UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Strategic Realty Trust, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

STRATEGIC REALTY TRUST, INC.

400 South El Camino Real, Suite 1100

San Mateo, California 94402

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

AND INTERNET AVAILABILITY OF PROXY MATERIALS

Dear Stockholder:

On Wednesday, June 15, 2016, we will hold our 2016 annual meeting of stockholders at the Marriott Hotel, 1770 South Amphlett Boulevard, San Mateo, California 94402. The meeting will begin at 9:00 a.m. local time.

We are holding this meeting to:

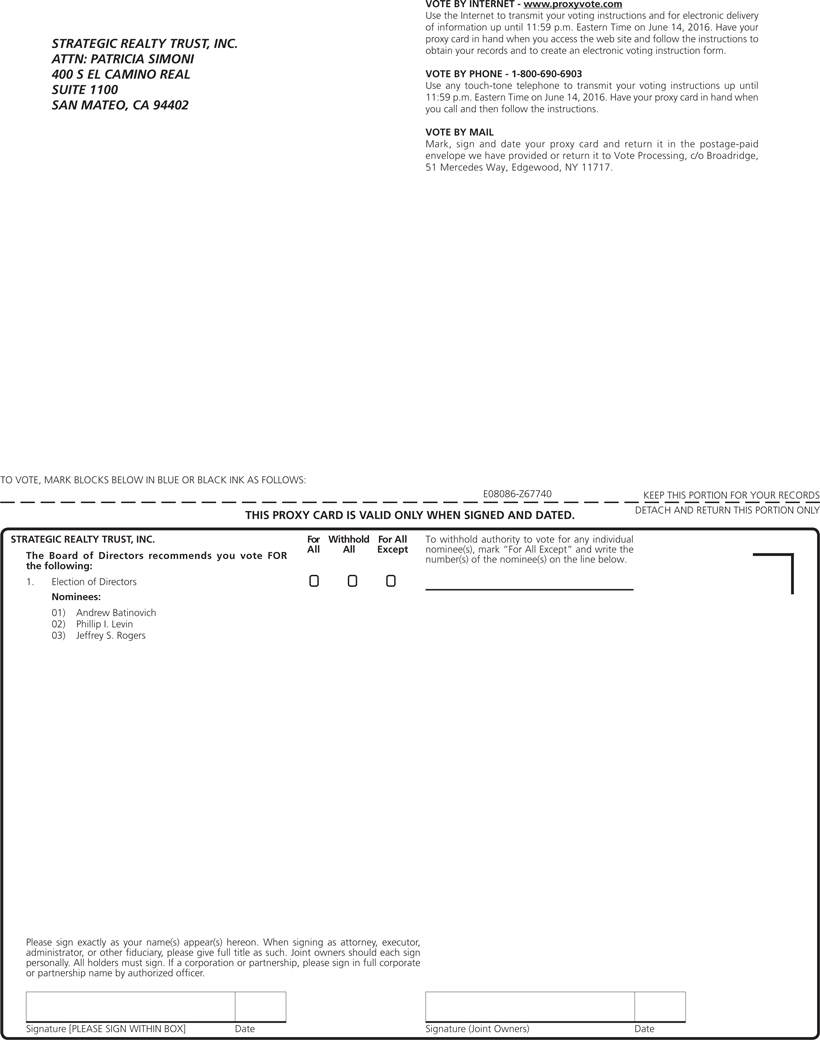

| 1. | Elect three nominees to the board of directors to serve until the 2018 or 2019 annual meeting of stockholders and until their successors are duly elected and qualified. |

The board of directors recommends a vote FOR each of the three nominees to the board of directors.

| 2. | Attend to such other business as may properly come before the meeting and any adjournments or postponements thereof. |

The board of directors has selected March 21, 2016 as the record date for determining stockholders entitled to vote at the meeting.

This proxy statement and proxy card are being mailed to you on or about April 6, 2016, along with a copy of our 2015 annual report.

Whether you plan to attend the meeting and vote in person or not, we urge you to have your vote recorded as early as possible.Please complete, sign and date the accompanying proxy card and return it in the accompanying self-addressed postage-paid return envelope. Alternatively, you may be able to vote over the Internet or by telephone, depending on how your account is registered. Please refer to the instructions on your proxy card.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 15, 2016:

Our proxy statement, form of proxy card and 2015 annual report to stockholders are also available at www.srtreit.com.

| | By Order of the Board of Directors, |

| | |

| |  |

| | Andrew Batinovich |

| | Chief Executive Officer |

April 6, 2016

San Mateo, California

TABLE OF CONTENTS

STRATEGIC REALTY TRUST, INC.

400 South El Camino Real, Suite 1100

San Mateo, California 94402

(650) 343-9300

PROXY STATEMENT

Annual Meeting Information and Purpose of Proxy Statement

We are providing these proxy materials in connection with the solicitation by the board of directors of Strategic Realty Trust, Inc. (“Strategic Realty Trust,” the “Company,” “we,” “our” or “us”), a Maryland corporation, of proxies for use at the 2016 annual meeting of stockholders to be held on June 15, 2016, at 9:00 a.m. local time at the Marriott Hotel, 1770 South Amphlett Boulevard, San Mateo, California 94402, and at any adjournments or postponements thereof for the purposes set forth in the accompanying Notice of 2016 Annual Meeting of Stockholders (the “Notice of 2016 Annual Meeting”).

This proxy statement, which includes the Notice of 2016 Annual Meeting, and the accompanying form of proxy and voting instructions are first being mailed or given to stockholders on or about April 6, 2016.

Annual Report

On April 6, 2016, our Annual Report for the year ended December 31, 2015 (which includes a copy of our Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission (the “SEC”)) was mailed to each of our stockholders of record as of the close of business on March 21, 2016.

Our Annual Report on Form 10-K, as filed with the SEC, may be accessed online through our website atwww.srtreit.com or through the SEC’s website atwww.sec.gov. In addition, you may request a copy of our Annual Report on Form 10-K by writing to us at the following address: 400 South El Camino Real, Suite 1100, San Mateo, California 94402, Attention: Secretary.

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

| Q: | Why did you send me this proxy statement? |

| A: | We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote your shares at the 2016 annual stockholders meeting. This proxy statement includes information that we are required to provide to you under the rules of the SEC and is designed to assist you in voting. |

| A: | A proxy is a person who votes the shares of stock of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. When you submit your proxy, you are appointing Phillip I. Levin, Jeffrey S. Rogers, and Terri Garnick, each of whom is one of our officers or directors, as your proxies, and you are giving them permission to vote your shares of common stock at the annual meeting. The appointed proxies will vote your shares of common stock as you instruct, unless you submit your proxy without instructions. In this case, they will vote FOR the election of each of the three nominees to the board of directors. With respect to any other proposals to be voted upon, they will vote in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion. If you do not submit your proxy, your shares will not be voted at the annual meeting. This is why it is important for you to return your proxy card to us (or authorize a proxy over the Internet or by telephone) as soon as possible whether or not you plan on attending the annual meeting. |

| Q: | When is the annual meeting and where will it be held? |

| A: | The 2016 annual meeting of stockholders will be held on June 15, 2016, at 9:00 a.m. local time at the Marriott Hotel, 1770 South Amphlett Boulevard, San Mateo, California 94402. |

| Q: | What is the purpose of the 2016 annual meeting? |

| A: | At the 2016 annual meeting, stockholders will vote on the election of three nominees to serve on the board of directors and on any other proposal to be voted on. |

