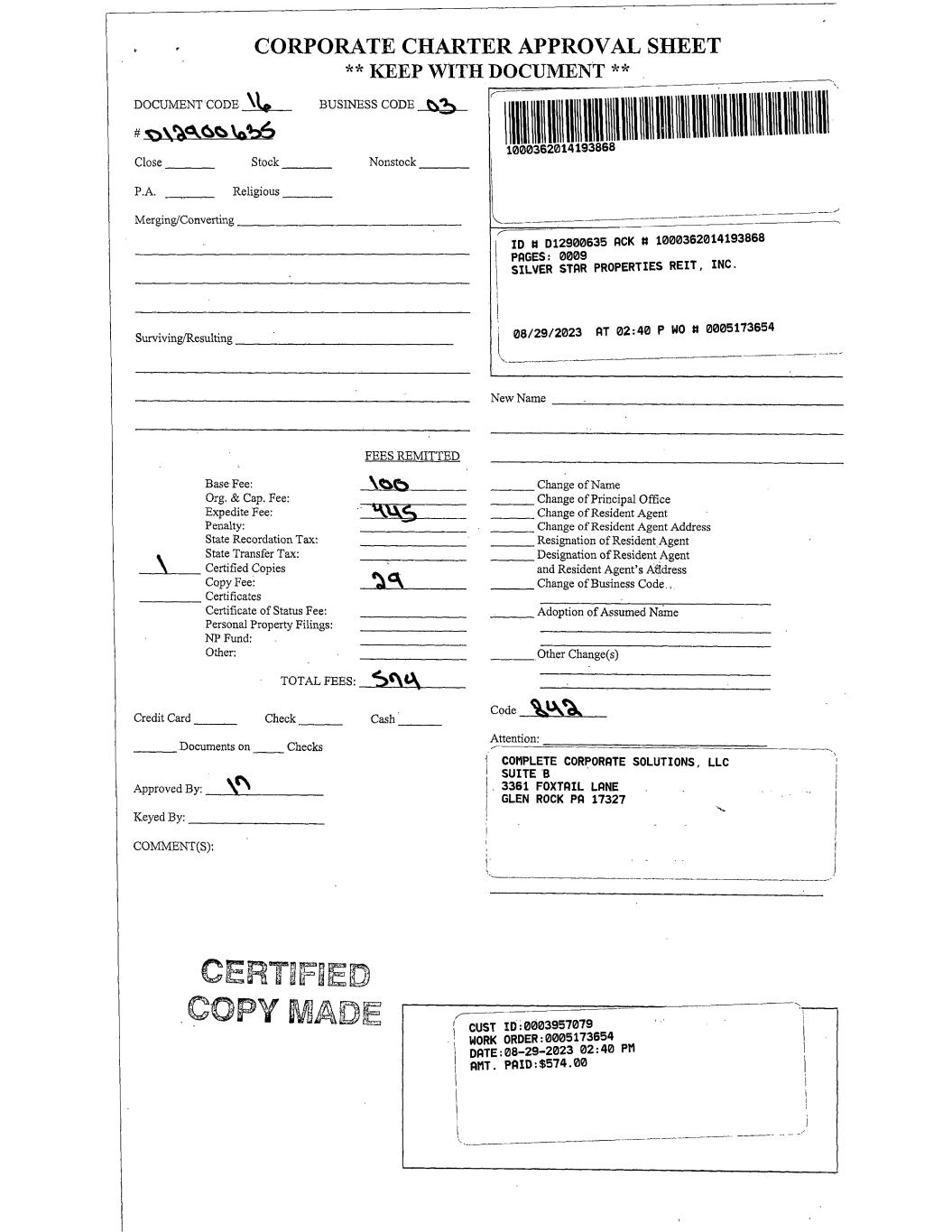

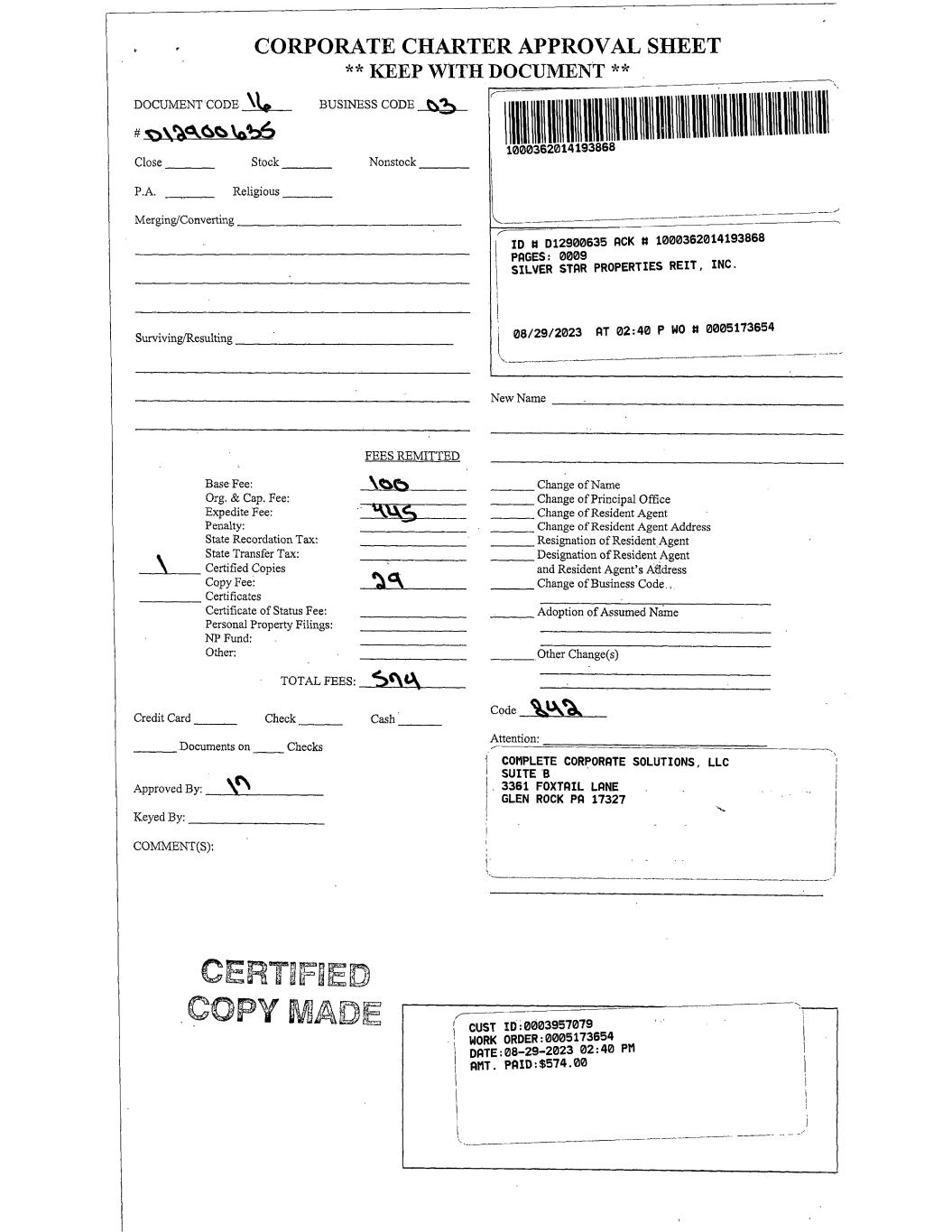

CORPORATE CHARTER APPROVAL SHEET DOCUMENT CODE TU- Close________ Stock _ P.A. _____ Religious ** KEEP WITH DOCUMENT ** BUSINESS CODE -5^ Nonstock Merging/Converting _ Surviving/Resulting A. Base Fee: Org. & Cap. Fee: Expedite Fee: Penalty: State Recordation Tax; State Transfer Tax: Certified Copies Copy Fee: , Certificates Certificate of Status Fee: Personal Property Filings: NP Fund: Other: FEES REMITTED TOTAL FEES:. Credit Card Check Cash Documents on Checks Approved By: _ Keyed By;___________ COMMENT(S); 1000362014193868 ID H D12900635 PCK tt 1000362014193868 PRGES: 0009SILVER STAR PROPERTIES REIT, INC. 08/29/2023 AT 02:40 P WO tt 0005173654 New Name _ Change of Name . Change of Principal Office . Change of Resident Agent Change of Resident Agent Address . Resignation of Resident Agent , Designation of Resident Agent and Resident Agent’s Address , Change of Business Code., . Adoption of Assumed Name Other Change(s) Code Attention: COMPLETE CORPORATE SOLUTIONS, LLC SUITE B 3361 FOXTAIL LANE GLEN ROCK PA 17327 CUST 10:0003957079 WORK ORDER:0005173654 DATE:08-29-2023 02:40 PM AMT. PAID:$574.00

SILVER STAR PROPERTIES REIT, INC. ARTICLES SUPPLEMENTARY SERIES A JUNIOR PARTICIPATING PREFERRED STOCK Silver Star Properties REIT, Inc., a corporation organized and existing under the laws of the State of Maryland (the “Corporation”), DOES HEREBY CERTIFY: FIRST; That pursuant to the authority vested in the Board of Directors of the Corporation (the “Board of Directors”) in accordance with the provisions of the Third Amended and Restated Articles of Incorporation, as amended (the “Certificate of Incorporation”), the Board of Directors, by duly adopted resolutions, has classified and designated 175,547,615 shares of authorized but unissued preferred stock of the Corporation, $0,001 par value per share (“Preferred Stock”), as a separate series of preferred stock of the Corporation designated as “Series A Junior Participating Preferred Stock” with the following preferences, conversion rights and other rights, voting powers, restrictions, limitations as to dividends and other distributions, qualifications and terms and conditions of redemption. Series A Junior Participating Preferred Stock 1. Designation and Amount There shall be a series of Preferred Stock that shall be designated as “Series A Junior Participating Preferred Stock,” and the number of shares constituting such series shall be 175,547,615. Such number of shares may be increased or decreased by resolution of the Board of Directors; provided, however, that no decrease shall reduce the number of shares of Series A Junior Participating Prefeired Stock to less than the number of shares then issued and outstanding plus the number of shares issuable upon exercise of outstanding rights, options or warrants or upon conversion of outstanding securities issued by the Corporation. 2, Dividends and Distributions. (A) Subject to the prior and superior rights of the holders of any shares of any class or series of stock of the Corporation ranking prior and superior to the shares of Series A Junior Participating Preferred Stock with respect to dividends, the holders of shares of Series A Junior Participating Preferred Stock, in preference to the holders of shares of any class or series of stock of the Corporation ranking junior to the Series A Junior Participating Preferred Stock in respect thereof, shall be entitled to receive, when, as and if declared by the Board of Directors out

