UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22241

Partners Group Private Equity (Master Fund), LLC

(Exact name of registrant as specified in charter)

c/o Partners Group (USA) Inc.

1114 Avenue of the Americas, 37th Floor

New York, NY 10036

(Address of principal executive offices) (Zip code)

Robert M. Collins

1114 Avenue of the Americas, 37th Floor

New York, NY 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 908-2600

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| (a) | The Report to Shareholders is attached herewith. |

PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC

(a Delaware Limited Liability Company)

Annual Report

For the Year Ended March 31, 2023

See the inside front cover for important information about access to your Fund’s annual and semiannual shareholder reports. |

|

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website, and each time a report is posted you will be notified by mail and provided with a website address to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the Fund, by calling 1-888-977-9790.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-888-977-9790 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive paper reports will apply to all Partners Group funds held in your account if you invest through a financial intermediary or all Partners Group funds held with the fund complex if you invest directly with the Fund.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Table of Contents

For the Year Ended March 31, 2023

| | |

Report of Independent Registered Public Accounting Firm | 1 |

Management’s Discussion of Fund Performance | 2-5 |

Consolidated Schedule of Investments | 6-28 |

Consolidated Statement of Assets and Liabilities | 29 |

Consolidated Statement of Operations | 30 |

Consolidated Statements of Changes in Net Assets | 31 |

Consolidated Statement of Cash Flows | 32-33 |

Consolidated Financial Highlights | 34-35 |

Notes to Consolidated Financial Statements | 36-52 |

Fund Expenses | 53 |

Fund Management | 54-56 |

Other Information | 57-61 |

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Report of Independent Registered Public Accounting Firm

For the Year Ended March 31, 2023

To the Board of Managers and Members of

Partners Group Private Equity (Master Fund), LLC

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of Partners Group Private Equity (Master Fund), LLC and its subsidiaries (the “Fund”) as of March 31, 2023, the related consolidated statements of operations and cash flows for the year ended March 31, 2023, the consolidated statement of changes in net assets for each of the two years in the period ended March 31, 2023, including the related notes, and the consolidated financial highlights for each of the five years in the period ended March 31, 2023 (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2023, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period ended March 31, 2023 and the financial highlights for each of the five years in the period ended March 31, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these consolidated financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our procedures included confirmation of securities owned as of March 31, 2023 by correspondence with the custodian, portfolio company investees, private equity funds or agent banks; when replies were not received from the custodian, portfolio company investees, private equity funds or agent banks, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Dallas, Texas

May 30, 2023

We have served as the auditor of one or more investment companies in the Partners Group investment company group since 2010.

1

Partners Group Private Equity (Master Fund), LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2023

Dear Members1,

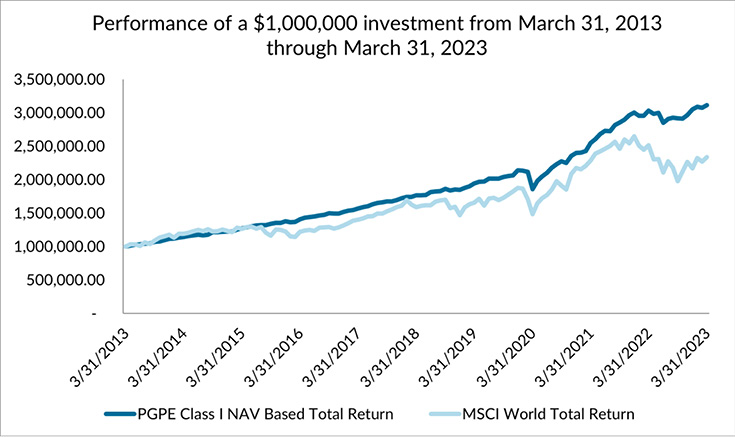

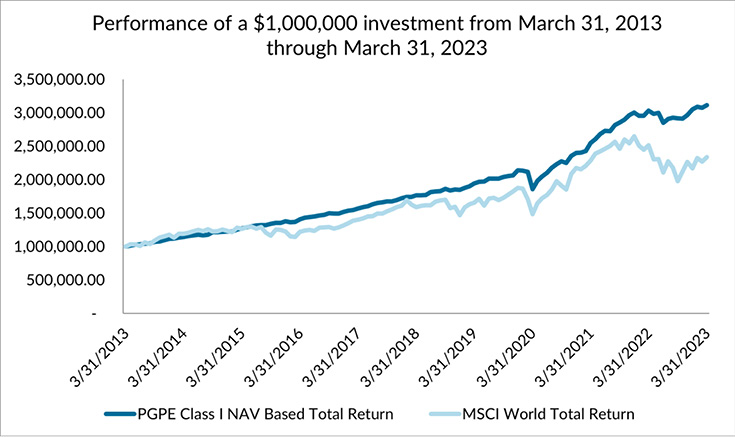

Partners Group is pleased to present the Partners Group Private Equity (Master Fund), LLC (the “Fund”) annual report for the fiscal year ended March 31, 2023. The Fund (Class I)2 produced a 2.68% total return for the fiscal year and finished the year with $13.62 billion of net assets. It was the Fund’s thirteenth consecutive year of positive performance. The Fund intends to declare dividends each year equal to all or substantially all of its taxable income. As such, in December 2022 the Fund distributed $0.2411 per share to investors, entirely composed of long-term capital gains.

Management commentary

Investors faced a number of new challenges in 2022. We observed a substantial shift toward a world characterized by higher inflation, more moderate growth, and a multipolar economy. Financial markets had a major correction in the first nine months of 2022 as a result of the regime change toward higher interest rates, with global equities and bond price indices falling significantly. In the last quarter of 2022, market sentiment began to improve largely due to surprisingly resilient economic activity in the US and Europe, the “reopening” of China, a perceived peaking of inflation, and a more positive outlook regarding central bank monetary policy. We believe that the risk of a more severe downturn is lower than previously thought.

We believe that the Fund was well positioned for these challenges given the Adviser’s long-term investment strategy and the Fund’s significant diversification.

The control ownership approach and transformational investment strategy (i.e., executing on a specific and customized value creation plan for each company) enabled our portfolio companies to be resilient during this turbulent period. For example, the Fund’s private equity direct portfolio, which accounts for the largest single component of the Fund’s investment allocation, grew EBITDA by 18% in the 2022 calendar year, while maintaining EBITDA margins at 22%3. These strong fundamentals largely outweighed the negative effects of decreased equity multiples caused by public equity market declines and a modest decline in industry-wide buyout exit multiples.

The Fund has also benefited from the Adviser’s ability to build a diversified portfolio. As of March 31, 2023, the Fund has direct and indirect exposure to more than 5,000 portfolio companies across North America (53%), Europe (35%), Asia-Pacific (8%), and other regions (4%)4. Of these, the Fund held direct interests in 463 assets (70% of portfolio value), 193 primary commitments (15%), 92 stakes in secondary investments (13%), and 91 listed investments (2%)4. The Fund was further diversified across more than 15 different vintage years.

2

Partners Group Private Equity (Master Fund), LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2023 (continued)

With these strong business fundamentals and robust portfolio construction, the Fund generated positive returns, outperforming the MCSI World TR index by 9.7% in the fiscal year ended March 31, 2023, although there is no single investment benchmark that is closely comparable to the Fund (see below).

| Annualized Total Return as of 31 March 20232 |

| | 1 Year | 5 Year | 10 Year |

PGPE Class I NAV Based TR | 2.7% | 12.0% | 12.0% |

PGPE Class A NAV Based TR | 2.0% | 11.2% | n.a.5 |

PGPE Class A NAV Based TR with Sales Load7 | -1.6% | 10.5% | n.a.5 |

MSCI World TR6 | -7.0% | 8.0% | 8.9% |

Portfolio positioning

As has been the case since the Fund’s inception, the Adviser’s relative value views will vary across asset class, investment type, geography, or position in the capital structure. We believe that the flexibility afforded by the Fund’s ability to make Direct Investments and primary and secondary Private Equity Fund Investments in a variety of markets, regions, and sectors, will continue to help the Fund achieve its investment objectives. Direct Equity, specifically control buyouts, continued to be the investment focus of 2022 as we believe that they will be the most important driver of returns in future.

Private Equity

During the fiscal year, Private Equity Investments accounted for most of the Fund’s investment allocation and were the largest contributor to positive performance. Direct Equity remained the largest exposure within Private Equity, followed by Primary and Secondary fund investments. The Fund’s portfolio companies demonstrated significant EBITDA resilience in 2022 as a result of carefully selected non-cyclical themes (e.g., healthcare and business IT) and hands-on engagement with portfolio companies. Additionally, by design, a majority of our Private Equity Direct portfolio is hedged against variable interest rates in their liabilities and have debt maturities not until 2025 and beyond.

For new investments, the most attractive relative values were found in mid- and upper mid-cap firms with proven business models and differentiated customer propositions. New infrastructure investments within the Private Equity portfolio have a similar focus on direct investing in growth areas such as digital infrastructure and energy transition.

3

Partners Group Private Equity (Master Fund), LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2023 (continued)

Direct Debt

The expected returns for the Direct Debt asset class increased meaningfully in 2022, especially as it benefited from rising rates as a floating-rate asset class. Credit spreads widened and original issue discounts increased, while the most common benchmark rate (3M SOFR) increased from near-zero to over 4%. Direct Debt opportunities in the US and Europe offered returns in the high single digits. Increasingly, companies turned to private credit providers as banks stepped away from underwriting and new issuance markets almost dried up. We saw the best relative value in the senior part of the capital structure, and the Fund increased its tactical target allocation to Direct Debt. A thematic approach was applied to the selection of sectors and companies, and we looked for opportunities with significant equity cushions, moderate levels of leverage, and contractual protection. The Fund’s portfolio is highly diversified and highly selective, and we seek to minimize risks associated with lower rated issuers.

Other investments

A small percentage of the Fund’s investments is allocated to other more liquid assets, such as Common Stocks (listed infrastructure and listed private equity), and, to a much lesser extent, Asset-Backed Securities. Within the Common Stock portfolio, infrastructure held up better than private equity during 2022. Regulated utilities such as water network operators and waste management companies performed best, due to inflation-linked prices, long-term concessions, and strong market positions. Toll road investments were another strong performer, as they benefited from a continued recovery in traffic volumes.

Looking ahead

The economic conditions appear to be improving compared with just a few months ago. A widespread fear of energy disruptions in Europe did not materialize, and private demand in the US has so far been resilient to rising rates. As inflation slows, there is increasing clarity regarding the terminal level of central bank policy rates. Accordingly, we believe that the risk of a more severe recession has reduced. But we also acknowledge that uncertainty still exists while inflation is elevated and central banks are tightening. We therefore remain cautious about our underwriting for the time being due to possible headwinds to near-term real GDP growth.

That said, we are excited to be investing in this environment. Historically, private markets have shown a high level of resilience during economic downturns, with downturn-era vintages historically outperforming vintages at the economic peaks (although past performance is no guarantee of future outcomes). Because we maintained a strong liquidity position in the Fund last year, we have capital available to invest in 2023.