Management will also report on the status of our portfolio of properties. In addition, representatives of Moss Adams LLP, our independent registered public accounting firm, are expected to attend the 2016 annual meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to questions from our stockholders.

| Q: | What is the board of directors’ voting recommendation? |

| A: | The board of directors recommends a vote FOR each of the three nominees to the board of directors. |

| Q: | Who is entitled to vote? |

| A: | Only stockholders of record at the close of business on March 21, 2016, the record date, are entitled to receive notice of the annual meeting and to vote the shares of common stock of the Company that they hold on the record date at the annual meeting, or any postponements or adjournments thereof. As of the record date, there were 11,037,948 shares of common stock issued and outstanding and entitled to vote. Each outstanding share of common stock entitles its holder to cast one vote on each proposal to be voted on. |

| Q: | What constitutes a quorum? |

| A: | A quorum consists of the presence in person or by proxy of stockholders entitled to cast 50% of all the votes entitled to be cast at the annual meeting. There must be a quorum present in order for the annual meeting to be a duly held meeting at which business can be conducted. Generally, if you submit your proxy, then you will at least be considered part of the quorum. Abstentions and broker non-votes will be counted to determine whether a quorum is present. A broker “non-vote” occurs when a broker, bank or other nominee holding shares for a beneficial owner is present in person or by proxy but does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that matter and has not received voting instructions from the beneficial owner. |

| Q: | Can I attend the annual meeting? |

| A: | You are invited to attend the annual meeting if you were a stockholder of record or a beneficial holder as of the close of business on March 21, 2016, or you hold a valid legal proxy for the 2016 annual meeting.If you are the stockholder of record, your name will be verified against the list of stockholders of record prior to your being admitted to the annual meeting. You should be prepared to present photo identification for admission. If you are a beneficial holder, you will need to provide proof of beneficial ownership on the record date as well as your photo identification, for admission. If you do not provide photo identification or comply with the other procedures outlined above upon request, you may not be admitted to the annual meeting. |

| Q: | How do I vote my shares? |

| A: | Stockholders of record may vote their shares in the following manner: |

| · | Authorizing a Proxy by Mail — Stockholders may authorize a proxy by completing the accompanying proxy card and mailing it in the accompanying self-addressed postage-paid return envelope. |

| · | Authorizing a Proxy via the Internet — Eligible stockholders may authorize a proxy by going to www.proxyvote.com and following the online instructions. |

| · | Authorizing a Proxy by Telephone — Eligible stockholders may authorize a proxy by calling 1-800-690-6903 and following the recorded instructions. |

| · | In Person at the Meeting — Stockholders of record may vote in person at the annual meeting. Written ballots will be passed out to those stockholders who want to vote at the meeting. |

For those stockholders eligible to vote by Internet, we encourage you to do so, since this method of voting is quick, convenient, and cost-efficient. Please refer to your proxy card to see if you are eligible to vote by telephone or Internet. When you vote via the Internet or by telephone prior to the annual meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted.

If your shares are held by a bank, broker or other nominee (that is, in “street name”), you are considered the beneficial owner of your shares and you should refer to the instructions provided by your bank, broker or nominee regarding how to vote. In addition, because a beneficial owner is not the stockholder of record, you may not vote shares held by a bank, broker or nominee in street name at the annual meeting unless you obtain a “legal proxy” from the bank, broker or nominee that holds your shares, giving you the right to vote the shares at the meeting.

If you elect to attend the meeting, you can submit your vote in person, and any previous votes that you submitted will be superseded. If you return your signed proxy, you shares will be voted as you instruct, unless you give no instructions with respect to one or more of the proposals. In this case, unless you later instruct otherwise, your shares of common stock will be voted FOR each of the three nominees to the board of directors. With respect to any other proposals to be voted on, your shares of common stock will be voted in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in the discretion of Messrs. Levin and Rogers and Ms. Garnick.

| Q: | What if I submit my proxy and then change my mind? |

| A: | You have the right to revoke your proxy at any time before the annual meeting by: |

| · | delivering to our secretary a written notice of revocation; |

| · | returning a properly signed proxy bearing a later date; or |

| · | attending the annual meeting and voting in person (although attendance at the annual meeting will not cause your previously granted proxy to be revoked unless you specifically so request). |

To revoke a proxy previously submitted by mail or authorized via telephone or the Internet, you may simply authorize a proxy again at a later date using one of the procedures set forth above, but before the deadline for mail, telephone, or Internet voting, in which case the later submitted proxy will be recorded and the earlier proxy revoked.

If you hold shares of our common stock in “street name,” you will need to contact the institution that holds your shares and follow its instructions for revoking a proxy.

| Q: | What happens if additional proposals are presented at the annual meeting? |

| A: | Other than the matters described in this proxy statement, we do not expect any additional matters to be presented for a vote at the annual meeting. If other matters are presented and you are voting by proxy, your proxy grants the individuals named as proxy holders the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. |

| Q: | Will my vote make a difference? |

| A: | Yes. Your vote could affect the composition of our board of directors. Moreover, your vote is needed to ensure that a quorum is present at the annual meeting so that the proposals can be acted upon.YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes. |

| Q: | What are the voting requirements to elect the director nominees? |

| A: | Under our charter, the election of a director requires the affirmative vote of holders of a majority of the shares entitled to vote who are present in person or by proxy at an annual meeting at which a quorum is present. This means that, of the shares present in person or by proxy at an annual meeting, a director nominee needs to receive affirmative votes from a majority of such shares in order to be elected to the board of directors. Because of this majority vote requirement,“withhold” votes and broker non-votes will have the effect of a vote against each nominee for director. If an incumbent director nominee fails to receive the required number of votes for reelection, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualified. If you submit a proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the board of directors. |

| Q: | Who will bear the costs of soliciting votes for the meeting? |

| A: | The Company will bear the entire cost of its solicitation of proxies from its stockholders. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees of our advisor and its affiliates, who will not receive any additional compensation for such solicitation activities. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy solicitation materials to our stockholders. |

| Q: | Who will count the votes? |

| A: | The boardof directors will appoint an independent inspector of elections to tabulate the votes. |

| Q: | Where can I find the voting results of the annual meeting? |

| A: | The Company will report voting results in a Current Report on Form 8-K filed with the SEC within four business days following the annual meeting. If final voting results are not known when such report is filed, they will be announced in an amendment to such report within four business days after the final results become known. |

| Q: | Where can I find more information? |

| A: | We file annual, quarterly, current reports and other information with the SEC. Copies of SEC filings, including exhibits, can be obtained free of charge on our website at www.srtreit.com. This website address is provided for your information and convenience. Our website is not incorporated into this proxy statement and should not be considered part of this proxy statement. Additionally, you may read and copy any reports, statements or other information we file with the SEC on the website maintained by the SEC at http://www.sec.gov. Our SEC filings are also available to the public at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. You may obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the public reference facilities. |

BOARD OF DIRECTORS

Information about Director Nominees

The following table and biographical descriptions set forth information with respect to Andrew Batinovich, Phillip I. Levin and Jeffrey S. Rogers, our director nominees. Mr. Batinovich, Mr. Levin and Mr. Rogers are all currently members of our board of directors.

