UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

þ Soliciting Material Pursuant to § 240.14a-12

STRATEGIC REALTY TRUST, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Strategic Realty Trust

400 El Camino Real

San Mateo, CA 94402

www.srtreit.com

Quarterly Review for Q3, 2013

Highlights

| · | Sale of Willow Run Shopping Center in Colorado completed |

| · | Management transition complete |

| · | Cleaning up accounts receivables |

Dividend Prospects

We are pleased to report that we are making positive progress on our plan to resolve the Key Bank loan default and to remove the prohibition on dividends. Assuming we can reach agreement with KeyBank and close any required sales the Company should be in a position to declare a dividend around the end of the year.

The first of our property sales, Willow Run, closed on October 31, 2013. Willow Run was acquired in May of 2012 for $11,100,000 and originally was comprised of 95,791 square feet. Earlier this year a McDonald’s restaurant pad at the center was sold for $1,050,000 reducing the Center to 91,575 square feet. Combined with the current sales price of $10,825,000, the gross sales price for the center was $11,825,000. All proceeds from the sale were paid to Key Bank as required under the loan agreement as we continue to work with them on a modification to the loan that would allow for the resumption of the payment of dividends and the release of certain sales proceeds to the Company.

Willow was chosen for sale because it is one of the five properties securing the Key Bank loan, it had no prepayment issues or penalties, and Safeway, the anchor tenant, has just 6.5 years left on the its lease term. While we have no indication of whether or not Safeway would renew, there are reasons to be concerned that they may not. The Center was 87.4% occupied (adjusted for the pad sale) when acquired by SRT and since that time has lost 6,525 square feet of tenants, with the occupancy declining to 80.3%. The location of the property is difficult as it is not on either of the two main east-west arterial roads in Westminster, CO and there are competing grocery anchored centers on the adjoining arterials that enjoy daily traffic counts that are more than 25% higher than at Willow.

The other properties on the market, Visalia and Craig Promenade, are each under a contract of sale. We are currently in the buyers’ due diligence property review periods, and the closings are scheduled for late December. The pricing for these sales is reflective of a broadly marketed transaction and is not in any way “fire sale” pricing.

Property Operations

Management Transition

The transition to Glenborough and its affiliate, SRT Advisor, LLC, as the property manager and advisor took place on August 10, 2013. We believe the Company owns a solid portfolio of properties. We have developed and started to implement strategies that should increase both value and cash flow. On the whole, we believe this to be a portfolio of assets that, with proactive leasing and management, can grow in value.

Anchor Tenants Issues

Strong anchor tenants are important to the success of any retail center. Although the vast majority of our anchor tenants are stable and performing well, we are facing issues at three locations. Grocery chain Fresh & Easy is the anchor at both the San Jacinto and Topaz centers. Last year Tesco, an English company that is one of the largest grocers in the world and the parent of Fresh & Easy, decided to sell the chain and exit the U.S. market. While they recently found a private buyer for the chain, the buyer does not want all of the store locations. As a result, Tesco placed Fresh & Easy into bankruptcy, allowing them to reject (cancel) their leases on the stores not wanted by the buyer including the store at our Topaz Center, which they then closed. However, just recently Fresh & Easy had a change of heart and asked the court to reinstate the Topaz center lease, which it did. As a part of that election, we were brought current with past due rents and that lease is in full effect again, even though the store remains closed. It appears that Tesco may have another operator for this store and a number of others. So far it appears that Fresh & Easy at our San Jacinto Center will remain open and will be sold to the new buyer. We are actively managing this process in the bankruptcy courts in Delaware. The good news is for now both leases are still in effect, and one store remains open, but these leases remain in flux.

Ralphs, the grocery anchor at Morningside, closed their store in early 2013 but continues to pay rent. Ralphs does have another store nearby, and it appears that they did not think the market could support both stores. We are working with brokers to find a suitable replacement tenant. An empty anchor store does result in less traffic to the center which can be difficult for the smaller tenants. Ralphs still has eight years left on their lease.