We are actively building our pipeline of thematically-oriented target assets, where we have high conviction in the underlying theme and on the asset’s transformational growth trajectory. In our view, asset selection will be critical in this environment, and we believe that the ability to protect and grow earnings and margin will be key to investment returns in the years to come. In addition, market positioning and pricing power will be key differentiators.

We appreciate the trust and confidence you have demonstrated in Partners Group through your investment in the Fund. Thank you for your continued support. If you have any additional questions or comments, we invite you to contact your Partners Group representative directly or email the team at DLPGPEOperations@partnersgroup.com.

Sincerely,

Partners Group (USA) Inc.

Note: Data as of March 31, 2023.

1. | Terms used but not defined in this letter have the meanings set forth in the Notes to the Fund’s Financial Statements for the fiscal year ended March 31, 2023 hereinafter appearing. |

2. | Past performance is not indicative of future results. Returns shown do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the sale of Fund shares. All figures are net of all fees including advisory and incentive fees and fund expenses. Performance reflects expense reimbursements and/or fees waived by the adviser, without which performance would be lower. There is no assurance that similar results will be achieved in the future. Certain statements in this commentary are forward-looking statements. The forward-looking statements and other views expressed herein are those of Fund management as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any |

4

Partners Group Private Equity (Master Fund), LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2023 (continued)

obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives.

3. | Data as of December 31, 2022. |

4. | Figures based on net asset value calculated as of March 31, 2023. |

5. | The inception date of Class A is December 31, 2016. |

6. | The MSCI World Index captures large and mid cap representation across 23 Developed Markets (DM) countries. With 1,539 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US. The MSCI World Index was launched on March 31, 1986. Data prior to the launch date is back-tested data (i.e., calculations of how the index might have performed over that time period had the index existed). There are frequently material differences between back-tested performance and actual results. Past performance — whether actual or back-tested — is no indication or guarantee of future performance. The index is unmanaged and does not include fees. Investors may not invest in the index directly. The index does not serve as a benchmark for the Fund and the index performance is presented for illustrative purposes only. |

7. | Assumes Maximum Placement Fee for Class A of 3.50%. |

5

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023

INVESTMENT PORTFOLIO AS A PERCENTAGE OF TOTAL NET ASSETS

Common Stocks (1.17%)

North America (0.63%) | Industry | | Acquisition

Date | | | Shares | | | Fair

Value | |

American Tower Corp. | Communication | | | 05/29/20 | | | | 21,933 | | | $ | 4,474,771 | |

American Water Works Co., Inc. | Utilities | | | 02/16/16 | | | | 47,317 | | | | 6,928,628 | |

Ares Capital Corp. | Diversified Financial Services | | | 02/16/16 | | | | 141,722 | | | | 2,589,261 | |

Ares Management Corp. | Diversified Financial Services | | | 06/28/19 | | | | 35,642 | | | | 2,972,899 | |

Atmos Energy Corp. | Utilities | | | 02/16/16 | | | | 62,457 | | | | 7,012,047 | |

Blackstone Group, Inc. | Diversified Financial Services | | | 07/12/19 | | | | 53,164 | | | | 4,669,394 | |

Brookfield Asset Management, Inc. | Diversified Financial Services | | | 07/18/22 | | | | 28,626 | | | | 936,324 | |

Brookfield Corp. | Diversified Financial Services | | | 12/12/22 | | | | 30,526 | | | | 994,232 | |

Canadian National Railway Co. | Transportation | | | 05/14/19 | | | | 53,381 | | | | 6,289,116 | |

CMS Energy Corp. | Utilities | | | 11/01/19 | | | | 68,163 | | | | 4,181,118 | |

Crown Castle International Corp. | Communication | | | 02/16/16 | | | | 38,641 | | | | 5,170,939 | |

Equinix Inc. | Diversified Financial Services | | | 07/31/20 | | | | 5,388 | | | | 3,881,731 | |

Fortis Inc. | Utilities | | | 12/18/17 | | | | 99,204 | | | | 4,195,934 | |

Golub Capital BDC Inc. | Diversified Financial Services | | | 02/24/22 | | | | 142,000 | | | | 1,925,520 | |

HarbourVest Global Private Equity | Diversified Financial Services | | | 12/21/18 | | | | 82,676 | | | | 2,089,233 | |

KKR & Co., Inc. | Diversified Financial Services | | | 02/16/16 | | | | 71,534 | | | | 3,756,250 | |

Oaktree Specialty Lending Corp. | Financials | | | 04/07/21 | | | | 142,199 | | | | 2,667,634 | |

Onex Corporation | Diversified Financial Services | | | 02/16/16 | | | | 17,576 | | | | 817,410 | |

Republic Services Inc. | Commercial & Professional Services | | | 08/28/17 | | | | 46,358 | | | | 6,266,674 | |

TC Energy Corp. | Utilities | | | 11/01/19 | | | | 45,416 | | | | 1,763,887 | |

The Williams Companies, Inc. | Utilities | | | 03/20/23 | | | | 71,000 | | | | 2,118,640 | |

TPG Specialty Lending, Inc. | Diversified Financial Services | | | 01/25/23 | | | | 88,054 | | | | 1,609,627 | |

Union Pacific Corp. | Transportation | | | 06/29/16 | | | | 17,379 | | | | 3,495,786 | |

Waste Management Inc. | Utilities | | | 07/02/20 | | | | 20,897 | | | | 3,409,764 | |

Total North America (0.63%) | | | | | | | | | | | | 84,216,819 | |

| | | | | | | | | | | | | | |

Western Europe (0.54%) |

3i Group Plc | Diversified Financial Services | | | 10/01/20 | | | | 175,294 | | | | 3,648,818 | |

Aena SA | Transportation | | | 12/21/18 | | | | 41,641 | | | | 6,736,059 | |

Apax Global Alpha Ltd. | Diversified Financial Services | | | 01/19/21 | | | | 485,904 | | | | 929,470 | |

BBGI SICAV S.A. | Diversified Financial Services | | | 03/21/19 | | | | 2,696,279 | | | | 5,024,354 | |

Cellnex Telecom SA | Communication | | | 05/15/19 | | | | 196,350 | | | | 7,628,136 | |

Elia System Operator SA/NV | Utilities | | | 11/03/22 | | | | 18,839 | | | | 2,488,751 | |

EQT AB | Diversified Financial Services | | | 04/06/20 | | | | 69,107 | | | | 1,403,766 | |

Gimv N.V. | Diversified Financial Services | | | 02/12/16 | | | | 31,933 | | | | 1,542,061 | |

HBM Healthcare Investments AG | Diversified Financial Services | | | 04/07/20 | | | | 7,339 | | | | 1,718,980 | |

HgCapital Trust PLC | Diversified Financial Services | | | 02/12/16 | | | | 1,394,880 | | | | 5,903,526 | |

HICL Infrastructure Co Ltd. | Diversified Financial Services | | | 03/30/16 | | | | 2,076,718 | | | | 3,951,958 | |

ICG Graphite Enterprise Trust PLC | Diversified Financial Services | | | 02/12/16 | | | | 119,861 | | | | 1,470,758 | |

Intermediate Capital Group PLC | Diversified Financial Services | | | 12/12/16 | | | | 98,453 | | | | 1,479,369 | |

Investment AB Kinnevik | Diversified Financial Services | | | 04/06/20 | | | | 208,117 | | | | 3,102,351 | |

Investor AB | Diversified Financial Services | | | 08/28/17 | | | | 160,160 | | | | 3,186,894 | |

National Grid PLC | Utilities | | | 02/12/16 | | | | 418,463 | | | | 5,667,372 | |

6

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Common Stocks (continued)

Western Europe (continued) | Industry | | Acquisition

Date | | | Shares | | | Fair

Value | |

NB Private Equity Partners Ltd. | Diversified Financial Services | | | 11/06/19 | | | | 137,871 | | | $ | 2,393,665 | |

Orsted AS | Utilities | | | 06/15/21 | | | | 8,156 | | | | 693,215 | |

Pantheon International Participations Plc | Diversified Financial Services | | | 11/04/19 | | | | 480,330 | | | | 1,385,928 | |

Terna Rete Elettrica Nazionale SpA | Utilities | | | 01/05/18 | | | | 654,620 | | | | 5,379,363 | |

Vinci SA | Transportation | | | 02/12/16 | | | | 64,738 | | | | 7,435,437 | |

Total Western Europe (0.54%) | | | | | | | | | | | | 73,170,231 | |

| | | | | | | | | | | | | | |

Total Common Stocks (Cost $139,609,346)(1.17%) | | | | | | | | | | | $ | 157,387,050 | |

Asset-Backed Securities (0.36%) | Interest | | Acquisition

Date | | | Maturity

Date | | Investment

Type | | Principal | | | Fair

Value** | |

North America (0.16%) |

CIFC Funding 2021-VI Ltd. ***, + | 6.25% + L^^ | | | 09/22/21 | | | | 10/15/34 | | Series 2021-6A, Class E | | $ | 1,500,000 | | | $ | 1,406,932 | |

CIFC Funding 2022-IV Ltd. ***, + | 7.00% + SFvv | | | 04/20/22 | | | | 07/16/35 | | Series 2022-4A, Class E | | | 1,250,000 | | | | 1,189,423 | |

CIFC Funding Ltd. ***, + | 7.27% + SFvv | | | 04/05/22 | | | | 04/21/35 | | Series 2022-3A, Class E | | | 1,000,000 | | | | 949,323 | |

Madison Park Funding LX Ltd. + | 5.50% + SFvv | | | 11/28/22 | | | | 10/25/35 | | Series 2022-60A, Class D | | | 1,000,000 | | | | 1,032,087 | |

Madison Park Funding LX Ltd. + | 8.95% + SFvv | | | 11/28/22 | | | | 10/25/35 | | Series 2022-60A, Class E | | | 1,250,000 | | | | 1,281,866 | |

Magnetite CLO Ltd. ***, + | 6.20% + L^^ | | | 10/01/21 | | | | 10/25/34 | | Series 2021-30A, Class E | | | 1,625,000 | | | | 1,575,826 | |

Magnetite XXIV Ltd. ***, + | 6.40% + SFvv | | | 02/04/22 | | | | 04/15/35 | | Series 2019-24A, Class ER | | | 4,000,000 | | | | 3,890,161 | |

Magnetite XXVI Ltd. ***, + | 5.95% + L^^ | | | 08/02/21 | | | | 07/25/34 | | Series 2020-26A, Class ER | | | 1,000,000 | | | | 965,260 | |

Neuberger Berman CLO XXI Ltd. ***, + | 3.30% + L^^ | | | 04/02/21 | | | | 04/20/34 | | Series 2016-21A, Class DR2 | | | 500,000 | | | | 477,362 | |

Neuberger Berman CLO XXI Ltd. ***, + | 6.46% + L^^ | | | 04/02/21 | | | | 04/20/34 | | Series 2016-21A, Class ER2 | | | 1,000,000 | | | | 948,317 | |

