Exhibit 99.2

Disclaimer This presentation (“Presentation”) contains selected information about CSI Compressco LP (“CCLP” or the “Partnership”) and Spartan Energy Partners LP (“Spartan”), as well as certain transactions (the “Transactions”) entered into by CCLP and Spartan and certain other parties. Neither the Partnership nor any of its subsidiaries or affiliates have any obligation to update this Presentation. Although all information and opinions expressed in this Presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this Presentation. To the maximum extent permitted by law, none of the Partnership, its directors, officers, employees nor any other person accepts any liability, including, without limitation, any liability arising out of fault or negligence for any loss arising from the use of the information contained in this Presentation. Information contained in this Presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from our management’s estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. In some cases, we do not expressly refer to the sources from which this information is derived. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. These and other factors could cause our future performance to differ materially from our assumptions and estimates. FORWARD-LOOKING STATEMENTS This Presentation contains certain “forward-looking statements.” All statements, other than statements of historical facts, included in this Presentation that address activities, events, future strategy, other intentions or developments that the Partnership expects, believes or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as “believes,” “expects,” “estimates,” “may,” “will,” “should,” “could,” “seeks,” “plans,” “intends,” “anticipates,” “projects” or “scheduled to,” or other variations of such terms or comparable language. Without limiting the generality of the foregoing, forward-looking statements contained in this Presentation specifically include the expectations of plans, strategies, objectives and anticipated financial and operating results of the Partnership and statements related to the Transactions. These statements are based on certain assumptions made by the Partnership based on management’s experience and perception of historical trends, current conditions, anticipated future developments, the impact of the COVID-19 pandemic and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Partnership, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. These include, but are not limited to: economic and operating conditions that are outside of our control, including the trading price of our common units; the severity and duration of the COVID-19 pandemic and related economic repercussions and the resulting negative impact on the demand for oil and gas, operational challenges relating to the COVID-19 pandemic and efforts to mitigate the spread of the virus, including logistical challenges, remote work arrangements, and supply chain disruptions, other global or national health concerns; actions taken by members of OPEC and other oil producing nations with respect to oil production levels and announcements of potential changes in such levels, including the ability to agree on and comply with supply limitations; the duration and magnitude of the unprecedented disruption in the oil and gas industry; the levels of competition we encounter; our dependence upon a limited number of customers and the activity levels of our customers; our ability to replace our contracts with our customers, which are generally short-term contracts; the availability of adequate sources of capital to us; our existing debt levels and our ability to obtain additional financing or refinancing; our ability to continue to make cash distributions, or increase cash distributions from current levels, after the establishment of reserves, payment of debt service and other contractual obligations; the restrictions on our business that are imposed under our long-term debt agreements; our operational performance; the credit and risk profile of Spartan; ability of our general partner to retain key personnel; risks related to acquisitions and our growth strategy; the availability of raw materials and labor at reasonable prices; risks related to our foreign operations; the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies; potential material weaknesses in the future; information technology risks, including the risk of cyberattack; and other risks and uncertainties contained in our Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission. As a result, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and the Partnership undertakes no obligation to correct or update any forward looking statement, whether as a result of new information, future events or otherwise.

Executive Summary

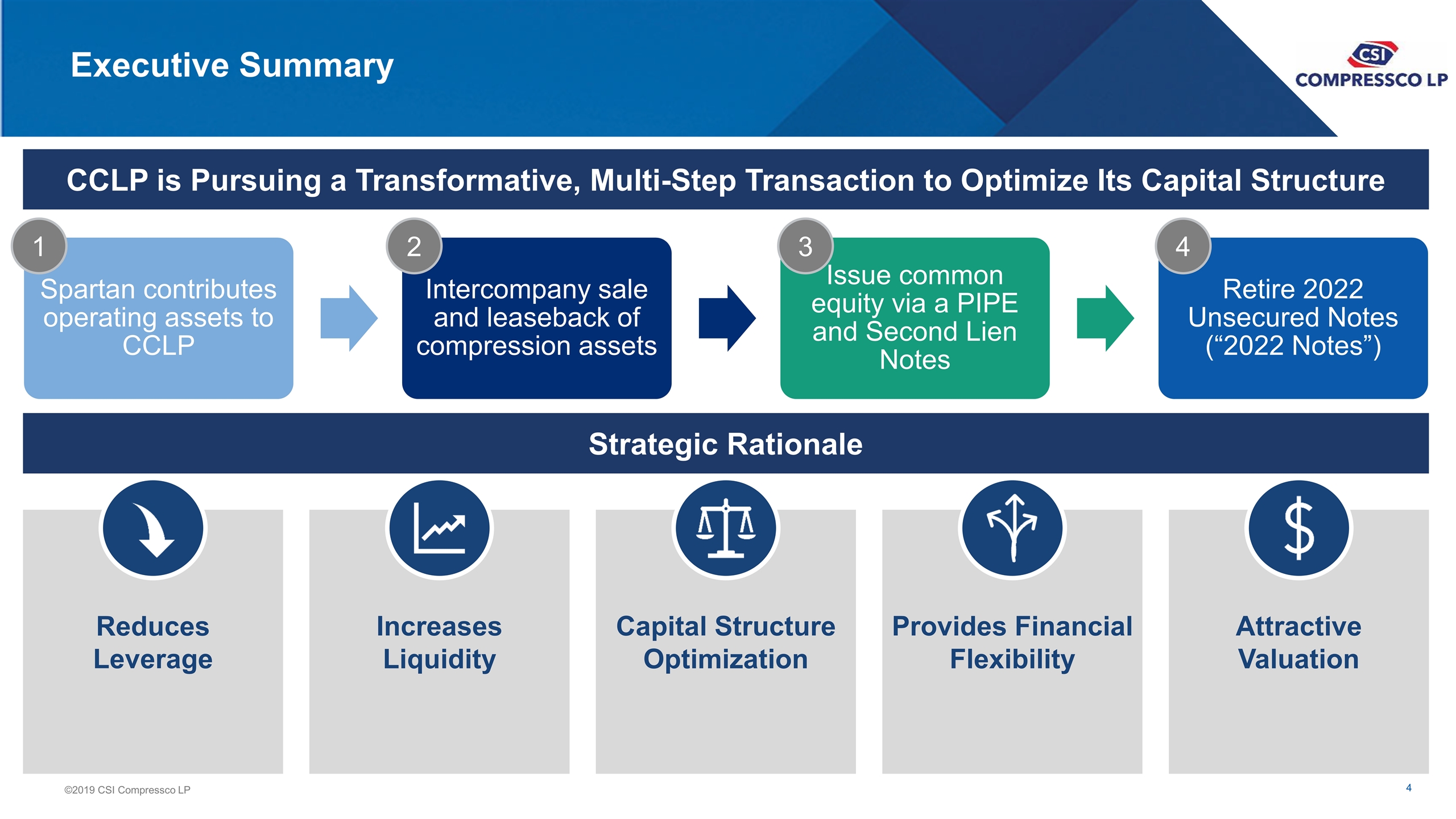

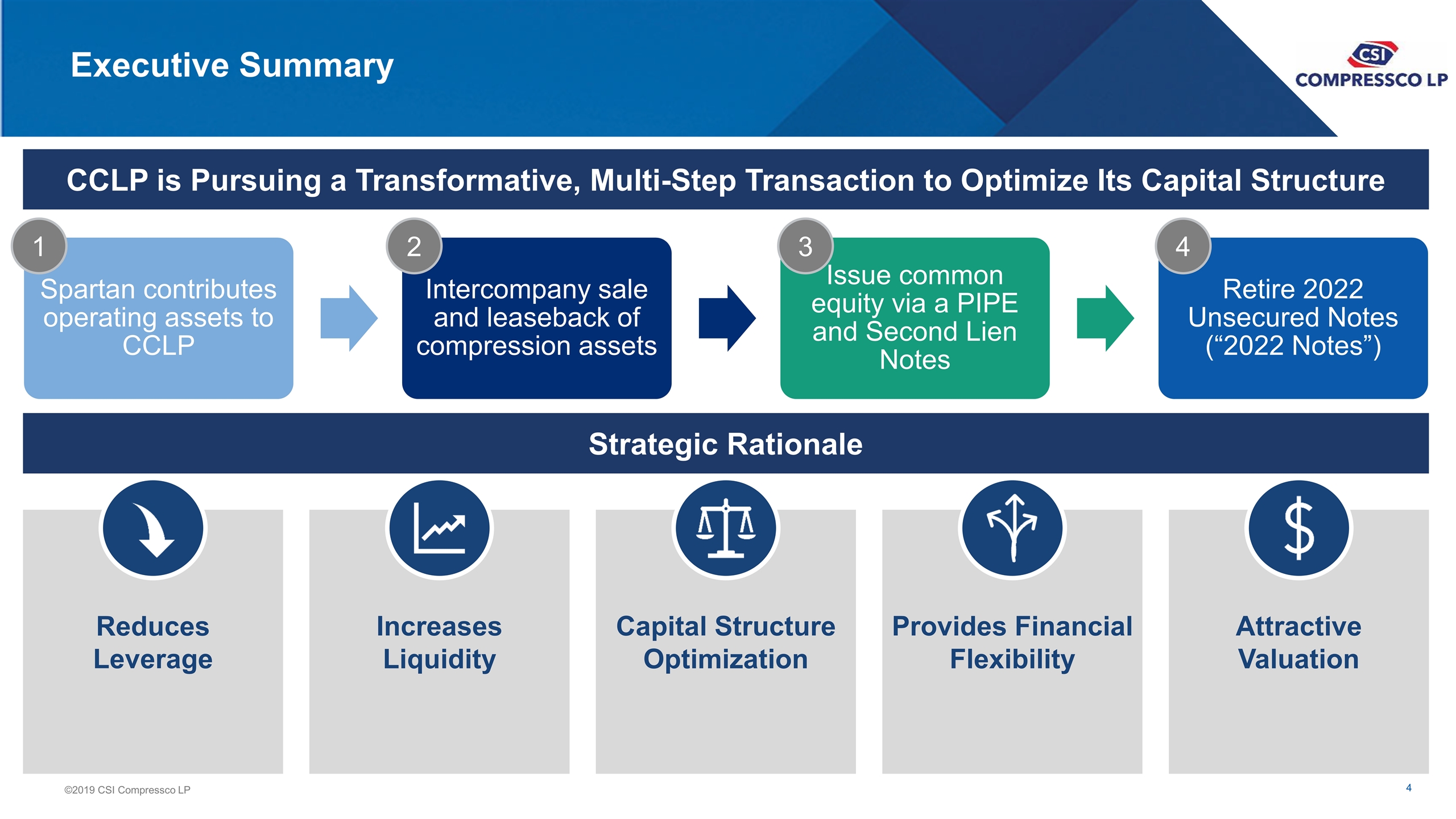

Executive Summary CCLP is Pursuing a Transformative, Multi-Step Transaction to Optimize Its Capital Structure 1 2 3 4 Reduces Leverage Strategic Rationale Increases Liquidity Capital Structure Optimization Provides Financial Flexibility Attractive Valuation Spartan contributes operating assets to CCLP Issue common equity via a PIPE and Second Lien Notes Retire 2022 Unsecured Notes (“2022 Notes”) Intercompany sale and leaseback of compression assets

