- IRWD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ironwood Pharmaceuticals (IRWD) DEF 14ADefinitive proxy

Filed: 21 Apr 20, 4:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| IRONWOOD PHARMACEUTICALS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

100 Summer Street, Suite 2300

Boston, Massachusetts 02110

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS OF

IRONWOOD PHARMACEUTICALS, INC.

| Date: | Wednesday, June 3, 2020 | |||

Time: | 9:00 a.m. Eastern Time | |||

Location: | Our 2020 annual meeting of stockholders will be a "virtual meeting." You will be able to attend the annual meeting, vote and submit questions via live webcast by visitingwww.virtualshareholdermeeting.com/IRWD2020. | |||

Purpose: | We are holding the annual meeting for stockholders to consider three company sponsored proposals: | |||

1. | To elect our Class I directors, Mark G. Currie, Ph.D., Jon Duane and Mark Mallon, each for a one-year term; | |||

2. | To hold an advisory vote on named executive officer compensation; and | |||

3. | To ratify our audit committee's selection of Ernst & Young LLP as our auditors for 2020. | |||

We will also consider action on any other matter that may be properly brought before the meeting or any postponement(s) or adjournment(s) thereof.

Our board of directors recommends you vote "for" each of the nominees for Class I director (proposal no. 1), "for" on an advisory vote on named executive officer compensation (proposal no. 2), and "for" ratification of our selection of auditors (proposal no. 3). Only stockholders of record at the close of business on April 13, 2020 are entitled to notice of and to vote at the meeting.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow us to furnish proxy materials to our stockholders on the internet. We believe these rules allow us to provide you with the information that you need while lowering the costs of delivery and reducing the environmental impact of the annual meeting.

The safety of our stockholders is important to us and given the current guidance by public health officials and protocols that federal, state and local governments have imposed surrounding the coronavirus (COVID-19) pandemic, at the time of this filing we believe it is not advisable to hold our annual meeting in person. Our virtual stockholder format uses technology designed to provide our stockholders rights and opportunities to participate in the virtual meeting similar to an in-person meeting. You may attend the meeting, vote and submit questions electronically during the meeting via live webcast by visiting the website provided above. A list of shareholders of record will be available electronically during the meeting. The website can be accessed on a computer, tablet, or phone with internet connection. To be admitted to the meeting atwww.virtualshareholdermeeting.com/IRWD2020, you must enter the 16-digit control number found on your proxy card, voting instruction form or notice that you received.

Proxy Material Mailing Date: April 21, 2020 | Sincerely, Chief Executive Officer |

| Letter From Our CEO | 1 | |||

| | | | | |

About Ironwood | 3 | |||

| | | | | |

Our Board of Directors | 5 | |||

| | | | | |

Proposal No. 1 Election of Directors | 25 | |||

| | | | | |

Our Executives | 27 | |||

| | | | | |

Executive Compensation | 30 | |||

| | | | | |

2020 Proxy Statement i

| ||

Dear Ironwood stockholders,

I want to begin by commenting on the COVID-19 pandemic. We are experiencing unprecedented times in modern history both in the U.S. and around the world. This pandemic is causing substantial disruption to our healthcare systems and severely impacting the global economy. At Ironwood, we are focused on doing our part to help mitigate the spread of COVID-19 and protect the safety and well-being of those around us, including our employees, healthcare providers, patients and broader communities, while striving to ensure that patients continue to gain access to the medications that they need. We have taken important actions to-date, and are regularly evaluating any potential impact on our business and assessing our preparedness and our plans to address the evolving circumstances.

Turning to the business: I became CEO of Ironwood just over a year ago now, and what a remarkable year it has been. Following the separation from Cyclerion Therapeutics, Inc., or the Separation, Ironwood became a GI-focused healthcare company dedicated to advancing the treatment of GI diseases and redefining the standard of care for GI patients. There are approximately 70 million people in the U.S. suffering from GI diseases today - that is one in every five Americans. The GI landscape represents an area of substantial unmet need, and one where we believe we can achieve real impact for patients.

We are now in the early stages of executing on our post-Separation strategy and our priorities are clear: drive LINZESS® (linaclotide) growth, advance our GI pipeline, and deliver sustainable profits.

LINZESS is now the number one prescription medicine in the U.S. for treating irritable bowel syndrome with constipation, or IBS-C, or chronic idiopathic constipation, or CIC, with growth of 14% in prescription demand in 2019 versus 2018. This strong performance translated to $803 million in 2019 U.S. net sales, which we benefit from through our 50-50 profit share with Allergan plc (together with its affiliates), or Allergan, in the U.S. We are proud of the successful execution of our strategy for LINZESS; we are one of the few pharmaceutical companies to have successfully discovered, developed and commercialized a product that has become the prescription market leader in its category. We look forward to working with our partner to continue to drive the LINZESS franchise forward for many years to come.

2020 Proxy Statement 1

But LINZESS is only the first installment of the Ironwood story. We have two innovative GI product candidates in our pipeline that we believe, if approved, could make a huge difference in improving the lives of millions of patients. IW-3718 is our bile sequestering agent designed to treat the eight to 10 million adult patients suffering from refractory gastroesophageal reflux disease despite treatment on proton pump inhibitors. MD-7246 is our delayed release formulation of linaclotide that, together with Allergan, is being evaluated as an oral, non-opioid, pain-relieving agent for patients suffering from abdominal pain associated with certain GI diseases.

The company achieved strong financial results in 2019, reporting full year net income for the first time in Ironwood's history. We also met or exceeded all of our 2019 financial guidance metrics and took several important actions post-Separation, including relocating our headquarters to Boston, restructuring our debt and amending our ex-U.S. linaclotide partnerships for China (including Hong Kong and Macau) and Japan.

We have a remarkable team, that as of April 21, 2020, includes approximately 137 employees based in our Boston headquarters and another 170 customer-facing employees based around the country. I am proud of what this team accomplished in 2019 and believe strongly in the opportunities we have in front of us.

I encourage you to read the pages that follow that tell you more about our board, our team, our strategy, our pay, and our culture—all of the things that contributed to our strong results in 2019 and, we believe, position us well for the future. We ask for your voting support on the items described in this proxy statement so we can have the opportunity to continue to deliver for you and for all of our stockholders.

Sincerely,

![]()

Mark Mallon

Chief Executive Officer and Director

2 Ironwood

2019 was a transformational year for Ironwood.

We are a gastrointestinal, or GI, healthcare company dedicated to advancing the treatment of GI diseases and redefining the standard of care for millions of GI patients. We are focused on the development and commercialization of innovative GI product opportunities in areas of large unmet need, leveraging our demonstrated expertise and capabilities in GI diseases. Our flagship product is linaclotide, which is trademarked under the names LINZESS® and CONSTELLA®, and is approved to treat adult patients suffering from IBS-C or CIC in more than 35 countries around the world.

We also have two innovative late-stage development programs that we believe, if approved, could be important treatment options for millions of patients. MD-7246 is our delayed release formulation of linaclotide that we are advancing with our partner Allergan, as an oral, intestinal, non-opioid, pain-relieving agent for patients with abdominal pain associated with certain GI diseases. IW-3718 is our gastric retentive formulation of a bile acid sequestrant that we are developing for the potential treatment of refractory gastroesophageal reflux disease, or refractory GERD.

On April 1, 2019, we completed a tax-free spin-off of our soluble guanylate cyclase, or sGC, business into a separate publicly traded company, Cyclerion Therapeutics, Inc., or Cyclerion. In completing the separation of our sGC business into Cyclerion, or the Separation, in 2019 we advanced our vision of becoming the leader in U.S. GI healthcare, building on our commercial success with LINZESS and advancing our GI development portfolio. Our strategy is focused on three core priorities: drive LINZESS growth, advance our GI development portfolio and strengthen our financial profile. We made significant progress on each of these priorities in 2019:

2020 Proxy Statement 3

approximately $25.2 million in connection with associated capped call transactions, repurchase $215.0 million aggregate principal amount of our outstanding 2.25% Convertible Senior Notes due 2022 and redeem all of our outstanding 8.375% Notes due 2026.

