Exhibit (a)(5)(E)

| UNITED STATES DISTRICT COURT |

| SOUTHERN DISTRICT OF NEW YORK |

|

| ------------------------------------------------------------------------------------------------ | |

| KEN CALLEN, | |

| Plaintiff, | Case No. 1:22-cv-1903 |

| | |

| v. | COMPLAINT FOR VIOLATIONS OF |

| | SECTIONS 14(e) AND 20(a) OF |

| RESONANT INC., GEORGE B. HOLMES, | THE SECURITIES EXCHANGE ACT |

| MICHAEL J. FOX, RUBEN CABALLERO, | OF 1934 |

| ALAN B. HOWE, JACK H. JACOBS, | |

| JOSHUA JACOBS, JEAN F. RANKIN, | |

| ROBERT TIRVA and MARTIN S. | JURY TRIAL DEMAND |

| MCDERMUT. | |

| Defendants. | |

| | |

Plaintiff Ken Callen (“Plaintiff”), by his undersigned attorneys, alleges as follows based (i) upon personal knowledge with respect to himself and his own acts, and (ii) upon information and belief as to all other matters based on the investigation conducted by his attorneys, which included, among other things, a review of relevant U.S. Securities and Exchange Commission (“SEC”) filings, and other publicly available information.

NATURE OF THE ACTION

1. This action is brought by Plaintiff against Resonant, Inc. (“Resonant” or the “Company”), members of the Company’s board of directors (“Board”) and certain executive officers for violations of Sections 14(e) and 20(a) of the Securities Exchange Act of 1934 (“Exchange Act”), 15 U.S.C. § 78n(e) and § 78t(a). Plaintiff’s claims arise in connection with the Board’s recommendation that the stockholders of the Company tender their shares to PJ Cosmos Acquisition Company Inc., (“PJCAC”), a wholly owned subsidiary of Murata Electronics North America, Inc. (together with PJCAC, “Murata America”), pursuant to Murata America’s offer to acquire all of the issued and outstanding shares of Resonant for $4.50 per share in cash (“Tender Offer”).

2. On February 14, 2022, Resonant and Murata America announced that they had entered into an agreement (“Merger Agreement”) providing for Murata America to purchase all outstanding shares of Resonant in a tender offer at $4.50 per share in cash (“Merger Consideration”).

3. On February 28, 2022, Murata America commenced the Tender Offer by filing a Tender Offer Statement on Schedule TO (“TO Statement”) with the Securities and Exchange Commission (“SEC”). The TO Statement provides that the Tender Offer expires one minute after 11:59 p.m., Eastern Time, on March 25, 2022 (“Expiration Date”), unless extended or earlier terminated in accordance with the Merger Agreement. The TO Statement further provides that if the number of Resonant shares validly tendered pursuant to the Tender Offer, when added to the share already owned by Murata America, represent a majority of the total number of Resonant shares outstanding, and certain other conditions are satisfied, the Tender Offer will be consummated and PJCAC will be merged with and into Resonant under Section 251(h) of the General Corporation Law of the State of Delaware (“DGCL”) without a vote by Resonant stockholders, with Resonant continuing as the surviving corporation and a wholly-owned subsidiary of Murata America (“Merger”).

4. On February 28, 2022, Defendants filed a materially false and misleading Schedule 14D-9 Solicitation/Recommendation Statement (“Recommendation Statement”) with the SEC recommending that Resonant stockholders tender their shares to Murata America pursuant to the Tender Offer. Specifically, the Recommendation Statement contains material misrepresentations and omissions concerning, among other things: (i) the false opinions of Resonant management concerning Resonant’s projected sales from 2022-2026, as presented in the Recommendation Statement (which differ by an order of magnitude from the far more optimistic opinion concerning Resonant’s projected sales shared by Defendant Holmes four times in prior public statements); and (ii) the flawed discounted cash flow analysis prepared by Centerview Partners LLC (“Centerview”), which used relied on management’s false projections and inflated discount rates. Such material misrepresentations and omissions render the Recommendation Statement false and misleading in violation of the above-referenced Exchange Act provisions.

5. It is imperative that such violations are promptly cured to enable Resonant’s public stockholders to make an informed decision concerning whether to tender their shares to Murata America before the Expiration Date. Therefore, Plaintiff seeks to enjoin Defendants from closing the Tender Offer and/or taking any steps to consummate the Merger, until such violations are cured. Alternatively, if the Tender is closed and the Merger is consummated, Plaintiff reserves the right to recover damages suffered by himself and similarly-situated investors as a result of such violations.

JURISDICTION AND VENUE

6. This Court has subject matter jurisdiction over the claims asserted herein for violations of Sections 14(e) and 20(a) of the Exchange Act pursuant to Section 27 of the Exchange Act, 15 U.S.C. § 78aa, and 28 U.S.C. § 1331 (federal question jurisdiction).

7. This Court has personal jurisdiction over each of the Defendants because each defendant has sufficient minimum contacts with the United States so as to make the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice. See Moon Joo Yu v. Premiere Power LLC, No. 14 CIV. 7588 KPF, 2015 WL 4629495, at *5 (S.D.N.Y. Aug. 4, 2015) (because Exchange Act provides for nationwide service of process, and Defendant resides within the United States, and conducts business within the United States, he should reasonably anticipate being haled into court in the United States, and Court’s exercise of personal jurisdiction over Defendant with respect to Plaintiffs’ securities fraud claim is proper); In re LIBOR-Based Fin. Instruments Antitrust Litig., No. 11 MDL 2262 NRB, 2015 WL 6243526, at *23 (S.D.N.Y. Oct. 20, 2015) (“[w]hen the jurisdictional issue flows from a federal statutory grant that authorizes suit under federal-question jurisdiction and nationwide service of process .. . . Second Circuit has consistently held that the minimum-contacts test in such circumstances looks to contacts with the entire United States rather than with the forum state.”).

