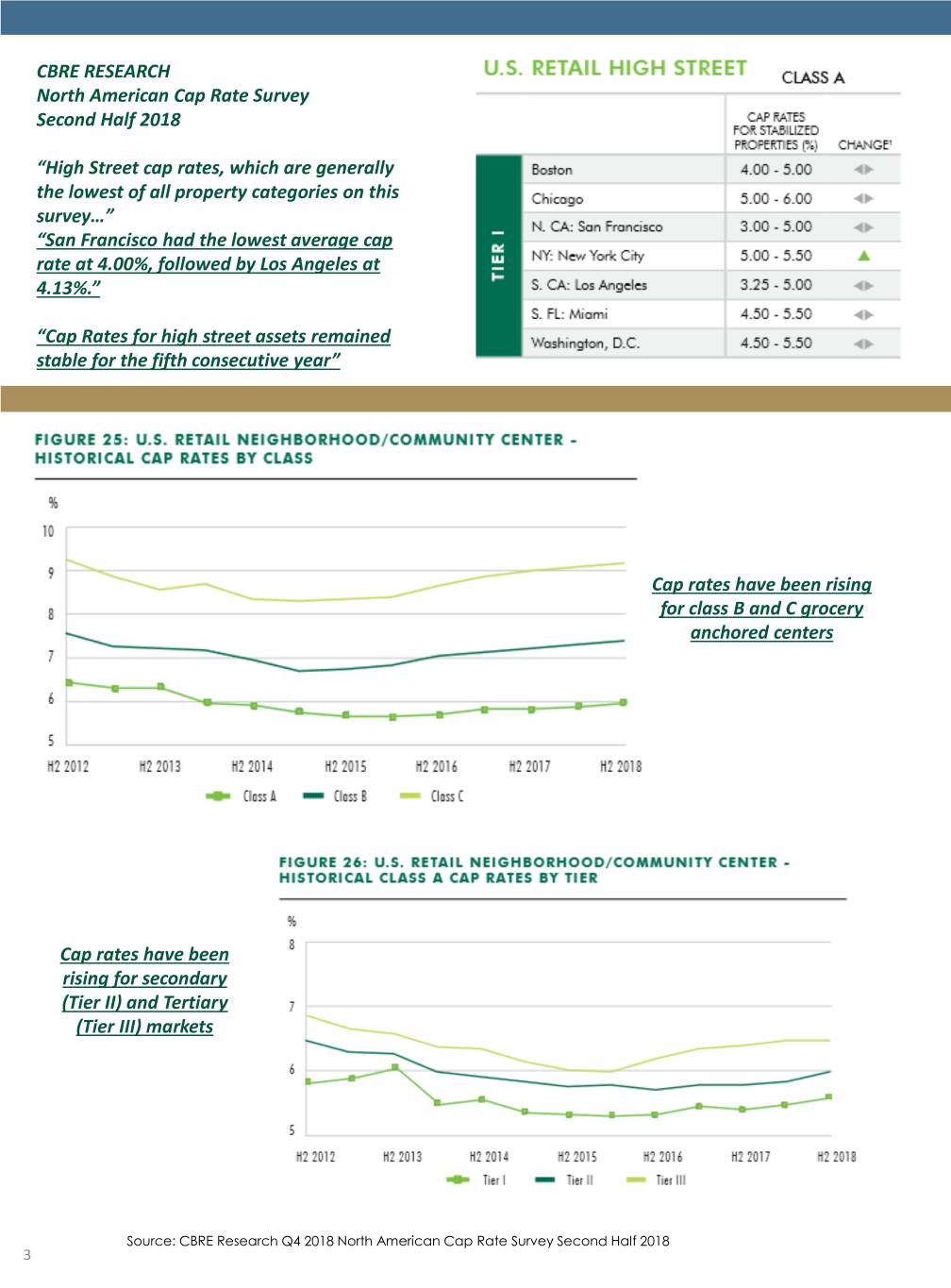

66 Bovet Road Shareholder Newsletter Suite 100 San Mateo, CA 94402 April 2019 650-343-9300 SRTREIT.com Overview and Update We continue to implement the Company’s strategic plan to build a core portfolio of high-quality west coast urban retail properties. Our strategy is to own retail estate in desirable, walkable urban locations with high population density and above-average household incomes in premier supply constrained markets. In hindsight, it appears to have been a good decision to refocus the strategy away from grocery anchored centers in secondary and tertiary markets to urban street retail in premier markets. Investor demand for urban properties in premier markets remains strong, and pricing and values, in our view, seems to be holding up while we have seen less demand and rising cap rates resulting in weakening prices for grocery anchored centers in secondary markets (see article in this newsletter). In addition the grocery business, long thought to be internet resilient by many, was definitely rattled by Amazon’s purchase of Whole Foods, which not only shocked grocers but also buyers of grocery anchored centers. The timing of the strategy shift and subsequent property sales, which was largely driven by anchor lease renewal dates and loan lockouts opening up (allowing us to prepay loans, albeit with prepayment fees), allowed us to avoid some big problems in the legacy portfolio. For example we were able (i) to sell the BI-LO grocery store in Chester, South Carolina just months before the bankruptcy of BI-LO chain, (ii) to sell Visalia Marketplace before the bankruptcy of Kmart’s parent Sears, (iii) to sell San Jacinto Plaza before the closure of Fresh and Easy Grocery Store (today the center is only 47% leased), (iv) to sell Morningside Marketplace in Fontana, CA before the Ralph’s lease ended as they were not in occupancy, and (v) to sell Willow Run in Westminster, Co before Safeway closed their grocery store. We were also able to complete some timely renewals of major tenants prior to selling of some of the legacy assets, such as (i) Kroger at Ensenada Square in Arlington, TX and (ii) Old Navy at Pinehurst Square East in Bismarck, North Dakota. We have had some setbacks as well. At Topaz in Hesperia, Fresh and Easy filed bankruptcy and vacated before we could sell the asset due to loan prepayment issues. We have been able to back fill space with a Kaiser Healthcare Clinic and offices for the County of San Bernardino and we expect to begin marketing the property for sale later this year after the County moves in. We had Gelson’s decide not to move forward with their store at the Sunset property in Hollywood, CA (please see the article in this newsletter for more information). Finally, at Turkey Creek, we marketed the property and had picked a buyer and negotiated a purchase and sale agreement that was ready for signature when one of the three tenants unexpectedly announced that they were going out of business, scuttling that sale. We are continuing to try to backfill that vacant space. Strategic Realty Trust is a non-traded real estate investment trust and is focused on building a portfolio of high quality urban and street retail properties in major west coast markets.

