other, unrelated issuers in transactions similar to the exchange offer. We cannot assure you that the SEC would take the same position with respect to the exchange offer. If any of the conditions described above is not satisfied, you may not rely on the SEC interpretations and you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale or other transfer of the new notes. Failure to so comply may result in liability to you under the Securities Act. We will not be responsible for or indemnify you against any liability you may incur under the Securities Act. |

10

| | Each broker-dealer that receives new notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. See "Plan of Distribution and Selling Restrictions." |

Expiration Date | | The exchange offer will expire at 5:00 p.m., New York City time, on • , 200 • , unless we extend the expiration date. |

Withdrawal | | You may withdraw your tender of old notes under the exchange offer at any time before the exchange offer expires. Any withdrawal must be in accordance with the procedures described in "The Exchange Offer—Withdrawal Rights." |

Procedures for Tendering Old Notes | | Each holder of old notes that wishes to accept the exchange offer must, before the exchange offer expires: |

| | • | | transmit a properly completed and duly executed letter of transmittal, together with all other documents required by the letter of transmittal, including the old notes, to the exchange agent; |

| | • | | if old notes are tendered in accordance with book-entry procedures, arrange with The Depository Trust Company, or DTC, to cause to be transmitted to the exchange agent an agent's message indicating, among other things, the holder's agreement to be bound by the letter of transmittal; or |

| | • | | comply with the procedures described below under "The Exchange Offer—Procedures for Tendering Old Notes—Guaranteed Delivery." |

| | A holder of old notes that tenders old notes in the exchange offer must represent, among other things, that: |

| | • | | the holder is acquiring the new notes in its ordinary course of business; |

| | • | | the holder is not engaged in, does not intend to engage in and has no arrangement or understanding with any person to participate in a distribution of the new notes; |

| | • | | the holder is not an affiliate of the issuer or any guarantor; |

| | • | | the holder is not acting on behalf of any person who could not truthfully make the foregoing representations; and |

| | • | | if such holder is a broker-dealer that will receive new notes for its own account in exchange for old notes that were acquired as a result of market-making or other trading activities, then such holder will deliver a prospectus (or, to the extent permitted by law, make available a prospectus to purchasers) in connection with any resale of such new notes. |

11

| | Do not send letters of transmittal, certificates representing old notes or other documents to us or DTC. Send these documents only to the exchange agent at the address or facsimile number given in this prospectus and in the letter of transmittal. |

Special Procedures for Tenders by Beneficial Owners of Old Notes | | If: |

| | • | | you beneficially own old notes; |

| | • | | those notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee or custodian; and |

| | • | | you wish to tender your old notes in the exchange offer, |

| | you should contact the registered holder as soon as possible and instruct it to tender on your behalf and comply with the instructions set forth in this prospectus and the letter of transmittal. |

Guaranteed Delivery | | If you hold old notes in certificated form or if you own old notes in the form of a book-entry interest in a global note deposited with the trustee, as custodian for DTC, and you wish to tender those old notes, but: |

| | • | | the certificates for your old notes are not immediately available or all required documents are unlikely to reach the exchange agent before the exchange offer expires; or |

| | • | | you cannot complete the procedure for book-entry transfer on time, |

| | you may tender your old notes in accordance with the procedures described in "The Exchange Offer—Procedures for Tendering Old Notes—Guaranteed Delivery." |

Consequences of Not Exchanging Old Notes | | If you do not tender your old notes or we reject your tender, your old notes will remain outstanding and will continue to be subject to the provisions in the indenture regarding the transfer and exchange of the old notes and the existing restrictions on transfer set forth in the legends on the old notes. Holders of old notes will not be entitled to any further registration rights. See "Risk Factors—Risks Associated with the Exchange Offer—If you fail to comply with the procedures for tendering old notes, your old notes will remain outstanding after the consummation of the exchange offer" for further information. |

Appraisal or Dissenters' Rights | | You do not have any appraisal or dissenters' rights in connection with the exchange offer. |

12

Certain Material U.S. Federal Tax Consequences | | If the "stated redemption price at maturity" of the new notes exceeds their "issue price" by more than the statutory de minimis threshold, the new notes will be treated as having been issued with original issue discount for United States federal income tax purposes. A U.S. holder (as defined in "Certain Material United States Federal Income Tax Consequences") of a new note may be required to include such original issue discount in gross income as it accrues, in advance of the receipt of cash attributable to that income and regardless of the U.S. holder's regular method of accounting for United States federal income tax purposes. See "Certain Material United States Federal Income Tax Consequences" for more detail. |

