The selling stockholders and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of his/hers/its shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders may use any one or more of the following methods when selling shares:

The selling stockholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus, provided they meet certain requirements under Rule 144. Broker-dealers engaged by a selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from a selling stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The selling stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved.

In connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Transactions under this prospectus may or may not involve brokers or dealers. The selling stockholders may sell securities directly to purchasers or to or through broker-dealers, who may act as agents or principals. Broker-dealers engaged by the selling stockholder may arrange for other broker-dealers to participate in selling securities. Broker-dealers or agents may receive compensation in the form of commissions, discounts or concessions from the selling stockholder in amounts to be negotiated in connection with the sale. Broker-dealers or agents may also receive compensation in the form of discounts, concessions or commissions from the purchasers of securities for whom the broker-dealers may act as agents or to whom they sell as principal, or both. This compensation as to a particular broker-dealer might exceed customary commissions.

SSC, a selling stockholder under this prospectus, is a FINRA registered broker-dealer, and is also an underwriter within the meaning of section 2(a)(11) of the Securities Act in connection with the resale of the securities acquired by SSC in our 2009 – 2010 Private Placement. As a result SSC may have civil liability under Sections 11 and 12 of the Securities Act for any omissions or misstatements in this prospectus and the registration statement of which it is a part. Any of the other selling stockholders and any brokers, dealers or agents, upon effecting the sale of any of the shares offered in this prospectus, may also be “underwriters” as that term is defined under the Securities Act. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling stockholders may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares against liabilities, including liabilities arising under the Securities Act. The selling stockholders will be subject to the prospectus delivery requirements of the Securities Act.

We have not been informed by any selling stockholder that SSC will be paid commissions or fees in connection with the resale of the shares of common stock or Warrants offered by the selling stockholders pursuant to this prospectus, nor have we been informed by any selling stockholder that they have engaged SSC to act as a selling agent in connection with the shares of common stock offered hereby.

Prior to a selling stockholder entering into an agreement with a broker-dealer, such broker-dealer will need to seek and obtain clearance of the underwriting compensation and arrangements from FINRA. Upon being notified by a selling stockholder that a material arrangement has been entered into with a broker-dealer for the sale of shares through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, we will file a supplement to this prospectus, if required pursuant to Rule 424(b) under the Securities Act, disclosing:

We have informed the selling stockholders that Regulation M promulgated under the Exchange Act may be applicable to them with respect to any purchase or sale of our common stock. In general, Rule 102 under Regulation M prohibits any person connected with a distribution of our common stock from directly or indirectly bidding for, or purchasing for any account in which it has a beneficial interest, any of the shares or any right to purchase the shares, for a period of one business day before and after completion of its participation in the distribution.

During any distribution period, Regulation M prohibits a selling stockholder and any other persons engaged in the distribution from engaging in any stabilizing bid or purchasing our common stock except for the purpose of preventing or retarding a decline in the open market price of the common stock. None of these persons may effect any stabilizing transaction to facilitate any offering at the market. As the selling stockholders will be offering and selling our common stock at the market, Regulation M will prohibit them from effecting any stabilizing transaction in contravention of Regulation M with respect to the shares.

We also have advised the selling stockholder that they should be aware that the anti-manipulation provisions of Regulation M under the Exchange Act will apply to purchases and sales of shares of common stock by the selling stockholder, and that there are restrictions on market-making activities by persons engaged in the distribution of the shares. Under Regulation M, the selling stockholder or their agents may not bid for, purchase, or attempt to induce any person to bid for or purchase, shares of our common stock while the selling stockholder is distributing shares covered by this prospectus. Regulation M may prohibit the selling stockholder from covering short sales by purchasing shares while the distribution is taking place, despite any contractual rights to do so under the Agreement. We have advised the selling stockholders that they should consult with their own legal counsel to ensure compliance with Regulation M.

In November 2010, we entered into a non-exclusive investment banking agreement with SSC pursuant to which we agreed to pay a sales commission with respect to certain financings effected, or alternative transactions entered into, by us through introductions by SSC. We also agreed to pay SSC a monthly fee of 5,000 shares of common stock. We concurrently entered into a 24 month institutional public relations retainer agreement with an affiliate of SSC pursuant to which we agreed to issue the affiliate five year options to purchase 250,000 shares at $1.60 per share and 250,000 shares at $5.00 per share, with certain demand registration rights. In June 2011, the options to purchase 250,000 shares at $1.60 per share were exercised on a cashless basis, resulting in a net issuance of 175,000 shares. The resale of the 250,000 shares underlying the option exercisable at $5.00 is being registered hereby. In connection with our January 2011 Private Placement, we issued to SSC five year warrants to purchase up to 272,000 shares of our common stock at $2.50 as payment of commissions. These warrants were subsequently assigned to affiliates of SSC. In January 2011, we entered into a finder’s agreement with Aspenwood Capital under which Aspenwood would introduce potential investors to the Company. The Company agreed to pay up to a 10% cash fee and to issue a five year warrant to purchase up to 10% of the number of shares sold to investors introduced to the Company by Aspenwood at an exercise price equal to 125% of the equity purchase price. In connection with our January 2011 Private Placement, we issued to Aspenwood Capital five year warrants to purchase up to 4,000 shares of our common stock at $2.50 as payment of commissions. These warrants were subsequently assigned to affiliates of Aspenwood. The warrant may be exercised on a cashless basis at any time subsequent to August 31, 2011 in the event the Company does not maintain an effective registration statement on file with the SEC. The Company has paid $5,000 under this agreement as of June 20, 2011.

Between January and February 2011, we entered into a series of transactions with accredited investors pursuant to which we sold an aggregate of 1,600,000 shares of our common stock and five year warrants to purchase up to 1,600,000 shares of common stock, exercisable at $2.50 per share, for gross proceeds of $4,000,000. The Company paid cash commissions of $318,000 and issued five year warrants to purchase up to 305,000 shares of its common stock at an exercise price of $2.50 per share. The 1,600,000 shares of common stock, the 1,600,000 shares of common stock underlying the warrants, and the 305,000 shares of common stock issuable upon the exercise of the warrant, are being registered hereby. Between May and June, 2011, certain investors participating in the January 2011 Private Placement exercised their options and were issued an aggregate of 6,240,000 shares of common stock along with five-year warrants to purchase up to 6,240,000 shares of common stock exercisable at $2.50 per share, resulting in aggregate gross proceeds to the Company of $15,600,000. In connection with the option exercise, we paid to broker-dealers $872,000 in cash commissions and issued five-year warrants to purchase 1,192,000 shares of common stock at an exercise price of $2.50 per share on identical terms as the investor warrants. The securities issued in connection with the option exercises are not being registered hereby.

We are required to pay the fees and expenses incident to the registration of the shares. We have agreed to issue certain shares of our common stock in the event that this resale registration statement is not effective within 150 days of the original filing date with the SEC, see “Description of Securities to be Registered and Our Capital Stock.” We have agreed to indemnify certain of the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

This prospectus relates to the sale of up to 8,908,125 shares of our common stock, which includes an aggregate of 1,336,250 shares of common stock underlying Class A Warrants, an aggregate of 678,125 shares of common stock underlying Class B Warrants, an aggregate of 250,000 shares of common stock underlying the Other Warrants, and an aggregate of 1,905,000 shares of common stock underlying the January 2011 Warrants. The following description of our capital stock is only a summary. You should also refer to our articles of incorporation and bylaws, which have been filed as exhibits to the registration statement of which this prospectus forms a part.

