The accompanying notes should be read in conjunction with the financial statements

MAP FINANCIAL GROUP, INC

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

1 – ORGANIZATION AND BUSINESS

Map Financial Group Inc. (the “Company”), was incorporated in the state of Nevada on June 27, 2008, and elected to have its fiscal year end on December 31. The Company is a financial services holding company and was formed for the purpose of acquiring subsidiaries located in various Caribbean countries which operate in the financial services sector and primarily offer micro loans to employees of various governmental and approved private companies.

2 – SIGNIFICANT ACCOUNTING POLICIES

Use of Accounting Estimates– The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of certain assets and liabilities and disclosures. Accordingly, the actual amounts could differ from those estimates. Any adjustments applied to estimate amounts are recognized in the year in which such adjustments are determined.

Income taxes– Future income taxes are recorded using the asset and liability method whereby future tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Future tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability settled. The effect of future tax assets and liabilities of a change in tax rate is recognized in income in the period that substantive enactment or enactment occurs. To the extent that the company does not consider it to be more likely than not that a future tax asset will be recovered, it provides a valuation allowance against the net future losses time.

Cash and Cash Equivalents– For the purpose of the statement of cash flows, the Company considers all short-term debt securities purchased with maturity of three months or less to be cash equivalents.

Property and equipment– Property and equipment are carried at cost. Depreciation is provided using the straight line method over the estimated useful lives of the related asset.

- 5 -

MAP FINANCIAL GROUP, INC.

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Advertising Costs– The Company expenses advertising costs as incurred.

Earnings per common share– Basic earnings per common share is calculated using the weighted average number of common shares during each reporting period. Diluted earnings per common share includes potentially dilutive securities such as outstanding options and warrants, using various methods such as the treasury stock or modified treasury stock method in the determination of dilutive shares outstanding during each reporting period. The Company does not have any potentially dilutive instruments for this reporting period.

Fair value of Financial Instruments– The carrying value of accrued expenses approximates fair value due to the short period of time to maturity.

Recent Accounting Pronouncements– In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments, which is an Amendment of FASB Statement Nos. 133 and 140. This Statement resolves issues addressed in Statement 133 Implementation of Issue No. D1, “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets.” This Statement is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. Management does not believe that the adoption of SFAS No. 155 will have a material impact on the Company’s financial statements.

In July 2006, the Financial Accounting Standard Board (FASB) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109 (Fin 48) which provides clarification related to the process associated with accounting for uncertain tax provisions recognized in consolidated financial statements. FIN 48 prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. FIN 48 also provides guidance related to, among other things, classification, accounting for interest and penalties associated with tax positions, and disclosure requirements. Currently this pronouncement has no effect on the financial statements.

In September 2006, the Financial Accounting Standard Board issued SFAS No. 157 “Fair Value Measurement” that provides enhanced guidance for using fair value to measure assets and liabilities. The standard applies whenever other standards require (or permit) assets or liabilities to be measured at fair value. The standard does not expand the use of fair value in any new circumstances. This Statement is effective for financial statements issued for fiscal years beginning afterNovember 15, 2007, and interim periods within those fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period within that fiscal year. Currently this pronouncement has no e ffect on the financial statements.

- 6 -

MAP FINANCIAL GROUP, INC.

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No 159, The Fair Value Option for Financial Assets and Liabilities (SFAS No. 159). SFAS No. 159 provides the option to report certain financial assets and liabilities at fair value, with the intent to mitigate volatility in financial reporting that can occur when related assets and liabilities are recorded on different bases. The Company does not expect SFAS No. 159 to have a material impact on the financial statements.

Revenue recognition:

Income on all loans is recognized using the interest method. Service and other related fees are recognized when earned. For impaired loans accrual of interest is discontinued on a loan when management believes, after considering collection efforts and other factors that the borrower’s financial condition is such that the collection of interest is doubtful. Loans are considered impaired when it is probable that the Company will be unable to collect all contractual principal and interest payments due in accordance with the terms of the loan agreement.

Accounts receivable and Allowance for Doubtful Accounts:

Accounts receivable are stated at the amount the Company expects to collect. The Company maintains allowances for doubtful accounts for estimates losses resulting from the inability of its customers to make payments. Management considers the following factors when determining the collectibility of specific customer accounts: customer credit worthiness, past transactions history with the customer and changes in customer payment terms. Based on management’s assessment, the Company provides for estimated uncollectible amounts through a charge to earnings and a credit to the valuation allowance.

3 – COMMON STOCK

The Company is authorized to issue 500,000,000 par value $0.001 common shares. There were 10,000,000 shares issued and outstanding at July 31, 2008.

4 – PREFERRED STOCK

The Company is authorized to issue 5,000,000 par value $0.001 preferred shares. There were no shares issued and outstanding at July 31, 2008.

- 7 -

MAP FINANCIAL GROUP, INC

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2008

5 – CONCENTRATION OF RISK

The Company maintains cash in deposit accounts in federally insured banks. At times, the balance in the accounts may be in excess of federally insured limits.