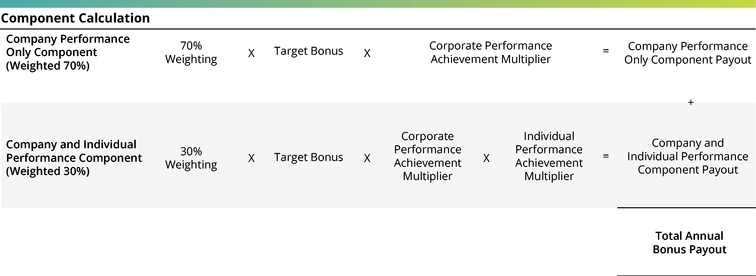

We demonstrated strong progress across our corporate goals in 2019, exceeding some goals and achieving certain stretch goals. As a result, our 2019 company performance achievement multiplier, which we used as a key consideration in determining executive compensation for 2019 performance, was 130%, as determined by the compensation and HR committee of our board of directors. Please see theCompensation Discussion and Analysis section included elsewhere in this proxy statement for detailed information on compensation to our 2019 named executive officers.

In this proxy statement, references to "the company" or "Ironwood" and, except within the Audit Committee Report and the Compensation Committee Report, references to "we", "us" or "our" mean Ironwood Pharmaceuticals, Inc. LINZESS® and CONSTELLA® are trademarks of Ironwood Pharmaceuticals, Inc. Any other trademarks referred to in this proxy statement are the property of their respective owners. All rights reserved. The contents of our website are not incorporated into this document and you should not consider information provided on our website to be part of this document.

4 Ironwood

Who We Are |

The following table sets forth certain information, as of April 21, 2020, with respect to each of our directors:

| | | | | | | | | | | | | |

Name | Age | Class | Year Term Expires | Audit Committee | Governance and Nominating Committee | Compensation & HR Committee | ||||||

| | | | | | | | | | | | | |

Mark G. Currie, Ph.D. | 65 | I | 2020 | | | | ||||||

Jon R. Duane | 61 | I | 2020 | ✓ | ✓ | |||||||

Mark Mallon, Chief Executive Officer | 57 | I | 2020 | | | | ||||||

Marla L. Kessler | 50 | II | 2021 | ✓ | ||||||||

Catherine Moukheibir | 60 | II | 2021 | C | | | ||||||

Lawrence S. Olanoff, M.D., Ph.D. | 68 | II | 2021 | C | ||||||||

Andrew Dreyfus | 61 | III | 2022 | | | C | ||||||

Julie H. McHugh, Chair | 55 | III | 2022 | ✓ | ✓ | |||||||

Edward P. Owens | 73 | III | 2022 | ✓ | | | ||||||

| | | | | | | | | | | | | |

"C" indicates chair of the committee.

2020 Proxy Statement 5

Class I Directors (nominated for election at the 2020 annual meeting)

| | | |

| MARK G. CURRIE, Ph.D. President and Chief Scientific Officer, Cyclerion Age: 65 Director since 2019 | • Dr. Currie has served as president and chief scientific officer of Cyclerion Therapeutics, Inc. since April 2019, and previously served as senior vice president, chief scientific officer and president of R&D at Ironwood Pharmaceuticals, Inc. from 2002 to April 2019. • Prior to joining Ironwood, Dr. Currie directed cardiovascular and central nervous system disease research as vice president of discovery research at Sepracor, Inc. • Previously, Dr. Currie initiated, built and led discovery pharmacology and also served as director of arthritis and inflammation at Monsanto Company. • Dr. Currie earned a B.S. in biology from the University of South Alabama and holds a Ph.D. in cell biology from the Bowman-Gray School of Medicine of Wake Forest University. • We believe that Dr. Currie's vast experience leading the research and development efforts of an international biotechnology company will prove instrumental in guiding us through the research and development of novel therapies. |

6 Ironwood

| | | |

| JON R. DUANE Senior Partner Emeritus, McKinsey & Company Age: 61 Director since 2019 Board Committees • Governance and Nominating Committee • Compensation and HR Committee | • Mr. Duane is senior partner emeritus at McKinsey & Company, or McKinsey. Before his retirement in December 2017, Mr. Duane had served as a partner at McKinsey since 1992. • At McKinsey, Mr. Duane founded and led the firm's biotech practice. In that role, Mr. Duane advised both private and public companies in the pharmaceutical, medical device and life science industries, as well as academic research centers, on various strategic initiatives. • Mr. Duane has served as the executive chair on the board of Nashville Biosciences since 2017. • Mr. Duane graduated from Wesleyan University with a B.A. in government and received an M.B.A from Harvard Business School. • Mr. Duane brings to the board of directors significant experience advising academic research centers and companies across the life science and medical device industries. | |

| | | |

| MARK MALLON Chief Executive Officer, Age: 57 Director since 2019 | • Prior to joining Ironwood in January 2019 as executive senior advisor and becoming chief executive officer of Ironwood in April 2019, Mr. Mallon was a member of the senior executive team of AstraZeneca PLC and led certain key strategic functions: global product and portfolio strategy, global medical affairs, and corporate affairs. • After joining AstraZeneca in 1994, Mr. Mallon held a number of senior sales and marketing roles, including executive vice president, international from January 2013 to April 2017 and executive vice president, global product and portfolio strategy from August 2016 to December 2018. • Mr. Mallon started his career in the biopharmaceutical industry in management consulting. • Mr. Mallon earned his B.S. in chemical engineering from the University of Pennsylvania and his M.B.A. in marketing and finance from the Wharton School of Business. • Given his role as our chief executive officer, we believe Mr. Mallon brings unique and in-depth insight on the operations and management of the company, which together with Mr. Mallon's extensive experience building and shaping businesses, and his deep knowledge of GI, is valuable to our board of directors. |

2020 Proxy Statement 7

Class II Directors (term expires at the 2021 annual meeting)

| | | |

MARLA L. Senior Vice President for Strategy, Marketing and Communications, IQVIA, Inc. Age: 50 Director since 2019 Board Committees • Compensation and HR Committee | • Ms. Kessler has been the senior vice president for strategy, marketing and communications for IQVIA Holdings Inc., or IQVIA, (formerly IMS Health and Quintiles) since October 2016. • Previously, Ms. Kessler served in various roles for IQVIA, including vice president for global services marketing and knowledge management from June 2013 to September 2016, regional leader of the IMS Consulting Group in Europe from 2011 to 2013, location manager for the London IMS Consulting Group from 2009 to 2011 and senior principal from 2008 to 2009. • Before joining IQVIA, Ms. Kessler led several marketing efforts for Pfizer, Inc. from 2004 to 2007 and worked in consulting for McKinsey & Company from 1996 to 2004. • Ms. Kessler received a B.S. in economics from Arizona State University and an M.B.A. from the Fuqua School of Business at Duke University. • Ms. Kessler provides an important commercial perspective to our board of directors given her expertise in strategic marketing, evidence-based research and customer experience in the life science industry. | |

| | | |

| CATHERINE MOUKHEIBIR Chief Executive Officer, Age: 60 Director since 2019 Board Committees • Audit Committee, Chair | • Ms. Moukheibir currently serves as chief executive officer, as well as chairman of the board of directors, of MedDay Pharmaceuticals, or MedDay. • Prior to that, Ms. Moukheibir served as the senior advisor for finance and a member of the executive board of directors at Innate Pharma SA from March 2011 to December 2016, and as the chief financial officer for Movetis N.V. from 2008 to 2010, when it was acquired. • Ms. Moukheibir previously served as the director of capital markets for Zeltia Group S.A. from 2001 to 2007. • In addition to her service on the board of directors of MedDay, Ms. Moukheibir also serves on the board of directors of Orphazyme A/S, Genkyotex SA, and Kymab Group Limited. She also held past directorships on the boards of directors of Ablynx NV, Cerenis Therapeutics SA and Creabilis S.A. • Ms. Moukheibir has an M.A. in economics and an M.B.A. from Yale University. • Ms. Moukheibir's long leadership career in the biopharmaceutical industry, as well as her deep background in international finance, provide her with valuable business and financial expertise in support of our corporate objectives. |