We are authorized to issue 100,000,000 shares of common stock, $0.01 par value, of which 34,455,009 shares were issued and outstanding as of June 20, 2011. We are also authorized to issue 10,000,000 shares of preferred stock, par value $0.001, none of which have been issued as of June 20, 2011.

Common Stock

The holders of common stock are entitled to one vote per share with respect to all matters required by law to be submitted to stockholders. The holders of common stock have the sole right to vote, except as otherwise provided by law or by our certificate of incorporation, including provisions governing any preferred stock. The common stock does not have any cumulative voting, preemptive, subscription or conversion rights. Election of directors and other general stockholder action requires the affirmative vote of a majority of shares represented at a meeting in which a quorum is represented. The outstanding shares of common stock are validly issued, fully paid and non-assessable.

Subject to the rights of any outstanding shares of preferred stock, the holders of common stock are entitled to receive dividends, if declared by our board of directors out of funds legally available. In the event of liquidation, dissolution or winding up of the affairs of the Company, the holders of common stock are entitled to share ratably in all assets remaining available for distribution to them after payment or provision for all liabilities and any preferential liquidation rights of any preferred stock then outstanding.

The authorized but unissued shares of our common stock are available for future issuance without shareholder approval. These additional shares may be used for a variety of corporate purposes, including future public offering to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of common stock may enable our Board to issue shares of stock to persons friendly to existing management, which may deter or frustrate a takeover of the Company.

Preferred Stock

We are authorized to issue of blank check authorized preferred stock. No shares of preferred stock are issued and outstanding, and we have no present plans for the issuance thereof. Our board of directors has the authority, without action by our stockholders, to designate and issue preferred stock in one or more series. Our board of directors may also designate the rights, preferences, and privileges of each series of preferred stock, any or all of which may be greater than the rights of the common stock. It is not possible to state the actual effect of the issuance of any shares of preferred stock on the rights of holders of the common stock until the board of directors determines the specific rights of the holders of the preferred stock. However, these effects might include:

| · | restricting dividends on the common stock; |

| · | diluting the voting power of the common stock; |

| · | impairing the liquidation rights of the common stock; and |

| · | delaying or preventing a change in control without further action by the stockholders |

Warrants

Class A Warrants

Rights to Purchase Shares of Common Stock. There are Class A Warrants issued and outstanding to purchase an aggregate of 1,523,750 shares of common stock. Each Class A Warrant entitles the registered holder to purchase from one share of common stock at an exercise price of $0.50 per share. Each Class A Warrant is exercisable at any time on or before December 31, 2011.

Call. Each Class A Warrant is redeemable by us if the our common stock trades at $0.75 or more for a period of at least twenty of the last thirty trading days at any time during the term of the Class A Warrant. The redemption price is $0.01 per share of common stock.

Exercise. The Class A Warrants are immediately exercisable. The holder of a Class A Warrant may exercise such warrant by surrendering the warrant exercise form properly completed and executed, together with payment of the exercise price to the Company. The exercise price will be payable in cash, certified check or wire transfer of funds. If the Class A Warrant is exercised only in part, then, unless the warrant expired, the Company shall, at its expense, deliver a new warrant representing the right to purchase the remaining shares of common stock.

Adjustments. The exercise price and the number of shares of common stock purchasable upon exercise of the Class A Warrant, are subject to adjustment upon the occurrence of certain events, including stock dividends, reclassifications, reorganizations, consolidations, and mergers.

Class B Warrants

Rights to Purchase Shares of Common Stock. There are Class B Warrants issued and outstanding to purchase an aggregate of 771,875 shares of common stock. Each Class B Warrant entitles the registered holder to purchase one share of common stock at an exercise price of $0.75 per share. Each Class B Warrant is exercisable at any time on or before December 31, 2011.

Call. Each Class B Warrant is redeemable by us if the our common stock trades at $1.00 or more for a period of at least twenty of the last thirty trading days at any time during the term of the Class B Warrant. The redemption price is $0.01 per share of common stock.

Exercise. The Class B Warrants are immediately exercisable. The holder of a Class B Warrant may exercise such warrant by surrendering the warrant exercise form properly completed and executed, together with payment of the exercise price to the Company. The exercise price will be payable in cash, certified check or wire transfer of funds. If the Class B Warrant is exercised only in part, then, unless the warrant expired, the Company shall, at its expense, deliver a new warrant representing the right to purchase the remaining shares of common stock.

Adjustments. The exercise price and the number of shares of common stock purchasable upon exercise of the Class B Warrant, are subject to adjustment upon the occurrence of certain events, including stock dividends, reclassifications, reorganizations, consolidations, and mergers.

Other Warrants

In November 2010, the Company entered into a 24 month institutional public relations retainer agreement with an affiliate of SSC pursuant to which it was issued five-year options, terminating on November 1, 2015, to purchase 250,000 shares of common stock at $5.00 per share. These options were subsequently assigned to another affiliate of SSC in February 2011, and a warrant to purchase 250,000 shares of common stock at $1.60 per share was exercised in June 2011 on a cashless basis resulting in the issuance of 175,000 shares of commons tock. The number of shares and exercise price per share subject to the option shall be adjusted in the case of any dividend, stock split or other recapitalization or reorganization of the Company so that the option shall not be diminished or diluted.

January 2011 Warrants and warrants issued upon exercise of options issued in January 2011 Private Placement

Rights to Purchase Shares of Common Stock. In January 2011, we issued warrants to purchase an aggregate of 1,905,000 shares of common stock (which includes warrants to purchase 305,000 shares of common stock issued to registered broker dealers as commissions, each of which have identical terms to the investor warrants). Each warrant entitles the registered holder to purchase one share of common stock at an exercise price of $2.50 per share, on or prior to January 25, 2016. The investors in the January 2011 Private Placement also received options for 120 days to purchase up to 6,400,000 shares of common stock at $2.50 per share with 100% warrant coverage through the issuance of warrants to purchase up to 6,400,000 shares of common stock at an exercise price of $2.50 per share. In May and June 2011, certain of these investors exercised their options and were issued (in addition to 6,240,000 shares of common stock) new warrants to purchase up to 6,240,000 shares of common stock. Each of these new warrants entitles the registered holder to purchase one share of common stock at an exercise price of $2.50 per share, on or prior to May 31, 2016.

Call. These warrants are not callable by the Company.

Exercise. The warrants are immediately exercisable. The holder of a warrant may exercise such warrant by surrendering the warrant exercise form properly completed and executed, together with payment of the exercise price to the Company. The exercise price will be payable in cash, Additionally, in the event that the Company fails to maintain an effective registration statement covering the resale of the shares of common stock underlying the January 2011 Warrants, commencing six months after the issuance date and for the duration of the term of the warrants, the holders have the right to exercise such warrants on a cashless basis.

Adjustments. The exercise price and the number of shares of common stock purchasable upon exercise of the warrant, are subject to adjustment upon the occurrence of certain events, including stock dividends, reclassifications, reorganizations, consolidations, and mergers.

Registration Rights.

In April 2011, the Texas General Land Office approved the Company’s operation plan for Round Top. The plan calls for the completion of approximately 50 drill holes totaling at least 12,000 feet of reverse circulation drilling. Road and site preparation is in progress and drilling is planned to begin in August 2011.

Drilling on Round Top is planned to twin certain of the historic drill holes, infill drill between existing holes and step out drill beyond the known area to better define the margins of the deposit. Coverage is planned to be adequate to begin block modeling of the deposit. The Company has designated the sites for several holes on adjacent Little Round Top Mountain, and several additional holes are planned to test the deeper potential. This drilling is expected to produce at least 150 tonnes of sample, all of which will be packaged and used for metallurgical testing.

