December 2019

Forward Looking Statements & Non-GAAP Measures Forward-Looking Statements: This presentation includes certain statements that are or may be deemed to be forward-looking statements. Generally, the use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “projects,” “anticipate,” “believe,” “assume,” “could,” “should,” “plans,” “targets” or similar expressions that convey the uncertainty of future events, activities, expectations or outcomes identify forward-looking statements that the company intends to be included within the safe harbor protections provided by the federal securities laws. These forward-looking statements include statements concerning expected results of operational business segments for 2019, anticipated benefits from our acquisitions of assets and businesses, estimated earnings, and statements regarding our beliefs, expectations, plans, goals, future events and performance, and other statements that are not purely historical. These forward-looking statements are based on certain assumptions and analyses made in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond our control. Investors are cautioned that any such statements are not guarantees of future performance or results and that actual results or developments may differ materially from those projected in the forward-looking statements. Some of the factors that could affect actual results are described in the section titled “Risk Factors” contained in the Annual Report on Form 10-K for the year ended December 31, 2018, for CSI Compressco LP (“CCLP”) as well as other risks identified from time to time in the reports on Form 10-Q and Form 8-K filed by CCLP with the Securities and Exchange Commission. Statements in this presentation are made as of the date on the cover unless stated otherwise herein. CCLP is under no obligation to update or keep current the information contained in this document. Further Disclosure Regarding the Use of Non-GAAP Measures: Management views revenue, cash from operating activities, distributable cash flow (“DCF”), and Adjusted EBITDA as useful measures to assess our performance in prior periods. Adjusted EBITDA, a performance measure used by management, is defined as net income (loss) plus: (1) interest expense (net of interest income), (2) income tax provision, (3) non-cash cost of compressors sold (4) depreciation, amortization, accretion and impairments, (5) equity compensation expense, and (6) other unusual items. The Partnership defines DCF as Adjusted EBITDA less current income tax expense, maintenance capital expenditures, and interest expense, plus non-cash interest expense. Adjusted EBITDA and DCF are not defined under GAAP and do not purport to be an alternative to net income or any other GAAP financial measures as a measure of operating performance. Because not all companies use identical calculations, our presentation of Adjusted EBITDA and DCF may not be comparable to other similarly titled measures of other companies. Management views Adjusted EBITDA and DCF as useful to investors and other external users of our consolidated financial statements as an additional tool to evaluate and compare our operating performance, because Adjusted EBITDA and DCF are a measurement of a company’s operating performance without regard to items such as interest expense, taxes, depreciation, and amortization, which can vary substantially from company to company. The reconciliation included in the Financial Data Appendix to this presentation is not a substitute for financial information prepared in accordance with GAAP, and should be considered within the context of our complete financial results for the periods indicated, which are available on our website at www.csicompressco.com.

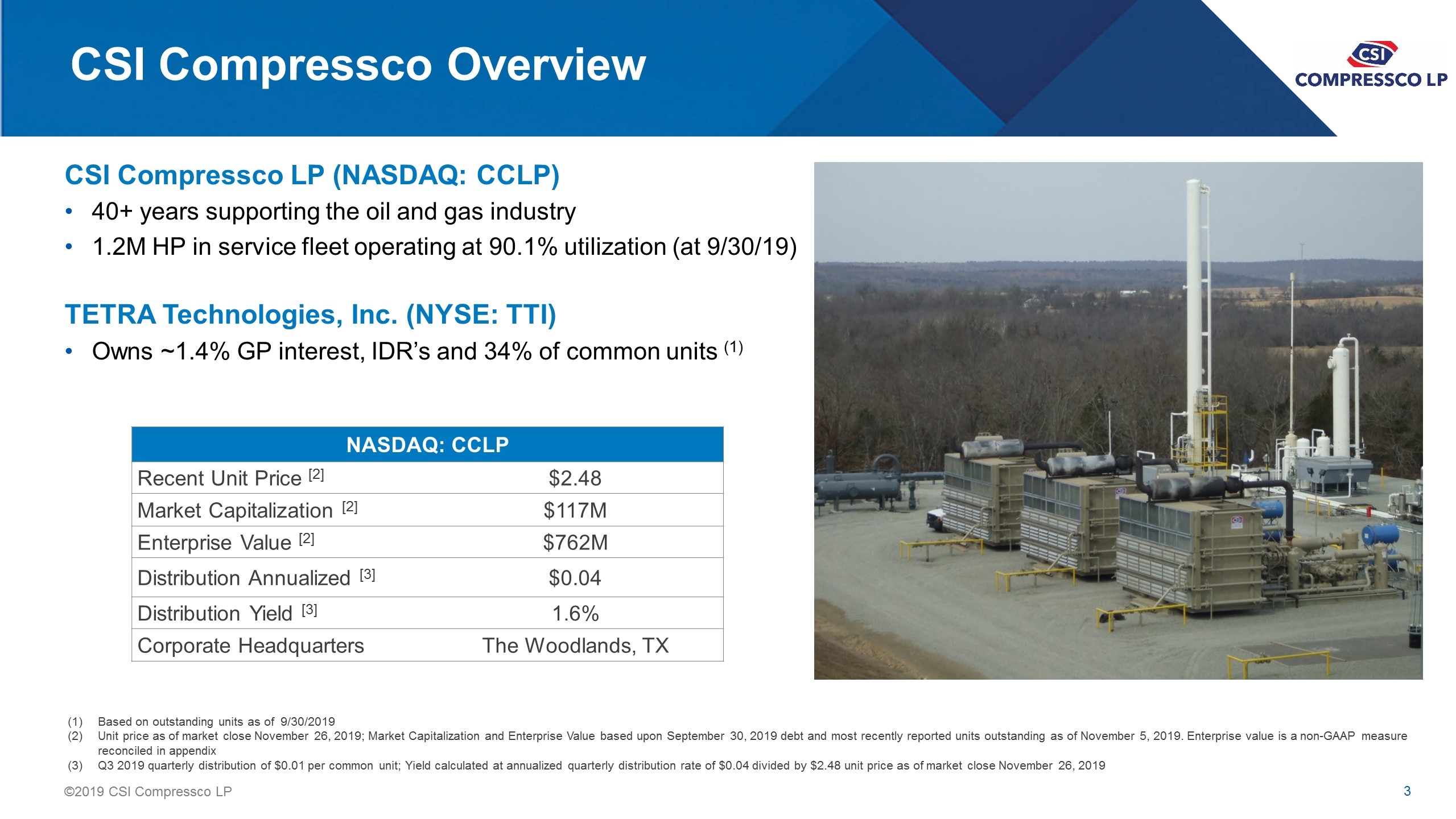

CSI Compressco Overview CSI Compressco LP (NASDAQ: CCLP) 40+ years supporting the oil and gas industry 1.2M HP in service fleet operating at 90.1% utilization (at 9/30/19) TETRA Technologies, Inc. (NYSE: TTI) Owns ~1.4% GP interest, IDR’s and 34% of common units (1) NASDAQ: CCLP Recent Unit Price [2] $2.48 Market Capitalization [2] $117M Enterprise Value [2] $762M Distribution Annualized [3] $0.04 Distribution Yield [3] 1.6% Corporate Headquarters The Woodlands, TX Based on outstanding units as of 9/30/2019 Unit price as of market close November 26, 2019; Market Capitalization and Enterprise Value based upon September 30, 2019 debt and most recently reported units outstanding as of November 5, 2019. Enterprise value is a non-GAAP measure reconciled in appendix Q3 2019 quarterly distribution of $0.01 per common unit; Yield calculated at annualized quarterly distribution rate of $0.04 divided by $2.48 unit price as of market close November 26, 2019

Q3 2019 Highlights On November 6, 2019, re-affirmed 2019 adjusted EBITDA(1) guidance of $125M-$130M Continued improvements in Compression Services revenues and margins Highest high gross margins of 53.2% since the acquisition of Compressor Systems, Inc. in 2014 Improvement in gross margin for compression services was a function of (a) higher pricing, (b) deploying new capital generating ROIC of ~20% (c) placing new capital where existing equipment is concentrated, and (d) cost initiatives Utilization for the fleet is 90.1%, up 100 basis points sequentially The utilization for >1,000 horsepower equipment was 97.4%(2) Utilized $31.9M of cash to complete redemption of Series A Preferred Units in 2019 Capital disciplined by selectively deploying capital to limited core customers Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP Reconciliation” in appendix for more information and reconciliation to net loss. (2) As of September 30, 2019

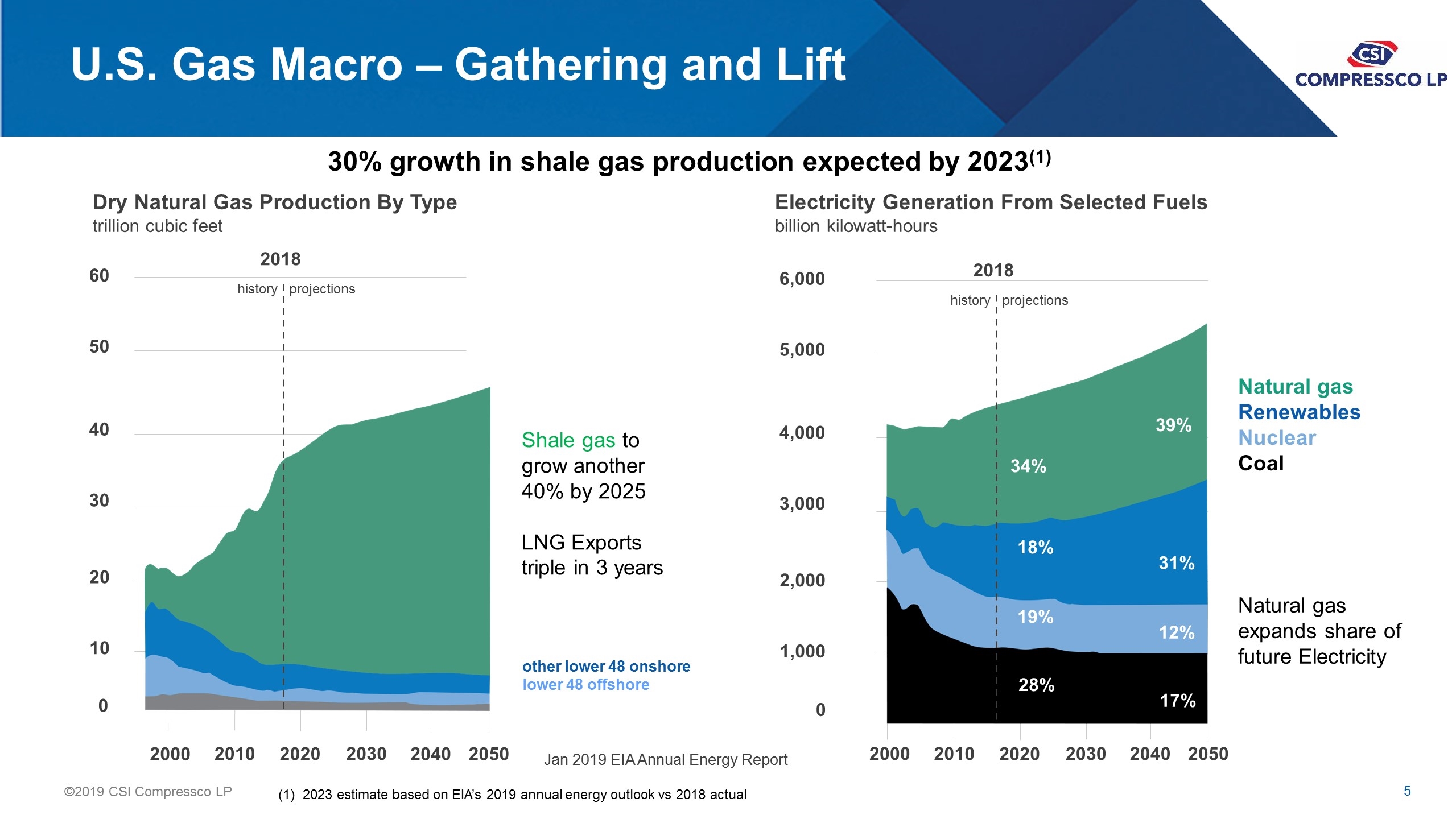

U.S. Gas Macro – Gathering and Lift Jan 2019 EIA Annual Energy Report Natural gas Renewables Nuclear Coal Natural gas expands share of future Electricity Electricity Generation From Selected Fuels billion kilowatt-hours 6,000 5,000 4,000 3,000 2,000 1,000 0 2000 2010 2020 2030 2050 2040 2018 history projections 34% 18% 19% 28% 39% 31% 12% 17% Dry Natural Gas Production By Type trillion cubic feet 60 50 40 30 20 10 0 2000 2010 2020 2030 2050 2040 2018 history projections other lower 48 onshore lower 48 offshore Shale gas to grow another 40% by 2025 LNG Exports triple in 3 years 30% growth in shale gas production expected by 2023(1) (1) 2023 estimate based on EIA’s 2019 annual energy outlook vs 2018 actual

