F e b r u a r y 2 8 , 2 0 2 2 Tra n s fo r m i n g D i s e a s e M a n a ge m e nt

D i s c l a i m e rs F O R W A R D - L O O K I N G S T A T E M E N T S This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning the effects of the COVID-19 pandemic on our business and our efforts to address its impact on our business; any estimated sizes of the total addressable markets of our current or future commercial and pipeline products within our dermatologic and GI franchises; our revenue outlook for the 2022 fiscal year, including any additional financial or operational metrics or related expectations with respect to future performance; the impact, accuracy and effectiveness of our commercial and pipeline tests on physicians, patients and their treatment plans, and their individual or collective impact on our prospects and plans, including any objectives of management related thereto; the ability of our tests to provide valuable, clinically actionable information to clinicians and patients, improve health and guide patient care; expected launch dates for tests in our pipeline expansion and estimates regarding their total addressable markets or future success; expectations regarding LCD effective dates and reimbursement capabilities; our ability to utilize existing relationships and build a suite of complementary tests in a single call point; increases in headcount in furtherance of our pipeline tests, clinical research and development and other expected drivers of growth, as well as efficiencies and synergies from capital expenditures related to expansion of lab facilities contributing to our growth; our ability to develop clinical evidence and publish peer-reviewed reports and studies that increase adoption among providers and commercial payors; estimated healthcare cost savings provided by our tests; the ability of our risk stratification tests to classify risk of metastasis in ways that better support risk-appropriate treatment than reliance on traditional clinicopathologic risk factors alone; program milestones for our pipeline test designed to predict systemic therapy response and the potential of systemic therapy guidance tools to streamline therapeutic interventions for patients and avoid ineffective, expensive medication courses; our sales team’s ability to achieve optimal productivity; and our ability to integrate our recent acquisitions into our existing business and the ability of such acquisitions to complement our existing business. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation, the effects of the COVID-19 pandemic on our business and our efforts to address its impact on our business, subsequent study results and findings may contradict earlier study results and findings, including with respect to the diagnostic and prognostic tests discussed in this press release, actual application of our tests may not provide the aforementioned benefits to patients, and the risks set forth under the heading “Risk Factors” in our in our Annual Report on Form 10-K for the twelve months ended December 31, 2021, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law. 2

3 MISSION: VISION: VALUES: Improving health through innovative tests that guide patient care To transform disease management by keeping people first: patients, clinicians, employees and investors Trust, Excellence, Collaboration, Integrity, Innovation and Excitement

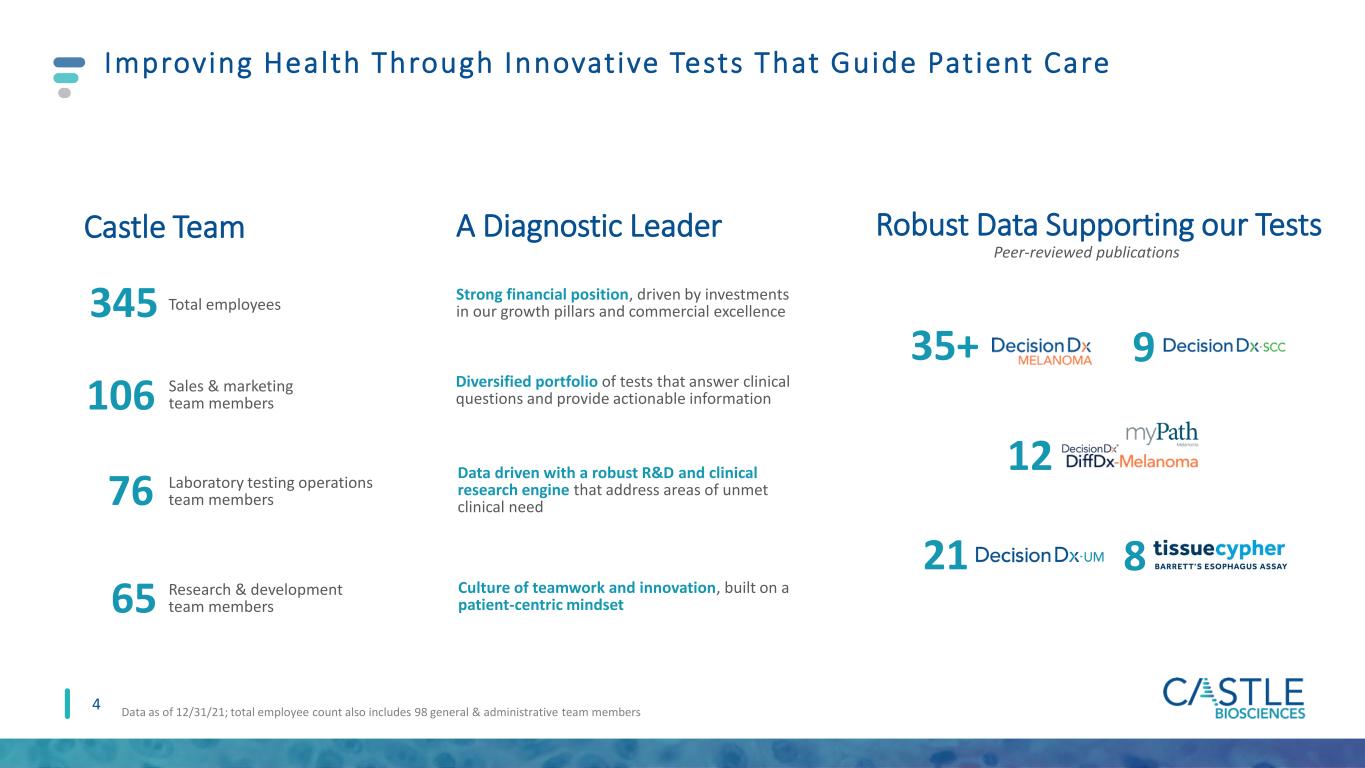

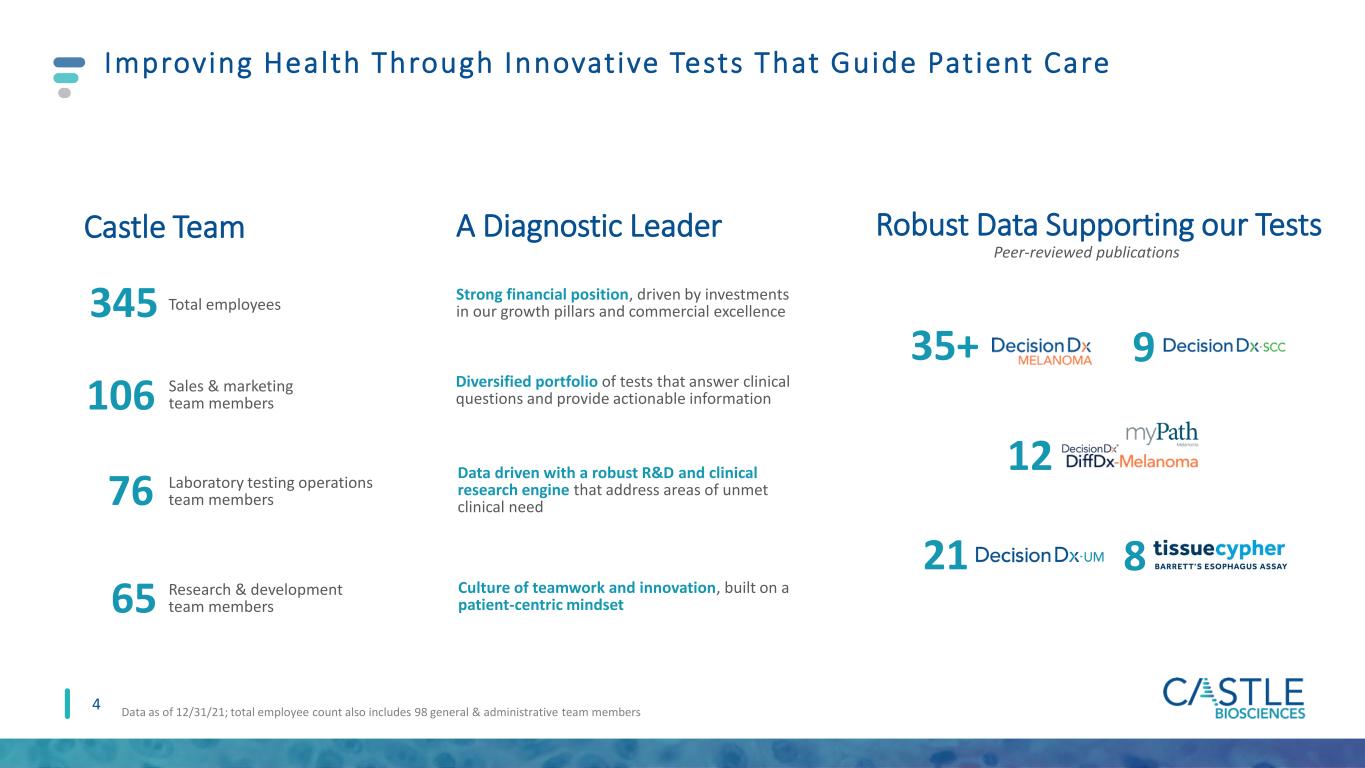

Improving Health Through Innovative Tests That Guide Patient Care 4 A Diagnostic Leader Robust Data Supporting our TestsCastle Team 345 Total employees 76 Laboratory testing operations team members 65 35+ Peer-reviewed publications Strong financial position, driven by investments in our growth pillars and commercial excellence Diversified portfolio of tests that answer clinical questions and provide actionable information Data driven with a robust R&D and clinical research engine that address areas of unmet clinical need Culture of teamwork and innovation, built on a patient-centric mindset 9 12 8 21 Research & development team members Data as of 12/31/21; total employee count also includes 98 general & administrative team members 106 Sales & marketing team members

F i n a n c i a l Pe r fo r m a n c e S u m m a r y 2 0 2 1 2021 2020 Revenue $94.1M $62.6M Adj. Revenue1 $90.8M $62.5M Total GEP test reports2 28,118 18,185 Total Derm test reports2 26,500 16,790 Operating Cash Flow $(19.0)M $9.9M Adj. Operating Cash Flow1 $(12.5)M $1.5M Gross Margin 81.1% 84.5% Adj. Gross Margin1 82.6% 84.5% Cash & Cash Equivalents $330M as of 12/31/2021 $410M as of 12/31/2020 1See Non-GAAP reconciliations at the end of this presentation. 2DecisionDx-SCC was launched on 8/31/20; DecisionDx DiffDx-Melanoma was launched on 11/2/20 5

6 Cast le Remains Focused On Transforming Disease Management Strate g ic p r in c ip le s th at c re ate va lu e for cu stome rs , p at ie nts an d stockh o ld e rs Address areas with unmet clinical need Leverage advanced technologies for innovative tests Accelerate test adoption through commercial excellence Provide robust data to support the clinical value of our tests

D r i v i n g L o n g - Te r m G r o w t h T h r o u g h A S t r o n g D e r m F o u n d a t i o n , P i p e l i n e a n d S t r a t e g i c O p p o r t u n i t i e s 7 Near-to Mid-term Growth (Potential LCD effective in 2023) (Potential LCD effective in 2023) Mid-to Long-term Growth Pipeline Expansion (Expected launches ~2025) Strategic Opportunities 2022-2023 2024 and beyond Strategic Opportunities Dermatology Gastrointestinal Strategic Opps

