PROXY STATEMENT

100 Gateway Drive, Suite 100

Bethlehem, Pennsylvania 18017

(610) 882-8800

May 7, 2021

Annual Meeting Information

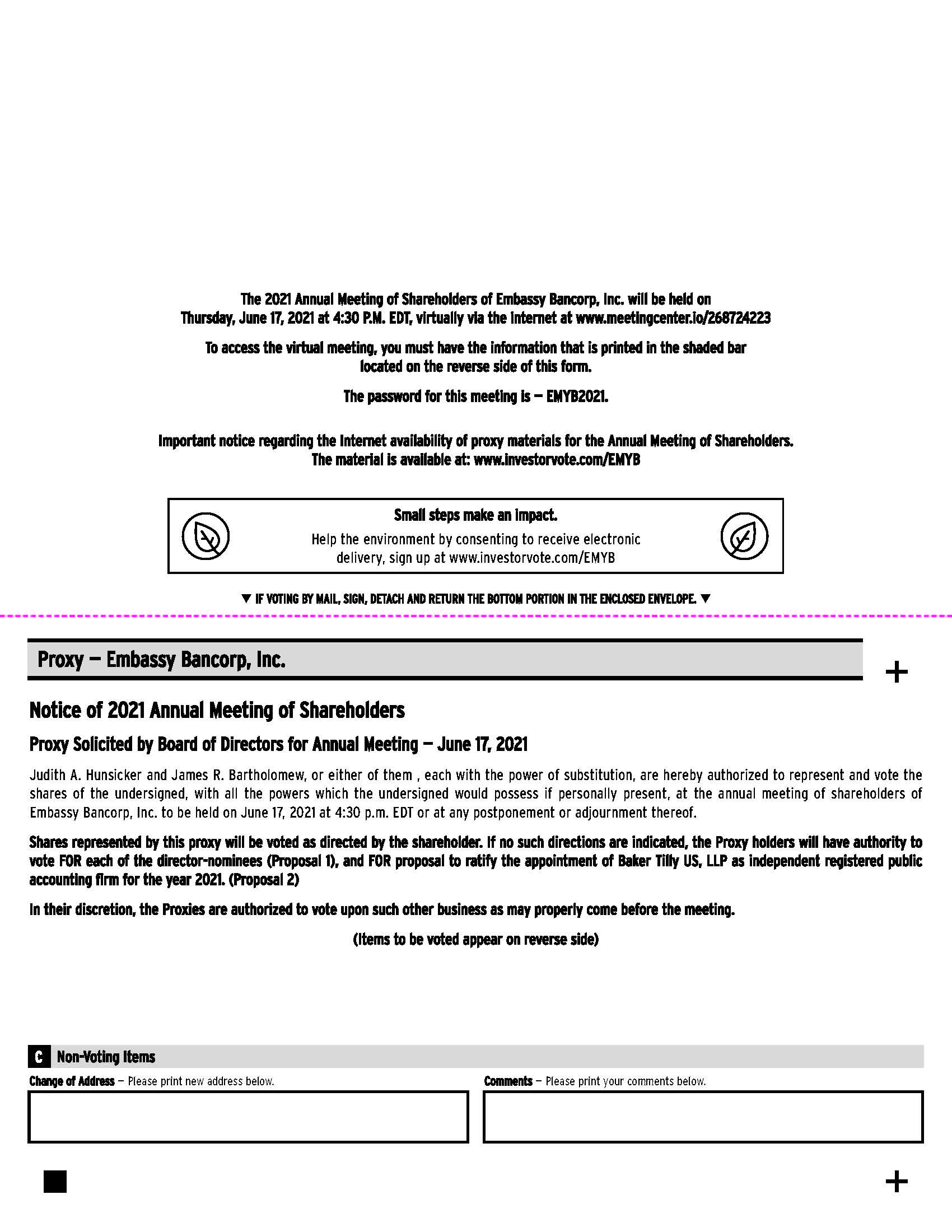

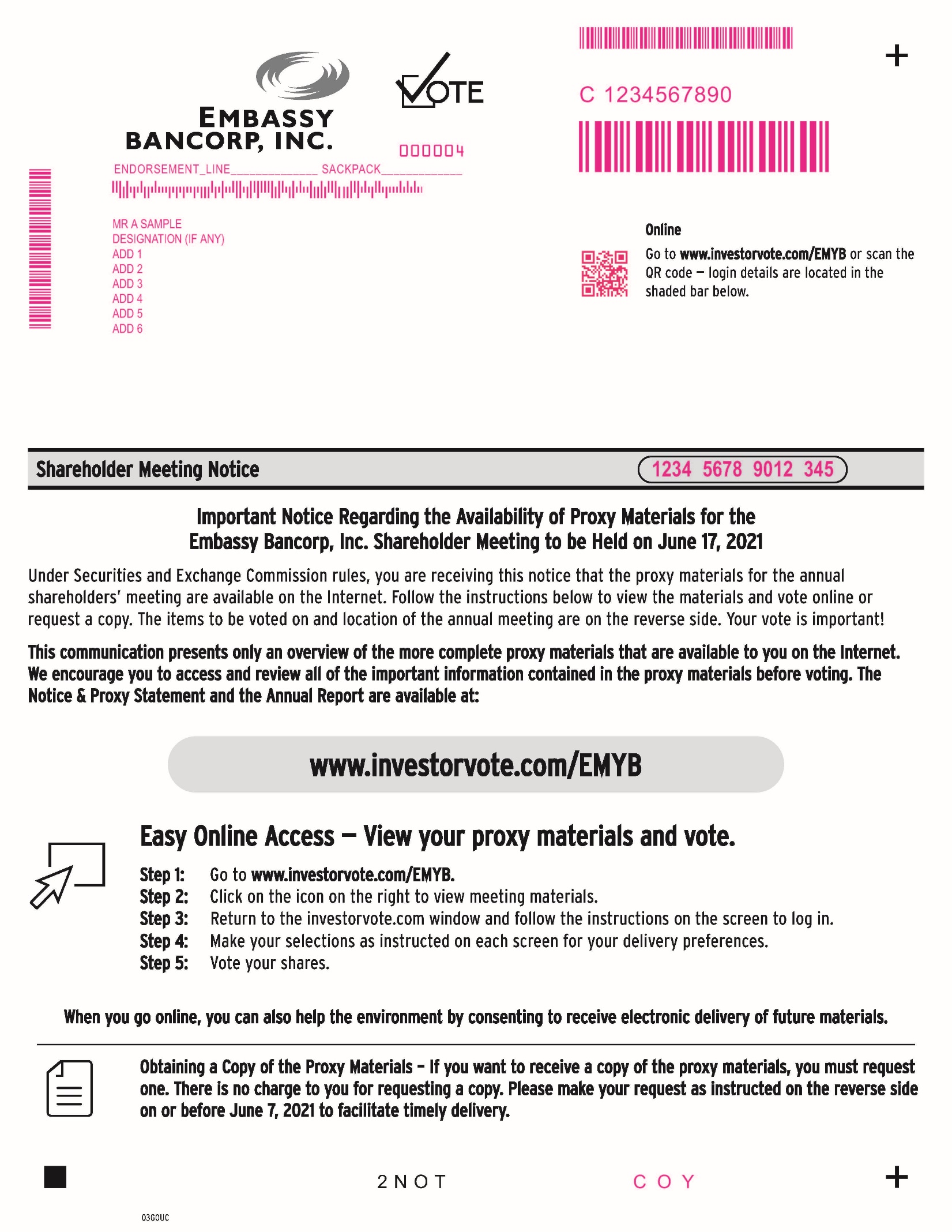

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Embassy Bancorp, Inc. (the “Company”) for use at the Company’s Annual Meeting of Shareholders to be held in virtual meeting format only on Thursday, June 17, 2021, at 4:30 p.m. E.D.T. This proxy statement and the accompanying proxy are first being made available to shareholders of the Company on or about May 7, 2021.

How can I attend the annual meeting?

The annual meeting will be held in a virtual meeting format conducted exclusively by webcast. You are entitled to participate in the annual meeting only if you were a shareholder of the Company as of the close of business on April 19, 2021, or if you hold a valid proxy for the annual meeting. No physical meeting will be held.

You will be able to attend the annual meeting online by visiting www.meetingcenter.io/268724223. You will also be able to vote your shares online by attending the annual meeting by webcast, although we encourage you to vote your shares as soon as possible to ensure a quorum.

To participate in the annual meeting, you will need to review the information included on your Notice or on your proxy card. The password for the meeting is EMBY2021.

Beneficial holders, those who hold your shares through an intermediary such as a bank or broker, can use your broker provided control number to access the webcast or may register in advance using the instructions below.

The meeting will begin promptly at 4:30 p.m. EDT. We encourage you to access the meeting prior to the start time leaving ample time for check in. Please follow the registration instructions as outlined in this proxy statement and your proxy card.

How do I register to attend the annual meeting via the Internet?

If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the annual meeting via the Internet. Please follow the instructions on the Notice or proxy card that you received.

Beneficial holders, those who hold your shares through an intermediary such as a bank or broker, can choose to register in advance to attend the annual meeting via the Internet. Registering in advance by following the below instructions will enable a beneficial holder to vote during the annual meeting.

To register to attend the annual meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Embassy Bancorp, Inc. holdings, along with your name and email address, to Computershare. Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com. Requests for registration by mail should be directed to:

Computershare

Embassy Bancorp, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on Monday, June 14, 2021.

