©2024 Castle Biosciences 1 Fourth Quarter 2023 February 28, 2024 Empowering people, Informing care decisions

©2024 Castle Biosciences 2 Disclaimers Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning: our positioning for continued growth and value creation; our ongoing studies generating data and their impact on driving adoption of our tests; study observations and interpretations of study data, including conclusions about the benefits and impact of our tests on treatment decisions and patient outcomes; our expected 2024 catalysts; and the timing and achievement of program milestones. The words “anticipates,” “can,” “could,” “estimates,” “expects,” “may,” “potential,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward- looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation: our estimates and assumptions underlying our estimated U.S. total addressable market for our commercially available tests; our ability to continue to receive reimbursement for our DecisionDx-SCC test at the current rate through the end of 2024 and reimbursement for our other products and subsequent coverage decisions, our estimated total addressable markets for our products and product candidates and the related expenses, capital requirements and potential needs for additional financing, the anticipated cost, timing and success of our product candidates, and our plans to research, develop and commercialize new tests and our ability to successfully integrate new businesses, assets, products or technologies acquired through acquisitions, the effects of macroeconomic events and conditions, including inflation and monetary supply shifts, labor shortages, liquidity concerns at, and failures of, banks and other financial institutions or other disruptions in the banking system or financing markets and recession risks, supply chain disruptions, outbreaks of contagious diseases and geopolitical events (such as the ongoing Israel-Hamas War and Ukraine-Russia conflict), among others, on our business and our efforts to address its impact on our business; subsequent study or trial results and findings may contradict earlier study or trial results and findings or may not support the results discussed in this presentation, including with respect to the diagnostic and prognostic tests discussed in this presentation; actual application of our tests may not provide the anticipated benefits to patients; and the risks set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law. .

