Our directors and officers do not have unexercised options, stock that has not vested, or equity incentive plan awards.

The following table lists, as of October 27, 2008, the number of shares of common stock of our Company that are beneficially owned by (i) each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of common stock by our principal shareholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security if that person has a right to acquire the security within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

(1) Mr. Malamud does not hold any shares directly, he disclaims beneficial ownership of all of these shares and he holds irrevocable proxies to vote all of these shares. These shares include (i) 10,000,000 shares issued in a private in July 2008, and (ii) 10,000,000 shares issued to Bayville Global, Ltd., a British Virgin Islands corporation, on August 29, 2008, in exchange for all of the share capital of FastCash International Limited, a British Virgin Islands company.

(2) Mr. Popack does not hold any shares directly and disclaims beneficial ownership of all of these shares. These shares include (i) 4,100,000 shares issued to Bayville Global in a private in July 2008, and (ii) 10,000,000 shares issued to Bayville Global on August 29, 2008, in exchange for all of the share capital of FastCash International. One of the indirect beneficial owners of Bayville Global is The Cape Settlement, a trust existing under the laws of Gibraltar. The beneficiaries of The Cape Settlement could include Mr. Popack.

(3) Includes (i) 4,100,000 shares issued in a private in July 2008, and (ii) 10,000,000 shares issued on August 29, 2008, in exchange for all of the share capital of FastCash International.

(4) These shares were issued to NBL Technologies Inc., a corporation organized under the laws of Belize which is owned and controlled by Mr. Tonge, our chief operating officer, in a private placement in July 2008.

(5) Mr. Drizin does not hold any shares directly and disclaims beneficial ownership of all of these shares. These shares were issued to Ice Assets, LLC, a New York limited liability company in which Mr. Drizin owns 50% of the membership interests, in a private placement in July 2008, and they include (i) 2,500,000 shares, and (ii) an option to purchase 1,000,000 shares for the next 12 months at an exercise price of $1.00 per share.

(6) Includes (i) 2,500,000 shares, and (ii) an option to purchase 1,000,000 shares for the next 12 months at an exercise price of $1.00 per share.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On July 17, 2008 Bayville Global, Ltd., a British Virgin Islands corporation, purchased an aggregate of 4,100,000 shares of our common stock for $4,100 in a private placement that was completed on July 31, 2008. The indirect beneficial owners of Bayville Global are The Cape Settlement and The Carriage Settlement. The beneficiaries of The Cape Settlement could include Messrs. Malamud

43

and Popack. None of our officers and directors has any direct ownership interest in Bayville Global and none of them is currently employed by Bayville Global.

On August 29, 2008 we completed the acquisition of all of the issued and outstanding share capital of FastCash International Limited, a British Virgin Islands company, from Bayville Global in a share exchange in which we issued 10 million shares of our common stock to Bayville Global.

On August 6, 2008, Ice Assets, LLC, a New York limited liability company which is 50% owned by Mr. Drizin, a director of ours, executed a $10,000,000 Line of Credit agreement with MapCash Management Ltd. The proceeds of this $10,000,000 Line of Credit agreement are intended to fund loans made by MapCash Management to FastCash International and its subsidiaries under the Master Loan Agreement. Interest on the $10,000,000 Line of Credit agreement accrues at the rate of 10% per annum and all outstanding amounts are due and payable to Ice Assets on July 10, 2010. Pursuant to the Line of Credit agreement, Ice Assets has the right to designate one member to our board of directors for so long as any portion of the principal amount of the Line of Credit remains outstanding. Upon termination of the Line of Credit agreement, the right of Ice Assets to designate one member of our board of directors will terminate.

For 12 months from the date of this prospectus, Ice Assets has an option to purchase 1 million shares of our issued and outstanding share capital at an exercise price of $1.00 per share.

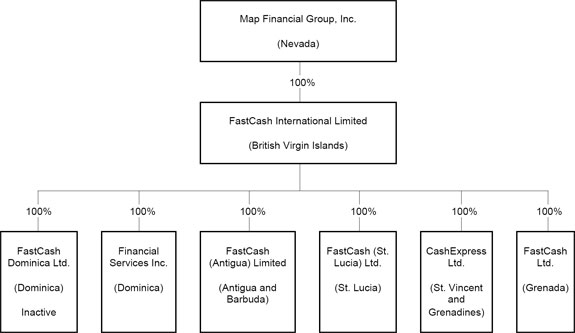

On July 14, 2008, FastCash International Limited, our wholly-owned subsidiary, and Robert Tonge, our Chief Operating Officer, executed a stock purchase agreement, pursuant to which FastCash International acquired all of the issued and outstanding share of capital stock of Financial Services Inc., a Commonwealth of Dominica corporation, FastCash (Antigua) Limited, an Antigua and Barbuda corporation, FastCash (St. Lucia) Ltd., a St. Lucia corporation, CashExpress Ltd., a St. Vincent and Grenadines corporation, FastCash Ltd., a Grenada corporation, and FastCash Dominica Ltd., An inactive Commonwealth of Dominica corporation, for $6.

Service Agreements with NBL Technologies Inc.

Between May 2006 and October 2007 each of our operating subsidiaries executed a services agreement with NBL Technologies Inc., a Belize corporation that is owned and controlled by Robert Tonge, our Chief Operating Officer, where he has served as managing director since June 27, 2005. Pursuant to each of these five agreements, NBL Technologies receives payments of $4,417.61 per annum, for an aggregate of $22,088.05 per annum. In the seven month periods ended July 31, 2008 and 2007, respectively, fees of $12,867 and $5,882 were paid to NBL Technologies pursuant to these services agreements. Mr. Tonge earned $18,035 in the year ended December 31, 2007 and $13,166 in the seven months ended July 31, 2008 as consideration for services that he provided to NBL Technologies.

44

Revolving Loan Promissory Notes in Favor of MapCash Holdings, LLC

Between May 2006 and June 2007 each of the Operating Subsidiaries executed a revolving loan promissory note in favor of MapCash Holdings, LLC in the principal amount of $1,000,000. Mr. Malamud, our Chief Executive Officer, President and Director, served as the President of MapCash Holdings, which he founded in partnership with another of our directors, David Eliezer Popack, from May 2000 until June 2008. As consideration for his services as President, MapCash Holdings paid Mr. Malamud $57,692 in the year ended December 31, 2007 and $59,999 in the seven months ended July 31, 2008. Our Chief Financial Officer, Mr. Rosenberg, served as Chief Financial Officer of MapCash Holdings from December 2007 to June 2008. As consideration for his services as Chief Financial Officer, MapCash Holdings paid Mr. Rosenberg $23,076 in the seven months ended July 31, 2008. In addition, MapCash Holdings paid Mr. Popack $60,000 in the year ended December 31, 2007 as consideration for services that he provided to MapCash Holdings.

On November 12, 2008 these revolving loan promissory notes were repaid in full and cancelled, using funds borrowed from MapCash Management by each Operating Subsidiary pursuant to the Master Loan Agreement.

