Exhibit 10.1

123 MISSION STREET

OFFICE LEASE

Pacific Mission Corporation,

a Delaware corporation

Landlord

and

New Relic, Inc.,

a Delaware corporation

Tenant

DATED AS OF: June 17, 2015

TABLE OF CONTENTS

| Paragraph | Page | |||||||

| 1. | Premises | 1 | ||||||

| 2. | Certain Basic Lease Terms | 1 | ||||||

| 3. | Term; Delivery of Possession of Premises | 3 | ||||||

| 4. | Premises “As Is” | 3 | ||||||

| 5. | Monthly Rent | 5 | ||||||

| 6. | Letter of Credit | 7 | ||||||

| 7. | Additional Rent: Increases in Operating Expenses and Tax Expenses | 8 | ||||||

| 8. | Use of Premises; Compliance with Law | 13 | ||||||

| 9. | Alterations and Restoration | 15 | ||||||

| 10. | Repair | 16 | ||||||

| 11. | Abandonment | 17 | ||||||

| 12. | Liens | 17 | ||||||

| 13. | Assignment and Subletting | 18 | ||||||

| 14. | Indemnification | 22 | ||||||

| 15. | Insurance | 23 | ||||||

| 16. | Mutual Waiver of Subrogation Rights | 25 | ||||||

| 17. | Utilities | 25 | ||||||

| 18. | Personal Property and Other Taxes | 28 | ||||||

| 19. | Rules and Regulations | 28 | ||||||

| 20. | Surrender; Holding Over | 28 | ||||||

| 21. | Subordination and Attornment | 29 | ||||||

| 22. | Financing Condition | 30 | ||||||

| 23. | Entry by Landlord | 30 | ||||||

| 24. | Insolvency or Bankruptcy | 30 | ||||||

| 25. | Default and Remedies | 31 | ||||||

| 26. | Damage or Destruction | 34 | ||||||

| 27. | Eminent Domain | 35 | ||||||

| 28. | Landlord’s Liability; Sale of Building | 36 | ||||||

| 29. | Estoppel Certificates | 37 | ||||||

| 30. | Right of Landlord to Perform | 37 | ||||||

| 31. | Late Charge | 37 | ||||||

| 32. | Attorneys’ Fees; Waiver of Jury Trial | 37 | ||||||

| 33. | Waiver | 38 | ||||||

| 34. | Notices | 38 | ||||||

| 35. | Notice of Surrender | 39 | ||||||

| 36. | Defined Terms and Marginal Headings | 39 | ||||||

| 37. | Time and Applicable Law | 39 | ||||||

| 38. | Successors | 39 | ||||||

| 39. | Entire Agreement; Modifications | 40 | ||||||

| 40. | Light and Air | 40 | ||||||

| 41. | Name of Building | 40 | ||||||

| 42. | Severability | 40 | ||||||

| 43. | Authority | 40 | ||||||

| 44. | No Offer | 41 | ||||||

1

| Paragraph | Page | |||||||||

| 45. | Real Estate Brokers | 41 | ||||||||

| 46. | Consents and Approvals | 41 | ||||||||

| 47. | Reserved Rights | 41 | ||||||||

| 48. | Financial Statements | 42 | ||||||||

| 49. | Substitution of Premises | 42 | ||||||||

| 50. | Nondisclosure of Lease Terms | 42 | ||||||||

| 51. | Hazardous Substance Disclosure | 42 | ||||||||

EXHIBITS:

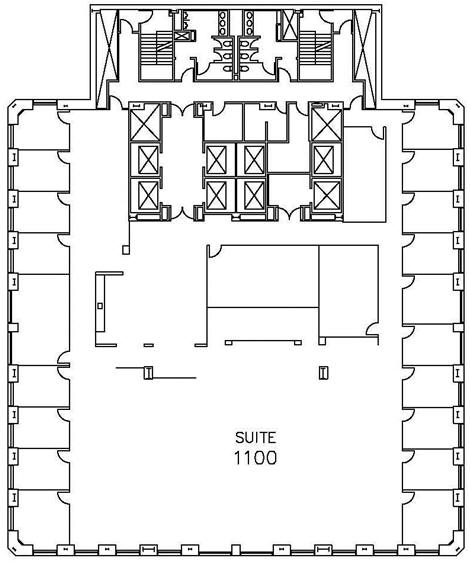

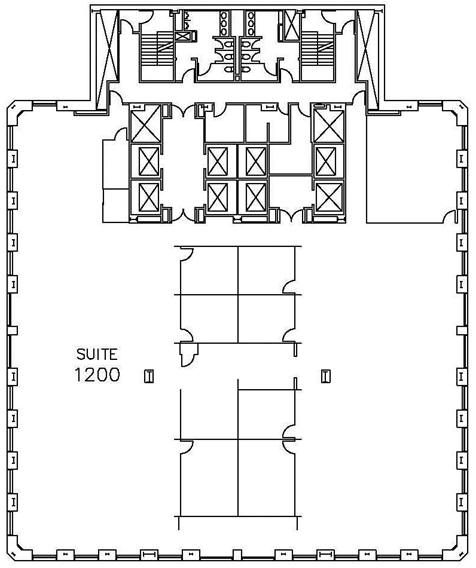

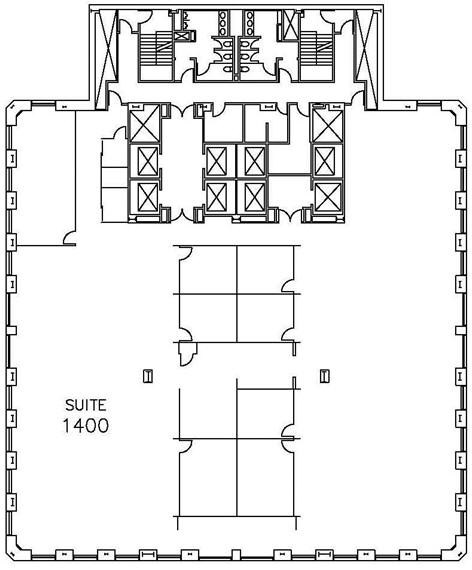

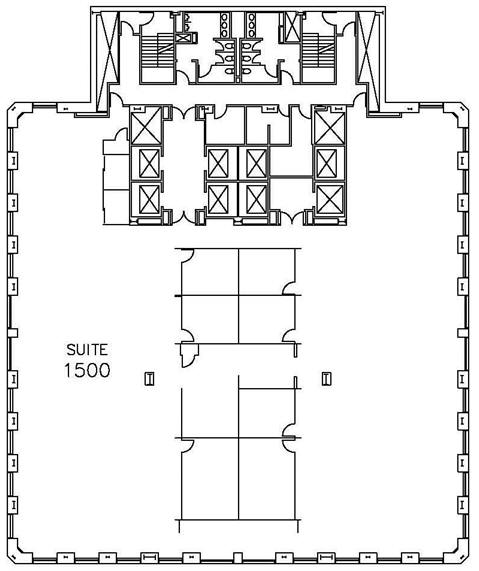

A - Outline of Premises

B - Rules and Regulations

C - Form of Letter of Credit

2

LEASE

THIS LEASE is made as of the 17th day of June, 2015, between PACIFIC MISSION CORPORATION, a Delaware corporation (“Landlord”), and NEW RELIC, INC., a Delaware corporation (“Tenant”).

1.Premises.

Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, on the terms and conditions set forth herein, the space outlined on the attachedExhibit A (the “Premises”). The Premises are located on the floor(s) specified in Paragraph 2 below of the building located at 123 Mission Street, at the intersection of Main and Mission Streets, San Francisco, California (the “Building”). For purposes of this Lease, the term “Land” shall mean, collectively, the parcels of land currently designated as Assessor’s Parcel Nos. 14, 15, 16, 17 and 18 of Block 3717, City and County of San Francisco, California, together with all appurtenant rights and easements. The Building, its garage, the Land and the other improvements on the Land are referred to herein as the “Real Property.”

Tenant’s lease of the Premises shall include the right to use, in common with others and subject to the other provisions of this Lease, the public lobbies, entrances, stairs, elevators and other public portions and common areas of the Building. All of the windows and outside walls of the Premises and any space in the Premises used for shafts, stacks, pipes, conduits, ducts, electrical equipment or other utilities or Building facilities are reserved solely to Landlord and Landlord shall have rights of access through the Premises for the purpose of operating, maintaining and repairing the same. Subject to the terms and conditions of this Lease, Tenant shall have access to and use of the Premises and the common areas of the Building and the Real Propertytwenty-four (24) hours per day, seven (7) days per week.

2.Certain Basic Lease Terms.