You will receive a confirmation of your registration by email after Computershare receives your registration materials.

Who is entitled to vote?

Holding the Company’s common stock on April 19, 2021, the record date, entitles the holder to attend and vote at the meeting. On the record date, 7,516,783 shares of the Company’s common stock were outstanding. Each share of the Company’s common stock entitles its holder to one vote on all matters presented at the meeting. See “What vote is required to approve each proposal?” below.

On what am I voting?

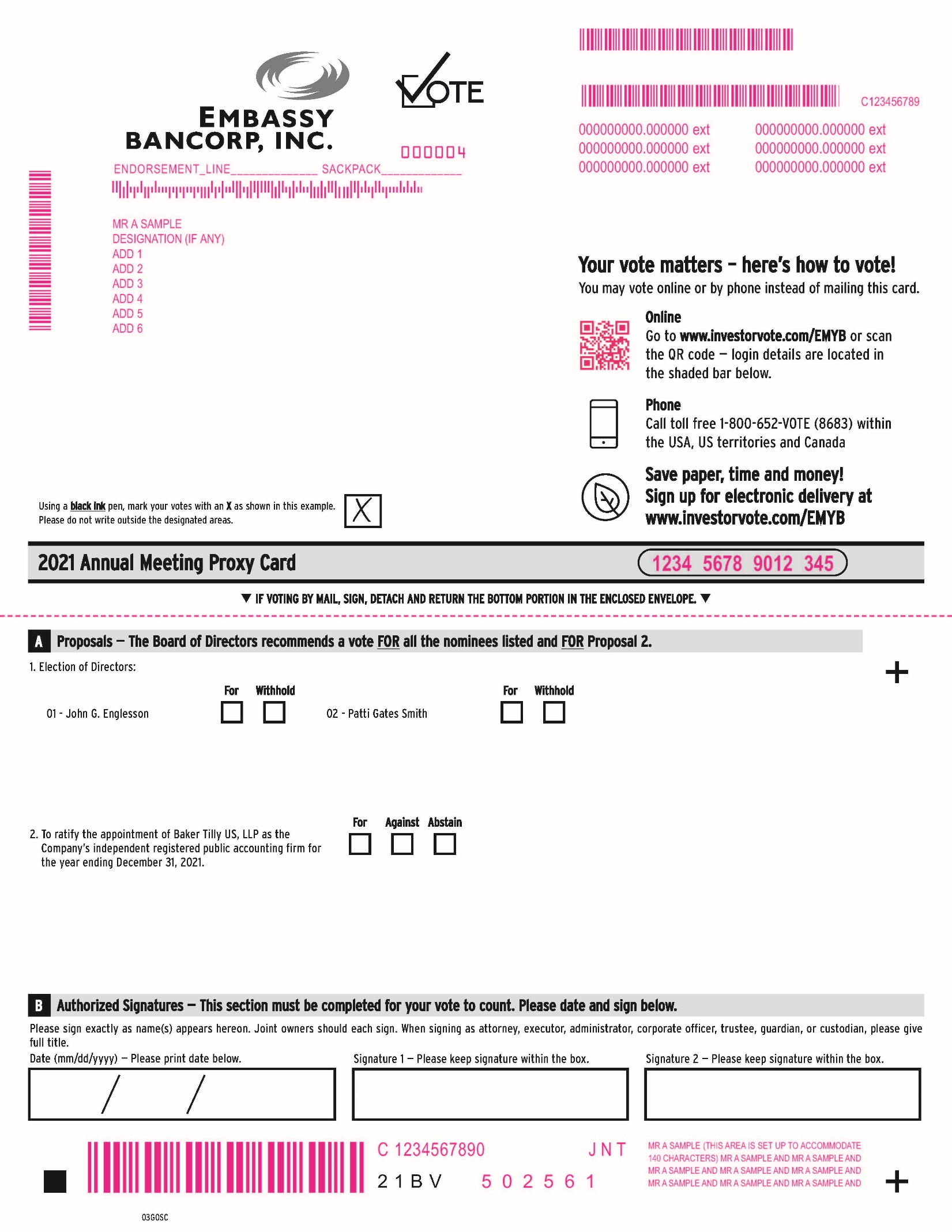

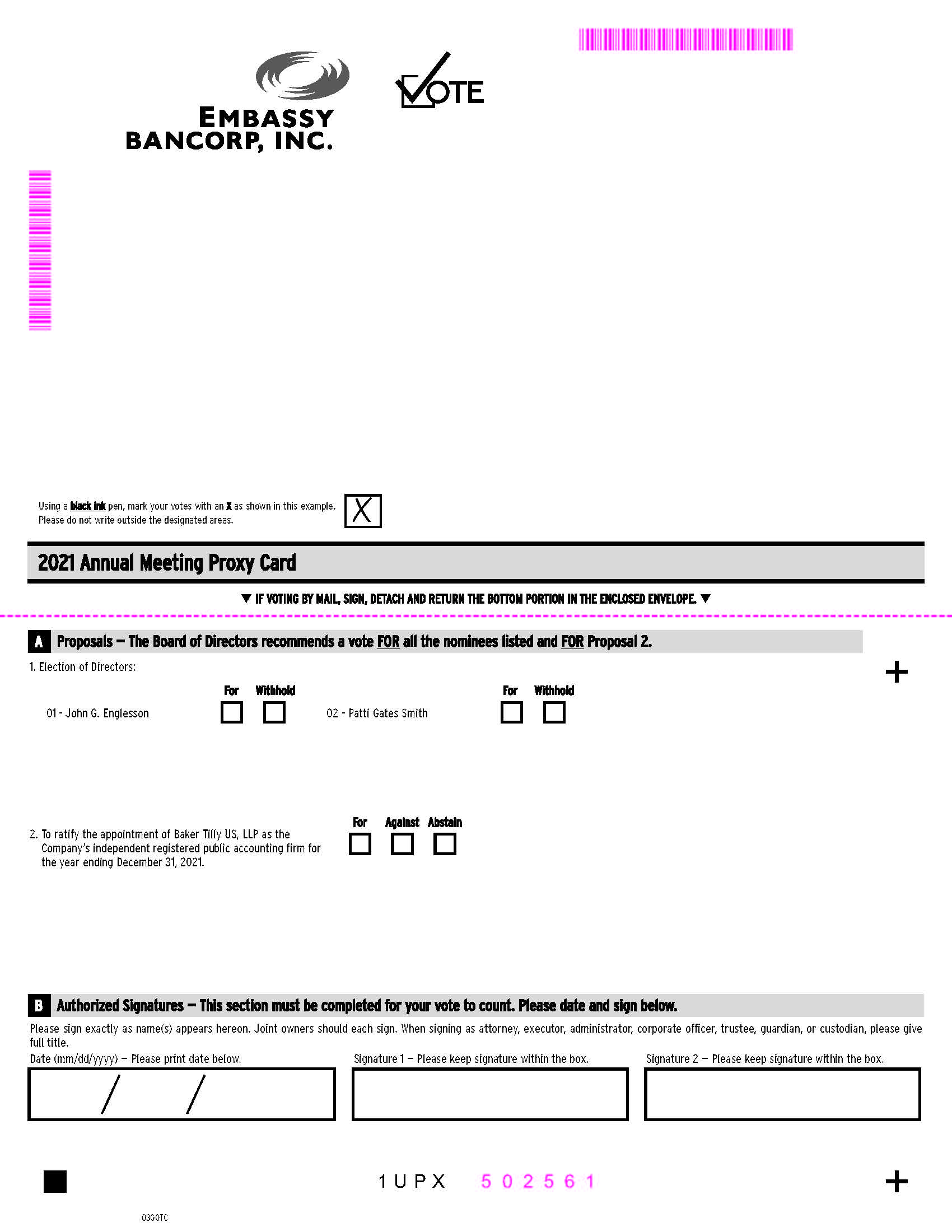

You will be asked to elect two (2) Directors as Class 2 Directors to serve for three-year terms expiring in 2024 and to ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. The Board of Directors is not aware of any other matters to be presented for action at the annual meeting. If any other matter requiring a vote of the shareholders would be presented at the meeting, the proxies will vote according to the directions of the Company’s Board of Directors.

How does the Board of Directors recommend I vote on the proposals?

The Board of Directors recommends that you vote:

| · | | “FOR” the election of each of the nominees for Director listed in this proxy statement; and |

| · | | “FOR” the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. |

How do I vote?

Shareholders of record can choose one of the following ways to vote:

Voting by Proxy Card via mail

| · | | Date your proxy and sign your name exactly as it appears on your proxy. |

| · | | Mail it using the enclosed, postage-paid envelope. |

| · | | If you sign your proxy card, but do not make any selections, your proxy will vote “FOR” the election of each of the nominees for Director listed in the attached proxy statement; and “FOR” the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. |

Voting by Internet prior to the Annual Meeting

| · | | Go to www.investorvote.com/EMYB |

| · | | Follow steps outlined on the secure website. |

Voting by Telephone

| · | | Call toll free 1-800-652-VOTE (8683) on a touch tone telephone. |

| · | | Follow the instructions provided by the recorded message. |

Voting by Internet during the Annual Meeting

| · | | Go to www.meetingcenter.io/268724223 on the date of the annual meeting, login using your control number and password and follow the on-screen instructions. Beneficial holders will be permitted to vote during the annual meeting if such holder registered in advance of the annual meeting following the instructions set forth above in “How do I register to attend the annual meeting via the Internet?” |

How do I change my vote?

