As filed with the Securities and Exchange Commission on April 28, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report .

Commission file number000-53445

KB Financial Group Inc.

(Exact name of Registrant as specified in its charter)

KB Financial Group Inc.

(Translation of Registrant’s name into English)

The Republic of Korea

(Jurisdiction of incorporation or organization)

84,Namdaemoon-ro,Jung-gu, Seoul 04534, Korea

(Address of principal executive offices)

Peter BongJoong Kwon

84,Namdaemoon-ro,Jung-gu, Seoul 04534, Korea

TelephoneNo.: +82-2-2073-2844

FacsimileNo.: +82-2-2073-2848

(Name, telephone,e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of each class | | Name of each exchange on which registered |

American Depositary Shares, each representing one share of Common Stock | | New York Stock Exchange |

Common Stock, par value ₩5,000 per share | | New York Stock Exchange* |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

386,351,693 shares of Common Stock, par value₩5,000 per share

Indicate by check mark if the registrant is awell-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule12b-2 of the Exchange Act. (Check one):

x Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | |

| ¨ U.S. GAAP | | x International Financial Reporting Standards as issued by the International Accounting Standards Board | | ¨ | | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). ¨ Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

* Not for trading, but only in connection with the registration of the American Depositary Shares.

TABLE OF CONTENTS

i

ii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

The financial statements included in this annual report are prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. As such, we make an explicit and unreserved statement of compliance with IFRS as issued by the IASB with respect to our consolidated financial statements as of December 31, 2014 and 2015 and for the years ended December 31, 2013, 2014 and 2015 included in this annual report. Unless indicated otherwise, the financial information in this annual report as of and for the years ended December 31, 2011, 2012, 2013, 2014 and 2015 has been prepared in accordance with IFRS as issued by the IASB, which is not comparable to information prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP.

In accordance with rule amendments adopted by the U.S. Securities and Exchange Commission which became effective on March 4, 2008, we are not required to provide a reconciliation to U.S. GAAP.

Unless expressly stated otherwise, all financial data included in this annual report are presented on a consolidated basis.

In this annual report:

| | • | | references to “we,” “us” or “KB Financial Group” are to KB Financial Group Inc. and, unless the context otherwise requires, its subsidiaries; |

| | • | | references to “Korea” are to the Republic of Korea; |

| | • | | references to the “government” are to the government of the Republic of Korea; |

| | • | | references to “Won” or “₩” are to the currency of Korea; and |

| | • | | references to “U.S. dollars,” “$” or “US$” are to United States dollars. |

Discrepancies between totals and the sums of the amounts contained in any table may be a result of rounding.

For your convenience, this annual report contains translations of Won amounts into U.S. dollars at the noon buying rate of the Federal Reserve Bank of New York for Won in effect on December 31, 2015, which was ₩1,169.3 = US$1.00.

1

FORWARD-LOOKING STATEMENTS

The U.S. Securities and Exchange Commission encourages companies to discloseforward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This annual report containsforward-looking statements.

Words and phrases such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “future,” “goal,” “intend,” “may,” “objective,” “plan,” “positioned,” “predict,” “project,” “risk,” “seek to,” “shall,” “should,” “will likely result,” “will pursue,” “plan” and words and terms of similar substance used in connection with any discussion of future operating or financial performance or our expectations, plans, projections or business prospects identifyforward-looking statements. In particular, the statements under the headings “Item 3.D. Risk Factors,” “Item 5. Operating and Financial Review and Prospects” and “Item 4.B. Business Overview” regarding our financial condition and other future events or prospects areforward-looking statements. Allforward-looking statements are management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in theforward-looking statements.

In addition to the risks related to our business discussed under “Item 3.D. Risk Factors,” other factors could cause actual results to differ materially from those described in theforward-looking statements. These factors include, but are not limited to:

| | • | | our ability to successfully implement our strategy; |

| | • | | future levels ofnon-performing loans; |

| | • | | our growth and expansion; |

| | • | | the adequacy of allowances for credit and investment losses; |

| | • | | availability of funding and liquidity; |

| | • | | our exposure to market risks; and |

| | • | | adverse market and regulatory conditions. |

By their nature, certain disclosures relating to these and other risks are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains, losses or impact on our income or results of operations could materially differ from those that have been estimated. For example, revenues could decrease, costs could increase, capital costs could increase, capital investment could be delayed and anticipated improvements in performance might not be fully realized.

In addition, other factors that could cause actual results to differ materially from those estimated by theforward-looking statements contained in this annual report could include, but are not limited to:

| | • | | general economic and political conditions in Korea or other countries that have an impact on our business activities or investments; |

| | • | | the monetary and interest rate policies of Korea; |

| | • | | inflation or deflation; |

2

| | • | | unanticipated volatility in interest rates; |

| | • | | foreign exchange rates; |

| | • | | prices and yields of equity and debt securities; |

| | • | | the performance of the financial markets in Korea and globally; |

| | • | | changes in domestic and foreign laws, regulations and taxes; |

| | • | | changes in competition and the pricing environments in Korea; and |

| | • | | regional or general changes in asset valuations. |

For further discussion of the factors that could cause actual results to differ, see the discussion under “Item 3.D. Risk Factors” contained in this annual report. We caution you not to place undue reliance on theforward-looking statements, which speak only as of the date of this annual report. Except as required by law, we are not under any obligation, and expressly disclaim any obligation, to update or alter anyforward-looking statements, whether as a result of new information, future events or otherwise.

All subsequentforward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this annual report.

| Item 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| Item 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| Item 3.A. | Selected Financial Data |

The selected consolidated financial and operating data set forth below as of and for the years ended December 31, 2011, 2012, 2013, 2014 and 2015 have been derived from our audited consolidated financial statements, which have been prepared in accordance with IFRS as issued by the IASB. Our consolidated financial statements as of and for the years ended December 31, 2011, 2012, 2013, 2014 and 2015 have been audited by independent registered public accounting firm Samil PricewaterhouseCoopers.

You should read the following data together with the more detailed information contained in “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements included elsewhere in this annual report. Historical results do not necessarily predict future results.

3

Consolidated statements of comprehensive income data

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2011 | | | 2012(1) | | | 2013(1) | | | 2014(1) | | | 2015(1) | | | 2015(2) | |

| | | (in billions of Won, except common share data) | | | (in millions of US$,

except common

share data) | |

Interest income | | ₩ | 13,956 | | | ₩ | 14,210 | | | ₩ | 12,357 | | | ₩ | 11,635 | | | ₩ | 10,376 | | | US$ | 8,874 | |

Interest expense | | | (6,852 | ) | | | (7,172 | ) | | | (5,834 | ) | | | (5,219 | ) | | | (4,173 | ) | | | (3,569 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 7,104 | | | | 7,038 | | | | 6,523 | | | | 6,416 | | | | 6,203 | | | | 5,305 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Fee and commission income | | | 2,830 | | | | 2,754 | | | | 2,657 | | | | 2,666 | | | | 2,971 | | | | 2,541 | |

Fee and commission expense | | | (1,035 | ) | | | (1,187 | ) | | | (1,178 | ) | | | (1,283 | ) | | | (1,436 | ) | | | (1,228 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net fee and commission income | | | 1,795 | | | | 1,567 | | | | 1,479 | | | | 1,383 | | | | 1,535 | | | | 1,313 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net gains on financial assets and liabilities at fair value through profit or loss | | | 1,036 | | | | 812 | | | | 757 | | | | 439 | | | | 360 | | | | 308 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net other operating income (expenses) | | | (1,092 | ) | | | (1,532 | ) | | | (1,305 | ) | | | (1,041 | ) | | | (716 | ) | | | (612 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

