UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

SHENGTAI POWER INTERNATIONAL, INC.

(Exact name of small business issuer as specified in its charter)

Nevada | 26-3504254 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Building 9, Xinhe New Industrial Park Fuyong Township, Bao An District Shenzhen, China, 518014 |

(Address of Principal Executive Offices; Zip Code) |

| |

Registrant’s Telephone Number, Including Area Code: | 86 755 3385 0387 |

Securities to be registered under Section 12(b) of the Act:

Title of each class to be so registered

None | | Name of each exchange on which each class is to be registered

None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition for “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

| | | | |

| Non-Accelerated Filer | ¨ | Smaller Reporting Company | Q |

1

TABLE OF CONTENTS

2

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Our Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” above.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

•

our ability to overcome competition in our market;

•

the impact that a downturn or negative changes in the consumer electronics prices could have on our business and profitability;

•

our ability to simultaneously fund the implementation of our business plan and invest in new projects;

•

economic, political, regulatory, legal and foreign exchange risks associated with international expansion;

•

loss of key members of our senior management.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this prospectus. You should read this registration statement and the documents that we reference and filed as exhibits to the registration statement completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except as otherwise indicated by the context, references in this report to:

•

“Company,” “we,” “us,” or “our,” are references to the combined business of Shengtai Power International, Inc., a Nevada corporation, together with its wholly-owned subsidiary, Happy Corporation Limited, or HCL, a Hong Kong limited company, and HCL’s wholly owned subsidiary, Shenzhen Shengtai Industrial Company Limited, or Shengtai, a PRC limited company.

•

“China,” the “State” and “PRC” are references to the People’s Republic of China;

•

“RMB” are to Renminbi, the legal currency of China;

•

the “Securities Act” are to Securities Act of 1933, as amended;

•

the “Exchange Act” are to the Securities Exchange Act of 1934, as amended; and

•

RMB7.3046 = $1.00 for its December 31, 2007 audited balance sheet, with the exception of the equity accounts, and RMB7.8087 = $1.00 for its December 31, 2006 audited balance sheets, with the exception of the equity accounts. The equity accounts were stated at their historical rate. The average exchange rates applied to income statement and statements cash flows for the years ended December 31, 2007 and 2006 were RMB7.5653 and RMB8.3117, respectively.

3

OUR BUSINESS

Overview of Our Business

We are a Nevada holding company whose PRC-based operating subsidiary, Shengtai, is primarily engaged in the research and development, design, production, distribution and support of power supply products. The Company’s main products include power supplies, chargers, Direct Current (DC) regulated power supplies, Alternating Current/Direct Current (AC/DC) power supply adaptors, AC/DC modules, DC/DC converters, and DC/DC modules. Our products are principally used as power supplies for Liquid Crystal Display Televisions (LCD TVs). Our products are sold by our internal sales team to manufacturing customers in China, Europe and Asia.

Our Corporate History and Structure

The Company was organized under the laws of the State of Arizona, in 2004, as VT Video Services, Inc., a wholly owned subsidiary of Visitalk Capital Corporation, or VCC, which in turn was a wholly owned subsidiary of Visitalk.com, or Visitalk, as part of the implementation of Visitalk’s Chapter 11 reorganization plan. VCC was authorized by the Visitalk plan as the reorganized debtor. Effective as of June 11, 2008, the name of the Company was officially changed from VT Video Services, Inc. to Bay Peak 1 Acquisition Corp., in connection with our merger into eVillage Energy, Inc., a Nevada Corporation. On October 22, 2008, we changed our name to Shengtai Power International, Inc., in connection with our reverse merger acquisition of Happy Corporation Limited, or HCL, a Hong Kong limited company. As a result of the reverse acquisition transaction, we now conduct our operations in the PRC through our wholly owned PRC subsidiary, Shenzhen Shengtai Industrial Company Limited, or Shengtai.

Reverse Acquisition

On October 9, 2008, we completed a reverse acquisition transaction through a share exchange with HCL, whereby we issued to the shareholders of HCL, 36,580,586 shares of our common stock, par value $.001, in exchange for 100% of the issued and outstanding capital stock of HCL.HCL thereby became our wholly owned subsidiary and its subsidiary, Shengtai, became our indirect subsidiary. As a result of the merger, on October 9, 2008, Lanny Lang, resigned from all corporate offices and as a director of the Company andDerong Zou was appointed Chief Executive Officer, Tong Luo was appointed Chief Financial Officer and Hongdong Zhang was appointed our Chief Operating Officer. On same day, the board of directors appointed Derong Zou, Hongdong Zhang, Tailin Wang and John Eliasov to serve as members of the board of directors of the Company, with Derong Zou serving as Chairman of the board of directors. Cory Roberts will remain as a director of the Company. As a condition to the closing of the reverse acquisition, we filed a certificate of amendment to our articles of incorporation with the Nevada Secretary of State on October 22, 2008, to change our name from Bay Peak 1 Acquisition Corp. to Shengtai Power International, Inc.

Acquisition of Shengtai

Our wholly-owned subsidiary, HCL is a Hong Kong limited company that was incorporated on November 8, 2007. Prior to the reverse acquisition described herein, HCL was wholly-owned by Shaoping Lu (a 20% minority holder) and John David Eliasov (the 80% majority holder). On July 6, 2008, HCL entered into equity purchase agreement to acquire all the capital of Shengtai for RMB10,000,000 (approximately $1,459,854). The transaction was approved on July 10, 2008, by the Shenzhen Bureau of Commerce, subject to the PRCRegulations on Merger with and Acquisition of Domestic Enterprises by Foreign Investors, or Merger Regulations, which requires the equity interest transfer price to be paid in full by a date certain, or in the absence of such express date, within one year commencing from the issuance of the new business license. On September 5, 2008, a renewed business license w as issued by the Shenzhen Administration for Industry and Commerce, and Shengtai was converted into a wholly foreign owned enterprise. Shengtai was organized under the laws of the PRC on November 23, 2000 and its scope of business includes the research and development, design, production, distribution and support of power supply products. Shengtai’s new business license is valid through September 4, 2018.

4

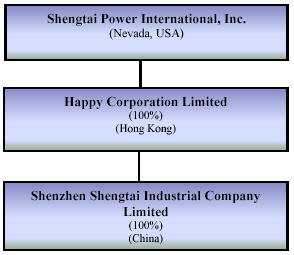

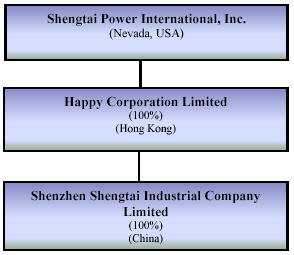

Corporate Structure

The following chart reflects our organizational structure as of the date of this registration statement.

Our corporate headquarters are located at Building 9, Xinhe New Industrial Park, Fuyong Township, Bao An District, Shenzhen, China, 518014. Our telephone number is (+86) 755 -3385 0387. We maintain a website at www.adaptorst.com that contains information about our company, but that information is not a part of this prospectus.

