Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2011 (unaudited)

Partners Group Private Equity (Master Fund), LLC (the “Master Fund”) was organized as a limited liability company under the laws of the State of Delaware on August 4, 2008 and commenced operations on July 1, 2009. The Master Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. The Master Fund is managed by Partners Group (USA) Inc. (the “Adviser”), an investment adviser registered under the Investment Advisers Act of 1940, as amended. A Board of Managers (the “Board”) has overall responsibility for the management and supervision of the business operations of the Master Fund. To the fullest extent permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Master Fund, any committee of the Board, or the Adviser. The objective of the Master Fund is to seek attractive long-term capital appreciation by investing in a diversified portfolio of private equity investments.

The Master Fund is a master investment portfolio in a master-feeder structure. Partners Group Private Equity, LLC, Partners Group Private Equity (Institutional), LLC, Partners Group Private Equity (TEI), LLC, and Partners Group Private Equity (Institutional TEI), LLC, (collectively “the Feeders”) invest substantially all of their assets, directly or indirectly, in the limited liability company interests (“Interests”) of the Master Fund and become members of the Master Fund (“Members”).

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

a. Basis of Accounting

The Master Fund’s accounting and reporting policies conform with generally accepted accounting principles within the United States (“U.S. GAAP”).

| | b. Valuation of Investments |

Investments held by the Master Fund include direct, primary and secondary private equity investments (collectively, “Private Equity Investments”).

Private Equity Investments

The Master Fund values interests in Private Equity Investments at fair value, which ordinarily is based on the value determined by their respective investment managers, in accordance with procedures established by the Board. Private Equity Investments are subject to the terms of their respective offering documents. Valuations of Private Equity Investments are subject to estimates and are net of management and performance incentive fees or allocations that may be payable pursuant to such offering documents. If the Adviser determines that the most recent value reported by a Private Equity Investment does not represent fair value or if a Private Equity Investment fails to report a value to the Master Fund, a fair value determination is made under procedures established by and under the general supervision of the Board. Because of the inherent uncertainty in valuation, the estimated values may differ from the values that would have been used had a ready market for the securities existed, and the differences could be material.

The following is a summary of the inputs used in valuing the Master Fund's Private Equity Investments at fair value. The inputs or methodology used for valuing the Master Fund's Private Equity Investments are not necessarily an indication of the risk associated with investing in those investments. The Master Fund's valuation procedures require evaluation of all relevant factors available at the time the Master Fund values its investments. The fair values of financial instruments traded in active markets are based on quoted market prices at the end of the reporting period. The quoted market price used for financial assets held by the Master Fund is the bid price at the end of the reporting period.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2011 (unaudited) (continued)

| 2. | Significant Accounting Policies (continued) |

b. Valuation of Investments (continued)

In assessing the fair value of non-traded financial instruments, the Master Fund uses a variety of methods such as time of last financing, earnings and multiple analysis, discounted cash flow and third party valuation, and makes assumptions that are based on market conditions existing at each end of the reporting period. Quoted market prices or dealer quotes for specific similar instruments are used for long-term debt where appropriate. Other techniques, such as option pricing models and estimated discounted value of future cash flows, are used to determine fair value for the remaining financial instruments.

Daily Traded Direct Investments

The Master Fund values direct investments traded (1) on one or more of the U.S. national securities exchanges or the OTC Bulletin Board at their last sales price, and (2) on NASDAQ will be valued at the NASDAQ Official Closing Price, at the close of trading on the exchanges or markets where such securities are traded for the business day as of the relevant determination date. If no sale or official closing price of particular securities are reported on a particular day, the securities will be valued at the closing bid price for securities held long, or the closing ask price for securities held short, or if a closing bid or ask price, as applicable, is not available, at either the exchange or system-defined closing price on the exchange or system in which such securities are principally traded. Securities traded on a foreign securities exchange generally will be valued at their closing prices on the exchange where such securities are primarily traded and translated into U.S. dollars at the current exchange rate provided by a recognized pricing service.

Equity securities for which no prices are obtained under the foregoing procedures, including those for which a pricing service supplies no exchange quotation or a quotation that is believed by the Adviser not to reflect the market value, will be valued at the bid price, in the case of securities held long, or the ask price, in the case of securities held short, supplied by one or more dealers making a market in those securities or one or more brokers. High quality investment grade debt securities (e.g., treasuries, commercial paper, etc.) with a remaining maturity of 60 days or less are valued by the Adviser at amortized cost, which the Boards of Managers have determined to approximate fair value.

