January 9, 2023 Transforming Disease Management

2 Disclaimers This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning: our expectation that we will meet or exceed the top end of our range for total revenue guidance for our fiscal year ended December 31, 2022; our preliminary financial and operational results for our fourth quarter and fiscal year ended December 31, 2022, including our expected cash and cash equivalents and short-term investments as of December 31, 2022 and our expected number of total test reports during 2022; estimated sizes of the total addressable markets of our current and future commercial and pipeline products within our dermatologic, gastrointestinal and mental health franchises, and our anticipated actions to further the growth of these franchises and products in 2023 and beyond, and any resulting financial or operational metrics or related expectations with respect to future performance; our expectations regarding timelines and milestones for our dermatologic, gastrointestinal and mental health franchises; our three-year projections for revenue, adjusted gross margins, other operating expenses and net operating cash flow; the potential of DecisionDx-Melanoma to aid in risk-aligned treatment plans for improved patient outcomes and survival rates; the potential of TissueCypher testing to change clinical practice when incorporated into patient management plans; our expectation that we will achieve net operating cash flow positivity by 2025; our expectation that our focused growth investments will contribute to long-term profitability; our milestone expectations regarding the Palmetto/MolDx draft LCD for DecisionDx-SCC, finalization of a Palmetto/Noridian LCD for DiffDx-Melanoma by the end of Q2 2023, publication of a collaborative NCI study showing higher melanoma specific survival for patients tested with DecisionDx-Melanoma, new GI and MyPath/DiffDx commercial team expansion reaching optimal productivity in Q2 2023, expected closure of our San Diego lab by the end of 2022; components and drivers of our near-to mid-term growth and mid-to long-term growth; the impact, accuracy and effectiveness of our commercial and pipeline tests on physicians, patients and their treatment plans, and their individual or collective impact on our prospects and plans, including any objectives of management related thereto; the ability of our tests to provide valuable, clinically actionable information to clinicians and patients, improve health and guide patient care; expected expansion of outside sales territories; our progress roadmaps for our tests; expected launch dates for tests in our pipeline expansion and estimates regarding their total addressable markets or future success; expectations regarding LCD effective timeframes and reimbursement capabilities; the ability of our risk stratification tests to classify risk of metastasis in ways that better support risk-appropriate treatment than reliance on traditional clinicopathologic risk factors alone; integration timelines, growth expectations and strategic opportunities for our TissueCypher test and GI franchise, and our IDgenetix test and our mental health franchise; and our ability to integrate our recent acquisitions into our existing business and the ability of such acquisitions to complement our existing business. The words “anticipates,” “believes,” “can,” “estimates,” “expects,” “plans,” “potential,” “preliminary,” “will” and similar expressions are intended to identify forward-looking statements, although not all forward- looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation: adjustments to our preliminary financial results resulting from, among other things, the completion of our end-of-period reporting processes and related activities, including the audit by our independent registered public accounting firm of our financial statements; the timing and amount of revenue we are able to recognize in a given fiscal period; the accuracy of our assumptions and expectations underlying our three-year revenue and other financial targets (including, without limitation, our assumptions or expectations regarding: (i) continued reimbursement for our DecisionDx-SCC test at the current rate and reimbursement for our other products and subsequent coverage decisions, (ii) our estimated total addressable markets for our products and product candidates and the related expenses, capital requirements and potential needs for additional financing, (iii) the anticipated cost, timing and success of our product candidates, and our plans to research, develop and commercialize new tests and (iv) our ability to successfully integrate new businesses, assets, products or technologies acquired through previously completed acquisitions); the effects of the COVID-19 pandemic on our business and our efforts to address its impact on our business; subsequent study or trial results and findings may contradict earlier study or trial results and findings or may not support the results discussed in this presentation, including with respect to the diagnostic and prognostic tests discussed in this presentation; actual application of our tests may not provide the aforementioned benefits to patients; and the risks set forth under the heading “Risk Factors” in our Quarterly Report on Form 10- Q for the three months ended September 30, 2022, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law. Forward-Looking Statements

January 9, 2023 Preliminary Q4 2022 Information

4 Castle Is Focused on Improving Health through Innovative Tests That Guide Patient Care Gastroenterology Mental HealthUveal MelanomaDermatology Answering clinical questions to guide care along the patient journey

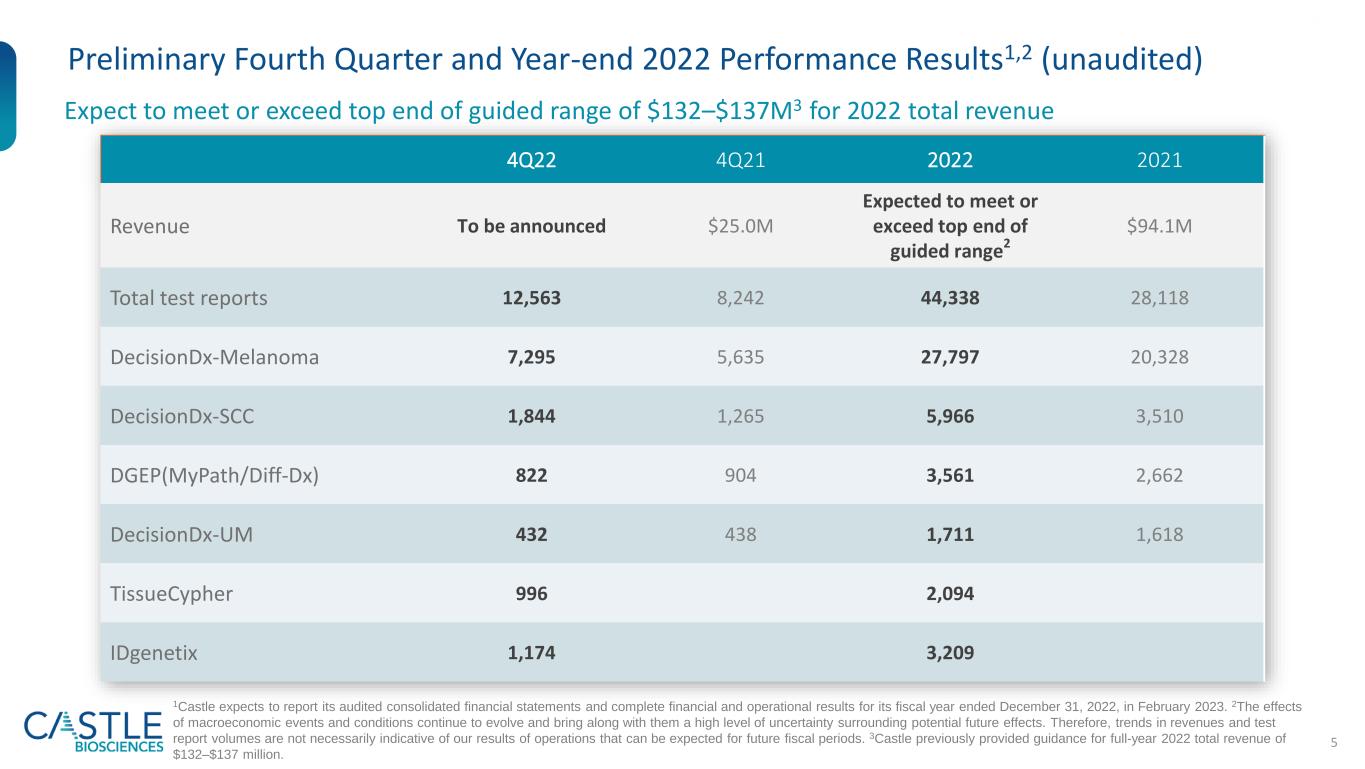

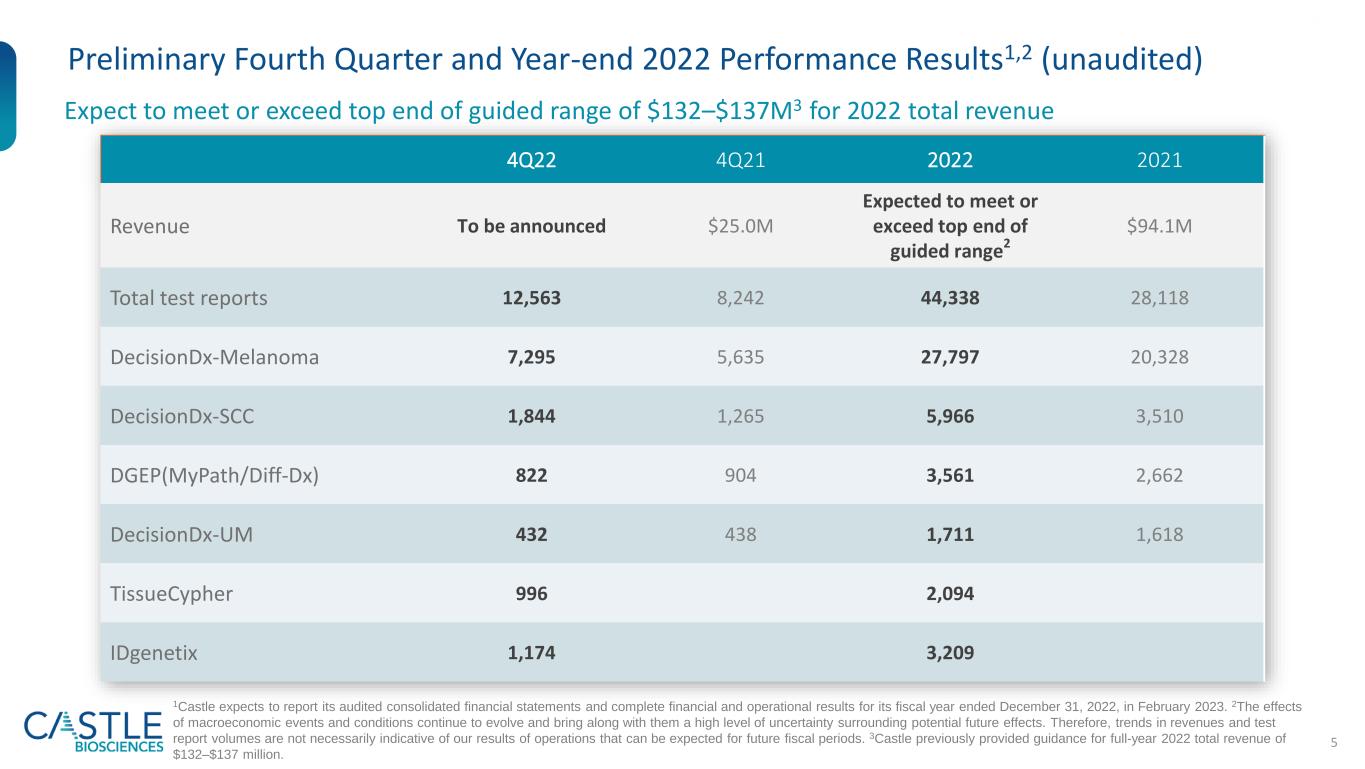

5 Preliminary Fourth Quarter and Year-end 2022 Performance Results1,2 (unaudited) Expect to meet or exceed top end of guided range of $132–$137M3 for 2022 total revenue 1Castle expects to report its audited consolidated financial statements and complete financial and operational results for its fiscal year ended December 31, 2022, in February 2023. 2The effects of macroeconomic events and conditions continue to evolve and bring along with them a high level of uncertainty surrounding potential future effects. Therefore, trends in revenues and test report volumes are not necessarily indicative of our results of operations that can be expected for future fiscal periods. 3Castle previously provided guidance for full-year 2022 total revenue of $132–$137 million. 4Q22 4Q21 2022 2021 Revenue To be announced $25.0M Expected to meet or exceed top end of guided range2 $94.1M Total test reports 12,563 8,242 44,338 28,118 DecisionDx-Melanoma 7,295 5,635 27,797 20,328 DecisionDx-SCC 1,844 1,265 5,966 3,510 DGEP(MyPath/Diff-Dx) 822 904 3,561 2,662 DecisionDx-UM 432 438 1,711 1,618 TissueCypher 996 2,094 IDgenetix 1,174 3,209

6 2022 Year-end Cash, Cash Equivalents & Marketable Investment Securities Expected To Be Approximately $259 million1 Cash, Cash Equivalents and Marketable Investment Securities As of 3/31/22 $309M As of 6/30/22 $273M As of 9/30/22 $266M As of 12/31/22 ~$259M (expected) 1This amount is preliminary, unaudited and subject to adjustment as a result of, among other things, the completion of financial closing procedures, including the audit by our independent registered public accounting firm of our financial statements. As a result, amounts may differ from the amount that will be reflected in our financial statements as of and for the year-ended December 31, 2022. Accordingly, undue reliance should not be placed on this preliminary information.

Third Quarter 2022 November 2, 2022 Transforming Disease Management

8 Financial Performance Summary Q3 2022 7,727 7,352 12,114 9,824 31,775 27,363 Total test reports Total Derm test reports 3Q21 3Q22 Nine Months Ended September 30, 2022 1See Non-GAAP reconciliations at the end of this presentation. 2Cash use includes acquisitions of AltheaDx and Cernostics. $23.5M $23.6M $37.0M $37.3M $98.7M $100.6M Revenue Adj. Revenue1 77.9% 80.9% 69.8% 76.2% 71.1% 77.6% Gross Margin Adj. Gross Margin1 $(6.1)M $(3.0)M $(5.2)M $(5.2)M $(35.7)M $(35.7)M Operating Cash Flow Adj. Operating Cash Flow1 $363M $266M2 Cash, Cash Equivalents & Marketable Investment Securities as of end of period

9 Mission Improving health through innovative tests that guide patient care Vision To transform disease management by keeping people first: patients, clinicians, employees and investors Values ExCIITE: Excitement, Collaboration, Integrity, Innovation, Trust and Excellence

10 Three Strategic Guideposts That Create Value for Customers, Patients and Stockholders Continuous Evolution & Improvement Exceptional Employees Customer & Solution Centric We hire and keep the right people, by Castle’s commitment to doing the right thing for employees and nurturing our thriving culture We are an industry leader by challenging the status quo with deep scientific expertise, unique value insight, and robust data development We value best-in-class customer experience at all points along the testing journey, and we leverage multiple solutions for a single customer to provide a single source of high quality molecular diagnostic tests

11 Driving Long-Term Growth through Strong Execution and our Operational Guideposts Dermatology Mental Health Gastrointestinal Strategic Opportunities Pipeline Expansion (Expected Launches by 2025) Mental Health Gastrointestinal Strategic Opportunities Near- to Mid-term Growth Mid- to Long-term Growth Dermatology Exceptional Employees, Continuous Evolution & Improvement and Customer & Solution Centric

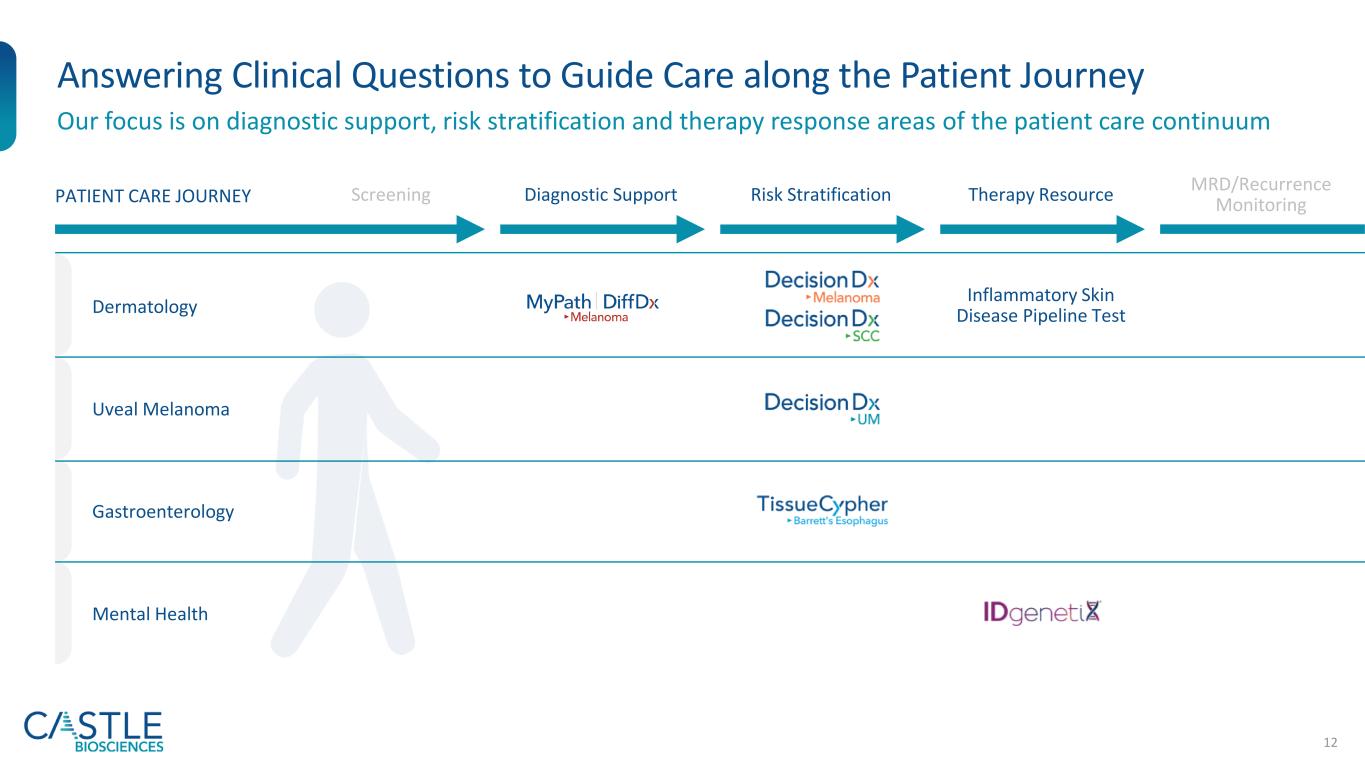

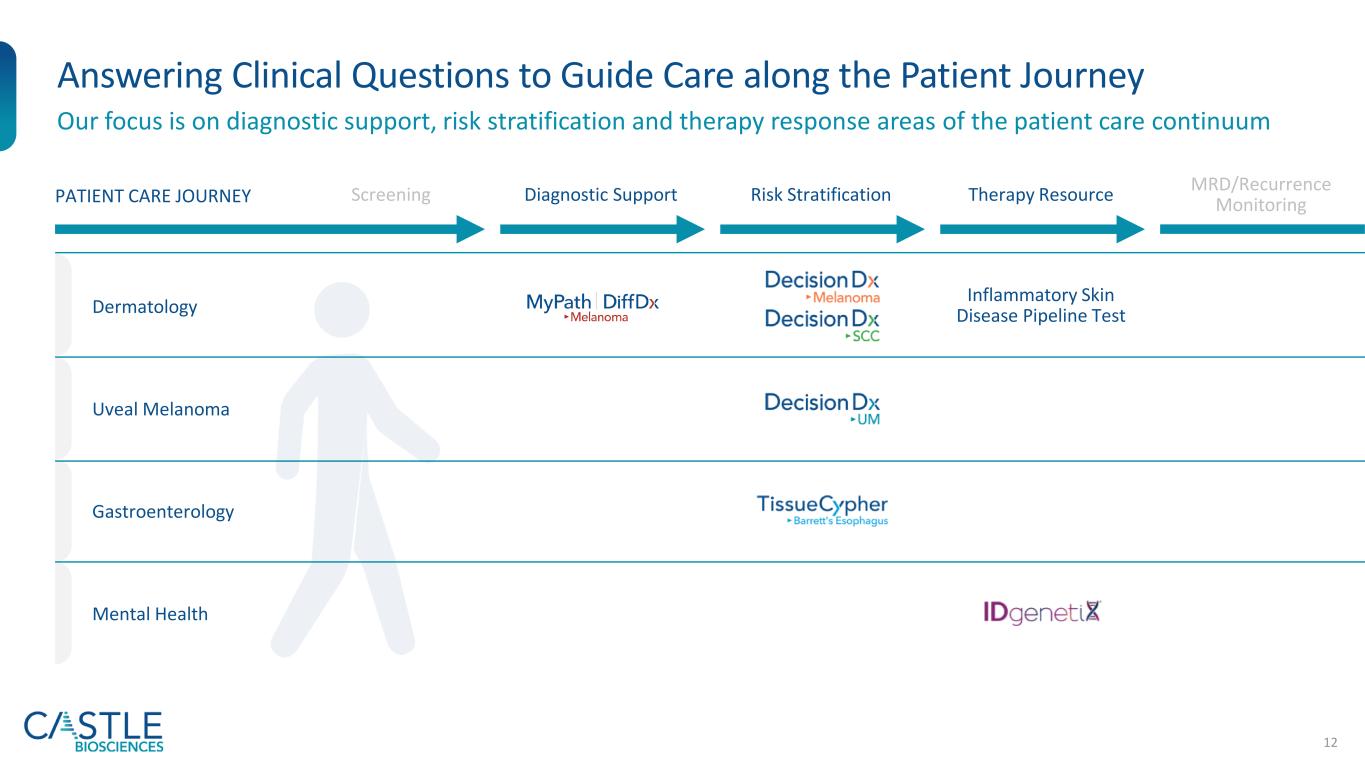

12 Answering Clinical Questions to Guide Care along the Patient Journey Our focus is on diagnostic support, risk stratification and therapy response areas of the patient care continuum Dermatology Uveal Melanoma Gastroenterology Mental Health Screening Diagnostic Support Risk Stratification Therapy Resource MRD/Recurrence MonitoringPATIENT CARE JOURNEY Inflammatory Skin Disease Pipeline Test