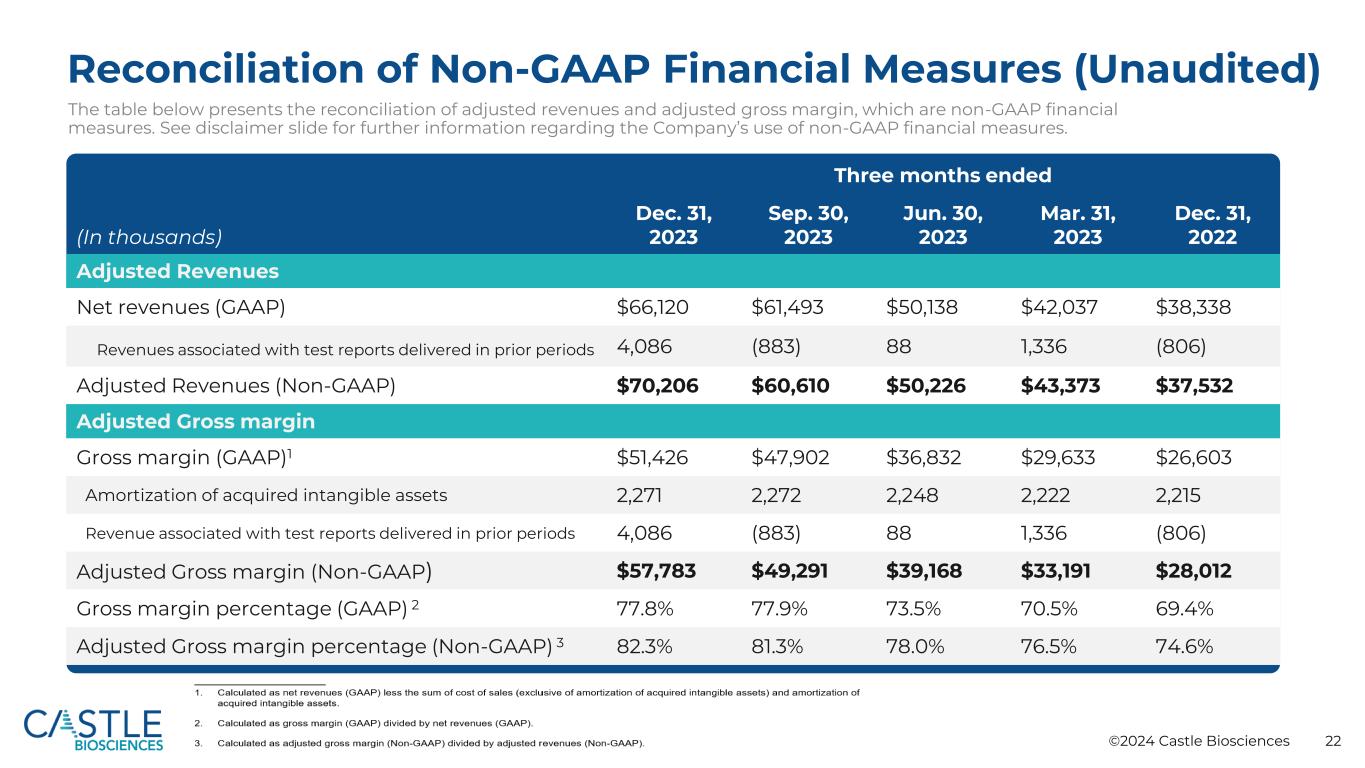

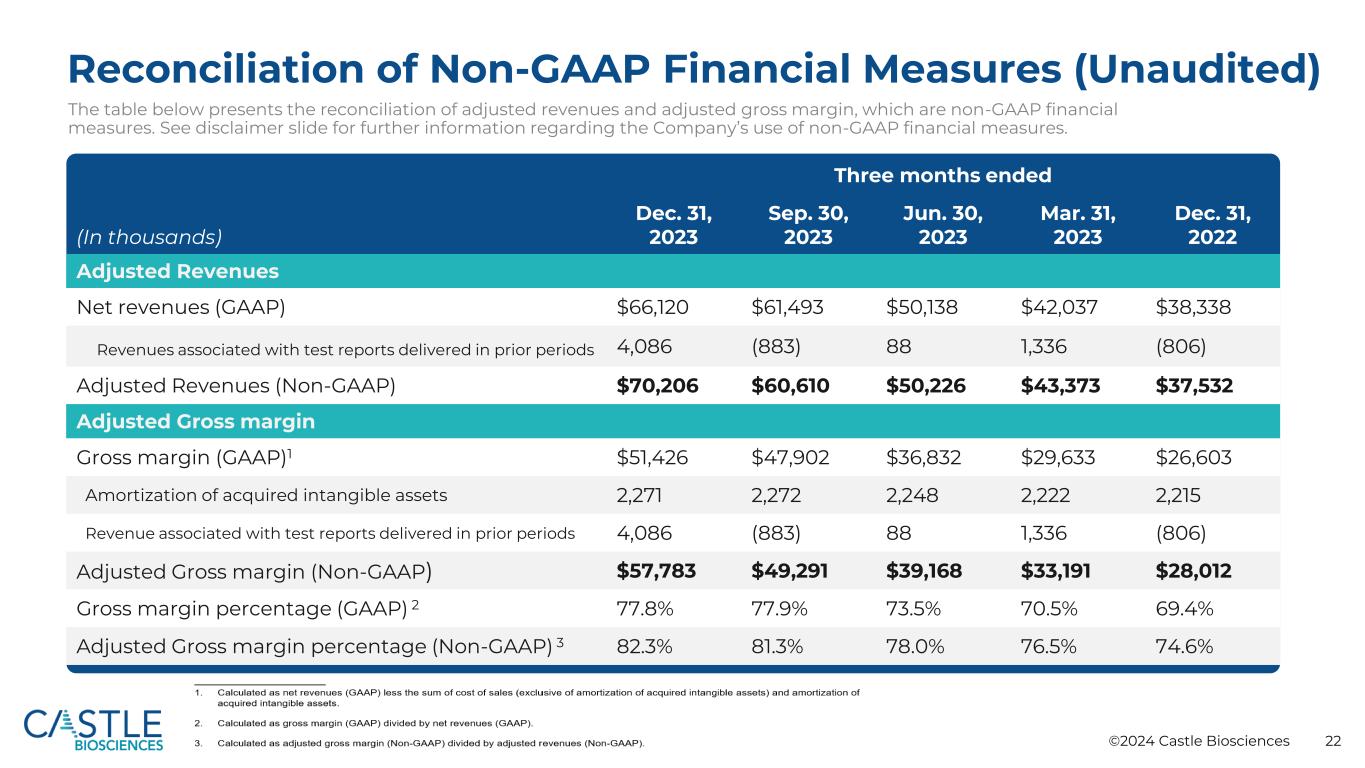

©2024 Castle Biosciences 3 Disclaimers Financial Information; Non-GAAP Financial Measures In this presentation, we use the metrics of Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenues and Adjusted Gross Margin reflect adjustments to GAAP net revenues to exclude net positive and/or net negative revenue adjustments recorded in the current period associated with changes in estimated variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted EBITDA excludes from net loss: interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense, change in fair value of contingent consideration and acquisition-related transaction costs. We use Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA internally because we believe these metrics provide useful supplemental information in assessing our revenue and operating performance reported in accordance with GAAP, respectively. We believe that Adjusted Revenues, when used in conjunction with our test report volume information, facilitates investors’ analysis of our current-period revenue performance and average selling price performance by excluding the effects of revenue adjustments related to test reports delivered in prior periods, since these adjustments may not be indicative of the current or future performance of our business. We believe that providing Adjusted Revenues may also help facilitate comparisons to our historical periods. Adjusted Gross Margin is calculated using Adjusted Revenues and therefore excludes the impact of revenue adjustments related to test reports delivered in prior periods, which we believe is useful to investors as described above. We further exclude acquisition-related intangible asset amortization in the calculation of Adjusted Gross Margin. We believe that excluding acquisition-related intangible asset amortization may facilitate gross margin comparisons to historical periods and may be useful in assessing current-period performance without regard to the historical accounting valuations of intangible assets, which are applicable only to tests we acquired rather than internally developed. We believe Adjusted EBITDA may enhance an evaluation of our operating performance because it excludes the impact of prior decisions made about capital investment, financing, investing and certain expenses we believe are not indicative of our ongoing performance. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes. These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin, or net loss reported in accordance with GAAP; should be considered in conjunction with our financial information presented in accordance with GAAP; have no standardized meaning prescribed by GAAP; are unaudited; and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future, there may be other items that we may exclude for purposes of these non-GAAP financial measures, and we may in the future cease to exclude items that we have historically excluded for purposes of these non-GAAP financial measures. Likewise, we may determine to modify the nature of adjustments to arrive at these non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measure as used by us in this press release and the accompanying reconciliation tables have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the tables at the end of this presentation. Industry and Market Data This presentation includes certain information and statistics obtained from third-party sources. The Company has not independently verified the accuracy or completeness of any such third- party information.

©2024 Castle Biosciences 4 Proven strategy designed to drive value creation for our stakeholders FOCUS on best/first-in-class tests with high, unmet clinical need and significant market opportunity BUILD robust clinical evidence PENETRATE target markets to further test adoption by clinicians and payers