| Name | | Age | | Position |

| | | | | |

| Andrew Batinovich | | 57 | | Chief Executive Officer, Corporate Secretary and Director |

| | | | | |

| Phillip I. Levin | | 76 | | Independent Director |

| | | | | |

| Jeffrey S. Rogers | | 47 | | Independent Director |

Andrew Batinovich has served as our Chief Executive Officer and as a member of our board of directors since August 2013. Mr. Batinovich has also served as our Corporate Secretary since October 2013. From August 2013 through January 2014, Mr. Batinovich also served as our Chief Financial Officer. Mr. Batinovich has over 30 years of experience in the acquisition and management of commercial properties including retail, office and industrial. Mr. Batinovich also serves as President and Chief Executive Officer of Glenborough, a privately held full-service real estate investment and management company focused on the acquisition, management and leasing of institutional quality commercial properties including retail, office and industrial properties. From December 2006 to October 2010, Mr. Batinovich served as President and Chief Executive Officer of Glenborough Acquisition Co., a company formed by an affiliate of Morgan Stanley which acquired Glenborough Realty Trust, a NYSE-listed REIT, in 2006 in a transaction valued at $1.9 billion. In 1996, Mr. Batinovich co-founded Glenborough Realty Trust, and served as President from 1997 to 2010, and as Chief Executive Officer from 2003 to 2010. Mr. Batinovich also served as Glenborough Realty Trust’s Chief Operating Officer from 1996 to 2002 and Chief Financial Officer from 1996 to 1997. During his 11 years with Glenborough Realty Trust, the company grew from just over $100 million in assets to approximately $1.9 billion. Prior to founding Glenborough Realty Trust, Mr. Batinovich served as Chief Operating Officer and Chief Financial Officer of Glenborough Corporation, a private real estate investment and management company, from 1984 until its merger with Glenborough Realty Trust in 1996. Prior to joining Glenborough Corporation in 1983, Mr. Batinovich was an officer of Security Pacific National Bank. Mr. Batinovich has served as an independent director of Sunstone Hotel Investors (SHO: NYSE), a public REIT that invests in hotel properties, since November 2011, and as an independent director of RAIT Financial Trust (RAS: NYSE), a public REIT that provides debt financing options to owners of commercial real estate and invests directly into commercial real estate, since March 2013. In addition, Mr. Batinovich is currently an independent director of G. W. Williams Co., a privately owned real estate company primarily focused on West Coast multi-family properties. Mr. Batinovich earned a BA in International Business Administration from the American University of Paris.

The board of directors has determined that Mr. Batinovich is qualified to serve as one of our directors due to his significant management experience for public and private real estate companies.

Phillip I. Levinhas served as one of our independent directors since April 2011. Mr. Levin has served, since 1991, as President of Levin Development Company, a real estate development and consulting firm. Prior to founding Levin Development Company in 1991, Mr. Levin served for approximately 16 years with Coopers & Lybrand, L.L.P. (now PricewaterhouseCoopers), where he became the Managing Partner of the firm’s consulting practice in Michigan. From 1970 to 1974, Mr. Levin served as Manager of the Consulting Services Division of Arthur Young & Company (now Ernst & Young) in Toledo, Ohio. Prior to joining Arthur Young & Company, Mr. Levin served as a Financial Analyst for Ford Motor Company for approximately eight years. Mr. Levin holds a Master of Business Administration in Finance and a Bachelor of Science degree in Accounting from the University of Pittsburgh.

The board of directors has determined that Mr. Levin is qualified to serve as one of our directors due to his experience as an officer of a real estate development and consulting firm and his professional experience as a certified public accountant. In addition, the board of directors believes that Mr. Levin is qualified to serve as the financial expert and chairperson of the audit committee due to his extensive experience as a certified public accountant.

Jeffrey S. Rogers has served as one of our independent directors since March 2009. Currently, Mr. Rogers is the President and Chief Executive Officer of LiftForward, Inc. LiftForward is an online financial community that connects investors with small businesses seeking capital. Prior to LiftForward, Mr. Rogers was the President of Zazma, Inc. (now known as Behalf, Inc.), which provides online financing to small and medium-sized businesses for the purchase of inventory, supplies, equipment and services. Prior to Zazma (now known as Behalf, Inc.), Mr. Rogers, as President and Chief Operating Officer, grew and managed one of the largest professional services firms in the United States, Integra Realty Resources, Inc. Integra, with 64 offices in the United States and Mexico, serves financial institutions, corporations, law firms, and government agencies. Under his leadership, the company built proprietary analytical technology in the industry, which fueled record growth for the company over a nine-year period. Prior to joining Integra, Mr. Rogers held other operating positions and worked for several Wall Street firms as an investment banker. Mr. Rogers currently serves on the board of directors of Presidential Realty Corp., a public real estate investment trust (“REIT”). Mr. Rogers has also served on the Finance Committee of the Young Presidents Organization since March 2009 and as Audit Committee Chairman from July 2010 to July 2012. Mr. Rogers earned a Master of Business Administration degree from The Darden School, University of Virginia in Charlottesville, Virginia, a Juris Doctorate degree from Washington and Lee University School of Law in Lexington, Virginia and a Bachelor of Arts degree in Economics from Washington and Lee University.

The board of directors has determined that Mr. Rogers is qualified to serve as one of our directors due to his previous leadership position with a commercial real estate valuation and counseling firm and his professional experience.

Information about Directors Continuing in Office

The following table and biographical descriptions set forth information with respect to the member of our board of directors who is not up for election at the 2016 annual meeting.

| Name | | Age | | Position |

| | | | | |

| Todd A. Spitzer | | 55 | | Chairman of the Board and Independent Director |

Todd A. Spitzerhas served as one of our independent directors since January 22, 2014. Mr. Spitzer has also served as the Chairman of our board of directors and the Co-Chair of the audit committee since January 2014. Mr. Spitzer is currently the Orange County California Supervisor for the Third District. Mr. Spitzer has chaired the Orange County California Transportation Authority’s Finance and Administration Committee since January 2013 where he oversees the finances of the $1.2 billion agency, as well as the funds managed through the county’s transportation taxes. Since January 2013, he has also been a voting member of the Foothill and San Joaquin Hills Transportation Corridor Agencies. In addition, since 2011, Mr. Spitzer has been a consultant and social media advisor with expertise designing social media platforms and policies for broker–dealers regulated by FINRA and the SEC. From 2010 to the present, Mr. Spitzer has also served as an attorney at law at the Spitzer Law Office. From 2008 through 2010, Mr. Spitzer served as an assistant district attorney in the Orange County California District Attorney’s Office. Between December 2002 and November 2008, Mr. Spitzer served as an elected member of the California State Assembly. Mr. Spitzer earned a Master in Public Policy degree from the University of California, Berkeley in Berkeley, California, a Juris Doctorate degree from the University of California Hastings College of Law, in San Francisco, California, and a Bachelor of Arts degree in Government from the University of California, Los Angeles in Los Angeles, California.

The board of directors has determined that Mr. Spitzer is qualified to serve as one of our directors due to the depth of his experience in public policy and governance and his professional experience as an attorney. The board has also determined that Mr. Spitzer meets the independence standards of our corporate governance documents, the SEC, the New York Stock Exchange (“NYSE”) and applicable law.

EXECUTIVE OFFICERS

The following table and biographical descriptions set forth information with respect to our executive officers:

| Name | | Age | | Position |

| | | | | |

| Andrew Batinovich | | 57 | | Chief Executive Officer, Corporate Secretary and Director |

| | | | | |

| Terri Garnick | | 55 | | Chief Financial Officer and Treasurer |

For biographical information regarding Mr. Batinovich, see “Board of Directors—Information about Director Nominees” above.