6 – COMMITMENTS AND CONTINGENCIES

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and its legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed. Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

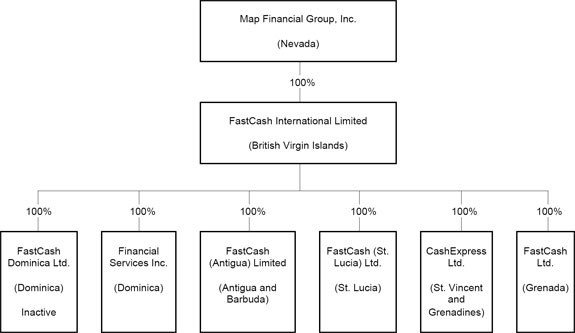

7 – SUBSEQUENT EVENT - ACQUISITIONS

On August 29, 2008 the Company acquired FastCash International Ltd, a holding company incorporated in the British Virgin Islands, and its subsidiaries by issuing 10,000,000 common shares in exchange for all of its outstanding shares. These subsidiaries include Financial Services Inc. which is located in the Commonwealth of Dominica; FastCash (Grenada); FastCash (Antigua); FastCash (St. Lucia) and Cash Express (St Vincent). These companies operate in the financial services industry and offer primarily short term micro loans.

The FastCash International acquisition was accounted for as a capital transaction followed by a recapitalization, in which the companies were acquired by the issuance of 10,000,000 common shares in return for 100 % of the common stock of FastCash International Ltd.

- 8 -

MAP FINANCIAL GROUP INC.

CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

MAP FINANCIAL GROUP INC.

CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

TABLE OF CONTENTS

| | |

| | PAGE |

| CONSOLIDATED BALANCE SHEETS | |

| AS OF SEPTEMBER 30, 2008 AND 2007 | 1 |

| |

| CONSOLIDATED STATEMENTS OF INCOME | |

| FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007 | 2 |

| |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY | |

| FOR THE PERIOD JANUARY 1, THROUGH SEPTEMBER 30, 2008 | 3 |

| |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007 | 4 |

| |

| |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | 5-11 |

MAP FINANCIAL GROUP INC.

CONSOLIDATED BALANCE SHEETS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

| | | | | |

| |

| | 2008 | | 2007 |

| | | | | |

| ASSETS |

| Current Assets: | | | | | |

| Cash and cash equivalents (Note 2) | $ | 194,229 | | $ | 97,235 |

| Accounts receivable - net of allowances (Note 2) | | 1,583,458 | | | 856,255 |

| Prepaid expenses | | 5,498 | | | 1,618 |

| |

| Total Current Assets | | 1,783,185 | | | 955,108 |

| |

| Property and equipment, net (Note 2 and 3) | | 57,638 | | | 27,660 |

| |

| Other Assets: | | | | | |

| Deposit | | 5,251 | | | 199 |

| TOTAL ASSETS | $ | 1,846,074 | | $ | 982,967 |

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| |

| Current Liabilities: | | | | | |

| Accounts payable and accrued expenses | $ | 268,916 | | $ | 89,938 |

| Current portion of long term debt | | - | | | 14,180 |

| Note payable (Note 4) | | 1,462,433 | | | 764,127 |

| Total Current Liabilities | | 1,731,349 | | | 868,245 |

| |

| Long term liabilities: | | | | | |

| Long term debt (Note 5) | | - | | | 17,162 |

| |

| Stockholders' Equity: | | | | | |

| |

| Common stock (Note 6) | | 20,000 | | | 14,704 |

| Additional paid- in capital | | 12,730 | | | - |

| Retained earnings | | 81,995 | | | 82,856 |

| Total Stockholders' Equity | | 114,725 | | | 97,560 |

| |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 1,846,074 | | $ | 982,967 |

-1-

MAP FINANCIAL GROUP INC.

CONSOLIDATED STATEMENTS OF INCOME

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

| | | | | | |

| | 2008 | | 2007 |

| Income | $ | 897,446 | | $ | 365,487 |

| Expenses: | | | | | |

| General and administrative expenses | | 549,790 | | | 214,429 |

| Interest expense | | 156,378 | | | 62,759 |

| Total operating expenses | | 706,168 | | | 277,188 |

| Income before provision of income taxes | | 191,278 | | | 88,299 |

| Provision for income taxes | | 73,318 | | | 31,099 |

| Net profit | $ | 117,960 | | $ | 57,200 |

| |

| |

| Basic and diluted net profit per share | $ | 0.00590 | | $ | 0.00286 |

| Weighted average number of common shares outstanding | | 20,000,000 | | | 20,000,000 |

-2-

MAP FINANCIAL GROUP INC.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2008

(UNAUDITED)

| | | | | | | | | | | | | | | | |

| | COMMON STOCK | | ADDITIONAL | | | | | | | | |

| | NUMBER OF | | | | | PAID-IN | | RETAINED | | STOCKHOLDERS |

| | SHARES | | AMOUNT | | CAPITAL | | EARNINGS | | EQUITY |

| |

| Balance at January 1, 2008 | - | | $ | - | | $ | | - | | $ | (35,965 | ) | | $ | (35,965 | ) |

| |

| Net profit | - | | | - | | | | - | | | 117,960 | | | | 117,960 | |

| Issuance of shares | 20,000,000 | | | 20,000 | | | | - | | | - | | | | 20,000 | |

| Additional paid in capital | | | | | | | | | | | | | | | | |

| on recapitalization | - | | | - | | | | 12,730 | | | - | | | | 12,730 | |

| Balance at September 30, 2008 | 20,000,00 | | $ | 20,000 | | $ | | 12,730 | | $ | 81,995 | | | $ | 114,725 | |