Planned Exploration and Development Activities

Over the next twelve to eighteen months we plan to conduct additional geological studies, sampling and drilling at our Round Top property. The timing of these expenditures is dependent upon the availability of drilling contractors.

The Company has contracted Aeroquest Airborne to conduct a detailed aeromagnetic and gamma spectrograph survey of Round Top, which has now been completed and data is being processed. Metallurgical analysis of the drill hole samples is planned to commence in August 2011. Onsite contract geological services will be ongoing through February 2012. We estimate that the total cost of our planned exploration and development activities will be approximately $2,200,000. The Company will rely on third party consultants and contractors to perform the exploration and development activities. The Company has not identified the individuals who will be performing all of the planned work.

We will also be required to pay a $45,000 lease payment to the State of Texas in August 2011 for our Round Top project. We estimate that in July 2011 we will be required to pay a $20,000 permitting and compliance fee to the Texas Railroad Commission, and in September and October 2011, we will be required to pay approximately $20,000 for prospecting permits to the State of Texas for our Round Top project.

Our capital expenditures for the next twelve months are estimated to be $170,000, which will include the following: (i) in July and August 2011, we intend to spend approximately $75,000 to purchase transportation equipment and to construct a field office; (ii) in September 2011 we intend to purchase ventilation equipment for our Round Top project for approximately $10,000, and (iii) approximately $75,000 for additional office and field equipment necessary to carry out our operations. The remaining $10,000 will be spent on other miscellaneous equipment necessary for us to conduct our exploration. The estimated timeframe for these payments, including the amounts, may change.

We have estimated that our general and administrative expenditures, which will be spent ratably over the next twelve months, to total approximately $1,325,000. Payroll, payroll taxes, benefits and associated travel for four employees is estimated to be $520,000 over this period of time. We estimate that we will incur professional fees of approximately $120,000 over the next twelve months. These fees will be primarily associated with the audit and reviews of our financial statements and Exchange Act filings, which will occur after each quarter end and after our fiscal year end. We estimate that we will incur approximately $600,000 for professional fees associated with the assistance of the management and supervision of our field operations. The remainder of our general and administrative expenditures totaling $85,000 will be spent on items necessary for us to conduct our general business affairs. Our exploration activities will be carried out by our geologic staff and such qualified outside contractors as is necessary. At present we have an office/lab trailer at the site and will expand these facilities as the project develops. We believe that we have sufficient capital to fund operations and exploration activity on our Round Top prospect through the end of calendar year 2011. We will, however, need to raise additional funding subsequent to calendar year 2011 to continue our exploration and development activities.

Improvements and Equipment

The Round Top rare earth prospect was initially developed in the late 1980's as a beryllium resource. As a result, several pieces of equipment were present at the property when the Company acquired the lease, some of which we have repaired as described below. The previous operators had also built out several roads at the prospect site, which we believe are suitable for our current exploration plans.

There exists on the Round Top site a 1,115 foot, 10 foot by 10 foot decline from the surface into the Round Top prospect. There are steel sets every five feet, in some cases less, and the entire working is lagged with timber. There are “escape holes” at intervals to allow personnel to avoid equipment. The escape holes are all in good operating condition. There is also a 36 foot steel ventilation line in place that runs for approximately 75 feet into the prospect. There is a 125 hp axial plane ventilation fan in place. We have leveled the fan and rehabilitated the control panel, and believe it to be operational. We intend to install a "soft start" motor starter switch for the 100kw generator.

A baghouse is also located on the property that will need its electronic controls rehabilitated and modernized and filters installed. There is a 6" Victaulic compressed air line extending from the compressor station outside to the faces. There are numerous valves at strategic locations underground. There is one 2' steel Victaulic water line for drill water and an additional partly plastic Victaulic water line for dust suppression sprayers, which also has sprayers in place.

There is electric cable from the portal to the face and a switch box underground. Some additional switching gear will need to be installed at the portal. The mine portal has a sturdy locking steel door in place that we have reconditioned.

There is a 500 barrel (23,000 gal) water tank below the mine dump for water to be hauled in and stored. This tank appears to be in good shape. The water line from the tank to the mine portal is missing and will have to be replaced. The water system will need a submersible pump, switching gear and approximately 1000 ft of 2" poly line to render the water system serviceable.

Description of Rare Earth and other Rare Elements

The Round Top rare earth prospect was initially developed in the late 1980's as a beryllium resource. During the course of the beryllium exploration, approximately 200 drill holes penetrated varying thicknesses of the rhyolite volcanic rock that makes up the mass of Round Top Mountain and caps the beryllium-uranium deposits which occur in the underlying limestones; some 100 more were drilled on Little Round Top, Sierra Blanca and Little Blanca Mountains.

The Texas Bureau of Economic Geology, working with the project geologists, conducted an investigation of the rhyolite to better understand its rare metal content. This research shows that the rhyolite laccoliths at Sierra Blanca are enriched in a variety of REEs and other rare elements such as tantalum, niobium, thorium and lithium. They analyzed a series of samples from outcrop and drill holes and studied the geochemistry and mineralogy of the rhyolite. The results of their research were published in the GSA, Geological Society of America, Special Paper 246, 1990. The research states that the thorium is presently in the rhyolite, and generally is more difficult to separate from the adjoining rock and is slightly radioactive. The Round Top rhyolite requires further evaluation of its mineralogical makeup and economic modeling to determine the appropriate course for potential future commercial development.

The rare earth element supply has been dominated by China, which has historically used its ability to overproduce as a means of discouraging development by others. It is now being considered that China will soon utilize their production domestically, and in order to conserve their declining resources, will not make available these metals to the rest of the developed world in the quantities supplied in the past. This "drying up" of the Chinese source comes at a time when there increasing usage of these elements. Rare earth elements have a wide variety of useful characteristics and are currently components in a number of commercial products and critical applications across industries ranging from defense to medical to high technology. Their applicability to green energy technologies has generated considerable recent interest. An example is their use in the manufacture of super strength permanent magnets, a major emerging area of development. The market has focused mainly on their use in small hybrid vehicles and wind turbines. We believe that these applications are important, but that the adoption of small sized, high power permanent magnet electric motors and generators to reduce energy costs, particularly diesel, by the traditional heavy trucking, railroads, construction, mining and other heavy industry could stimulate a demand greater than currently being forecast.

Uranium

The presence of uranium has long been known. Various companies conducted reconnaissance in the area during the last cycle of uranium activity in the 1970’s. This exploration was in its beginning stages when the uranium market collapsed in the early 1980’s. The prior operator of the project logged visible uranium mineralization in several drill holes but low prices prevailing at the time of the project precluded any interest on their part. No radiometric logging of the drill holes was done and no radiation measurement was done in the mine workings.

Beryllium

Beryllium is a light, strong, very ridged metal with high thermal conductivity. Beryllium is most commonly used as an alloy with other metals, particularly copper, to make springs, contacts and other applications where rigidity, fatigue resistance and good electrical and thermal conductivity are required. Many everyday electronic applications use beryllium-copper alloys in contacts and current carrying springs. Pure beryllium metal and high beryllium alloys are also used where reliable, dimensionally stable parts are needed in high stress or high heat environments. Transparency to x-ray and other radiation is another important characteristic of beryllium metal. Companies engaged in aerospace, X-ray equipment manufacturing, oil drilling, sub-atomic particle research, and nuclear reactor industries are the primary users of beryllium metal. Beryllia (BeO) ceramics are used where superior heat conductivity and light weight are required. Beryllium is not an exchanged traded commodity and its marketing is done under negotiated terms.