8. Venue is proper under 28 U.S.C. § 1391(b) because Defendants transact business in this District. In particular, Resonant’s common stock trades under the ticker “Resonant” on NASDAQ, which is headquartered in this District, and the false and misleading Recommendation Statement was filed with the SEC, which is headquartered in this District. See Mariash v. Morrill, 496 F.2d 1138, 1144 (2d Cir. 1974) (venue appropriate in the Southern District of New York where an act or transaction constituting the alleged violation occurred in the Southern District of New York); United States v. Svoboda, 347 F.3d 471, 484 n.13 (2d Cir. 2003) (venue in tender offer fraud prosecution appropriate in District).

PARTIES

9. Plaintiff is, and has been at all relevant times, a continuous stockholder of Resonant stock.

10. Defendant Resonant is a Delaware corporation with its principal executive offices located at 10900 Stonelake Blvd., Suite 100, Office 02-130, Austin, TX 78759. Resonant’s common stock trades on Nasdaq under the ticker symbol “RESN.”

11. Defendant George B. Holmes (“Holmes”) has, at all relevant times, served as the Chairman of the Board, and the Chief Executive Officer (“CEO”) of Resonant.

12. Defendant Michael J. Fox (“Fox”) has, at all relevant times, served as a member of the Board.

13. Defendant Ruben Caballero (“Caballero”) has, at all relevant times, served as a member of the Board.

14. Defendant Alan B. Howe (“Howe”) has, at all relevant times, served as a member of the Board.

15. Defendant Jack H. Jacobs (“Jack Jacobs”) has, at all relevant times, served as a member of the Board.

16. Defendant Joshua Jacobs (“Joshua Jacobs”) has, at all relevant times, served as a member of the Board.

17. Defendant Jean F. Rankin (“Rankin”) has, at all relevant times, served as a member of the Board.

18. Defendant Robert Tirva (“Tirva”) has, at all relevant times, served as a member of the Board.

19. Defendant Martin S. McDermut has, at all relevant times, served as the Chief Financial Officer (“CFO”) of Resonant. McDermut signed the Recommendation Statement in his capacity as CFO of Resonant.

20. Defendants identified in paragraphs 11 to 19 are collectively referred to herein as the “Individual Defendants,” and together with Resonant, collectively, the “Defendants.”

OTHER RELEVANT ENTITIES

21. Murata America is a wholly-owned subsidiary of Murata Manufacturing Co., Ltd. (“Murata Japan”), of Kyoto, Japan. Murata Japan is a global manufacturer of electronic components.

SUBSTANTIVE ALLEGATIONS

Company Background

22. Resonant designs radio frequency (RF) filters for the mobile device industry. RF filters are electronic components used in mobile devices to select required signals and filter out unwanted signals, and thereby ensure clear communication without “noise.” Signals are electromagnetic waves that transmit information. Mobile phones send signals to (and receive them from) cell towers using RF waves (which are a form of energy in the electromagnetic spectrum that falls between FM radio waves and microwaves).

Pre-Existing Relationship Between Resonant and Murata and Murata Japan

23. As an emerging manufacturer of sophisticated electronic components, Resonant sought a development partner to assist in the commercialization of its line of XBAR filters. On July 31, 2019, Resonant’s search for a partner culminated in a deal pursuant to which Resonant sold 3,960,560 shares to Murata America and other investors at $2.53/share (with 2,766,798 of those shares to be issued to Murata for approximately $7.0 million).

24. As a result of the foregoing transaction, Murata America currently owns approximately 4.1% of the outstanding shares of Resonant common stock. Therefore, in connection with the Merger, Murata America stands on both sides of the transaction.

25. The closing of Murata America’s investment in Resonant was subject to, among other conditions, the execution of a multi-year agreement providing Murata Japan with rights to multiple proprietary circuit designs utilizing Resonant’s XBAR technology.

26. On September 30, 2019, Resonant and Murata Japan entered into a collaboration and license agreement (“CLA”) under which (i) Resonant and Murata Japan agreed to collaborate on the development of proprietary circuit designs using Resonant’s XBAR technology, (ii) Resonant agreed to license those designs to Murata Japan for products in four specific radio frequency bands in exchange for Murata Japan’s agreement to pay Resonant up to $9.0 million in pre-paid royalties and other fees (of which $4.5 million had been paid to Resonant as of the date of the Recommendation Statement); and (iii) Resonant granted exclusive rights to Murata Japan to use Resonant’s XBAR technology in mobile communication devices for thirty (30) months, i.e., through March 31, 2022 (“Murata Exclusivity Expiration Date”).

27. Under the CLA, Resonant and Murata Japan and their respective management and engineering personnel collaborated on the design of radio frequency filters using Resonant’s XBAR technology. In that context, the management of Resonant and Murata Japan also discussed possible alternatives for broadening their commercial relationship, including by expanding the scope of the CLA and the potential for Murata Japan to acquire Resonant.

28. From March 2021 through September 2021, Resonant and Murata Japan negotiated an increase in the number of radio frequency bands for which filters were being developed under the CLA.

29. These discussions culminated in Resonant and Murata Japan executing, on September 30, 2021, an Addendum to the CLA (“CLA Addendum”), which (i) provides for the development of proprietary circuit designs using Resonant’s XBAR technology for up to four additional specific radio frequency bands; and (ii) licenses the designs for these four additional bands to Murata Japan in exchange for Murata Japan’s agreement to pay Resonant a minimum of $4.0 million, and up to an aggregate of between $8.0 million and $36.0 million, in pre-paid royalties and other fees (of which $7.0 million has been paid to Resonant as of the date of the Recommendation Statement). Under the CLA Addendum, Murata Japan retained exclusive rights to Resonant’s XBAR technology for use in mobile communication devices through the Murata Exclusivity Expiration Date (i.e., March 31, 2022).

Resonant’s Financial Results in Q4 2020

30. On March 15, 2021, Resonant announced its results for the fourth quarter (Q4) of 2020. On an earnings call held on March 15, 2021 (“Q4 2020 Earnings Call”), Defendant Holmes touted Resonant’s progress under the CLA:

[W]e achieved the second milestone under the [CLA] in October, well ahead of schedule. This is incredibly significant as it validates our XBAR filters for 5G, meaning they do what we say they are going to do and we confirm targeted performance, packaging, and initial reliability. This achievement brings in prepaid royalties in the millions of dollars rather than having to wait for unit shipments. We have received 50% of the prepaid royalties for these first four bands today. We're now focused on the next phase of the agreement, which focuses on building a commercial platform and high-volume manufacturing of XBAR based RF filters for 5G applications. From here, we have two more milestones to hit as their designs move to commercial production and high-volume OEM shipments. Our work with [Murata Japan] is going exactly as anticipated, and it remains the potential for us to contract with them for additional designs this year.