Conditions | | The exchange offer is subject to the conditions that: |

| | • | | the exchange offer does not violate any applicable law or applicable interpretations of the staff of the SEC; |

| | • | | no action or proceeding shall have been instituted or threatened in any court or by any governmental agency with respect to the exchange offer and no material adverse development shall have occurred with respect to the issuer; and |

| | • | | all governmental approvals shall have been obtained that the issuer deems necessary for the consummation of the exchange offer. |

Use of Proceeds | | We will not receive any proceeds from the exchange offer or the issuance of the new notes. The old notes were issued to IAC as a distribution in connection with the spin-off and other transactions described in this prospectus. See "The Transactions" and "Use of Proceeds." |

Acceptance of Old Notes and Delivery of New Notes | | The issuer will accept for exchange any and all old notes properly tendered prior to the expiration of the exchange offer. The issuer and the guarantors will complete the exchange offer and the issuer will issue the new notes promptly after the expiration date. |

Exchange Agent | | The Bank of New York Mellon, National Association is serving as exchange agent for the exchange offer. The address and the facsimile and telephone numbers of the exchange agent are provided in this prospectus under "The Exchange Offer—Exchange Agent" and in the letter of transmittal. |

13

THE NEW NOTES

The form and terms of the new notes will be identical in all material respects to the form and terms of the old notes, except that the new notes:

- •

- will have been registered under the Securities Act;

- •

- will not bear restrictive legends restricting their transfer under the Securities Act;

- •

- will not entitle holders to the registration rights that apply to the old notes; and

- •

- will not contain provisions relating to additional interest in connection with the old notes under circumstances related to the timing of the exchange offer.

The new notes will represent the same debt as the old notes and will be governed by the same indenture, which is governed by New York law and is referred to in this prospectus as the indenture. In this section of the prospectus, under the heading "The New Notes," the term "notes" refers to both the new notes and the old notes.

| | | | | | |

| Issuer | | Interval Acquisition Corp., a Delaware corporation |

Notes Offered |

|

$300,000,000 aggregate principal amount of 9.5% Senior Notes due 2016 |

Maturity Date |

|

September 1, 2016 |

Interest |

|

Annual rate: 9.5% |

|

|

Interest will be payable in cash on March 1 and September 1 of each year, beginning on March 1, 2009. |

Guarantees |

|

The old notes are, and the new notes will be, guaranteed, jointly and severally, by the guarantors. |

Ranking |

|

The old notes are, and the new notes will be, the issuer's unsecured obligations, ranking: |

|

|

• |

|

equally in right of payment with all of the issuer's existing and future senior debt; |

|

|

• |

|

senior in right of payment to all of the issuer's future subordinated indebtedness, if any; and |

|

|

• |

|

effectively junior to (i) all debt and other liabilities (including trade payables) of our subsidiaries that are not guarantors and (ii) all secured obligations to the extent of the value of the collateral securing such obligations, including obligations under our senior secured credit agreement. |

|

|

Each guarantor's guarantee of the old notes is, and the new notes will be, that guarantor's unsecured obligation, ranking: |

|

|

• |

|

equally in right of payment with all existing and future senior debt of such guarantor; |

|

|

• |

|

senior in right of payment to all future subordinated indebtedness, if any, of such guarantor; and |

14

|

|

• |

|

effectively junior to secured obligations of such guarantor to the extent of the value of the collateral securing such obligations, including the secured guarantee by such guarantor of our obligations under our senior secured credit agreement. |

|

|

In the event that our secured creditors exercise their rights with respect to our assets pledged to them, our secured creditors would be entitled to be repaid in full from the proceeds of those assets before those proceeds would be available for distribution to other creditors, including holders of the notes. The assets of the issuer's subsidiaries that are not guarantors of the notes will be subject to the prior claims of all creditors, including trade creditors, of those non-guarantor subsidiaries. |

|

|

As of September 30, 2008: |

|

|

• |

|

the issuer and its subsidiaries had $450.0 principal amount of indebtedness on a consolidated basis, of which: |

|

|

|

|

• |

|

$300.0 million principal amount of the notes, and |

|

|

|

|

• |

|

$150.0 million principal amount of secured debt; |

|

|

• |

|

an additional $50.0 million was available for borrowing on a secured basis under our senior secured credit facilities, which borrowings and related guarantees would be secured. |