Our Industry and Market Trends

Liquid Crystal Display Market

The power supply industry is closely associated with the consumer electronics industry in general and with the market for Liquid Crystal Display, or LCD, products in particular. LCDs are used to present data and images in a wide variety of applications, ranging from cell phones to car navigation and entertainment systems to the larger displays used in flat panel televisions and computer monitors, including laptop computer screens. The LCD power supply industry is currently made up of many small- and medium-sized companies that manufacture and distribute products to larger LCD TV manufactures for integration to consumer products.

LCD technology allows for a higher level of light output than other types of panel displays. It has become the mainstream technology in today’s display market with demand for such technology increasing by 10 - 15% per year. Generally, companies that manufacture power supplies provide them as a component to other parties, which incorporate them into a finished display unit, which consists of a LCD film, such as a thin film transistor, that bears the image, the power supply and the shell that is used to hold the backlight, film and other components in place. As a result, our customers are typically the assemblers of the LCD modules and customers who are the final assemblers of the products that are sold to consumers.

According to Displaybank, a reputable Korean based research firm, the global LCD display market from 2007 to 2012 would grow at an annual rate of 13%, which from 74 million television sets to 192 million television sets. LCD market was approximately $48.5 billion in 2004, and it is expected to grow to approximately $94 billion by 2010. This significant growth projection is being driven by an increase in the breadth of applications utilizing LCDs to take advantage of their increased brightness and clarity, the development of new LCD-related technologies and the growing use of LCDs in larger screen applications, e.g. television sets.

Liquid Crystal Display Market in China

According to the 11th five year plan of the Information Industry Ministry, the PRC government is committed to enhancing the construction of a flat television industry, push the television set industry to develop from the lower end of the industry chain to the higher end, focus on the manufacturing of single unit televisions and develop system installation and services capabilities. Because we manufacture and sell an important component of LCD TVs, we expect to benefit from the PRC government’s support of this industry.

5

The domestic market for LCD TVs continues to grow. According to a 2006 White Paper on the China Flat Screen Television Market, released by the State Information Center and State Grid Corporation of China, revenue for flat screen televisions in the domestic retail market for 2005 was $5.57 billion of which $4.54 billion was attributed to LCD TVs. Revenue from flat screen televisions in 2006 increased by 122%, while the sales volume increased 151%. According to the same report sales of flat screens were estimated to increase an additional 68% in 2007 to 8.1 million flat screen televisions. The sales volume of LCD TV was estimated to increase by 80% over the same period. This rapid increase is partly attributable to the affordability of LCD TV; the average price of LCD TVs in the 32-inch to 42-inch market range decreased by 32% in 2006. The decrease in the price of LCD TVs along with the increase in consumer discretionary income has had a positive impact on the demand for televisions.

We consider our industry to be one that is expanding, as electronics are incorporated into a growing number of products and devices that benefit from the display of information and images. We have benefited from certain cost and strategic advantages relative to our competitors, and those advantages have enabled us to maintain attractive margins on our products up to this point. However, as a growing percentage of backlight production shifts to the PRC from higher-cost countries, price competition will increase, and our ability to preserve margins will depend on our continuing to improve our product quality, production efficiency and customer services relative to our competitors.

Our Products

We specialize in the research and development, design, production, distribution and support of power supply products that are principally used for LCDs. The Company’s main products include chargers, DC regulated power supplies, AC/DC power supply adaptors, AC/DC modules, DC/DC converters, and DC/DC modules. Those applications include color displays for a variety of consumer electronic products such as cell phones, car televisions and navigation systems, digital cameras, televisions, computer displays, camcorders, Personal Digital Assistants (PDAs) and Digital Video Disks (DVDs), Compact Disk (CD) and Moving Picture Experts Group Audio III/IV (MP3/MP4) players, appliance displays and the like.

LCD screens are widely used in various electronic products, such as cell phone screens, MP3/MP4 screens, digital photo frames, medical video devices, computer monitors, and LCD TVs. The output of LCD TVs has rapidly increased to meet consumer demand. The global output of LCD TV is expected to 76.7 million units in 2009, according to report of Isuppli, a research company. With the high growth projections in the LCD TV market there has been an increase in the intensity of the competition from part suppliers to include power supplies such as those manufactured by the Company.

LCDs consist of a top layer that uses electronic impulses, filters and liquid crystal molecules to create an image, often in color. However, the LCD component itself generates relatively little in the way of luminance or light output, making the image on the screen impractical to use on its own under most conditions. Another component to these displays are backlights, which provide the luminance that enables viewers to see a distinct image on the screen in a wide variety of lighting conditions. Backlights operate much in the same way the bulb in a film projector or a slide projector does, converting the dark image on the film to a bright image that can be readily viewed. Our power supply products are incorporated into LCD products and regulate the electrical current used to operate the LCD, audio and tunes as required. Our leading dual switch fly back and power correction technology improves safety, electromagnetic compatibility and efficiency of the products and also improves the rationality of circuit structure and production technology of the power supply.

The following table summarizes our major products by product category.

Product Type | Series | Scope of Applicability |

Power Supply Products for LCD TVs | 300W Series Products | LCD Panel Size 37” – 52” |

200W Series Products | LCD Panel Size 26” – 32” |

Three-in-one Set Power Supply | LCD Panel Size 17” – 19” |

80W Built-in Power Supply | LCD TV and LCD Displays |

Inverter Products for LCD | n/a | Lamp Driving of LCD TV and LCD Display |

Others (0.6% of 2007 net sales) | 60W Series Products | External Power Supply of Digital Communication Products |

12W Series Products | External Power Supply of Digital Communication Products |

1.5W Charger | n/a | External Power Supply for Mini-digital Communication Products |

6

Power Supply Products -The power supply product category is our largest product category representing $8.39 million or 50.3% of our net sales for the year 2007. Our power supply products are designed to different specifications based on the size of the LCD panel they will be used in. All of our power supply products are designed for use in multiple voltage inputs so they are useable in most countries.

Inverter Products for LCD Panels -Our LCD power inverter products can be sorted as three groups: high voltage board, two-in-one and three-in-one. The function of our high voltage board inverter product is to convert DC voltage to high voltage that can supply power to LCD backlights. The high voltage product can reach 800 volts alternating currents, or VACs, which could then be enough to light an LCD backlight. Our two-in-one inverter product is a new type of product that combines LCD power supply circuits and LCD backlight power supply circuits to lower the LCD power cost and enabling a more competitively priced LCD product. Our three-in-one inverter product adds an audio power amplifier control circuit to the original two-in-one power supply, which further improves the integration of the power supply and also lowers the LCD power cost.

Power Adaptors -Power adaptors consist of 60 watt and 12 watt series products, which are used as external power supplies for digital communication appliances. These products are specially designed for very small consumer electronics. The chip sets used in our products are purchased from manufactures of semi-conductors such as ON, Inline, Fairchild, and Toshiba. Once received at our manufacturing facility they are modified and updated by the our technicians to improve reliability and stability for use in our products.

