| 4.1. | Capital Requirements |

Table 6: Capital Requirements

| Activities | | USD million | |

| Acquisition of additional working interests | | | 5.0 | |

| Recompletion, deepening, or drilling, including evaluation of the shale reservoirs | | | 28.0 | |

| Acquisition of additional undeveloped acreage / seismic work | | | 5.0 | |

| General working capital | | | 2.0 | |

| Total | | | 40.0 | |

Acquisition of additional working interest

Approximately USD 5 to acquire additional working interest in KGP. The additional working interest is expected to have a base net asset value of USD 7-11 million, and include estimated ORGIP of 0.85-1.52 Tcf shale resources and 0.062-0.191 Tcf conventional gas resources.

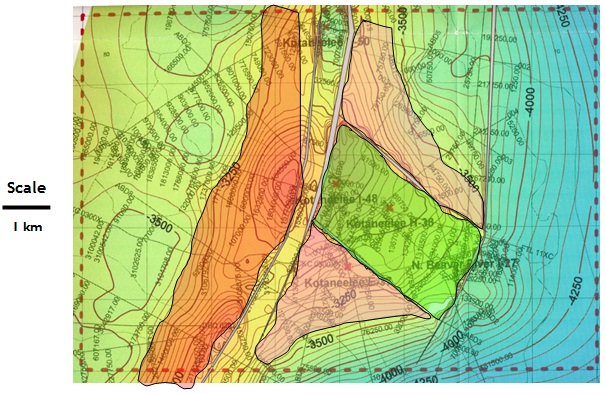

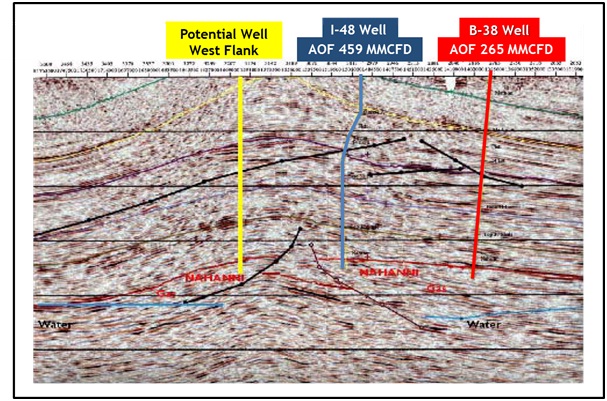

Successful Nahanni production (south-east flank)

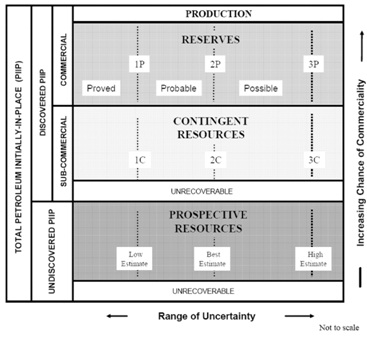

The successful drilling into the Nahanni layer on the south-east flank would shift current contingent resources into proven (1P), probable (2P) and possible (3P) reserves.

Successful Nahanni/Arnica production (western flank)

The successful drilling to the Arnica formation would add reserves (1P-3P) and resources.

Shale evaluation

The new drilling on the eastern and western flanks will allow for significant shale evaluation and analysis, and will be critical to the development process.

Successful Arnica well (south-east flank)

This is expected to shift a portion of the current probable (2P) and possible (3P) reserves into the proven (1P) reserves category. Further, based on the offset logs and seismic work that will be performed, it is expected that additional probable and possible reserves will be booked.

Successful Flett production

This is expected to shift a portion of the current probable (2P) and possible (3P) reserves into the proven (1P) reserves category, and potentially to result in the recognition of additional probable and possible reserves.