Near-Term Catalysts Expected to Facilitate A CCLP Transformation Address 2022 Debt Maturity Capital Structure Optimization Smart Consolidation Beginning of macro cycle inflection point Significant improvement in order book International operations activity accelerating Electrification of fleet Targeting new build opportunities in core areas with highest return Intensely focused on capital discipline Gain Scale in Recovering Market

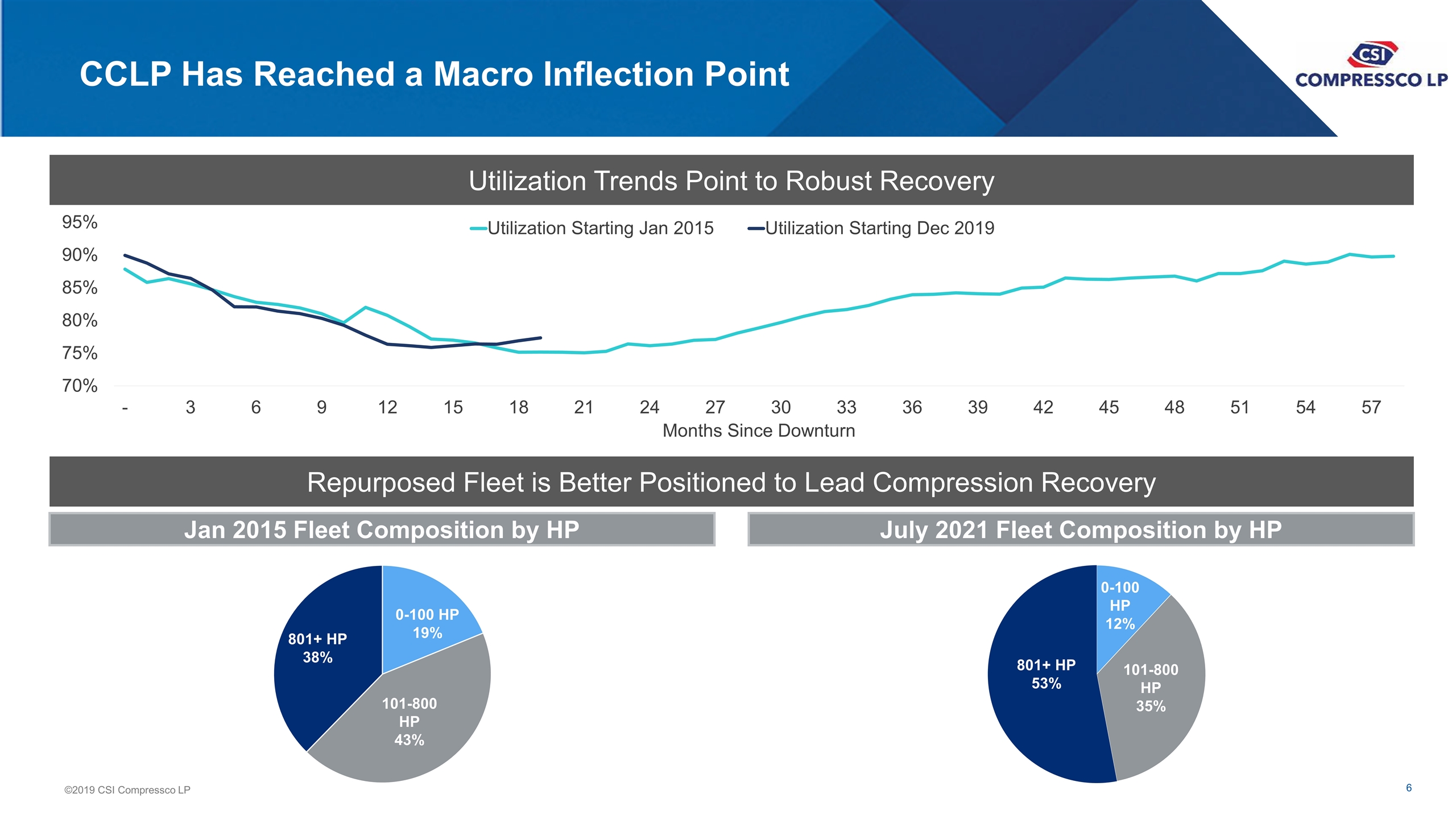

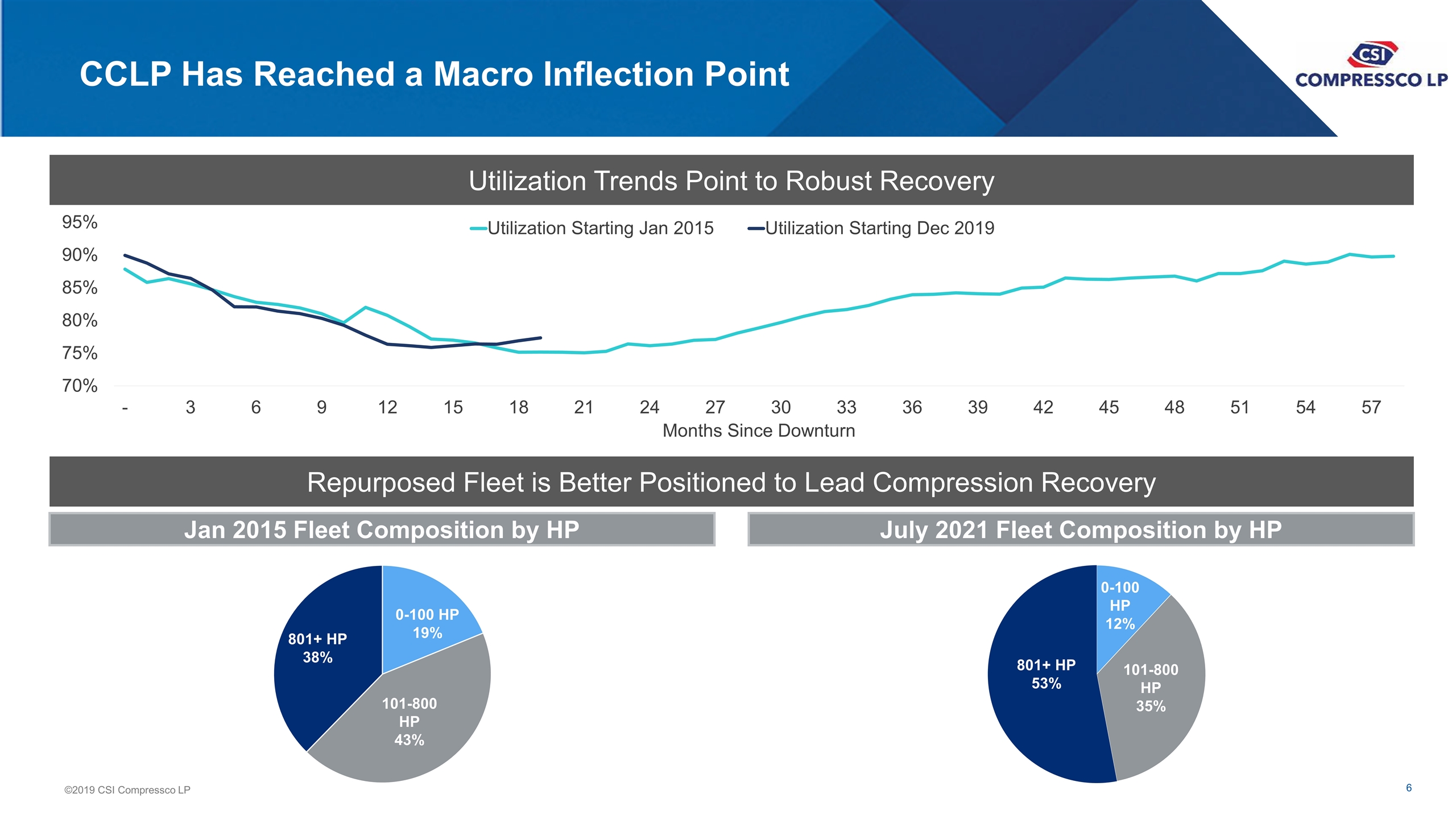

Utilization Trends Point to Robust Recovery Repurposed Fleet is Better Positioned to Lead Compression Recovery CCLP Has Reached a Macro Inflection Point 47% Jan 2015 Fleet Composition by HP July 2021 Fleet Composition by HP 801+ HP 38% 0-100 HP 19% 101-800 HP 43% 801+ HP 53% 0-100 HP 12% 101-800 HP 35%