Manufacturing and Distribution

Most of our products are manufactured in our new state-of-the-art manufacturing facility on a 13,000 square meters sitelocated at Building 9, Xinhe New Industrial Park, Fuyong Township, Bao An District, Shenzhen, People’s Republic of China 518014. We have three production lines, each production line with a daily production capacity of 1,500 LCD TV power supply products and 3,500 adaptors, or approximately 30,000 LCD TV power supply products and 120,000 adaptors per month. Our current output is approximately 250,000 to 400,000and the product lines are running almost under full capacity.

Some of our products are manufactured for us through contractual relationships with other manufacturing companies, in accordance with our own proprietary formulations and know how. When we work under such arrangements, we make our own production plan, arrange for raw materials supplies and otherwise work closely with such production facilities in an effort to achieve the highest quality standards and product availability.

In order to coordinate and manage the manufacturing of our products, we utilize a significant demand planning and forecasting process that is directly tied to our production planning and purchasing systems. Using this sophisticated planning software and process allows us to balance our inventory levels to provide exceptional service to distributors while minimizing working capital and inventory obsolescence.

Our products are parceled in pearl cotton, then insulated in double layer shell-paper, and finally installed in outer packaging. This treatment is useful to avoid collision and improve security during product delivery and storage. We provide on site service for domestic customers, and serve oversea customers through our trading agents.

Major Suppliers of our Raw Materials

Our focus on product quality includes the use of quality materials obtained from selected international suppliers, and thorough quality control inspection of raw materials prior to use in production and finished products prior to shipment. We have our own quality control lab in which we apply the Military Standard that describes the sampling procedures and tables for inspection by attributes (MIL-STD-105E) standard to routinely test raw materials and finished products.

7

The table below lists our major suppliers of raw materials as of December 31, 2007, showing the cumulative dollar amount of raw materials purchased from them during the fiscal year ended December 31, 2007, and the percentage of raw materials purchased from each supplier as compared to procurement of all raw materials.

Rank | Supplier Name | Cumulative Amount Purchased During Fiscal Year 2007(RMB million) | Percentage of Total Purchases During Fiscal Year 2007 |

1 | Shenzhen BaoAn ChangDa Industrial Company Limited | 8.23 | 10.98% |

2 | Shenzhen Keyfaith Electronic Company Limited | 5.59 | 7.47% |

3 | Shenzhen Dongsheng Electronic Company Limited | 5.25 | 7.02% |

4 | Xinhua Electronics (Huizhou) Company Limited | 5.25 | 7.01% |

5 | Shenzhen Xinlilai Hardware and Plastic Company Limited | 4.91 | 6.56% |

| | Total | 29.23 | 39.04 % |

The cost of raw materials included in our cost of sales for 2007 and 2006, were $9.90 million and $6.15 million, respectively, representing 86.29% and 87.84% of our cost of sales, respectively. We currently maintain sufficient supplies of raw materials for approximately 30 days of production. The prices of some of our key input materials such as transformers, line materials, hardware materials and packing materials are currently increasing. However, we are confident that we can offset these increases with our cost reduction programs and by raising the prices of our products.

Our Major Customers

We earn revenues through the sale of our products through an established network of distributors who sell our products to customers throughout China, and through a network of trading agents who sell our products to customers abroad.

During fiscal years 2007 and 2006, our five largest customers were the Konka Group, or Konka, Videocon Industries Limited, or Videocon, Skyworth Group Company Limited, or Skyworth, Coby Electronics Company Limited., or Coby, and IVT Technology Limited, or ITV. These customers combined accounted for approximately $10.53 million, or 63% of our total sales revenue in 2007, and $8.37 million, or 84% of our total sales revenue in 2006. Our largest customer, Konka, accounted for approximately 20% and 50% of our total revenues for the years ended December 31, 2007 and 2006, respectively.

The geographic distribution of our customer base in China is as depicted in the table below:

Area | Quantity of Consumer 2006 | Quantity of Consumer 2007 |

South | 94.92% | 73.86% |

East | 3.89% | 5.75% |

West | 0.53% | 1.11% |

Middle | 0.45% | 0.61% |

North | 0.21% | 0% |

Overseas | 0% | 18.67% |

The following table shows our largest customers in 2007, ranked in order of percentage of revenues.

Rank | Customer Name | Percentage of Revenue |

1 | Konka | 20% |

2 | Videocon | 18% |

3 | Skyworth | 11% |

4 | Coby | 8% |

5 | ITV | 5% |

6 | Other Customers | 38% |

Total Sales (US $) | $16.68 million | 100% |

8

Our Sales and Marketing Efforts

Product Sales

We rely on direct distribution and the business development efforts of our organized sales representatives to increase sales. Our sales team maintains close relationships with television and LCD manufactures to ensure continued awareness of our products and the advantages our products have over those of our competitors. To help increase market penetration we have established sales offices in Eastern China, the Yangtze River Delta and Europe.

Our sales market is mainly located in the Pearl River Delta, allowing us to maintain long-term relationships with our largest customers who are also located in that area. Our sales team, which includes approximately 18 sales representatives is currently located in Shenzhen and Shanghai. We plan to expand our sales network to cover more Chinese cities, including Beijing, Guangzhou and Qingdao, and in overseas locations in Europe, Asia and the United States.

We currently generate revenues only from the sale of power supplies for LCDs. Since our major production base is in China, and since export revenues and net income in overseas entities did not account for a significant portion of our total consolidated revenues and net income, management believes that the following table presents useful information for measuring business performance, financing needs, and preparing our corporate budget, among other things.

(In million U.S. Dollars) | Years Ended December 31, |

| | 2006 | 2007 |

Sales to China domestic customers | 9.97 | 13.57 |

Sales to overseas customers* | 0 | 3.11 |

TOTAL | 9.97 | 16.68 |

* The company sold to the over sea market through domestic agents in 2006, so no data for international markets is available.

During 2006 and 2007, we derived $9.97 million and $13.57 million, or 100% and 81.33%, respectively, of our revenues from customers in China, including Hong Kong and Taiwan, the domicile of our principal operating subsidiary.

Our Growth Strategy

We are committed to growing our business in the coming years. The key elements of our growth strategy are summarized below:

•

Major Market Strategy. We are planning to setup a strategic product complimentary partnership relationship with LCD monitor mother board/LCD TV mother board companies to synchronize the development of LCD monitor and mother board, lead the market and provide one stop service for LCD manufacturers. The company will further develop the overseas market when we have enough capital and setup complimentary cooperation with Samsung, Sony, Hitachi, Toshiba, Panasonic and etc, develop Shengtai to be one of the best LCD TV power supply manufactures. We are planning to setup our headquarter in the high-tech area of Shenzhen, China, and increase the production ability by expanding, purchase and annex other power supply companies in the industry and increase the production ability and finally reach the goal of 15 to 2 0% market share in the global LCD TV power supply market.