Acquisition of additional lands

The acquisition of an additional 30,000 acres by the Company could potentially add gas resources of 7-13 Tcf of shale ORGIP (double the current resources).

| | EFLO Energy, Inc. | March 2013 | Page 23 |

5. | Senior Executive and Management Team |

| 5.1. | Ownership Structure and Overview |

EFLO is listed on the Over-The-Counter-Quotation-Board (OTCQB) exchange under the ticker EFLO. Details of the Company’s capital structure are highlighted below in Table 7 as of February 6, 2013.

Table 7: Capital Structure

| Name | Position |

| Shares Issued and Outstanding | 19,422,020 |

| Warrants and Options | 3,748,101 |

| Fully Diluted Shares | 23,170,171 |

| Insider Ownership | 62% |

| Market Capitalization | USD 41 million |

| Average Price Performance (60 days) | USD 2.11 |

Table 8 below highlights a list of major shareholders:

Table 8: EFLO Major Shareholders

| Name | Shares | Warrants | % |

| Holloman Corporation | 4,530,870 | 10,870 | 23.37% |

| Pacific LNG Operations Limited | 4,000,000 | - | 20.60% |

| VP Bank (Switzerland) Ltd. | 1,027,500 | - | 5.29% |

| Directors and Officers (as a group) | 2,199,103 | 700,000 | 14.41% |

| 5.2.1. | Holloman Corporation |

Holloman Corporation is a Houston-based employee owned upstream/midstream construction contractor with design/build capabilities. Holloman offers construction services and turnkey installations of gathering systems, gas processing/treating, compression, pumping stations, metering facilities and natural gas storage.

Since 1960, when the company was founded by Sam Holloman as Holloman Construction, the company has completed 5000 projects for over 300 customers. Holloman is active in Marcellus, Bakken, Barnett, Haynesville and Eagle Ford Unconventional Gas projects for both pipeline and gas plant facilities.

| 5.2.2. | Pacific LNG Operations Ltd. |

Pacific LNG Operations Ltd. is a Singapore-based oil and gas company. It is a substantial indirect interest holder in the Elk and Antelope gas discoveries in Papua New Guinea, and 47.5% LNG partner in Liquid Niugini Gas Limited with InterOil Corporation (NYSE-IOC). Liquid Niugini Gas is proposing the construction of a 3.8 mmtpa LNG project in Papua New Guinea. Pacific LNG also has a working interest in the significant gas and condensate discoveries in the Elk and Antilope fields.

| | EFLO Energy, Inc. | March 2013 | Page 24 |

| 5.2.3 | VP BANK (SWITZERLAND) LTD. |

A member of a private banking group based in Zurich, Switzerland. It is owned by the Verwaltungs- und Privat-Bank, Vaduz, one of the three largest banks in Liechtenstein

The Board of Directors for the Company is comprised of six members, listed in Table 9 below.

Table 9: EFLO Board of Directors

| Name | Position | Date of Appointment |

| Henry Aldorf | Chairman of the Board of Directors | June 18, 2012 |

| Keith Macdonald | Chief Executive Officer and Secretary | March 10, 2011 |

| Robert Wesolek | Chief Financial and Accounting Officer | June 16, 2011 |

| James Hutton | President and Director | June 18, 2012 |

| Eric Prim | Director | March 17, 2011 |

| James Ebeling | Director | June 22, 2011 |

The executive management team of the Company consists of a number of seasoned industry veterans in the oil and gas business. Selected biographies of key employees are provided below:

| 5.4.1. | Henry Aldorf, MsC, MBA (Chairman & Director) |

Mr. Aldorf has 37 years’ experience in the petroleum and chemicals industry. Since February 2010, Mr. Aldorf has served as President of Pacific LNG Operations Ltd. and Liquid Niugini Gas Limited. From August 2001 to January 2010, Mr. Aldorf held a variety of senior executive positions with Marathon Oil including; President of Marathon International and Vice-President of Global Upstream of Marathon Oil (2008-2010), Senior Vice President International Business Development – Marathon Oil International (2006-2008), Senior Vice-President West Africa, Middle East and Asia Business Development (2005-2006), and Senior Vice-President West Africa Business Development (2004-2005). In the latter position Mr. Aldorf was responsible for Marathon's EG LNG project in Equatorial Guinea and was the first Managing Director of EG LNG Co. Before joining Marathon in 2001, Mr. Aldorf worked for Unocal in a variety of positions of increasing responsibility, in both the chemical and business development organization of that company. His international experience includes Europe, United States, Canada, Russian Federation, Brazil, the Asia Pacific Region, Japan, Korea and China. He graduated from the University of Leiden in the Netherlands, with a Bachelor of Science degree in Chemistry and Biochemistry. He also gained a Master of Science degree in Chemical Engineering from Technical University in Delft in the Netherlands, and holds a master of Business Administration from the INSEAD graduate business school, Fountainebleau, France.

| 5.4.2. | Keith Macdonald, CA (Chief Executive Officer & Director) |

Keith Macdonald has been President of Bamako Investment Management Ltd., a private holding and financial advisory company since 1994. He is currently Chairman and director of Drakkar Energy Ltd., a private in situ oil sands company. In addition, Mr. Macdonald currently serves on the board of Bellatrix Exploration Ltd. (TSX), Rocky Mountain Dealerships Inc. (TSX), Madalena Ventures Inc. (TSVX), Surge Energy Inc. (TSX), Mountainview Energy Ltd. (TSVX), Holloman Energy Corporation (OTCQB), WCSB Oil & Gas Royalty Income Funds and Orange Directional Services Inc.. Most recently, he was a director of Profound Energy Inc. (TSX), Cordy Oilfield Services Inc.(TSVX), Stratabound Minerals Inc.(TSVX) and Breaker Energy Ltd (TSX) , and prior thereto a director of several public and private oil and gas companies. Mr. Macdonald was founder, President and Director of New Cache Petroleums from 1987 until its amalgamation in 1994 and thereafter Chief Financial Officer and Director until its sale in 1999. He is a past Chairman and director of the Small Explorers and Producers of Canada.

| | EFLO Energy, Inc. | March 2013 | Page 25 |

| 5.4.3. | James Hutton (President & Director) |

James Hutton has spent his career in the financial services industry and for the past 25 years has specialized in structured finance and resource company finance. He has served as President and Chief Executive Officer of Hutton Capital Corporation, a company engaged in investment banking since September 1996. In April 1998, Mr. Hutton also founded, and was President and Chief Executive Officer of the Canada Dominion Resources Group of companies, one of the largest flow-through share funds in Canada. The Canada Dominion Resources Group focused their investments on mining and energy issuers actively exploring for resources in Canada. The Canada Dominion Resources Group was acquired from Mr. Hutton by the Dundee/Dynamic Mutual fund organization in December of 2006. In addition, Mr. Hutton was the President and Chief Operating Officer of the CMP Resource Group from 2003 to 2005. He also serves as director of Tasman Metals Ltd. (AMEX/TSXV-TSM), SantaCruz Silver Mining Inc. (TXSV-SCZ), Batero Gold Corp. (TSXV-BAT) and Caymus Resources Inc. (TSXV-CJX).

| 5.4.4. | Robert Wesolek (Chief Financial Officer & Director) |

Robert Wesolek has been the Chief Financial Officer of Holloman Energy Corporation since August 4, 2009, and has acted as an executive consultant providing financial, regulatory and system design services to emerging corporations since 2006. Prior to 2006, Mr. Wesolek served as Chief Financial Officer and director of House of Brussels Chocolates Inc. (2004-2006), President and Chief Executive Officer of The Navigates Corporation (1998-2004), Chief Financial Officer of Sharp Technology Inc. (1998-2001), President of the Desktop Software Division of Citadel Security Software (1996-1998), and Chief Operating Officer of Kent Marsh Ltd., Inc. (1988-1996). During the period from 1980 to 1988, Mr. Wesolek was a Senior Practice Manager in the Audit Division of Arthur Andersen LLP.