Other than as described above, with respect to the compensation paid to (i) Mr. Tonge by NBL Technologies in the year ended December 31, 2007 ($18,035) and in the seven months ended July 31, 2008 ($13,166), (ii) to Mr. Malamud by MapCash Holdings in the year ended December 31, 2007 ($57,692) and in the seven months ended July 31, 2008 ($59,999), (iii) to Mr. Rosenberg by MapCash Holdings in the seven months ended July 31, 2008 ($23,076), and (iv) to Mr. Popack by MapCash Holdings in the year ended December 31, 2007 ($60,000), none of our officers and directors has earned any income as a result of their associations with Bayville Global, Ltd., The Cape Settlement, The Carriage Settlement, Ice Assets, LLC, MapCash Holdings, MapCash Management Ltd. and NBL Technologies in the year ended December 31, 2007 and in the seven months ended July 31, 2008.

LEGAL MATTERS

David Lubin & Associates, PLLC has opined on the validity of the shares of common stock being offered hereby.

EXPERTS

The financial statements included in this prospectus and in the registration statement have been audited by Frumkin, Lukin & Zaidman CPAs PC, an independent registered public accounting firm, to the extent and for the period set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

45

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Our By-laws provide to the fullest extent permitted by law, our directors or officers, former directors and officers, and persons who act at our request as a director or officer of a body corporate of which we are a shareholder or creditor shall be indemnified by us. We believe that the indemnification provisions in our By-laws are necessary to attract and retain qualified persons as directors and officers.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-1 under the Securities Act with the SEC for the securities offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules which are part of the registration statement. For additional information about us and our securities, we refer you to the registration statement and the accompanying exhibits and schedules. Statements contained in this prospectus regarding the contents of any contract or any other documents to which we refer are not necessarily complete. In each instance, reference is made to the copy of the contract or document filed as an exhibit to the registration statement, and each statement is qualified in all respects by that reference. Copies of the registration statement and the accompanying exhibits and schedules may be inspected without charge (and copies may be obtained at prescribed rates) at the public reference facility of the SEC at Room 1024, 100 F Street, N.E. Washington, D.C. 20549.

You can request copies of these documents upon payment of a duplicating fee by writing to the SEC. You may call the SEC at 1-800-SEC-0330 for further information on the operation of its public reference rooms. Our filings, including the registration statement, will also be available to you on the Internet web site maintained by the SEC at http://www.sec.gov.

PART II – INFORMATION NOT REQUIRED IN PROSPECTUS

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The following table sets forth the expenses in connection with the issuance and distribution of the securities being registered hereby. All such expenses will be borne by the Company.

| | | | |

Securities and Exchange Commission registration fee | | $ | 19.65 | |

Legal fees and miscellaneous expenses (*) | | $ | 52,000 | |

Accounting fees and expenses (*) | | $ | 122,000 | |

Total (*) | | $ | 174,019.65 | |

(*) Estimated.

46

INDEMNIFICATION OF DIRECTORS, OFFICERS, EMPLOYEES

AND AGENTS

Our officers and directors are indemnified as provided by the Nevada Revised Statutes and our bylaws.

Under the Nevada Revised Statutes, director immunity from liability to a company or its shareholders for monetary liabilities applies automatically unless it is specifically limited by a company’s Articles of Incorporation. Our Articles of Incorporation do not specifically limit our directors’ immunity. Excepted from that immunity are: (a) a willful failure to deal fairly with the company or its stockholders in connection with a matter in which the director has a material conflict of interest; (b) a violation of criminal law, unless the director had reasonable cause to believe that his or her conduct was lawful or no reasonable cause to believe that his or her conduct was unlawful; (c) a transaction from which the director derived an improper personal profit; and (d) willful misconduct.

Our bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by Nevada law; provided, however, that we may modify the extent of such indemnification by individual contracts with our directors and officers; and, provided, further, that we shall not be required to indemnify any director or officer in connection with any proceeding, or part thereof, initiated by such person unless such indemnification: (a) is expressly required to be made by law, (b) the proceeding was authorized by our board of directors, (c) is provided by us, in our sole discretion, pursuant to the powers vested in us under Nevada law or (d) is required to be made pursuant to the bylaws.

Our bylaws also provide that we may indemnify a director or former director of subsidiary corporation and we may indemnify our officers, employees or agents, or the officers, employees or agents of a subsidiary corporation and the heirs and personal representatives of any such person, against all expenses incurred by the person relating to a judgment, criminal charge, administrative action or other proceeding to which he or she is a party by reason of being or having been one of our directors, officers or employees.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and control persons pursuant to the foregoing provisions or otherwise, we have been advised that, in the opinion of the Securities and Exchange Commission, such indemnification is against public policy, and is, therefore, unenforceable.

RECENT SALES OF UNREGISTERED SECURITIES

On July 31, 2008 we completed a private placement of 10 million shares of our common stock to 18 investors. The consideration paid for the shares was $0.001 per share, for aggregate gross proceeds of $10,000. The shares were offered and sold pursuant to an exemption from the registration requirements of the Securities Act of 1933, pursuant to Section 4(2) of the Securities Act as a transaction by an issuer not involving a public offering. Offers to subscribe in the private placement were made only to persons who are familiar with our business and our founders, all of the offerees subscribed for shares and all of them executed irrevocable voting proxies in favor of Mr. Malamud, our president and chief executive officer. All of the

47

subscribers (other than one subscriber who is an employee of the Company) represented that they are accredited investors, as defined in Regulation D of the Securities Act, and they all represented that they acquired the shares for their own accounts as principals, not as nominees or agents, for investment purposes only and not with a view to or for resale or distribution.

On August 29, 2008 we completed the acquisition of all of the issued and outstanding share capital of FastCash International Limited, a British Virgin Islands company, in a share exchange in which we issued 10 million shares of our common stock to Bayville Global, Ltd. as consideration for all of the issued and outstanding share capital of FastCash International. The shares issued in the share exchange were offered pursuant to an exemption from the registration requirements of the Securities Act of 1933 provided by Section 4(2) of the Securities Act.