Neuberger Berman Loan Advisers CLO 45 Ltd. ***, + | 6.25% + L^^ | | | 10/07/21 | | | | 10/14/35 | | Series 2021-45A, Class E | | | 1,000,000 | | | | 968,291 | |

Ocean Trails CLO IX ***, + | 7.45% + L^^ | | | 09/22/21 | | | | 10/15/34 | | Series 2020-9A, Class ER | | | 2,647,264 | | | | 2,399,505 | |

Ocean Trails CLO XII Ltd. ***, + | 8.11% + SFvv | | | 05/13/22 | | | | 07/20/35 | | Series 2022-12A, Class E | | | 1,000,000 | | | | 971,805 | |

Southwick Park CLO LLC ***, + | 6.25% + L^^ | | | 11/16/21 | | | | 07/20/32 | | Series 2019-4A, Class ER | | | 800,000 | | | | 711,735 | |

Symphony CLO XXV Ltd. ***, + | 6.50% + L^^ | | | 03/12/21 | | | | 04/19/34 | | Series 2021-25A, Class E | | | 752,616 | | | | 715,224 | |

Symphony CLO XXXIII Ltd. ***, + | 7.10% + SFvv | | | 04/27/22 | | | | 04/24/35 | | Series 2022-33A, Class E | | | 1,250,000 | | | | 1,169,580 | |

Tallman Park CLO Ltd. ***, + | 6.35% + L^^ | | | 04/09/21 | | | | 04/20/34 | | Series 2021-1A, Class E | | | 500,000 | | | | 487,254 | |

Wellman Park CLO Ltd. ***, + | 6.25% + L^^ | | | 05/10/21 | | | | 07/15/34 | | Series 2021-1A, Class E | | | 1,000,000 | | | | 971,655 | |

Total North America (0.16%) | | | | | | | | | | | | | | | | | 22,111,606 | |

| | | | | | | | | | | | | | | | | | | |

Western Europe (0.20%) |

Aurium CLO V Designated Activity Co. ***, + | 3.50% + E## | | | 03/08/21 | | | | 04/17/34 | | Series 5A, Class ER | | | 1,500,000 | | | | 1,454,340 | |

Aurium CLO VII DAC ***, + | 5.86% + E## | | | 02/04/22 | | | | 05/15/34 | | Series 7A, Class E | | | 1,521,243 | | | | 1,434,364 | |

Avoca CLO XXVI DAC ***, + | 9.12% + E## | | | 02/23/22 | | | | 04/15/35 | | Series 26A, Class F | | | 1,200,000 | | | | 1,090,915 | |

Avoca CLO XXVI DAC ***, + | 6.51% + E## | | | 02/23/22 | | | | 04/15/35 | | Series 26A, Class E | | | 750,000 | | | | 714,860 | |

Blackrock European CLO VIII DAC ***, + | 3.30% + E## | | | 02/03/22 | | | | 01/20/36 | | Series 8A, Class DR | | | 1,000,000 | | | | 963,955 | |

Blackrock European CLO VIII DAC ***, + | 6.26% + E## | | | 02/03/22 | | | | 01/20/36 | | Series 8A, Class ER | | | 2,500,000 | | | | 2,311,242 | |

Boyce Park CLO Ltd. ***, + | 6.25% + SFvv | | | 01/28/22 | | | | 04/21/35 | | Series 2022-1A, Class E | | | 2,625,000 | | | | 2,437,308 | |

Carlyle Euro CLO 2021-1 DAC ***, + | 6.12% + E## | | | 05/01/21 | | | | 04/15/34 | | Series 2021-1A, Class D | | | 333,000 | | | | 309,472 | |

Carlyle Global Market Strategies 2015-1 Ltd. ***, + | 0.00% | | | 01/20/22 | | | | 01/16/33 | | Series 2015-1A, Class SUB | | | 3,000,000 | | | | 1,254,793 | |

Carlyle Global Market Strategies 2015-1 Ltd. ***, + | 5.50% + E## | | | 01/20/22 | | | | 01/16/33 | | Series 2015-1A, Class DR | | | 1,502,063 | | | | 1,364,115 | |

Carysfort Park CLO ***, + | 6.14% + E## | | | 03/12/21 | | | | 07/28/34 | | Series 2021-1A, Class D | | | 500,000 | | | | 474,514 | |

CVC Cordatus Loan Fund + | 6.16% + E## | | | 11/07/22 | | | | 01/15/37 | | Series 26A, Class D1 | | | 1,100,000 | | | | 1,215,274 | |

CVC Cordatus Loan Fund + | 7.73% + E## | | | 11/07/22 | | | | 01/15/37 | | Series 26A, Class D2 | | | 400,000 | | | | 443,917 | |

Edmondstown Park CLO DAC + | 6.19% + E## | | | 11/18/22 | | | | 07/21/35 | | Series 1A, Class D | | | 1,100,000 | | | | 1,123,070 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

7

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Asset-Backed Securities (continued)

Western Europe (continued) | Interest | | Acquisition

Date | | | Maturity

Date | | Investment

Type | | Principal | | | Fair

Value** | |

Edmondstown Park CLO DAC + | 6.77% + E## | | | 11/18/22 | | | | 07/21/35 | | Series 1A, Class E | | $ | 1,250,000 | | | $ | 1,378,559 | |

Octagon 58 Ltd. ***, + | 7.20% + SFvv | | | 04/21/22 | | | | 07/15/37 | | Series 2022-1A, Class E | | | 2,140,000 | | | | 2,020,863 | |

Otranto Park CLO ***, + | 7.05% + E## | | | 03/04/22 | | | | 05/15/35 | | Series 1A, Class E | | | 1,172,000 | | | | 1,155,948 | |

Otranto Park CLO ***, + | 4.15% + E## | | | 03/04/22 | | | | 05/15/35 | | Series 1A, Class D | | | 750,000 | | | | 750,450 | |

Palmer Square European Loan Funding 2021-1 DAC ***, + | 5.95% + E## | | | 08/02/21 | | | | 04/15/31 | | Series 2021-1A, Class E | | | 714,000 | | | �� | 706,344 | |

Palmer Square European Loan Funding 2021-2 DAC ***, + | 8.05% + E## | | | 10/15/21 | | | | 07/15/31 | | Series 2021-2A, Class F | | | 375,000 | | | | 349,386 | |

Palmer Square European Loan Funding 2021-2 DAC ***, + | 5.90% + E## | | | 10/15/21 | | | | 07/15/31 | | Series 2021-2A, Class E | | | 625,000 | | | | 596,281 | |

Palmer Square European Loan Funding 2022-1 DAC ***, + | 5.90% + E## | | | 02/03/22 | | | | 10/15/31 | | Series 2022-1A, Class E | | | 667,000 | | | | 636,404 | |

Palmer Square European Loan Funding 2022-1 DAC ***, + | 8.05% + E## | | | 02/03/22 | | | | 10/15/31 | | Series 2022-1A, Class F | | | 500,000 | | | | 465,944 | |

Palmer Square European Loan Funding 2022-1 DAC ***, + | 7.37% + E## | | | 03/17/22 | | | | 10/15/31 | | Series 2022-2A, Class E | | | 1,500,000 | | | | 1,501,198 | |

Total Western Europe (0.20%) | | | | | | | | | | | | | | | | 26,153,516 | |

| | | | | | | | | | | | | | | | | | | |

Total Asset-Backed Securities (Cost $52,182,615)(0.36%) | | $ | 48,265,122 | |

Private Equity Investments (93.17%)

Direct Investments * (66.84%) Direct Equity (58.97%) | Investment Type | | Acquisition

Date | | | Shares | | | Fair

Value** | |

Asia - Pacific (4.73%) |

AAVAS Financiers Limited +, a, e | Common equity | | | 03/28/18 | | | | 3,891,752 | | | $ | 68,682,470 | |

Argan Mauritius Limited +, a, e | Common equity | | | 05/09/16 | | | | 106,215 | | | | 20,955,136 | |

KKR Pebble Co-Invest L.P. +, a, c, e | Limited partnership interest | | | 05/13/21 | | | | — | | | | 25,946,509 | |

Kowloon Co-Investment, L.P. +, a, c | Limited partnership interest | | | 11/04/15 | | | | — | | | | 7,383,938 | |

Partners Terra Pte. Ltd. +, a, b, e | Common equity | | | 05/14/21 | | | | 4,372,335 | | | | 4,968,343 | |

PG Esmeralda Pte. Ltd. +, a, b, e | Common equity | | | 03/03/21 | | | | 5,433,284 | | | | 4,674,212 | |

PG Esmeralda Pte. Ltd. +, a, b, e | Preferred equity | | | 03/03/21 | | | | 488,996 | | | | 42,067,958 | |

PG Esmeralda Pte. Ltd. +, a, b, e | Preferred equity | | | 09/26/22 | | | | 63,417 | | | | 6,955,017 | |

PG Loa Pte. Ltd. +, a | Common equity | | | 04/25/22 | | | | 1,209,388 | | | | 1,281,067 | |

PG Loa Pte. Ltd. +, a | Preferred equity | | | 04/25/22 | | | | 22,978,363 | | | | 24,340,267 | |

Sunsure Energy Private Limited +, a, b, c, e | Member interest | | | 12/27/22 | | | | — | | | | 7,228,256 | |

Sunsure Energy Private Limited +, a, b, e | Common equity | | | 12/27/22 | | | | 481,884 | | | | 481,884 | |

Sunsure Energy Private Limited +, a, b, e | Preferred equity | | | 12/27/22 | | | | 1,927,535 | | | | 1,927,535 | |

Touchstone Co-Investment, L.P. +, a, c, e | Limited partnership interest | | | 06/24/19 | | | | — | | | | 1,906,991 | |

TPG Upswing Co-Invest, L.P. +, a, c | Limited partnership interest | | | 01/10/19 | | | | — | | | | 30,366,144 | |

Zenith Longitude Limited +, a, b, e | Common equity | | | 08/13/21 | | | | 6,682,671 | | | | 384,917,110 | |

Total Asia - Pacific (4.73%) | | | | | | | | | | | | 634,082,837 | |

| | | | | | | | | | | | | | |

North America (29.00%) |

Alliant Insurance Services, Inc. +, a, c | Limited partnership interest | | | 12/01/21 | | | | — | | | | 27,697,847 | |

AP VIII Prime Security Services Holdings, L.P. +, a, c, e | Limited partnership interest | | | 05/02/16 | | | | — | | | | 9,341,805 | |

Astorg VII Co-Invest ERT +, a, c | Limited partnership interest | | | 04/28/21 | | | | — | | | | 64,252,476 | |

BCPE Hercules Holdings, L.P. +, a, c | Limited partnership interest | | | 07/30/18 | | | | — | | | | 44,471,363 | |

BI Gen Holdings, Inc. +, a | Common equity | | | 01/01/21 | | | | 14,561 | | | | 321,416 | |

CapitalSpring Finance Company, LLC +, a, b | Common equity | | | 03/01/17 | | | | 3,020,546 | | | | 2,945,931 | |

CB Poly Holdings, LLC +, a, e | Preferred equity | | | 08/16/16 | | | | 171,270 | | | | 55,334,606 | |