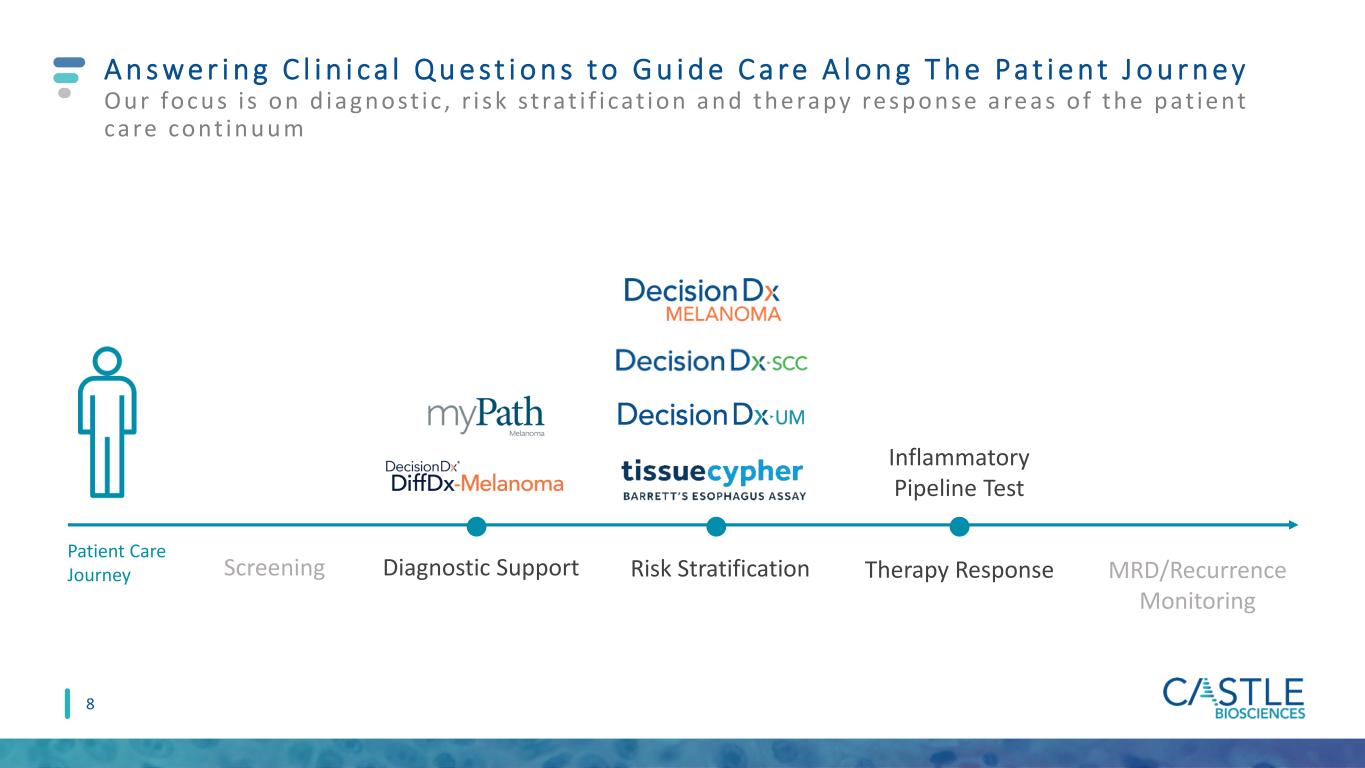

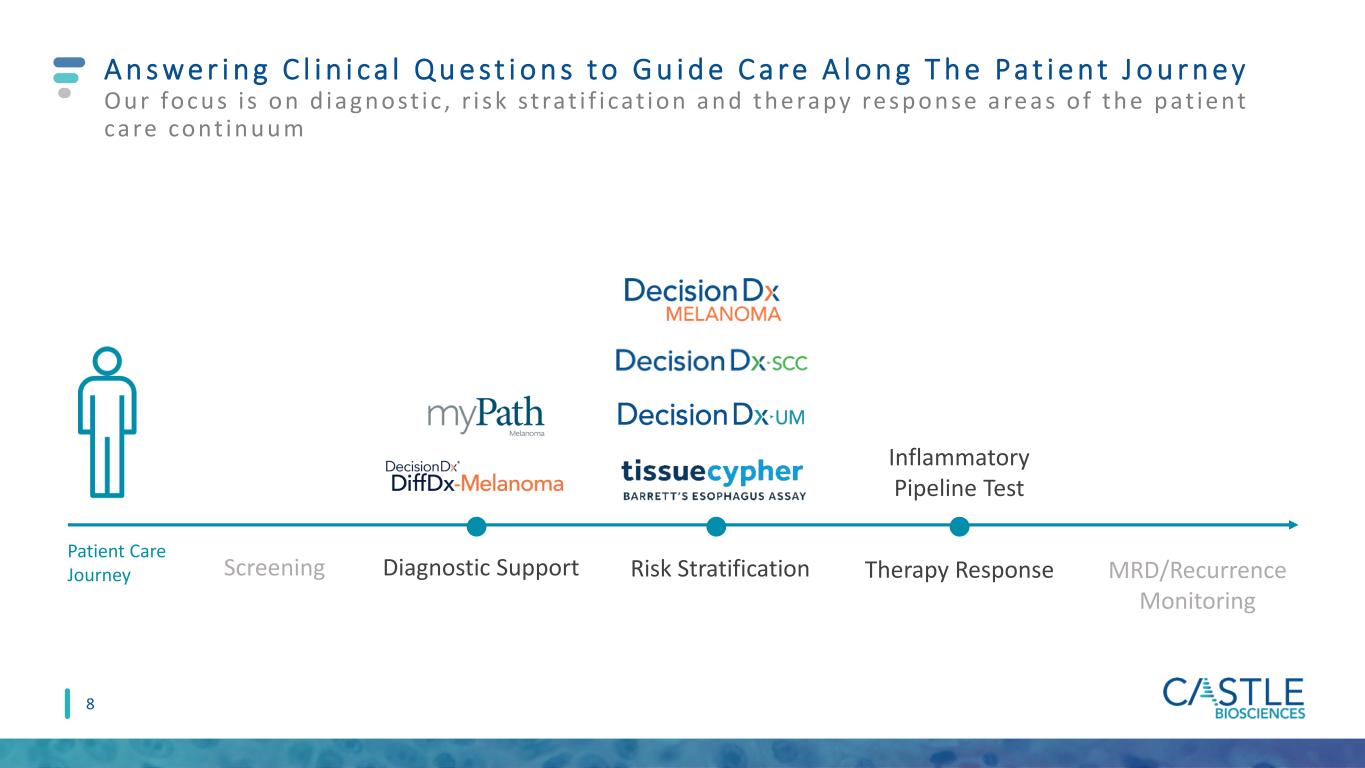

4 88 Screening Diagnostic Support Risk Stratification Therapy Response MRD/Recurrence Monitoring A n s w e r i n g C l i n i c a l Q u e s t i o n s t o G u i d e C a re A l o n g T h e Pa t i e n t J o u r n e y Our focus i s on d iag nost ic , r i s k st rat i f i cat ion and the rapy re s pons e are as o f the pat ie nt care cont in u u m Inflammatory Pipeline Test Patient Care Journey

Pi l lars Of Our Growth Plan 9 Cons iste nt exe cut ion fur the rs our le ad ing pos i t ion in de rmato logy and in the Dx s pace Strong Core Derm Business Pipeline Initiatives Strategic Opportunities • Continuing provider education • Optimizing commercial team • Evolving our go-to-market strategy (EMA, VA) • NCI/SEER collaboration • Ability to answer clinical questions/impact patient care • Utilizing our areas of expertise (genomics, spatialomics, AI) to develop innovative tests • Focusing on complementary/ adjacent disease states • Areas where we can utilize our commercial success • Potential to create a suite of tests in a single call point • Ability to answer clinical questions/impact patient care • Early reimbursement wins + +

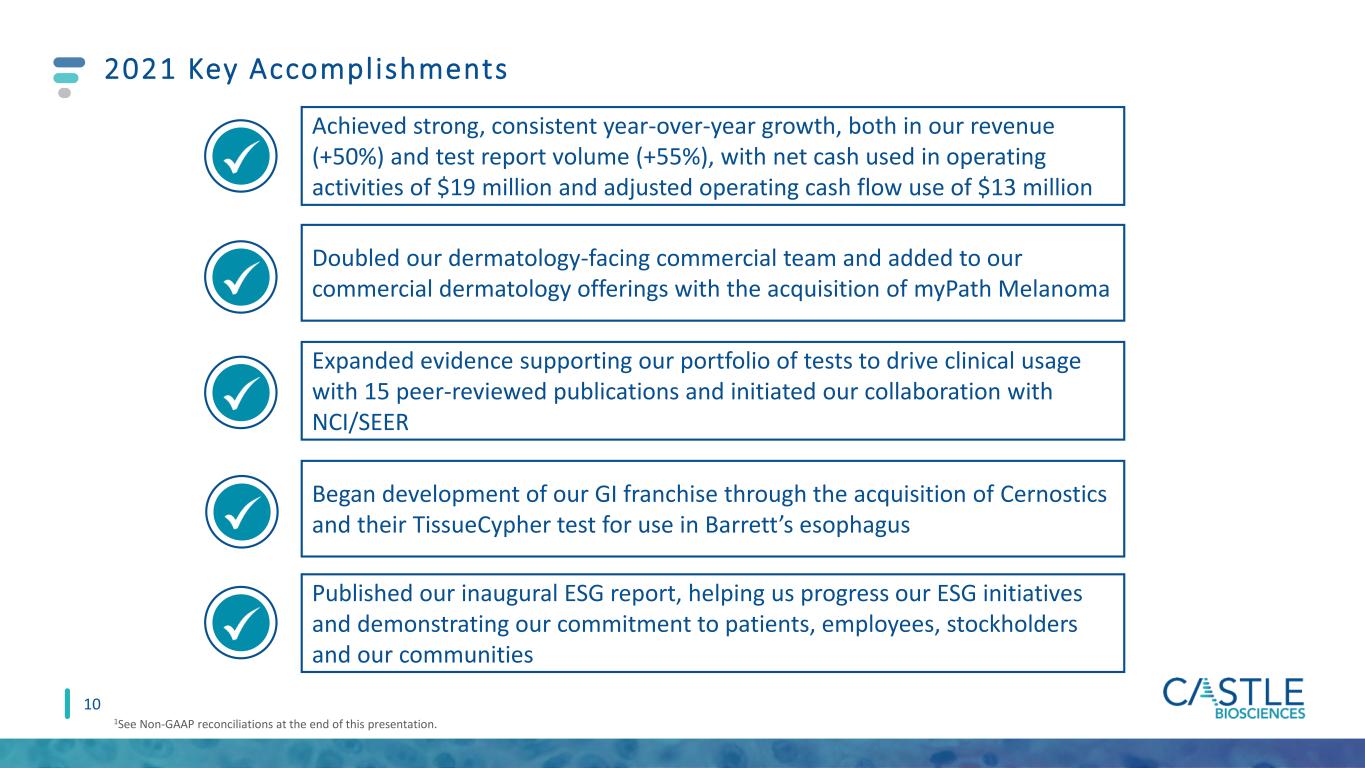

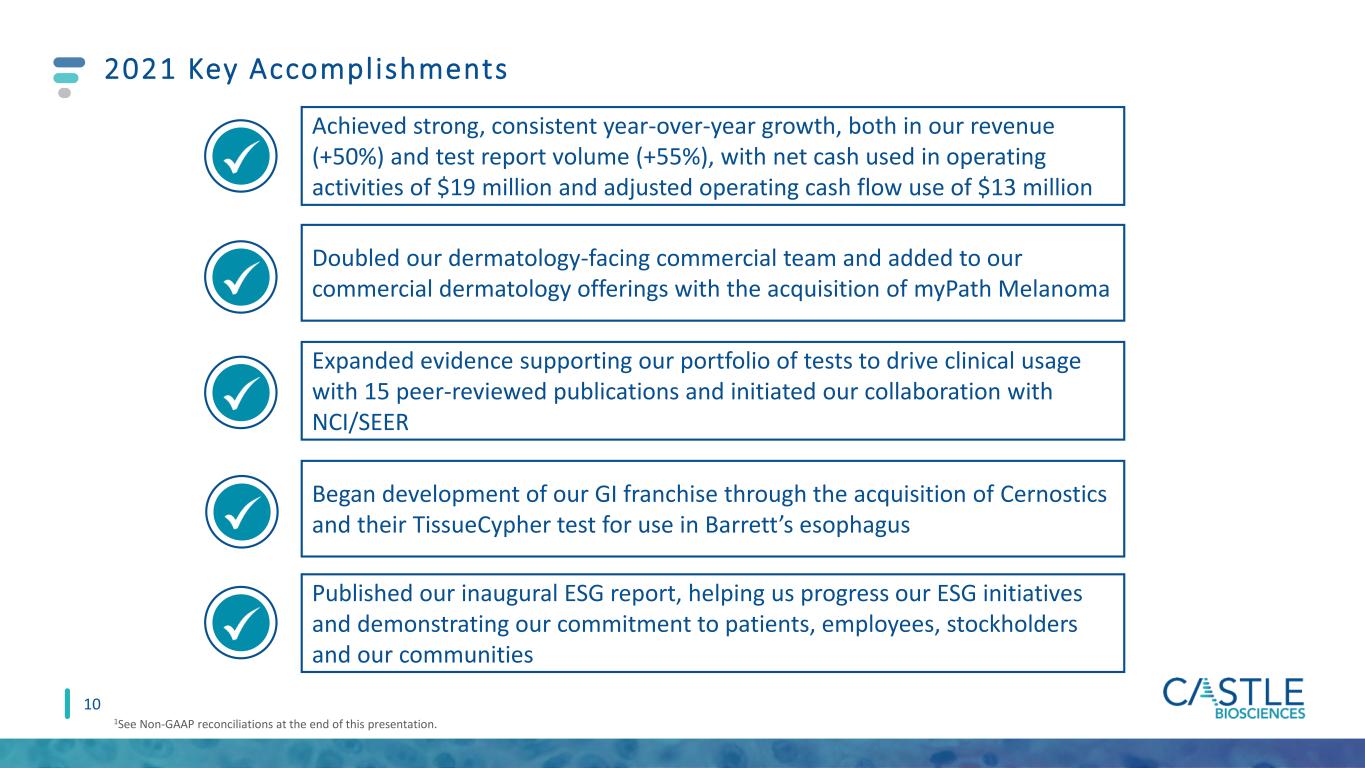

Doubled our dermatology-facing commercial team and added to our commercial dermatology offerings with the acquisition of myPath Melanoma Achieved strong, consistent year-over-year growth, both in our revenue (+50%) and test report volume (+55%), with net cash used in operating activities of $19 million and adjusted operating cash flow use of $13 million Expanded evidence supporting our portfolio of tests to drive clinical usage with 15 peer-reviewed publications and initiated our collaboration with NCI/SEER Began development of our GI franchise through the acquisition of Cernostics and their TissueCypher test for use in Barrett’s esophagus Published our inaugural ESG report, helping us progress our ESG initiatives and demonstrating our commitment to patients, employees, stockholders and our communities 10 2021 Key Accomplishments 1See Non-GAAP reconciliations at the end of this presentation.

