SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form 20-F/A

Amendment No. 4

[X] Registration Statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934;

[ ] Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

For the fiscal year ended:

[ ] Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

For the transition period from _______ to ________

[ ] Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

Commission file number:0-53479

DOVE ENERGY INC.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Alberta, Canada

(Jurisdiction of incorporation or organization)

800-6th Avenue SW, Suite 410

Calgary, Alberta

Canada T2P 3G3

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Exchange Act: None.

Securities registered or to be registered pursuant to Section 12(g) of the Exchange Act:

Title of Class: Common Stock, no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

The number of outstanding shares of the issuer’s common Stock as of December 31, 2007: 23,301,000

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer o | | | Accelerated filer o | | | Non-accelerated filer x | | |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP x | | | International Financial Reporting Standards as issued | | | Other o | | |

| | | by the International Accounting Standards Board o | | | | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item theregistrant has elected to follow.

Item 17 o Item 18 o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

INTRODUCTION | 5 |

BUSINESS OF DOVE ENERGY INC. | 5 |

FINANCIAL AND OTHER INFORMATION | 5 |

FORWARD- LOOKING STATEMENTS | 5 |

| | |

PART I |

Item 1. | Identity of Directors, Senior Management and Advisers | 6 |

| Directors | 6 |

| Senior Management | 6 |

| Advisors | 7 |

| Auditors | 7 |

Item 2. | Offer Statistics and Expected Timetable | * |

Item 3. | Key Information | 7 |

| Selected Financial Data | 7 |

| Capitalization and Indebtedness | 9 |

| Reason for the Offer and Use of Proceeds | 10 |

| Risk Factors | 10 |

Item 4. | Information on the Company | 18 |

| History and Development of the Company | 18 |

| Business Overview | 19 |

| Organizational Structure | 22 |

| Property, Plants and Equipment | 22 |

Item 4A | Unresolved Staff Comments | * |

Item 5. | Operating and Financial Review and Prospects | 32 |

| Operating Results | 32 |

| Liquidity and Capital Resources | 35 |

| Research and Development | 40 |

| Trend Information | 40 |

| Off-balance sheet arrangements | 40 |

| Tabular disclosure of contractual obligations | 41 |

| Safe harbor | 42 |

Item 6. | Directors, Senior Management and Employees | 42 |

| Directors and Senior Management | 42 |

| Compensation of Directors and Officers | 43 |

| Board Policies | 44 |

| Employees | 44 |

| Share Ownership | 44 |

Item 7. | Major Shareholders and Related Party Transactions | 45 |

| Major Shareholders | 45 |

| Related Party Transactions | 46 |

| Interest of Experts and Counsel | 46 |

Item 8. | Financial Information | 46 |

| Consolidated Statements and Other Financial Information | 46 |

| | Significant Changes | | 46 |

| Item 9. | The Offer and Listing | | 46 |

| Item 10. | Additional Information | | 48 |

| | Share Capital | | 48 |

| | Memorandum and articles of incorporation | | 49 |

| | Material Contracts | | 51 |

| | Exchange Controls | | 51 |

| | Taxation | | 52 |

| | Dividends and paying agents | | 57 |

| | Statements by experts | | 57 |

| | Documents on display | | 57 |

| | Subsidiary Information | | 57 |

Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 57 |

Item 12. | Description of Securities Other Than Equity Securities | * |

PART II |

Item 13. | Defaults, Dividends Arrearages and Delinquencies | * |

Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | * |

Item 15. | Controls and Procedures | * |

Item 16A. | Audit Committee Financial Expert | * |

Item 16B. | Code of Ethics | * |

Item 16C. | Principal Accountant Fees and Services | * |

Item 16D. | Exemptions from the Listing Standards for Audit Committees | * |

Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchases | * |

Item 17. | Financial Statements | 59 |

Item 18. | Financial Statements | 59 |

Item 19. | Exhibits | 60 |

SIGNATURES | 61 |

CERTIFICATIONS | 62 |

INTRODUCTION

Dove Energy Inc. was organized under the laws of Alberta, Canada on February 15, 2005. In this Registration Statement, the “Company”, "we," "our" and "us" refer to Dove Energy Inc. (unless the context otherwise requires). The Company files Registration Statement Amendment No 2 (“Registration Statement”) to include interim financial statements for the period ended September 30, 2008. Summary discussions of documents referred to in this Registration Statement may not be complete and we refer you to the actual documents for more complete information. Our principal corporate offices are located at 800-6th Avenue SW, Suite 410, , Calgary, Alberta, Canada T2P 3G3; our telephone number is (403) 612-1980.

BUSINESS OF DOVE ENERGY INC.

Dove Energy Inc. is involved in the evaluation, acquisition and development of oil and gas properties. The Company's primary properties are located in Alberta, Canada.

FINANCIAL AND OTHER INFORMATION

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (“CDN$” or “$”). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

FORWARD-LOOKING STATEMENTS

This document (principally in ITEM No. 4, “Information on the Company” and ITEM No. 5, “Operating and Financial Review and Prospects) and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance. The words ‘‘believe’’, ‘‘anticipate’’, ‘‘intends’’, ‘‘estimate’’, ‘‘forecast’’, ‘‘project’’, ‘‘plan’’, ‘‘potential’’, ‘‘may’’, ‘‘should’’, ‘‘expect’’ and similar expressions identify forward-looking statements. Please note in this Registration Statement, ‘‘we’’, ‘‘us’’, ‘‘our’’, ‘‘the Company’’, all refer to Dove Energy Inc. and its subsidiaries.

The forward-looking statements in this document are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors and matters discussed elsewhere herein, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the strength of world economies, fluctuations in currencies and interest rates, general market conditions, changes in the Company’s operating expenses, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions and other important factors described from time to time in the reports filed by the Company with the Securities and Exchange Commission.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

1.A.1. Directors

Table No.1 lists as of February 3, 2009, the names of the Directors of the Company.

Table No.1

Directors

| |

| | | | | | | | | |

| Name | | | | Age | | Date First Elected or Appointed | | |

| |

| | | | | | | | | |

| Kene Ufondu (1) | | | | 41 | | February 2005 | | |

| Victor DeLaet (1) | | | | 53 | | February 2005 | | |

| (1) Resident/Citizen of Calgary Alberta, Canada | | |

| | | | | | |

| All business addresses: | | | c/o Dove Energy Inc. | | |

| | | 800-6th Avenue SW, Suite 410 | | |

| | | Calgary, Alberta, Canada T2P 3G3 | | |

1.A.2. Senior Management

Table No. 2 lists, as of February 3, 2009, the names of the Senior Management of the Company. The Senior Management serves at the pleasure of the Board Directors.