As used herein, the following terms shall have the meaning specified below:

| a. | Floor(s) on which the Premises are located: 11th, 12th, 14th, 15th. The Premises are currently designated as Suite 1100, 1200, 1400, 1500. Landlord and Tenant agree that for the purpose of this Lease, the Premises shall be deemed to contain 14,067 rentable square feet of space per floor, totaling 56,268 total rentable square feet of space. The Building shall be deemed to contain 346,435 rentable square feet of space. |

| b. | Landlord’s delivery of Premises: Landlord shall deliver the Premises to Tenant with Landlord’s Code Compliance Work completed and otherwise in the condition required under Paragraph 4 as follows: (i) Landlord shall deliver Suite 1100 on August 1, 2015 (the “Suite 1100 Delivery Date”), and (ii) Landlord shall deliver Suites 1200, 1400 and 1500 on April 1, 2016 (the “Remainder Delivery Date”). |

| c. | Lease term: Subject to Landlord’s timely delivery of the respective portions of the Premises as set forth in Paragraph 2.b., Suite 1100 shall commence on November 1, 2015 (the “Commencement Date”), and end on October 31, 2023 (the “Expiration Date”) for a term of eight (8) |

1

| years. Suites 1200, 1400 and 1500 shall commence on June 1, 2016 (the “Additional Suites Commencement Date”) and end coterminous with Suite 1100. |

| d. | Monthly Rent: Subject to adjustment as set forth in Paragraph 3.b., the respective sums set forth as follows: |

Period for Suite 1100 | Monthly Rent | Rate Per Sq. Ft. (Per Annum) | ||||||

11/01/15-10/31/16 | $ | 72,679.50 | $ | 62.00 | ||||

11/01/16-10/31/17 | $ | 74,859.89 | $ | 63.86 | ||||

11/01/17-10/31/18 | $ | 77,105.68 | $ | 65.78 | ||||

11/01/18-10/31/19 | $ | 79,418.85 | $ | 67.75 | ||||

11/01/19-10/31/20 | $ | 81,801.42 | $ | 69.78 | ||||

11/01/20-10/31/21 | $ | 84,255.46 | $ | 71.88 | ||||

11/01/21-10/31/22 | $ | 86,783.12 | $ | 74.03 | ||||

11/01/22-10/31/23 | $ | 89,386.62 | $ | 76.25 | ||||

Period for Suites 1200, 1400, 1500 | Monthly Rent | Rate Per Sq. Ft. (Per Annum) | ||||||

06/01/16-10/31/16* | $ | 0.00 | * | $ | 0.00 | * | ||

11/01/16-10/31/17 | $ | 224,579.66 | $ | 63.86 | ||||

11/01/17-10/31/18 | $ | 231,317.05 | $ | 65.78 | ||||

11/01/18-10/31/19 | $ | 238,256.56 | $ | 67.75 | ||||

11/01/19-10/31/20 | $ | 245,404.25 | $ | 69.78 | ||||

11/01/20-10/31/21 | $ | 252,766.38 | $ | 71.88 | ||||

11/01/21-10/31/22 | $ | 260,349.37 | $ | 74.03 | ||||

11/01/22-10/31/23 | $ | 268,159.85 | $ | 76.25 | ||||

| * | The Monthly Rent for the first five (5) months of the Lease term following the Additional Suites Commencement Date is subject to abatement upon the terms and conditions of Section 5.f. of the Lease. |

| e. | Security Deposit: $3.4 Million Dollars in the form of a Letter of Credit, subject to reduction as set forth in Paragraph 6. |

| f. | Tenant’s Share: As of the Commencement Date for Suite 1100 of the Premises, 4.06%; as of the Additional Suites Commencement Date for Suites 1200, 1400 and 1500 of the Premises, 16.24%. |

| g. | Base Year: The calendar year 2016. |

Base Tax Year: The fiscal tax year ending June 30, 2016.

| h. | Real estate broker(s): Savills Studley (Tenant’s broker) and Avison Young (Landlord’s broker). |

2

3.Term; Delivery of Possession of Premises.

a. The term of this Lease shall commence on the Commencement Date (as defined in Paragraph 2.b.) as to Suite 1100 and on the Additional Suites Commencement Date as to Suites 1200, 1400 and 1500 and, unless sooner terminated pursuant to the terms hereof or at law, shall expire on the Expiration Date (as defined in Paragraph 2.b.).

b. If Landlord, for any reason whatsoever, cannot deliver possession of the Premises to Tenant in the condition required under Paragraph 4 on the Suite 1100 Delivery Date, as to Suite 1100, and the Remainder Delivery Date, as to Suites 1200, 1400 and 1500, respectively, then, as Tenant’s sole and exclusive remedy, Tenant shall be granted and receive a credit in an amount equal to one (1) day of Monthly Rent and Additional Rent due under this Lease for each day of delay beyond the thirtieth (30th) day following the Suite 1100 Delivery Date and the Remainder Delivery Date, respectively, in delivering the relevant portion of the Premises in the condition required under Paragraph 4. Except as specifically provided in the Paragraph 3.b. above, if Landlord fails to timely deliver the relevant portions of the Premises on the Suite 1100 Delivery Date or the Remainder Delivery Date, respectively, this Lease shall not be void or voidable, nor shall Landlord be liable to Tenant for any loss or damage resulting therefrom. Except as specifically provided herein, no delay in delivery of possession of the Premises shall operate to extend the term of this Lease or amend Tenant’s obligations under this Lease.

c. Intentionally omitted.

4.Premises “As Is”; Initial Alterations; Landlord’s Allowance.

a.Premises As Is. Tenant shall accept the Premises in their “as is” state and condition and, except for (i) completion by Landlord of the Code Compliance Work (as defined below) prior to the Suite 1100 Delivery Date and the Remainder Delivery Date, respectively, (ii) Landlord’s ongoing maintenance and alterations and improvements, and (iii) Landlord’s payment of the Landlord’s Allowance, Landlord shall have no obligation to make or pay for any improvements or renovations in or to the Premises or to otherwise prepare the Premises for Tenant’s occupancy. Prior to the Suite 1100 Delivery Date, Landlord, at no cost to Tenant (through payment of Operating Expenses or otherwise), shall complete any and all code compliance work (including, without limitation, path of travel, ADA, fire and life safety, and Title 24) (“Code Compliance Work”) as such pertains to the common areas of the Building that serve the Premises;provided that Landlord shall have no obligation to perform any Code Compliance Work with respect to the restrooms, elevator lobbies and any other areas that might otherwise be deemed to be common areas to the extent such restrooms, lobbies and other areas are located on Floors 11, 12, 14 and 15 inasmuch as Tenant is leasing such floors in their entirety and will have sole responsibility for any Code Compliance Work related thereto. Following Landlord’s delivery of the relevant portions of the Premises, Tenant shall have the right to complete initial alterations, additions and improvements to the Premises to prepare the Premises for Tenant’s occupancy and use thereof (the “Initial Alterations”) pursuant to the terms and conditions of this Lease. Construction of the Initial Alterations shall be subject to Landlord’s approval in accordance with Paragraph 9 hereof and otherwise governed by Paragraph 9 hereof, except as expressly set forth in Paragraph 4.b. below. The general contractor selected by Tenant in accordance with Paragraph 9 hereof to construct the Initial Alterations in referred to hereinafter as “Contractor”.

3

b.Landlord’s Allowance. Landlord shall contribute toward the cost of the design, construction and installation of the Initial Alterations (including, without limitation, Construction Management Fee) an aggregate amount not to exceed Two Million Two Hundred Fifty Thousand Seven Hundred Twenty and 00/100 Dollars ($2,250,720.00) (which equals $40.00 per rentable square foot of the Premises) (the “Landlord’s Allowance”). Except as set forth in the preceding provision, no portion of Landlord’s Allowance may be applied to the cost of personal property, equipment, trade fixtures, furniture (including work stations and modular office furniture, regardless of the method of attachment to wall and/or floors), voice, data or cabling, signage, Monthly Rent, Additional Rent, moving expenses or other amounts payable by Tenant pursuant to this Lease.

To the extent that the cost of construction of the Initial Alterations (including the Construction Management Fee) exceeds the funds available therefor from Landlord’s Allowance, then Tenant shall pay all such excess (the “Excess Cost”). At such time as the Initial Allowance Disbursement (as defined below) has been entirely disbursed, Tenant shall commence payment of the then-estimated Excess Costs, if any, for the Initial Alterations to the Contractor; provided that Tenant shall not be required to fund any portion of the Excess Costs that is then unknown, which portion shall be payable by Tenant, if at all, following full disbursement by Landlord of the Landlord’s Allowance.