CB Titan MidCo Holdings, Inc. +, a | Common equity | | | 01/01/21 | | | | 56,634 | | | | 35,049 | |

CBI Parent, L.P. +, a, b | Common equity | | | 01/06/21 | | | | 1,145,918 | | | | 49,483,981 | |

CBI Parent, L.P. +, a, b, c | Member interest | | | 10/17/22 | | | | — | | | | 5,806,888 | |

CD&R Mercury Co-Investor, L.P. +, a, c, e | Limited partnership interest | | | 10/14/20 | | | | — | | | | 234,184,586 | |

Confluent Health Holdings LP +, a, b, e | Common equity | | | 01/31/23 | | | | 3,232 | | | | 8,502,052 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

8

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Private Equity Investments (continued)

Direct Investments * (continued) Direct Equity (continued) | Investment Type | | Acquisition

Date | | | Shares | | | Fair

Value** | |

North America (continued) |

Confluent Health, LLC +, a, b, e | Common equity | | | 06/24/19 | | | | 27,246 | | | $ | 58,553,771 | |

ConvergeOne Investment L.P. +, a | Common equity | | | 07/03/19 | | | | 3,120 | | | | 469,307 | |

Cowboy Topco, Inc. +, a | Common equity | | | 05/18/22 | | | | 1,348,750 | | | | 1,389,640 | |

Cure Holdings, LLC +, a, e | Common equity | | | 05/13/21 | | | | 241,557 | | | | 1,207,850 | |

Dermatology Holdings, L.P. +, a, b, c, e | Limited partnership interest | | | 04/01/22 | | | | — | | | | 123,530,154 | |

DIF VI Co-Invest Project 2C C.V. +, a, c, e | Limited partnership interest | | | 03/15/22 | | | | — | | | | 55,102,707 | |

ECP Parent, LLC +, a, b | Common equity | | | 11/15/21 | | | | 105,520,023 | | | | 134,424,811 | |

EdgeCore Holdings, L.P. +, a, b, c, e | Limited partnership interest | | | 11/10/22 | | | | — | | | | 46,333,333 | |

Encore Holdings LP +, a, b, c, e | Limited partnership interest | | | 07/01/22 | | | | — | | | | 59,878,467 | |

EnfraGen LLC +, a, b, e | Common equity | | | 09/17/19 | | | | 37,786 | | | | 68,814,259 | |

EQT Infrastructure IV Co-Investment (B) SCSp +, a, c | Limited partnership interest | | | 03/09/20 | | | | — | | | | 122,477,860 | |

EQT IX Co-Investment (F) SCSp +, a, c, e | Limited partnership interest | | | 11/15/21 | | | | — | | | | 121,735,387 | |

EQT VIII Co-Investment (C) SCSp +, a, c, e | Limited partnership interest | | | 01/25/19 | | | | — | | | | 123,504,638 | |

EXW Coinvest L.P. +, a, c | Limited partnership interest | | | 06/17/16 | | | | — | | | | 19,918,899 | |

FRP Investors II, L.P. +, a, c, e | Limited partnership interest | | | 09/16/22 | | | | — | | | | 51,281,843 | |

Halo Parent Newco, LLC +, a | Preferred equity | | | 02/22/22 | | | | 1,109 | | | | 17,974,459 | |

Icebox Holdco I Inc. +, a, b, c | Member interest | | | 03/01/22 | | | | — | | | | 62,801,819 | |

Icebox Parent L.P. +, a, b, c | Limited partnership interest | | | 12/22/21 | | | | — | | | | 142,209,239 | |

Idera Parent L.P. +, a, b, c, e | Limited partnership interest | | | 03/02/21 | | | | — | | | | 235,094,054 | |

KDOR Merger Sub Inc. +, a | Common equity | | | 05/11/18 | | | | 481 | | | | 1 | |

KENE Holdings, L.P. +, a, c | Limited partnership interest | | | 08/08/19 | | | | — | | | | 420,155 | |

KKR Cavalry Co-Invest Blocker Parent L.P. +, a, c, e | Limited partnership interest | | | 03/24/22 | | | | — | | | | 47,943,203 | |

KKR Enterprise Co-Invest AIV A L.P. +, a, c, e | Limited partnership interest | | | 07/31/20 | | | | — | | | | 700,330 | |

KKR Enterprise Co-Invest L.P. +, a, e | Common equity | | | 10/09/18 | | | | 9,684 | | | | — | |

KPOCH Holdings, L.P. +, a, b, c | Limited partnership interest | | | 11/10/22 | | | | — | | | | 197,028,562 | |

KPSKY Holdings L.P. +, a, b, c | Limited partnership interest | | | 10/19/21 | | | | — | | | | 63,907,232 | |

KSLB Holdings, LLC +, a | Common equity | | | 07/30/18 | | | | 252,000 | | | | 543 | |

LTF Holdings, Inc. +, a, e | Common equity | | | 01/06/20 | | | | 3,464,630 | | | | 55,260,847 | |

Matterhorn Topco, L.P. +, a | Common equity | | | 05/19/21 | | | | 88,040 | | | | 13,997,691 | |

MHS Acquisition Holdings, LLC +, a, b | Common equity | | | 03/10/17 | | | | 356 | | | | 628,574 | |

MHS Acquisition Holdings, LLC +, a, b | Preferred equity | | | 03/10/17 | | | | 35,285 | | | | 341,421 | |

MHS Blocker Purchaser L.P. +, a, b, c | Limited partnership interest | | | 03/10/17 | | | | — | | | | 74,999,298 | |

Milestone Investment Holdings, LLC +, a, e | Common equity | | | 09/23/21 | | | | 22,293,150 | | | | 30,396,135 | |

Multiplan Corp. +, a | Common equity | | | 06/07/16 | | | | 485,959 | | | | 505,397 | |

NC Ocala Co-Invest Alpha, L.P. +, a, c | Limited partnership interest | | | 11/24/21 | | | | — | | | | 78,168,465 | |

NDES Holdings, LLC +, a | Preferred equity | | | 09/19/11 | | | | 500,000 | | | | 2,793,328 | |

OHCP IV SF COI, L.P. +, a, b, c | Limited partnership interest | | | 01/31/18 | | | | — | | | | 52,652,424 | |

OMNIA Coinvest L.P. +, a, c, e | Limited partnership interest | | | 10/23/20 | | | | — | | | | 21,077,477 | |

Onex Fox, L.P. +, a, c, e | Limited partnership interest | | | 04/25/19 | | | | — | | | | 74,800,429 | |

Orion Opportunity L.P. +, a, c, e | Limited partnership interest | | | 09/01/21 | | | | — | | | | 46,306,275 | |

Patriot SPV, L.P. +, a, c | Limited partnership interest | | | 03/18/21 | | | | — | | | | 59,874,948 | |

PG BRPC Investment, LLC +, a, b, e | Common equity | | | 08/01/19 | | | | 32,079 | | | | 83,240,775 | |

PG Delta HoldCo, LLC +, a, b, e | Common equity | | | 06/24/21 | | | | 30,950,766 | | | | 56,758,170 | |

Raptor Holding Parent, L.P. +, a | Common equity | | | 04/01/22 | | | | 11,209 | | | | 1,317,850 | |

Real Hero Topco, L.P. +, a, c | Limited partnership interest | | | 04/01/21 | | | | — | | | | 10,942,640 | |

Safari Co-Investment L.P. +, a, c, e | Limited partnership interest | | | 03/14/18 | | | | — | | | | 10,824,021 | |

SC Landco Parent, LLC +, a | Common equity | | | 11/21/13 | | | | 2,672 | | | | 485,957 | |

SC Landco Parent, LLC +, a | Preferred equity | | | 04/21/17 | | | | — | | | | 1 | |

Shermco Intermediate Holdings, Inc. +, a, e | Common equity | | | 06/05/18 | | | | 11,525 | | | | 1,593,722 | |

Shingle Coinvest L.P. +, a, c, e | Limited partnership interest | | | 05/29/18 | | | | — | | | | 191,112,129 | |

SIH RP HoldCo L.P. +, a, e | Common equity | | | 09/10/19 | | | | 5,995,126 | | | | 63,594,303 | |

SLP West Holdings Co-Invest Feeder II, L.P. +, a, c | Limited partnership interest | | | 08/18/17 | | | | — | | | | 28,799,459 | |

SnackTime PG Holdings, Inc. +, a, b, e | Common equity | | | 05/23/18 | | | | 12 | | | | 23,099,045 | |

SnackTime PG Holdings, Inc. +, a, b, c, e | Member interest | | | 05/23/18 | | | | — | | | | 20,664,120 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

9

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Private Equity Investments (continued)

Direct Investments * (continued) Direct Equity (continued) | Investment Type | | Acquisition

Date | | | Shares | | | Fair

Value** | |

North America (continued) |

Specialty Pharma Holdings LP +, a, b, c | Limited partnership interest | | | 04/01/21 | | | | — | | | $ | 133,140,783 | |

Starfish Intermediate, Inc. +, a | Preferred equity | | | 06/06/22 | | | | 57,176 | | | | 194,419,248 | |

Stonepeak Tiger (Co-Invest) Holdings (I-B) L.P. +, a, c, e | Limited partnership interest | | | 08/17/21 | | | | — | | | | 31,591,900 | |

SureWerx Topco, L.P. +, a, b, c, e | Limited partnership interest | | | 12/28/22 | | | | — | | | | 52,920,539 | |

T-VIII Mercury Co-Invest L.P. +, a, c, e | Limited partnership interest | | | 07/29/21 | | | | — | | | | 5,099,651 | |

Thermostat Purchaser, L.P. +, a, b, c | Limited partnership interest | | | 08/31/21 | | | | — | | | | 72,485,016 | |

TKC Topco LLC +, a | Common equity | | | 10/14/16 | | | | 4,632,829 | | | | 201,927 | |

VEEF II Co-Invest 2-A, L.P. +, a, c | Limited partnership interest | | | 03/15/22 | | | | — | | | | 4,629,072 | |

Velocity Holdings US LP +, a, c, e | Limited partnership interest | | | 08/31/22 | | | | — | | | | 24,284,273 | |

VEPF VII Co-Invest 2-A, L.P. +, a, c, e | Limited partnership interest | | | 04/06/21 | | | | — | | | | 89,499,127 | |

WHCG Purchaser, L.P. +, a, b, c | Limited partnership interest | | | 06/22/21 | | | | — | | | | 14,861,436 | |

Woof Parent L.P. +, a | Common equity | | | 12/21/20 | | | | 1,441 | | | | 2,769,094 | |

Total North America (29.00%) | | | | | | | | | | | | 3,889,217,490 | |

| | | | | | | | | | | | | | |

Rest of World (1.63%) |

Carlyle Retail Turkey Partners, L.P. +, a, c | Limited partnership interest | | | 07/11/13 | | | | — | | | | 6,636,639 | |

Zabka Polska SA +, a, e | Preferred equity | | | 09/25/19 | | | | 120,777,003 | | | | 3,309,622 | |

Zabka Polska SA +, a | Common equity | | | 09/25/19 | | | | 2,551,723 | | | | 208,235,862 | |