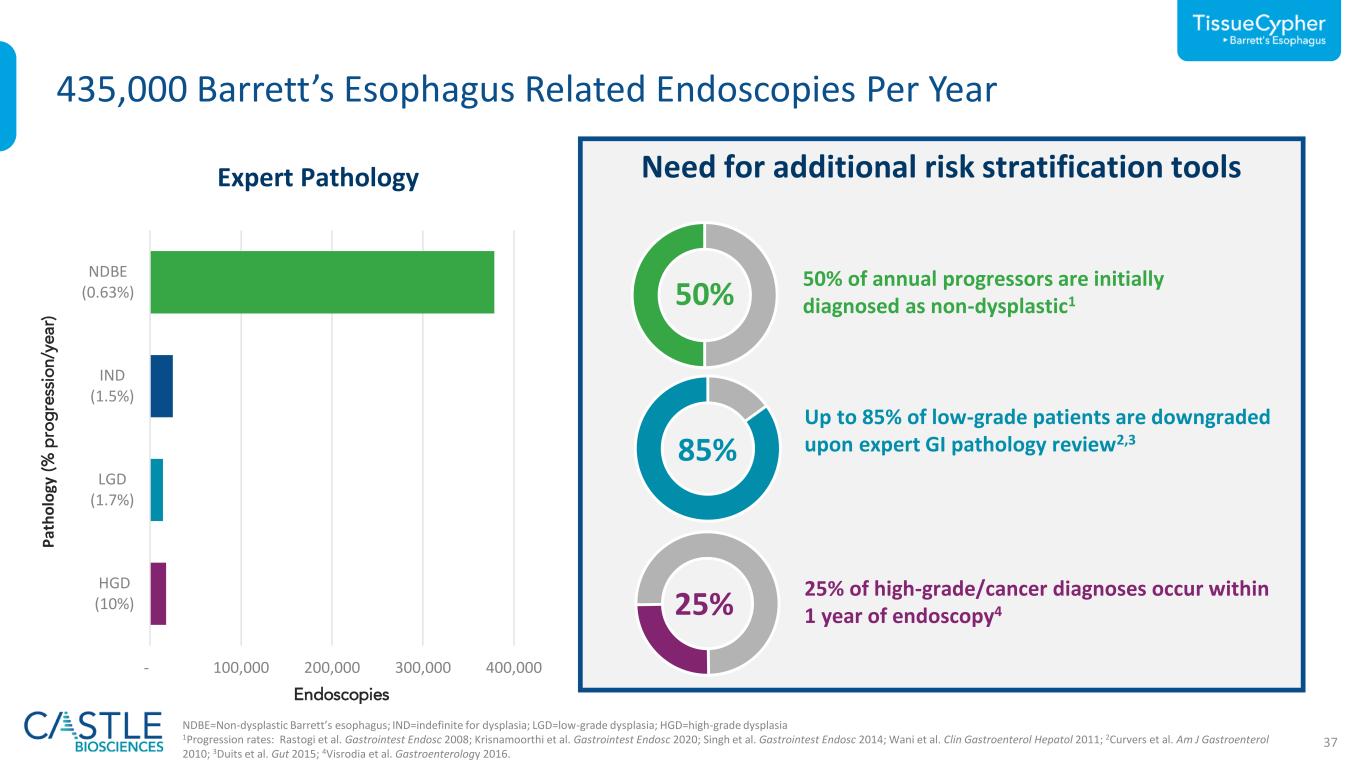

13 Estimated ~$8B U.S. Total Addressable Market1 for Commercially Available Tests Dermatology Gastroenterology Mental Health Cutaneous melanoma/ risk of metastasis, SLNB positivity risk Patients classified as Stage I, II or III2 ~$540M ~130K Cutaneous squamous cell carcinoma/risk of metastasis Patients w/high-risk features2 ~$820M ~200K Suspicious pigmented lesions/melanoma status Patients w/ diagnostically ambiguous lesions ~$600M ~300K Barrett’s esophagus/risk of progression to esophageal cancer Patients receiving upper GI endoscopies/year who meet the intended use criteria for TissueCypher3 ~$1B ~415K Mental health therapy response Based on indicated use of IDgenetix for patients diagnosed with depression, anxiety and other mental health conditions ~$5B Tests in pipeline add an additional estimated ~$3.6B to our U.S. TAM ($1.9B for inflammatory skin disease pipeline test and ~1.7B for additional dermatology pipeline tests) 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors.2Annual U.S. incidence for Stage I, II or III melanoma estimated at 130,000; annual U.S. incidence for squamous cell carcinoma estimated at 1,000,000 with addressable market limited to carcinomas with one or more high risk features; annual U.S. incidence for suspicious pigmented lesion biopsies estimated at 2,000,000 with addressable market limited to the 15% with an indeterminant biopsy.3415,000 upper GI endoscopies/year with confirmed dx of BE (ND, IND, LGD, EXCLUDING HGD) x $2,513 = U.S. only TAM of ~$1 billion

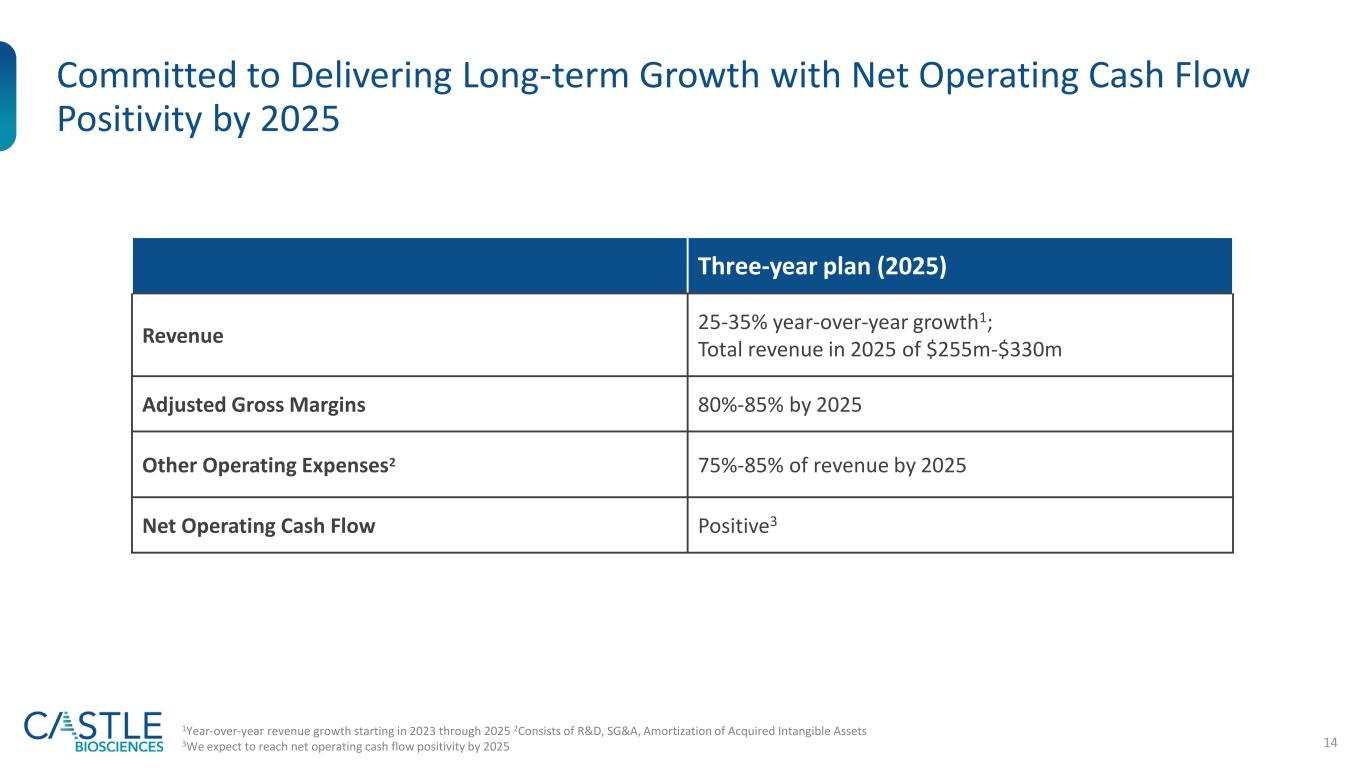

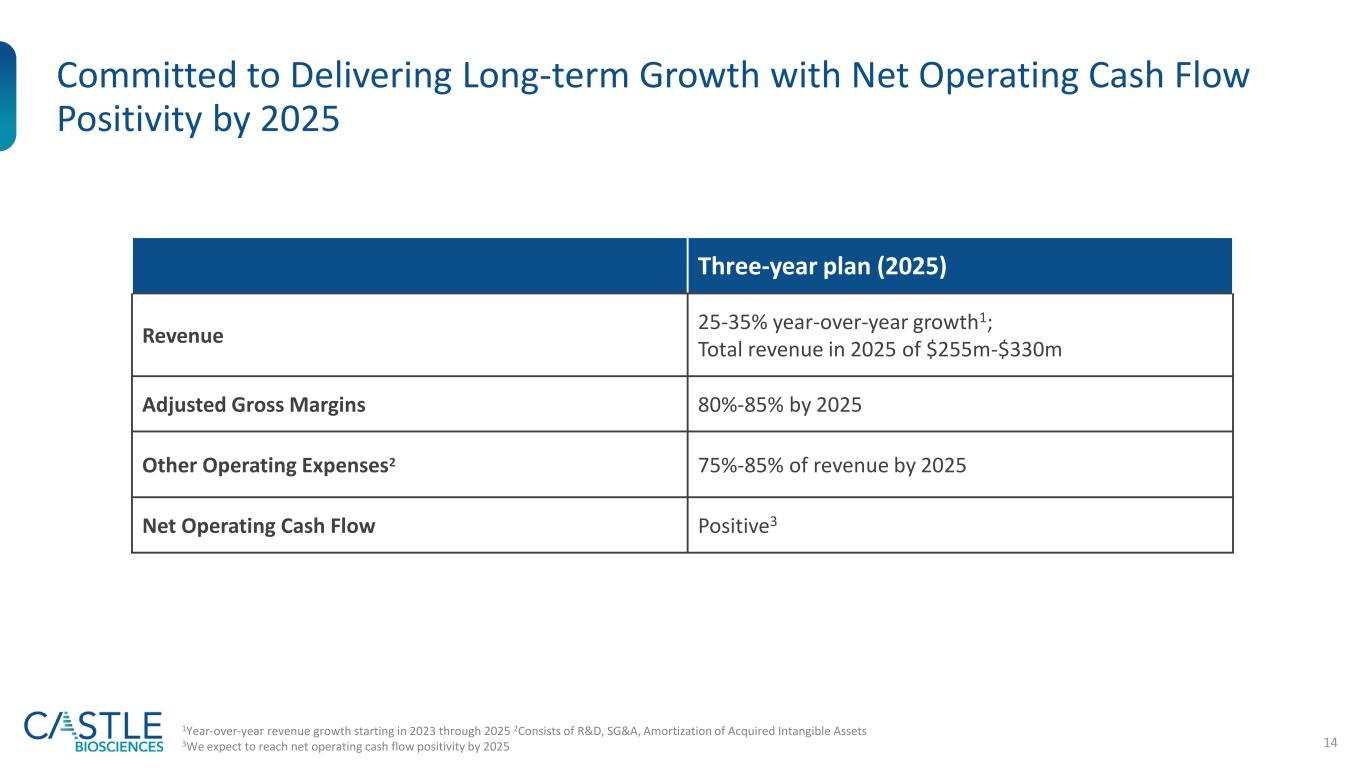

14 Committed to Delivering Long-term Growth with Net Operating Cash Flow Positivity by 2025 Three-year plan (2025) Revenue 25-35% year-over-year growth1; Total revenue in 2025 of $255m-$330m Adjusted Gross Margins 80%-85% by 2025 Other Operating Expenses2 75%-85% of revenue by 2025 Net Operating Cash Flow Positive3 1Year-over-year revenue growth starting in 2023 through 2025 2Consists of R&D, SG&A, Amortization of Acquired Intangible Assets 3We expect to reach net operating cash flow positivity by 2025

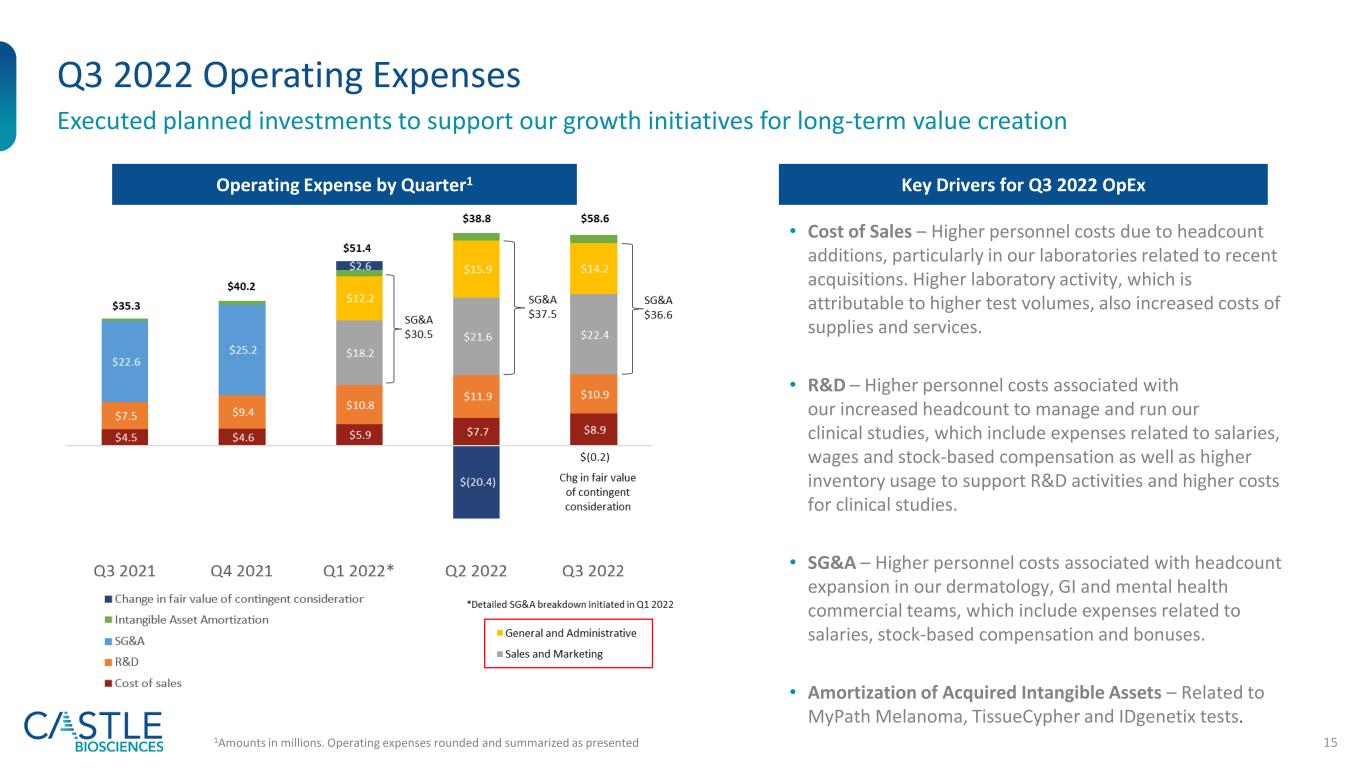

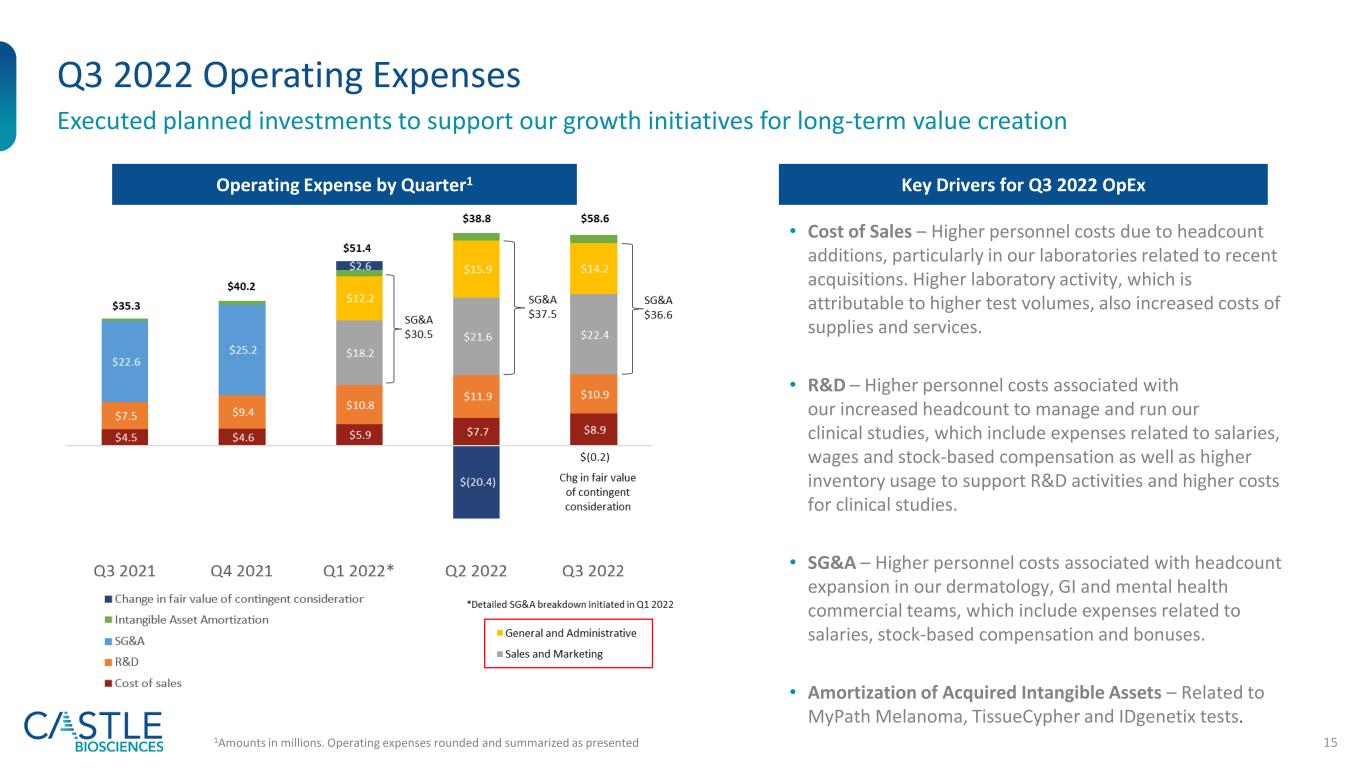

15 Q3 2022 Operating Expenses Executed planned investments to support our growth initiatives for long-term value creation Operating Expense by Quarter1 1Amounts in millions. Operating expenses rounded and summarized as presented Key Drivers for Q3 2022 OpEx • Cost of Sales – Higher personnel costs due to headcount additions, particularly in our laboratories related to recent acquisitions. Higher laboratory activity, which is attributable to higher test volumes, also increased costs of supplies and services. • R&D – Higher personnel costs associated with our increased headcount to manage and run our clinical studies, which include expenses related to salaries, wages and stock-based compensation as well as higher inventory usage to support R&D activities and higher costs for clinical studies. • SG&A – Higher personnel costs associated with headcount expansion in our dermatology, GI and mental health commercial teams, which include expenses related to salaries, stock-based compensation and bonuses. • Amortization of Acquired Intangible Assets – Related to MyPath Melanoma, TissueCypher and IDgenetix tests.