31. Defendant Holmes thereafter opined that Murata Japan “alone could represent a potential of over $100 million in annual revenue for Resonant.”1 Explaining the basis for this projection, Defendant Holmes stated:

While that seems like a big step from where we are today, it becomes clear when observing [Murata Japan’s] position in the industry. The top seven filter manufacturer controlled over 90% of the market for filters and duplexers, [Murata Japan] has the largest market share in both categories, controlling 37% of the filter market and 32% of the duplexer market. Their filter market share is bigger than the second and third largest players combined. Further, [Murata Japan] has established relationships with some of the world’s largest handset OEMs which allows us to leverage their expertise to bring XBAR into the market versus doing it ourselves.

1 All emphasis is added unless otherwise noted.

Resonant’s Financial Results in Q1 2021

32. On May 12, 2021, Resonant announced its results for the first quarter (Q1) of 2021. On an earnings call held on May 12, 2021 (“Q1 2021 Earnings Call”), Defendant Holmes again addressed the potential the CLA:

[W]e achieved the second of four milestones under this agreement in October. This was a critical point of the process as it validated our XBAR filters for 5G with confirm targeted performance, packaging and initial reliability. As a result of this achievement which occurred ahead of schedule, we have been able to monetize the partnership in form of prepaid royalties. To date we have received 50% of the prepaid royalties for the initial contract. As a next step with [Murata Japan], we will move to the commercial production phase of the agreement and turn our focus to high volume manufacturing of XBAR-based RF filters for 5G applications. Our work with [Murata Japan] validates our belief that finding RF filter solutions that can meet the demands high frequency applications is paramount for the industry. Going forward there remains the potential for us to contract with [Murata Japan] for additional designs this year as we work towards the remaining two milestones of the agreement. Allow me to put the opportunity of this partnership [with Murata Japan] into perspective by observing the competitive landscape of the RF filter manufacturing industry category.

A few key facts are as follows: 98% of the market for filters and duplexers are controlled by the Top 7 filter manufacturers. [Murata Japan] has the largest market share in both categories, controlling 37% of the filter market and 32% of duplexer market. Their filter market share is bigger than the second and third largest filter players combined. Further, [Murata Japan] has established relationships with some of the world's largest OEMs which allows us to leverage their expertise to bring XBAR into the market versus doing it ourselves.

33. With that background, Defendant Holmes opined for the second time in as many conference calls that “[g]iven these market dynamics,” Murata Japan “alone represents a potential of over $100 million of annual revenue for Resonant.”

Resonant’s Financial Results in 2Q 2021

34. On August 11, 2021, Resonant announced its results for the second quarter (Q2) of 2021. On an earnings call held on August 11, 2021 (“Q2 2021 Earnings Call”), Defendant Holmes again addressed the potential of the CLA:

The market for filters and duplexers is extremely concentrated. The top seven filter manufacturers controlling 96% of the market. [Murata Japan] has the largest market share in both categories, controlling 36% of the filter market and 33% of the duplexer market.

[Murata Japan is] also the largest filter supplier by a significant margin as evidenced by their filter market share being larger than the second and third largest players combined. By leveraging [Murata Japan’s] established relationships with the world’s largest handset OEMs, we expect XBAR technologies to penetrate a large portion of the market.

35. Defendant Holmes then opined for the third time in as many conference calls that “[t]his partnership [with Murata Japan] alone represents the potential of over $100 million in annual revenue for Resonant.”

Resonant’s Financial Results in 3Q 2021

36. On November 10, 2021, Resonant announced its results for the third quarter (Q3) of 2021. On an earnings call held on November 10, 2021 (“Q3 2021 Earnings Call”), Defendant Holmes highlighted the execution of the CLA Addendum, which had expanded the CLA “from $9 million to a value ranging from $17 million to $43 million depending on the complexity of the bands chosen [by Murata Japan].” Defendant Holmes also observed that “as a licensing company . . . we expect to have very high operating margins,” and added that there “also remains the potential for us to contract even more designs with [Murata Japan], which is especially attractive given their dominant share of the RF and duplexer market.” Defendant Holmes then reiterated for the fourth time in as many conference calls that “we believe this partnership [with Murata Japan] could potentially increase to $100 million annual revenue opportunities for Resonant when 5G and Wi-Fi 6 reach the full-scale deployments.”

Murata America Proposes to Acquire Resonant

37. On September 20, 2021, ten days before execution of the CLA Addendum, senior Murata Japan executives conveyed their interest in acquiring Resonant to Defendant Holmes. Defendant Holmes asked for a written proposal.

38. On October 12, 2021, Murata America proposed acquiring Resonant for $4.00 per share in cash. Discussions continued between Defendant Holmes and Murata Japan executives, and in the meantime, on November 9, 2021, the Board retained Centerview to serve as its financial advisor. Thereafter, Centerview began meeting with multiple parties to solicit their interest in pursuing a transaction with Resonant.

The Financial Projections of Resonant’s Management and Financial Opinion of Centerview

39. On December 9, 2021, Murata America increased its bid to $4.20 per share in cash. Thereafter, purportedly for the first time, Resonant management prepared long-range financial projections for fiscal years 2022 through 2026, consisting of two sets of projections, “Case One” and “Case Two” (together, the “Case Projections”), which were approved by the Board on December 15, 2021, for presentation to Murata America and other bidders, and later used by Centerview to prepare a discounted cash flow analysis (“DCF Analysis”) as part of its fairness opinion (“Centerview Fairness Opinion”).