If you give the proxy we are soliciting, you may revoke it at any time before it is exercised:

| · | | by voting online via the Internet, by telephone or by signing and returning a later-dated proxy; or |

| · | | by giving written notice to Embassy Bancorp, Inc., 100 Gateway Drive, Suite 310, Bethlehem, PA 18017, Attention: Judith A. Hunsicker, Corporate Secretary; or |

| · | | by voting electronically during the annual meeting. |

Beneficial holders should follow the instructions of his or her broker regarding revocation of proxies. You should note that your presence at the virtual meeting, alone, without voting, will not revoke an otherwise valid proxy.

How does discretionary authority apply?

If your shares are held in an account at a bank, brokerage firm, broker-dealer or other similar organization, then you are a beneficial owner of shares held in street name. In that case, you will have received these proxy materials from that organization holding your account and, as a beneficial owner, you have the right to instruct your broker, bank, trustee, or nominee how to vote the shares held in your account. If no voting instructions are given, your broker or nominee has discretionary authority to vote your shares on your behalf on routine matters. A “broker non-vote” results on a matter when your broker or nominee returns a proxy but does not vote on a particular proposal because it does not have discretionary authority to vote on that proposal and has not received voting instructions from you. We believe that your broker or nominee only has discretionary voting power with respect to the proposal regarding the ratification of the appointment of the independent registered public accounting firm. You may not vote shares held in street name at the annual meeting unless you obtain a legal proxy from that organization holding your account.

If you appropriately mark, sign and return the enclosed proxy card or voting instruction card, as the case may be, in time to be voted at the annual meeting, or if you vote by telephone or Internet in accordance with the instructions on the proxy card or voting instruction card, as the case may be, the shares represented thereby will be voted in accordance with your instructions. Signed proxies not marked to the contrary will be voted “FOR” the election of the two named nominees for our Board of Directors and “FOR” the ratification of the appointment of our independent registered public accounting firm for the year ending December 31, 2021.

What is a quorum?

The presence, virtually or by proxy, of holders of at least a majority of the outstanding shares of common stock of the Company is necessary to constitute a quorum at the annual meeting. There must be a quorum for business to be transacted at the meeting. Abstentions are counted for purposes of determining the presence or absence of a quorum, but are not considered a vote cast under Pennsylvania law. Brokers holding shares in “street name” for their customers are generally not entitled to vote on certain matters unless they receive voting instructions from their customers. Such shares for which brokers have not received voting instructions from their customers are called “broker non-votes.” Under Pennsylvania law, broker non-votes will be counted to determine if a quorum is present with respect to any matter to be voted upon by shareholders at the meeting only if such shares have been voted at the meeting on a matter other than a procedural motion.

As of April 19, 2021, the record date, 7,516,783 shares of common stock were issued and outstanding. The holders of a majority of the outstanding shares, or at least 3,758,393 shares, must be present virtually or represented by proxy in order to establish a quorum. If you attend the webcast using your control number and password, you will be deemed “present” for the annual meeting.

What vote is required to approve each proposal?

Election of Directors

Directors will be elected by a plurality of the votes cast at the Annual Meeting by the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Plurality means that the individuals who receive the largest number of “FOR” votes cast are elected as directors up to the maximum number of directors to be chosen at the Annual Meeting. Accordingly, the two (2) nominees for Class 2 Director receiving the highest number of “FOR” votes shall be elected as directors. Abstentions and broker non-votes will not affect the outcome of the election of directors. Shareholders may not vote their shares cumulatively in the election of directors. If any nominee should refuse or be unable to serve, the proxy will be voted for such other person as shall be designated by the Board of Directors. The Company has no knowledge that any of the nominees will refuse or be unable to serve if elected.

Other Proposals

Under the Bylaws of the Company, unless otherwise provided by law, a majority of votes cast by shares present, in person or by proxy, is necessary to approve other routine proposals or business properly presented at the meeting, including without limitation, the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm. Abstentions and broker non-votes will have no effect in calculating the votes on any such matters.

Who will count the vote?

The Judges of Election appointed by the Board of Directors will count the votes cast in person or by proxy at the meeting.

How are proxies being solicited?

The Company will bear its own cost of solicitation of proxies for the meeting. In addition to solicitation by mail, the Company’s Directors, Executive Officers and employees may solicit proxies personally or by telephone, facsimile transmission or otherwise. These Directors, Executive Officers and employees will not be additionally compensated for their solicitation efforts, but may be reimbursed for out-of-pocket expenses incurred in connection with these efforts. The Company will reimburse brokerage firms, fiduciaries, nominees and others for their out-of-pocket expenses incurred in forwarding proxy materials to beneficial owners of shares of common stock held in their names.

What is the deadline for shareholder proposals at next year’s annual meeting?

Any shareholder who, in accordance with and subject to the provisions of the proxy rules of the Securities and Exchange Commission, wishes to submit a proposal for inclusion in the next year’s Company proxy statement and proxy ballot, for its 2022 annual meeting of shareholders, must deliver the proposal in writing to the Secretary of Embassy Bancorp, Inc. at the Company’s principal executive offices at 100 Gateway Drive, Suite 310, Bethlehem, Pennsylvania, not later than January 7, 2022. In addition, under Rule 14a-4(c)(1) promulgated under the Securities and Exchange Act of 1934, as amended, if any shareholder proposal intended to be presented at the 2021 annual meeting without inclusion in our proxy statement was received at our principal executive offices after January 7, 2021, then a proxy will have the ability to confer discretionary authority to vote on the proposal.

How may I submit a question for the Annual Meeting?

In order for management to thoroughly consider and answer any question that you may have about the Company or our annual meeting materials, including our financial statements, and to ensure an efficient virtual meeting, we ask that you submit your questions in advance of the annual meeting. You may submit questions by mail or email, clearly marked “Question for Annual Meeting” by contacting Judith A. Hunsicker, Secretary, at 100 Gateway Drive, Suite 310, Bethlehem, Pennsylvania 18017 or jhunsicker@embassybank.com. Questions received by June 11, 2021 will be compiled by the Secretary and relayed promptly to management and the Board. Management and the Board will endeavor to address all relevant questions so submitted at the Annual Meeting of Shareholders, as circumstances permit.

What if I have trouble accessing the Annual Meeting virtually?

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is no longer supported. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it, or you may call the virtual annual meeting support line at 1-888-724-2416.

Internet Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on June 17, 2021. This proxy statement, the enclosed proxy card and our 2020 Annual Report are available at www.investorvote.com/EMYB.

Cautionary Statement Regarding Forward-Looking Statements

This proxy statement and the documents that have been incorporated herein by reference may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, these statements can be identified by the use of words such as “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “target,” “will,” “would” and similar expressions. Actual results and trends could differ materially from those set forth in such statements due to various risks, uncertainties and other factors. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the following: risks and uncertainties related to the COVID-19 pandemic and resulting governmental and societal responses; ineffectiveness of our business strategy due to changes in current or future market conditions; the effects of competition, and of changes in laws and regulations, including industry consolidation and development of competing financial products and services; interest rate movements; changes in credit quality; difficulties in integrating distinct business operations, including information technology difficulties; volatilities in the securities markets; and deteriorating economic conditions; the failure of the SBA to honor its guarantee of loans issued under the Paycheck Protection Program; and other risks and uncertainties, including those detailed in our filings with the Securities and Exchange Commission (the “SEC”).

Although forward-looking statements help provide additional information about us, investors should keep in mind that forward-looking statements are only predictions, at a point in time, and are inherently less reliable than historical information. You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement. We assume no obligation to update any forward-looking statement in order to reflect any event or circumstance that may arise after the date of this proxy statement, other than as may be required by applicable law or regulation.

About Embassy

Embassy Bancorp, Inc. (OTCQX: EMYB) is the holding company for Embassy Bank for the Lehigh Valley (the “Bank”), which was formed in 2001 by members of the Lehigh Valley, Pennsylvania, community to ensure that the Lehigh Valley would have a locally-owned, locally-managed bank for many years to come. To this day, the focus remains local – the Board of Directors is comprised of local business owners, and many of the Company’s shareholders are also some of the Bank’s longest-serving customers – and that focus has paid off with a strong history of growth and financial performance. From its humble beginnings in a trailer on the construction site of its first office, the Company has grown to almost $1.5 billion in assets, $1.1 billion in loans and $1.3 billion in deposits, all without any acquisitions and under the guidance of an executive management team that has now been together for nearly two decades.

The Company provides a traditional range of financial products and services to meet the depository and credit needs of individual consumers, small and medium sized businesses and professionals in the Lehigh Valley and its surrounding communities. In order to differentiate the Company from its larger competitors, there is a strong focus on service that is highly personalized, efficient and responsive to local needs. The Company employs an experienced, well-trained, highly motivated staff, with interest in building quality client relationships using contemporary delivery systems and client service facilities. The Company’s senior management team has extensive banking experience and establishes the Company’s goal to serve the financial needs of its clients and provide a profitable return to its shareholders, consistent with safe and sound banking practices.

The Company credits its success in large part to its dedicated executive management team who have guided the Bank since its inception, together with its highly personalized relationship banking model, while always keeping a sharp focus on credit quality. By staying in-market and thoroughly understanding its customers, products and services, the Company not only survived, but thrived through and following the financial crises of the Great Recession, having never participated in any subprime lending and never obtained any governmental funding through the TARP or SBLF programs.