Terri Garnick has served as our Chief Financial Officer and Treasurer since January 2014. Since April 2005, Ms. Garnick has served as Senior Vice President and Chief Accounting Officer for our property manager, Glenborough. Ms. Garnick oversees all property management accounting, financial statement preparation, SEC reporting, cash management, internal audit, external audit coordination, and tax returns for Glenborough and its investment affiliates, as well as information technology and human resources functions. Ms. Garnick and Glenborough have been providing accounting services to the Company since May 2013. From June 2001 until April 2005, Ms. Garnick worked as Special Projects Coordinator at Glenborough. Between January 1996 and June 2001, Ms. Garnick served as Senior Vice President and Chief Accounting Officer for Glenborough Realty Trust, Inc., a real estate investment trust with a portfolio of primarily office properties. Prior to the merger of Glenborough with Glenborough Realty Trust, Inc., Ms. Garnick served from August 1992 until January 1996 as Vice President of Glenborough Corporation, a private real estate investment and management firm. Prior to her promotion to Vice President, Ms. Garnick worked at Glenborough Corporation as an Accounting Manager from October 1989 until August 1992. Before joining Glenborough Corporation in 1989, Ms. Garnick was Controller at August Financial Corporation, a real estate investment and management company and a Senior Accountant at Deloitte, Haskins & Sells, an accounting firm. Ms. Garnick earned a certified public accountant designation from the state of California and holds a Bachelor of Science degree in Accounting from San Diego State University.

CORPORATE GOVERNANCE

Board of Directors

The board of directors held 15 meetings during the fiscal year ended December 31, 2015. Each of our current directors attended at least 75% of the aggregate of the total number of meetings of the board of directors held during the period for which he served as a director and the aggregate total number of meetings held by all committees of the board of directors on which he served during the periods in which he served.

Director Attendance at Annual Meetings

Although we have no policy with regard to attendance by the members of the board of directors at our annual meetings, we invite and encourage the members of the board of directors to attend our annual meetings to foster communication between stockholders and the board of directors. All of our current directors were present, either in person or by telephone, at the 2015 annual meeting of stockholders held on September 25, 2015, which was adjourned due to a lack of a quorum.

Contacting the Board of Directors

Any stockholder who desires to contact members of the board of directors may do so by writing to: Strategic Realty Trust, Inc. Board of Directors, 400 South El Camino Real, Suite 1100, San Mateo, California 94402, Attention: Secretary. Communications received will be distributed by our secretary to such member or members of the board of directors as deemed appropriate by our secretary, depending on the facts and circumstances outlined in the communication received. For example, if any questions regarding accounting, internal accounting controls and auditing matters are received, they will be forwarded by our secretary to the audit committee for review.

Director Independence

We have a four-member board of directors. We do not consider Andrew Batinovich to be an independent director. Mr. Batinovich is affiliated with our advisor and property manager and currently serves as our chief executive officer. The three remaining directors comprising our current board of directors qualify as “independent directors” as defined in our charter in compliance with the requirements of the North American Securities Administrators Association’s Statement of Policy Regarding Real Estate Investment Trusts. Although our shares are not listed on any national securities exchange, we consider our three independent directors, who constitute a majority of our board of directors and all of the members of the audit committee, to be “independent” as defined by the NYSE.

Our charter provides that a majority of the directors must be “independent directors.” As defined in our charter, an “independent director” is a person who is not, on the date of determination, and within the last two years from the date of determination has not been, directly or indirectly, associated with our sponsor or our advisor by virtue of (1) ownership of an interest in our sponsor, our advisor, or any of their affiliates, other than us; (2) employment by our sponsor, our advisor, or any of their affiliates; (3) service as an officer or director of our sponsor, our advisor, or any of their affiliates, other than as one of our directors; (4) performance of services, other than as a director, for us; (5) service as a director or trustee of more than three real estate investment trusts organized by our sponsor or advised by our advisor; or (6) maintenance of a material business or professional relationship with our sponsor, our advisor, or any of their affiliates.

Nomination of Directors

We do not have a standing nominating committee or another committee performing a similar function. Our board of directors has determined that it is appropriate for us not to have a nominating committee because our four-member board of directors, which considers all matters for which a nominating committee would be responsible, has three independent directors. Each member of our board of directors participates in the consideration of nominees. Our board of directors considers many factors in connection with each candidate, including judgment, integrity, diversity, prior experience, the value of the candidate’s experience relative to the experience of other board members and the candidate’s willingness to devote substantial time and effort to board responsibilities. We do not have any minimum qualifications with respect to nominees; however, our charter requires that our affiliated directors have at least three years of relevant experience demonstrating the knowledge and experience required to successfully acquire and manage the type of assets being acquired by us and that at least one of our independent directors has three years of relevant real estate experience. Our board of directors does not have a formal written policy regarding the consideration of diversity in identifying director nominees. Nevertheless, considerations of diversity will continue to be important factors in identifying and recruiting new directors.

Our board of directors also will consider recommendations made by stockholders for director nominees. In order to be considered by our board of directors, recommendations made by stockholders must be submitted within the timeframe required to request a proposal to be included in the proxy materials. See “Proposals for 2017 Annual Meeting.” In evaluating the persons recommended as potential directors, our board of directors will consider each candidate without regard to the source of the recommendation and take into account those factors that our board of directors determines are relevant. Stockholders may directly nominate potential directors (without the recommendation of our board of directors) by satisfying the procedural requirements for such nomination as provided in our bylaws.

Board Leadership Structure; Role in Risk Oversight

It is the policy of the board of directors that the role of chairman is separate from that of chief executive officer. Therefore, the positions of chairman of the board and chief executive officer are held by separate persons. In addition, the board of directors has determined that the chairman shall be independent within the meaning of the NYSE listing standards. Currently our chairman of the board is Mr. Spitzer and our chief executive officer is Mr. Batinovich. Mr. Spitzer has served as chairman of the board of directors since January 22, 2014. Prior to January 22, 2014, John B. Maier II served as chairman of the board, a position he had held since October, 2013. Mr. Batinovich was appointed our chief executive officer and as a member of our board of directors in August 2013. Our board of directors has three independent directors out of a four-member board.

The board believes that the current structure is appropriate and effective for our Company. The board believes that there are advantages to having an independent chairman of the board for matters such as communications and relations between the board, the chief executive officer, and other senior leadership; assisting the board in reaching consensus on particular strategies and policies; and facilitating robust evaluation processes for senior leadership, the board, and the chief executive officer. In addition, the board believes that the current leadership structure helps to ensure that the appropriate level of oversight, independence and responsibility is applied to all board decisions, including risk oversight. The duties of the independent chairman of the board include: chairing meetings of the board of directors and executive sessions of the independent directors; facilitating discussion outside board meetings among the independent directors on key issues and concerns; serving as non-executive conduit to the chief executive officer of views, concerns and issues of the directors; interacting with external stakeholders, outside advisors and employees at the discretion of the board; and supporting proper flow of information to the board to ensure the opportunity for effective preparation and discussion of business under consideration. The chairman serves as an information resource for the other independent directors and acts as a liaison between directors, committee chairs and management.

Our board of directors has an active role in overseeing the management of risks applicable to us and our operations. We face a number of risks, including economic risks, environmental and regulatory risks, and other risks such as the impact of competition. How well we manage these and other risks can ultimately determine our success. The board of directors manages our risk through its approval of all property acquisitions, assumptions of debt and its oversight of our executive officers and advisor. The board of directors may also establish committees it deems appropriate to address specific areas in more depth than may be possible at a meeting of our full board of directors, provided that the majority of the members of each committee are independent directors. To date, our board of directors has established an investment committee, an audit committee and a special committee.