Table No. 2

Senior Management

| |

| | | | | | | | | |

| Name | | Position | | Age | | Date of First Appointment | | |

| |

| | | | | | | | | |

| Kene Ufondu | | President & CEO | | 41 | | February 2005 | | |

| Victor DeLaet | | CFO and Secretary | | 53 | | February 2005 | | |

| All business addresses: | | | c/o Dove Energy Inc. | | |

| | | 800-6th Avenue SW, Suite 410 | | |

| | | Calgary, Alberta, Canada T2P 3G3 | | |

________________________________________________________________________________________________________________________________

Kene Ufondu functions as President and Chief Executive officer of the Company. His duties include leading the search for business opportunities, strategic planning, business development, operation, liaison with auditors and accountants, lawyers, regulatory authorities, the financial community/shareholders; and reporting to the Board of Directors.

Victor DeLaet functions as Chief Financial Officer. His functions include financial administration; accounting and financial statements; liaison with auditors, accountants and the financial community/shareholders; and preparation/ payment/organization of the expenses/taxes/activities of the Company. His business functions as Corporate Secretary include insuring the Company’s compliance with all statutory and regulatory requirements.

1. B. Advisors

| The Company’s attorneys are: | | | D.M.B.H. Barristers & Solicitors | | |

| x | | | 1200, 1015-4th Street SW | | |

| x | | | Calgary AB Canada T2R 1J4 | | |

1. C. Auditors

The Company’s auditors for its financial statements for each of the preceding three periods were, Meyers Norris Penny LLP, Independent Registered Chartered Accountants, 7th Floor, 715 – 5 Avenue SW, Calgary AB Canada T2P 2X6.

Item 2. Offer Statistics and Expected Timetable

Not Applicable.

Item 3. Key Information

A. Selected Financial Data

The following selected financial data for the years ended December 31, 2007 and 2006 is derived from our audited financial statements, included herein and, in the opinion of management include all adjustments (consisting solely of normally recurring adjustments) necessary to present fairly the information set forth therein. The selected financial data from the period of inception to December 31, 2005 is derived from the unaudited financial statements of the Company, included herein and, in the opinion of management include all adjustments (consisting solely of normally recurring adjustments) necessary to present fairly the information set forth therein. The selected financial data, as well as the financial statements and accompanying notes, are prepared in accordance with accounting principles generally accepted in the United States, referred to in this annual report as US GAAP. The Registrant presents its financial statements in Canadian dollars. All dollar amounts in this Form 20-F are in Canadian dollars, except where otherwise indicated. You should read the following selected financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and accompanying notes and other financial information included elsewhere in this registration statement.

| | | | Period Ended | | | Period Ended | | | Year Ended | | | Year Ended | | | From Inception | |

| | | | Sept. 30, 2008 | | | Sept. 30 2007 | | | Dec. 31, 2007 | | | Dec. 31, 2006 | | | (Feb. 15, 2005 to | |

| | | | (unaudited) | | | (unaudited) | | | | | | | | | Dec. 31, 2005 | |

| | | | | | | | | | | | | | | | | | |

| Statement of Operations Data: | | | | | | | | | | | | | | | | | |

| Total revenues | | | $ | 110,222 | | $ | 132,087 | | $ | 160,475 | | $ | 64,823 | | $ | 11,112 | |

| Net Income/(Net Loss) | | | | (114,426 | ) | | (194,962 | ) | | (277,660 | ) | | (391,965 | ) | | (257,478 | ) |

| Basic and diluted net loss per share | | | | (0.01 | ) | | (0.02 | ) | | (0.01 | ) | | (0.02 | ) | | (0.01 | ) |

| Weighted average number of | | | | | | | | | | | | | | | | | |

| Shares used in computing basic and | | | | | | | | | | | | | | | | | |

| Diluted net loss per share- | | | | 23,337,438 | | | 23,217,117 | | | 23,337,438 | | | 22,849,205 | | | 18,289,381 | |

| Balance Sheet Data: * | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | $ | 87,632 | | $ | 112,317 | | $ | 112,317 | | $ | 451,772 | | $ | 721,622 | |

| Other Current Assets | | | | 161,154 | | | 178,304 | | | 178,304 | | | 79,990 | | | 43,223 | |

| Total current assets | | | | 248,786 | | | 290,621 | | | 290,621 | | | 531,762 | | | 764,845 | |

| Other Assets, Net | | | | 0.00 | | | 62,215 | | | 62,215 | | | 169,538 | | | 65,000 | |

| Oil and Gas Property Interests | | | | 743,495 | | | 804,675 | | | 804,675 | | | 866,403 | | | 488,262 | |

| Total assets | | | | 992,281 | | | 1,157,511 | | | 1,157,511 | | | 1,642,703 | | | 1,318,107 | |

| Total current liabilities | | | | 283,538 | | | 353,818 | | | 353,818 | | | 589,170 | | | 332,087 | |

| Total liabilities | | | | 562,701 | | | 613,505 | | | 613,505 | | | 809,387 | | | 532,285 | |

| Total accumulated deficit | | | | (1,107,830 | ) | | (993,404 | ) | | (993,404 | ) | | (649,444 | ) | | (257,478 | ) |

| Total stockholders’ equity (deficit) | | | | 992,281 | | | 1,157,511 | | | 1,157,511 | | | 1,642,703 | | | (1,318,107 | ) |

* Balance sheet data for the period ended September 30, 2007 is for the year ended December 31, 2007.

EXCHANGE RATES

The following table sets out the exchange rates for the conversion of Canadian dollars into United States dollars, expressed in United States dollars. The exchange rates used are the closing rates provided by The Bank of Canada. The table lists the rate in effect at the end of the following periods, the average exchange rates (based on the average of the exchange rates on the last day of each month in such periods), and the range of high and low exchange rates for such periods.

Year ended December 31, | | | | | | | | | | | | | | | | | |

|---|

| | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

|---|

| End of Period | | | | 1.01 | | | .86 | | | .86 | | | .83 | | | .77 | |

| Average for Period | | | | .98 | | | .87 | | | .83 | | | .81 | | | .72 | |

| High for Period | | | | 1.09 | | | .91 | | | .86 | | | .85 | | | .77 | |

| Low for Period | | | | .84 | | | .85 | | | .80 | | | .72 | | | .64 | |

The following table sets out the range of high and low exchange rates, for the conversion of Canadian dollars into United States dollars for each of the corresponding months during 2007 and 2008. The exchange rates used are the closing rates as provided by the Bank of Canada.

| Month | | | | High | | Low | |

|---|

| December 2007 | | | | 1.02 | | 0.98 |

| January 2008 | | | | 1.01 | | 0.97 |

| February 2008 | | | | 1.03 | | 0.98 |

| March 2008 | | | | 1.00 | | 0.97 |

| April 2008 | | | | 1.00 | | 0.97 |

| May 2008 | | | | 1.00 | | 0.98 |

| June 2008 | | | | 1.01 | | 0.97 |

| July 2008 | | | | 1.00 | | 0.97 |

| August 2008 | | | | 0.98 | | 0.94 |

September 2008 | | | | 0.97 | | 0.93 |

October 2008 | | | | 0.94 | | 0.77 |

November 2008 | | | | 0.87 | | 0.78 |

| December 2008 | | | | 0.84 | | 0.77 |

The exchange rate on December 31, 2008 for the conversion of United States dollars into Canadian dollars was $1.22 (CDN$1.00 = US$1.22). The exchange rates used are the noon buying rates in New York City for cable transfers in foreign currencies, as certified for customs purposes by the Federal Reserve Bank of New York.B. Capitalization and Indebtedness.