Competition

The mining industry is highly competitive. We will be competing with numerous companies, substantially all with far greater resources available to them. We therefore will be at a significant disadvantage in the course of acquiring mining properties and obtaining materials, supplies, labor, and equipment. Additionally, we are and will continue to be an insignificant participant in the business of mining properties. A large number of established and well-financed companies are active in the mining industry and will have an advantage over us if they are competing for the same properties. Nearly all such entities have greater financial resources, technical expertise and managerial capabilities than ourselves and, consequently, we will be at a competitive disadvantage in identifying possible mining properties and procuring the same.

Government Approvals

General

The exploration, drilling and mining industries operate in a legal environment that requires permits to conduct virtually all operations. Thus permits are required by local, state and federal government agencies. Local authorities, usually counties, also have control over mining activity. The various permits address such issues as prospecting, development, production, labor standards, taxes, occupational health and safety, toxic substances, air quality, water use, water discharge, water quality, noise, dust, wildlife impacts, as well as other environmental and socioeconomic issues. Permits known to be required are (i) an operating plan for the conduct of exploration and development approved by the Texas General Land Office, (ii) an operating plan for production approved by the Texas General Land Office, (iii) various reporting to and approval by the Texas Railroad Commission regarding drilling and plugging of drill holes, and (v) reporting to and compliance with regulations of the Texas Commission of Environmental Quality.

Prior to receiving the necessary permits to explore or mine, the operator must comply with all regulatory requirements imposed by all governmental authorities having jurisdiction over the project area. Very often, in order to obtain the requisite permits, the operator must have its land reclamation, restoration or replacement plans pre-approved. Specifically, the operator must present its plan as to how it intends to restore or replace the affected area. Often all or any of these requirements can cause delays or involve costly studies or alterations of the proposed activity or time frame of operations, in order to mitigate impacts. All of these factors make it more difficult and costly to operate and have a negative and sometimes fatal impact on the viability of the exploration or mining operation. Finally, it is possible that future changes in these laws or regulations could have a significant impact on our business, causing those activities to be economically reevaluated at that time.

Approvals Relating to Uranium Mining

Uranium mining is regulated by the federal government, states and, in some cases, by Indian tribes. Compliance with such regulation has a material effect on the economics of company operations and the timing of project development.

Radioactive Material License. Before commencing operations in Texas, a radioactive material license must be applied for and obtained. Under the federal Atomic Energy Act, the United States Nuclear Regulatory Commission (“NRC”) has primary jurisdiction over the issuance of a radioactive material license. However, the Atomic Energy Act also allows for states with regulatory programs deemed satisfactory by the NRC to take primary responsibility for issuing the radioactive material license. The Commission has ceded jurisdiction for such licenses to Texas. The Texas Commission of Environmental Quality (TCEQ) is the administrative agency with jurisdiction in Texas over the radioactive material license.

Underground Injection Control Permits ("UIC"). The federal Safe Drinking Water Act creates a nationwide regulatory program protecting groundwater. This law is administered by the United States Environmental Protection Agency (the "EPA"). The TCEQ is permitted by the EPA to administer the UIC permits. The TCEQ also regulates air quality and surface deposition or discharge of treated wastewater associated with the mining process and which we are required to obtain.

Effect of Existing or Probable Government Regulations

Mineral exploration, including mining operations are subject to governmental regulation. Our operations may be affected in varying degrees by government regulation such as restrictions on production, price controls, tax increases, expropriation of property, environmental and pollution controls or changes in conditions under which minerals may be marketed. An excess supply of certain minerals may exist from time to time due to lack of markets, restrictions on exports, and numerous factors beyond our control. These factors include market fluctuations and government regulations relating to prices, taxes, royalties, allowable production and importing and exporting minerals. The effect of these factors cannot be accurately determined, and we are not aware of any probable government regulations that would impact the Company. This section is intended as a brief overview of the laws and regulations described herein and is not intended to be a comprehensive treatment of the subject matter.

Overview. Like all other mining companies doing business in the United States, we are subject to a variety of federal, state and local statutes, rules and regulations designed to protect the quality of the air and water, and threatened or endangered species, in the vicinity of its operations. These include “permitting” or pre-operating approval requirements designed to ensure the environmental integrity of a proposed mining facility, operating requirements designed to mitigate the effects of discharges into the environment during exploration, mining operations, and reclamation or post-operation requirements designed to remediate the lands affected by a mining facility once commercial mining operations have ceased.

Federal legislation in the United States and implementing regulations adopted and administered by the Environmental Protection Agency, the Forest Service, the Bureau of Land Management, the Fish and Wildlife Service, the Army Corps of Engineers and other agencies—in particular, legislation such as the federal Clean Water Act, the Clean Air Act, the National Environmental Policy Act, the Endangered Species Act, the National Forest Management Act, the Wilderness Act, and the Comprehensive Environmental Response, Compensation and Liability Act—have a direct bearing on domestic mining operations. These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

The Clean Water Act. The federal Clean Water Act is the principal federal environmental protection law regulating mining operations in the United States as it pertains to water quality.

At the state level, water quality is regulated by the Environment Department, Water and Waste Management Division under the Water Quality Act (state). If our exploration or any future development activities might affect a ground water aquifer, it will have to apply for a Ground Water Discharge Permit from the Ground Water Quality Bureau in compliance with the Groundwater Regulations. If exploration affects surface water, then compliance with the Surface Water Regulations is required.

The Clean Air Act. The federal Clean Air Act establishes ambient air quality standards, limits the discharges of new sources and hazardous air pollutants and establishes a federal air quality permitting program for such discharges. Hazardous materials are defined in the federal Clean Air Act and enabling regulations adopted under the federal Clean Air Act to include various metals. The federal Clean Air Act also imposes limitations on the level of particulate matter generated from mining operations.

National Environmental Policy Act (NEPA). NEPA requires all governmental agencies to consider the impact on the human environment of major federal actions as therein defined.

Endangered Species Act (ESA). The ESA requires federal agencies to ensure that any action authorized, funded or carried out by such agency is not likely to jeopardize the continued existence of any endangered or threatened species or result in the destruction or adverse modification of their critical habitat. In order to facilitate the conservation of imperiled species, the ESA establishes an interagency consultation process. When a federal agency proposes an action that “may affect” a listed species, it must consult with the USFWS and must prepare a “biological assessment” of the effects of a major construction activity if the USFWS advises that a threatened species may be present in the area of the activity.

National Forest Management Act. The National Forest Management Act, as implemented through title 36 of the Code of Federal Regulations, provides a planning framework for lands and resource management of the National Forests. The planning framework seeks to manage the National Forest System resources in a combination that best serves the public interest without impairment of the productivity of the land, consistent with the Multiple Use Sustained Yield Act of 1960.

Wilderness Act. The Wilderness Act of 1964 created a National Wilderness Preservation System composed of federally owned areas designated by Congress as “wilderness areas” to be preserved for future use and enjoyment.

The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). CERCLA imposes clean-up and reclamation responsibilities with respect to discharges into the environment, and establishes significant criminal and civil penalties against those persons who are primarily responsible for such discharges.