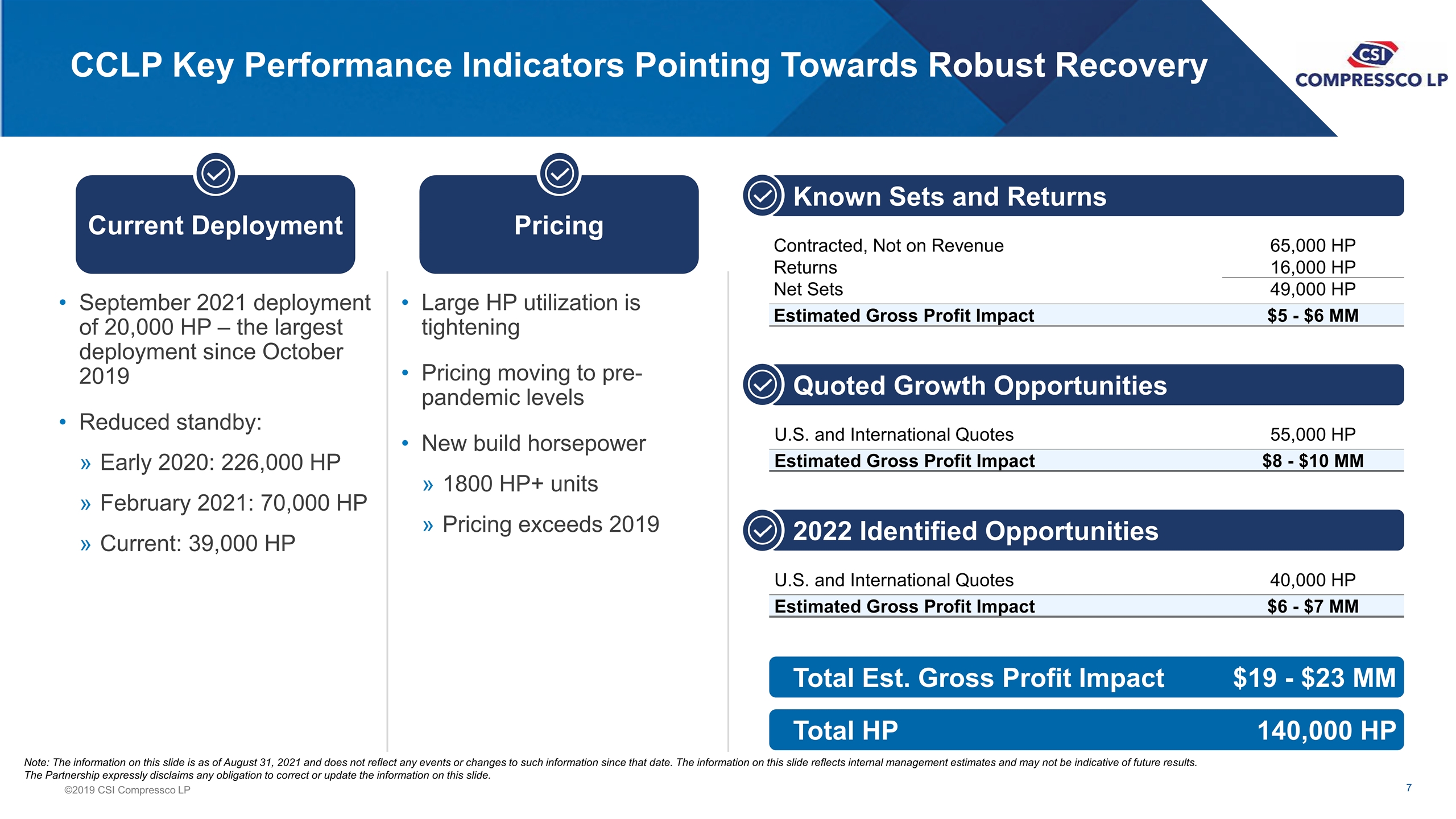

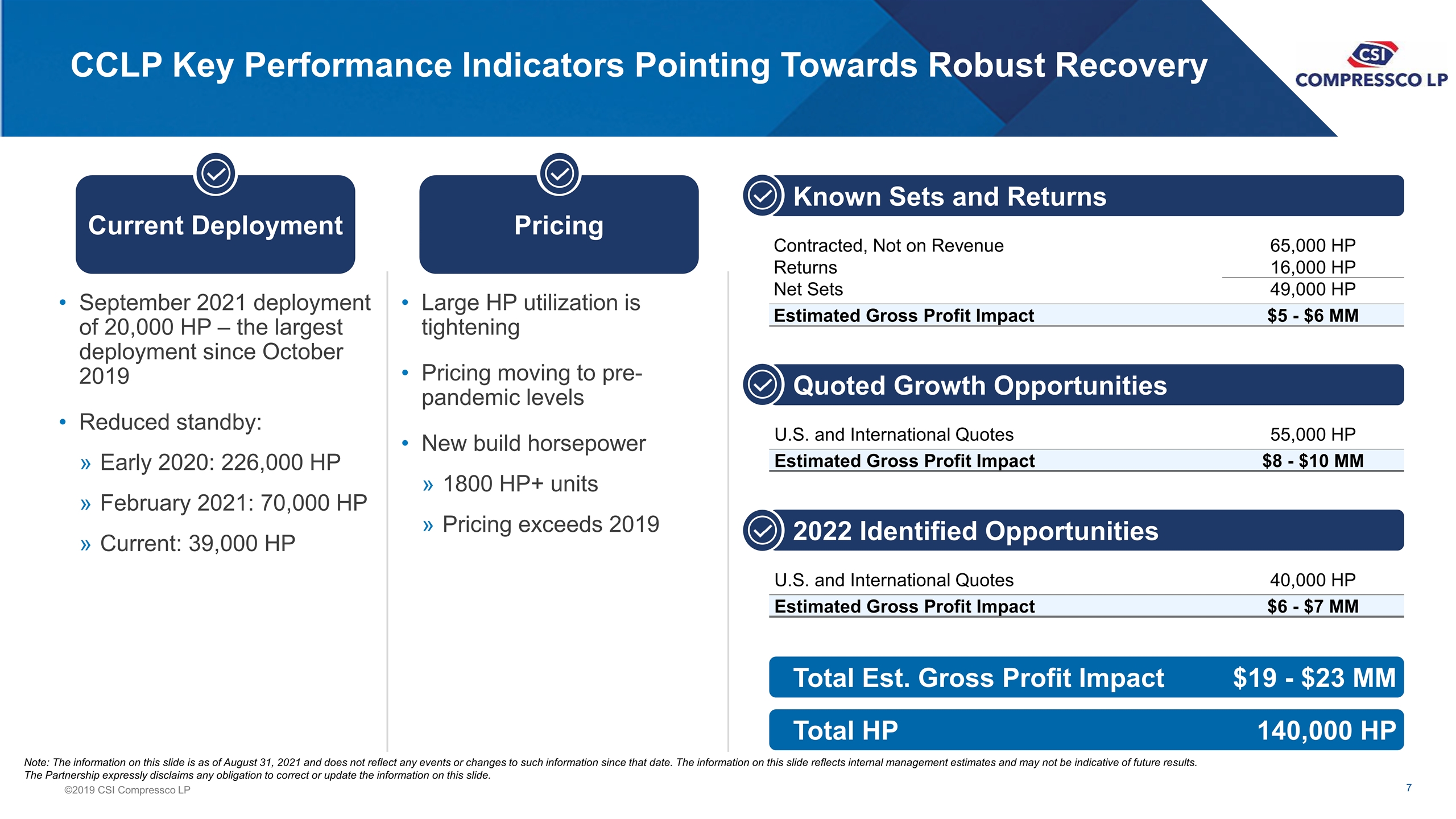

CCLP Key Performance Indicators Pointing Towards Robust Recovery Known Sets and Returns Quoted Growth Opportunities 2022 Identified Opportunities Total Est. Gross Profit Impact Contracted, Not on Revenue 65,000 HP Returns 16,000 HP Net Sets 49,000 HP Estimated Gross Profit Impact $5 - $6 MM U.S. and International Quotes 55,000 HP Estimated Gross Profit Impact $8 - $10 MM U.S. and International Quotes 40,000 HP Estimated Gross Profit Impact $6 - $7 MM $19 - $23 MM Current Deployment Pricing September 2021 deployment of 20,000 HP – the largest deployment since October 2019 Reduced standby: Early 2020: 226,000 HP February 2021: 70,000 HP Current: 39,000 HP Large HP utilization is tightening Pricing moving to pre-pandemic levels New build horsepower 1800 HP+ units Pricing exceeds 2019 Total HP 140,000 HP Note: The information on this slide is as of August 31, 2021 and does not reflect any events or changes to such information since that date. The information on this slide reflects internal management estimates and may not be indicative of future results. The Partnership expressly disclaims any obligation to correct or update the information on this slide.