8 Ironwood

| | | |

| LAWRENCE S. OLANOFF, M.D., Ph.D. Former Chief Operating Officer, Forest Laboratories, Inc. Age: 68 Director since 2015 Board Committees • Governance and Nominating Committee, Chair | • Dr. Olanoff most recently served as chief operating officer for Forest Laboratories, Inc., or Forest, (acquired by Allergan plc) from October 2006 to December 2010. Dr. Olanoff also served as a director of Forest from October 2006 to July 2014. • From July 2005 to October 2006, Dr. Olanoff was president and chief executive officer and a director at Celsion Corporation. He also served as executive vice president and chief scientific officer of Forest from 1995 to 2005. • Prior to joining Forest in 1995, Dr. Olanoff served as senior vice president of clinical research and development at Sandoz Pharmaceutical Corporation (now a division of the Novartis Group) and at the Upjohn Company in a number of positions, including corporate vice president of clinical development and medical affairs. • In addition, he is currently an adjunct assistant professor and special advisor to the president for corporate relations at the Medical University of South Carolina (MUSC), an ex-officio director of the MUSC Foundation for Research Development, chairman of the board of directors of Mitochondria in Motion, and a member of the board of directors of Clinical Biotechnology Research Institute at Roper St. Francis Hospital, the Westedge Project, and the Zucker Institute for Applied Neurosciences. Dr. Olanoff also held past directorships on the boards of directors of Axovant Sciences Ltd. and Celsion Corporation. • Dr. Olanoff received his Ph.D. in biomedical engineering and M.D. degree from Case Western Reserve University. • Dr. Olanoff's detailed knowledge of the pharmaceutical industry, his broad operational experience and his research and development leadership over the course of his career make him an important asset to our board of directors. |

Class III Directors (term expires at the 2022 annual meeting)

| | | |

| ANDREW DREYFUS President and Chief Executive Officer for Blue Cross Blue Shield of Massachusetts Age: 61 Director since 2016 Board Committees • Compensation and HR Committee, Chair | • Mr. Dreyfus has served as president and chief executive officer for Blue Cross Blue Shield of Massachusetts, or BCBSMA, one of the largest Blue Cross Blue Shield plans in the country, since September 2010. From July 2005 to September 2010, Mr. Dreyfus served as the executive vice president of health care services of BCBSMA. • Prior to joining BCBSMA, he served as the first president of the Blue Cross Blue Shield of Massachusetts Foundation. Mr. Dreyfus also previously served as executive vice president of the Massachusetts Hospital Association and held a number of senior positions in Massachusetts state government, including undersecretary of consumer affairs and business regulation. • Mr. Dreyfus serves on the board of directors of BCBSMA, the Blue Cross Blue Shield Association, Jobs for Massachusetts, Boys & Girls Club of Boston, RIZE Massachusetts and NACD New England Chapter, and the advisory board of Ariadne Labs. • Mr. Dreyfus received a B.A. in English from Connecticut College. • Mr. Dreyfus brings to our board of directors significant expertise in the healthcare payer and reimbursement market, and broad management and executive leadership experience, providing valuable insight as we continue to develop and commercialize medicines in an evolving healthcare landscape. |

2020 Proxy Statement 9

| | | |

| JULIE H. McHUGH, CHAIR Former Chief Operating Officer, Endo Health Solutions, Inc. Age: 55 Director since 2014 Board Committees • Audit Committee • Governance and Nominating Committee | • Ms. McHugh most recently served as chief operating officer for Endo Health Solutions, Inc., or Endo, from March 2010 through May 2013, where she was responsible for the specialty pharmaceutical and generic drug businesses. • Prior to joining Endo, Ms. McHugh was the chief executive officer of Nora Therapeutics, Inc. • Before that she served as company group chairman for the worldwide virology business unit of Johnson & Johnson, or J&J, and previously she was president of Centocor, Inc., a J&J subsidiary. While at J&J, Ms. McHugh oversaw the development and launches of several products, including Remicade® (infliximab), Prezista® (darunavir) and Intelence® (etravirine), and she was responsible for oversight of a research and development portfolio including compounds targeting HIV, hepatitis C, and tuberculosis. • Prior to joining Centocor, Inc., Ms. McHugh led the marketing communications for gastrointestinal drug Prilosec® (omeprazole) at Astra-Merck Inc. • She currently chairs the board of visitors for the Smeal College of Business of Pennsylvania State University as well as serves on the board of directors of Aerie Pharmaceuticals, Inc., Lantheus Holdings, Inc. and Trevena, Inc., all publicly held companies, and The New Xellia Group, a privately held company. She previously served on the board of directors for ViroPharma Inc., Epirus Biopharmaceuticals, Inc., the Biotechnology Industry Organization, the Pennsylvania Biotechnology Association and the New England Healthcare Institute. • Ms. McHugh received her M.B.A. degree from St. Joseph's University and her B.S. degree from Pennsylvania State University. • Ms. McHugh's experience as a chief executive officer and a chief operating officer at large multinational pharmaceutical companies makes her a valuable member of our board of directors, particularly as we evolve as a company and seek to maximize our current products and execute on our corporate strategy and associated pipeline. |

| | | |

| EDWARD P. OWENS Former Partner, Portfolio Manager and Global Industry Analyst, Wellington Management Company, LLP Age: 73 Director since 2013 Board Committees • Audit Committee | • Mr. Owens was previously partner, portfolio manager and global industry analyst with Wellington Management Company, LLP where he worked in investment management from 1974 to 2012. He was the portfolio manager of the Vanguard Health Care Fund for 28 years from its inception in May 1984 until his retirement from Wellington in December 2012. • Mr. Owens serves on the board of directors of Stealth BioTherapeutics Corp. He has a B.S. in physics from the University of Virginia and an M.B.A. from Harvard Business School. • He brings to our board of directors extensive experience in evaluating and investing in life sciences companies, providing valuable insight as we continue to strive towards our goal of maximizing long-term stockholder value. |

10 Ironwood

How We are Selected and Evaluated |

We believe that our board of directors should be comprised of individuals with sophistication and experience in many substantive areas that will help us achieve our vision of becoming a leading GI company dedicated to advancing treatments for GI diseases and advancing care for millions of GI patients.

The core criteria that we use in evaluating each nominee to our board consists of the following: (a) an owner-oriented attitude and a commitment to represent the interests of our stockholders, demonstrated, in part, through ownership of our capital stock; (b) strong personal and professional ethics, integrity and values; (c) strong business acumen and savvy; (d) a deep, genuine passion for our business and the patients whom we serve; (e) demonstrated achievement in the nominee's field of expertise; (f) the absence of conflicts of interest that would impair the nominee's ability to represent the interests of our stockholders; (g) the ability to dedicate the time necessary to regularly participate in meetings of the board and committees of our board; and (h) the potential to contribute to the diversity of our board of directors, as a result of the nominee's professional background, expertise, gender, age or ethnicity.