16 Presented three-year financial targets and strategic guideposts at 2022 Investor Day AGA Clinical Practice Update released with best practice advice for the potential utilization of TissueCypher to risk stratify patients with non-dysplastic Barrett’s esophagus Key Q3 and Recent 2022 Accomplishments Received AZBio Fast Lane Award from the Arizona Bioindustry Association (AZBio), recognizing Castle’s achievement of outstanding milestones in the last 18 months Expanded evidence supporting Dermatology and Uveal Melanoma tests through the publication of four new peer-reviewed studies1 Achieved strong growth over Q3 2021 in total revenue (+58%) and achieved a new record in total test report volume (12,114, +57% compared to Q3 2021) 1Jarell et al. JAAD 2022 (DecisionDx-Melanoma); Ahmed et al. Cancer Medicine 2022 (DecisionDx-Melanoma); Williams et al. Melanoma Management 2022 (DecisionDx-UM); Hooper et al. Cancer Investigation 2022 (DecisionDx-SCC)

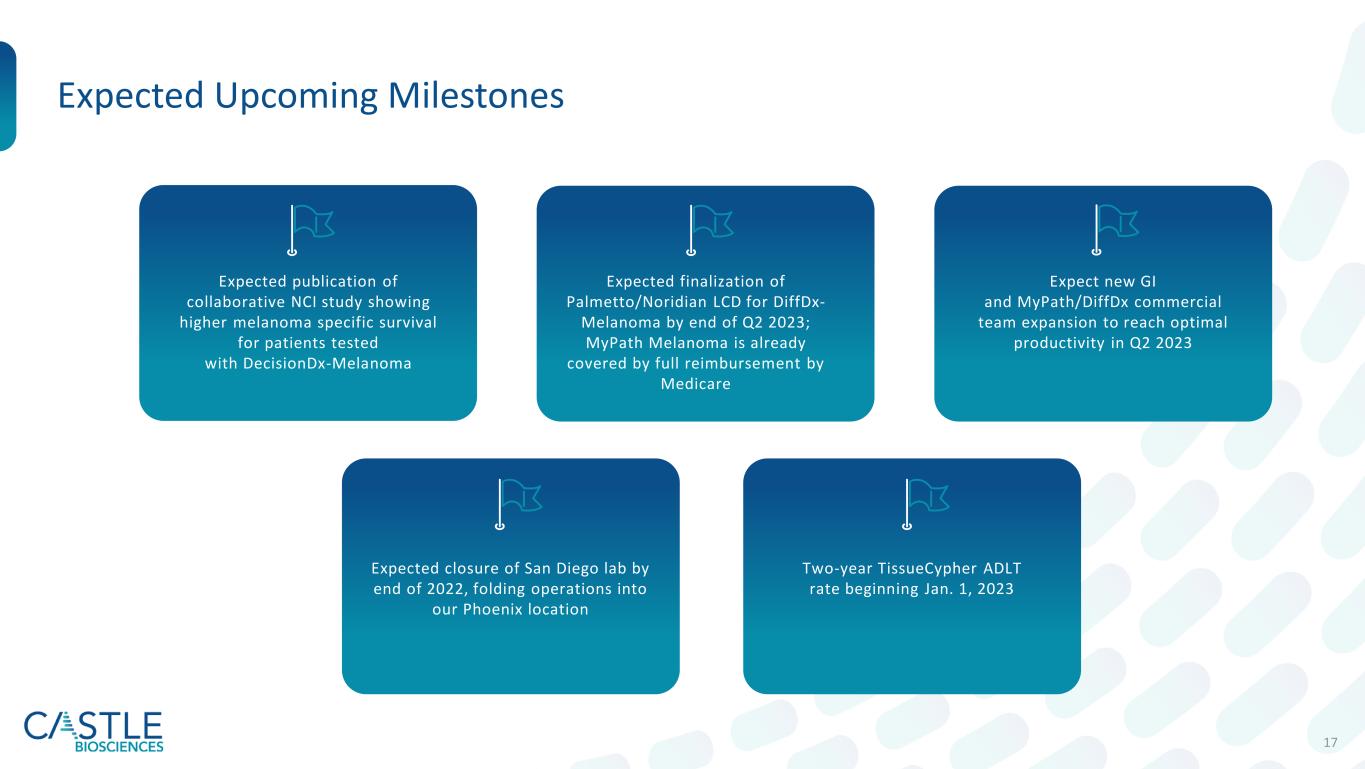

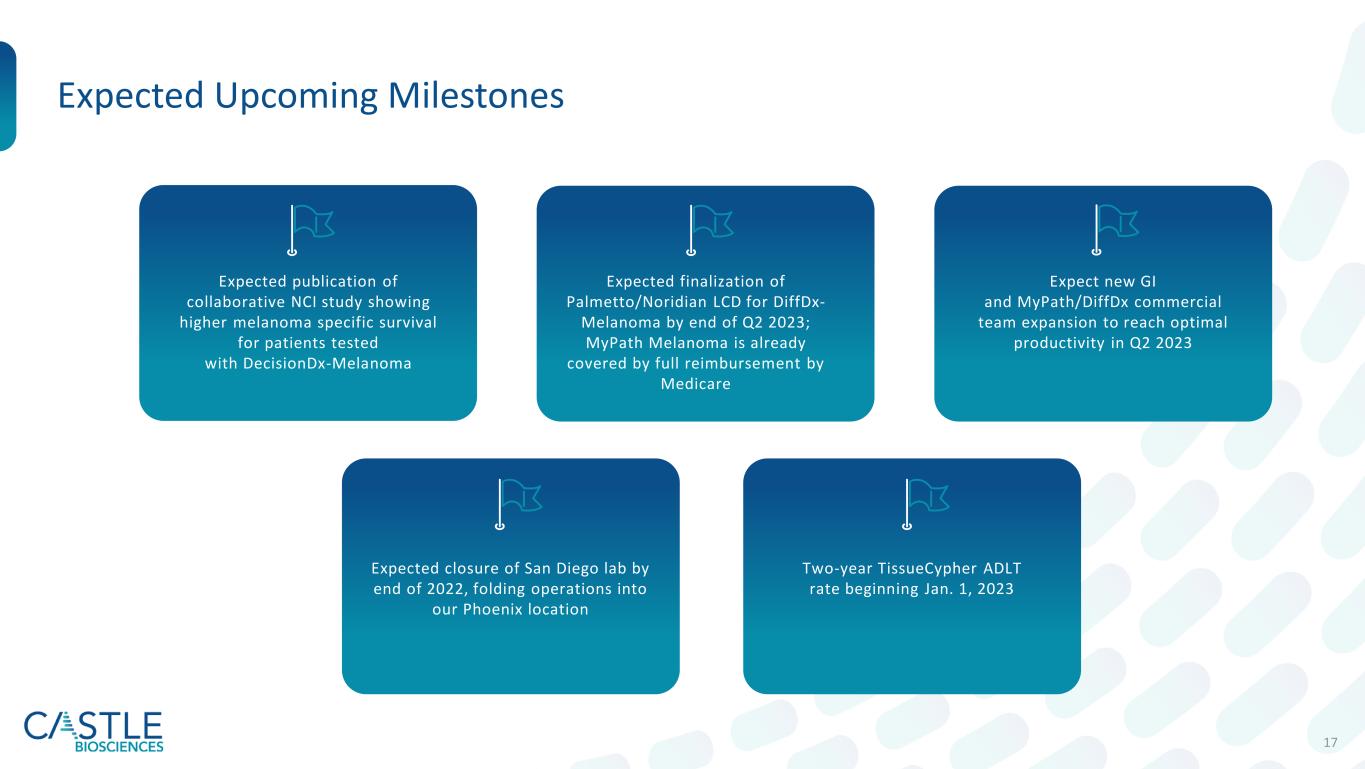

17 Expected publication of collaborative NCI study showing higher melanoma specific survival for patients tested with DecisionDx-Melanoma Expected finalization of Palmetto/Noridian LCD for DiffDx- Melanoma by end of Q2 2023; MyPath Melanoma is already covered by full reimbursement by Medicare Expect new GI and MyPath/DiffDx commercial team expansion to reach optimal productivity in Q2 2023 Expected closure of San Diego lab by end of 2022, folding operations into our Phoenix location Two-year TissueCypher ADLT rate beginning Jan. 1, 2023 Expected Upcoming Milestones

18 First-to-Market Dermatologic Franchise, Additional Growth Opportunities Diagnostic Support Risk Stratification Therapy Response1 1Target launch anticipated by the end of 2025 2New and unique ordering clinicians for all dermatologic tests combined between Oct. 1, 2021-Sept. 30, 2022 . Inflammatory Skin Disease Therapy Response Pipeline Strong provider growth and continued adoption with ~2,335 new ordering clinicians and ~9,155 unique ordering clinicians for our dermatologic tests over the last 12 months2

20 Traditional Approaches to Staging Melanoma Miss Patients with Aggressive Tumor Biology *Excludes stage IV AJCCv7 J Clin Oncol 2009. SEER data release 2017. Ibrahim et al. Ann Surg Oncol 2020.

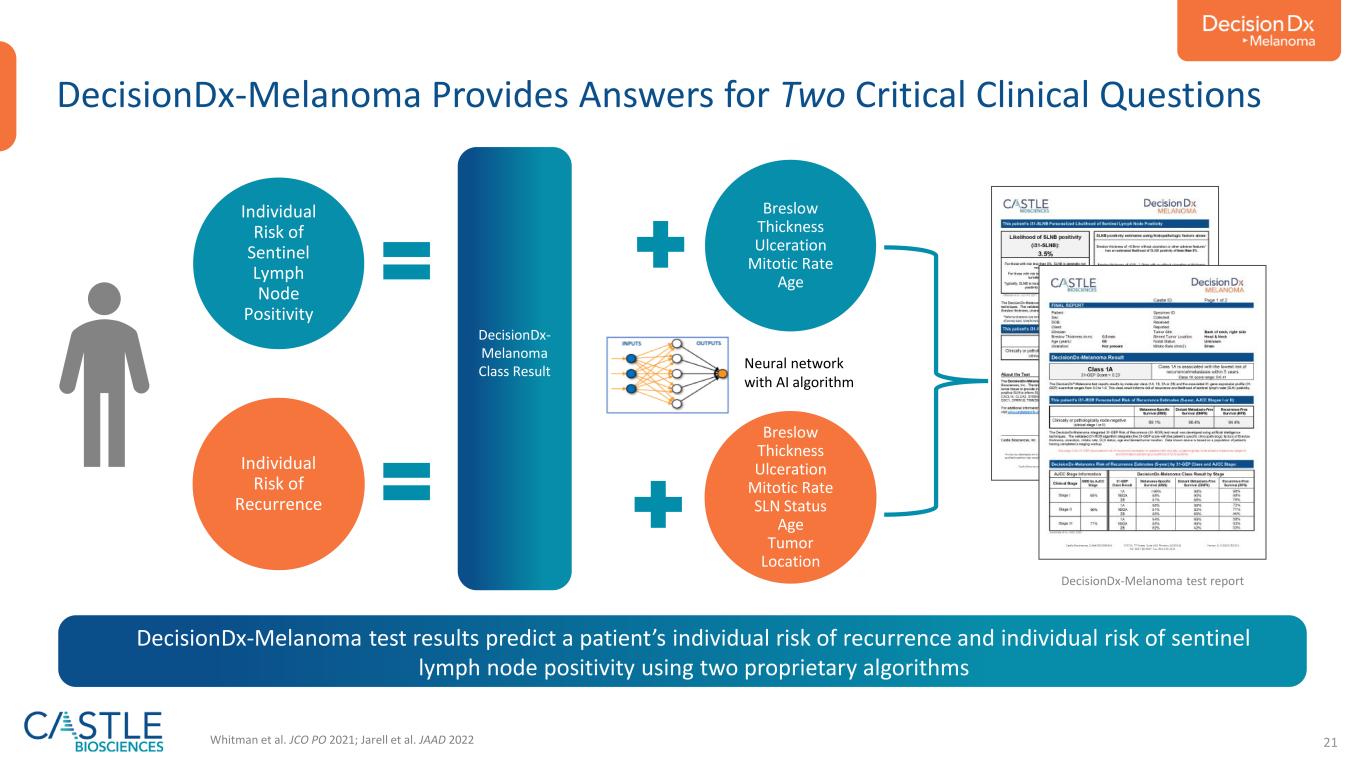

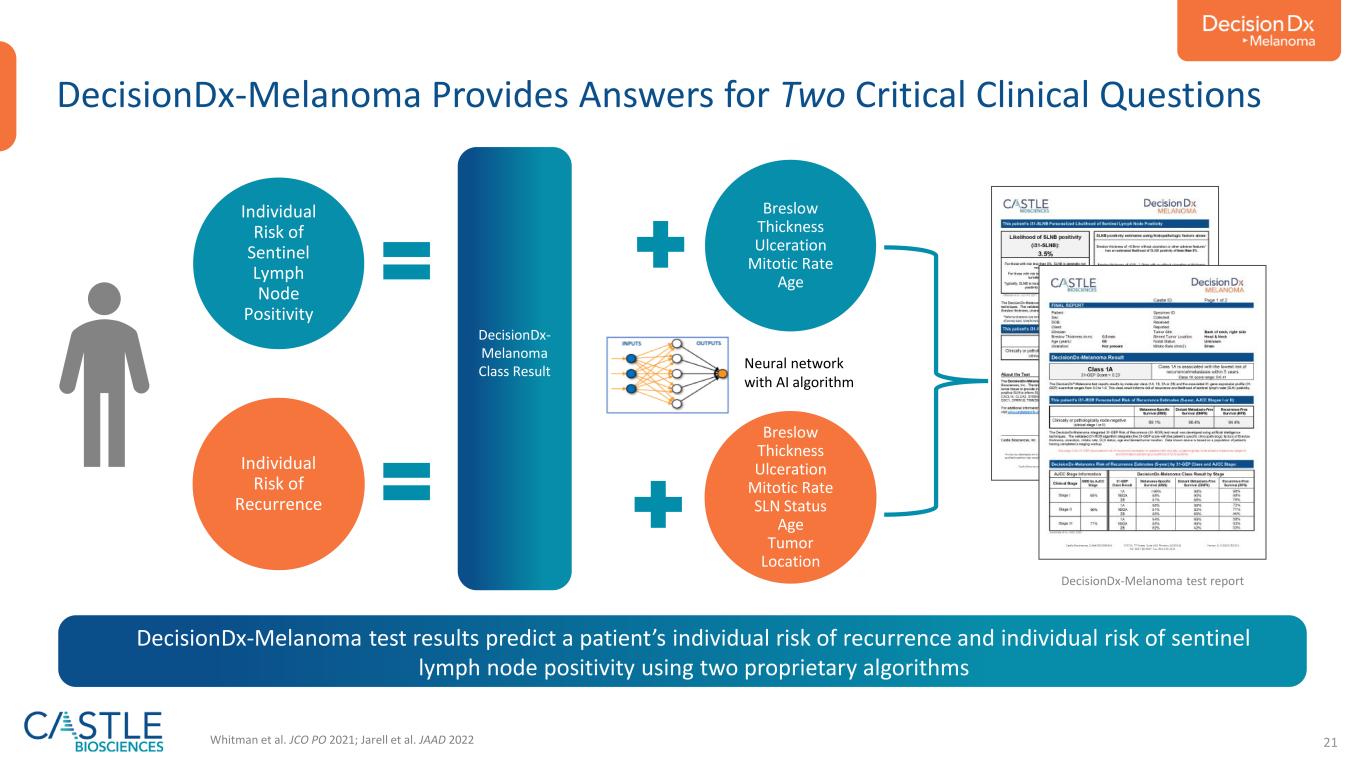

21 DecisionDx- Melanoma Class Result Breslow Thickness Ulceration Mitotic Rate Age Breslow Thickness Ulceration Mitotic Rate SLN Status Age Tumor Location Individual Risk of Sentinel Lymph Node Positivity Individual Risk of Recurrence Whitman et al. JCO PO 2021; Jarell et al. JAAD 2022 Neural network with AI algorithm DecisionDx-Melanoma Provides Answers for Two Critical Clinical Questions DecisionDx-Melanoma test report DecisionDx-Melanoma test results predict a patient’s individual risk of recurrence and individual risk of sentinel lymph node positivity using two proprietary algorithms

22 DecisionDx-Melanoma GEP Has Consistent and Independent Evidence of Prognostic Value across Studies Greenhaw et al. JAAD 2020 1086420 100 80 60 40 20 0 Time (Years) % R e cu rr e n ce F re e 1086420 100 80 60 40 20 0 Time (Years) % D is ta n t M e ta st as is F re e RFS DMFS Breslow thickness (per mm) 1.12 (1.03-1.22), p=0.01 1.14 (1.02-1.26), p=0.02 Ulceration 1.63 (1.18-2.25), p=0.003 2.03 (1.48-2.78), p<0.001 Age (per year) 1.01 (0.99-1.03), p=0.60 1.00 (0.98-1.03), p=0.65 SLNB 2.42 (1.88-3.10), p<0.001 2.80 (2.07-3.77), p<0.001 31-GEP test 2.90 (2.01-4.19), p<0.001 2.75 (1.76-4.32), p<0.001) FEATURE HR RFS (95% CI) p-value HR DMFS (95% CI) p-value Class 1A Lowest Risk Class 1B/2A Increased Risk Class 2B Highest Risk • Quantifies expression of 31 genes from primary tumor using RT-PCR • Applies validated algorithm 31-GEP class result remains a consistent component of all DecisionDx-Melanoma reports

Collaboration with the National Cancer Institute Linking DecisionDx-Melanoma clinical testing with patients captured in the NCI-SEER Registry