Landlord shall disburse the first One Million Six Hundred Eighty-Eight Thousand Forty Dollars ($1,688,040.00) of the Landlord’s Allowance (“Initial Allowance Disbursement”) directly to Tenant within thirty (30) days after Landlord’s receipt of monthly progress payment requests from Tenant which requests shall include (A) invoices of Contractor, subcontractors or suppliers, as applicable, furnished to Landlord by Tenant covering work actually performed to date, construction in place to date and materials delivered to the site to date (as may be applicable), describing in reasonable detail such work, construction and/or materials, (B) conditional lien waivers executed by Contractor plus subcontractors or suppliers supplying work or materials in any amount, for their portion of the work covered by the requested disbursement, and (C) unconditional lien waivers executed by Contractor and the persons or entities performing the work or supplying the materials covered by Landlord’s previous disbursements for the work or materials covered by such previous disbursements (all such waivers to be in the forms prescribed by California Civil Code Section 3262). No payment will be made for materials or supplies not incorporated into the construction, regardless of whether the materials or supplies are located on the Premises. Landlord may withhold the amount of any and all retentions provided for in original contracts or subcontracts until the earlier to occur of (i) expiration of the applicable lien periods or (ii) Landlord’s receipt of unconditional lien waivers and full releases upon final payment (in the form prescribed by California Civil Code Section 3262) from the Contractor and all subcontractors and suppliers involved in the Initial Alterations as provided above in this paragraph. Once the Initial Allowance Disbursement has been made and Tenant has paid the then-estimated Excess Costs as required above, Landlord shall disburse the remainder of the Landlord’s Allowance on the same terms and conditions set forth above in this paragraph. As provided above, once the Landlord’s Allowance has been fully disbursed, Tenant shall pay any remaining Excess Costs associated with the Initial Alterations.

Notwithstanding anything to the contrary contained herein, in no event shall Landlord be obligated to disburse any portion of Landlord’s Allowance during any period that an Event of Default continues (but the foregoing shall not relieve Landlord from its obligation to make such disbursement after such Event of Default shall be cured).

c.Construction. Landlord and Tenant acknowledge that a contractor approved by Landlord as set forth in Paragraph 9 (“Approved Contractor”) shall construct the Initial Alterations, and further acknowledge and agree that Tenant shall be required to use Landlord-approved

4

MEP subcontractors in connection with construction of the Initial Alterations. With respect to construction of the Initial Alterations, Tenant shall pay Landlord a construction management fee of Thirty Three Thousand Seven Hundred Sixty and 80/100ths Dollars ($33,760.80) (the “Construction Management Fee”) but shall not be required to pay any Alteration Operations Fee with respect to the Initial Alterations as set forth in Paragraph 9.

d.Changes. Intentionally omitted.

e.Tenant Delays. Intentionally omitted.

f.Early Entry. Following Landlord’s delivery of the relevant portion of the Premises in the condition required under Paragraph 4, Tenant shall have the right to enter the Premises for the purposes Tenant’s design, engineering, permitting and construction activities as well as for installation of furniture, fixtures, electronic communication equipment, telephones or other equipment or special improvements, including millwork. The provisions of this Lease, including without limitation Paragraphs 15 and 16 of this Lease, entitled “Indemnification” and “Insurance”, respectively, shall apply in full during the period of such early entry, and Tenant shall be solely responsible for all such furniture, fixtures and equipment and for any loss or damage thereto from any cause whatsoever; however Monthly Base Rent and Additional Rent shall be not be payable during such early entry period until the dates set forth in Paragraph 2.d.

g.Building Services During Early Entry. Tenant may use the Building’s freight elevator and loading dock, on a non-exclusive basis during Business Hours, and in accordance with the Building’s rules and procedures (including scheduling and sharing requirements), free of charge during the period of early entry granted pursuant to Paragraph 4.f. above. If Tenant desires use of the freight elevator or loading dock during other than Business Hours, then Tenant may reserve such use in compliance with the Building’s rules and procedures and shall pay Landlord a reasonable amount for providing any elevator personnel or security services in connection with such use. Any such security services shall be solely for the benefit of Landlord’s property, and in no event shall Landlord be liable to Tenant for, and Tenant hereby releases Landlord and its agents and contractors from, liability for, any theft, loss or damage of or to Tenant’s property during the period of such early entry

h.As-Is. Except as provided above in this Paragraph 4, Landlord shall deliver the Premises to Tenant in their as-is condition, and Landlord shall have no obligation to make or pay for any alterations, additions, improvements or renovations thereto to prepare the same for Tenant’s occupancy; provided, however, that the foregoing shall not relieve Landlord from its ongoing maintenance and repair obligations pursuant to this Lease.

5.Monthly Rent.

a. Commencing as of the Commencement Date, and continuing thereafter on or before the first day of each calendar month during the term hereof, Tenant shall pay to Landlord, as monthly rent for the Premises, the Monthly Rent specified in Paragraph 2 above (“Monthly Rent”). If Tenant’s obligation to pay Monthly Rent hereunder commences on a day other than the first day of a calendar month, or if the term of this Lease terminates on a day other than the last day of a calendar month, then the Monthly Rent payable for such partial month shall be appropriately prorated on the basis of a thirty (30) day month. Monthly Rent and the Additional Rent specified in Paragraph 7 shall be paid

5

by Tenant to Landlord, in advance, without deduction, offset, prior notice or demand (except as set forth in this Lease), in immediately available funds of lawful money of the United States of America, or by good check as described below, to the lockbox location designated by Landlord, or to such other person or at such other place as Landlord may from time to time designate in thirty (30) days prior writing to Tenant. Payments made by check must be drawn either on a California financial institution or on a financial institution that is a member of the federal reserve system. Notwithstanding the foregoing, Tenant shall pay to Landlord at least thirty (30) days prior to the Commencement Date for Suite 1100 of the Premises an amount equal to the Monthly Rent payable for the first full calendar month of the Lease term after Tenant’s obligation to pay Monthly Rent shall have commenced hereunder, which amount shall be applied to the Monthly Rent first due and payable hereunder.

b. All amounts payable by Tenant to Landlord under this Lease, or otherwise payable in connection with Tenant’s occupancy of the Premises, in addition to the Monthly Rent hereunder and Additional Rent under Paragraph 7, shall constitute rent owed by Tenant to Landlord hereunder.

c. Any rent not paid by Tenant to Landlord when due shall bear interest from the date due to the date of payment by Tenant at an annual rate of interest (the “Interest Rate”) equal to the lesser of (i) twelve percent (12%) per annum or (ii) the maximum annual interest rate allowed by law on such due date for business loans (not primarily for personal, family or household purposes) not exempt from the usury law, provided that the first one (1) time (and only the first one (1) time) in any twelve (12) consecutive month period during the term of this Lease that Tenant fails to pay rent when due, such rent payment shall bear interest only if (and at such time that) such failure is not cured within two (2) days after receipt by Tenant of notice from Landlord that such rent was not timely paid.

d. No security or guaranty which may now or hereafter be furnished to Landlord for the payment of rent due hereunder or for the performance by Tenant of the other terms of this Lease shall in any way be a bar or defense to any of Landlord’s remedies under this Lease or at law.

e. Notwithstanding anything to the contrary in this Lease: (i) in no event may any rent under this Lease be based in whole or in part on the income or profits derived from the Premises, except for percentage rent based on gross (not net) receipts or sales; (ii) if the holder of a Superior Interest (as defined in Paragraph 21 below) succeeds to Landlord’s interest in the Lease (“Successor Landlord”) and the Successor Landlord is advised by its counsel that all or any portion of the rent payable under this Lease is or may be deemed to be “unrelated business income” within the meaning of the Internal Revenue Code or regulations issued thereunder, such Successor Landlord may, at its option, unilaterally amend the calculation of rent so that none of the rent payable to Landlord under the Lease will constitute “unrelated business income,” but the amendment will not increase Tenant’s payment obligations or other liability under this Lease or reduce the Landlord’s obligations under this Lease and (iii) upon the Successor Landlord’s request, Tenant shall execute any document such holder deems necessary to effect the foregoing amendment to this Lease.

f. Provided Tenant is not in default under this Lease (beyond expiration of applicable notice and cure periods), Tenant shall not be obligated to pay Monthly Rent for the Premises for the first five (5) months of the Lease term following the Additional Suites Commencement Date (such abated amount, collectively, is the “Abated Rent”). Tenant shall be and remain obligated during each of such months to pay all Additional Rent otherwise due under this Lease, including, without limitation, pursuant to Article 7 below. In the event of a default by Tenant under this Lease which results in either the early termination of this Lease and/or Tenant vacating and/or being evicted from the Premises, then as

6

part of the recovery permitted Landlord hereunder, Landlord shall be entitled to a recovery of the Abated Rent conditionally abated pursuant to this Section 5.f., i.e., such Abated Rent shall in such case not be deemed to have been forgiven or abated, but shall become immediately due and payable as unpaid rent which had been earned at the date of default.

