StrategicStrategic Realty Realty Trust Trust is is a a nonnon-traded-traded real real estate estate Shareholder Newsletter investmentinvestment trust, trust, focused focused onon building building a a portfolio portfolio of of April 2020 highhigh quality quality urban urban and and streetstreet retail retail properties properties in in SRTREIT.COM majormajor west west coast coast marketsmarkets The Year in Review Coming into 2020 the Company was making progress and had some important recent accomplishments, positive activity and momentum. The Company: • Completed an $18,000,000 financing to pay down the Company’s bank line of credit that was due February 15, 2020 with a covenant light loan (less restrictive) when compared to the prior line of credit that it replaced. • Sold its interest in the SGO Joint Ventures to add $4,200,000 of cash liquidity. • Was under contract to sell its last remaining legacy (original) properties, Topaz Marketplace in Hesperia, CA and The Shops at Turkey Creek in Knoxville, TN. • Core San Francisco and Los Angeles urban portfolio was 93% leased and occupied. • Joint Venture property at 3032 Wilshire in Santa Monica, CA was nearing construction completion and the project was 60% preleased with negotiations underway for another 16%. COVID -19 Overview How has the COVID Crisis Affected the Company? The COVID-19 crisis has dramatically affected retail businesses across the country. Mitigation policies such as shelter in place, social distancing and mandatory store closures have hampered retail tenants’ ability to stay open, retain and pay employees and rent. The majority of the Company’s tenants have had to close their stores and have had to layoff virtually all of their employees and shut down their operations. Some have stayed open with limited operations and limited staff. The Company was in contract to sell its property in Knoxville, TN (Turkey Creek), but the buyer cancelled the contract due to the uncertainty of the situation and the real estate lending and financial markets. This property is the last remaining legacy asset of the original portfolio. The buyer was an affiliate of the two tenants, Connor Steakhouse and Conner Concepts. Earlier this year in light of the impending Covid-19 threat, the Company’s Advisor and Manager began to implement its business continuity plan. The Company has been able to transition all employees and operations to a remote work environment, beginning on March 16, 2020, prior to the issuance of the shelter in place guidelines in the San Francisco Bay Area. Company operations have continued successfully during these difficult times, and we have been fortunate that our employees have remained healthy and safe while working from home. 1