The Company takes great pride in the fact that it has preserved shareholder value over the years, in part, by funding its growth through a combination of retained earnings and holding company leverage, rather than dilutive equity offerings. In fact, its Board of Directors and executive management team collectively hold over 27% of the Company’s outstanding shares, ensuring that the interests of the Board and management are directly aligned with those of its shareholders.

Despite this strong historical performance, in 2020, we experienced one of the most volatile economic environments in memory. It goes without saying that the COVID-19 pandemic represents a novel and unprecedented challenge to the banking industry which has required a new level of resilience and adaptability. The uncertainties and risks posed by, and governmental and societal responses resulting from, the economy and pandemic are unlike any that we have seen in this Country’s history. Our team proudly implemented new ways to serve and help our customers, communities, shareholders and one another. Embassy stood and continues to stand ready to work through this challenge, as it did during the Great Recession.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Board of Directors

The Company’s Bylaws provide that the Company’s business shall be managed by a Board of Directors of not less than five and not more than twenty-five Directors, who shall hold office for a three-year term or until their successors are duly elected and qualified. The Board has set the number of Directors at eight (8). Pursuant to the Bylaws, the Board of Directors is divided into three Classes: Class 1, Class 2 and Class 3, with each class serving a staggered, three-year term of office and being as nearly equal in number as possible. Each of the members of the Company’s Board of Directors also serves as a Director of the Bank.

Nominees for Election

The Board of Directors proposes the following two (2) nominees be elected as Class 2 Directors to hold office for a period of three (3) years and until their successors have been elected and qualified:

John G. Englesson

Patti Gates Smith

Each of the nominees currently serves as a Class 2 Director with a term expiring in 2021.

The two (2) nominees for Director receiving the highest number of votes cast by shareholders entitled to vote for the election of Directors shall be elected. Unless otherwise instructed, proxies received from shareholders will be voted for the election of the above-named nominees. If the nominees should become unavailable for any reason, proxies received from shareholders will be voted in favor of substitute nominees, as the Board of Directors shall determine. The Board of Directors has no reason to believe that the nominees will be unable to serve if elected. Any vacancy occurring on the Board of Directors, for any reason, may be filled by a majority of the Directors then in office until the expiration of the term of the vacancy.

The Board of Directors recommends a vote FOR the election of the above-named nominees for election as Directors.

Information as to Nominees and Directors

We provide below information as of the date of this proxy statement about each nominee and Director of the Company. The information includes information each Director has given the Company about his/her age, all positions held, principal occupation and business experience for the past five years. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led the Board of Directors to the conclusion that the nominee should serve as a Director, the Company also believes that all of the current Directors and nominees have demonstrated good judgment, strength of character, and an independent mind, as well as a reputation for integrity and the highest personal and professional ethics. No Director of the Company is a Director of any other publicly-held company.

Nominees for Class 2 Director (Current Class 2 Directors with terms expiring in 2021)

John G. Englesson, 68

Mr. Englesson is Co-Owner and Co-Founder of Integrity Business Services, LLC (Integrity SBS). Integrity SBS provides business process services to small, medium and large scaled companies. Mr. Englesson also owns and is President of 6.023 Corporation d.b.a. zAxis Corporation, a company dedicated to advising business leaders on profitably growing their businesses. He has served in a number of executive management positions, as well as on several boards of emerging technology businesses. He was one of the principal owners of Chadwick Telecommunications Corporation and the "Chadwick Family" of Companies. Mr. Englesson has volunteered his time with numerous community organizations, including his current participation in the Allentown Economic Development Corporation as a Board Member and its Secretary. He has also served on the Mayor of Allentown’s Transition Team as the Chair of the Community and Economic Development Committee, the Bethlehem Economic Development Corporation as its President, the Lehigh Valley Economic Development Corporation as its Chair, the Rotary Club of Bethlehem as its President, and the American Hellenic Educational Progressive Association as its President. The Board believes that Mr. Englesson’s entrepreneurial and technical experience, as well as his knowledge and involvement within the community, well qualifies him for service as a Director of the Company.

Patti Gates Smith, 63

Ms. Gates Smith is the owner/consultant of GatesSmith Consulting, a company with a focus in educational events and foundation management. She is currently the Assistant to the SELC District President of Lutheran Church Missouri Synod. She was formerly a School Administrator with The Lutheran Academy and also a Perinatal Clinical Nurse Specialist for Easton Hospital. She was the Director of Professional Development at PA State Nurses Association. Ms. Gates Smith is currently a committee member of the ArtsQuest Foundation Campaign and a member of the Altar Guild at Concordia Evangelical Lutheran Church. She is an alumnus of Leadership Lehigh Valley, Class of 1995, serving as a past President of the Alumni Association and also as a member of the Board of Directors. Her community involvement has included such organizations as American Red Cross, as an Executive Committee Board Member; The Lutheran Academy, as Secretary of the Board; Good Shepherd Rehabilitation Hospital, as Quality Counsel Member and

St. Luke's Visiting Nurse Association as Past Board Chair and Chair of the Hospice Endowment Campaign which raised over $2.5 million dollars. Ms. Gates Smith was also a past board member of the Pennsylvania Perinatal Association. The Board believes that Ms. Gates Smith's experience in the medical field, as a provider and as an entrepreneur, as well as her knowledge and involvement within the community, well qualifies her for service as a Director of the Company.

Current Class 3 Directors (terms to expire in 2022)

Bernard M. Lesavoy, 62

Mr. Lesavoy is an attorney and holds a Bachelor's and Master's Degree in Business Administration, as well as a law degree, all from George Washington University. He has been practicing law in the Lehigh Valley since 1987. He is currently a member of Lesavoy Butz & Seitz LLC and heads the firm's Corporate and Real Estate Departments. Mr. Lesavoy concentrates his practice in business, corporate, real estate, and business succession matters. Mr. Lesavoy previously served on the advisory council of Ambassador Bank. His community involvement includes, among many others, present and/or former service on the boards of St. Luke's University Health Network, the Greater Lehigh Valley Chamber of Commerce, the Bar Association of Lehigh County, and the South Whitehall Township Zoning Hearing Board. The Board believes that Mr. Lesavoy's years of experience practicing law in the Lehigh Valley, his knowledge and involvement within the community, and his prior service on the advisory council of a bank, well qualifies him for service as a Director of the Company.

David M. Lobach, Jr. Chairman, 71

Mr. Lobach is the President, Chief Executive Officer, and Chairman of the Company and the Bank and has served as President and Chief Executive Officer since 2008 and 2001, respectively, and Chairman since 2009. He was co-founder of the Bank. He began his banking career in 1971. He was Executive Vice President and Chief Operating Officer of Ambassador Bank. During his 19-year tenure with First Valley Bank prior thereto, Mr. Lobach oversaw such areas as private banking, commercial services, corporate business development, consumer lending functions, and holding company activities. Mr. Lobach currently serves on the Board of St. Luke’s Hospital Network, previously as Chairman. In addition, he currently serves on the boards of Lehigh Carbon Community College Foundation Board and on the advisory board for Bethlehem Area Vocational Technical School. He is a former member of the Federal Reserve Bank of Philadelphia Advisory Council. He has taught and/or participated in various banking and business programs at area colleges and universities, including Lehigh, Dickinson and Rutgers. He is a former member of the Board of Trustees of Moravian College Seminary in Bethlehem, PA. He is past vice chairman of Eastern States BankCard Association, Visa Division and has served the Lehigh Valley community as a volunteer on the boards of such organizations as Junior Achievement, Boys and Girls Club, United Way, Lehigh Valley Chamber of Commerce, State Theater, Pennsylvania Bankers Education Committee, Wellness Community, Northampton County Historical Society, The Seed Farm, and the Lehigh Valley Community Foundation. The Board believes that Mr. Lobach’s extensive and diverse banking background and experience, as well as his extensive knowledge of and involvement in the community, well qualifies him for service as a Director of the Company.

John C. Pittman, 71

Mr. Pittman was a member of the advisory council of Ambassador Bank. He is currently President of J.C. Pittman Inc. He formerly was Chief Executive Officer of John C. Pittman/Sport Stars, Inc., an international photo manufacturing company specializing in the youth activities market. Prior to founding his photographic business, Mr. Pittman served as an educator in the fields of science and photography. Mr. Pittman is a member of the Amusement Ride Safety Board as an appointee of former Governor Ridge and a former member of the United States Selective Service System Appeal Board for the Commonwealth of PA. Mr. Pittman also served as a member of the Board of Trustees of Massanutten Military Academy in Virginia and is a founding Director of the Museum of Speed in Bedford, PA. The Board believes that Mr. Pittman’s experience as an entrepreneur operating his business in the Lehigh Valley, in addition to his prior service as advisory council to a bank, well qualifies him for service as a Director of the Company.

John T. Yurconic, 53

Mr. Yurconic is the President of The Yurconic Agency, a local insurance, vehicle registration and driver’s license services agency with 13 locations in Lehigh, Northampton, Schuylkill, Berks Luzerne and Carbon counties. He began his insurance career in 1989 after graduating from Lafayette College. Mr. Yurconic currently serves on the board of Synergy Holdings Corp., a workmen’s compensation specialist insurance company and PA Messenger Services, Inc. Mr. Yurconic also served on the advisory council of Ambassador Bank. He currently serves on the board of the Greater Lehigh Valley Chamber of Commerce and is the President of Lehigh Country Club. He has previously served as an executive board member for the Minsi Trail Council of the Boys Scouts of America and board member for St. Luke’s University Health Network Allentown Campus. The Board believes that Mr. Yurconic’s experience in the insurance business since 1989, serving the greater Lehigh Valley community, his prior service as advisory council of a bank, and his knowledge and involvement within the community, well qualifies him for service as a Director of the Company.