of funds legally available for the purpose, quarterly dividends payable in cash each year (each such date being referred to herein as a “Quarterly Dividend Payment Dale”), commencing on the first Quarterly Dividend Payment Date after the first issuance of a share or fraction of a share of Series A Junior Participating Preferred Stock, in an amount per share (rounded to the nearest cent) equal to the sum of (1) the Adjustment Number (as defined below) times the aggregate per share amount of all cash dividends, plus (2) the Adjustment Number times the aggregate per share amount (payable in kind) of all non-cash dividends or other distributions other than a dividend payable in shares of Common Stock, par value $0,001 per share, of the Corporation (the “Common Stock”), or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), in each case declared on the Common Stock since the immediately preceding Quarterly Dividend Payment Date, or, with respect to the first Quarterly Dividend Payment Date, since the fust issuance of any share or fraction of a share of Series A Junior Participating Preferred Stock. The “Adjustment Number” shall initially be five (5). In the event the Corporation shall at any time after August 18,2023 (i) declare and pay any dividend on Common Stock payable in shares of Common Stock, (ii) subdivide the outstanding Common Stock or (iii) combine the outstanding Common Stock into a smaller number of shares, then in each such case the Adjustment Number in effect immediately prior to such event shall be adjusted by multiplying such Adjustment Number by a fraction the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event. (B) The Corporation shall declare a dividend or distribution on the Series A Junior Participating Prefeired Stock as provided in paragraph (A) above immediately after it declares a dividend or distribution on the Common Stock (other than a dividend payable in shares of Common Stock). (C) Dividends shall begin to accrue and be cumulative on outstanding shares of Series A Junior Participating Preferred Stock from the Quarterly Dividend Payment Date next preceding the date of issue of such shares of Series A Junior Participating Preferred Stock, unless the date of issue of such shares is prior to the record date for the first Quarterly Dividend Payment Date; in which case dividends on such shares shall begin to accrue from the date of issue of such shares, or unless the date of issue is a Quarterly Dividend Payment Date or is a date after the record date for the determination of holders of shares of Series A Junior Participating Preferred Stock entitled to receive a quarterly dividend and before such Quarterly Dividend Payment Date, in either of which events such dividends shall begin to accrue and be cumulative from such Quarterly Dividend Payment Date. Accrued but unpaid dividends shall not bear interest. Dividends paid on the shares of Series A Junior Participating Preferred Stock in an amount less than the total amount of such dividends at the time accrued and payable on such shares shall be allocated pro rata on a share-by-share basis among all such shares at the time outstanding. The Board of Directors may