6.Letter of Credit.

Tenant shall deliver to Landlord on the later to occur of (i) completion of Landlord’s assignment of this Lease in connection with Landlord’s reorganization, (ii) concurrently with its execution of this Lease, as security for the performance of Tenant’s covenants and obligations under this Lease, an original irrevocable standby letter of credit, (iii) within ten (10) Business Days of Landlord’s written request therefor if Landlord elects not to complete its reorganization; or (iv) the Suite 1100 Delivery Date (the “Letter of Credit”) in the amount of Three Million Four Hundred Thousand Dollars ($3,400,000.00), naming Landlord as beneficiary, which Landlord may draw upon to cure any Event of Default under the Lease (or any breach under this Lease where there exist circumstances under which Landlord is enjoined or otherwise prevented by operation of law from giving to Tenant a written notice which would be necessary for such failure of performance to constitute an Event of Default under this Lease), or to compensate Landlord for any damage Landlord incurs as a result of such Event of Default and to which Landlord is entitled under the terms and conditions of this Lease. Any such draw on the Letter of Credit shall not constitute a waiver of any other rights of Landlord with respect to such Event of Default, breach or failure to perform. The Letter of Credit shall be issued by a major commercial bank reasonably acceptable to Landlord, have an expiration date not earlier than the sixtieth (60th) day after then applicable expiration date under this Lease (or, in the alternative, have a term of not less than one (1) year and be automatically renewable for an additional one (1) year period unless notice of non-renewal is given by the issuer to Landlord not later than sixty (60) days prior to the expiration thereof) and shall provide that Landlord may make partial and multiple draws thereunder, up to the face amount thereof. In addition, the Letter of Credit shall provide that, in the event of Landlord’s assignment or other transfer of its interest in this Lease, the Letter of Credit shall be freely transferable by Landlord without charge and without recourse to the assignee or transferee of such interest and the bank shall confirm the same to Landlord and such assignee or transferee. The Letter of Credit shall provide for payment to Landlord upon the issuer’s receipt of a sight draft from Landlord together with a statement by Landlord that the requested sum is due and payable from Tenant to Landlord in accordance with the provisions of this Lease, shall be in the form attached hereto asExhibit C, and to the extent different from the form attached hereto asExhibit C, otherwise be in form and content reasonably satisfactory to Landlord. If the Letter of Credit has an expiration date earlier than sixty (60) days after the then applicable expiration date under this Lease, then throughout the term of this Lease (including any renewal or extension of the term) Tenant shall provide evidence of renewal of the Letter of Credit to Landlord at least fifteen (15) Business Days prior to the date the Letter of Credit expires. If Landlord draws on the Letter of Credit pursuant to the terms hereof, Tenant shall within five (5) Business Days after notice thereof from Landlord replenish the Letter of Credit or provide Landlord with an additional or amended letter of credit conforming to the requirements of this paragraph so that the amount available to Landlord from the Letter of Credit(s) provided hereunder is the amount specified in this Lease. Tenant’s failure to deliver any replacement, additional or extension of the Letter of Credit, or evidence of renewal of the Letter of Credit, within the time specified under this Lease shall be an Event of Default. If Landlord liquidates any portion of the Letter of Credit pursuant to this Paragraph 6, Landlord shall hold the funds received from the Letter of Credit as a cash security deposit for Tenant’s performance under this Lease, subject to reduction of the Security Deposit as provided below. Landlord shall not be required to segregate such security deposit from its other funds and no interest shall accrue or be payable to Tenant with respect thereto. If Tenant is not in default at the expiration or termination of this Lease, within sixty (60) days thereafter Landlord

7

shall return to Tenant the Letter of Credit or the balance of the security deposit then held by Landlord, as applicable; provided, however, that in no event shall any such return be construed as an admission by Landlord that Tenant has performed all of its covenants and obligations hereunder. Tenant hereby unconditionally and irrevocably waives the benefits and protections of California Civil Code Section 1950.7, and, without limitation of the scope of such waiver, acknowledges that Landlord may use all or any part of the Letter of Credit or the proceeds thereof to compensate Landlord for damages resulting from termination of this Lease and the tenancy created hereunder (including, without limitation, damages recoverable under California Civil Code Section 1951.2) to the extent Landlord is entitled to such damages under the terms and conditions of this Lease.

Notwithstanding the foregoing, provided that no Event of Default, or a default that subsequently matures into an Event of Default (or any monetary breach under this Lease where there exist circumstances under which Landlord is enjoined or otherwise prevented by operation of law from giving to Tenant a written notice which would be necessary for such monetary breach to constitute an Event of Default under this Lease), by Tenant under this Lease has occurred on or prior to November 1, 2018, the Letter of Credit amount required hereunder shall reduce by an amount equal to two (2) months’ Monthly Rent (based on the Monthly Rent due at the time of the reduction). Thereafter, if the same conditions apply on each anniversary of November 1, 2018, the Letter of Credit amount required hereunder shall reduce each year by an amount equal to one (1) month’s Monthly Rent (based on the Monthly Rent due at the time of the reduction). If Tenant is entitled to any reduction in the amount of the Letter of Credit, Landlord shall cooperate with Tenant as soon as reasonably practicable following Tenant’s request to replace or amend the then existing Letter of Credit to reflect such reduced amount required hereunder; provided, however, that in no event shall any such reduction be construed as an admission by Landlord that Tenant has performed all of its covenants and obligations under this Lease.

7.Additional Rent: Increases in Operating Expenses and Tax Expenses.

a.Operating Expenses. Tenant shall pay to Landlord, at the times hereinafter set forth, Tenant’s Share, as specified in Paragraph 2.f. above, of any increase in the Operating Expenses (as defined below) incurred by Landlord in each calendar year subsequent to the Base Year specified in Paragraph 2.g. above, over the Operating Expenses incurred by Landlord during the Base Year. The amounts payable under this Paragraph 7.a. and Paragraph 7.b. below are termed “Additional Rent” herein.

The term “Operating Expenses” shall mean the total costs and expenses incurred by Landlord in connection with the management, operation, maintenance and repair of the Real Property, including, without limitation, the following costs: (1) salaries, wages, bonuses and other compensation (including hospitalization, medical, surgical, retirement plan, pension plan, union dues, life insurance, including group life insurance, welfare and other fringe benefits, and vacation, holidays and other paid absence benefits) relating to employees of Landlord or its agents at the level of property manager or below (the “Reimbursable Employees”) to the extent engaged in the operation, repair, or maintenance of the Real Property; (2) payroll, social security, workers’ compensation, unemployment and similar taxes with respect to such Reimbursable Employees to the extent allocable to such Reimbursable Employees’ work at the Real Property, and the cost of providing disability or other benefits imposed by law or otherwise, with respect to such Reimbursable Employees to the extent allocable to such Reimbursable Employee’s work at the Real Property; (3) the cost of uniforms (including the cleaning, replacement and pressing thereof) provided to such employees and specifically worn at the Real Property; (4) premiums and other charges incurred by Landlord with respect to fire, other casualty, rent and liability insurance, any other insurance as is deemed necessary or advisable in the reasonable judgment of