| 5.4.5. | H. Wayne Hamal (Chief Operating Officer) |

H. Wayne Hamal has over 25 years of oil and gas industry experience with both major and independent oil companies. He was General Manager of Exploration and Production (2008-2011), and Senior Engineering and Drilling Manager (2005-2008), for InterOil Corporation (NYSE-IOC) operating in Papua New Guinea. In that role, he was instrumental in the development of the drilling program for InterOil and was integral to the discovery and appraisal of the Elk/Antelope gas condensate fields. From 2002 to 2005, Mr. Hamal worked for Marathon Oil Company (NYSE-MRO) as Joint Venture Manager, Equatorial Guinea, West Africa, where he worked directly with production operations and major projects primarily involved with the development of the Alba gas condensate field and associated LPG, methanol and LNG plants. Before joining Marathon, Mr. Hamal worked for CMS Oil and Gas (1987-2001) where he held a variety of engineering positions, both domestic and international, including Production Manager Equatorial Guinea, West Africa. Mr. Hamal holds a Bachelor of Science degree in Petroleum Engineering from the Colorado School of Mines.

| 5.4.6. | Eric Prim, B.Sc, MBA (Director) |

Eric Prim is the President of Pilot Energy Solutions, and has been Vice President of its affiliate, Holloman Corporation since 1997. He has served as a director of Holloman Energy Corporation since 2007 and also became that company’s Chief Operating Officer in 2009. Prior to his association with Holloman, Mr. Prim held senior technical management positions with Hunt Energy (1982-1987) and Rexene Corporation (1987-1997). Mr. Prim holds a B.S. in Chemical Engineering from The University of Texas (1982) and an M.B.A. from Amber University (1987). Mr. Prim is a registered Professional Engineer in Texas and holds eight issued or pending U.S. Patents, all pertaining to energy technology.

| | EFLO Energy, Inc. | March 2013 | Page 26 |

| 5.4.7. | James Ebeling (Director) |

James Ebeling is the Chief Financial Officer of Holloman Corporation. During the period from 2001 to 2007, Mr. Ebeling was Vice President of SUEZ Energy North America, Inc. In that capacity, he provided project management and development services on a variety of multi-billion dollar energy related projects. Prior to 2001, Mr. Ebeling served as Vice President of Hawkins Oil and Gas (1996-2001), Vice President of Transworld Oil Company (1989-1996), Vice President of Anchor Coupling (1984-1989), and Vice President of the Charter Company (1981-1984).

| | EFLO Energy, Inc. | March 2013 | Page 27 |

A description of major risks factors and considerations is contained below. For a more extensive description of these risks the reader should consult the Company’s most recent 10-K.

These factors could have a material adverse effect on the Company’s businesses, operations and financial condition that, in turn, could have a material adverse effect on the Company’s ability to produce and deliver hydrocarbons, and generate positive cash flow. The risks and uncertainties described below are not the only ones the Company faces. Additional risks and uncertainties not presently known or that are currently deemed immaterial may also harm the business.

The Company’s proved natural gas reserve estimates may prove to be incorrect and may be subject to revision.

There are numerous uncertainties inherent in estimating crude oil and natural gas reserves and their estimated values. The reserves the Company reports in its filings with the SEC are estimates and such estimates may prove to be inaccurate because of these uncertainties. Reservoir engineering is a subjective and inexact process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner. Substantial expenditures are required to establish proven and probable resource reserves. Whether a resource will be commercially viable depends on a number of factors outside our control, which include, without limitation, the particular attributes of the resource formation, and proximity to infrastructure; prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, development, production, stimulation and fracking, royalties, land tenure, land use, importing and exporting of resources and environmental protection. For these reasons, estimates of the economically recoverable quantities of crude oil and natural gas attributable to any particular group of properties, classifications of such reserves based on risk of recovery, and estimates of the future net cash flows prepared by different engineers or by the same engineers but at different times may vary substantially. Accordingly, reserve estimates may be subject to downward or upward adjustment. Actual production, revenue and expenditures with respect to our reserves will likely vary from estimates, and such variances may be material.