Shareholder Newsletter April 2020 SRTREIT.COM How has COVID-19 Affected Retail and the Economy? For the month of March U.S. retail sales were down 8.7% from the prior year. This is the largest decline on record and outpaced the previous record of 3.9% for November 2008. Economists at JP Morgan now estimate that U.S. gross domestic product for the second quarter could decline by 40% and the unemployment rate could reach 20%. Will the COVID-19 Crisis affect the status of Company Distributions? Given the uncertainly of the present environment and the financial issues that mandated closures put on the Company’s tenants , the Board of Directors has, similar to many other public companies, voted to suspend the distribution for the first quarter of 2020 which would normally have been paid out April 30, 2020. Future distributions will be reviewed each quarter and will depend on how fast the economy regains momentum and how well the Company’s tenants perform. Will the COVID-19 Crisis affect the status of Company Death and Disability Redemption Program? The Company has also suspended the Death and Disability Program to further conserve cash. As the situation changes, the Board of Directors will continue review and may reopen the program when warranted. Financial Update At March 31, 2020 the Company had over $5,000,000 in cash and loan reserves. In addition, the Turkey Creek property in Knoxville is debt free and is available to finance if needed. The sale of the Company’s interests in the SGO Joint Ventures in the fourth quarter added $4,200,000 in cash to the overall liquidity of the Company. The Company has one secured loan and each of the Southern California joint ventures has one secured loan. In the last newsletter it was reported that the Company had paid off approximately $18,000,000 of the KeyBanc Line of Credit with a new secured loan from Prime Finance and that the balance of the line was expected to be paid from the sale of the Topaz Marketplace property in Hesperia, CA. The sale of the Topaz property closed on February 10, 2020 and the KeyBanc line was paid off in full at maturity. The Prime Finance loan is secured by six of the Company’s core urban properties in Los Angeles and San Francisco. This loan does not have the sort of restrictive covenants and ongoing debt coverage ratios that could