8

Landlord, or any insurance required by the holder of any Superior Interest (as defined in Paragraph 21 below), and, after the Base Year, costs of repairing an insured casualty to the extent of the deductible amount under the applicable insurance policy (provided, however, that if the cost of any such insurance for the Base Year is greater than the cost of such insurance in subsequent year(s) of the Lease term due to unusual increases or fluctuations in the rate or scope of such insurance in the Base Year and such unusual increases or fluctuations are not present in the applicable subsequent year(s), Operating Expenses for the Base Year may be adjusted, for purposes of determining the Operating Expenses payable by Tenant in the applicable subsequent year(s), to reflect what the cost of such insurance would have been in the Base Year had the normal rates and scope of service applied); (5) water charges and sewer rents or fees applicable to the common areas of the Real Property (provided, however, that if the cost of any such service for the Base Year is greater than the cost of such service in subsequent year(s) of the Lease term due to unusual increases or fluctuations in the rate or scope of such service in the Base Year and such unusual increases or fluctuations are not present in the applicable subsequent year(s), Operating Expenses for the Base Year may be adjusted, for purposes of determining the Operating Expenses payable by Tenant in the applicable subsequent year(s), to reflect what the cost of such service would have been in the Base Year had the normal rates and scope of service applied); (6) license, permit and inspection fees for the Real Property and operation thereof; (7) sales, use and excise taxes on goods and services purchased by Landlord in connection with the operation, maintenance or repair of the Real Property and Building systems and equipment; (8) telephone, telegraph, postage, stationery supplies and other expenses incurred in connection with the operation, maintenance, or repair of the Real Property; (9) management fees and expenses, Tenant’s monthly payment of which shall not exceed three percent (3%) of the then current Monthly Rent and Additional Rent; (10) costs of repairs to and maintenance of the Real Property, including building systems and appurtenances thereto and normal repair and replacement ofworn-out equipment, facilities and installations, but excluding capital replacements or the replacement of major building systems (except to the extent provided in (16) and (17) below); (11) fees and expenses for janitorial, window cleaning, guard, extermination, water treatment, rubbish removal, plumbing and other services and inspection or service contracts for elevator, electrical, mechanical, HVAC and other building equipment and systems or as may otherwise be necessary or proper for the operation, repair or maintenance of the common areas of the Real Property; (12) costs of supplies, tools, materials, and equipment to the extent used in connection with the operation, maintenance or repair of the Real Property; (13) accounting, legal and other professional fees and expenses to the extent specific to the operation of the Real Property; (14) fees and expenses for maintaining the exterior of the Building and the sidewalks, landscaping and other common areas of the Real Property; (15) costs and expenses for electricity, chilled water, air conditioning, water for heating, gas, fuel, steam, heat, lights, power and other energy related utilities required in connection with the operation, maintenance and repair of the common areas of the Real Property (provided, however, that if the cost of any energy related utility for the Base Year is greater than the cost of such utility in subsequent year(s) of the Lease term due to unusual increases or fluctuations in the rate for such utility in the Base Year and such unusual increases or fluctuations are not present in the applicable subsequent year(s), Operating Expenses for the Base Year may be adjusted, for purposes of determining the Operating Expenses payable by Tenant in the applicable subsequent year(s), to reflect what the cost of such utility would have been in the Base Year had normal rates applied); (16) the cost of any capital improvements made by Landlord to the Real Property or capital assets acquired by Landlord after the Base Year in order to comply with any local, state or federal law, ordinance, rule, regulation, code or order of any governmental entity or insurance requirement (collectively, “Legal Requirement”) with which the Real Property was not required to comply during the Base Year, or to comply with any amendment or other change to the enactment or interpretation of any Legal Requirement from its enactment or interpretation during the Base Year, provided, that Operating Expenses shall not include any costs to comply with Legal Requirements in effect at the time the Building was originally constructed to the extent Landlord elected to delay its compliance with such Legal Requirements; (17) the

9

cost of any capital improvements made by Landlord to the Building or capital assets acquired by Landlord after the Base Year for the protection of the health and safety of the occupants of the Real Property or that are designed to reduce other Operating Expenses; (18) the cost of furniture, draperies, carpeting, landscaping and other customary and ordinary items of personal property (excluding paintings, sculptures and other works of art) provided by Landlord for use in common areas of the Building or the Real Property or in the Building office (to the extent that such Building office is dedicated to the operation and management of the Real Property); provided, however, that leasing or rental costs of a rotating or other art program for the common areas of the Building or the Real Property shall be included in Operating Expenses; and (19) any expenses and costs resulting from substitution of work, labor, material or services in lieu of any of the above itemizations, or for any additional work, labor, services or material resulting from compliance with any Legal Requirement applicable to the Real Property or any parts thereof; and (20) Building office rent or rental value for a building office not in excess of two thousand (2,000) rentable square feet and at an aggregate rent not in excess of the fair market value of such space, as the same may change from year to year. With respect to the costs of items included in Operating Expenses under (16) and (17), such costs shall be amortized over the useful life, as reasonably determined by Landlord based upon generally accepted accounting principles, together with interest on the unamortized balance at a rate per annum equal to three (3) percentage points over the six-month United States Treasury bill rate in effect at the time such item is constructed or acquired, or at such higher rate as may have been paid by Landlord on funds borrowed for the purpose of constructing or acquiring such item, but in either case not more than the maximum rate permitted by law at the time such item is constructed or acquired.

Operating Expenses shall not include the following: (i) depreciation or amortization on the Building or equipment or systems therein; (ii) debt service; (iii) rental under any ground or underlying lease; (iv) interest (except as expressly provided in this Paragraph 7.a.); (v) Tax Expenses (as defined in Paragraph 7.b. below); (vi) attorneys’ fees and expenses incurred in connection with lease negotiations with prospective Building tenants, enforcement of any lease or defense of Landlord’s title to or interest in the Premises, the Building or the Real Property; (vii) the cost (including any amortization thereof) of any improvements or alterations which would be properly classified as capital expenditures according to generally accepted accounting practices (except to the extent expressly included in Operating Expenses pursuant to this Paragraph 7.a.); (viii) the cost of decorating, improving for tenant occupancy, painting or redecorating portions of the Building to be demised to tenants or otherwise exclusively occupied by tenants; (ix) executive salaries above the level of property manager; (x) advertising; (xi) real estate broker’s or other leasing commissions; (xii) repairs, alterations, additions, improvements or replacements made to rectify or correct any defect in the original design, materials or workmanship of the Premises, prior to construction of the Initial Alterations, the Building or the Real Property; (xiii) costs incurred due to violation by Landlord or any other tenant in the Premises, the Building or the Real Property of the terms and conditions of any lease, or cost, penalties or fines incurred due to violation by Landlord of any Legal Requirements which are the obligation of Landlord; (xiv) the cost of any service provided to Tenant or other occupants of the Premises, the Building or the Real Property for which Landlord is entitled to be reimbursed, or the cost of any services provided to any building or facility not a part of the Real Property; (xv) interest, penalties or other costs arising out of Landlord’s failure to make timely payments of its obligations unless such failure occurs as a result of Tenant’s failure to timely pay Tenant’s Share of Operating Expenses; (xvi) costs, expenses, depreciation or amortization for repairs and replacements required to be made by Landlord without inclusion in Operating Expenses; or (xvii) costs related to maintaining the legal existence of the entity which comprises Landlord. In addition, there shall be deducted from Operating Expenses any amounts received by Landlord during the term of this Lease to the extent the amounts are reimbursement for expenses which (A) previously were included in Operating Expenses under this Lease, (B) are included in Operating Expenses during the term of this Lease for the year in which the insurance proceeds are received or (C) are included as Operating Expenses in a subsequent year of the term of this Lease.

10

b.Tax Expenses. Tenant shall pay to Landlord as Additional Rent under this Lease, at the times hereinafter set forth, Tenant’s Share, as specified in Paragraph 2.e. above, of any increase in Tax Expenses (as defined below) incurred by Landlord in each calendar year subsequent to the Base Tax Year specified in Paragraph 2.f. above, over Tax Expenses incurred by Landlord during the Base Tax Year. Notwithstanding the foregoing, if any reassessment, reduction or recalculation of any item included in Tax Expenses during the term results in a reduction of Tax Expenses, then for purposes of calculating Tenant’s Share of increases in Tax Expenses from and after the calendar year in which such adjustment occurs, Tax Expenses for the Base Tax Year shall be adjusted to reflect such reduction. Landlord shall pay, or cause the payment of, all Taxes before any fine, penalty, interest or cost may be added thereto, become due or be imposed by operation of law for the nonpayment or late payment thereof. In no event shall Tenant be liable for any discount forfeited or penalty incurred as a result of late payment by Landlord unless such late payment occurs as a result of Tenant’s failure to timely pay Tenant’s Share of Tax Expenses. Following Tenant’s written request, Landlord shall provide complete copies of tax bills.

The term “Tax Expenses” shall mean all taxes, assessments (whether general or special), excises, transit charges, housing fund assessments or other housing charges, improvement districts, levies or fees, ordinary or extraordinary, unforeseen as well as foreseen, of any kind, which are assessed, levied, charged, confirmed or imposed on the Real Property, on Landlord with respect to the Real Property, on the act of entering into leases of space in the Real Property, on the use or occupancy of the Real Property or any part thereof, with respect to services or utilities consumed in the use, occupancy or operation of the Real Property, on any improvements, fixtures and equipment and other personal property of Landlord located in the Real Property and used in connection with the operation of the Real Property, or on or measured by the rent payable under this Lease or in connection with the business of renting space in the Real Property, including, without limitation, any gross income tax or excise tax levied with respect to the receipt of such rent, by the United States of America, the State of California, the City and County of San Francisco, any political subdivision, public corporation, district or other political or public entity or public authority, and shall also include any other tax, fee or other excise, however described, which may be levied or assessed in lieu of, as a substitute (in whole or in part) for, or as an addition to, any other Tax Expense. Tax Expenses shall include reasonable attorneys’ and professional fees, costs and disbursements incurred in connection with proceedings to contest, determine or reduce Tax Expenses. If it shall not be lawful for Tenant to reimburse Landlord for any increase in Tax Expenses as defined herein, the Monthly Rent payable to Landlord prior to the imposition of such increases in Tax Expenses shall be increased to net Landlord the same net Monthly Rent after imposition of such increases in Tax Expenses as would have been received by Landlord prior to the imposition of such increases in Tax Expenses.