The Resource Conservation and Recovery Act (RCRA). RCRA was designed and implemented to regulate the disposal of solid and hazardous wastes. It restricts solid waste disposal practices and the management, reuse or recovery of solid wastes and imposes substantial additional requirements on the subcategory of solid wastes that are determined to be hazardous. Like the Clean Water Act, RCRA provides for citizens’ suits to enforce the provisions of the law.

National Historic Preservation Act. The National Historic Preservation Act was designed and implemented to protect historic and cultural properties. Compliance with the Act is necessary where federal properties or federal actions are undertaken, such as mineral exploration on federal land, which may impact historic or traditional cultural properties, including native or Indian cultural sites.

Employees

Including our executive officers, we currently have four full time employees. In order to implement our business plan, we will be required to employ qualified technical and administrative employees or retain the services of qualified consultants with the technical expertise to evaluate the mineral properties.

We currently have insurance coverage to cover property losses in the amount of $100,000 and general liability coverage in the amount of $1,000,000 per occurrence and in the aggregate of $2,000,000. We also maintain Directors and Officers insurance in the aggregate of $5,000,000.

Research and Development

The Company has spent only nominal amounts during each of the last two fiscal years on research and development activities.

Legal Proceedings

From time to time, the Company may become involved in litigation relating to claims arising out of its operations in the normal course of business. No legal proceedings, government actions, administrative actions, investigations or claims are currently pending against us or involve the Company which, in the opinion of the management of the Company, could reasonably be expected to have a material adverse effect on its business or financial condition. There are no proceedings in which any of the directors, officers or affiliates of the Company, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to that of the Company

Facilities

Our current headquarters are located at 304 Inverness Way South, Suite 365, Englewood, CO 80112.

Glossary of Terms |

| Alteration | | Any physical or chemical change in a rock or mineral subsequent to its formation. |

| Breccia | | A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

| Concession | | A grant of a tract of land made by a government or other controlling authority in return for stipulated services or a promise that the land will be used for a specific purpose. |

| Core | | The long cylindrical piece of a rock, about an inch in diameter, brought to the surface by diamond drilling. |

| Diamond drilling | | A drilling method in which the cutting is done by abrasion using diamonds embedded in a matrix rather than by percussion. The drill cuts a core of rock, which is recovered in long cylindrical sections. |

| Drift | | A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a cross-cut which crosses the rock formation. |

| Exploration | | Work involved in searching for ore, usually by drilling or driving a drift. |

| Exploration expenditures | | Costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects that may contain mineral deposit reserves. |

| Grade | | The average assay of a ton of ore, reflecting metal content. |

| Host rock | | The rock surrounding an ore deposit. |

| Intrusive | | A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface. |

| Lode | | A mineral deposit in solid rock. |

| Ore | | The naturally occurring material from which a mineral or minerals of economic value can be extracted profitably or to satisfy social or political objectives. The term is generally but not always used to refer to metalliferous material, and is often modified by the names of the valuable constituent; e.g., iron ore. |

| Ore body | | A continuous, well-defined mass of material of sufficient ore content to make extraction economically feasible. |

| Mine development | | The work carried out for the purpose of opening up a mineral deposit and making the actual ore extraction possible. |

| Mineral | | A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form. |

| Mineralization | | The presence of economic minerals in a specific area or geological formation. |

| Mineral reserve | | That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of “Ore” when dealing with metalliferous minerals. |

Probable (Indicated) reserves | | Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

Prospect Proven (Measured) reserves | | A mining property, the value of which has not been determined by exploration. Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| Resources | | The calculated amount of material in a mineral deposit, based on limited drill information. |

| Tonne | | A metric ton which is equivalent to 2,200 pounds. |

| Trend | | A general term for the direction or bearing of the outcrop of a geological feature of any dimension, such as a layer, vein, ore body, or fold. |

| Unpatented mining claim | | A parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim. |

| Vein | | A mineralized zone having a more or less regular development in length, width, and depth, which clearly separates it from neighboring rock. |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management’s Discussion and Analysis should be read in conjunction with the financial statements of Texas Rare Earth Resources Corp. and notes thereto as set forth herein. Readers are also urged to carefully review and consider the various disclosures made by us, which attempt to advise interested parties of the factors which affect our business, including without limitation, the disclosures made under “Risk Factors.”

Overview and Organizational History

We were incorporated in the State of Nevada in 1970 as Standard Silver Corporation. In July, 2004, our Articles of Incorporation were amended and restated to increase the number of shares of common stock to 25,000,000, and in March 2007, we affected a 1-for-2 reverse stock split. In September, 2008, we amended and restated our Articles of Incorporation to allow the increase of the number of shares of common stock from 25,000,000 to 100,000,000, and to authorize an additional 10,000,000 shares of preferred stock, to be issued at management’s discretion. In September 2010 amended our Amended and Restated Articles of Incorporation to change our name from Standard Silver Corporation to Texas Rare Earth Resources Corp.

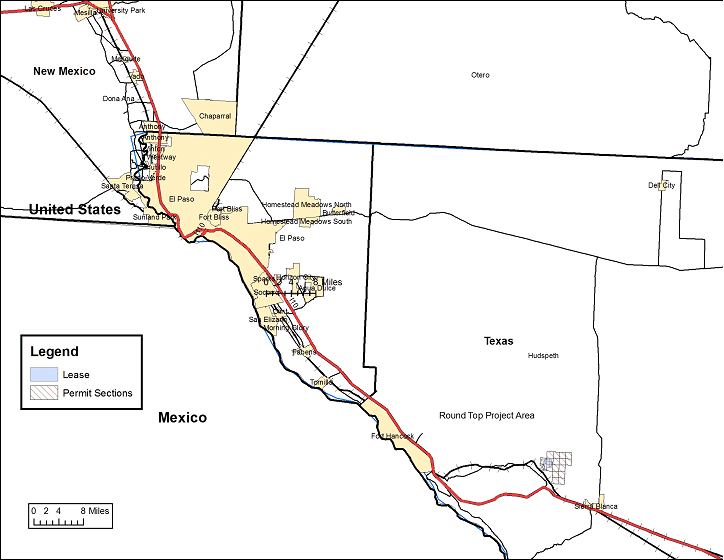

We are a mining company engaged in the business of the acquisition and development of mineral properties. We currently hold a twenty year lease, executed in August 2010, to explore and develop an 860 acre rare earth uranium-beryllium prospect located in Hudspeth County, Texas known as “Round Top” and prospecting permits covering an adjacent 9,345 acres. We also hold prospecting permits on certain other mineral properties located in Texas and New Mexico. We are currently not evaluating any additional prospects, and intend to focus the primarily on the development of our Round Top rare earth prospect. We currently have limited operations and have not established that our Round Top property contains any proven reserves or probable reserves. The strategic necessity of developing rare earth resources, the compelling fundamentals of uranium and the future potential for beryllium in the nuclear fuel cycle all present what we believe to be excellent opportunities for us.

We intend to (i) conduct a geologic, and radiometric study of the surface of the rhyolite to define areas where beryllium, rare earth minerals and thorium are concentrated in fractures, breccias or magmatic segregations, and to understand the distribution of uranium in this rock (ii) conduct radiation and geologic mapping underground to better define the distribution and habit of occurrence of the uranium, (iii) re-log drill samples that are stored on the property with emphasis on uranium and rare metal distribution (iv) conduct a sampling and laboratory examination program to determine the precise mineralogy of the rare elements in the rhyolite and (v) use these results to develop a drill program to test higher grade rare earth targets deeper in the rhyolite.