9

•

Product Strategy. Our products are based on LCD and adaptor power supply and we are developing two-in-one LCD TV power supply, which is a new power supply with a combination of the original ordinary LCD TV power supply and LCD screen backlight circuit. This new power supply integrates the two different kinds of power supply and can lower the cost of power supply to LCD TV and give the product more competition advantage. In the future, the company will invest more in the research and development of three-in-one LCD TV power supply, which adds audio power magnifier control onto current two-in-one LCD TV power supply, improves the integration of the LCD TV power supply circuit and increase the competitive ability and risk resistant ability, integrate industry resources, and give the company more competitive advantages. We are planning to cooperate with manufacturers of LED power supply, medical power supply, electricity power supply, communication power supply and etc to diversify and grasp industrial product market on a professional base.

•

Sales Strategy. Now our sales revenue mainly depends on business men and combines direct selling with market promotion. We plan to setup representative offices in East China, the Yangzi River Delta and Europe to further develop the domestic and international market, acquire LCD TV mother board design companies and provide technical support to LCD TV manufacturers from the source of the market; setup joint ventures with famous television manufactures In China, stably control the power supply product orders from television manufacturers, and this will be able to ensure the stability and fast development of the company.

•

Acquisition Strategies:We are planning to choose suitable power supply companies for acquisition and cooperation. We are very familiar with the power supply industry in China and we have deep knowledge, understandings of the current situation about the products, the customers, the viable manufacturers in this industry, we also have special connections with most of the players in the industry, and this give us inside information about the competitors and other relevant manufacturers, this enable us to screen and select the right target companies for acquisitions. We are planning to acquire a number of power supply companies in the coming 3 to 5 years. Our goal is to become the biggest and most professional business and home applicants power supply designer and manufacturer with international influence in the world.

Our Research and Development Efforts

We currently operate our research and development department located in Shenzhen. As of 2008, we have 25 research and development personnel, 18 of whom hold advanced degrees. Our research and development department is responsible for developing advanced technologies and new power supply products and for training technicians. We are currently developing a new two-in-one power supply that combines ordinary LCD TV power circuit and back light power circuit of the LCD screen into a single unit to reduce overall manufacturing costs and simplify installation for manufacturers using our power supplies.

We spent approximately $220,000, $350,000 and $470,000 for the years ended 2005, 2006 and 2007, respectively, on research and development efforts to improve existing products and processes and to develop new products, not including the expenses to develop particular power supply products utilizing existing technology to meet customer specifications for products. We plan to increase our research and development efforts in 2008 and have budgeted $600,000 for this purpose.

In addition to our product development work, taking existing, available technology and adapting it to the specific needs of a customer for a particular product, we engage in research and development, which involves developing new, proprietary techniques or products. Our growth rate is attributable to a number of patents, especially in the area of two-in-one and three-in-one power supplies and other innovations that improve the quality and durability of our products relative to other power supply manufacturers.

We are engaged in efforts to develop some technologies that reduce energy consumption and other environmental impacts of our devices. The innovations can be used for a variety of applications in screens of almost all sizes. Management believes that many of our new technologies will be patentable, and we expect to file for and maintain both Chinese and/or international patents where the value of the invention warrants the expense and effort of doing so.

10

Our Competition

The market for power supply products in China have developed in recent years. The use of LCD screens in various electronic products have rapidly increased to meet consumer demand. The global output of LCD TVs, in particular, is expected to 76.7 million units in 2009, according to report of Isuppli, a research company. With the high growth projections in the LCD TV market, there has been an increase in the intensity of competition from the manufacturers of power supply products to include their parts in these products.

As with most other products, a competitive advantage in the market for power supplies is derived from a favorable combination of quality, price and customer service. We believe that we are well-positioned to compete effectively in all three of those areas. Our patented dual switch fly back technology in our large sized LCD TV power supply products, simplifies our production technology and effectively lowered our costs, affording us more profits and a stronger competitive advantage. In addition, China’s well-known labor cost advantages relative to Japan, Korea and Taiwan have enabled us to put price pressure on our foreign rivals, thereby helping us to gain market share while maintaining profitability and margins, as our financial results show. However, as more of the world’s power supply production shifts to China, our comparative advantage due to lower costs relative to other Asian countries will diminish and many potential competitors could enter the market without significant barriers to entry.

Currently, the major manufacturers of LCD TV power supply products, such as Delta, FSP and Lite-on, are located in Taiwan. Their products account for approximately 70% of the LCD TV power supply market. These manufactures are the primary power supply manufactures for Samsung, Philips and Sony, among others. These companies have a comparative advantage in capital and scale, but their products are quite expensive and are mainly oriented for the high-end market. With the rapid growth of the LCD TV industry, more and more domestic companies are now engaged in the production of LCD TV power supply products. However, a majority of them have not explored or developed independent intellectual property rights, and the core technology of LCD TV power supply products is still controlled by a few companies, including ours. In addition, since LCD TV manufacturers prefer to choose power supply products with better quality, new entrants to the industry will need to spend at least three years in research and development in order to reach the quality control standards set by LCD TV manufacturers.

Our senior management team brings over a decade of industry knowledge regarding our industry and regarding current and potential competitors. We believe that our main domestic competitors are Shenzhen Jewel Electronic and Technology Co. Limited, or Shenzhen Jewel, and Shenzhen Megemeet Co. Limited, or Megemeet, who combined hold a 15 to 20% market share. Shenzhen Jewel was previously a transformer producer and we believe that it lacks experience in the production of power supply products, which causes issues with the stability and security of its products and has caused a gradual decline in its market share. Megemeet is good at product research and development, but it does not have its own production facilities, which causes critical issues related to quality control and renders it unable to accept a great deal of orders or to complete production and tim ely delivery of its products to its customers’ satisfaction. Furthermore, while our power supply products can be used in all kinds of LCD products, Megemeet and Shenzhen Jewel’s products are mainly used in LCD monitors and large sized LCD TV sets, a smaller market compared to the market for all products. In addition, we currently meet the new environmental protective standards in all our departments, including research and development, design and production, thereby securing a place for our products in future markets.

Competitive Strengths

We believe that our competitive strengths include the following:

•

Experience and Proven Management Team. We have over 7 years experience in the design, manufacture and sales of power supply products. In addition, our management team has a proven track record of successful management and has a great deal of experience in the consumer electronics and power supply industry and business development. The Company has an experienced management team which operates under the strategic direction of the Board of Directors. The management team has extensive knowledge and experience in the design, production and distribution of power supplies. Our Chief Executive Officer, Mr. Derong Zou, has assembled a team of experienced executives, including Mr. John Eliasov, Mr. Hongdong Zhang, Mr. Zhang Qian, Mr Tailin Wang, Mr. Liang Qiang, and Mr. Tong Luo. Details regarding these key me mbers is disclosed under the headingOur Directors and Officers, herein.