As illustrated in the matrix below, we believe our directors possess the professional and personal qualifications and necessary expertise both within and outside of the healthcare industry to maintain a diverse and experienced board of directors that can effectively represent stockholders.

| | | | | | | | | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | |

| | Broader Business | Healthcare Industry | ||||||||||||||

| Ironwood Board of Directors | Capital Allocation / Finance / Accounting | Strategic Transactions | Risk Management | Human Capital | Public Company Board | Senior Leadership (small biotech) | Senior Leadership (large pharma) | Customer / Market Insights (patient, payer, physician) | ||||||||

| | | | | | | | | | | | | | | | | |

Julie H. McHugh | ✓ | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Andrew Dreyfus | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Lawrence S. Olanoff, M.D., Ph.D. | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Mark Mallon | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Jon R. Duane | ✓ | ✓ | ✓ | | | | | ✓ | ||||||||

Edward P. Owens | ✓ | ✓ | ✓ | ✓ | ||||||||||||

Mark G. Currie | ✓ | ✓ | ✓ | ✓ | | ✓ | ✓ | ✓ | ||||||||

Marla L. Kessler | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Catherine Moukheibir | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | | | ||||||||

| | | | | | | | | | | | | | | | | |

Director Succession Planning

We refresh our board of directors and assess our board succession plans regularly. As of April 21, 2020, the average age of our independent directors' was 61 years, and the average tenure of our independent directors was approximately 3.5 years. Five of our nine directors (including Mr. Mallon) joined our board of directors in 2019.

Annual Evaluations

Our directors conduct annual evaluations to assess the performance and effectiveness of the board of directors and each committee in which they are a member. In addition, each director completes a self-evaluation as well as a peer evaluation of each other director. For 2019, each director completed a written questionnaire which solicited open-ended and candid feedback on an anonymous basis. In addition to the director evaluations, we also solicit annual feedback from senior management concerning the board's performance on an anonymous basis. After the collective board and

2020 Proxy Statement 11

committee evaluations and comments (including those from senior management) and the self and peer evaluations and comments were compiled, the chair of the governance and nominating committee met with our chair of the board and chief executive officer to discuss the board and committee evaluations and individual evaluations for directors. The chair of the committee also conducted individual feedback sessions with each director to discuss the results of his or her individual evaluation and then provided the committee with a summary of the individual evaluations for the Class I directors up for election at the 2020 annual meeting of stockholders. The chair of the committee then presented a summary of the collective board and committee evaluations and comments (including those from senior management) to the governance and nominating committee and full board of directors.

Director Nomination Process

Our governance and nominating committee identifies potential director candidates through referrals and recommendations, including from incumbent directors, management and stockholders, as well as through business and other organizational networks. We and our board of directors retained and paid third party firms to assist in identifying and evaluating potential director nominees to join our board of directors upon the completion of the Separation, including our chief executive officer. Stockholders who wish to recommend candidates may contact the governance and nominating committee in the manner described inStockholder Communications, Proposals and Nominations for Directorships—Communications. Stockholder-recommended candidates whose recommendations comply with these procedures will be evaluated by the governance and nominating committee in the same manner as candidates identified by the governance and nominating committee.

How We are Organized and Governed |

Board Size and Terms

Our Eleventh Amended and Restated Certificate of Incorporation, as amended, or our Certificate of Incorporation, states that our board of directors shall consist of between one and 15 members, and the precise number of directors shall be fixed by a resolution of our board of directors. Our board of directors currently consists of nine members. Each director holds office until his or her successor is duly elected and qualified or until his or her death, resignation or removal. Any vacancy on the board of directors, including a vacancy that results from an increase in the number of directors, may be filled by a vote of the majority of the directors then in office. Any additional directorships resulting from an increase in the number of directors will be apportioned by our board of directors among the three classes until the declassification of our board of directors, as described further below.

In accordance with the terms of our Certificate of Incorporation, our board of directors is currently divided into three classes, which has resulted in staggered elections. Upon the expiration of the term of a class of directors, directors in that class will be eligible to be nominated and elected for a new term at the annual meeting in the year in which their term expires. The current members of each class are set forth in the table above underWho We Are.

On the recommendation of our board of directors, our stockholders voted at our 2019 annual meeting of stockholders to amend our Certificate of Incorporation to declassify our board of directors to allow the company's stockholders to vote on the election of the entire board of directors on an annual basis, rather than on a staggered basis. Consistent with the amendment to our Certificate of Incorporation that was approved by our stockholders, the declassification of the board of directors will be phased in as follows:

12 Ironwood

For so long as our board of directors is classified, directors may be removed by our stockholders only for cause. Following the declassification of our board of directors, our directors will be removable with or without cause by our stockholders.

We separate the roles of chair of the board of directors and chief executive officer and rotate the chair approximately every five years, unless the governance and nominating committee recommends otherwise. Our board of directors believes that this structure enhances the board of directors' oversight of, and independence from, management, and enables the board of directors to carry out its responsibilities on behalf of our stockholders. This leadership structure also allows Mr. Mallon, our chief executive officer, to focus his time and energy on operating and managing the company, while leveraging the experience and perspective of Ms. McHugh, the current chair of our board of directors. We expect the next chair rotation will take place in 2024.

Director Independence

Under Nasdaq Rule 5605, a majority of a listed company's board of directors must be comprised of independent directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company's audit, compensation and governance and nominating committees be independent, and that audit and compensation committee members satisfy the additional independence criteria set forth in Rule 10A-3 and 10C-1, respectively, under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Under Nasdaq Rule 5605(a)(2), a director will only qualify as an "independent director" if, in the opinion of that company's board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our board of directors determined that none of Messrs. Dreyfus, Duane and Owens, Mses. Kessler, McHugh and Moukheibir, and Dr. Olanoff, representing seven of our eight non-employee directors and seven of our nine directors, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that term is defined under Nasdaq Rule 5605(a)(2). Mr. Mallon, our current chief executive officer, and Dr. Currie, who served as our senior vice president, chief scientific officer and president of R&D until the Separation, were not determined to be independent due to their current or recent employment with the company. Our board of directors also determined that each of the current members of our audit committee, our governance and nominating committee, and our compensation and HR committee satisfies the independence standards for such committee established by Rule 10A-3 and 10C-1 under the Exchange Act, the Securities and Exchange Commission, or the SEC, rules and the Nasdaq rules, as applicable. In making such determinations, our board of directors considered the information requested from and provided by each director concerning their background, employment and affiliations, including family relationships, the relationships that each such non-employee director has with Ironwood and all other facts and circumstances the board of directors deemed relevant in determining their independence. As part of such determination, the board of directors considered: (a) the volume of business between BCBSMA, the company in which Mr. Dreyfus serves as president and chief executive officer, and Ironwood, which amounted to less than 1% of the annual revenues of each company in 2019; and (b) payments made by Ironwood to IQVIA, the company in which Ms. Kessler serves as a senior vice president, which amounted to less than 1% of the annual revenues of IQVIA in 2019.

Risk Oversight

Our board of directors retains ultimate responsibility for risk oversight and our management retains the responsibility for risk management. In carrying out its risk oversight responsibilities, our board of directors reviews the long- and short-term internal and external risks facing the company through its participation in long-range strategic planning, and the annual review and evaluation of corporate risks that the audit committee reports. Our board of directors also believes that separating the roles of chair of the board of directors and chief executive officer enhances the board of directors' ability to oversee risk in an objective manner.

We have implemented and continue to refine a formalized enterprise risk management process. On an ongoing basis, we identify key risks, assess their potential impact and likelihood, and, where appropriate, implement operational

2020 Proxy Statement 13

measures and controls or purchase insurance coverage in order to help ensure adequate risk mitigation. Together with our board of directors, we are closely monitoring the developments and impact of COVID-19 on our business and operations, including employees, and are working to quickly address and mitigate risks in the evolving and dynamic environment.