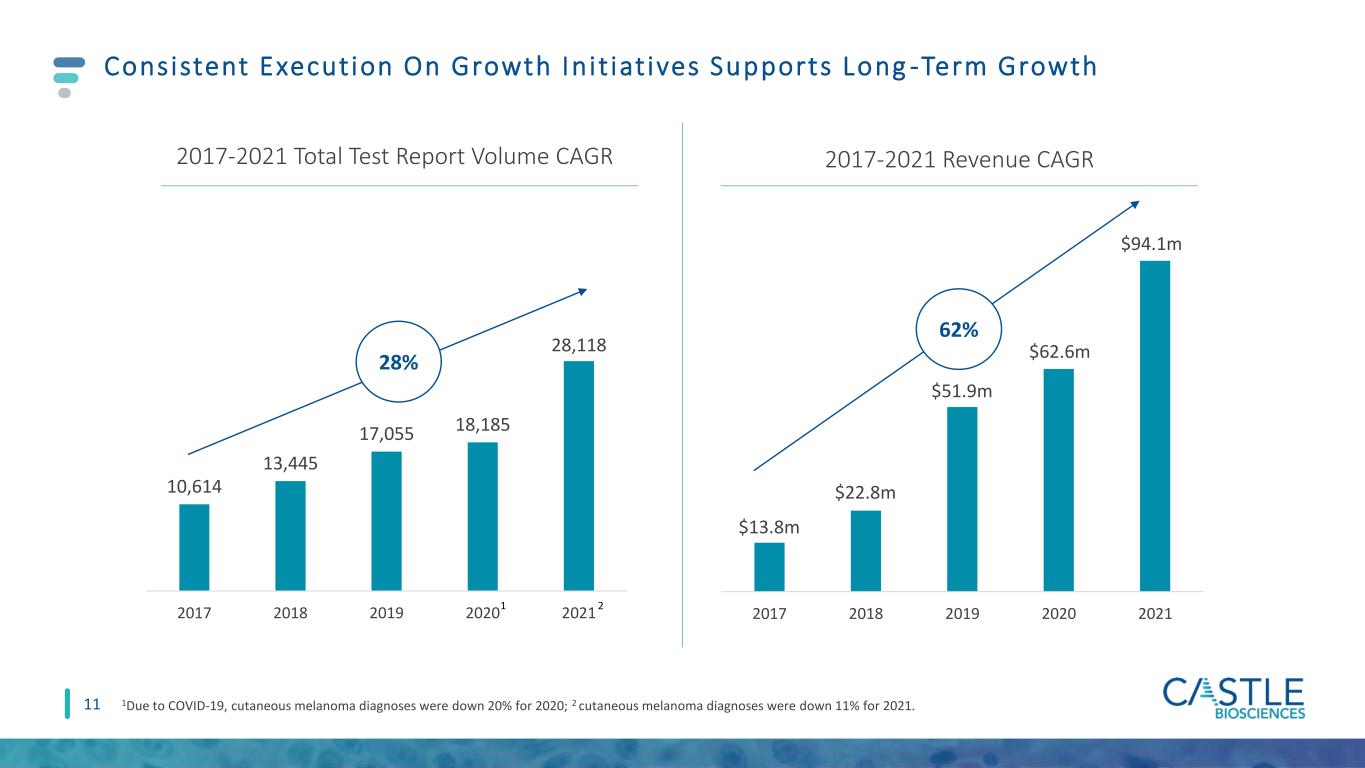

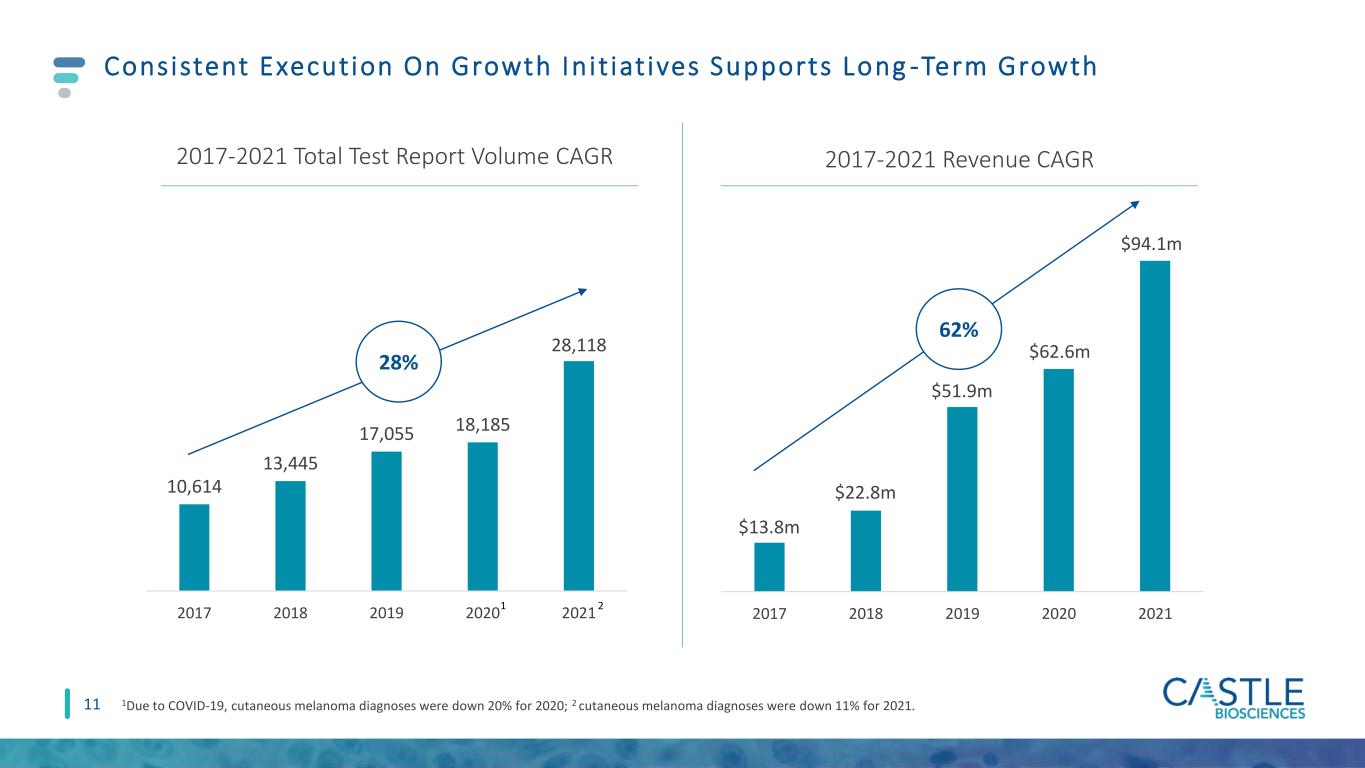

10,614 13,445 17,055 18,185 28,118 2017 2018 2019 2020 2021 11 Consistent Execut ion On Growth In i t iat ives Supports Long -Term Growth 2017 2018 2019 2020 2021 $22.8m $51.9m $62.6m $94.1m $13.8m 2017-2021 Revenue CAGR 2017-2021 Total Test Report Volume CAGR 62% 28% 1 2 1Due to COVID-19, cutaneous melanoma diagnoses were down 20% for 2020; 2 cutaneous melanoma diagnoses were down 11% for 2021.

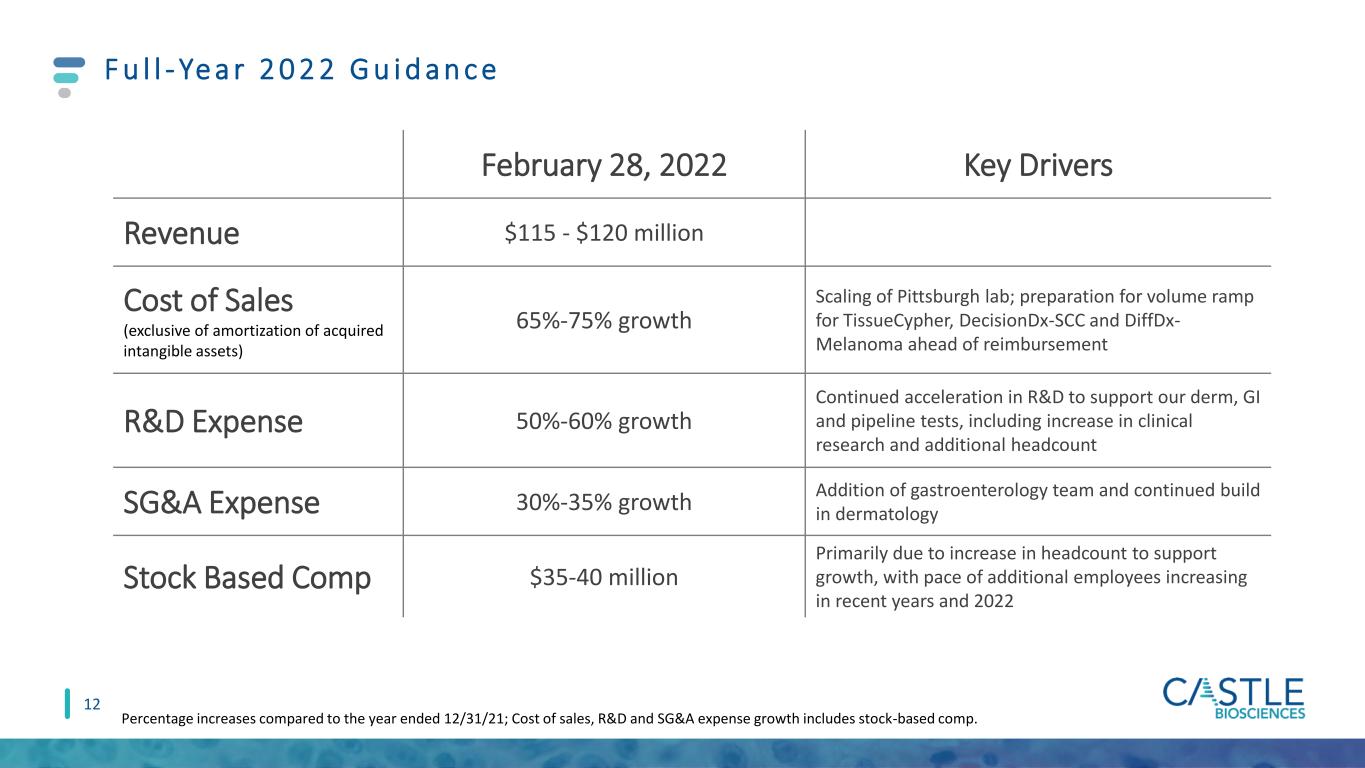

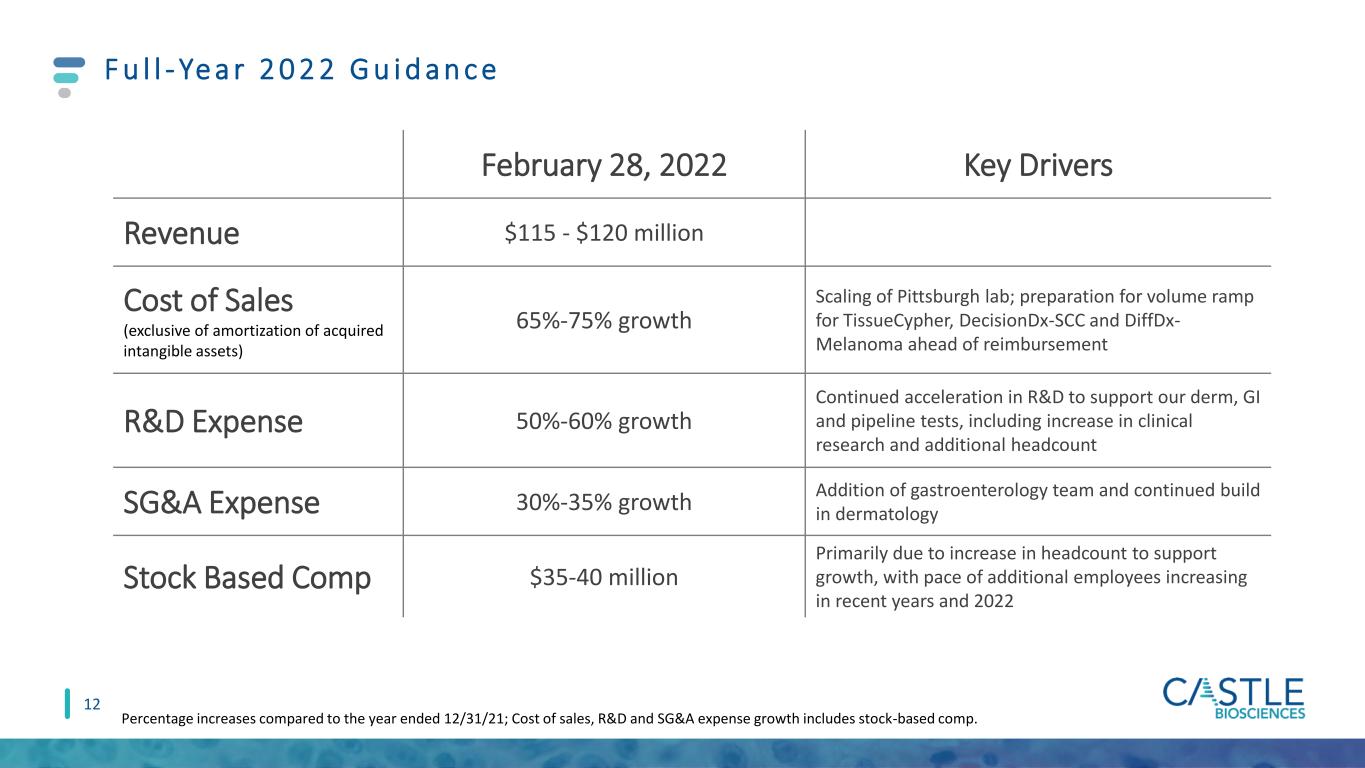

F u l l - Ye a r 2 0 2 2 G u i d a n c e 12 February 28, 2022 Key Drivers Revenue $115 - $120 million Cost of Sales (exclusive of amortization of acquired intangible assets) 65%-75% growth Scaling of Pittsburgh lab; preparation for volume ramp for TissueCypher, DecisionDx-SCC and DiffDx- Melanoma ahead of reimbursement R&D Expense 50%-60% growth Continued acceleration in R&D to support our derm, GI and pipeline tests, including increase in clinical research and additional headcount SG&A Expense 30%-35% growth Addition of gastroenterology team and continued build in dermatology Stock Based Comp $35-40 million Primarily due to increase in headcount to support growth, with pace of additional employees increasing in recent years and 2022 Percentage increases compared to the year ended 12/31/21; Cost of sales, R&D and SG&A expense growth includes stock-based comp.