EXHIBITS

The following exhibits are filed as part of this registration statement:

| | |

Exhibit | | Description |

| |

|

| | |

3.1 | | Articles of Incorporation of Map Financial Group, Inc.* |

| | |

3.2 | | By-Laws of Map Financial Group, Inc. * |

| | |

3.3 | | Form of Stock Certificate.* |

| | |

5.1 | | Form of opinion of David Lubin & Associates, PLLC, regarding the legality of the securities being registered.** |

| | |

10.1 | | Form of Regulation D Subscription Agreement.* |

| | |

10.1.1 | | Form of Regulation S Subscription Agreement.* |

| | |

10.2 | | Share Exchange Agreement, dated as of August 29, 2008, by and among |

48

| | |

| | Map Financial Group, Inc., Bayville Global, Ltd., Line Trust Corporation as Trustees of The Cape Settlement and Line Trust Corporation as Trustees of The Carriage Settlement.* |

| | |

10.2.1 | | Amendment No. 1 to the Share Exchange Agreement, dated as of August 29, 2008, by and among Map Financial Group, Inc., Bayville Global Ltd., Line Trust Corporation as Trustees of The Cape Settlement and Line Trust Corporation as Trustees of The Carriage Settlement.** |

| | |

10.3 | | Stock Purchase Agreement, dated as of July 14, 2008, by and between Robert Tonge and FastCash International Limited.* |

| | |

10.4 | | Master Loan Agreement, dated as of August 6, 2008, by and between MapCash Management, Ltd. and FastCash International, Limited, FastCash Dominica Limited, Financial Services Inc., FastCash (St. Lucia) Ltd., CashExpress Ltd., FastCash Limited and FastCash (Antigua) Limited.* |

| | |

10.5 | | $10 Million Line of Credit, date August 6, 2008, from Ice Assets, LLC to MapCash Management Ltd.* |

| | |

10.6 | | Option Agreement, dated as of September 11, 2008, by and between Map Financial Group, Inc. and Ice Assets, LLC.* |

| | |

10.7 | | Master Services Agreement, dated as of July 31, 2008, by and between FastCash International Limited and Map Financial Group, Inc.* |

| | |

10.8 | | Services Agreement, dated as of May 12, 2006, by and between Financial Services Inc. and NBL Technologies Inc.* |

| | |

10.9 | | Services Agreement, dated as of June 10, 2006, by and between FastCash (Antigua) Limited and NBL Technologies Inc.* |

| | |

10.10 | | Services Agreement, dated as of June 10, 2006, by and between FastCash (St. Lucia) Ltd. and NBL Technologies Inc.* |

| | |

10.11 | | Services Agreement, dated as of October 24, 2007, by and between CashExpress Ltd. and NBL Technologies Inc.* |

| | |

10.12 | | Services Agreement, dated as of May 24, 2007, by and between FastCash Limited and NBL Technologies Inc.* |

| | |

10.13 | | Form of Promissory Note signed by customers.* |

| | |

10.14 | | Form of Salary Deduction Authorization signed by employers of customers.* |

| | |

10.15 | | Form of Salary Confirmation Authorization signed by employers of customers.* |

49

| | |

10.16 | | Services Agreement, dated as of June 2008, between FastCash (St. Lucia) Ltd., Tax & Corporate Law Offices, Rudolph Francis and Cheryl Francis.* |

| | |

10.17 | | Letter, dated September 19, 2008, from Map Financial Group, Inc. and FastCash (St. Lucia) Ltd. to Mr. Rudolph Francis and Ms. Cheryl Francis regarding the termination of the Services Agreement, dated as of June 2008, between FastCash (St. Lucia) Ltd., Tax & Corporate Law Offices, Rudolph Francis and Cheryl Francis.* |

| | |

10.18 | | Revolving Loan Promissory Note, dated May 12, 2006 in the principal amount of $1,000,000, made by Financial Services Inc. in favor of MapCash Holdings, LLC.* |

| | |

10.19 | | Revolving Loan Promissory Note, dated July 10, 2006 in the principal amount of $1,000,000, made by FastCash (Antigua) Limited in favor of MapCash Holdings, LLC.* |

| | |

10.20 | | Revolving Loan Promissory Note, dated June 29, 2007 in the principal amount of $1,000,000, made by FastCash (St. Lucia) Ltd. in favor of MapCash Holdings, LLC.* |

| | |

10.21 | | Revolving Loan Promissory Note, dated October 24, 2007 in the principal amount of $1,000,000, made by CashExpress Ltd. in favor of MapCash Holdings, LLC.* |

| | |

10.22 | | Revolving Loan Promissory Note, dated May 24, 2007 in the principal amount of $1,000,000, made by FastCash Ltd. in favor of MapCash Holdings, LLC.* |

| | |

10.23 | | Form of Initial Public Offering Subscription Agreement.** |

| | |

10.24 | | Proxy executed by Bayville Global, Ltd. in favor of Jonathan Chesky Malamud.** |

| | |

10.25 | | Form of proxy executed by certain shareholders in favor of Jonathan Chesky Malamud.** |

| | |

14 | | Code of Ethics.* |

| | |

| | |

23.1 | | Consent of Frumkin, Lukin & Zaidman CPAs PC.*** |

| | |

| | |

23.2 | | Consent of David Lubin & Associates, PLLC (included in Exhibit 5.1). |

* Previously filed, as an exhibit to the Company’s Registration Statement on Form S-1 on September 29, 2008.

** Previously filed, as an exhibit to Amendment No. 1 to the Company’s Registration Statement on Form S-1/A on November 20, 2008.

*** Filed herewith.

50

FINANCIAL STATEMENTS

The following financial statements are attached hereto and are filed as part of this registration statement:

Map Financial Group, Inc. audited, consolidated financial statements as at July 31, 2008 and for the period from June 27, 2008 (inception) through July 31, 2008;

Unaudited, consolidated financial statements of FastCash International Limited as at July 31, 2008 and 2007, for the period from April 15, 2008 (inception) through July 31, 2008; and

Audited, combined financial statements of Financial Services Inc. and Affiliates for the years ended December 31, 2007 and December 31, 2006.

UNDERTAKINGS

The undersigned registrant hereby undertakes:

(a)(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement to:

(i) Include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

(2) That, for determining liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the

51

securities offered therein, and the offering of the securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered that remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(c) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that

52

is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

53

SIGNATURES

In accordance with the requirements of the Securities Act of 1933, the Company has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on December 12, 2008.

| | | |

| MAP FINANCIAL GROUP, INC. | |

| | | |

| By: | /s/ Jonathan Chesky Malamud | |

| |

| |

| Name: | Jonathan Chesky Malamud | |

| | Title: Chief Executive | |

| | Officer, President and Director | |

| | (Principal Executive Officer) | |

| | | |

| By: | /s/ Samuel Rosenberg | |

| |

| |

| Name: | Samuel Rosenberg | |

| Title: | Chief Financial Officer | |

| | (Principal Accounting Officer) | |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | |

Date: | | Signature: | | Name: | | Title: |

| |

| |

| |

|

| | | | | | |

December 12, 2008 | | /s/ Jonathan Chesky Malamud | | Jonathan Chesky | | Chief Executive Officer, |

| |

| | Malamud | | President and Director |

| | | | | | |

| | | | | | |

December 12, 2008 | | /s/ David Eliezer Popack | | David Eliezer | | Director |

| |

| | Popack | | |

| | | | | | |

December 12, 2008 | | /s/ Joel Zev Drizin | | Joel Zev Drizin | | Director |

| |

| | | | |

54

MAP FINANCIAL GROUP, INC.

FINANCIAL STATEMENTS

JULY 31, 2008

MAP FINANCIAL GROUP, INC

FINANCIAL STATEMENTS

JULY 31, 2008

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Map Financial Group Inc.