Tax Expenses shall not include (i) income, franchise, transfer, inheritance or capital stock taxes, unless, due to a change in the method of taxation, any of such taxes is levied or assessed against Landlord in lieu of, as a substitute (in whole or in part) for, or as an addition to, any other charge which would otherwise constitute a Tax Expense; or (ii) any business licenses tax or tax or increase which may be levied on profits, gross receipts, sales or renewals or any tax or charge upon the Base Rent or other charges payable by Tenant under the Lease except to the extent that such license tax, tax or increase is in lieu of any Tax Expenses then currently payable by Tenant under the terms of this Lease.

11

c.Adjustment for Occupancy Factor. Notwithstanding any other provision herein to the contrary, in the event the Building is not fully occupied during any calendar year during the term after the Base Year, an adjustment shall be made by Landlord in computing Operating Expenses for such year so that the Operating Expenses shall be computed for such year as though the Building had been fully occupied during such year. In addition, if any particular work or service includable in Operating Expenses is not furnished to a tenant who has undertaken to perform such work or service itself, Operating Expenses shall be deemed to be increased by an amount equal to the additional Operating Expenses which would have been incurred if Landlord had furnished such work or service to such tenant. The parties agree that statements in this Lease to the effect that Landlord is to perform certain of its obligations hereunder at its own or sole cost and expense shall not be interpreted as excluding any cost from Operating Expenses or Tax Expenses if such cost is an Operating Expense or Tax Expense pursuant to the terms of this Lease.

d.Intention Regarding ExpensePass-Through. It is the intention of Landlord and Tenant that the Monthly Rent paid to Landlord throughout the term of this Lease shall be absolutely net of all increases, respectively, in Tax Expenses and Operating Expenses over, respectively, Tax Expenses for the Base Tax Year and Operating Expenses for the Base Year, and the foregoing provisions of this Paragraph 7 are intended to so provide.

e.Notice and Payment. On or before the first day of each calendar year during the term hereof subsequent to the Base Year, or as soon as practicable thereafter, Landlord shall give to Tenant notice of Landlord’s estimate of the Additional Rent, if any, payable by Tenant pursuant to Paragraphs 7.a. and 7.b. for such calendar year subsequent to the Base Year. On or before the first day of each month during each such subsequent calendar year which is at least thirty (30) days following Tenant’s receipt of Landlord’s estimate of Additional Rent, Tenant shall pay to Landlord one-twelfth (1/12th) of the estimated Additional Rent; provided, however, that if Landlord’s notice is not given prior to the first day of any calendar year Tenant shall continue to pay Additional Rent on the basis of the prior year’s estimate until the month which is at least thirty (30) days after Landlord’s notice is given. If at any time (but not more than once per calendar year) it appears to Landlord that the Additional Rent payable under Paragraphs 7.a. and/or 7.b. will vary from Landlord’s estimate by more than five percent (5%), Landlord may, by written notice to Tenant, revise its estimate for such year, and subsequent payments by Tenant for such year shall be based upon the revised estimate. On the first monthly payment date which is at least thirty (30) days after any new estimate is delivered to Tenant, Tenant shall also pay any accrued cost increases, based on such new estimate.

f.Annual Accounting. Within one hundred fifty (150) days after the close of each calendar year subsequent to the Base Year, or as soon after such one hundred fifty (150) day period as practicable, Landlord shall deliver to Tenant a statement of the Additional Rent payable under Paragraphs 7.a. and 7.b. for such year and such statement shall be final and binding upon Landlord and Tenant (except that the Tax Expenses included in such statement may be modified by any subsequent adjustment or retroactive application of Tax Expenses affecting the calculation of such Tax Expenses and set forth in this Lease). Landlord’s annual statement delivered to Tenant pursuant to this Paragraph 7.f. of the Lease shall be based on the results of an audit of the operations of the Building prepared for the applicable year by a nationally recognized certified public accounting firm selected by Landlord, and upon Tenant’s request, Landlord shall promptly deliver to Tenant a copy of the auditor’s statement on which Landlord’s annual statement is based. If the annual statement shows that Tenant’s payments of Additional Rent for such calendar year pursuant to Paragraph 7.e. above exceeded Tenant’s obligations for the calendar year, Landlord shall credit the excess to the next succeeding installments of estimated Additional Rent or, if this Lease has expired or otherwise terminated, Landlord shall pay such excess to

12

Tenant within thirty (30) days of delivery of the annual statement to Tenant. Subject to Tenant’s audit rights, if the annual statement shows that Tenant’s payments of Additional Rent for such calendar year pursuant to Paragraph 7.e. above were less than Tenant’s obligation for the calendar year, Tenant shall pay the deficiency to Landlord within thirty (30) days after delivery of such statement.

g.Proration for Partial Lease Year. If this Lease terminates on a day other than the last day of a calendar year, the Additional Rent payable by Tenant pursuant to this Paragraph 7 applicable to the calendar year in which this Lease terminates shall be prorated on the basis that the number of days from the commencement of such calendar year to and including such termination date bears to three hundred sixty (360).

h.Electricity furnished to the Premises. Notwithstanding anything to the contrary in Paragraph 17 of the Lease or in this Paragraph 8, electricity furnished to the Premises shall not be included in Operating Expenses, and shall instead be separately paid for by Tenant as hereafter provided. In addition to the Monthly Rent, Additional Rent, and other charges payable under the Lease for the Premises, commencing on the relevant Commencement Date for each portion of the Premises and for the balance of the Lease term, Tenant shall pay for all electricity supplied to the Premises as measured by electrical submeters dedicated to the Premises (the “Submetering Equipment”). Landlord shall operate, maintain and repair the Submetering Equipment throughout the term of the Lease at its sole cost and expense. The data from all Submetering Equipment readings documenting Tenant’s electrical use shall be shared on a monthly basis with Tenant. Tenant shall pay Landlord for all electricity supplied to the Premises, as rent on a monthly basis, within thirty (30) days after Landlord’s delivery of an invoice and reasonable supporting documentation to Tenant. The electricity shall be billed to and paid by Tenant at Landlord’s actual cost thereof (calculated at the average rate per kilowatt hour charged to landlord for electricity supplied to the Building). The parties acknowledge that the electricity paid for by Tenant pursuant to this Paragraph does not include electricity required to supply basic HVAC Service to the Premises pursuant to Paragraph 17a(ii) of the Lease, and the cost thereof shall be included in Operating Expenses.

8.Use of Premises; Compliance with Law.

a.Use of Premises. The Premises shall be used solely for general office purposes for the business of Tenant as described in Paragraph 2.g. above and for no other use or purpose.

Tenant shall not do or suffer or knowingly permit Tenant’s Parties (as defined below) to do anything in or about the Premises or the Real Property, nor bring or keep anything therein, which would in any way subject Landlord, Landlord’s agents or the holder of any Superior Interest (as defined in Paragraph 21) to any liability, increase the premium rate of or decrease in the coverage of any fire, casualty, liability, rent or other insurance relating to the Real Property or any of the contents of the Building, or cause a cancellation of, or give rise to any defense by the insurer to any claim under, or conflict with, any policies for such insurance. If any act or omission of Tenant results in any such increase in premium rates, Tenant shall pay to Landlord upon demand the amount of such increase. Tenant shall not do or suffer or permit anything to be done in or about the Premises or the Real Property which will materially obstruct or interfere with the rights of other tenants or occupants of the Building or injure them, or use or suffer or permit the Premises to be used for any unlawful purpose or other purpose in violation of Paragraph 8.a., nor shall Tenant cause, maintain, suffer or permit any nuisance in, on or about the Premises or the Real Property. Without limiting the foregoing, no loudspeakers or other similar device which can be heard outside the Premises shall, without the prior written approval of Landlord, be used in or about the Premises. Tenant shall not commit or suffer to be committed any waste in, to or about the

13

Premises. Landlord may from time to time conduct fire and life safety training for tenants of the Building, including evacuation drills and similar procedures. Tenant agrees to participate in such activities as reasonably requested by Landlord.