40. The Case One Projections assume that Murata America remains Resonant’s only significant technology and licensing partners during the relevant time period:

Case One Projections

| | | For Fiscal Year

Ending December 31, | |

| ($ In millions) | | 2022E | | | 2023E | | | 2024E | | | 2025E | | | 2026E | |

| Revenue | | | 7.8 | | | | 14.6 | | | | 24.0 | | | | 35.1 | | | | 48.7 | |

| Operating income | | | (34.1 | ) | | | (29.0 | ) | | | (21.2 | ) | | | (11.6 | ) | | | 0.7 | |

| Adjusted EBITDA(1) | | | (27.7 | ) | | | (22.3 | ) | | | (14.2 | ) | | | (4.5 | ) | | | 8.1 | |

| Capital expenditures and other | | | 0.7 | | | | 0.7 | | | | 0.7 | | | | 0.7 | | | | 0.7 | |

41. The Case Two Projections assume that: (i) in addition to Murata America, Resonant adds multiple significant technology development and licensing partners during the projections period; (ii) an increase in market share for Resonant’s filter designs; and (iii) an increase from 7% to 10% in the assumed royalty rate for the license of Resonant’s filter designs:

Case Two Projections

| | | For Fiscal Year

Ending December 31, | |

| ($ In millions) | | 2022E | | | 2023E | | | 2024E | | | 2025E | | | 2026E | |

| Revenue | | | 7.8 | | | | 18.2 | | | | 35.7 | | | | 60.2 | | | | 96.6 | |

| Operating income | | | (34.1 | ) | | | (26.3 | ) | | | (11.3 | ) | | | 10.5 | | | | 45.3 | |

| Adjusted EBITDA(1) | | | (27.7 | ) | | | (19.5 | ) | | | (4.1 | ) | | | 18.1 | | | | 53.2 | |

| Capital expenditures and other | | | 0.7 | | | | 0.7 | | | | 0.7 | | | | 0.7 | | | | 0.7 | |

42. In connection with the Centerview Fairness Opinion, Centerview used the Case Projections to prepare estimates of unlevered cash flows for years 2022 to 2026:

Case One Projections: The estimated unlevered free cash flows for the years 2022 through 2026 were, respectively (in millions): ($34.1), ($29.0), ($21.2), ($11.6) and $0.6.

Case Two Projections: The estimated unlevered free cash flows for the years 2022 through 2026 were, respectively (in millions): ($34.1), ($26.3), ($11.3), $8.3 and $35.8.

43. Centerview used its estimates of unlevered cash flows to prepare a DCF Analysis that valued Resonant based on the Case Projections using discount rates ranging from 14.5% to 16.0%. The DCF Analysis purported to yield value ranges for Resonant’s common stock of (i) approximately $0.79 and $1.19 per share using the Case One Projections, and (ii) of approximately $3.81 and $4.82 per share using the Case Two Projections.

The Board Approves the Merger and Resolves to Recommend

That Resonant Stockholders Tender Their Shares

44. On January 30, 2022, Murata America submitted what it stated was its last, best and final offer of $4.50 per share in cash.

| 45. | On February 2, 2022, Resonant entered into exclusive negotiations with Murata America. |

46. On February 14, 2022, after several rounds of negotiations, the Board held a meeting at which, inter alia, Centerview orally presented the Centerview Fairness Opinion (which was later committed to writing) concluding that the Merger Consideration was fair, from a financial point of view, to Resonant shareholders.

47. Following the oral presentation of the Centerview Fairness Opinion, and for the reasons set forth in the Recommendation Statement (including consideration of the Centerview Fairness Opinion), the Board unanimously (1) approved the Merger Agreement and the transactions contemplated thereby (“Proposed Transactions”), including the Tender Offer and the Merger, (2) determined that the Proposed Transactions, including the Tender Offer and the Merger, are in the best interests of Resonant and its stockholders, (3) resolved that the Merger shall be governed by and effected under Section 251(h) of the DGCL, and (4) resolved to recommend that Resonant stockholders tender their shares to Murata America pursuant to the Tender Offer.

48. On February 14, 2022, the Merger Agreement was executed, and later that same day, Resonant and Murata America issued a joint press release announcing the execution of the Merger Agreement and the forthcoming commencement of the Tender Offer.

Receipt of Different Consideration by Officers and Directors

49. The Recommendation Statement acknowledges that the executive officers and directors of Resonant may be considered to have interests in the Proposed Transactions (including the Tender Offer and the Merger) “that may be different from or in addition to those of the Company’s stockholders generally.”

50. Under the Merger Agreement, each outstanding Resonant Restricted Stock Unit (“RSU”), whether vested or unvested, that is outstanding immediately prior to the closing of the Merger, shall automatically convert into a right of its holder to receive cash payments upon consummation of the Merger, as per formulas described in the Recommendation Statement.

51. As a result of such automatic acceleration and vesting of all outstanding RSU’s upon consummation of the Merger, Resonant’s executive officers and directors collectively stand to earn millions in cash upon consummation of the Merger—a major liquidity event— as per the following tables appearing in the Recommendation Statement:

| | | Number of Shares | | | | |

| | | Underlying RSUs | | | | |

| | | (Time-Based | | | Amount of RSU | |

| Name | | Vesting) | | | Consideration($) | |

| Executive Officers: | | | | | | | | |

| George B. Holmes | | | 431,101 | | | | 1,939,954.50 | |

| Martin S. McDermut | | | 143,233 | | | | 644,548.50 | |

| Dylan Kelly | | | 302,759 | | | | 1,362,415.50 | |

| Clint Brown | | | 188,024 | | | | 846,108.00 | |

| Neal Fenzi | | | 119,367 | | | | 537,151.50 | |

| Lisa Wolf | | | 135,539 | | | | 609,925.50 | |

| Non-Employee Directors: | | | | | | | | |

| Ruben Caballero | | | 106,553 | | | | 479,488.50 | |

| Michael J. Fox | | | 108,334 | | | | 487,503.00 | |

| Alan B. Howe | | | 57,499 | | | | 258,745.50 | |

| Jack H. Jacobs | | | 57,499 | | | | 258,745.50 | |

| Joshua Jacobs | | | 57,499 | | | | 258,745.50 | |

| Jean F. Rankin | | | 67,499 | | | | 303,745.50 | |

| Robert Tirva | | | 67,499 | | | | 303,745.50 | |

52. Absent the Merger Agreement providing for automatic acceleration and vesting of all outstanding RSU’s upon consummation of the Merger, the RSU’s of Resonant’s top three officers would only accelerate and fully vest in the event of a “Qualifying Termination” within a 24-month period following a “change in control.” However, there is no indication that any of these officers will be terminated after the Merger closes, and thus absent the automatic acceleration and vesting of all RSU’s upon consummation of the Merger, there would be no major liquidity event for such officers.