|

|

Our non-guarantor subsidiaries accounted for $42.4 million or 13.3% of our total revenues for the nine months ended September 30, 2008 and approximately $47.1 million, or 13.1% of our total revenues for the year ended December 31, 2007 and accounted for $96.5 million or 9.8% of our total assets and approximately $50.1 million or 6.0% of our total liabilities as of September 30, 2008. |

|

|

See "The Transactions" and "Description of Certain Indebtedness." |

Optional Redemption |

|

The issuer may not redeem the notes, in whole or in part, prior to September 1, 2012. On or after September 1, 2012, the issuer may redeem the notes, in whole or in part, at a price equal to 100% of the principal amount of the notes plus accrued and unpaid interest as set forth under "Description of New Notes—Optional Redemption." |

Change of Control Offer |

|

Upon the occurrence of a change of control, holders of notes will have the right to require the issuer to repurchase some or all of their notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. See "Description of New Notes—Change of Control." |

15

Certain Covenants |

|

The indenture governing the notes contains covenants limiting, among other things, the issuer's ability and the ability of the issuer's restricted subsidiaries to: |

|

|

• |

|

incur additional debt; |

|

|

• |

|

pay dividends on capital stock or repurchase capital stock; |

|

|

• |

|

make certain investments; |

|

|

• |

|

enter into certain types of transactions with affiliates; |

|

|

• |

|

limit dividends or other payments by our restricted subsidiaries to us; |

|

|

• |

|

use assets as security in other transactions; and |

|

|

• |

|

sell certain assets or merge with or into other companies. |

|

|

These covenants are subject to important exceptions and qualifications. See "Description of New Notes." |

16

Summary Consolidated Historical Financial and Other Data

The following table presents certain historical financial data and other data for ILG and its consolidated subsidiaries, including Interval Acquisition Corp., for each of the years in the five-year period ended December 31, 2007 and for the nine months ended September 30, 2007 and 2008. The data from each of the years in the five-year period ending December 31, 2007 was derived, in part, from our historical consolidated financial statements included elsewhere in this prospectus and reflects our operations and financial position at the dates and for the periods indicated. The data for the nine months ended September 30, 2007 and 2008 was derived, in part, from our unaudited interim consolidated financial statements included elsewhere in this prospectus and reflects our operations and financial position at the dates and for the periods indicated. However, this financial information does not necessarily reflect what our historical financial position and results of operations would have been had we been a stand-alone public company during the periods presented.

The unaudited historical financial data below and our unaudited interim consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements. In our opinion, the unaudited historical financial data below and our unaudited interim consolidated financial statements for the nine months ended September 30, 2007 and 2008 include all adjustments necessary for a fair presentation of such information and statements. Our results for the nine months ended September 30, 2008 are not necessarily indicative of the results for the year ending December 31, 2008.

The information in this table should be read in conjunction with the consolidated financial statements and accompanying notes and other financial data included herein.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, | | Nine Months Ended

September 30, | |

|---|

| | 2003 | | 2004 | | 2005 | | 2006 | | 2007(1) | | 2007 | | 2008 | |

|---|

| | (unaudited)

| | (unaudited)

| |

| |

| |

| | (unaudited)

| | (unaudited)

| |

|---|

| |

(in thousands)

| |

|---|

Operating Results: | | | | | | | | | | | | | | | | | | | | | | |

Revenue | |

$ |

206,453 | |

$ |

242,101 | |

$ |

260,843 | |

$ |

288,646 | |

$ |

360,407 | |

$ |

268,337 | |

$ |

319,876 | |

Gross profit | | | 146,574 | | | 178,213 | | | 200,049 | | | 222,353 | | | 259,608 | | | 196,619 | | | 217,354 | |

Operating income | | | 24,507 | | | 49,624 | | | 72,824 | | | 86,128 | | | 106,566 | | | 83,317 | | | 89,147 | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | | | |

| | Interest income | | | 1,701 | | | 3,870 | | | 6,518 | | | 8,914 | | | 10,345 | | | 7,694 | | | 10,793 | |

| | Interest expense | | | (2,020 | ) | | (1,162 | ) | | (623 | ) | | (357 | ) | | (205 | ) | | (165 | ) | | (5,487 | ) |

| | Other income (expense) | | | 322 | | | (626 | ) | | (272 | ) | | (774 | ) | | (606 | ) | | (616 | ) | | 835 | |