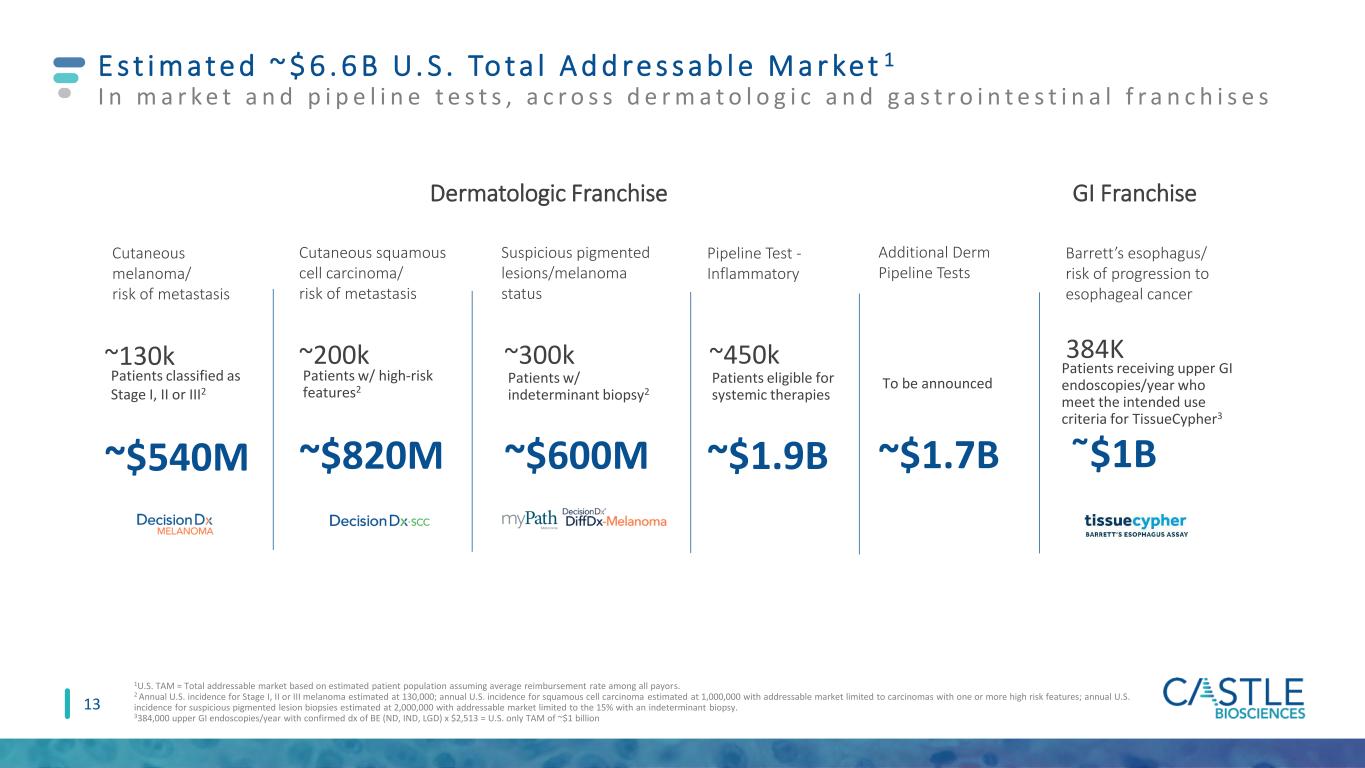

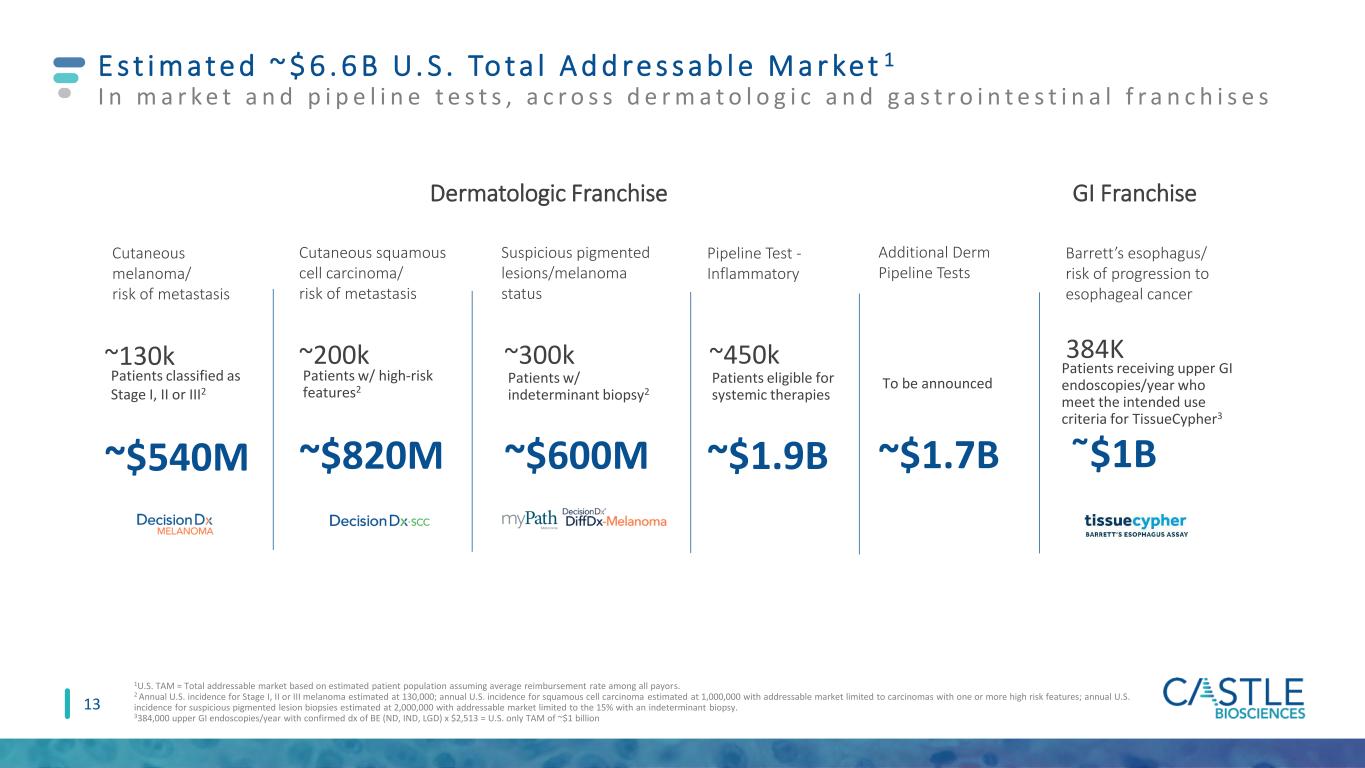

Additional Derm Pipeline Tests To be announced ~$1.7B Barrett’s esophagus/ risk of progression to esophageal cancer Patients receiving upper GI endoscopies/year who meet the intended use criteria for TissueCypher3 ῀$1B 384K E s t i m a t e d ~ $ 6 . 6 B U. S . To t a l A d d re s s a b l e M a r ke t 1 I n m a r k e t a n d p i p e l i n e t e s t s , a c r o s s d e r m a t o l o g i c a n d g a s t r o i n t e s t i n a l f r a n c h i s e s 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2 Annual U.S. incidence for Stage I, II or III melanoma estimated at 130,000; annual U.S. incidence for squamous cell carcinoma estimated at 1,000,000 with addressable market limited to carcinomas with one or more high risk features; annual U.S. incidence for suspicious pigmented lesion biopsies estimated at 2,000,000 with addressable market limited to the 15% with an indeterminant biopsy. 3384,000 upper GI endoscopies/year with confirmed dx of BE (ND, IND, LGD) x $2,513 = U.S. only TAM of ~$1 billion 13 Cutaneous melanoma/ risk of metastasis Cutaneous squamous cell carcinoma/ risk of metastasis Suspicious pigmented lesions/melanoma status Pipeline Test - Inflammatory ~130k ~200k ~300k ~450k ~$540M ~$820M ~$600M ~$1.9B Patients classified as Stage I, II or III2 Patients w/ high-risk features2 Patients w/ indeterminant biopsy2 Patients eligible for systemic therapies Dermatologic Franchise GI Franchise

Potential DecisionDx-SCC and DecisionDx DiffDx-Melanoma draft LCD 14 2022 Anticipated Catalysts Potential expansion of commercial teams to further accelerate test adoption and volume growth in GI and Derm Continued evidence development, data presentations and peer-reviewed publications to support the value of our test and increase adoption with providers and commercial payers Pipeline updates in Derm franchise

New GI commercial team of ~ 14 outside territories hired, trained and in the field in January 2022, GI focused medical science liaisons and internal sales associates hired 15 Year-to-date 2022, two abstracts for GI conferences (podium presentations at ESGE Days 2022 and DDW 2022) and one peer-reviewed publication accepted Lab floorplan and workflow reconfigurations have increased efficiencies with more progress expected throughout 2022 Leveraging spatialomics expertise to identify pipeline opportunities in GI and dermatology GI/Cernostics Integration Update Fu e l in g mid - an d lon g - te rm g rowth wi th T i s s u e Cyp h er® p lat form an d G I f ran ch is e Planned capex investments (lab expansion and additional headcount) expected to allow for further enhancements to automation, a significant increase to throughput and provide support for potential future GI tests off the TissueCypher spatialomics platform

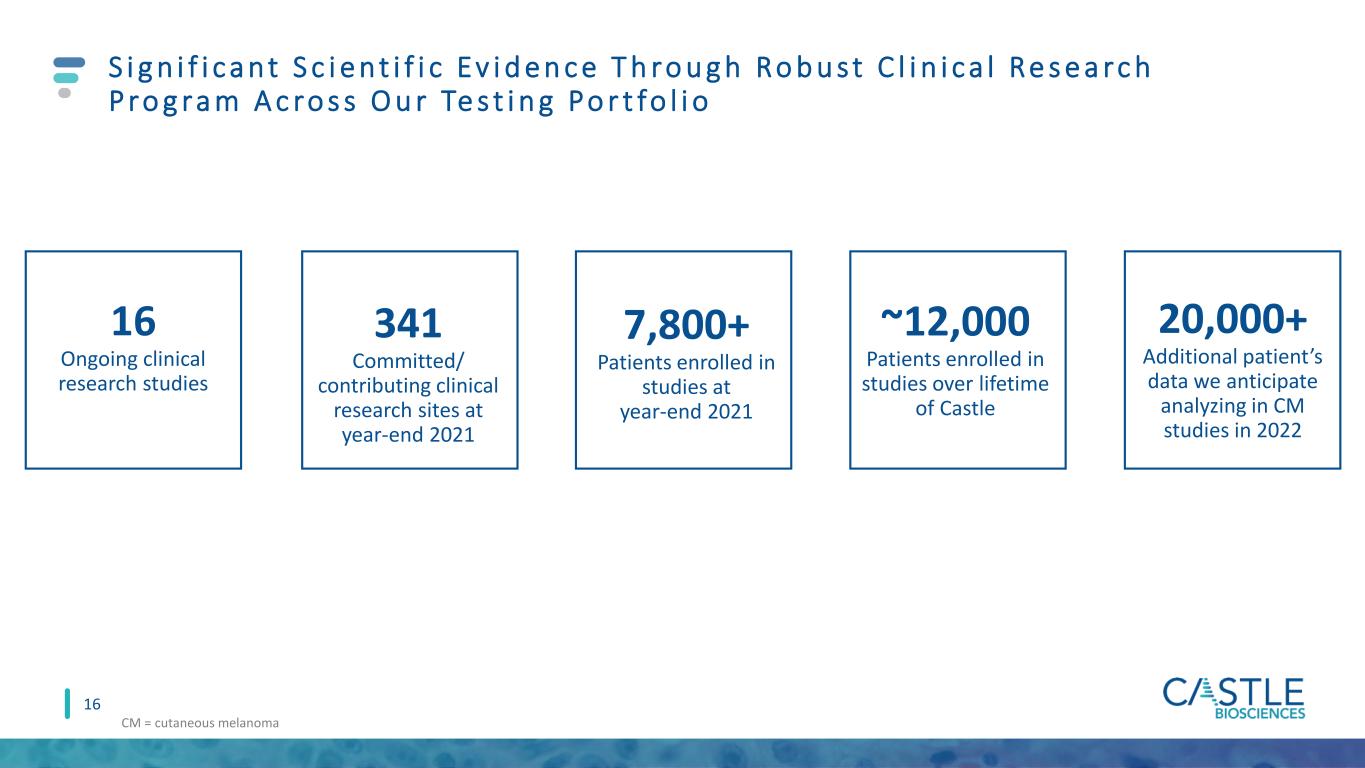

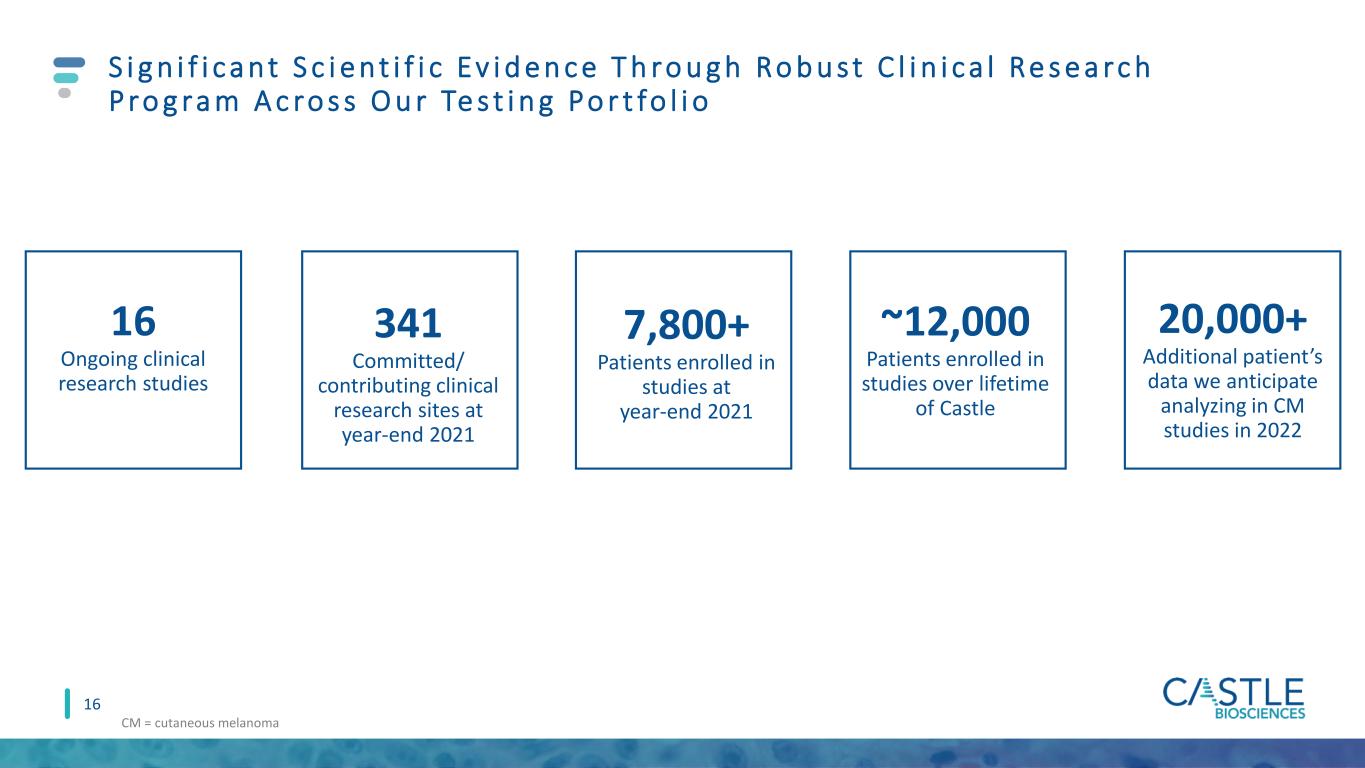

S i g n i f i c a n t S c i e n t i f i c Ev i d e n c e T h ro u g h Ro b u s t C l i n i c a l Re s e a rc h P ro g ra m A c ro s s O u r Te s t i n g Po r t fo l i o 16 16 Ongoing clinical research studies 341 Committed/ contributing clinical research sites at year-end 2021 ~12,000 Patients enrolled in studies over lifetime of Castle 7,800+ Patients enrolled in studies at year-end 2021 20,000+ Additional patient’s data we anticipate analyzing in CM studies in 2022 CM = cutaneous melanoma

17 Accelerat ing Investments In C l inical Development G e n e rat in g d ata th at s u p p orts th e c l in ica l va lu e o f ou r te sts an d s u p p orts p rov id e r an d p aye r ad opt ion 102 Committed sites ~1,400 Patients enrolled 4 Ongoing studies 144 ~3,100 3 Committed sites Patients enrolled Ongoing studies 25 ~3,250 3 Committed sites Patients enrolled Ongoing studies 11 ~630 3 Committed sites Subjects1 enrolled Ongoing studies Upcoming Q1-Q2 Data Presentations • SSO 2022 • AAD 2022 • AAD 2022 • ACMS 2022 • ESGE Days 2022 • DDW 2022 1Subjects includes patients and physicians

18 First To Market Dermatologic Franchise, Addit ional Growth Opportunit ies Diagnostic Support Risk-Stratification Therapy Response1 1Target launch anticipated by the end of 2025 . Inflammatory Pipeline