General and administrative expenses | | | (3,887 | ) | | | (3,846 | ) | | | (3,984 | ) | | | (4,010 | ) | | | (4,524 | ) | | | (3,869 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating profit before provision for credit losses | | | 4,956 | | | | 4,039 | | | | 3,470 | | | | 3,187 | | | | 2,858 | | | | 2,445 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Provision for credit losses | | | (1,513 | ) | | | (1,607 | ) | | | (1,443 | ) | | | (1,228 | ) | | | (1,037 | ) | | | (887 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net operating profit | | | 3,443 | | | | 2,432 | | | | 2,027 | | | | 1,959 | | | | 1,821 | | | | 1,558 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Share of profit (loss) of associates and joint ventures | | | 5 | | | | (15 | ) | | | (199 | ) | | | 13 | | | | 203 | | | | 174 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net othernon-operating income (expense) | | | (142 | ) | | | (118 | ) | | | (12 | ) | | | (71 | ) | | | 140 | | | | 120 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net non-operating profit (loss) | | | (137 | ) | | | (133 | ) | | | (211 | ) | | | (58 | ) | | | 343 | | | | 294 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Profit before income tax | | | 3,306 | | | | 2,299 | | | | 1,816 | | | | 1,901 | | | | 2,164 | | | | 1,852 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Tax income (expense) | | | (565 | ) | | | (520 | ) | | | (541 | ) | | | (486 | ) | | | (437 | ) | | | (374 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Profit for the year | | ₩ | 2,741 | | | ₩ | 1,779 | | | ₩ | 1,275 | | | ₩ | 1,415 | | | ₩ | 1,727 | | | US$ | 1,478 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Items that will not be reclassified to profit or loss: | | | | | | | | | | | | | | | | | | | | | | | | |

Remeasurements of net defined benefit | | | (32 | ) | | | (30 | ) | | | 41 | | | | (100 | ) | | | (23 | ) | | | (20 | ) |

| | | | | | |

Items that may be reclassified subsequently to profit or loss: | | | | | | | | | | | | | | | | | | | | | | | | |

Exchange differences on translating foreign operations | | | 6 | | | | (26 | ) | | | (2 | ) | | | 17 | | | | 45 | | | | 39 | |

Valuation gains (losses) on financial investments | | | (240 | ) | | | 246 | | | | (4 | ) | | | 249 | | | | (29 | ) | | | (25 | ) |

Shares of other comprehensive income (loss) of associates and joint ventures | | | (1 | ) | | | (44 | ) | | | (10 | ) | | | (32 | ) | | | — | | | | — | |

Cash flow hedges | | | (1 | ) | | | (1 | ) | | | 2 | | | | (10 | ) | | | 1 | | | | 1 | |

Losses on hedges of a net investment in a foreign operation | | | — | | | | — | | | | — | | | | — | | | | (25 | ) | | | (22 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other comprehensive income (loss) for the year, net of tax | | | (268 | ) | | | 145 | | | | 27 | | | | 124 | | | | (31 | ) | | | (27 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income for the year | | ₩ | 2,473 | | | ₩ | 1,924 | | | ₩ | 1,302 | | | ₩ | 1,539 | | | ₩ | 1,696 | | | US$ | 1,451 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Profit attributable to: | | | | | | | | | | | | | | | | | | | | | | | | |

Shareholders of the parent company | | ₩ | 2,686 | | | ₩ | 1,770 | | | ₩ | 1,272 | | | ₩ | 1,401 | | | ₩ | 1,698 | | | US$ | 1,452 | |

Non-controlling interests | | | 55 | | | | 9 | | | | 3 | | | | 14 | | | | 29 | | | | 26 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | ₩ | 2,741 | | | ₩ | 1,779 | | | ₩ | 1,275 | | | ₩ | 1,415 | | | ₩ | 1,727 | | | US$ | 1,478 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income attributable to: | | | | | | | | | | | | | | | | | | | | | | | | |

Shareholders of the parent company | | ₩ | 2,414 | | | ₩ | 1,904 | | | ₩ | 1,313 | | | ₩ | 1,526 | | | ₩ | 1,667 | | | US$ | 1,426 | |

Non-controlling interests | | | 59 | | | | 20 | | | | (11 | ) | | | 13 | | | | 29 | | | | 25 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | ₩ | 2,473 | | | ₩ | 1,924 | | | ₩ | 1,302 | | | ₩ | 1,539 | | | ₩ | 1,696 | | | US$ | 1,451 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Earnings per share | | | | | | | | | | | | | | | | | | | | | | | | |

Basic earnings per share | | ₩ | 7,310 | | | ₩ | 4,580 | | | ₩ | 3,291 | | | ₩ | 3,626 | | | ₩ | 4,396 | | | US$ | 3.76 | |

Diluted earnings per share | | | 7,293 | | | | 4,567 | | | | 3,277 | | | | 3,611 | | | | 4,376 | | | | 3.74 | |

4

| (1) | Pursuant to the adoption of IFRS 10,Consolidated Financial Statements, which is effective beginning in 2013, our consolidated financial statements as of and for the years ended December 31, 2013, 2014 and 2015 include trust accounts for which we guarantee only the repayment of principal, as well as certain other entities, which were not previously subject to consolidation, while excluding certain other entities that were previously consolidated. Our consolidated financial statements as of and for the year ended December 31, 2012 have been restated to retroactively apply this change. Amounts for 2012 reflect such restatement, while amounts for 2011 have not been correspondingly restated. |

| (2) | Won amounts are expressed in U.S. dollars at the rate of ₩1,169.3 to US$1.00, the noon buying rate in effect on December 31, 2015 as quoted by the Federal Reserve Bank of New York in the United States. |

Consolidated statements of financial position data

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2011 | | | 2012(1) | | | 2013(1) | | | 2014(1) | | | 2015(1) | | | 2015(2) | |

| | | (in billions of Won) | | | (in millions

of US$) | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and due from financial institutions | | ₩ | 9,178 | | | ₩ | 10,593 | | | ₩ | 14,793 | | | ₩ | 15,424 | | | ₩ | 16,316 | | | US$ | 13,954 | |

Financial assets at fair value through profit or loss | | | 6,326 | | | | 9,560 | | | | 9,329 | | | | 10,758 | | | | 11,174 | | | | 9,557 | |

Derivative financial assets | | | 2,449 | | | | 2,091 | | | | 1,819 | | | | 1,968 | | | | 2,278 | | | | 1,948 | |

Loans | | | 212,107 | | | | 213,645 | | | | 219,001 | | | | 231,450 | | | | 245,005 | | | | 209,539 | |

Financial investments | | | 35,432 | | | | 36,467 | | | | 34,849 | | | | 34,961 | | | | 39,137 | | | | 33,471 | |

Investments in associates and joint ventures | | | 892 | | | | 935 | | | | 755 | | | | 670 | | | | 1,738 | | | | 1,486 | |

Property and equipment | | | 3,186 | | | | 3,100 | | | | 3,061 | | | | 3,083 | | | | 3,287 | | | | 2,812 | |

Investment property | | | 52 | | | | 53 | | | | 166 | | | | 378 | | | | 212 | | | | 181 | |

Intangible assets | | | 468 | | | | 493 | | | | 443 | | | | 489 | | | | 467 | | | | 399 | |

Current income tax assets | | | 292 | | | | 333 | | | | 347 | | | | 306 | | | | 19 | | | | 16 | |

Deferred income tax assets | | | 22 | | | | 18 | | | | 16 | | | | 16 | | | | 8 | | | | 7 | |

Assets held for sale | | | 10 | | | | 35 | | | | 38 | | | | 70 | | | | 49 | | | | 42 | |

Other assets | | | 7,467 | | | | 8,747 | | | | 7,551 | | | | 8,783 | | | | 9,375 | | | | 8,019 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | ₩ | 277,881 | | | ₩ | 286,070 | | | ₩ | 292,168 | | | ₩ | 308,356 | | | ₩ | 329,065 | | | US$ | 281,431 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Financial liabilities at fair value through profit or loss | | ₩ | 1,388 | | | ₩ | 1,851 | | | ₩ | 1,115 | | | ₩ | 1,819 | | | ₩ | 2,975 | | | US$ | 2,544 | |

Derivative financial liabilities | | | 2,059 | | | | 2,055 | | | | 1,795 | | | | 1,797 | | | | 2,326 | | | | 1,989 | |

Deposits | | | 190,337 | | | | 197,346 | | | | 200,882 | | | | 211,549 | | | | 224,268 | | | | 191,804 | |

Debts | | | 16,824 | | | | 15,965 | | | | 14,101 | | | | 15,865 | | | | 16,241 | | | | 13,890 | |