We currently do not have any producing properties and consequently, we have no current operating income or cash flow and have not generated any revenues. Further exploration will be required before a final evaluation as to the economic and practical feasibility of any of the properties is determined. We plan to raise additional capital to exploit current projects, including Round Top, and to acquire, evaluate, and develop new properties.

Between 2003 and 2007, our operations were minimal. In 2007 we acquired (i) interests in two mineral properties, the Old Hadley and the Macho Mines, located in southwestern New Mexico, (ii) a 28.5% interest in La Cañada Mining and Exploration LLC (“La Cañada”), (iii) the King Mine located in Boise County, Idaho, and (iv) rights to lease the Round Top Beryllium Deposit (“Round Top Deposit”) located in Hudspeth County, Texas. In June 2008, the Old Hadley and Round Top Deposit mines were assigned to La Cañada in exchange for La Cañada’s commitment to finance and develop the assigned properties. In September 2008, La Cañada assigned these two mines back to us. In October 2009, La Cañada redeemed our 28.5% interest. In January 2009, the Company relinquished all of its rights to the King Mine.

Results of Operations

Quarters ended February 28, 2011 (as restated) and 2010

General & Revenue

We had no operating revenues during the six months (“six month period”) and three months (“three month period”) ended February 28, 2011 and 2010. We are not currently profitable. As a result of ongoing operating losses, we had an accumulated deficit of $2,959,465 as of February 28, 2011.

Operating expenses and resulting losses from Operations.

We incurred exploration costs for the six month period ended February 28, 2011 and 2010 in the amount of approximately $119,000 and $30,000, respectively, and approximately $72,000 and $18,000 for the three month period ended February 28, 2011 and 2010, respectively. These expenditures were primarily related to outside geological consulting and sampling services relating to our Round Top project.

Our general and administrative (“G&A”) expenses for the six month period ended February 28, 2011 and 2010 were approximately $1,420,000 and $348,000, respectively. Our G&A expenses for the six month period ended February 28, 2011 included approximately $1,050,000 for public relations fees, of which $998,000 of this amount was stock compensation for services; approximately $130,000 for fees paid to auditors and other professionals associated with the audits and reviews of our financial statements and a registration statement; and $52,000 for other outside professional services. The remainder of our G&A expenses for the six month period ended February 28, 2011 were working capital and corporate expenditures. Our G&A expenses for the six month period ended February 28, 2010 were primarily related to the audits of our financial statements and approximately $263,000 in stock-based compensation to a director and other professional consultants.

Our G&A expenses for the three month period ended February 28, 2011 and 2010 were approximately $398,000 and $301,000, respectively. Our G&A expenses for the three month period ended February 28, 2011 included approximately $56,000 for public relations fees, of which approximately $28,800 of this amount was stock compensation for services; approximately $106,000 for fees paid to auditors and other professionals associated with the audits and reviews of our financial statements and a registration statement; and $52,000 for other outside professional services. The remainder of our G&A expenses for the three month period ended February 28, 2011 were working capital and corporate expenditures. Our G&A expenses for the three month period ended February 28, 2010 were primarily related to the audits of our financial statements and approximately $249,000 in stock-based compensation to a director.

We accrued interest expense on related party notes payable in the amount of $1,200 and $7,000 for the six month period ended February 28, 2011 and 2010, respectively, and $1,000 and $5,000 for the three month period ended February 28, 2011 and 2010, respectively. In December 2010, the notes payable principal balance of $73,000 and accrued interest for the advances to certain officers were paid in full.

Our net loss for the six-month period ended February 28, 2011 and 2010 was approximately $1,540,000 and $385,000, respectively. Our net loss for the three-month period ended February 28, 2011 and 2010 was approximately $467,000 and $324,000, respectively.

Results of Operations

Fiscal Years ended August 31, 2010 and 2009

General & Revenue

We had no operating revenues during the fiscal years ended August 31, 2010 and 2009. We are not currently profitable. As a result of ongoing operating losses, we had an accumulated deficit of $1,422,634 as of August 31, 2010. As discussed in the Company’s financial statements, the Company’s absence of significant revenues, recurring losses from operations, and its need for additional financing in order to fund its projected loss raise substantial doubt about its ability to continue as a going concern.

Operating expenses and resulting losses from Operations.

We incurred exploration costs for the fiscal years ended August 31, 2010 and 2009, in the amount of $126,929 and $19,042, respectively. These expenditures were primarily related to outside consulting services relating to our Round Top project. Our general and administrative expenses for the fiscal years ended August 31, 2010 and 2009, respectively, were $424,987 and $32,749, primarily for professional fees associated with the audits of our financial statements, director stock-based compensation in the amount of $249,000 and other general and administrative expenses necessary for our operations. We had losses from operations for the fiscal years ended August 31, 2010 and 2009, respectively, totaling $551,916 and $73,590. We recorded an impairment loss on mineral property investments in the amount of $21,799 for the year ended August 31, 2009 and an impairment loss on notes receivable in the amount of $54,370 for the year ended August 31, 2009 from our investment in La Canada. Our net loss for the fiscal years ended August 31, 2010 and 2009, respectively, was $558,380 and $134,043.

Liquidity and Capital Resources

As of February 28, 2011, we had a working capital surplus of approximately $4,020,000, resulting primarily from our January 2011 Private Placement. We believe that we have sufficient capital to fund our planned operation through the end of calendar year 2011. During the six month period ending February 28, 2011, we invested $10,536 in mineral properties. We purchased transportation and facilities equipment for our Round Top property in the approximate amount of $28,000 during the six month period ended February 28, 2010.

Over the next twelve to eighteen months we plan to conduct significant geological studies, sampling and drilling at our Round Top property. The timing of these expenditures is dependent upon a number of factors, including the availability of drilling contractors. We estimate these expenditures will total approximately $2,200,000 for exploration costs, $150,000 relating to the approval of our initial plan of operations and permitting fees, $170,000 in capital expenditures, and approximately $1,325,000 in general and administrative expenditures.

Our exploration costs are estimated to be approximately $2,200,000, and our timeline includes (i) conducting and interpreting an airborne geophysical survey planned for the third quarter of this fiscal year, (ii) drilling approximately 12,000 feet and the collection of approximately 5,000 samples that will be ongoing through January 2012, (iii) metallurgical analysis of these samples that will take place during this timeframe, (iv) onsite contract geological services that will be ongoing through February 2012, and (v) ongoing other expenditures over the next twelve months that are necessary to accomplish our exploration efforts. There is no assurance that we will be able to complete these activities in the timeframe set forth above, or at all. Our airborne geophysical survey was completed in June 2011 and we are awaiting its interpretation.

We estimate that we will incur approximately $150,000 in expenditures to file our initial plan of operations with the State of Texas and to acquire necessary permits. Our initial plan of operations was approved in April 2011 and triggered an additional one time property cost of $65,000. We will be required to pay a $45,000 lease payment to the State of Texas in August 2011 for our Round Top project. We estimate that in July 2011 we will be required to pay a $20,000 permitting and compliance fee to the Texas Railroad Commission, and in September and October 2011, we will be required to pay approximately $20,000 for prospecting permits to the State of Texas for our Round Top project. The estimated timeframe for these payments, including the amounts, may change.

Our capital expenditures for the next twelve months are estimated to be $170,000, which will include the following: (i) in July and August 2011, we intend to spend approximately $75,000 to purchase transportation equipment and to construct a field office; (ii) in September 2011 we intend to purchase ventilation equipment for our Round Top project for approximately $10,000, and (iii) approximately $75,000 for additional office and field equipment necessary to carry out our operations. The remaining $10,000 will be spent on other miscellaneous equipment necessary for us to conduct our exploration. The estimated timeframe for these payments, including the amounts, may change.