Overview and Update (continued) Benefits of Urban Street Retail As part of our plan we have paid off all Tenants want to be there long-term fixed rate debt to increase our flexibility. Our direct debt is much lower Above-average household incomes and a dense than we when started this transition and population base = higher retail sales per square foot. was under $18 million at year end. Omni-Channel or Internet Resistant Retailers. We are beginning construction shortly on Our portfolio includes necessity based retailers, the redevelopment of our 3032 Wilshire restaurants, services and luxury goods. project in Santa Monica, CA with our joint High barriers to entry. venture partner (please see the article in In perpetually constrained markets, it’s hard to build this newsletter for more information). new inventory, low supply leads to strong rent growth. More stable cash flow. In 2018, our Board of Directors met with three investment banks and discussed Less risk than commodity locations with low barriers various possible avenues for the to entry means lower vacancy risk. Company to raise additional equity for growth and also to look for ways to High-demand urban areas like LA and SF are provide liquidity options for existing perennially undersupplied and difficult to build shareholders. The consensus of the environments advisors and the Board was that until the Wilshire and Sunset joint ventures are further along in the development process they would be difficult to value for a new investor or buyer. When fair market value is not easily determinable, investors tend to discount the value of the asset until the value is clearer. In light of those issues it was decided that the best course of action at the time was to continue to sell the non-core assets and to work to complete the Wilshire and Sunset projects. Our Board will continue to consider options for the Company that can provide liquidity for existing shareholders and capital for growth. 2

CBRE RESEARCH North American Cap Rate Survey Second Half 2018 “High Street cap rates, which are generally the lowest of all property categories on this survey…” “San Francisco had the lowest average cap rate at 4.00%, followed by Los Angeles at 4.13%.” “Cap Rates for high street assets remained stable for the fifth consecutive year” Cap rates have been rising for class B and C grocery anchored centers Cap rates have been rising for secondary (Tier II) and Tertiary (Tier III) markets Source: CBRE Research Q4 2018 North American Cap Rate Survey Second Half 2018 3

3032 Wilshire Boulevard Santa Monica, CA We expect to close the construction loan on this redevelopment project and begin the renovation of this former Bank of America branch into a new multi-tenant retail center very soon. The project is 48% pre-leased and we are in discussions with a number of tenants for the balance of the space. The project will be expanded from 10,000 SF to 11,500 SF by increasing the size of the original partial second floor and includes 68 parking spaces in the rear lot. Wilshire Boulevard is one of Los Angeles’ Grand Boulevards commencing in downtown at Grand Avenue and continuing all 16 miles west to the ocean in Santa Monica near our site. The current tenants include LIT Fitness, who is taking the second floor and Currying Flavors and Paderia Bakehouse, who are leasing spaces off the Berkeley street side of the building. This leaves us with the prime Wilshire and corner facing spaces to lease. We are optimistic that as we begin construction we will be able reach agreements with perspective tenants to fill most or all of the remaining space. 4