Debentures | | | 27,070 | | | | 24,270 | | | | 27,040 | | | | 29,201 | | | | 32,601 | | | | 27,881 | |

Provisions | | | 798 | | | | 670 | | | | 678 | | | | 614 | | | | 607 | | | | 520 | |

Defined benefit liabilities | | | 128 | | | | 84 | | | | 64 | | | | 76 | | | | 73 | | | | 63 | |

Current income tax liabilities | | | 589 | | | | 265 | | | | 211 | | | | 232 | | | | 31 | | | | 26 | |

Deferred income tax liabilities | | | 221 | | | | 154 | | | | 62 | | | | 93 | | | | 179 | | | | 153 | |

Other liabilities | | | 15,087 | | | | 18,328 | | | | 20,237 | | | | 19,597 | | | | 20,862 | | | | 17,842 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | ₩ | 254,501 | | | ₩ | 260,988 | | | ₩ | 266,185 | | | ₩ | 280,843 | | | ₩ | 300,163 | | | US$ | 256,712 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

5

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2011 | | | 2012(1) | | | 2013(1) | | | 2014(1) | | | 2015(1) | | | 2015(2) | |

| | | (in billions of Won) | | | (in millions

of US$) | |

Total Equity | | | | | | | | | | | | | | | | | | | | | | | | |

Capital stock | | ₩ | 1,932 | | | ₩ | 1,932 | | | ₩ | 1,932 | | | ₩ | 1,932 | | | ₩ | 1,932 | | | US$ | 1,652 | |

Capital surplus | | | 15,842 | | | | 15,840 | | | | 15,855 | | | | 15,855 | | | | 15,855 | | | | 13,559 | |

Accumulated other comprehensive income | | | 168 | | | | 295 | | | | 336 | | | | 461 | | | | 429 | | | | 369 | |

Retained earnings | | | 5,256 | | | | 6,820 | | | | 7,860 | | | | 9,067 | | | | 10,464 | | | | 8,949 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Equity attributable to shareholders of the parent company | | | 23,198 | | | | 24,887 | | | | 25,983 | | | | 27,315 | | | | 28,680 | | | | 24,529 | |

Non-controlling interests | | | 182 | | | | 195 | | | | — | | | | 198 | | | | 222 | | | | 190 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total equity | | ₩ | 23,380 | | | ₩ | 25,082 | | | ₩ | 25,983 | | | ₩ | 27,513 | | | ₩ | 28,902 | | | US$ | 24,719 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity | | ₩ | 277,881 | | | ₩ | 286,070 | | | ₩ | 292,168 | | | ₩ | 308,356 | | | ₩ | 329,065 | | | US$ | 281,431 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Pursuant to the adoption of IFRS 10,Consolidated Financial Statements, which is effective beginning in 2013, our consolidated financial statements as of and for the years ended December 31, 2013, 2014 and 2015 include trust accounts for which we guarantee only the repayment of principal, as well as certain other entities, which were not previously subject to consolidation, while excluding certain other entities that were previously consolidated. Our consolidated financial statements as of and for the year ended December 31, 2012 have been restated to retroactively apply this change. Amounts as of December 31, 2012 reflect such restatement, while amounts as of December 31, 2011 have not been correspondingly restated. |

| (2) | Won amounts are expressed in U.S. dollars at the rate of ₩1,169.3 to US$1.00, the noon buying rate in effect on December 31, 2015 as quoted by the Federal Reserve Bank of New York in the United States. |

Profitability ratios and other data

| | | | | | | | | | | | | | | | | | | | |

| | | As of or for the year Ended December 31, | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (Percentages) | |

Profit (loss) attributable to stockholders as a percentage of: | | | | | | | | | | | | | | | | | | | | |

Average total assets(1) | | | 0.99 | % | | | 0.60 | % | | | 0.44 | % | | | 0.47 | % | | | 0.54 | % |

Average stockholders’ equity(1) | | | 11.47 | | | | 7.13 | | | | 5.00 | | | | 5.30 | | | | 6.05 | |

Dividend payout ratio(2) | | | 10.23 | | | | 13.40 | | | | 15.01 | | | | 21.48 | | | | 22.32 | |

Net interest spread(3) | | | 2.64 | | | | 2.48 | | | | 2.31 | | | | 2.22 | | | | 2.07 | |

Net interest margin(4) | | | 2.88 | | | | 2.71 | | | | 2.51 | | | | 2.39 | | | | 2.20 | |

Efficiency ratio(5) | | | 43.96 | | | | 48.78 | | | | 53.45 | | | | 55.72 | | | | 61.28 | |

Cost-to-average assets ratio(6) | | | 1.41 | | | | 1.33 | | | | 1.37 | | | | 1.34 | | | | 1.43 | |

Won loans (gross) as a percentage of Won deposits | | | 107.97 | | | | 106.37 | | | | 107.12 | | | | 107.73 | | | | 107.88 | |

Total loans (gross) as a percentage of total deposits | | | 113.25 | | | | 109.92 | | | | 110.44 | | | | 110.57 | | | | 110.40 | |

| (1) | Average balances are based on daily balances for our banking, credit card and investment and securities operations and monthly or quarterly balances for our other operations. |

| (2) | Represents the ratio of total dividends declared on common stock as a percentage of profit attributable to stockholders. |

| (3) | Represents the difference between the yield on average interest earning assets and cost of average interest bearing liabilities. |

| (4) | Represents the ratio of net interest income to average interest earning assets. |

| (5) | Represents the ratio of general and administrative expenses to the sum of net interest income, net fee and commission income, net gain on financial assets and liabilities at fair value through profit or loss and net other operating income. |

| (6) | Represents the ratio of general and administrative expenses to average total assets. |

6

Capital ratios

| | | | | | | | | | | | |

| | | As of or for the year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | |

| | | (Percentages) | |

Consolidated capital adequacy ratio of KB Financial Group(1) | | | 15.38 | % | | | 15.53 | % | | | 15.48 | % |

Capital adequacy ratios of Kookmin Bank | | | | | | | | | | | | |

Tier I capital adequacy ratio(2) | | | 12.61 | | | | 13.38 | | | | 13.74 | |

Common equity Tier I capital adequacy ratio(2) | | | 12.61 | | | | 13.38 | | | | 13.74 | |

Tier II capital adequacy ratio(2) | | | 2.81 | | | | 2.59 | | | | 2.27 | |

Average stockholders’ equity as a percentage of average total assets | | | 8.87 | | | | 8.83 | | | | 8.87 | |

| (1) | Under applicable guidelines of the Financial Services Commission, we, as a bank holding company, are required to maintain a minimum consolidated capital adequacy ratio of 8%. See “Item 4.B. Business Overview—Supervision and Regulation—Principal Regulations Applicable to Financial Holding Companies—Capital Adequacy.” |

| (2) | Kookmin Bank’s capital adequacy ratios are computed in accordance with the guidelines issued by the Financial Services Commission. See “Item 4.B. Business Overview—Supervision and Regulation—Principal Regulations Applicable to Banks—Capital Adequacy.” |

Credit portfolio ratios and other data

| | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (in billions of Won, except percentages) | |

Total loans(1) | | ₩ | 215,555 | | | ₩ | 216,914 | | | ₩ | 221,862 | | | ₩ | 233,902 | | | ₩ | 247,587 | |

Totalnon-performing loans(2) | | | 1,180 | | | | 1,606 | | | | 1,421 | | | | 1,068 | | | | 922 | |

Other impaired loans not included innon-performing loans | | | 2,285 | | | | 2,086 | | | | 2,669 | | | | 1,996 | | | | 2,075 | |

Total ofnon-performing loans and other impaired loans | | | 3,465 | | | | 3,692 | | | | 4,090 | | | | 3,064 | | | | 2,997 | |

Total allowances for loan losses | | | 3,448 | | | | 3,269 | | | | 2,861 | | | | 2,452 | | | | 2,582 | |

Non-performing loans as a percentage of total loans | | | 0.55 | % | | | 0.74 | % | | | 0.64 | % | | | 0.46 | % | | | 0.37 | % |

Non-performing loans as a percentage of total assets | | | 0.42 | % | | | 0.56 | % | | | 0.49 | % | | | 0.35 | % | | | 0.28 | % |