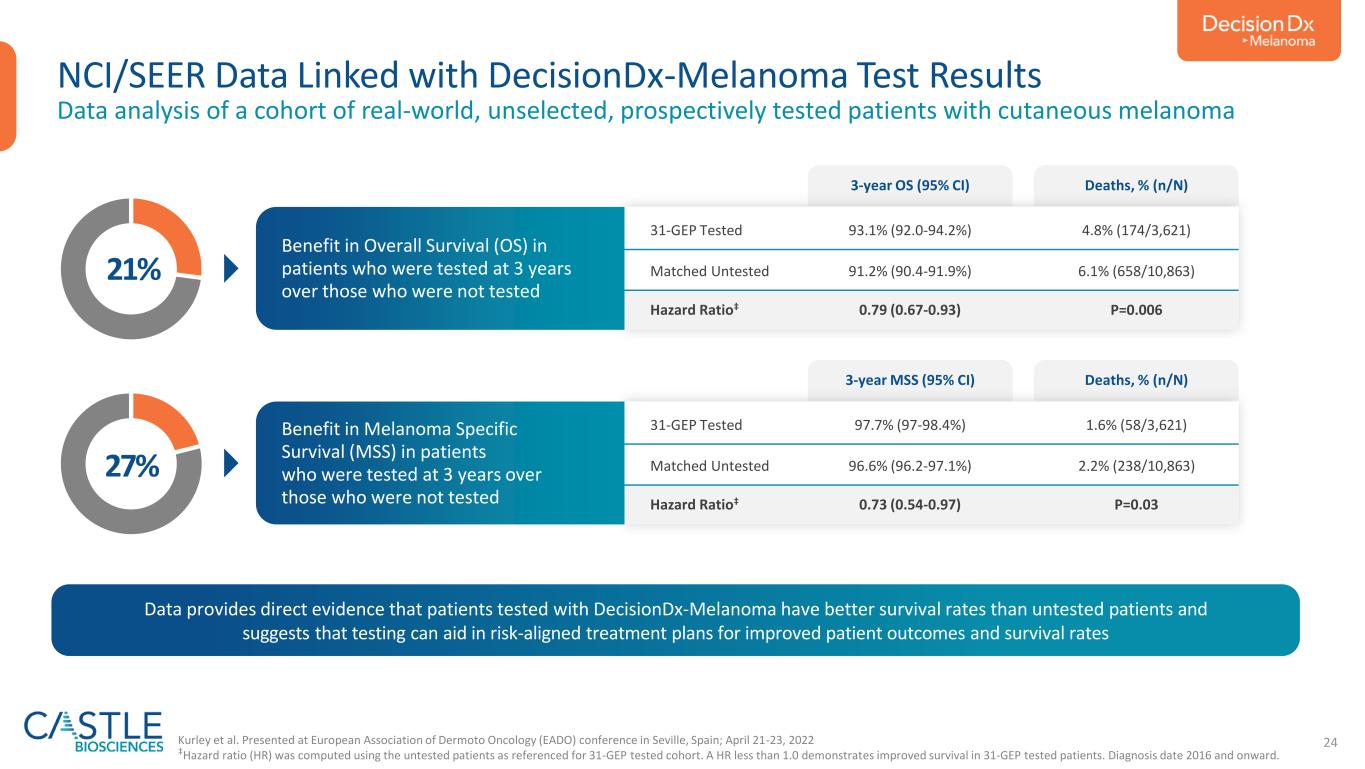

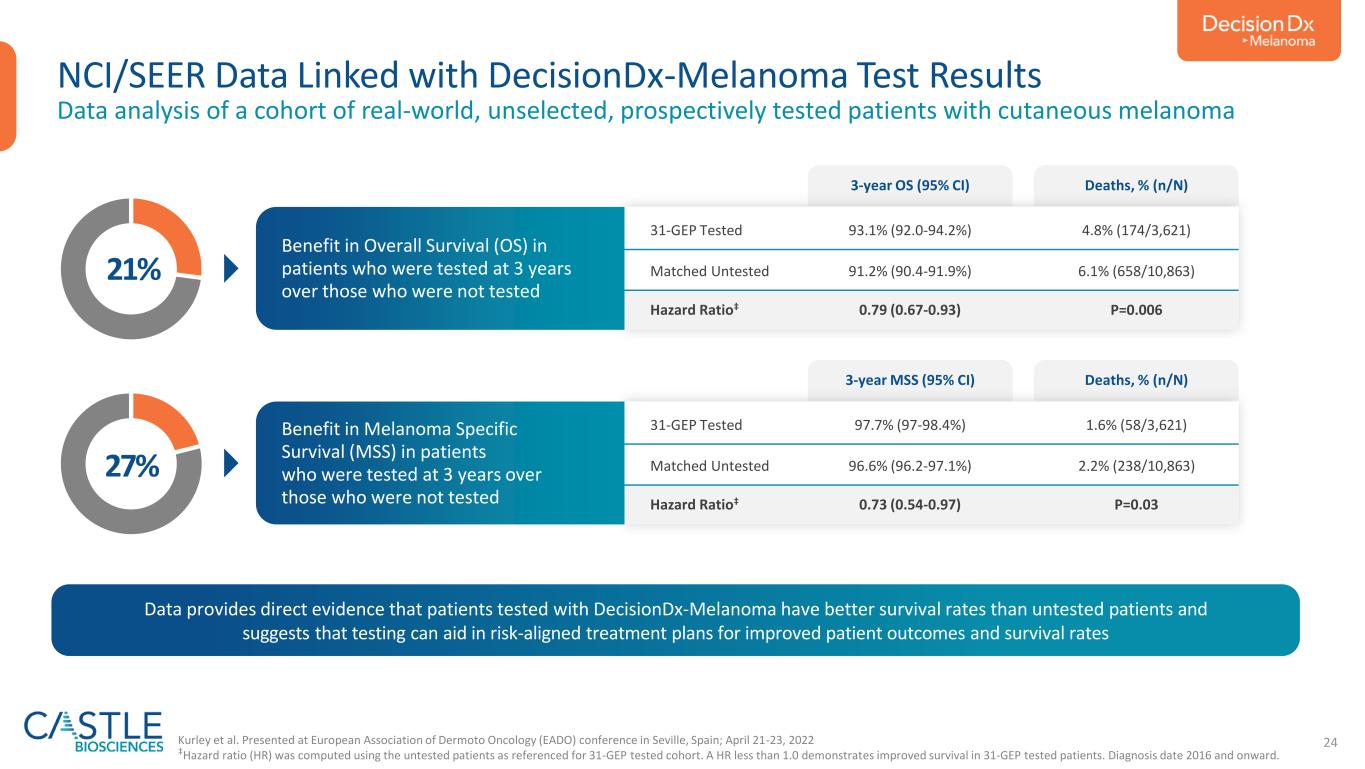

24 NCI/SEER Data Linked with DecisionDx-Melanoma Test Results Data analysis of a cohort of real-world, unselected, prospectively tested patients with cutaneous melanoma 31-GEP Tested 93.1% (92.0-94.2%) 4.8% (174/3,621) Matched Untested 91.2% (90.4-91.9%) 6.1% (658/10,863) Hazard Ratio‡ 0.79 (0.67-0.93) P=0.006 3-year OS (95% CI) Deaths, % (n/N) Benefit in Overall Survival (OS) in patients who were tested at 3 years over those who were not tested 31-GEP Tested 97.7% (97-98.4%) 1.6% (58/3,621) Matched Untested 96.6% (96.2-97.1%) 2.2% (238/10,863) Hazard Ratio‡ 0.73 (0.54-0.97) P=0.03 3-year MSS (95% CI) Deaths, % (n/N) Benefit in Melanoma Specific Survival (MSS) in patients who were tested at 3 years over those who were not tested 21% 27% Kurley et al. Presented at European Association of Dermoto Oncology (EADO) conference in Seville, Spain; April 21-23, 2022 ‡Hazard ratio (HR) was computed using the untested patients as referenced for 31-GEP tested cohort. A HR less than 1.0 demonstrates improved survival in 31-GEP tested patients. Diagnosis date 2016 and onward. Data provides direct evidence that patients tested with DecisionDx-Melanoma have better survival rates than untested patients and suggests that testing can aid in risk-aligned treatment plans for improved patient outcomes and survival rates

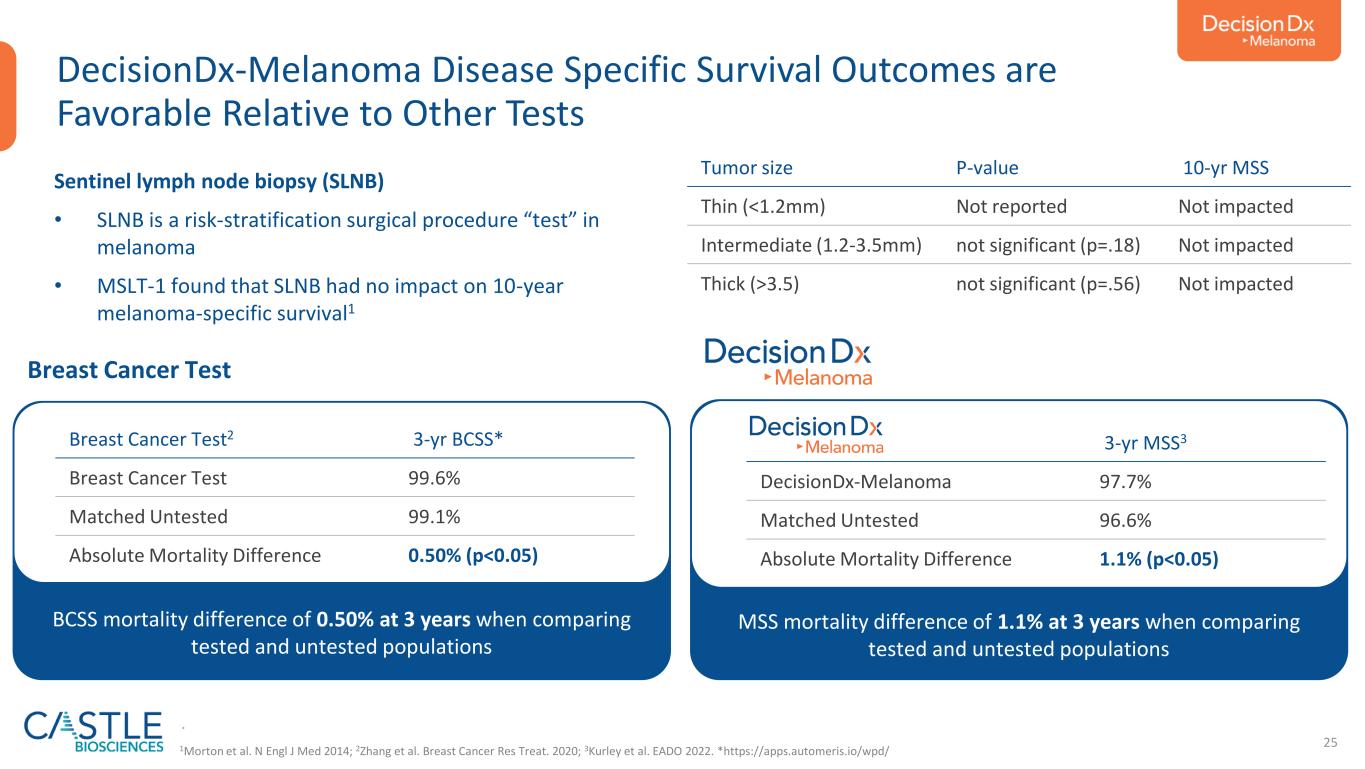

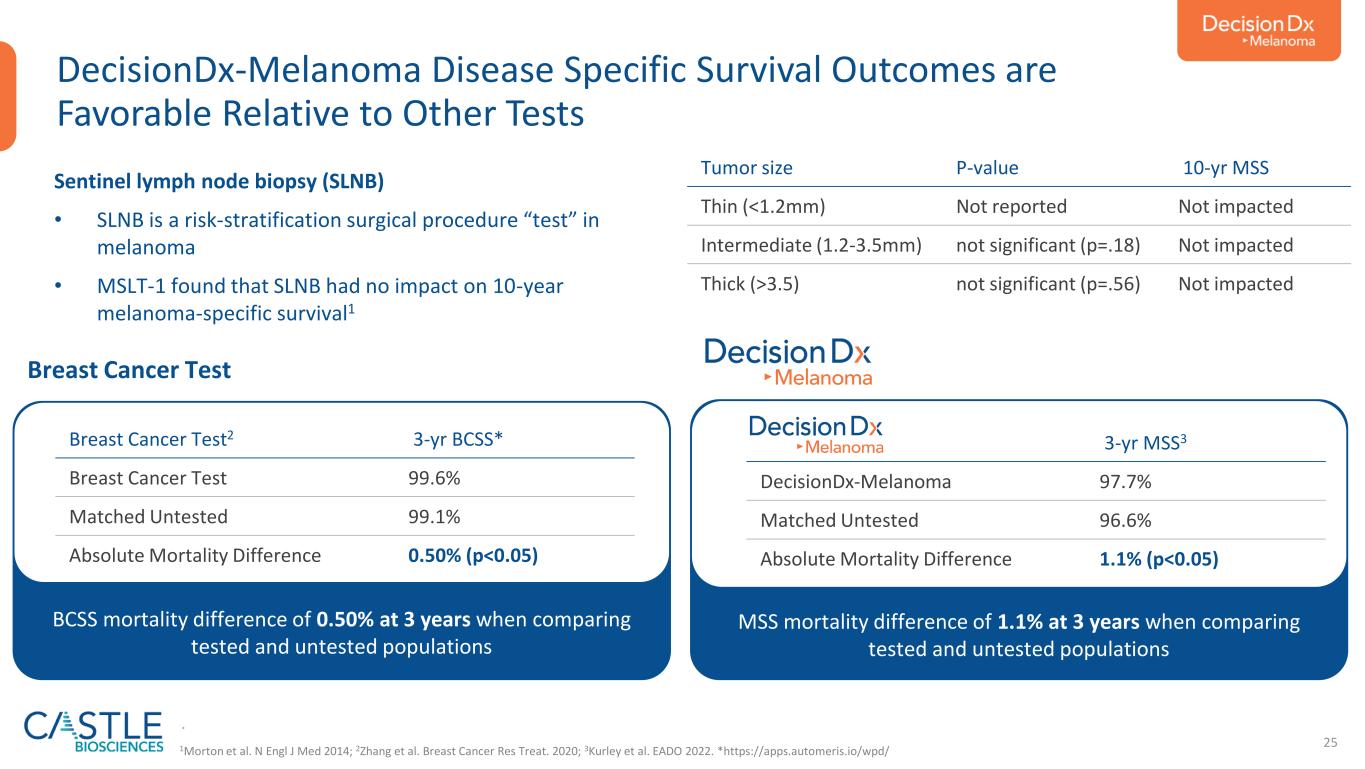

25 DecisionDx-Melanoma Disease Specific Survival Outcomes are Favorable Relative to Other Tests MSS mortality difference of 1.1% at 3 years when comparing tested and untested populations Sentinel lymph node biopsy (SLNB) • SLNB is a risk-stratification surgical procedure “test” in melanoma • MSLT-1 found that SLNB had no impact on 10-year melanoma-specific survival1 Tumor size P-value 10-yr MSS Thin (<1.2mm) Not reported Not impacted Intermediate (1.2-3.5mm) not significant (p=.18) Not impacted Thick (>3.5) not significant (p=.56) Not impacted BCSS mortality difference of 0.50% at 3 years when comparing tested and untested populations Breast Cancer Test2 3-yr BCSS* Breast Cancer Test 99.6% Matched Untested 99.1% Absolute Mortality Difference 0.50% (p<0.05) . 3-yr MSS3 DecisionDx-Melanoma 97.7% Matched Untested 96.6% Absolute Mortality Difference 1.1% (p<0.05) Breast Cancer Test 1Morton et al. N Engl J Med 2014; 2Zhang et al. Breast Cancer Res Treat. 2020; 3Kurley et al. EADO 2022. *https://apps.automeris.io/wpd/

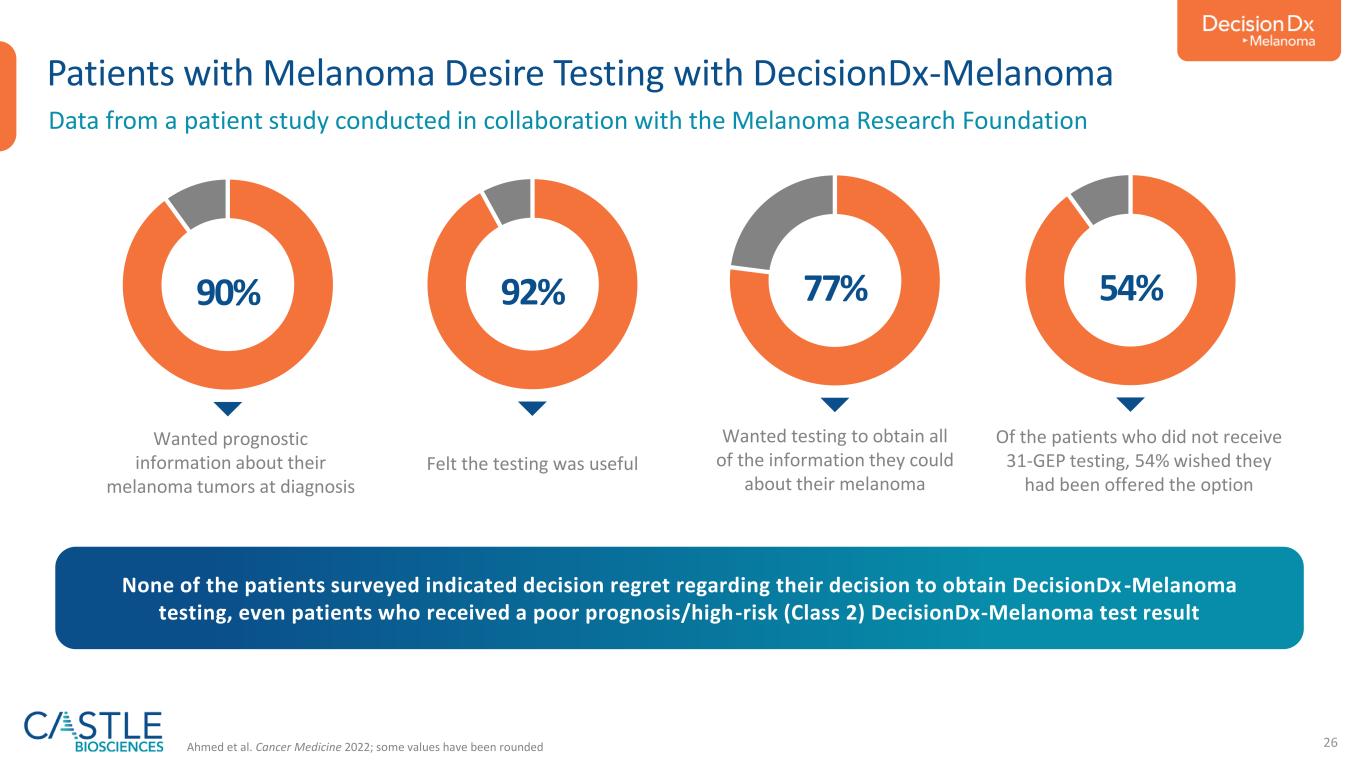

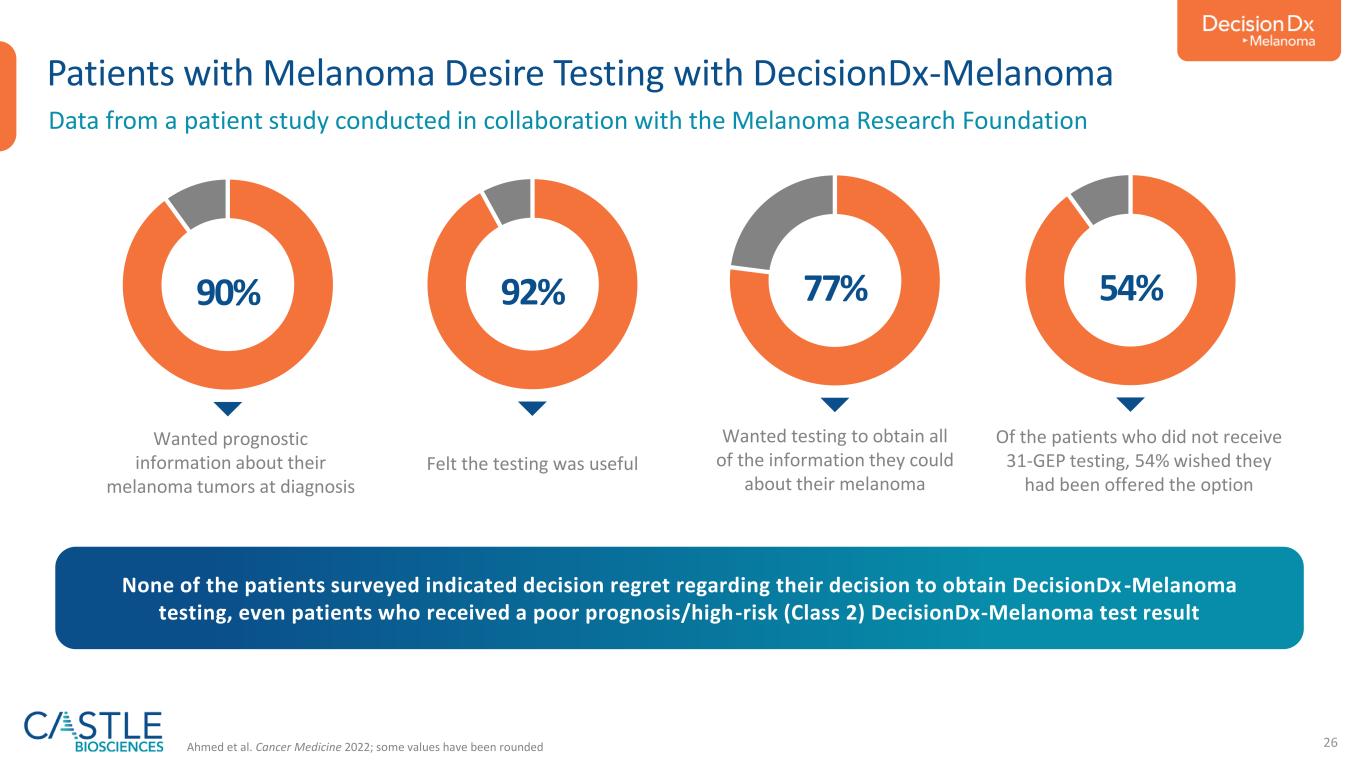

26 Patients with Melanoma Desire Testing with DecisionDx-Melanoma 90% Ahmed et al. Cancer Medicine 2022; some values have been rounded None of the patients surveyed indicated decision regret regarding their decision to obtain DecisionDx -Melanoma testing, even patients who received a poor prognosis/high-risk (Class 2) DecisionDx-Melanoma test result Wanted prognostic information about their melanoma tumors at diagnosis 92% Felt the testing was useful 77% Wanted testing to obtain all of the information they could about their melanoma 54% Of the patients who did not receive 31-GEP testing, 54% wished they had been offered the option Data from a patient study conducted in collaboration with the Melanoma Research Foundation