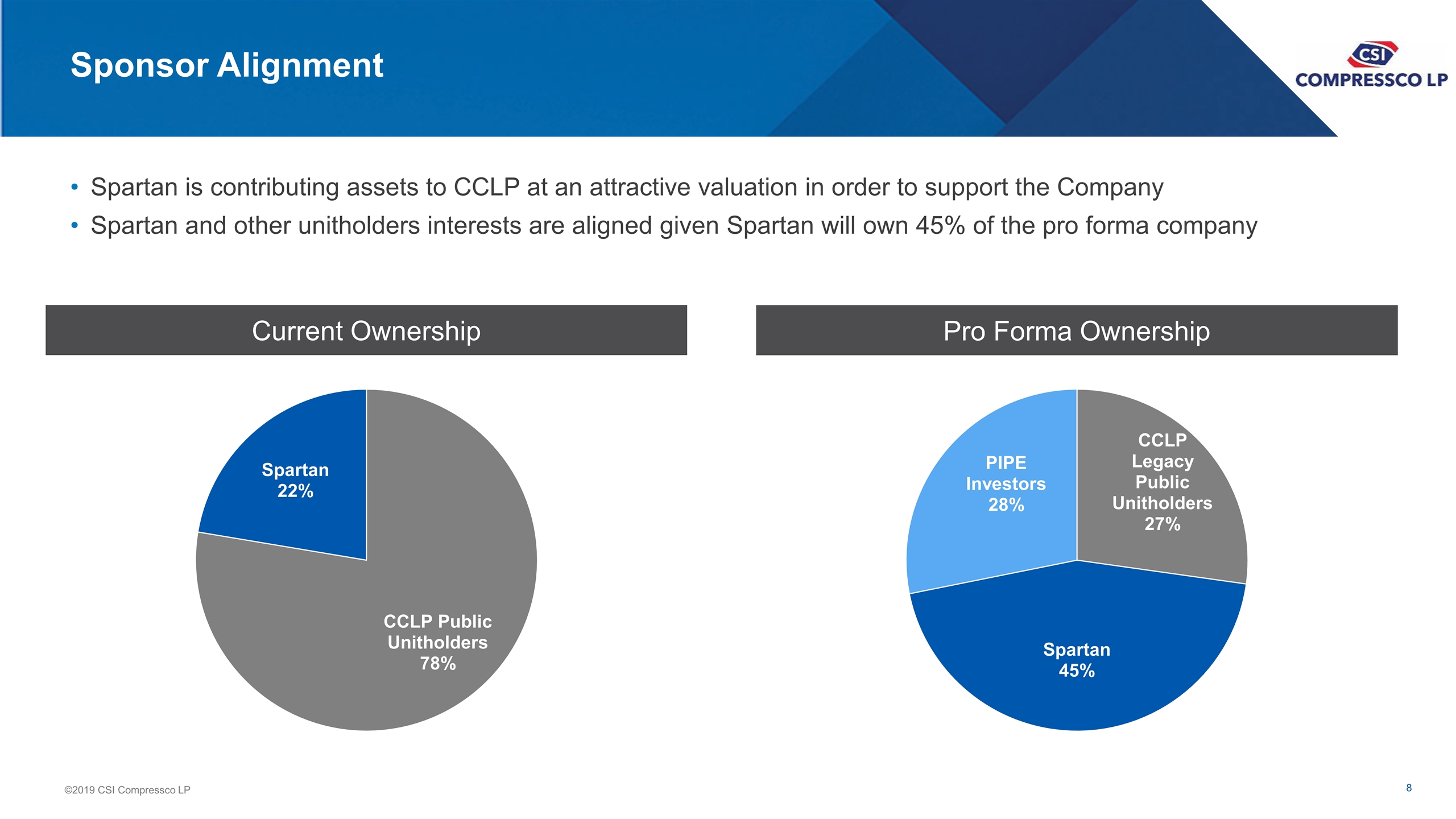

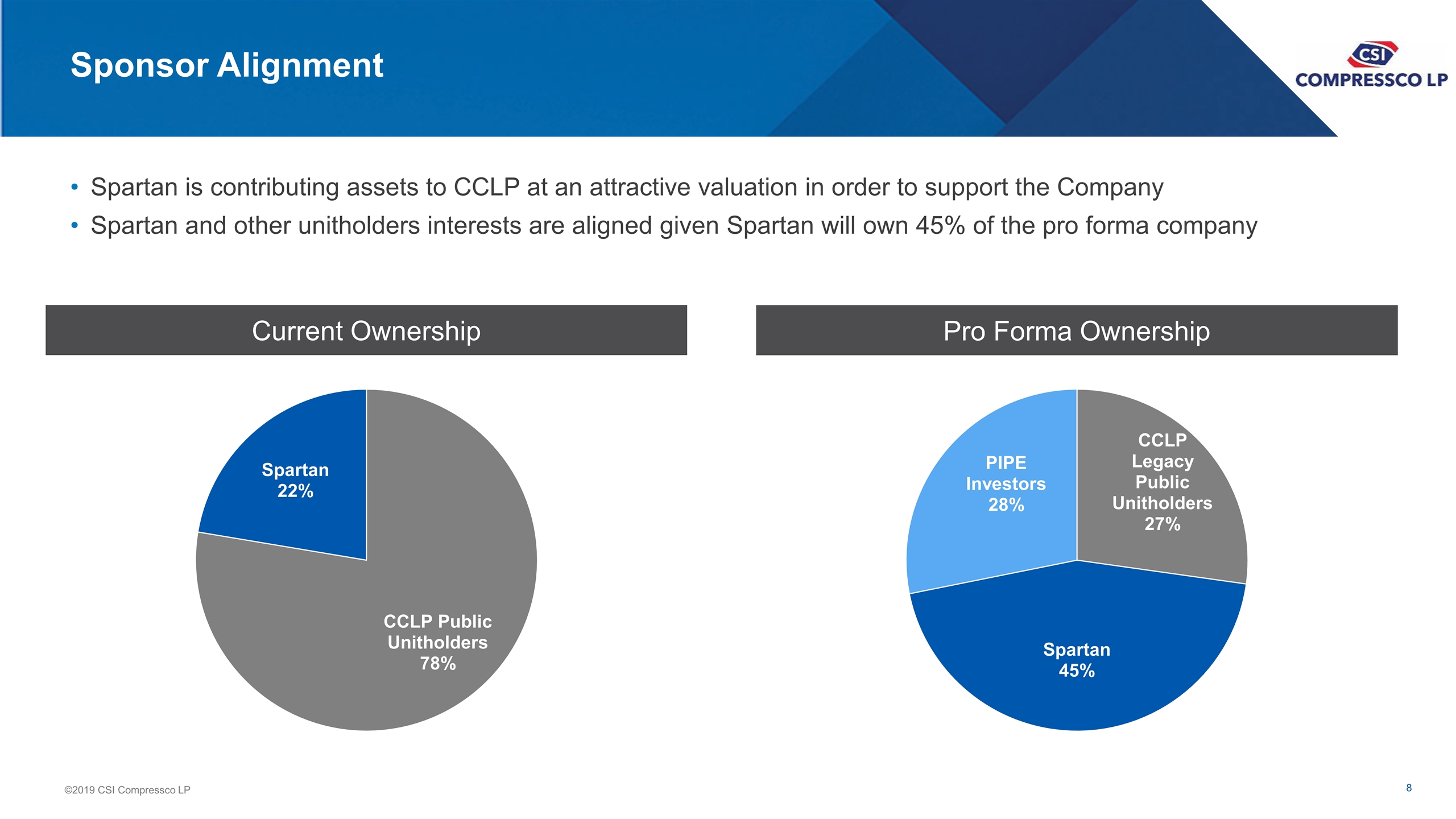

Sponsor Alignment Spartan is contributing assets to CCLP at an attractive valuation in order to support the Company Spartan and other unitholders interests are aligned given Spartan will own 45% of the pro forma company Current Ownership Pro Forma Ownership