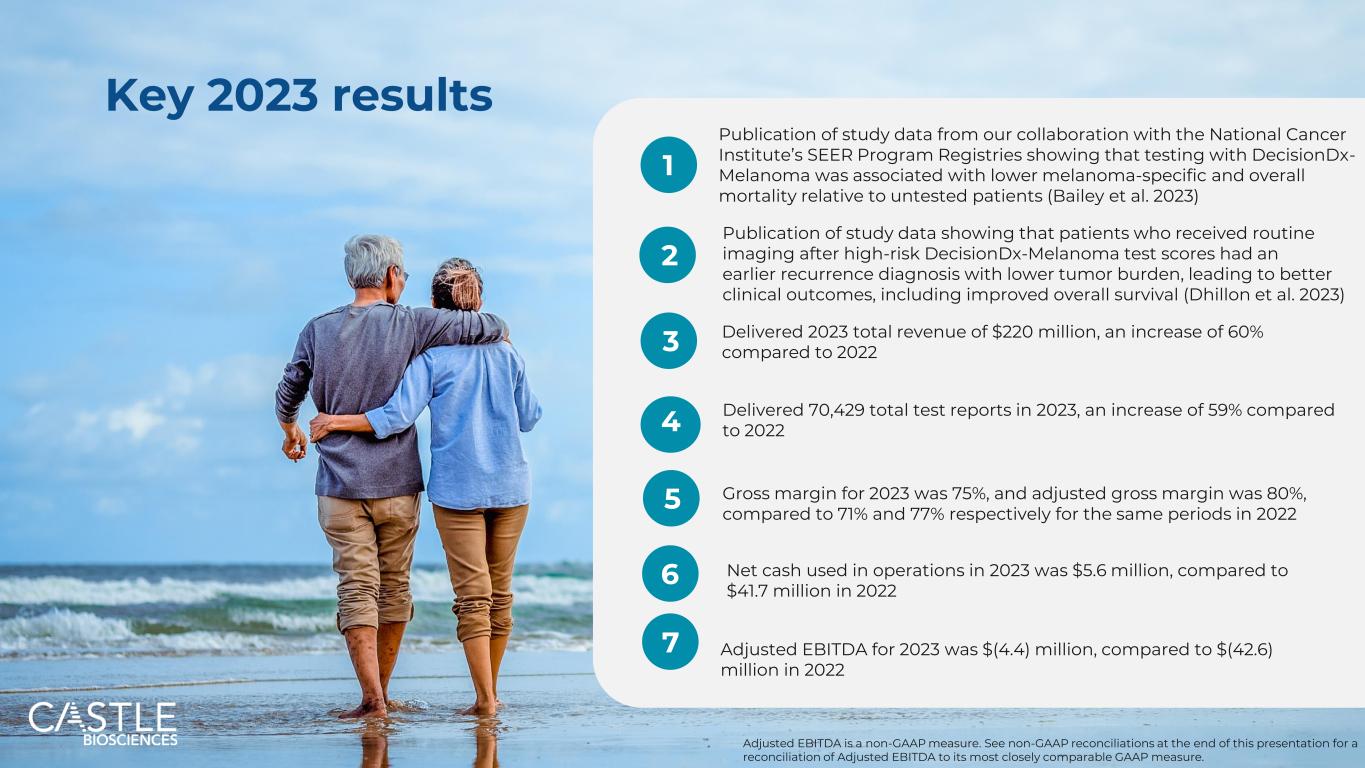

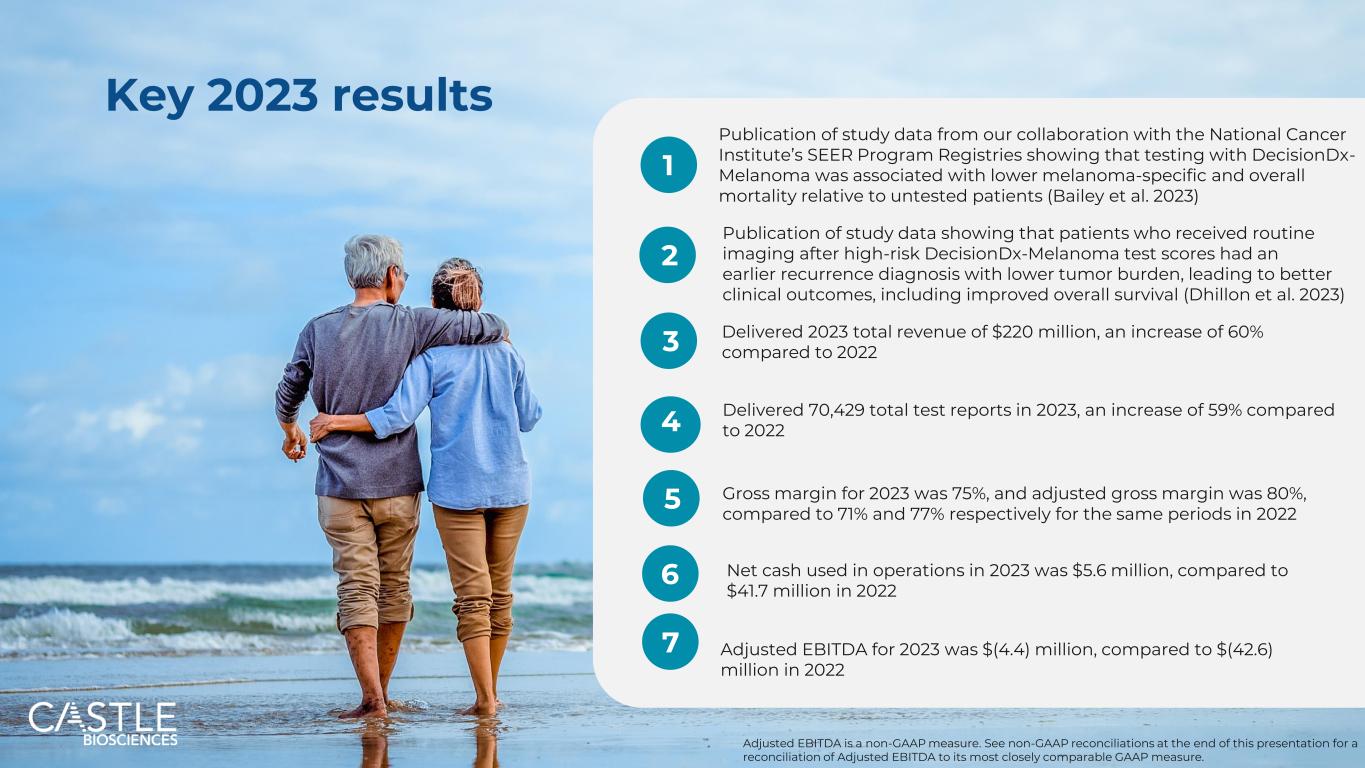

©2024 Castle Biosciences 5 Key 2023 results 1 Delivered 70,429 total test reports in 2023, an increase of 59% compared to 20224 Gross margin for 2023 was 75%, and adjusted gross margin was 80%, compared to 71% and 77% respectively for the same periods in 2022 5 Net cash used in operations in 2023 was $5.6 million, compared to $41.7 million in 2022 6 Delivered 2023 total revenue of $220 million, an increase of 60% compared to 2022 Adjusted EBITDA for 2023 was $(4.4) million, compared to $(42.6) million in 2022 7 Publication of study data from our collaboration with the National Cancer Institute’s SEER Program Registries showing that testing with DecisionDx- Melanoma was associated with lower melanoma-specific and overall mortality relative to untested patients (Bailey et al. 2023) Publication of study data showing that patients who received routine imaging after high-risk DecisionDx-Melanoma test scores had an earlier recurrence diagnosis with lower tumor burden, leading to better clinical outcomes, including improved overall survival (Dhillon et al. 2023) 2 3 Adjusted EBITDA is a non-GAAP measure. See non-GAAP reconciliations at the nd f this presentation for a reconciliation of Adjusted EBITDA to its most closely comparable GAAP measure.

©2024 Castle Biosciences 6 Evidence development timeline for DecisionDx-SCC DecisionDx-SCC launched commercially 2020 2021 2022 2023 2024 YTD Number of peer-reviewed publications 1 2 4 5 4 Somani et al. – Using DecisionDx-SCC to guide ART decisions for SCC patients could result in substantial Medicare healthcare savings of up to ~$972 million annually. Moody et al. (accepted) – Including tumor biology- based risk stratification from the DecisionDx-SCC test in ART decisions can refine risk and identify appropriate SCC patients who are likely to benefit from treatment, as well as those who can consider deferring it. 2019 SCC=cutaneous squamous cell carcinoma, ART=adjuvant radiation therapy, NCCN=National Comprehensive Cancer Network, BWH=Brigham and Women’s Hospital , AJCC8=American Joint Committee on Cancer 8th Edition Gopal et al. – Multi-disciplinary expert consensus guidelines provide a suggested workflow that integrates DecisionDx-SCC testing and AJCC8 staging with NCCN guidelines to improve precision in ART recommendations based on which patients are at the highest risk for metastasis and most likely to benefit from treatment. Wysong et al. (accepted) – Study of 897 patients analyzed the independent performance of DecisionDx-SCC from risk factors and staging systems, and demonstrated significantly improved predictive accuracy when test results were integrated with NCCN guidelines and AJCC8 and BWH staging to guide risk-appropriate treatment pathway decisions.