- 3 -

MAP FINANCIAL GROUP INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

| | | | | | | | |

| | 2008 | | 2007 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | |

| |

| Net profit | $ | 117,960 | | | $ | 57,200 | |

| |

| Adjustments to reconcile net profit to net cash used in | | | | | | | |

| operating activities: | | | | | | | |

| Depreciation | | 10,670 | | | | 9,875 | |

| Non cash items (note 6) | | 4,350 | | | | - | |

| |

| Changes in operating assets and liabilities: | | | | | | | |

| Increase in accounts receivable | | (421,161 | ) | | | (554,928 | ) |

| Decrease(increase) in prepaid expenses | | (1,914 | ) | | | 174 | |

| Increase in deposits | | (2,941 | ) | | | - | |

| Increase in accounts payable and accrued expenses | | 136,155 | | | | 77,829 | |

| |

| Netcash used in operating activities | | (156,881 | ) | | | (409,850 | ) |

| |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

| Purchase of property and equipment | | (31,222 | ) | | | (5,489 | ) |

| Net cash used in investing activities | | (31,222 | ) | | | (5,489 | ) |

| |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | |

| |

| Proceeds from issuance of common stock | | 10,000 | | | | 7,352 | |

| Repayment of bank loan | | (28,568 | ) | | | (7,815 | ) |

| Proceeds from note payable | | 348,605 | | | | 488,798 | |

| Net cash provided by financing activities | | 330,037 | | | | 488,335 | |

| |

| Net increase in cash and cash equivalents | | 141,934 | | | | 72,996 | |

| |

| Cash and cash equivalents at beginning of period | | 52,295 | | | | 24,239 | |

| |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 194,229 | | | $ | 97,235 | |

| Supplemental cash flow information: | | | | | | | |

| Interest paid | $ | 73,438 | | | $ | 35,248 | |

| Income taxes paid | $ | - | | | $ | - | |

- 4 -

MAP FINANCIAL GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

1 – ORGANIZATION AND BUSINESS

Map Financial Group Inc. (the “Company”), was incorporated in the state of Nevada on June 27, 2008 and elected to have its fiscal year end on December 31. The Company is a financial services holding company and was formed for the purpose of acquiring subsidiaries located in various Caribbean countries which operate in the financial services sector and primarily offer micro loans to employees of various governmental and approved private companies.

2 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Financial Statement Presentation –The consolidated financial statements include the accounts of Map Financial Group Inc. and its wholly-owned subsidiaries, FastCash International Ltd. (BVI), Financial Services Inc located in the Commonwealth of Dominica.; FastCash (St. Lucia) Ltd.; FastCash Antigua Ltd; FastCash Ltd (Grenada); Cash Express Ltd (St. Vincent).All significant intercompany accounts and transactions have been eliminated in consolidation. The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States and general practices within the financial services industry.

Use of Accounting Estimates– The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of certain assets and liabilities and disclosures. Accordingly, the actual amounts could differ from those estimates. Any adjustments applied to estimate amounts are recognized in the year in which such adjustments are determined.

Income taxes– Future income taxes are recorded using the asset and liability method whereby future tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Future tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability settled. The effect of future tax assets and liabilities of a change in tax rate is recognized in income in the period that substantive enactment or enactment occurs. To the extent that the company does not consider it to be more likely than not that a future tax asset will be recovered, it provides a valuation allowance against the net future losses time.

Cash and Cash Equivalents– For the purpose of the statement of cash flows, the Company considers all short-term debt securities purchased with maturity of three months or less to be cash equivalents.

- 5 -

MAP FINANCIAL GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Property and equipment– Property and equipment are carried at cost. Depreciation is provided using the straight line method over the estimated useful lives of the related asset.

Advertising Costs– The Company expenses advertising costs as incurred.

Earnings per common share– Basic earnings per common share is calculated using the weighted average number of common shares during each reporting period. Diluted earnings per common share includes potentially dilutive securities such as outstanding options and warrants, using various methods such as the treasury stock or modified treasury stock method in the determination of dilutive shares outstanding during each reporting period. The Company does not have any potentially dilutive instruments for this reporting period.

Fair value of Financial Instruments– The carrying value of accrued expenses approximates fair value due to the short period of time to maturity.

Recent Accounting Pronouncements– In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments, which is an Amendment of FASB Statement Nos. 133 and 140. This Statement resolves issues addressed in Statement 133 Implementation of Issue No. D1, “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets.” This Statement is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. Management does not believe that the adoption of SFAS No. 155 will have a material impact on the Company’s financial statements.