CCLP Overview

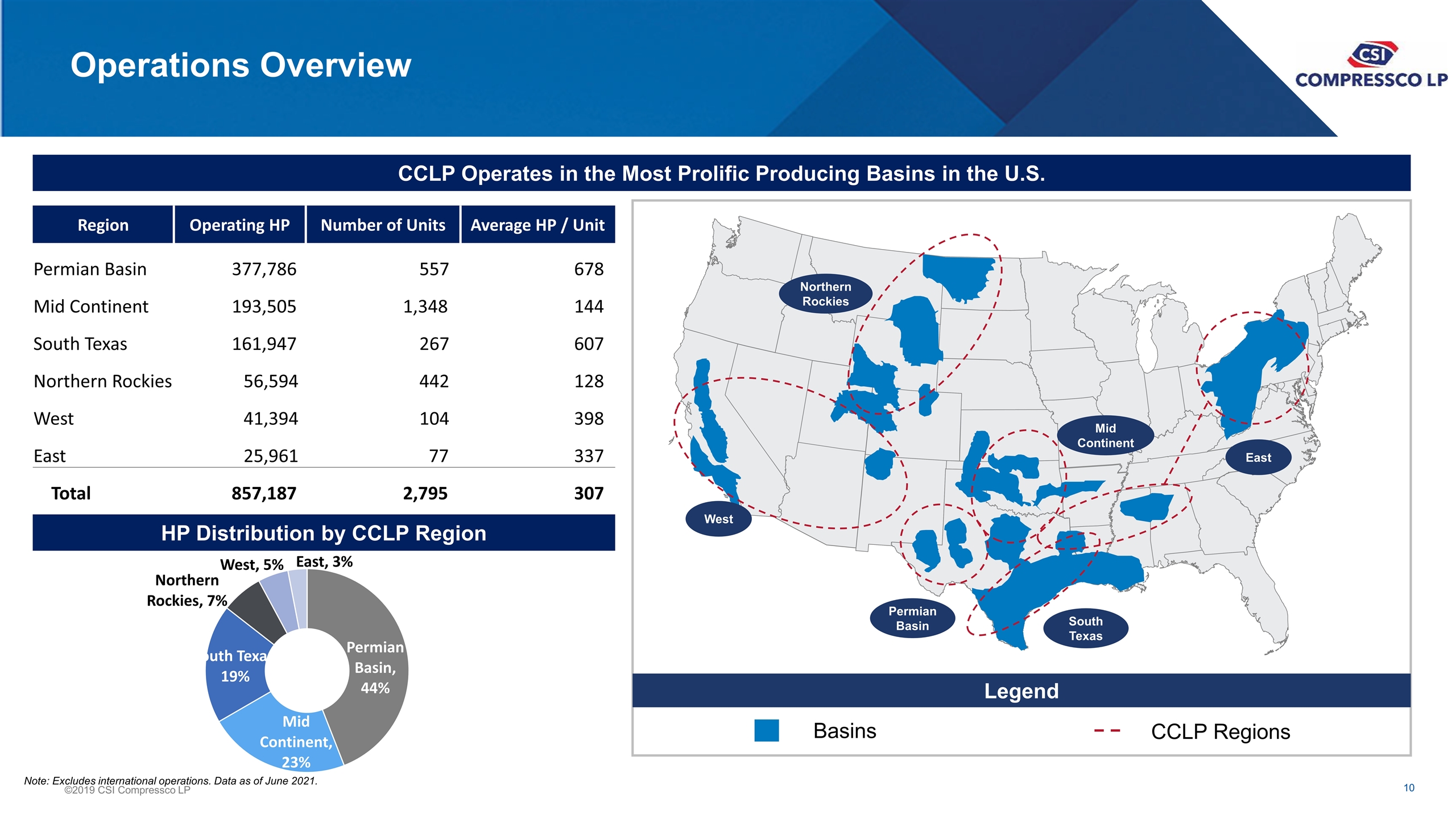

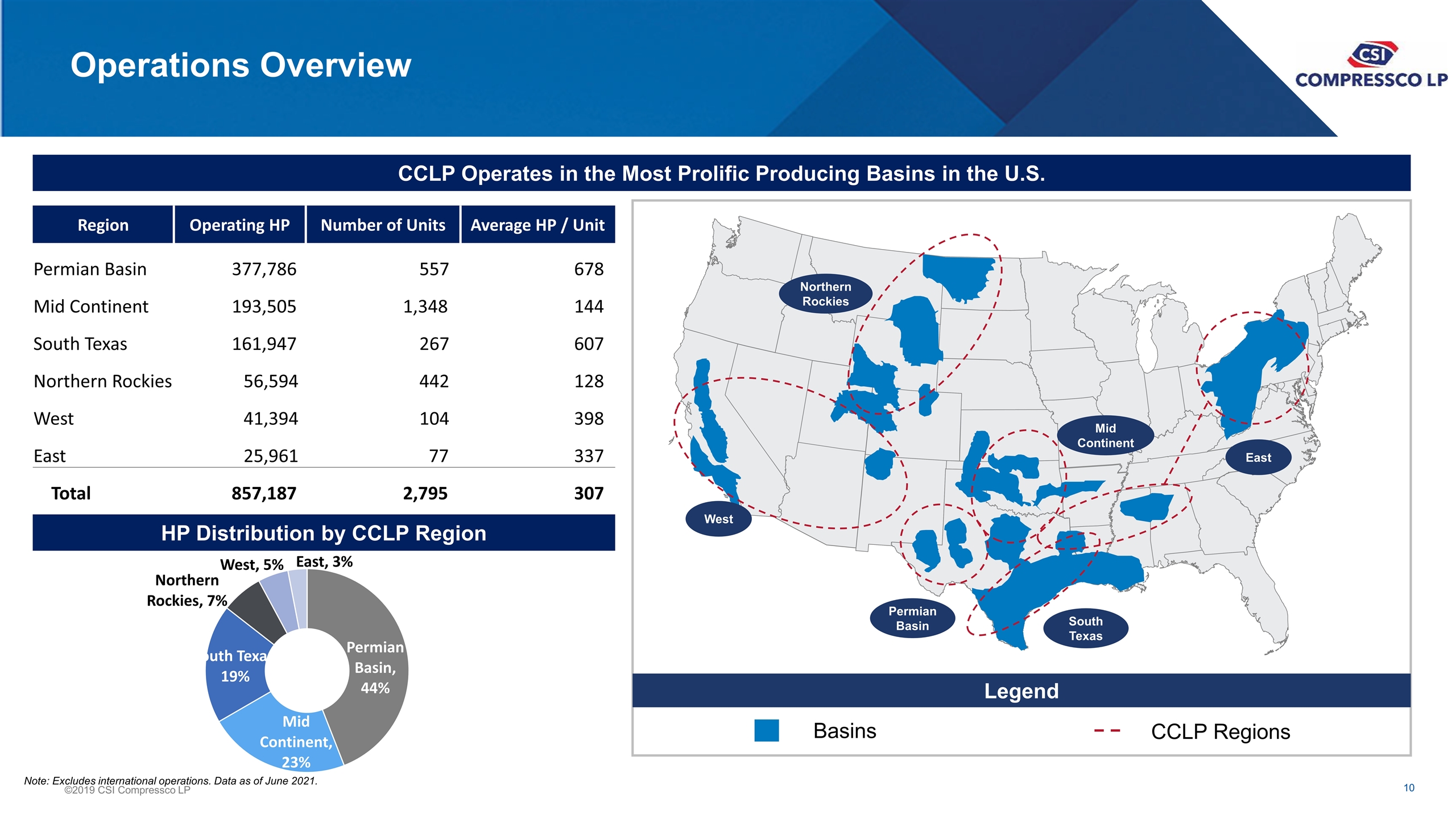

Operations Overview CCLP Operates in the Most Prolific Producing Basins in the U.S. Region Operating HP Number of Units Average HP / Unit Permian Basin 377,786 557 678 Mid Continent 193,505 1,348 144 South Texas 161,947 267 607 Northern Rockies 56,594 442 128 West 41,394 104 398 East 25,961 77 337 Total 857,187 2,795 307 HP Distribution by CCLP Region Note: Excludes international operations. Data as of June 2021. Legend Basins CCLP Regions Northern Rockies West Permian Basin South Texas Mid Continent East

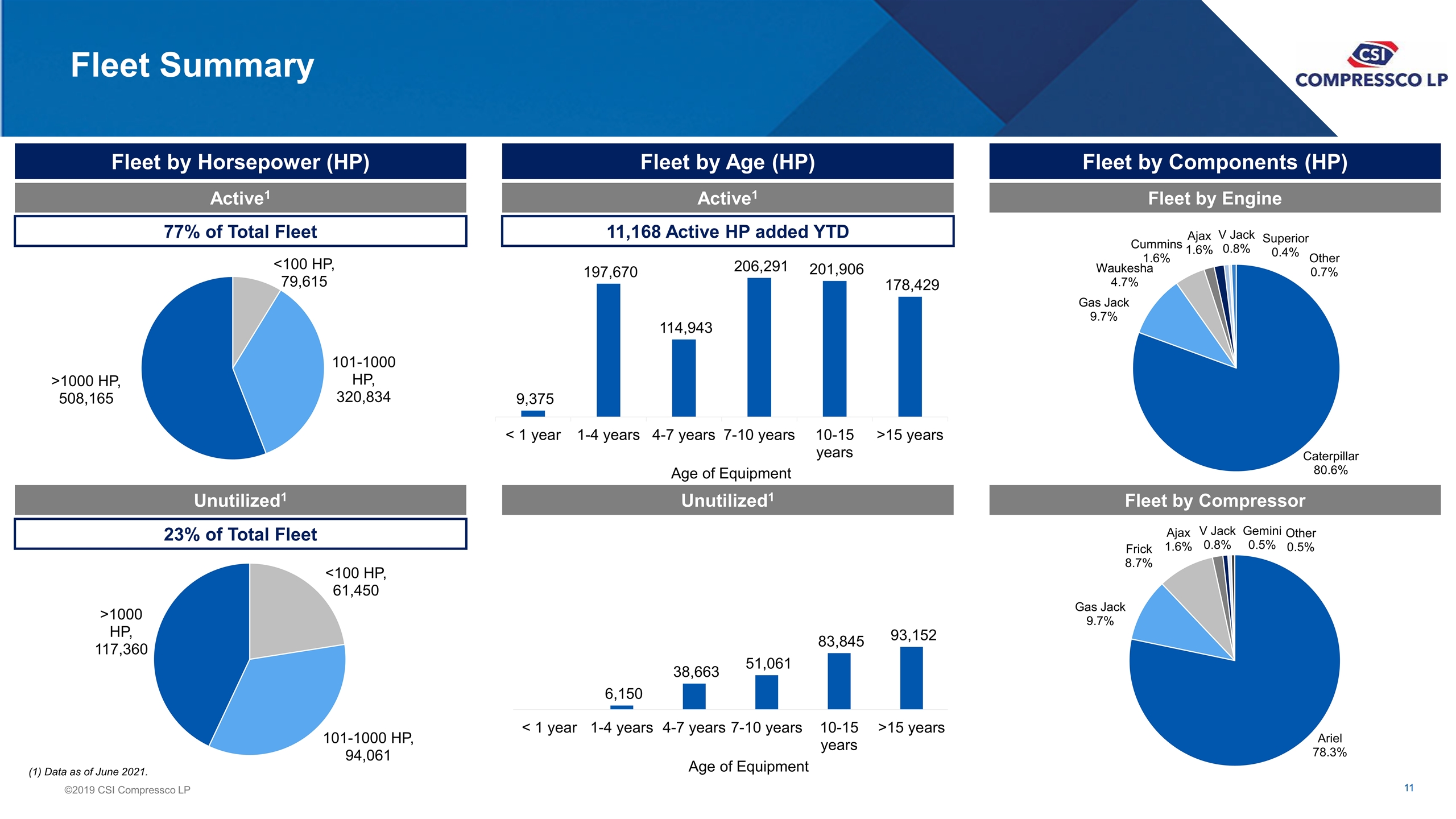

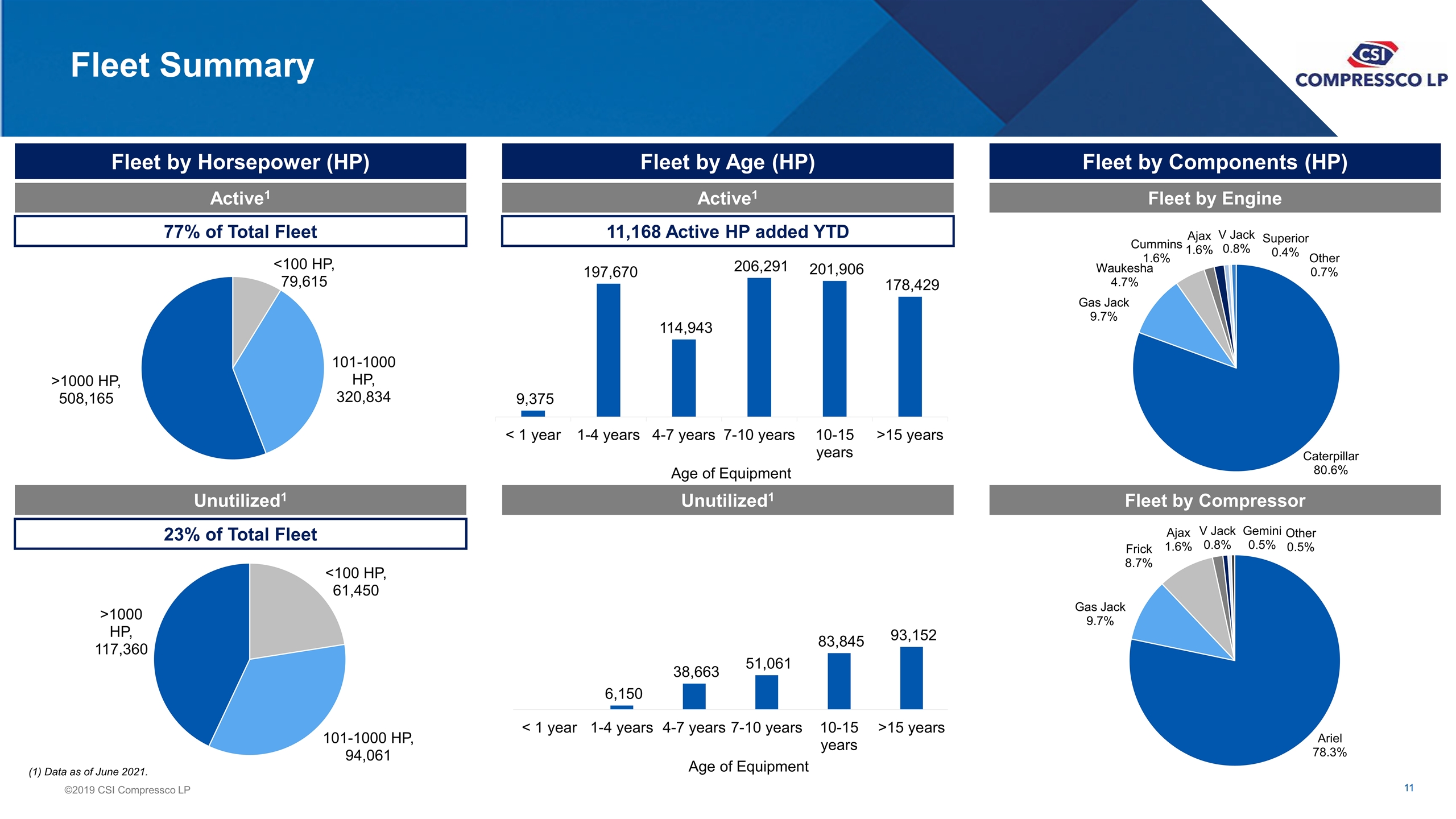

Fleet Summary Fleet by Horsepower (HP) Fleet by Age (HP) Fleet by Components (HP) Active1 Active1 Fleet by Engine Fleet by Compressor Unutilized1 Unutilized1 77% of Total Fleet 23% of Total Fleet Age of Equipment 11,168 Active HP added YTD Age of Equipment (1) Data as of June 2021.