trigger a default caused by tenants not paying rent or seeking rent relief (unlike the former line of credit). The Company has shared with the lender the status of the tenants and asked what, if any, the lender might offer in the way of concessions to the Company, including lowering or removing the Libor floor of 150 basis points on the borrowing rate. The lender has indicated as a debt fund that they have their own debt, borrowing rate floors, margin calls, bad loans and issues and are not in a position to offer any support at this time. Notwithstanding the impact of the Covid-19 crisis on the nation at large and the retail industry, the Company remains in compliance with all of the terms of its construction loan on Wilshire. That loan matures May 10, 2022, with options to extend for two additional twelve-month periods, subject to certain conditions. Similarly, the Company remains in compliance with the terms of the loan on Sunset which matures on October 30, 2020. The lender has renewed the loan once since issued and has been contacted to begin discussions about an extension. 2

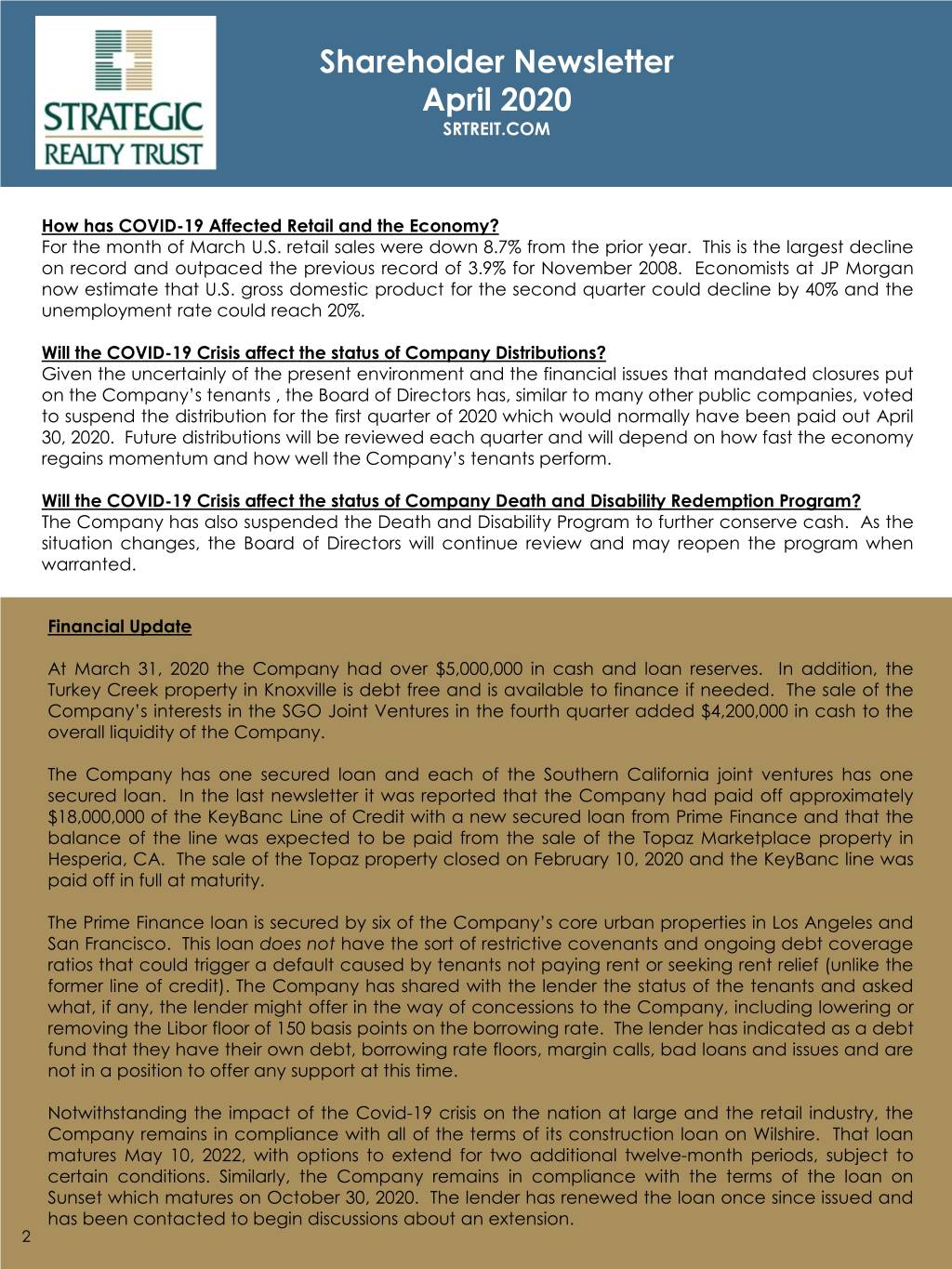

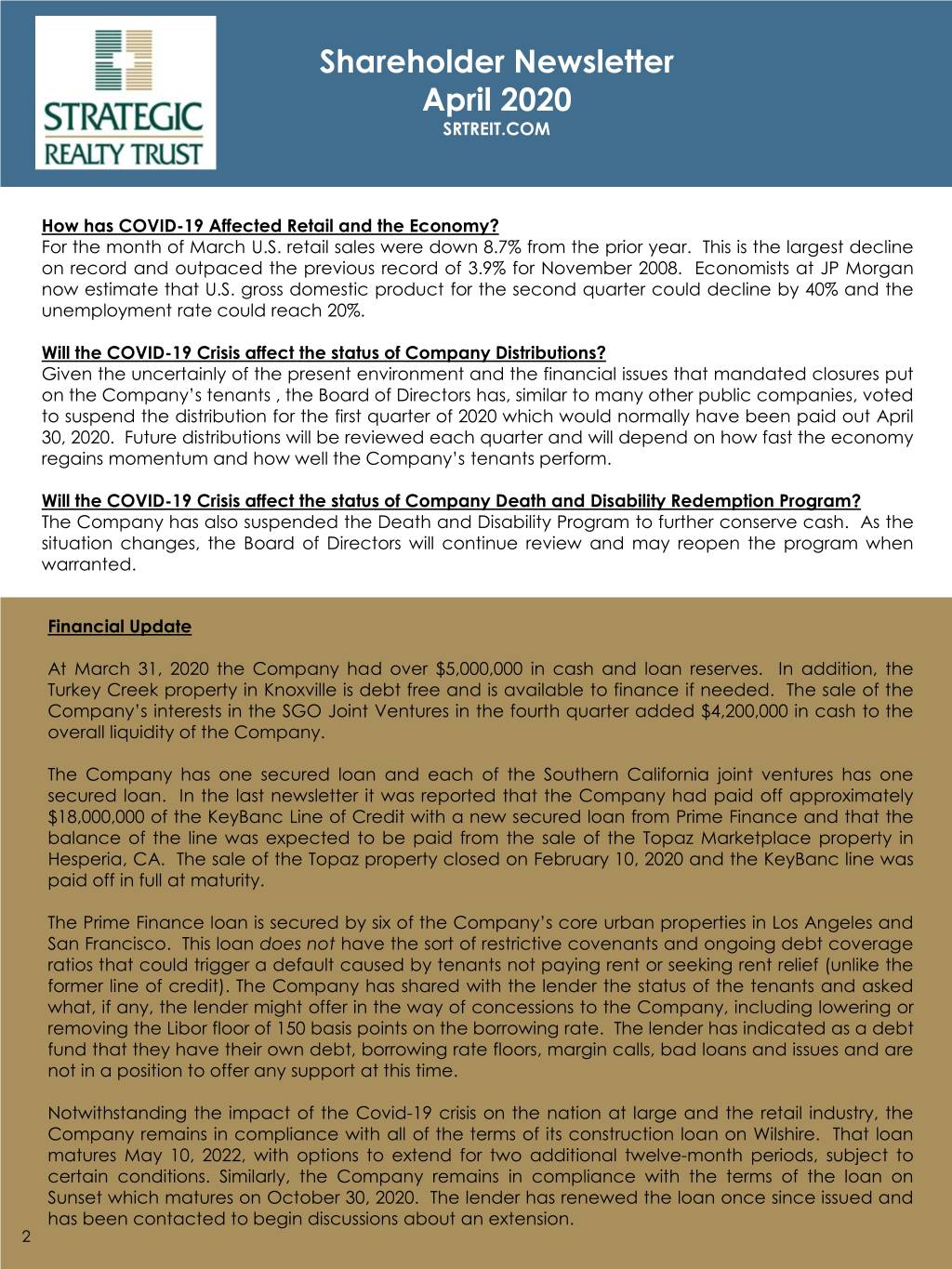

Shareholder Newsletter April 2020 SRTREIT.COM Property Update The Company has seven operating properties and two redevelopment joint ventures. The seven operating properties include six core urban retail properties and one legacy retail property. The core portfolio occupancy is 93% leased. Market Demographics - 3 Miles Property Sub Market Location SF Occ. Population Households Avg Income 400 Grove St. Hayes Valley San Francisco 2,000 100% 528,946 263,910 132,027 388 Fulton St. Hayes Valley San Francisco 3,110 100% 528,946 263,910 132,027 450 Hayes St. Hayes Valley San Francisco 3,481 100% 528,946 263,910 132,027 8 Octavia St. Hayes Valley San Francisco 3,640 47% 553,241 271,660 132,267 1790 Fulton St. NOPA San Francisco 3,759 100% 580,669 281,405 130,266 3701-3717 W Sunset Blvd. Silver Lake Los Angeles 10,500 100% 529,495 202,676 60,302 Total 26,490 93% 541,707 257,912 119,819 As previously stated , a majority of the tenants have not paid April rent and are asking for some type of rent deferral or assistance. The Company is reviewing these requests on a case by case basis and we are working with these tenants to understand the status of their businesses, the financing options available to them and their financial resources. In most cases, it is in the Company’s best interest to try to help these tenants remain in business and reopen when