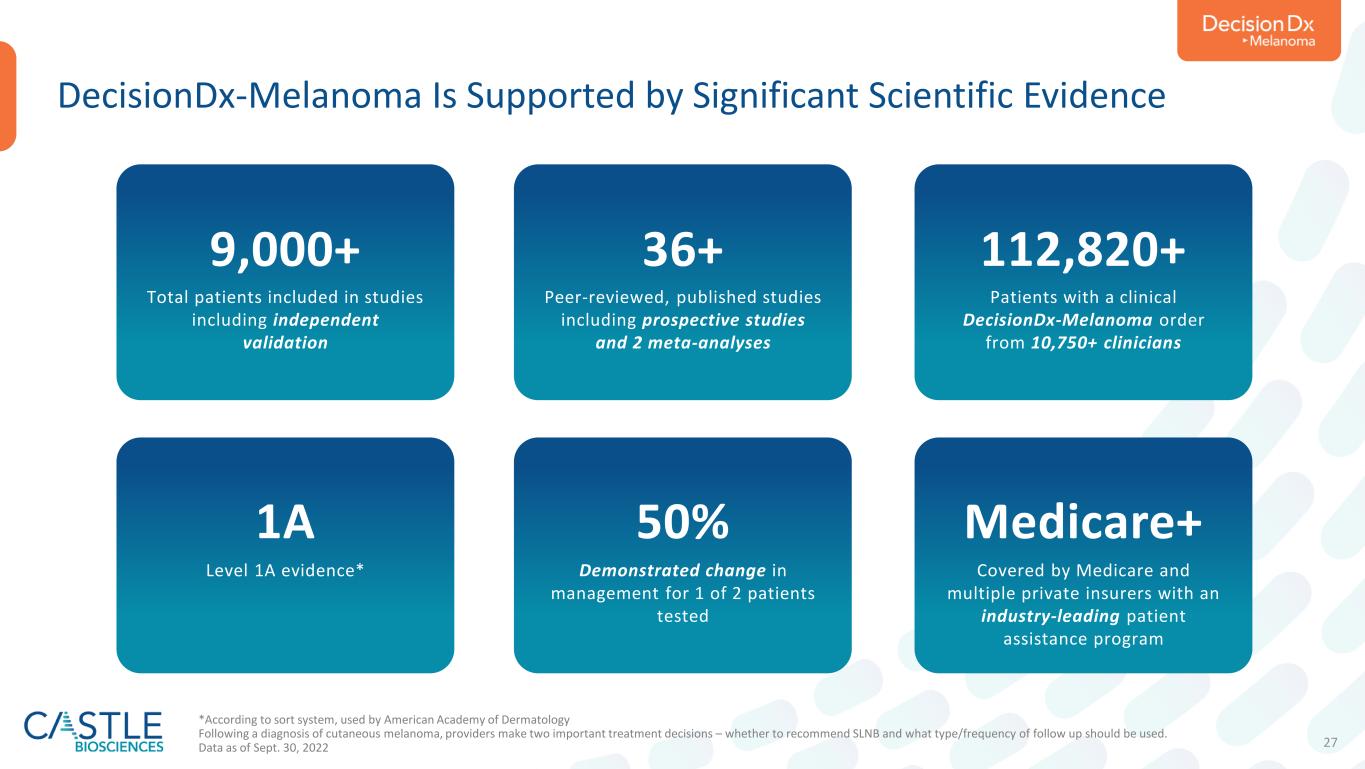

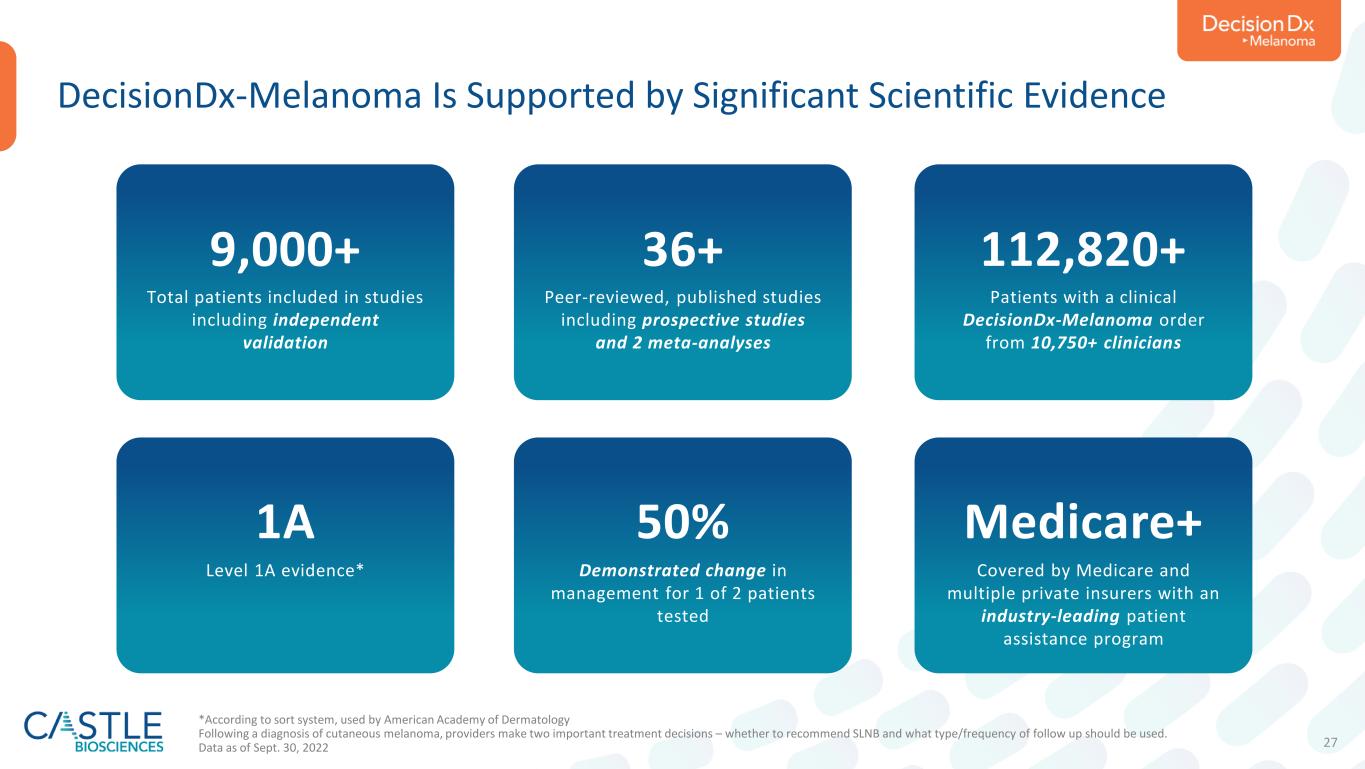

27 DecisionDx-Melanoma Is Supported by Significant Scientific Evidence 9,000+ Total patients included in studies including independent validation 36+ Peer-reviewed, published studies including prospective studies and 2 meta-analyses 112,820+ Patients with a clinical DecisionDx-Melanoma order from 10,750+ clinicians 1A Level 1A evidence* 50% Demonstrated change in management for 1 of 2 patients tested Medicare+ Covered by Medicare and multiple private insurers with an industry-leading patient assistance program *According to sort system, used by American Academy of Dermatology Following a diagnosis of cutaneous melanoma, providers make two important treatment decisions – whether to recommend SLNB and what type/frequency of follow up should be used. Data as of Sept. 30, 2022

29 Cutaneous Squamous Cell Carcinoma Is an Emerging Problem in the U.S. • Managing SCC is a significant clinical issue as deaths from SCC are now estimated to exceed those from melanoma • Because cancer treatment plans and their outcomes are guided by risk for metastasis, prognostic accuracy has direct implications on patient management • Traditional staging fails to identify >30% of SCC cases who go on to metastasize, and >75% of SCC cases are over-called by staging • Unlike melanoma, breast and other common cancers, SCC patient care has not been personalized with risk predicting gene expression profile (GEP) tests SEER data release 2019; Mansouri et al. JAMA Dermatol 2017; https://www.skincancer.org/skin-cancer-information/skin-cancer-facts/ Utility of traditional clinicopathologic risk factors is limited by their low positive predictive value 2,0000 ~7,650 DEATHS PER YEAR IN THE U.S. 4,000 6,000 8,000 10,000 12,000 14,000 16,000 >15,000 Melanoma SCC

30 How is Risk Assessment Traditionally Done for SCC Patients? • The SCC community uses the term “high-risk” SCC to describe different patient populations • Current SCC staging fails to identify >30% of cases who will go on to experience metastasis Additional Risk Factors from NCCN and Mohs AUC: Rapidly growing tumor, neurologic symptoms, LVI, site of prior RT or chronic inflammatory process, and select histologic subtypes (also see template for SCC testing criteria) NCCN1 HR or Mohs AUC2 >2 cm3, Deep3 (broad definition), PNI3 (broad def’), Poorly differentiated3, LVI5 Ear, Lip, Temple3 Scalp6 Immunocompromised3 BWH4 T2a Any 1 of: >2 cm, Deep (>SC fat), PNI (≥0.1mm), Poorly diff’ BWH4 T2b Any 2-3 of: >2 cm, Deep (>SC fat), PNI (≥0.1mm), Poorly diff’ “HIGH RISK”Broader Criteria Narrower Criteria Higher PPV 1 NCCN Guidelines for Squamous Cell Skin Cancer v2.2022; 2 Connolly et al. JAAD 2012; 3 Thompson et al. JAMA Derm 2016; 4 Jambusaria-Pahlajani et al. JAMA Derm 2013; 5 Skulsky et al. Head & Neck 2016; 6 Mo et al. JAMA Derm 2020

31 DecisionDx-SCC Predicts Metastatic Risk For SCC Patients With One Or More Risk Factors Wysong et al. JAAD 2021; Ibrahim et al. Future Oncology 2021 Class 1: Low Biological Risk Less than half the general study population risk • Quantifies expression of 40 genes from primary tumor using RT-PCR • Applies a validated neural network algorithm • Accurately classifies patients as low, moderate or high biological risk Class 2A: Moderate Biological Risk Similar to the strongest traditional factors SCC patients with one or more risk factors Class 2B: High Biological Risk ≥50% risk of metastasis

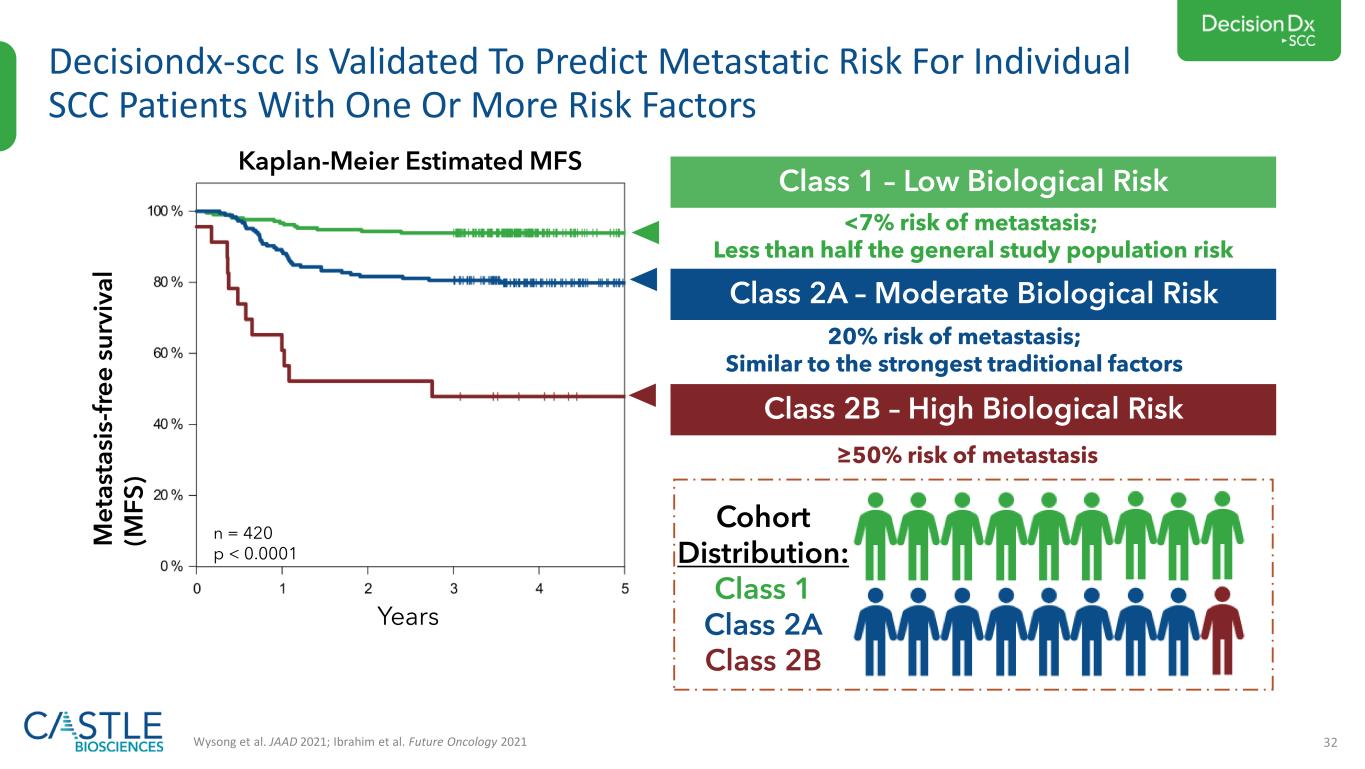

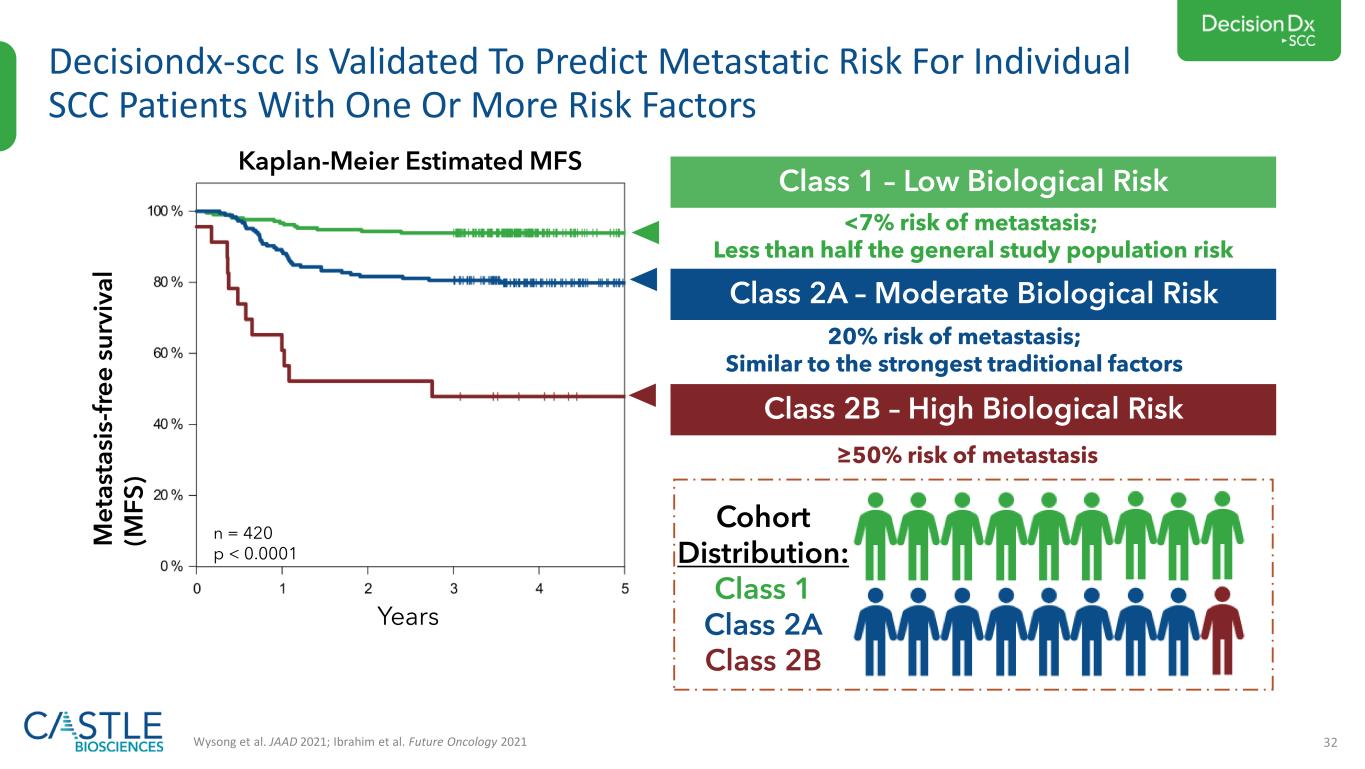

32 Decisiondx-scc Is Validated To Predict Metastatic Risk For Individual SCC Patients With One Or More Risk Factors Wysong et al. JAAD 2021; Ibrahim et al. Future Oncology 2021 M e ta st a si s- fr e e s u rv iv a l (M F S ) Years n = 420 p < 0.0001 Cohort Distribution: Class 1 Class 2A Class 2B Kaplan-Meier Estimated MFS Class 1 – Low Biological Risk <7% risk of metastasis; Less than half the general study population risk Class 2A – Moderate Biological Risk 20% risk of metastasis; Similar to the strongest traditional factors Class 2B – High Biological Risk ≥50% risk of metastasis

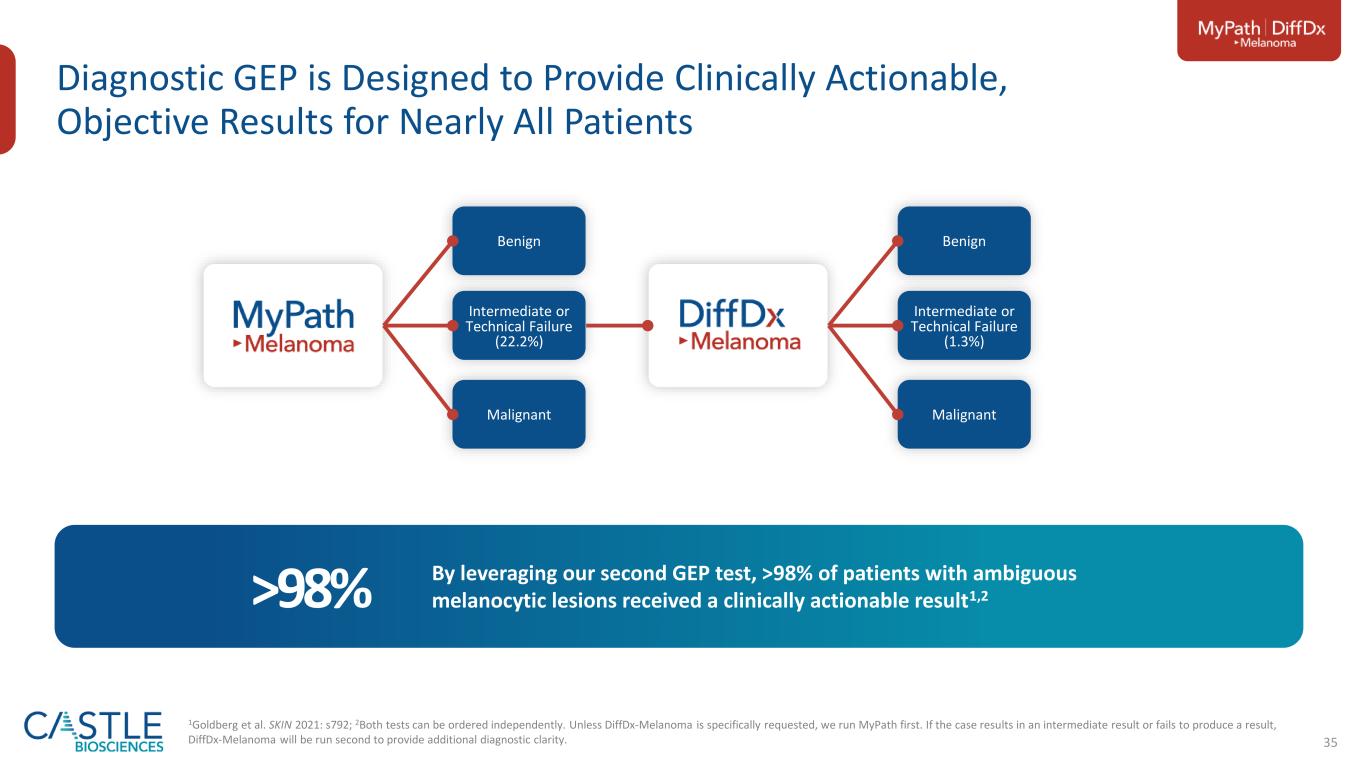

34 A clinical hurdle for dermatopathology is the accurate diagnosis of difficult-to-diagnose melanocytic neoplasms Unmet Need in Patients with a Difficult-to-Diagnose Pigmented Lesion Of the estimated two million suspicious pigmented lesions biopsied annually in the U.S., approximately 300,000 of those cannot be classified with confidence as either benign tissue or melanoma through traditional histopathology methods These difficult-to-diagnose lesions are commonly sent for second opinions to expert dermatopathologists who have more experience with challenging cases; however, the nature of many lesions remains ambiguous with discordant rates of lesions in this category of 25-43% (Elmore et al. 2017) Diagnostic ambiguity can lead to clinical management uncertainty and overtreatment, leading to unnecessary excisions and increased patient morbidity, and undertreatment, with the potential for missing diagnoses of malignant melanoma The Clinical Problem