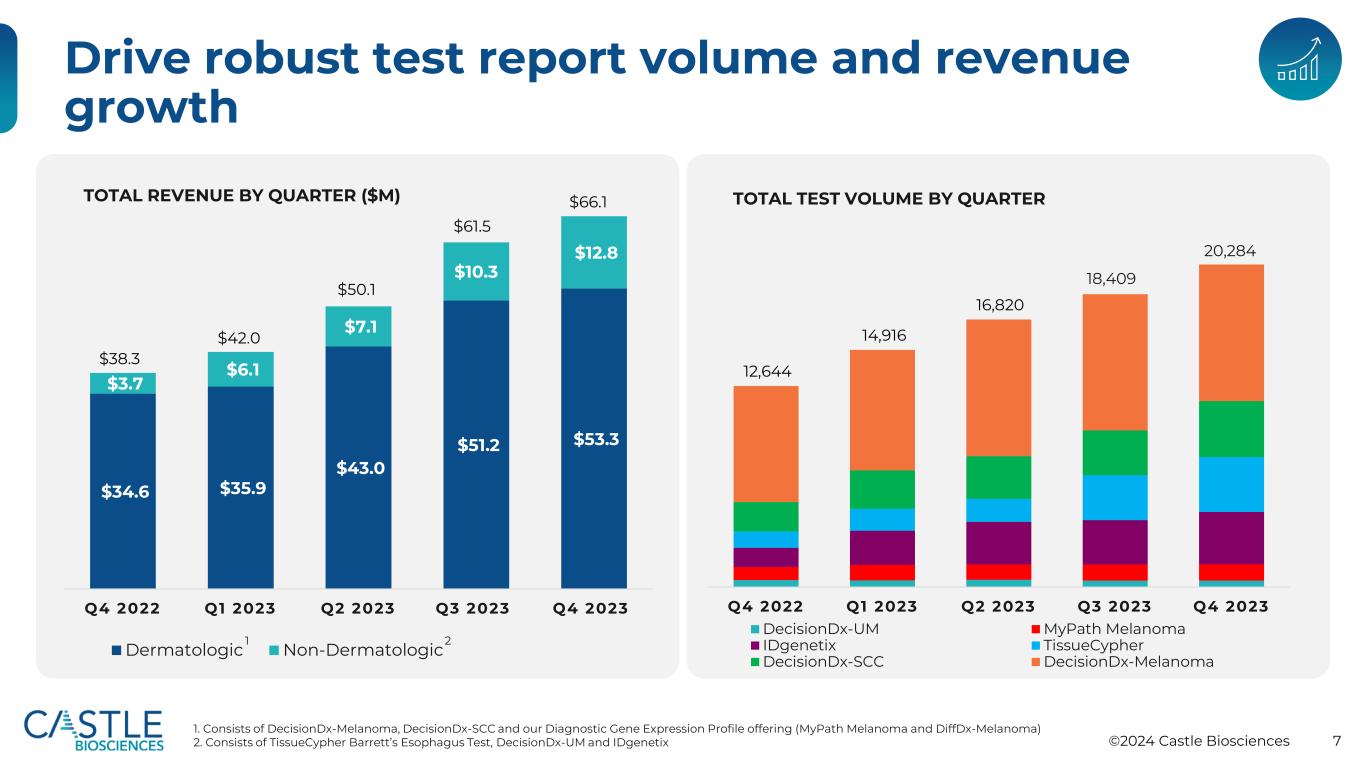

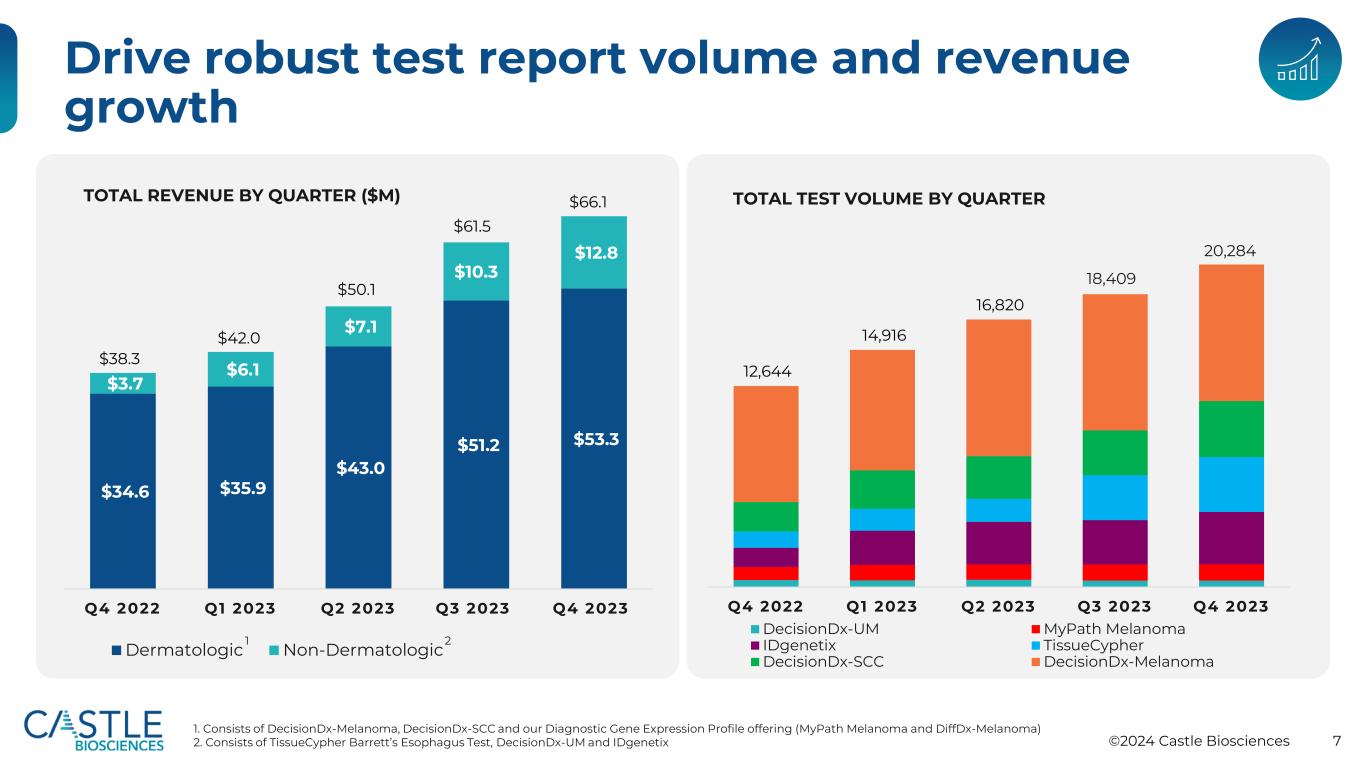

©2024 Castle Biosciences 7 Drive robust test report volume and revenue growth $34.6 $35.9 $43.0 $51.2 $53.3 $3.7 $6.1 $7.1 $10.3 $12.8 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Dermatologic Non-Dermatologic $38.3 $42.0 $50.1 $61.5 $66.1TOTAL REVENUE BY QUARTER ($M) Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 DecisionDx-UM MyPath Melanoma IDgenetix TissueCypher DecisionDx-SCC DecisionDx-Melanoma 12,644 14,916 16,820 TOTAL TEST VOLUME BY QUARTER 1. Consists of DecisionDx-Melanoma, DecisionDx-SCC and our Diagnostic Gene Expression Profile offering (MyPath Melanoma and DiffDx-Melanoma) 2. Consists of TissueCypher Barrett’s Esophagus Test, DecisionDx-UM and IDgenetix 1 2 18,409 20,284

©2024 Castle Biosciences 8 Maintain strong Adjusted Gross Margin 74.6% 76.5% 78.0% 81.3% 82.3% Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 ADJUSTED GROSS MARGIN BY QUARTER1,2 $9.5 $10.2 $11.1 $11.3 $12.4 $11.3 $14.4 $13.3 $12.9 $13.0 $38.4 $46.8 $44.7 $44.6 $44.1 $2.2 $2.2 $2.2 $2.3 $2.3 $0.3 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Cost of Sales R&D SG&A Amortization of acquired intangible assets Change in fair value of contingent consideration (0.3) OPERATING EXPENSES BY QUARTER ($M)3 1. Adjusted Gross Margin is a non-GAAP measure. See Non-GAAP reconciliations at the end of this presentation for a reconciliation of Adjusted Gross margin to its most closely comparable GAAP measure. 2. Calculated as adjusted gross margin (Non-GAAP) divided by adjusted revenues (Non-GAAP) 3. Total operating expenses, including cost of sales

©2024 Castle Biosciences 9 Improving operating cash flow and Adjusted EBITDA $(6.0) $(25.4) $(3.8) $5.0 $18.6 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 OPERATING CASH FLOW BY QUARTER ($M) 1. As of December 31, 2023; includes Cash, Cash Equivalents & Marketable Investment Securities 2. Net cash used in operating activities for the three months ended March 31, 2023 included $17.7M related to payout of annual bonuses as well as certain healthcare benefit contributions. 3. Adjusted EBITDA is a non-GAAP measure. See non-GAAP reconciliations at the end of this presentation for a reconciliation of Adjusted EBITDA to its most closely comparable GAAP measure. 4. Adjusted EBITDA excludes from net loss interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense, change in fair value of contingent consideration and acquisition-related transaction cost $(10.4) $(15.1) $(5.3) $6.6 $9.4 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 ADJUSTED EBITDA BY QUARTER ($M)3,4 Cash position of ~$243M1 supports growth initiatives