The Master Fund has adopted the authoritative guidance under U.S. GAAP for estimating the fair value of investments in investment companies that have calculated net asset value in accordance with the specialized accounting guidance for investment companies. Accordingly, in circumstances in which net asset value of an investment in an investment company is not determinative of fair value, the Master Fund estimates the fair value of such investment using the net asset value of the investment (or its equivalent) without further adjustment, if the net asset value of the investment is determined in accordance with the specialized accounting guidance for Investment Companies as of the reporting entity's measurement date.

c. Cash and Cash Equivalents

Pending investment in Private Equity Investments and in order to maintain liquidity, the Master Fund holds cash, including amounts held in foreign currency and short-term interest bearing deposit accounts. At times, such amounts may exceed federally insured limits.

The Master Fund has not experienced any losses in such accounts and does not believe that it is exposed to any significant credit risk on such accounts.

d. Foreign Currency Translation

The books and records of the Master Fund are maintained in U.S. dollars. Generally, assets and liabilities denominated in non-U.S. currencies are translated into U.S. dollar equivalents using valuation date exchange rates, while purchases, realized gains and losses, income and expenses are translated at the transaction date exchange rates. As of September 30, 2011 the Master Fund has twenty-seven investments denominated in Euros, five investments denominated in Australian Dollars, two investments denominated in Swedish Kronor, one investment denominated in Norwegian Kronor, one investment denominated in British Pounds, and one investment denominated in Hong Kong Dollars. The Master Fund does not isolate the portion of the results of operations due to fluctuations in foreign exchange rates from changes in fair values of the investments during the period.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2011 (unaudited) (continued)

| 2. | Significant Accounting Policies (continued) |

e. Investment Income

The Master Fund initially records distributions of cash or in-kind securities at fair value from Private Equity Investments based on the information from distribution notices when distributions are received. Thus, the Master Fund would recognize within the Statement of Operations its share of realized gains or (losses) and the Master Fund’s share of net investment income or (loss) based upon information received regarding distributions, from managers of the Private Equity Investments. Unrealized depreciation on investments, within the Statement of Operations, includes the Master Fund’s share of unrealized gains and losses, realized undistributed gains, and the Master Fund’s share of undistributed net investment income or (loss) from Private Equity Investments for the relevant period.

The Master Fund bears all expenses incurred, on an accrual basis, in the business of the Master Fund, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Master Fund’s account; legal fees; accounting, auditing, and tax preparation fees; custodial fees; fees for data and software providers; costs of insurance; registration expenses; managers’ fees; and expenses of meetings of the Board.

The Master Fund is treated as a partnership for federal income tax purposes and therefore is not subject to U.S. federal income tax. For income tax purposes, the individual partners will be taxed upon their distributive share of each item of the Master Fund’s profit and loss.

The Master Fund has adopted the authoritative guidance on accounting for and disclosure of uncertainty in tax positions. The Financial Accounting Standards Board (“FASB”) issued Accounting for Uncertainty in Income Taxes which, requires the Adviser to determine whether a tax position of the Master Fund is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. For tax positions meeting the more likely than not threshold, the tax amount recognized in the financial statements is reduced by the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authority.

The Master Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Master Fund is subject to examination by federal, state, local and foreign jurisdictions, where applicable. As of September 30, 2011, the tax years from the year 2010 forward remain subject to examination by the major tax jurisdictions under the statute of limitations.

The preparation of financial statements in conformity with U.S. GAAP requires the Master Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in capital from operations during the reporting period. Actual results can differ from those estimates.

| 3. | Fair Value Measurements |

In January 2010, the FASB issued Improving Disclosures about Fair Value Measurements, which clarifies existing disclosure and requires additional disclosures for fair value measurements. Effective for interim and annual reporting periods beginning after December 31, 2009, entities will be required to disclose significant transfers into and out of Level 1 and 2 measurements in the fair value hierarchy and the reasons for those transfers. Effective for fiscal years beginning after December 31, 2010, and for interim periods within those fiscal years, entities need to disclose information about purchases, sales, issuances and settlements of Level 3 securities on a gross rather than net basis. Management continues to evaluate the application of Improving Disclosure about Fair Value Measurements to the Master Funds, and is not in a position at this time to evaluate the significance of its impact, if any on the Master Fund’s financial statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2011 (unaudited) (continued)

| 3. | Fair Value Measurements (continued) |

As required by Fair Value Measurements, investments are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Estimated values may differ from the values that would have been used if a ready market existed or of the investments were liquidated at the valuation date. Fair Value Measurements established a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Master Fund’s investments. The inputs are summarized in the three broad levels listed below:

Valuation of Investments

· Level 1 – Quoted prices are available in active markets for identical investments as of the measurement date. The type of investment included in Level I include marketable securities that are primarily traded on a securities exchange or over-the-counter. The fair value is determined to be the last sale price on the determination date, or, if no sales occurred on any such day, the mean between the closing bid and ask prices on such day. As required by Fair Value Measurements, the Master Fund does not apply a blockage discount to the quoted price for these investments, even in situations where the Master Fund holds a large position and a sale could reasonably impact the quoted price.

· Level 2 – Pricing inputs are other than quoted prices in active markets (i.e. Level I pricing) and fair value is determined through the use of models or other valuation methodologies through direct or indirect corroboration with observable market data. Investments which are generally included in this category include corporate notes, convertible notes, warrants and restricted equity securities. The fair value of legally restricted equity securities is generally may be discounted depending on the likely impact of the restrictions on liquidity and Adviser’s estimates.

· Level 3 – Pricing inputs are unobservable for the investment and include situations where there is little, if any, market activity for the investment. The inputs into the determination of fair value require significant management judgment or estimation. Investments that are included in this category generally include equity investments that are privately owned, as well as convertible notes and warrants that are not actively traded. The fair value for investment using Level 3 pricing inputs are based on Adviser’s estimates which consider a combination of various performance measurements including the timing of the transaction, the market in which the company operates, comparable market transactions, company performance and projections and various performance multiples as applied to EBITDA or a similar measure of earnings for the latest reporting period and forward earnings, as well as discounted cash flow analysis. When the inputs used to measure fair value may fall into different levels of the fair value hierarchy, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement.

Due to the inherent uncertainty of valuations, estimates values may differ significantly from the values that would have been used had a ready market for the securities existed, and the differences could be material.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2011 (unaudited) (continued)

| 3. | Fair Value Measurements (continued) |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

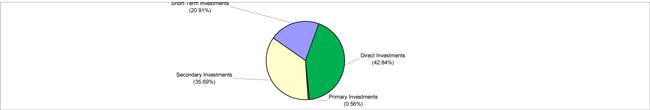

| Direct Investments* | | $ | - | | | $ | - | | | $ | 112,696,902 | | | $ | 112,696,902 | |

| Primary Investments* | | | - | | | | - | | | | 1,462,444 | | | | 1,462,444 | |

| Secondary Investments* | | | - | | | | - | | | | 93,890,830 | | | | 93,890,830 | |

| Short-Term Investments | | | 55,000,000 | | | | - | | | | - | | | | 55,000,000 | |

| Total | | $ | 55,000,000 | | | $ | - | | | $ | 208,050,176 | | | $ | 263,050,176 | |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

| | | Direct Investments | | | Primary Investments | | | Secondary Investments | | | Total | |

| Balance as of April 1, 2011 | | $ | 61,284,877 | | | $ | 976,299 | | | $ | 51,986,768 | | | $ | 114,247,944 | |

| Realized gain | | | 407,786 | | | | - | | | | - | | | | 407,786 | |

| Net change in unrealized appreciation | | | 629,132 | | | | (198,636 | ) | | | 6,244,576 | | | | 6,675,072 | |

| Net purchases (sales) | | | 50,375,107 | | | | 684,781 | | | | 35,659,486 | | | | 86,719,374 | |

| Net transfers in or out of Level 3 | | | - | | | | - | | | | - | | | | - | |

| Balance as of September 30, 2011 | | $ | 112,696,902 | | | $ | 1,462,444 | | | $ | 93,890,830 | | | $ | 208,050,176 | |

The amount of the net change in unrealized appreciation/depreciation for the six month period ended September 30, 2011 relating to investments in Level 3 assets still held at September 30, 2011 is $6,675,072, which is included as a component of net change in unrealized appreciation on investments in Private Equity Investments.