The volatility of natural gas and condensate prices may adversely affect the Company’s ability to generate positive cash flows and be profitable.

The Company’s ability to generate positive cash flows is highly dependent on the price of, and demand for natural gas. Even relatively modest changes in natural gas prices may significantly change cash flows generated by the Company. Historically, the markets for natural gas and condensates have been volatile and are likely to continue to be volatile in the future. Prices for natural gas may fluctuate widely in response to relatively minor changes in the supply of, and demand for natural gas and condensates and a variety of additional factors that are beyond the Company’s control, such as:

| ● | economic and political developments in oil and gas producing regions; |

| global and regional supply and demand, and expectations regarding future supply and demand, for petroleum products; |

| speculation in the commodity futures market; |

| technological advances affecting energy consumption; |

| prices and availability of alternative fuels; |

| global economic and political conditions; and |

| prices and availability of new technologies. |

| | EFLO Energy, Inc. | March 2013 | Page 28 |

The Company cannot predict future natural gas and condensate price movements.

Changes to regulations with respect to the gas market may materially impact the business.

The exploration, production and sale of oil and gas are extensively regulated by governmental authorities. Applicable legislation is under constant review for amendment or expansion. These efforts frequently result in an increase in the regulatory burden on companies in the oil and gas industry and consequently an increase in the cost of doing business and decrease in profitability. Numerous governmental departments and agencies are authorized to, and have, issued rules and regulations imposing additional burdens on the oil and gas industry that often are costly to comply with and carry substantial penalties for non-compliance. Production operations are affected by changing tax and other laws relating to the petroleum industry, constantly changing administrative regulations and possible delays, interruptions or termination by government authorities.

Oil and gas mineral rights may be held by individuals, corporations or governments having jurisdiction over the area in which such mineral rights are located. As a general rule, parties holding such mineral rights grant licenses or leases to third parties to facilitate the exploration and development of these mineral rights. The terms of the leases and licenses are generally established to require timely development. Notwithstanding the ownership of mineral rights, the government of the jurisdiction in which mineral rights are located generally retains authority over the drilling and operation of oil and gas wells.

Current, as well as future, environmental laws and regulation may have a material effect on the business.

The Company’s operations are also subject to a variety of constantly changing laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. Failure to comply with environmental laws and regulations can result in the imposition of substantial fines and penalties as well as potential orders suspending or terminating the Company’s rights to operate. Some environmental laws to which the Company is subject provide for strict liability for pollution damage, rendering a company liable for environmental damage without regard to negligence or fault on the part of such company.

In addition, the Company may be subject to claims alleging personal injury or property damage as a result of alleged exposure to hazardous substances, such as oil and gas related products or for other reasons. Some environmental protection laws and regulations may expose the Company to liability arising out of the conduct of operations or conditions caused by others, or for acts which were in compliance with all applicable laws at the time the acts were performed. Changes in environmental laws and regulations, or claims for damages to persons, property, natural resources or the environment, could result in substantial costs and liabilities to the Company. These laws and regulations may substantially increase the cost of exploring, developing, producing or processing oil and gas and may prevent or delay the commencement or continuation of a given project and thus generally could have a material adverse effect upon the Company’s capital expenditures, earnings, or competitive position. The Company believes that it is in substantial compliance with current applicable environmental laws and regulations. Nevertheless, changes in existing environmental laws and regulations or in the interpretations thereof could have a significant impact on the Company and the oil and gas industry in general.

| | EFLO Energy, Inc. | March 2013 | Page 29 |

The Company’s drilling activities may not be commercially successful, which would adversely affect the financial condition of its business.