Table No. 5 sets forth the capitalization and indebtedness of the Company as of September 30, 2008.

Table No. 5

Capitalization and Indebtedness

September 30, 2008

______________________________________________________________________________

______________________________________________________________________________

| Shareholders’ equity: | | | | | |

| Common Shares, no par value; | | | | | |

| Unlimited number of shares authorized | | | | | |

| 22,802,500 Class A shares issued and outstanding | | | $ | 1,415,050 | |

| 598,500 Class B shares issued and outstanding | | | | 299,250 | |

| Total | | | | 1,537,410 | |

| Retained Earnings (deficit) | | | | (1,107,830 | ) |

| Net Shareholders’ Equity | | | | 429,580 | |

| TOTAL CAPITALIZATION | | | $ | 992,281 | |

--------------------------------------------------------------------------------------------------------------------

September 30, 2008

Warrants Outstanding: | $nil |

Stock Options Outstanding: | $nil |

Preference Shares Outstanding: | $nil |

Capital Leases: | $nil |

Guaranteed Debt: | $nil |

Secured Debt: | $nil |

______________________________________________________________________________

______________________________________________________________________________

C. Reasons for the Offer and Use of the Proceeds.

Not Applicable.

D. Risk Factors.

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment. The risks described below are not the only ones we face. Additional risks that generally apply to publicly traded companies, that are not yet identified or that are currently perceived as immaterial, may also impair our business operations. Our business, operating results and financial condition could be adversely affected by any of the following risks. You should refer to the other information set forth in this document, including our financial statements and the related notes.

This registration statement also contains certain forward-looking statements that involve risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “expects,” “anticipates,” “intends,” “plans” and similar expressions. Our actual results could differ materially from those discussed in these statements. Factors that could contribute to such differences include, but are not limited to, those discussed below and elsewhere in this registration statement.

RISK FACTORS RELATED TO OUR BUSINESS AND OPERATIONS

We are an exploration stage company, with limited operating history, which raises substantial doubt as to our ability to successfully develop profitable business operations and makes an investment in our common shares very risky.

It may be difficult to evaluate our business and prospects because we have a limited operating history. We were incorporated and we began operations in February, 2005. As a result we have only recently commenced oil and gas exploration operations. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered in establishing a business in the oil and natural gas industries. We have been focused on organizational, start-up, property acquisition, and fund-raising activities. There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Our future operating results will depend on many factors, including:

• our ability to raise adequate working capital;

• success of our development and exploration;

• demand for natural gas and oil;

• the level of our competition and responding to competitive developments;

• our ability to attract and maintain key management and employees; and

• our ability to efficiently explore, develop and produce sufficient quantities of marketable natural gas or oil in a highly competitive and speculative environment while maintaining quality and controlling costs.

To achieve profitable operations, we must, alone or with others, successfully execute on the factors stated above. If we are not successful in executing any of the above stated factors, our business will not be profitable,, which make our common shares a less attractive investment and may harm the trading of our common shares if and when they are trading on the OTC Bulletin Board.

We have a history of operating losses and a significant accumulated deficit, and we may not maintain revenue or achieve profitability in the future.

We have not been profitable since our inception in February 2005. We expect to continue to incur additional losses for the next fiscal year as a result of a high level of operating expenses, significant up-front expenditures, pursuing new initiatives for the Company and our development and exploration activities. We have had to rely on raising money through private placement of our stock to fund our ventures and operations. While we have had some revenues, we may never realize significant revenues from our core business or be profitable. Factors that will influence the timing and amount of our growth and profitability include:

| | • | | the success of implementing our business plan; | | |

| | • | | obtaining the necessary funding to grow our business; and | | |

| | • | | our ability to expand, diversify and grow our business. | | |

At this stage of our business, even with our good faith efforts, potential investors have a high probability of losing their investment.

Because the nature of our business is expected to change as a result of shifts in the market price of oil and natural gas, competition, and the development of new and improved technology, management forecasts are not necessarily indicative of future operations and should not be relied upon as an indication of future performance.

Our Management may incorrectly estimate projected occurrences and events within the timetable of its business plan, which would have an adverse effect on our results of operations and, consequently, make our common shares a less attractive investment and harm the trading of our common shares if and when our shares begin trading on the OTC Bulletin Board. We plan to list our common shares on the OTC Bulletin Board and, if our shares are accepted for listing, investors may find it difficult to sell their shares on the OTC Bulletin Board.

There is substantial doubt about our ability to continue operations in the future as a going concern as a result shareholders may lose some or all of their investment in our Company.

We have incurred net losses of ($993,404) from February, 2005 (the date we commenced our oil and gas operations) to December 31, 2007. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern. We will need to obtain additional funds in the future. Our plans to deal with this cash requirement include loans from existing shareholders, raising additional capital from the public or private sale of equity or entering into a strategic arrangement with a third party. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

We also face significant challenges in the commercialization of the oil and natural gas products that we offer. Our business may fail if we do not achieve significant revenue growth or obtain sufficient funding. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered in such a transition. We may never, achieve profitable operations.

If capital is not available to us to fund future operations, we will not be able to pursue our business plan and operations would come to a halt and our common shares would be nearly worthless.

Cash on hand is not sufficient to fund our anticipated operating needs for the next twelve months. We will require substantial additional capital to participate in the development of our properties as well as for acquisition and/or development of other producing properties. We need to raise additional capital, which may be in the form of loans from current shareholders and/or from public and private equity offerings. Our ability to access capital will depend on our success in participating in properties that are successful in exploring for and producing oil and gas at profitable prices. It will also be dependent upon the status of the capital markets at the time such capital is sought. Should sufficient capital not be available, the development of our business plan could be delayed and, accordingly, the implementation of our business strategy would be adversely affected. In such event it would not be likely that investors would obtain a profitable return on their investments or a return of their investments at all.

We are heavily dependent on our President and Chief Executive Officer and Chief Financial Officer. The loss of either, whose knowledge, leadership and technical expertise upon which we rely, would harm our ability to execute our business plan.