11

•

Low Cost Manufacturing and High Quality. Our use of dual switch fly back and Power Factor Correction (PFC) circuit technologies, which has simplified our product while ensuring product quality and product stability, has effectively reduced our raw materials and production costs. We use our patent technology on LCD TV power supply and two in one and three in one power supply, and the technology helps reduce the quantity of the material used in unit product, improve stability and increase product efficiency, effectively reduce the material cost and manufacturing cost. In addition, our use of high quality chips from top companies, such as ON, Infineon, Fairchild, and Toshiba, makes our power supply products more effective, longer lasting and energy efficient.

•

Short Delivery Cycle. An important factor in our ability to compete is our relative short cycle time from the receipt of a customer’s order to the initial delivery of products to the customer. On average, this is a 10- to 20-day process for us, while many of our competitors take longer to reach the same result. Our short cycle time is due to, among other things, our modern facilities and equipment, along with our large and skilled product development staff.

•

Research and Development and Technology. We have a strong research and development department that continuously develops new products and introduce new technologies. We collaborate under technological consulting contracts with personnel at the University of Electronic Science and Technology of China (Chengdu) and No. 43 Institute of Hefei to enhance the technical power of the company. We are paying the above consultants in two ways, a RMB480,000 annual consulting fee and profit dividend. When the University and Institute have good innovation, improvement regarding LCD power supply, two in one and three in one power supply to reduce cost and improve competitive capability, according to the profit the patent to non patented technology bring the company after 12 months, the company will pa y a certain amount of dividend according to the amount both parties agreed before start manufacturing with the technology. One example of this advanced technology is our patented dual switch fly back and PFC circuit technologies, which simplified and improved on product quality. Another example is our newly developed LCD TV power supply that combines ordinary LCD TV power supply circuits with LCD screen back light power supply circuits. We have applied to the PRC State Intellectual Property Office for the design copyright for this product.

•

Strong Brand Recognition. We believe that our strong Shengtai™ brand drives the sales of our products, regardless of the action of competitors and competitor’s products. A strong brand ensures market acceptance and facilitates market penetration of our new products. In order to bolster and grow theShengtai™ brand, stringent quality control and assurance are our highest priority, and our ongoing marketing, advertising and public relations efforts continue to stress the quality, safety and innovativeness of our products. With a strong brand, excellent brand awareness in our target markets and a passionate and dedicated distribution channel, we believe that we are ideally placed to leverage goodwill from our brand into future growth.

Regulation

Because our operating subsidiary is located in the PRC, we are regulated by the national and local laws of the PRC. We do not require any special government permits to produce our products other than those permits that are required of all corporations in China.

We are also subject to PRC’s foreign currency regulations. The PRC government has controlled Renminbi reserves primarily through direct regulation of the conversion of Renminbi into other foreign currencies. Although foreign currencies, which are required for “current account” transactions, can be bought freely at authorized PRC banks, the proper procedural requirements prescribed by PRC law must be met. At the same time, PRC companies are also required to sell their foreign exchange earnings to authorized PRC banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the PRC government.

Under current PRC laws and regulations, Foreign Invested Enterprises, or FIEs, may pay dividends only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, FIEs in China are required to set aside at least 10% of their after-tax profit based on PRC accounting standards each year to its general reserves until the cumulative amount of such reserves reaches 50% of its registered capital, which is currently 10,000,000.00 Renminbi or about 1,500,000.00 US Dollars. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

12

As a manufacturer of consumer products that are distributed to U.S. consumers, we are also subject to the US Consumer Products Safety Act, which empowers the Consumer Products Safety Commission to exclude from the market products that are found to be unsafe or hazardous. Under certain circumstances, the Consumer Products Safety Commission could require us to repurchase or recall one or more of our products. To date our products have not been subject to any product recalls initiated by the Consumer Products Safety Commission

Our distributors also require that our products carry a UL Mark (Underwriters Laboratory) or a CE Mark, respectively. Underwriters Laboratories, Inc. evaluates products, components, materials and systems for compliance to specific requirements, and permits acceptable products to carry the UL (certification) Mark, as long as they remain compliant with such standards. A manufacturer of a UL certified product must demonstrate compliance with the appropriate safety requirements, many of which are developed by UL and demonstrate that it has a program in place to ensure that each copy of the product complies with the appropriate requirements. If a product design is modified, a representative example may need to be retested before a UL Mark can be attached to the new product or its packaging. The CE marking is a mandatory European marking for certain product groups to indicate con formity with the essential health and safety requirements set out in European Directives. To permit the use of a CE mark on a product, proof that the item meets the relevant requirements must be documented. Sometimes this is achieved using an independent testing organization which evaluates the product and its documentation. Often it is achieved by a company-internal self-certification process. In either case, the responsible organization (manufacturer, representative, importer) has to issue anEC-Declaration of Conformity(EC-DoC) indicating its identity, the list of European Directives he declares compliance with, a list of standards the product complies with, and a legally binding signature on behalf of the organization. All our products are UL or CE certified in the PRC, United States, Canada and the European Union. In addition, we hold an ISO9001:2000 certificate of international quality, issued in Germany.

Laws regulating certain consumer products also exist in some cities and states, as well as in other countries in which we sell our products. We believe that we are in material compliance with all of the laws and regulations applicable to us.

Our Intellectual Property

The continued success of our business is dependent on our intellectual property portfolio consisting of registered trademarks, design patents and utility patents related to our products. We currently own a ten-year design patent for our “power circuit board of liquid crystal display” technology, that was awarded in March 2008, and our application for a utility patent for our “power switching circuit” is still in progress. The foregoing patent and patent application rights were formerly held in the name of Mr. Feng Ding. However, Mr. Ding transferred these rights to Shengtai, pursuant to a patent application right transfer agreement, dated April 3, 2007, for a purchase price of RMB4,500,000 (approximately $594,821 at the time). PRC regulations require that the transfer documents be filed with the relevant PRC state patent administration department in order to effect the transfer of the patent and the patent application rights. We are in the process of filing the transfer documents in order to effectuate the transfer.

We market our products under the trademark  or Shengtai™.

or Shengtai™.

In addition, we protect our know-how technologies through confidentiality agreements we entered into with our employees in our production department.

Our Employees

As of June 30, 2008, we had a total of 357 full-time employees and 20 part-time employees. The following table illustrates the allocation of these employees among the various job functions conducted at our company.

Department | Number of Full-time Employees |

Production | 275 |

Sales | 18 |

Administration | 34 |

Finance | 5 |

Research and Development | 25 |

Total | 357 |

13

We believe that our relationship with our employees is good. The remuneration payable to employees includes basic salaries and allowances. We have not experienced any significant problems or disruption to our operations due to labor disputes, nor have we experienced any difficulties in recruitment and retention of experienced staff.

Our ability to achieve our operational and financial objectives depends in part upon our ability to retain key technical, marketing and operational personnel, and to attract new employees as required to support growth. Working capital constraints may impair our ability to retain and attract the staff needed to maintain current operations and meet the needs of anticipated growth.

In addition, we rely on consultants to a significant extent to supplement our regular employee staff in certain key functional areas and to support management in the execution of our business strategy. These consultants are independent contractors. There can be no assurance that, if one or more of the consultants were to terminate their services, we would be able to identify suitable replacements. Failure to do so could materially and adversely affect our operating and financial results.