shelter in place orders or mandated closures are lifted. If these tenants fail, finding replacement tenants, in some cases, may be costly and take time. For more information please visit the Company’s website at www.srtreit.com. The Company is Many of the Company’s tenants are optimistic about gettingadvised openby SRT againAdvisors,and LLC gettingan affiliateback of to Glenborough, LLC. Glenborough also acts as the work. Others are concerned about future “social distancing”Company’srequirements property manager.for their Forbusinesses, more such as restaurants that may be required to remove tablesinformationor reduce pleaseseating visit Glenborough’sthereby reducing website at income, salons having to leave stations or chairs vacantwww.glenborough.com.to create distance between customers, again thereby reducing income. Others are worried that customers will be reluctant to come out and spend immediately, or that spending will be constrained by the current economic Thedownturnforegoing includes. forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which suchThestatementsCompanyare based, andmaygenerallyneedare identifiedto makeby the usesomeof wordsleasesuch as “hope”,modifications“hopeful”, “may,” “will,”or replace“seeks,” “anticipates,”some“believes,”tenants“estimates,”over“expects,”time.“plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The CompanyHowever,undertakesthereno obligationaretothoseupdate orwhorevise forwardbelieve-looking that,statementsasto reflectmorechangedtoolsassumptions,are developedthe occurrence of tounanticipatedfight COVIDevents or changes-19—to future operatingincreasedresults over time,testing,unless requiredenhancedby law. Such statementsmonitoring,are subject to knowndataand unknownanalysis,risks and uncertaintiesand identificationwhich could cause actualofresultseffectiveto differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statementstherapeutics. These statements—theare basedcountryon a numbercan,of assumptionsanchoredinvolving thebyjudgmentadviceof managementof healthcare. The Company canspecialists,provide no assurancesincrementallyas to its ability to acquire propertiesfosterthateconomicare consistent withactivityits strategic plan,insellthepropertiesnearin its currenttermportfolio,andenteratintosomenew leasespointor modifywithexisting leases,a vaccinesuccessfully manageandthetime,existing propertiesthe in its portfolio, successfully develop its redevelopment projects and execute potential strategic alternatives. These statements also depend on