Total other income, net | | | 3 | | | 2,082 | | | 5,623 | | | 7,783 | | | 9,534 | | | 6,913 | | | 6,141 | |

Earnings before income taxes and minority interest | | | 24,510 | | | 51,706 | | | 78,447 | | | 93,911 | | | 116,100 | | | 90,230 | | | 95,288 | |

Net income | | $ | 14,918 | | $ | 31,730 | | $ | 49,243 | | $ | 58,043 | | $ | 71,056 | | $ | 55,114 | | $ | 56,818 | |

- (1)

- Reflects results of RQH from May 31, 2007, the date on which RQH was acquired, through December 31, 2007.

17

| | | | | | | | | | | | | | | | |

| | Years Ended December 31, | |

|---|

| | 2003 | | 2004 | | 2005 | | 2006 | | 2007(1) | |

|---|

| |

| |

| | (unaudited)

| |

| |

| |

|---|

Other Operating Metrics: | | | | | | | | | | | | | | | | |

Interval | | | | | | | | | | | | | | | | |

Total active members (in thousands)(2) | | | 1,594 | | | 1,696 | | | 1,782 | | | 1,850 | | | 1,961 | |

Average revenue per member(3) | | $ | 122.72 | | $ | 136.94 | | $ | 140.37 | | $ | 149.55 | | $ | 156.75 | |

RQH | | | | | | | | | | | | | | | | |

Available room nights (in thousands)(4) | | | — | | | — | | | — | | | — | | | 955 | |

Revenue per available room(5) | | | — | | | — | | | — | | | — | | $ | 127.14 | |

- (1)

- Includes RQH from May 31, 2007, the date on which RQH was acquired.

- (2)

- Active members as of the end of the period. Active members are members in good standing that have paid membership fees and any other applicable charges in full as of the end of the period or are within the allowed grace period.

- (3)

- Membership fee revenue, transaction revenue and ancillary revenue, such as revenue related to insurance and travel related services provided to members of ILG's exchange networks for the applicable period, divided by the monthly weighted average number of active members during the applicable period.

- (4)

- Number of nights available at RQH—managed vacation properties during the period.

- (5)

- Gross lodging revenue divided by the number of available room nights during the period.

| | | | | | | | | | | | | | | | | | | |

| | December 31, | | September 30, | |

|---|

| | 2003(1) | | 2004(1) | | 2005(1) | | 2006 | | 2007 | | 2008(1) | |

|---|

| | (in thousands)

| |

|---|

Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 20,034 | | $ | 33,810 | | $ | 36,443 | | $ | 37,557 | | $ | 67,113 | | $ | 129,921 | |

Total assets | | | 799,847 | | | 789,383 | | | 783,032 | | | 767,677 | | | 922,617 | | | 981,529 | |

Total shareholders' equity | | | 522,577 | | | 467,746 | | | 439,947 | | | 408,887 | | | 513,367 | | | 145,132 | |

18

| | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, | | Nine Months Ended September 30, | |

|---|

| | 2003 | | 2004 | | 2005 | | 2006 | | 2007(2) | | 2007 | | 2008 | |

|---|

| | (unaudited)

| | (unaudited)

| |

| |

| |

| | (unaudited)

| | (unaudited)

| |

|---|

| |

(In thousands, except for ratios)

| |

|---|

Cash Flow Data: | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | | N/A | | | N/A | | $ | 95,031 | | $ | 106,387 | | $ | 125,580 | | $ | 97,061 | | $ | 97,675 | |

Net cash used in investing activities | | | N/A | | | N/A | | | (89,095 | ) | | (110,247 | ) | | (208,910 | ) | | (74,134 | ) | | (82,948 | ) |

Net cash (used in) provided by financing activities | | | N/A | | | N/A | | | (33 | ) | | 465 | | | 112,192 | | | 258 | | | 50,026 | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | $ | 34,489 | | $ | 33,764 | | $ | 32,588 | | $ | 33,052 | | $ | 35,294 | | $ | 26,561 | | $ | 26,486 | |

Capital expenditures | | | (8,091 | ) | | (6,927 | ) | | (8,966 | ) | | (6,682 | ) | | (10,319 | ) | | (6,878 | ) | | (9,596 | ) |

EBITDA(3) | | | 51,553 | | | 76,458 | | | 99,303 | | | 114,634 | | | 137,074 | | | 112,120 | | | 122,560 | |

Ratio of earnings to fixed charges | | | 6.0 | | | 14.0 | | | 23.5 | | | 28.2 | | | 34.6 | | | 36.0 | | | 13.1 | |

- (1)

- Balance sheet data as of December 31, 2003, 2004 and 2005 and September 30, 2008 is unaudited.