As required by applicable Chinese laws, we have entered into employment contracts with all of our officers, managers and employees.

Our employees in China participate in a state pension scheme organized by Chinese municipal and provincial governments. In addition, we are required by Chinese laws to cover employees in China with various types of social insurance. We have purchased social insurances for all of our employees.

RISK FACTORS

You should carefully consider the following risks, as well as the other information contained in this annual report, before investing in our securities. If any of the following risks actually occurs, our business could be harmed. You should refer to the other information set forth or referred to in our annual report, including our consolidated financial statements and the related notes incorporated by reference herein.

RISKS RELATED TO OUR BUSINESS

Adverse trends in the electronics industry, such as an overall decline in price or a shift away from products that incorporate our power supplies, may reduce our revenues and profitability.

Our business depends on the continued vitality of the electronics industry, which is subject to rapid technological change, short product life cycles and profit margin pressures. In addition, the electronics industry historically has been cyclical and subject to significant downturns characterized by diminished product demand, accelerated erosion of average selling prices and production over-capacity.It is also characterized by sudden upswings in the cycle, which can lead to shortages of key components needed for our business, for which there is not always an alternative source. Economic conditions affecting the electronics industry in general or our major customers may adversely affect our operating results by reducing the level of business that they furnish to us or the price they are willing to pay for our products. If our customers’ products fail to gain wi despread commercial acceptance, become obsolete or otherwise suffer from low sales volume, our revenues and profitability may stagnate or decline.

A few customers account for a significant portion of our sales, and the loss of any one of these customers may reduce our revenues and profits.

A significant portion of our revenue is generated from a small number of customers. The aggregate percentage of the revenue contributed by our top three customers in the year ended December 31, 2007 was 50%, with roughly 38% coming from the two largest customers. Under present conditions, the loss of any of these customers, or a significant reduction in our level of sales to any or all of them, could have a material adverse effect on our business and operating results.

14

We do not have long-term purchase commitments from our customers and may have to rely on customer forecasts in making production decisions, and any cancellation of purchase commitments or orders may result in the waste of raw materials or work in process associated with those orders, reducing both our revenues and profitability.

As a power supply manufacturer, we must provide increasingly rapid product turnaround. A variety of conditions, both specific to individual customers and generally affecting the demand for these products, may cause customers to cancel, reduce or delay orders. Cancellations, reductions or delays by a significant customer or by a group of customers would result in a material reduction in revenue. Those customer decisions could also result in excess and obsolete inventory and/or unabsorbed manufacturing capacity, which could reduce our profits or impair our cash flow. On occasion, customers require rapid increases in production, which can strain our resources, leading to a reduction in our margins as a result of the additional costs necessary to meet those demands.

Our customers generally do not provide us with firm, long-term volume purchase commitments. In addition, industry trends over the past five years have led to dramatically shortened lead times on purchase orders, as rapid product cycles have become the norm. Although we sometimes enter into manufacturing contracts with our customers, these contracts principally clarify order lead times, inventory risk allocation and similar matters, rather than providing for firm, long-term commitments to purchase a specified volume of products at a fixed price. As a result, customers can generally cancel purchase commitments or reduce or delay orders at any time. The large percentage of our sales to customers in the electronics industry, which is subject to severe competitive pressure, rapid technological change and product obsolescence, increases our inventory and overhead risks, among oth ers, as we must maintain inventories of raw materials, work in process and finished goods to meet customer delivery requirements, and those inventories may become obsolete if the anticipated customer demand does not materialize.

We also make significant decisions, including determining the levels of business that we will seek and accept, production schedules, component procurement commitments, facility requirements, personnel need, and other resource requirements, based upon our estimates of customer requirements. The short-term nature of our customers’ commitments and the possibility of rapid changes in demand for these products reduce our ability to estimate accurately the future requirements of those customers. Because many of our costs and operating expenses are fixed, a reduction in customer demand can reduce our gross margins and operating results. In order to transact business, we assess the integrity and creditworthiness of our customers and suppliers and we may, based on this assessment, incur design and development costs that we expect to recoup over a number of orders produced for t he customer. Such assessments are not always accurate and expose us to potential costs, including the write off of costs incurred and inventory obsolescence if the orders anticipated do not materialize. We may also occasionally place orders with suppliers based on a customer’s forecast or in anticipation of an order that is not realized. Additionally, from time to time, we may purchase quantities of supplies and materials greater than required by customer orders to secure more favorable pricing, delivery or credit terms. These purchases can expose us to losses from cancellation costs, inventory carrying costs or inventory obsolescence, and hence adversely affect our business and operating results.

Failure to optimize our manufacturing potential and cost structure could materially increase our overhead, causing a decline in our margins and profitability.

We strive to utilize the manufacturing capacity of our facilities fully but may not do so on a consistent basis. Our factory utilization is dependent on our success in accurately forecasting demand, predicting volatility, timing volume sales to our customers, balancing our productive resources with product mix, and planning manufacturing services for new or other products that it intends to produce. Demand for contract manufacturing of these products may not be as high as we expect, and we may fail to realize the expected benefit from our investment in our manufacturing facilities. Our profitability and operating results are also dependent upon a variety of other factors, including: utilization rates of manufacturing lines, downtime due to product changeover, impurities in raw materials causing shutdowns, and maintenance of contaminant-free operati ons. Failure to optimize our manufacturing potential and cost structure could materially and adversely affect our business and operating results.

Moreover, our cost structure is subject to fluctuations from inflationary pressures in China and other geographic regions where we conduct business. China is currently experiencing dramatic growth in its economy. This growth may lead to continued pressure on wages and salaries that may exceed increases in productivity. In addition, these may not be compensated for and may be exacerbated by currency movements.

15

We face intense competition, and many of our competitors have substantially greater resources than we have. Increased competition from these competitors may reduce our revenues or decrease our margins, either or both of which would reduce our profitability and could impair cash flow.

We operate in a competitive environment that is characterized by price deflation and technological change. We compete with major international and domestic companies. Our major competitors include Shenzhen Jewel Electronic and Technology Co. Limited, Shenzhen Megemeet Co. Limited and other similar companies primarily located in Japan, Taiwan, Korea, Hong Kong and China Mainland. Our competitors may have greater market recognition and substantially greater financial, technical, marketing, distribution, purchasing, manufacturing, personnel and other resources than we do. Furthermore, some of our competitors have manufacturing and sales forces that are geographically diversified, allowing them to reduce transportation expenses, tariff costs and currency fluctuations for certain customers in markets where their facilities are located. Many competitors have production lines that allow them to produce more sophisticated and complex devices than we currently do and to offer a broader range of display devices to our target customers. Other emerging companies or companies in related industries may also increase their participation in the display and display module markets, which would intensify competition in our markets. We might lose some of our current or future business to these competitors or be forced to reduce our margins to retain or acquire that business, which could decrease our revenues or slow our future revenue growth and lead to a decline in profitability.