We have estimated that our general and administrative expenditures, which will be spent ratably over the next twelve months, to total approximately $1,325,000. Payroll, payroll taxes, benefits and associated travel for four employees is estimated to be $520,000 over this period of time. We estimate that we will incur professional fees of approximately $120,000 over the next twelve months. These fees will be primarily associated with the audit and reviews of our financial statements and Exchange Act filings, which will occur after each quarter end and after our fiscal year end. We estimate that we will incur approximately $600,000 for professional fees associated with the assistance of the management and supervision of our field operations. The remainder of our general and administrative expenditures totaling $85,000 will be spent on items necessary for us to conduct our general business affairs. Our exploration activities will be carried out by our geologic staff and such qualified outside contractors as is necessary. We have an office/lab trailer at the site. We will expand these facilities as the project develops. We believe that we have sufficient capital to fund operations and exploration activity on our Round Top prospect through the end of calendar year 2011. We will, however, need to raise additional funding subsequent to calendar year 2011 to continue our exploration and development activities.

As of the date hereof, the Company is not able to quantify the amount of capital needed to fund its working capital needs after calendar 2011, nor is it able to quantify the amount of capital needed to develop the Round Top project. The amount of capital will be dependent upon the Company’s business strategy to exploit the Round Top project. The Company intends to raise additional working capital through best efforts debt or equity financing, as we have no firm commitments for equity capital investments to any established credit facility. No assurance can be given that additional financing will be available, on terms acceptable to the Company. The Company’s viability is contingent upon its ability to receive external financing. Failure to obtain sufficient working capital may result in management resorting to the sale of assets or otherwise curtailing operations.

Contractual Commitments

In August 2010, we entered into a mining lease with the Texas General Land Office covering Sections 7 and 18 of Township 7, Block 71 and Section 12 of Block 72, covering approximately 860 acres in Hudspeth County, Texas. Under the lease, we will pay the State of Texas a lease bonus of $197,800, $35,000 of which was paid upon the execution of the lease, $65,000 of which was paid in connection with the approval of our initial plan of operations to conduct exploration, and $97,800 of which will be due when we submit a supplemental plan of operations to conduct mining. Upon the sale of minerals removed from Round Top, we will pay the State of Texas a $500,000 minimum advance royalty. Thereafter, we will pay the State of Texas a production royalty equal to eight percent (8%) of the market value of uranium and other fissionable materials removed and sold from Round Top and six and one quarter percent (6 ¼%) of the market value of all other minerals removed and sold from Round Top.

If production of paying quantities of minerals has not been obtained on or before August 17, 2011, we may pay the State of Texas a delay rental to extend the term of the lease in an amount equal to $44,718. Thereafter, assuming production of paying quantities has not been obtained, we may pay additional delay rental fees to extend the term of the lease for successive one (1) year periods pursuant to the following schedule:

| | | Per Acre Amount | | | Total Amount | |

| August 17, 2012 – 2014 | | $ | 50 | | | $ | 44,718 | |

| August 17, 2015 – 2019 | | $ | 75 | | | $ | 67,077 | |

| August 17, 2019 – 2024 | | $ | 150 | | | $ | 134,155 | |

| August 17, 2025 – 2029 | | $ | 200 | | | $ | 178,873 | |

Recently Issued Accounting Pronouncements

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position, or cash flow.

Critical Accounting Estimates

Management’s discussion and analysis of financial condition and results of operations is based on our financial statements, which have been prepared in accordance with GAAP. Preparation of financial statements requires management to make assumptions, estimates and judgments that affect the reported amounts of assets, liabilities, revenues, costs and expenses, and the related disclosures of contingencies. Management bases its estimates on various assumptions and historical experience, which are believed to be reasonable; however, due to the inherent nature of estimates, actual results may differ significantly due to changed conditions or assumptions. On a regular basis, management reviews the accounting policies, assumptions, estimates and judgments to ensure that our financial statements are fairly presented in accordance with GAAP. However, because future events and their effects cannot be determined with certainty, actual results could differ from our assumptions and estimates, and such differences could be material. Management believes that the following critical accounting estimates and judgments have a significant impact on our financial statements: (i) fair value estimates relating to options and warrants and (ii) managements estimate that no contingency accrual is necessary in relation to the registration rights agreement with investors in the 2009-2010 Private Placement and the January 2011 Private Placement.

DETERMINATION OF OFFERING PRICE

The selling stockholders will offer their shares at a price of $4.52 per share until such time as the Company's common stock is listed on a national securities exchange after which time such selling shareholders may sell their shares at prevailing market or privately negotiated prices, in one or more transactions that may take place by ordinary broker's transactions, privately-negotiated transactions or through sales to one or more dealers for resale. The selling stockholders will receive all proceeds from the sale of the common stock. We will, however, receive the sale price of any common stock we sell to the selling stockholder upon exercise of the Warrants. We expect to use the proceeds received from the exercise of the Warrants, if any, for general working capital purposes. Our common stock is currently listed for quotation on the Pink Sheets published by OTC Markets, Inc. under the symbol “TRER.”

MARKET PRICE INFORMATION AND DIVIDEND POLICY

Our common stock is listed for quotation on the Pink Sheets published by OTC Markets Group, Inc. under the symbol “TRER.” The market for our common stock on the Pink Sheets is extremely limited, sporadic and highly volatile. The quotations reflect inter-dealer prices without retail mark-up, mark-down or commission and may not represent actual transactions. The following table sets forth the range of high and low bid prices during the last two completed fiscal years and the subsequent interim period for which financials are included in this prospectus.

| Fiscal Year 2011 | | High | | | Low | |

| Quarter ended February 28, 2011 | | $ | 3.80 | | | $ | 2.72 | |

| Quarter ended November 30, 2010 | | $ | 3.05 | | | $ | 0.65 | |

| | | | | | | | | |

| Fiscal Year 2010 | | High | | | Low | |

| Quarter ended August 31, 2010 | | $ | 1.02 | | | $ | 0.25 | |

| Quarter ended May 31, 2010 | | $ | 0.99 | | | $ | 0.55 | |

| Quarter ended February 28, 2010 | | $ | 1.05 | | | $ | 0.36 | |

| Quarter ended November 30, 2009 | | $ | 1.08 | | | $ | 0.37 | |

| | | | | | | | | |

| Fiscal Year 2009 | | High | | | Low | |

| Quarter ended August 31, 2009 | | $ | 2.05 | | | $ | 0.11 | |

| Quarter ended May 31, 2009 | | $ | 0.51 | | | $ | 0.11 | |

| Quarter ended February 28, 2009 | | $ | 0.51 | | | $ | 0.11 | |

| Quarter ended November 30, 2008 | | $ | 0.69 | | | $ | 0.11 | |

The last bid price of our common stock on June 16, 2011 was $3.55 per share.

Holders

The approximate number of holders of record of our common stock as of June 20, 2011 was 522.

Dividends

We have not paid any cash dividends on our equity security and our board of directors has no present intention of declaring any cash dividends. We are not prohibited from paying any dividends pursuant to any agreement or contract.