| | *Direct private equity investments are private investments directly into the equity or debt of selected operating companies, often together with the management of the company. Primary investments are investments in newly established private equity partnerships where underlying portfolio companies are not known as of the time of investment. Secondary investments involve acquiring single or portfolios of assets on the secondary market. |

| 4. | Allocation of Members’ Capital |

Net profits or net losses of the Master Fund for each Allocation Period (as defined below) are allocated among and credited to or debited against the capital accounts of the Members. Each Allocation Period begins on the day after the last day of the preceding Allocation Period and ends at the close of business on the first to occur thereafter of: (1) the last day of a calendar month, (2) the last day of a taxable year; (3) the day preceding a day on which Interests are purchased, (4) a day on which Interests are repurchased by the Master Fund pursuant to tenders of Interests by Members, or (5) a day on which any amount is credited to or debited from the capital account of any Member other than an amount to be credited to or debited from the capital accounts of all Members in accordance with their respective investment percentages.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2011 (unaudited) (continued)

| 5. | Subscription and Repurchase of Members’ Interests |

Interests are generally offered for purchase as of the first day of each calendar month, except that Interests may be offered more or less frequently as determined by the Board in its sole discretion.

The Board may, from time to time and in its sole discretion, cause the Master Fund to repurchase Interests from Members pursuant to written tenders by Members at such times and on such terms and conditions as established by the Board. In determining whether the Master Fund should offer to repurchase Interests, the Board considers the recommendation of the Adviser, as well as a variety of other operational, business and economic factors. The Adviser anticipates recommending to the Master Fund Board that, under normal circumstances, the Master Fund conduct repurchase offers quarterly on or about each January 1st, April 1st, July 1st and October 1st. The Master Fund does not intend to distribute to the Members any of the Master Fund’s income, but currently expects to reinvest substantially all income and gains allocable to the Members.

| 6. | Management Fees, Incentive Allocation, and Fees and Expenses of Managers |

The Adviser is responsible for providing day-to-day investment management services to the Master Fund, subject to the ultimate supervision of and subject to any policies established by the Board, pursuant to the terms of an investment management agreement with the Master Fund (the "Investment Management Agreement"). Under the Investment Management Agreement, the Adviser is responsible for developing, implementing and supervising the Master Fund's investment program.

In consideration for such services, the Master Fund pays the Adviser a monthly management fee equal to 1/12th of 1.25% (1.25% on an annualized basis) of the greater of (i) the Master Fund’s net asset value and (ii) the Master Fund’s net asset value less cash and cash equivalents plus the total of all commitments made by the Master Fund that have not yet been drawn for investment.

In addition, at the end of each calendar quarter (and at certain other times), an amount (the “Incentive Allocation”) equal to 10% of the excess, if any, of (i) the allocable share of the net profits of the Master Fund for the relevant period of each Member over (ii) the then balance, if any, of that Member’s Loss Recovery Account (as defined below) will be debited from such Member’s capital account and credited to a capital account of the Adviser (or, to the extent permitted by applicable law, of an affiliate of the Adviser) in the Master Fund maintained solely for the purpose of being allocated the Incentive Allocation and thus, does not participate in the Members’ Equity Allocation.

The Master Fund maintains a memorandum account for each Member (each, a “Loss Recovery Account”). Each Member’s Loss Recovery Account has an initial balance of zero and is (i) increased upon the close of each Allocation Period by the amount of the relevant Member’s allocable share of the net losses of the Master Fund for the Allocation Period, and (ii) decreased (but not below zero) upon the close of such Allocation Period by the amount of such Member’s allocable share of the net profits of the Master Fund for the Allocation Period. The Incentive Allocation is calculated and charged to each Member as of the end of each Allocation Period. The Allocation Period with respect to a Member whose Interest is repurchased or is transferred in part is treated as ending only for the portion of Interests so repurchased or transferred. In addition, only the net profits of the Master Fund, if any, and the balance of the Loss Recovery Account attributable to the portion of the Interest being repurchased or transferred (based on the Member’s capital account amount being so repurchased or transferred) is taken into account in determining the Incentive Allocation for the Allocation Period then ending. The Member’s Loss Recovery Account is not adjusted for such Member’s allocable share of the net losses of the Master Fund, if any, for the Allocation Period then ending that are attributable to the portion of the Interest so repurchased or transferred. For the six month period ended September 30, 2011 an aggregate Incentive Allocation of $997,447 was credited to the Incentive Allocation Account.