Current Class 1 Directors (terms to expire in 2023)

Frank “Chip” Banko III, 62

Mr. Banko III is the retired President of Warren Distributing Co., a wholesale distribution company with three locations in New Jersey. He had worked in the family-owned and operated businesses since 1979, which include real estate holdings, and has a working knowledge of all aspects of those businesses. Mr. Banko III was previously a board member of Lehigh County Agricultural Society and has also previously served on the board of the Wildlands Conservancy. The Board believes that Mr. Banko III’s experience as an entrepreneur, as well as his business knowledge, well qualifies him for service as a Director of the Company.

Geoffrey F. Boyer, CFP, 76

Mr. Boyer has been a Certified Financial Planner since 1985, with 45+ years' experience in financial planning, investments, insurance and banking. Mr. Boyer is a graduate, former board member and President of Leadership Lehigh Valley and has been named to Who’s Who in Finance and Industry. He served as a past President of the Emmaus Rotary Club. He formerly served on the Board of the Greater Lehigh Valley Chamber of Commerce and as President of the Small Business Council. With his wife, he previously served as Co-Chair of the Lehigh Valley Red Cross Clara Barton Society. As part of his succession plan, Mr. Boyer merged his company, Boyer Financial Group, into Quantum Financial Management, LLC in December 2018. He continues to serve as an officer or director of several other local small businesses and charitable endeavors. The Board believes that Mr. Boyer’s years of experience in financial planning, investments and insurance, as well as his knowledge and involvement in the community, well qualifies him for service as a Director of the Company.

All of the foregoing individuals have served as Directors since the organization of the Company in 2008, with the exception of Mr. Banko III (2011) and Ms. Gates Smith (2016), and all have served as Directors of the Bank since its inception in 2001, with the exception of Mr. Yurconic (2007), Mr. Banko III (2011) and Ms. Gates Smith (2016).

Governance of the COMPANY

Pursuant to the Pennsylvania Business Corporation Law of 1988, as amended, and the Company’s Bylaws, the business of the Company is managed under the direction of the Board of Directors. Members of the Board are kept informed of the Company’s business through discussions with the CEO and other Executive Officers, by reviewing materials provided to them, and by participation in meetings of the Board and its committees. By incorporating under Pennsylvania law, our Board owes its fiduciary duty to the Company and not to any single constituency of the Company. This ensures that, in considering any action or inaction, the Board is free to consider the impact of such action or inaction on any or all of the Company’s constituencies, which includes the Company’s shareholders, employees, customers and community, and is not required to regard any single constituency (such as the short-term interests of shareholders) as dominant or controlling.

As a part of its strategic planning process, the Board regularly engages with members of the Company’s executive management team and professional advisors in order to review and evaluate the Company’s business plan and strategic direction. Particular attention is paid to trends in the financial services industry both locally and nationally, continued customer migration toward mobile and electronic banking products and services, developments in the area of cyber-security and advances in the tools and techniques utilized by cyber criminals, and overall risk management, in order to ensure that the Company is well-positioned to continue its mission to remain an independent, locally-owned and operated community bank. As evidenced by its strong historical earnings and asset quality, and the retention of the same senior management team for 20 years, the Company continues to successfully execute its mission.

As with any company, succession planning is an important aspect of the Board’s strategic planning process, particularly as members of the Company’s Board and management team continue to age. While no individual member of the Board or senior management team has communicated an expectation or desire to retire in the near-term, the Board continues to work with executive management to implement programs and procedures designed to mitigate against the risk of disruption caused by expected and unexpected departures of key personnel. Because a significant contributing factor to the Company’s long-term success has been the efficiency with which it runs its operations, an important component of these programs is cross-training of officers among various disciplines within the Company, which is intended to ensure that the Company will always have the benefit of a well-rounded team of officers able to support multiple functional areas within the Company should the need arise.

Director Independence

As of April 19, 2021, all but three members of the Board of Directors are considered independent as determined in accordance with the independence standards of the NASDAQ Stock Market. Mr. Lobach, Chairman, President and CEO of the Company, Bernard Lesavoy, Esquire, whose firm provides legal services to the Company and who also serves as an officer of Red Bird Associates, LLC, and Frank Banko III, who serves as an officer of and owns 45% of Red Bird Associates LLC and who also receives rent from the Bank for a branch office, are not considered independent in accordance with the independence standards of the NASDAQ Stock Market. In determining the Directors’ independence, in addition to matters disclosed under “Certain Relationships and Related Transactions” below, the Board of Directors considered each Director’s beneficial ownership of Company common stock, loan transactions between the Bank and the Directors, their family members and businesses with whom they are associated, as well as any contributions made to non-profit organizations with whom they are associated.

Except with respect to the individuals noted above, in each case, the Board determined that none of the transactions impaired the independence of the Director. For more information, please refer to “Certain Relationships and Related Transactions” below.

Leadership Structure of the Board

The Board has discretion to combine or separate the positions of Chairman and Chief Executive Officer of the Company. Since June of 2009, David M. Lobach, Jr. has served as Chairman, President and Chief Executive Officer of both entities. The Board of

Directors appointed Mr. Lobach to the additional position of Chairman believing that his service as President and Chief Executive Officer of the Bank and the Company since their respective inceptions, as well as his role as a co-founder of the Bank, uniquely qualified him for this role. The Board of Directors believes that at this time, Mr. Lobach’s leadership in these capacities will ensure that management is aligned with the Board and positioned to effectively implement the business strategy endorsed by the Board.

The Board has not appointed a Lead Independent Director.

Role of the Board of Directors in Risk Oversight

The Board is responsible for providing oversight of the Company’s risk management processes and for overseeing the risk management function of the Company. In carrying out its responsibilities, the Board of Directors works closely with senior risk officers and meets at least bi-annually to review management’s assessment of risk exposure and the process in place to monitor and control such exposure. In addition, the Audit Committee meets no less than quarterly to review annual and quarterly reports on Forms 10-Q and 10-K, internal audits and loan reviews, and meets in executive session with internal auditors, the Company’s principal accountants, and the Chief Financial Officer, among others, to assess risk that may affect the entire Company.

Attendance at Meetings

The Board of Directors held fourteen meetings in 2020, and meets no less frequently than on a monthly basis.

During 2020, each of the Directors attended 100% of the aggregate of all meetings of the Board and the committees on which he/she served, with the exception of Mr. Banko who attended 93%.

Each Director and nominee are expected to attend the annual meeting. All of the current Directors were present for the 2020 annual meeting of shareholders.

Committees of the Board of Directors

Audit Committee

The Audit Committee of the Company’s Board of Directors met four times during 2020, and operates pursuant to a written charter, a copy of which is available on the Company’s website at www.embassybank.com under “Investor Relations, Corporate Information, Governance Documents”. The Audit Committee is currently comprised of Messrs. Boyer, Englesson (Chairman), Pittman, Yurconic and Ms. Gates Smith. Mr. Lobach attends the committee meetings in a non-voting capacity. All voting members of the Audit Committee are considered independent as determined in accordance with the independence standards of the NASDAQ Stock Market.

The Audit Committee is charged with providing assistance to the Board in fulfilling its responsibilities to the shareholders in the areas of financial controls and reporting. Principally, these responsibilities entail assessing the effectiveness of the internal control system over financial reporting, reviewing adherence to policies and procedures and assuring the safeguarding of all Company assets and the accuracy of the Company’s financial statements and reports. In so doing, it is the responsibility of the Audit Committee to monitor and maintain the lines of communications between the Board of Directors, external auditors, internal auditors and the senior management of the Company. The external auditor shall be ultimately accountable to the Audit Committee. Additionally, the Company’s independent registered public accounting firm has unrestricted access to the Audit Committee.

The Board of Directors has determined that the Company does not have an “Audit Committee Financial Expert”, as defined by the SEC, serving on the Audit Committee. The Board of Directors believes that the members of the Audit Committee are able to read and understand consolidated financial statements of the Company, are familiar with the Company and its business, and are capable of fulfilling the duties and responsibilities of an Audit Committee without the necessity of having an “Audit Committee Financial Expert” as a member.

For further information regarding the Audit Committee, see the discussion under the caption: “Report of Audit Committee” below.

Personnel Committee

The Bank’s Personnel Committee performs the functions of a compensation committee. When acting in such capacity, the duties of the Personnel Committee are as follows: to establish the compensation of officers and employees of the Company and Bank; to examine periodically the compensation structure of the Company; and to supervise welfare, pension and other compensation plans of the Bank and the Company. With respect to the compensation of the Company’s Named Executive Officers (identified below), the Personnel Committee recommends to the full Board of Directors for its approval the compensation (both salary and bonus) of such persons based on, among other things, the following factors: the overall performance of the Company for the prior year; the amounts allocated in the Company’s budget toward compensation; and its review of the individual performance of the Named Executive Officers. The Personnel Committee delegates to the Named Executive Officers the authority to establish the compensation of all other employees of the Company, within the parameters established by the Committee.

The Company did not engage the services of a compensation consultant in 2020. The Personnel Committee is currently comprised of the following Directors: Messrs. Banko, Englesson, Lesavoy (Chairman) and Lobach. As a member of the Personnel Committee, as well as President and Chief Executive Officer, Mr. Lobach abstains from all voting and discussion with respect to matters pertaining to the compensation of the Named Executive Officers. The Personnel Committee does not operate under a formal charter.