While engaged in the business of exploiting oil/gas properties, the nature of the Company’s business, its ability to continue its exploration of potential exploration projects, and to develop a competitive edge in the marketplace, depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense and the Company may not be able to attract and retain such personnel. Our success is also dependent on our ability to retain and attract experienced engineers,

geoscientists and other technical and professional staff. The Company’s growth will depend, on the efforts of its Senior Management, including: its President, Kene Ufondu and its CFO/Secretary, Victor DeLaet. Loss of these individuals could have a material adverse effect on the Company. The Company has no key-man life insurance or written contacts with Senior Management or Directors.

Volatility of oil and gas prices and markets could make it difficult for us to achieve profitability and less likely investors in our common shares will receive a return on their investment.

Our ability to achieve profitability is substantially dependent on prevailing prices for natural gas and oil. The amounts of and price obtainable for any oil and gas production that we achieve will be affected by market factors beyond our control. If these factors are not favorable over time to our financial interests, it is likely that owners of our common shares will lose their investments. Such factors include:

• worldwide or regional demand for energy, which is affected by economic conditions;

• the domestic and foreign supply of natural gas and oil;

• weather conditions;

• domestic and foreign governmental regulations;

• political conditions in natural gas and oil producing regions;

• the ability of members of the Organization of Petroleum Exporting Countries to agree upon and maintain oil prices and production levels; and

• the price and availability of other fuels.

Drilling wells is speculative, often involving significant costs that may be more than our estimates. Any material inaccuracies in drilling costs, estimates or underlying assumptions will reduce the profitability of our business and will negatively affect our results of operations.

Developing and exploring for natural gas and oil involves a high degree of operational and financial risk, which precludes definitive statements as to the time required and costs involved in reaching certain objectives. The budgeted costs of drilling, completing and operating wells are often exceeded and can increase significantly when drilling costs rise due to a tightening in the supply of various types of oilfield equipment and related services. Drilling may be unsuccessful for many reasons, including title problems, weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas or oil well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economic.

The natural gas and oil business involves numerous uncertainties and operating risks that can prevent us from realizing profits and can cause substantial losses.

Our development, exploitation and exploration activities may be unsuccessful for many reasons, including weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas and oil well does not ensure a profit on investment. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economical.

The natural gas and oil business involves a variety of operating risks, including:

• fires;

• explosions;

• blow-outs and surface cratering;

• uncontrollable flows of oil, natural gas, and formation water;

• natural disasters, such as hurricanes and other adverse weather conditions;

• pipe, cement, or pipeline failures;

• casing collapses;

• embedded oil field drilling and service tools;

• abnormally pressured formations; and

• environmental hazards, such as natural gas leaks, oil spills, pipeline ruptures and discharges of toxic gases.

If we experience any of these problems, it could affect well bores, gathering systems and processing facilities, which could adversely affect our ability to conduct operations. We could also incur substantial losses as a result of:

• injury or loss of life;

• severe damage to and destruction of property, natural resources and equipment;

• pollution and other environmental damage;

• clean-up responsibilities;

• regulatory investigation and penalties;

• suspension of our operations; and

• repairs to resume operations.

The unavailability or high cost of drilling rigs, equipment, supplies, personnel and other services could adversely affect our ability to execute on a timely basis our development, exploitation and exploration plans within our budget.

Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts with providers of drilling rigs and, consequently we may not be able to obtain drilling rigs when we need them. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

We are subject to complex laws and regulations, including environmental regulations, which can adversely affect the cost, manner or feasibility of doing business.

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

• location and density of wells;

• the handling of drilling fluids and obtaining discharge permits for drilling operations;

• accounting for and payment of royalties on production from state, federal and Indian lands;

• bonds for ownership, development and production of natural gas and oil properties;

• transportation of natural gas and oil by pipelines;

• operation of wells and reports concerning operations; and

• taxation.

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

Our oil and gas operations may expose us to environmental liabilities.

If we experience any leakage of crude oil and/or gas from the subsurface portions of a well, our gathering system could cause degradation of fresh groundwater resources, as well as surface damage, potentially resulting in suspension of operation of a well, fines and penalties from governmental agencies, expenditures for remediation of the affected resource, and liabilities to third parties for property damages and personal injuries. In addition, any sale of residual crude oil collected as part of the drilling and recovery process could impose liability on us if the entity to which the oil was transferred fails to manage the material in accordance with applicable environmental health and safety laws.

Exploratory drilling involves many risks and we may become liable for pollution or other liabilities which may have an adverse effect on our financial position.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot adequately insure or which we may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

The potential profitability of oil and gas ventures depends upon factors beyond the control of our company.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

Because we are organized under the Canada Business Corporations Act, enforcement of civil liabilities against us or our officers or directors may be difficult or impossible from outside the jurisdiction of Canada.

We are a corporation organized under the Canada Business Corporations Act. All of our directors and officers reside in Canada. Because all or a substantial portion of our assets and the assets of these persons are located outside the United States, it may be difficult for an investor to sue, for any reason, us or any of our officers or directors outside the United States. If an investor was able to obtain a judgment against us or any of our officers or directors in a United States court based on United States securities laws or other reasons, it may be difficult, if not impossible, to enforce such judgment in Canada

We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in locating and commercializing oil and natural gas reserves.

The natural gas and oil market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

We face risks associated with foreign operations

It is anticipated that substantially all of our revenue will be derived from fees in foreign countries.

In addition, there are certain difficulties and risks inherent in doing business internationally, including the burden of complying with multiple and often conflicting regulatory requirements, foreign exchange controls, potential restrictions or tariffs on activities that may be imposed, potentially adverse tax consequences and tax risks, as well as political and economic instability. Changes in the political, regulatory and taxation structure of jurisdictions in which we operate could have a material adverse effect on our business, revenues, operating results and financial condition.

RISKS RELATING TO OWNING OUR COMMON SHARES

We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of an unlimited number of common shares without par value. The future issuance of our unlimited authorized common shares may result in substantial dilution in the percentage of our common shares held by our then existing shareholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common shares.

Our common shares are subject to the "Penny Stock" Rules of the SEC and we have no established market for our securities, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than USD $5.00 per share or with an exercise price of less than USD $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| | | • | | | that a broker or dealer approve a person's account for transactions in penny stocks; and | | |

| | | | | | | | |

| | | • | | | Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common shares and cause a decline in the market value of our stock. | | |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

• obtain financial information and investment experience objectives of the person; and

• make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

• sets forth the basis on which the broker or dealer made the suitability determination; and

• that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

• the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We are a “foreign private issuer”, and you may not have access to the information you could obtain about us if we were not a “foreign private issuer”.