53. Additionally, because the acquisition of Resonant contemplated by the Merger Agreement is an all-cash deal, Resonant’s executive officers and directors will earn over $20 million on their current illiquid stockholdings upon consummation of the Merger (beyond the earnings resulting from immediate acceleration and vesting of RSU’s), as per the following table appearing in the Recommendation Statement:

| | | Number of

Shares Owned | | | Value of

Shares Owned | |

| Executive Officers: | | | | | | | | |

| George B. Holmes | | | 527,436 | | | $ | 2,373,462.00 | |

| Martin S. McDermut(1) | | | 271,825 | | | | 1,223,212.50 | |

| Dylan Kelly | | | 174,197 | | | | 783,886.50 | |

| Neal Fenzi | | | 584,730 | | | | 2,631,285.00 | |

| Clint Brown (2) | | | 118,750 | | | | 534,375.00 | |

| Lisa Wolf(3) | | | 170,608 | | | | 767,736.00 | |

| Non-Employee Directors: | | | | | | | | |

| Ruben Caballero | | | 154,462 | | | | 695,079.00 | |

| Michael J. Fox(4) | | | 2,121,168 | | | | 9,545,256.00 | |

| Alan B. Howe | | | 69.184 | | | | 311,328.00 | |

| Jack H. Jacobs | | | 64,184 | | | | 288,828.00 | |

| Joshua Jacobs | | | 67,684 | | | | 304,578.00 | |

| Jean F. Rankin | | | 73,512 | | | | 330,804.00 | |

| Robert Tirva | | | 64,184 | | | | 288,828.00 | |

| Total | | | 4,461,924 | | | $ | 20,078,658.00 | |

The Recommendation Statement Contains Material Misrepresentations and Omissions

54. Defendants disseminated a false and misleading Recommendation Statement to Resonant’s stockholders that misrepresents or omits material information that is necessary for Resonant stockholders to make an informed decision concerning whether to tender their shares to Murata pursuant to the Tender Offer.

False and Misleading Statements Regarding Preparation and Disclosure of Long-Range Financial Projections

55. The Recommendation Statement states that, in December 2021, “management prepared, for the first time, long-range financial projections for the fiscal years 2022 through 2026.” The “projections” referred to in this statement were the Case Projections set forth above.

56. The Recommendation Statement further states that the “Company does not, as a matter of course, publicly disclose long-term forecasts or internal projections as to future performance or results of operations given the inherent unpredictability of underlying assumptions and projections.”

57. The statements referenced in paragraphs 55-56 above were false and misleading. As noted above, on the Q4 2020 Earnings Call, Q1 2021 Earnings Call, Q2 2021 Earnings Call, and Q3 2021 Earnings Call, Defendant Holmes repeatedly expressed the belief that the partnership with Murata Japan “alone” represented “a potential of over $100 million in annual revenue for Resonant.” In opining on the annual revenue potential from the partnership with Murata Japan “alone,” Defendant Holmes detailed the assumptions underlying his belief, which indicated that management had visibility into the revenue potential of the partnership with Murata Japan. Thus, contrary to the statements above in the Recommendation Statement, Resonant had previously prepared long-range projections based on various assumptions, and Defendant Holmes had publicly disclosed those projections and the assumptions underlying them.

The Case Projections in the Recommendation Statement Were Subjectively and Objectively False Statements of Opinion

58. As noted, on the on the Q4 2020 Earnings Call, Q1 2021 Earnings Call, Q2 2021 Earnings Call, and Q3 2021 Earnings Call, Defendant Holmes repeatedly expressed the belief that the partnership with Murata Japan “alone” represented a potential of over $100 million in annual revenue for Resonant. In sharp contrast, based on the assumption that Murata America would remain Resonant’s only significant technology and licensing partners during the period of 2022 to 2026, Resonant’s management expressed the view in the Case One Projections that revenue would grow from $7.8 million in 2022 to $48.7 million in 2026—less than half the $100 million in annual revenue potential touted by Defendant Holmes in the four prior earnings calls before the Merger.

59. Indeed, the Case Two Projections do not even reach $100 million in revenue in 2026, even though the Case Two Projections rest on substantially more favorable assumptions than Defendant Holmes had disclosed on the Earnings Calls in connection with opining on the annual revenue potential from Murata Japan alone. Specifically, the Case Two Projections assumed: (i) in addition to Murata America, Resonant would add multiple significant technology development and licensing partners during the projections period; (ii) an increase in market share for Resonant’s filter designs; and (iii) an increase from 7% to 10% in the assumed royalty rate for the license of Resonant’s filter designs. Yet, the Case Two Projections still fall short of Defendant Holmes’ projections relying on the partnership with Murata Japan alone.

60. Given the huge discrepancy between the prior public statements of Defendant Holmes concerning the $100 million annual revenue potential from the partnership with Murata Japan “alone,” and the revenue potential appearing in the Case Projections in the Recommendation Statement, the Case Projections plainly did not reflect the legitimately held opinion of Resonant management regarding either the annual revenue potential from a partnership with Murata Japan “alone” or the annual revenue potential based on the additional assumptions underlying the Case Two Projections. Instead, it is apparent that the projections of the annual revenue potential from the partnership with Murata Japan alone in Defendants Holmes’ prior public statements represented the legitimately held opinion of Resonant management, and the Case Projections were created solely for the improper purpose of engineering a DCF Analysis that would allow Centerview to conclude that the Merger Consideration was fair. In sum, because Resonant management did not genuinely and honestly believe the Case Projections in the Recommendation Statement, such projections are subjectively false.