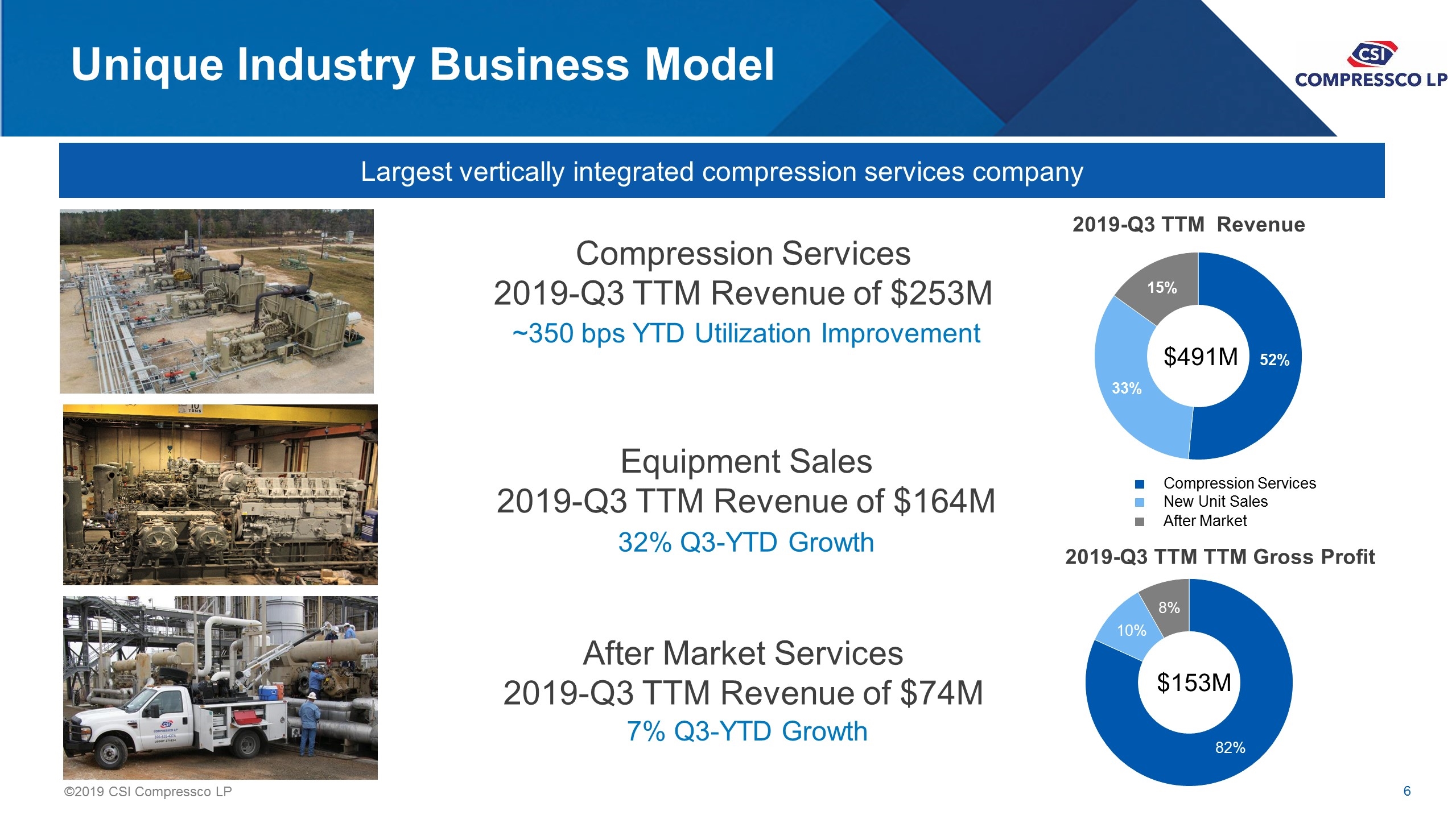

Unique Industry Business Model Equipment Sales 2019-Q3 TTM Revenue of $164M Compression Services 2019-Q3 TTM Revenue of $253M After Market Services 2019-Q3 TTM Revenue of $74M Largest vertically integrated compression services company 7% Q3-YTD Growth 32% Q3-YTD Growth ~350 bps YTD Utilization Improvement 2019-Q3 TTM Revenue 2019-Q3 TTM TTM Gross Profit Compression Services New Unit Sales After Market $491M $153M

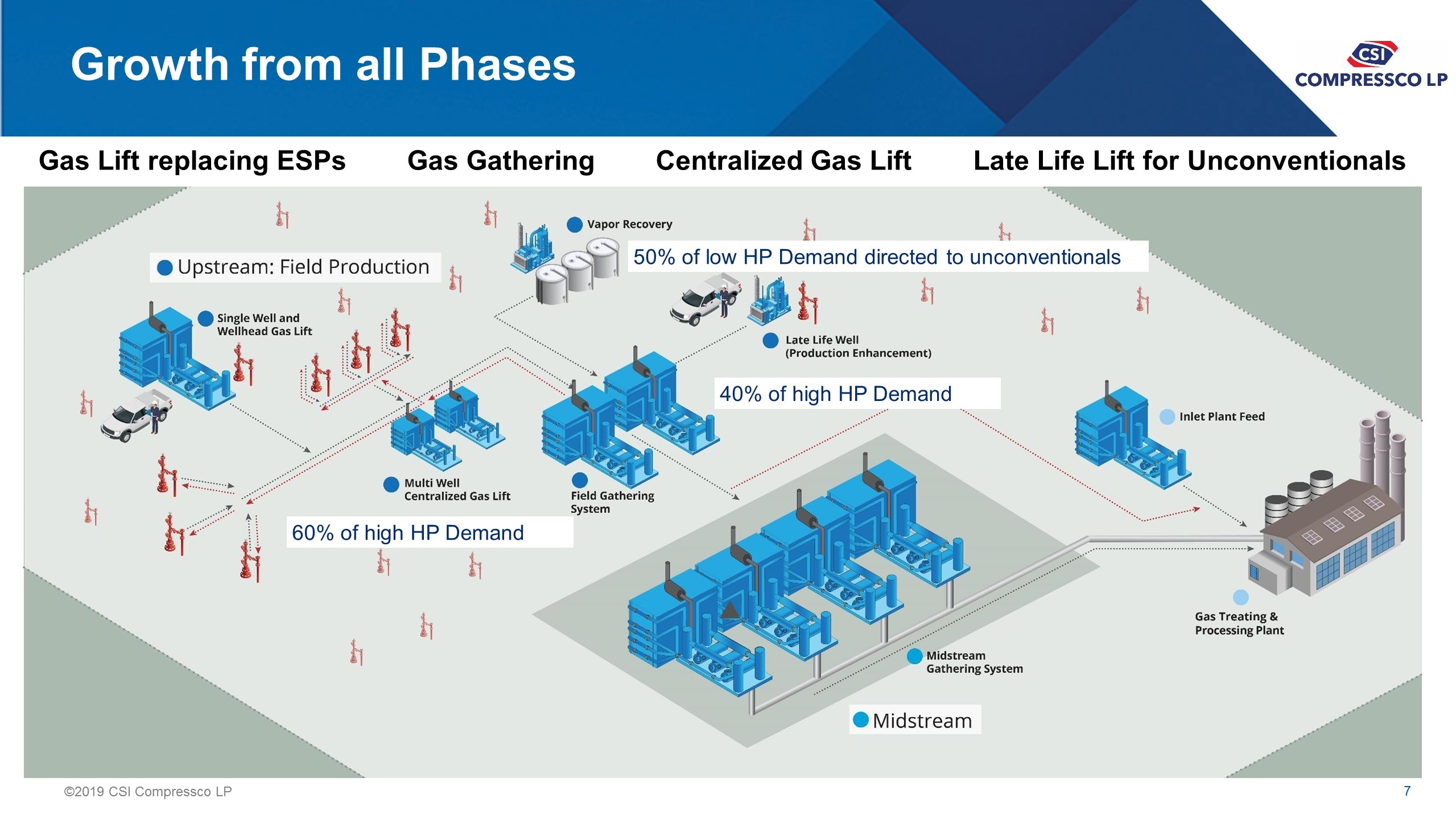

Growth from all Phases Gas Lift replacing ESPs Gas Gathering Centralized Gas Lift Late Life Lift for Unconventionals 60% of high HP Demand 40% of high HP Demand 50% of low HP Demand directed to unconventionals

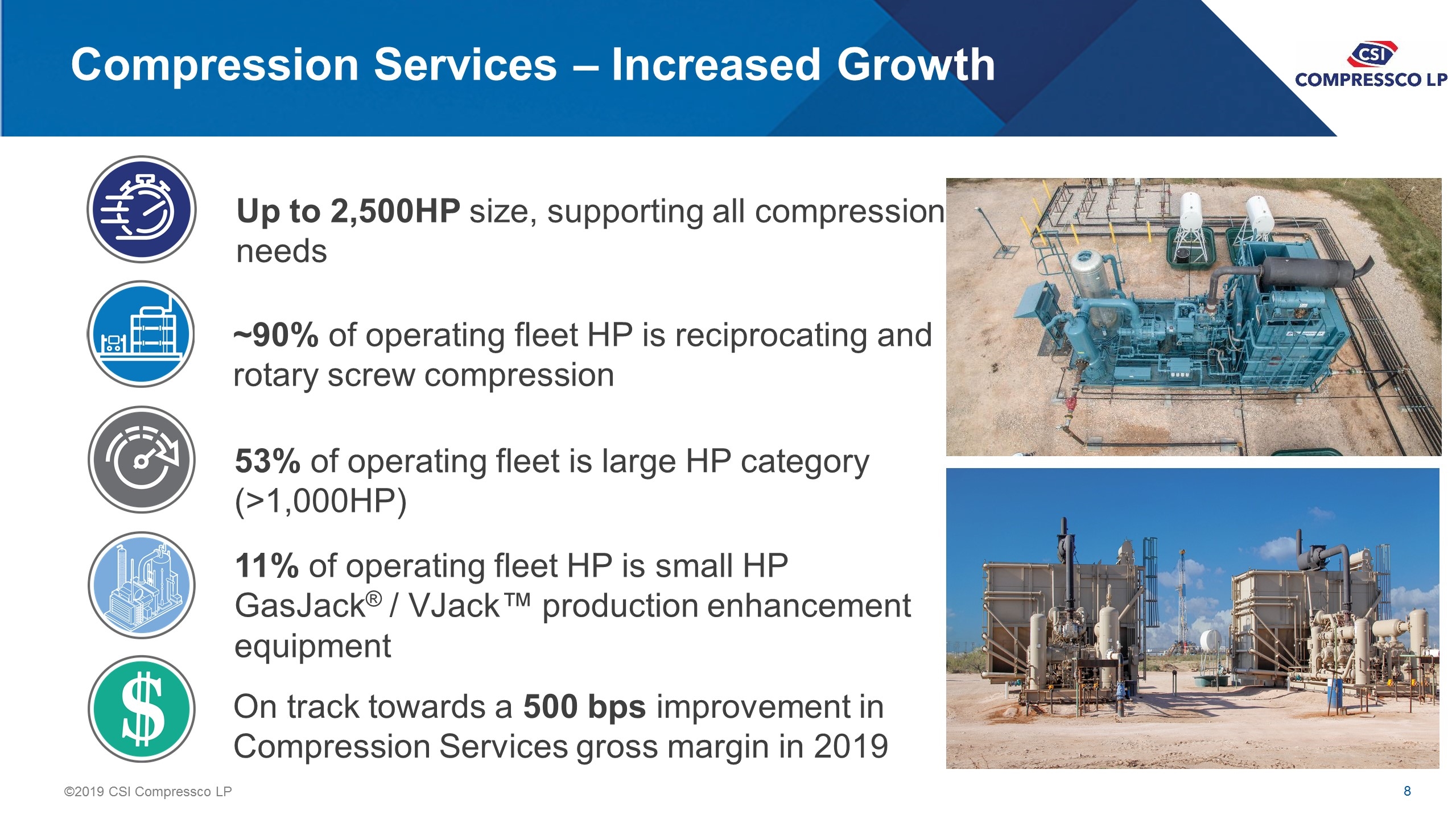

Compression Services – Increased Growth Up to 2,500HP size, supporting all compression needs ~90% of operating fleet HP is reciprocating and rotary screw compression 11% of operating fleet HP is small HP GasJack® / VJack™ production enhancement equipment 53% of operating fleet is large HP category (>1,000HP) On track towards a 500 bps improvement in Compression Services gross margin in 2019