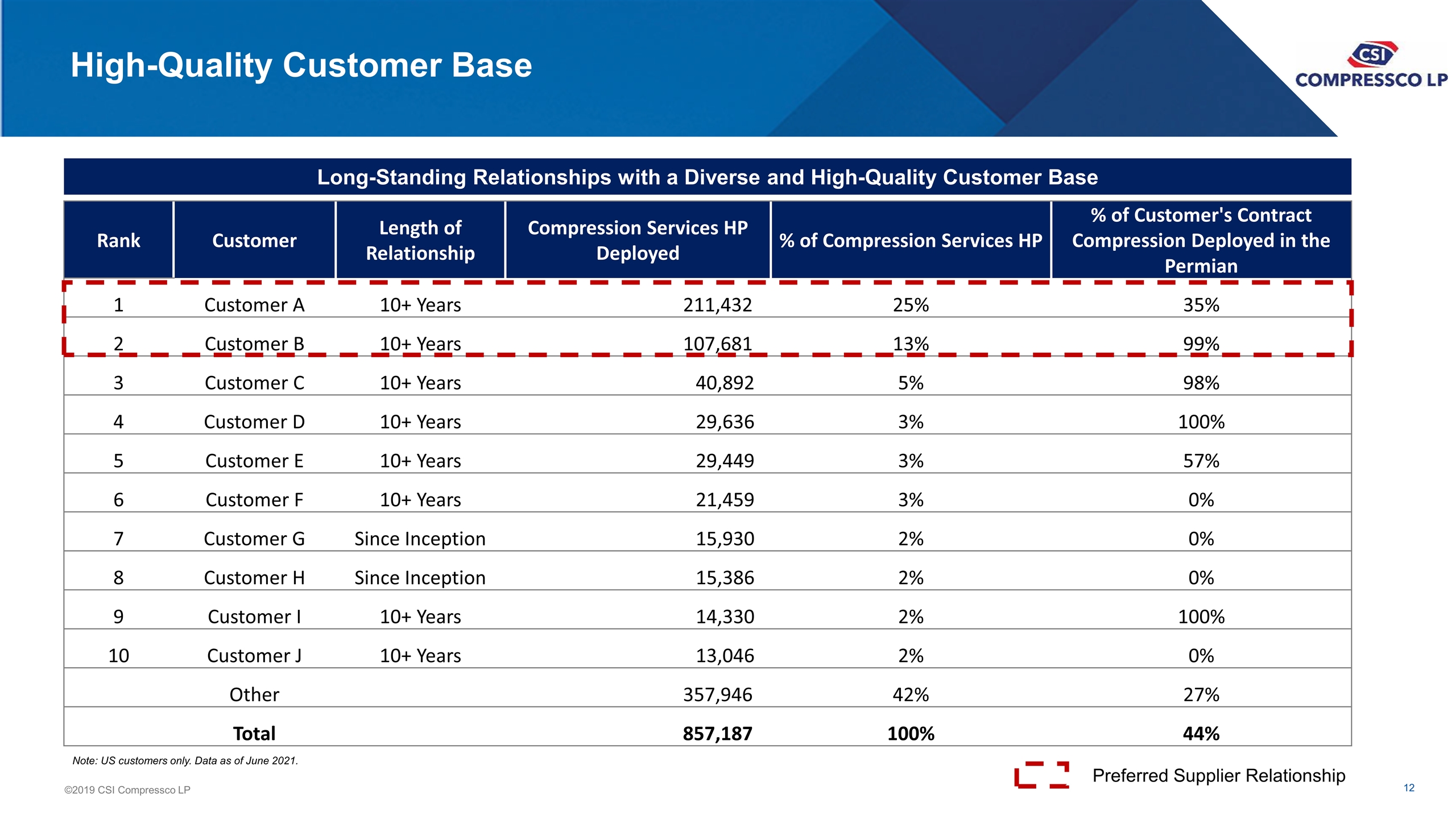

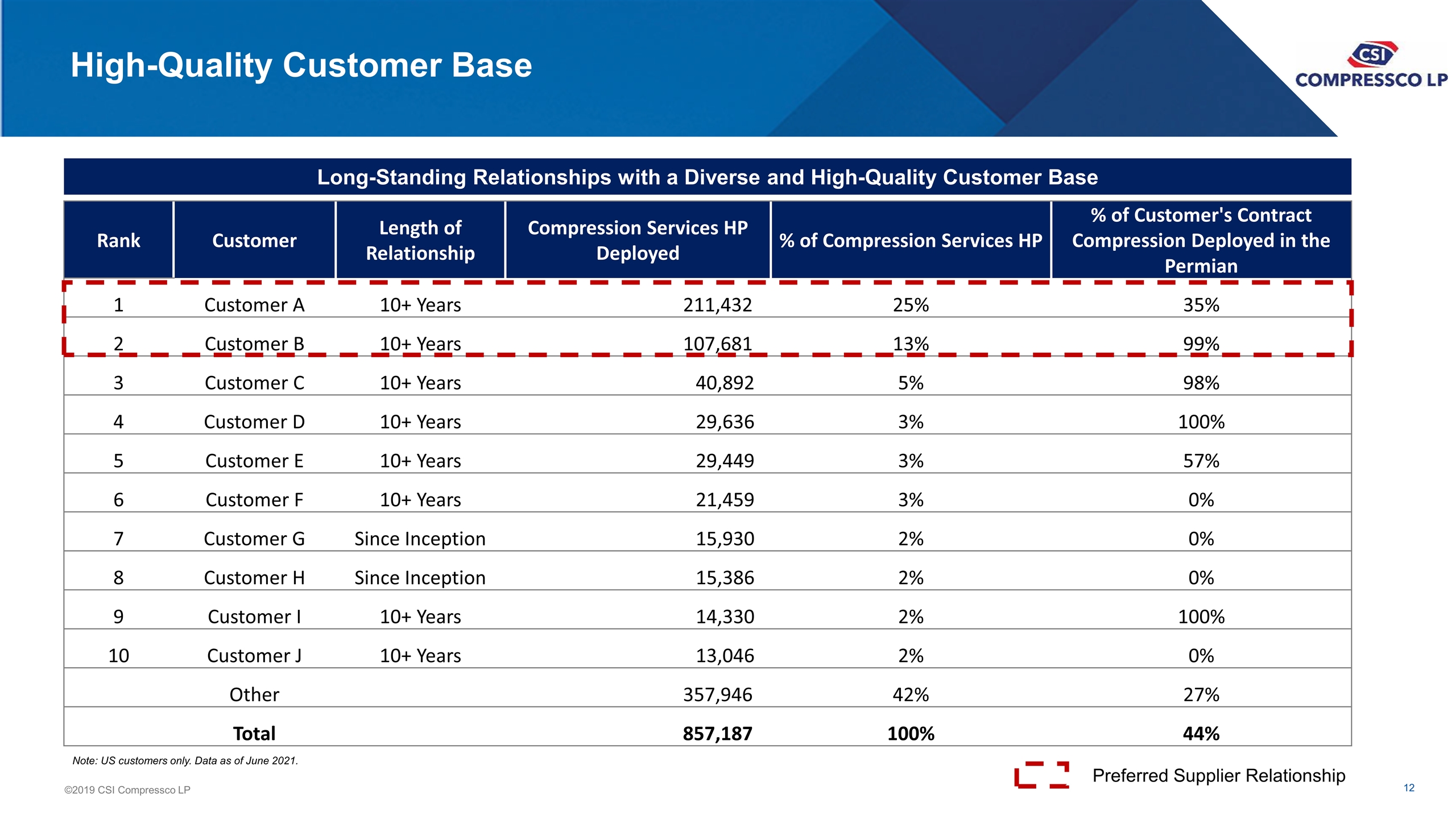

High-Quality Customer Base Rank Customer Length of Relationship Compression Services HP Deployed % of Compression Services HP % of Customer's Contract Compression Deployed in the Permian 1 Customer A 10+ Years 211,432 25% 35% 2 Customer B 10+ Years 107,681 13% 99% 3 Customer C 10+ Years 40,892 5% 98% 4 Customer D 10+ Years 29,636 3% 100% 5 Customer E 10+ Years 29,449 3% 57% 6 Customer F 10+ Years 21,459 3% 0% 7 Customer G Since Inception 15,930 2% 0% 8 Customer H Since Inception 15,386 2% 0% 9 Customer I 10+ Years 14,330 2% 100% 10 Customer J 10+ Years 13,046 2% 0% Other 357,946 42% 27% Total 857,187 100% 44% Long-Standing Relationships with a Diverse and High-Quality Customer Base Note: US customers only. Data as of June 2021. Preferred Supplier Relationship