61. The Case Projections are also objectively false because they plainly relied on unreasonable and inaccurate assumptions, as evidenced by the huge gap between the prior public statements of Defendant Holmes concerning the $100 million annual revenue potential from the partnership with Murata Japan “alone,” and the far more pessimistic revenue potential appearing in the Case Projections in the Recommendation Statement (even when, in the case of the Case Two Projections, making more favorable assumptions). There can be no plausible explanation for that vast gap other than that, in connection with preparing the Case Projections in the Recommendation Statement, Resonant management manipulated assumptions in order to generate the more pessimistic Case Projections for the sole purpose of ensuring a DCF Analysis that would allow Centerview to conclude the Merger Consideration was fair.

62. Defendants harbored an incentive to create the subjectively and objectively false Case Projections and thereby make the Merger Consideration appear fair because they stand to reap millions from their Resonant shares, and acceleration of Resonant RSU’s, if the all-cash transaction with Murata is consummated. That incentive motivated Resonant management to provide Centerview with the false Case Projections, which depressed the value share ranges derived from the DCF Analysis, and thereby made the Merger Consideration appear fair, when in fact, it is not.

The Centerview Financial Opinion Was False and Misleading

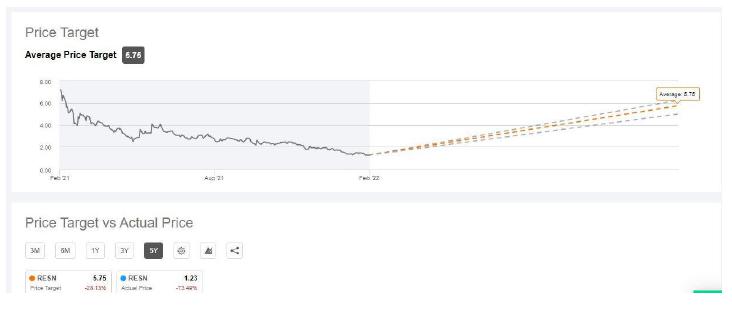

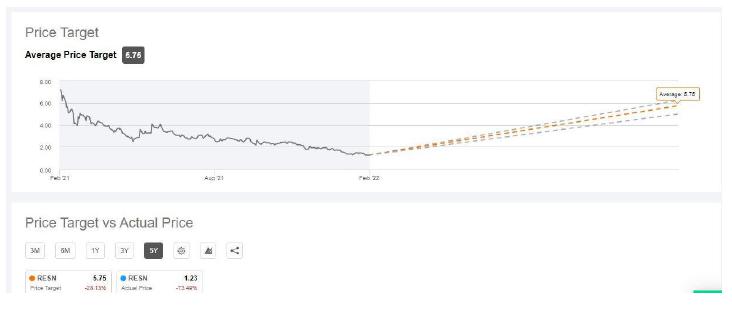

63. Since one of the key components of the DCF Analysis underlying the Centerview Fairness Opinion was the Case Projections, and those projections are subjectively and objectively false, the Centerview Fairness Opinion is also false and misleading to the extent it uses the false and misleading Case Projections as one of the key components to calculate value per share ranges under the DCF Analysis. Had the DCF Analysis used reasonable projections that Resonant management genuinely believed, the value per share ranges derived from the DCF Analysis would have been higher and indicated that the Merger Consideration was not fair.2

64. Indeed, the Centerview Fairness Opinion acknowledges that an analysis of Wall Street price targets as of February 11, 2022, indicated low and high price targets for Resonant ranging from $5.00 to $6.25 per share (both above the price per share approved by the Board). Likewise, according to an analysis of Wall Street Resonant price targets in the last 90 days published on Seeking Alpha on February 15, 2022, the 7 analysts covering Resonant had an average price target of $5.75 per share, which is above the price per share approved by the Board:

2 While the Centerview Fairness Opinion purported to rely on other valuation measures, it is widely recognized that DCF analysis is entitled to the greatest weight. Andaloro v. PFPC Worldwide, Inc., No. CIV.A. 20289, 2005 WL 2045640, at *9 (Del. Ch. Aug. 19, 2005) (“The DCF method is frequently used in this court and, I, like many others, prefer to give it great, and sometimes even exclusive, weight when it may be used responsibly.”).