Other Committees

The Company does not have any other standing committees.

Nominating Process

The Company’s Board of Directors does not have a standing nominating committee. The Bank’s Personnel Committee, however, reviews the qualifications of and makes recommendations to the Board of Directors of the Company regarding potential candidates to be nominated for election to the Board of Directors.

The Personnel Committee does not have a charter. It considers the nomination of all candidates for Director on a case-by-case basis. The factors considered by the Personnel Committee include a candidate’s education, business and professional background and experience, banking experience, community involvement, character, integrity as well as the individual’s contribution to the Board’s overall diversity. Additionally, the Company’s Bylaws require that every Director be a shareholder of the Company.

Due to the infrequency of nominations, the Company does not have a written policy with respect to the nomination of candidates by shareholders; however, in considering nominations for Director, its policy is to not distinguish between nominations recommended by shareholders and those recommended by the Personnel Committee. If any shareholder wishes to recommend any candidate for nomination to the Board, he or she should submit the name of such person to the Personnel Committee at the address shown on the cover page of this proxy statement. In order to be considered for nomination in connection with the next annual meeting of shareholders, such name and the candidate’s principal occupation, business and professional background, education, community involvement and banking experience should be provided to the Personnel Committee on or before the deadline for submitting proposals for inclusion in the Company’s proxy statement for its next annual meeting.

Shareholder Communications

The Board of Directors does not have a formal process for shareholders to send communications to the Board of Directors. Investors wishing to communicate with the Board or any member may do so by addressing any communication, care of the Board or any Director, to the Company at the address shown on the first page of this proxy statement.

Code of Conduct (Ethics)

The Board of Directors has adopted a Code of Conduct (Ethics) policy governing the Company’s Directors, Executive Officers and employees. The Code of Conduct governs such matters as conflicts of interest and use of corporate opportunity, financial reporting, violation of the Company’s policies, and the like. The Board has also adopted a Whistleblower Policy to provide a means by which employees may report violations or suspected violations of law or Company policies without fear of retaliation. The Audit Committee Chair is responsible for investigating and resolving such reports. A copy of the Code of Conduct (Ethics) policy and Whistleblower Policy are available on the Company’s website at www.embassybank.com under “Investor Relations, Corporate Information, Governance Documents”.

Restrictions on Hedging

The Board of Directors has adopted an Insider Trading Policy that includes anti-hedging provisions that prohibit all employees and directors from short-selling Company securities and from engaging in transactions in any derivative of Company securities (other than securities issued under a Company compensation plan), including buying and selling options.

Certain Relationships and Related Transactions

The Board of Directors of the Company has instituted a policy in connection with extensions of credit by the Bank to any Director, officer or employee of the Company or Bank, or to any business entity in which a Director, officer or employee of the Company or Bank has a direct or indirect interest. These extensions of credit shall only be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unrelated persons, and in the opinion of management do not involve more than the normal risk of collection or present other unfavorable features. At December 31, 2020, total loans and commitments of approximately $15.4 million were outstanding to our Executive Officers, Directors, and their affiliated businesses, which represented approximately 14% of our shareholders’ equity at such date.

In January 2003, an investment group comprised of insiders of the Company formed Red Bird Associates, LLC (“Red Bird”) for purposes of purchasing the office building in which the principal offices of the Bank and Company are located. Red Bird purchased

the property subject to the existing leases of all tenants in the building, including the Bank. The previous owner of the building was unrelated to the Company, the Bank or any of the Directors. The original terms for the Bank’s lease were negotiated with the former owner in the year 2000. In 2017, the Bank and Red Bird agreed to extend the term through February 28, 2022 on terms comparable for similar space in the Lehigh Valley area. Red Bird received rents for the Gateway Drive location totaling $588,924 during 2020 and the Bank has an outstanding lease commitment to pay approximately $3,471,248 over the remaining term of the lease. Red Bird also owns 5,600 shares of Company common stock. The following Directors and Executive Officers of the Company currently hold equity interests in Red Bird: Mr. Banko III (managing member), Mr. Boyer, Ms. Hunsicker, Mr. Lesavoy (managing member), Mr. Lobach, and Mr. Pittman.

In March 2006, the Bank entered into a lease agreement with former Director Frank Banko providing for the lease of 2,918 square feet of first floor office space for the purpose of opening a branch at 925 W. Broad St. in Bethlehem, which lease is now held by Director Frank Banko III. Prior to its execution, the Bank obtained a third-party valuation of the market rent for the space and believes that the rental terms are fair, reasonable and comparable to the terms for similar space in the Lehigh Valley area. During 2020, the Bank paid $45,959 for rent of the West Broad St., Bethlehem, location and has an outstanding lease commitment to pay $224,409 over the remaining term of the lease.

Bernard M. Lesavoy, Esquire, serves as a Director of the Company and the Bank and is currently a principal of Lesavoy Butz & Seitz LLC. Lesavoy Butz & Seitz LLC provides legal services to the Company and the Bank. In 2020, the Bank paid $29,137 to Lesavoy Butz & Seitz LLC in consideration for such services.

Pursuant to the Company’s Code of Conduct (Ethics), the Board is responsible for overseeing transactions between the Company and/or the Bank and any of its affiliated parties, including Directors and Executive Officers. In accordance therewith, each of the foregoing transactions was approved by a majority of the disinterested Directors then in office. It is the policy of the Company to ensure that transactions with affiliates are conducted on an arm’s length basis.

Executive Officers

We identify below each of the Executive Officers of the Company and the Bank, their age as of May 7, 2021, the position they currently hold and their professional experience.

David M. Lobach, Jr., 71

See profile set forth above under the heading “Current Class 3 Directors”.

Judith A. Hunsicker, 60

Ms. Hunsicker, First Executive Officer, is the Chief Operating and Financial Officer of the Company and the Bank, serving in such capacity since the organization of the entities in 2008 and 2001, respectively. She began her banking career in 1980. Prior to joining the Company, she was most recently a member of the senior management team of Lafayette Ambassador Bank and formerly Vice President and Chief Financial Officer of Ambassador Bank. Prior thereto, she was an Assistant Vice President/Commercial Services at First Valley Bank. She is a member of the Home Ownership Counseling Program of the Community Action Committee of the Lehigh Valley, the Moravian Leadership Council for Moravian College, and the Lehigh Valley CRA Officers Group. She is the former chairperson of the boards and is currently a board member of the Lehigh Valley Community Land Trust, and Skills USA, Lehigh Valley Council. She also serves as secretary, board and executive committee member of Community Lenders Community Development Corporation and serves as president of the board of the Pratyush Sinha Foundation. She previously served as a board member or volunteer with such organizations as the Bethlehem YMCA, New Bethany Ministries, Minsi Trails Council of the Boy Scouts of America, Lehigh Valley Coalition of Affordable Housing, Junior Achievement of the Lehigh Valley, and Neighborhood Housing Services of the Lehigh Valley.

James R. Bartholomew, 67

Mr. Bartholomew serves as Senior Executive Vice President of the Company and the Bank, as well as Senior Lending Officer of the Bank. He began his banking career in 1974. Prior to joining the Bank at its inception in November, 2001, he was a Senior Vice President and Territory Sales Manager with PNC Bank (1992 to 2001), a Division Manager of Bank of Pennsylvania (1989 to 1992) and held various positions leading to Vice President at First Valley Bank (1974 to 1989). He has previously served as Chairman of the Board of Lehigh Valley Economic Development Corporation and on their Board of Directors. He has also served in the past as a Foundation Board Member at Bethlehem Catholic High School and Northampton Community College, and participated on the boards of the Allentown Boys Club, Hispanic American Organization and Allentown Economic Development Corporation. He currently serves on the boards of The Friends of the Bethlehem Mounted Police, St. Francis Center for Renewal, and Lehigh Valley Community Foundation.

Diane M. Cunningham, 53

Ms. Cunningham serves as Executive Vice President of the Company and the Bank, currently overseeing the retail bank network, consumer lending and marketing. She began her banking career in 1988 and has previously served as Assistant Vice President at Lafayette Ambassador Bank and Assistant Vice President of Ambassador Bank. She is a graduate of Northampton Community College and has served on various boards for non-profit organizations, including Toastmasters International, YWCA Allentown and The Lehigh Valley Workforce Investment Board.

Lynne M. Neel, 59

Ms. Neel serves as Executive Vice President and Assistant Secretary of the Company and the Bank, currently overseeing finance, deposit operations, loan operations and investor relations. She is a graduate of Moravian College and began her banking career in 1985 at the former Valley Federal Savings & Loan. Prior to joining the Bank, at its inception in September 2001, she was an Assistant Vice President at Lafayette Ambassador Bank. She has served and/or volunteered for such organizations as Special Olympics, Habitat for Humanity, United Way, Big Brothers/Big Sisters, St. Paul's Lutheran Church, Palmer Township Athletic Association, Easton Area High School Musical Theatre Program, and Easton Area High School Softball Community Weekend committee. She currently serves on the board for Equi-librium in Nazareth, PA.