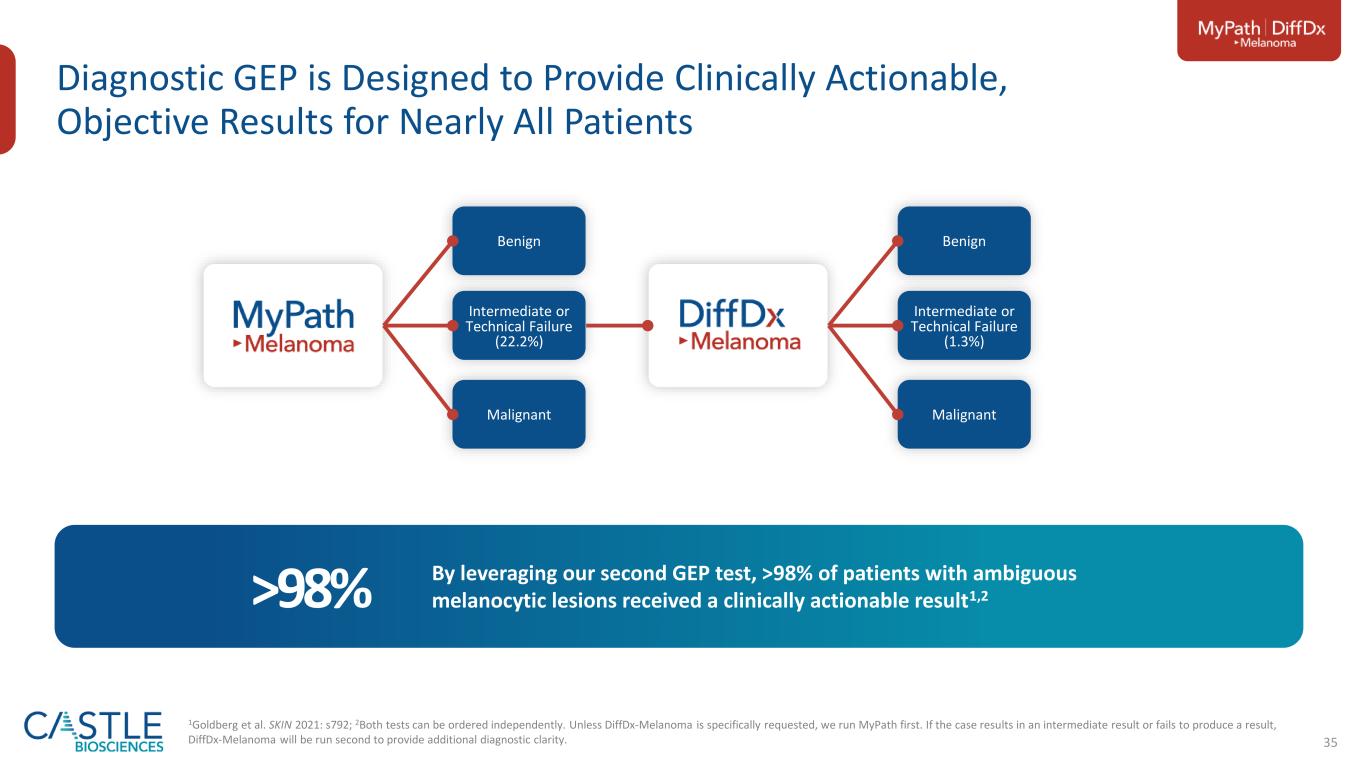

35 Diagnostic GEP is Designed to Provide Clinically Actionable, Objective Results for Nearly All Patients Benign Intermediate or Technical Failure (1.3%) Malignant Benign Intermediate or Technical Failure (22.2%) Malignant By leveraging our second GEP test, >98% of patients with ambiguous melanocytic lesions received a clinically actionable result1,2>98% 1Goldberg et al. SKIN 2021: s792; 2Both tests can be ordered independently. Unless DiffDx-Melanoma is specifically requested, we run MyPath first. If the case results in an intermediate result or fails to produce a result, DiffDx-Melanoma will be run second to provide additional diagnostic clarity.

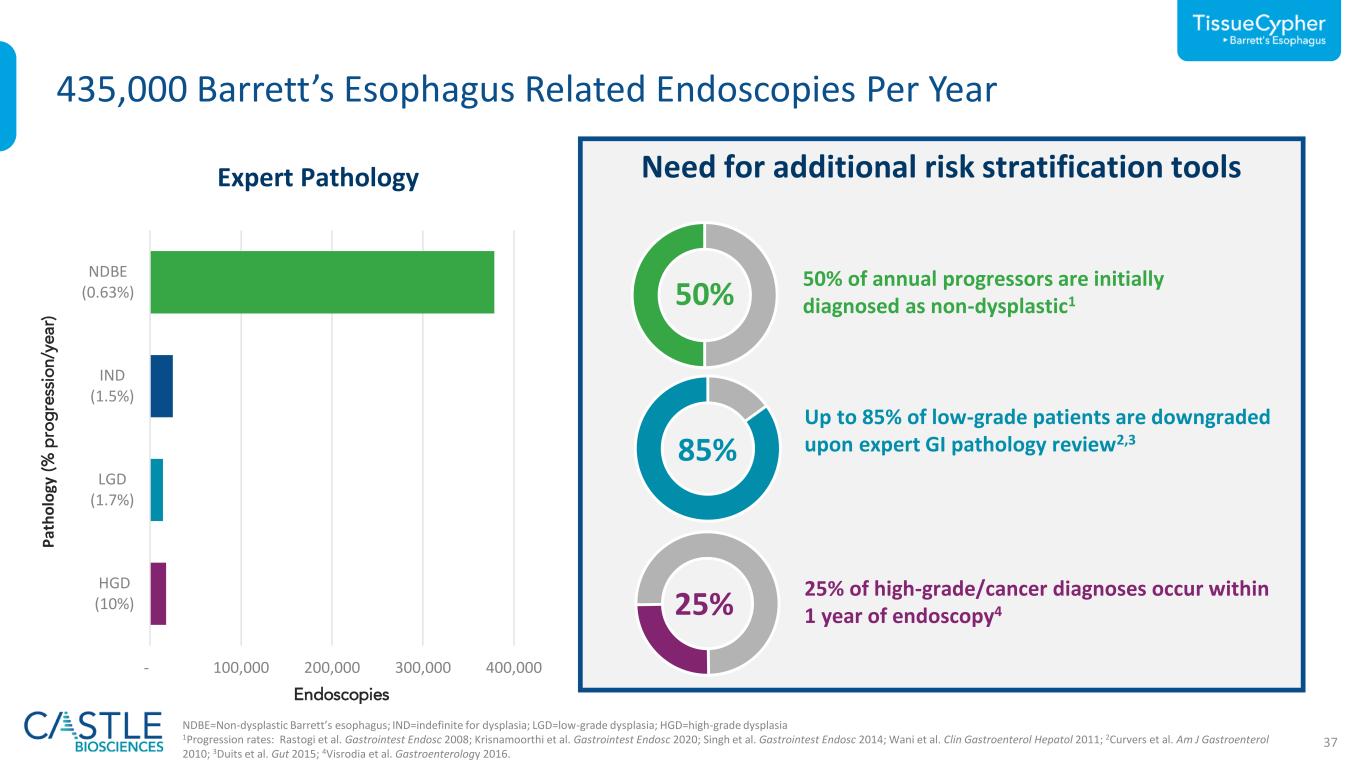

37 - 100,000 200,000 300,000 400,000 HGD (10%) LGD (0.26%) IND (1.5%) NDBE (0.80%) LGD (1.7 63 Need for additional risk stratification tools 435,000 Barrett’s Esophagus Related Endoscopies Per Year Expert Pathology NDBE=Non-dysplastic Barrett’s esophagus; IND=indefinite for dysplasia; LGD=low-grade dysplasia; HGD=high-grade dysplasia 1Progression rates: Rastogi et al. Gastrointest Endosc 2008; Krisnamoorthi et al. Gastrointest Endosc 2020; Singh et al. Gastrointest Endosc 2014; Wani et al. Clin Gastroenterol Hepatol 2011; 2Curvers et al. Am J Gastroenterol 2010; 3Duits et al. Gut 2015; 4Visrodia et al. Gastroenterology 2016. 50% 50% of annual progressors are initially diagnosed as non-dysplastic1 85% Up to 85% of low-grade patients are downgraded upon expert GI pathology review2,3 25% 25% of high-grade/cancer diagnoses occur within 1 year of endoscopy4 P at h o lo gy (% p ro g re ss io n /y e a r) Endoscopies

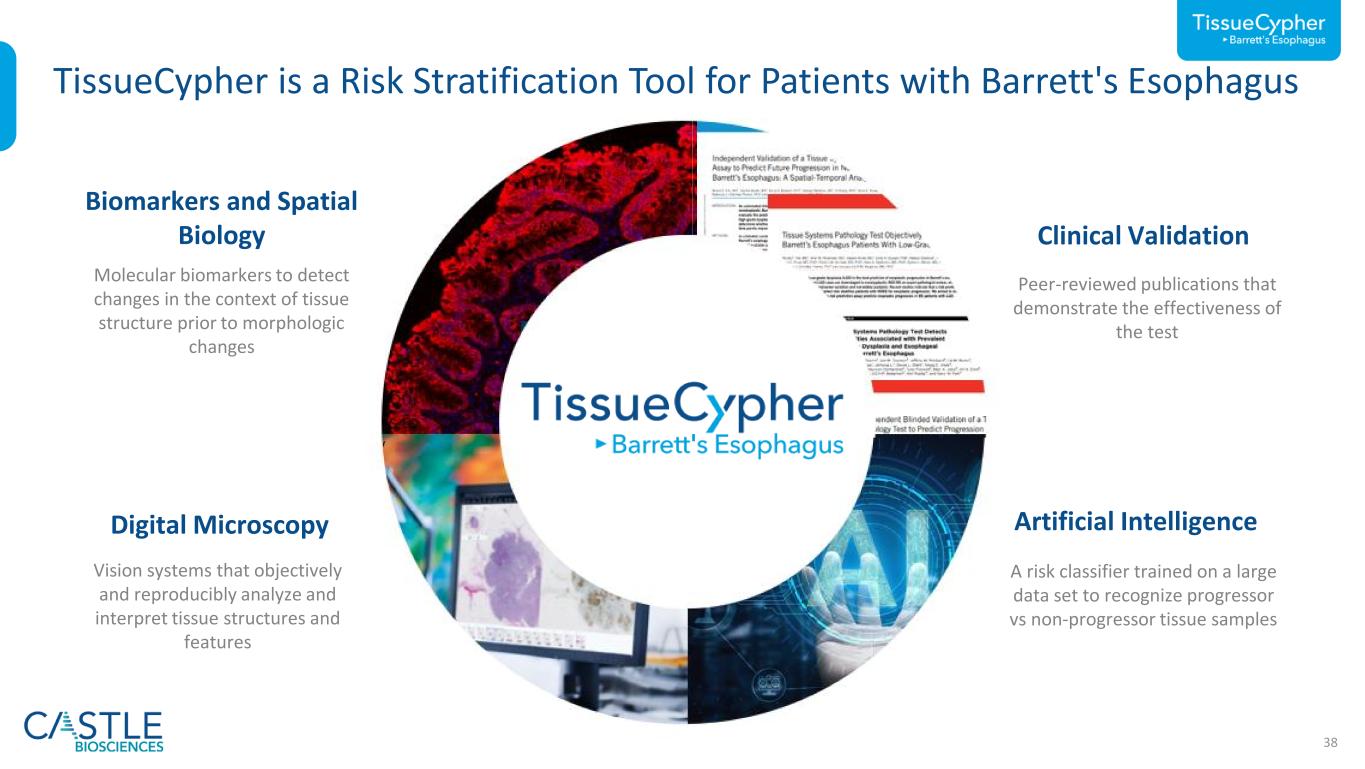

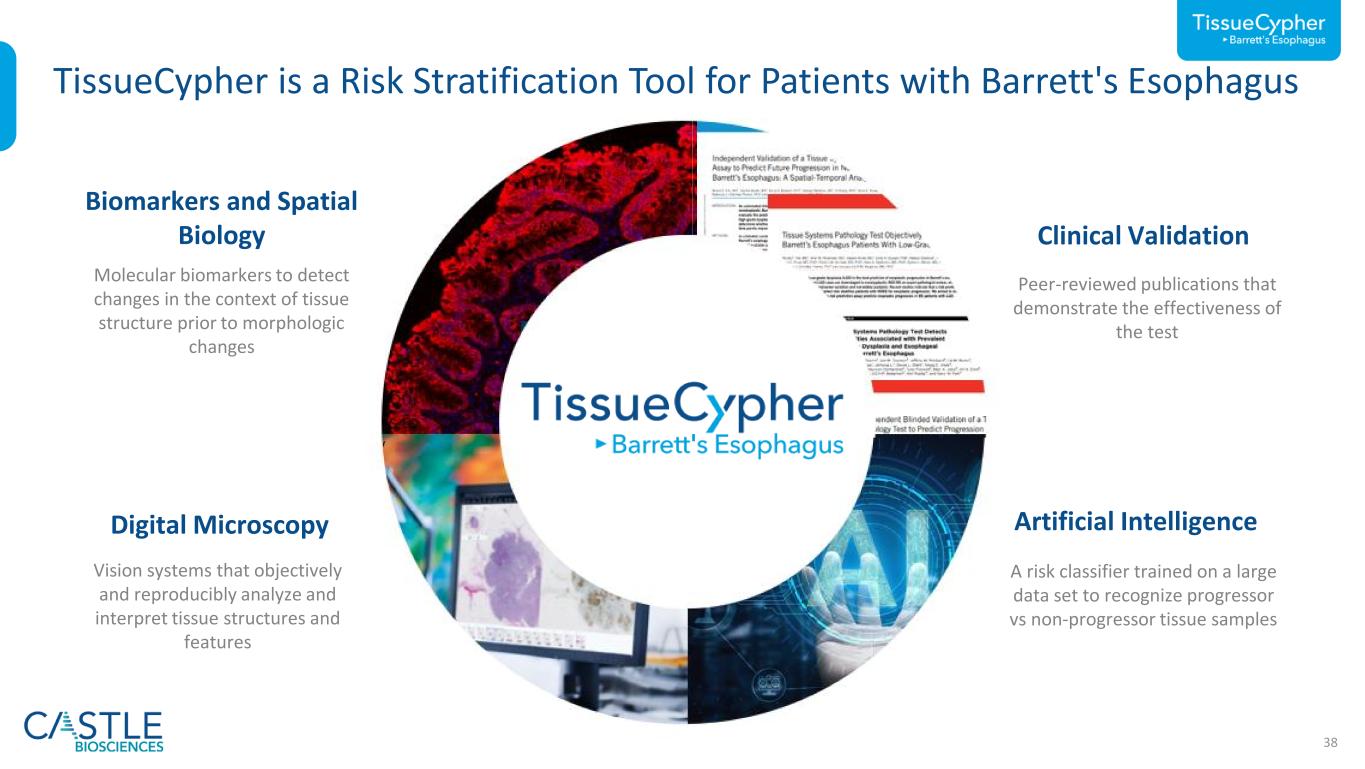

38 Molecular biomarkers to detect changes in the context of tissue structure prior to morphologic changes Biomarkers and Spatial Biology Vision systems that objectively and reproducibly analyze and interpret tissue structures and features Digital Microscopy Peer-reviewed publications that demonstrate the effectiveness of the test Clinical Validation A risk classifier trained on a large data set to recognize progressor vs non-progressor tissue samples Artificial Intelligence TissueCypher is a Risk Stratification Tool for Patients with Barrett's Esophagus

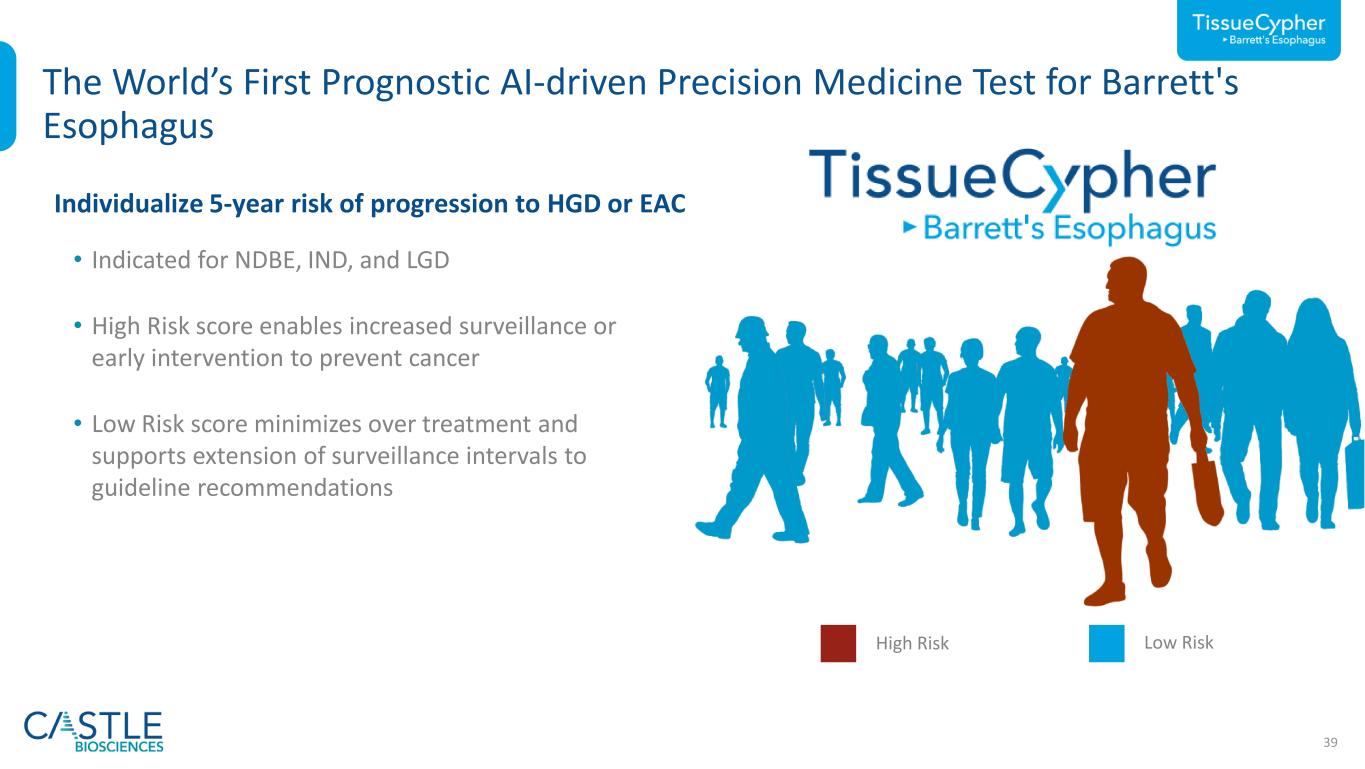

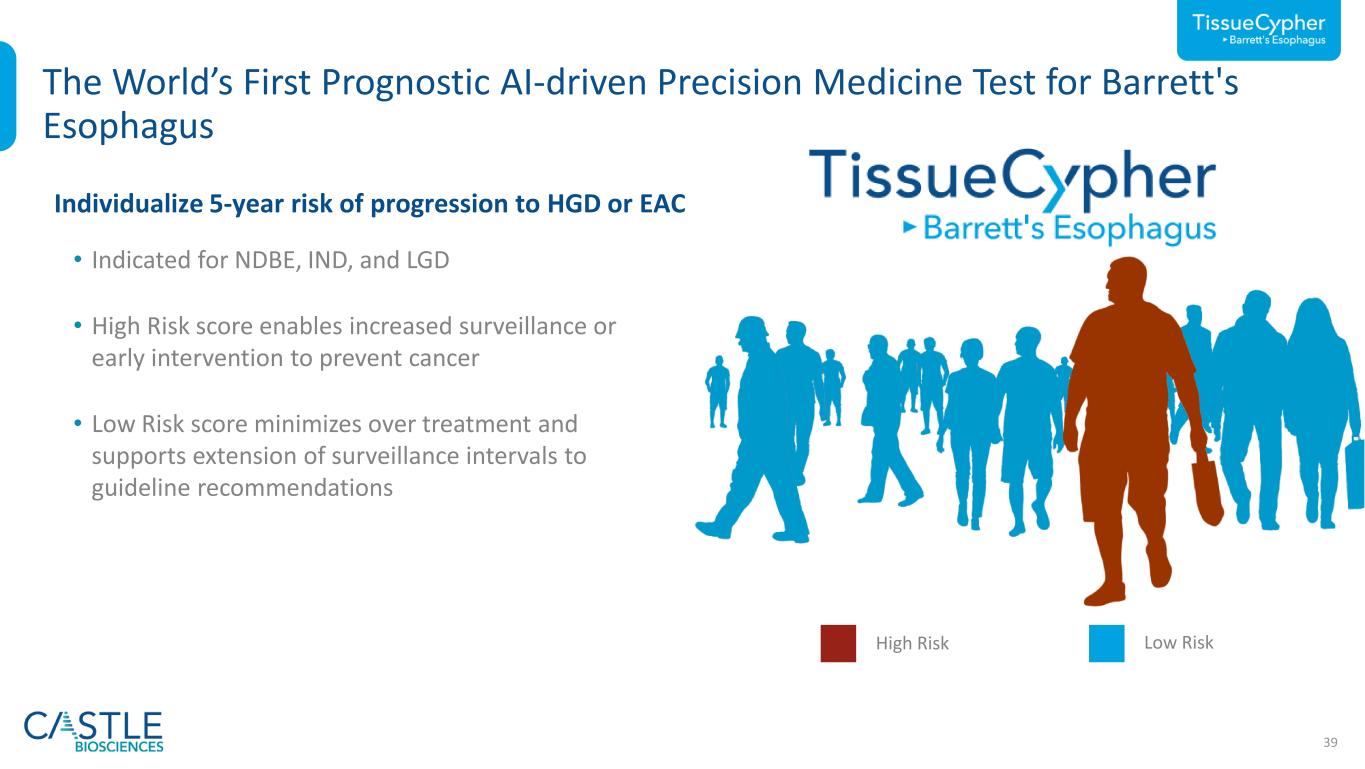

39 The World’s First Prognostic AI-driven Precision Medicine Test for Barrett's Esophagus Low RiskHigh Risk • Indicated for NDBE, IND, and LGD • High Risk score enables increased surveillance or early intervention to prevent cancer • Low Risk score minimizes over treatment and supports extension of surveillance intervals to guideline recommendations Individualize 5-year risk of progression to HGD or EAC

