Annual Meeting of Shareholders

June 20, 2024

Caution on Forward Looking Statements

This presentation may contain forward-looking statements, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Embassy Bancorp, Inc.’s (“Company”)

operations and policies and regarding general economic conditions. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions that, by their nature, are not susceptible to accurate forecast, and are subject to significant uncertainty.

Such forward-looking statements can be identified by the use of forward- looking terminology such as “believes”, “expects”, “may”, “intends”, “will”, “should”, “anticipates”, or the negative of any of the foregoing or other variations thereon or comparable terminology, or by discussion of strategy.

No assurance can be given that the future results covered by forward- looking statements will be achieved. Such statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from future results expressed or implied by such forward- looking statements.

Important factors that could impact the Company’s operating results include, but are not limited to, (i) the effects of changing economic conditions in the Company’s market areas and nationally, (ii) credit risks of commercial, real estate, consumer and other lending activities, (iii) significant changes in interest rates and related deposit flows, (iv) changes in federal and state banking laws and regulations which could impact the Company’s operations including policies of the U.S. Department of Treasury and Federal Reserve system, (v) changes in accounting policies or procedures as may be required by FASB or regulatory agencies, (vi) geopolitical events in the Ukraine and Russia,

(vii) adverse developments in the financial industry generally, such as the recent bank failures and related responsive measures to manage such developments, and (viii) other external developments which could materially affect the Company’s business and operations, as well as the risks described in the Company’s Form 10-K for the year ended December 31, 2023 and subsequent filings with the SEC.

Certain information contained in this presentation and statements made orally during this presentation relate to or are based on publications and other data obtained from third-party sources. While the Company believes these third-party sources to be reliable as of the date of this presentation, the Company has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources.

2

Board

of Directors

Frank "Chip" Banko IIIGeoffrey F. BoyerJohn G. EnglessonBernard M. Lesavoy

David M. Lobach, Jr.

Chairman

3

John C. PittmanPatti Gates SmithJohn T. Yurconic

Leadership Team

David M. Lobach, Jr.Judith A. HunsickerDiane M. CunninghamLynne M. Neel

Mark A. CascianoMichael B. MacyJeffrey C. SkuminBrandi L. StefanovJennifer A. Tropeano

4

Business

of the Meeting

5

Business

of the Meeting

Determination of a Quorum

Proposal #1

To elect two Class 2 Directors of the Company for a term of 3 years:

• John G. Englesson

• Patti Gates Smith

7

Business

of the Meeting

Determination of a Quorum

Proposal #1

To elect two Class 2 Directors of the Company for a term of 3 years:

• John G. Englesson

• Patti Gates Smith

Proposal #2

To ratify the appointment of Baker Tilly US, LLP as the company’s independent registered public accounting firm for the year ending December 31, 2024.

8

Business

of the Meeting

Final Voting in Progress

9

Business

of the Meeting

The Polls are Now Closed

10

Strength. Stability.

Community.

- Lynne Neel

11

22

Years Serving Lehigh Valley

113

Dedicated Team Members

10

Branch Offices

28,843

Satisfied

Customers

Superior

12Figures as of 3/31/2024

Strength

Long-term organic growth. Exceptional credit quality. Industry-leading efficiency. Expense control.

Healthy liquidity position.

Stability

Expert leadership team and board.

Unwavering strategy consistently applied.

Time-tested results.

Well-positioned for future growth.