Total ofnon-performing loans and other impaired loans as a percentage of total loans | | | 1.61 | % | | | 1.70 | % | | | 1.84 | % | | | 1.31 | % | | | 1.21 | % |

Allowances for loan losses as a percentage of total loans | | | 1.60 | % | | | 1.51 | % | | | 1.29 | % | | | 1.05 | % | | | 1.04 | % |

| (1) | Before deduction of allowances for loan losses. |

| (2) | Non-performing loans are defined as those loans, including corporate, retail and other loans, which are past due by 90 days or more. |

7

Selected Statistical Information

Average Balance Sheets and Related Interest

The following table shows our average balances and interest rates for the past three years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | |

| | | Average

Balance (1) | | | Interest

Income (2)(3) | | | Average

Yield | | | Average

Balance (1) | | | Interest

Income (2)(3) | | | Average

Yield | | | Average

Balance (1) | | | Interest

Income (2)(3) | | | Average

Yield | |

| | | (in billions of Won, except percentages) | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and interest earning deposits in other banks | | ₩ | 5,905 | | | ₩ | 146 | | | | 2.47 | % | | ₩ | 7,811 | | | ₩ | 190 | | | | 2.43 | % | | ₩ | 8,980 | | | ₩ | 152 | | | | 1.69 | % |

Financial investment (debt securities) (4) | | | 33,339 | | | | 1,269 | | | | 3.81 | | | | 31,530 | | | | 1,120 | | | | 3.55 | | | | 32,423 | | | | 989 | | | | 3.05 | |

Loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate | | | 100,614 | | | | 4,526 | | | | 4.50 | | | | 101,875 | | | | 4,145 | | | | 4.07 | | | | 105,821 | | | | 3,618 | | | | 3.42 | |

Mortgage | | | 44,514 | | | | 1,826 | | | | 4.10 | | | | 48,160 | | | | 1,746 | | | | 3.63 | | | | 51,467 | | | | 1,554 | | | | 3.02 | |

Home equity | | | 30,275 | | | | 1,287 | | | | 4.25 | | | | 32,030 | | | | 1,216 | | | | 3.80 | | | | 33,572 | | | | 1,047 | | | | 3.12 | |

Other consumer | | | 30,536 | | | | 1,974 | | | | 6.46 | | | | 32,981 | | | | 2,019 | | | | 6.12 | | | | 35,351 | | | | 1,843 | | | | 5.21 | |

Credit cards (5) | | | 11,611 | | | | 1,242 | | | | 10.70 | | | | 11,312 | | | | 1,123 | | | | 9.93 | | | | 11,907 | | | | 1,091 | | | | 9.16 | |

Foreign | | | 2,851 | | | | 87 | | | | 3.05 | | | | 2,631 | | | | 76 | | | | 2.89 | | | | 2,794 | | | | 82 | | | | 2.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans (total) | | | 220,401 | | | | 10,942 | | | | 4.96 | | | | 228,989 | | | | 10,325 | | | | 4.51 | | | | 240,912 | | | | 9,235 | | | | 3.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average interest earning assets | | ₩ | 259,645 | | | ₩ | 12,357 | | | | 4.76 | % | | ₩ | 268,330 | | | ₩ | 11,635 | | | | 4.34 | % | | ₩ | 282,315 | | | ₩ | 10,376 | | | | 3.67 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | | 7,688 | | | | — | | | | — | | | | 7,978 | | | | — | | | | — | | | | 8,804 | | | | — | | | | — | |

Financial assets at fair value through profit or loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Debt securities (3) | | | 8,091 | | | | — | | | | — | | | | 8,631 | | | | — | | | | — | | | | 9,321 | | | | — | | | | — | |

Equity securities | | | 1,280 | | | | — | | | | — | | | | 847 | | | | — | | | | — | | | | 689 | | | | — | | | | — | |

Other | | | 42 | | | | — | | | | — | | | | 47 | | | | — | | | | — | | | | 62 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial assets at fair value through profit or loss (total) | | | 9,413 | | | | — | | | | — | | | | 9,525 | | | | — | | | | — | | | | 10,072 | | | | — | | | | — | |

Financial investment (equity securities) | | | 2,671 | | | | — | | | | — | | | | 2,999 | | | | — | | | | — | | | | 3,177 | | | | — | | | | — | |

Investment in associates | | | 882 | | | | — | | | | — | | | | 698 | | | | — | | | | — | | | | 1,048 | | | | — | | | | — | |

Derivative financial assets | | | 1,760 | | | | — | | | | — | | | | 1,791 | | | | — | | | | — | | | | 2,121 | | | | — | | | | — | |

Premises and equipment | | | 3,191 | | | | — | | | | — | | | | 3,197 | | | | — | | | | — | | | | 3,230 | | | | — | | | | — | |

Intangible assets | | | 475 | | | | — | | | | — | | | | 463 | | | | — | | | | — | | | | 470 | | | | — | | | | — | |

Allowances for loan losses | | | (4,108 | ) | | | — | | | | — | | | | (3,556 | ) | | | — | | | | — | | | | (2,922 | ) | | | — | | | | — | |

Othernon-interest earning assets | | | 8,555 | | | | — | | | | — | | | | 7,570 | | | | — | | | | — | | | | 7,748 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total averagenon-interest earning assets | | | 30,527 | | | | — | | | | — | | | | 30,665 | | | | — | | | | — | | | | 33,748 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average assets | | ₩ | 290,172 | | | ₩ | 12,357 | | | | 4.26 | % | | ₩ | 298,995 | | | ₩ | 11,635 | | | | 3.89 | % | | ₩ | 316,063 | | | ₩ | 10,376 | | | | 3.28 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | |

| | | Average

Balance (1) | | | Interest

Expense | | | Average

Cost | | | Average

Balance (1) | | | Interest

Expense | | | Average

Cost | | | Average

Balance (1) | | | Interest

Expense | | | Average

Cost | |

| | | (in billions of Won, except percentages) | |

Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Demand deposits | | ₩ | 60,894 | | | ₩ | 285 | | | | 0.47 | % | | ₩ | 67,612 | | | ₩ | 283 | | | | 0.42 | % | | ₩ | 82,614 | | | ₩ | 291 | | | | 0.35 | % |

Time deposits | | | 130,286 | | | | 3,940 | | | | 3.02 | | | | 130,258 | | | | 3,516 | | | | 2.70 | | | | 123,977 | | | | 2,674 | | | | 2.16 | |

Certificates of deposit | | | 1,780 | | | | 54 | | | | 3.03 | | | | 1,689 | | | | 46 | | | | 2.72 | | | | 3,645 | | | | 70 | | | | 1.92 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits (total) | | | 192,960 | | | | 4,279 | | | | 2.22 | | | | 199,559 | | | | 3,845 | | | | 1.93 | | | | 210,236 | | | | 3,035 | | | | 1.44 | |

Debts | | | 20,173 | | | | 365 | | | | 1.81 | | | | 19,085 | | | | 342 | | | | 1.79 | | | | 19,649 | | | | 271 | | | | 1.38 | |

Debentures | | | 25,319 | | | | 1,190 | | | | 4.70 | | | | 28,048 | | | | 1,032 | | | | 3.68 | | | | 30,885 | | | | 867 | | | | 2.81 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average interest bearing liabilities | | ₩ | 238,452 | | | ₩ | 5,834 | | | | 2.45 | % | | ₩ | 246,692 | | | ₩ | 5,219 | | | | 2.12 | % | | ₩ | 260,770 | | | ₩ | 4,173 | | | | 1.60 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest bearing demand deposits | | | 3,252 | | | | — | | | | — | | | | 3,486 | | | | — | | | | — | | | | 3,836 | | | | — | | | | — | |

Derivative financial liabilities | | | 1,789 | | | | — | | | | — | | | | 1,669 | | | | — | | | | — | | | | 2,046 | | | | — | | | | — | |

Financial liabilities at fair value through profit or loss | | | 1,697 | | | | — | | | | — | | | | 1,497 | | | | — | | | | — | | | | 2,453 | | | | — | | | | — | |