On a quarterly basis, key risks, status of mitigation activities, and potential new or emerging risks are reported to and discussed with senior management and further addressed with our board of directors, as necessary. On at least an annual basis, a long-term comprehensive enterprise risk management update is provided to our board of directors. The long-term goal of our enterprise risk management process is to ingrain a culture of risk awareness and mitigation throughout the organization that can be applied to our current business activities as well as our assessment and pursuit of future business opportunities.

As set forth in its charter, our audit committee discusses with management any significant risks or exposures facing Ironwood, evaluates the steps management has taken or proposes to take to mitigate such risks, and reviews our compliance with such mitigation plans. As part of fulfilling these responsibilities, the audit committee meets regularly with Ernst & Young LLP, our independent registered public accounting firm, and members of our management, including our chief executive officer and chief financial officer. Our audit committee also discusses with Ernst & Young LLP any significant risks or exposures facing the company to the extent that such risks or exposures relate to accounting and financial reporting, and reviews related mitigation plans with Ernst & Young LLP. In addition, our audit committee reviews the risk factors presented in our annual reports on Form 10-K and our quarterly reports on Form 10-Q that we file with the SEC.

As part of our board of directors' risk oversight role, our compensation and HR committee reviews and evaluates the risks associated with our compensation programs and succession plans, as it is responsible under its charter for approving the compensation of all of our executive officers and overseeing the maintenance and presentation to our board of directors, of succession plans for members of our senior management. Likewise, our governance and nominating committee is responsible for evaluating the performance, operations and composition of our board of directors and the sufficiency of our corporate governance guidelines, either of which may impact our risk profile from a governance perspective.

In performing their risk oversight functions, each committee of our board of directors has full access to management, as well as the ability to engage outside advisors.

Hedging and Pledging Policy

As part of our insider trading prevention policy, our directors and executive officers are prohibited from engaging in any hedging or monetization transactions of our company securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds. In addition, our insider trading prevention policy generally prohibits our directors and executive officers from holding company securities in a margin account or pledging company securities as collateral for a loan.

Corporate Governance Guidelines

We have adopted corporate governance guidelines which are accessible through the Investors section of our website atwww.ironwoodpharma.com, under the heading Corporate Governance, and which are available in print to any stockholder who requests them from our secretary. Our board of directors believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duties to stockholders, and relies on these guidelines to provide that framework. Among other things, the guidelines help to ensure that our board of directors is independent from management, that our board of directors adequately performs its oversight functions, and that the interests of our board of directors and management align with the interests of our stockholders.

14 Ironwood

Board Meetings

Our board of directors held 17 meetings during 2019. As stated in our corporate governance guidelines, we expect our directors to rigorously prepare for, attend, and participate in all board and applicable committee meetings. Each director is expected to ensure that other existing and planned future commitments do not materially interfere with his or her service as a director. We also expect that all of our directors up for election at, or who have a term that continues after, an annual meeting of stockholders will attend such annual meeting. In 2019, each incumbent director attended at least 75% of all meetings of the board of directors and all committees of the board of directors on which he or she served that were held during the period that such director was a member of the board of directors or the applicable committee. All nine of our directors at the time of our 2019 annual meeting of stockholders attended this meeting.

Committees

Our board of directors has established an audit committee, a governance and nominating committee and a compensation and HR committee. In addition, our board of directors established a capital allocation committee in 2018 to oversee and monitor the company's business mix and capital allocation decisions in order to make recommendations to the board of directors, as well as advise on the Separation. This committee was disbanded upon completion of the Separation. Each of the audit committee, the governance and nominating committee and the compensation and HR committee operates under a charter approved by our board of directors. Copies of each charter are accessible through the Investors section of our website atwww.ironwoodpharma.com, under the heading Corporate Governance, and are available in print to any stockholder who requests them from our secretary. The chair of each of our committees is expected to rotate approximately every three to five years, unless the governance and nominating committee recommends otherwise.

Audit Committee

We have a separately designated standing audit committee established by our board of directors for the purpose of overseeing our accounting and financial reporting processes and audits of our financial statements. The members of our audit committee are Mses. Moukheibir and McHugh and Mr. Owens. Ms. Moukheibir chairs the audit committee. Our audit committee met six times during 2019. Our audit committee assists our board of directors in its oversight of significant risks facing Ironwood, the integrity of our financial statements and our independent registered public accounting firm's qualifications, independence and performance.

Our audit committee's responsibilities include:

2020 Proxy Statement 15

Our board of directors has determined that Ms. Moukheibir is an audit committee financial expert, as defined in Item 407(d)(5) of Regulation S-K.

16 Ironwood

Audit Committee Report

In the course of our oversight of Ironwood's financial reporting process, we have (i) reviewed and discussed with management the company's audited financial statements for the fiscal year ended December 31, 2019, (ii) discussed with Ernst & Young LLP, the company's independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the PCAOB and the SEC, and (iii) received the written disclosures and the letter from Ernst & Young LLP, the company's independent registered public accounting firm, required by applicable requirements of the PCAOB regarding the independent registered public accounting firm's communications with us concerning independence, discussed with the independent registered public accounting firm its independence, and considered whether the provision of non-audit services by the independent registered public accounting firm is compatible with maintaining its independence.

Based on the foregoing review and discussions, we recommended to the board of directors of the company that the audited financial statements be included in the company's Annual Report on Form 10-K for the year ended December 31, 2019 for filing with the SEC.

| By the Audit Committee, | ||

Catherine Moukheibir, Chair Julie H. McHugh Edward P. Owens |

2020 Proxy Statement 17

Governance and Nominating Committee

The members of our governance and nominating committee are Messrs. Olanoff and Duane and Ms. McHugh. Mr. Olanoff chairs the governance and nominating committee. Our governance and nominating committee met two times during 2019.

Our governance and nominating committee's responsibilities include:

Compensation and HR Committee

The members of our compensation and HR committee are Messrs. Dreyfus and Duane and Ms. Kessler. Mr. Dreyfus chairs our compensation and HR committee. Our compensation and HR committee met seven times during 2019. Our compensation and HR committee assists our board of directors in fulfilling its responsibilities relating to the compensation of our board of directors and our executive officers.

Our compensation and HR committee's responsibilities include:

18 Ironwood

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation and HR committee is or has at any time during the past fiscal year been an officer or employee of Ironwood. None of the members of our compensation and HR committee has formerly been an officer of Ironwood. None of our executive officers serve, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our board of directors or compensation and HR committee. None of the members of our compensation and HR committee had any relationship with us that requires disclosure under any paragraph of Item 404 of Regulation S-K under the Exchange Act.

How We Are Paid |

The majority of the compensation that our non-employee directors receive for service on our board of directors is paid in the form of restricted shares of our Class A common stock. Vesting of these shares of restricted stock is contingent on each non-employee director continuing to serve as a member of the board of directors on the last day of each applicable vesting period. If a director ceases serving as a member of our board of directors at any time during the vesting period of a restricted stock award, or RSA, unvested shares will be forfeited on the date of such director's termination of service.

Director Compensation Plan, effective January 2014

From January to May 2019, our directors were compensated pursuant to our prior director compensation plan, which became effective January 1, 2014, or the 2014 Director Compensation Plan. Under this plan, at each annual meeting of stockholders, our non-employee directors received an annual grant of the number of restricted shares of our Class A common stock calculated by dividing (i) the dollar amount for total director compensation approximating the 25th percentile of our current peer group on the date of grant, by (ii) the average closing price of our Class A common stock on the Nasdaq Global Select Market for the six months preceding the month in which the applicable annual meeting of stockholders occurs. Such restricted shares vested 25% on each three-month anniversary of the grant date over a nine-month period and the remaining 25% on the day before the date of the annual meeting of stockholders for the next calendar year.