In July 2006, the Financial Accounting Standard Board (FASB) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109 (Fin 48) which provides clarification related to the process associated with accounting for uncertain tax provisions recognized in consolidated financial statements. FIN 48 prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. FIN 48 also provides guidance related to, among other things, classification, accounting for interest and penalties associated with tax positions, and disclosure requirements. Currently this pronouncement has no effect on the financial statements.

- 6 -

MAP FINANCIAL GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

In September 2006, the Financial Accounting Standard Board issued SFAS No. 157 “Fair Value Measurement” that provides enhanced guidance for using fair value to measure assets and liabilities. The standard applies whenever other standards require (or permit) assets or liabilities to be measured at fair value. The standard does not expand the use of fair value in any new circumstances. This Statement is effective for financial statements issued for fiscal years beginning afterNovember 15, 2007, and interim periods within those fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period within that fiscal year. Currently this pronouncement ha s no effect on the financial statements.

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No 159, The Fair Value Option for Financial Assets and Liabilities (SFAS No. 159). SFAS No. 159 provides the option to report certain financial assets and liabilities at fair value, with the intent to mitigate volatility in financial reporting that can occur when related assets and liabilities are recorded on different bases. The Company does not expect SFAS No. 159 to have a material impact on the financial statements.

Foreign currency translation:

The financial position and results of operations of the Company’s foreign subsidiaries are measured using the local currency, Eastern Caribbean Dollars as the functional currency, except FastCash International Inc. whose functional currency is the US$. These subsidiaries generate and expend cash primarily in their local currency. Revenues and expenses of such subsidiaries have been translated into U.S. dollars at average exchange rates prevailing during the period. Assets and liabilities have been translated at the rates of exchange on the balance sheet date.

Nature of Operations in Foreign Countries:

All of the Company’s subsidiaries are located in various foreign countries. These foreign operations are subject to various political, economic, and other risks and uncertainties inherent in the countries in which the Company operates. Among other risks, the Company’s operations are subject to the risks of restrictions on transfer of funds; changing taxation policies; foreign exchange restrictions; and political conditions and government regulations.

- 7 -

MAP FINANCIAL GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Revenue recognition:

Income on all loans is recognized using the interest method. Service and other related fees are recognized when earned. For impaired loans accrual of interest is discontinued on a loan when management believes, after considering collection efforts and other factors that the borrower’s financial condition is such that the collection of interest is doubtful. Loans are considered impaired when it is probable that the Company will be unable to collect all contractual principal and interest payments due in accordance with the terms of the loan agreement.

Allowance for doubtful accounts:

The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience and a review of the current status of the accounts receivable. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. Accounts receivable are presented net of an allowance for doubtful accounts.

| | | |

| | 2008 | | 2007 |

| Accounts receivable | $ | 1,678,091 | | $ | 880,458 |

| Allowance | 94,633 | | 24,203 |

| Accounts receivable - net | $ | 1,583,458 | | $ | 856,255 |

3 – PROPERTY AND EQUIPMENT

Property and equipment at September, 2008 and 2007 consist of the following:

| | | |

| | 2008 | | 2007 |

| Furniture and fixtures | $ | 26,430 | | $ | 10,606 |

| Equipment and computers | 28,484 | | 12,533 |

| Leasehold Improvements | 8,928 | | - |

| Software | 26,060 | | 24,062 |

| | 89,902 | | 47,201 |

| Accumulated depreciation | 32,264 | | 19,541 |

| | $ | 57,638 | | $ | 27,660 |

Depreciation expenses for the period September 30, 2008 and 2007 totaled $10,670 and $9,875 respectively.

- 8 -

MAP FINANCIAL GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

4 – NOTE PAYABLE

This represents amounts due by the various subsidiaries in the form of a revolving credit agreement in the amount of $1,000,000 each, totaling $5,000,000. Under the terms of the agreement interest is charged at a rate of 15% which is due and payable on the first day of each January, April, July and October. Advances and any unpaid accrued interest are due and payable on demand. Amounts due at September 30, 2008 and 2007 were $1,462,433 $764,127 respectively.

The Company’s subsidiaries entered into a master loan agreement with MapCash Management, Ltd in the amount of $10,000,000. Advances and any unpaid accrued interest under the terms of the agreement are due and payable on demand. Interest is charged at a rate of 15% per annum which are due on the first day of each January, April, July and October. The proceeds of the loan shall be used solely for its working capital needs.

5 – BANK LOAN PAYABLE

The Company had an unsecured promissory note which expires in the year 2010 and at which interest is charged at 12.5 percent annually. This loan was fully repaid in July 2008.

| | | | | |

| | 2008 | | 2007 |

| Balance due | $ | - | | $ | 31,342 |

| Current portion | | - | | | (14,180) |

| Long term | $ | - | | $ | 17,162 |

6 – COMMON STOCK

The Company is authorized to issue 500,000,000 common shares. There were 20,000,000 par value $0.001 shares issued and outstanding at September 30, 2008 of which 10,000,000 shares were issued in exchange for all the outstanding common shares of FastCash International Ltd and its subsidiaries on August 29, 2008.

7 – PREFERRED STOCK

The Company is authorized to issue 5,000,000 par value $0.001 preferred shares. There were no shares issued and outstanding at September 30, 2008.