INFORMATION CONCERNING SHARE OWNERSHIP

Beneficial ownership of shares of the Company’s common stock is determined in accordance with SEC Rule 13d-3, which provides that a person should be credited with the ownership of any stock held, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise, in which the person has or shares:

| · | | Voting power, which includes power to vote or to direct the voting of the stock; |

| · | | Investment power, which includes the power to dispose or direct the disposition of the stock; or |

| · | | The right to acquire beneficial ownership within 60 days after April 19, 2021. |

Beneficial Ownership of Principal Holders

The following table shows, to the best of the Company’s knowledge, those persons or entities, who owned of record or beneficially, on April 19, 2021, more than 5% of the Company’s outstanding common stock.

| | | | |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership of Common Stock | Percentage of Common Stock Beneficially Owned | |

Frank Banko III | 517,091 | (1) | 6.82% | |

c/o Embassy Bancorp, Inc. | | | | |

100 Gateway Drive, Suite 100 | | | | |

Bethlehem, PA 18017 | | | | |

| | | | |

David M. Lobach, Jr. | 513,471 | (2) | 6.77% | |

c/o Embassy Bancorp, Inc. | | | | |

100 Gateway Drive, Suite 100 | | | | |

Bethlehem, PA 18017 | | | | |

| | | | |

(1) Includes 2,629 shares held by spouse and 5,600 shares attributable to Mr. Banko as Manager of Red Bird. | |

(2) Includes 8,854 shares held jointly with spouse; 49,905 shares held by spouse; 205 shares held jointly with son; 491 shares held as custodian under UGMA; and 35,609 shares issuable pursuant to presently exercisable stock options. Of that amount, 18,524 shares are pledged as security. | |

| |

Beneficial Ownership of Executive Officers and Directors

The following table sets forth, as of April 19, 2021, and from information supplied by the respective persons, the amount and the percentage, if over 1%, of the common stock of the Company beneficially owned by each Director, each nominee for Director, each of the Named Executive Officers and all Executive Officers of the Company as a group.

| | | | |

Name of Individual or Identity of Group | Amount and Nature of Beneficial Ownership (1) | | Percent of Class | |

| | | | |

Directors and Named Executive Officers | | | | |

Frank Banko III | 517,091 | (2) | 6.82% | |

James R. Bartholomew | 31,015 | (3) | * | |

Geoffrey F. Boyer | 101,819 | (4) | 1.34% | |

John G. Englesson | 55,148 | (5) | * | |

Judith A. Hunsicker | 84,875 | (6) | 1.12% | |

Bernard M. Lesavoy | 175,260 | (7) | 2.31% | |

David M. Lobach, Jr. | 513,471 | (8) | 6.77% | |

John C. Pittman | 376,362 | (9) | 4.96% | |

Patti G. Smith | 243,495 | (10) | 3.21% | |

John T. Yurconic | 35,162 | (11) | * | |

| | | | |

All Executive Officers, Directors and Nominees as a Group (12 Persons) | 2,153,546 | | 28.41% | |

* Indicates beneficial ownership of less than 1% | | | | |

(1) Unless otherwise indicated, to the knowledge of the Company, all persons listed have sole voting and investment power | |

with respect to their shares of Company common stock, except to the extent authority is shared by spouses under | |

applicable law. Pursuant to the rules of the SEC, the number of shares of common stock deemed outstanding includes | |

shares issuable pursuant to options held by the respective person or group that are currently exercisable or may be exercised | |

within 60 days of April 20, 2021 (“presently exercisable stock options”), in the amount of 63,632. Amounts reported in | |

this column also includes shares attributable to the respective person as a result of their ownership interest in and/or position with | |

Red Bird Associates, LLC. Fractional shares beneficially owned by such individuals have been rounded down to the number of | |

whole shares beneficially owned. Beneficial ownership may be disclaimed as to certain of these shares. | |

(2) Includes 2,629 shares held by spouse and 5,600 shares attributable to Mr. Banko as Manager of Red Bird. | |

(3) Includes 2,887 shares held jointly with spouse; 130 shares held by spouse as custodian under UGMA; and 4,227 shares | |

issuable pursuant to presently exercisable stock options. | |

(4) Includes 5,276 shares held by spouse and 6,153 shares held by daughter. | |

(5) Includes 5,013 shares held by spouse. | |

(6) Includes 55 shares held jointly with spouse and 23,796 shares issuable pursuant to presently exercisable stock options. | |

(7) Includes 97,991 shares held jointly with spouse; 2,688 shares held by spouse; 24,075 held as custodian under UGMA; and | |

5,600 shares attributable to Mr. Lesavoy as Manager of Red Bird. Of the stated amount, 57,000 shares are pledged as security. | |

(8) Includes 8,854 shares held jointly with spouse; 49,905 shares held by spouse; 205 shares held jointly with son; 491 shares held as | |

custodian under UGMA; and 35,609 shares issuable pursuant to presently exercisable stock options. Of that amount, 18,524 | |

shares are pledged as security. | |

(9) Includes 5,555 shares held by spouse and 150 shares held by spouse as custodian under UGMA. | |

(10) All shares held as trustee of Ms. Smith's living trust. | |

(11) All shares held jointly with spouse. | |

INFORMATION CONCERNING COMPENSATION

Compensation Philosophy

Return on Investment in Our People

The Board of Director’s annual compensation decisions are the product of a multi-step process. Annual salary adjustments are determined in light of budgetary constraints and overall performance. Both cash and equity bonuses are completely discretionary and based upon an evaluation of both the employee’s and Company’s overall performance for the prior year.

In determining the amounts to be allocated toward compensation in the Company’s annual budget, generally, as well as the compensation to be paid to the Named Executive Officers, specifically, the Board of Directors and Personnel Committee have always placed a strong emphasis on the overall performance of the Company, its efficiency ratio (e.g., noninterest expense divided by total revenue (net interest income plus noninterest income)), and the productivity ratios of total assets to employee, total loans to employee, total deposits to employee, and net income to employee (the “employee ratios”). The Board believes that the efficiency ratio and employee ratios are particularly important in determining compensation because it views such ratios as reasonable indicators of individual and team efforts. The Board also believes in running the Company for the long term and looks toward its management team to lead the Company’s future growth.

It is by design that the Company runs a very efficient operation, relying greatly on the knowledge and experience of its executive management team, and, where appropriate, the outsourcing of certain functions to high quality vendors, in order to do so. This level of efficiency requires that individual members of the Company’s executive management team assume roles that are most often held by multiple individuals at banks within the Company’s peer group. For example, David M. Lobach, Jr. serves as Chairman of the Board, as well as President and Chief Executive Officer, Judith A. Hunsicker serves as Chief Operating Officer and Chief Financial Officer, James R. Bartholomew serves as Senior Lending Officer and oversees business banking and business development, Diane M. Cunningham oversees retail banking and consumer lending, as well as marketing, and Lynne M. Neel oversees the finance department, deposit and loan operations and investor relations, to name a few such examples. This multidisciplinary approach is replicated throughout the Company. This structure makes it difficult, if not impossible, to conduct a true “apples-to-apples” comparison of the compensation of the Company’s executive management team with that of its peers. Therefore, in considering compensation, the Board pays particular attention to other, objectively measurable criteria, such as the employee ratios described above and the salary and benefit costs of its peers as a percent of average assets, as described below.

For the year ended December 31, 2020, the Company’s team productivity benchmarks or employee ratios were in the very top quartile of performance in comparison to those institutions that the Company considers its peers (e.g., a total of 19 Pennsylvania financial institutions with total assets ranging from $1.0 billion to $2.0 billion). Importantly, it should be noted that those financial institutions the Company considers its peers have 73% greater overall average salary and benefit costs as a percent of average assets than that of the Company’s. When one considers this fact together with the return on investment on an employee-by-employee basis, as indicated by the employee ratios, the Board feels strongly that employees are fairly compensated for their efforts. In other words, because the Company has fewer employees supporting a greater number of assets, loans, deposits, and net income than the average of its peers, it is beneficial for the Company to pay such employees for their high level of expectations and resulting performance.

Risk Management

The Board of Directors believes that its compensation philosophy and the resultant compensation paid to the Company’s employees, and the programs and practices on which such compensation decisions are based, are reasonable and do not present any risks that are reasonably likely to have a material adverse effect on the Company.

More specifically, with respect to risk management, the Board believes that by allocating a significant percentage of an employee’s total compensation to salary, not linking annual incentive compensation to pre-determined annual performance criteria, and rewarding employees for their efforts on an employee-by-employee basis, the Company’s compensation program is fair to the Company and the employee, and any incentive for an employee to take unnecessary and excessive risk is adequately minimized.

Long Term Performance

Finally, and most importantly, the Board believes that its approach to compensation has enabled the Company to enjoy a stable team of highly engaged banking professionals who have continued to fine tune the Company’s unique business model, culture, and resulting performance growing the Company from $0 in assets to over $1.4 billion in assets with minimal shareholder dilution over the last ten (10) years.

Executive Compensation

The following Executive Officers have been identified as our “Named Executive Officers”: David M. Lobach, Jr.-Chairman, President and Chief Executive Officer; Judith A. Hunsicker-First Executive Officer, Chief Operating and Financial Officer; and James A. Bartholomew-Senior Executive Vice President and Senior Lending Officer.