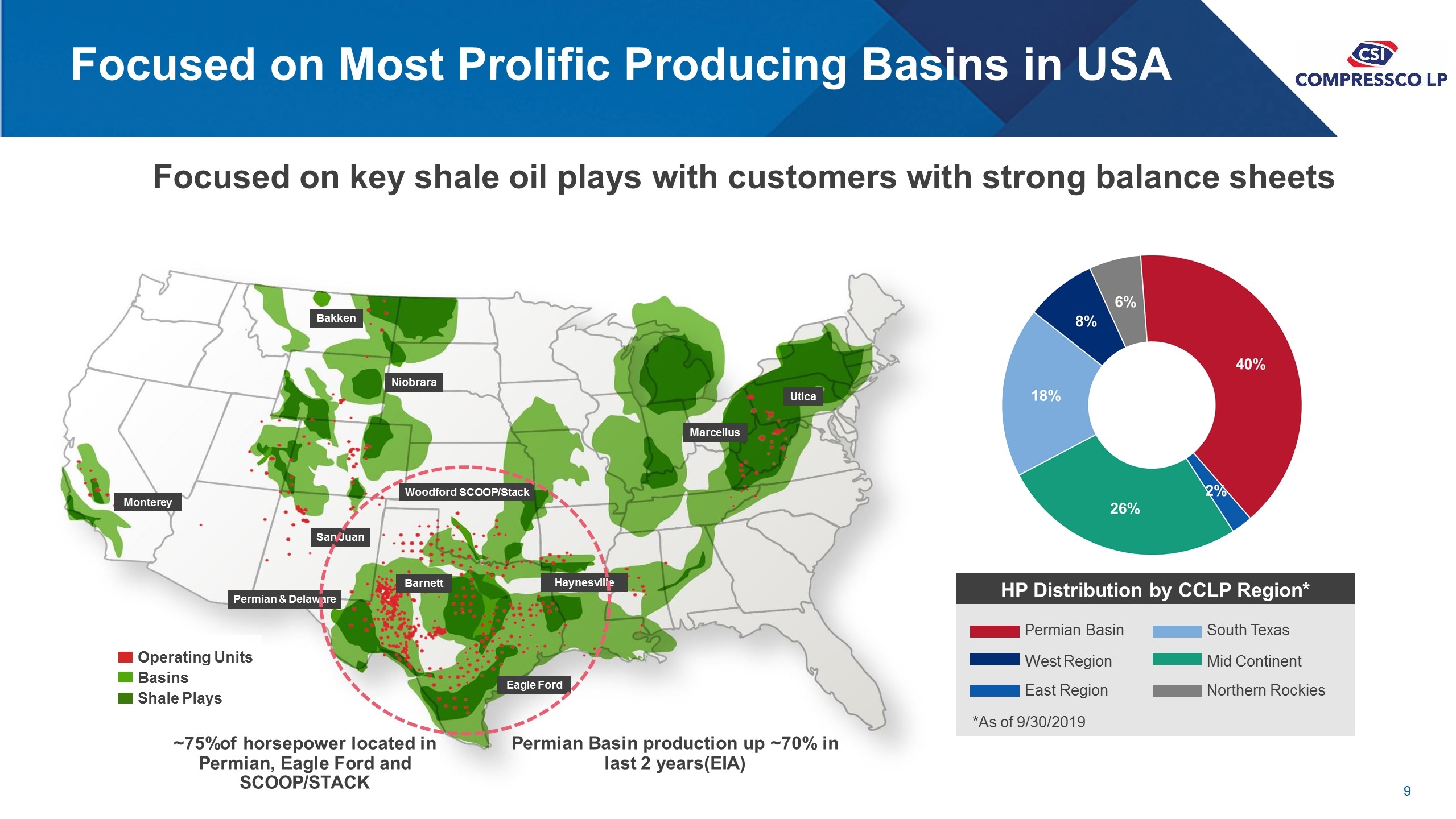

Focused on Most Prolific Producing Basins in USA Focused on key shale oil plays with customers with strong balance sheets Permian Basin West Region East Region South Texas Mid Continent Northern Rockies HP Distribution by CCLP Region* *As of 9/30/2019 Eagle Ford Marcellus Utica Permian & Delaware Barnett Haynesville Bakken Niobrara Monterey San Juan Woodford SCOOP/Stack Operating Units Basins Shale Plays ~75%of horsepower located in Permian, Eagle Ford and SCOOP/STACK Permian Basin production up ~70% in last 2 years(EIA)

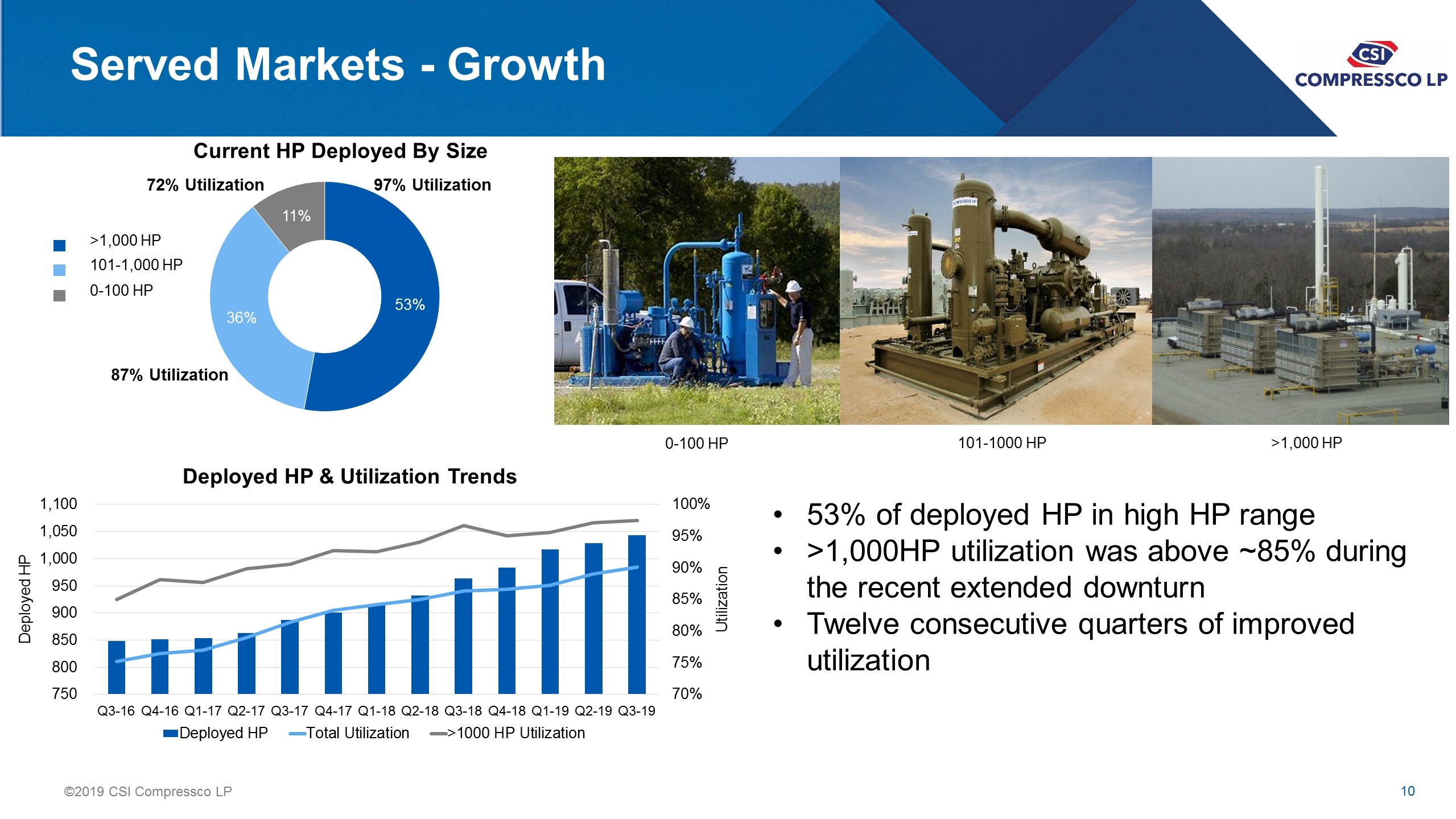

Served Markets - Growth Deployed HP & Utilization Trends 53% of deployed HP in high HP range >1,000HP utilization was above ~85% during the recent extended downturn Twelve consecutive quarters of improved utilization >1,000 HP 101-1,000 HP 0-100 HP Current HP Deployed By Size 97% Utilization 72% Utilization 87% Utilization 0-100 HP 101-1000 HP >1,000 HP

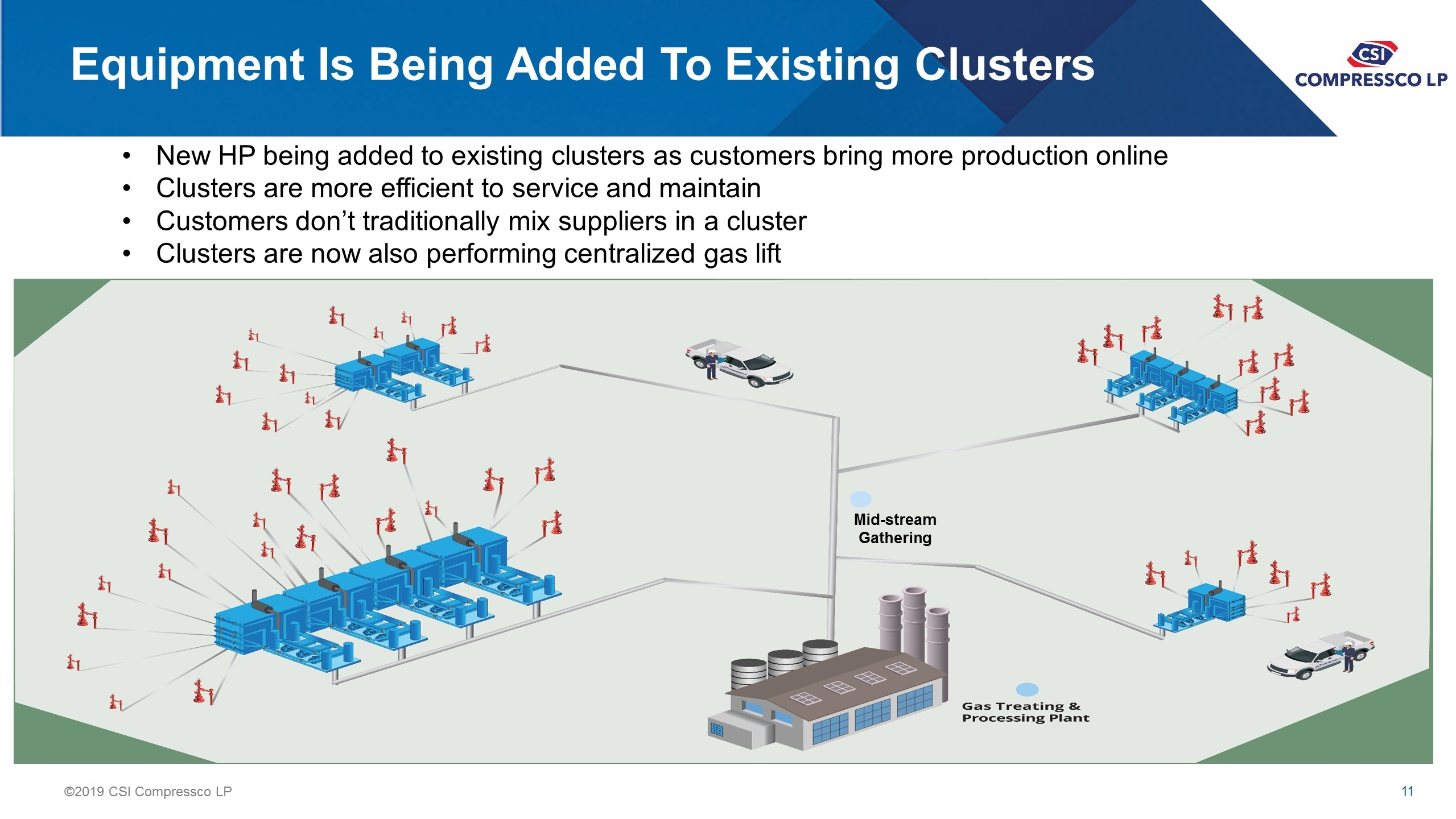

Equipment Is Being Added To Existing Clusters New HP being added to existing clusters as customers bring more production online Clusters are more efficient to service and maintain Customers don’t traditionally mix suppliers in a cluster Clusters are now also performing centralized gas lift Mid-stream Gathering