fix a record date for the determination of holders of shares of Series A Junior Participating Preferred Stock entitled to receive payment of a dividend or distrihution declared thereon, which record date shall be no more than 60 days prior to the date fixed for the payment thereof. (D) In determining, whether a dividend or distribution (other than upon voluntary or involuntary liquidation), by dividend, redemption or other acquisition of shares or otherwise, is permitted under the Maryland general Corporation law, amounts that would be needed, if the Corporation were to be dissolved at the time of the dividend or distribution, to satisfy the preferential right upon dissolution of the holders of shares of Series A Junior Participating Preferred Stock shall not be added to the Corporation’s total liabilities. 3, Voting Rights. The holders of shares of Series A Junior Participating Prefened Stock shall have the following voting rights: (A) Each share of Series A Junior Participating Prefeined Stock shall entitle the holder thereof to a number of votes equal to the Adjustment Number on all matters submitted to a vote of the stockholders of the Corporation. (B) Except as required by law, by Section 3(C) and by Section 10 hereof, holders of Series A Junior Participating Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent they are entitled to vote with holders of Common Stock as set forth herein) for taking any corporate action. (C) If, at the time of any annual meeting of stockliolders for the election of directors, the equivalent of five quarterly dividends (whether or not consecutive) payable on any share or shares of Series A Junior Participating Preferred Stock are in default, the number of directors constituting the Board of Directors shall be increased by two. In addition to voting together with the holders of Common Stock for the election of other directors of the Corporation, the holders of record of the Series A Junior Participating Preferred Stock, voting separately as a class to the exclusion of the holders of Common Stock, shall be entitled at said meeting of stockholders (and at each subsequent annual meeting of stockholders), unless all dividends in arrears on the Series A Junior Participating Prefemed Stock have been paid or declared and set apart for payment prior thereto, to vote for the election of two directors of the Corporation, the holders of any Series A Junior Participating Preferred Stock being entitled to cast a number of votes per share of Series A Junior Participating Preferred Stock as is specified in paragraph (A) of this Section 3. Each such additional director shall serve until the next annual meeting of stockholders for the election of directors, or until his successor shall be elected and shall qualify, or until his right to hold such office terminates pursuant to the provisions of this Section 3(C). Until the default in payments of all dividends which permitted the election of said dhectors shall