Leasing and Occupancy

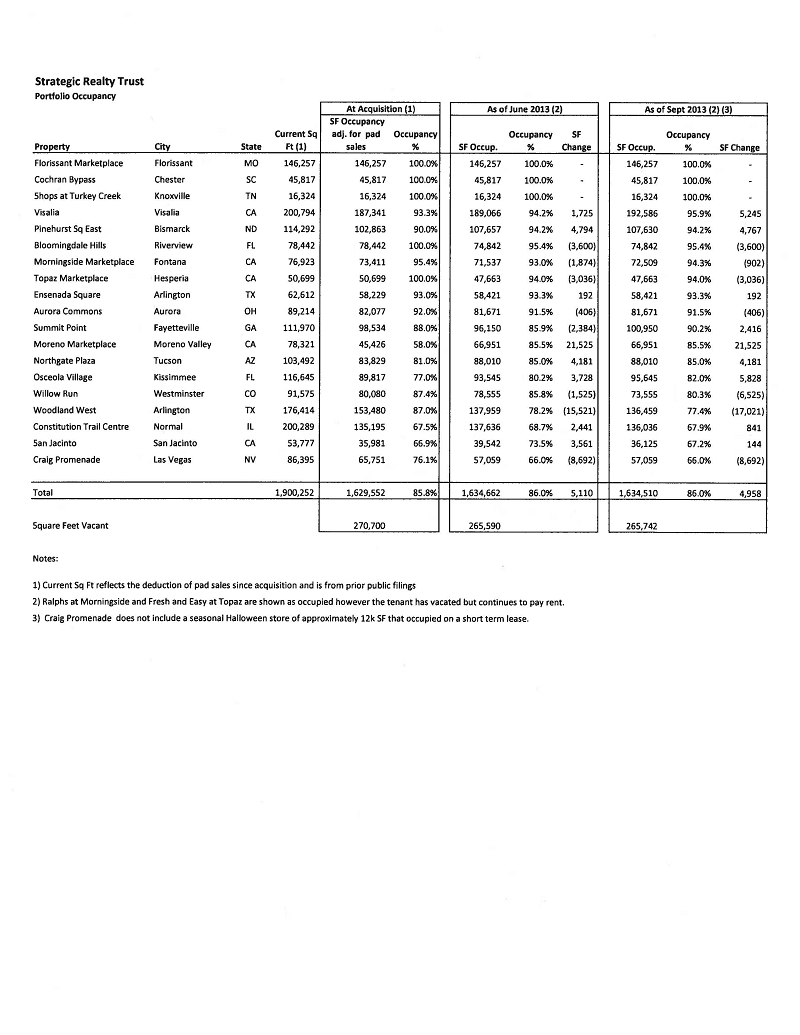

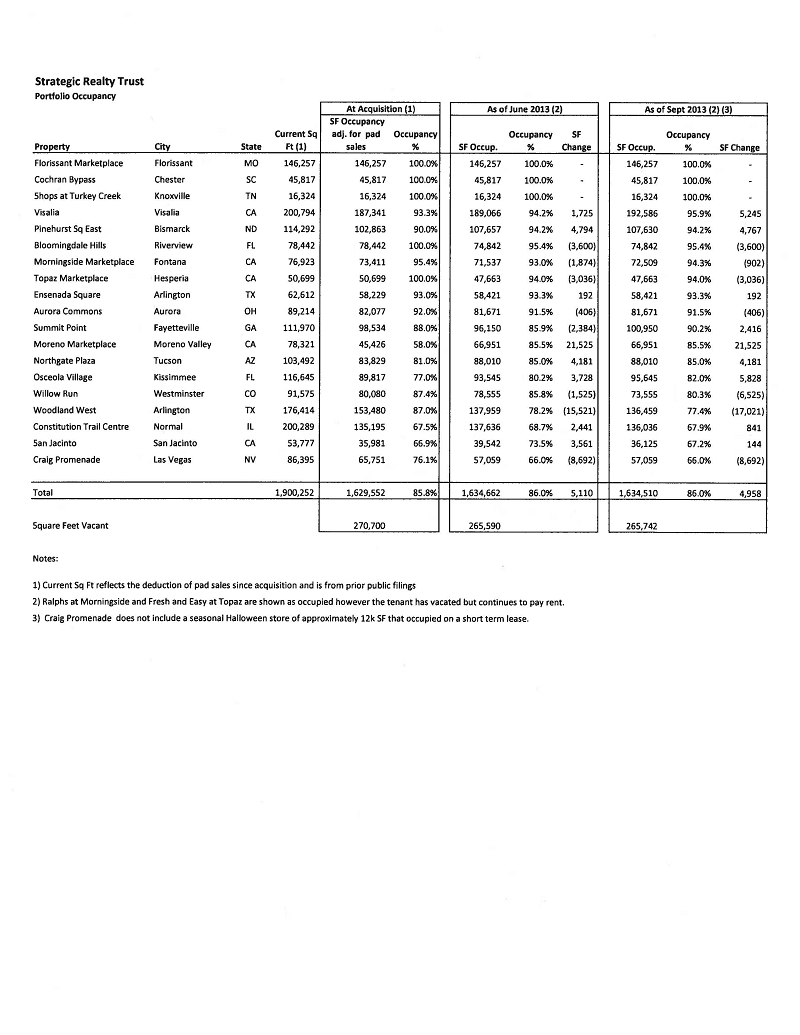

The occupancy of the 19 properties as of September 30, 2013 was 86.0% or 1,634,510 sf. Starting with occupancy levels at the purchase date of each property and adjusting for pad sales, the original occupancy was 85.8% or 1,634,662SF. Since acquisition of each property the net increase in total occupancy for the portfolio adjusted for pad sales is only 4,958 s.f. (See exhibit attached for a listing of current property occupancies.)