Total Rest of World (1.63%) | | | | | | | | | | | | 218,182,123 | |

| | | | | | | | | | | | | | |

South America (0.01%) |

Centauro Co-Investment Fund, L.P. +, a, c | Limited partnership interest | | | 11/28/13 | | | | — | | | | 1,668,530 | |

Total South America (0.01%) | | | | | | | | | | | | 1,668,530 | |

| | | | | | | | | | | | | | |

Western Europe (23.60%) |

Ark EquityCo SAS +, a, c, e | Limited partnership interest | | | 02/21/22 | | | | — | | | | 13,736,104 | |

Aston Lux Acquisitions S.à.r.l. +, a, c | Limited partnership interest | | | 11/28/19 | | | | — | | | | 3,420,272 | |

Aston Lux Acquisitions S.à.r.l. +, a | Common equity | | | 01/11/21 | | | | 218,625 | | | | 233,035 | |

Astorg VIII Co-Invest Open Health +, a, c | Limited partnership interest | | | 08/04/22 | | | | — | | | | 23,349,440 | |

Bock Capital JVCo Nature S.à.r.l. +, a, b | Common equity | | | 07/01/21 | | | | 12,590,000,000 | | | | 119,970,996 | |

Camelia Investment 1 Limited +, a, b | Preferred equity | | | 10/12/17 | | | | 6,768,617,529 | | | | 141,003,242 | |

Camelia Investment 1 Limited +, a, b | Common equity | | | 10/12/17 | | | | 86,516 | | | | 34,519,556 | |

Capri Acquisitions Topco Limited +, a | Common equity | | | 11/01/17 | | | | 8,345,985 | | | | 78,368,759 | |

CD&R Market Co-Investor, L.P. +, a, c, e | Limited partnership interest | | | 11/10/21 | | | | — | | | | 50,248,813 | |

Ciddan S.à.r.l. +, a | Preferred equity | | | 09/15/17 | | | | 23,249,522 | | | | 28,052,232 | |

Ciddan S.à.r.l. +, a | Common equity | | | 09/15/17 | | | | 12,263,242 | | | | 78,081,702 | |

Climeworks AG +, a | Common equity | | | 04/25/22 | | | | 63,085 | | | | 486,801 | |

Climeworks AG +, a, e | Preferred equity | | | 04/25/22 | | | | 7,823,400 | | | | 63,551,010 | |

EQT Future Co-Investment (C) SCSp +, a, c | Limited partnership interest | | | 02/15/23 | | | | — | | | | 48,178,954 | |

EQT Jaguar Co-Investment SCSp +, a, b, c, e | Limited partnership interest | | | 11/30/18 | | | | — | | | | 118,778,917 | |

EQT VIII Co-Investment (D) SCSp +, a, c, e | Limited partnership interest | | | 10/01/19 | | | | — | | | | 197,359,516 | |

Fides S.p.A +, a | Common equity | | | 12/15/16 | | | | 78,505 | | | | 513,238 | |

Global Blue Group Holding AG +, a | Common equity | | | 09/11/20 | | | | 97,250 | | | | 581,219 | |

Global Blue Holding L.P. +, a, c | Limited partnership interest | | | 07/31/12 | | | | — | | | | 10,605,291 | |

Green DC LuxCo S.à.r.l. +, a, b, c, e | Member interest | | | 01/20/22 | | | | — | | | | 15,986,931 | |

Green DC LuxCo S.à.r.l. +, a, b | Common equity | | | 01/20/22 | | | | 19,595,288 | | | | 60,887,852 | |

KKR Matterhorn Co-Invest L.P. +, a, c | Limited partnership interest | | | 11/02/12 | | | | — | | | | 961,180 | |

KKR Pegasus Co-Invest L.P. +, a, c | Limited partnership interest | | | 07/07/22 | | | | — | | | | 12,746,098 | |

KKR Sprint Co-Invest L.P. +, a, c | Limited partnership interest | | | 09/29/22 | | | | — | | | | 44,901,409 | |

KKR Traviata Co-invest L.P. +, a, c | Limited partnership interest | | | 12/18/19 | | | | — | | | | 132,430,437 | |

Luxembourg Investment Company 261 S.à.r.l. +, a | Common equity | | | 07/31/18 | | | | 1,480 | | | | 67,408,311 | |

Luxembourg Investment Company 261 S.à.r.l. +, a, c | Member interest | | | 07/31/18 | | | | — | | | | 59,541,135 | |

Luxembourg Investment Company 285 S.à.r.l. +, a, b | Preferred equity | | | 08/22/19 | | | | 7,865,820 | | | | 23,698,151 | |

Luxembourg Investment Company 285 S.à.r.l. +, a, b, c | Member interest | | | 08/22/19 | | | | — | | | | 20,694,895 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

10

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Private Equity Investments (continued)

Direct Investments * (continued) Direct Equity (continued) | Investment Type | | Acquisition

Date | | | Shares | | | Fair

Value** | |

Western Europe (continued) |

Luxembourg Investment Company 285 S.à.r.l. +, a, b | Common equity | | | 08/22/19 | | | | 6,999,953 | | | $ | 3,312,213 | |

Luxembourg Investment Company 293 S.à.r.l. +, a, b, e | Common equity | | | 06/26/19 | | | | 9,789,622 | | | | 36,569,726 | |

Luxembourg Investment Company 293 S.à.r.l. +, a, b, c, e | Member interest | | | 06/26/19 | | | | — | | | | 5,148,507 | |

Luxembourg Investment Company 314 S.à.r.l. +, a, b | Common equity | | | 08/22/19 | | | | 192,000 | | | | 1 | |

Luxembourg Investment Company 404 S.à.r.l. +, a, b, e | Common equity | | | 02/14/23 | | | | — | | | | 259,313 | |

Luxembourg Investment Company 404 S.à.r.l. +, a, b, e | Preferred equity | | | 02/14/23 | | | | — | | | | 2,333,820 | |

Luxembourg Investment Company 414 S.à.r.l. +, a, b, c, e | Member interest | | | 07/02/21 | | | | — | | | | 55,573,020 | |

Luxembourg Investment Company 414 S.à.r.l. +, a, b, e | Common equity | | | 07/02/21 | | | | 12,111,360 | | | | 45,324,050 | |

Luxembourg Investment Company 430 S.à.r.l. +, a, b, e | Common equity | | | 05/10/21 | | | | 52,594,635 | | | | 71,624,666 | |

Luxembourg Investment Company 430 S.à.r.l. +, a, b, c, e | Member interest | | | 05/10/21 | | | | — | | | | 15,081,767 | |

Magnesium Co-Invest SCSp +, a, c, e | Limited partnership interest | | | 05/19/22 | | | | — | | | | 85,869,277 | |

Mauritius (Luxemburg) Investments S.à.r.l. +, a | Common equity | | | 10/19/21 | | | | 11,698 | | | | 1 | |

May Co-Investment S.C.A. +, a, b | Common equity | | | 11/09/20 | | | | 1,059,375 | | | | 64,107,397 | |

Montagu LuxCo +, a | Common equity | | | 02/22/22 | | | | 450,000 | | | | 55,357,189 | |

Nerve Co-Invest SCSp +, a, c, e | Limited partnership interest | | | 01/27/21 | | | | — | | | | 38,373,223 | |

Nerve Co-Invest SCSp +, a, c | Limited partnership interest | | | 01/31/23 | | | | — | | | | 5,200,954 | |

Oakley Capital V Co-Investment (A) SCSp +, a, c, e | Limited partnership interest | | | 12/12/22 | | | | — | | | | 43,841,520 | |

Orbiter Investments S.à.r.l. +, a, e | Common equity | | | 12/17/21 | | | | 5,977,270 | | | | 180,264,244 | |

OT Luxco 3 & Cy S.C.A. +, a | Warrants | | | 12/01/17 | | | | 844,552.92 | | | | 1,654,084 | |

Partners Group Satellite HoldCo S.à.r.l. +, a, b, e | Common equity | | | 03/22/23 | | | | 13,000 | | | | 4,792,184 | |

Partners Group Satellite HoldCo S.à.r.l. +, a, b, e | Preferred equity | | | 03/22/23 | | | | 132,968 | | | | 49,016,666 | |

Partners Group Satellite Warehouse S.C.S. +, a, b | Member interest | | | 03/22/23 | | | | — | | | | 1,461,859 | |

PG Investment Company 1 S.à.r.l. +, a, b, c | Member interest | | | 10/28/21 | | | | — | | | | 91,515,608 | |

PG Investment Company 1 S.à.r.l. +, a, b, e | Common equity | | | 10/28/21 | | | | 12,822,040 | | | | 8,467,374 | |

PG Investment Company 18 S.à.r.l. +, a, b, e | Preferred equity | | | 07/07/22 | | | | 113,856,528 | | | | 127,351,248 | |

PG Investment Company 18 S.à.r.l. +, a, b, e | Common equity | | | 07/07/22 | | | | 12,650,106 | | | | 1 | |

PG Investment Company 24 S.à.r.l. +, a, b, e | Common equity | | | 07/13/22 | | | | 928,445 | | | | 3,101,707 | |

PG Investment Company 24 S.à.r.l. +, a, b, e | Preferred equity | | | 07/13/22 | | | | 101,367,616 | | | | 118,000,625 | |

PG Lion Management Warehouse S.C.S +, a, b, c | Limited partnership interest | | | 08/22/19 | | | | — | | | | 700,087 | |

PG TLP S.à.r.l. +, a, b, c, e | Member interest | | | 04/14/21 | | | | — | | | | 20,033,882 | |

PG TLP S.à.r.l. +, a, b, e | Common equity | | | 04/14/21 | | | | 6,377,426 | | | | 81,390,710 | |

PG Wave Limited +, a, b, e | Common equity | | | 02/03/22 | | | | 53,215,581 | | | | 73,041,328 | |

Pharmathen GP S.à.r.l. +, a, b | Common equity | | | 01/20/22 | | | | 110,300 | | | | 1 | |

Pharmathen Topco S.à.r.l. +, a, b | Preferred equity | | | 01/20/22 | | | | 98,858,068 | | | | 107,607,990 | |

Pharmathen Topco S.à.r.l. +, a, b | Common equity | | | 01/20/22 | | | | 79,910 | | | | 1 | |

Polyusus Lux XVI S.à.r.l. +, a, b, e | Common equity | | | 05/23/18 | | | | 44,442,345 | | | | — | |

Polyusus Lux XVI S.à.r.l. +, a, b, e | Preferred equity | | | 05/23/18 | | | | 244,659,996 | | | | 3,449,964 | |

Polyusus Lux XVI S.à.r.l. +, a, b, c, e | Member interest | | | 10/01/22 | | | | — | | | | 1,237,462 | |

Polyusus Lux XXIII S.à.r.l. +, a, e | Preferred equity | | | 04/11/22 | | | | 1,155,552 | | | | 70,156 | |

Polyusus Lux XXIII S.à.r.l. +, a, e | Common equity | | | 08/19/21 | | | | 4,383,568 | | | | 3 | |

