A u g u s t 8 , 2 0 2 2 Tra n s fo r m i n g D i s e a s e M a n a g e m e nt

D i s c l a i m e rs F O R W A R D - L O O K I N G S T A T E M E N T S This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning: estimated sizes of the total addressable markets of our current and future commercial and pipeline products within our dermatologic, GI and mental health franchises; our expectations with respect to future financial or operations performance, including revenue opportunities for our tests; the impact, accuracy and effectiveness of our commercial and pipeline tests on physicians, patients and their treatment plans, including the potential impact of DecisionDx-Melanoma on survival rates, and their individual or collective impact on our prospects and plans, including any objectives of management related thereto; the ability of our tests to provide valuable, clinically actionable risk stratification information to clinicians and patients, improve health and guide patient care; expected expansion of outside sales territories and laboratory facilities; our progress roadmaps for our tests; expected launch dates for tests in our pipeline expansion and estimates regarding their total addressable markets or future success; expectations regarding LCD effective timeframes and reimbursement capabilities; our ability to utilize existing relationships and build a suite of complementary tests in a single call point; increases in headcount in furtherance of our pipeline tests, clinical research and development and other expected drivers of growth, as well as efficiencies and synergies from capital expenditures related to expansion of laboratory facilities contributing to our growth; our ability to develop clinical evidence and publish peer-reviewed reports and studies that increase adoption among providers and commercial payors; estimated healthcare cost savings provided by our tests; the ability of our risk stratification tests to classify risk of metastasis in ways that better support risk-appropriate treatment than reliance on traditional clinicopathologic risk factors alone; program milestones for our pipeline test designed to predict systemic therapy response and the potential of systemic therapy guidance tools to streamline therapeutic interventions for patients and avoid ineffective, expensive medication courses; integration timelines, expected future revenue contributions, potential cost savings, growth expectations and strategic opportunities for our TissueCypher test and GI franchise, and our IDgenetix test and our mental health franchise; and our ability to integrate our recent acquisitions into our existing business and the ability of such acquisitions to complement our existing business. The words “anticipates,” “believes,” “can,” “could,” “estimates,” “expects,” “may,” “plans,” “potential,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation, the effects of the COVID-19 pandemic on our business and our efforts to address its impact on our business, subsequent study or trial results and findings may contradict earlier study or trial results and findings, including with respect to the diagnostic and prognostic tests discussed in this presentation, actual application of our tests may not provide the aforementioned benefits to patients, and the risks set forth under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended June 30, 2022, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law. 2

3 MISSION: VISION: VALUES: Improving health through innovative tests that guide patient care To transform disease management by keeping people first: patients, clinicians, employees and investors ExCIITE: Excitement, Collaboration, Integrity, Innovation, Trust and Excellence

4 Castle Remains Focused on Transforming Disease Management S t rate g ic pr inc ip le s t hat c re ate va lue for custome rs , pat ie nt s and s tockholde rs Address areas with unmet clinical need Leverage advanced technologies to develop innovative tests Accelerate test adoption through proven commercial excellence Provide robust data to support the clinical value of our tests

4 55 Screening Diagnostic Support Risk Stratification Therapy Response MRD/Recurrence Monitoring Answering Cl inical Questions to Guide Care Along the Patient Journey Our focus i s on d iagnost ic , r i s k s t rat i f i cat ion and t he rapy re s pons e are as o f t he pat ie nt care cont inuum Inflammatory Therapy Response Pipeline Test Patient Care Continuum D erm ato lo gy U veal M e lan o m a G astro - in testin al M e n tal H ealth

Financial Performance Summary Q2 2022 2Q21 2Q22 Total test reports 7,007 11,034 Total Derm test reports 6,539 9,424 Revenue $22.8M $34.8M Adj. Revenue1 $22.9M $34.3M Gross Margin 82.6% 71.9% Adj. Gross Margin1 83.9% 77.6% Operating Cash Flow $(6.4)M $(9.0)M Adj. Operating Cash Flow1 $(4.3)M $(9.0)M Cash & Cash Equivalents $368M as of 06/30/2021 $273M as of 06/30/2022 1See Non-GAAP reconciliations at the end of this presentation. 6

Q2 2022 Operating Expenses 7 Operating Expense by Quarter1 1Amounts in millions. Operating expenses rounded and summarized as presented E xe cute d p lanne d inve st me nts to s upport our grow t h in i t iat ive s for long- te rm va lue cre at ion Key Drivers for Q2 2022 OpEx • Cost of Sales – Higher personnel costs due to headcount additions, particularly in our laboratories related to recent acquisitions. Higher laboratory activity also increased costs of supplies and services, which is attributable to higher test volumes. • R&D - Higher personnel costs associated with our increased headcount to manage and run our clinical studies, which include expenses related to salaries, bonuses, benefits and stock-based compensation as well as activity-driven cost increases. • SG&A - Higher personnel costs associated with headcount expansion in our dermatology, GI and mental health commercial teams, which include expenses related to salaries, bonuses, benefits and stock-based compensation. • Amortization of Acquired Intangible Assets - Related to MyPath Melanoma, TissueCypher and IDgenetix tests. • Change in Fair Value of Contingent Consideration - Related to remeasurement of earnout payments.