We have audited the accompanying balance sheet of Map Financial Group Inc. as of July 31, 2008 and the related statements of income, stockholders’ equity and cash flows for the period June 27, 2008 (inception) through July 31, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statement. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Map Financial Group Inc. for the period June 27, 2008 (inception) through July 31, 2008 in conformity with accounting principles generally accepted in the United States of America.

| |

| FRUMKIN, LUKIN & ZAIDMAN CPAs’, P.C. |

Rockville Centre, New York

September 22, 2008

MAP FINANCIAL GROUP, INC

BALANCE SHEET

JULY 31, 2008

| | | | |

ASSETS | | | | |

Current Assets: | | | | |

Cash and cash equivalents (Note 2) | | $ | 10,000 | |

| | | | |

Total Current Assets | | | 10,000 | |

| |

|

| |

| | | | |

TOTAL ASSETS | | $ | 10,000 | |

| |

|

| |

| | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| | | | |

Current Liabilities: | | | | |

Accounts payable and accrued expenses | | $ | — | |

| | | | |

Total Current Liabilities | | | — | |

| |

|

| |

| | | | |

Stockholders’ Equity: | | | | |

Common stock, par value $0.001, 500,000,000 shares authorized; 10,000,000 shares issued and outstanding as of July 31, 2008 (Note 6) | | | 10,000 | |

Retained earnings | | | — | |

| |

|

| |

Total Stockholders’ Equity | | | 10,000 | |

| |

|

| |

| | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 10,000 | |

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements

- 1 -

MAP FINANCIAL GROUP, INC

STATEMENT OF INCOME

FOR THE PERIOD JUNE 27, 2008 (INCEPTION) THROUGH JULY 31, 2008

| | | | |

Income | | $ | — | |

| | | | |

Expenses: | | | | |

| | | | |

General and administrative expenses | | | — | |

| |

|

| |

| | | | |

Operating Profit | | | — | |

| | | | |

Other expenses: | | | | |

Interest expense | | | — | |

| |

|

| |

| | | | |

Net profit | | $ | — | |

| |

|

| |

| | | | |

Basic and diluted net profit per share | | $ | — | |

| |

|

| |

| | | | |

Weighted average number of common shares outstanding | | | 10,000,000 | |

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements

- 2 -

MAP FINANCIAL GROUP, INC

STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD JUNE 27, 2008 (INCEPTION) THROUGH JULY 31, 2008

| | | | | | | | | | | | | | | | |

| | COMMON STOCK | | | | | | | | | | |

| |

| | | | | | | | | | |

| | NUMBER OF

SHARES | | AMOUNT | | ADDITIONAL

PAID - IN

CAPITAL | | RETAINED

EARNINGS | | STOCKHOLDERS

EQUITY | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

Balance at inception | | | — | | $ | — | | $ | — | | $ | — | | $ | — | |

| | | | | | | | | | | | | | | | |

Net profit | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

Issuance of stock | | | 10,000,000 | | | 10,000 | | | — | | | — | | | 10,000 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Balance at July 31, 2008 | | | 10,000,000 | | $ | 10,000 | | $ | — | | $ | — | | $ | 10,000 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements

- 3 -

MAP FINANCIAL GROUP, INC

STATEMENT OF CASH FLOWS

FOR THE PERIOD JUNE 27, (INCEPTION) THROUGH JULY 31, 2008

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| | | | |

Net profit | | $ | — | |

| | | | |

Adjustments to reconcile net profit to net cash used in operating activities: | | | | |

Depreciation | | | — | |

Changes in operating assets and liabilities: | | | | |

Increase in due from affiliates | | | — | |

Increase in prepaid expenses | | | — | |

Increase in deposits | | | — | |

Increase in accounts payable and accrued expenses | | | — | |

Increase in due to affiliates | | | — | |

| |

|

| |

| | | | |

Net cash used in operating activities | | | — | |

| |

|

| |

| | | | |

Net cash (used) from financing activities | | | — | |

| |

|

| |

| | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| | | | |

Issuance of common stock | | | 10,000 | |

| | | — | |

| |

|

| |

| | | | |

Net cash provided by financing activities | | | 10,000 | |

| |

|

| |

| | | | |

Net increase in cash and cash equivalents | | | 10,000 | |

| | | | |

CASH AND CASH EQUIVALENTS, Beginning of period | | | — | |

| |

|

| |

| | | | |

CASH AND CASH EQUIVALENTS, End of period | | $ | 10,000 | |

| |

|

| |

| | | | |

Supplemental cash flow information: | | | | |

Interest paid | | $ | — | |

| |

|

| |

Income taxes paid | | $ | — | |

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements

- 4 -

MAP FINANCIAL GROUP, INC

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

1 – ORGANIZATION AND BUSINESS

Map Financial Group Inc. (the “Company”), was incorporated in the state of Nevada on June 27, 2008, and elected to have its fiscal year end on December 31. The Company is a financial services holding company and was formed for the purpose of acquiring subsidiaries located in various Caribbean countries which operate in the financial services sector and primarily offer micro loans to employees of various governmental and approved private companies.

2 – SIGNIFICANT ACCOUNTING POLICIES

Use of Accounting Estimates – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of certain assets and liabilities and disclosures. Accordingly, the actual amounts could differ from those estimates. Any adjustments applied to estimate amounts are recognized in the year in which such adjustments are determined.

Income taxes – Future income taxes are recorded using the asset and liability method whereby future tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Future tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability settled. The effect of future tax assets and liabilities of a change in tax rate is recognized in income in the period that substantive enactment or enactment occurs. To the extent that the company does not consider it to be more likely than not that a future tax asset will be recovered, it provides a valuation allowance against the net future losses time.

Cash and Cash Equivalents – For the purpose of the statement of cash flows, the Company considers all short-term debt securities purchased with maturity of three months or less to be cash equivalents.

Property and equipment – Property and equipment are carried at cost. Depreciation is provided using the straight line method over the estimated useful lives of the related asset.

- 5 -

MAP FINANCIAL GROUP, INC.

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Advertising Costs – The Company expenses advertising costs as incurred.

Earnings per common share – Basic earnings per common share is calculated using the weighted average number of common shares during each reporting period. Diluted earnings per common share includes potentially dilutive securities such as outstanding options and warrants, using various methods such as the treasury stock or modified treasury stock method in the determination of dilutive shares outstanding during each reporting period. The Company does not have any potentially dilutive instruments for this reporting period.

Fair value of Financial Instruments – The carrying value of accrued expenses approximates fair value due to the short period of time to maturity.

Recent Accounting Pronouncements – In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments, which is an Amendment of FASB Statement Nos. 133 and 140. This Statement resolves issues addressed in Statement 133 Implementation of Issue No. D1, “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets.” This Statement is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. Management does not believe that the adoption of SFAS No. 155 will have a material impact on the Company’s financial statements.