- (2)

- Reflects the results of RQH from May 31, 2007, the date on which RQH was acquired.

- (3)

- EBITDA is defined as net income excluding, if applicable: (1) non-cash compensation expense, (2) depreciation, (3) amortization and impairment of intangibles, (4) goodwill impairments, (5) income tax provision, (6) minority interest in income of consolidated subsidiaries, (7) interest income and interest expense and (8) other non-operating income and expense. Our presentation of EBITDA may not be comparable to similarly-titled measures used by other companies. ILG believes this measure is useful to investors because it represents the consolidated operating results from ILG's segments, excluding the effects of any non-cash expenses. We also believe this non-GAAP financial measure improves the transparency of our disclosures, provides a meaningful presentation of our results from our business operations, excluding the impact of certain items not related to our core business operations and improves the period to period comparability of results from business operations. EBITDA has certain limitations in that it does not take into account the impact to ILG's statement of operations of certain expenses, including non-cash compensation.

EBITDA should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. ILG endeavors to compensate for the limitations of the non-GAAP measure presented by also providing the comparable GAAP measure with equal or greater prominence and descriptions of the reconciling

19

items, including quantifying such items, to derive the non-GAAP measure.

EBITDA is reconciled to net income as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, | | Nine Months Ended September 30, | |

|---|

| | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2007 | | 2008 | |

|---|

| | (unaudited)

| | (unaudited)

| |

| |

| |

| | (unaudited)

| | (unaudited)

| |

|---|

Net Income | | $ | 14,918 | | $ | 31,730 | | $ | 49,243 | | $ | 58,043 | | $ | 71,056 | | $ | 55,114 | | $ | 56,818 | |

Non-cash compensation expense | | | 1,826 | | | 1,705 | | | 1,259 | | | 3,286 | | | 3,629 | | | 2,242 | | | 6,927 | |

Depreciation expense | | | 9,269 | | | 8,544 | | | 7,368 | | | 7,832 | | | 8,415 | | | 6,100 | | | 7,056 | |

Amortization expense of intangibles | | | 25,220 | | | 25,220 | | | 25,220 | | | 25,220 | | | 26,879 | | | 20,461 | | | 19,430 | |

Income tax provision | | | 9,592 | | | 19,975 | | | 29,204 | | | 35,868 | | | 45,032 | | | 35,108 | | | 38,460 | |

Minority interest in income of consolidated subsidiaries | | | — | | | — | | | — | | | — | | | 12 | | | 8 | | | 10 | |

Interest income | | | (1,701 | ) | | (3,869 | ) | | (6,518 | ) | | (8,914 | ) | | (10,345 | ) | | (7,694 | ) | | (10,793 | ) |

Interest expense | | | 2,020 | | | 1,162 | | | 623 | | | 357 | | | 205 | | | 165 | | | 5,487 | |

Other non-operating (income) expense | | | (322 | ) | | 626 | | | 272 | | | 774 | | | 606 | | | 616 | | | (835 | ) |

| | | | | | | | | | | | | | | | |

EBITDA | | $ | 60,822 | | $ | 85,093 | | $ | 106,671 | | $ | 122,466 | | $ | 145,489 | | $ | 112,120 | | $ | 122,560 | |

| | | | | | | | | | | | | | | | |

20

RISK FACTORS

You should carefully consider the risk factors discussed below as well as the other information contained in this prospectus before deciding whether to invest in the notes. The risks discussed below, any of which could materially and adversely affect our business, financial condition or results of operations, are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition or results of operations. In this "Risk Factors" section, the term "notes" refers to both the new notes and the old notes.

Risks Relating to Our Indebtedness and the Notes

We may not be able to generate sufficient cash to service our debt obligations, including our obligations under the notes.

Our ability to make payments on and to refinance our indebtedness, including the notes, will depend on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness, including the notes.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our indebtedness, including the notes. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Our senior secured credit agreement and the indenture governing the notes restrict our ability to dispose of assets, use the proceeds from any disposition of assets and to refinance our indebtedness. We may not be able to consummate those dispositions or to obtain the proceeds that we could realize from them and these proceeds may not be adequate to meet any debt service obligations then due.