- 9 -

MAP FINANCIAL GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30 2008 AND 2007

(UNAUDITED)

8 – CONCENTRATION OF RISK

The Company maintains cash in deposit accounts in federally insured banks. At times, the balance in the accounts may be in excess of federally insured limits.

9 – COMMITMENTS AND CONTINGENCIES

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and its legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, the estimated liability would be accrued in the Company& #146;s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed. Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

Agreements:

Each operating subsidiary of the Company has a corporate services agreement with NBL Technologies Inc., an entity that is controlled by the Chief Operating Officer of the Company. Under the terms of the agreement each subsidiary pays a monthly fee to NBL Technologies Inc. for personnel management, administrative services, and other services as governed by the agreement. Such fees paid to NBL Technologies for the period September 30, 2008 and 2007 totaled $14,706 and $8,823 respectively.

- 10 -

MAP FINANCIAL GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008 AND 2007

(UNAUDITED)

9 – COMMITMENTS AND CONTINGENCIES (CONT’D)

Facility Leases

Various subsidiaries of the Company leases office space on a month to month basis while others have leases expiring at various dates through 2012. These leases generally provide for fixed annual rentals. The future minimal rental payments required under these leases are as follows:

| | | |

| Year ending September 30, | | | Amount |

| 2008 | | $ | 22,479 |

| 2009 | | | 45,343 |

| 2010 | | | 46,167 |

| 2011 | | | 50,583 |

| 2012 | | | 48,771 |

| Total | | $ | 213,343 |

Rent expense charged to operations for September 30, 2008 and 2007 totaled $28,508 and $18,309 respectively.

10 – CHANGE IN ACCOUNTING PRINCIPLE:

During the period the Company changed from the direct method of recording bad debts to the allowance method in accordance with generally accepted accounting principles. Prior periods presented have been restated to reflect the change. The effect of the change was to decrease net income for the period by $5,177 and decrease income tax by $2,338.

11 – ACQUISITIONS:

On August 29, 2008 the Company acquired FastCash International Ltd, a holding company incorporated in the British Virgin Islands, and its subsidiaries by issuing 10,000, 000 common shares in exchange for all of its common shares. These subsidiaries include Financial Services Inc. which is located in the Commonwealth of Dominica; FastCash Ltd. (Grenada); FastCash (Antigua) Ltd; FastCash (St. Lucia) Ltd. and Cash Express Ltd. (St Vincent). These companies operate in the financial services industry and offer primarily short term micro loans.

This acquisition was accounted for as a capital transaction followed by a recapitalization, and includes the historical financial information of the subsidiaries for the nine months ended September 30, 2008 and 2007. As a result of the transaction the total outstanding shares of the subsidiaries were charged to additional paid-in capital.

- 11 -

|

FINANCIAL SERVICES, INC. AND AFFILIATES |

|

COMBINED FINANCIAL STATEMENTS |

|

DECEMBER 31, 2007 AND 2006 |

FINANCIAL SERVICES INC. AND AFFILIATES

COMBINED FINANCIAL STATEMENTS

DECEMBER 31, 2007 AND 2006

INDEPENDENT AUDITORS’ REPORT |

To the Board of Directors

Financial Services Inc. and Affiliates

1650 Eastern Parkway

Brooklyn, NY 11233 |

We have audited the accompanying combined balance sheets of Financial Services Inc. and affiliates (the Company) as of December 31, 2007 and 2006 and the related combined statements of operations, stockholder’s equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company and its affiliates are not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Accordingly we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statement. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Financial Services Inc. and affiliates at December 31, 2007 and 2006, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

FRUMKIN, LUKIN & ZAIDMAN CPAs’, P.C.

Rockville Centre, New York

June 4, 2008 |

FINANCIAL SERVICES, INC AND AFFILIATES

COMBINED BALANCE SHEETS

DECEMBER 31, 2007 AND DECEMBER 31, 2006

| | | | | | | |

| | 2007 | | 2006 | |

| |

| |

| |

ASSETS | | | | | | | |

Current Assets: | | | | | | | |

Cash and cash equivalents (Note 2) | | $ | 52,295 | | $ | 24,239 | |

Accounts receivable (Note 2) | | | 1,162,297 | | | 301,631 | |

Prepaid expenses | | | 3,584 | | | 1,792 | |

| |

|

| |

|

| |

| | | | | | | |

Total Current Assets | | | 1,218,176 | | | 327,662 | |

| | | | | | | |

Property and equipment, net (Note 2 and 3) | | | 37,086 | | | 32,048 | |

| | | | | | | |

Other Assets: | | | | | | | |

Deposit | | | 2,310 | | | 199 | |

| |

|

| |

|

| |

TOTAL ASSETS | | $ | 1,257,572 | | $ | 359,909 | |

| |

|

| |

|

| |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

| | | | | | | |

Current Liabilities: | | | | | | | |

Accounts payable and accrued expenses | | $ | 132,761 | | | 12,109 | |

Current portion of long term debt | | | 11,029 | | | 11,029 | |

Note payable (Note 4) | | | 1,113,828 | | | 275,329 | |

| |

|

| |

|

| |

Total Current Liabilities | | | 1,257,618 | | | 298,467 | |

| |

|

| |

|

| |

| | | | | | | |

Long term liabilities: | | | | | | | |

Long term debt | | | 17,539 | | | 28,128 | |

| |

|

| |

|

| |

| | | | | | | |

Stockholders’ Equity: | | | | | | | |

| | | | | | | |

Common stock (Note 5) | | | 18,380 | | | 7,352 | |

Retained earnings (accumulated deficit) | | | (35,965 | ) | | 25,962 | |

| |

|

| |

|

| |

Total Stockholders’ Equity | | | (17,585) | | | 33,314 | |

| |

|

| |

|

| |

| | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 1,257,572 | | $ | 359,909 | |

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements.