©2024 Castle Biosciences 10 2023 Revenue Above Previously- Reported Guidance 2023 Revised Revenue Guidance* 2023 Revenue At least $210M $219.8M $183.4M 2023 Dermatologic Revenue 2023 Non-Dermatologic Revenue $36.4M *Provided full-year 2023 revenue guidance of at least $210 million on January 9, 2024, up from initial revenue guidance of $170-180 million provided on February 28, 2023 2023 Initial Revenue Guidance* $170- 180M

©2024 Castle Biosciences 11©2024 Castle Biosciences - castlebiosc en es.com 1 Expected 2024 Catalysts 1 2 3 4 Full year impact of studies showing patients who receive DecisionDx-Melanoma as part of their clinical management have improved survival compared to those who are not tested DecisionDx-SCC value in use of adjuvant radiation therapy to be published, based on our 2023 study Additional development updates on our inflammatory disease pipeline program in the second half of 2024 Commercial expansion in alignment with Castle principles and servant leadership culture

©2024 Castle Biosciences 12 Appendix

©2024 Castle Biosciences 13 DecisionDx-Melanoma DERMATOLOGY Provides comprehensive, personalized, genomic tumor information to guide management for patients with cutaneous melanoma; test launched in May 2013 Demonstrated change in management for 1 of 2 patients tested2 ~26% ~154,800 patients with a clinical DecisionDx- Melanoma order from 13,000+ clinicians 50% Clinical Validity, Utility and Demonstrated Patient Outcomes Demonstrated clinical validity, utility and impact, backed by 50 peer-reviewed publications (as of February 2024), including two publications (Bailey et al. 2023 and Dhillon et al. 2023) demonstrating an association with testing and improved patient outcomes Reimbursement Reimbursement coverage through Medicare Administrative Contractor (MAC), Noridian, the MAC that oversees our Phoenix laboratory and is part of the MolDX® program that assesses molecular diagnostic technologies market penetration1 1. Data as of 2023 from third-party data and management estimates; 2. Dillon et al. 2022

©2024 Castle Biosciences 14 DecisionDx-SCC DERMATOLOGY Identifies the risk of metastasis in patients with squamous cell carcinoma (SCC) and one or more risk factors; test launched in August 2020 Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 16 peer-reviewed publications, including data showing that DecisionDx- SCC can significantly impact patient management plans in a risk-appropriate manner within established guidelines Real-World Use Framework Study in Clinical, Cosmetic and Investigational Dermatology highlights a clinician-derived, real-world algorithm that provides a framework to incorporate DecisionDx-SCC test results into clinical practice within NCCN guidelines recommendations net annual Medicare savings that could be realized by using DecisionDx-SCC to guide adjuvant radiation therapy decisions1 ~200,000 ~78% Up to ~$972M patients diagnosed annually with SCC and classified as high risk in the U.S. of clinicians ordering DecisionDx-SCC also ordered DecisionDx- Melanoma (2023) 1. Somani et al. 2024

©2024 Castle Biosciences 15 MyPath Melanoma DERMATOLOGY Aids in the diagnosis and management for patients with ambiguous melanocytic lesions Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 17 peer-reviewed publications demonstrating the performance and utility of the test in providing objective information to aid in diagnosis in ambiguous melanocytic lesions Guideline Support • National Comprehensive Cancer Network guidelines for cutaneous melanoma in the principles for molecular testing • American Society of Dermatopathology in the Appropriate Use Criteria for ancillary diagnostic testing • American Academy of Dermatology guidelines of care for the management of primary cutaneous melanoma peer-reviewed publications ~300,000 patients each year present with a diagnostically ambiguous lesion >45,000 lesions tested clinically (as of 12/31/2023) 17

©2024 Castle Biosciences 16 TissueCypher GASTROENTEROLOGY A leading risk-stratification test designed to predict risk of progression to esophageal cancer in patients with Barrett’s esophagus Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 14 peer-reviewed publications demonstrating the ability and performance of the test in risk-stratifying patients with Barrett’s esophagus to guide risk- appropriate treatment decisions AGA Clinical Practice Update Recognized by the American Gastroenterological Association in the 2022 Clinical Practice Update on New Technology and Innovation for Surveillance and Screening in Barrett’s Esophagus as a tool that may be used by physicians to risk stratify non-dysplastic patients ~415,000 patients receiving upper GI endoscopies per year who meet intended use criteria for TissueCypher 1 in 40 patients progress to esophageal cancer within 5 years (among patients with BE) 14 peer-reviewed publications

©2024 Castle Biosciences 17 IDgenetix MENTAL HEALTH Advanced pharmacogenomic (PGx) test designed to guide medication selection and management for patients with neuropsychiatric conditions, such as depression and anxiety Advanced PGx • Demonstrated clinical validity, utility and impact, backed by 19 peer-reviewed publications • Eliminate trial and error prescribing Easy to Use • 10 mental health and pain conditions in one report • Collection of DNA sample via simple cheek swab • 3-5 days to receive test report on average • Specialized sales and medical science liaison support improved chance of remission of depression symptoms vs. control1 3 in 1 test • drug-gene interaction • drug-drug interactions • lifestyle factors 2X >2.5X improved chance of medication response vs. control1 1 Bradley, et al. 2018