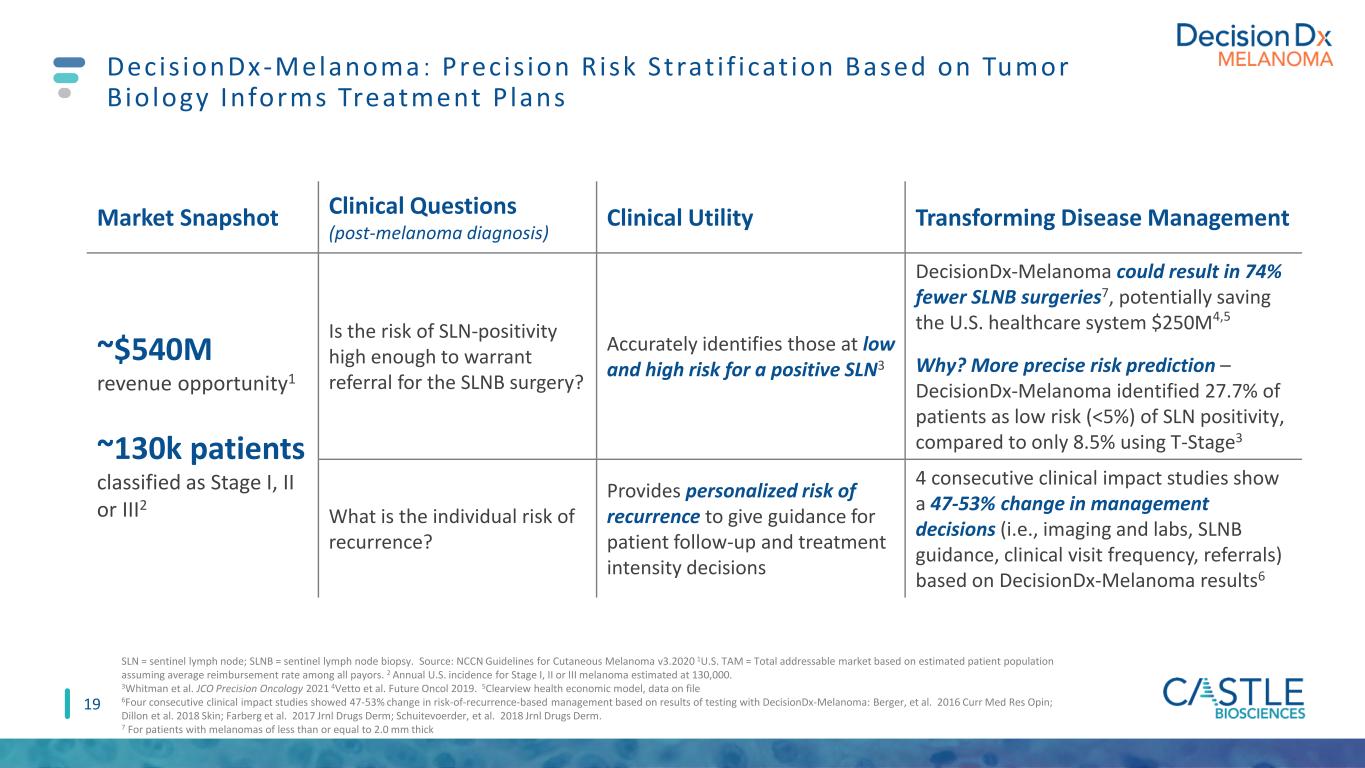

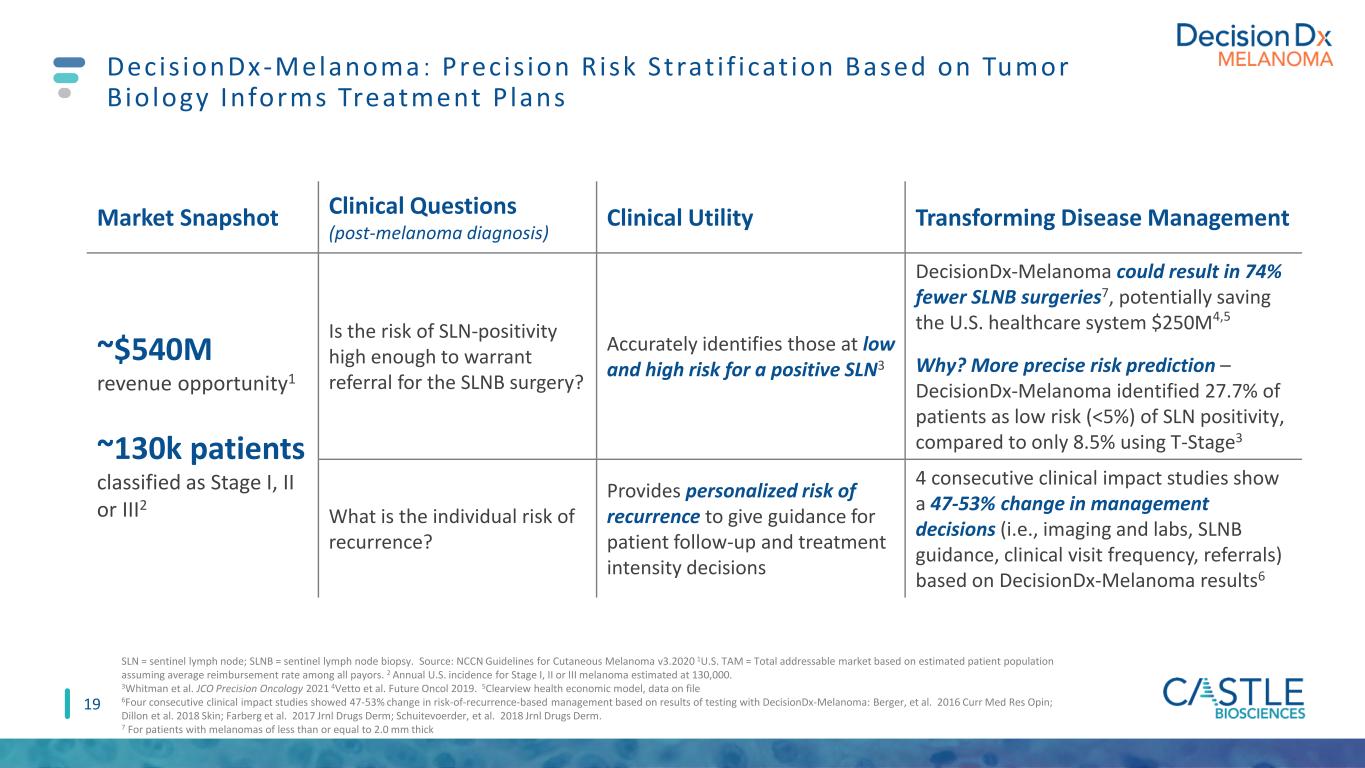

19 Decis ionDx-Melanoma : Prec is ion R isk Strat i f icat ion Based on Tumor Biology Informs Treatment P lans Market Snapshot Clinical Questions (post-melanoma diagnosis) Clinical Utility Transforming Disease Management ~$540M revenue opportunity1 ~130k patients classified as Stage I, II or III2 Is the risk of SLN-positivity high enough to warrant referral for the SLNB surgery? Accurately identifies those at low and high risk for a positive SLN3 DecisionDx-Melanoma could result in 74% fewer SLNB surgeries7, potentially saving the U.S. healthcare system $250M4,5 Why? More precise risk prediction – DecisionDx-Melanoma identified 27.7% of patients as low risk (<5%) of SLN positivity, compared to only 8.5% using T-Stage3 What is the individual risk of recurrence? Provides personalized risk of recurrence to give guidance for patient follow-up and treatment intensity decisions 4 consecutive clinical impact studies show a 47-53% change in management decisions (i.e., imaging and labs, SLNB guidance, clinical visit frequency, referrals) based on DecisionDx-Melanoma results6 SLN = sentinel lymph node; SLNB = sentinel lymph node biopsy. Source: NCCN Guidelines for Cutaneous Melanoma v3.2020 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2 Annual U.S. incidence for Stage I, II or III melanoma estimated at 130,000. 3Whitman et al. JCO Precision Oncology 2021 4Vetto et al. Future Oncol 2019. 5Clearview health economic model, data on file 6Four consecutive clinical impact studies showed 47-53% change in risk-of-recurrence-based management based on results of testing with DecisionDx-Melanoma: Berger, et al. 2016 Curr Med Res Opin; Dillon et al. 2018 Skin; Farberg et al. 2017 Jrnl Drugs Derm; Schuitevoerder, et al. 2018 Jrnl Drugs Derm. 7 For patients with melanomas of less than or equal to 2.0 mm thick

20 Current Melanoma Staging Misses Patients With Aggressive Tumor Biology 80% 12% 8% Stage at Diagnosis Stage II Stage III Stage I Excludes Stage IV 26% 34% 40% Melanoma Deaths by Stage at Diagnosis Stage II Stage III Stage I Excludes Stage IV 92% Stage I or II 60% Stage I or II The majority of melanoma deaths occur in patients who were diagnosed at Stage I or II 1AJCC v7 J Clin Oncol 2009; 2SEER data release 2017; 3Morton et al. N Engl J Med 2014; 4Whiteman et al. J Invest Dermatol 2015; 5Shaikh et al. J Natl Cancer Inst 2016; 6Poklepovic and Carvajal. ONCOLOGY 2018; 7Ibrahim et al. Ann Surg Oncol 2020

D e c i s i o n D x - M e l a n o m a I s S u p p o r t e d B y S i g n i f i c a n t S c i e n t i f i c E v i d e n c e 21 6,000+ Patients included in studies including independent validation 90,000+ Patients with a DecisionDx-Melanoma order from more than 9,300 clinicians 35+ Peer-reviewed, published studies including 2 meta-analyses 1A Level 1A evidence* Medicare+ Covered by Medicare and multiple private insurers with an industry- leading patient assistance program 50% Demonstrated change in management for 1 of 2 patients tested *According to sort system, used by American Academy of Dermatology Following a diagnosis of cutaneous melanoma, providers make two important treatment decisions – whether to recommend SLNB and what type/frequency of follow up should be used.

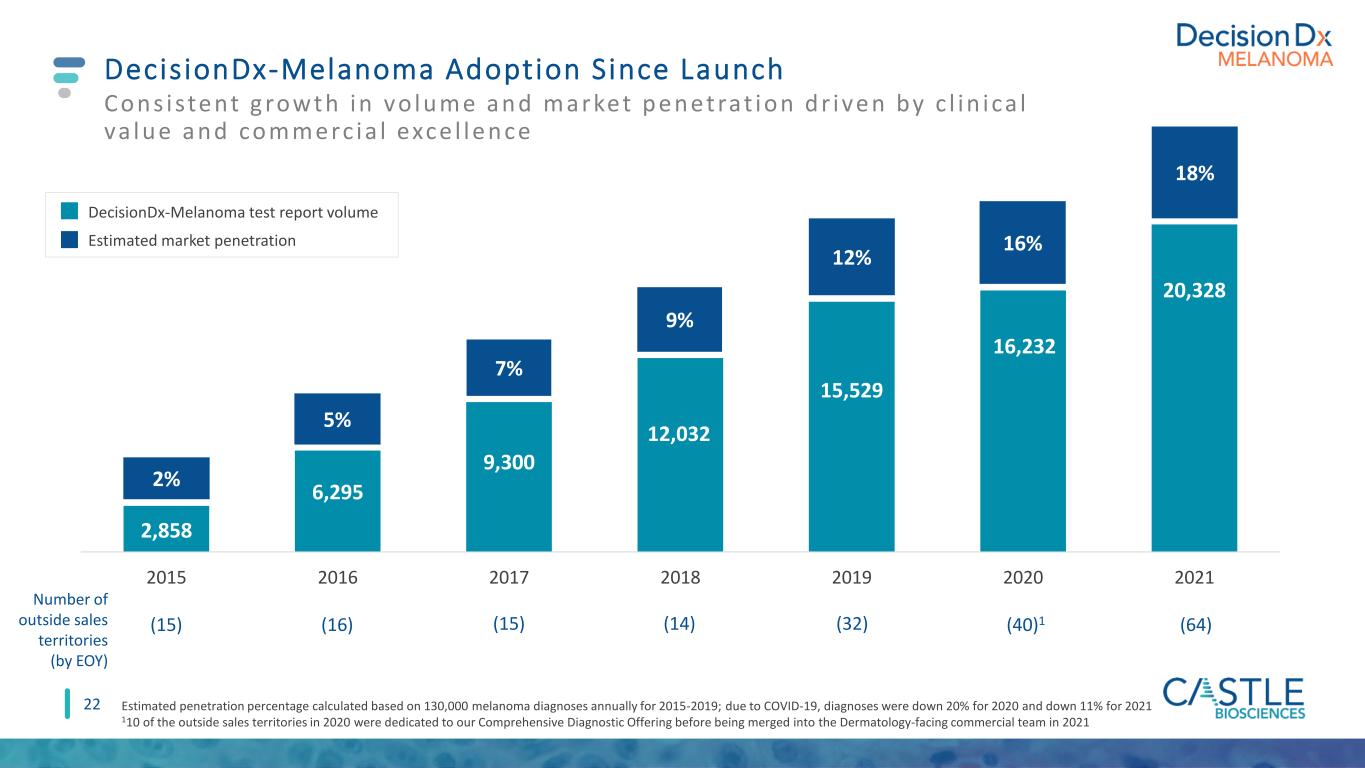

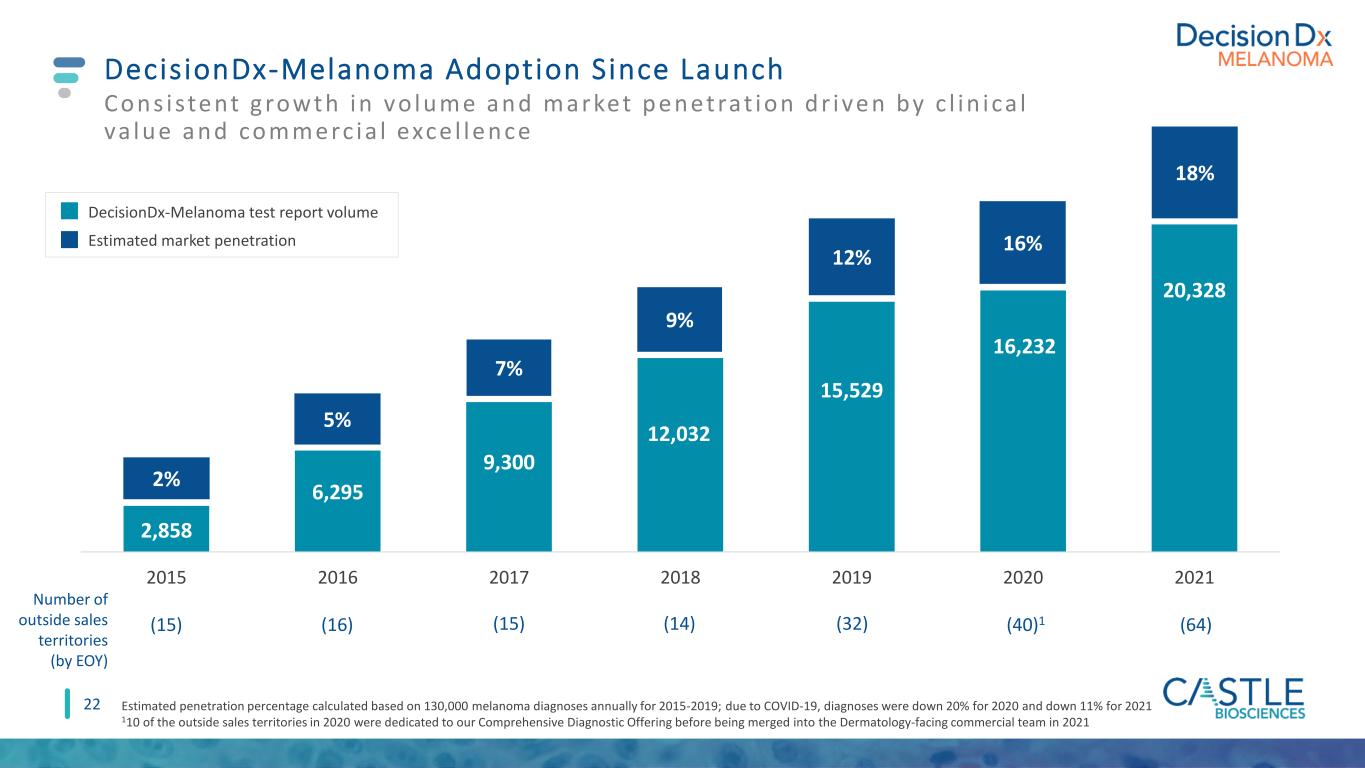

DecisionDx-Melanoma Adoption Since Launch 22 Con s iste nt g rowth in vo lu me an d market p e n etrat ion d r ive n by c l in ica l va lu e an d comme rc ia l exce l le n ce Estimated penetration percentage calculated based on 130,000 melanoma diagnoses annually for 2015-2019; due to COVID-19, diagnoses were down 20% for 2020 and down 11% for 2021 110 of the outside sales territories in 2020 were dedicated to our Comprehensive Diagnostic Offering before being merged into the Dermatology-facing commercial team in 2021 2,858 6,295 9,300 12,032 15,529 16,232 20,328 2015 2016 2017 2018 2019 2020 2021 2% 5% 7% 9% 12% 16% 18% DecisionDx-Melanoma test report volume Estimated market penetration (15) Number of outside sales territories (by EOY) (16) (15) (14) (32) (40)1 (64)