Oil and gas exploration is not an exact science, and involves a high degree of risk. The primary exploration risk lies in the drilling of dry holes or drilling and completing wells which, though productive, do not produce gas and/or oil in sufficient amounts to return the amounts expended and produce a profit.

Hazards, such as unusual or unexpected formation pressures, downhole fires, blowouts, loss of circulation of drilling fluids and other conditions are involved in drilling and completing oil and gas wells and, if such hazards are encountered, completion of any well may be substantially delayed or prevented. In addition, adverse weather conditions can hinder or delay operations, as can shortages of equipment and materials or unavailability of drilling, completion, and/or work-over rigs. Even though a well is completed and is found to be productive, water and/or other substances may be encountered in the well, which may impair or prevent production or marketing of oil or gas from the well. Exploratory drilling involves substantially greater economic risks than development drilling because the percentage of wells completed as producing wells is usually less than in development drilling. Exploratory drilling itself can be of varying degrees of risk and can generally be divided into higher risk attempts to discover a reservoir in a completely unproven area or relatively lower risk efforts in areas not too distant from existing reservoirs. While exploration adjacent to or near existing reservoirs may be more likely to result in the discovery of oil and gas than in completely unproven areas, exploratory efforts are nevertheless high risk activities.

Although the completion of oil and gas wells is, to a certain extent, less risky than drilling for oil and gas, the process of completing an oil or gas well is nevertheless associated with considerable risk. In addition, even if a well is completed as a producer, the well for a variety of reasons may not produce sufficient oil or gas in order to repay the Company’s investment in the well.

The Company’s business involves many operating risks that can cause substantial losses; insurance may not protect it against all these risks.

The Originator’s business may experience hazards and risks inherent in drilling for, producing and transporting natural gas and condensates. These hazards and risks may result in loss of hydrocarbons, environmental pollution, personal injury claims and other damage to the Properties from third parties and include:

| encountering formations with abnormal pressures; |

| encountering unusual or unexpected geological formations; |

| unexpected operational events; |

| compliance with environmental and governmental regulations; and |

The business is insured against some, but not all, of the hazards associated with the business. The occurrence of an event that is not covered or not fully covered by insurance could have a material adverse effect on the Company’s ability to generate positive cash flows and be profitable.

| | EFLO Energy, Inc. | March 2013 | Page 30 |

Intense competition in the industry may affect the Company’s future financial condition.

The oil and gas industry is highly competitive. Numerous independent oil and gas companies, oil and gas syndicates and major oil and gas companies actively seek out and bid for oil and gas properties as well as for the services of third party providers, such as drilling companies, upon which the Company relies. From time to time, seismic vendors, drilling contractors, rigs and supplies may be in short supply. Their availability may be controlled by other larger explorers in the area. Native title holders or certain of the Company’s competitors may control pipeline capacity, roads, bridges and other infrastructure it requires to access or fully exploit its properties. The Company’s reliance upon their resources may create a competitive disadvantage for the Company. A substantial number of competitors have longer operating histories and substantially greater financial and personnel resources than the Company does, and have demonstrated the ability to operate through industry cycles. Some of the Company’s competitors not only explore for, produce and market petroleum and natural gas, but also carry out refining operations and market the resultant products on a worldwide basis which may provide them with additional sources of capital.

Larger and better capitalized competitors may be in a position to outbid the Company for particular prospect rights. These competitors may also be better able to withstand sustained periods of unsuccessful drilling. Larger competitors may be able to absorb the burden of any changes in laws and regulations more easily than the Company can, which would adversely affect the Company’s competitive position. Petroleum and natural gas producers also compete with other suppliers of energy and fuel to industrial, commercial and individual customers. Competitive conditions may be substantially affected by various forms of energy legislation and/or regulation considered from time to time by the governments and/or their agencies and other factors which are out of the Company’s control including, international political conditions, terrorism, overall levels of supply and demand for oil and gas, and the markets for synthetic fuels and alternative energy sources.