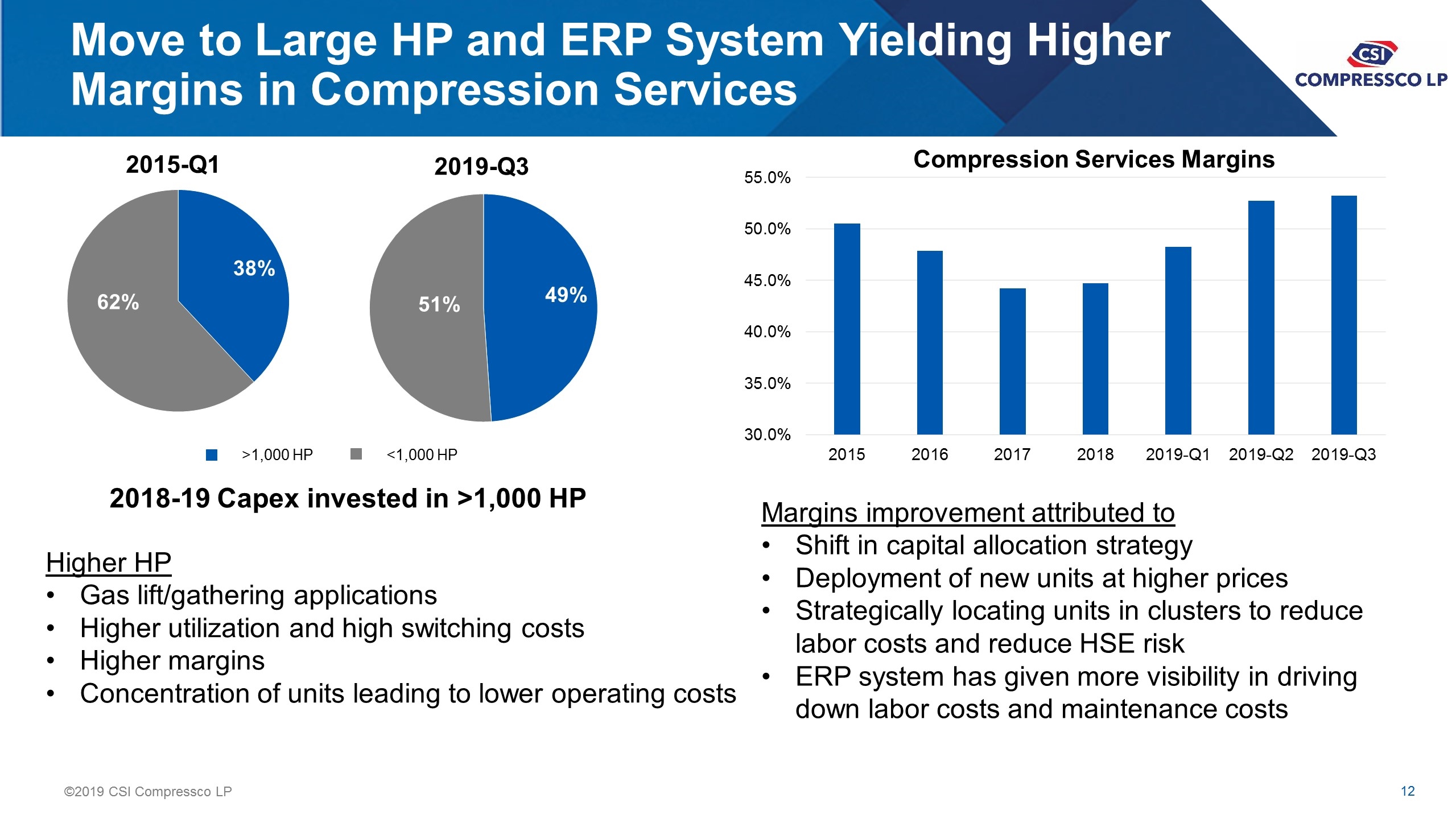

Move to Large HP and ERP System Yielding Higher Margins in Compression Services Higher HP Gas lift/gathering applications Higher utilization and high switching costs Higher margins Concentration of units leading to lower operating costs >1,000 HP <1,000 HP 2015-Q1 2019-Q3 Margins improvement attributed to Shift in capital allocation strategy Deployment of new units at higher prices Strategically locating units in clusters to reduce labor costs and reduce HSE risk ERP system has given more visibility in driving down labor costs and maintenance costs Compression Services Margins 2018-19 Capex invested in >1,000 HP

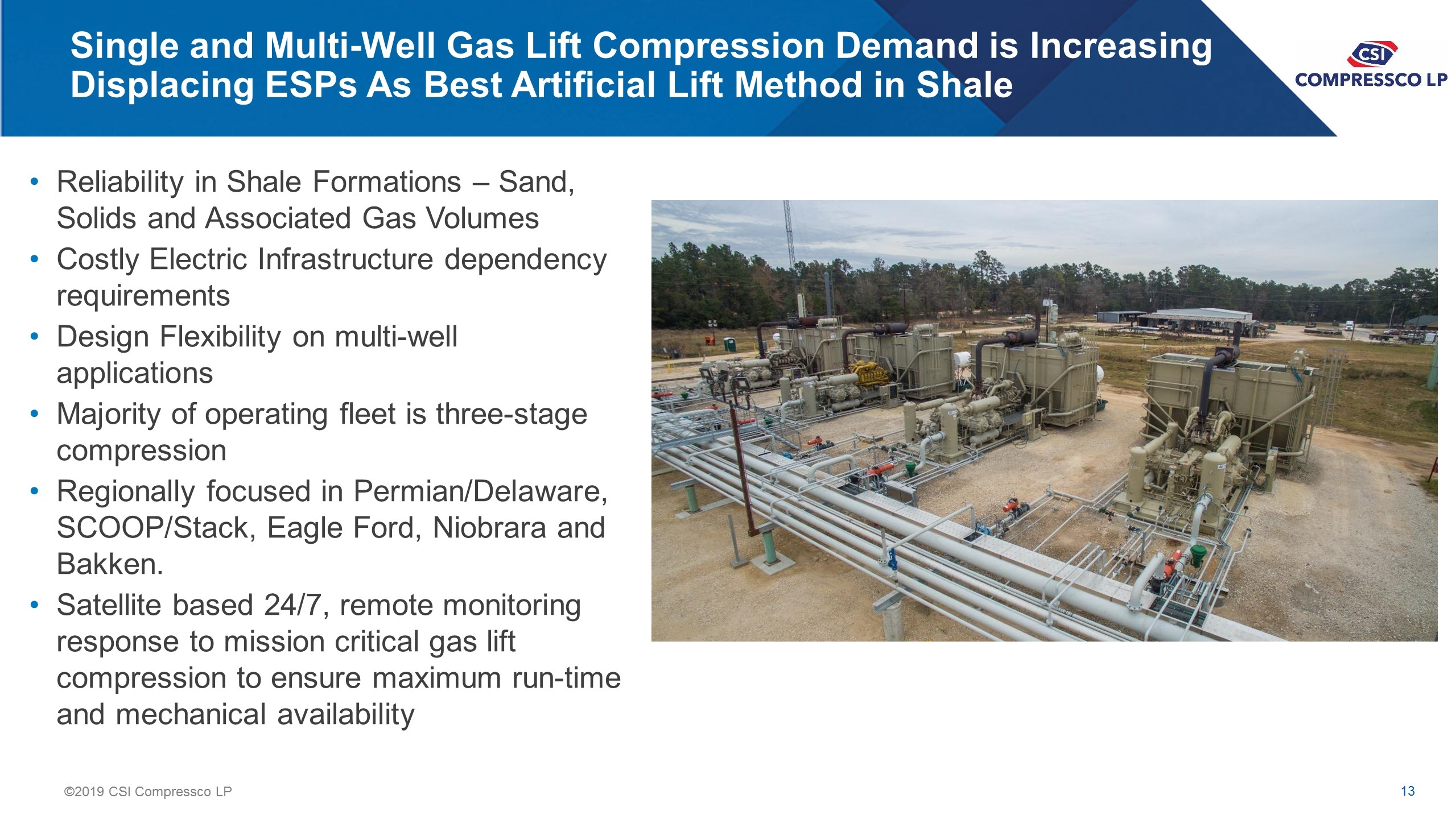

Single and Multi-Well Gas Lift Compression Demand is Increasing Displacing ESPs As Best Artificial Lift Method in Shale Reliability in Shale Formations – Sand, Solids and Associated Gas Volumes Costly Electric Infrastructure dependency requirements Design Flexibility on multi-well applications Majority of operating fleet is three-stage compression Regionally focused in Permian/Delaware, SCOOP/Stack, Eagle Ford, Niobrara and Bakken. Satellite based 24/7, remote monitoring response to mission critical gas lift compression to ensure maximum run-time and mechanical availability

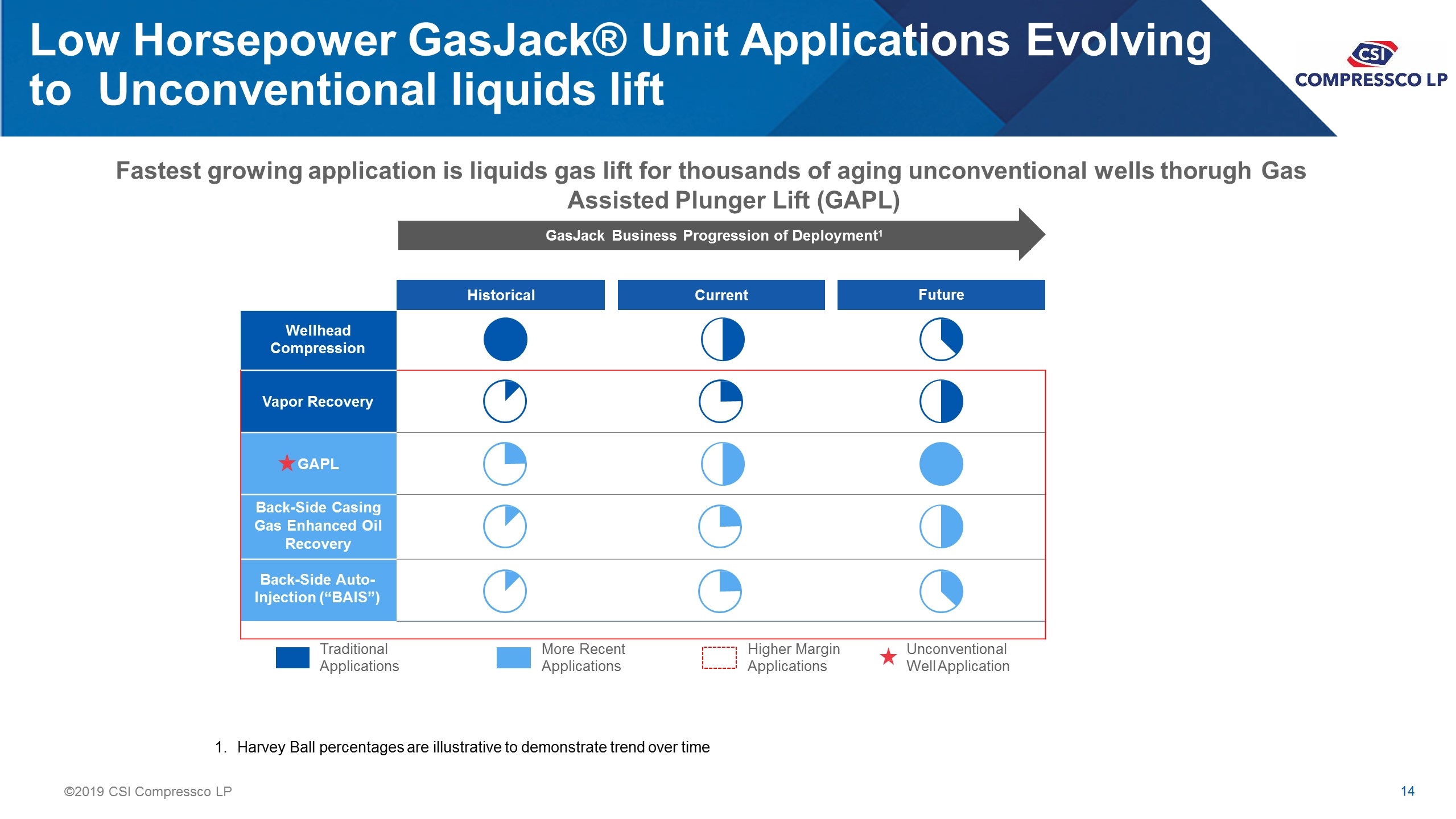

Low Horsepower GasJack® Unit Applications Evolving to Unconventional liquids lift Fastest growing application is liquids gas lift for thousands of aging unconventional wells thorugh Gas Assisted Plunger Lift (GAPL) GasJack Business Progression of Deployment1 1.Harvey Ball percentages are illustrative to demonstrate trend over time Traditional Applications More Recent Applications Higher Margin Applications Historical Current Future Wellhead Compression Vapor Recovery GAPL Back-Side Casing Gas Enhanced Oil Recovery Back-Side Auto- Injection (“BAIS”) Unconventional Well Application

New Unit and After Market Service Offerings Largest compression fabrication facility in the Permian Basin Integrated business model is highly capital efficient generating positive working capital with no new capital required for growth High RONCE for New Unit and After Market strong contributors to growth and returns Pull-through revenue from New Unit Sales – Contract maintenance opportunities Growing customer installed base