Currently, our leasing pipeline looks very strong. We did a comprehensive review of the quality and performance of all our leasing brokers and found that changes needed to be made. Of the 11 properties with the lowest occupancies, we replaced five of the leasing teams, and on the other six we are working closely with the brokerage teams to maximize leasing performance.

As for tenant renewals, we have about 15 leases in negotiations totaling over 37,000 square feet. On the new tenant side we have 14 new leases under negotiation totaling almost 50,000 square feet.

Based on this leasing activity, we could see our occupancy increase by 2.6 percentage points up to 88.6%.

We have also revamped the leasing process to speed up negotiations and to provide better legal support to the leasing process. By having in-house counsel, we can focus on producing leasing documents in a timely fashion that both protects the interest of the Company and delivers the best possible deal for SRT. We have already had a positive impact on the quality of documentation on several of the transition deals that were initiated by the former manager.

Property Management

We have made progress on a number of fronts.

| · | We have reduced uncollected tenant rents by 36% from $2.2 million at June 30 to $1.4 million at September 30 with further reductions since quarter end. |

| · | We updated delinquent state filings (with penalties) of the property owning subsidiaries so that the entities would regain good legal standing, which enables us to commence legal actions against tenants for rent collection or eviction. |

| · | We have filed lawsuits and evicted deadbeat tenants. |

| · | Overall accounts payable have been reduced by $2.5 million. |

| · | We are now paying property vendors on a current basis; this allows us to avoid late fees and penalties that were suffered in the past. We also believe we are receiving better vendor attention, as suppliers are being treated in a professional fashion. |

In order to provide you with examples of the types of progress we have made, we will focus on the Company’s property at Constitution Trail.

| · | We have reduced accounts receivable 55% from $730,000 to $330,000 as of October 31, 2013 and we are still working to get it reduced further to a more reasonable level. |

| · | We found that a health club tenant had not paid rent since December 2012 (over $70,000). According to the former property manager at Thompson National Properties (TNP), she was “awaiting approval from corporate to pursue with default notice through a lawyer.” We were able to evict the tenant in October and a final settlement is pending with the former tenant. We currently have a lease draft out for review with a new franchisee of the health club chain to reopen the location. |

| · | We found that a restaurant tenant had not paid rent since September 2012 (over $40,000) and according to the former property manager at Thompson National Properties (TNP), she was “awaiting approval from corporate to pursue with default notice through a lawyer.” The tenant continued to operate without paying rent until Glenborough assumed management. The tenant now has resumed making payments and the account is now being closely monitored. |

| · | A national fast food hamburger restaurant franchise, after unsuccessfully trying to work with the prior property manager, stopped paying rent in June 2013 and threatened to close the store. After numerous discussions with the tenant, the delinquent balance of over $38,000 has been paid in full. |

| · | A wireless phone store owed rent for nine months and the former TNP property manager claimed the business had been sold but “she was still waiting for paperwork.” We researched the situation, and in fact the tenant had assigned their lease to another operator in February of 2012. The new tenant paid no rent after August 2012 and accumulated a delinquent balance of over $30,000 and then vacated the space. In September 2013 we negotiated a settlement with the former tenant, and we have received a substantial payment with the remainder of delinquent balance in the process of being paid off. |

| · | A clothing retailer had filed for bankruptcy, but we noticed on our property inspection that they we still occupying the space and selling their remaining inventory from this and other stores. Upon investigation we found that TNP had not filed a claim for administrative rent even though the tenant had filed for bankruptcy in September of 2012. As a result of filing an administrative rent claim in bankruptcy court, we have been awarded $50,000 to settle the outstanding claim. A timely filing for administrative rent by the former manager may have yielded more. |

| · | Schnuck’s, the grocery anchor, and the second largest tenant of the REIT (also in Florissant in St Louis) had hundreds of thousands of dollars of disputed Common Area Maintenance (CAM) charges from 2009 through 2013 and has been frustrated in their efforts to get it cleaned up with TNP and the prior owner of the property. We have begun to reconcile the CAM charges with Schnuck’s for the last four years and should have that resolved shortly. Schnuck’s has said “Glenborough is the best thing to happen to Constitution Trail since inception.” |

These are only a few examples of the types of proactive property management that we are implementing across the portfolio that we believe will enhance the value and performance of the Company’s assets.