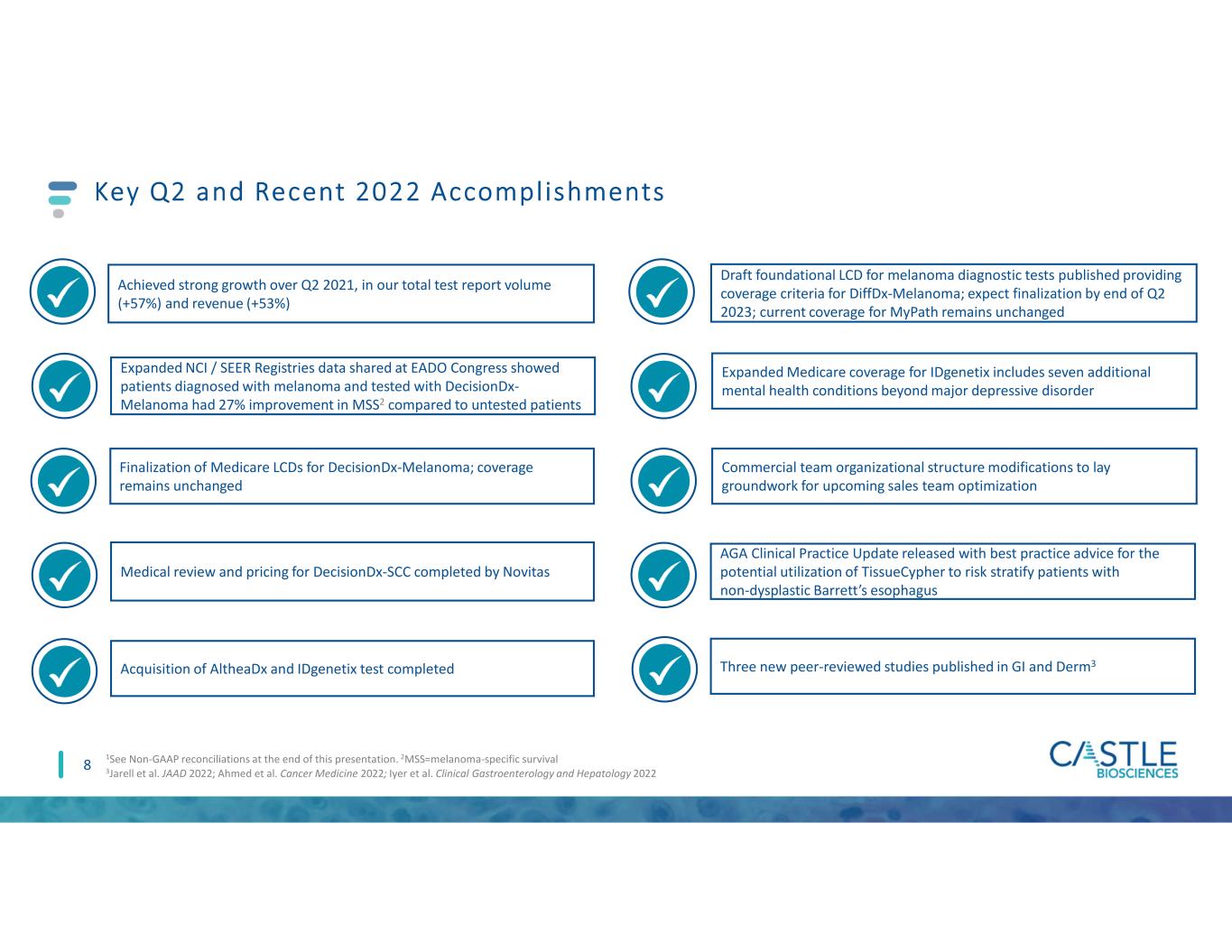

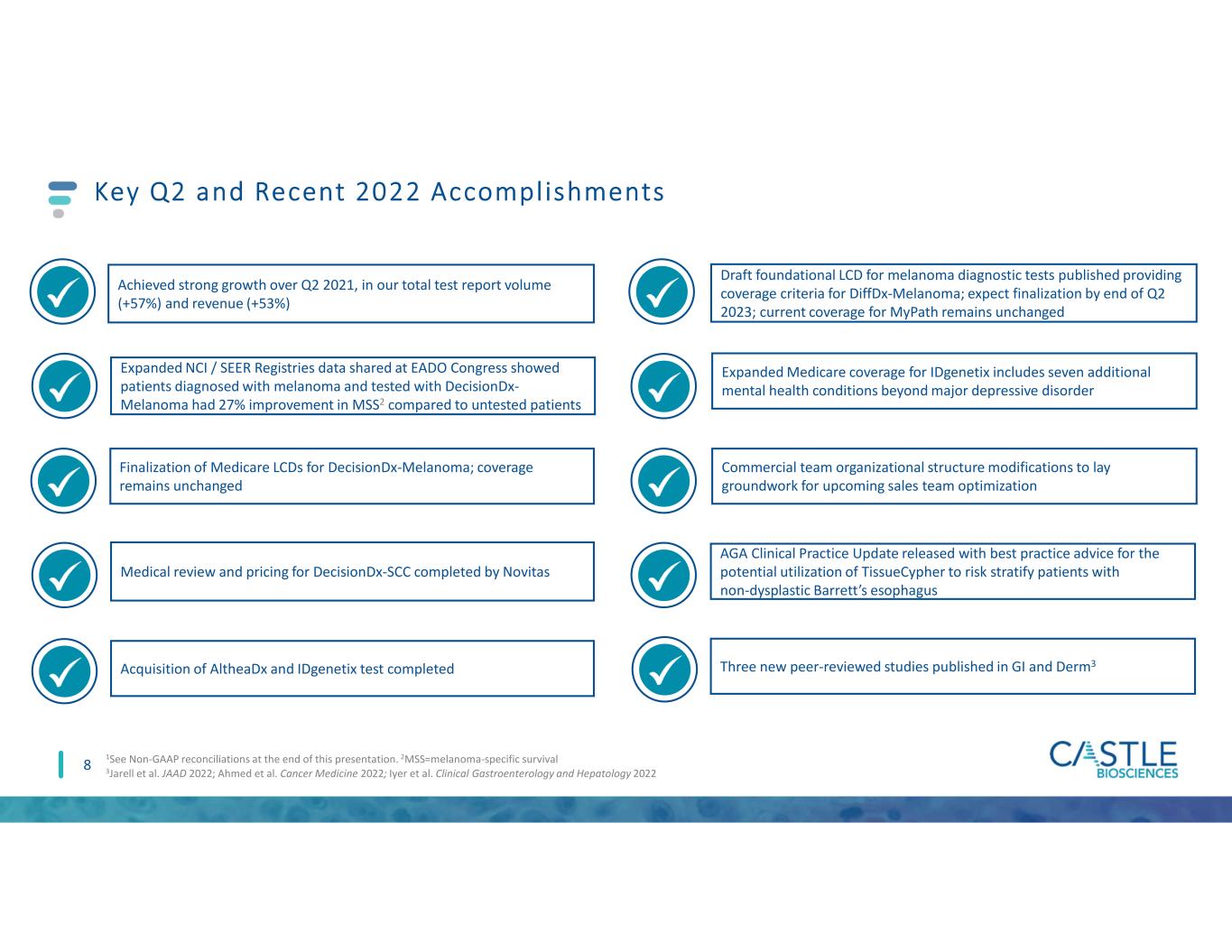

Draft foundational LCD for melanoma diagnostic tests published providing coverage criteria for DiffDx-Melanoma; expect finalization by end of Q2 2023; current coverage for MyPath remains unchanged Expanded NCI / SEER Registries data shared at EADO Congress showed patients diagnosed with melanoma and tested with DecisionDx- Melanoma had 27% improvement in MSS2 compared to untested patients 8 Key Q2 and Recent 2022 Accomplishments 1See Non-GAAP reconciliations at the end of this presentation. 2MSS=melanoma-specific survival 3Jarell et al. JAAD 2022; Ahmed et al. Cancer Medicine 2022; Iyer et al. Clinical Gastroenterology and Hepatology 2022 Achieved strong growth over Q2 2021, in our total test report volume (+57%) and revenue (+53%) Acquisition of AltheaDx and IDgenetix test completed Expanded Medicare coverage for IDgenetix includes seven additional mental health conditions beyond major depressive disorder Finalization of Medicare LCDs for DecisionDx-Melanoma; coverage remains unchanged Commercial team organizational structure modifications to lay groundwork for upcoming sales team optimization AGA Clinical Practice Update released with best practice advice for the potential utilization of TissueCypher to risk stratify patients with non-dysplastic Barrett’s esophagus Three new peer-reviewed studies published in GI and Derm3 Medical review and pricing for DecisionDx-SCC completed by Novitas

Barrett’s esophagus/ risk of progression to esophageal cancer Patients receiving upper GI endoscopies/year who meet the intended use criteria for TissueCypher3 ῀$1B ~384K Our Commercial ly Avai lable Tests Now Serve an Est imated ~$8B U.S. Total Addressable Market1 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2 Annual U.S. incidence for Stage I, II or III melanoma estimated at 130,000; annual U.S. incidence for squamous cell carcinoma estimated at 1,000,000 with addressable market limited to carcinomas with one or more high risk features; annual U.S. incidence for suspicious pigmented lesion biopsies estimated at 2,000,000 with addressable market limited to the 15% with an indeterminant biopsy. 3384,000 upper GI endoscopies/year with confirmed dx of BE (ND, IND, LGD) x $2,513 = U.S. only TAM of ~$1 billion 9 Cutaneous melanoma/ risk of metastasis Cutaneous squamous cell carcinoma/ risk of metastasis Suspicious pigmented lesions/melanoma status ~130K ~200K ~300K ~$540M ~$820M ~$600M Patients classified as Stage I, II or III2 Patients w/ high-risk features2 Patients w/ indeterminant biopsy2 Gastroenterology Mental health therapy response Based on indicated use of IDgenetix for patients diagnosed with depression, anxiety and other mental health conditions ῀$5B Mental HealthDermatology Tests in pipeline add an additional estimated ~$3.6B to our U.S. TAM ($1.9B for inflammatory skin disease pipeline test and ~1.7B for additional dermatology pipeline tests)

Driving Long-Term Growth through our Foundational Strategy: Strong Core Derm Business, Pipeline Init iat ives and Strategic Opportunit ies 10 Near-to Mid-term Growth Mid-to Long-term Growth (Expected launches ~2025) 2022-2024 2024 and beyond Gastrointestinal Strategic Opps Mental Health Gastrointestinal Dermatology Gastrointestinal Mental Health Strategic Opportunities Dermatology Gastrointestinal Mental Health Pipeline Expansion Strategic Opportunities Dermatology Gastrointestinal

Operational Growth Pi l lars 11 Cons i s te nt exe cut ion f ur t he rs our le ad ing pos i t ion in de rmato logy and in t he Dx s pace Strong Core Derm Business Pipeline Initiatives Strategic Opportunities • Continuing provider education • Optimizing commercial team • Evolving our go-to-market strategy • Data that drives value: NCI/SEER collaboration • Ability to answer clinical questions/impact patient care • Utilizing our areas of expertise (genomics, spatialomics, AI) to develop innovative tests • Focusing on complementary/ adjacent disease states • Significant opportunities where early reimbursement wins have been achieved and we can utilize our commercial success • Potential to create a suite of tests in a single call point + +

12 Accelerating Investments in Cl inical Development Ongoing s t ud ie s to ge ne rate data t hat s upport s t he c l in ica l va lue of our te sts and prov ide r and paye r adopt ion 100 Committed sites ~2,455 Patients enrolled 3 Ongoing studies1 147 ~3,500 5 Committed sites Patients enrolled Ongoing studies 25 ~3,400 3 Committed sites Patients enrolled Ongoing studies 12 ~690 3 Committed sites Subjects2 enrolled Ongoing studies Data as of July 7, 2022 1Decrease from Q1 2022 in ongoing studies reflects closing of PERSONALize study. 2Subjects includes patients and physicians. 3SEER cancer registries linked CM cases diagnosed from 2013-2018 to data for patients with stage I-III CM tested with the 31-GEP (n=5,226) as of April 21, 2022. 3 ~40 1 Committed sites Patients enrolled Ongoing study Ongoing collaboration with NCI/SEER has allowed for studies with 5,200+ patients clinically tested with DecisionDx-Melanoma to date3

Our Core Derm Bus iness i s S t rong

Strong Core Derm Business Pi l lar of Growth 14 Continuing provider education Optimizing commercial team Enhancing digital presence NCI/SEER collaboration Robust conference attendance, data presentations/posters, peer-reviewed publications and peer-to-peer programs Additional dedicated commerical sales representatives for Castle’s Diagnostic GEP offering, MyPath and DiffDx- Melanoma, planned for mid- Q3 2022 Investments to drive volume, improve customer engagement and expand market segments Expanded NCI/SEER study shows patients diagnosed with melanoma and tested with DecisionDx-Melanoma (n=3,261) had a 27% improvement in melanoma-specific survival compared to untested patients