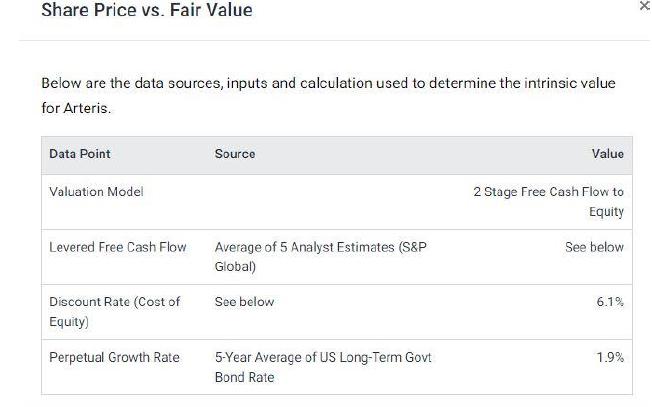

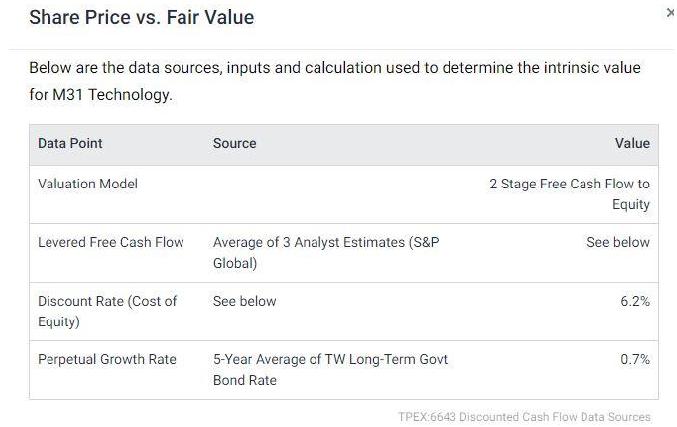

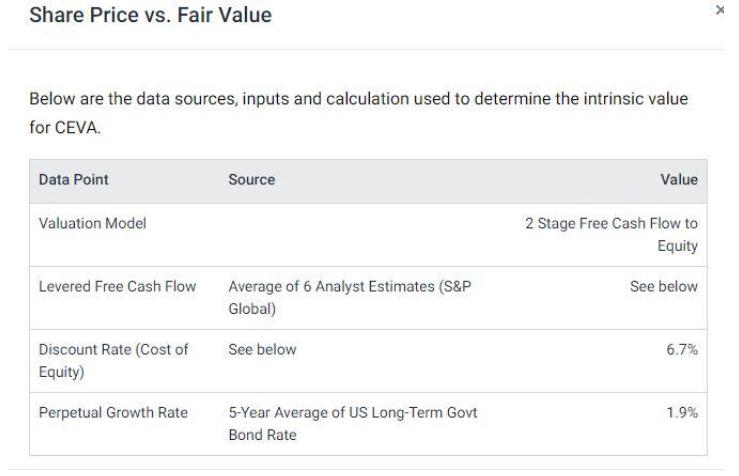

Separately, Centerview apparently made no effort to value Resonant’s substantial patent portfolio. According to slides presented in connection with the Q2 2021 Earnings Call, Resonant has more pending and issued patents with respect to filter designs than vastly larger companies like Qualcom, Broadcom, and Skyworks.

65. Beyond its reliance on the false and misleading Case Projections, the description of the Centerview Fairness Opinion in the Recommendation Statement also improperly fails to disclose certain key inputs and assumptions underlying the analyses on which it was based, which further renders it false and misleading. Without this information, as described below, Resonant’s public stockholders are unable to fully understand these analyses and, thus, are unable to determine what weight, if any, to place on the Centerview Fairness Opinion in determining whether to tender their shares. This omitted information, if disclosed, would significantly alter the total mix of information available to Resonant’s stockholders.

66. With respect to Centerview’s Discounted Cash Flow Analysis of Resonant, the Recommendation Statement fails to adequately disclose how Centerview determined that a discount rate range of 14.50% to 16.00% was appropriate. The explanation that the discount rate reflects “Centerview’s analysis of the Company’s weighted average cost of capital (“WACC”)” is bereft of any explanation.

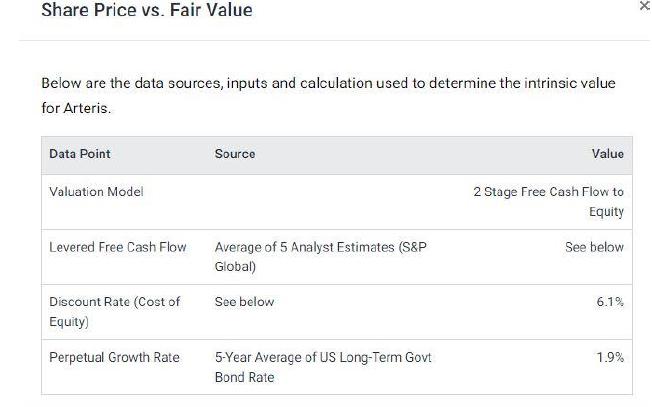

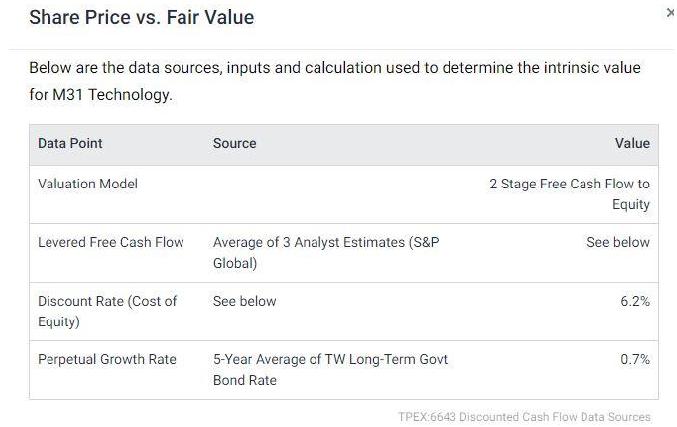

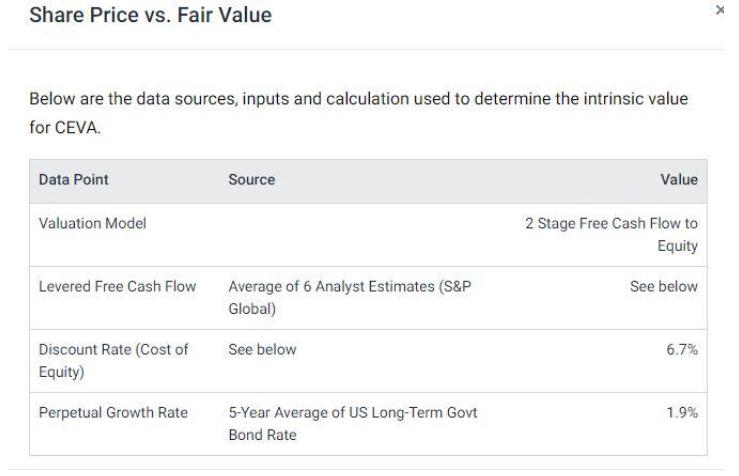

67. Notably, the online research firm Simply Wall Street uses far lower discount rates (calculated according to a fully disclosed methodology) to value the four public companies that Centerview identifies as comparable to Resonant in the Centerview Fairness Opinion’s Selected Public Company Analysis: Alphawave IP Group (6.3% discount rate), Arteris Inc. (6.2%), (CEVA (6.7%), and M31 Technology Corp. (6.2%):

68. The vastly higher discount rate range of 14.50% to 16.00% used by Centerview (according to an undisclosed methodology) sharply depressed the value range for Resonant’s shares. See In re Topps Co. S'holders Litig., 926 A.2d 58, 76 (Del. Ch. 2007) (raising discount rates drives down the resulting value range). Shareholders are entitled to further disclosure on how Centerview derived its seemingly excessively high discount rate range. See Topps, 926 A.2d at 76 (subjective judgments regarding discount rates are not scientific, “but highly-paid valuation advisors should be able to rationally explain them.”).