-1-

|

FINANCIAL SERVICES INC. AND AFFILIATES |

COMBINED STATEMENTS OF INCOME |

FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006 |

| | | | | | | |

| | 2007 | | 2006 | |

| |

| |

| |

| | | | | |

Income | | $ | 476,922 | | $ | 188,539 | |

| | | | | | | |

Expenses: | | | | | | | |

| | | | | | | |

General and administrative expenses | | | 420,545 | | | 131,292 | |

Interest expense | | | 98,869 | | | 38,986 | |

| |

|

| |

|

| |

| | | | | | | |

Operating Expenses | | | 519,414 | | | 170,278 | |

| |

|

| |

|

| |

| | | | | | | |

(Loss) income before provision for income taxes | | | (42,492 | ) | | 18,261 | |

| | | | | | | |

Provision for income taxes | | | 19,435 | | | 10,290 | |

| |

|

| |

|

| |

| | | | | | | |

Net (loss) profit | | $ | (61,927 | ) | $ | 7,971 | |

| |

|

| |

|

| |

| | | | | | | |

Basic and diluted net (loss) profit per share | | $ | (1.23854 | ) | $ | 0.39855 | |

| |

|

| |

|

| |

| | | | | | | |

Weighted average number of common shares outstanding | | | 50,000 | | | 20,000 | |

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements.

-2-

|

FINANCIAL SERVICES INC. AND AFFILIATES |

COMBINED STATEMENT OF STOCKHOLDERS’ EQUITY |

FOR THE PERIOD JANUARY 1, 2006 THROUGH DECEMBER 31, 2007 |

| | | | | | | | | | | | | | | | |

| | COMMON STOCK | | | | | | | | |

| |

| | ADDITIONAL | | | | | | |

| | NUMBER OF | | | | PAID - IN | | RETAINED | | STOCKHOLDERS’ | |

| | SHARES | | AMOUNT | | CAPITAL | | EARNINGS | | EQUITY | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

Balance at January 1, 2006 | | | — | | $ | — | | $ | — | | $ | 17,991 | | $ | 17,991 | |

| | | | | | | | | | | | | | | | |

Issue of common stock | | | 20,000 | | | 7,352 | | | — | | | — | | | 7,352 | |

| | | | | | | | | | | | | | | | |

Net profit | | | — | | | — | | | — | | | 7,971 | | | 7,971 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Balance at December 31, 2006 | | | 20,000 | | | 7,352 | | | — | | | 25,962 | | | 33,314 | |

| | | | | | | | | | | | | | | | |

Issue of common stock | | | 30,000 | | | 11,028 | | | — | | | | | | 11,028 | |

| | | | | | | | | | | | | | | | |

Net (loss) | | | — | | | — | | | — | | | (61,927 | ) | | (61,927 | ) |

| | | | | | | | | | | | | | | | |

Balance at December 31, 2007 | | | 50,000 | | $ | 18,380 | | $ | — | | $ | (35,965 | ) | $ | (17,585) | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements.

-3-

|

FINANCIAL SERVICES INC. AND AFFILIATES |

COMBINED STATEMENTS OF CASH FLOWS |

FOR THE YEARS ENDED DECEMBER 31, 2007 AND DECEMBER 31, 2006 |

| | | | | | | |

| | 2007 | | 2006 | |

| |

| |

| |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | |

| | | | | | | |

Net (loss) profit | | $ | (61,927 | ) | $ | 7,971 | |

| | | | | | | |

Adjustments to reconcile net (loss) profit to net cash used in operating activities: | | | | | | | |

Depreciation | | | 11,520 | | | 9,349 | |

Changes in operating assets and liabilities: | | | | | | | |

Increase in accounts receivable | | | (860,666 | ) | | (206,781 | ) |

Decrease in due from affiliates | | | — | | | 4,861 | |

Increase in prepaid expenses | | | (1,792 | ) | | (689 | ) |

Increase in deposits | | | (2,111 | ) | | (199 | ) |

Increase (decrease) in accounts payable and accrued expenses | | | 120,652 | | | (5,402 | ) |