Securities Authorized for Issuance under Equity Compensation Plans

In September 2008, the board of directors adopted our 2008 Stock Option Plan, which was also approved by our shareholders in September 2008. The 2008 Plan allows for the grant of up to 2,000,000 shares of our common stock for awards to our offices, directors, employees and consultants. The 2008 Plan provides for the grant of incentive stock options, nonqualified stock options, restricted stock, stock appreciation rights, and stock grant awards. The 2008 Plan also permits the grant of awards that qualify for the “performance-based compensation” exception to the $1,000,000 limitation on the deduction of compensation imposed by Section 162(m) of the Code. As of the date of this prospectus, a total of 1,240,000 shares of our common stock remained available for future grants under the 2008 Plan. The following table sets forth certain information as of August 31, 2010 concerning our common stock that may be issued upon the exercise of options or warrants or pursuant to purchases of stock under the 2008 Plan:

| Plan Category | (a) Number of Securities to be Issued Upon the Exercise of Outstanding Options and Warrants | (b) Weighted-Average Exercise Price of Outstanding Options and Warrants | (c) Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) |

| Equity compensation plans approved by stockholders | 0 | N/A | 2,000,000(1) |

| Equity compensation plans not approved by stockholders | -- | N/A | -- |

| | | | |

| Total | 0 | N/A | 2,000,000(1) |

| (1) | Does not include options to purchase an aggregate of 3,495,000 shares of common stock issued to the Company’s executive officers and directors between February and May 2011. |

MANAGEMENT

Our current executive officers and directors are:

| Name | Age | Position | Positions Held Since |

| Marc LeVier | 62 | President, Chief Executive Officer, and Director | May 2011 |

| Daniel E. Gorski | 72 | Director Chief Operating Officer | January 2007 May 2011 |

| Chris Mathers | 52 | Chief Financial Officer | December 2010 |

| G.W. (Mike) McDonald | 74 | Vice President | January 2004 |

| Cecil C. Wall | 78 | Secretary & Treasurer | January 2004 |

| Stanley Korzeb | 56 | Vice President | January 2006 |

| Anthony Marchese | 53 | Director | December 2009 |

| General Gregory Martin | 62 | Director | February 2011 |

| Graham A. Karklin | 61 | Director | March 2011 |

| Jim Graham | 63 | Director | April 2011 |

Marc LeVier. Mr. LeVier was appointed as the Company president, chief executive officer and as a director in May 2011. With 40 years experience in advanced process engineering, Mr. LeVier spent the last 22 years prior to May 2011 with Newmont Mining Corporation (“Newmont”) in several professional capacities. As head of Metallurgical Research and Development, he led the development of processes for resources which have become Newmont’s primary producing properties today. These include the development of the Gold Quarry refractory ore treatment plant (ROTP) at the Carlin Trend in Nevada, the Batu Hijau porphyry copper-gold mine in Indonesia, the heap leach operations at Minera Yanacocha in Peru, the Ahafo operations in Ghana, the Phoenix operation in Nevada, and the Boddington operation in Australia. Additionally, Mr. LeVier led teams in the development of the former operations at Minahasa in Indonesia and the Zarafshan-Newmont Joint Venture heap leach operation in Uzbekistan. Prior to Newmont, Mr. LeVier worked for Exxon Minerals Company, Joy Manufacturing Corporation and Derrick Manufacturing Corporation. He served in the U.S. Army Corps of Engineers during the Vietnam era.

Mr. LeVier is internationally has served on Industrial Advisory Boards at Montana Tech, South Dakota School of Mines & Technology, Virginia Tech, Michigan Tech, and the University of Arizona. He has also served on the AMIRA BOD, which is an international collaborative research group based in Australia, and the Society for Mining, Metallurgy and Exploration BOD. Mr. LeVier is a member of the Mining and Metallurgical Society (MMSA) and served as its President for four years. Mr. LeVier holds both a Bachelor’s and Master’s degree in Metallurgical Engineering from Michigan Technological University.

Daniel E. Gorski. Mr. Gorski has severed as a director of the Company since January 2006 and as the Company’s chief operating officer since May 2011. Prior thereto, Mr. Gorski served as the Company’s president and chief executive officer from January 2007 to May 2011. From July 2004 to January 2006, Mr. Gorski was the co-founder and vice president of operations for High Plains Uranium Inc., a uranium exploration and development company that went public on the Toronto Stock Exchange in December 2005. Between June 1996 to May 2004, Mr. Gorski served as an officer and director of Metalline Mining Co., a publicly traded mining and development company with holdings in the Sierra Mojada Mining District, Coahuila, Mexico. From January 1992 to June 1996, Mr. Gorski was the exploration geologist under contract to USMX Inc. and worked exclusively in Latin America. Mr. Gorski earned a BS in 1960 from Sul Ross State College, in Alpine, Texas and an MA in 1970 from the University of Texas in Austin, Texas. Mr. Gorski has over thirty-five years of experience in the mining industry. Mr. Gorski’s extensive technical knowledge and experience in the mining industry led the Board to conclude that Mr. Gorski should serve as a member of the Board of Directors.

Chris Mathers. Mr. Mathers was appointed as the Company’s chief financial officer in November 2010. From 2000 through 2010, Mr. Mathers was involved in providing contract chief financial officer and consulting services to a wide variety of privately and publicly held companies, including GFS Forex and Futures, Inc., InterbankFX, Nexus Nano Electronics and as a tax practitioner for a number of individuals and corporations. From 1993 through 1999 Mr. Mathers served as CFO to InterSystems, Inc. (AMEX:II). Mr. Mathers began his career in public accounting with the international accounting firm of PriceWaterhouse. Mr. Mathers holds a BBA in accounting from Southwestern University located in Georgetown, Texas, and is also a certified public accountant.

Mike McDonald. Mr. McDonald has served as the Company’s vice president since January 2004, as chief financial officer from January 2004 to November 2010, and as a director from January 2004 to March 2011. Since 2001 through present, Mr. McDonald worked as an associate with BW Energy Consultants, Inc., doing title work, leasing, rights-of way, due diligence and prospect management. From 1994 till 2001, Mr. McDonald was an associate with the Magee Corporation performing various contract prospect management services. . In 1980, he founded the oil and gas exploration company, Roseland Oil & Gas, Inc. and served as its president until 1987. From 1975 to 1980 he was employed with Exxon. Mr. McDonald received his B.S. Degree in Geology in 1955 from Sul Ross University in Alpine, Texas. Mr. McDonald’s extensive management experience led the Board to conclude that Mr. McDonald should serve as a member of the Board of Directors.

Cecil C. Wall. Mr. Wall has served as the Company’s secretary and treasurer since January 2004 and as a director from January 2004 to April 2011. Prior thereto, Mr. Wall served as vice president and directors for Brenex Oil Corporation, an oil and gas producing company located in St. George, Utah, from April 1998 to November 2003. Since 1969, Mr. Wall has been engaged in oil and gas and his businesses. Mr. Wall attended Utah State University, in Logan, Utah from 1951 to 1952. Mr. Wall’s management experience led the Board to conclude that Mr. Wall should serve as a member of the Board of Directors.

Stanley Korzeb. Mr. Korzeb has served as the Company’s vice president since 2007. From May 2006 to November 2006, Mr. Korzeb served as exploration geologist for Teck Cominco of the Pend Oreille Mine in Metalline Falls, Washington. From February 2004 to December 2005, Mr. Korzeb was the Chief geologist for Metalline Mining Company in Coeur D’ Alene, Idaho. From September 1980 to February 1996, Mr. Korzeb was employed by the U.S. Bureau of Mines as a Geologist in Denver, Colorado. Mr. Korzeb received a Master of Science in Geology in 1977 from Miami University in Oxford, Ohio, and a BS in Geology from the University of Massachusetts in 1975.