Polyusus Lux XXIII S.à.r.l. +, a, e | Preferred equity | | | 08/19/21 | | | | 13,114,964 | | | | 453,895 | |

Refresco 2 Co-Invest SCSp +, a, c | Limited partnership interest | | | 07/12/22 | | | | — | | | | 36,425,367 | |

Root JVCo S.à.r.l. +, a, b, c | Member interest | | | 09/29/20 | | | | — | | | | 38,619,797 | |

Root JVCo S.à.r.l. +, a, b, e | Common equity | | | 02/07/23 | | | | 1,969,352 | | | | 19,116,700 | |

Root JVCo S.à.r.l. +, a, b, e | Preferred equity | | | 02/07/23 | | | | 6,731,408 | | | | 48,670,545 | |

S.TOUS, S.L +, a | Common equity | | | 10/06/15 | | | | 622 | | | | 19,565,808 | |

Stark Perseus Investment +, a, e | Common equity | | | 02/26/21 | | | | 963,052 | | | | 586,894 | |

Stark Perseus Topco +, a, c, e | Member interest | | | 02/26/21 | | | | — | | | | 3,113,237 | |

Stark Perseus Topco +, a, e | Common equity | | | 02/26/21 | | | | 26,921,454 | | | | 69,766,204 | |

Surfaces SLP (SCSp) +, a, b, c | Limited partnership interest | | | 10/01/20 | | | | — | | | | 36,858,430 | |

Veonet Co-Invest SCSp (Lux) +, a, c, e | Limited partnership interest | | | 03/09/22 | | | | — | | | | 39,327,814 | |

Total Western Europe (23.60%) | | | | | | | | | | | | 3,163,934,015 | |

| | | | | | | | | | | | | | |

Total Direct Equity (58.97%) | | | | | | | | | | | $ | 7,907,084,995 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

11

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Private Equity Investments (continued)

Direct Investments * (continued) Direct Debt (7.87%) | Interest | | Acquisition

Date | | | Maturity

Date | | Investment

Type | | Principal | | | Fair

Value** | |

Asia - Pacific (0.46%) |

BYJU’s Alpha, Inc. +, a | Cash 8.00% + L (0.75% Floor)^^ | | | 01/19/22 | | | | 11/24/26 | | Senior | | $ | 2,370,023 | | | $ | 1,947,862 | |

FFML Holdco Limited +, a | Cash 6.25% + BBSY (0.75% Floor)†† | | | 11/30/22 | | | | 11/30/28 | | Senior | | | 12,373,591 | | | | 12,182,174 | |

Fugue Finance B.V. +, a | Cash 3.25% + E## | | | 08/24/20 | | | | 08/30/24 | | Senior | | | 1,299,487 | | | | 1,188,480 | |

Fugue Finance B.V. +, a | Cash 4.50% + SF (0.50% Floor)vv | | | 03/10/23 | | | | 01/31/28 | | Senior | | | 1,500,000 | | | | 1,500,315 | |

Genesis Care Finance Pty Ltd. +, a | Cash 5.00% + L (1.00% Floor)^^ | | | 07/28/20 | | | | 05/14/27 | | Senior | | | 2,134,000 | | | | 581,515 | |

Global Academic Group Limited +, a | Cash 6.00% + BBSY (0.50% Floor)†† | | | 07/26/22 | | | | 07/26/27 | | Senior | | | 12,728,400 | | | | 12,679,706 | |

Global Academic Group Limited +, a | Cash 6.00% + BBSY (0.50% Floor)†† | | | 07/29/22 | | | | 07/29/27 | | Senior | | | 4,651,970 | | | | 4,446,583 | |

Greencross Limited +, a | Cash 5.75% + L (0.75% Floor)^^ | | | 03/22/22 | | | | 03/23/28 | | Senior | | | 10,313,325 | | | | 10,096,429 | |

ICON Cancer Care +, a | Cash 7.25% + BBSY (0.50% Floor)† | | | 04/12/22 | | | | 03/29/30 | | Second Lien | | | 10,284,819 | | | | 8,860,163 | |

Snacking Investments BidCo Pty Limited +, a | Cash 4.00% + SF (1.00% Floor)v | | | 01/15/20 | | | | 12/18/26 | | Senior | | | 1,261,000 | | | | 1,254,165 | |

Stiphout Finance, LLC +, a | Cash 3.00% + L (1.00% Floor)^ | | | 10/30/15 | | | | 10/30/25 | | Senior | | | 4,669,916 | | | | 4,695,879 | |

Voyage Australia Pty Ltd +, a | Cash 3.50% + L (0.50% Floor)^^ | | | 07/23/21 | | | | 06/18/28 | | Senior | | | 1,674,250 | | | | 1,655,415 | |

Total Asia - Pacific (0.46%) | | | | | | | | | | | | | | | | | 61,088,686 | |

| | | | | | | | | | | | | | | | | | | |

North America (4.98%) |

Acrisure LLC +, a | Cash 3.75% + L (0.50% Floor)^ | | | 08/18/21 | | | | 02/13/27 | | Senior | | | 2,167,000 | | | | 2,104,699 | |

Acrisure LLC +, a | Cash 3.50% + L^ | | | 03/27/20 | | | | 02/15/27 | | Senior | | | 1,848,864 | | | | 1,789,358 | |

Acrisure LLC +, a | Cash 4.25% + L (0.50% Floor)^ | | | 12/08/21 | | | | 02/15/27 | | Senior | | | 987,500 | | | | 969,602 | |

ADMI Corp. +, a | Cash 3.75% + L (0.50% Floor)^ | | | 07/14/21 | | | | 12/23/27 | | Senior | | | 1,379,000 | | | | 1,281,608 | |

Air Medical Group Holdings, Inc. +, a | Cash 4.75% + L (1.00% Floor)^ | | | 02/25/21 | | | | 10/02/25 | | Senior | | | 977,500 | | | | 701,356 | |

AIT Buyer, LLC +, a | Cash 7.50% + L (0.75% Floor)^^ | | | 04/06/21 | | | | 03/30/29 | | Second Lien | | | 6,860,000 | | | | 6,699,052 | |

Alliant Holdings Intermediate, LLC +, a | Cash 3.50% + L (0.50% Floor)^ | | | 12/08/21 | | | | 11/05/27 | | Senior | | | 1,576,000 | | | | 1,561,800 | |

Amneal Pharmaceuticals, Inc. +, a, f | Cash 3.50% + L^^ | | | 05/18/22 | | | | 05/04/25 | | Senior | | | 8,454,175 | | | | 8,056,986 | |

Apex Group Treasury Limited +, a | Cash 3.75% + L (0.50% Floor)^^ | | | 08/27/21 | | | | 07/27/28 | | Senior | | | 2,076,735 | | | | 2,033,466 | |

Apex Tool Group +, a | Cash 5.25% + SF (0.50% Floor)v | | | 02/22/22 | | | | 02/08/29 | | Senior | | | 992,500 | | | | 876,427 | |

Applovin Corporation +, a | Cash 3.35% + L^^ | | | 03/24/21 | | | | 08/15/25 | | Senior | | | 977,041 | | | | 976,122 | |

Applovin Corporation +, a | Cash 3.10% + L (0.50% Floor)^^ | | | 12/08/21 | | | | 10/25/28 | | Senior | | | 1,386,000 | | | | 1,380,948 | |

AQA Acquisition Holding, Inc. +, a | Cash 4.25% + L (0.50% Floor)^^ | | | 03/18/21 | | | | 03/03/28 | | Senior | | | 1,080,750 | | | | 1,056,439 | |

AqGen Island Holdings, Inc. +, a | Cash 6.50% + L (0.50% Floor)^^ | | | 08/19/21 | | | | 08/02/29 | | Second Lien | | | 7,049,750 | | | | 6,380,024 | |

athenahealth Group, Inc. +, a, e | Cash 3.50% + SF (0.50% Floor)vv | | | 02/23/22 | | | | 02/15/29 | | Senior | | | 2,919,841 | | | | 5,898,481 | |

athenahealth Group, Inc. +, a, e | Cash 3.50% + SF (0.50% Floor)vv | | | 01/27/22 | | | | 02/15/29 | | Senior | | | 119,565 | | | | 111,495 | |

Banff Guarantor, Inc. +, a | Cash 5.50% + L (0.50% Floor)^ | | | 01/31/22 | | | | 02/27/26 | | Second Lien | | | 1,700,000 | | | | 1,647,410 | |

Banff Merger Sub Inc. +, a | Cash 3.75% + L^ | | | 01/31/22 | | | | 10/02/25 | | Senior | | | 2,800,206 | | | | 2,766,085 | |

Barracuda Networks, Inc. +, a | Cash 7.00% + SF (0.50% Floor)vv | | | 05/17/22 | | | | 08/15/30 | | Second Lien | | | 4,000,000 | | | | 3,586,680 | |

Bausch & Lomb Inc. +, a | Cash 3.25% + SF (0.50% Floor)vv | | | 05/18/22 | | | | 05/10/27 | | Senior | | | 3,283,500 | | | | 3,194,107 | |

Bella Holding Company, LLC +, a | Cash 3.75% + L (0.75% Floor)^ | | | 05/13/21 | | | | 04/01/28 | | Senior | | | 3,546,000 | | | | 3,427,900 | |

BI Gen Holdings, Inc. +, a | Cash 4.25% + L^^ | | | 10/04/18 | | | | 09/05/25 | | Senior | | | 1,432,750 | | | | 1,415,199 | |

BI Gen Holdings, Inc. +, a | Cash 8.13% + L (1.00% Floor)^^ | | | 12/21/20 | | | | 08/31/26 | | Second Lien | | | 1,950,000 | | | | 1,950,000 | |

BlueConic Holding, Inc. +, a | Cash 5.50% + L (0.75% Floor)^^ | | | 01/27/22 | | | | 01/27/28 | | Senior | | | 18,912,000 | | | | 18,272,789 | |

Brookfield WEC Holdings, Inc. +, a | Cash 2.75% + L (0.50% Floor)^ | | | 09/12/18 | | | | 08/01/25 | | Senior | | | 972,392 | | | | 969,232 | |

Brown Group Holding, LLC +, a | Cash 3.75% + SF (0.50% Floor)vv | | | 06/09/22 | | | | 07/02/29 | | Senior | | | 995,000 | | | | 995,831 | |

Burger Bossco Intermediate, Inc. +, a | Cash 4.25% + L (1.00% Floor)^ | | | 01/01/21 | | | | 04/25/24 | | Senior | | | 151,200 | | | | 119,259 | |

Burger Bossco Intermediate, Inc. +, a | PIK 10.00% + L (1.00% Floor)^^ | | | 12/31/20 | | | | 04/25/25 | | Second Lien | | | 354,993 | | | | 1 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

12

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Private Equity Investments (continued)

Direct Investments * (continued) Direct Debt (continued) | Interest | | Acquisition

Date | | | Maturity

Date | | Investment

Type | | Principal | | | Fair

Value** | |

North America (continued) |

Campaign Monitor (UK) Limited +, a | Cash 8.90% + L (1.00% Floor)^^ | | | 01/01/21 | | | | 11/06/25 | | Second Lien | | $ | 1,650,000 | | | $ | 1,634,802 | |