Summary Compensation Table

The table below sets forth the compensation awarded to, earned by, or paid to each of the Named Executive Officers for the year ended December 31, 2020 and the prior fiscal year. While employed, executives are entitled to base salary, participation in the executive compensation programs identified below, and other benefits common to all employees of the Bank.

| | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards ($) (1) | Stock Awards ($) (2) | Non-qualified Deferred Compensation Earnings ($) (3) | All Other Compensation

($) (4) | Total ($) |

David M. Lobach | 2020 | $ | 690,493 | | $ | 133,219 | | $ | - | | $ | 301,255 | | $ | 85,417 | | $ | 35,973 | | $ | 1,246,357 |

CEO, President and Chairman | 2019 | $ | 633,103 | | $ | 126,875 | | $ | - | | $ | - | | $ | 196,782 | | $ | 29,765 | | $ | 986,525 |

Judith A. Hunsicker | 2020 | $ | 478,848 | | $ | 92,385 | | $ | - | | $ | 72,140 | | $ | 331,865 | | $ | 14,211 | | $ | 989,450 |

First Executive Officer, COO, and CFO | 2019 | $ | 439,049 | | $ | 87,986 | | $ | - | | $ | - | | $ | 152,470 | | $ | 10,003 | | $ | 689,508 |

James R. Bartholomew | 2020 | $ | 363,352 | | $ | 70,103 | | $ | - | | $ | 35,916 | | $ | 246,633 | | $ | 14,836 | | $ | 730,840 |

Senior Executive Vice President and SLO | 2019 | $ | 333,152 | | $ | 66,764 | | $ | 4,500 | | $ | - | | $ | 69,848 | | $ | 12,011 | | $ | 486,276 |

(1) Option awards are valued based upon the Black-Scholes option valuation model. The actual value, if any, that may be realized will depend on the |

excess of the stock price over the exercise price on the date the option is exercised. Therefore, there is no assurance the value realized will be at |

or near the value estimated by the Black-Scholes model. The assumptions underlying the Black-Scholes model of the options granted in 2016 |

were determined with the following weighted averages: dividend yield of 1.03%, risk free interest rate of 2.35%, |

expected life of 6.0 years and expected volatility of 25.58%. The weighted average fair value of options granted in 2016 was $3.28 per share. |

(2) Restricted stock granted to employees are valued using the provisions of Accounting Standards Codification Topic 718. Amounts represent |

the full grant date fair value of the restricted stock awards granted on March 23, 2020 for 2019 service ($160,974 for Mr. Lobach of which |

$110,228 was issued in lieu of a periodic increase to benefits payable under the existing supplemental executive retirement plan agreement, |

$35,190 for Ms. Hunsicker and $17,519 for Mr. Bartholomew) and December 18, 2020 for 2020 service ($140,281 for Mr. Lobach of |

which $86,995 was issued in lieu of a periodic increase to benefits payable under the existing supplemental executive retirement plan agreement, |

$36,950 for Ms. Hunsicker and $18,397 for Mr. Bartholomew). Depending upon the terms of each respective grant, some percentage of the |

shares of restricted stock granted vests on each anniversary of the date of grant. The vesting periods range from three to five years. The |

assumptions used in the calculation of these amounts are included in the footnotes to the audited financial statements included in our respective |

Annual Report on Form 10-K for the fiscal years ended December 31, 2020 and 2019. |

(3) Non-qualified deferred compensation earnings represent the annual change in the accrual under the unfunded, non-qualified Supplemental |

Executive Retirement Plan ("SERP") for each employee. The amounts for the SERP liability are impacted by modifications in the amounts |

payable to each employee and assumptions around the interest rates used to discount the future payment obligations and estimated retirement date. |

(4) Includes Deferred Salary Savings Plan (401 (k)) company matching contributions, life insurance premiums, and personal use of company vehicle. |

The current annual salaries of the Named Executive Officers are: Mr. Lobach - $699,399; Ms. Hunsicker - $485,024 and Mr. Bartholomew - $368,038.

In 2003, the Bank adopted a 401(k) Plan for all of its employees, including the above-Named Executive Officers. The Plan provides that the Bank will contribute 50% of the contribution made by each employee, with the Bank’s contribution not to exceed 4% of compensation. The Bank’s contribution to each of the Named Executive Officers is included in the table above in the column titled “All Other Compensation”.

In addition to the above-described compensation, Executive Officers of the Company, as well as all other employees of the Company and the Bank, receive a benefit package consisting of hospitalization and health insurance coverage, optical and dental coverage, disability benefits and life insurance in the amount of three times annual salary in the event of death while employed. The Named Executive Officers each have employment agreements and supplement executive retirement plan agreements, as described below under “Agreements with Executive Officers,” and are eligible to participate in the Company’s 2010 Stock Incentive Plan, also described below.

Outstanding Equity Awards at Fiscal Year End Table

The following table sets forth information concerning the grant and exercise of stock options and the grant of restricted stock awarded to the Company’s Named Executive Officers.

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Outstanding Equity Awards at Fiscal Year End | | | | | | | | | | | | | | | |

As of 12-31-20 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

Name and Principal Position | Year | | Number of Securities Underlying Unexercised Options

(#) Exercisable | | Number of Securities Underlying Unexercised Options

(#) Un-exercisable | | Option Exercise Price ($) | | Option Expiration Date | | Shares That Have Not Vested | | Stock Award Grant Date | Market Value of Shares That Have Not Vested ($) | | Stock Expiration Date | Unearned Shares, Units or Other Rights that Have Not Vested (#) | Market Value of Unearned Shares, Units or Other Rights that Have Not Vested ($) |

David M. Lobach | | | | | | | | | | | | | | | | | | |

CEO, President and | 2020 | | - | | - | | $ - | | N/A | | 9,867 | (1) | 12/17/2020 | 140,881 | | N/A | N/A | N/A |

Chairman | 2020 | | - | | - | | - | | N/A | | 13,856 | (2) | 03/23/2020 | 197,836 | | N/A | N/A | N/A |

| 2019 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2018 | | - | | - | | - | | N/A | | 6,966 | (3) | 12/21/2018 | 99,461 | | N/A | N/A | N/A |

| 2017 | | - | | - | | - | | N/A | | 5,720 | (4) | 12/20/2017 | 81,670 | | N/A | N/A | N/A |

| 2016 | | - | | - | | - | | N/A | | 6,579 | (5) | 12/21/2016 | 93,935 | | N/A | N/A | N/A |

| 2015 | | - | | - | | - | | N/A | | 6,731 | (6) | 12/23/2015 | 96,105 | | N/A | N/A | N/A |

| 2014 | | 17,781 | | - | | 7.51 | | 01/17/23 | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2013 | | 17,828 | | - | | 7.00 | | 02/22/22 | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| Total | | 35,609 | | - | | $ 7.25 | | | | 49,719 | | | 709,888 | | | | |

Judith A. Hunsicker | | | | | | | | | | | | | | | | | | |

First Executive Officer, | 2020 | | - | | - | | $ - | | N/A | | 2,599 | (7) | 12/17/2020 | 37,109 | | N/A | N/A | N/A |

COO, and CFO | 2020 | | - | | - | | - | | N/A | | 3,029 | (8) | 03/23/2020 | 43,248 | | N/A | N/A | N/A |

| 2019 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2018 | | - | | - | | - | | N/A | | 736 | (9) | 12/21/2018 | 10,509 | | N/A | N/A | N/A |

| 2017 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2016 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2015 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2014 | | 11,882 | | - | | 7.51 | | 01/17/23 | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2013 | | 11,914 | | - | | 7.00 | | 02/22/22 | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| Total | | 23,796 | | - | | $ 7.25 | | | | 6,364 | | | 90,865 | | | | |

James R. Bartholomew | | | | | | | | | | | | | | | | | | |

Senior Executive Vice | 2020 | | - | | - | | $ - | | N/A | | 1,294 | (7) | 12/17/2020 | 18,476 | | N/A | N/A | N/A |

President and SLO | 2020 | | - | | - | | - | | N/A | | 1,508 | (8) | 03/23/2020 | 21,531 | | N/A | N/A | N/A |

| 2019 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2018 | | - | | - | | - | | N/A | | 367 | (9) | 12/21/2018 | 5,240 | | N/A | N/A | N/A |

| 2017 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2016 | | 4,227 | | - | | 12.64 | | 12/21/2025 | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2015 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2014 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| 2013 | | - | | - | | - | | N/A | | N/A | | N/A | N/A | | N/A | N/A | N/A |

| Total | | 4,227 | | - | | $ 12.64 | | | | 3,169 | | | 45,247 | | | | |

| | | | | | | | | | | | | | | | | | |

(1) The awards include 3,748 shares that vest in three equal annual installments beginning 12/17/21 and 6,119 shares that vest in four equal installments beginning 12/17/21. |

(2) The awards include 4,368 shares that vest in three equal annual installments beginning 03/23/21 and 9,488 shares that vest in five equal installments beginning 03/23/21. |

(3) The awards include 3,186 shares that vest in three equal annual installments beginning 12/21/19 and 8,855 shares that vest in six equal installments beginning 12/21/19. |

(4) The awards include 2,809 shares that vest in three equal annual installments beginning 12/20/18 and 10,009 shares that vest in seven equal installments beginning 12/20/18. |

(5) The awards include 6,047 shares that vest in three equal annual installments beginning 12/21/17 and 13,158 shares that vest in eight equal installments beginning 12/21/17. |

(6) The awards include 3,920 shares that vest in three equal annual installments beginning 12/23/16 and 15,143 shares that vest in nine equal installments beginning 12/23/16. |

(7) The awards vest in three equal annual installments beginning 12/17/21. |

(8) The awards vest in three equal annual installments beginning 03/23//21. |

(9) The awards vest in three equal annual installments beginning 12/21/19. |

|

| | | | | | | | | | | | | | | | | | |

The Company does not currently maintain any non-qualified contributory deferred compensation plans in which its Named Executive Officers participate.

Agreements with Executive Officers

Employment Agreements