Spartan Overview

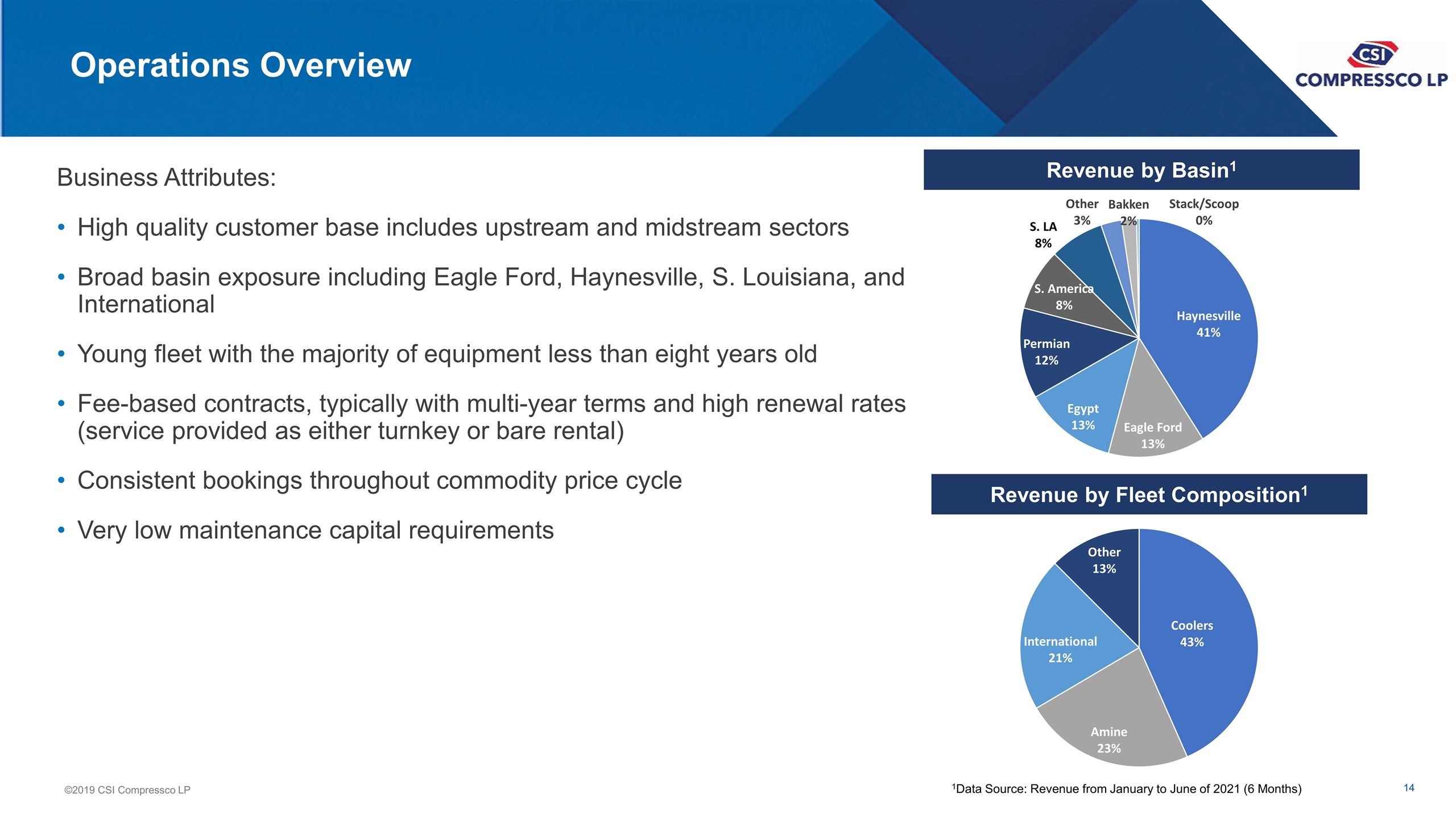

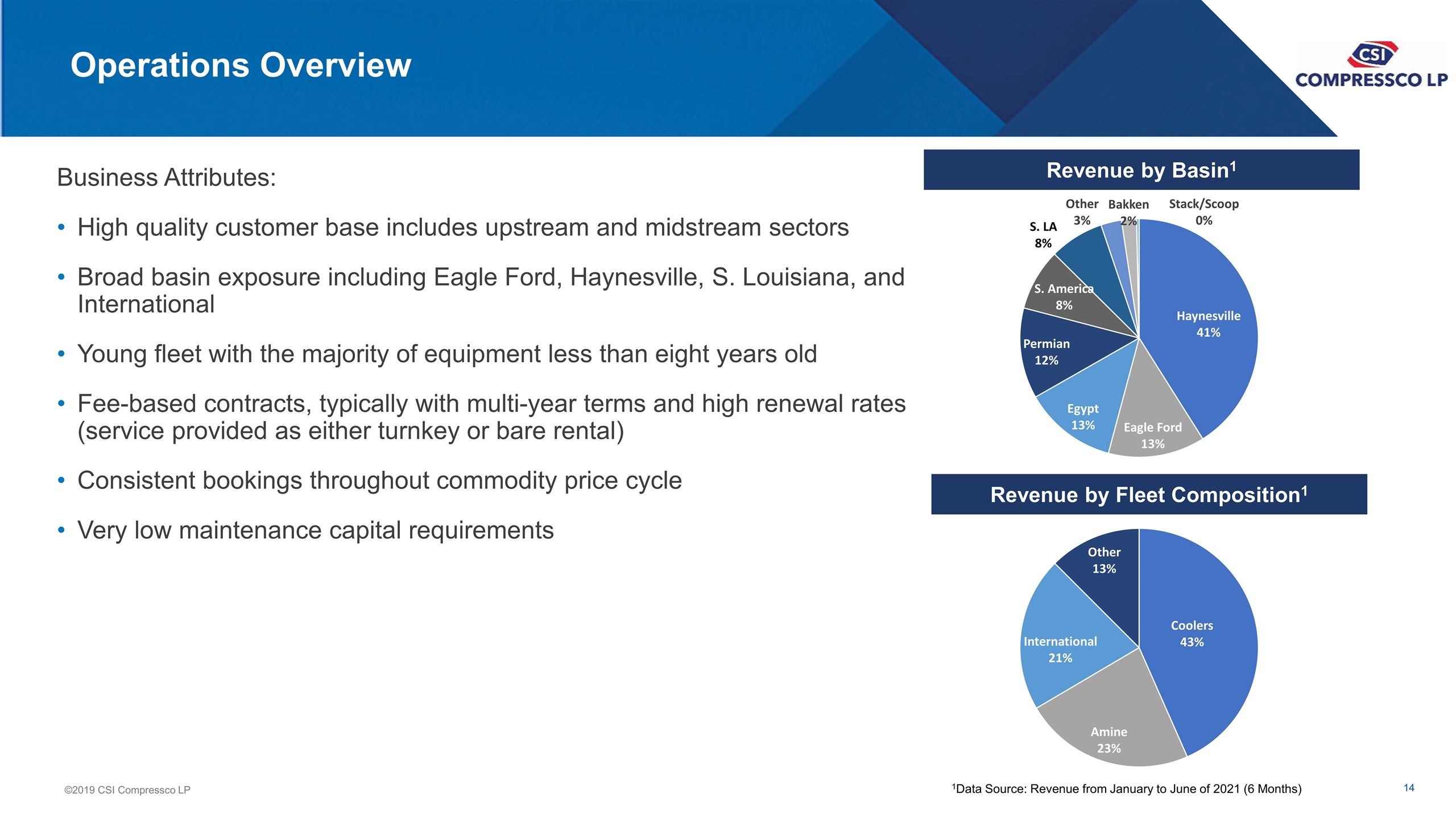

Operations Overview Revenue by Basin1 Business Attributes: High quality customer base includes upstream and midstream sectors Broad basin exposure including Eagle Ford, Haynesville, S. Louisiana, and International Young fleet with the majority of equipment less than eight years old Fee-based contracts, typically with multi-year terms and high renewal rates (service provided as either turnkey or bare rental) Consistent bookings throughout commodity price cycle Very low maintenance capital requirements Revenue by Fleet Composition1 1Data Source: Revenue from January to June of 2021 (6 Months)