CapitalSpring Finance Company, LLC +, a, b | Cash 8.00% | | | 03/01/17 | | | | 02/10/25 | | Mezzanine | | | 4,863,488 | | | | 4,396,666 | |

CapitalSpring Finance Company, LLC +, a, b | PIK 5.00% | | | 03/01/17 | | | | 02/10/25 | | Mezzanine | | | 3,444,547 | | | | 2,681,828 | |

Carestream Dental Equipment, Inc. +, a | Cash 4.50% + L (0.50% Floor)^^ | | | 11/26/21 | | | | 09/01/24 | | Senior | | | 1,376,009 | | | | 1,278,312 | |

Carestream Dental Equipment, Inc. +, a | Cash 8.00% + L (1.00% Floor)^^ | | | 11/26/21 | | | | 09/01/25 | | Second Lien | | | 3,000,000 | | | | 2,820,000 | |

Central Parent, Inc. +, a | Cash 4.50% + SF (0.50% Floor)vv | | | 07/12/22 | | | | 07/06/29 | | Senior | | | 997,500 | | | | 995,680 | |

Charlotte Buyer Inc +, a | Cash 5.25% + SF (0.50% Floor)vv | | | 08/16/22 | | | | 02/11/28 | | Senior | | | 997,500 | | | | 955,735 | |

Charter NEX US, Inc. +, a | Cash 3.75% + L (0.75% Floor)^^ | | | 05/31/19 | | | | 12/01/27 | | Senior | | | 1,434,535 | | | | 1,417,163 | |

Cheniere Energy Partners +, a | Cash 3.75% + L (0.50% Floor)^^ | | | 06/09/21 | | | | 06/04/28 | | Senior | | | 3,250,500 | | | | 3,231,208 | |

Clydesdale Acquisition Holdings, Inc. +, a | Cash 4.175% + SF (0.50% Floor)vv | | | 04/19/22 | | | | 04/13/29 | | Senior | | | 1,290,250 | | | | 1,263,039 | |

ConnectWise, LLC +, a | Cash 3.50% + L (0.75% Floor)^^ | | | 10/06/21 | | | | 09/29/28 | | Senior | | | 1,678,750 | | | | 1,626,289 | |

Conservice Midco, LLC, +, a | Cash 4.25% + L^ | | | 05/18/20 | | | | 05/13/27 | | Senior | | | 1,657,500 | | | | 1,632,986 | |

Conterra Ultra Broadband Holdings, Inc. +, a | Cash 4.70% + L (1.00% Floor)^ | | | 06/06/19 | | | | 04/30/26 | | Senior | | | 1,636,348 | | | | 1,532,538 | |

ConvergeOne Holdings, Inc. +, a | Cash 5.00% + L^ | | | 03/27/19 | | | | 01/04/26 | | Senior | | | 2,887,500 | | | | 1,762,819 | |

ConvergeOne Holdings, Inc. +, a | Cash 8.50% + L^ | | | 04/15/19 | | | | 01/04/27 | | Second Lien | | | 31,200,000 | | | | 11,856,000 | |

Convergint Tech LLC +, a | Cash 6.75% + L (0.75% Floor)^ | | | 04/12/21 | | | | 03/30/29 | | Second Lien | | | 1,400,000 | | | | 1,238,713 | |

Cornerstone OnDemand, Inc. +, a | Cash 3.75% + L (0.50% Floor)^ | | | 10/22/21 | | | | 10/16/28 | | Senior | | | 1,188,000 | | | | 1,100,385 | |

Critical Start +, a | Cash 5.25% + SF (0.75% Floor)vv | | | 05/18/22 | | | | 05/18/28 | | Senior | | | 8,201,971 | | | | 8,165,992 | |

Critical Start, Inc. +, a, e | Cash 6.00% + SF (0.75% Floor)vv | | | 05/18/22 | | | | 05/18/28 | | Senior | | | — | | | | (30,861 | ) |

Critical Start, Inc. +, a | Cash 6.25% + SF (0.75% Floor)vv | | | 03/27/23 | | | | 05/17/28 | | Senior | | | 4,495,833 | | | | 4,362,769 | |

Crown Subsea Communications Holding, Inc. +, a | Cash 4.75% + L (0.75% Floor)^^ | | | 05/05/21 | | | | 04/27/27 | | Senior | | | 4,487,671 | | | | 4,435,794 | |

CSC Holdings, LLC +, a | Cash 2.50% + L^ | | | 08/11/21 | | | | 04/15/27 | | Senior | | | 3,446,701 | | | | 3,055,724 | |

CSC Holdings, LLC +, a | Cash 2.25% + L^ | | | 12/07/18 | | | | 01/15/26 | | Senior | | | 2,892,342 | | | | 2,747,725 | |

DCert Buyer, Inc. +, a | Cash 4.00% + L^ | | | 10/24/19 | | | | 10/16/26 | | Senior | | | 1,943,665 | | | | 1,907,532 | |

Deerfield Dakota Holding, LLC +, a | Cash 3.75% + SF (1.00% Floor)vv | | | 06/01/20 | | | | 04/09/27 | | Senior | | | 972,500 | | | | 937,004 | |

Delta Topco, Inc. +, a | Cash 3.75% + L (0.75% Floor)^^ | | | 01/06/21 | | | | 12/01/27 | | Senior | | | 2,063,250 | | | | 1,917,956 | |

Dentive Capital, LLC +, a, e | Cash 7.00% + SF (0.75% Floor)vv | | | 12/23/22 | | | | 12/22/28 | | Senior | | | — | | | | (43,916 | ) |

Dentive Capital, LLC +, a | Cash 6.75% + SF (0.75% Floor)vv | | | 12/23/22 | | | | 12/22/28 | | Senior | | | 10,125,421 | | | | 9,822,539 | |

DexKo Global Inc. +, a | Cash 3.75% + L (0.50% Floor)^^ | | | 10/07/21 | | | | 09/22/28 | | Senior | | | 254,301 | | | | 236,945 | |

Dexko Global, Inc. +, a | Cash 3.75% + L (0.50% Floor)^^ | | | 10/07/21 | | | | 10/04/28 | | Senior | | | 1,329,699 | | | | 1,238,947 | |

DG Investment Intermediate Holdings 2, Inc. +, a | Cash 4.75% + SF (0.75% Floor)vv | | | 11/15/22 | | | | 03/31/28 | | Senior | | | 995,000 | | | | 976,344 | |

DG Investment Intermediate Holdings 2, Inc. +, a | Cash 3.50% + L (0.75% Floor)^ | | | 04/23/21 | | | | 03/31/28 | | Senior | | | 1,277,292 | | | | 1,243,323 | |

Diamond Parent Midco Inc. +, a | Cash 6.25% + L (1.00% Floor)^^ | | | 09/01/22 | | | | 08/04/25 | | Senior | | | 29,214,733 | | | | 28,776,512 | |

Dwyer Instruments, LLC +, a, e | Cash 6.00% + L (0.75% Floor)^^ | | | 07/01/22 | | | | 07/21/27 | | Senior | | | 9,887,328 | | | | 297,855 | |

EAB Global, Inc. +, a | Cash 4.00% + SF (0.75% Floor)v | | | 08/25/21 | | | | 11/19/26 | | Senior | | | 4,125,758 | | | | 2,124,520 | |

ECI Macola/Max Holding, LLC +, a | Cash 3.75% + L (0.75% Floor)^^ | | | 09/13/21 | | | | 11/09/27 | | Senior | | | 1,670,100 | | | | 1,635,446 | |

Element Materials Technology Group US Holdings Inc.(EM Midco 2 US LLC) +, a | Cash 4.25% + SF (0.50% Floor)vv | | | 08/17/22 | | | | 06/22/29 | | Senior | | | 997,501 | | | | 987,840 | |

Endurance International Group Holdings, Inc. +, a | Cash 3.50% + L (0.75% Floor)^^ | | | 04/28/21 | | | | 02/10/28 | | Senior | | | 3,831,750 | | | | 3,582,686 | |

Engineered Machinery Holdings, Inc. +, a | Cash 3.50% + L (0.75% Floor)^^ | | | 08/16/21 | | | | 05/21/28 | | Senior | | | 1,580,000 | | | | 1,560,906 | |

Envision Healthcare Corp. +, a | Cash 4.50% + SF (1.00% Floor)vv + PIK 7.00% | | | 04/29/22 | | | | 04/29/28 | | Second Lien | | | 39,264,768 | | | | 29,669,920 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

13

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Private Equity Investments (continued)

Direct Investments * (continued) Direct Debt (continued) | Interest | | Acquisition

Date | | | Maturity

Date | | Investment

Type | | Principal | | | Fair

Value** | |

North America (continued) |

Envision Healthcare Holdings, Inc. +, a | Cash 4.50% + SF (1.00% Floor)v | | | 04/29/22 | | | | 04/28/28 | | Second Lien | | $ | 3,678,337 | | | $ | 2,779,488 | |

Epiq Systems +, a | Cash 4.75% + SF (0.75% Floor)v | | | 06/02/22 | | | | 04/26/29 | | Senior | | | 3,980,000 | | | | 3,706,872 | |

Evergreen Services Group, LLC +, a | Cash 6.15% + SF (0.75% Floor)vv | | | 06/15/22 | | | | 06/14/29 | | Senior | | | 9,850,053 | | | | 9,751,427 | |

Evergreen Services Group, LLC +, a, e | Cash 6.15% + SF (0.75% Floor)vv | | | 01/30/23 | | | | 06/15/29 | | Senior | | | 183,588 | | | | 181,750 | |

Explorer Holdings, Inc. +, a, e | Cash 8.00% + L (0.50% Floor)^ | | | 02/04/20 | | | | 02/04/28 | | Second Lien | | | 19,491,899 | | | | 18,322,384 | |

Filtration Group Corporation +, a | Cash 3.50% + L (0.50% Floor)^ | | | 11/01/21 | | | | 10/21/28 | | Senior | | | 2,068,500 | | | | 2,038,445 | |

First Student Bidco Inc. +, a | Cash 3.00% + L (0.50% Floor)^^ | | | 08/11/21 | | | | 08/21/28 | | Senior | | | 1,089,937 | | | | 1,046,535 | |

First Student Bidco, Inc. +, a | Cash 4.00% + SF (0.50% Floor)vv | | | 08/05/22 | | | | 07/21/28 | | Senior | | | 997,662 | | | | 977,709 | |

Flynn Restaurant Group LP +, a | Cash 4.25% + L (0.50% Floor)^ | | | 12/10/21 | | | | 11/22/28 | | Senior | | | 2,277,000 | | | | 2,217,798 | |

Galls, LLC +, a | Cash 6.25% + L (1.00% Floor)^^ | | | 12/22/20 | | | | 01/31/25 | | Senior | | | 514,791 | | | | 489,485 | |

GHX Ultimate Parent Corporation +, a | Cash 3.25% + L (1.00% Floor)^^ | | | 01/01/21 | | | | 06/22/24 | | Senior | | | 1,910,879 | | | | 1,900,732 | |