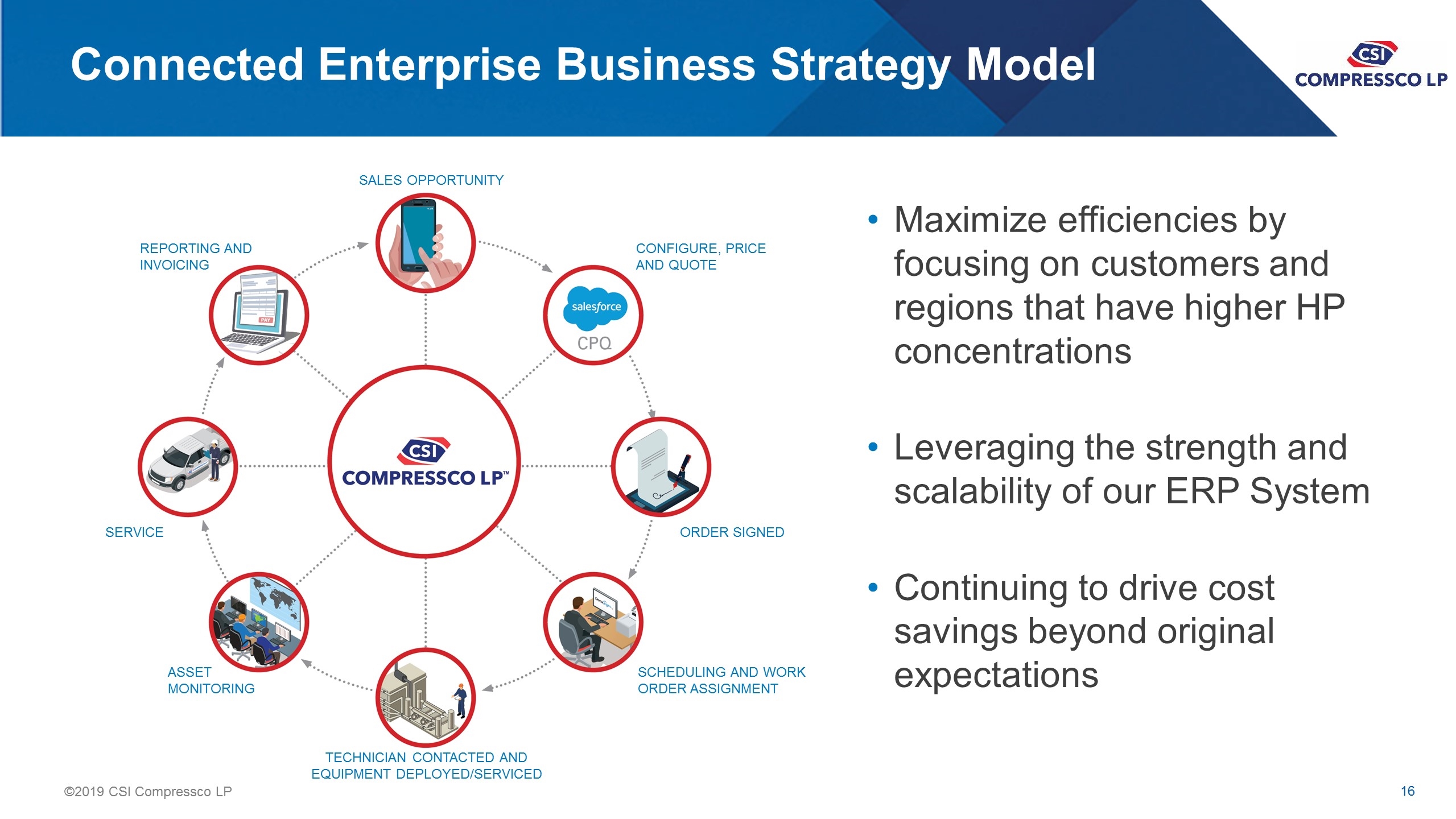

Connected Enterprise Business Strategy Model SALES OPPORTUNITY CONFIGURE, PRICE AND QUOTE TECHNICIAN CONTACTED AND EQUIPMENT DEPLOYED/SERVICED ASSET MONITORING SERVICE REPORTING AND INVOICING ORDER SIGNED SCHEDULING AND WORK ORDER ASSIGNMENT Maximize efficiencies by focusing on customers and regions that have higher HP concentrations Leveraging the strength and scalability of our ERP System Continuing to drive cost savings beyond original expectations

Environmental, Social, Governance (ESG) Environmental Natural gas focused, which is expected to play role in reducing CO2 emissions(1) Compliance with industry emissions regulations Multiple metrics/KPIs to focus on environmental protection Vapor recovery Social Stable workforce Robust and regular training programs Actively participate with customers in their CSR (Corporate Social Responsibility) and Supplier Sustainability programs Support several local and national organizations Governance Diverse and independent board comprised of industry leaders Conflicts committee of two independent board members Ethics Code of conduct review, FCPA training and review, Quarterly SOX questionnaire Safety Strong safety commitment and culture with dedicated HSE staff Active and engaged leadership team with a top down stance GeoTab on all company vehicles to drive positive driving behaviors Tablet based JSEA by all mechanical workforce Source IEA Vapor recovery

Financial Overview

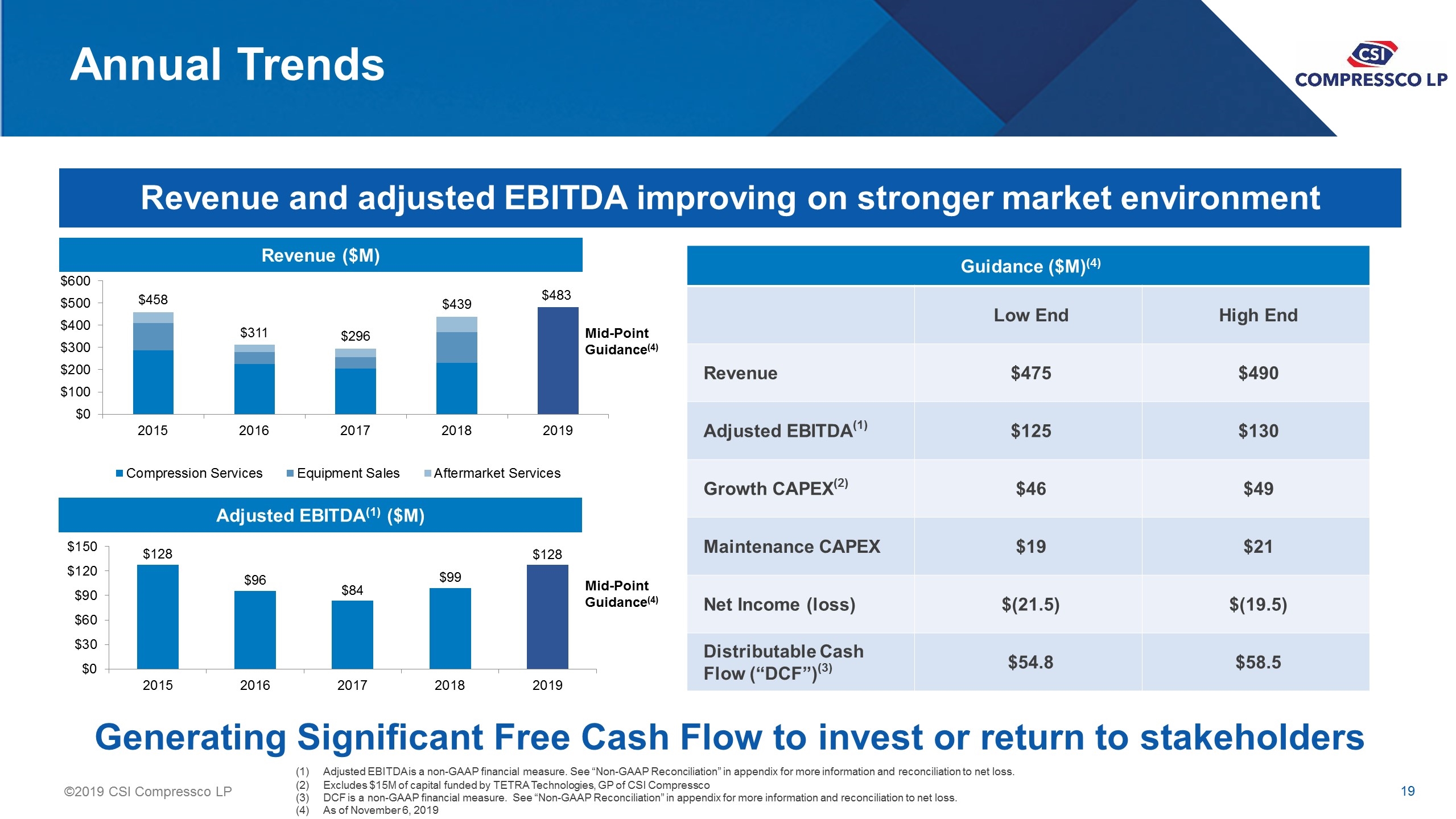

Annual Trends Well positioned to capitalize on the growing compression market Revenue and adjusted EBITDA improving on stronger market environment Revenue ($M) Adjusted EBITDA(1) ($M) Mid-Point Guidance(4) Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP Reconciliation” in appendix for more information and reconciliation to net loss. Excludes $15M of capital funded by TETRA Technologies, GP of CSI Compressco DCF is a non-GAAP financial measure. See “Non-GAAP Reconciliation” in appendix for more information and reconciliation to net loss. As of November 6, 2019 Guidance ($M)(4) Low End High End Revenue $475 $490 Adjusted EBITDA(1) $125 $130 Growth CAPEX(2) $46 $49 Maintenance CAPEX $19 $21 Net Income (loss) $(21.5) $(19.5) Distributable Cash Flow (“DCF”)(3) $54.8 $58.5 Generating Significant Free Cash Flow to invest or return to stakeholders Mid-Point Guidance(4) $600 $500 $400 $300 $200 $100 $0 $458 $311 $296 $439 $483 2015 2016 2017 2018 2019 $150 $120 $90 $60 $30 $0 $128 $96 $84 $99 $128 2015 2016 2017 2018 2019

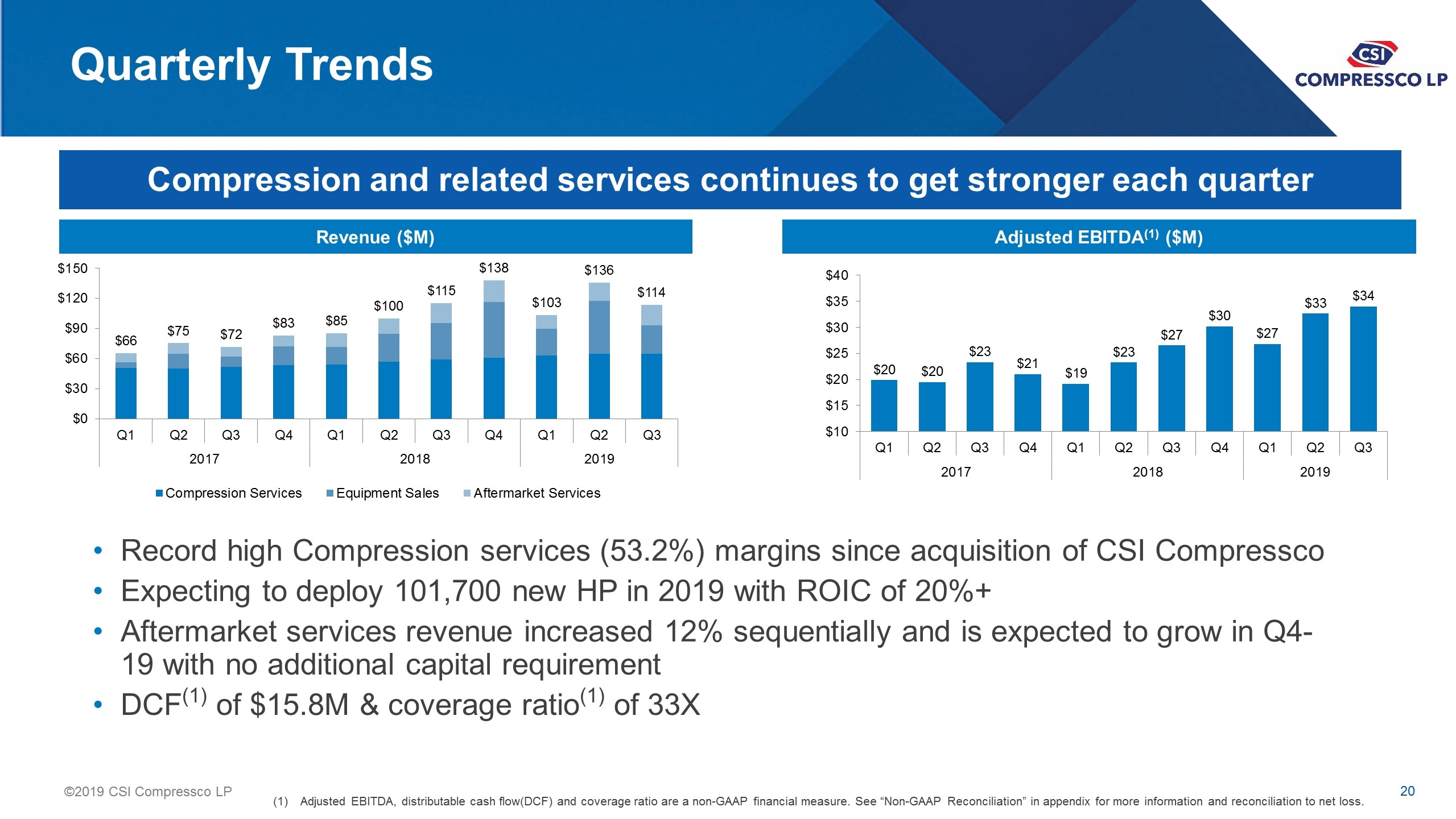

Quarterly Trends Well positioned to capitalize on the growing compression market Compression and related services continues to get stronger each quarter Revenue ($M) Adjusted EBITDA(1) ($M) Adjusted EBITDA, distributable cash flow(DCF) and coverage ratio are a non-GAAP financial measure. See “Non-GAAP Reconciliation” in appendix for more information and reconciliation to net loss. Record high Compression services (53.2%) margins since acquisition of CSI Compressco Expecting to deploy 101,700 new HP in 2019 with ROIC of 20%+ Aftermarket services revenue increased 12% sequentially and is expected to grow in Q4-19 with no additional capital requirement DCF(1) of $15.8M & coverage ratio(1) of 33X $150 $120 $90 $60 $30 $0 $66 $75 $72 $83 $85 $100 $115 $138 $103 $136 $114 Q1 Q2 Q3 Q4 2017 2018 2019 $40 $35 $30 $25 $20 $15 $10 $23 $21 $19 $27 $30 $33 $34