We have a substantial amount of indebtedness, which could adversely affect our financial position and prevent us from fulfilling our obligations under the notes.

We have a substantial amount of indebtedness. As of September 30, 2008, we had total debt of approximately $426.7 million, consisting of $300 million of notes offered hereby with an original issue discount of $23.5 million and $150 million of borrowings under our senior secured credit facilities. We also had an additional $50 million, net of any letters of credit usage, available for borrowing under the revolving portion of our senior secured credit facilities at that date. We may also incur significant additional indebtedness in the future. Our substantial indebtedness may:

- •

- make it difficult for us to satisfy our financial obligations, including making scheduled principal and interest payments on the notes and our other indebtedness;

- •

- limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions or other general business purposes;

- •

- limit our ability to use our cash flow or obtain additional financing for future working capital, capital expenditures, acquisitions or other general business purposes;

- •

- require us to use a substantial portion of our cash flow from operations to make debt service payments; limit our flexibility to plan for, or react to, changes in our business and industry;

- •

- place us at a competitive disadvantage compared to our less leveraged competitors; and

- •

- increase our vulnerability to the impact of adverse economic and industry conditions.

21

Despite our current level of indebtedness, we may still be able to incur substantially more indebtedness. This could exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of the indenture limit, but do not prohibit, us or our subsidiaries from incurring additional indebtedness. If we incur any additional indebtedness that ranks equally with the notes and the guarantees, the holders of that indebtedness will be entitled to share ratably with the holders of the notes and the guarantees in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. This may have the effect of reducing the amount of proceeds paid to you. If new indebtedness is added to our current debt levels, the related risks that we and our subsidiaries now face could intensify.

The notes and the guarantees will be unsecured and effectively subordinated to our and the guarantors' existing and future secured indebtedness.

The notes and the guarantees will be general unsecured obligations ranking effectively junior in right of payment to all of our existing and future secured indebtedness and that of each guarantor, including indebtedness under our senior secured credit facilities. Additionally, the indenture governing the notes permits us to incur additional secured indebtedness in the future. In the event that we or a guarantor is declared bankrupt, becomes insolvent or is liquidated or reorganized, any indebtedness that is effectively senior to the notes and the guarantees will be entitled to be paid in full from our assets or the assets of the guarantor, as applicable, securing such indebtedness before any payment may be made with respect to the notes or the affected guarantees. Holders of the notes will participate ratably with all holders of our unsecured indebtedness that is deemed to be of the same class as the notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. As of September 30, 2008, the notes and the guarantees were effectively subordinated to $150 million of senior secured indebtedness all of which would have been under our senior secured credit facilities. We also had an additional $50 million available for borrowing under the revolving portion of our senior secured credit facilities, and the notes and the guarantees would have been effectively subordinated to any borrowings thereunder.

Claims of noteholders will be structurally subordinate to claims of creditors of our subsidiaries that do not guarantee the notes.

The notes will not be guaranteed by our non-U.S. subsidiaries. Accordingly, claims of holders of the notes will be structurally subordinated to the claims of creditors of these non-guarantor subsidiaries, including trade creditors. All obligations of our non-guarantor subsidiaries will have to be satisfied before any of the assets of these subsidiaries would be available for distribution, upon a liquidation or otherwise, to us or a guarantor of the notes. In the event of the liquidation, dissolution, reorganization, bankruptcy or similar proceeding of the business of a subsidiary that is not a guarantor, creditors of that subsidiary would generally have the right to be paid in full before any distribution is made to us or the holders of the notes. In any of these events, we may not have sufficient assets to pay amounts due on the notes with respect to the assets of that subsidiary. As of September 30, 2008, we had $450 million of outstanding debt on a consolidated basis, of which $150 million was secured debt (excluding $50 million of unused revolving commitments, net of any letters of credit usage, under our senior secured credit facilities.) Our non-guarantor subsidiaries accounted for approximately $42.4 million, or 13.3%, of our total revenues for the nine months ended September 30, 2008, and approximately $47.1 million, or 13.1%, of our total revenues for the year ended December 31, 2007, and approximately $96.5 million, or 9.8%, of our total assets and approximately $50.1 million, or 6.0%, of our total liabilities as of September 30, 2008.

22

If we default on our obligations to pay our indebtedness, we may not be able to make payments on the notes.