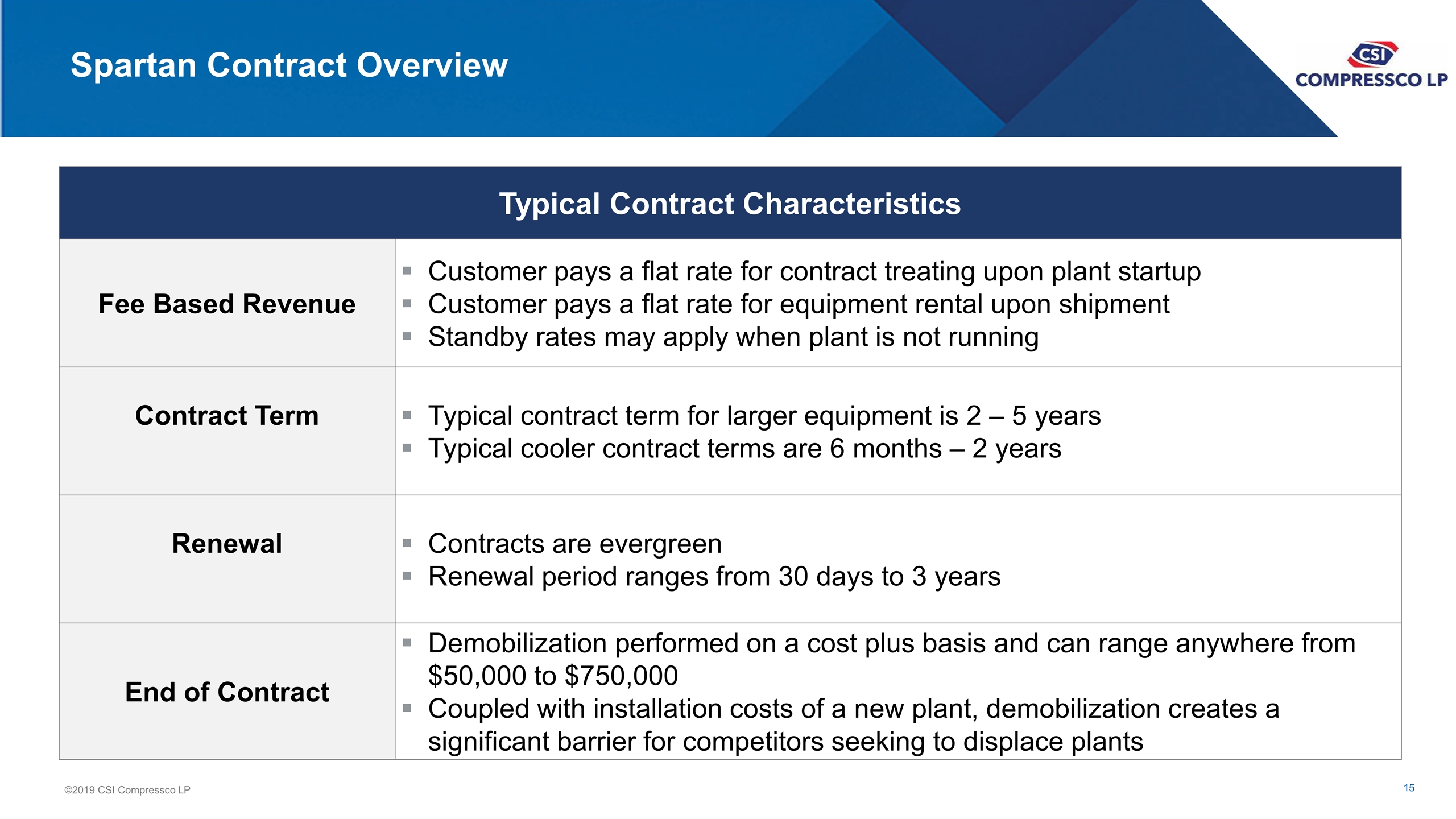

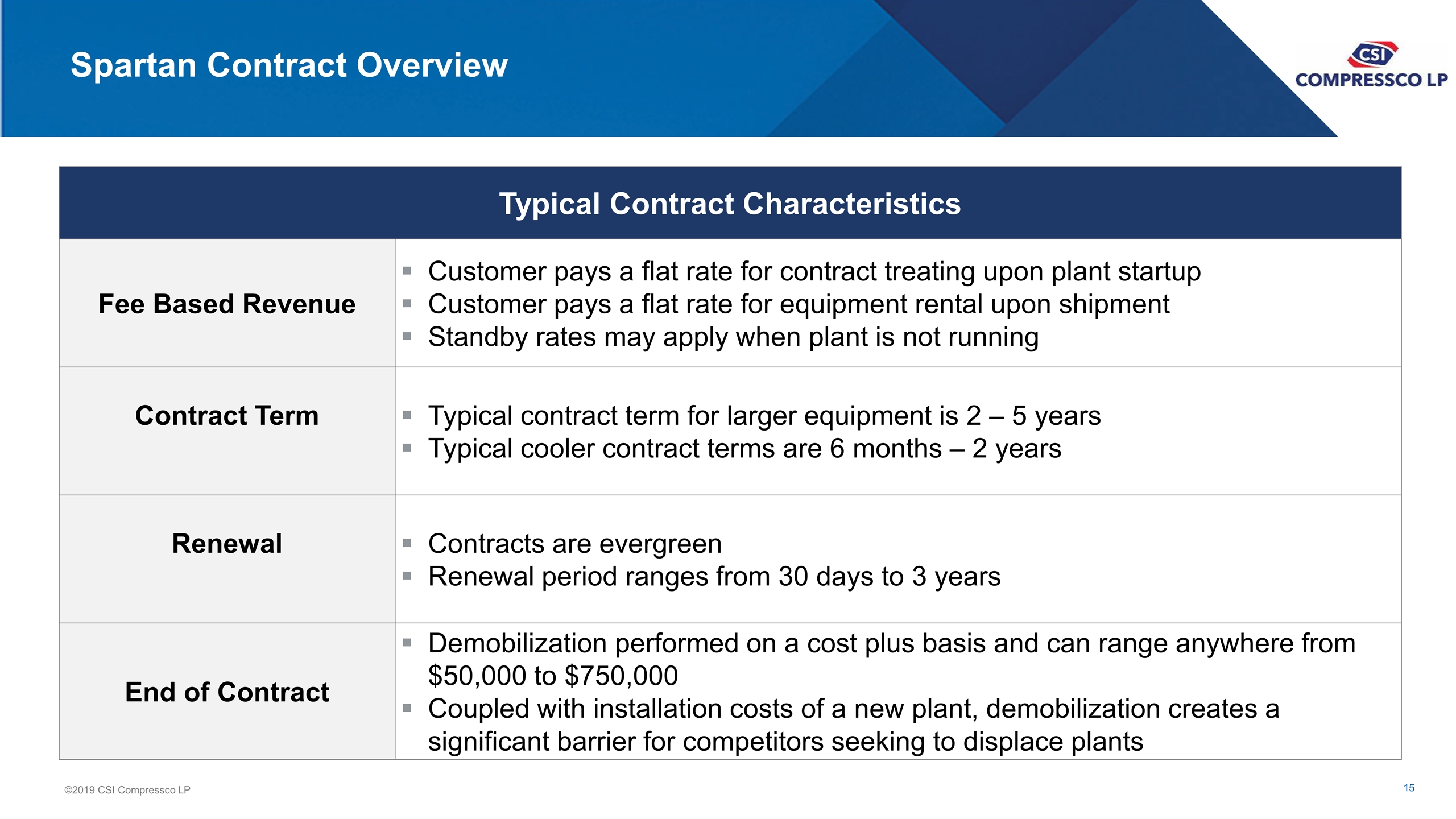

Spartan Contract Overview Typical Contract Characteristics Fee Based Revenue Customer pays a flat rate for contract treating upon plant startup Customer pays a flat rate for equipment rental upon shipment Standby rates may apply when plant is not running Contract Term Typical contract term for larger equipment is 2 – 5 years Typical cooler contract terms are 6 months – 2 years Renewal Contracts are evergreen Renewal period ranges from 30 days to 3 years End of Contract Demobilization performed on a cost plus basis and can range anywhere from $50,000 to $750,000 Coupled with installation costs of a new plant, demobilization creates a significant barrier for competitors seeking to displace plants

Financial Summary

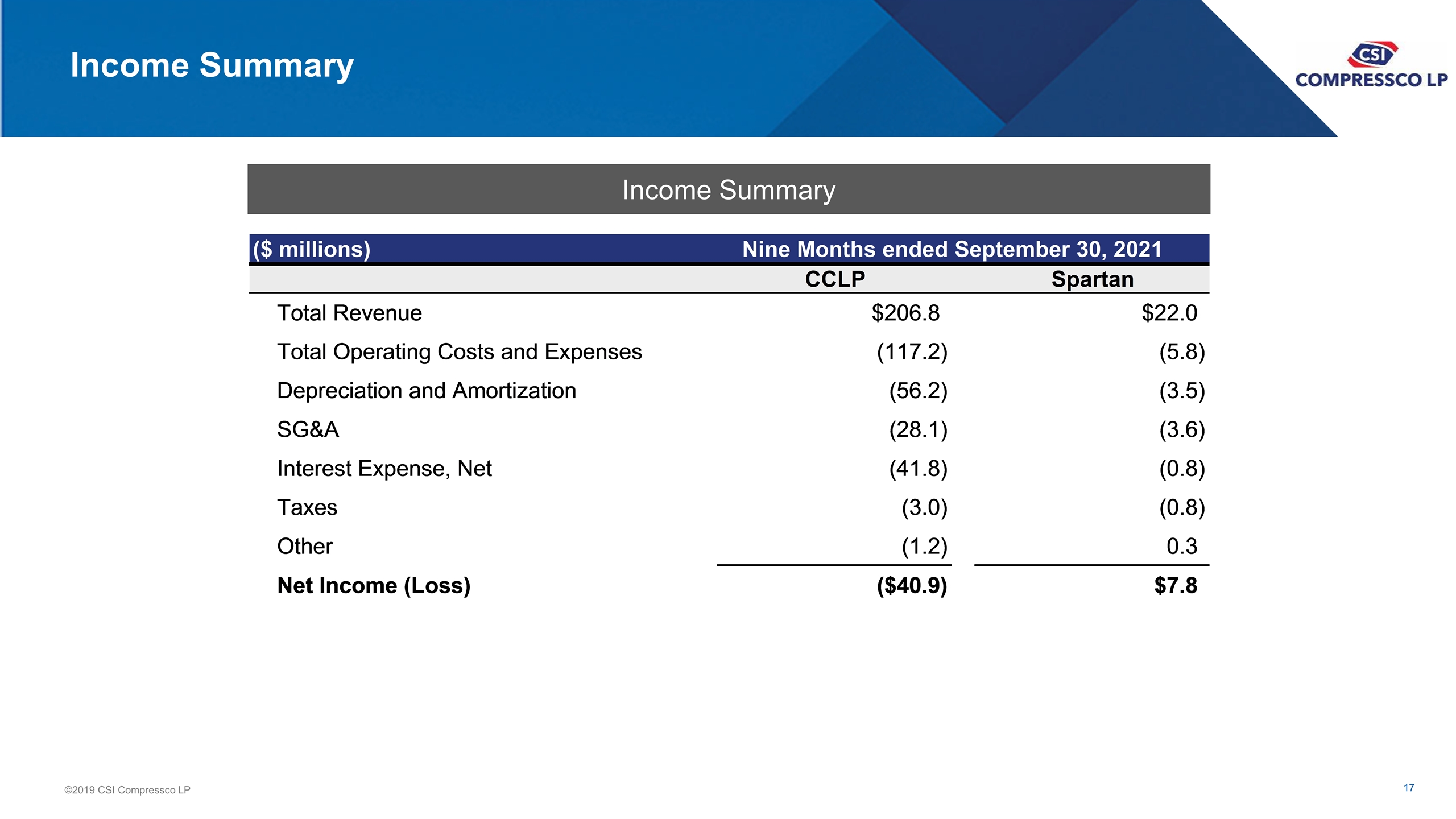

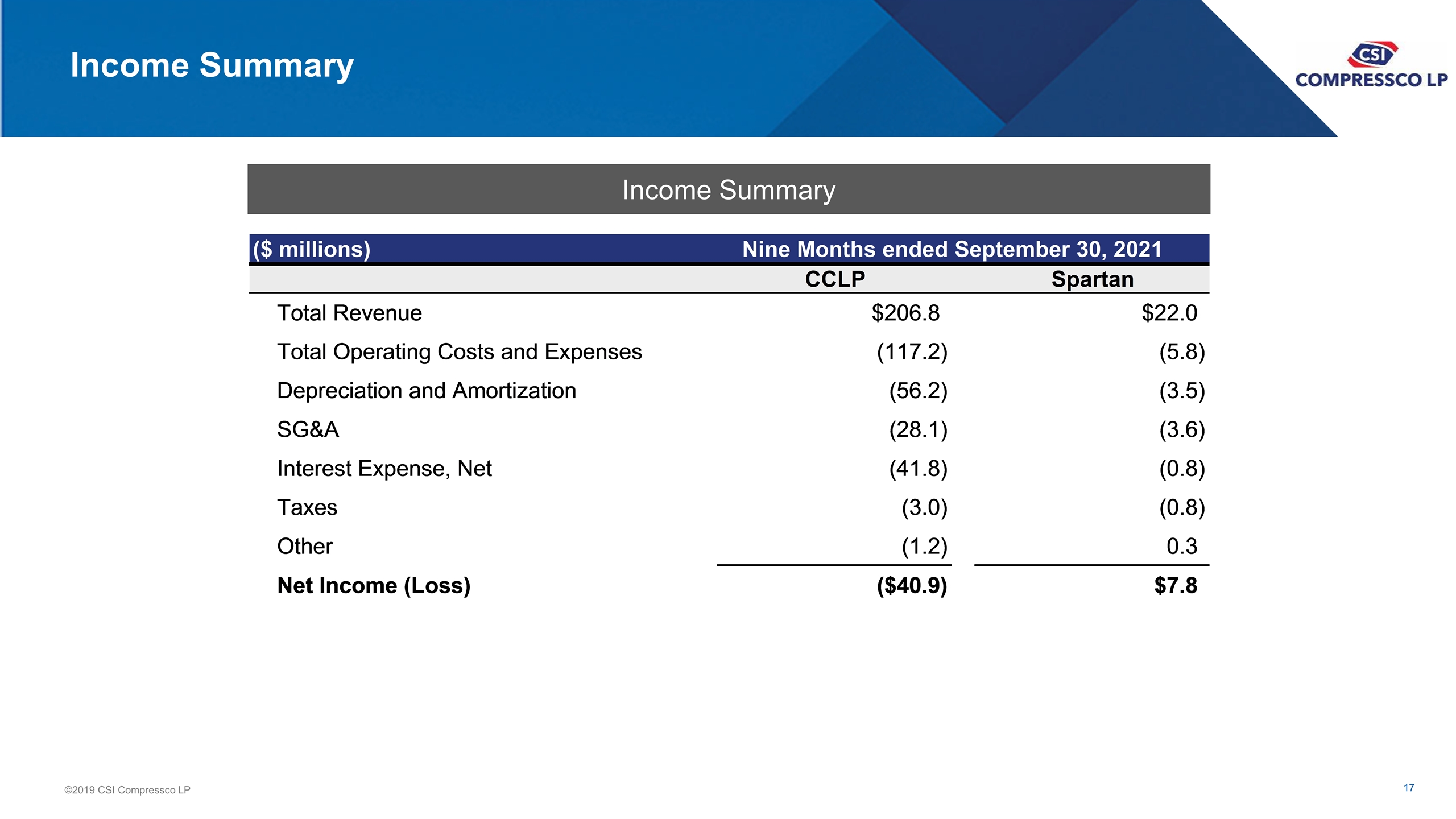

Income Summary Income Summary Gross Margin – Contract Services (%) Gross Margin – AMS (%)

Spartan believes in the transaction, contributing assets and increasing equity ownership in CCLP Key Takeaways Spartan and Other Equity Holders Will be Fully Aligned Reduces Leverage Spartan Contribution Strategic Rationale Increases Liquidity Capital Structure Optimization Provides Financial Flexibility Attractive Valuation All equity holders stand to benefit alongside Spartan should the stock perform well Spartan will own ~45% of pro forma CCLP