Under our 2014 Director Compensation Plan, if a non-employee director was elected other than at an annual meeting of our stockholders, on the start date of such non-employee directors service on the board of directors, such non-employee director was granted the number of restricted shares of our Class A common stock granted to non-employee directors at the most recent annual meeting of our stockholders, prorated based on the number of days between the last annual meeting of our stockholders and the date on which the non-employee director began service with us. In connection with their election to the board, on April 1, 2019, each of Mses. Kessler and Moukheibir, Dr. Currie and Mr. Duane were issued 2,995 restricted shares of our Class A common stock, which vested in full on the day before the date of our 2019 annual meeting of stockholders.

In addition, pursuant to our 2014 Director Compensation Plan, the chair of our board and each of the committee chairs received annual compensation of $10,000, payable quarterly in unrestricted stock or cash at the individual director's election. Shares of our Class A common stock issued to our directors under our 2014 Director Compensation Plan were granted under our Amended and Restated 2010 Employee, Director and Consultant Equity Incentive Plan, or the 2010 Plan. Further, whether the shares of restricted stock are vested or not, no director may transfer any shares of restricted stock granted pursuant to our 2014 Director Compensation Plan while such person is a director of Ironwood, subject to limited exceptions.

2020 Proxy Statement 19

Under our 2014 Director Compensation Plan, non-employee directors also were reimbursed for reasonable travel and other expenses incurred in connection with attending meetings of the board of directors and its committees.

Non-Employee Director Compensation Policy, effective May 2019

Following a competitive assessment of market data related to non-executive director compensation provided by Pearl Meyer & Partners, LLC, or Pearl Meyer, our compensation consultant at the time, our compensation and HR committee approved our non-employee director compensation policy, or the 2019 Director Compensation Policy, effective in May 2019. Under our 2019 Director Compensation Policy, at each annual meeting of stockholders, our non-employee directors are granted restricted shares of our Class A common stock with a grant date fair value of $250,000, determined based on the average closing price of our Class A common stock on the Nasdaq Global Select Market (or the stock exchange on which our stock is being actively traded) for the six months preceding the month in which the award is granted, rounded down to the nearest whole share. Such restricted shares vest in full on the date immediately preceding the date of the next annual meeting of stockholders.

Under our 2019 Director Compensation Policy, if a non-employee director is elected other than at an annual meeting of our stockholders, then upon his or her initial election to our board of directors, such director will be granted the number of restricted shares of our Class A common stock granted to non-employee directors at the most recent annual meeting of our stockholders, prorated based on the number of days between the last annual meeting of our stockholders and the date on which the non-employee director began service with us. Such restricted shares will vest in full on the date immediately preceding the date of the next annual meeting of stockholders. In addition, each non-employee director who is first elected to our board of directors will, upon his or her initial election, be granted restricted shares of our Class A common stock with a grant date fair value of $250,000, determined based on the average closing price of our Class A common stock on the Nasdaq Global Select Market (or the stock exchange on which our stock is being actively traded) for the six months preceding the month in which the award is granted, rounded down to the nearest whole share. Such restricted shares vest in three equal installments on the first three anniversaries of the grant date.

Shares of restricted stock that were granted to our directors under our 2019 Director Compensation Policy in connection with our 2019 annual meeting of stockholders were granted under our 2010 Plan. After May 2019, shares of restricted stock granted to directors under our 2019 Director Compensation Policy will be granted under our 2019 Equity Incentive Plan, or our 2019 Plan.

In addition to equity grants, each non-employee director receives an annual retainer under our 2019 Director Compensation Policy for his or her service on our board of directors, as well as additional fees for board chair, committee or committee chair service as follows:

| | | |

|---|---|---|

| | | |

| | Fees | |

| | | |

| Annual retainer for members of the board of directors | $50,000 ($80,000 for the chair) | |

| Additional annual retainer for members of the audit committee | $10,000 ($20,000 for the chair) | |

| Additional annual retainer for members of the compensation and HR committee | $7,500 ($15,000 for the chair) | |

| Additional annual retainer for members of the governance and nominating committee | $5,000 ($10,000 for the chair) | |

| | | |

20 Ironwood

All cash fees are payable quarterly in arrears and will be prorated for any quarter of partial service, and fees payable under our 2019 Director Compensation Policy were retroactive to April 1, 2019. Each non-employee director may elect, prior to January 1 of the year with respect to which such election will be effective, to receive fully vested shares of our Class A common stock at no cost in lieu of his or her annual cash retainer and any additional cash retainers for board chair, committee or committee chair service set forth above. The number of shares of our Class A common stock to be issued will be determined by dividing the applicable cash retainer(s) the director would be eligible to receive by the closing price of our Class A common stock on the Nasdaq Global Select Market (or the stock exchange on which our stock is being actively traded) on the date the cash fees would otherwise be paid, rounded down to the nearest whole share. Further, non-employee directors are reimbursed for reasonable travel and other expenses incurred in connection with attending meetings of the board of directors and its committees.

Director Stock Ownership Guidelines

In May 2019, we instituted stock ownership guidelines that provide that each non-employee director must accumulate and continuously hold shares of our Class A common stock with a value equal to or greater than three times the amount of the then-current annual retainer paid to the non-employee director for service on our board of directors (excluding any additional board chair, committee, or committee chair retainers). Non-employee directors are required to achieve this level of ownership by the later of (a) May 30, 2021 (the date which is two years from the date of our 2019 annual meeting of stockholders) and (b) two years from the date the individual began service with us, or the Ownership Date.

Compliance with the stock ownership requirements will be measured on the date of the annual meeting of stockholders each year based on the annual retainer then in effect. Following the Ownership Date, until a non-employee director holds the required ownership level and if such director does not hold the number of shares of our Class A common stock to meet the stock ownership requirements at any time thereafter, such director will be required to retain 100% of any shares of our Class A common stock held or received upon the vesting or settlement of equity awards or the exercise of stock options, in each case, net of shares sold to cover applicable taxes and the payment of any exercise or purchase price (if applicable). Further, following the Ownership Date, to the extent a non-employee director does not hold the number of shares of our Class A common stock that meets this threshold, such director will be automatically deemed to have elected to receive any cash retainer for service on our board of directors or a committee thereof in the form of shares of our Class A common stock in an amount that satisfies the threshold shortfall.

In addition to the stock ownership guidelines described above, the non-employee director share transfer restrictions described above under our 2014 Director Compensation Plan remain in effect with respect to any shares granted under that plan.

We believe our stock ownership guidelines and other transfer restrictions ensure that the interests of our directors, each of whom has equity in the business, are aligned with those of our stockholders and further focus our directors on maximizing long-term value.