We depend on the market acceptance of our customers’ products, and significant slowdown in demand for those products would reduce our revenues and our profits.

Currently, we do not sell products to end users. Instead, we design and manufacture various power supply product solutions that our customers incorporate into their products. As a result, our success depends almost entirely upon the widespread market acceptance of our customers’ products. Any significant slowdown in the demand for our products would likely reduce our revenues and profits. Therefore, we must identify industries that have significant growth potential and establish strong, long-term relationships with manufacturers in those industries. Our failure to identify potential growth opportunities or establish these relationships would limit our revenue growth and profitability.

We extend credit to our customers and may not be able to collect all receivables due to us, and our inability to collect such receivables may have an adverse effect on our immediate and long-term liquidity.

We extend credit to our customers based on assessments of their financial circumstances, generally without requiring collateral. As of December 31, 2007, our accounts receivable, after deducting an allowance for bad debts, was nearly $3.17 million. Our overseas customers may be subject to economic cycles and conditions different from those of our domestic customers. We may also be unable to obtain satisfactory credit information or adequately secure the credit risk for some of these overseas customers. The extension of credit presents an exposure to risk of uncollected receivables. Additionally, we may not realize from receivables denominated in a foreign currency the anticipated amounts in United States dollar terms due to fluctuations in currency values. Our inability to collect on these accounts may reduce on our immediate and long ter m liquidity.

The growth of our business depends on our ability to finance new products and services and these increased costs may reduce our cash flows and, if the products and services in which we have invested do not succeed, it would reduce our profitability.

We operate in the consumer electronics industry, which is characterized by rapid change. New technologies are appearing with increasing frequency to supplant existing technologies. In order to capture increased market share, manufacturers are adopting a shorter product life cycle from a cosmetic, if not functional, standpoint, but those cosmetic changes generally have little if any direct effect on the power supply products that the new designs incorporate. Technological advances, the introduction of new products, new designs and new manufacturing techniques could render our inventory obsolete, or it could shift demand into areas where we are not currently engaged. If we fail to adapt to those changing conditions in a timely and efficient manner, our revenues and profits would likely decline. To remain competitive, we must continue to incur significant costs in product deve lopment, equipment and facilities and to make capital investment. These costs may increase, resulting in greater fixed costs and operating expenses.

Our future operating results will depend to a significant extent on our ability to continue to provide new product solutions and electronic manufacturing services that compare favorably on the basis of time to market, cost and performance with the design and manufacturing capabilities and competing third-party suppliers and technologies. Our failure to increase our net sales sufficiently to offset these increased costs would reduce our profitability.

16

We are subject to lengthy sales cycles, and it could take longer than we anticipate before our sales and marketing efforts result in revenue.

Our focus on developing a customer base that requires custom power supplies and devices means that it may take longer to develop strong customer relationships. Moreover, factors specific to certain industries have an impact on our sales cycles. In particular, those customers who operate in or supply to the medical and automotive industries require longer sales cycles, as qualification processes are longer and more rigorous, often requiring extensive field audits. These lengthy and challenging sales cycles may mean that it could take longer before our sales and marketing efforts result in revenue to us, if at all. As a result, the return on the time and effort invested in developing these opportunities may be deferred, or may not be realized at all, reducing our profitability.

Products we manufacture may contain design or manufacturing defects, which could result in reduced demand for our services and customer claims, causing us to sustain additional costs, loss of business reputation and legal liability.

We manufacture products to our customers’ requirements, which can be highly complex and may at times contain design or manufacturing errors or failures. Any defects in the products we manufacture, whether caused by a design, manufacturing or component failure or error, may result in returns, claims, delayed shipments to customers or reduced or cancelled customer orders. If these defects occur, we will incur additional costs, and if they occur in large quantity or frequently, we may sustain additional costs, loss of business reputation and legal liability.

We could become involved in intellectual property disputes, resulting in substantial costs and diversion of our management resources. Such disputes could materially and adversely affect our business by increasing our expenses and limiting the resources that we can devote to expansion of our business, even if we ultimately prevail.

Shengtai currently possesses one Chinese patent and one patent application right. If a patent is infringed upon by a third party, we may need to devote significant time and financial resources to attempt to halt the infringement. We may not be successful in defending the patents involved in such a dispute. Similarly, while we do not knowingly infringe on patents, copyrights or other intellectual property rights owned by other parties; we may be required to spend a significant amount of time and financial resources to resolve any infringement claims against us. We may not be successful in defending our position or negotiating an alternative remedy. Any litigation could result in substantial costs and diversion of our management resources and could reduce our revenues and profits.

Our customers may decide to design and/or manufacture the products that they currently purchase from us, which may reduce our revenues and profits, as we may not be able to compete successfully with these in-house developments.

Our competitive position could also be adversely affected if one or more of our customers decide to design and/or manufacture their own backlights and display modules. We may not be able to compete successfully with these in-house developments by our customers, which would tend to favor their in-house supply over us, even in cases where price and quality may not be comparable.

We may develop new products that may not gain market acceptance, and our significant costs in designing and manufacturing services for new product solutions may not result in sufficient revenue to offset those costs or to produce profits.

We operate in an industry characterized by frequent and rapid technological advances, the introduction of new products and new design and manufacturing technologies. As a result, we may be required to expend funds and commit resources to research and development activities, possibly requiring additional engineering and other technical personnel; purchasing new design, production, and test equipment; and continually enhancing design and manufacturing processes and techniques. We may invest in equipment employing new production techniques for existing products and new equipment in support of new technologies that fail to generate adequate returns on the investment due to insufficient productivity, functionality or market acceptance of the products for which the equipment may be used. We could, therefore, incur significant sums in design and manufacturing services for new prod uct solutions that do not result in sufficient revenue to make those investments profitable. Furthermore, customers may change or delay product introductions or terminate existing products without notice for any number of reasons unrelated to us, including lack of market acceptance for a product. Our future operating results will depend significantly on our ability to provide timely design and manufacturing services for new products that compete favorably with design and manufacturing capabilities and third party suppliers.

17

Our component and materials suppliers may fail to meet our needs, causing us to experience manufacturing delays, which may harm our relationships with current or prospective customers and reduce sales.

We do not have long term supply contracts with the majority of our suppliers or for specific components. This generally serves to reduce our commitment risk but does expose us to supply risk and to price increases that we may not be able to pass to our customers. In our industry, at times, there are shortages of some of the materials and components that it uses. If we are unable to obtain sufficient components on a timely basis, we may experience manufacturing delays, which could harm our relationships with current or prospective customers and reduce sales. Moreover, some suppliers may offer preferential terms to our competitors, who may have greater buying power or leverage in negotiations. That would place us at a competitive disadvantage.

We may be affected by power shortages, causing delays in delivery of products to our customers, resulting in possible loss of business or claims against us and cause us to lose future business from those or other customers.