Property Operating Expenses

We are working to reduce property operating expenses while maintaining or increasing tenant satisfaction. With the transition to Glenborough from TNP, property management fees are down 20% from 5% of rents to 4% of rents. We are working to lower administrative costs at the properties and by paying invoices on a current basis, we can avoid late fees and penalties. We will be rebidding many of the services such as landscape and parking lot maintenance to look for better pricing.

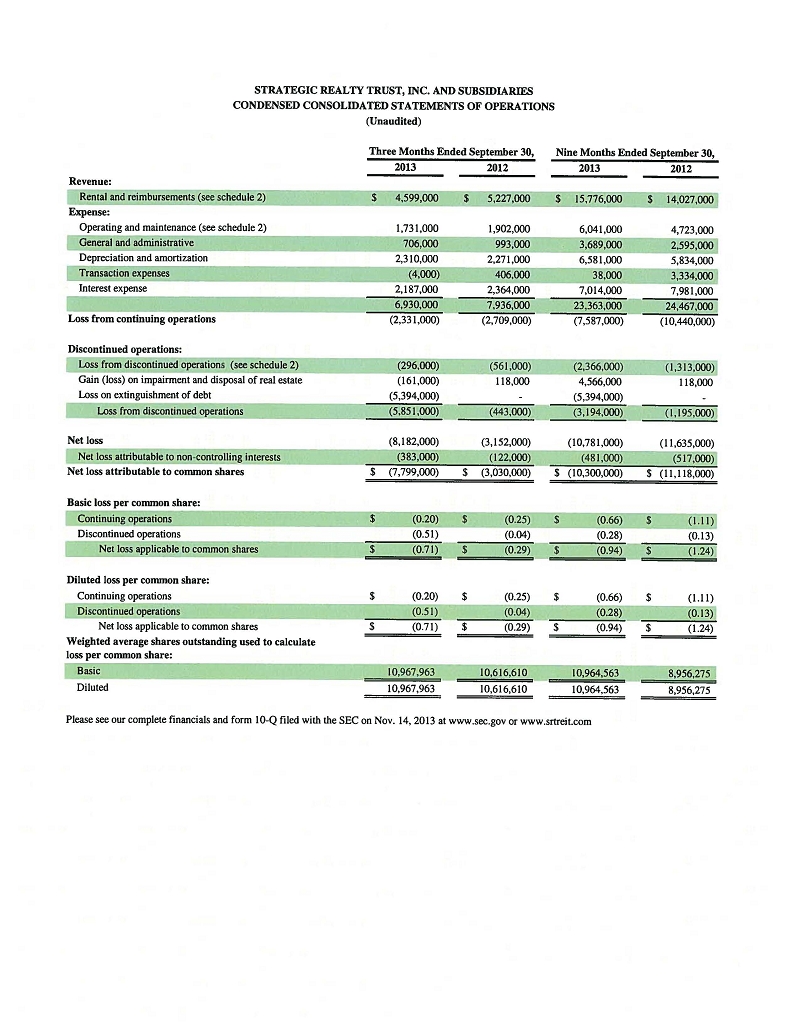

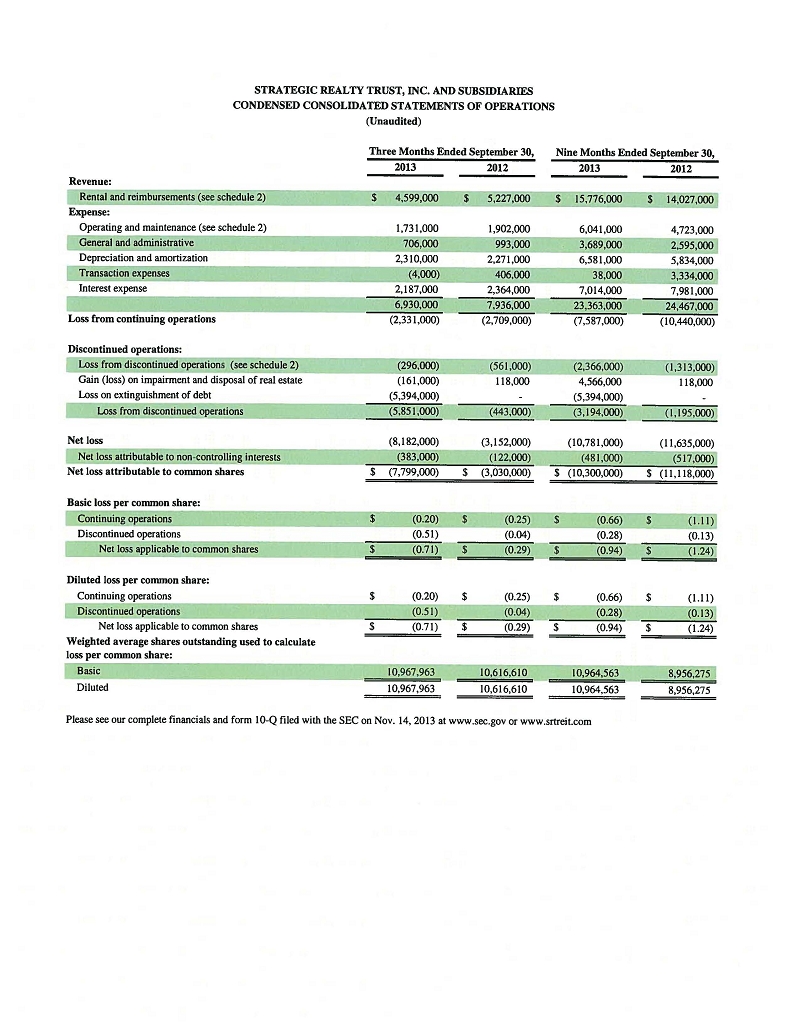

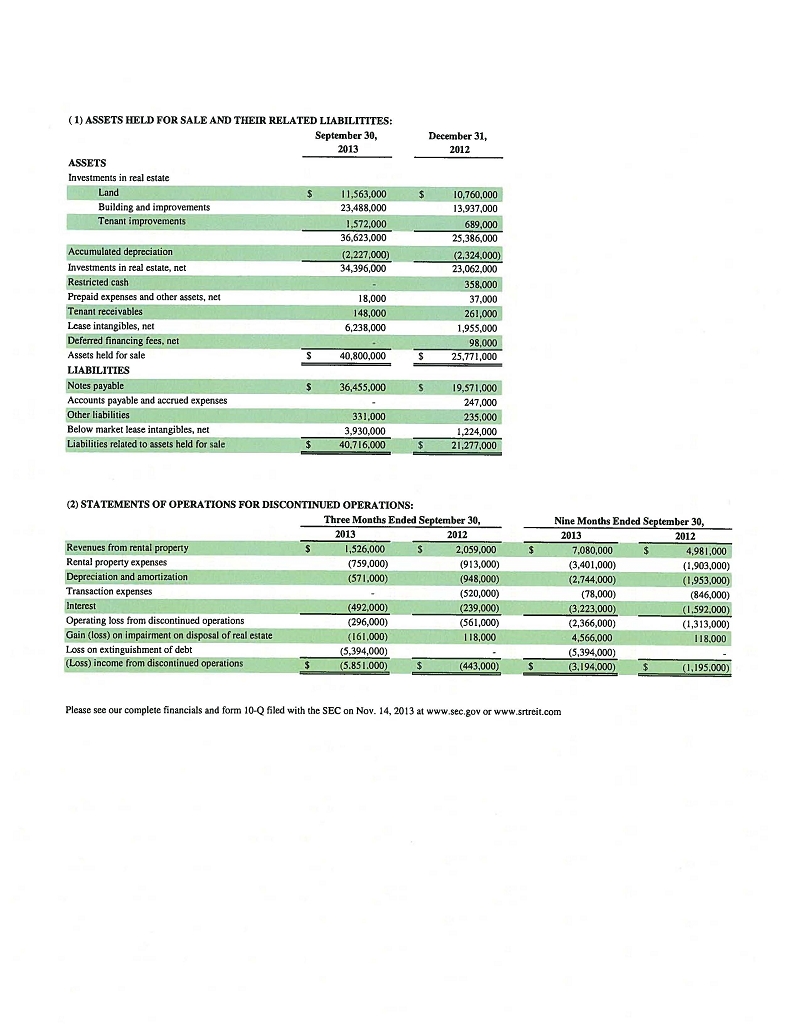

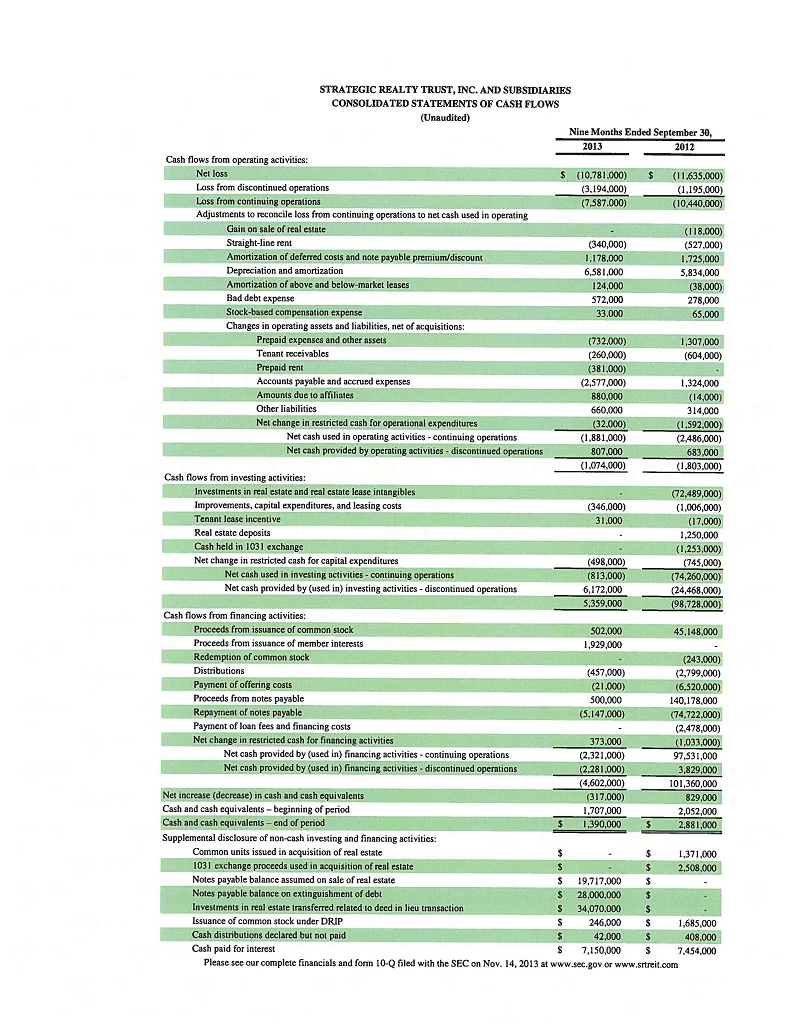

Financial Statement Review

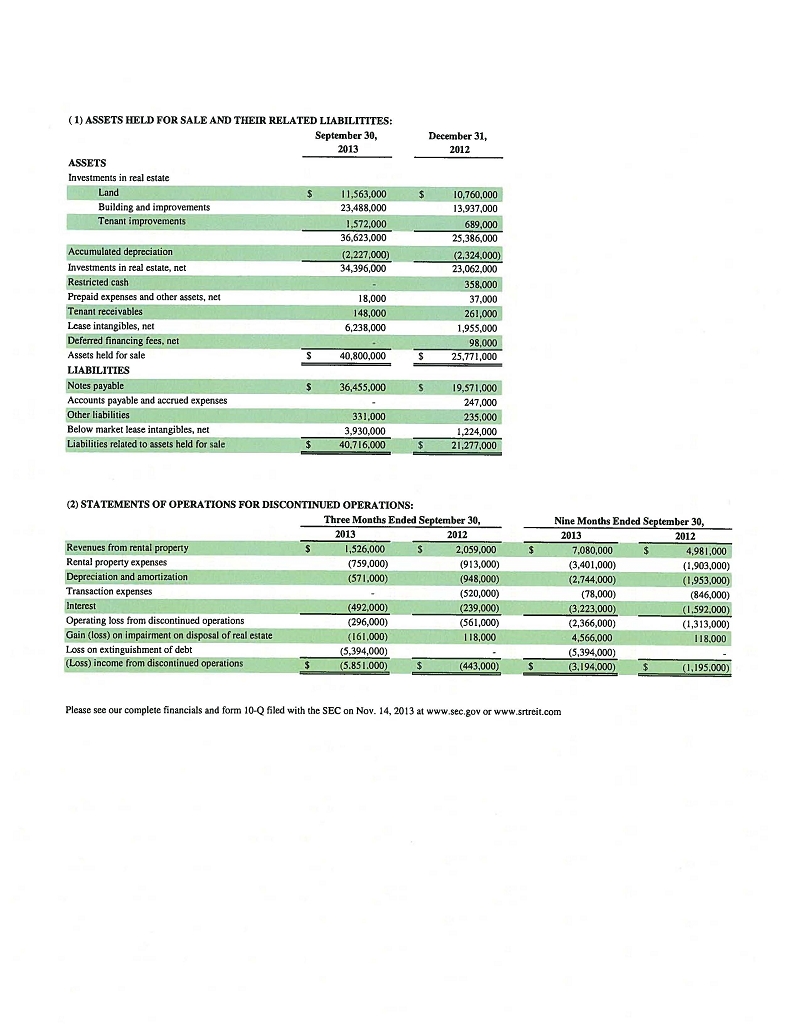

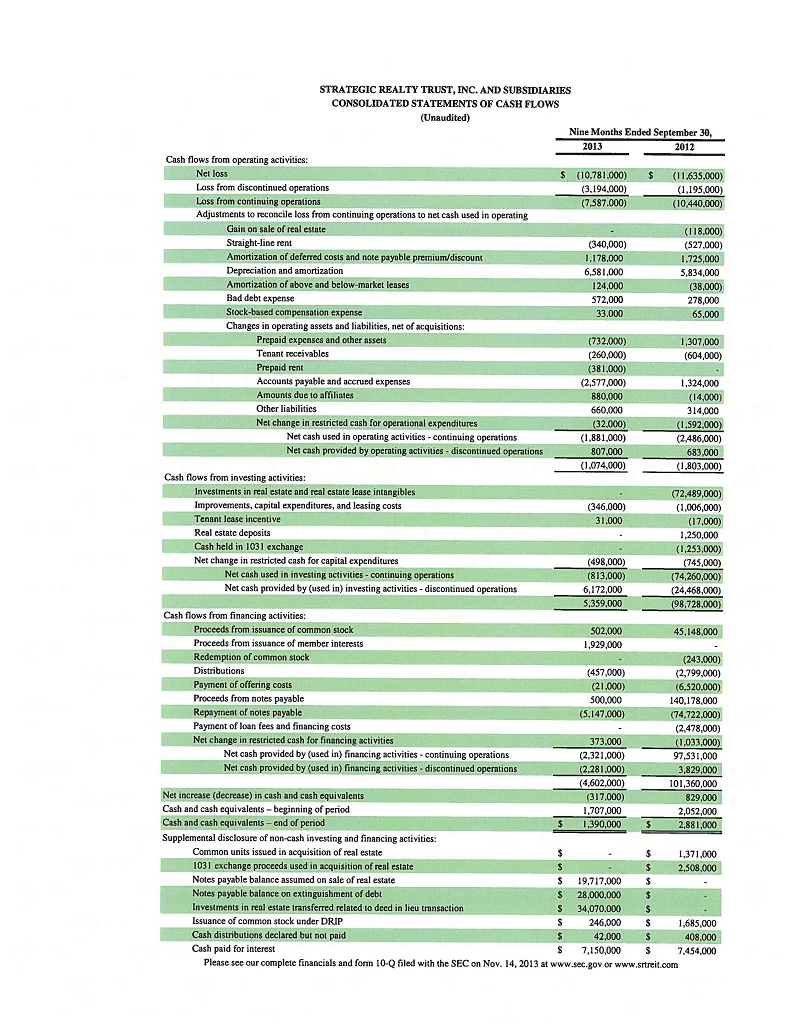

As of September 30, 2013, the two major uses of cash flow have been to pay down property-secured debt by $5.1 million and to reduce accounts payable by $2.5 million. These are important steps to restoring a sound financial position for the Company.