Othernon-interest bearing liabilities | | | 19,157 | | | | — | | | | — | | | | 18,778 | | | | — | | | | — | | | | 18,705 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average non-interest bearing liabilities | | | 25,895 | | | | — | | | | — | | | | 25,430 | | | | — | | | | — | | | | 27,040 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average liabilities | | | 264,347 | | | | 5,834 | | | | 2.21 | | | | 272,122 | | | | 5,219 | | | | 1.92 | | | | 287,810 | | | | 4,173 | | | | 1.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total equity | | | 25,825 | | | | — | | | | — | | | | 26,873 | | | | — | | | | — | | | | 28,253 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average liabilities and equity | | ₩ | 290,172 | | | ₩ | 5,834 | | | | 2.01 | % | | ₩ | 298,995 | | | ₩ | 5,219 | | | | 1.75 | % | | ₩ | 316,063 | | | ₩ | 4,173 | | | | 1.32 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Average balances are based on daily balances for our banking, credit card and investment and securities operations and monthly or quarterly balances for our other operations. |

| (2) | We do not invest in anytax-exempt securities. |

| (3) | Excludes interest income from debt securities at fair value through profit or loss. |

| (4) | Information related to investment securities classified asavailable-for-sale has been computed using amortized cost, and therefore does not give effect to changes in fair value that are reflected as a component of total equity. |

| (5) | Interest income from credit cards includes principally cash advance fees of ₩353 billion, ₩276 billion and ₩236 billion and interest on credit card loans of ₩435 billion, ₩408 billion and ₩453 billion for the years ended December 31, 2013, 2014 and 2015, respectively, but does not include interchange fees. |

The following table presents our net interest spread, net interest margin, and asset liability ratio for the past three years:

| | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | |

| | | (percentages) | |

Net interest spread (1) | | | 2.31 | % | | | 2.22 | % | | | 2.07 | % |

Net interest margin (2) | | | 2.51 | | | | 2.39 | | | | 2.20 | |

Average asset liability ratio (3) | | | 108.89 | | | | 108.77 | | | | 108.26 | |

| (1) | The difference between the average rate of interest earned on interest earning assets and the average rate of interest paid on interest bearing liabilities. |

| (2) | The ratio of net interest income to average interest earning assets. |

| (3) | The ratio of average interest earning assets to average interest bearing liabilities. |

9

Analysis of Changes in Net Interest Income—Volume and Rate Analysis

The following table provides an analysis of changes in interest income, interest expense and net interest income based on changes in volume and changes in rate for 2013 compared to 2014 and 2014 compared to 2015. Information is provided with respect to: (1) effects attributable to changes in volume (changes in volume multiplied by prior rate) and (2) effects attributable to changes in rate (changes in rate multiplied by prior volume). Changes attributable to the combined impact of changes in rate and volume have been allocated proportionately to the changes due to volume changes and changes due to rate changes.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2014 vs. 2013

Increase/(Decrease)

Due to Change in | | | 2015 vs. 2014

Increase/(Decrease)

Due to Change in | |

| | | Volume | | | Rate | | | Total | | | Volume | | | Rate | | | Total | |

| | | (in billions of Won) | |

Interest earning assets | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and interest earning deposits in other banks | | ₩ | 46 | | | ₩ | (2 | ) | | ₩ | 44 | | | ₩ | 26 | | | ₩ | (64 | ) | | ₩ | (38 | ) |

Financial investment (debt securities) | | | (66 | ) | | | (83 | ) | | | (149 | ) | | | 31 | | | | (162 | ) | | | (131 | ) |

Loans: | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate | | | 57 | | | | (438 | ) | | | (381 | ) | | | 156 | | | | (683 | ) | | | (527 | ) |

Mortgage | | | 141 | | | | (221 | ) | | | (80 | ) | | | 115 | | | | (307 | ) | | | (192 | ) |

Home equity | | | 71 | | | | (142 | ) | | | (71 | ) | | | 57 | | | | (226 | ) | | | (169 | ) |

Other consumer | | | 152 | | | | (107 | ) | | | 45 | | | | 138 | | | | (314 | ) | | | (176 | ) |

Credit cards | | | (31 | ) | | | (88 | ) | | | (119 | ) | | | 57 | | | | (89 | ) | | | (32 | ) |

Foreign | | | (7 | ) | | | (4 | ) | | | (11 | ) | | | 5 | | | | 1 | | | | 6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total interest income | | ₩ | 363 | | | ₩ | (1,085 | ) | | ₩ | (722 | ) | | ₩ | 585 | | | ₩ | (1,844 | ) | | ₩ | (1,259 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | 2014 vs. 2013

Increase/(Decrease)

Due to Change in | | | 2015 vs. 2014

Increase/(Decrease)

Due to Change in | |

| | | Volume | | | Rate | | | Total | | | Volume | | | Rate | | | Total | |

| | | (in billions of Won) | |

Interest bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | | |

Demand deposits | | ₩ | 30 | | | ₩ | (32 | ) | | ₩ | (2 | ) | | ₩ | 59 | | | ₩ | (51 | ) | | ₩ | 8 | |

Time deposits | | | (1 | ) | | | (423 | ) | | | (424 | ) | | | (164 | ) | | | (678 | ) | | | (842 | ) |

Certificates of deposit | | | (3 | ) | | | (5 | ) | | | (8 | ) | | | 41 | | | | (17 | ) | | | 24 | |

Debts | | | (19 | ) | | | (4 | ) | | | (23 | ) | | | 10 | | | | (81 | ) | | | (71 | ) |

Debentures | | | 119 | | | | (277 | ) | | | (158 | ) | | | 97 | | | | (262 | ) | | | (165 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total interest expense | | | 126 | | | | (741 | ) | | | (615 | ) | | | 43 | | | | (1,089 | ) | | | (1,046 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net interest income | | ₩ | 237 | | | ₩ | (344 | ) | | ₩ | (107 | ) | | ₩ | 542 | | | ₩ | (755 | ) | | ₩ | (213 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

10

Exchange Rates

The table below sets forth, for the periods and dates indicated, information concerning the noon buying rate for Won, expressed in Won per one U.S. dollar. The “noon buying rate” is the rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. Unless otherwise stated, translations of Won amounts into U.S. dollars in this annual report were made at the noon buying rate in effect on December 31, 2015, which was ₩1,169.3 to US$1.00. We do not intend to imply that the Won or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or Won, as the case may be, at any particular rate, or at all. On April 22, 2016, the noon buying rate was ₩1,147.9 = US$1.00.

| | | | | | | | | | | | | | | | |

| | | Won per U.S. dollar (noon buying rate) | |

| | | Low | | | High | | | Average (1) | | | Period-End | |

2011 | | | 1,049.2 | | | | 1,197.5 | | | | 1,106.9 | | | | 1,158.5 | |

2012 | | | 1,063.2 | | | | 1,185.0 | | | | 1,126.2 | | | | 1,063.2 | |

2013 | | | 1,050.1 | | | | 1,161.3 | | | | 1,094.7 | | | | 1,055.3 | |

2014 | | | 1,008.9 | | | | 1,117.7 | | | | 1,052.3 | | | | 1,090.9 | |

2015 | | | 1,063.0 | | | | 1,196.4 | | | | 1,131.0 | | | | 1,169.3 | |

October | | | 1,120.9 | | | | 1,180.0 | | | | 1,143.2 | | | | 1,140.5 | |

November | | | 1,136.5 | | | | 1,172.7 | | | | 1,153.5 | | | | 1,149.4 | |

December | | | 1,140.7 | | | | 1,188.0 | | | | 1,169.9 | | | | 1,169.3 | |

2016 (through April 22) | | | 1,126.0 | | | | 1,242.6 | | | | 1,188.4 | | | | 1,147.9 | |

January | | | 1,190.4 | | | | 1,217.0 | | | | 1,203.3 | | | | 1,210.0 | |

February | | | 1,186.1 | | | | 1,242.6 | | | | 1,216.2 | | | | 1,238.1 | |

March | | | 1,138.9 | | | | 1,229.6 | | | | 1,181.6 | | | | 1,138.9 | |

April (through April 22) | | | 1,126.0 | | | | 1,158.4 | | | | 1,145.7 | | | | 1,147.9 | |

Source: Federal Reserve Bank of New York.

| (1) | The average of the daily noon buying rates of the Federal Reserve Bank in effect during the relevant period (or portion thereof). |

| Item 3.B. | Capitalization and Indebtedness |

Not applicable.

| Item 3.C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Risks relating to our retail credit portfolio

Future changes in market conditions as well as other factors may lead to increases in delinquency levels of our retail loan portfolio.