Great American Outdoors Group, LLC +, a | Cash 3.75% + L (0.75% Floor)^^ | | | 05/14/21 | | | | 03/06/28 | | Senior | | | 1,759,703 | | | | 1,739,915 | |

Heartland Dental Holdings, Inc. +, a, e | Cash 3.75% | | | 05/15/18 | | | | 04/30/25 | | Senior | | | 2,187,667 | | | | 2,110,875 | |

Heartland Dental Holdings, Inc. +, a | Cash 3.50% + L^ | | | 05/15/18 | | | | 04/30/25 | | Senior | | | 605,972 | | | | 567,774 | |

Heartland Dental, LLC +, a | Cash 4.00% + L^ | | | 06/21/21 | | | | 04/30/25 | | Senior | | | 982,500 | | | | 926,414 | |

Heartland Home Services, Inc. +, a | Cash 6.75% + SF (1.00% Floor)v | | | 11/08/22 | | | | 12/15/26 | | Senior | | | 12,000,000 | | | | 11,869,698 | |

Help/Systems Holdings Inc. +, a | Cash 6.75% + L (0.75% Floor)^^ | | | 11/05/21 | | | | 11/19/27 | | Second Lien | | | 3,600,000 | | | | 2,961,000 | |

Help/Systems Holdings Inc. +, a | Cash 4.00% + L (0.75% Floor)^^ | | | 06/25/21 | | | | 11/19/26 | | Senior | | | 4,125,758 | | | | 3,691,522 | |

Hornblower Sub, LLC +, a | Cash 4.50% + L^^ | | | 05/01/19 | | | | 04/27/25 | | Senior | | | 936,299 | | | | 565,525 | |

Husky Injection Molding Systems Ltd. +, a, f | Cash 3.00% + L (1.00% Floor)^^ | | | 05/22/19 | | | | 03/28/25 | | Senior | | | 4,949,095 | | | | 4,703,953 | |

Hyland Software Inc. +, a | Cash 3.50% + L (0.75% Floor)^^ | | | 10/27/20 | | | | 07/01/24 | | Senior | | | 2,953,764 | | | | 2,923,902 | |

Idera, Inc. +, a, b | Cash 3.75% + L (0.75% Floor)^ | | | 12/17/18 | | | | 06/27/24 | | Senior | | | 1,244,979 | | | | 1,191,675 | |

Imperial Dade +, a | Cash 4.63% + SF (0.50% Floor)vv | | | 06/24/22 | | | | 06/11/26 | | Senior | | | 990,000 | | | | 981,337 | |

Indy US Bidco, LLC +, a | Cash 3.75% + L (0.75% Floor)^^ | | | 03/29/21 | | | | 03/06/28 | | Senior | | | 980,075 | | | | 831,844 | |

INNIO Group Holdings GmbH +, a | Cash 3.25% + E### | | | 11/30/18 | | | | 10/31/25 | | Senior | | | 1,415,436 | | | | 1,308,210 | |

Integrity Marketing Acquisition, LLC +, a, e | Cash 5.75% + SF (0.75% Floor)vv | | | 06/21/22 | | | | 08/27/25 | | Senior | | | 16,464,723 | | | | 16,102,735 | |

Iris Holdings Inc. +, a | Cash 4.75% + SF (0.50% Floor)vv | | | 06/15/22 | | | | 06/28/28 | | Senior | | | 1,839,753 | | | | 1,588,516 | |

KCIBT Intermediate II, Inc. +, a | Cash 1.00% + L (1.00% Floor)^^ + PIK 4.25% + L (1.00% Floor)^^ | | | 12/23/20 | | | | 06/01/25 | | Senior | | | 245,356 | | | | 177,883 | |

KENE Acquisition, Inc. +, a | Cash 8.25% + L^^ | | | 12/15/21 | | | | 08/08/27 | | Second Lien | | | 175,500 | | | | 167,822 | |

KENE Acquisition, Inc. +, a | Cash 8.25% + L (1.00% Floor)^^ | | | 01/01/21 | | | | 08/09/27 | | Second Lien | | | 1,462,500 | | | | 1,398,519 | |

KENE Acquisition, Inc. +, a | Cash 8.25% + L^^ | | | 08/05/22 | | | | 08/09/27 | | Second Lien | | | 984,997 | | | | 941,905 | |

Kingpin Intermediate Holdings LLC +, a | Cash 3.50% + L (1.00% Floor)^ | | | 10/05/18 | | | | 07/03/24 | | Senior | | | 1,313,639 | | | | 1,312,615 | |

Knowlton Development Corporation Inc. +, a | Cash 3.75% + L^^ | | | 06/24/22 | | | | 12/22/25 | | Senior | | | 1,488,372 | | | | 1,444,956 | |

KSLB Holdings, LLC +, a | Cash 8.75% + L (1.00% Floor)^ | | | 01/01/21 | | | | 07/30/26 | | Second Lien | | | 3,212,308 | | | | 2,742,714 | |

LBM Acquisition, LLC +, a | Cash 3.25% + L (0.75% Floor)^ | | | 09/07/21 | | | | 12/17/27 | | Senior | | | 3,244,904 | | | | 3,066,434 | |

LogMeIn, Inc. +, a | Cash 4.75% + L^ | | | 09/03/20 | | | | 08/31/27 | | Senior | | | 4,900,000 | | | | 2,813,409 | |

LSCS Holdings, Inc. +, a | Cash 4.50% + L (0.50% Floor)^^ | | | 02/14/22 | | | | 12/16/28 | | Senior | | | 2,567,500 | | | | 2,475,494 | |

LTI Holdings, Inc. +, a | Cash 3.50% + L^ | | | 10/22/18 | | | | 09/06/25 | | Senior | | | 955,000 | | | | 923,767 | |

Magenta Buyer LLC +, a | Cash 8.25% + L (0.75% Floor)^^ | | | 10/13/21 | | | | 07/27/29 | | Second Lien | | | 2,000,000 | | | | 1,506,670 | |

Magenta Buyer LLC +, a | Cash 5.00% + L (0.75% Floor)^^ | | | 08/02/21 | | | | 07/27/28 | | Senior | | | 3,456,250 | | | | 2,861,896 | |

Marnix SAS +, a | Cash 3.75% + L (0.50% Floor)^^ | | | 12/17/21 | | | | 08/04/28 | | Senior | | | 1,473,750 | | | | 1,468,231 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

14

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

March 31, 2023 (continued)

Private Equity Investments (continued)

Direct Investments * (continued) Direct Debt (continued) | Interest | | Acquisition

Date | | | Maturity

Date | | Investment

Type | | Principal | | | Fair

Value** | |

North America (continued) |

Maverick Bidco, Inc. +, a | Cash 6.75% + L (0.75% Floor)^^ | | | 05/26/21 | | | | 05/18/29 | | Second Lien | | $ | 6,603,000 | | | $ | 6,008,730 | |

McAfee Inc. +, a | Cash 4.00% + S>> | | | 03/09/22 | | | | 03/01/29 | | Senior | | | 2,580,500 | | | | 2,437,773 | |

Medline Borrower, L.P. +, a | Cash 3.25% + L (0.50% Floor)^^ | | | 11/03/21 | | | | 10/23/28 | | Senior | | | 1,089,000 | | | | 1,063,136 | |

Mercury Borrower, Inc. +, a | Cash 6.50% + L (0.50% Floor)^^ | | | 04/11/22 | | | | 08/02/29 | | Second Lien | | | 900,000 | | | | 814,500 | |

Michaels Stores, Inc. +, a | Cash 4.25% + L (0.75% Floor)^^ | | | 04/26/21 | | | | 04/15/28 | | Senior | | | 2,161,500 | | | | 1,986,689 | |

Mitchell International, Inc. +, a | Cash 3.75% + L (0.50% Floor)^ | | | 10/21/21 | | | | 10/15/28 | | Senior | | | 3,762,000 | | | | 3,563,329 | |

Mitchell International, Inc. +, a | Cash 6.50% + L (0.50% Floor)^^ | | | 10/26/21 | | | | 10/15/29 | | Second Lien | | | 1,000,000 | | | | 854,380 | |

MJH Healthcare Holdings, LLC +, a | Cash 3.50% + SF (0.50% Floor)v | | | 04/08/22 | | | | 01/28/29 | | Senior | | | 1,683,000 | | | | 1,647,236 | |

National Spine & Pain Centers, LLC +, a | Cash 5.00% + L (1.00% Floor)^ | | | 01/01/21 | | | | 06/02/24 | | Senior | | | 525,863 | | | | 222,039 | |

National Spine & Pain Centers, LLC +, a | Cash 7.00% + SF (1.00% Floor)v | | | 11/14/22 | | | | 02/13/26 | | Senior | | | 30,919 | | | | 30,919 | |

Navicure, Inc. +, a | Cash 4.00% + L^^ | | | 11/19/19 | | | | 10/22/26 | | Senior | | | 2,922,254 | | | | 2,917,242 | |

NEP Group, Inc. +, a | Cash 3.25% + L^^ | | | 02/10/22 | | | | 10/20/25 | | Senior | | | 1,959,079 | | | | 1,823,168 | |

NEP Group, Inc. +, a | Cash 4.00% + L (0.50% Floor)^^ | | | 12/06/21 | | | | 10/20/25 | | Senior | | | 1,876,250 | | | | 1,755,851 | |

Netsmart, Inc. +, a | Cash 4.00% + L (1.00% Floor)^ | | | 07/16/18 | | | | 10/01/27 | | Senior | | | 2,211,017 | | | | 2,185,037 | |

NortonLifeLock Inc. +, a | Cash 2.00% + SF (0.50% Floor)vv | | | 09/20/22 | | | | 09/12/29 | | Senior | | | 2,231,398 | | | | 2,209,274 | |

NSM Top Holdings Corp. +, a | Cash 5.25% + L^ | | | 11/26/19 | | | | 11/16/26 | | Senior | | | 1,451,250 | | | | 1,357,645 | |

NSPC Intermediate II, LLC +, a | Cash 8.00% + SF (1.00% Floor)vv | | | 12/27/22 | | | | 02/28/23 | | Senior | | | 10,306 | | | | 10,306 | |

NSPC Intermediate II, LLC +, a | Cash 8.50% + SF (1.00% Floor)vv | | | 02/13/23 | | | | 02/16/26 | | Senior | | | 30,919 | | | | 30,919 | |

nThrive Health Inc. +, a | Cash 4.00% + L (0.50% Floor)^^ | | | 05/24/22 | | | | 12/18/28 | | Senior | | | 1,980,000 | | | | 1,848,825 | |

Oceankey (U.S.) II Corp. +, a | Cash 3.50% + L (0.50% Floor)^ | | | 01/06/22 | | | | 12/15/28 | | Senior | | | 1,881,000 | | | | 1,778,137 | |

OEConnection LLC +, a | Cash 4.00% + L^^ | | | 10/28/19 | | | | 09/25/26 | | Senior | | | 2,921,607 | | | | 2,878,703 | |