We are considered a "foreign private issuer" under the Securities Act of 1933, as amended. As a foreign private issuer we will not have to file quarterly reports with the SEC nor will our directors, officers and 10% stockholders be subject to Section 16(b) of the Exchange Act. As a foreign private issuer we will not be subject to the proxy rules of Section 14 of the Exchange Act. Furthermore, Regulation FD does not apply to non-U.S. companies and will not apply to us. Accordingly, you may not be able to obtain information about us as you could obtain if we were not a “foreign private issuer”.

Because we do not intend to pay any cash dividends on our Common shares, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

We may become a passive foreign investment company, or PFIC, which could result in adverse U.S. tax consequences to U.S. investors.

If we are a “passive foreign investment company” or “PFIC” as defined in Section 1297 of the Code, U.S. Holders will be subject to U.S. federal income taxation under one of two alternative tax regimes at the election of each such U.S. Holder. Section 1297 of the Code defines a PFIC as a corporation that is not formed in the United States and either (i) 75% or more of its gross income for the taxable year is “passive income”, which generally includes interest, dividends and certain rents and royalties or (ii) the average percentage, by fair market value (or, if we elect, adjusted tax basis), of its assets that produce or are held for the production of “passive income” is 50% or more. Whether we are a PFIC in any year and the tax consequences relating to PFIC status will depend on the composition of our income and assets, including cash. U.S. Holders should be aware, however, that if we become a PFIC, we may not be able or willing to satisfy record-keeping requirements that would enable U.S. Holders to make an election to treat us as a “qualified electing fund” for purposes of one of the two alternative tax regimes applicable to a PFIC, which would result in adverse tax consequences to our shareholders who are U.S. citizens.

Our Existing Shareholders, Officers, Directors and their Affiliates have Substantial Ownership Control of the Company and this could adversely affect the Company’s Shareholders.

The Company’s Senior Management, Directors and greater-than-five-percent stockholders (and their affiliates), acting together, have the ability to control substantially all matters submitted to the Company’s stockholders for approval (including the election and removal of directors and any merger, consolidation or sale of all or substantially all of the Company’s assets) and to control the Company’s management and affairs. Accordingly, this concentration of ownership may have the effect of delaying, deferring or preventing a change in control of the Company, impeding a merger, consolidation, takeover or other business combination involving the Company or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, which in turn could materially adversely affect the market price of the Company’s stock.

Management and Directors Are Associated with Other Resource Companies

Certain of the Directors and Senior Management of the Company are also Directors and/or Senior Management and/or significant shareholders of other companies, including those also involved in natural resources. If our officers devote less than one hundred percent of their time to the Company’s business, this could have a material adverse effect on the Company’s business, revenues, operating results and financial condition. Moreover, as the Company is engaged in the business of exploiting oil/gas properties, such associations may give rise to conflicts of interest from time to time. The Directors of the Company are required by law to act honestly and in good faith with a view to the best interests of the Company and to disclose any interest that they may have in any project or opportunity of the Company. If a conflict of interest arises at a meeting of the Board of Directors, any Director in a conflict must disclose his interest and abstain from voting on such matter. In determining whether or not the Company will participate in any project or opportunity, the Directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at the time.

We do not have an established public trading market therefore you may be unable to sell your shares.

We intend to apply to have our shares quoted on the Over the Counter Bulletin Board, however, at present our shares are not traded on any market. A significant trading market in our shares may not develop, or if developed, we may not be able to sustain such a market.

Our Stock Price may be volatile exposing the Company to increased litigation and regulatory costs and it may also affect the ability of our shareholders to sell our securities

Many factors could affect the market price of our common shares. These factors include but are not limited to:

· Variations in our operating results;

· Variations in industry growth rates;

· Actual or anticipated announcements of technical innovations or new products or product enhancements by us or our competitors;

· General economic conditions in the markets for our products and services;

· Divergence of our operating results from analysts’ expectations; and

· Changes in earnings estimates by research analysts.

In particular, the market prices of the shares of many companies in the oil exploration and natural gas sectors experience wide fluctuations that are often unrelated to the operating performance of such companies. When the market price of a company's stock drops significantly, shareholders often institute securities class action lawsuits against that company. Such a lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources. Any of these events could have a material adverse effect on our business, financial condition and results of operations.

Our common stock could become subject to additional sales practice requirements for low priced securities. Our common stock could become subject to Rule 15g-9 under the Securities Exchange Act of 1934, which imposes additional sales practice requirements on broker-dealers that sell our shares of common stock to persons other than established customers and "accredited investors" or individuals with net worth in excess of $1,000,000 or annual incomes exceeding $200,000 or $300,000 together with their spouses.

Rule 15g-9 requires a broker-dealer to make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to sale. Consequently, the rule may affect the ability of broker-dealers to sell our securities and may affect the ability of our shareholders to sell any of our securities in the secondary market; generally define a "penny stock" to be any non-Nasdaq equity security that has a market price less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions; requires broker dealers to deliver, prior to a transaction in a penny stock, a risk disclosure document relating to the penny stock market.

Disclosure is also required to be made about compensation payable to both the broker-dealer and the registered representative and current quotations for the securities. In addition, the rule requires that broker dealers deliver to customers monthly statements that disclose recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Item 4. Information on the Company

A. History and Development of the Company

Dove Energy Inc. was incorporated under the laws of Alberta, Canada on February 15, 2005. Our headquarters are located at 800-6th Avenue SW, Suite 410, , Calgary, Alberta, Canada T2P 3G3. The telephone number is (403) 612-1980.

The Company's fiscal year ends December 31st. The Company intends to list its common shares on the Over the Counter Bulletin Board in the United States using the symbol DOVEF, if it is available.

The Company has an unlimited number of common shares without par value authorized. At September 30, 2008, there were 22,702,500 common shares issued and outstanding.

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CDN$).

The Company is in the oil and gas business as an operator. The Company initially acquired its core property in 2006 in the Enchant area in the Province of Alberta consisting of various working interest twenty-five to one hundred percent (25% - 100%) in seven (7) sections of crown mineral rights. Crown mineral rights are owned by the Province and are purchased through a leasehold for a period of five years.

In April 2006 the Company purchased an additional four (4) sections of crown mineral rights in the Enchant area in the province of Alberta with a one hundred (100) percent working interest.

In August 2006 the Company purchased an additional 4 sections of crown mineral rights in the Enchant area in the province of Alberta with a one hundred (100) percent working interest.

The Company is pursing relatively low risk oil and gas production and development in the Western Sedimentary basin of Alberta and Saskatchewan Canada. Two primary zones of interest exist in the Enchant area based on the probability of finding commercial quantities and rates of oil and gas. At the time of acquisition three existing wells were producing (at about 45 MCF/day) (Million Cubic Feet). In November 2006 one of the shut-in wells was re-entered and re-completed. The re-completed zone commenced production at the rate of 78 MCF/day in December 2006. This increased in May 2007 to almost 100 MCF/day.