In recent years, consumer debt has increased significantly in Korea. Our portfolio of retail loans, including mortgage and home equity loans, increased from ₩103,432 billion as of December 31, 2012 to ₩107,644 billion as of December 31, 2013, ₩119,249 billion as of December 31, 2014 and ₩124,194 billion as of December 31, 2015. As of December 31, 2015, our domestic retail loans represented 50.1% of our total lending. Within our retail loan portfolio, the outstanding balance of other consumer loans, which unlike mortgage or home equity loans are often unsecured and therefore tend to carry a higher credit risk, increased from ₩28,969 billion as of December 31, 2012 to ₩36,312 billion as of December 31, 2015; as a percentage of total outstanding retail loans, such balance increased from 28.0% as of December 31, 2012 to 29.2% as of December 31, 2015. The growth of our retail lending business, which generally offers higher margins than other lending activities, has contributed significantly to our interest income and profitability in recent years.

11

The growth of our retail loan portfolio, together with adverse economic conditions in Korea and globally in recent years, may lead to increases in delinquency levels and a deterioration in asset quality. The amount of ournon-performing retail loans (defined as those that are past due by 90 days or more) decreased from ₩762 billion as of December 31, 2012 to ₩546 billion as of December 31, 2013, ₩395 billion as of December 31, 2014 and ₩329 billion as of December 31, 2015. However, higher delinquencies in our retail loan portfolio in the future will require us to increase our loan loss provisions andcharge-offs, which in turn will adversely affect our financial condition and results of operations.

Our large exposure to consumer debt means that we are exposed to changes in economic conditions affecting Korean consumers. Accordingly, a rise in unemployment, an increase in interest rates, a deterioration of the real estate market or difficulties in the Korean economy may have an adverse effect on Korean consumers, which could result in reduced growth and further deterioration in the credit quality of our retail loan portfolio. See “Risks relating to Korea—Unfavorable financial and economic developments in Korea may have an adverse effect on us.” In order to minimize our risk as a result of such exposure, we are continuing to strengthen our risk management processes, including further improving the retail lending process, upgrading our retail credit rating system, as well as strengthening the overall management of our portfolio. Despite our efforts, however, there is no assurance that we will be able to prevent significant credit quality deterioration in our retail loan portfolio.

In light of adverse conditions in the Korean economy affecting consumers, in March 2009, the Financial Services Commission requested Korean banks, including us, to establish a“pre-workout program,” including a credit counseling and recovery service, for retail borrowers with outstandingshort-term debt defaults. Under thepre-workout program, which has been in operation since April 2009, maturity extensions and/or interest reductions are provided for retail borrowers with total loans of ₩1.5 billion or less (consisting of no more than ₩500 million of unsecured loans and ₩1 billion of secured loans) who are in arrears on their payments for more than 30 days but less than 90 days or for retail borrowers with an annual income of ₩40 million or less who have been in arrears on their payments for 30 days or more on an aggregate basis for the 12 months prior to their application.In addition, in March 2015, in response to increasing levels of consumer debt and amid concerns over thedebt-servicing capacity of retail borrowers if interest rates were to rise, the Korean government launched, and requested Korean banks to participate in, a mortgage loan refinancing program aimed at reducing the payment burden on and improving the asset quality of outstanding mortgage loans. Under such refinancing program, over 340,000 qualified retail borrowers converted their outstandingnon-amortizingfloating-rate mortgage loans from Korean commercial banks (including us) into amortizingfixed-rate mortgage loans with lower interest rates, amounting to an aggregate principal amount of ₩34 trillion for all commercial banks in 2015. Our participation in such refinancing program may lead to a decrease in our interest income on our outstanding mortgage loans, as well as in our overall net interest margin. Moreover, our participation in suchgovernment-led initiatives to provide financial support to retail borrowers may lead us to offer credit terms for such borrowers that we would not generally offer, which may have an adverse effect on our results of operations and financial condition.

Our credit card operations may generate losses in the future, which could hurt our financial condition and results of operations.

With respect to our credit card portfolio, our delinquency ratio (which represents the ratio of amounts that are overdue by 30 days or more to total outstanding balances) increased from 1.3% as of December 31, 2012 to 1.7% as of December 31, 2013 but decreased to 1.5% as of December 31, 2014 and 1.2% as of December 31, 2015. In line with industry practice, we have restructured a portion of delinquent credit card account balances (defined as balances overdue by 30 daysor more) as loans. As of December 31, 2015, these restructured loans outstanding amounted to ₩36 billion. Because these loans are not treated as being delinquent at the time of conversion or for a period of time thereafter, our delinquency ratios may not fully reflect all delinquent amounts relating to our outstanding loans. Including all restructured loans, outstanding balances overdue by 30 days or more accounted for 1.4% of our credit card receivables (including credit card loans) as of December 31, 2015. Delinquencies may increase in 2016 and in the future as a result of, among other things, adverse economic conditions in Korea and the inability of Korean consumers to manage increased household debt.

12

Despite our continuing efforts to sustain and improve our credit card asset quality and performance, we may experience increased delinquencies or deterioration of the asset quality of our credit card portfolio, which would require us to increase our loan loss provisions andcharge-offs and adversely affect our overall financial condition and results of operations.

In addition, in February 2014, the Financial Services Commission suspended the new credit card issuance and other related activities of our credit card subsidiary, KB Kookmin Card Co., Ltd., for three months from February to May 2014, in response to an incident involving the misappropriation of the personal information of a large number of its customers by an employee of an external credit information company in the first half of 2013. Specifically, during such suspension period, KB Kookmin Card was prohibited from engaging in the following activities:

| | • | | adding new subscribers for credit cards, prepaid cards and debit cards or issuing such types of cards (except as permitted by the chairman of the Financial Services Commission for public policy purposes); |

| | • | | providing new or additional credit lines to credit card customers; and |

| | • | | providing new services through mail order or telemarketing channels or related to travel or insurance products. |

Furthermore, in connection with the misappropriation incident, a number of customers have filed lawsuits against KB Kookmin Card seeking damages, and it could become subject to additional litigation. See “Item 8A. Consolidated Statements and Other Financial Information—Legal Proceedings.” KB Kookmin Card has also incurred and may continue to incur significant costs relating to the issuance of replacement cards for customers and other associated costs. KB Kookmin Card may also incur costs relating to the compensation of customers for losses incurred as a result of the fraudulent use of the misappropriated personal information. Accordingly, the misappropriation incident and the resulting regulatory sanctions (including thethree-month suspension of KB Kookmin Card’s new business activities), customer claims and costs could have a material adverse effect on our business, reputation, results of operations and financial condition.

Risks relating to oursmall- andmedium-sized enterprise loan portfolio

We have significant exposure tosmall- andmedium-sized enterprises, and any financial difficulties experienced by these customers may result in a deterioration of our asset quality and have an adverse impact on us.