40 TissueCypher Is the Strongest Independent Predictor of Progression HR = Hazard ratio. Pooled analysis completed by Castle Biosciences. 1Critchley-Thorne et al. Cancer Epidemiol Biomarkers Prev 2016; 2Critchley-Thorne et al. Cancer Epidemiol Biomarkers Prev 2017; 3Davison et al. Am J Gastroenterol 2020; 4Frei et. al. Clin Transl Gastroenterol 2020; 5 Frei et. al. Am J Gastroenterol 2021 n=699 patients1-5 (ND n=567, IND n=50, LGD n=82) 152 incident progressors, 38 prevalent cases, 509 non-progressors Original Pathologic Diagnosis HR = 7.7 (high- vs. low-risk) p<0.0001 HR = 2.8 (inter- vs. low-risk) p<0.0001 TissueCypher

3–5-year surveillance3,4 1-year surveillance2 Endoscopic Eradication Therapy (EET) or 6–12- month surveillance2 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% Consideration of Patient Management Based on Risk of Progression 1Progression rates: Rastogi et al. Gastrointest Endosc 2008; Krisnamoorthi et al. Gastrointest Endosc 2020; Singh et al. Gastrointest Endosc 2014; Wani et al. Clin Gastroenterol Hepatol 2011. 2Consensus guidelines from ACG (2015), AGA (Medical Position Statement, 2011) and ASGE (2019); 3Shaheen et al. Am J Gastroenterol 2022 4Komanduri et al. Clin Gastroenterol Hepatol 2022. *Data on file, Castle Biosciences. Data from pooled analysis of TissueCypher’s risk stratification performance reported in five clinical validation studies. 5 -y e a r ri sk o f p ro g re ss io n Histology only NDBE1 IND1 LGD1NDBE (Low-Risk)* NDBE (High-Risk)* LGD/IND (High-Risk)* LGD/IND (Low-Risk)* High-Risk TissueCypherLow-Risk TissueCypher 41

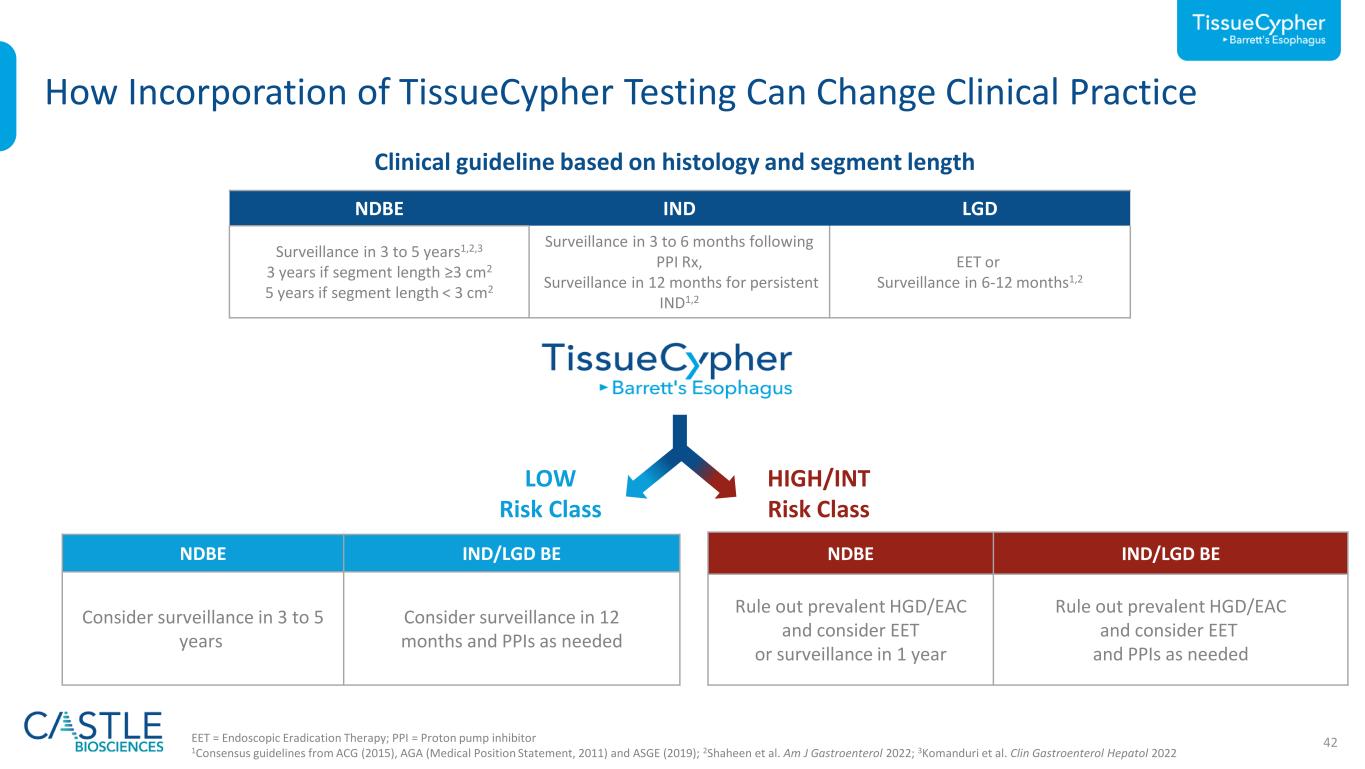

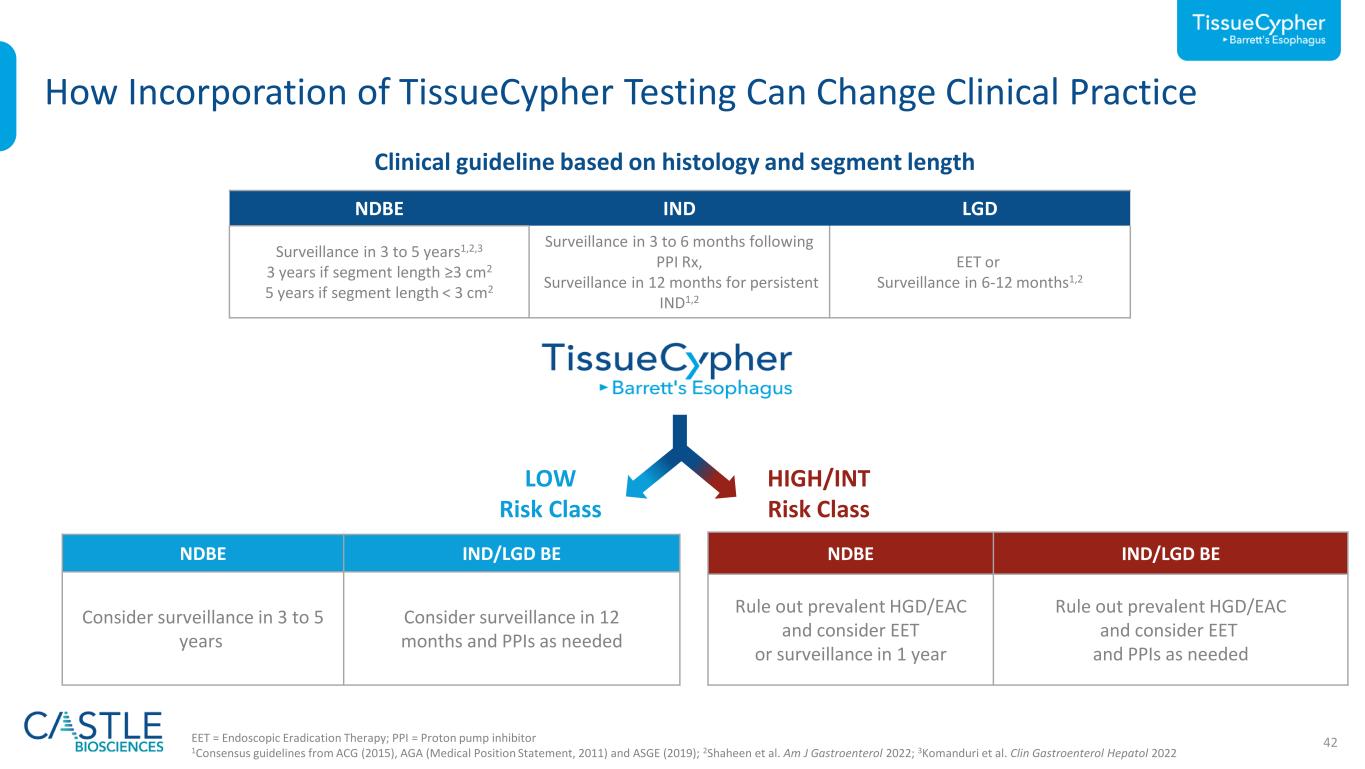

42EET = Endoscopic Eradication Therapy; PPI = Proton pump inhibitor 1Consensus guidelines from ACG (2015), AGA (Medical Position Statement, 2011) and ASGE (2019); 2Shaheen et al. Am J Gastroenterol 2022; 3Komanduri et al. Clin Gastroenterol Hepatol 2022 How Incorporation of TissueCypher Testing Can Change Clinical Practice NDBE IND LGD Surveillance in 3 to 5 years1,2,3 3 years if segment length ≥3 cm2 5 years if segment length < 3 cm2 Surveillance in 3 to 6 months following PPI Rx, Surveillance in 12 months for persistent IND1,2 EET or Surveillance in 6-12 months1,2 Clinical guideline based on histology and segment length NDBE IND/LGD BE Consider surveillance in 3 to 5 years Consider surveillance in 12 months and PPIs as needed LOW Risk Class NDBE IND/LGD BE Rule out prevalent HGD/EAC and consider EET or surveillance in 1 year Rule out prevalent HGD/EAC and consider EET and PPIs as needed HIGH/INT Risk Class

44 Medication Selection for Mental Illness Is Challenging ~53% of patients with major depressive disorder (MDD) have an inadequate response to first-line treatment1 Inadequate Therapy Response 72% of patients with MDD do not achieve remission using current standard of care treatment approaches2 Low Remission Rates The likelihood of discontinuation rises from 8.6% with first-line medication treatment to 41.4% with fourth-line treatment3 High Prevalence of Adverse Drug Events 1https://pubmed.ncbi.nlm.nih.gov/16390886/; 2https://pubmed.ncbi.nlm.nih.gov/16390886/ 3STAR*D Trial Combined Across Four Medication Cycles ”…finding an effective antidepressant can take years” - Mental Health America

45 2.5x Increase in Remission Rates for Severe Depression Demonstrated Enhanced Clinical Outcomes vs. Standard of Care Control IDgenetix Response Rate ≥ 50% Reduction from Baseline Remission Rate Patients Achieving Remission p-value 0.05 0.02p-value 0.01 0.001 >2.5x increase in remission rate vs. control 2x increase in response rate vs. control Bradley et al. J Psychiatr Res 2018.

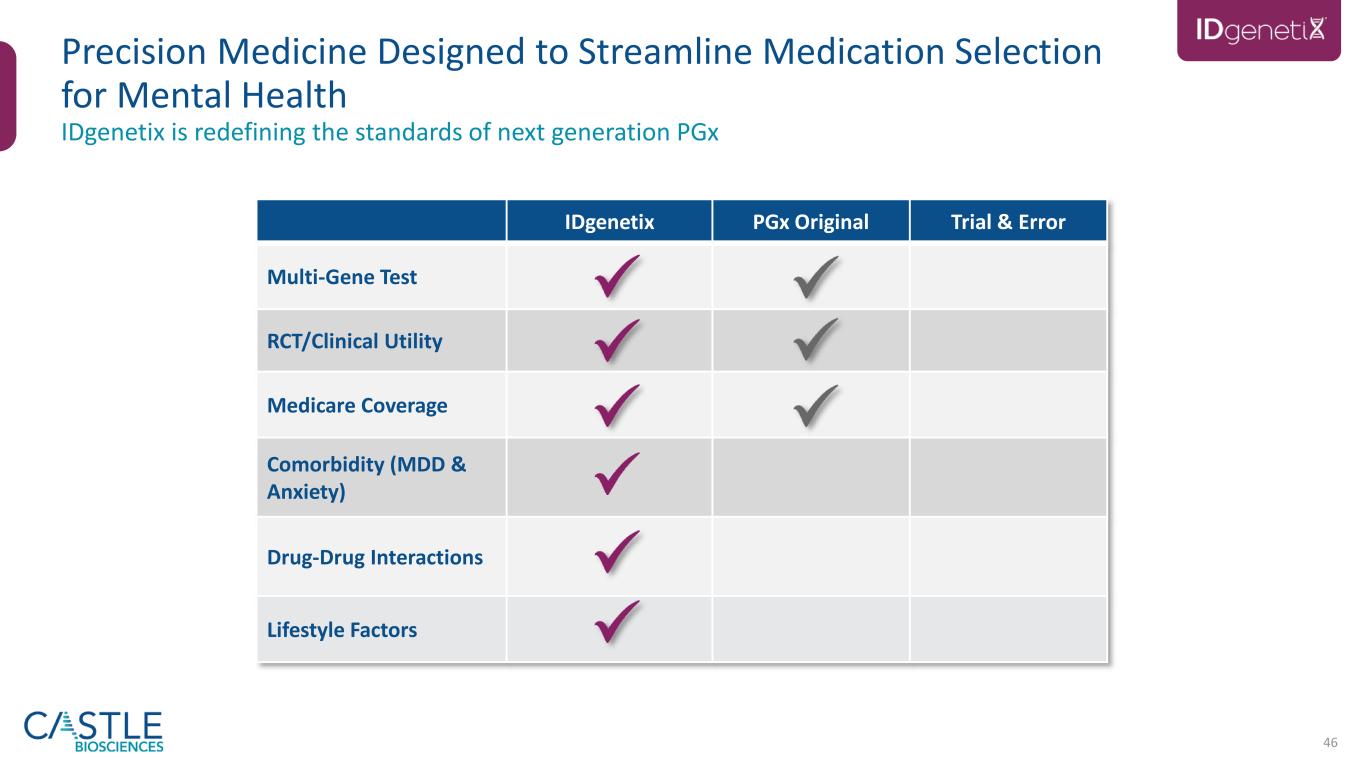

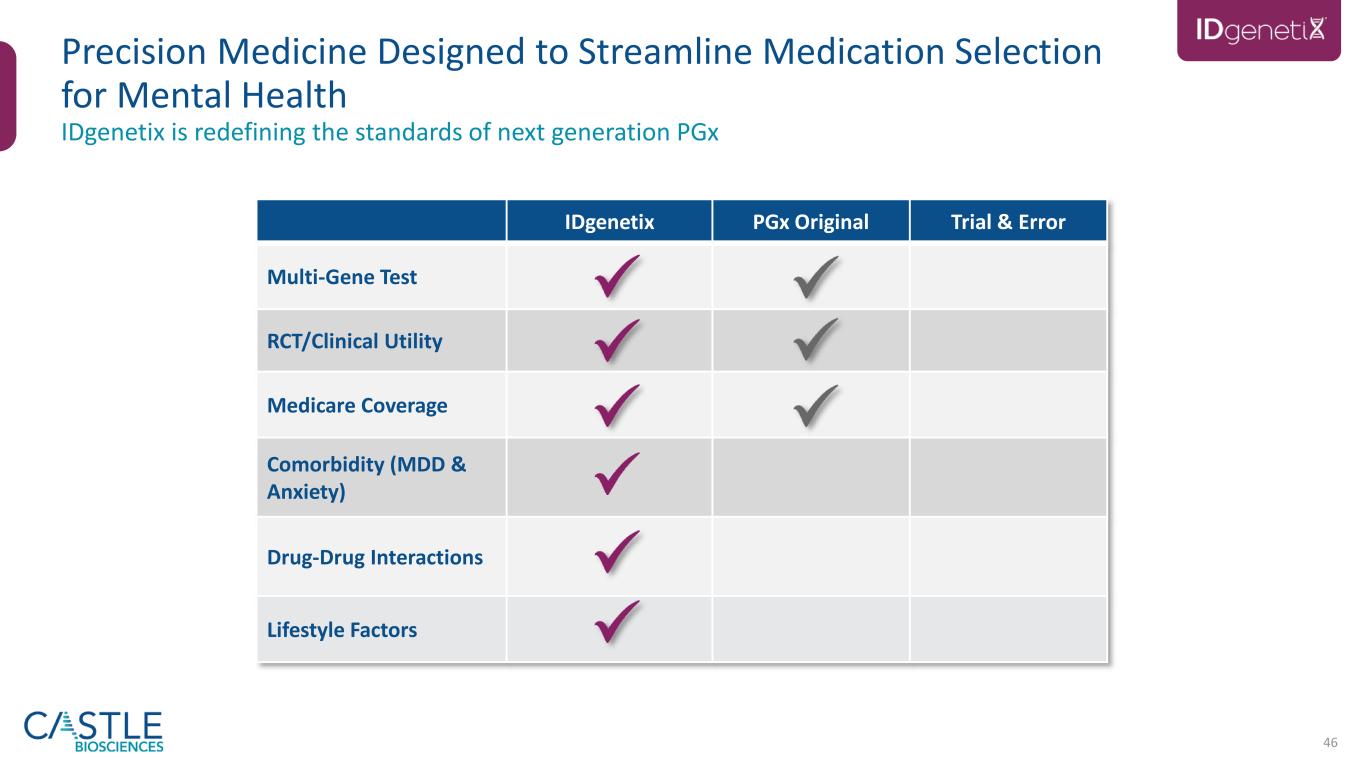

46 IDgenetix PGx Original Trial & Error Multi-Gene Test RCT/Clinical Utility Medicare Coverage Comorbidity (MDD & Anxiety) Drug-Drug Interactions Lifestyle Factors IDgenetix is redefining the standards of next generation PGx Precision Medicine Designed to Streamline Medication Selection for Mental Health