Our manufacturing facility consumes a significant amount of electricity, and there are a significant number of industrial facilities in the area where this factory is located. Therefore, power shortages may occur and the facility may be deprived of electricity for undetermined periods of time. This may result in longer production timeframes and delays in delivery of product to our customers. Failure to meet delivery deadlines may result in the loss of business or claims against us, which may have a material and adverse effect on our business, profitability and reputation.

Our financial performance could be harmed if compliance with new environmental regulations becomes too burdensome.

Although we believe that we are operating in compliance with applicable Chinese government environmental laws, there is no assurance that we will be in compliance consistently, as such laws and regulations or their interpretation and implementation change. Failure to comply with environmental regulation could result in the imposition of fines, suspension or halting of production or closure of manufacturing operations.

We may not be able to secure financing needed for future operating needs on acceptable terms, or on any terms at all.

From time to time, we may seek additional equity or debt financing to provide the capital required to maintain or expand our design and production facilities and equipment and/or working capital, as well as to repay outstanding loans if cash flow from operations is insufficient to do so. We cannot predict with certainty the timing or amount of any such capital requirements. If such financing is not available on satisfactory terms, we may be unable to expand our business or to develop new business at the rate desired.

A disruption in the supply of utilities, fire or other calamity at our manufacturing plant would disrupt production of our products and adversely affect our sales.

Our products are manufactured at our production facility located in Shenzhen in the PRC. While we have not in the past experienced any calamities which disrupted production, any disruption in the supply of utilities, in particular, electricity or power supply, or any outbreak of fire, flood or other calamity resulting in significant damage at our facilities would severely affect our production and have a material adverse effect on our business, financial condition and results of operations.

We maintain insurance policies covering losses with respect to damages to our properties and products. We do not have insurance coverage for machinery and inventories of raw materials. There is no assurance that our insurance would be sufficient to cover all of our potential losses.

Due to our geographic location of our main manufacturing facilities, the recent earthquake in Sichuan province does not have any material impact in our operation. Our production was neither disrupted nor affected.

18

Failure to manage growth effectively could result in inefficiencies that could increase our costs, reducing our profitability.

We have increased the number of our manufacturing and design programs and intend to expand further the number and diversity of our programs. The number of locations where we manufacture may also increase. Our ability to manage our planned growth effectively will require us to:

•

Enhance quality control, operation, financial and management systems;

•

Expand facilities and equipment; and

•

Successfully hire, train and motivate additional employees, including the technical personnel necessary to operate our production facilities.

An expansion and diversification of our product range, manufacturing and sales will result in increases in our overhead and selling expenses. We may also be required to increase staffing and other expenses as well as expenditures on plant, equipment and property in order to meet the anticipated demand of our customers. Customers, however, generally do not commit to firm production schedules for more than a short time in advance. Any increase in expenditures in anticipation of future orders that do not materialize would adversely affect our profitability. Customers also may require rapid increases in design and production services that place an excessive short-term burden on our resources and reduce our profitability.

Potential strategic alliances may not achieve their objectives, which could lead to wasted effort or involvement in ventures that are not profitable and could harm our company’s reputation.

We are currently exploring strategic alliances designed to enhance or complement our technology or to work in conjunction with our technology, increase our manufacturing capacity, provide additional know-how, components or supplies, and develop, introduce and distribute products and services utilizing our technology and know-how. Any strategic alliances we entered into may not achieve their strategic objectives, and parties to our strategic alliances may not perform as contemplated. As a result, the alliances themselves may run at a loss, which would reduce our profitability, and if the products or customer service provided by such alliances were of inferior quality, our reputation in the marketplace could be harmed, affecting our existing and future customer relationships.

We may not be able to retain, recruit and train adequate management and production personnel. We rely heavily on those personnel to help develop and execute our business plans and strategies, and if we lose such personnel, it would reduce our ability to operate effectively.

Our success is dependent, to a large extent, on our ability to retain the services of our executive management, who have contributed to our growth and expansion to date. The executive directors and vice president of production play an important role in our operations and the development of our new products. Accordingly, the loss of their services, in particular Mr. Derong Zou and Hongdong Zhang, without suitable replacements, will have an adverse affect on our business generally, operating results and future prospects.

In addition, our continued operations are dependent upon our ability to identify and recruit adequate management and production personnel in China. We require trained graduates of varying levels and experience and a flexible work force of semi-skilled operators. Many of our current employees come from the more remote regions of China as they are attracted by the wage differential and prospects afforded by Shenzhen and our operations. With the economic growth currently being experienced in China, competition for qualified personnel will be substantial, and there can be no guarantee that a favorable employment climate will continue and that wage rates we must offer to attract qualified personnel will enable us to remain competitive internationally. Inability to attract such personnel may or the increased cost of doing so could reduce our competitive advantage relative to othe r backlight producers,

reducing or eliminating our growth in revenues and profits.

RISKS RELATING TO DOING BUSINESS IN CHINA

If China does not continue its policy of economic reforms, it could, among other things, result in an increase in tariffs and trade restrictions on products we produce or sell following a business combination, making our products less attractive and potentially reducing our revenues and profits.

China’s government has been reforming its economic system since the late 1970s. The economy of China has historically been a nationalistic, “planned economy,” meaning it has functioned and produced according to governmental plans and pre-set targets or quotas.

19

However, in recent years, the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership in business enterprises. Although we believe that the changes adopted by the government of China have had a positive effect on the economic development of China, additional changes still need to be made. For example, a substantial portion of productive assets in China are still owned by the Chinese government. Additionally, the government continues to play a significant role in regulating industrial development. We cannot predict the timing or extent of any future economic reforms that may be proposed, but should they occur, they could reduce our operating flexibility or require us to divert our efforts to products or ventures that are less profitable than those we would elect to pursue on our own.

A recent positive economic change has been China’s entry into the World Trade Organization, the global international organization dealing with the rules of trade between nations. It is believed that China’s entry will ultimately result in a reduction of tariffs for industrial products, a reduction in trade restrictions and an increase in trading with the United States. However, China has not fully complied with all of its WTO obligations to date, including fully opening its markets to American goods and easing the current trade imbalance between the two countries. If actions are not taken to rectify these problems, trade relations between the United States and China may be strained, and this may have a negative impact on China's economy and our business by leading to the imposition of trade barriers on items that incorporate our products, which would reduce our re venues and profits.

The Chinese government could change its policies toward, or even nationalize, private enterprise, which could leave us unable to use the assets we have accumulated for the purpose of generating profits for the benefit of our shareholders.

Over the past several years, the Chinese government has pursued economic reform policies, including the encouragement of private economic activities and decentralization of economic regulation. The Chinese government may not continue to pursue these policies or may significantly alter them to our detriment from time to time without notice. Changes in policies by the Chinese government that result in a change of laws, regulations, their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion or imports and sources of supply could materially reduce the value of our business by making us uncompetitive or, for example, by reducing our after-tax profits. The nationalization or other expropriation of private enterprises by the Chinese government could result in the total loss of our investment in China, where a significant portion of our pr ofits are generated.

The Chinese legal system may have inherent uncertainties that could materially and adversely impact our ability to enforce the agreements governing our operations.