15 First-to-Market Dermatologic Franchise, Additional Growth Opportunit ies Diagnostic Support Risk Stratification Therapy Response1 1Target launch anticipated by the end of 2025 2New and unique ordering clinicians for all dermatologic tests combined between June 30, 2021-June 30, 2022 . Inflammatory Skin Disease Therapy Response Pipeline Strong provider growth and continued adoption with ~2,280 new ordering clinicians and ~6,960 unique ordering clinicians for our dermatologic tests over the last 12 months2

16 DecisionDx-Melanoma: Precision Risk Strati f ication Based on an Individual Patient ’s Tumor Biology Informs Treatment Plans Market Snapshot Clinical Questions (post-melanoma diagnosis) Clinical Utility Transforming Disease Management ~$540M revenue opportunity1 ~130k patients classified as Stage I, II or III2 Is the risk of SLN-positivity high enough to warrant referral for the SLNB surgery? Accurately identifies those at low and high risk for a positive SLN3 DecisionDx-Melanoma could result in 74% fewer SLNB surgeries4, potentially saving the U.S. healthcare system $250M5,6 due to more precise risk stratification3 What is the individual risk of recurrence? Provides personalized risk of recurrence to give guidance for patient follow-up and treatment intensity decisions Only melanoma prognostic test shown to be associated with improved survival; patients diagnosed with cutaneous melanoma and tested with DecisionDx-Melanoma had a 27% improvement in melanoma-specific survival compared to untested patients7 In clinical utility studies, 45% of patients were re-stratified and ~50% of clinicians changed patient management based on DecisionDx- Melanoma results8 SLN = sentinel lymph node; SLNB = sentinel lymph node biopsy. Source: NCCN Guidelines for Cutaneous Melanoma v3.2020 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2 Annual U.S. incidence for Stage I, II or III melanoma estimated at 130,000. 3Whitman et al. JCO Precision Oncology 2021; 4For patients with melanomas of less than or equal to 2.0 mm thick; 5Vetto et al. Future Oncol 2019. 6Clearview health economic model, data on file 7Kurley et al. Presented at EADO, April 21-23, 2022; 8Berger et al. CMRO 2016; Dillon et al. Skin J Cutan Med; Farberg et al. J Drugs Derm 2017; Schuitevoerder et al. J Drugs Derm 2018; Dillon et al. CMRO 2022

17 Current Melanoma Staging Misses Patients with Aggressive Tumor Biology 80% 12% 8% Stage at Diagnosis Stage II Stage III Stage I Excludes Stage IV 26% 34% 40% Melanoma Deaths by Stage at Diagnosis Stage II Stage III Stage I Excludes Stage IV 92% Stage I or II 60% Stage I or II The majority of melanoma deaths occur in patients who were diagnosed at Stage I or II 1AJCC v7 J Clin Oncol 2009; 2SEER data release 2017; 3Morton et al. N Engl J Med 2014; 4Whiteman et al. J Invest Dermatol 2015; 5Shaikh et al. J Natl Cancer Inst 2016; 6Poklepovic and Carvajal. ONCOLOGY 2018; 7Ibrahim et al. Ann Surg Oncol 2020