In August 2006 the Company purchased 4 sections of surface to basement mineral rights within its core area of operation. In October 2006 the Company purchased 43 km. of publicly available two dimensional (2-D) seismic data which was reprocessed using updated techniques and computer hardware to enhance data that was acquired by previous operators. This seismic study was able to locate 9 potential drillable locations of which three (3) are for oil prospects and six (6) are for gas. Seismic maps were compiled to quantify the data from 2-D reprocessed lines. Following this, the Corporation acquired 4 additional sections of surface to basement mineral rights. At this time there are nine (9) possible drillable locations in inventory but they would be continuously evaluated for suitability and expansion as drilling takes place to ensure that they meet any revised criteria to remain as drillable locations.

The Company’s focus is now on the proving of the presence of the Nisku oil accumulation in its assets. This will lead to the subsequent acquisition of additional producing petroleum and natural gas properties, and the development and production of crude oil and natural gas. The key to the Company’s corporate mandate is to conduct business as a low-cost operator by benefiting from hands-on management, while also outsourcing most exploration and development expenditures. Also on this note, the Company is committed to maintaining minimum infrastructure. The Company’s method of operation adheres to the following principles: focusing on a methodically identified strategic geographic area, start to develop exploitation and exploration ideas; use leading-edge technology to evaluate, develop and operate; maintain hands-on management, operate when possible; outsource services where possible; and strive to be the lowest-cost operator with minimum infrastructure and significant working interests.

Nisku oil pools have been discovered as far east as the Grand Forks Area but in the immediate area of Bow Island town there have been very few wells drilled deeper than the top portion of the Livingstone. In this area the Nisku is also known as the Arcs Formation. The largest pool is located near the town of Vauxhall and has a NW-SE trend but other Arcs pools do not appear to conform to any particular pattern. It would appear that lack of exploratory drilling is responsible for not extending the discovery of additional Arcs oil wells to the east. In the Vauxhall-Grand Forks, 361 Arcs oil well have produced an average of 115,000 STB to date including 47 wells that have since been converted to water injection. There are currently 71 injection wells. While it is difficult to ascribe the same reserves to the Arcs drilling location on Dove's lands it is reasonable to assume that a successful Arcs oil well would have a percentage of the reserves in the Enchant Field Arcs wells. There are 3 potentially drillable Arcs location on Dove's lands.

Financings

The Company has financed its operations through funds raised in loans, public/private placements of common shares, shares issued for property, shares issued in debt settlements, and shares issued upon exercise of stock options and share purchase warrants.

______________________________________________________________________________________________

Fiscal | | | | | | | Number of | | | Capital | |

|---|

Year | | | Nature of Share Issuance | | | | Shares | | | Raised | |

|---|

| Fiscal 2005 | | | Private Placement-Common Shares | | | | 2,304,000 | | $ | 1,152,000 | |

| | | | | | | | | | | | |

| Fiscal 2006 | | | Private Placement-Common Shares | | | | 100,000 | | $ | 50,000 | |

| | | | Private Placement-Common Shares | | | | 443,500 | | $ | 221,750 | |

| | | | Private Placement-Common Shares | | | | 443,500 | | $ | 665,250 | |

| | | | | | | | | | | | |

| Fiscal 2007 | | | Private Placement | | | | 155,000 | | $ | 155,000 | |

______________________________________________________________________________________________

Capital Expenditures

Fiscal 2005: $289,650 for mineral property acquisition/exploration | |

Fiscal 2006: $160,101.00 for mineral property acquisition/exploration |

Fiscal 2007: $69,988.32 for oil/gas property acquisition/exploration | |

B. Business Overview

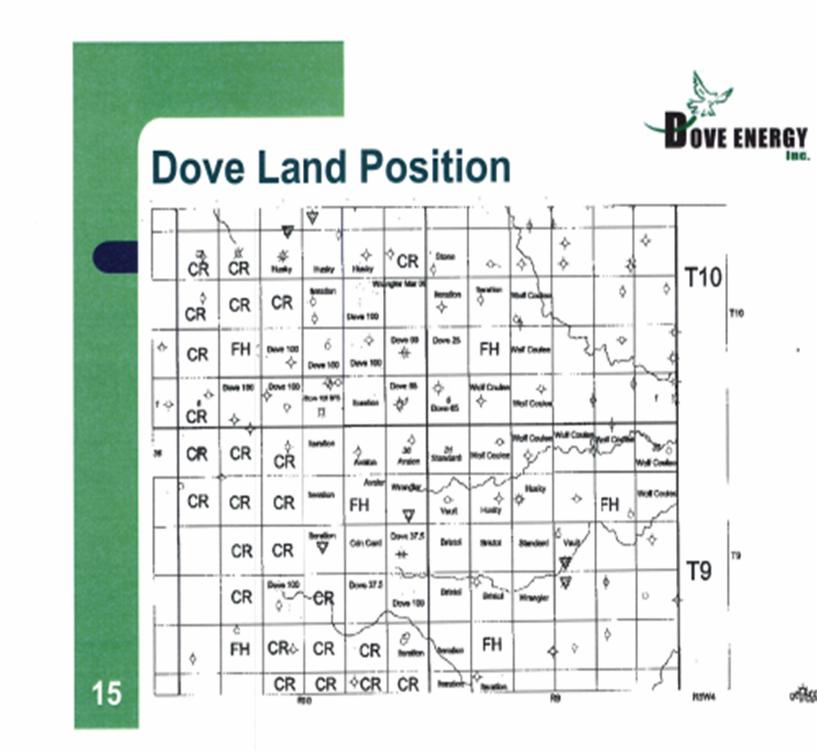

The Company operates in the oil and gas industry with a focus in the Western Sedimentary basin of Alberta and Saskatchewan’s bypassed and unexploited zones. The Company has interests in a total of 15 Mineral/Surface leases located in south east Alberta, Canada. A description of the Company’s properties is set out below.

The Company’s wells are located in the Enchant area of South East Alberta. Wells are 102/02-01-010-10W4, 100/11-06-010-09W4 and 100/06-03-010-10W4. These three wells have been providing revenue to the Company since December 2005. A workover (see Glossary below) on 102/02-01-010-10W4 in 2007 increased the revenue from this well from what it produced prior to the workover.

Plan of Operations

Source of Funds for Fiscal 2007/2008

The Company’s primary source of funds since incorporation has been through the issuance of common shares and loans. The Company had $160,827.00 of oil/gas production revenue during Fiscal 2007; and, $113,001 in oil/gas production revenue for the nine months ended September 30, 2008. Oil/gas production revenue during Fiscal 2009 is a function of several indeterminate factors, including the volatility of oil/gas prices and whether the Company acquires additional interests in producing oil/gas properties. Notwithstanding this unpredictability, the Company's preliminary budget estimates $121,596.80 in oil/gas production revenue for fiscal 2009.