Tenant agrees not to employ any person, entity or contractor for any work in the Premises (including moving Tenant’s equipment and furnishings in, out or around the Premises) whose presence may give rise to a labor or other disturbance in the Building and, if necessary to prevent such a disturbance in a particular situation, Landlord may require Tenant to employ union labor for the work.

b.Compliance with Law. Tenant shall not do or knowingly permit Tenant’s Parties to do in or about the Premises which will in any way conflict with any Legal Requirement (as defined in Paragraph 7.a.(16) above) now in force or which may hereafter be enacted. Tenant, at its sole cost and expense, shall promptly comply with all such present and future Legal Requirements relating to Tenant’s particular use of the Premises (as opposed to Tenant’s use of the Premises for general office purposes in a normal and customary manner), and shall perform all work to the Premises or other portions of the Real Property required to effect such compliance. Notwithstanding the foregoing, however, Tenant shall not be required to perform any changes to the Premises or other portions of the Real Property unless such changes are related to or affected or triggered by (i) Tenant’s Alterations (as defined in Paragraph 9 below) (ii) Tenant’s particular use of the Premises (as opposed to Tenant’s use of the Premises for general office purposes in a normal and customary manner), (iii) Tenant’s particular employees or employment practices, or (iv) the construction of the Initial Alterations. The judgment of any court of competent jurisdiction or the admission of Tenant in an action against Tenant, whether or not Landlord is a party thereto, that Tenant has violated any Legal Requirement shall be conclusive of that fact as between Landlord and Tenant. Tenant shall as soon as reasonably practicable furnish Landlord with any notices received from any insurance company or governmental agency or inspection bureau regarding any unsafe or unlawful conditions within the Premises or the violation of any Legal Requirement.

c.Hazardous Materials. Tenant shall not cause or knowingly permit the storage, use, generation, release, handling or disposal (collectively, “Handling”) of any Hazardous Materials (as defined below), in, on, or about the Premises or the Real Property by Tenant or any agents, employees, contractors, licensees, subtenants, customers, guests or invitees of Tenant (collectively with Tenant, “Tenant Parties”), except that Tenant shall be permitted to use normal quantities of office supplies or products (such as copier fluids or cleaning supplies) customarily used in the conduct of general business office activities (“Common Office Chemicals”), provided that the Handling of such Common Office Chemicals shall comply at all times with all Legal Requirements, including Hazardous Materials Laws (as defined below). Notwithstanding anything to the contrary contained herein, however, in no event shall Tenant permit any usage of Common Office Chemicals in a manner that may cause the Premises or the Real Property to be contaminated by any Hazardous Materials or in violation of any Hazardous Materials Laws. Tenant shall immediately advise Landlord in writing of (a) any and all enforcement, cleanup, remedial, removal, or other governmental or regulatory actions instituted, completed, or threatened pursuant to any Hazardous Materials Laws relating to any Hazardous Materials affecting the Premises; and (b) all claims made or threatened in writing by any third party against Tenant, Landlord, the Premises or the Real Property relating to damage, contribution, cost recovery, compensation, loss, or injury resulting from any Hazardous Materials on or about the Premises. Without Landlord’s prior written consent, Tenant shall not take any remedial action or enter into any agreements or settlements in response to the presence of any Hazardous Materials in, on, or about the Premises. Tenant shall be solely responsible for and shall indemnify, defend and hold Landlord and all other Indemnitees (as defined in Paragraph 14.b. below), harmless from and against all Claims (as defined in Paragraph 14.b. below), arising out of or in connection with, or otherwise relating to (i) any Handling of

14

Hazardous Materials by any Tenant Party in violation of this Paragraph 8.c. or Tenant’s breach of any other obligations under this Lease with respect to Hazardous Materials, or (ii) any removal, cleanup, or restoration work and materials necessary to return the Real Property or any other property of whatever nature located on the Real Property to their condition existing prior to the Handling of Hazardous Materials in, on or about the Premises by any Tenant Party in violation of this Paragraph 8.c. Tenant’s obligations under this paragraph shall survive the expiration or other termination of this Lease. For purposes of this Lease, “Hazardous Materials” means any explosive, radioactive materials, hazardous wastes, or hazardous substances, including without limitation asbestos containing materials, PCB’s, CFC’s, or substances defined as “hazardous substances” in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. Section 9601-9657; the Hazardous Materials Transportation Act of 1975, 49 U.S.C. Section 1801-1812; the Resource Conservation and Recovery Act of 1976, 42 U.S.C. Section 6901-6987; or any other Legal Requirement regulating, relating to, or imposing liability or standards of conduct concerning any such materials or substances now or at any time hereafter in effect (collectively, “Hazardous Materials Laws”).

d.Applicability of Paragraph. The provisions of this Paragraph 8 are for the benefit of Landlord, the holder of any Superior Interest (as defined in Paragraph 21 below), and the other Indemnitees only and are not nor shall they be construed to be for the benefit of any tenant or occupant of the Building.

9.Alterations and Restoration.

a. Tenant shall not make or permit to be made any alterations, modifications, additions, decorations or improvements to the Premises, or any other work whatsoever that would directly or indirectly involve the penetration or removal (whether permanent or temporary) of, or require access through, in, under, or above any floor, wall or ceiling, or surface or covering thereof in the Premises (collectively, “Alterations”), except as expressly provided in this Paragraph 9. If Tenant desires any Alteration, including the Initial Alterations, Tenant must obtain Landlord’s prior written approval of such Alteration, which approval shall not be unreasonably withheld, conditioned or delayed. With respect to the Initial Alterations, Landlord shall respond to a written request for consent, delivered by Tenant together with reasonably complete documentation as to the scope and design of the Initial Alterations, within ten (10) Business Days;provided, however, that if Landlord shall fail to respond within such ten (10) Business Day period, Tenant shall so notify Landlord and if Landlord shall then fail to deliver a response to Tenant within three (3) Business Days of Landlord’s receipt of Tenant’s second notice, the Initial Alterations described in Tenant’s written request for consent shall be deemed approved. For all other Alterations, the process described in the preceding sentence shall apply, however the time periods shall be fifteen (15) Business Days and seven (7) Business Days, respectively.

All Alterations shall be made at Tenant’s sole cost and expense (including the expense of complying with all present and future Legal Requirements, including those regarding asbestos, if applicable, and any other work required to be performed in other areas within or outside the Premises directly arising out of the Alterations), subject to Landlord’s payment of the Landlord’s Allowance with respect to the Initial Alterations. Tenant shall either (i) arrange for Landlord to perform the work on terms and conditions acceptable to Landlord and Tenant, each in its sole discretion or (ii) bid the project out to contractors approved by Landlord in writing in advance (which approval shall not be unreasonably withheld, conditioned or delayed). Tenant shall provide Landlord with a copy of the information submitted to bidders at such time as the bidders receive their copy. Regardless of the contractors who perform the work pursuant to the above, Tenant shall pay Landlord on demand prior to or during the course of such construction amount (the “Alteration Operations Fee”) equal to three percent (3%) of the

15

total cost of the Alteration (and for purposes of calculating the Alteration Operations Fee, such cost shall include architectural and engineering fees, but shall not include permit fees) as compensation to Landlord for Landlord’s internal review of Tenant’s plans and general oversight of the construction (which oversight shall be solely for the benefit of Landlord and shall in no event be a substitute for Tenant’s obligation to retain such project management or other services as shall be necessary to ensure that the work is performed properly and in accordance with the requirements of this Lease). Landlord and Tenant confirm that no Alteration Operations Fee shall be payable with respect to the Initial Alterations in recognition of Tenant’s obligation to pay the Construction Management Fee as provided herein. Tenant shall also reimburse Landlord for Landlord’s expenses such as for electrical energy consumed in connection with the work, freight elevator operation, additional cleaning expenses, additional security services, fees and charges paid to third party architects, engineers and other consultants for review of the work and the plans and specifications with respect thereto and to monitor contractor compliance with Building construction requirements, and for other miscellaneous costs incurred by Landlord as result of the construction of Alterations, including the Initial Alterations.