Investment Committee

Our board of directors has a separately designated standing investment committee. Our board of directors has delegated to the investment committee (1) certain responsibilities with respect to investment in specific investments proposed by our advisor and (2) the authority to review our investment policies and procedures on an ongoing basis and recommend any changes to our board of directors. Currently, the only member of the investment committee is Jeffrey S. Rogers.

The investment committee is currently inactive and held no meetings during the year ended December 31, 2015. Matters that could have come before the investment committee have been referred to the entire board of directors for approval. Because it has not been used, the board of directors has voted to disband the investment committee and all matters that previously could have been delegated to the investment committee will remain under the authority of the entire board of directors.

Audit Committee

Our board of directors has a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The audit committee meets on a regular basis, at least quarterly and more frequently as necessary. The audit committee’s primary function is to assist the board of directors in fulfilling its oversight responsibilities by reviewing the financial information to be provided to the stockholders and others, the system of internal controls that management has established and the audit and financial reporting process. The current members of the audit committee are Phillip I. Levin, Jeffrey S. Rogers and Todd A. Spitzer, each an independent director. Mr. Levin is the designated audit committee financial expert. Mr. Levin and Mr. Spitzer are co-chairs of the audit committee.

The audit committee operates under a written charter. A copy of the audit committee charter is available on our web site at www.srtreit.com. The audit committee held four meetings during the year ended December 31, 2015.

Independent Auditors

During the year ended December 31, 2015, Moss Adams LLP (“Moss Adams”) served as our independent auditor and provided certain domestic tax and other services. Moss Adams has served as our independent auditor since April 2013. The audit committee intends to engage Moss Adams as our independent auditor to audit our financial statements for the year ending December 31, 2016. The audit committee may, however, select new auditors at any time in the future in its discretion if it deems such decision to be in our best interest. Any decision to select new auditors would be disclosed to the stockholders in accordance with applicable securities laws.

Pre-Approval Polices

The audit committee pre-approves all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our independent registered public accounting firm, subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(b) of the Exchange Act and the rules and regulations of the SEC. All services rendered by our independent registered public accounting firm for the years ended December 31, 2015 and 2014 were pre-approved in accordance with the policies and procedures described above.

Audit Fees and Non-Audit Fees

The aggregate fees billed to us for professional accounting services, including the audit of our financial statements and the non-audit fees charged to us by our independent registered public accounting firm, all of which were preapproved by the audit committee, are set forth in the table below.

| | | 2015 | | | 2014 | |

| Audit fees | | $ | 337,500 | | | $ | 357,400 | |

| | | | | | | | | |

| Audit-related fees | | | — | | | | — | |

| | | | | | | | | |

| Tax fees | | $ | — | | | | 66,350 | |

| | | | | | | | | |

| All other fees | | | — | | | | — | |

| | | | | | | | | |

| Total | | $ | 337,500 | | | $ | 423,750 | |

For purposes of the preceding table, all professional fees are classified as follows:

| · | Audit fees — These are fees for professional services performed for the audit of our annual financial statements and the required review of quarterly financial statements and other procedures performed by our independent auditors in order for them to be able to form an opinion on our consolidated financial statements. These fees also cover services that are normally provided by independent auditors in connection with statutory and regulatory filings or engagements. |

| · | Audit-related fees — These are fees for assurance and related services that traditionally are performed by independent auditors that are reasonably related to the performance of the audit or review of the financial statements, such as due diligence related to acquisitions and dispositions, attestation services that are not required by statute or regulation, internal control reviews, and consultation concerning financial accounting and reporting standards. |

| · | Tax fees— These are fees for all professional services performed by professional staff in our independent auditor’s tax division, except those services related to the audit of our financial statements. These include fees for tax compliance, tax planning, and tax advice, including federal, state, and local issues. Services may also include assistance with tax audits and appeals before the Internal Revenue Service and similar state and local agencies, as well as federal, state, and local tax issues related to due diligence. |

| · | All other fees— These are fees for any services not included in the above-described categories, including assistance with internal audit plans and risk assessments. |

AUDIT COMMITTEE REPORT TO STOCKHOLDERS

The audit committee of the board of directors operates under a written charter adopted by the board of directors. The role of the audit committee is to oversee the Company’s financial reporting process on behalf of the board of directors, including: (1) the integrity of the Company’s financial statements and internal control over financial reporting, (2) the Company’s compliance with legal and regulatory requirements, (3) the independent auditor’s qualifications and independence, and (4) the performance of the Company’s independent auditor and internal audit function.

The Company’s management has the primary responsibility for the Company’s financial statements as well as its financial reporting process, principles and internal controls. The independent registered public accounting firm is responsible for performing an audit of the Company’s annual financial statements and expressing an opinion as to the conformity of such financial statements with accounting principles generally accepted in the United States of America. The members of the audit committee are not full-time employees of the Company and are not performing the functions of auditors or accountants. As such, it is not the duty or responsibility of the audit committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures or to set auditor independence standards. Members of the audit committee necessarily rely on the information provided to them by management and the independent auditors. Accordingly, the audit committee’s considerations and discussions referred to below do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Company’s auditors are in fact “independent.”

In this context, in fulfilling its oversight responsibilities, the audit committee reviewed the 2015 audited financial statements with management, including a discussion of the quality and acceptability of the financial reporting and controls of the Company. The audit committee reviewed with Moss Adams, which was responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles, their judgments as to the quality and the acceptability of the financial statements and the matters required to be discussed under Statement on Auditing Standards No. 16 (Communication with Audit Committees). The audit committee received from Moss Adams the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Moss Adams’s communications with the audit committee concerning independence, and discussed with Moss Adams their independence from the Company. In addition, the audit committee considered whether Moss Adams’s provision of non-audit services is compatible with Moss Adams’s independence.

The audit committee discussed with Moss Adams the overall scope and plans for the audit. The audit committee meets periodically with Moss Adams, with and without management present, to discuss the results of their examinations and their evaluations of the overall quality of the financial reporting of the Company.

Based on the reviews and discussions described above, the audit committee recommended to the board of directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 30, 2016.

| | Audit Committee: |

| | |

| | Phillip I. Levin |

| | |

| | Todd A. Spitzer |

| | |

| | Jeffrey S. Rogers |

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Executive Officer Compensation

None of our executive officers are employed by us or receive any compensation from us in exchange for their service as our executive officers. Currently, Andrew Batinovich serves as our Chief Executive Officer and Corporate Secretary, and Terri Garnick serves as our Chief Financial Officer and Treasurer. We have no other executive officer positions. Our executive officers are officers and/or employees of our advisor or its affiliates, and our executive officers are compensated by our advisor or its affiliates, in part, for their services to us or our subsidiaries. See “Certain Relationships and Related-Party Transactions” below for a discussion of the fees paid to our advisor and its affiliates.

Director Compensation

If a director is also one of our executive officers or an affiliate of our advisor, we do not pay any compensation to that person for services rendered to us as a director. The amount and form of compensation payable to our independent directors for their service to us is determined by our board of directors, based upon recommendations from our advisor.