factors such as future economic, competitive andcountrymarket conditionsshouldand otherreturnrisks identifiedto ainmorePart I, ItemnormalIA of the Company’sstateAnnualas withReportotheron Form 10pandemics-K for the year endedinDecemberthe past31, 2018. and subsequent periodic reports, as filed with the SEC. Actual events may differ materially from the anticipated events discussed above. 3

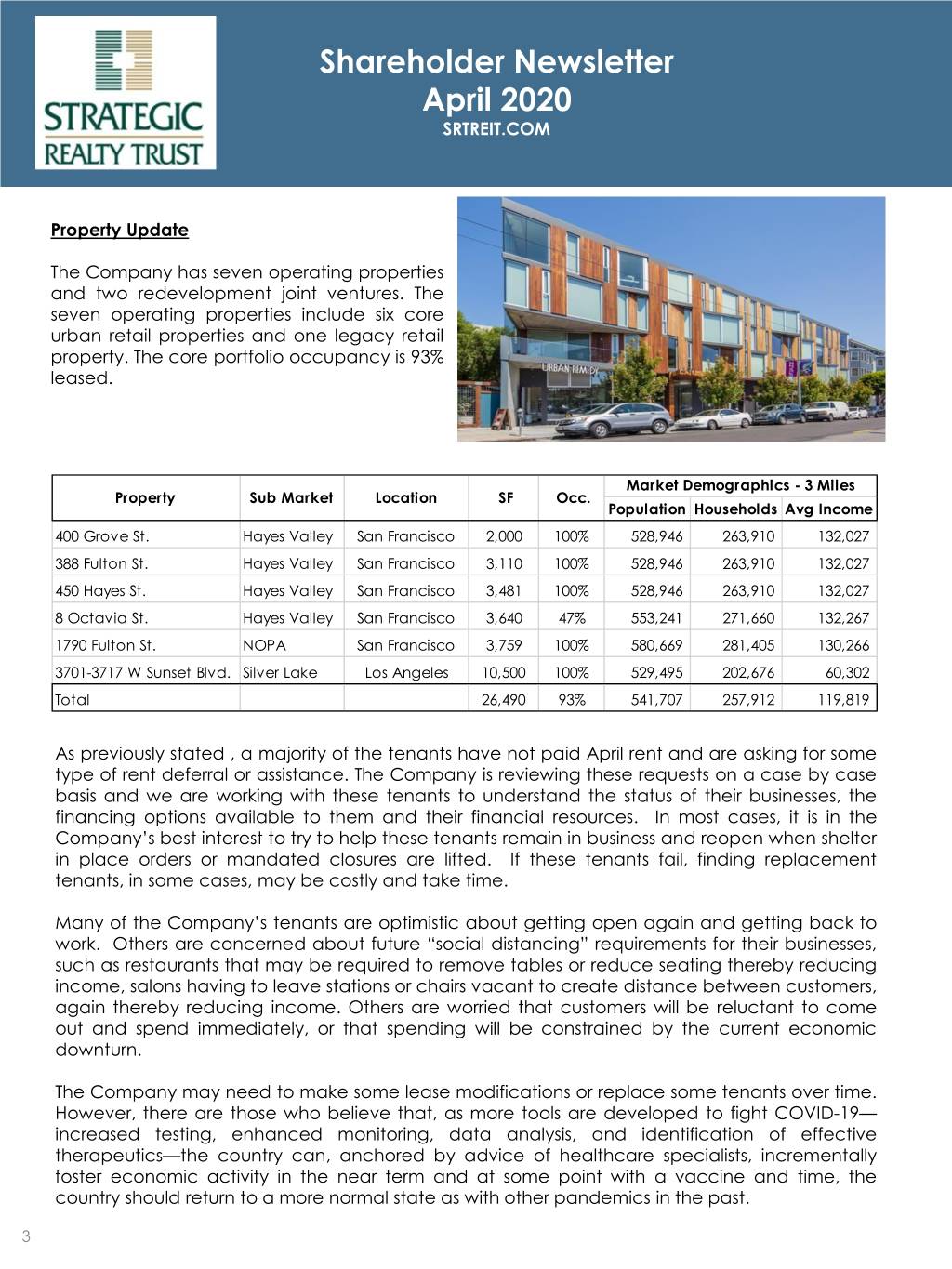

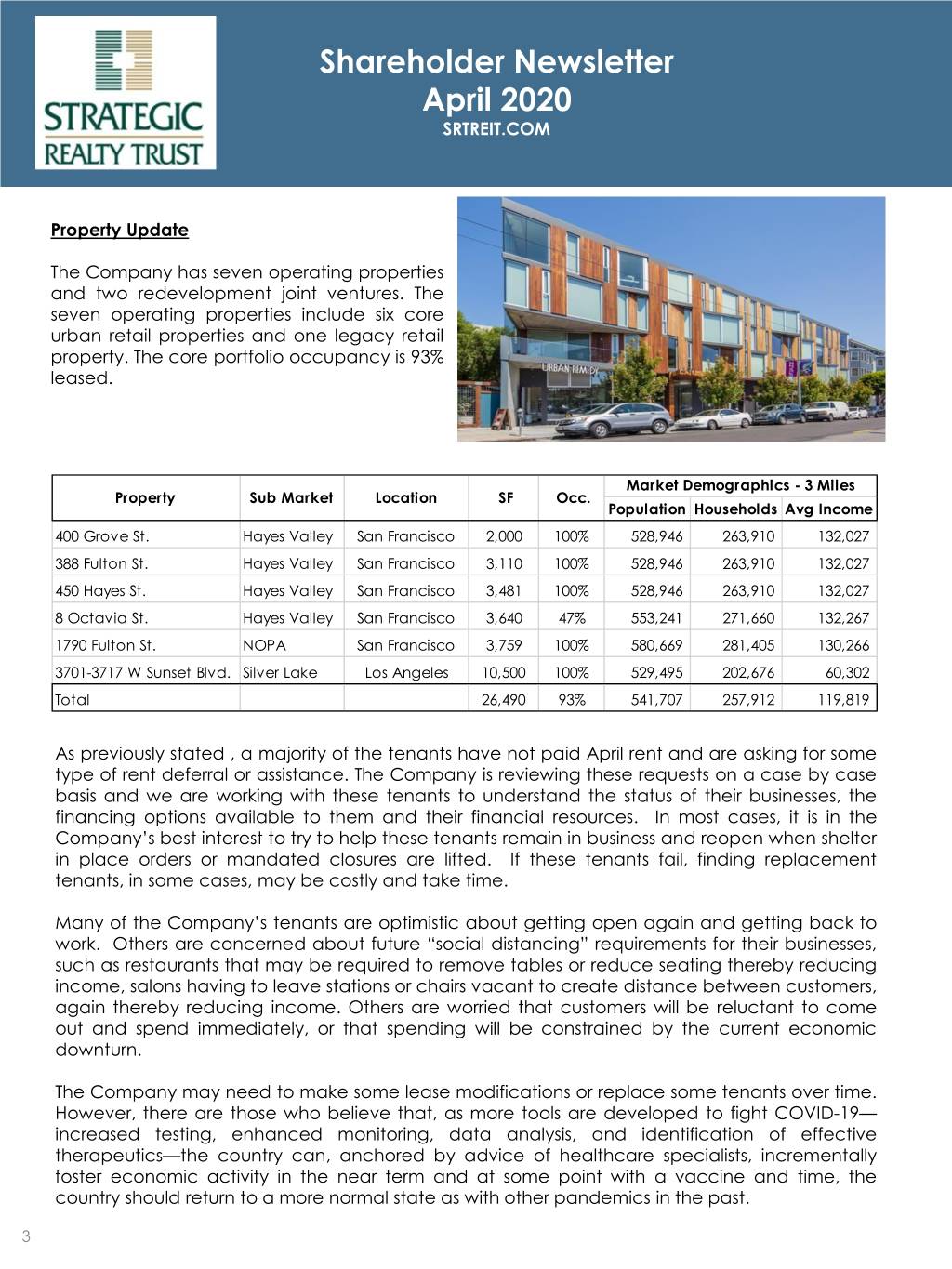

Shareholder Newsletter April 2020 SRTREIT.COM 3032 Wilshire Santa Monica, CA This project is nearing completion, with spaces ready shortly to be turned over to tenants to begin their tenant improvements. The project is 60% leased and the venture partner had three more letters of intent under negotiation when the crisis hit. These three tenants are in the food service business and they are holding off at this time to concentrate on their other locations. Since these will be limited seating spaces (with patio seating also) designed for carry out and deliver services, they could work well in a social distancing scenario. So far construction has been allowed to continue in Santa Monica, although we have experienced some minor delays as a result of shelter in place mitigation rules. Depending on market conditions this project could be stabilized later this year and we could begin to look at refinancing the construction debt with lower cost financing. The foregoing includes forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “hope”, “hopeful”, “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The Company can provide no assurances as to its ability to acquire properties that are consistent with its strategic plan, sell properties in its current portfolio, enter into new leases or modify existing leases, successfully manage the existing properties in its portfolio, successfully develop its redevelopment projects and execute potential strategic alternatives. These statements also depend on factors such as future economic, competitive and market conditions and other risks identified in Part I, Item IA of the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and subsequent periodic reports, as filed with the SEC. Actual events may differ materially from the anticipated events discussed above. 4

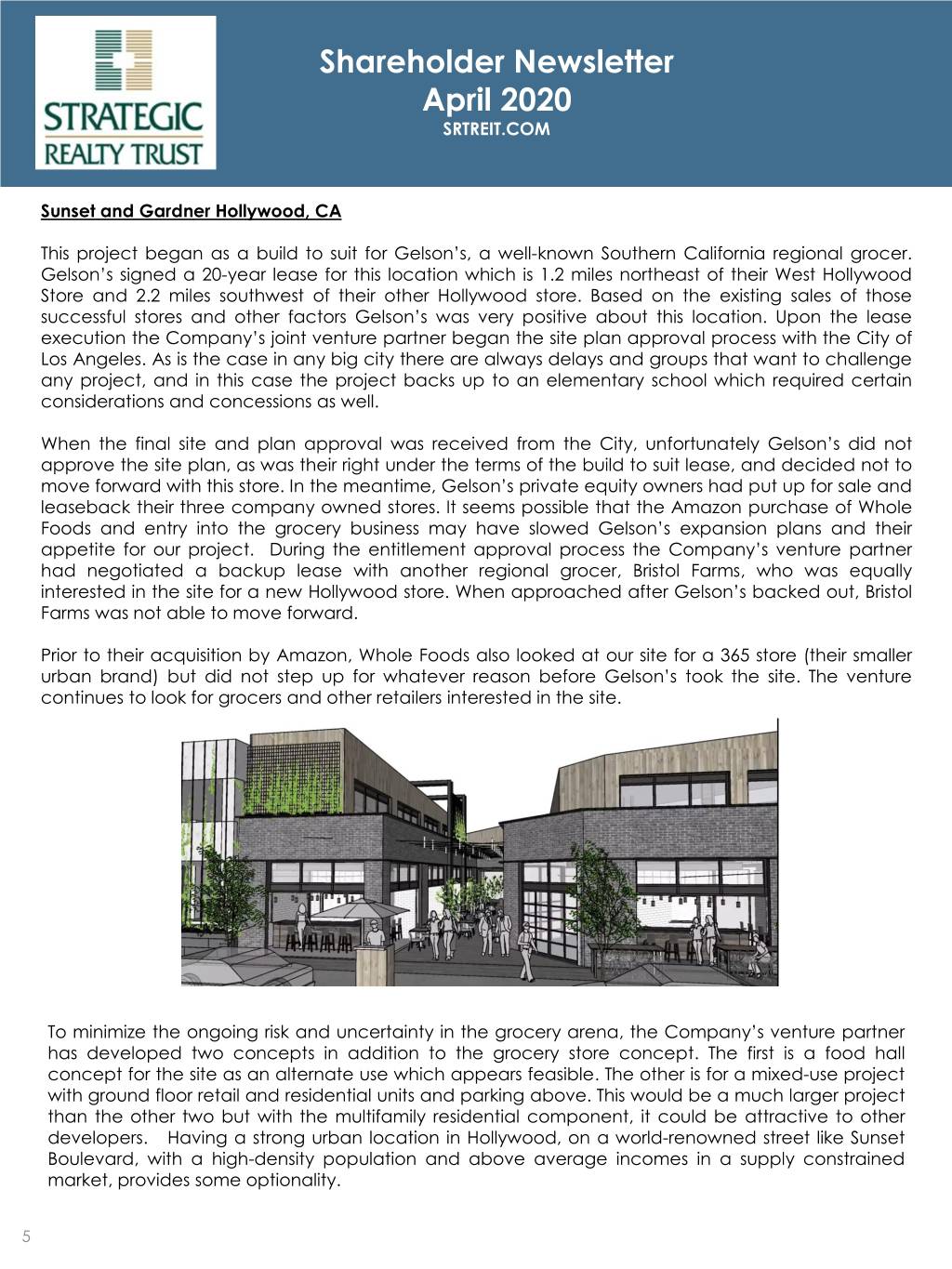