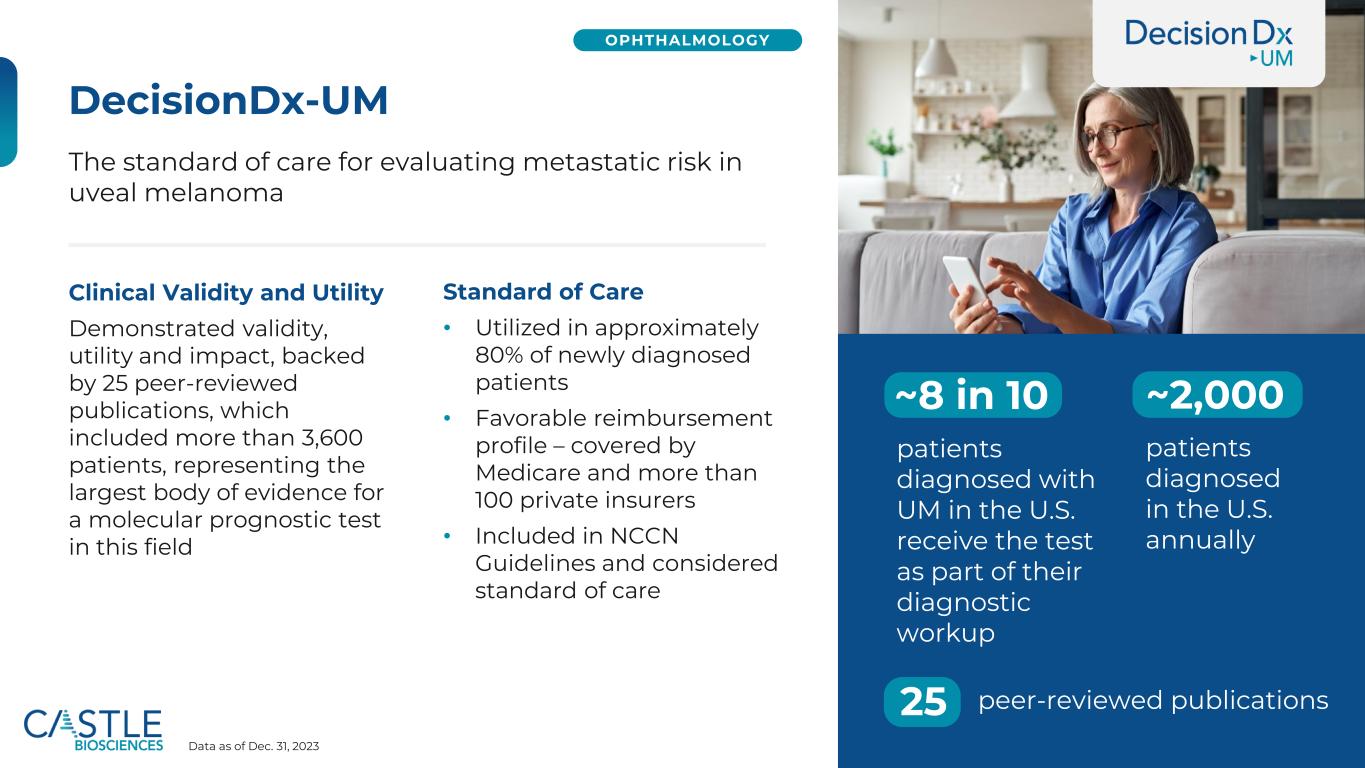

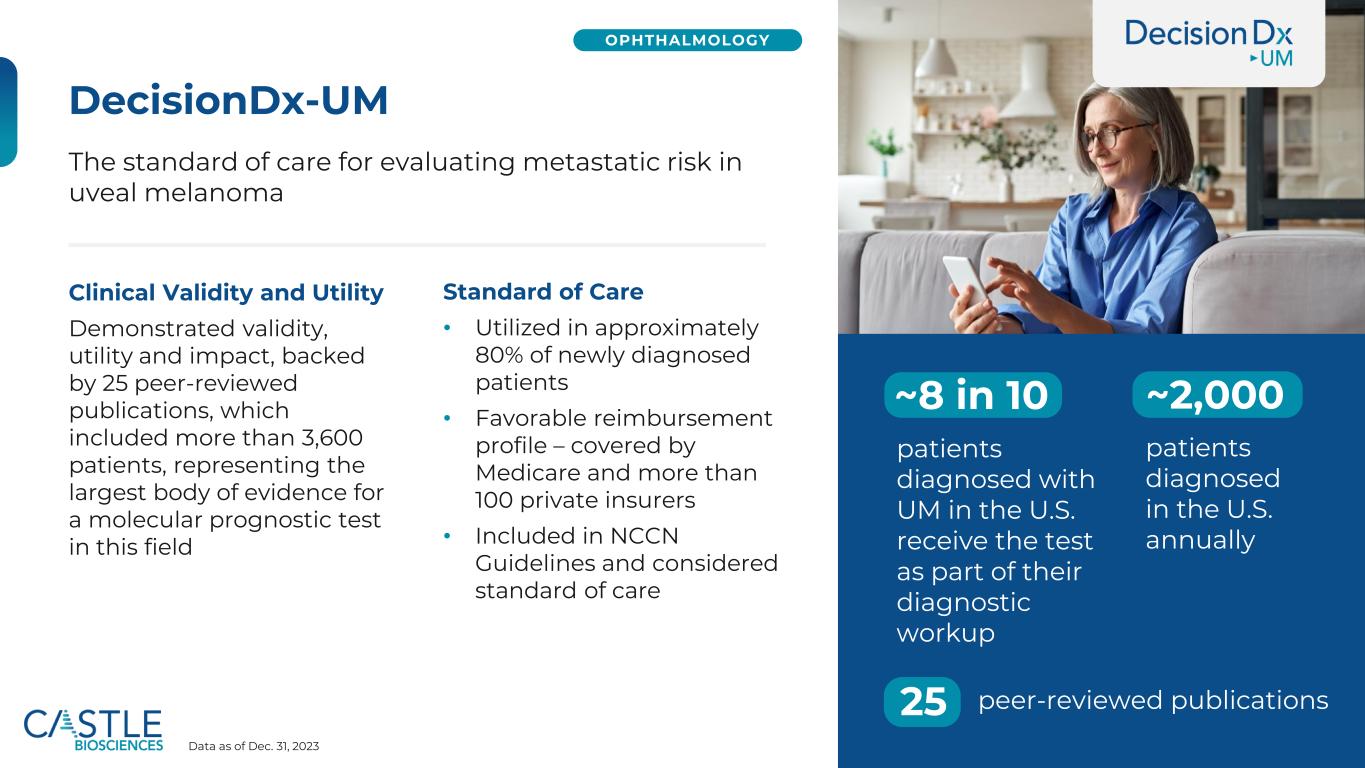

©2024 Castle Biosciences 18 DecisionDx-UM OPHTHALMOLOGY The standard of care for evaluating metastatic risk in uveal melanoma Standard of Care • Utilized in approximately 80% of newly diagnosed patients • Favorable reimbursement profile – covered by Medicare and more than 100 private insurers • Included in NCCN Guidelines and considered standard of care peer-reviewed publications ~8 in 10 ~2,000 25 patients diagnosed in the U.S. annually patients diagnosed with UM in the U.S. receive the test as part of their diagnostic workup Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 25 peer-reviewed publications, which included more than 3,600 patients, representing the largest body of evidence for a molecular prognostic test in this field Data as of Dec. 31, 2023