In July 2006, the Financial Accounting Standard Board (FASB) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109 (Fin 48) which provides clarification related to the process associated with accounting for uncertain tax provisions recognized in consolidated financial statements. FIN 48 prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. FIN 48 also provides guidance related to, among other things, classification, accounting for interest and penalties associated with tax positions, and disclosure requirements. Currently this pronouncement has no effect on the financial statements.

In September 2006, the Financial Accounting Standard Board issued SFAS No. 157 “Fair Value Measurement” that provides enhanced guidance for using fair value to measure assets and liabilities. The standard applies whenever other standards require (or permit) assets or liabilities to be measured at fair value. The standard does not expand the use of fair value in any new circumstances. This Statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period within that fiscal year. Currently this pronouncement has no effect on the financial statements.

- 6 -

MAP FINANCIAL GROUP, INC.

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No 159, The Fair Value Option for Financial Assets and Liabilities (SFAS No. 159). SFAS No. 159 provides the option to report certain financial assets and liabilities at fair value, with the intent to mitigate volatility in financial reporting that can occur when related assets and liabilities are recorded on different bases. The Company does not expect SFAS No. 159 to have a material impact on the financial statements.

Revenue recognition:

Income on all loans is recognized using the interest method. Service and other related fees are recognized when earned. For impaired loans accrual of interest is discontinued on a loan when management believes, after considering collection efforts and other factors that the borrower’s financial condition is such that the collection of interest is doubtful. Loans are considered impaired when it is probable that the Company will be unable to collect all contractual principal and interest payments due in accordance with the terms of the loan agreement.

Accounts receivable and Allowance for Doubtful Accounts:

Accounts receivable are stated at the amount the Company expects to collect. The Company maintains allowances for doubtful accounts for estimates losses resulting from the inability of its customers to make payments. Management considers the following factors when determining the collectibility of specific customer accounts: customer credit worthiness, past transactions history with the customer and changes in customer payment terms. Based on management’s assessment, the Company provides for estimated uncollectible amounts through a charge to earnings and a credit to the valuation allowance.

3 – COMMON STOCK

The Company is authorized to issue 500,000,000 par value $0.001 common shares. There were 10,000,000 shares issued and outstanding at July 31, 2008.

4 – PREFERRED STOCK

The Company is authorized to issue 5,000,000 par value $0.001 preferred shares. There were no shares issued and outstanding at July 31, 2008.

- 7 -

MAP FINANCIAL GROUP, INC

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

5 – CONCENTRATION OF RISK

The Company maintains cash in deposit accounts in federally insured banks. At times, the balance in the accounts may be in excess of federally insured limits.

6 – COMMITMENTS AND CONTINGENCIES

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and its legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

7 – SUBSEQUENT EVENT - ACQUISITIONS

On August 29, 2008 the Company acquired FastCash International Ltd, a holding company incorporated in the British Virgin Islands, and its subsidiaries by issuing 10,000,000 common shares in exchange for all of its outstanding shares. These subsidiaries include Financial Services Inc. which is located in the Commonwealth of Dominica; FastCash (Grenada); FastCash (Antigua); FastCash (St. Lucia) and Cash Express (St Vincent). These companies operate in the financial services industry and offer primarily short term micro loans.

The FastCash International acquisition was accounted for as a capital transaction followed by a recapitalization, in which the companies were acquired by the issuance of 10,000,000 common shares in return for 100 % of the common stock of FastCash International Ltd.

- 8 -

FASTCASH INTERNATIONAL LTD.

CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED

FASTCASH INTERNATIONAL LTD.

CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

TABLE OF CONTENTS

FASTCASH INTERNATIONAL LTD.

CONSOLIDATED BALANCE SHEETS

JULY 31, 2008 AND 2007

(UNAUDITED)

| | | | 2008 | | | | 2007 | |

ASSETS | | | |

Current Assets: | | | | | | | | | | | |

Cash and cash equivalents (Note 2) | | | | $ | 157,325 | | | | $ | 60,436 | |

Accounts receivable (Note 2) | | | | | 1,771,567 | | | | | 554,409 | |

Prepaid expenses | | | | | 1,500 | | | | | 2,748 | |

| | | | | | | | | | | |

Total Current Assets | | | | | 1,930,392 | | | | | 617,593 | |

| | | | | | | | | | | |

Property and equipment, net (Note 2 and 3) | | | | | 40,971 | | | | | 30,989 | |

| | | | | | | | | | | |

Other Assets: | | | | | | | | | | | |

Deposit | | | | | 2,310 | | | | | 199 | |

TOTAL ASSETS | | | | $ | 1,973,673 | | | | $ | 648,781 | |

| | | | | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| | | | | | | | | |

Current Liabilities: | | | | | | | | | |

Accounts payable and accrued expenses | | | | $ | 259,470 | | | | $ | 53,094 | |

Current portion of long term debt | | | | | — | | | | | 11,029 | |

Note payable (Note 4) | | | | | 1,540,031 | | | | | 484,510 | |

Total Current Liabilities | | | | | 1,799,501 | | | | | 548,633 | |

| | | | | | | | | | | |

Long term liabilities: | | | | | | | | | | | |

Long term debt (Note 5) | | | | | — | | | | | 22,101 | |

| | | | | | | | | | | |

Stockholders’ Equity: | | | | | | | | | | | |

| | | | | | | | | | | |

Common stock (Note 6) | | | | | 4,350 | | | | | 14,704 | |

Additional paid- in capital | | | | | 18,380 | | | | | — | |

Retained earnings | | | | | 151,442 | | | | | 63,343 | |

Total Stockholders’ Equity | | | | | 174,172 | | | | | 78,047 | |

| | | | | | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | $ | 1,973,673 | | | | $ | 648,781 | |

| | | | | | | | | | | | |

- 1 -

FASTCASH INTERNATIONAL LTD,

CONSOLIDATED STATEMENTS OF INCOME

FOR THE SEVEN MONTHS ENDED JULY 31, 2008 AND 2007

(UNAUDITED)

| | | | 2008 | | | | 2007 | |

| | | | | | | | | |

Income | | | | $ | 758,960 | | | | $ | 231,942 | |

| | | | | | | | | | | |

Expenses: | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

General and administrative expenses | | | | | 391,876 | | | | | 142,364 | |

Interest expenses | | | | | 118,576 | | | | | 37,808 | |

| | | | | | | | | | | |

Total operating expenses | | | | | 510,452 | | | | | 180,172 | |

| | | | | | | | | | | |

Income before provision of income taxes | | | | | 248,508 | | | | | 51,770 | |

| | | | | | | | | | | |

Provision for income taxes | | | | | 82,008 | | | | | 16,763 | |

| | | | | | | | | | | |

Net profit | | | | $ | 166,500 | | | | $ | 35,007 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Basic and diluted net profit per share | | | | $ | 38.27586 | | | | $ | 8.04759 | |

| | | | | | | | | | | |

Weighted average number of common shares outstanding | | | | | 4,350 | | | | | 4,350 | |

- 2 -

FASTCASH INTERNATIONAL LTD.