One of our core businesses is lending tosmall- andmedium-sized enterprises (as defined under “Item 4.B. Business Overview—CorporateBanking—Small- andMedium-sized Enterprise Banking”). Our loans tosmall- andmedium-sized enterprises increased from ₩70,471 billion as of December 31, 2012 to ₩78,665 billion as of December 31, 2015. During that period,non-performing loans (defined as those loans that are past due by 90 days or more) tosmall- andmedium-sized enterprises decreased from ₩680 billion as of December 31, 2012 to ₩309 billion as of December 31, 2015, and thenon-performing loan ratio for such loans decreased from 1.0% as of December 31, 2012 to 0.4% as of December 31, 2015. However, ournon-performing loans andnon-performing loan ratio may increase in 2016. According to data compiled by the Financial Supervisory Service, the delinquency ratio forWon-currency loans by Korean commercial banks tosmall- andmedium-sized enterprises was 0.7% as of December 31, 2015.The delinquency ratio for loans tosmall- andmedium-sized enterprise is calculated as the ratio of (1) the outstanding balance of such loans in respect of which either principal or interest payments are overdue by one month or more to (2) the aggregate outstanding balance of such loans. Our delinquency ratio for such Won currency loans decreased from 1.1% as of December 31, 2012 to 0.5% as of December 31, 2015.However, our delinquency ratio for such Won currency loans may increase in 2016. In recent years, we have taken measures which sought to stem rising delinquencies in our loans tosmall- andmedium-sized enterprises, including through strengthening the review of loan applications and closer

13

monitoring of thepost-loan performance ofsmall- andmedium-sized enterprise borrowers in industry sectors that are relatively more sensitive to downturns in the economy and have shown higher delinquency ratios, such as construction, lodging, retail and wholesale, restaurants and real estate. Despite such efforts, however, there is no assurance that delinquency levels for our loans tosmall- andmedium-sized enterprises will not rise in the future. In particular, financial difficulties experienced bysmall- andmedium-sized enterprises as a result of, among other things, adverse economic conditions in Korea and globally in recent years may lead to a deterioration in the asset quality of our loans to this segment. Any such deterioration would result in increasedcharge-offs and higher provisioning and reduced interest and fee income from this segment, which could have a material adverse impact on our financial condition and results of operations.

In addition, manysmall- andmedium-sized enterprises have close business relationships with the largest Korean commercial conglomerates, known as “chaebols,” primarily as suppliers. Any difficulties encountered by thosechaebols would likely hurt the liquidity and financial condition of relatedsmall- andmedium-sized enterprises, including those to which we have exposure, also resulting in an impairment of their ability to repay loans.

A substantial part of oursmall- andmedium-sized enterprise lending comprises loans to “small office/home office” customers, or SOHOs. SOHOs, which we currently define to include sole proprietorships and individual business interests, are usually dependent on a limited number of suppliers or customers. SOHOs tend to be affected to a greater extent than larger corporate borrowers by fluctuations in the Korean economy. In addition, SOHOs often maintain less sophisticated financial records than other corporate borrowers. Although we continue to make efforts to improve our internally developed credit rating systems to rate potential borrowers, particularly with respect to SOHOs, and intend to manage our exposure to these borrowers closely in order to prevent any deterioration in the asset quality of our loans to this segment, we may not be able to do so as intended.

In light of the deteriorating financial condition and liquidity position ofsmall- andmedium-sized enterprises in Korea since the global financial crisis commencing in the second half of 2008, the Korean government introduced policies and initiatives intended to encourage Korean banks to provide financial support tosmall- andmedium-sized enterprises. For example, in October 2008, the Financial Supervisory Service requested Korean banks, including us, to establish a “fast track” program to provide liquidity assistance tosmall- andmedium-sized enterprises on an expedited basis. Under the fast track program we established, which has been extended until December 31, 2016, we provide liquidity assistance to qualifiedsmall- andmedium-sized enterprise borrowers applying for such assistance, in the form of new loans or maturity extensions or interest rate adjustments with respect to existing loans, after expedited credit review and approval by us. The overall prospects for the Korean economy in 2016 and beyond remain uncertain, and the Korean government may extend or renew existing or past policies and initiatives or introduce new policies or initiatives to encourage Korean banks to provide financial support tosmall- andmedium-sized enterprises. Our participation in suchgovernment-led initiatives may lead us to extend credit tosmall- andmedium-sized enterprise borrowers that we would not otherwise extend, or offer terms for such credit that we would not otherwise offer, in the absence of such initiatives. Furthermore, there is no guarantee that the financial condition and liquidity position of oursmall- andmedium-sized enterprise borrowers benefiting from such initiatives will improve sufficiently for them to service their debt on a timely basis, or at all. Accordingly, increases in our exposure tosmall- andmedium-sized enterprise borrowers resulting from suchgovernment-led initiatives may have a material adverse effect on our financial condition and results of operations.

We have exposure to Korean construction and shipbuilding companies, and financial difficulties of these companies may have an adverse impact on us.

As of December 31, 2015, we had loans outstanding to construction companies and shipbuilding companies (many of which aresmall- andmedium-sized enterprises) in the amount of ₩3,482 billion and ₩974 billion, or 1.4% and 0.4% of our total loans, respectively. We also have other exposures to Korean construction and shipbuilding companies, including in the form of guarantees extended on behalf of such companies (which included ₩606 billion of confirmed guarantees for construction companies and ₩1,698 billion of confirmed guarantees for shipbuilding companies as of December 31, 2015) and debt and equity securities of such

14

companies held by us. In the case of construction companies, such exposures include guarantees provided to us by general contractors with respect to financing extended by us for residential and commercial real estate development projects. In the case of shipbuilding companies, such exposures include refund guarantees extended by us on behalf of shipbuilding companies to cover their obligation to return a portion of the ship order contract amount to customers in the event of performance delays or defaults under shipbuilding contracts.

The construction industry in Korea has experienced an overall downturn in recent years, due to excessive investment in residential property development projects, stagnation of real property prices and reduced demand for residential property, especially in areas outside of Seoul, including as a result of the deterioration of the Korean economy. The shipbuilding industry in Korea has also experienced a severe downturn in recent years due to a significant decrease in ship orders, primarily due to adverse conditions in the global economy and the resulting slowdown in global trade. In response to the deteriorating financial condition and liquidity position of borrowers in the construction and shipbuilding industries, which were disproportionately impacted by adverse economic developments in Korea and globally, the Korean government implemented a program in 2009 to promote expedited restructuring of such borrowers by their Korean creditor financial institutions, under the supervision of major commercial banks. In accordance with such program, 24 construction companies and five shipbuilding companies became subject to workout in 2009, following review by their creditor financial institutions (including us) and the Korean government. Each year since 2009, the Financial Services Commission and the Financial Supervisory Service have announced the results of subsequent credit risk evaluations conducted by creditor financial institutions (including us) of companies in Korea with outstanding credit exposures of ₩50 billion or more, pursuant to which a number of companies were selected by such financial institutions for restructuring in the form of workout, liquidation or court receivership. Most recently, in 2015, 54 companies with outstanding credit exposures of ₩50 billion or more (14 of which were construction companies and four of which were shipbuilding companies) were selected by such financial institutions for restructuring. However, there is no assurance that these measures will be successful in stabilizing the Korean construction and shipbuilding industries.

The allowances that we have established against our credit exposures to Korean construction and shipbuilding companies may not be sufficient to cover all future losses arising from these and other exposures. If the credit quality of our exposures to Korean construction and shipbuilding companies declines further, we may be required to take substantial additional provisions (including in connection with restructurings of such companies), which could adversely impact our results of operations and financial condition. Furthermore, although a portion of our credit exposures to construction and shipbuilding companies are secured by collateral, such collateral may not be sufficient to cover uncollectible amounts in respect of such credit exposures. See “—Other risks relating to our business—A decline in the value of the collateral securing our loans and our inability to realize full collateral value may adversely affect our credit portfolio.”

We also haveconstruction-related credit exposures under our project financing loans for real estate development projects in Korea. In light of the general deterioration in the asset quality of real estate project financing loans in Korea in recent years, Korean banks, including Kookmin Bank, implemented a uniform set of guidelines to apply more stringent criteria in evaluating the asset quality of real estate project financing loans. As a result, we may be required to establish additional allowances with respect to our outstanding real estate project financing loans, which could adversely affect our financial condition and results of operations.

Risks relating to our financial holding company structure and strategy

We may not succeed in implementing our strategy to take advantage of, or fail to realize the anticipated benefits of, our financial holding company structure.

One of our principal strategies is to take advantage of our financial holding company structure to become a comprehensive financial services provider capable of offering a full range of products and services to our large existing base of retail and corporate banking customers. The continued implementation of these plans may

15

require additional investments of capital, infrastructure, human resources and management attention. This strategy entails certain risks, including the possibility that we may face significant competition from other financial holding companies and more specialized financial institutions in particular segments. If our strategy does not succeed, we may incur losses on our investments and our results of operations and financial condition may suffer.

Furthermore, our success under a financial holding company structure depends on our ability to realize the anticipated synergies, growth opportunities and cost savings from coordinating the businesses of our various subsidiaries. Although we have been integrating certain aspects of our subsidiaries’ operations into our financial holding company structure, our subsidiaries will generally continue to operate as independent entities with separate management and staff and our ability to direct our subsidiaries’day-to-day operations may be limited.