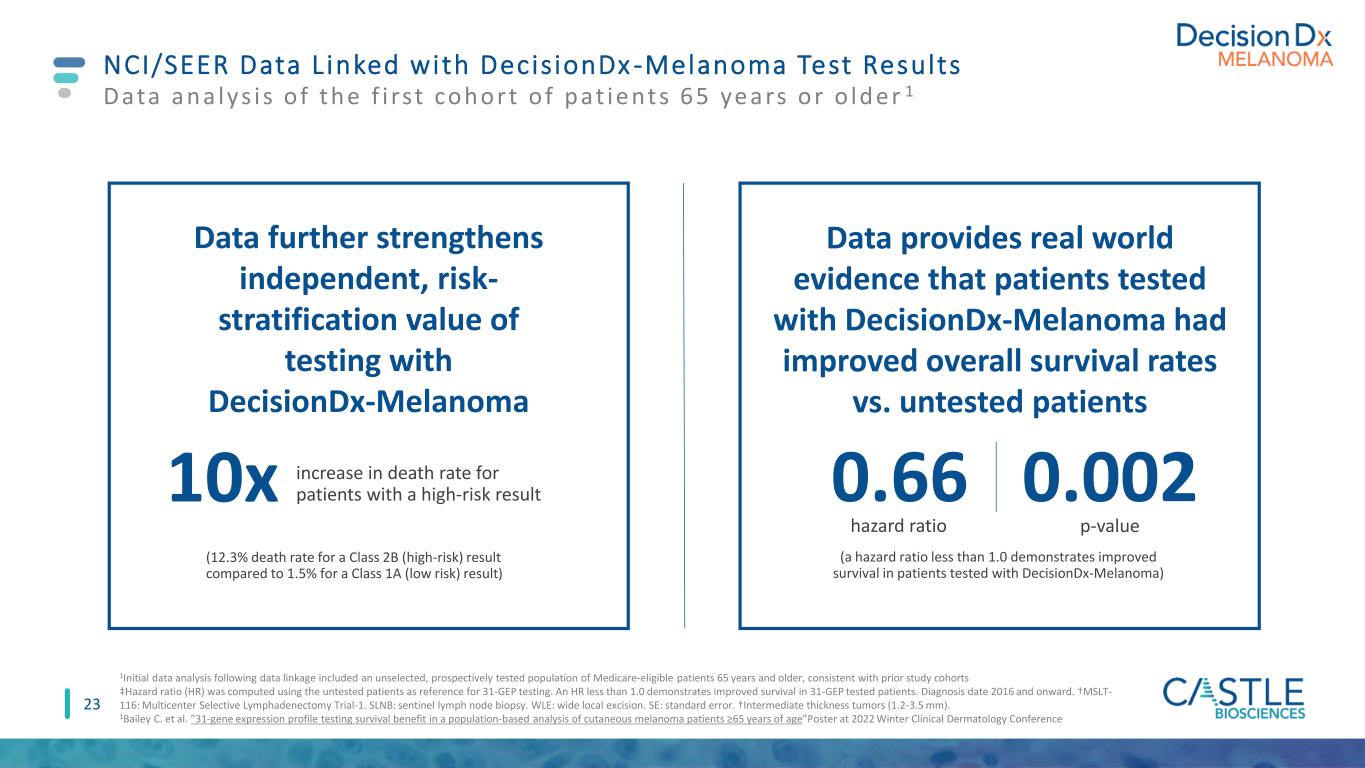

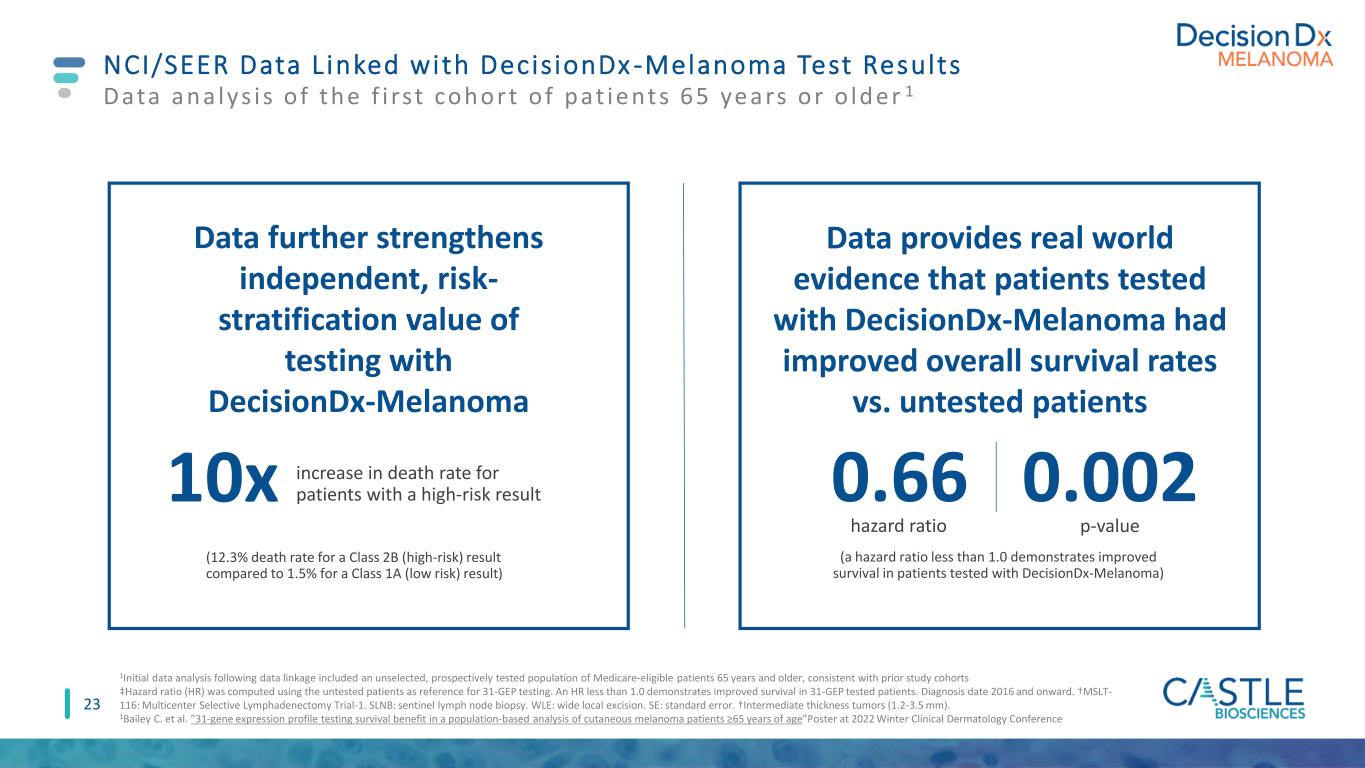

23 NCI/SEER Data L inked with Decis ionDx -Melanoma Test Results 1Initial data analysis following data linkage included an unselected, prospectively tested population of Medicare-eligible patients 65 years and older, consistent with prior study cohorts ‡Hazard ratio (HR) was computed using the untested patients as reference for 31-GEP testing. An HR less than 1.0 demonstrates improved survival in 31-GEP tested patients. Diagnosis date 2016 and onward. †MSLT- 116: Multicenter Selective Lymphadenectomy Trial-1. SLNB: sentinel lymph node biopsy. WLE: wide local excision. SE: standard error. †Intermediate thickness tumors (1.2-3.5 mm). 1Bailey C. et al. ”31-gene expression profile testing survival benefit in a population-based analysis of cutaneous melanoma patients ≥65 years of age”Poster at 2022 Winter Clinical Dermatology Conference 0.66 Data an a lys i s o f th e f i rst coh ort o f p at ie nts 65 ye ars or o ld e r 1 Data provides real world evidence that patients tested with DecisionDx-Melanoma had improved overall survival rates vs. untested patients increase in death rate for patients with a high-risk result10x (12.3% death rate for a Class 2B (high-risk) result compared to 1.5% for a Class 1A (low risk) result) hazard ratio 0.002 p-value Data further strengthens independent, risk- stratification value of testing with DecisionDx-Melanoma (a hazard ratio less than 1.0 demonstrates improved survival in patients tested with DecisionDx-Melanoma)