All such work shall be performed diligently and in afirst-class workmanlike manner and in accordance with plans and specifications approved by Landlord, and shall comply with all Legal Requirements and Landlord’s construction standards, procedures, conditions and requirements for the Building as in effect from time to time (including Landlord’s requirements relating to insurance and contractor qualifications) and provided in writing to Tenant upon request to Landlord. In no event shall Tenant employ any person, entity or contractor to perform work in the Premises whose presence may give rise to a labor or other disturbance in the Building. Any Alterations, including, without limitation, moveable partitions that are affixed to the Premises (but excluding moveable, free standing partitions) and all carpeting, shall at once become part of the Building and the property of Landlord. Tenant shall give Landlord not less than five (5) days prior written notice of the date the construction of the Alteration is to commence. Landlord may post and record an appropriate notice of nonresponsibility with respect to any Alteration and Tenant shall maintain any such notices posted by Landlord in or on the Premises.

b. At Landlord’s sole election, (which Landlord shall confirm to Tenant in writing upon request from Tenant at the time of Landlord’s consent to the relevant Alterations or within fifteen (15) days following other written request from Tenant), any or all Alterations made for or by Tenant shall be removed by Tenant from the Premises at the expiration or sooner termination of this Lease and the Premises shall otherwise be delivered to Landlord in good condition and repair, ordinary wear and tear excepted. If Landlord does not elect to require removal of all or any portion of the Alterations, Tenant shall have no right or obligation to remove all or any portion of any Alterations made during the term of this Lease (including, without limitation, the Initial Alterations). Any required removal of the Alterations and the restoration of the Premises to good condition and repair, ordinary wear and tear excepted, shall be performed by a general contractor selected by Tenant and reasonably approved by Landlord, in which event Tenant shall pay the general contractor’s fees and costs in connection with such work. Any separate work letter or other agreement which is hereafter entered into between Landlord and Tenant pertaining to Alterations shall be deemed to automatically incorporate the terms of this Lease without the necessity for further reference thereto.

10.Repair

a. By taking possession of the Premises, Tenant agrees that the Premises are in the condition required under this Lease, subject to completion of Landlord’s Code Compliance Work as required under Paragraph 4.a. Tenant, at Tenant’s sole cost and expense, shall keep the Premises and every part thereof (including the interior walls and ceilings of the Premises, those portions of the

16

Building systems located within and exclusively serving the Premises, and improvements and Alterations) in good condition and repair. Tenant waives all rights to make repairs at the expense of Landlord as provided by any Legal Requirement now or hereafter in effect. It is specifically understood and agreed that, except as specifically set forth in this Lease, Landlord has no obligation and has made no promises to alter, remodel, improve, repair, decorate or paint the Premises or any part thereof, and that no representations respecting the condition of the Premises or the Building have been made by Landlord to Tenant. Tenant hereby waives the provisions of California Civil Code Sections 1932(1), 1941 and 1942 and of any similar Legal Requirement now or hereafter in effect.

b. Except as specifically provided in the immediately preceding paragraph, Landlord, subject to reimbursement through Operating Expenses permitted under this Lease, shall keep any and all portions of the Real Property and every part thereof, in good condition and repair.

11.Abandonment.

Tenant shall not abandon the Premises or any part thereof at any time during the term hereof without fulfilling its other obligations under this Lease (including as set forth in Paragraph 10). Abandonment by Tenant of the Premises without Tenant fulfilling its other obligations under this Lease shall constitute an Event of Default hereunder regardless of whether Tenant continues to pay Monthly Rent and Additional Rent under this Lease. Upon the expiration or earlier termination of this Lease, or if Tenant surrenders all or any part of the Premises or is dispossessed of the Premises by process of law, or otherwise, any movable furniture, equipment, trade fixtures, or other personal property belonging to Tenant and left on the Premises for five (5) Business Days following receipt by Tenant of notice of same from Landlord shall at the option of Landlord be deemed to be abandoned and, whether or not the property is deemed abandoned, Landlord shall have the right to remove such property from the Premises and charge Tenant for the removal and any restoration of the Premises as provided in Paragraph 9. Landlord may charge Tenant for the storage of Tenant’s property left on the Premises at such rates as Landlord may from time to time reasonably determine, or, Landlord may, at its option, store Tenant’s property in a public warehouse at Tenant’s expense. Notwithstanding the foregoing, neither the provisions of this Paragraph 11 nor any other provision of this Lease shall impose upon Landlord any obligation to care for or preserve any of Tenant’s property left upon the Premises, and Tenant hereby waives and releases Landlord from any claim or liability in connection with the removal of such property from the Premises and the storage thereof and specifically waives the provisions of California Civil Code Section 1542 with respect to such release. Landlord’s action or inaction with regard to the provisions of this Paragraph 11 shall not be construed as a waiver of Landlord’s right to require Tenant to remove its property, restore any damage to the Premises and the Building caused by such removal, and make any restoration required pursuant to Paragraph 9 above.

12.Liens.

Tenant shall not permit any mechanic’s, materialman’s or other liens arising out of work performed at the Premises by or on behalf of Tenant (other than work performed by Landlord for the benefit of Tenant) to be filed against the fee of the Real Property nor against Tenant’s interest in the Premises. At least ten (10) days prior to and during the performance of any such work by Tenant, as to which Tenant shall have provided no less than twenty (20) days’ prior written notice to Landlord, Landlord shall have the right to post and keep posted on the Premises any notices which it deems necessary for protection from such liens. If any such liens are filed and are not removed or stayed within ten (10) Business Days’ following written notice to Tenant, Landlord without waiving its rights based on such breach by Tenant and without releasing Tenant from any obligations hereunder, pay and satisfy the

17

same and in such event the sums so paid by Landlord shall be due and payable by Tenant immediately without notice or demand, with interest from the date paid by Landlord through the date Tenant pays Landlord, at the Interest Rate. Tenant agrees to indemnify, defend and hold Landlord and the other Indemnitees (as defined in Paragraph 14.b. below) harmless from and against any Claims (as defined in Paragraph 14.b. below) for mechanics’, materialmen’s or other liens in connection with any Alterations, repairs or any work performed, materials furnished or obligations incurred by or for Tenant (other than by Landlord for the benefit of Tenant).

13.Assignment and Subletting.

a.Landlord’s Consent. Landlord’s and Tenant’s agreement with regard to Tenant’s right to transfer all or part of its interest in the Premises is as expressly set forth in this Paragraph 13. Tenant agrees that, except upon Landlord’s prior written consent, which consent shall not (subject to Landlord’s rights under Paragraph 13.d. below) be unreasonably withheld, conditioned or delayed, neither this Lease nor all or any part of the leasehold interest created hereby shall, directly or indirectly, voluntarily or involuntarily, by operation of law or otherwise, be assigned, mortgaged, pledged, encumbered or otherwise transferred by Tenant or Tenant’s legal representatives or successors in interest (collectively, an “assignment”) and neither the Premises nor any part thereof shall be sublet or be used or occupied for any purpose by anyone other than Tenant (collectively, a “sublease”); provided that an assignment or sublease may occur in a Permitted Transfer (as defined below) without Landlord’s consent but otherwise in compliance with the terms of this Paragraph 13. Any assignment or subletting without Landlord’s prior written consent, except for subleases pursuant to a Permitted Transfer, shall, at Landlord’s option, be void and shall constitute an Event of Default entitling Landlord to terminate this Lease and to exercise all other remedies available to Landlord under this Lease and at law.

The parties hereto agree and acknowledge that, among other circumstances for which Landlord may reasonably withhold its consent to an assignment or sublease, it shall be reasonable for Landlord to withhold its consent where: (i) the assignment or subletting would materially increase the operating costs for the Building or the burden on the Building services, or materially increase the foot traffic to/from the Premises, elevator usage or security concerns in the Building, (ii) the space will be used for a school or training facility, an entertainment, sports or recreation facility, retail sales to the public (unless Tenant’s permitted use is retail sales), a personnel or employment agency, an office or facility of any governmental or quasi-governmental agency or authority, a place of public assembly (including without limitation a meeting center, theater or public forum), any use by a foreign government orquasi-governmental agency or authority (including without limitation an embassy or consulate or similar office), or a facility for the provision of social, welfare or clinical health services or sleeping accommodations (whether temporary, daytime or overnight); (iii) the proposed assignee or subtenant is a current tenant of the Building or has been in negotiations with Landlord as a prospective tenant of the Building during the six (6) months preceding Tenant’s request for Landlord’s consent; (iv) the creditworthiness of a proposed assignee or subtenant is not substantially similar to the then current creditworthiness of Tenant; (v) Landlord determines that the character of the business that would be conducted by the proposed assignee or subtenant at the Premises, or the manner of conducting such business, would be materially inconsistent with the character of the Building as a first-class office building; (vi) the proposed assignee or subtenant is an entity or a parent,wholly-owned subsidiary or affiliate of an entity with whom Landlord or Landlord’s parent entity, wholly-owned subsidiary or affiliate is then currently in litigation; (vii) the assignment or subletting conflicts with any exclusive uses granted to other tenants of the Real Property prior to Tenant’s request for Landlord’s consent, or with the terms of

18

any easement, covenant, condition or restriction, or other agreement affecting the Real Property and entered into prior to Tenant’s request for Landlord’s consent; or (viii) the assignment or subletting would involve a change in use from that expressly permitted under this Lease. Landlord’s foregoing rights and options shall continue throughout the entire term of this Lease.