Director Compensation Table

The following table sets forth information regarding the compensation earned during the year ended December 31, 2019 by each of our directors who served in 2019 other than (i) Mr. Mallon, our current chief executive officer and current member of our board of directors, (ii) Peter Hecht, our former chief executive officer and former member of board of directors, and (iii) Mark Currie, our former senior vice president, chief scientific officer and president of R&D and current member of our board of directors. Neither Mr. Mallon nor Dr. Hecht received compensation for his service on our board of directors, and Dr. Currie's compensation for service on our board of directors is included in theSummary Compensation Table available elsewhere in this proxy statement.

| | | | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| Name* | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) | |||||||

| | | | | | | | | | | |

Andrew Dreyfus | $ | 48,736 | (2) | $ | 244,317 | $ | 293,053 | |||

Jon R. Duane | $ | 45,795 | (3) | $ | 286,306 | $ | 332,101 | |||

Marsha H. Fanucci | $ | 2,500 | (4) | $ | — | $ | 2,500 | |||

Marla L. Kessler | $ | 43,125 | (5) | $ | 286,306 | $ | 329,431 | |||

Terrance G. McGuire | $ | 2,492 | (6) | $ | — | $ | 2,492 | |||

Julie H. McHugh | $ | 73,750 | (7) | $ | 244,317 | $ | 318,067 | |||

Catherine Moukheibir | $ | 52,500 | (8) | $ | 286,306 | $ | 338,806 | |||

Lawrence S. Olanoff | $ | 45,000 | (9) | $ | 244,317 | $ | 289,317 | |||

Edward P. Owens | $ | 47,500 | (10) | $ | 244,317 | $ | 291,817 | |||

Amy W. Schulman | $ | 2,492 | (11) | $ | — | $ | 2,492 | |||

Douglas E. Williams, Ph.D. | $ | — | $ | — | $ | — | ||||

| | | | | | | | | | | |

2020 Proxy Statement 21

22 Ironwood

On April 1, 2019, each of the non-employee directors who was on our board of directors prior to the date of the Separation held 4,056 unvested shares of our Class A common stock, which represented 25% of the annual restricted stock award of 16,223 shares of our Class A common stock granted on the date of our 2018 annual meeting of stockholders. In connection with the Separation, on April 1, 2019, each such director received a dividend of 405 shares of unrestricted shares of Cyclerion common stock, which amount was determined according to a fixed ratio of one share of Cyclerion common stock for every 10 shares of unvested Ironwood Class A common stock. In addition to receiving 405 shares of Cyclerion common stock, the Separation had the following impact on unvested restricted stock held by directors at the time of the Separation:

| | | | ||

|---|---|---|---|---|

| | | | | |

| Directors | Ironwood | Cyclerion | ||

| | | | | |

| Directors who remained on Ironwood's board of directors following the Separation (Ms. McHugh, Messrs. Dreyfus and Owens and Dr. Olanoff) | Retained the 4,056 shares of Ironwood Class A common stock that were unvested as of April 1, 2019, which shares vested in full on the date of our 2019 annual meeting of stockholders | | ||

| Directors who transitioned to Cyclerion's board of directors in connection with the Separation (Mses. Fanucci and Schulman and Mr. McGuire) | Forfeited the 4,056 shares of Ironwood Class A common stock shares that were unvested as of April 1, 2019 | Received 3,279 shares of unvested Cyclerion common stock, which were granted on substantially the same terms and vesting conditions as were applicable to the 4,056 forfeited shares of Ironwood Class A common stock(1) | ||

| Director who transitioned off of Ironwood's board of directors and did not join Cyclerion's Board of Directors (Dr. Williams) | Forfeited 4,056 Ironwood shares that were unvested as of April 1, 2019 | | ||

| | | | | |

(1) The 3,279 shares of unvested Cyclerion common stock granted in connection with the Separation were calculated by dividing (i) $13.45 (the volume-weighted average price of Ironwood's Class A common stock for the 10 days preceding the Separation) by (ii) $14.81 (the purchase price of Cyclerion common stock as of the date of the Separation), then multiplying the quotient by (iii) 4,056 shares.

Furthermore, the directors who joined Ironwood's board of directors in connection with the Separation (Mses. Kessler and Moukheibir, Dr. Currie and Mr. Duane) also received 405 shares of Cyclerion common stock in addition to the award of 2,995 shares of restricted Ironwood Class A common stock granted on April 1, 2019 in connection with joining our board of directors. Further information on the impact of the Separation on directors' equity is available elsewhere in this proxy statement under the captionCompensation Discussion and Analysis—Equity Impact of the Separation.

2020 Proxy Statement 23

Proposal No. 1 |

Our board of directors has nominated each of our current Class I directors—Dr. Currie and Messrs. Duane and Mallon—for election at the 2020 annual meeting. Each of Dr. Currie and Messrs. Duane and Mallon has indicated his willingness to serve if elected and has consented to be named in the proxy statement. Should any nominee become unavailable for election at the annual meeting, the persons named on the enclosed proxy card as proxy holders may vote all proxies given in response to this solicitation for the election of a substitute nominee chosen by our board of directors.

Vote Required

The three nominees for director with the highest number of affirmative votes will be elected as directors to serve for one year and until their successors are duly elected and qualified or until their death, resignation or removal. Because there is no minimum vote required, abstentions and broker non-votes will not affect the outcome of this proposal.

26 Ironwood

Who We Are |

The following table sets forth certain information, as of April 21, 2020, with respect to each of our executive officers, other than Mr. Mallon, whose biographical information is included elsewhere in this proxy statement under the captionOur Board of Directors:

| | | | | | |

Name | Age | Position(s) | |||

| | | | | | |

Gina Consylman, CPA | | 48 | Senior Vice President, Chief Financial Officer | ||

Conor Kilroy | 38 | Senior Vice President, General Counsel | |||

Thomas A. McCourt | | 62 | President | ||

Jason Rickard | 49 | Senior Vice President, Chief Operating Officer | |||

Michael Shetzline, M.D., Ph.D. | | 61 | Chief Medical Officer, Senior Vice President and Head of Drug Development | ||

| | | | | | |

| | | |

| GINA CONSYLMAN, CPA Senior Vice President, Chief Financial Officer of Ironwood Pharmaceuticals, Inc. Age: 48 Joined Ironwood 2014 | • Ms. Consylman has served as our senior vice president, chief financial officer since November 2017. Ms. Consylman previously served as our interim chief financial officer from September 2017 to November 2017, and as our vice president of finance and chief accounting officer from August 2015 to November 2017. She also previously served as our vice president, corporate controller and chief accounting officer from June 2014 to July 2015. • Prior to joining Ironwood, Ms. Consylman served as vice president, corporate controller and principal accounting officer of Analogic Corporation, or Analogic, (which was acquired by funds affiliated with Altaris Capital Partners, LLC) from February 2012 to June 2014, where she oversaw Analogic's global accounting team. • Prior to joining Analogic, Ms. Consylman served in various finance roles at Biogen Inc., or Biogen, from November 2009 to February 2012, culminating in her service as senior director, corporate accounting where she was responsible for the accounting teams for the corporate and U.S. commercial business units. • Before joining Biogen, Ms. Consylman also served as corporate controller at Varian Semiconductor Equipment Associates, Inc. (subsequently acquired by Applied Materials, Inc.) • Ms. Consylman currently serves on the board of directors, including as chair of the audit committee, of Verastem, Inc. Ms. Consylman, a Certified Public Accountant, began her career in public accounting at Ernst & Young LLP. She holds a B.S. in accounting from Johnson & Wales University and a M.S. in taxation from Bentley University. |

2020 Proxy Statement 27

| | | |

| CONOR KILROY Senior Vice President, General Counsel of Ironwood Pharmaceuticals, Inc. Age: 38 Joined Ironwood 2013 | • Mr. Kilroy has served as our senior vice president since April 2020 and general counsel since April 2019. Prior to becoming senior vice president and general counsel, Mr. Kilroy served as senior director, assistant general counsel from June 2016 to April 2019, director, senior corporate counsel from June 2014 to June 2016 and as associate director, corporate counsel from June 2013 to June 2014. • Before joining Ironwood, Mr. Kilroy was corporate counsel, securities, at Boston Scientific Corporation from 2012 to 2013 and was an associate at Goodwin Procter LLP from 2007 to 2011. • Mr. Kilroy holds a B.A. from Brandeis University and a J.D. from Boston College Law School. |

| | | |

| THOMAS A. McCOURT President of Ironwood Pharmaceuticals, Inc. Age: 62 Joined Ironwood 2009 | • Mr. McCourt has served as our president since April 2019 and, prior to April 2019, had served as our senior vice president of marketing and sales and chief commercial officer since joining Ironwood in 2009. • Prior to joining Ironwood, Mr. McCourt led the U.S. brand team for denosumab at Amgen Inc. from April 2008 to August 2009. Prior to that, Mr. McCourt was with Novartis AG from 2001 to 2008, where he directed the launch and growth of ZELNORM™ for the treatment of patients with IBS-C and CIC and held a number of senior commercial roles, including vice president of strategic marketing and operations. • Mr. McCourt was also part of the founding team at Astra Merck Inc., leading the development of the medical affairs and science liaison group and then serving as brand manager for PRILOSEC® and NEXIUM®. • Mr. McCourt serves on the board of directors, including on the audit and compensation committees, of Acceleron Pharma Inc. and has a degree in pharmacy from the University of Wisconsin. |