Company Goals and Objectives

The long term objective of the Company is to establish cash flow from prospects having low risk and high net reserve potential. When sufficient cash flows are realized to maintain a reasonable capital reserve for operating expenses and contingencies, the Company will allocate the highest portion of the net revenue possible to acquire more properties. It is the opinion of the Company’s management that the greatest value to shareholders can be realized through the development of current existing land positions and acquisition of new oil and gas properties.

The short term objectives of the Company are to drill and complete three light oil and three gas drill locations with multiple zones within the next twelve (12) months and recomplete and workover five gas wells. These activities will, if successful, reposition the Company from a start-up oil and gas company to a significant producer with positive cash flow. This will create the opportunities for more acquisitions of producing oil and gas properties, and/ or joint ventures with other producers.

Use of Funds for Fiscal 2008/2009

During Fiscal 2008 and Fiscal 2009, respectively, the Company estimates that it might expend approximately $84,737.61 and $112,983.48 on general/administrative expenses. During Fiscal 2008 and Fiscal 2009, respectively, the Company estimates that it might expend about $3 million and $1 million, on exploration and property acquisition expenses. These estimates are contingent upon many factors, including whether the Company is successful in acquiring additional oil/gas production property.

United States vs. Foreign Sales/Assets

The Company generated $113,001 in oil/gas production revenue in the first nine months of Fiscal 2008, all in Canada. The Company’s assets are located in Canada.

Material Effects of Government Regulation

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. The oil and gas leases currently leased by the Company are owned by the Province of Alberta and are managed by the Department of Energy. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

• location and density of wells;

• the handling of drilling fluids and obtaining discharge permits for drilling operations;

• accounting for and payment of royalties on production from state, federal and Indian lands;

• bonds for ownership, development and production of natural gas and oil properties;

• transportation of natural gas and oil by pipelines;

• operation of wells and reports concerning operations; and

• taxation.

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

Anticipated Changes to Facilities And Employees

Management of the Company anticipates no changes to either facilities or employees in the near future.

Seasonality, Dependency upon Patents, Licenses, Contracts, Processes, Sources and Availability of Raw Materials

Certain of the Company’s properties may be in remote locations and subject to significant temperature variations and changes in working conditions. It may not be possible to actively explore the Company’s properties in Alberta throughout the year because of seasonal changes in the weather. If exploration is pursued at the wrong time of year, the Company may incur additional costs to address issues relating to the weather.

Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts with providers of drilling rigs and, consequently we may not be able to obtain drilling rigs when we need them. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

Competition

The natural gas and oil exploration industry is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

Organizational Structure

The Company was incorporated under the Alberta Business Corporations Act on February 15, 2005. The Company is not part of a group and has no subsidiaries.

D. Property, Plants and Equipment

Corporate Offices

We do not own any real property. Our offices are located at 800-6th Avenue SW, Suite 410, , Calgary, Alberta, Canada T2P 3G3. We sub-lease 200 square feet from Focused Money Solutions Inc. on a five-year term that automatically renews for five years unless terminated.. Monthly rent is $1000.00. We believe that the facilities will be adequate for the foreseeable future.

Oil and Gas Glossary

ABANDONED WELL: A well not in use because it was a dry hole originally, or because it has ceased to produce.

AREA OF INTEREST: The area immediately surrounding a successful well in which the investors (in the good well) have an implied right to participate in any future wells drilled by the same operator.

ASSIGNMENT: The legal instrument whereby Oil and Gas Leases or Overriding Royalty interests are assigned or conveyed.

ASSIGNEE: The individual to whom Oil and Gas Leases or Overriding Royalty are assigned.

ASSIGNOR: The individual conveying Oil and Gas Leases or Overriding Royalty in an Assignment.

BONUS: Cash consideration paid to a landowner or mineral owner on the execution of an Oil, Gas and Mineral Lease.

COMPLETION - To finish a well so that it is ready to produce oil or gas. After reaching total depth (T.D.), casing is run and cemented; casing is perforated opposite the producing zone, tubing is run, and control and flow valves are installed at the wellhead. Well completions vary according to the kind of well, depth, and the formation from which the well is to produce.

CRUDE OIL - Oil as it comes from the well; unrefined petroleum.

DELAY RENTAL: Yearly payments made during primary term to Lessor to delay drilling.

DEPOSIT - An accumulation of oil or gas capable of being produced commercially.

DEVELOPMENT WELLS - Wells drilled in an area already proved to be productive.

DISCOVERY WELL - An exploratory well that encounters a new and previously untapped petroleum deposit; a successful wildcat well. A discovery well may also open a new horizon in an established field.

EXPLORATION: A general term referring to all efforts made in the search for new deposits of oil and gas.

FLOWING WELL: A well capable of producing oil or gas by its own energy without the aid of a mechanical pump. Normally a pump is put on the well after the pressure reduction inhibits the rate of production.

FRACCING: The process of pumping fluids into a productive formation at high rates of injection to hydraulically break the rock. The “fractures” which are created in the rock act as flow channels for the oil and gas into the well.

GAS: “Any fluid, combustible or non combustible which is produced in a natural state from the earth and which maintains a gaseous or rarified state at ordinary temperature and pressure conditions”. Code of Federal Regulations, Title 30, Mineral resources, Chap. 11, Geological Survey, 221.2.

GAS WELL: A well that produces natural gas which is not associated with crude oil.

GEOLOGY: The science of the history of the Earth and its life as recorded in rocks.

GRANTOR: A person who grants or conveys lands, minerals, etc.

GRANTEE: The person receiving the grant of lands, minerals, etc.

GROSS WORKING INTEREST: See definition for Working Interest.

HYDROCARBONS: Organic chemical compounds of hydrogen and carbon atoms. There are a vast number of these compounds and they form the basis of all petroleum products. They may exist as gases, liquids and solids.

JOINT OPERATING AGREEMENT: An agreement among working interest owners describing how a well is to be operated.

LANDMAN: The individual who negotiates oil and gas leases with mineral owners, cures title defects and negotiates with other companies on agreements concerning the lease.

LANDOWNER: The person who generally owns all or part of the minerals under his lands and is entitled to lease the same.

LEASE: See Oil, Gas and Mineral Lease.

LESSEE: The person who receives the lease, sometimes called the tenant.

LESSOR: The person giving the lease, sometimes called grantor or landlord.

MINERAL OWNER: Generally one who owns only minerals under a tract of land (but no surface) along with the right to execute a lease on the same.

MINERALS (MINERAL INTEREST): See definition for Participating Royalty.