Shareholder Newsletter April 2020 SRTREIT.COM Sunset and Gardner Hollywood, CA This project began as a build to suit for Gelson’s, a well-known Southern California regional grocer. Gelson’s signed a 20-year lease for this location which is 1.2 miles northeast of their West Hollywood Store and 2.2 miles southwest of their other Hollywood store. Based on the existing sales of those successful stores and other factors Gelson’s was very positive about this location. Upon the lease execution the Company’s joint venture partner began the site plan approval process with the City of Los Angeles. As is the case in any big city there are always delays and groups that want to challenge any project, and in this case the project backs up to an elementary school which required certain considerations and concessions as well. When the final site and plan approval was received from the City, unfortunately Gelson’s did not approve the site plan, as was their right under the terms of the build to suit lease, and decided not to move forward with this store. In the meantime, Gelson’s private equity owners had put up for sale and leaseback their three company owned stores. It seems possible that the Amazon purchase of Whole Foods and entry into the grocery business may have slowed Gelson’s expansion plans and their appetite for our project. During the entitlement approval process the Company’s venture partner had negotiated a backup lease with another regional grocer, Bristol Farms, who was equally interested in the site for a new Hollywood store. When approached after Gelson’s backed out, Bristol Farms was not able to move forward. Prior to their acquisition by Amazon, Whole Foods also looked at our site for a 365 store (their smaller urban brand) but did not step up for whatever reason before Gelson’s took the site. The venture continues to look for grocers and other retailers interested in the site. To minimize the ongoing risk and uncertainty in the grocery arena, the Company’s venture partner hasThe foregoingdevelopedincludes forwardtwo-lookingconceptsstatements within thein meaningadditionof the Federalto thePrivate SecuritiesgroceryLitigationstoreReformconceptAct of 1995. The. CompanyThe firstintendsisthatasuchfoodforward-halllooking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Theseconceptstatementsforincludethestatementssite asregardingan thealternateintent, belief orusecurrentwhichexpectationsappearsof the Companyfeasibleand members. Theof itsothermanagementis forteam,aasmixedwell as the-assumptionsuse projecton which withsuch statementsgroundare based,floorandretailgenerallyandare identifiedresidentialby the use ofunitswords suchandas “hope”,parking“hopeful”,above“may,” “will,”. This“seeks,”would“anticipates,”be“believes,”a