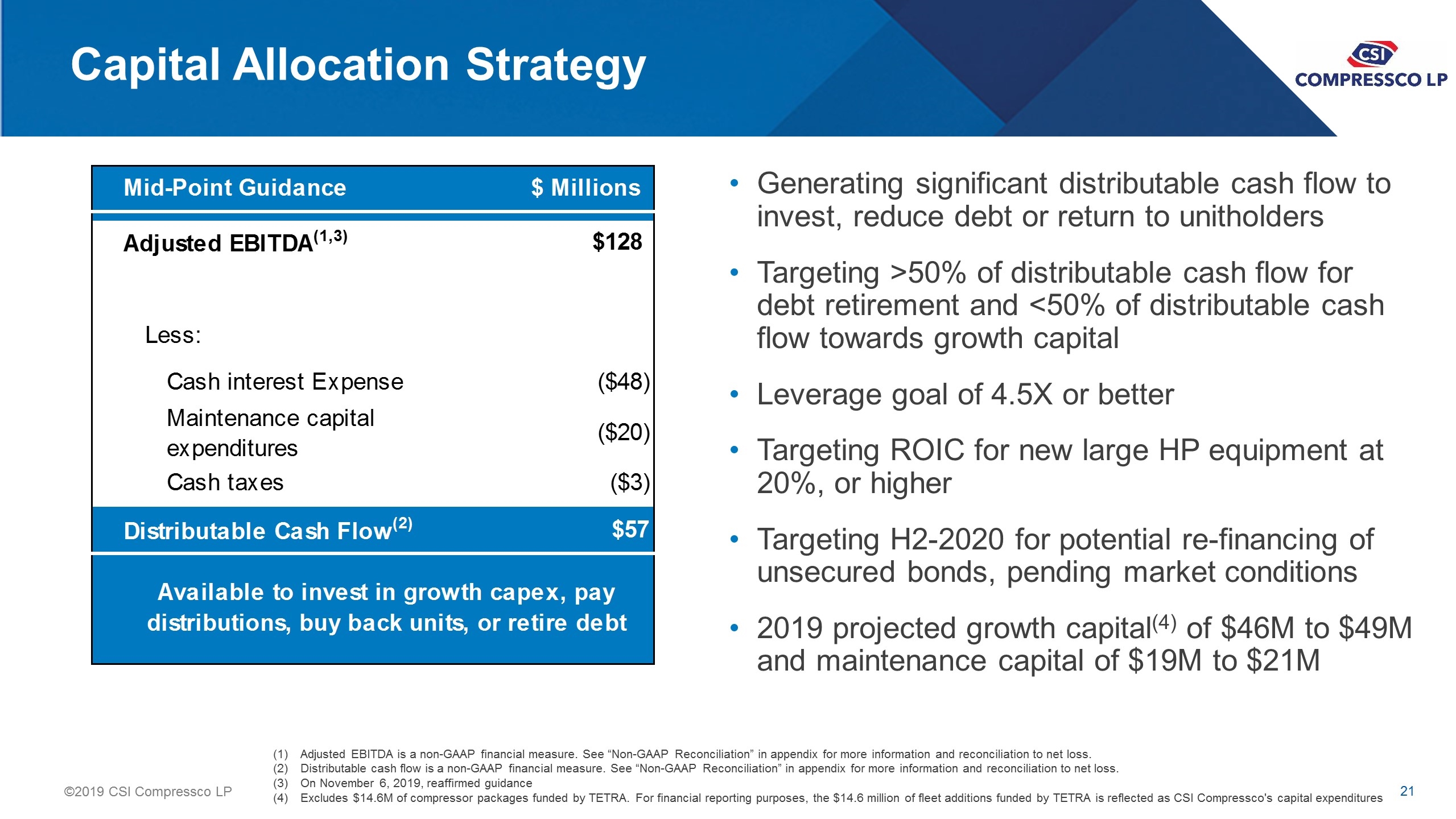

Capital Allocation Strategy Generating significant distributable cash flow to invest, reduce debt or return to unitholders Targeting >50% of distributable cash flow for debt retirement and <50% of distributable cash flow towards growth capital Leverage goal of 4.5X or better Targeting ROIC for new large HP equipment at 20%, or higher Targeting H2-2020 for potential re-financing of unsecured bonds, pending market conditions 2019 projected growth capital(4) of $46M to $49M and maintenance capital of $19M to $21M Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP Reconciliation” in appendix for more information and reconciliation to net loss. Distributable cash flow is a non-GAAP financial measure. See “Non-GAAP Reconciliation” in appendix for more information and reconciliation to net loss. On November 6, 2019, reaffirmed guidance Excludes $14.6M of compressor packages funded by TETRA. For financial reporting purposes, the $14.6 million of fleet additions funded by TETRA is reflected as CSI Compressco's capital expenditures Mid-Point Guidance $ Millions Adjusted EBITDA(1,3) $128 Less: Cash interest Expense ($48) Maintenance capital ($20) expenditures Cash taxes ($3) Distributable Cash Flow(2) $57 Available to invest in growth capex, pay distributions, buy back units, or retire debt

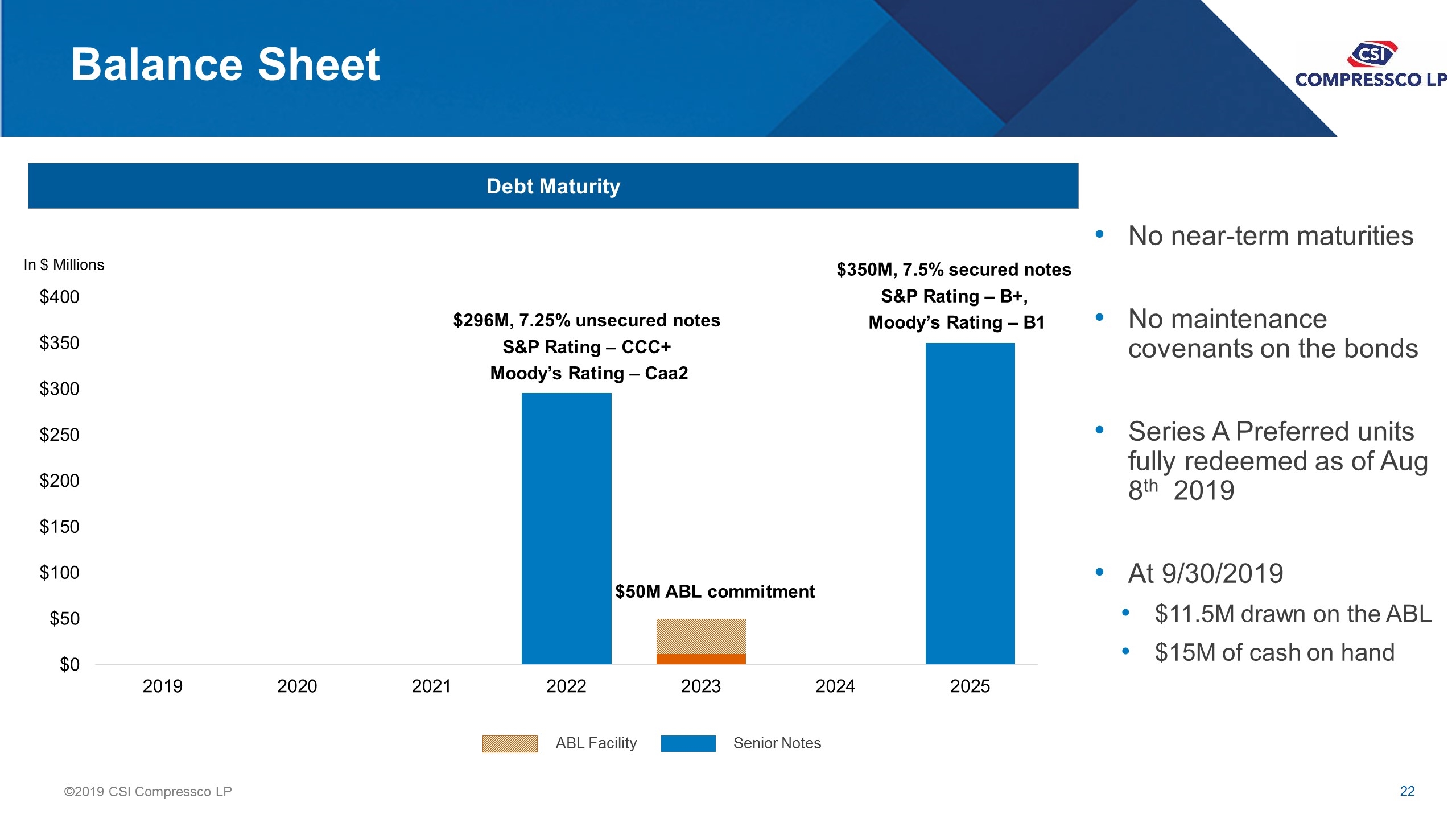

Balance Sheet Debt Maturity Senior Notes ABL Facility $296M, 7.25% unsecured notes S&P Rating – CCC+ Moody’s Rating – Caa2 $350M, 7.5% secured notes S&P Rating – B+, Moody’s Rating – B1 In $ Millions $50M ABL commitment No near-term maturities No maintenance covenants on the bonds Series A Preferred units fully redeemed as of Aug 8th 2019 At 9/30/2019 $11.5M drawn on the ABL $15M of cash on hand

Appendix Reconciliation and Other Financial Data Tables

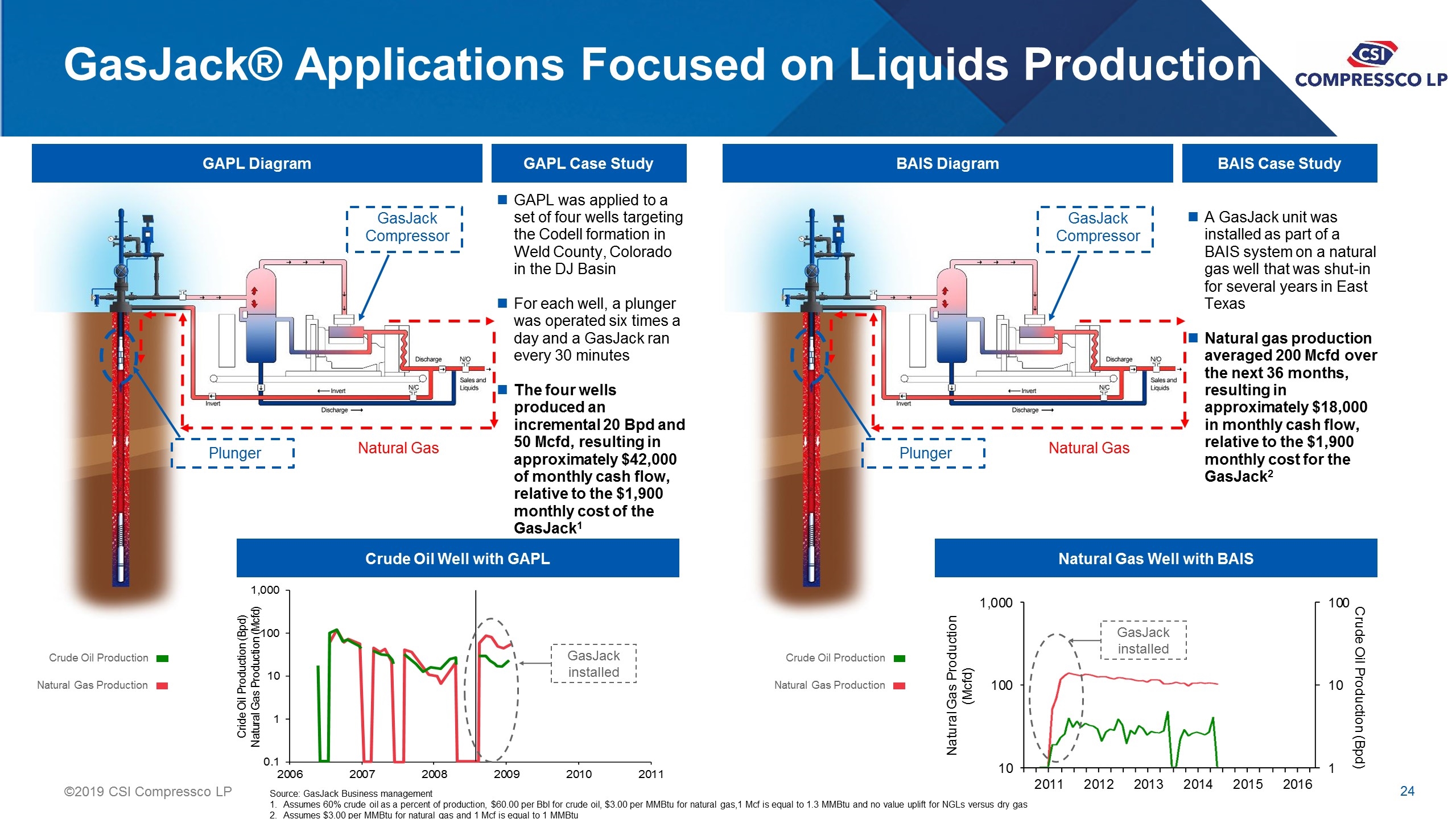

GasJack® Applications Focused on Liquids Production GAPL Diagram Plunger Natural Gas GasJack Compressor GAPL Case Study GAPL was applied to a set of four wells targeting the Codell formation in Weld County, Colorado in the DJ Basin For each well, a plunger was operated six times a day and a GasJack ran every 30 minutes The four wells produced an incremental 20 Bpd and 50 Mcfd, resulting in approximately $42,000 of monthly cash flow, relative to the $1,900 monthly cost of the GasJack1 GasJack installed Crude Oil Well with GAPL Crude Oil Production Natural Gas Production BAIS Diagram Plunger Natural Gas GasJack Compressor BAIS Case Study A GasJack unit was installed as part of a BAIS system on a natural gas well that was shut-in for several years in East Texas Natural gas production averaged 200 Mcfd over the next 36 months, resulting in approximately $18,000 in monthly cash flow, relative to the $1,900 monthly cost for the GasJack2 Natural Gas Well with BAIS Crude Oil Production Natural Gas Production GasJack installed Source: GasJack Business management Assumes 60% crude oil as a percent of production, $60.00 per Bbl for crude oil, $3.00 per MMBtu for natural gas,1 Mcf is equal to 1.3 MMBtu and no value uplift for NGLs versus dry gas Assumes $3.00 per MMBtu for natural gas and 1 Mcf is equal to 1 MMBtu

Non-GAAP Financial Measures This presentation includes as a non-GAAP financial measure, Adjusted EBITDA, Enterprise Value and Distributable Cash Flow (“DCF”). Adjusted EBITDA and DCF are used as a supplemental financial measure by management to: evaluate the financial performance of assets without regard to financing methods, capital structure or historical cost basis; assess our ability to generate available cash sufficient to make distributions to our common unitholders and General Partner; evaluate the financial performance of our assets without regard to financing methods, capital structure, or historical cost basis; measure operating performance and return on capital as compared to our competitors; and determine our ability to incur and service debt and fund capital expenditures. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, and before certain non-cash charges consisting of impairments, bad debt expense attributable to bankruptcy of customer, equity compensation, non-cash costs of compressors sold, fair value adjustments of our Preferred Units, administrative expenses under the Omnibus Agreement paid in equity using common units, write-off of unamortized financing costs and excluding acquisition and transaction costs and severance. Distributable cash flow (“DCF”) is used as a supplemental financial measure, as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. DCF is also used in setting forward expectations and in communications with the board of directors of our general partner. We define DCF as Adjusted EBITDA less current income tax expense, maintenance capital expenditures, interest expense, and severance expense, plus non-cash interest expense. Adjusted EBITDA should not be considered an alternative to net income or any other measure of financial performance presented in accordance with GAAP. This non-GAAP financial measure may not be comparable to similarly titled measures of other entities, as other entities may not calculate this non-GAAP financial measure in the same manner. Management compensates for the limitations of Adjusted EBITDA as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision making process.