NET REVENUE INTEREST: An owner's interest in the revenues of a well.

NET WORKING INTEREST: Share in well proceeds attributable to the Working Interest.

NON-OPERATING INTEREST: A working interest owner in a well, but is not Operator.

NON-PARTICIPATING ROYALTY: A royalty interest which "participates" in any oil or gas found but does not "participate" in lease bonuses or rentals.

OFFSET WELL - (1) A well drilled on the next location to the original well. The distance form the first well to the offset well depends upon spacing regulations and whether the original well produces oil or gas. (2) A well drilled on one tract of land to prevent the drainage of oil or gas to an adjoining tract where a well is being drilled or is already producing.

OIL - A liquid hydrocarbon. (see "Crude Oil")

OIL OR GAS BEHIND THE PIPE - Refers to oil and gas sands or formations knowingly passed through, never produced. Such formations usually were of low permeability (tight formations) that, say 20 years ago, were uneconomical to produce when oil was around $5 or less a barrel. Other times formations would be purposely ignored because the operator was going deeper for bigger game, so the less-spectacular, plain-Jane sands were cased off. When the price of crude oil reached $30 per barrel, the bypassed formations looked pretty good and were opened up and produced.

OIL, GAS & MINERAL LEASE: The agreement outlining the basic terms of developing lands or minerals such as royalty to be paid, length of time, description of lands.

OIL & GAS LEASE: See definition for Oil, Gas and Mineral Lease.

OIL OR GAS IN PLACE: Crude oil or gas estimated to exist in a field or a reservoir; oil in the formation not yet produced.

OPERATING AGREEMENT: See definition for Joint Operating Agreement.

OPERATING EXPENSES: The costs of operating a well

OPERATING INTEREST: A working interest owner who is also the well operator.

OPERATOR: The party designated in the Operating Agreement to conduct the operations of the well.

OVERRIDING ROYALTY: A royalty interest derived from the working interest, in excess of the royalty provided in the Oil Lease. Usually added on during an intervening Assignment.

PAID-UP LEASE: An Oil and Gas Lease where rental payments are paid along with bonus.

PARTICIPATING ROYALTY: A royalty interest giving its owner the right to "participate" in bonuses received in leasing along with the right to "participate" in any oil or gas found.

PRIMARY TERM: The initial period in an Oil and Gas Lease to develop the property.

RESERVOIR: A porous, permeable sedimentary rock formation containing quantities of oil and/or gas enclosed or surrounded by layers of less-permeable or impervious rock; a structural trap; a stratigraphic trap.

RECOMPLETION: Any major operation performed on a well after its completion in an attempt to restore or improve its ability to produce.

ROYALTY: Funds received from the production of oil or gas, free of costs, except taxes.

ROYALTY DEED: A deed conveying a royalty interest.

SEVERENCE TAX: A state or municipal tax on oil and gas products levied at the wellhead for the removal of the hydrocarbons. Also called Production Tax.

SEVERED MINERAL INTEREST: An interest in the minerals in, on and under a given tract of land owned by a person other than the surface owner.

SEVERED ROYALTY INTEREST: Non-expense bearing interest in minerals produced and saved from a tract owned by someone other than the surface owner. Owner of severed royalty interest gets a share of production from wells, but does not have to share the costs of production. The interest may be set up prior or subsequent to the leasing of the land, granted or reserved for years, for life, in fee simple defeasible or in perpetuity.

SHUT-IN ROYALTY: Payment to royalty owners under the terms of a mineral lease which allows the lessee to defer production from a well capable of producing in paying quantities but shut-in for lack of a market or marketing facilities.

SURFACE OWNER: Usually a landowner who owns no minerals under his land.

TESTING - When each new well is competed, a series of tests are run on the well. The various tests are used to estimate the daily deliverability, payout, and reserves.

TIGHT HOLE - A drilling well about which all information - depth, formations encountered, drilling rate, logs - is kept secret by the operator.

TOTAL DEPTH (T.D.) - The depth of a well when drilling is completed. Total depth of a well is the vertical distance from the rig floor to the bottom of the hole. A 10,000-foot well may take 11,300 feet of casing to complete the well because the well bore has drifted several degrees from vertical, adding 1,300 feet to the depth of the hole, not the depth of the well.

UNLEASED MINERAL INTEREST: A mineral interest not subject to an Oil Lease.

WORKING INTEREST: The right granted to the lessee of a property to explore for and to produce and own oil, gas or other minerals. The working interest owners bear the exploration, development, and operating costs on either a cash, penalty or carried basis.

WORKOVER - Operations on a producing well to restore or increase production. Tubing is pulled and the casing at the bottom of the well is pumped or washed free of sand that may have accumulated.

Mineral & Surface Leases

The Company has an interest in 5 Surface Leases and 12 Mineral Leases in Alberta, Canada. All of these leases are in the Enchant area, which is located in south east Alberta, Canada.

Oil & Gas Background

Oil and gas are contained in the pores and fractures of certain sedimentary rocks in the same way that water is held in a sponge.

The majority of oil wells in Canada use a primary recovery method to produce oil to the surface. This is the process whereby simple mechanical pumps are used to raise oil to the surface. There are a number of methods that are used to improve primary recovery such as infill drilling, which involved drilling more wells into the same pool so that the oil does not have to travel as far through the rock to reach a wellbore.

Secondary recovery is used to further oil production by injecting water or natural gas to maintain reservoir pressure and push oil out of the rock.

There are more advanced methods to recover light and medium crude oil which is referred to as tertiary recovery. This recovery method uses natural gas liquids (ethane, propane and butane) by injecting them into special injection wells. When dissolved, these liquids reduce surface tension and viscosity to help release the oil from the reservoir rock.

Even with all these techniques, the average recovery in the light oil fields is a little more than 30 per cent of the original oil. The remaining resource represents billions of cubic metres of oil that has been discovered in Western Canada but cannot be produced economically with existing technology.

Acquisition Details

Mineral Leases

M0014

The 90% property interest was acquired on December 1, 2005

M0045

The 25% property interest was acquired on December 1, 2005

M0046

The 65% property interest was acquired on December 1, 2005

M0047

The 100% property interest was acquired on December 1, 2005

M0048

The 37.5% property interest was acquired on December 1, 2005

M0049

The 75% property interest was acquired on December 1, 2005

M0002

The 100% property interest was acquired on August 10, 2006

M0003

The 100% property interest was acquired on August 10, 2006

M0004

The 100% property interest was acquired on April 5, 2007

M0005

The 100% property interest was acquired on April 5, 2007

M0006

The 100% property interest was acquired on April 5, 2007

M0007

The 100% property interest was acquired on April 5, 2007

Total paid for land acquisitions was $289,650.

Southern Alberta Regional Geology