The following table sets forth the compensation paid to our directors for the year ended December 31, 2015:

| Name | | Fees Earned or

Paid in Cash(1) | | | Restricted

Stock

Grants(2) | | | All Other

Compensation | | | Total | |

| Phillip I. Levin | | $ | 50,000 | | | $ | — | | | $ | — | | | $ | 50,000 | |

| | | | | | | | | | | | | | | | | |

| Jeffrey S. Rogers | | | 40,000 | | | | — | | | | — | | | | 40,000 | |

| | | | | | | | | | | | | | | | | |

| Todd A. Spitzer | | | 50,000 | | | | — | | | | — | | | | 50,000 | |

| | | | | | | | | | | | | | | | | |

| Andrew Batinovich(3) | | | — | | | | — | | | | — | | | | — | |

| (1) | The amounts shown in this column include fees earned for services rendered in 2015, regardless of when paid. |

| (2) | Reflects grants of shares of restricted common stock pursuant to our incentive award plan. The amounts shown in this column reflect the aggregate fair value computed as of the grant date in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. |

| (3) | Andrew Batinovich does not receive compensation as a director because he serves as our Chief Executive Officer and Corporate Secretary. |

Cash Compensation

All directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attending meetings of the board of directors. If a director is also one of our officers, we will not pay any compensation to such person for services rendered as a director.

We pay each of our independent directors an annual fee of $40,000, which fee is paid monthly in arrears and prorated for the actual period of service. We pay each of the audit committee co-chairs an additional annual fee of $10,000, which is paid monthly in arrears and prorated for the actual period of service. We do not pay any additional fees for committee service, service as chairman of the board or a committee, or attendance at board of directors or committee meetings. Under our bylaws, director compensation for 2015 was limited to $40,000 per year, except that each co-chairman of the audit committee was entitled to an additional $2,500 per quarter.

Equity Plan Compensation

We have reserved 2,000,000 shares of common stock for stock grants pursuant to our 2009 Long-Term Incentive Award Plan, which we refer to as the “incentive award plan.” We did not grant any equity compensation awards pursuant to the incentive award plan during the year ended December 31, 2015.

Compensation Committee Interlocks and Insider Participation

We currently do not have a compensation committee of our board of directors or another committee performing a similar function because we do not plan to pay any compensation to our officers. There are no interlocks or insider participation as to compensation decisions.

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information about our common stock that may be issued upon the exercise of options, warrants and rights under our incentive award plan, as of December 31, 2015.

| Plan Category | | Number of Securities to

be Issued Upon Exercise

of Outstanding Options,

Warrants and Rights(1) | | | Weighted-

Average Exercise

Price of

Outstanding

Options,

Warrants and

Rights | | | Number of

Securities

Remaining

Available for

Future Issuance

Under Equity Compensation

Plans | |

| Equity compensation plans approved by security holders: | | | — | | | $ | — | | | | 1,950,000 | |

| Equity compensation plans not approved by security holders: | | | N/A | | | | N/A | | | | N/A | |

| Total | | | — | | | | — | | | | 1,950,000 | |

| (1) | One-third of the restricted stock granted to each independent director pursuant to the terms of our incentive award plan becomes non-forfeitable on the grant date and one-third of the remaining shares of restricted stock become non-forfeitable on each of the first two anniversaries of the grant date. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of March 31, 2016 for each person or group that holds more than 5% of our common stock, for each of our current directors and executive officers and for our current directors and executive officers as a group. To our knowledge, each person that beneficially owns our shares has sole voting and disposition power with regard to such shares.

Unless otherwise indicated below, each person or entity has an address in care of our principal executive offices at 400 South El Camino Real, Suite 1100, San Mateo, California 94402.

Name of Beneficial Owner(1) | | Number of Shares

Beneficially Owned | | | Percent of

All Shares | |

| Andrew Batinovich(2) | | | 139,517 | | | | 1.26 | % |

| | | | | | | | | |

| Todd A. Spitzer | | | 0 | | | | * | |

| | | | | | | | | |

| Phillip I. Levin | | | 10,092 | | | | * | |

| | | | | | | | | |

| Jeffrey S. Rogers | | | 14,398 | | | | * | |

| | | | | | | | | |

| Terri Garnick | | | 0 | | | | * | |

| | | | | | | | | |

| All directors and executive officers as a group | | | 164,007 | | | | 1.48 | % |

| * | Less than 1% of the outstanding common stock. |

| (1) | Under SEC rules, a person is deemed to be a “beneficial owner” of a security if he or she has or shares “voting power,” which includes the power to dispose of or to direct the disposition of such security. A person also is deemed to be a beneficial owner of any securities that he or she has a right to acquire within 60 days. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which he or she has no economic or pecuniary interest. |

| (2) | Includes 139,517 shares held by Glenborough Property Partners, LLC. Mr. Batinovich may be deemed to have beneficial ownership of the shares beneficially owned by Glenborough Property Partners, LLC. |

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors and executive officers, and any persons holding more than 10% of our outstanding common stock, have filed reports with the SEC with respect to their initial ownership of common stock and any subsequent changes in that ownership. We believe that during 2015 each of our officers and directors complied with any applicable filing requirements. In making this statement, we have relied solely on written representations of our directors and executive officers and copies of reports that they have filed with the SEC. In 2015, no person held more than 10% of the outstanding common stock.

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

The following describes all transactions and currently proposed transactions between us and any related person, since January 1, 2014, in which more than $120,000 was or will be involved and such related person had or will have a direct or indirect material interest. Our independent directors are specifically charged with and have examined the fairness of such transactions to our stockholders, and (except as noted below) are of the view that all such transactions are fair and reasonable to us.

Guaranty Fee

In connection with the acquisition financing on Osceola Village, we entered into a Master Lease Agreement with TNP SRT Osceola Village Master Lessee, LLC, a wholly owned subsidiary of our operating partnership. Pursuant to the Master Lease Agreement, our former sponsor, Thompson National Properties, LLC (“TNP”), made certain guarantees with respect to the Master Lease Agreement. As consideration for the guaranty, we entered into a reimbursement and fee agreement to provide for up-front payments and annual guaranty fee payments for the duration of the guaranty period. For the years ended December 31, 2015 and 2014, we paid $1,000 and $14,000, respectively, in guaranty fees to our Prior Advisor and its affiliates. As of December 31, 2014, guaranty fees of approximately $1,000 were included in amounts due to affiliates.

Fees Paid to our Advisor

In August 2013 we entered into an advisory agreement with our advisor and on August 3, 2015, we entered into the Second Amendment to the Advisory Agreement (as amended, the “Advisory Agreement”) with our advisor to renew the Advisory Agreement for an additional term of 12 months, beginning on August 10, 2015. In all other material respects, the terms of the Advisory Agreement remained unchanged.