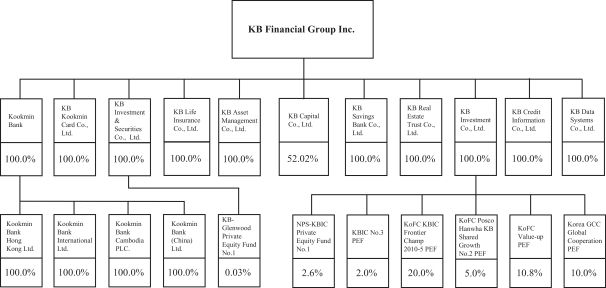

In addition, one of the intended benefits of our financial holding company structure is that it enhances our ability to engage in mergers and acquisitions which we decide to pursue in the future as part of our strategy. For example, in March 2014, we acquired 52.02% of the outstanding shares of KB Capital Co., Ltd. (formerly named Woori Financial Co., Ltd.), a publicly listed Korean consumer finance company, from Woori Finance Holdings Co., Ltd. for ₩280 billion. Furthermore, in June 2015, we acquired 19.47% of the outstanding shares of KB Insurance Co., Ltd. (formerly named LIG Insurance Co., Ltd.), a publicly listed Korean property and casualty insurance company, from a group of individual shareholders for ₩651 billion, and in November 2015, further increased our shareholding in KB Insurance to 33.29% by acquiring its treasury shares for ₩231 billion. Most recently, in April 2016, we entered into a share purchase agreement to acquire 22.56% of the outstanding shares of Hyundai Securities Co., Ltd., a publicly listed Korean securities brokerage firm, from Hyundai Merchant Marine Co., Ltd. and other shareholders for ₩1,250 billion, which amount is subject to change pending closing. Pursuant to applicable Korean law, we will be required to increase our shareholding in Hyundai Securities to at least 30% within one year from the date of such acquisition. The completion of such acquisition is subject to regulatory approvals and other closing conditions. Following such acquisition, we may consider merging Hyundai Securities with KB Investment & Securities.See “Item 5.A. Operating Results—Overview—Acquisitions.” We may also consider acquiring or merging with other financial institutions to achieve balanced growth and diversify our revenue base. The integration of our subsidiaries’ or investees’ separate businesses and operations, as well as those of any companies we may acquire or merge with in the future, under our financial holding company structure could require a significant amount of time, financial resources and management attention. Moreover, that process could disrupt our operations (including our risk management operations) or information technology systems, reduce employee morale, produce unintended inconsistencies in our standards, controls, procedures or policies, and affect our relationships with customers and our ability to retain key personnel. The realization of the anticipated benefits of our financial holding company structure and any mergers or acquisitions we decide to pursue may be blocked, delayed or reduced as a result of many factors, some of which may be outside our control. These factors include:

| | • | | difficulties in integrating the diverse activities and operations of our subsidiaries or investees or any companies we may merge with or acquire, including risk management operations and information technology systems, personnel, policies and procedures; |

| | • | | difficulties in reorganizing or reducing overlapping personnel, branches, networks and administrative functions; |

| | • | | restrictions under the Financial Holding Company Act and other regulations on transactions between a financial holding company and, or among, its subsidiaries; |

| | • | | unforeseen contingent risks, including lack of required capital resources, increased tax liabilities or restrictions in our overseas operations, relating to our financial holding company structure; |

| | • | | unexpected business disruptions; |

| | • | | failure to attract, develop and retain personnel with necessary expertise; |

16

Accordingly, we may not be able to realize the anticipated benefits of our financial holding company structure, and our business, results of operations and financial condition may suffer as a result.

We depend on limited forms of funding to fund our operations at the holding company level.

We are a financial holding company with no significant assets other than the shares of our subsidiaries. Our primary sources of funding and liquidity are dividends from our subsidiaries, direct borrowings and issuances of equity or debt securities at the holding company level. In addition, as a financial holding company, we are required to meet certain minimum financial ratios under Korean law, including with respect to liquidity, leverage and capital adequacy.Our ability to meet our obligations to our direct creditors and employees and our other liquidity needs and regulatory requirements at the holding company level depends on timely and adequate distributions from our subsidiaries and our ability to sell our securities or obtain credit from our lenders.

The ability of our subsidiaries to pay dividends to us depends on their financial condition and operating results. In the future, our subsidiaries may enter into agreements, such as credit agreements with lenders or indentures relating tohigh-yield or subordinated debt instruments, that impose restrictions on their ability to make distributions to us, and the terms of future obligations and the operation of Korean law could prevent our subsidiaries from making sufficient distributions to us to allow us to make payments on our outstanding obligations. See “—As a financial holding company, we depend on receiving dividends from our subsidiaries to pay dividends on our common stock.” Any delay in receipt of or shortfall in payments to us from our subsidiaries could result in our inability to meet our liquidity needs and regulatory requirements, including minimum liquidity and capital adequacy ratios, and may disrupt our operations at the holding company level.

In addition, creditors of our subsidiaries will generally have claims that are prior to any claims of our creditors with respect to their assets. Furthermore, our inability to sell our securities or obtain funds from our lenders on favorable terms, or at all, could also result in our inability to meet our liquidity needs and regulatory requirements and may disrupt our operations at the holding company level.

As a financial holding company, we depend on receiving dividends from our subsidiaries to pay dividends on our common stock.

Since our principal assets at the holding company level are the shares of our subsidiaries, our ability to pay dividends on our common stock largely depends on dividend payments from those subsidiaries. Those dividend payments are subject to the Korean Commercial Code, the Bank Act and regulatory limitations, generally based on capital levels and retained earnings, imposed by the various regulatory agencies with authority over those entities. For example:

| | • | | under the Korean Commercial Code, dividends may only be paid out of distributable income, an amount which is calculated by subtracting the aggregate amount of a company’spaid-in capital and certain mandatory legal reserves as well as certain unrealized profits from its net assets, in each case as of the end of the prior fiscal period; |

| | • | | under the Bank Act, a bank also must credit at least 10% of its net profit to a legal reserve each time it pays dividends on distributable income until that reserve equals the amount of its totalpaid-in capital; and |

| | • | | under the Bank Act and the requirements of the Financial Services Commission, if a bank fails to meet its required capital adequacy ratio or otherwise becomes subject to management improvement measures imposed by the Financial Services Commission, then the Financial Services Commission may restrict the declaration and payment of dividends by that bank. |

17

Our subsidiaries may not continue to meet the applicable legal and regulatory requirements for the payment of dividends in the future. If they fail to do so, they may stop paying or reduce the amount of the dividends they pay to us, which would have an adverse effect on our ability to pay dividends on our common stock.

Although increasing our fee income is an important part of our strategy, we may not be able to do so.

We have historically relied on interest income as our primary revenue source. While we have developed new sources of fee income as part of our business strategy, our ability to increase our fee income and thereby reduce our dependence on interest income will be affected by the extent to which our customers generally accept the concept offee-based services. Historically, customers in Korea have generally been reluctant to pay fees in return forvalue-added financial services, and their continued reluctance to do so will adversely affect the implementation of our strategy to increase our fee income. Furthermore, the fees that we charge to customers are subject to regulation by Korean financial regulatory authorities, which may seek to implement regulations or measures that may also have an adverse impact on our ability to achieve this aspect of our strategy.

We may suffer customer attrition or our net interest margin may decrease as a result of our competition strategy.

We have been pursuing, and intend to continue to pursue, a strategy of maintaining or enhancing our margins where possible and avoid, to the extent possible, entering into price competition. In order to execute this strategy, we will need to maintain relatively low interest rates on our deposit products while charging relatively higher rates on loans. If other banks and financial institutions adopt a strategy of expanding market share through interest rate competition, we may suffer customer attrition due to rate sensitivity. In addition, we may in the future decide to compete to a greater extent based on interest rates, which could lead to a decrease in our net interest margins. Any future decline in our customer base or our net interest margins as a result of our future competition strategy could have an adverse effect on our results of operations and financial condition.

Risks relating to competition

Competition in the Korean financial industry is intense, and we may lose market share and experience declining margins as a result.