| |

|

| |

|

| |

| | | | | | | |

Net cash used in operating activities | | | (794,324 | ) | | (190,890 | ) |

| |

|

| |

|

| |

| | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

Purchase of property and equipment | | | (16,559 | ) | | (12,943 | ) |

| |

|

| |

|

| |

Net cash used in investing activities | | | (16,559 | ) | | (12,943 | ) |

| |

|

| |

|

| |

| | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | |

| | | | | | | |

Issuance of common stock | | | 11,028 | | | 7,352 | |

Repayment of bank loan | | | (10,589 | ) | | (9,351 | ) |

Repayment of short term loans | | | — | | | (68,530 | ) |

Proceeds from note payable | | | 838,500 | | | 276,763 | |

| |

|

| |

|

| |

Net cash provided by financing activities | | | 838,939 | | | 206,234 | |

| |

|

| |

|

| |

| | | | | | | |

Net increase in cash and cash equivalents | | | 28,056 | | | 2,401 | |

| | | | | | | |

Cash and cash equivalents at beginning of period | | | 24,239 | | | 21,838 | |

| |

|

| |

|

| |

| | | | | | | |

CASH AND CASH EQUIVALENTS AT END OF PERIOD | | $ | 52,295 | | $ | 24,239 | |

| |

|

| |

|

| |

Supplemental cash flow information: | | | | | | | |

Interest paid | | $ | 36,750 | | $ | 18,412 | |

| |

|

| |

|

| |

Income taxes paid | | $ | — | | $ | — | |

| |

|

| |

|

| |

The accompanying notes should be read in conjunction with the financial statements.

- 4 -

FINANCIAL SERVICES INC. AND AFFILIATES

NOTES TO COMBINED FINANCIAL STATEMENTS

DECEMBER 31, 2007 AND 2006

1 – ORGANIZATION AND BUSINESS

Financial Services Inc. and affiliates (the “Company”), were incorporated in various Caribbean countries during 2006 and 2007 and elected to have its fiscal year end on December 31. These Companies operate in the financial services industry and offer primarily short term micro loans to employees of various governmental and approved private companies.

2 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Financial Statement Presentation –The combined financial statements include the accounts of Financial Services Inc. and its affiliates, FastCash (St Lucia) Ltd; FastCash Antigua Ltd; FastCash Ltd (Granada); Cash Express (St Vincent), which together are under common control. The combined financial statements present more meaningful information than if financial statements for each affiliate are presently separately. All significant intercompany accounts and transactions have been eliminated in the combination. The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States and general practices within the financial services industry.

Use of Accounting Estimates– The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of certain assets and liabilities and disclosures. Accordingly, the actual amounts could differ from those estimates. Any adjustments applied to estimate amounts are recognized in the year in which such adjustments are determined.

Income taxes– Future income taxes are recorded using the asset and liability method whereby future tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Future tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability settled. The effect of future tax assets and liabilities of a change in tax rate is recognized in income in the period that substantive enactment or enactment occurs. To the extent that the company does not consider it to be more likely than not that a future tax asset will be recovered, it provides a valuation allowance against the net future losses time.

Cash and Cash Equivalents– For the purpose of the statement of cash flows, the Company considers all short-term debt securities purchased with maturity of three months or less to be cash equivalents.

Property and equipment– Property and equipment are carried at cost. Depreciation is provided using the straight line method over the estimated useful lives of the related asset.

- 5 -

FINANCIAL SERVICES, INC. AND AFFILITES

NOTES TO COMBINED FINANCIAL STATEMENT

DECEMBER 31, 2007 AND 2006

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Advertising Costs– The Company expenses advertising costs as incurred. Advertising costs for the years ended December 31, 2007 and 2006 were $54,874 and $13,343 respectively.

Earnings (loss) per common share– Basic earnings (loss) per common share are calculated using the weighted average number of common shares during each reporting period. Diluted earnings (loss) per common share includes potentially dilutive securities such as outstanding options and warrants, using various methods such as the treasury stock or modified treasury stock method in the determination of dilutive shares outstanding during each reporting period. The Company does not have any potentially dilutive instruments for this reporting period.

Fair value of Financial Instruments– The carrying value of accrued expenses approximates fair value due to the short period of time to maturity.

Recent Accounting Pronouncements– In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments, which is an Amendment of FASB Statement Nos. 133 and 140. This Statement resolves issues addressed in Statement 133 Implementation of Issue No. D1, “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets.” This Statement is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. Management does not believe that the adoption of SFAS No. 155 will have a material impact on the Company’s financial statements.

In July 2006, the Financial Accounting Standard Board (FASB) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109 (Fin 48) which provides clarification related to the process associated with accounting for uncertain tax provisions recognized in consolidated financial statements. FIN 48 prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. FIN 48 also provides guidance related to, among other things, classification, accounting for interest and penalties associated with tax positions, and disclosure requirements. Currently this pronouncement has no effect on the financial statements.

In September 2006, the Financial Accounting Standard Board issued SFAS No. 157 “Fair Value Measurement” that provides enhanced guidance for using fair value to measure assets and liabilities. The standard applies whenever other standards require (or permit) assets or liabilities to be measured at fair value. The standard does not expand the use of fair value in any new circumstances. This Statement is effective for financial statements issued for fiscal years beginning afterNovember 15, 2007, and interim periods within those fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period within that fiscal year. Currently this pronouncement has no e ffect on the financial statements.