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE SEVEN MONTHS ENDED JULY 31, 2008

(UNAUDITED)

| | COMMON STOCK | | ADDITIONAL | | | | | |

| | NUMBER OF | | | | PAID - IN | | RETAINED | | STOCKHOLDERS’ | |

| | SHARES | | AMOUNT | | CAPITAL | | EARNINGS | | EQUITY | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Balance at January 1, 2008 | | — | | $ | — | | $ | — | | $ | (15,058 | ) | $ | (15,058 | ) |

| | | | | | | | | | | | | | | |

Net profit | | | | | — | | | — | | | 166,500 | | | 166,500 | |

| | | | | | | | | | | | | | | |

Issue of shares | | 4,350 | | | 4,350 | | | — | | | — | | | 4,350 | |

| | | | | | | | | | | | | | | |

Additional paid in capital | | | | | | | | | | | | | | | |

on recapitalization | | — | | | — | | | 18,380 | | | — | | | 18,380 | |

| | | | | | | | | | | | | | | |

Balance at July 31, 2008 | | 4,350 | | $ | 4,350 | | $ | 18,380 | | $ | 151,442 | | $ | 174,172 | |

- 3 -

FASTCASH INTERNATIONAL LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SEVEN MONTHS ENDED JULY 31, 2008 AND 2007

(UNAUDITED)

| | | | | | 2008 | | 2007 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | | | |

| | | | | | | | | | | |

Net profit | | | | | | $ | 166,500 | | $ | 35,007 | |

| | | | | | | | | | | |

Adjustments to reconcile net profit to net cash used in | | | | | | | | | | | |

operating activities: | | | | | | | | | | | |

Depreciation | | | | | | | 7,994 | | | 6,088 | |

Changes in operating assets and liabilities: | | | | | | | | | | | |

Increase in accounts receivable | | | | | | | (588,363 | ) | | (250,404 | ) |

Decrease(increase) in prepaid expenses | | | | | | | 2,084 | | | (956 | ) |

Increase in accounts payable and accrued expenses | | | | | | | 126,709 | | | 40,987 | |

| | | | | | | | | | | |

Net cash used in operating activities | | | | | | | (285,076 | ) | | (169,278 | ) |

| | | | | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | |

Purchase of property and equipment | | | | | | | (11,879 | ) | | (5,031 | ) |

Net cash used in investing activities | | | | | | | (11,879 | ) | | (5,031 | ) |

| | | | | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | |

| | | | | | | | | | | |

Proceeds from issuance of common stock | | | | | | | 4,350 | | | 7,352 | |

Repayment of bank loan | | | | | | | (28,568 | ) | | (6,027 | ) |

Proceeds from note payable | | | | | | | 426,203 | | | 209,181 | |

Net cash provided by financing activities | | | | | | | 401,985 | | | 210,506 | |

| | | | | | | | | | | |

Net increase in cash and cash equivalents | | | | | | | 105,030 | | | 36,197 | |

| | | | | | | | | | | |

Cash and cash equivalents at beginning of period | | | | | | | 52,295 | | | 24,239 | |

| | | | | | | | | | | |

CASH AND CASH EQUIVALENTS AT END OF PERIOD | | | | | | $ | 157,325 | | $ | 60,436 | |

Supplemental cash flow information: | | | | | | | | | | | |

Interest paid | | | | | | $ | 64,676 | | $ | 34,536 | |

Income taxes paid | | | | | | $ | — | | $ | — | |

- 4 -

FASTCASH INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

1 – ORGANIZATION AND BUSINESS

FastCash International Limited. (the “Company”), was incorporated in the Territory of the British Virgin Islands on April 15, 2008 and elected to have its fiscal year end on December 31. The Company is a financial services holding company with several wholly- owned subsidiaries located in various Caribbean countries. The subsidiaries offer primarily short term micro loans to employees of various governmental and approved private companies.

2 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Financial Statement Presentation – The consolidated financial statements include the accounts of FastCash International Ltd. and its wholly-owned subsidiaries, Financial Services Inc located in the Commonwealth of Dominica.; FastCash (St. Lucia) Ltd.; FastCash Antigua Ltd; FastCash Ltd (Grenada); Cash Express Ltd (St. Vincent). All significant intercompany accounts and transactions have been eliminated in consolidation. The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States and general practices within the financial services industry.

Use of Accounting Estimates – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of certain assets and liabilities and disclosures. Accordingly, the actual amounts could differ from those estimates. Any adjustments applied to estimate amounts are recognized in the year in which such adjustments are determined.

Income taxes – Future income taxes are recorded using the asset and liability method whereby future tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Future tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability settled. The effect of future tax assets and liabilities of a change in tax rate is recognized in income in the period that substantive enactment or enactment occurs. To the extent that the company does not consider it to be more likely than not that a future tax asset will be recovered, it provides a valuation allowance against the net future losses time.

Cash and Cash Equivalents – For the purpose of the statement of cash flows, the Company considers all short-term debt securities purchased with maturity of three months or less to be cash equivalents.

- 5 -

FASTCASH INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Property and equipment – Property and equipment are carried at cost. Depreciation is provided using the straight line method over the estimated useful lives of the related asset.

Advertising Costs – The Company expenses advertising costs as incurred.

Earnings per common share – Basic earnings per common share is calculated using the weighted average number of common shares during each reporting period. Diluted earnings per common share includes potentially dilutive securities such as outstanding options and warrants, using various methods such as the treasury stock or modified treasury stock method in the determination of dilutive shares outstanding during each reporting period. The Company does not have any potentially dilutive instruments for this reporting period.

Fair value of Financial Instruments – The carrying value of accrued expenses approximates fair value due to the short period of time to maturity.

Recent Accounting Pronouncements – In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments, which is an Amendment of FASB Statement Nos. 133 and 140. This Statement resolves issues addressed in Statement 133 Implementation of Issue No. D1, “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets.” This Statement is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. Management does not believe that the adoption of SFAS No. 155 will have a material impact on the Company’s financial statements.

In July 2006, the Financial Accounting Standard Board (FASB) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109 (Fin 48) which provides clarification related to the process associated with accounting for uncertain tax provisions recognized in consolidated financial statements. FIN 48 prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. FIN 48 also provides guidance related to, among other things, classification, accounting for interest and penalties associated with tax positions, and disclosure requirements. Currently this pronouncement has no effect on the financial statements.

- 6 -

FASTCASH INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

In September 2006, the Financial Accounting Standard Board issued SFAS No. 157 “Fair Value Measurement” that provides enhanced guidance for using fair value to measure assets and liabilities. The standard applies whenever other standards require (or permit) assets or liabilities to be measured at fair value. The standard does not expand the use of fair value in any new circumstances. This Statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period within that fiscal year. Currently this pronouncement has no effect on the financial statements.