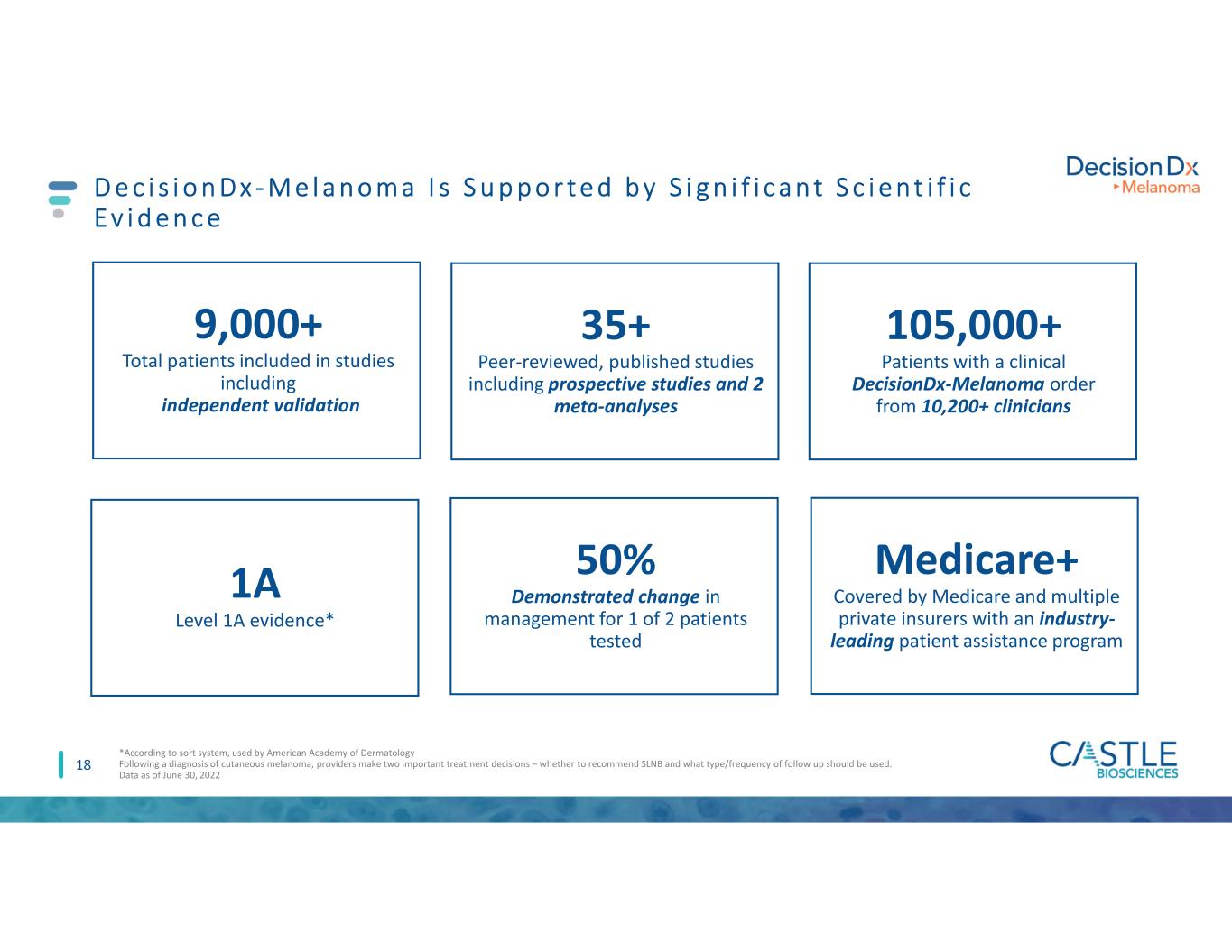

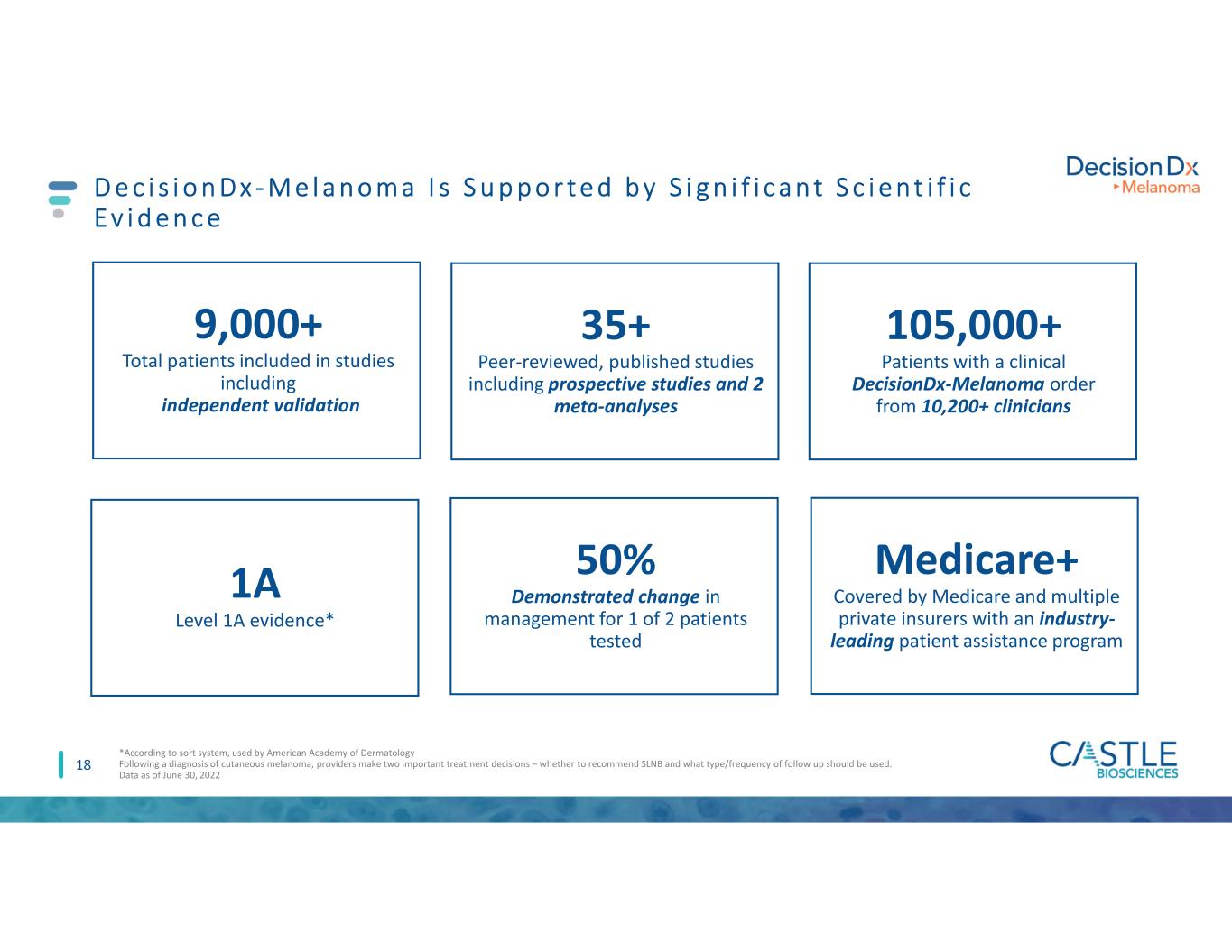

1A Level 1A evidence* D e c i s i o n D x - M e l a n o m a I s S u p p o r t e d b y S i g n i f i c a n t S c i e n t i f i c E v i d e n c e 18 9,000+ Total patients included in studies including independent validation 105,000+ Patients with a clinical DecisionDx-Melanoma order from 10,200+ clinicians 35+ Peer-reviewed, published studies including prospective studies and 2 meta-analyses Medicare+ Covered by Medicare and multiple private insurers with an industry- leading patient assistance program 50% Demonstrated change in management for 1 of 2 patients tested *According to sort system, used by American Academy of Dermatology Following a diagnosis of cutaneous melanoma, providers make two important treatment decisions – whether to recommend SLNB and what type/frequency of follow up should be used. Data as of June 30, 2022

NCI/SEER Data L inked with DecisionDx-Melanoma Test Results Data ana lys i s o f a cohort o f re a l -wor ld , uns e le cted , pros pe ct ive ly te ste d pat ie nt s w i t h cutane ous me lanoma 19 Data provide direct evidence that patients tested with DecisionDx-Melanoma can have better survival rates than untested patients Suggests that testing can aid in risk-aligned treatment plans for improved patient outcomes and survival rates 3-year MSS (95% CI) Deaths, % (n/N) 31-GEP Tested 97.7% (97.0-98.4%) 1.6% (58/3621) Matched Untested 96.6% (96.2-97.1%) 2.2% (238/10863) Hazard ratio‡ 0.73 (0.54-0.97) P=0.03 27% Benefit in MSS in patients that were tested at 3 years over those that were not tested 21% Benefit in OS in patients that were tested at 3 years over those that were not tested 3-year OS (95% CI) Deaths, % (n/N) 31-GEP Tested 93.1% (92.0-94.2%) 4.8% (174/3621) Matched Untested 91.2% (90.4-91.9%) 6.1% (658/10863) Hazard ratio‡ 0.79 (0.67-0.93) P=0.006 ‡Hazard ra�o (HR) was computed using the untested pa�ents as reference for 31-GEP tested cohort. An HR less than 1.0 demonstrates improved survival in 31-GEP tested patients. Diagnosis date 2016 and onward Kurley et al. European Association of Dermato Oncology (EADO) conference in Seville, Spain; April 21-23, 2022