much“estimates,”larger“expects,”project“plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The thanCompanytheundertakesotherno obligationtwo butto updatewithor revisetheforwardmultifamily-looking statementsresidentialto reflect changedcomponent,assumptions, the occurrenceit couldof unanticipatedbe attractiveevents or changesto otherto future developersoperating results over. time,Havingunless requireda bystronglaw. Suchurbanstatements locationare subject to knownin Hollywood,and unknown risks andonuncertaintiesa worldwhich-renownedcould cause actualstreetresults to differlikemateriallySunsetfrom those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking Boulevard,statements. These statementswith aare highbased on-densitya number of populationassumptions involvingandthe judgmentaboveof managementaverage. The Companyincomescan providein noa assurancessupplyas constrainedto its ability to acquire properties that are consistent with its strategic plan, sell properties in its current portfolio, enter into new leases or modify existing leases, successfully manage the existing properties in its portfolio,market,successfullyprovidesdevelop itssomeredevelopmentoptionalityprojects and. execute potential strategic alternatives. These statements also depend on factors such as future economic, competitive and market conditions and other risks identified in Part I, Item IA of the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and subsequent periodic reports, as filed with the SEC. Actual events may differ materially from the anticipated events discussed above. 5

For more information please visit the Company’s website at www.srtreit.com. The Company is advised by SRT Advisors, LLC an affiliate of Glenborough, LLC. Glenborough also acts as the Company’s property manager. For more information please visit Glenborough’s website at www.glenborough.com. Property Sales MacKenzie Mini‐Tender Offer It was also reported that the Company was in You may have received correspondence from contract to sell The Shops at Turkey Creek MacKenzie Realty Capital, Inc (The “Bidder”) property, but that the buyer had not yet relating to a tender offer to purchase your released contingencies and the sale was shares of Strategic Realty Trust, Inc. (the “REIT”). subject to market closing conditions. As The Bidder has informed the Company that its discussed above the buyer eventually chose offer price will be $1.00 per share. The Board of not to go forward with the transaction. The Directors