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No 159, The Fair Value Option for Financial Assets and Liabilities (SFAS No. 159). SFAS No. 159 provides the option to report certain financial assets and liabilities at fair value, with the intent to mitigate volatility in financial reporting that can occur when related assets and liabilities are recorded on different bases. The Company does not expect SFAS No. 159 to have a material impact on the financial statements.

Foreign currency translation:

The financial position and results of operations of the Company’s foreign subsidiaries are measured using the local currency, Eastern Caribbean Dollars as the functional currency. These subsidiaries generate and expend cash primarily in their local currency. Revenues and expenses of such subsidiaries have been translated into U.S. dollars at average exchange rates prevailing during the period. Assets and liabilities have been translated at the rates of exchange on the balance sheet date.

Nature of Operations in Foreign Countries:

All of the Company’s subsidiaries are located in various foreign countries. These foreign operations are subject to various political, economic, and other risks and uncertainties inherent in the countries in which the Company operates. Among other risks, the Company’s operations are subject to the risks of restrictions on transfer of funds; changing taxation policies; foreign exchange restrictions; and political conditions and government regulations.

- 7 -

FASTCASH INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Revenue recognition:

Income on all loans is recognized using the interest method. Service and other related fees are recognized when earned. For impaired loans accrual of interest is discontinued on a loan when management believes, after considering collection efforts and other factors that the borrower’s financial condition is such that the collection of interest is doubtful. Loans are considered impaired when it is probable that the Company will be unable to collect all contractual principal and interest payments due in accordance with the terms of the loan agreement.

Direct Write-Off Method Used to Record Bad Debts:

The Company has elected to record bad debts using the direct write-off method. Generally accepted accounting principles require that the allowance method be used to recognize bad debts; however, the effect of using the direct write-off method is not materially different from the results that would have been obtained under the allowance method.

The company wrote off bad debts totaling 0 .34% and 0.80% of loans issued during 2007 and 2006 respectively. The following table represents the amounts that would have been charged to income had the allowance method been established.

| | | | | | | | | | |

| | 2008 | | 2007 | | 2006 | |

| |

| |

| |

| |

Bad debt written off | | $ | 43,700 | | $ | 9,204 | | $ | 6,787 | |

Total loans issued | | | — | | | 2,682,000 | | | 849,500 | |

Bad debt % | | | — | | | 0.34 | | | 0.80 | |

Accounts receivable | | | 1,815,300 | | | 1,183,200 | | | 304,000 | |

Allowance based on average of 2007 and 2006 bad debt % written off (0.57%) | | $ | 10,347 | | $ | 6,744 | | $ | 1,733 | |

| |

|

| |

|

| |

|

| |

Based on these results, management estimates that future defaults will not be materially different than if the allowance method had been established. The company will consider using the allowance method in the future should future conditions warrant doing so.

- 8 -

FASTCASH INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

3 – PROPERTY AND EQUIPMENT

Property and equipment at July 31, 2008 and 2007 consist of the following:

| | | | | | | |

| | 2008 | | 2007 | |

| |

| |

| |

Furniture and fixtures | | $ | 24,058 | | $ | 10,606 | |

Equipment and computers | | | 20,493 | | | 12,533 | |

Software | | | 26,060 | | | 24,062 | |

| |

|

| |

|

| |

| | | 70,611 | | | 47,201 | |

Accumulated depreciation | | | 29,640 | | | 16,212 | |

| |

|

| |

|

| |

| | $ | 40,971 | | $ | 30,989 | |

| |

|

| |

|

| |

Depreciation expenses for the period July 31, 2008 and July 31, 2007 totaled $7,994 and $6,088 respectively.

4 – NOTE PAYABLE

This represents amounts due by the various subsidiaries in the form of a revolving credit agreement in the amount of $1,000,000 each, totaling $5,000,000. Under the terms of the agreement interest is charged at a rate of 15% which is due and payable on the first day of each January, April, July and October. Advances and any unpaid accrued interest are due and payable on demand. Amounts due at July 31, 2008 and 2007 were $1,540,031and $484,510 respectively.

Subsequent Event:

On August 6, 2008 FastCash International and its subsidiaries entered into a master loan agreement with MapCash Management, Ltd in the amount of $10,000,000. Advances and any unpaid accrued interest under the terms of the agreement are due and payable on demand. Interest is charged at a rate of 15% per annum which are due on the first day of each January, April, July and October. The proceeds of the loan shall be used solely for its working capital needs.

5 – BANK LOAN PAYABLE

The Company has an unsecured promissory note which expires in the year 2010 and at which interest is charged at 12.5 percent annually. This loan was fully repaid in July 2008.

| | | | | | | |

| | 2008 | | 2007 | |

| |

| |

| |

Balance due | | $ | — | | $ | 33,130 | |

Current portion | | | — | | | (11,029 | ) |

| |

|

| |

|

| |

Long term | | $ | — | | $ | 22,101 | |

| |

|

| |

|

| |

- 9 -

FASTCASH INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

6 – COMMON STOCK

The Company is authorized to issue 4,350 common shares. There were 4,350 par value $1.00 shares issued and outstanding at July 31, 2008 .At July 31, 2007 the common shares issued and outstanding of four of its subsidiaries consisted of 40,000 par value $0.3676 common shares.

7 – CONCENTRATION OF RISK

The Company maintains cash in deposit accounts in federally insured banks. At times, the balance in the accounts may be in excess of federally insured limits.

8 – COMMITMENTS AND CONTINGENCIES

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and its legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

Agreements:

On July 31, 2008 the Company entered into a master service agreement with Map Financial Group Inc. to provide general corporate services to the Company and its subsidiaries in return for a fee. The agreement shall continue for a period of three years and shall automatically be extended thereafter for successive one year periods until terminated by either party.

Each subsidiary of the Company has a corporate services agreement with NBL Technologies Inc., an entity that is controlled by the Chief Operating Officer of the Company. Under the terms of the agreement each subsidiary pays a monthly fee to NBL Technologies Inc. for personnel management, administrative services, and other services as governed by the agreement. Such fees paid to NBL Technologies for the period ended July 31, 2008 and 2007 totaled $12,867 and $5,882 respectively.

- 10 -

FASTCASH INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JULY 31, 2008 AND 2007

(UNAUDITED)

8 – COMMITMENTS AND CONTINGENCIES (CONT’D)

Facility Leases

Various subsidiaries of the Company leases office space on a month to month basis while others have leases expiring at various dates through 2012. These leases generally provide for fixed annual rentals. The future minimal rental payments required under these leases are as follows:

| | | | | |

Year ending December 31, | | Amount | |

| |

| |

2008 | | | $ | 19,538 | |

2009 | | | | 10,051 | |

2010 | | | | 10,875 | |

2011 | | | | 10,875 | |

2012 | | | | 9,063 | |

| | |

|

| |

Total | | | $ | 60,402 | |

| | |

|

| |

9 – ACQUISITIONS:

On July 14, 2008 the Company acquired five foreign subsidiaries by issuing common shares in return for the net monetary assets of each subsidiary. These subsidiaries include Financial Services Inc. which is located in the Commonwealth of Dominica; FastCash Ltd. (Grenada); FastCash (Antigua) Ltd; FastCash (St. Lucia) Ltd. and Cash Express Ltd. (St Vincent). These companies operate in the financial services industry and offer primarily short term micro loans.