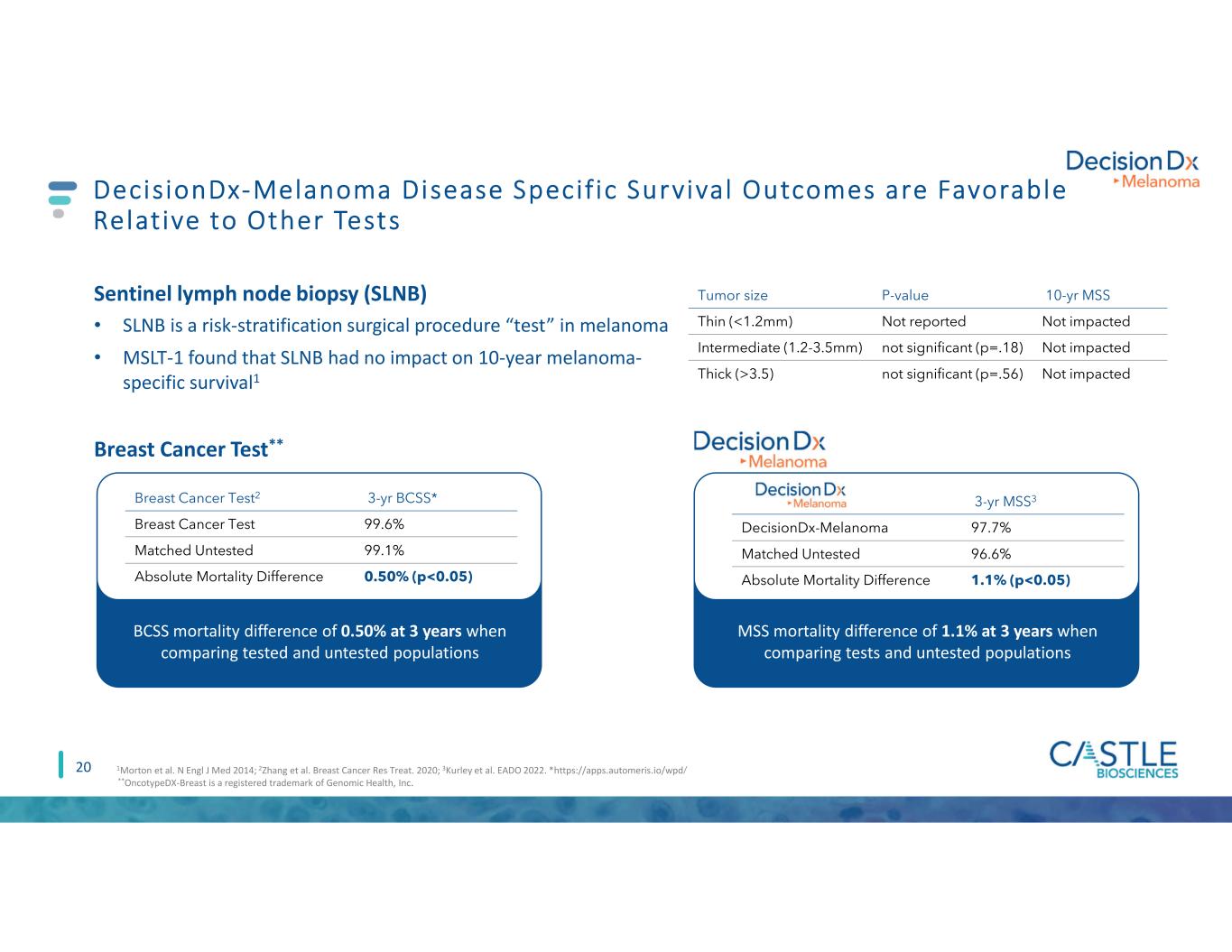

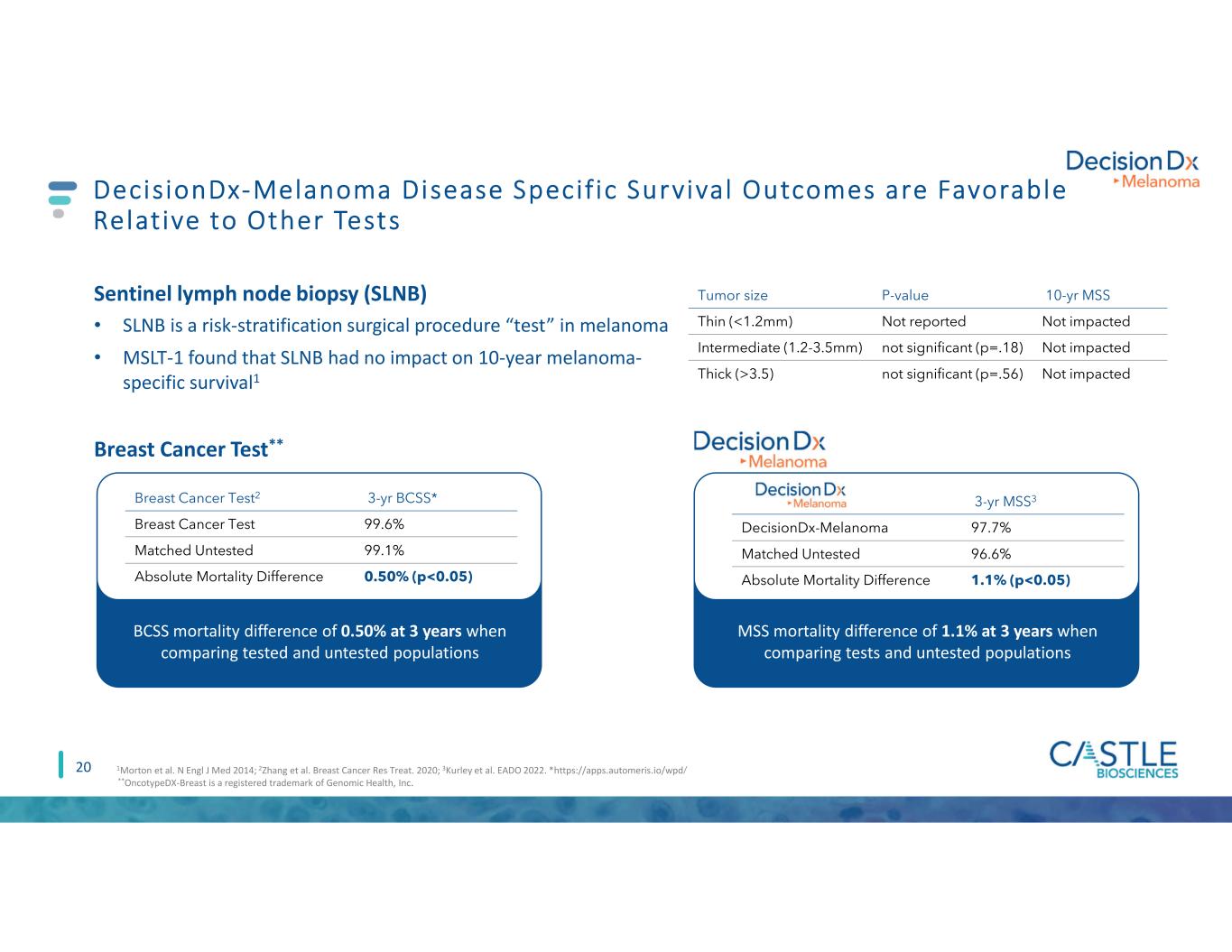

MSS mortality difference of 1.1% at 3 years when comparing tests and untested populations 20 DecisionDx-Melanoma Disease Specif ic Survival Outcomes are Favorable Relative to Other Tests Sentinel lymph node biopsy (SLNB) • SLNB is a risk-stratification surgical procedure “test” in melanoma • MSLT-1 found that SLNB had no impact on 10-year melanoma- specific survival1 Tumor size P-value 10-yr MSS Thin (<1.2mm) Not reported Not impacted Intermediate (1.2-3.5mm) not significant (p=.18) Not impacted Thick (>3.5) not significant (p=.56) Not impacted BCSS mortality difference of 0.50% at 3 years when comparing tested and untested populations Breast Cancer Test** Breast Cancer Test2 3-yr BCSS* Breast Cancer Test 99.6% Matched Untested 99.1% Absolute Mortality Difference 0.50% (p<0.05) **OncotypeDX-Breast is a registered trademark of Genomic Health, Inc. 1Morton et al. N Engl J Med 2014; 2Zhang et al. Breast Cancer Res Treat. 2020; 3Kurley et al. EADO 2022. *https://apps.automeris.io/wpd/ 3-yr MSS3 DecisionDx-Melanoma 97.7% Matched Untested 96.6% Absolute Mortality Difference 1.1% (p<0.05)

21 Patients with Melanoma Desire Testing with DecisionDx-Melanoma Ahmed et al. Cancer Medicine 2022; some values have been rounded Wanted prognostic information about their melanoma tumors at diagnosis 90% 92% Felt the testing was useful 77% Wanted testing to obtain all of the information they could about their melanoma NONE of the patients surveyed indicated decision regret over their decision to obtain DecisionDx-Melanoma testing, even patients who received a poor prognosis/high-risk (Class 2) DecisionDx-Melanoma test result

22 Market Snapshot Clinical Question (post-SCC diagnosis) Clinical Utility Transforming Disease Management ~$820M revenue opportunity1 ~200k patients with high-risk features2 Who is really at low risk or high risk for metastasis? Predicts metastatic risk for individual SCC patients with one or more risk factors Strongest independent predictor of SCC metastasis, compared to AJCC8 and BWH staging (Sensitivity of a DecisionDx-SCC Class 2A or 2B result (77.8%) was significantly higher (p<0.0001) than that of high-stage AJCC8 (38.1%) and BWH (30.2%))3 Incorporation of DecisionDx- SCC can improve management decisions within established guidelines 97% of clinicians would change patient management given DecisionDx-SCC results with 2 risk factors4 Proven significant and independent prognostic value for stratifying risk of metastasis in high-risk SCC patients Identifies nearly 80% of tumors traditionally staged as low risk (T1 tumors AJCC8 and/or BWH) that metastasized as biologically high risk5 SCC = squamous cell carcinoma; NCCN = National Comprehensive Cancer Network (NCCN); BWH = Brigham and Women's Hospital; AJCC8 = American Joint Committee on Cancer Eighth Edition 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2Annual U.S. incidence for squamous cell carcinoma estimated at 1,000,000 with addressable market limited to carcinomas with one or more high risk features. NCCN Guidelines for Squamous Cell Skin Cancer v1 2022 3Ibrahim et al., Future Oncology 2021; 4Goldberg et al., Presented at Winter Clinical Dermatology, January 14-19, 2022 5Farberg et al., Presented at American Academy of Dermatology Summer Meeting 2021; Ibrahim et al., Future Oncology 2021 DecisionDx-SCC: Del ivering Precis ion Pat ient C lassi f icat ion and Informing Squamous Cel l Carcinoma Management Decisions within Establ ished Guidel ines

D e c i s i o n D x - S C C C a n I n fo r m R i s k - A p p ro p r i a t e M a n a g e m e n t t o G u i d e P a t i e n t C a r e 23 1,010+ Validated across 2 independent studies spanning 1,018 patients1 2,100+ Clinicians have ordered DecisionDx-SCC Clinical development data as of July 7, 2022; other data as of June 30, 2022; 1Arron et al. Presented at ACMS 2022; Ibrahim et al. Future Oncology 2021; Teplitz et al. J Drugs Dermatol 2019; Litchman et al. CMRO 2020. 1 or more Validated to determine the biological risk of metastasis for SCC patients with 1 or more high risk factors 40 Quantifies expression of 40 genes from primary tumor using RT-PCR 10 Peer-reviewed publications to date ~3,500 Patients are currently enrolled in ongoing studies from 147 centers

24 C a s t l e ’s D i a g n o s t i c G E P O f f e r i n g C a n A i d i n t h e D i a g n o s i s a n d I n f o r m M a n a g e m e n t D e c i s i o n s f o r P a t i e n t s w i t h A m b i g u o u s M e l a n o c y t i c L e s i o n s Market Snapshot Clinical Question Clinical Utility Transforming Disease Management ~$600M revenue opportunity1 ~300k patients with an indeterminate biopsy2 After melanoma diagnosis, clinicians can order DecisionDx- Melanoma using the same tissue sample Is the melanocytic lesion malignant or benign? Designed to classify lesions objectively and accurately as benign, intermediate or malignant when the distinction cannot be made confidently by histopathology alone When the potential for malignancy cannot be excluded, the most appropriate treatment plan for a patient is unclear; clinicians typically recommend a treatment plan consistent with melanoma which may result in overtreatment of some patients4 Can adds diagnostic clarity and confidence for more informed patient care Proven utility in reducing ambiguous diagnoses (by ~43%)5 by dermatopathologists and reducing surgical re-excisions (by~77%) by dermatologists in patients with benign GEP results6 Guidelines support ancillary diagnostic testing in ambiguous melanocytic lesions, including NCCN, the American Academy of Dermatology and the American Society of Dermatopathology3 By leveraging a second GEP test, more than 99% of patients tested will receive a clinically actionable result7 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2Annual U.S. incidence for suspicious pigmented lesion biopsies estimated at 2,000,000 with addressable market limited to the 15% with an indeterminant biopsy 3NCCN Guidelines Version 2.2022 Melanoma: Cutaneous; Fung et al. J Cutan Pathol. E-pub 18 Sept. 2021; 1-15. 4Ensslin et al. Dermatol Surg 2018.; 5Cockerell et al. Medicine 2016; 6Farberg et al. SKIN J Cutaneous Med 2020; 7Goldberg et al. J Dermatol Physician Assist 2022