- 6 -

FINANCIAL SERVICES, INC. AND AFFILITES

NOTES TO COMBINED FINANCIAL STATEMENT

DECEMBER 31, 2007 AND 2006

2 – SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No 159, The Fair Value Option for Financial Assets and Liabilities (SFAS No. 159). SFAS No. 159 provides the option to report certain financial assets and liabilities at fair value, with the intent to mitigate volatility in financial reporting that can occur when related assets and liabilities are recorded on different bases. The Company does not expect SFAS No. 159 to have a material impact on the financial statements.

Foreign currency translation:

The financial position and results of operations of the Company’s and its affiliates are measured using the local currency, Eastern Caribbean Dollars as the functional currency. These companies generate and expend cash primarily in their local currency. Revenues and expenses of such affiliates have been translated into U.S. dollars at average exchange rates prevailing during the period. Assets and liabilities have been translated at the rates of exchange on the balance sheet date. There were no major exchange rate fluctuation during the period and therefore no foreign exchange gain or loss arising from translation was recorded for the year ended December 31, 2007 and 2006.

Revenue recognition:

Income on all loans is recognized using the interest method. Service and other related fees are recognized when earned. For impaired loans accrual of interest is discontinued on a loan when management believes, after considering collection efforts and other factors that the borrower’s financial condition is such that the collection of interest is doubtful. Loans are considered impaired when it is probable that the Company will be unable to collect all contractual principal and interest payments due in accordance with the terms of the loan agreement.

Allowance for doubtful accounts:

The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience and a review of the current status of the accounts receivable. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. Accounts receivable are presented net of an allowance for doubtful accounts.

| | | |

| | 2007 | | 2006 |

| |

| Accounts receivable | $ 1,201,981 | | $ 310,784 |

| Allowance | 39,684 | | 9,153 |

| Accounts receivable - net | $ 1,162,297 | | $ 301,631 |

- 7 -

FINANCIAL SERVICES, INC. AND AFFILITES

NOTES TO COMBINED FINANCIAL STATEMENT

DECEMBER 31, 2007 AND 2006

3 – PROPERTY AND EQUIPMENT

Property and equipment at December 31, 2007 and 2006 consist of the following:

| | | |

| | 2007 | | 2006 |

| |

| Furniture and fixtures | $ 17,552 | | $ 8,858 |

| Equipment and computers | 15,118 | | 12,155 |

| Software | 26,060 | | 21,160 |

| | 58,730 | | 42,173 |

| Less accumulated depreciation | 21,644 | | 10,125 |

| | $ 37,086 | | $ 32,048 |

Depreciation expense for the years ended December 31, 2007 and 2006 were $11,520 and $9,349 respectively.

4 – NOTE PAYABLE

This represents amounts due by the various affiliates in the form of a revolving credit agreement in the amount of $1,000,000 for each company for a total of $ 5,000,000. Under the terms of the agreement interest is charged at a rate of 15% which is due and payable on the first day of April, July and October. Advances and any unpaid accrued interest under the terms of the agreement are due and payable on demand. Amounts due at December 31, 2007 and 2006 were $1,113,828 and $275,329 respectively.

5 – COMMON STOCK

The Company and its affiliates are authorized to issue 11,020,000 par value $0.3676 common shares. Common shares issued and outstanding at December 31, 2007 and 2006 were 50,000 and 20,000 respectively.

6 – CONCENTRATION OF RISK

The Company maintains cash in deposit accounts in federally insured banks. At times, the balance in the accounts may be in excess of federally insured limits.

- 8 -

FINANCIAL SERVICES, INC. AND AFFILITES

NOTES TO COMBINED FINANCIAL STATEMENT

DECEMBER 31, 2007 AND 2006

7 – COMMITMENTS AND CONTINGENCIES

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and its legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed. Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

Facility Leases

Various affiliates of the Company leases office space on a month to month basis while others have leases expiring at various dates through 2012. These leases generally provide for fixed annual rentals. Rent expense charged to operations for the years ended December 31, 2007 and 2006 were $27,864 and $14,202 respectively.

The future minimal rental payments required under these leases are as follows:

| | |

| Year ending December 31, | | Amount |

| |

| 2008 | $ | 19,538 |

| 2009 | | 10,051 |

| 2010 | | 10,875 |

| 2011 | | 10,875 |

| 2012 | | 9,063 |

| Total | $ | 60,402 |

Agreements:

Each affiliate has a corporate services agreement with NBL Technologies Inc., an entity that is controlled by the Chief Operating Officer of the Company. Under the terms of the agreement each company pays a monthly fee to NBL Technologies Inc. for personnel management, administrative services and other services as governed by the agreement. Such fees paid to NBL Technologies for the years ended December 31, 2007 and 2006 totaled $13,971 and $4,412 respectively.

- 9 -

FINANCIAL SERVICES, INC. AND AFFILITES

NOTES TO COMBINED FINANCIAL STATEMENT

DECEMBER 31, 2007 AND 2006

8 – CHANGE IN ACCOUNTING PRINCIPLE:

During the period the Company changed from the direct method of recording bad debts to the allowance method in accordance with generally accepted accounting principles. Prior periods presented have been restated to reflect the change. The effect of the change was to decrease net income by $18,533 and decrease income tax by $601.

- 10 -