©2024 Castle Biosciences 19 Inflammatory Skin Disease PIPELINE Pipeline program to develop a genomic test aimed at guiding systemic therapy selection for patients with moderate-to-severe atopic dermatitis (AD), psoriasis (PSO) and related conditions • New data showing the ability of pipeline program to distinguish between responders and non-responders to AD therapy; and to distinguish between AD, PSO and mycosis fungoides (MF) skin lesions presented at the 2023 Fall Clinical Dermatology Conference® • Test results could empower clinicians to tailor therapy choices for patients by considering their molecular profiles, potentially sparing patients from undergoing numerous ineffective and costly medication trials before discovering an effective treatment to manage their symptoms • Q423: early discovery data presented • 2H2024: development data expected • By end of 2025: target launch Program Milestones 1 Data as of Dec. 31, 2023; 2patients with moderate-to-severe disease >45 Committed sites1 >1,000 Patients enrolled1,2 Inflammatory Skin Disease Pipeline Program

©2024 Castle Biosciences 20 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of adjusted revenues and adjusted gross margin, which are non-GAAP financial measures. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures. (In thousands) Three months ended Twelve months ended Dec. 31, 2023 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2022 Adjusted Revenues Net revenues (GAAP) $ 66,120 $ 38,338 $219,788 $137,039 Revenue associated with test reports delivered in prior periods 4,086 (806) 4,476 1,987 Adjusted revenues (Non-GAAP) $ 70,206 $ 37,532 $224,264 $139,026 Adjusted Gross Margin Gross margin (GAAP)1 $ 51,426 $ 26,603 $165,793 $ 96,764 Amortization of acquired intangible assets 2,271 2,215 9,013 8,266 Revenue associated with test reports delivered in prior periods 4,086 (806) 4,476 1,987 Adjusted Gross Margin (Non-GAAP) $ 57,783 $ 28,012 $179,282 $107,017 Gross margin percentage (GAAP)2 77.8 % 69.4 % 75.4 % 70.6 % Adjusted gross margin percentage (Non-GAAP)3 82.3 % 74.6% 79.9 % 77.0% 1. Calculated as net revenues (GAAP) less the sum of cost of sales (exclusive of amortization of acquired intangible assets) and amortization of acquired intangible assets. 2. Calculated as gross margin (GAAP) divided by net revenues (GAAP). 3. Calculated as adjusted gross margin (Non-GAAP) divided by adjusted revenues (Non-GAAP).

©2024 Castle Biosciences 21 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of adjusted EBITDA, which is a non-GAAP financial measure. See disclaimer slide for further information regarding the Company’s use of non-GAAP financial measures. (In thousands) Three months ended Twelve months ended Dec. 31, 2023 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2022 Adjusted EBITDA Net loss $(2,580) $ (20,618) $ (57,466) $ (67,138) Interest income (3,119) (2,275) (10,623) (3,968) Interest expense 2 4 11 17 Income tax expense (benefit) 39 57 101 (1,766) Depreciation and amortization expense 3,224 2,841 12,330 10,543 Stock-based compensation expense 11,802 9,923 51,219 36,321 Change in fair value of contingent consideration --- (300) — (18,287) Acquisition related transaction costs --- — — 1,711 Adjusted EBITDA (Non-GAAP) $9,368 $(10,368) $(4,428) $(42,567)

©2024 Castle Biosciences 22 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of adjusted revenues and adjusted gross margin, which are non-GAAP financial measures. See disclaimer slide for further information regarding the Company’s use of non-GAAP financial measures. (In thousands) Three months ended Dec. 31, 2023 Sep. 30, 2023 Jun. 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Adjusted Revenues Net revenues (GAAP) $66,120 $61,493 $50,138 $42,037 $38,338 Revenues associated with test reports delivered in prior periods 4,086 (883) 88 1,336 (806) Adjusted Revenues (Non-GAAP) $70,206 $60,610 $50,226 $43,373 $37,532 Adjusted Gross margin Gross margin (GAAP)1 $51,426 $47,902 $36,832 $29,633 $26,603 Amortization of acquired intangible assets 2,271 2,272 2,248 2,222 2,215 Revenue associated with test reports delivered in prior periods 4,086 (883) 88 1,336 (806) Adjusted Gross margin (Non-GAAP) $57,783 $49,291 $39,168 $33,191 $28,012 Gross margin percentage (GAAP) 2 77.8% 77.9% 73.5% 70.5% 69.4% Adjusted Gross margin percentage (Non-GAAP) 3 82.3% 81.3% 78.0% 76.5% 74.6%

©2024 Castle Biosciences 23 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of adjusted EBITDA, which is a non-GAAP financial measure. See disclaimer slide for further information regarding the Company’s use of non-GAAP financial measures. (In thousands) Three months ended Dec. 31, 2023 Sep. 30, 2023 Jun. 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Adjusted EBITDA Net loss $(2,580) $(6,905) $(18,777) $(29,204) $(20,618) Interest income (3,119) (2,769) (2,399) (2,336) (2,275) Interest expense 2 2 3 4 4 Income tax expense (benefit) 39 32 16 14 57 Depreciation and amortization expense 3,224 3,174 3,040 2,892 2,841 Stock-based compensation expense 11,802 13,043 12,849 13,525 9,923 Change in fair value of contingent consideration --- --- --- --- (300) Adjusted EBITDA (Non-GAAP) $9,368 $6,577 $(5,268) $(15,105) $(10,368)

©2024 Castle Biosciences 24 Thank You