Pursuant to the terms of the Advisory Agreement, we pay our advisor the fees described below, subject to certain limitations set forth in the Advisory Agreement and our charter.

| · | We pay our advisor an acquisition fee equal to 1% of (1) the cost of each investment acquired directly by us or (2) our allocable cost of an investment acquired pursuant to a joint venture, in each case including purchase price, acquisition expenses and any debt attributable to such investments. For the year ended December 31, 2015, we paid our advisor $79,000 in acquisition fees. For the year ended December 31, 2014, we did not pay our advisor any acquisition fees. |

| · | We pay our advisor an origination fee equal to 1% of the amount funded by us to acquire or originate real estate-related loans, including any acquisition expenses related to such investment and any debt used to fund the acquisition or origination of the real estate-related loans. We will not pay an origination fee to our advisor with respect to any transaction pursuant to which we are required to pay our advisor an acquisition fee. For the years ended December 31, 2015 and 2014, we did not pay our advisor any origination fees. |

| · | We pay our advisor a financing coordination fee equal to 1% of the amount made available and/or outstanding under any (1) financing obtained or assumed, directly or indirectly, by us or our operating partnership and used to acquire or originate investments, or (2) the refinancing of any financing obtained or assumed, directly or indirectly, by us or our operating partnership. For the year ended December 31, 2015, we paid our advisor a financing coordination fee of $87,000. For the year ended December 31, 2014, we paid our advisor a financing coordination fee of $300,000. |

| · | We pay our advisor a disposition fee of up to 50% of a competitive real estate commission, but not to exceed 3% of the contract sales price, in connection with the sale of an asset in which our advisor or any of its affiliates provides a substantial amount of services, as determined by our independent directors. For the year ended December 31, 2015, we paid our advisor $1,173,000 in disposition fees.For the year ended December 31, 2014, we paid our advisor $268,000 in disposition fees. |

| · | We pay our advisor an asset management fee equal to a monthly fee of 1/12th of 0.6% of the higher of (1) aggregate cost on a generally accepted accounting principles (“GAAP”) basis (before non-cash reserves and depreciation) of all investments we own, including any debt attributable to such investments or (2) the fair market value of our investments (before non-cash reserves and deprecation) if our board has authorized the estimate of a fair market value of our investments; provided, however, that the asset management fee will not be less than $250,000 in the aggregate during any one calendar year. For the year ended December 31, 2015, our advisor earned $978,000 in asset management fees, and $19,000 remained payable to our advisor at December 31, 2015.For the year ended December 31, 2014, our advisor earned $1,320,000 in asset management fees, and there was no amount payable to our advisor at December 31, 2014. |

In addition to the fees we will pay to our advisor, we or our operating partnership will pay directly, or reimburse our advisor for, certain third-party expenses paid or incurred by our advisor or its affiliates in connection with the services our advisor provides pursuant to the Advisory Agreement, subject to certain limitations as set forth in the Advisory Agreement. Those limitations include, the 2%/25% Guidelines discussed below with respect to certain general and administrative expenses. In addition, under the Advisory Agreement, to the extent that our advisor or any affiliate receives fees from any of our subsidiaries for services rendered to such subsidiary, then the amount of such fees will be offset against any amounts due to our advisor for the same services. For the year ended December 31, 2015, we incurred $250,000 of reimbursed operating expenses to our advisor, and $27,000 of reimbursed operating expenses was payable at December 31, 2015. For the year ended December 31, 2014, we incurred $72,000 of reimbursed operating expenses to our advisor, and there were no operating expense amounts payable at December 31, 2014.

2%/25% Guidelines

Under the Advisory Agreement, our advisor and its affiliates are entitled to reimbursement of actual expenses incurred for certain administrative and other services provided to us for which they do not otherwise receive a fee. We will not reimburse our advisor for any of its personnel costs or other overhead costs except for customary reimbursements for personnel costs under property management agreements entered into between our operating partnership and our advisor or its affiliates. We will not reimburse our advisor or its affiliates at the end of any fiscal quarter in which “total operating expenses” for the four consecutive fiscal quarters then ended, or the expense year, exceed the greater of (1) 2% of our average invested assets or (2) 25% of our net income for such expense year, which we refer to as the “2%/25% Guidelines.” Our advisor is required to reimburse us quarterly for any amounts by which our total operating expenses exceed the 2%/25% Guidelines in the previous expense year (the “Excess Amount”), or we may elect to subtract such Excess Amount from the “total operating expenses” for the subsequent fiscal quarter.

For purposes of the 2%/25% Guidelines, “total operating expenses” means all costs and expenses paid or incurred by us, as determined under U.S. generally accepted accounting principles, that are in any way related to our operation or to corporate business, including Advisory fees, but excluding (1) the expenses of raising capital such as legal, audit, accounting, underwriting, brokerage, listing, registration, and other fees, printing and other such expenses and taxes incurred in connection with the issuance, distribution, transfer, registration and listing of the shares, (2) interest payments, (3) taxes, (4) non-cash expenditures such as depreciation, amortization and bad debt reserves, (5) incentive fees, (6) acquisition fees, origination fees and acquisition expenses, (7) real estate commissions on the sale of property, and (8) other fees and expenses connected with the acquisition, disposition, management and ownership of real estate interests, mortgage loans or other property (including the costs of foreclosure, insurance premiums, legal services, maintenance, repair, and improvement of property). For purposes of calculating the Excess Amount, our board of directors has determined that “total operating expenses” will not include (a) amounts (i) paid to our Prior Advisor or its affiliates related to or in connection with the termination of the Prior Advisory Agreement, the dealer manager agreement, or any property management agreements or other agreements with our Prior Advisor or its affiliates, or (ii) amounts incurred in connection with the termination of the agreements described in the foregoing clause (i), including, without limitation, attorney’s fees, litigation costs and expenses and amounts paid in settlement (but excluding costs associated with obtaining lender approvals to any such termination and engagement of our advisor or its affiliates as a replacement under such agreements), and (b) “total operating expenses” incurred prior to the date of the execution of the Advisory Agreement.

Our “average invested assets” for any period are equal to the average book value of our assets invested in equity interests in, and loans secured by, real estate before deducting reserves for depreciation or bad debts or other similar non-cash reserves, computed by taking the average of such values at the end of each month during the period. Our “net income” for any period is equal to our total revenues less total expenses other than additions to reserves for depreciation, bad debts or other similar non-cash reserves and excluding any gain from the sale of our assets for such period.

Our advisor is required to reimburse the Excess Amount to us during the fiscal quarter following the end of the expense year unless (1) we elect to subtract the Excess Amount from the “total operating expenses” for the subsequent fiscal quarter, or (2) the independent directors determine that the excess expenses are justified based on unusual and non-recurring factors which they deem sufficient. If the independent directors determine that the excess expenses are justified, the Excess Amount may be carried over and included in “total operating expenses” in subsequent expense years and we will send our stockholders written disclosure, together with an explanation of the factors the independent directors considered in making such a determination. The determination will also be reflected in the minutes of the board of directors.

Issuance of Special Units to Advisor

Pursuant to the Advisory Agreement, in April 2014 we caused our operating partnership to issue to our advisor a separate series of limited partnership interests of our operating partnership in exchange for a capital contribution to our operating partnership of $1,000. The terms of the special units entitle our advisor to (i) 15% of our net sale proceeds upon disposition of our assets after our stockholders receive a return of their investment plus a 7% cumulative, non-compounded rate of return or (ii) an equivalent amount in the event we list our shares of common stock on a national securities exchange or upon certain terminations of the Advisory Agreement after our stockholders are deemed to have received a return of their investment plus a 7% cumulative, non-compounded rate of return.