cease to exist, any director who shall have been so elected pursuant to the provisions of this Section 3(C) may be removed at any time, without cause, only by the affirmative vote of the holders of the shares of Series A Junior Participating Preferred Stock at the time entitled to cast a majority of the votes entitled to be cast for the election of any such director at a special meeting of such holders called for that purpose, and any vacancy thereby created may be filled by the vote of such holders. If and when such default shall cease to exist, the holders of the Scries A Junior Participating Preferred Stock shall be divested of the foregoing special voting rights, subject to revesting in the event of each and every subsequent like default in payments of dividends. Upon the termination of the foregoing special voting rights, the terms of office of all persons who may have been elected directors pursuant to said special voting rights shall forthwith terminate, and the number of directors constituting the Board of Directors shall be I'educed by two. The voting rights granted by this Section 3(C) shall be in addition to any other voting rights granted to the holders of the Series A Junior Participating Preferred Stock in tliis Section 3. 4. Certain Restrictions. (A) Whenever quarterly dividends or other dividends or distributions payable on the Series A Junior Participating Preferred Stock as provided in Section 2 are in arrears, thereafter and until all accrued and unpaid dividends and distributions, whether or not declared, on shares of Series A Junior Participating Preferred Stock outstanding shall have been paid in Ml, the Corporation shall not: (i) declare or pay dividends on, make any other distributions on, or redeem or piuchase or otheiwise acquire for consideration any shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Junior Participating Preferred Stock other than (A) such redemptions or purchases that may be deemed to occur upon the exercise of stock options, warrants or similar rights or grant, vesting or lapse of restrictions on the grant of any other performance shares, restricted stock, restricted stock units or other equity awards to the extent that such shares represent all or a portion of (x) the exercise or purchase price of such options, warrants or similar rights or other equity awards and (y) the amount of withholding taxes owed by the recipient of such award in respect of such grant, exercise, vestmg or lapse of restrictions; (B) the repurchase, redemption, or other acquisition or retirement for value of any such shares from employees, former employees, directors, former directors, consultants or former consultants of the Corporation or their respective estate, spouse, former spouse or family member, pursuant to the terms of the agreements piusuant to which such shares were acquired; (ii) declare or pay dividends on or make any other distributions on any shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Junior Participating PrefeiTed Stock, except dividends paid ratably on the Series A Junior Participating Preferred Stock and all such parity stock on which dividends