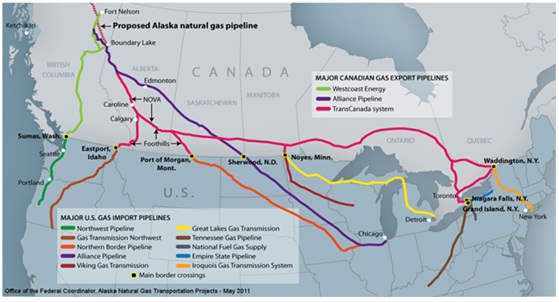

The Company is dependent on certain pipelines and transportation systems. Any damage or other material changes to those systems may materially affect the Company’s business.

The Company is dependent on certain pipelines as well as the links between pipeline networks for the transportation and gathering of hydrocarbons. These transportation services are provided by unaffiliated third parties, which the Company does not control.

The contracts governing the transportation of production output are of limited duration and may be terminated with limited notice. If these business relationships are terminated or materially altered, the Company may not be able to maintain satisfactory hydrocarbon transportation arrangements, which will hinder the Company’s ability to bring its hydrocarbons to market, and may materially adversely affect the results of its business.

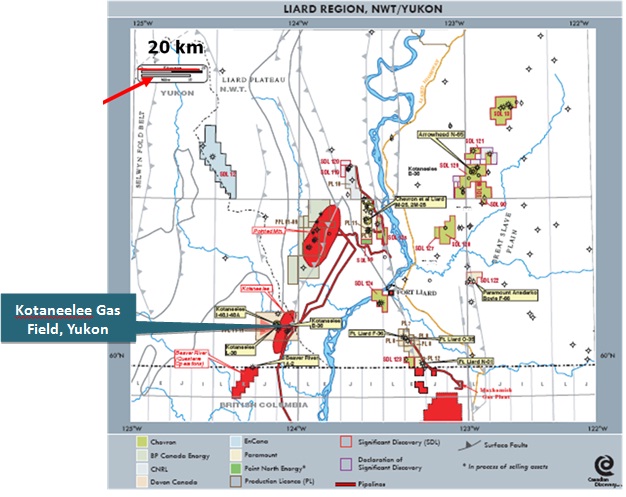

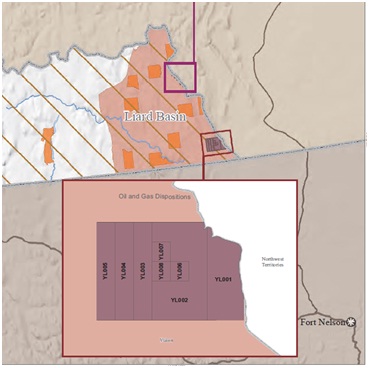

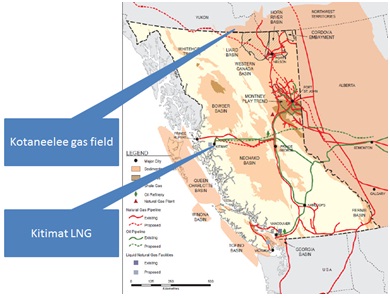

The Company’s business is located in the Liard Basin, Yukon and this concentration of activity makes its business vulnerable to the risks associated with that region, including the effects of severe weather.

Moreover, the Company is substantially dependent on production from the KGP and this dependence on a single asset makes the Originator vulnerable to any problems related to that asset.

The Company will for the foreseeable future derive all of its revenue from the production of hydrocarbons from a single project. As such, its results of operations are directly related to, and significantly impacted by, material changes in the economic production, or lack thereof, from that particular project.

EFL Information Memorandum 3-27-13

| | EFLO Energy, Inc. | March 2013 | Page 31 |