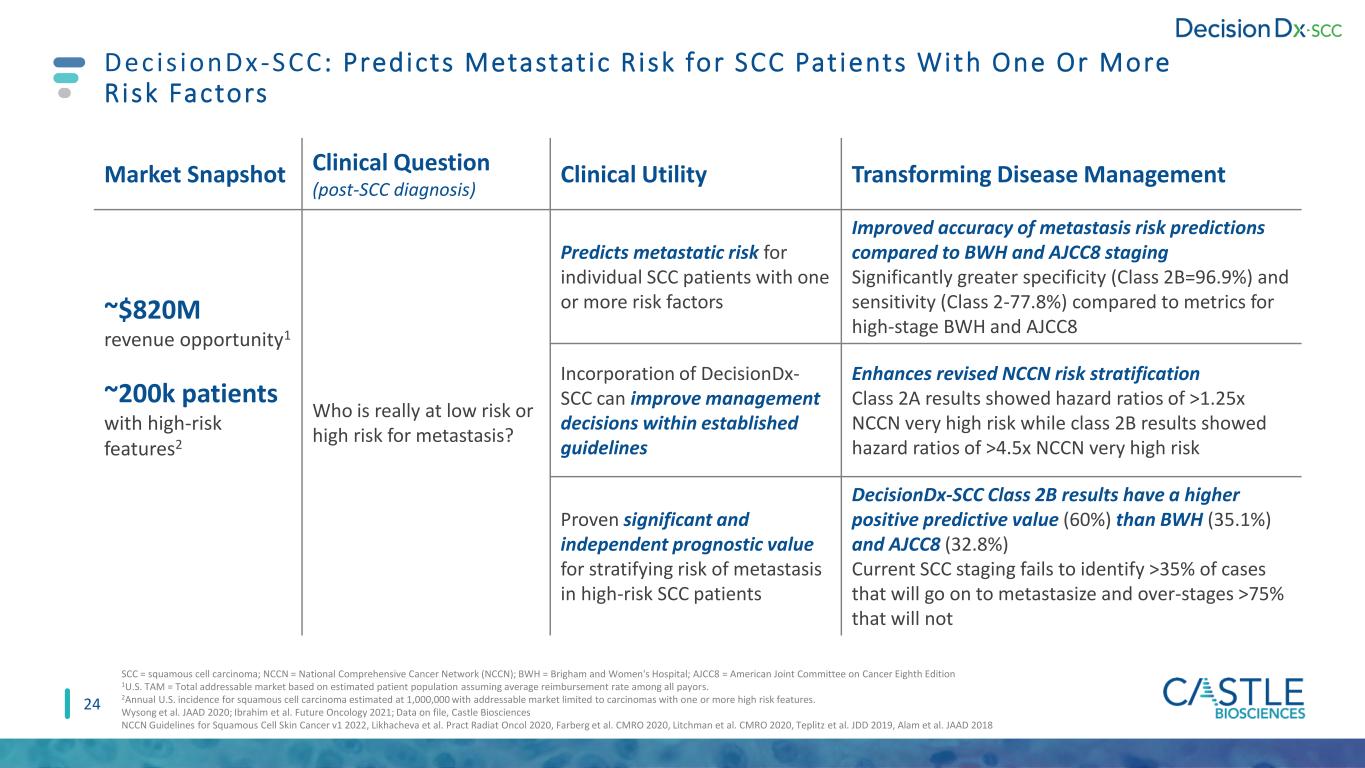

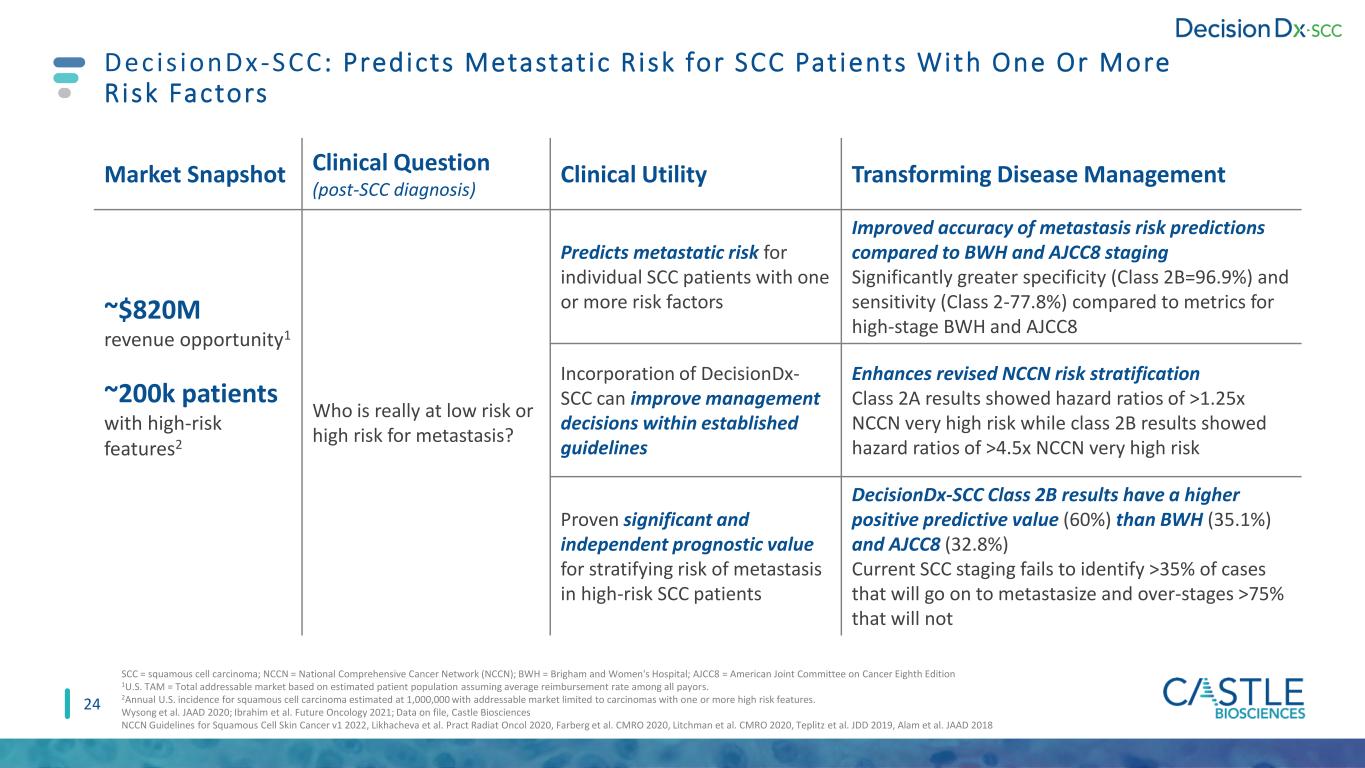

24 Decis ionDx-SCC : Predicts Metastat ic R isk for SCC Pat ients With One Or More Risk Factors Market Snapshot Clinical Question (post-SCC diagnosis) Clinical Utility Transforming Disease Management ~$820M revenue opportunity1 ~200k patients with high-risk features2 Who is really at low risk or high risk for metastasis? Predicts metastatic risk for individual SCC patients with one or more risk factors Improved accuracy of metastasis risk predictions compared to BWH and AJCC8 staging Significantly greater specificity (Class 2B=96.9%) and sensitivity (Class 2-77.8%) compared to metrics for high-stage BWH and AJCC8 Incorporation of DecisionDx- SCC can improve management decisions within established guidelines Enhances revised NCCN risk stratification Class 2A results showed hazard ratios of >1.25x NCCN very high risk while class 2B results showed hazard ratios of >4.5x NCCN very high risk Proven significant and independent prognostic value for stratifying risk of metastasis in high-risk SCC patients DecisionDx-SCC Class 2B results have a higher positive predictive value (60%) than BWH (35.1%) and AJCC8 (32.8%) Current SCC staging fails to identify >35% of cases that will go on to metastasize and over-stages >75% that will not SCC = squamous cell carcinoma; NCCN = National Comprehensive Cancer Network (NCCN); BWH = Brigham and Women's Hospital; AJCC8 = American Joint Committee on Cancer Eighth Edition 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2Annual U.S. incidence for squamous cell carcinoma estimated at 1,000,000 with addressable market limited to carcinomas with one or more high risk features. Wysong et al. JAAD 2020; Ibrahim et al. Future Oncology 2021; Data on file, Castle Biosciences NCCN Guidelines for Squamous Cell Skin Cancer v1 2022, Likhacheva et al. Pract Radiat Oncol 2020, Farberg et al. CMRO 2020, Litchman et al. CMRO 2020, Teplitz et al. JDD 2019, Alam et al. JAAD 2018

~20% of SCC patients (200,000 annually) have one or more clinical or pathological risk factors, and a subset will develop metastasis They suffer the majority of SCC mortality These factors alone are often not specific enough to determine risk-appropriate treatment and further management Decis ionDx-SCC Addresses the Unmet Need In High -Risk SCC Pat ients Wh o i s re a l ly at low r i s k or h ig h r i s k for metastas i s? NCCN=National Comprehensive Cancer Network; BWH = Brigham and Women’s Hospital; AJCC = American Joint Committee on Cancer SCC treatment plans are guided by risk of metastasis Risk-appropriate SCC management is limited by classification systems (NCCN, BWH, AJCC) with low positive predictive value (PPV) Deaths from SCC are now estimated to exceed those from melanoma 25

D e c i s i o n D x - S C C I n f o r m s R i s k - A p p r o p r i a t e M a n a g e m e n t To G u i d e P a t i e n t C a r e 26 For high-risk SCC patients with one or more risk factors Validated in 420-patient cohort of high-risk SCC from 33 U.S. centers 9 peer-reviewed publications to date ~3,100 patients have been enrolled in studies to date from 144 centers Utilizing existing sales channels: dermatologists (including Mohs surgeons) Incorporation of DecisionDx- SCC with traditional risk factors can improve patient classification compared to traditional risk factors alone

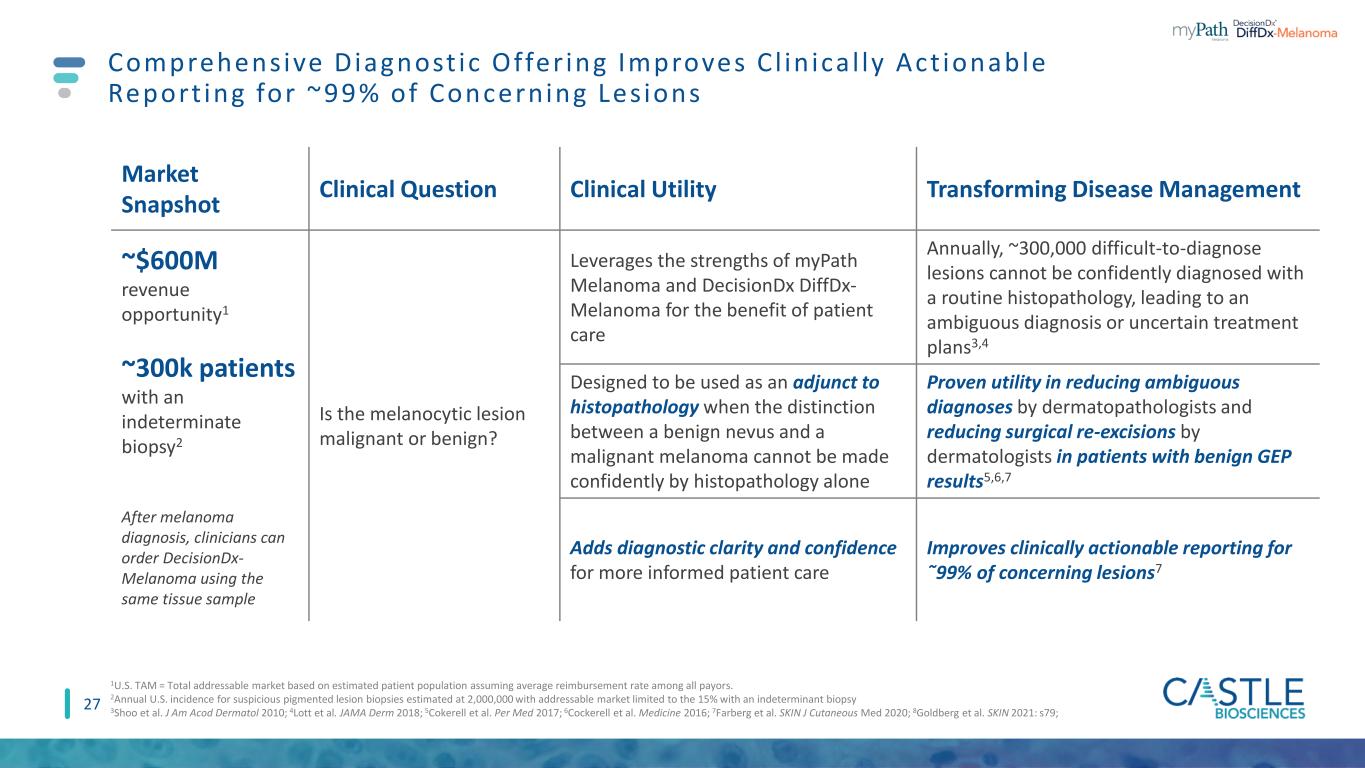

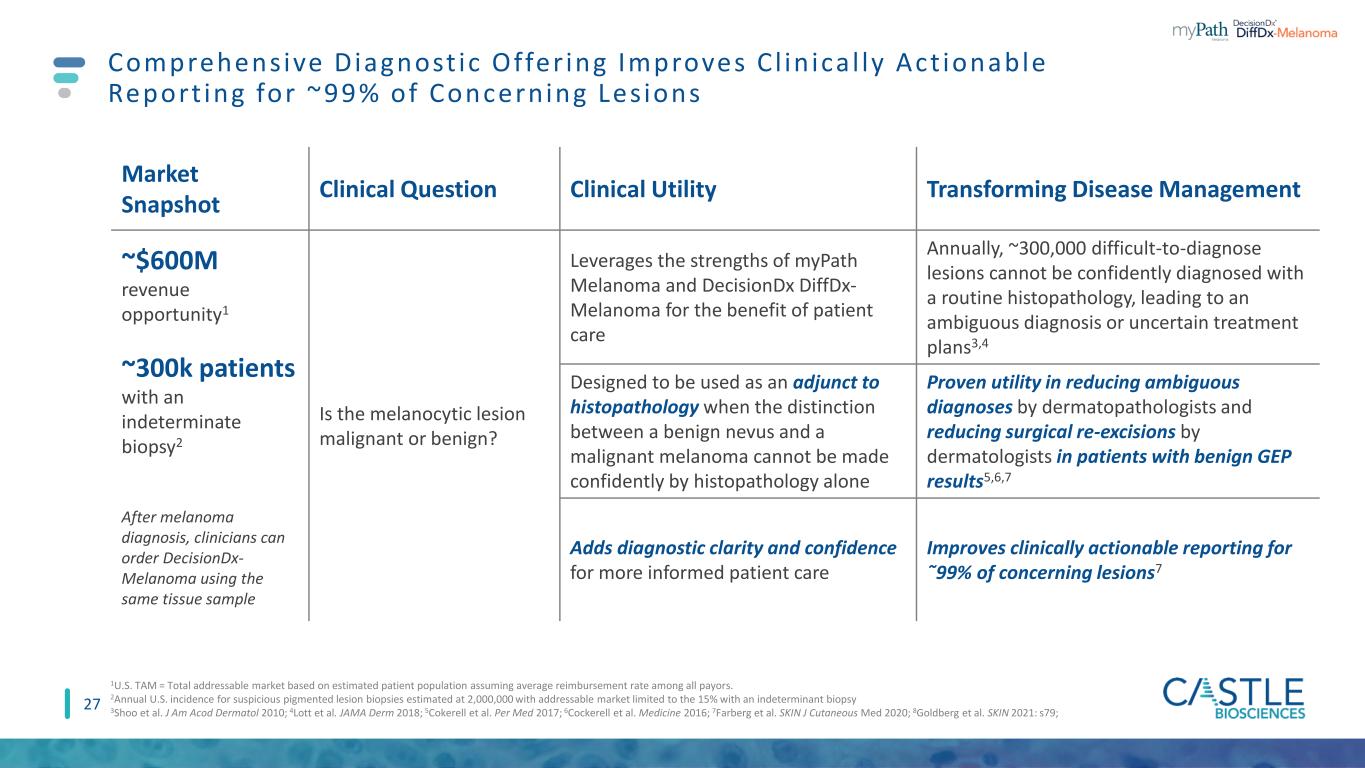

27 Comprehensive Diagnost ic Offer ing Improves C l in ica l ly Act ionable Report ing for ~99% of Concerning Les ions Market Snapshot Clinical Question Clinical Utility Transforming Disease Management ~$600M revenue opportunity1 ~300k patients with an indeterminate biopsy2 After melanoma diagnosis, clinicians can order DecisionDx- Melanoma using the same tissue sample Is the melanocytic lesion malignant or benign? Leverages the strengths of myPath Melanoma and DecisionDx DiffDx- Melanoma for the benefit of patient care Annually, ~300,000 difficult-to-diagnose lesions cannot be confidently diagnosed with a routine histopathology, leading to an ambiguous diagnosis or uncertain treatment plans3,4 Designed to be used as an adjunct to histopathology when the distinction between a benign nevus and a malignant melanoma cannot be made confidently by histopathology alone Proven utility in reducing ambiguous diagnoses by dermatopathologists and reducing surgical re-excisions by dermatologists in patients with benign GEP results5,6,7 Adds diagnostic clarity and confidence for more informed patient care Improves clinically actionable reporting for ῀99% of concerning lesions7 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2Annual U.S. incidence for suspicious pigmented lesion biopsies estimated at 2,000,000 with addressable market limited to the 15% with an indeterminant biopsy 3Shoo et al. J Am Acod Dermatol 2010; 4Lott et al. JAMA Derm 2018; 5Cokerell et al. Per Med 2017; 6Cockerell et al. Medicine 2016; 7Farberg et al. SKIN J Cutaneous Med 2020; 8Goldberg et al. SKIN 2021: s79;

D i a g n o s i n g M e l a n o m a , t h e C l i n i c a l I s s u e : U n c e r t a i n t y C r e a t e s A n O v e r - O r U n d e r - Tr e a t m e n t D i l e m m a Definitive melanoma diagnoses (invasive or in situ) Definitive benign diagnoses SLNB Imaging Increased Follow-up No additional treatment Routine follow-up Clinically evaluated suspicious pigmented lesions Wide Local Excision ~2 million melanocytic skin biopsies Uncertain malignant potential Primary treatment Staging, surveillance, and follow-up options Histopathologic evaluation 28

Inf lammatory Pipel ine Test 29

Targeting the Unmet Need In Moderate To Severe Psorias is And Atopic Dermatit is Common s k in d i s e as es wi th s ig n i f i cant pat ie nt impacts and costs to he a l th care syste m Treatments are significantly different for PSO and AD and can be costly (e.g., Humira for PSO ~$68k/year; Dupixent for AD is ~$38k/year) Systemic therapy guidance tools have the potential to streamline therapeutic interventions for patients and avoid ineffective, expensive medication courses Psoriasis (PSO) and Atopic Dermatitis (AD) are among the most frequently seen skin rashes 30 Cutaneous T Cell Lymphoma (CTCL) can mimic clinical presentation of AD and PSO ~20-30% of patients with PSO will go on to develop psoriatic arthritis, which can produce irreversible joint damage and significant patient morbidity Inflammatory Pipeline Test

31 Cast le’s Inf lammatory Sk in Disease Pipel ine Test I s Being Developed To Predict Systemic Therapy Response 50 Committed Sites Program Milestones Q32021 Steering committee formed with top KOLs 2025 Target launch 50 Total Target Sites Target Enrolled Patients As of 2/17/22 First patient enrolled Proof of RNA extraction method concept Q22022Q2-Q32021 5 Enrolled Patients Inflammatory Pipeline Test Target Patient Enrollm nt 4,800