12 Peer-reviewed publications, including prospective studies C a s t l e ’s D i a g n o s t i c G E P Te s t s P r o v i d e O b j e c t i v e a n d A c c u ra t e I n fo r m a t i o n fo r M o r e I n fo r m e d P a t i e n t C a r e 25 41,000+ Lesions clinically tested 8+ Years of clinical testing experience 2 Independently validated GEP tests to aid in diagnosis and guide patient management 3 GEP testing is supported by 3 national guidelines to aid in diagnosing ambiguous lesions Data as of June 30, 2022 Medicare+ Covered by Medicare and multiple private insurers with an industry- leading patient assistance program

D i a g n o s i n g M e l a n o m a , t h e C l i n i c a l I s s u e : U n c e r t a i n t y C r e a t e s a n O v e r - o r U n d e r - Tr e a t m e n t D i l e m m a Definitive melanoma diagnoses (invasive or in situ) Definitive benign diagnoses SLNB Imaging Increased Follow-up No additional treatment Routine follow-up Clinically evaluated suspicious pigmented lesions Wide Local Excision ~2 million melanocytic skin biopsies Uncertain malignant potential Primary treatment Staging, surveillance, and follow-up options Histopathologic evaluation 26

Strategic Opportunit ies

C e r n o s t i c s A c q u i s i t i o n A l i g n s w i t h O u r S t ra t e g i c O p p o r t u n i t i e s G o a l s 28 Integrat ion expected to be a meaningful revenue contr ibutor in 2024 Our capital allocation priorities include strategic acquisitions with potential for mid- to long-term value creation and revenue and earnings growth Gastroenterology call point has the potential for a suite of tests Attractive clinical targets, need to assess what and when Innovative test that addresses a high unmet clinical need Is this patient with Barrett’s Esophagus at a higher or lower risk of progression to HGD or EAC Immediately adds significant in-market estimated U.S. TAM $1 billion estimated U.S. TAM 1The Medicare reimbursement rate is currently $2,350 for TissueCypher. Already achieved early reimbursement wins TissueCypher is covered by Medicare1 and some regional plans

29 T i s s u e C y p h e r : D e s i g n e d t o I n d e p e n d e n t l y P r e d i c t s D e v e l o p m e n t o f E s o p h a g e a l C a n c e r i n P a t i e n t s w i t h B a r r e t t ’s E s o p h a g u s ( B E ) Market Snapshot Clinical Decision Point Clinical Utility Transforming Disease Management ῀$1B revenue opportunity1 ~384k patients receiving upper GI endoscopies/year w/ confirmed Dx of BE2 Which BE patients will progress to HGD or esophageal cancer? Provides a 5-year individual risk of progression to high-grade dysplasia or esophageal adenocarcinoma for patients with confirmed BE Strongest predictor of progression to esophageal cancer (risk-stratification) TissueCypher hazard ratio of 7.7 compared to GI expert pathologist diagnosis of 3.9 (p<0.0001); pooled analysis3-7 Identifies patients: 1) At risk for future progression and patients harboring prevalent HGD/EAC 2) At low risk of progression who may be able to avoid unnecessary treatment or surveillance Patients receiving a high-risk TissueCypher score are 9.4 times more likely to progress within 1–5 years3 Clinical use study demonstrates 55% change in patient management9 HGD = high-grade dysplasia; EAC = esophageal adenocarcinoma; BE = Barrett’s esophagus 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2384,000 upper GI endoscopies/year with confirmed dx of BE (ND, IND, LGD) x $2,513 = U.S. only TAM of ~$1 billion 3Critchley-Thorne et al. Cancer Epidemiol Biomarkers Prev 2016. 4Critchley-Thorne, et. al. Cancer Epidemiol Biomarkers Prev. Feb 2017 5Davison, et. al. Am J Gastroenterol. Feb 2020 6Frei, et. al. Clin Transl Gastroenterol. Oct 2020; 7Frei, et. al. Am J Gastroenterol. Apr 2021; 9Diehl, et.al. Endoscopy International Open, 2021, Mar; 9(3): E348-E355

5 -Y e ar R is k o f P ro gr e ss io n 3–5-year Surveillance3,4 1-year Surveillance2 EET or 6–12 month Surveillance2 NDBE1 IND1 LGD1 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% NDBE (Low-Risk)* NDBE (High-Risk)* LGD/IND (High-Risk)* LGD/IND (Low-Risk)* High-Risk TissueCypherLow-Risk TissueCypher 30 T i s s u e C y p h e r C a n C o n t r i b u t e S i g n i f i c a n t I m p r o v e m e n t s i n R i s k P r e d i c t i o n O v e r P a t h o l o g y A l o n e 1 Progression rates: Rastogi et al. Gastrointest Endosc 2008; Krisnamoorthi et al. Gastrointest Endosc 2020; Singh et al. Gastrointest Endosc 2014; Wani et al. Clin Gastroenterol Hepatol 2011. 2 Consensus guidelines from ACG (2015), AGA (Medical Position Statement, 2011) and ASGE (2019); 3 Shaheen et al. Am J Gastroenterol 2022 4 Komanduri et al. Clin Gastroenterol Hepatol 2022.*Data on file, Castle Biosciences. Data from pooled analysis of TissueCypher’s risk stratification performance reported in 5 clinical validation studies. Histology only

TissueCypher: S igni f icant 2022 Mi lestones A lready Achieved, Integrat ion On Track Q1 2022 31 March 24, 2022 Granted Advanced Diagnostic Laboratory Test (ADLT) status, exempts from 14-day rule April 2022 Entered into a lease agreement in Pittsburgh as part of our planned investment to expand laboratory capabilities 1Iyer et al. 2022 Clinical Gastroenterology and Hepatology Q2 2022 Ear ly T i s s ue Cyphe r pe r formance exce e d ing our ex pe ctat ions Ongoing 2022 Laboratory expansion efforts on track to handle anticipated test volume (move in expected end of Q1 2023) April 2022 Publication of independent pooled analysis supporting clinical value of TissueCypher (9th publication)1 Q4 2022+ Q2 2022 Podium presentations at ESGE Days 2022 and DDW 2022 Ongoing 2022+ Leveraging GI knowledge to identify potential pipeline opportunities July 2022 AGA Clinical Practice Update released with best practice advice for utilization of TissueCypher to risk- stratify patients with NDBE Sept. 2022 Based upon 2Q performance, will expand of GI sales team Q2 2022 Laboratory expansion efforts underway, including investments in new instruments, staffing and training to stay ahead of expected volume increases Jan 2, 2022 Initial GI Sales team members hired to launch test Q3 2022 December 6, 2021 Announced close of Cernostics acquisition

A l t h e a D x A c q u i s i t i o n A l i g n s w i t h O u r S t r a t e g i c O p p o r t u n i t i e s G o a l s 32 Our capital allocation priorities include strategic acquisitions with potential for mid- to long-term value creation and revenue and earnings growth Immediately adds significant in-market estimated U.S. TAM $5 billion estimated U.S. TAM Already achieved early reimbursement wins IDgenetix is covered by Medicare1 and United Healthcare 1The Medicare reimbursement rate is currently ~$1,500 for IDgenetix multi-gene testing for eight mental health conditions: major depressive disorder, schizophrenia, bipolar disorder, anxiety disorders, panic disorder, obsessive-compulsive personality disorder, post-traumatic stress disorder and attention deficit hyperactivity disorder. Ear ly fe e dback cons i s tent w i t h pre - de a l work , ex pe ct IDge net ix to be a me an ingf u l reve nue cont r ibutor in 2 0 2 4 Competitive, innovative test that addresses a high unmet clinical need Which medication is best for a patient based on his/her genetics? Potential to create a suite of indications and/or tests in a single call Potential application of technology across mental health market

IDgenetix: Integration Beginning, S ignif icant Mi lestones Already Achieved Q2 2022 Q3 2022 33 April 4, 2022 Announced acquisition of AltheaDx Q2 2022 Announced expanded Medicare coverage for IDgenetix (seven additional mental health conditions beyond major depressive disorder) April 26, 2022 Announced close of AltheaDx acquisition May 2022 Announced a collaboration with Camille Schrier, Miss America 2020, as part of Mental Health Awareness Month, to promote the potential of genetic testing and the IDgenetix® test to help improve treatment for mental health conditions May 2022 Relaunch IDgenetix website June 2022 Sales training to align mental health commercial team with Castle’s proven commercial playbook 2022+ Identify additional potential pipeline opportunities Q2-Q3 2022 Initiating integration of internal functions (e.g., Marketing, Reimbursement, Finance) Q3 2022 National Sales Director in place to lead mental health sales team Q2 2022 Commercial presence at APA, EPA and NEI mental health conferences

34 IDgenetix: Designed to Guide Timely and Evidence-Based Decisions on the Optimal Drug for Each Patient Market Snapshot Clinical Decision Point Clinical Utility Transforming Disease Management ῀$5B revenue opportunity1 Which medication is best for each patient? Provides drug-gene, drug-drug and lifestyle factor interactions to guide tailored treatment recommendations for patients in terms of their prescribed medications Randomized controlled trial showed a greater than 2.5 times improvement in remission rates for patients with severe depression, who were tested with IDgenetix, compared to those who did not have their genes tested2 Substantial annual cost savings potential of $5,962 per patient as a result of testing with IDgenetix3 Replacing standard-of-care, trial-and-error prescription practices in mental health with a scientifically-backed genetic test with the potential to: • Help patients achieve a faster therapeutic response • Reduce adverse events • Yield cost savings in the healthcare system 1U.S. TAM = Total addressable market based on indicated use of IDgenetix for patients diagnosed with depression, anxiety and other mental health conditions; 2Bradley et al., J Psychiatr Res. 2018 Jan; 96:100-107; 3Maciel et al. Neuropsychiatr Dis Treat 2018 IDgenetix provides drug-gene, drug-drug and lifestyle factor interactions