With three properties held for sale it is hard to compare rents and property operating expenses on the income statement as the three properties’ revenues and expenses are netted and shown as discontinued operations, as we are required to do under Generally Accept Accounting Principles (GAAP). In the future, we will look to include some supplemental information that may clarify some of the property operations.

General & Administrative Costs

G & A costs were down to $706,000 for the quarter from $993,000 last year. The expenses were about 1.2% of total assets which is more in-line for a REIT of this size. During the third quarter the internal accounting staff was laid off as part of the move to the new advisor, who will provide all accounting services. In conjunction with being appointed the new advisor Glenborough also rebated $150,000 in fees under the original consulting contract. Our biggest hurdle to achieve continued reduction in the G & A expense is Mr. Thompson. He has sued the Company for $10 million related to the termination of his property management agreements and is part of a group that has launched a proxy battle to take control of the board of directors, apparently as part of a plan to reinstate his companies as the advisor and property manager. We are making significant progress to improve the Company’s operations and financial position; unfortunately, the significant legal fees and proxy solicitation costs to defend the Company against Mr. Thompson and his group could hamper our efforts to reduce costs.

Lahaina Gateway Center

The third quarter financials reflect the transfer of the Lahaina property back to the lender. The total loss on the extinguishment of debt was $5,394,000. Actions taken mitigated the risks outlined below, and avoided litigation and foreclosure proceedings and potential losses to the Company that could have reached $15,000,000 or more. Additionally, a protracted legal battle with the lender would likely have paralyzed the Company, in a worst-case scenario leading to a fire-sale liquidation of the Company to resolve those issues.

There were significant real estate operating risks facing the Lahaina asset. The two largest tenants were Barnes and Noble and Office Max. The Company faced a real risk that one or both tenants could vacate the property prior to the end of their tenancies, and/or not renew their leases, which would seriously decrease the value of the center, and worsen the Company’s burden related to the already negative cash flow from the asset. Both retailers’ sales are below national averages for their retail segment and the higher rents in Hawaii versus the mainland cause their rent as a percentage of sales to move in the mid to high teens, signaling that the store might not be profitable for the chain.

Barnes and Noble’s CEO has publically said the he would like to close “over a third of the their stores” and one analyst report states “the chain is planning on closing roughly 350 stores (half of their total stores) over the next five or six years as leases expire.” Their lease expires in January of 2018 and they must provide notice for a renewal by July 2017. This deadline is just months before the loan would have been due and would have clouded any sale of the asset.