believe the Bidder’s offer price is Company expects to relist the property for substantially below the value of your shares sale. and recommend against selling your shares at that price. As you may recall, The Company In February the Company sold Topaz estimated the value of the shares of our Marketplace in Hesperia, CA for $10,450,000. common stock as $5.86 per share as of April 30, The property was 100% leased. This center 2019. For more information about the was one of the original grocer anchored Company’s valuation, see pp.26-30 of the centers and was anchored by a Fresh and REIT’s Annual Report on Form 10‐K filed with the Easy grocer who filed for bankruptcy in SEC on March 18, 2020. October 2015. Since that time the Company subdivided the center and sold off a DaVita To decline the Bidder’s tender offer, simply leased building on a new long-term lease for ignore it. You do not need to respond to $4,160,000 and backfilled the vacant grocer anything. space with two new tenants, the Country of San Bernardino and Kaiser Permanente Please be aware that the Bidder is in no way Health. The Company still holds a vacant affiliated with the Company, SRT Advisor LLC or building pad with a drive-thru. The proceeds Glenborough LLC. Although the Company’s of this sale paid off the balance of the stock is not publicly traded on an exchange, it KeyBanc line of credit. is possible to sell your shares in the secondary marketplace, which may result in share pricing in excess of the most recent tender offer amount. If you have questions about that process, please contact our shareholder services representative at 650-343-9300 or by email at shareholder.services@glenborough.com. The foregoing includes forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “hope”, “hopeful”, “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The Company can provide no assurances as to its ability to acquire properties that are consistent with its strategic plan, sell properties in its current portfolio, enter into new leases or modify existing leases, successfully manage the existing properties in its portfolio, successfully develop its redevelopment projects and execute potential strategic alternatives. These statements also depend on factors such as future economic, competitive and market conditions and other risks identified in Part I, Item IA of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent periodic reports, as filed with the SEC. Actual events may differ materially from the anticipated events discussed above 6