Sunset and Gardner-Sunset Boulevard Hollywood, CA This project began as a build to suit for Gelson’s, a well- known Southern California regional grocer. Gelson’s signed a 20 year lease for this location which is 1.2 miles northeast of their West Hollywood Store and 2.2 miles southwest of their other Hollywood store. Based on the existing sales of those successful stores and other factors Gelson’s was very positive about this location. Upon the lease execution our joint venture partner began the site plan approval process with the City of Los Angeles. We were seeking approval of the site and building plan, but no variances for height or density were required nor any changes to zoning. As is the case in any big city there are always delays and groups that want to challenge your project, and in our case this project backs up to an elementary school which required certain considerations and concessions as well. When we received our final site and plan approvals from the City, unfortunately Gelson’s did not approve the site plan, as was their right under the terms of the build to suit lease, and decided not to move forward with this store. Their issue was they wanted us to move the main auto entrance to the underground garage from Sunset Boulevard to the Gardner Street side, which made no sense to us as Gardner Street is used as the drop off and pick up access for the elementary school behind our site, so at 8 am and 3 pm our entrance would be blocked by the traffic back up. In the meantime, Gelson’s private equity owners had put up for sale and leaseback their three company owned stores. It seems possible that the Amazon purchase of Whole Foods and entry into the grocery business may have slowed Gelson’s expansion plans and their appetite for our project. During the approval process our JV partner had negotiated a backup lease with another regional grocer, Bristol Farms, who was equally interested in the site for a new Hollywood store. When approached after Gelson’s backed out, Bristol Farms was not able to move forward. We learned that their private equity owners had the company up for sale and did not want to commit to any new leases at that point. Based on their timing, it appears they may have wanted out of grocery business after the Amazon purchase. That sale has closed, and the new buyer of the Bristol Farm chain is a Korean group, Shinsegae which is the largest retailer in Korea. Recently, before the purchase of Bristol Farms, Shinsegae leased 38,000 square feet for a new store in Downtown Los Angeles and 12,000 for headquarters office space for the push into the US market beginning in Los Angeles. We have heard that they plan to keep the Bristol Farms management that was familiar with our project in place. How fast they plan to expand is unknown at this time, but we remain in discussion with them. Prior to their acquisition by Amazon, Whole Foods also looked at our site for a 365 store (their smaller urban brand) but did not step up for whatever reason before Gelson’s took the site. Then, Whole Foods was bought by Amazon and following the sale, they were out of the market for a year or so and not looking at new sites. They came back to us late last year and asked again about the site for a 365 store and we quoted; however, since then Amazon and Whole Foods have publicly said they are now discontinuing the 365 store concept. Given all this, we are not sure where they are, but we believe they will need to have some type of small (30-40,000 SF) urban food store concept if they want access to many urban markets such as Hollywood. In short, the disruption of the grocery space continues and we continue our discussions with the grocers. (continued) 5

Important Dates Most Recent 10K Filing 3/19/2019 Next 10 Q Filing Deadline 5/15/2019 Next Shareholder Newsletter 6/10/2019 Last Distribution Payment 1/31/2019 Next Distribution Payment 4/30/2019 Sunset and Gardner-Sunset Boulevard Hollywood, CA (continued) New Potential Food Hall Use for Site To minimize the continuing risk and uncertainty in the grocery arena, in the meantime our joint venture partner has developed a food hall concept for the site as an alternate use which appears attractive. The cost is much less than the grocery store and the return on cost is anticipated to be higher. We are submitting our revised site plan for this use shortly and will also retain our approvals for the grocery store. Those approvals are good for three years from issuance and could be extended. Having a strong urban location in Hollywood, on a world renowned street like Sunset Boulevard, with a high density population and above average incomes, in a supply constrained market where retailers want to be, does provide some optionality. For more information please visit the Company’s website at www.srtreit.com. The Company is advised by SRT Advisors, LLC an affiliate of Glenborough, LLC. Glenborough also acts as the Company’s property manager. For more information please visit Glenborough’s website at www.glenborough.com. The foregoing includes forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “hope”, “hopeful”, “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The Company can provide no assurances as to its ability to acquire properties that are consistent with its strategic plan, sell properties in its current portfolio, enter into new leases or modify existing leases, successfully manage the existing properties in its portfolio, successfully develop its redevelopment projects, to obtain construction financing and execute potential strategic alternatives. These statements also depend on factors such as future economic, competitive and market conditions and other risks identified in Part I, Item IA of the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and subsequent periodic reports, as filed with the SEC. Actual events may differ materially from the anticipated events discussed above.