G a st ro i nte st i n a l

33 TissueCypher : Designed to Predict Future Development Of Esophageal Cancer In Pat ients With Barrett ’s Esophagus Market Snapshot Clinical Decision Point Clinical Utility Transforming Disease Management ῀$1B revenue opportunity1 ~384k patients receiving upper GI endoscopies/year w/ confirmed Dx of BE2 Which BE patients will progress to HGD or esophageal cancer? Provides a 5-year individual risk of progression to high-grade dysplasia or esophageal adenocarcinoma for patients with confirmed BE TissueCypher high risk score independently predicted an almost 8-fold increased risk of progression to esophageal cancer3 Identifies patients: 1) At risk for future progression and patients harboring prevalent HGD/cancer 2) At low risk of progression who may be able to avoid unnecessary treatment or surveillance Strongest predictor of progression to esophageal cancer (risk-stratification) TissueCypher hazard ratio of 7.7 compared to GI expert pathologist diagnosis of 3.9 (p<0.0001); pooled analysis4-8 Clinical use study demonstrates 55% change in patient management9 HGD = high-grade dysplasia; EAC = esophageal adenocarcinoma; BE = Barrett’s esophagus 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2384,000 upper GI endoscopies/year with confirmed dx of BE (ND, IND, LGD) x $2,513 = U.S. only TAM of ~$1 billion 3Iyer, P, et. al. Prediction of Progression in Barrett’s Esophagus Using a Tissue Systems Pathology Test: A Pooled Analysis of International Multicenter Studies. DDW 2021 Presentation (Manuscript Submitted) 4Critchley-Thorne, et. al. Cancer Epidemiol Biomarkers Prev. Jan 2016; 5Critchley-Thorne, et. al. Cancer Epidemiol Biomarkers Prev. Feb 2017 6Davison, et. al. Am J Gastroenterol. Feb 2020 7Frei, et. al. Clin Transl Gastroenterol. Oct 2020; 8Frei, et. al. Am J Gastroenterol. Apr 2021; 9Diehl, et.al. Endoscopy International Open, 2021, Mar; 9(3): E348-E355

The Standard of Care for Evaluating Metastatic Risk in Uveal Melanoma

Decis ionDx-UM: The Standard Of Care In The Management Of Newly Diagnosed Uveal Melanoma ~2,000 patients diagnosed in the U.S. annually ~97% of patients – no evidence of metastatic disease at the time of diagnosis ~30% will develop metastases within 5 years Low-risk: ~67% Low Intensity Management High-risk: ~33% High Intensity Management Strong Evidence Base • 21 peer-reviewed publications, 3,000+ patients Widespread adoption • More than 90% of U.S. ocular oncology institutions order • 1,618 reports issued in 2021 Broad Reimbursement • In 2021, received payment on ~93% of claims • Medicare LCD covers patients with a confirmed diagnosis and no evidence of metastatic disease • 2022 Medicare rate of $7,776 AJCC and NCCN Guideline Inclusion Uveal Melanoma – A Rare Eye Cancer 15-Gene Expression Profile (GEP) Test 35 Facts About Uveal Melanoma

35.7% 64.3% FEMALE MALE Commitment To Diversity 36 A ll Em p lo ye es Ex ec u ti ve s E T H N I C I T Y/ R A C E G E N D E R Data as of 12/31/21, Executive= Executive Director or Regional Business Director level and above 64.6% 35.4% FEMALE MALE TOTAL EMPLOYEES = 345 75% 21.4% 3.6% CAUCASIAN OTHER (NOT HISPANIC OR LATINO) HISPANIC OR LATINO 64.3% 7.2% 4.6% 3.5% 20.4% CAUCASIAN HISPANIC OR LATINO ASIAN BLACK OR AFRICAN- AMERICAN TWO OR MORE RACES (NOT HISPANIC OR LATINO)

Committed to cu lt ivat ing a cu lture of innovat ion, cont inuous growth and advancement Award-Winning Company 37 2019 Technology Innovation in Melanoma Award Winner

CUTANEOUS MELANOMA1,2 SQUAMOUS CELL CARCINOMA UVEAL MELANOMA3 BARRETT’S ESOPHAGUS4 PROGNOSTIC DIAGNOSTIC PROGNOSTIC PROGNOSTIC PROGNOSTIC Predicting Individual Risk of Recurrence or Metastasis in Stage I, II, and III Melanoma Highly Accurate and Objective Tests Characterizing Difficult–to-Diagnose Melanocytic Lesions Better Identifies Risk of Metastasis in Patients with One or More Risk Factors The Standard of Care for Evaluating Metastatic Risk in Uveal Melanoma Predicting Individual Risk of Progression to Esophageal Cancer in Barrett’s Esophagus Cast le B iosciences I s Improving Health Through Innovative Tests That Guide Pat ient Care 4 38 38 12022 CMS rate: DecisionDx-Melanoma, $7,193; 22022 CMS rate: myPath-Melanoma, $1,950 32022 CMS rate: DecisionDx-UM, $7,776; 42022 CMS rate: TissueCypher BE, $2,513 https://www.cms.gov/medicaremedicare-fee-service-paymentclinicallabfeeschedclinical-laboratory-fee-schedule-files/22clabq1

THANK YOU

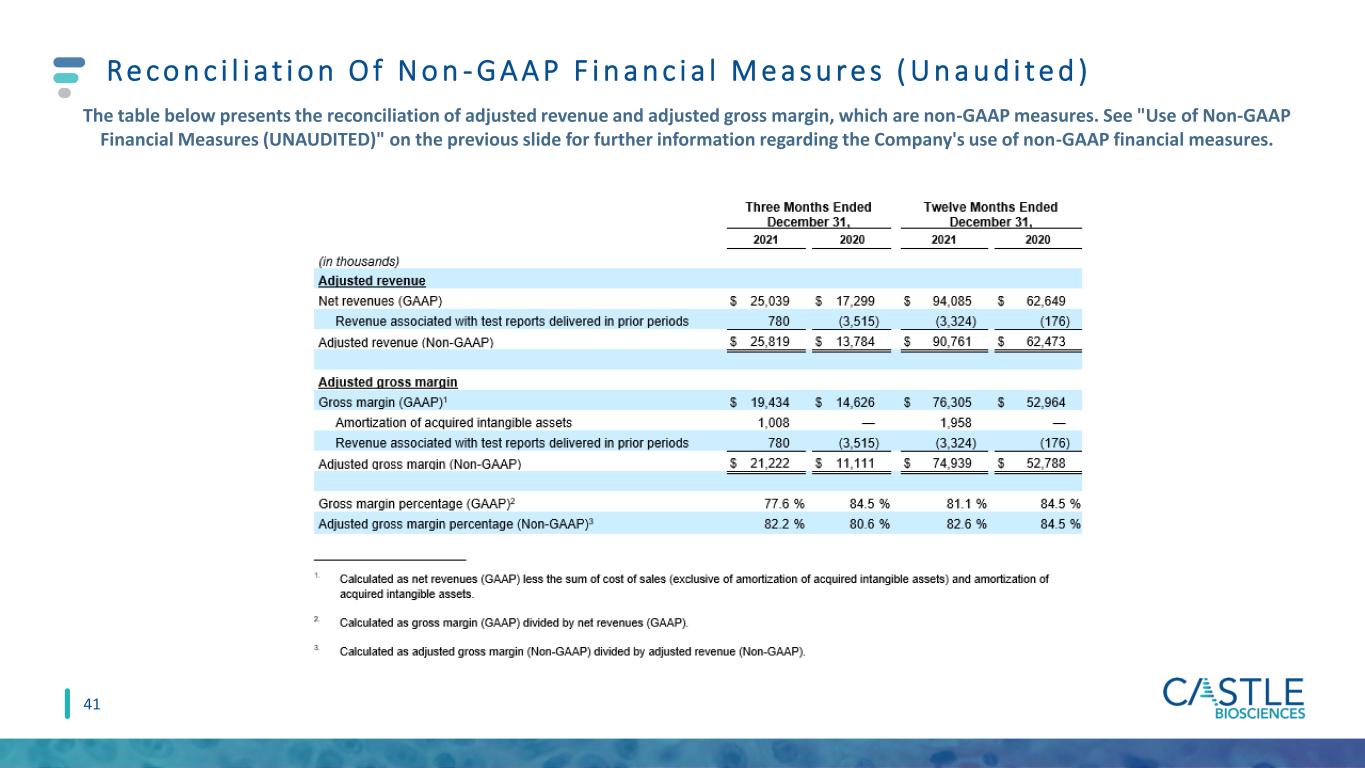

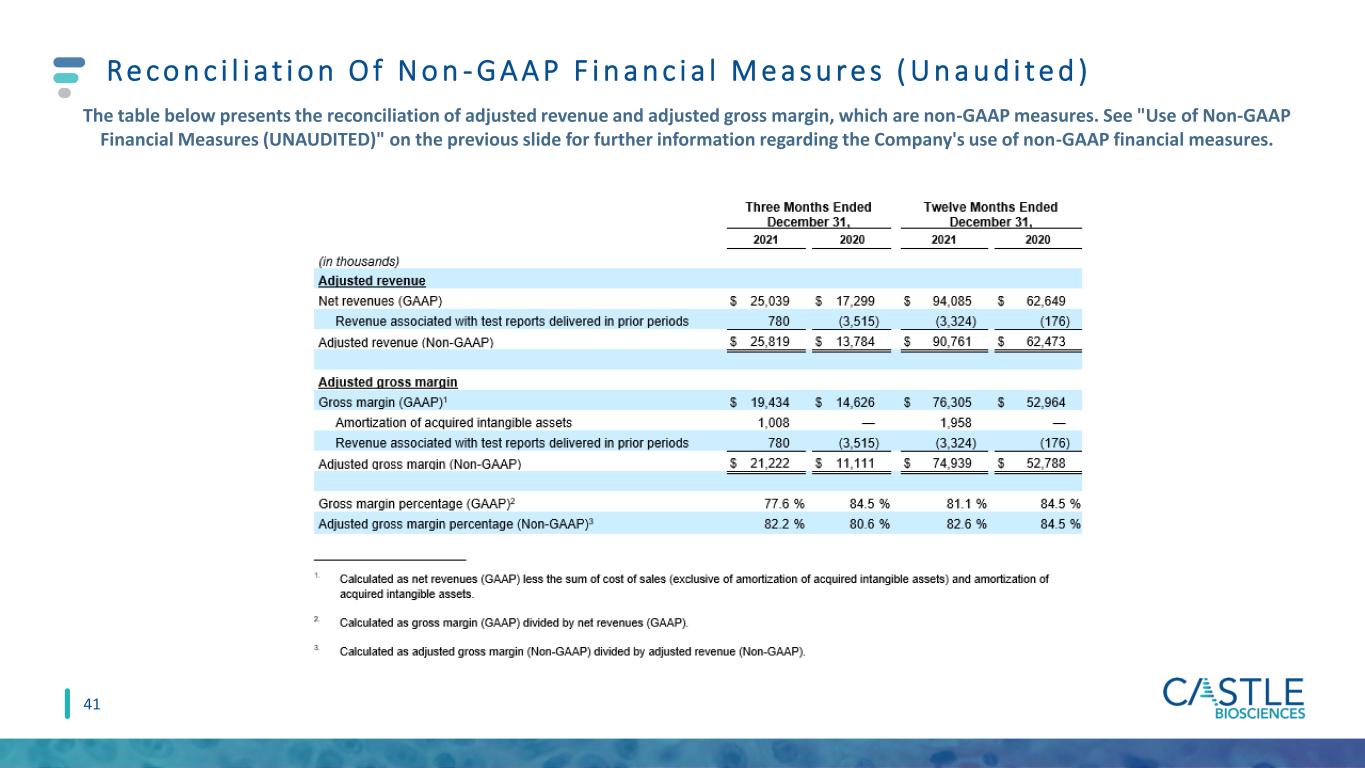

U s e O f N o n - G A A P F i n a n c i a l M e a s u re s ( U n a u d i t e d ) 40 In this presentation, we use the metrics of Adjusted Revenue, Adjusted Gross Margin and Adjusted Operating Cash Flow, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenue and Adjusted Gross Margin reflect adjustments to net revenues to exclude changes in variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted Operating Cash Flow excludes the effects of repayments to Medicare of COVID-19 government relief advancements to healthcare providers. We use Adjusted Revenue, Adjusted Gross Margin and Adjusted Operating Cash Flow internally because we believe these metrics provide useful supplemental information in assessing our revenue and cash flow performance, respectively. We believe Adjusted Revenue and Adjusted Gross Margin are also useful to investors because they provide additional information on current-period performance by removing the effects of revenue adjustments related to tests delivered in previous periods and acquisition-related intangible asset amortization, which we believe may facilitate revenue and gross margin comparisons to historical periods. We believe Adjusted Operating Cash Flow is also useful to investors as a supplement to GAAP measures in the assessment of our cash flow performance by removing the effects of COVID-19 government relief payments, which we believe are not indicative of our ongoing operations. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes. These non-GAAP financial measures are not meant to be substitutes for net revenues, gross margin or net cash (used in) provided by operating activities reported in accordance with GAAP and should be considered in conjunction with our financial information presented on GAAP basis. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the slides that follow.

Re c o n c i l i a t i o n O f N o n - G A A P F i n a n c i a l M e a s u r e s ( U n a u d i t e d ) The table below presents the reconciliation of adjusted revenue and adjusted gross margin, which are non-GAAP measures. See "Use of Non-GAAP Financial Measures (UNAUDITED)" on the previous slide for further information regarding the Company's use of non-GAAP financial measures. 41

Re c o n c i l i a t i o n O f N o n - G A A P F i n a n c i a l M e a s u r e s ( U n a u d i t e d ) The table below presents the reconciliation of adjusted operating cash flow, which is a non-GAAP measure. See "Use of Non-GAAP Financial Measures (UNAUDITED)" on the previous slide for further information regarding the Company's use of non-GAAP financial measures. 42

APPENDIX

Stuart Pharmaceuticals Robert Cook, PhD Senior Vice President, Research & Development L e a d e r s h i p Te a m O v e r v i e w M A N A G E M E N T T E A M Derek Maetzold Founder, Director, President and CEO Frank Stokes Chief Financial Officer Toby Juvenal Chief Commercial Officer Kristen Oelschlager, RN, CHC Chief Operating Officer Dan Bradbury Derek Maetzold Mara Aspinall Brad Cole Miles D. Harrison 44 Matthew Goldberg, MD Medical Director Tiffany Olson Kimberlee Caple Ellen Goldberg B O A R D O F D I R E C T O R S

Recent Achievements And Expected Future Milestones Oct. 2020: LCD expansion finalized for DecisionDx-Melanoma, effective date 12/6/20 2Q2022: Potential draft LCD for DecisionDx-SCC and DecisionDx DiffDx-Melanoma 2020 2021 2019 2022 2H2020: Initiation of work on additional dermatology pipeline products 4Q2020: Launch of DiffDx-Melanoma 2023: Potential effective LCD for DecisionDx-SCC and DecisionDx DiffDx- Melanoma 3Q2020: Dermatologic commercial team expansion 3Q2020: Launch of DecisionDx-SCC July 2019: IPO Dec 2019: Expanded outside sales territories to 32 = Achieved Feb. 2019: Expanded outside sales territories to 23 Aug. 2019: Expanded draft LCD for DecisionDx- Melanoma posted 45 1H2021: Dermatologic commercial team expansion to mid-60s 2018 Dec. 2018: Initial LCD effective for DecisionDx-Melanoma 2021+: Continued evidence development for all commercialized products 2021+: Continued development of dermatologic pipeline products; potential launches in 2025 2021: Acquired myPath® Melanoma Dec. 2021: Acquired Cernostics 2023 Jan. 2022: GI commercial team trained and in the field