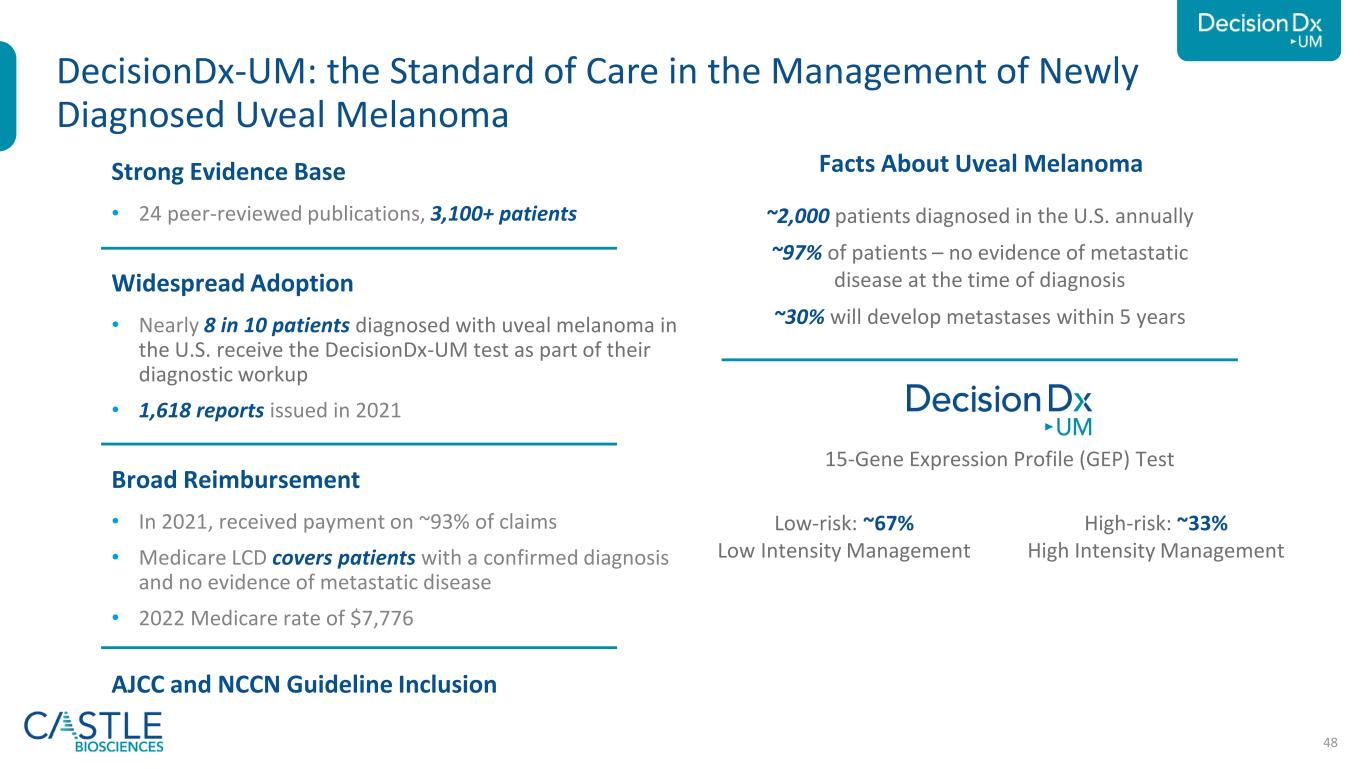

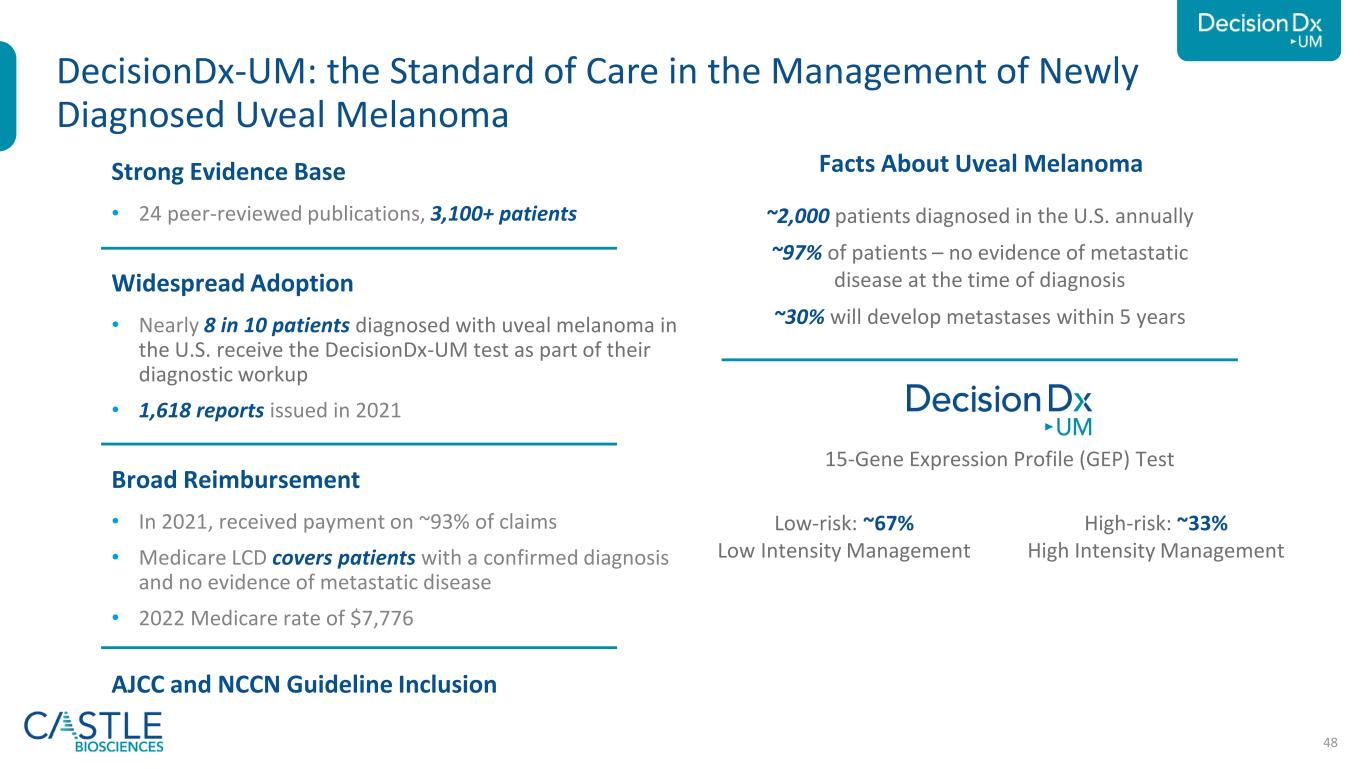

48 Strong Evidence Base • 24 peer-reviewed publications, 3,100+ patients Widespread Adoption • Nearly 8 in 10 patients diagnosed with uveal melanoma in the U.S. receive the DecisionDx-UM test as part of their diagnostic workup • 1,618 reports issued in 2021 Broad Reimbursement • In 2021, received payment on ~93% of claims • Medicare LCD covers patients with a confirmed diagnosis and no evidence of metastatic disease • 2022 Medicare rate of $7,776 AJCC and NCCN Guideline Inclusion DecisionDx-UM: the Standard of Care in the Management of Newly Diagnosed Uveal Melanoma ~2,000 patients diagnosed in the U.S. annually ~97% of patients – no evidence of metastatic disease at the time of diagnosis ~30% will develop metastases within 5 years Low-risk: ~67% Low Intensity Management High-risk: ~33% High Intensity Management Uveal Melanoma – A Rare Eye Cancer 15-Gene Expression Profile (GEP) Test Facts About Uveal Melanoma

Thank you

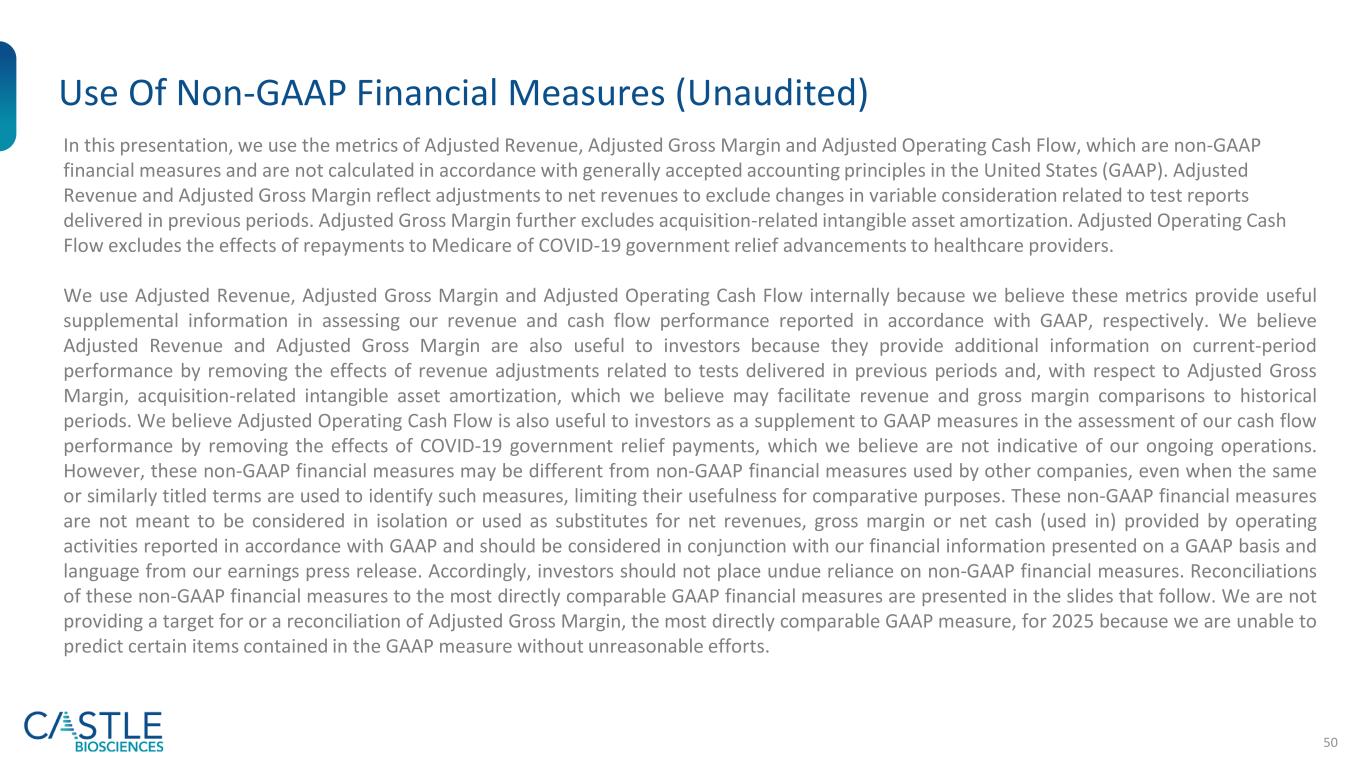

50 Use Of Non-GAAP Financial Measures (Unaudited) In this presentation, we use the metrics of Adjusted Revenue, Adjusted Gross Margin and Adjusted Operating Cash Flow, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenue and Adjusted Gross Margin reflect adjustments to net revenues to exclude changes in variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted Operating Cash Flow excludes the effects of repayments to Medicare of COVID-19 government relief advancements to healthcare providers. We use Adjusted Revenue, Adjusted Gross Margin and Adjusted Operating Cash Flow internally because we believe these metrics provide useful supplemental information in assessing our revenue and cash flow performance reported in accordance with GAAP, respectively. We believe Adjusted Revenue and Adjusted Gross Margin are also useful to investors because they provide additional information on current-period performance by removing the effects of revenue adjustments related to tests delivered in previous periods and, with respect to Adjusted Gross Margin, acquisition-related intangible asset amortization, which we believe may facilitate revenue and gross margin comparisons to historical periods. We believe Adjusted Operating Cash Flow is also useful to investors as a supplement to GAAP measures in the assessment of our cash flow performance by removing the effects of COVID-19 government relief payments, which we believe are not indicative of our ongoing operations. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes. These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin or net cash (used in) provided by operating activities reported in accordance with GAAP and should be considered in conjunction with our financial information presented on a GAAP basis and language from our earnings press release. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the slides that follow. We are not providing a target for or a reconciliation of Adjusted Gross Margin, the most directly comparable GAAP measure, for 2025 because we are unable to predict certain items contained in the GAAP measure without unreasonable efforts.

51 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of adjusted revenue and adjusted gross margin, which are non-GAAP financial measures. See previous slide for further information regarding the Company’s use of non-GAAP financial measures.

52 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of adjusted operating cash flow, which is a non-GAAP financial measure. See slide 47 for further information regarding the Company’s use of non-GAAP financial measures.

Appendix

54 ESG Focus Areas for 2022 and Beyond Environmental policy Environmental metrics DEI statement DEI metrics DEI action plan/roadmap Vendor code of conduct/supplier standard In 2022, Castle Biosciences received a rating of AA (on a scale of AAA-CCC) in the MSCI ESG Ratings assessment.

55 Employee Engagement is Part of our Core Strategy for Success Based on the results of Castle’s annual employee survey1 Castle employee engagement score: 81% Healthcare benchmark average engagement score: 53% Response Rate 89% 1Data from June 2022 employee engagement survey administered by Energage 43% 40% 16% 1% Enthusiastically engaged Engaged Disengaged Deeply disengaged 40% 41% 17% 2% Enthusiastically engaged Engaged Disengaged Deeply disengaged Response Rate 86% 2 0 2 2 Healthcare benchmark response rate: 63% Castle employee engagement score: 83% Healthcare benchmark average engagement score: 66% 2 0 2 1 Healthcare benchmark response rate: 59%

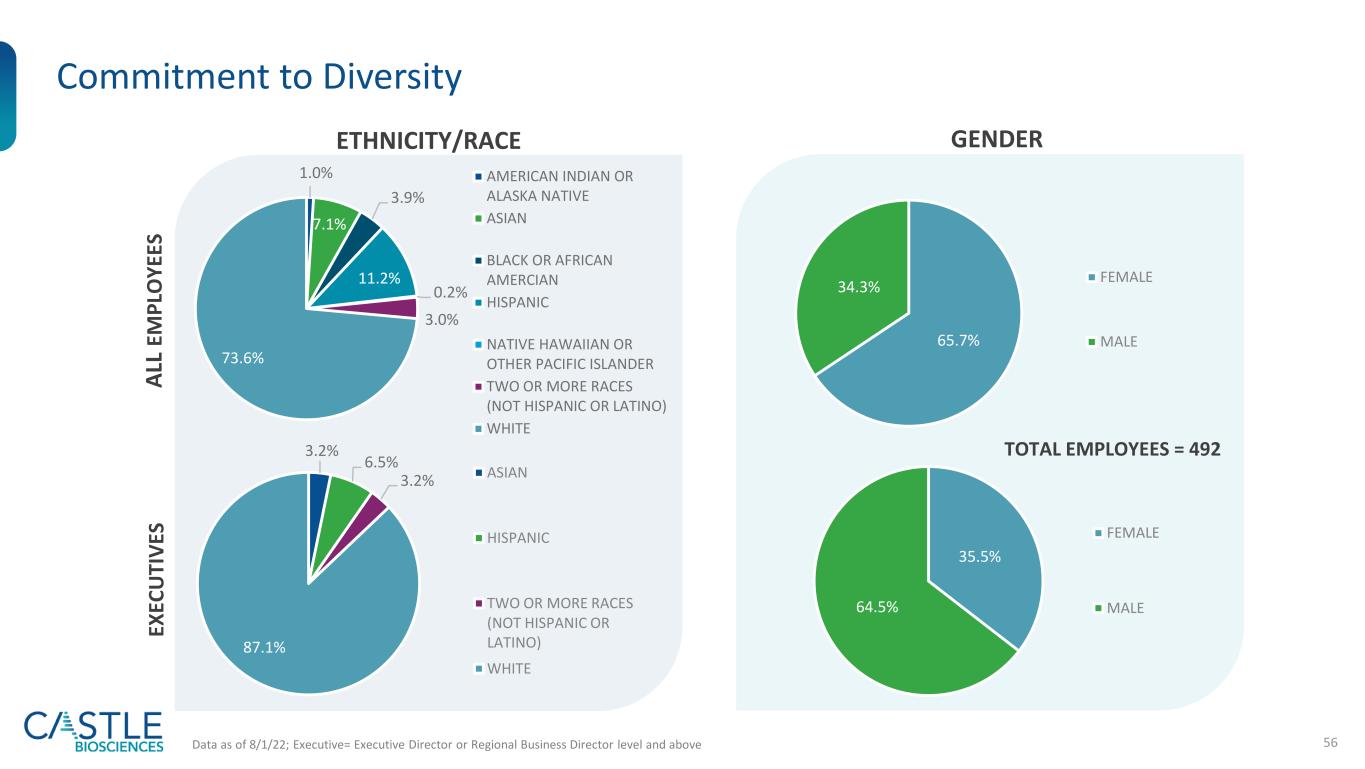

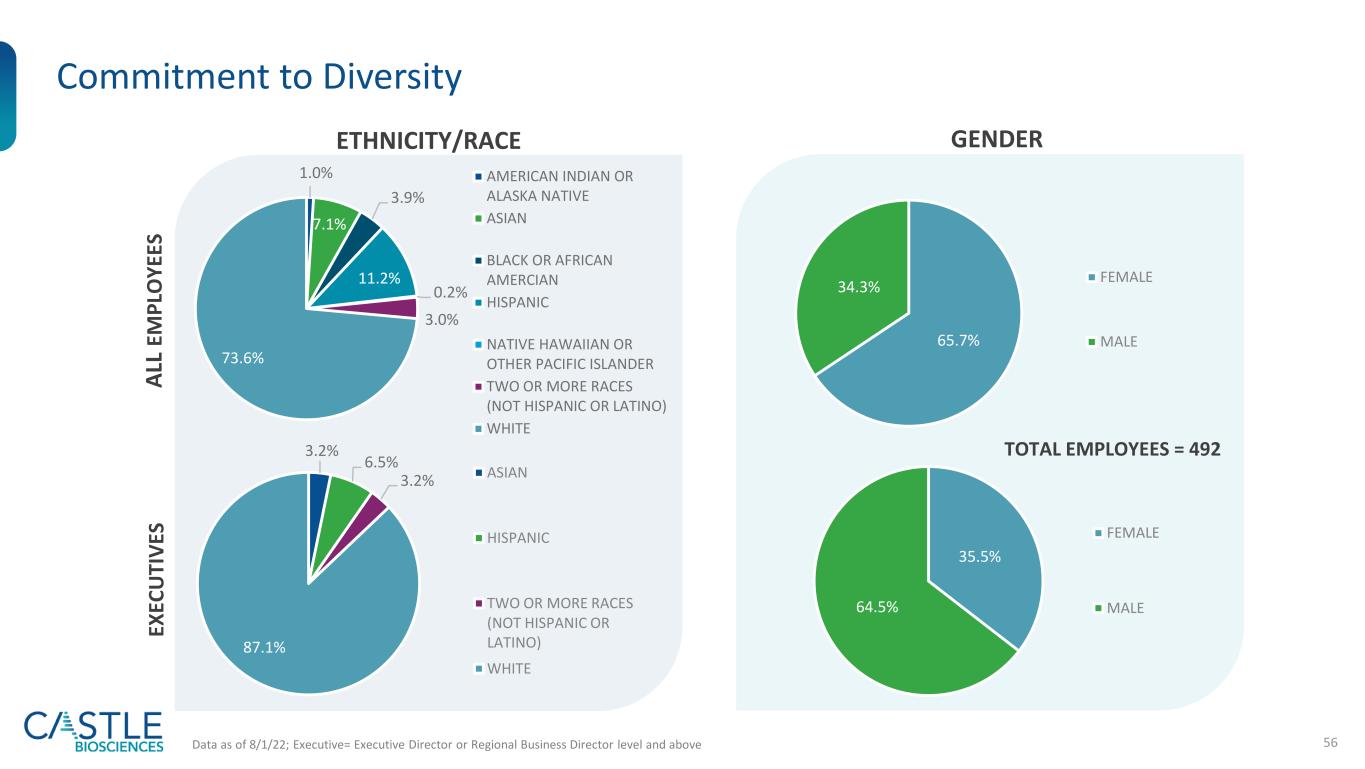

56 Commitment to Diversity ETHNICITY/RACE GENDER Data as of 8/1/22; Executive= Executive Director or Regional Business Director level and above TOTAL EMPLOYEES = 492 1.0% 7.1% 3.9% 11.2% 0.2% 3.0% 73.6% AMERICAN INDIAN OR ALASKA NATIVE ASIAN BLACK OR AFRICAN AMERCIAN HISPANIC NATIVE HAWAIIAN OR OTHER PACIFIC ISLANDER TWO OR MORE RACES (NOT HISPANIC OR LATINO) WHITE 3.2% 6.5% 3.2% 87.1% ASIAN HISPANIC TWO OR MORE RACES (NOT HISPANIC OR LATINO) WHITE 65.7% 34.3% FEMALE MALE EX EC U TI V ES A LL E M P LO Y EE S 35.5% 64.5% FEMALE MALE

57 Award-Winning Company Committed to cultivating a culture of innovation, continuous growth and advancement 2019 Technology Innovation in Melanoma Award Winner

58 Leadership Team Overview