Each member of the Board who is not an “interested person” of the Master Fund (the “Independent Board”), as defined by the 1940 Act, receives a fee of $35,000 per year, plus a one-time start-up bonus of $5,000 in connection with the establishment of the Master Fund. In addition, the Master Fund pays an additional fee of $10,000 per year (i) to the Chairman of the Board and to the Chairman of the Audit Committee. All Board members are reimbursed by the Master Fund for all reasonable out-of-pocket expenses incurred by them in performing their duties.

| 7. | Accounting, Administration, and Custodial Agreement |

In consideration for accounting, administrative, and recordkeeping services, the Master Fund pays UMB Fund Services, Inc.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2011 (unaudited) (continued)

| 7. | Accounting, Administration, and Custodial Agreement (continued) |

(the “Administrator”) a monthly administration fee based on the month-end net asset value of the Master Fund, subject to certain minimums. The Administrator also provides regulatory administrative services, transfer agency functions, and shareholder services at an additional cost. For these services the Administrator receives a fixed monthly fee, basis points on net assets, and a monthly fee based on the number of Member accounts as well as reasonable out of pocket expenses. For the six month period ended September 30, 2011, the total administration fee was $93,624.

UMB Bank, N.A. serves as custodian of the Master Fund’s assets and provides custodial services for the Master Fund.

| 8. | Investment Transactions |

Total purchases of Private Equity Investments for the six month period ended September 30, 2011 amounted to $94,247,951. Total distribution proceeds from redemptions of Private Equity Investments for the six month period ended September 30, 2011 amounted to $7,528,577. The cost of investments in Private Equity Investments for U.S. federal income tax purposes is adjusted for items of taxable income allocated to the Master Fund from such Private Equity Investments. The Master Fund relies upon actual and estimated tax information provided by the Private Equity Investments as to the amounts of taxable income allocated to the Master Fund as of September 30, 2011.

In the normal course of business, the Master Fund enters into contracts that provide general indemnifications. The Master Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Master Fund, and therefore cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

As of September 30, 2011, the Master Fund had contributed 75% or $194,701,899 of the total of $259,402,098 in capital commitments to the Private Equity Investments. Direct Investments contributed $111,598,914 of $114,967,040 in total commitments, Secondary Investments contributed $81,435,383 of $123,727,529 in total commitments, and Primary Investments contributed $1,667,602 of $20,707,529 in total commitments as of September 30, 2011.

An investment in the Master Fund involves significant risks, including industry risk, liquidity risk, interest rate risk and economic conditions risk, that should be carefully considered prior to investing and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Master Fund invests substantially all of its available capital in Private Equity Investments. These investments are generally restricted securities that are subject to substantial holding periods and are not traded in public markets, so that the Master Fund may not be able to resell some of its holdings for extended periods, which may be several years. The Master Fund may have a concentration of investments, as permitted by the private placement offering memorandum, in a particular industry or sector. Investment performance of the sector may have a significant impact on the performance of the Master Fund. The Master Fund’s investments are also subject to the risk associated with investing in private equity securities. The investments in private equity securities are illiquid, can be subject to various restrictions on resale, and there can be no assurance that the Master Fund will be able to realize the value of such investments in a timely manner.

Interests in the Master Fund provide limited liquidity since Members will not be able to redeem Interests on a daily basis because the Master Fund is a closed-end fund. Therefore investment in the Master Fund is suitable only for investors who can bear the risks associated with the limited liquidity of Interests and should be viewed as a long-term investment. No guarantee or representation is made that the investment objective will be met.

A further discussion of the risks associated with an investment in the Master Fund is provided in the Confidential Private Placement Memorandum and Statement of Additional Information.

Management has evaluated the impact of all subsequent events on the Master Fund through the date the financial statements were issued, and has determined that the following subsequent events require disclosure in the financial statements. Effective October 1, 2011 and November 1, 2011, there were additional capital contributions to the Fund in the amounts of $12,860,515 and $14,577,036, respectively. In addition, the board accepted tender requests in the amount of $3,088,845, which will be effective as of December 31, 2011.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Other Information (unaudited) (continued)

Proxy Voting

The Master Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Master Fund’s Form N-PX filing will be available: (i) without charge, upon request, by calling 1-877-591-4656 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Master Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Master Fund’s Form N-Q is available, without charge and upon request, on the SEC’s website at http://www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the Public Reference Room may be obtained by calling 1-800-SEC-0330.