are payable or in arrears in proportion to the total amounts to which the holders of all such shai'es are then entitled; or (iii) purchase or otherwise acquire for consideration any shares of Series A Junior Participating Preferred Stock, or any shares of stock ranking on a parity with the Series A Junior Participating Preferred Stock, except in accordance with a purchase offer made in writing or by publication (as determined by the Board of Directors) to all holders of Series A Junior Participating Preferred Stock, or to such holders and holders of any such shares ranking on a parity therewith, upon such terms as the Board of Directors, after consideration of the respective annual dividend rates and other relative rights and preferences of the respective series and classes, shall determine will result in fair and equitable treatment among the respective series or classes. (B) Tlie Corporation shall not permit any subsidiaiy of the Corporation to purchase or otherwise acquire for consideration any shares of stock of the Corporation unless the Corporation could, under paragraph (A) of this Section 4, purchase or otherwise acquire such shares at such time and in such manner. 5. Reacquired Shares. Any shares of Series A Junior Participating Preferred Stock purchased or otherwise acquired by the Corporation in any manner whatsoever shall be retired promptly after the acquisition thereof. All such shares shall upon their retirement become authorized but unissued shares of Preferred Stock and may be reissued as part of a new series of Preferred Stock to be created by resolution or resolutions of the Board of Directors, subject to any conditions and restrictions on issuance set forth herein. 6. Liquidation, Dissolution or Winding Up. (A) Upon any liquidation, dissolution or winding up of the Corporation, voluntary or otherwise, no distribution shall be made to the holders of shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Junior Participating Preferred Stock unless, prior thereto, the holders of shares of Series A Junior Participating Preferred Stock shall have received an amount per share (the “Series A Liquidation Preference”) the Adjustment Number times the per share amount of all cash and other property to be distributed in respect of the Common Stock upon such liquidation, dissolution or winding up of the Corporation. (B) In the event, however, that there are not sufficient assets available to permit payment in full of the Series A Liquidation Preference and the liquidation preferences of all other classes and series of stock of the Corporation, if any, that rank on a parity with the Series A Junior Participating Prefeined Stock in respect thereof, then the assets available for such distribution shall be distributed ratably to the holders of the Series A Junior Participating Prefeired Stock and the holders of such parity shares in proportion to tlieir respective liquidation preferences.