28 Ironwood

| | | |

| JASON RICKARD Senior Vice President, Chief Operating Officer of Ironwood Pharmaceuticals, Inc. Age: 49 Joined Ironwood 2012 | • Mr. Rickard has served as our chief operating officer since April 2020. Prior to his appointment as the company's senior vice president, chief operating officer, Mr. Rickard had been the company's senior vice president, operations since July 2018, in which Mr. Rickard most recently led the company's manufacturing, pharmaceutical development, quality, human resources, information technology and facilities functions. Before becoming senior vice president, operations, Mr. Rickard served as the company's vice president global operations and information technology from July 2015 to July 2018; vice president global operations from March 2014 to July 2015; vice president commercial manufacturing supply chain from June 2013 to March 2014; and head of supply chain from January 2012 to June 2013. • Prior to joining Ironwood, Mr. Rickard was with Genentech, Inc. from 2000 to 2012 in roles of increasing responsibility in manufacturing and supply chain. Mr. Rickard began his career as a mechanical engineer at AMOT Controls Corporation. • Mr. Rickard holds an M.S. from California State University—Sacramento and a B.S. from California State University—Chico, both in mechanical engineering. |

| | | |

| MICHAEL SHETZLINE, M.D., Ph.D. Chief Medical Officer, Senior Vice President and Head of Drug Development of Ironwood Pharmaceuticals, Inc. Age: 61 Joined Ironwood 2019 | • Dr. Shetzline has served as our chief medical officer, senior vice president and head of drug development since January 2019. Dr. Shetzline is a gastroenterologist and internist, with more than 25 years of experience in the biopharmaceutical industry and academia. • Before joining Ironwood, Dr. Shetzline was vice president and head of gastroenterology clinical sciences at Takeda Pharmaceuticals International Co., or Takeda, where he led global clinical development for all GI assets from January 2015 to January 2019. • Prior to Dr. Shetzline's role at Takeda, Dr. Shetzline served as vice president and global head of gastroenterology at Ferring International Pharmascience Center U.S., Inc., or Ferring, from September 2012 to January 2015, during which he led Ferring's clinical development programs in gastroenterology. Before that, Dr. Shetzline was vice president and global program head crossing multiple therapeutic areas and head of translational medicine GI discovery at Novartis Pharmaceuticals AG from 2002 to 2012. • Dr. Shetzline also served as gastroenterology program director and assistant professor of medicine at Duke University Medical Center from 1997 to 2002. Dr. Shetzline has published over 40 full papers and book chapters and acted as a reviewer for a range of medicine journals. • Dr. Shetzline earned his M.D. and Ph.D. from The Ohio State University in physiology and medicine. Dr. Shetzline completed his internal medicine residency and fellowship in gastroenterology and served on the faculty as a National Institutes of Health supported physician scientist at Duke University Medical Center. • Dr. Shetzline is a Fellow of the American College of Physicians, the American College of Gastroenterology, and the American Gastroenterological Association and certified by the American Board of Internal Medicine. |

2020 Proxy Statement 29

Dear Ironwood stockholders,

2019 was a transformative year for Ironwood, underscored by the clear execution from the Ironwood team in driving forward our mission to advance treatment of GI diseases and redefine the standard of care for millions of GI patients. Ironwood is undeniably a very different company today than it was a little over a year ago.

In line with the changes in the company's focus, strategy and leadership team marked by the Separation, we took the opportunity in 2019 to refresh a number of the company's significant plans and policies. At our 2019 annual meeting of stockholders, our stockholders approved our 2019 Equity Incentive Plan, which, among other features that we believe will advance the interests of our stockholders, did not continue the "evergreen" feature of our prior equity incentive plan and limited share recycling under the plan. Additionally, in early 2019, we adopted a clawback policy that provides that our board of directors may recover from our current and former executive offers certain incentive compensation under certain conditions upon a financial restatement. We also instituted formal stock ownership guidelines for directors to further align our director compensation program with the long-term performance of the company.

We also made several important changes to Ironwood's executive compensation program. As we discuss further below, we developed a competitive compensation package to recruit Mark Mallon, who became our CEO in connection with the Separation. We adopted a new executive compensation peer group that includes similarly sized commercial biopharmaceuticals peers (based on market capitalization, median revenue, number of employees, as well as other factors) to align to our post-Separation profile. In addition, for our 2020 executive equity compensation program, we decided to replace stock option grants with performance-based stock unit awards that are designed to further align executive pay with our performance, including stock price performance. We believe this important adjustment will motivate our executive team and further tie our executives' compensation to stockholder value.

As always, we are open to your feedback. Thank you for the privilege of serving as your compensation and HR committee chair.

Sincerely,

Andrew Dreyfus

Chair, Compensation and HR Committee

30 Ironwood

Compensation Discussion and Analysis

Executive Summary |

In 2019 and 2020, our executive compensation program has evolved along with the changes to our business marked by the Separation. Two key highlights, described further below, were: (1) the transition of our chief executive officer in connection with the Separation, and (2) the introduction of performance-based units, or PSUs, into our 2020 equity compensation program for our executive officers in lieu of stock options.

Stockholder Engagement and Say-On-Pay Vote Consideration |

Feedback from stockholders is an essential part of our executive compensation decision-making processes. Our company engages with many of our largest stockholders on an annual basis. We invite feedback on a wide variety of topics including corporate strategy, capital allocation, governance, and executive compensation. In 2019, senior management met with nearly all of Ironwood's largest 20 stockholders, which represented over 90% of our outstanding shares as of December 31, 2019.

Our stockholders also have the opportunity to cast a non-binding advisory vote on named executive officer compensation, or a "say-on-pay" vote, every year. This allows our stockholders to provide us with regular, timely and direct input on our executive compensation philosophy, policies and practices. We believe this enables us to further align our compensation programs with our stockholders' interests and to enhance our ability to consider stockholder feedback as part of our annual compensation review process. We sought stockholder input on our executive compensation programs through the say-on-pay vote at our 2019 annual meeting of stockholders and approximately 87% of votes cast by our stockholders voted in support of our named executive officer compensation.

2020 Proxy Statement 31

Compensation Decisions for 2019 and 2020 |

Named Executive Officers for 2019

This section discusses the principles underlying our policies and decisions with respect to the compensation of our executive officers who are named in theSummary Compensation Table, or our named executive officers. Provided below are material factors we believe are relevant to an analysis of these policies and decisions. Our named executive officers for 2019, which include executives who served the company prior to the Separation, were:

Ironwood executive officers:

Ironwood executive officers prior to the Separation:

Ms. Gilbert resigned from her position with Ironwood effective February 28, 2020. Additional information is provided under the captionPost-Employment Arrangements elsewhere in this proxy statement. Drs. Hecht and Currie each resigned from their respective positions with Ironwood in connection with the Separation in April 2019. Dr. Hecht is no longer an officer or director of Ironwood. Dr. Currie joined our board of directors in April 2019. Additional information is provided under the captionCompensation of Named Executive Officers Who Transitioned to Cyclerion, elsewhere in this proxy statement.

2019 CEO Transition Compensation