Clinical Trial Design • Randomized Controlled Trial (RCT) • Peer-reviewed and published in the Journal of Psychiatric Research • 685 participants, Depression and Anxiety • Double-blinded • Treated by a broader group of medical professionals, beyond psychiatrists • 20 independent clinical sites • 4, 8 and 12-week efficacy using HAM-A scale E n h a n c e d T h e ra p e u t i c Ef f i c a c y v s . S t a n d a r d o f C a r e 28% 36% 55% By T3 (Week 8) By T4 (Week 12) Response Rate ≥ 50% Reduction from Baseline p-value 0.01 0.001 73% 9% 13% 25% 35% By T3 (Week 8) By T4 (Week 12) Remission Rate Back to Normal p-value 0.05 0.02 Control IDgenetix 35 Bradley et al. J Psychiatr Res. 2018 Jan; 96:100-107.

I D g e n e t i x Te s t i n g P r o c e s s C o n s i s t s o f T h r e e I m p o r t a n t S t e p s 36 Drug Metabolism Genotyping Drug Response Genotyping Algorithmic Screening Analyzes patient-specific genetic variants that influence the function of drug metabolizing enzymes Influences how much of a drug is active in the body to produce therapeutic or toxic effects P R O C ES S IM P O R TA N C E Analyzes patient-specific genetic variants involved in the way medications work at the biologic site of action Influences the likelihood of a therapeutic or adverse drug response Screens for metabolic interactions caused by concomitant prescription, OTC and herbal medications that may significantly alter the metabolism of approved medications Identifies CYP450-mediated interactions that can alter which medications are optimal for each patient IM P O R TA N C E IM P O R TA N C E P R O C ES S P R O C ES S 1 2 3 IDgenetix testing is designed to provide tailored treatment recommendations for each patient by utilizing a bioinformatic algorithm to integrate patient-specific health information with comprehensive genetic results Drug-Gene Interactions Drug-Drug Interactions

Uveal Melanoma

38 DecisionDx-UM: the Standard of Care in the Management of Newly Diagnosed Uveal Melanoma Market Snapshot Clinical Decision Point Clinical Utility Transforming Disease Management More than 90% of U.S. ocular oncology institutions order DecisionDx- Melanoma (1,618 reports issued in 2021) What is the risk that a patient’s uveal melanoma (eye cancer) will spread or recur? Predicts the likelihood that a patient’s cancer will spread (metastasize) over the next five years to guide surveillance and treatment decisions Key statistics about uveal melanoma: • ~2,000 patients diagnosed in the U.S. annually • ~97% of patients – no evidence of metastatic disease at the time of diagnosis • ~30% will develop metastases within 5 years DecisionDx-UM has broad Medicare reimbursement1 (LCD covers patients with a confirmed diagnosis and no evidence of metastatic disease; received payment on ~93% of claims in 2021) Included in AJCC and NCCN guidelines 12022 Medicare rate of $7,776

Pipel ine In i t iat ives 39

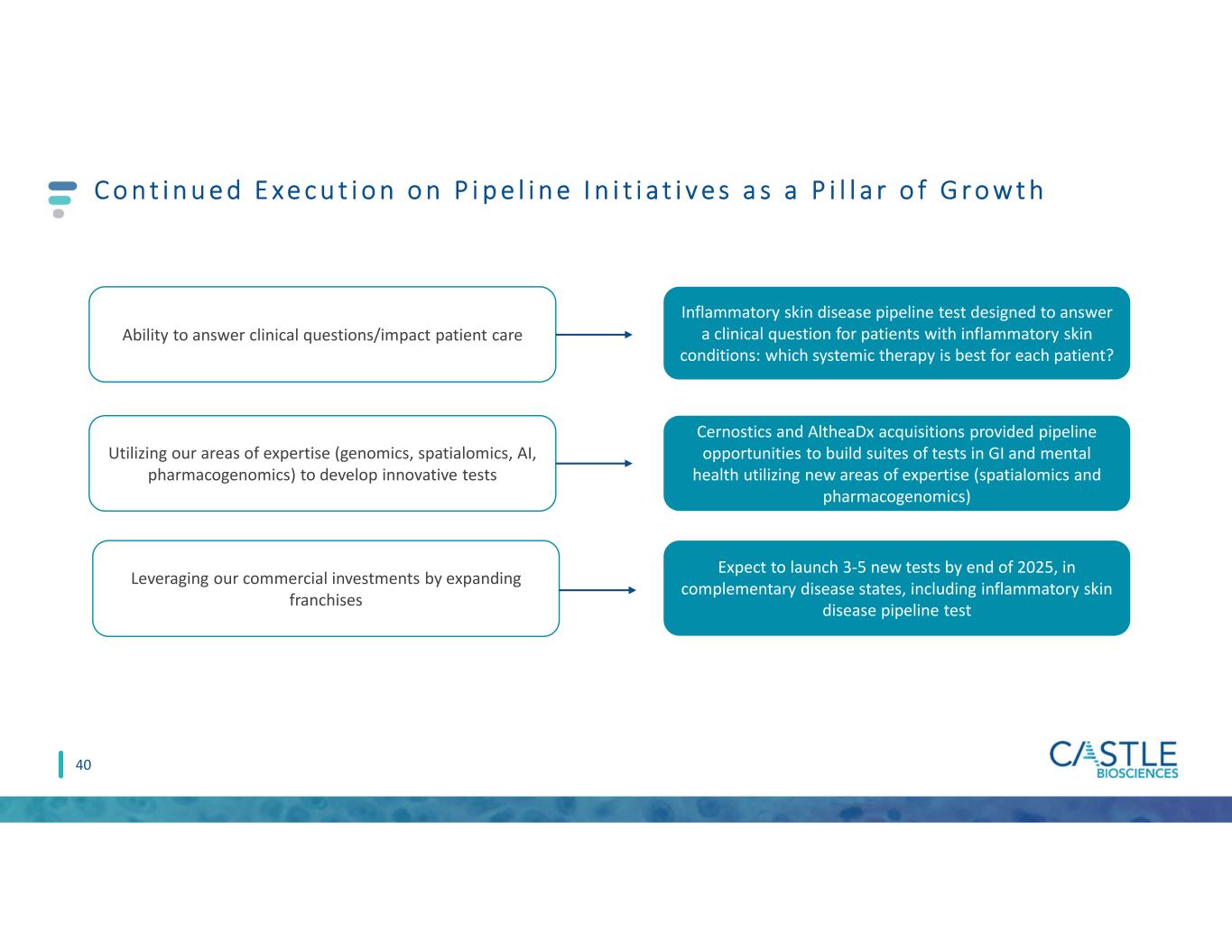

C o n t i n u e d E xe c u t i o n o n P i p e l i n e I n i t i a t i v e s a s a P i l l a r o f G r o w t h 40 Ability to answer clinical questions/impact patient care Utilizing our areas of expertise (genomics, spatialomics, AI, pharmacogenomics) to develop innovative tests Leveraging our commercial investments by expanding franchises Inflammatory skin disease pipeline test designed to answer a clinical question for patients with inflammatory skin conditions: which systemic therapy is best for each patient? Cernostics and AltheaDx acquisitions provided pipeline opportunities to build suites of tests in GI and mental health utilizing new areas of expertise (spatialomics and pharmacogenomics) Expect to launch 3-5 new tests by end of 2025, in complementary disease states, including inflammatory skin disease pipeline test