(C) Neither the merger or consolidation of the Coiporation into or with another entity nor the merger or consolidation of any other entity into or with the Coiporation shall be deemed to be a liquidation, dissolution or winding up of the Coiporation within the meaning of this Section 6. 7. Consolidation, Merger, Etc. In case the Corporation shall enter into any consolidation, merger, combination or other transaction in which the outstanding shares of Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, then in any such case each share of Series A Junior Participating Preferred Stock shall at the same time be similarly exchanged or changed in an amount per share equal to the Adjustment Number times the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, into which or for which each share of Common Stock is changed or exchanged. 8. No Redemption. Shares of Series A Junior Participating Preferred Stock shall not be subject to redemption by the Coiporation. 9. Ranking. The Series A Junior Participating Preferred Stock shall rank junior to all other series of Preferred Stock as to the payment of dividends and as to the distribution of assets upon liquidation, dissolution or winding up, unless the terms of any such series shall provide otherwise, and shall rank senior to the Common Stock as to such matters. 10. Amendment. At any time that any shares of Series A Junior Participating Preferred Stock are outstanding, the Certificate of Incorporation of the Corporation shall not be amended, by merger, consolidation or otherwise, which would materially alter or change the powers, preferences or special rights of the Series A Junior Participating Preferred Stock so as to affect them adversely without the affirmative vote of the holders of two-thirds of the outstanding shares of Series A Junior Participating Preferred Stock, voting separately as a class. 1 \. Fractional Shares. Series A Junior Participating Preferred Stock may be issued in fractions of a share that shall entitle the holder, in proportion to such holder’s fractional shares, to exercise voting rights, receive dividends, participate in distributions and to have the benefit of all other rights of holders of Series A Junior Participating Preferred Stock. SECOND: The Series A Junior Participating Preferred Stock has been classified and designated by the Board of Directors under the authority contained in the Certificate of Incorporation. -----------------------------------------CUST ID:0003957079 WORK ORDER:0005173654 DATE:08-29-2023 02:40 PM AMT. PAID-.$574.00

THIRD: These Articles Supplementary have been approved by the Board of Directors in the manner and by the vote required by law. FOURTH; The undersigned officer of the Coiporation acknowledges these Articles Supplementary to be the corporate act of the Corporation and, as to all matters or facts required to be verified under oath, the undersigned officer acknowledges that, to the best of such officer's knowledge, information and belief, these matters and facts are true in all material respects and that this statement is made imder the penalties for peijury.

IN WITNESS WHEREOF, the Corporation has caused these Articles Supplementary to be signed in its name and on its behalf by its President and attested by its Secretary on this 1day of August, 2023. ATTEST: Name; Michael Racusih Title: Secretary SILVER STAR PROPERTIES REIT, INC. By:. Name; David Wheeler Title; President