Office Max had obtained a reduction in their rent in 2010 from the prior owner due to poor sales. Industry analysts have projected that Office Max may be closing about 20% of their stores in the near term and their new store prototype is about half the size of this one. Their lease expires in March of 2019, and requires notice for a renewal by September of 2018. Again the timing is problematic, as that date is months after the loan maturity date (or any sales date needed to repay the loan). Uncertainty regarding this major renewal would severely impact the value of the center at loan maturity. If either or both tenants left, it would be very difficult and expensive to find a large replacement anchor tenant on an island of only 150,000 people.

TNP claims the property was worth more than the debt and bases that on a June 2012 appraisal, which valued the center at $37.7 million. The appraisal pointed out as a risk that certain tenants, including Hawaii Golf and Tennis and the Melting Pot, had unsustainably high rent to sales ratios, but nonetheless the appraiser calculated valuations assuming a high probability that both of those tenants would renew their leases. As reflected in the warning, but not the value, both tenants vacated due to the high cost of rent compared to their sales. Along these lines, both Office Max and Barnes and Noble operate with leasing costs in excess of 15% of sales, raising a red flag as to the success of those operations. Again, however, that appraisal assumes a high probability that Barnes and Noble and Office Max will renew their leases, which in our opinion are both questionable assumptions.

In addition to the significant real estate valuation and operational risks outlined above, as described previously (see the Company’s 8-K filed with the SEC on August 7, 2013, available on our website SRTreit.com), the loan terms and structure presented the Company with significant additional risks.

| · | The property was a cash flow drain on Company assets, with an interest rate of 9.4% scheduled to rise to 11.4%. |

| · | The Company could not prepay the loan by refinancing or selling the asset due to the punitive yield-maintenance provisions that would require a fee of approximately $12,000,000 in excess of the loan balance for a repayment or foreclosure in July of 2013. |

| · | The yield-maintenance provisions had the effect of postponing any sale or refinance efforts to the end of the loan term, at the very time that the assets valuation could be subject to the operation and tenant risks outlined above. |

| · | The onerous loan terms and lender approval rights make any assumption of the loan by a buyer in order to avoid yield maintenance extremely difficult, and would likely have negatively impacted the asset’s valuation. |

| · | The Company had no right to refinance the loan under the loan documents, nor any assurance of reaping any savings should the lender elect to refinance. |

| · | The Company faced full recourse liability (including yield maintenance) for the loan in certain events, including cross default provisions involving Thompson and his affiliates over which the Company had no control. These risks were enhanced given TNP’s reported significant negative net worth in 2012, as disclosed in a report by the Financial Industry Regulatory Authority. A TNP bankruptcy could subject the Company to recourse liability for the loan amount, default charges and the yield-maintenance expenses. |

| · | The lender had effective consent/control over a number of important Company matters, including board composition, board committee changes, transfers of company securities, and changes to the advisor agreement or provider that could significantly hamper future operations and strategic alternatives. |

Unfortunately, the Company’s former advisor misled the Board of Directors with respect to the Lahaina loan and acquisition, as well as its impact on the Key Bank loan. After a thorough and deliberate review of all of the issues outlined above, as well as efforts to explore alternatives with the Lahaina lender, the Board concluded that the risks and burdens of retaining the asset were significantly outweighed by any possible benefits. This result, however painful in the short term, removes significant risk from the Company’s balance sheet and positions the Company for future success.

Andrew Batinovich

CEO

Strategic Realty Trust, Inc.

Important Additional Information:

SRT expects to solicit revocations of written requests pursuant to a proxy statement to be filed with the Securities and Exchange Commission (the “SEC”). Shareholders are urged to read the proxy statement and other relevant materials when they become available because they will contain important information. SRT, its independent directors and its executive officers are, and SRT Advisor, LLC and Glenborough, LLC may be deemed to be, participants in such solicitation. Stockholders may obtain additional information regarding such participants and their interests from the proxy statement, when it is available, and from SRT’s periodic reports filed with the SEC. The periodic reports are available, and the proxy statement and other relevant documents will be available, at no charge at the web site of the SEC at www.sec.gov.

Forward Looking Statements:

This letter contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements can be generally identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “strive,” “continue” or other similar words. Readers of this letter should be aware that there are various factors that could cause actual results to differ materially from any forward-looking statements made in this letter. Factors that could cause or contribute to such differences include, but are not limited to, the outcome of litigation that may be associated with the hostile takeover attempt and difficulties and delays with property dispositions. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond our control. In particular, statements pertaining to our capital resources, portfolio performance, dividend policy and results of operations contain forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this letter.

EXHIBIT:

THIRD QUARTER PORTFOLIO OCCUPANCY AND FINANCIAL STATEMENTS