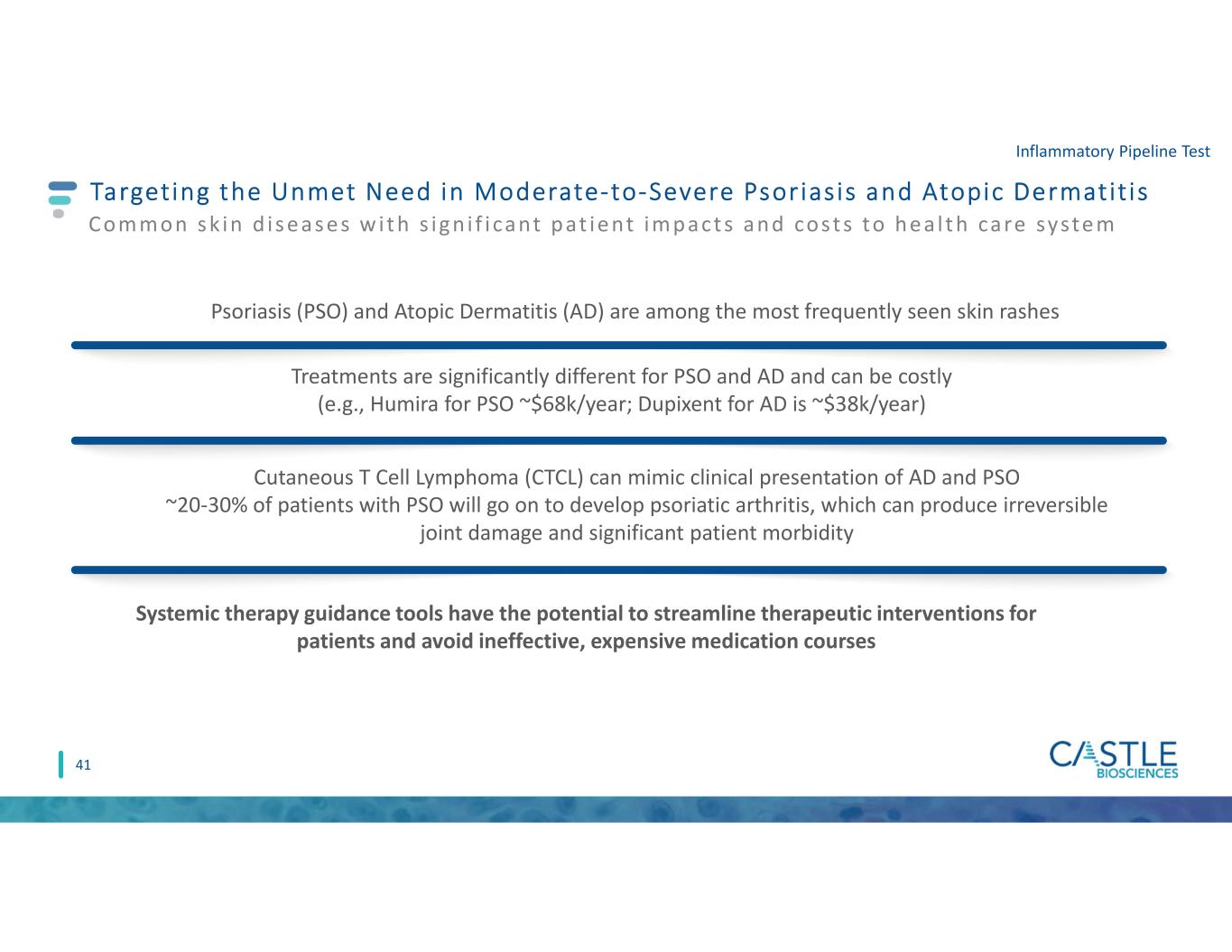

Targeting the Unmet Need in Moderate-to-Severe Psorias is and Atopic Dermatit is Common s k in d i s e as e s w i t h s ign i f i cant pat ie nt impact s and cost s to he a l t h care syste m Treatments are significantly different for PSO and AD and can be costly (e.g., Humira for PSO ~$68k/year; Dupixent for AD is ~$38k/year) Systemic therapy guidance tools have the potential to streamline therapeutic interventions for patients and avoid ineffective, expensive medication courses Psoriasis (PSO) and Atopic Dermatitis (AD) are among the most frequently seen skin rashes 41 Cutaneous T Cell Lymphoma (CTCL) can mimic clinical presentation of AD and PSO ~20-30% of patients with PSO will go on to develop psoriatic arthritis, which can produce irreversible joint damage and significant patient morbidity Inflammatory Pipeline Test

42 Castle’s Inf lammatory Skin Disease Pipeline Test Is Being Developed to Predict Systemic Therapy Response – IDENTITY Study Program Milestones Q32021 Steering committee formed with top KOLs 2025 Target launch 54 Committed Sites Data as of July 26, 2022 First patient enrolled Proof of RNA extraction method concept Q22022Q2-Q32021 Inflammatory Pipeline Test 2023 Initial validation and development data expected 303 Patients Enrolled

Env i ronmental , Soc ia l and Governance ( ESG)

44 E S G F o c u s A r e a s fo r 2 0 2 2 a n d B e y o n d Environmental policy Environmental metrics DEI mission statement DEI metrics DEI action plan/roadmap Vendor code of conduct/supplier standard 44 In 2022, Castle Biosciences received a rating of AA (on a scale of AAA-CCC) in the MSCI ESG Ratings assessment.

35.7% 64.3% FEMALE MALE Commitment to Diversity 45 A ll Em p lo ye e s Ex e cu ti ve s E T H N I C I T Y/ R A C E G E N D E R Data as of 12/31/21, Executive= Executive Director or Regional Business Director level and above 64.6% 35.4% FEMALE MALE TOTAL EMPLOYEES = 345 75% 21.4% 3.6% CAUCASIAN OTHER (NOT HISPANIC OR LATINO) HISPANIC OR LATINO 64.3% 7.2% 4.6% 3.5% 20.4% CAUCASIAN HISPANIC OR LATINO ASIAN BLACK OR AFRICAN- AMERICAN TWO OR MORE RACES (NOT HISPANIC OR LATINO)

THANK YOU

U s e O f N o n - G A A P F i n a n c i a l M e a s u r e s ( U n a u d i t e d ) 47 In this presentation, we use the metrics of Adjusted Revenue, Adjusted Gross Margin and Adjusted Operating Cash Flow, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenue and Adjusted Gross Margin reflect adjustments to net revenues to exclude changes in variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted Operating Cash Flow excludes the effects of repayments to Medicare of COVID-19 government relief advancements to healthcare providers. We use Adjusted Revenue, Adjusted Gross Margin and Adjusted Operating Cash Flow internally because we believe these metrics provide useful supplemental information in assessing our revenue and cash flow performance reported in accordance with GAAP, respectively. We believe Adjusted Revenue and Adjusted Gross Margin are also useful to investors because they provide additional information on current-period performance by removing the effects of revenue adjustments related to tests delivered in previous periods and , with respect to Adjusted Gross Margin, acquisition-related intangible asset amortization, which we believe may facilitate revenue and gross margin comparisons to historical periods. We believe Adjusted Operating Cash Flow is also useful to investors as a supplement to GAAP measures in the assessment of our cash flow performance by removing the effects of COVID-19 government relief payments, which we believe are not indicative of our ongoing operations. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes. These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin or net cash (used in) provided by operating activities reported in accordance with GAAP and should be considered in conjunction with our financial information presented on a GAAP basis and language from our earnings press release. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the slides that follow.

R e c o n c i l i a t i o n o f N o n - G A A P F i n a n c i a l M e a s u r e s ( U n a u d i t e d ) The table below presents the reconciliation of adjusted revenue and adjusted gross margin, which are non-GAAP financial measures. See "Use of Non- GAAP Financial Measures (UNAUDITED)" on the previous slide for further information regarding the Company's use of non-GAAP financial measures. 48

R e c o n c i l i a t i o n o f N o n - G A A P F i n a n c i a l M e a s u r e s ( U n a u d i t e d ) The table below presents the reconciliation of adjusted operating cash flow, which is a non-GAAP finanical measure. See "Use of Non- GAAP Financial Measures (UNAUDITED)" on the previous slide for further information regarding the Company's use of non-GAAP financial measures. 49

APPENDIX

C a s t l e B i o s c i e n c e s I s I m p ro v i n g H e a l t h t h r o u g h I n n o v a t i v e Te s t s T h a t G u i d e P a t i e n t C a r e 51 Dermatology Gastroenterology Mental HealthUveal Melanoma Portfolio of innovative tests designed to guide patient care

Improving Health through Innovative Tests that Guide Patient Care 52 A Diagnostic Leader Robust Data Supporting our TestsCastle Team 482 Total employees 111 Laboratory testing operations team members 87 35+ Peer-reviewed publications Strong financial position, driven by investments in our growth pillars and commercial excellence Diversified portfolio of tests that answer clinical questions and provide actionable information Data driven with a robust R&D and clinical research engine that address areas of unmet clinical need Culture of teamwork and innovation, built on a patient-centric mindset 10 12 9 23 Research & development team members Data as of 06/30/22; total employee count also includes 130 general & administrative team members 154 Sales & marketing team members

L e a d e rs h i p Te a m O v e r v i e w Dan Bradbury Derek Maetzold Mara Aspinall Brad Cole Miles D. Harrison 53 Stuart Pharmaceuticals Robert Cook, PhD Senior Vice President, Research & Development Derek Maetzold Founder, Director, President and CEO Frank Stokes Chief Financial Officer Toby Juvenal Chief Commercial Officer Kristen Oelschlager, RN, CHC Chief Operating Officer Matthew Goldberg, MD Medical Director Tiffany Olson Kimberlee Caple Ellen Goldberg B O A R D O F D I R E C T O R S Alice Izzo Senior Vice President, Marketing M A N A G E M E N T T E A M B OA R D O F D I R EC TO R S

Committed to cu l t ivat ing a cu l ture of innovat ion, cont inuous growth and advancement Award-Winning Company 54 2019 Technology Innovation in Melanoma Award Winner