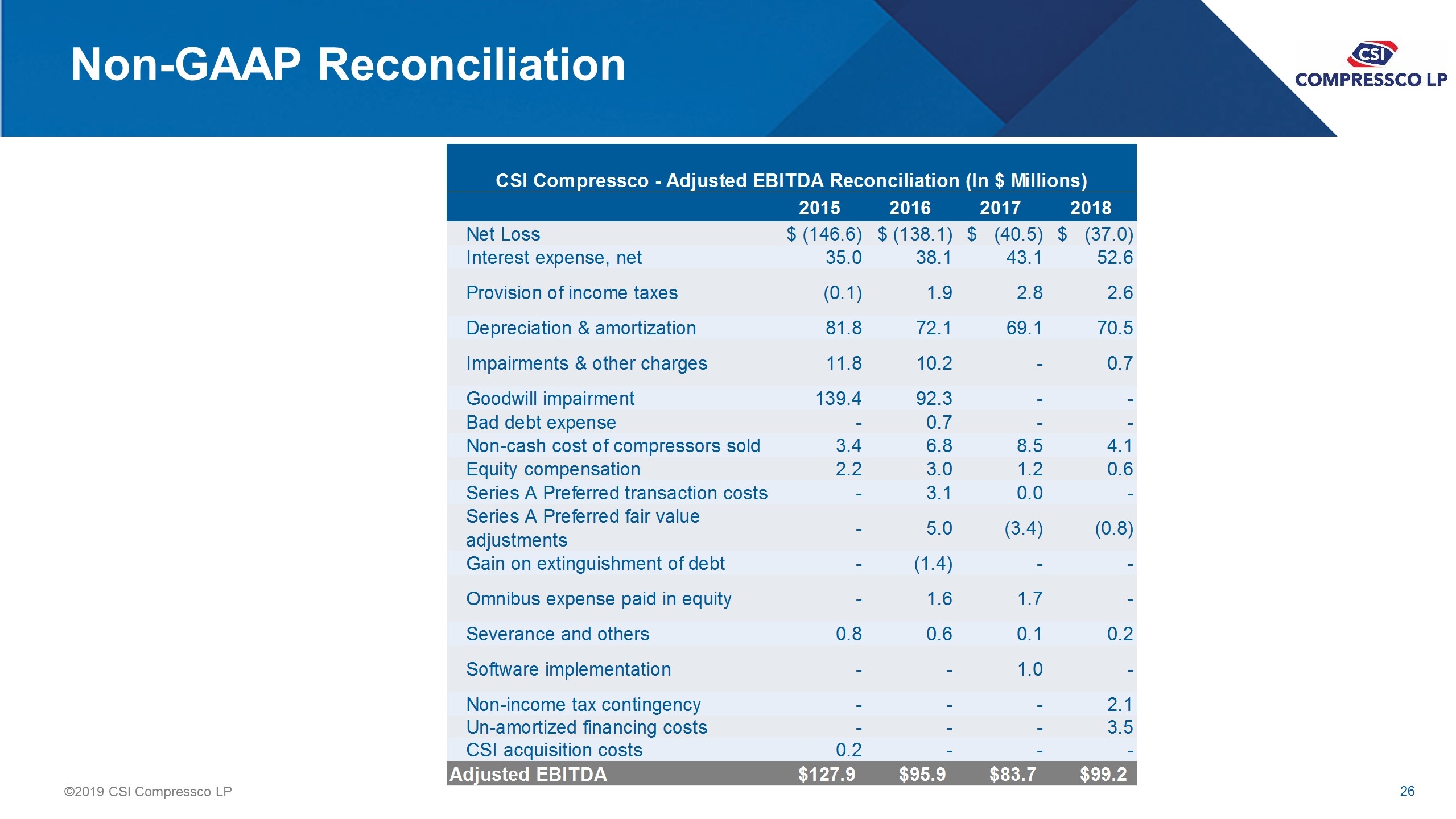

Non-GAAP Reconciliation CSI Compressco - Adjusted EBITDA Reconciliation (In $ Millions) 2015 2016 2017 2018 TTI Consolidated Net Loss $(146.6) $(138.1) $(40.5) $(37.0) Interest expense, net 35.0 38.1 43.1 52.6 Provision of income taxes (0.1) 1.9 2.8 2.6 Depreciation & amortization 81.8 72.1 69.1 70.5 Free Cash Flow before ARO settlements Impairments & other charges 11.8 10.2 - 0.7 Goodwill impairment 139.4 92.3 - - CSI Compressor Bad debt expense - 0.7 - - Non-cash cost of compressors sold 3.4 6.8 8.5 4.1 Equity compensation 2.2 3.0 1.2 0.6 Series A Preferred transaction costs - 3.1 0.0 - Series A Preferred fair value adjustments - 5.0 (3.4) (0.8) Gain on extinguishment of debt - (1.4) - - Omnibus expense paid in equity - 1.6 1.7 - Severance and others 0.8 0.6 0.1 0.2 Software implementation - - 1.0 - Non-income tax contingency - - - 2.1 Un-amortized financing costs charged to expense - - - 3.5 CSI acquisition costs 0.2 - - - Adjusted EBITDA $127.9 $95.9 $83.7 $99.2

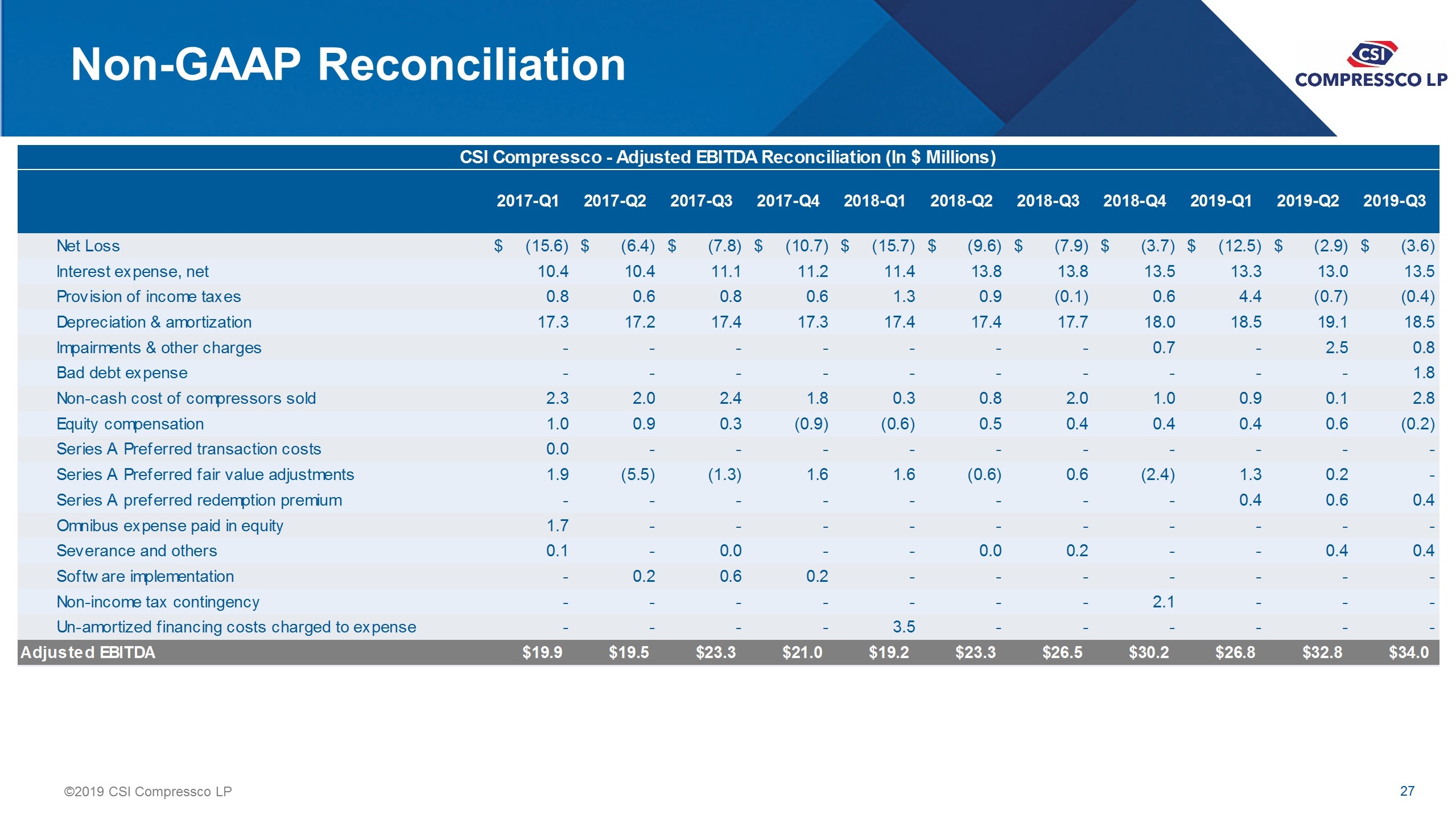

Non-GAAP Reconciliation CSI Compressco - Adjusted EBITDA Reconciliation (In $ Millions) 2017-Q1 2017-Q2 2017-Q3 2017-Q4 2018-Q1 2018-Q2 2018-Q3 2018-Q4 2019-Q1 2019-Q2 2019-Q3 TTI Consolidated Net Loss $(15.6) $(6.4) $(7.8) $(10.7) $(15.7) $(9.6) $(7.9) $(3.7) $(12.5) $(2.9) $(3.6) Interest expense, net 10.4 10.4 11.1 11.2 11.4 13.8 13.8 13.5 13.3 13.0 13.5 Provision of income taxes 0.8 0.6 0.8 0.6 1.3 0.9 (0.1) 0.6 4.4 (0.7) (0.4) Depreciation & amortization 17.3 17.2 17.4 17.3 17.4 17.4 17.7 18.0 18.5 19.1 18.5 Free Cash Flow before ARO settlements Impairments & other charges - - - - - - - 0.7 - 2.5 0.8 CSI Compressco Bad debt expense - - - - - - - - - - 1.8 Non-cash cost of compressors sold 2.3 2.0 2.4 1.8 0.3 0.8 2.0 1.0 0.9 0.1 2.8 Equity compensation 1.0 0.9 0.3 (0.9) (0.6) 0.5 0.4 0.4 0.4 0.6 (0.2) Series A Preferred transaction costs 0.0 - - - - - - - - - - Series A Preferred fair value adjustments 1.9 (5.5) (1.3) 1.6 1.6 (0.6) 0.6 (2.4) 1.3 0.2 - Series A preferred redemption premium - - - - - - - - 0.4 0.6 0.4 Omnibus expense paid in equity 1.7 - - - - - - - - - - Severance and others 0.1 - 0.0 - - 0.0 0.2 - - 0.4 0.4 Software implementation - 0.2 0.6 0.2 - - - - - - - Non-income tax contingency - - - - - - - 2.1 - - - Un-amortized financing costs charged to expense - - - - 3.5 - - - - - - Adjusted EBITDA $19.9 $19.5 $23.3 $21.0 $19.2 $23.3 $26.5 $30.2 $26.8 $32.8 $34.0