69. With respect to Centerview’s Unlevered Free Cash Flow projections appearing in the Case Projections, the Recommendation Statement fails to disclose how Centerview derived those unlevered free cash flow projections. Since Centerview used the unlevered free cash flows in its DCF Analysis, Resonant stockholders are entitled to further disclosures on how those unlevered free cash flows were derived.

CLAIMS FOR RELIEF

COUNT I

Against All Defendants for Violations of Section 14(e) of the Exchange Act

70. Plaintiff incorporates and repeats each and every allegation above as if fully set forth herein.

71. Section 14(e) of the Exchange Act provides that it is unlawful “for any person to make any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading .. . . in connection with any tender offer or request or invitation for tenders, or any solicitation of security holders in opposition to or in favor of any such offer, request, or invitation.” 15 U.S.C. § 78n(e).

72. Defendants disseminated the Recommendation Statement to Resonant stockholders recommending that Resonant stockholders tender their shares to Murata America in connection with the Tender Offer.

73. By virtue of their positions within the Company, and/or roles in the process of preparing, reviewing, and/or disseminating the Recommendation Statement, Defendants were aware of their duty not to make false and misleading statements in the Recommendation Statement, and not to omit material facts from the Recommendation Statement necessary to make statements made therein— in light of the circumstances under which they were made—not misleading.

74. Yet, as specified in paragraphs 54-69 above, in violation of Section 14(e) of the Exchange Act, Defendants knowingly or recklessly (i) made untrue statements of material fact in the Recommendation Statement, and (ii) omitted material facts from the Recommendation Statement necessary to make statements therein— in light of the circumstances under which they were made—not misleading, in order to induce Resonant stockholders to tender their shares in the Tender Offer, and thereby maximize their own personal gain from the immediate sale of all of their Resonant shares for cash, and the immediate conversion of all of their Resonant RSU’s into cash. As such, the material misrepresentations and omissions in the Recommendation Statement specified above were made by Defendants with scienter.

75. The material misrepresentations and omissions in the Recommendation Statement specified above are material insofar as there is a substantial likelihood that a reasonable Resonant stockholder would consider them important in deciding whether to tender their shares. In addition, a reasonable Resonant investor would view disclosures of the omitted facts specified above as significantly altering the “total mix” of information made available to Resonant stockholders.

76. Because of the material misrepresentations and omissions in the Recommendation Statement specified above, Plaintiff and other Resonant stockholders are threatened with irreparable harm insofar as Plaintiff and other Resonant stockholders will be deprived of their entitlement to make a fully informed decision as to whether to tender their shares in connection with the Tender Offer if such material misrepresentations and omissions are not corrected prior to the Expiration Date. Therefore, injunctive relief is appropriate.

COUNT II

Against the Individual Defendants for

Violations of Section 20(a) of the Exchange Act

77. Plaintiff incorporates and repeats each and every allegation above as if fully set forth herein

78. The Individual Defendants acted as controlling persons of Resonant within the meaning of Section 20(a) of the Exchange Act, as alleged herein. By virtue of their positions as officers and/or directors of Resonant, and participation in, and/or awareness of Resonant’s operations, and/or intimate knowledge of the contents of the Recommendation Statement filed with the SEC, they had the power to influence and control, and did influence and control, directly or indirectly, the decision-making of Resonant with respect to the Recommendation Statement, including the content and dissemination of the various statements in the Recommendation Statement that Plaintiff contends are materially false and misleading, and the omission of material facts specified above.

79. Each of the Individual Defendants was provided with or had unlimited access to copies of the Recommendation Statement and other statements alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause the statements to be corrected.

80. Each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of Resonant, and, therefore, is presumed to have had the power to control or influence the particular transactions giving rise to the securities violations alleged herein, and exercised same. In particular, the Recommendation Statement at issue references the unanimous recommendation of the Board to approve the Proposed Transactions, including the Tender Offer and the Merger, and recommend that Resonant stockholders tender their shares pursuant to the Tender Offer. The Individual Defendants thus were directly involved in the preparation of the Recommendation Statement.

81. In addition, as the Recommendation Statement sets forth at length, and as described herein, the Individual Defendants were involved in negotiating, reviewing, and approving the Proposed Transactions, including the Tender Offer and the Merger. The Recommendation Statement purports to describe the various issues and information that the Individual Defendants reviewed and considered in connection with such negotiation, review and approval. The Individual Defendants thus directly participated in the drafting of the Recommendation Statement.

82. By virtue of the foregoing, the Individual Defendants have violated Section 20(a) of the Exchange Act.

83. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(e), by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, the Individual defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of Individual Defendants’ conduct, Plaintiff will be irreparably harmed.

84. Plaintiff has no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff be fully protected from the immediate and irreparable injury that Defendants’ actions threaten to inflict, and can Plaintiff and other Resonant stockholders make an informed decision about whether to tender their shares pursuant to the Tender Offer.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff prays for judgment and relief as follows:

A. Preliminarily and permanently enjoining Defendants and their counsel, employees and all other agents and persons acting in concert with them from proceeding with, consummating, or closing the Proposed Transactions, including the Tender Offer and the Merger, unless and until Defendants disclose and disseminate to Resonant stockholders the material information specified above that has been omitted from the Recommendation Statement, and correct any false and misleading statements in the Recommendation Statement;

B. Rescinding, to the extent already implemented, the Merger Agreement or any of the transactions contemplated thereby, or granting Plaintiff rescissory damages.

C. Directing Defendant to account to Plaintiff for all damages suffered as a result of their misconduct.

D. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ fees and expenses; and

E. Granting such other and further relief as this Court may deem just and proper.

JURY DEMAND

Plaintiff demands a trial by jury on all claims and issues so triable.

| Dated: March 6, 2022 | WOHL & FRUCHTER LLP |

| | |

| | |

| | By: | /s Joshua E. Fruchter |

| | Joshua E. Fruchter (JF2970) |

| | 25 Robert Pitt Drive, Suite 209G |

| | Monsey, NY 10952 |

| | Tel: (845) 290-6818 |

| | Fax: (718) 504-3773 |

| | Email: jfruchter@wohlfruchter.com |

| | |

| | Attorneys for Plaintiff |