This acquisition was accounted for as a capital transaction followed by a recapitalization, and includes the historical financial information of the subsidiaries for the seven months ended July 31, 2008 and 2007. As a result of the transaction the total outstanding shares of the subsidiaries were charged to additional paid-in capital.

- 11 -

|

FINANCIAL SERVICES, INC. AND AFFILIATES |

|

COMBINED FINANCIAL STATEMENTS |

|

DECEMBER 31, 2007 AND 2006 |

FINANCIAL SERVICES INC. AND AFFILIATES

COMBINED FINANCIAL STATEMENTS

DECEMBER 31, 2007 AND 2006

INDEPENDENT AUDITORS’ REPORT

To the Board of Directors

Financial Services Inc. and Affiliates

1650 Eastern Parkway

Brooklyn, NY 11233

We have audited the accompanying combined balance sheets of Financial Services Inc. and affiliates (the Company) as of December 31, 2007 and 2006 and the related combined statements of operations, stockholder’s equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company and its affiliates are not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Accordingly we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statement. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Financial Services Inc. and affiliates at December 31, 2007 and 2006, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

FRUMKIN, LUKIN & ZAIDMAN CPAs’, P.C.

Rockville Centre, New York

June 4, 2008

FINANCIAL SERVICES, INC AND AFFILIATES

COMBINED BALANCE SHEETS

DECEMBER 31, 2007 AND DECEMBER 31, 2006

| | | | | | | |

| | 2007 | | 2006 | |

| |

| |

| |

ASSETS | | | | | | | |

Current Assets: | | | | | | | |

Cash and cash equivalents (Note 2) | | $ | 52,295 | | $ | 24,239 | |

Accounts receivable (Note 2) | | | 1,183,204 | | | 304,005 | |

Prepaid expenses | | | 3,584 | | | 1,792 | |

| |

|

| |

|

| |

| | | | | | | |

Total Current Assets | | | 1,239,083 | | | 330,036 | |

| | | | | | | |

Property and equipment, net (Note 2 and 3) | | | 37,086 | | | 32,048 | |

| | | | | | | |

Other Assets: | | | | | | | |

Deposit | | | 2,310 | | | 199 | |

| |

|

| |

|

| |

TOTAL ASSETS | | $ | 1,278,479 | | $ | 362,283 | |

| |

|

| |

|

| |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

| | | | | | | |

Current Liabilities: | | | | | | | |

Accounts payable and accrued expenses | | $ | 132,761 | | | 12,109 | |

Current portion of long term debt | | | 11,029 | | | 11,029 | |

Note payable (Note 4) | | | 1,113,828 | | | 275,329 | |

| |

|

| |

|

| |

Total Current Liabilities | | | 1,257,618 | | | 298,467 | |

| |

|

| |

|

| |

| | | | | | | |

Long term liabilities: | | | | | | | |

Long term debt | | | 17,539 | | | 28,128 | |

| |

|

| |

|

| |

| | | | | | | |

Stockholders’ Equity: | | | | | | | |

| | | | | | | |

Common stock (Note 5) | | | 18,380 | | | 7,352 | |

Retained earnings (accumulated deficit) | | | (15,058 | ) | | 28,336 | |

| |

|

| |

|

| |

Total Stockholders’ Equity | | | 3,322 | | | 35,688 | |

| |

|

| |

|

| |

| | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 1,278,479 | | $ | 362,283 | |

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements.

-1-

|

FINANCIAL SERVICES INC. AND AFFILIATES |

COMBINED STATEMENTS OF INCOME |

FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006 |

| | | | | | | |

| | 2007 | | 2006 | |

| |

| |

| |

| | | | | |

Income | | $ | 476,922 | | $ | 188,539 | |

| | | | | | | |

Expenses: | | | | | | | |

| | | | | | | |

General and administrative expenses | | | 402,012 | | | 128,918 | |

Interest expense | | | 98,869 | | | 38,986 | |

| |

|

| |

|

| |

| | | | | | | |

Operating Expenses | | | 500,881 | | | 167,904 | |

| |

|

| |

|

| |

| | | | | | | |

(Loss) income before provision for income taxes | | | (23,959 | ) | | 20,635 | |

| | | | | | | |

Provision for income taxes | | | 19,435 | | | 10,290 | |

| |

|

| |

|

| |

| | | | | | | |

Net (loss) profit | | $ | (43,394 | ) | $ | 10,345 | |

| |

|

| |

|

| |

| | | | | | | |

Basic and diluted net (loss) profit per share | | $ | (0.86788 | ) | $ | 0.51725 | |

| |

|

| |

|

| |

| | | | | | | |

Weighted average number of common shares outstanding | | | 50,000 | | | 20,000 | |

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements.

-2-

|

FINANCIAL SERVICES INC. AND AFFILIATES |

COMBINED STATEMENT OF STOCKHOLDERS’ EQUITY |

FOR THE PERIOD JANUARY 1, 2006 THROUGH DECEMBER 31, 2007 |

| | | | | | | | | | | | | | | | |

| | COMMON STOCK | | | | | | | | |

| |

| | ADDITIONAL | | | | | | |

| | NUMBER OF | | | | PAID - IN | | RETAINED | | STOCKHOLDERS’ | |

| | SHARES | | AMOUNT | | CAPITAL | | EARNINGS | | EQUITY | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

Balance at January 1, 2006 | | | — | | $ | — | | $ | — | | $ | 17,991 | | $ | 17,991 | |

| | | | | | | | | | | | | | | | |

Issue of common stock | | | 20,000 | | | 7,352 | | | — | | | — | | | 7,352 | |

| | | | | | | | | | | | | | | | |

Net profit | | | — | | | — | | | — | | | 10,345 | | | 10,345 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Balance at December 31, 2006 | | | 20,000 | | | 7,352 | | | — | | | 28,336 | | | 35,688 | |

| | | | | | | | | | | | | | | | |

Issue of common stock | | | 30,000 | | | 11,028 | | | — | | | | | | 11,028 | |

| | | | | | | | | | | | | | | | |

Net (loss) | | | — | | | — | | | — | | | (43,394 | ) | | (43,394 | ) |

| | | | | | | | | | | | | | | | |

Balance at December 31, 2007 | | | 50,000 | | $ | 18,380 | | $ | — | | $ | (15,058 | ) | $ | 3,322 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements.

-3-

|

FINANCIAL SERVICES INC. AND AFFILIATES |

COMBINED STATEMENTS OF CASH FLOWS |

FOR THE YEARS ENDED DECEMBER 31, 2007 AND DECEMBER 31, 2006 |