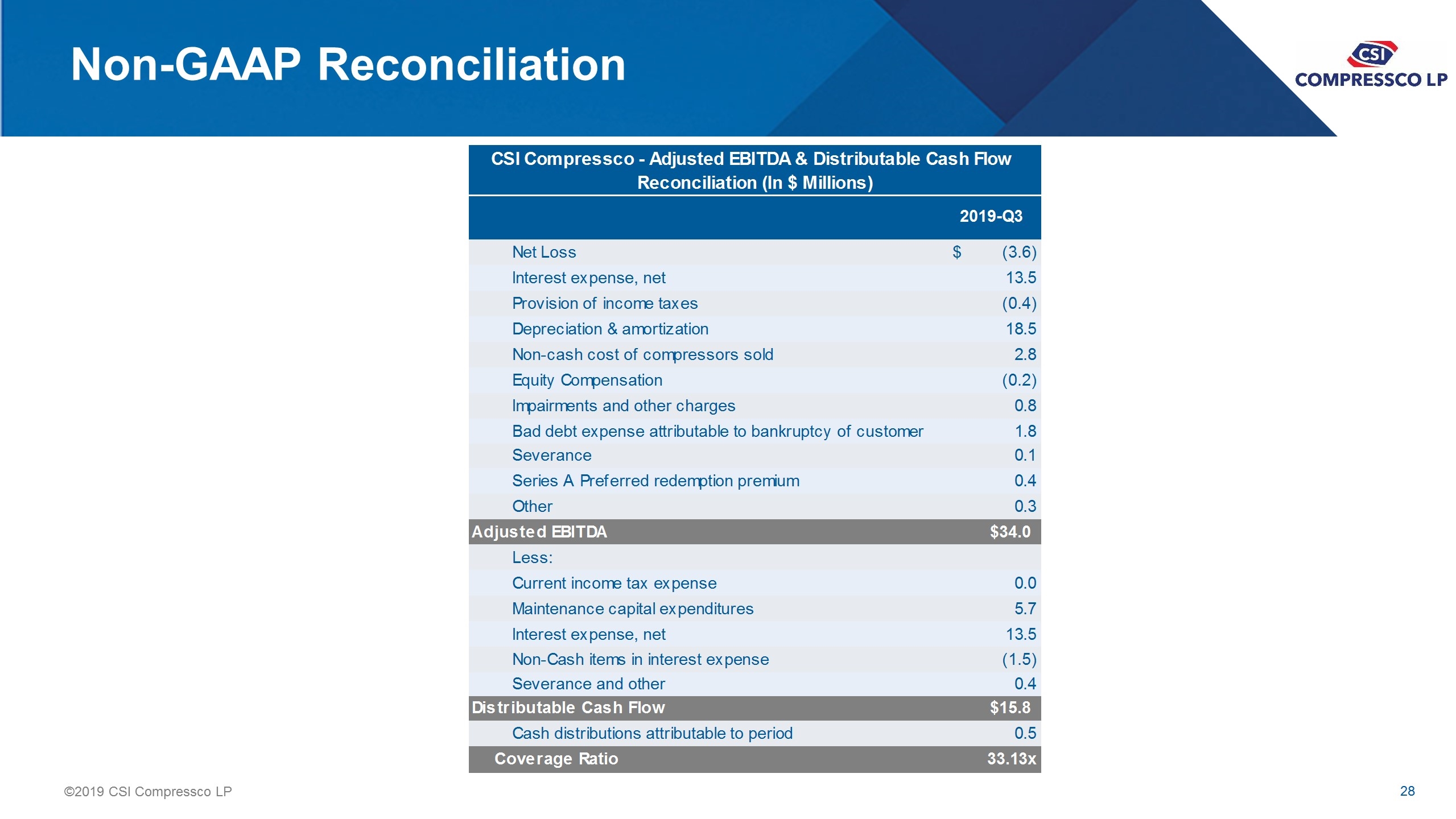

Non-GAAP Reconciliation CSI Compressco - Adjusted EBITDA & Distributable Cash Flow Reconciliation (In $ Millions) 2019-Q3 Net Loss $(3.6) Interest expense, net 13.5 Provision of income taxes (0.4) Depreciation & amortization 18.5 Non-cash cost of compressors sold 2.8 Equity Compensation (0.2) Impairments and other charges 0.8 Bad debt expense attributable to bankruptcy of customer 1.8 Severance 0.1 Series A Preferred redemption premium 0.4 Other 0.3 Adjusted EBITDA $34.0 Less: Current income tax expense 0.0 Maintenance capital expenditures 5.7 Interest expense, net 13.5 Non-Cash items in interest expense (1.5) Severance and other 0.4 Distributable Cash Flow $15.8 Cash distributions attributable to period 0.5 Coverage Ratio 33.13x

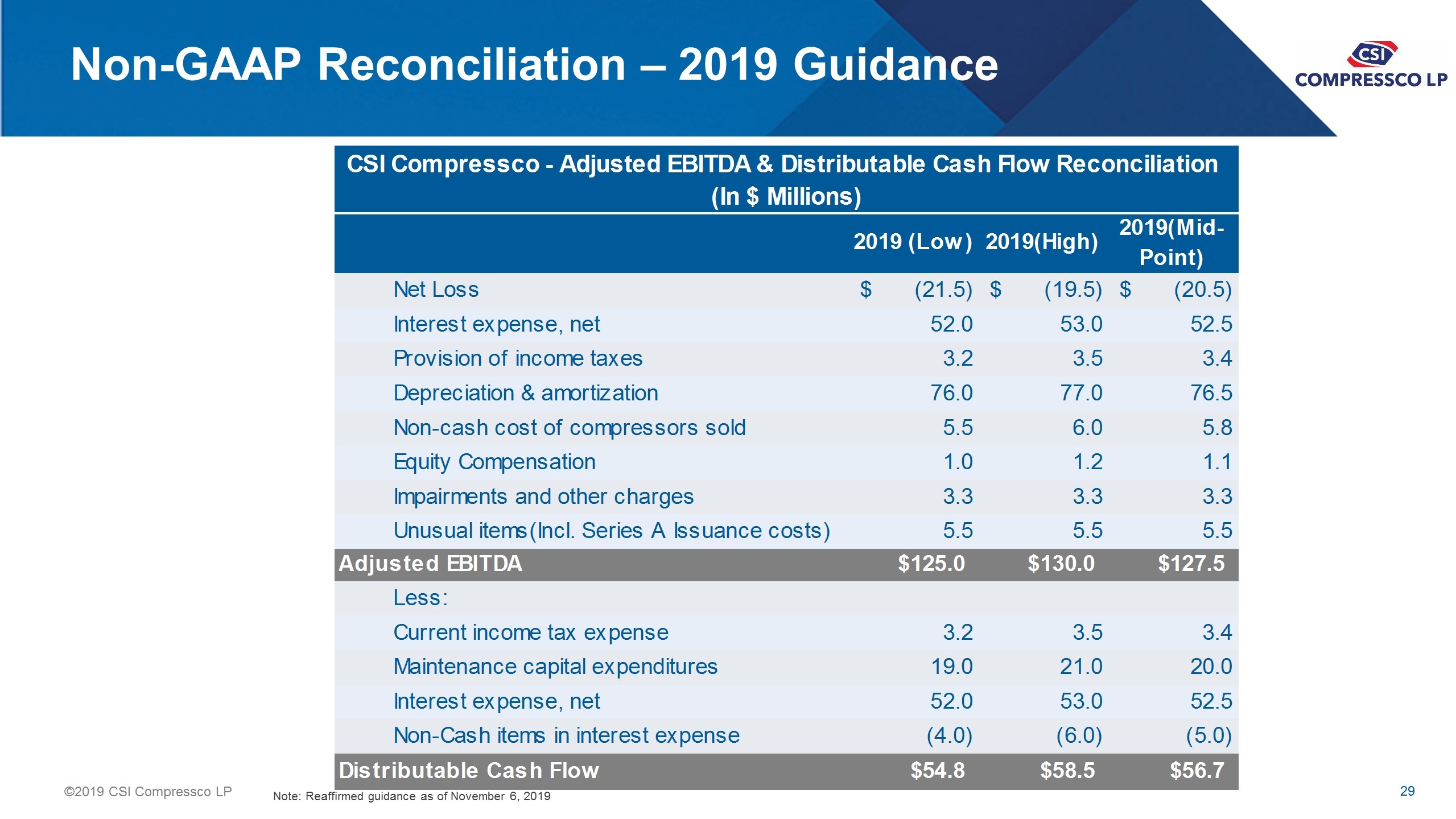

Non-GAAP Reconciliation – 2019 Guidance Note: Reaffirmed guidance as of November 6, 2019 CSI Compressco - Adjusted EBITDA & Distributable Cash Flow Reconciliation (In $ Millions) 2019 (Low) 2019(High) 2019(Mid-Point) Net Loss $(21.5) $(19.5) $(20.5) Interest expense, net 52.0 53.0 52.5 Provision of income taxes 3.2 3.5 3.4 Depreciation & amortization 76.0 77.0 76.5 Non-cash cost of compressors sold 5.5 6.0 5.8 Equity Compensation 1.0 1.2 1.1 Impairments and other charges 3.3 3.3 3.3 Unusual items(Incl. Series A Issuance costs) 5.5 5.5 5.5 Adjusted EBITDA $125.0 $130.0 $127.5 Less: Current income tax expense 3.2 3.5 3.4 Maintenance capital expenditures 19.0 21.0 20.0 Interest expense, net 52.0 53.0 52.5 Non-Cash items in interest expense (4.0) (6.0) (5.0) Distributable Cash Flow $54.8 $58.5 $56.7

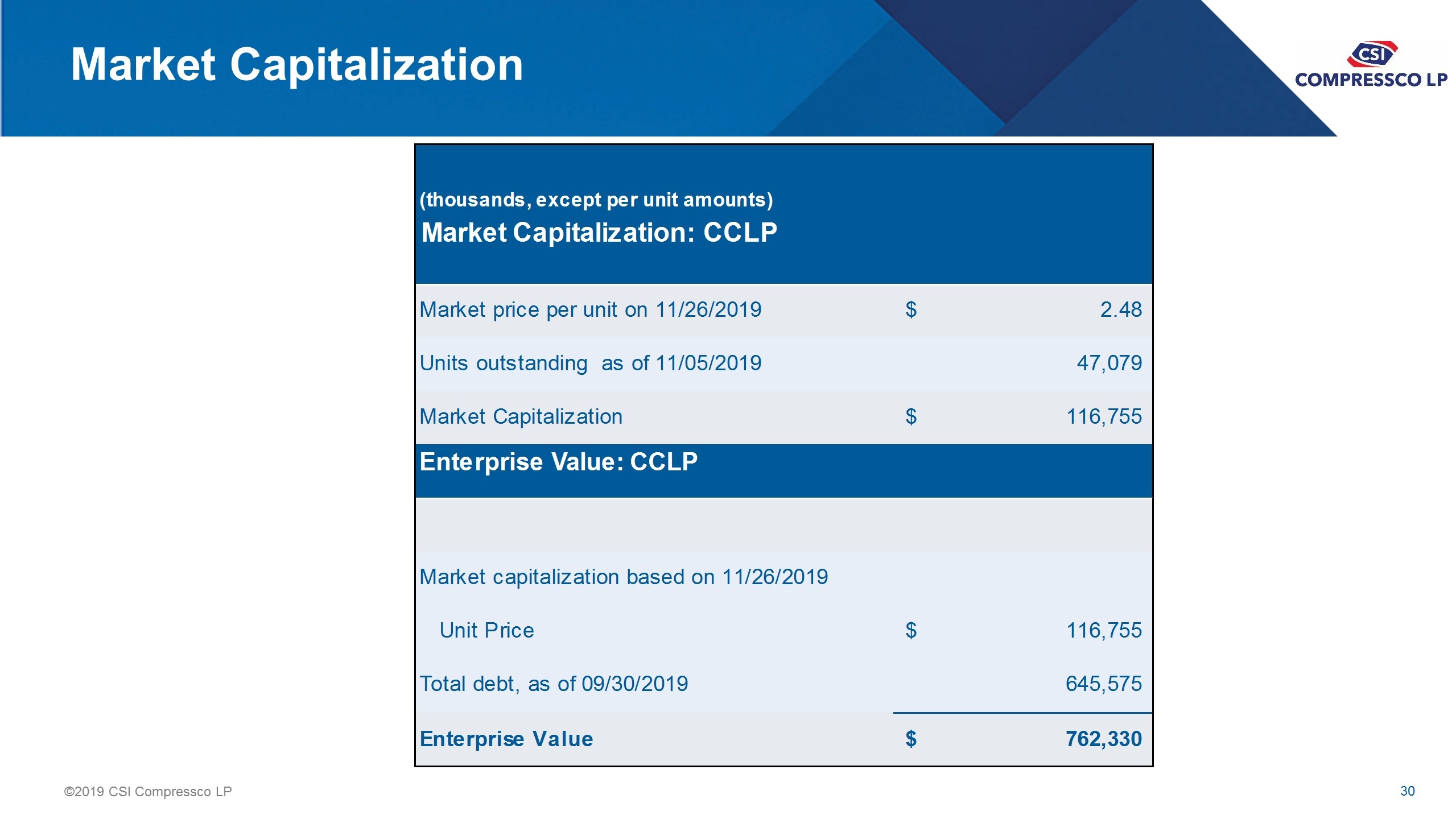

Market Capitalization (thousands, except per unit amounts) Market Capitalization: CCLP Market price per unit on 11/26/2019 $2.48 Units outstanding as of 11/05/2019 47,079 Market Capitalization $116,755 Enterprise Value: CCLP Market capitalization based on 11/26/2019 Unit Price $116,755 Total debt, as of 09/30/2019 645,575 Enterprise Value $762,330