Capital Infusion by Affiliate of Advisor

To enable us to meet our short-term liquidity needs for operations, as well as to build working capital for future operations, we determined that we needed to obtain a cash infusion of approximately $1,500,000 to $2,000,000 on or before July 15, 2013. In considering the available options for securing such cash infusion, we noted that all of our real property assets were encumbered with secured financing obligations, which would have restricted our ability to obtain secondary or junior financing secured by the assets. We also considered the sale of real property assets as a means of raising cash, but concluded that (1) the timing and uncertainty of such sales was disadvantageous, (2) the sale of properties with secured debt outside our line of credit with KeyBank National Association (“KeyBank”) would have resulted in significant prepayment penalties to retire current debt and (3) the sale of properties securing the KeyBank credit facility would not have resulted in net proceeds to us because, pursuant to the terms of the KeyBank credit facility, at the time all of the sales proceeds would be required to be used to pay down the KeyBank credit facility. We elected not to pursue third-party unsecured financing because such financing would have likely carried a relatively high interest rate. Further, any new financing would have required the consent of KeyBank. After considering the foregoing options, we ultimately approved a cash infusion of $1,929,000 in the form of an equity investment in Secured Holdings, our wholly owned subsidiary, by SRT Manager, an affiliate of Glenborough, as described below. As discussed below, under the agreement SRT Manager exercised control over the day-to-day business of Secured Holdings, provided that we retained control over certain major decisions with regard to property sales, acquisition, leasing and financing. We believed that, in addition to the benefits of obtaining the required infusion of working capital, the transition in day-to-day management of Secured Holdings might strengthen our position in ongoing negotiations with KeyBank with regard to an extension of our forbearance agreement with KeyBank and the restructuring of the KeyBank credit facility. The approval of KeyBank was obtained with respect to the transaction.

On July 9, 2013, SRT Manager acquired a 12% membership interest in Secured Holdings pursuant to a Membership Interest Purchase Agreement (the “Purchase Agreement”) by and among SRT Manager, Secured Holdings, us and our operating partnership. As of December 31, 2015, SRT Manager owned a 8.33% membership interest in Secured Holdings, and Secured Holdings owned two of the 15 multi-tenant retail properties in the Company’s property portfolio.For information regarding the ownership of Secured Holdings see “Transfer of Constitution Trail to Secured Holdings” and “–Entry Into Joint Venture Agreements–SGO Joint Venture” below.

Pursuant to the Purchase Agreement, SRT Manager contributed $1,929,000 to Secured Holdings in exchange for its membership interest. Following the acquisition of the 12% membership interest by SRT Manager, the remaining 88% membership interest in Secured Holdings was held by us, through our operating partnership. We also agreed to jointly and severally indemnify Secured Holdings and SRT Manager and their respective affiliates from and against any liabilities, damages, costs or expenses (including legal fees) resulting from or related to the termination of the management agreements between Secured Holdings or its subsidiaries and TNP Property Manager.

In connection with the acquisition of the membership interest in Secured Holdings by SRT Manager, SRT Manager and the operating partnership entered into the First Amended and Restated Limited Liability Company Agreement of Secured Holdings (the “Operating Agreement”) in July 2013. The day-to-day business, property and affairs of Secured Holdings were under the management and control of SRT Manager, as the sole manager of Secured Holdings. The Operating Agreement provided us with consent rights with respect to certain major decisions. SRT Manager could be removed for conduct constituting fraud, deceit, gross negligence, reckless or intentional misconduct or a knowing violation of law.

Pursuant to the Operating Agreement, we had the right, at any time, to initiate a buy-sell option with respect to the interests in Secured Holdings (the “Buy Sell Option”). SRT Manager could not exercise the Buy Sell Option. If we elected to exercise the Buy Sell Option, SRT Manager would have 30 days from the receipt of the option notice to elect to either (1) purchase our membership interest in Secured Holdings for the Distribution Amount (as defined below) allocable to us on the closing date or (2) sell its membership interest to us for the Distribution Amount allocable to SRT Manager on the closing date. The “Distribution Amount” would be an amount equal to the respective amounts that would be received by the members pursuant to the Operating Agreement (subject to adjustment on the closing date for outstanding cash balances, accounts payable and accounts receivable) in the event that Secured Holdings sold all of its properties and assets for the net asset value of the properties and assets (based upon third-party appraisals) free and clear of all liabilities other than then-existing mortgage loans and distributed the net proceeds from such sale to the members pursuant to the Operating Agreement, assuming that Secured Holdings had paid all liabilities and any and all applicable transfer taxes, document stamps, or similar fees.

Pursuant to the terms of the Operating Agreement, not less often than quarterly, after having made provisions for adequate cash reserves for current and future operating and working capital, SRT Manager would make distributions of available operating cash to the members in proportion to the members’ interests in Secured Holdings. In the event of the disposition or refinancing of a property, the net proceeds thereof would be distributed to the members within 30 days as follows: (1) first, to SRT Manager until it has received its previously unreturned capital contributions with respect to such property; (2) second, to SRT Manager until it has achieved a 7% internal rate of return with respect to its capital contributions with respect to such property; (3) next, to us until we have received our previously unreturned capital contributions with respect to such property; and (4) next, to all members in proportion to their respective membership interests.

The Operating Agreement further provided that, in the event a proposed disposition of a property (a “Proposed Disposition”) was approved by one member but failed to receive the required unanimous approval of all members, the Manager would notify the non-consenting member (the “Non-Consenting Member”) in writing and the Non-Consenting Member would have a right of first opportunity (the “ROFO”) to acquire the property that is the subject of the Proposed Disposition. If the Non-Consenting Member failed to deliver an offer for such property within 30 days’ notice, SRT Manager could pursue the Proposed Disposition on behalf of Secured Holdings. If the Non-Consenting Member did provide an offer, SRT Manager would have 10 business days from receipt of the offer to accept or reject the offer. If SRT Manager rejected the offer from the Non-Consenting Member, the property would be marketed for sale to unrelated third parties at a price in excess of the offer from the Non-Consenting Member, as set forth in the Operating Agreement.

Pursuant to the Operating Agreement, SRT Manager or its affiliates were entitled to receive the following fees from Secured Holdings:

| · | An acquisition fee payable for services rendered in connection with the selection, investigation and acquisition of investments by Secured Holdings. The total amount of the acquisition fees payable to SRT Manager or its affiliates equaled 1% of the cost of all investments, including acquisition expenses and any debt attributable to the investments. |

| · | A financing coordination fee payable for services rendered in connection with any financing obtained or assumed, directly or indirectly, by Secured Holdings or its subsidiaries and used to acquire investments, or the refinancing of any financing obtained or assumed, directly or indirectly, by Secured Holdings or its subsidiaries, in an amount equal to 1% of the amount made available or outstanding under any such financing or refinancing. |

| · | A disposition fee payable for services rendered in connection with the sale or transfer of any assets of Secured Holdings in an amount equal to up to 50% of a competitive real estate commission, but not to exceed 1% of the contract sales price. |

| · | A monthly asset management fee payable for services rendered in connection with the management of Secured Holdings’ assets in an amount equal to 1/12th of 0.6% of the higher of (1) the aggregate cost of all investments Secured Holdings owns, including the debt attributable to such investments, or (2) the fair market value of all investments Secured Holdings owns. |

In addition to the foregoing fees, SRT Manager or its affiliates were entitled to compensation for property management services pursuant to property management agreements between the us, Secured Holdings and SRT Manager or its affiliates. In addition, under the Advisory Agreement, to the extent that SRT Manager received fees from any of our subsidiaries for services rendered to such subsidiary, then the amount of such fees would be offset against any amounts due to our advisor for the same services.

In connection with our entry into the Oaktree Joint Venture, as discussed furtherbelow under“Oaktree Joint Venture,”Secured Holdings sold its two properties to the Oaktree Joint Venture. Pursuant to the Operating Agreement, the proceeds from the sale were distributed to the members of Secured Holdings. As a result, on March 12, 2015 Secured Holdings paid SRT Manager $2,102,000 in full redemption of its 8.33% membership interest in Secured Holdings.

Transfer of Constitution Trail to Secured Holdings