13

Community

$13.2M

Our Support to Lehigh Valley Agencies 2001 – 2023

$1.1M

2023 Charitable, Sponsorships & Support

57

LV Community Events

203

Organizations Served

14

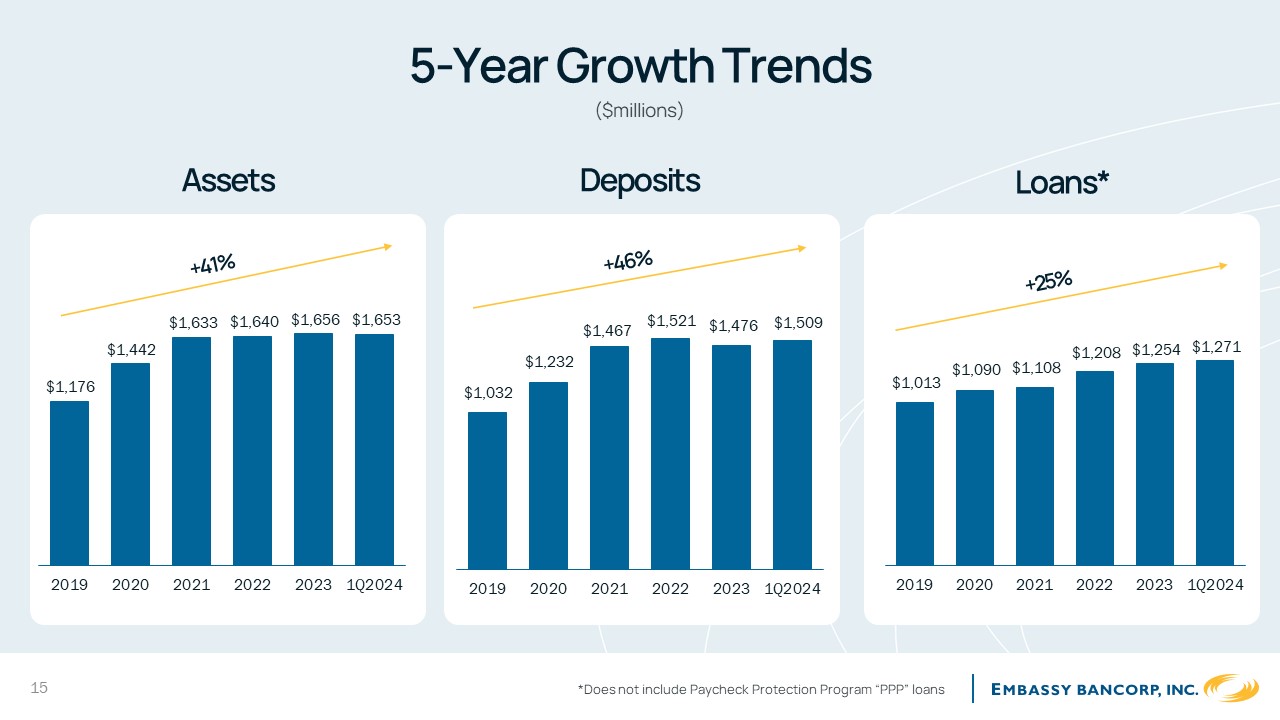

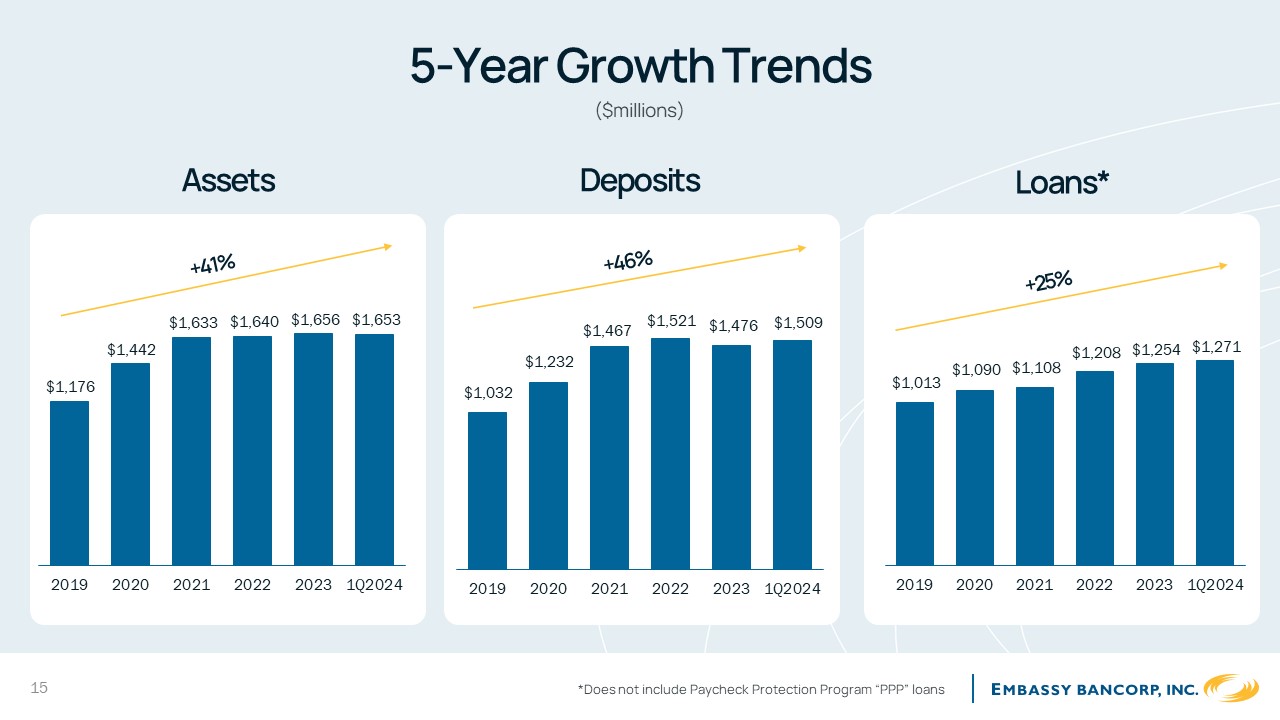

5-Year Growth Trends

($millions)

AssetsDepositsLoans*

$1,176

$1,442

$1,633 $1,640 $1,656 $1,653

$1,032

$1,232

$1,467$1,521 $1,476$1,509

$1,013

$1,090 $1,108

$1,208 $1,254 $1,271

201920202021202220231Q2024

201920202021202220231Q2024

20192020202120222023 1Q2024

15*Does not include Paycheck Protection Program “PPP” loans

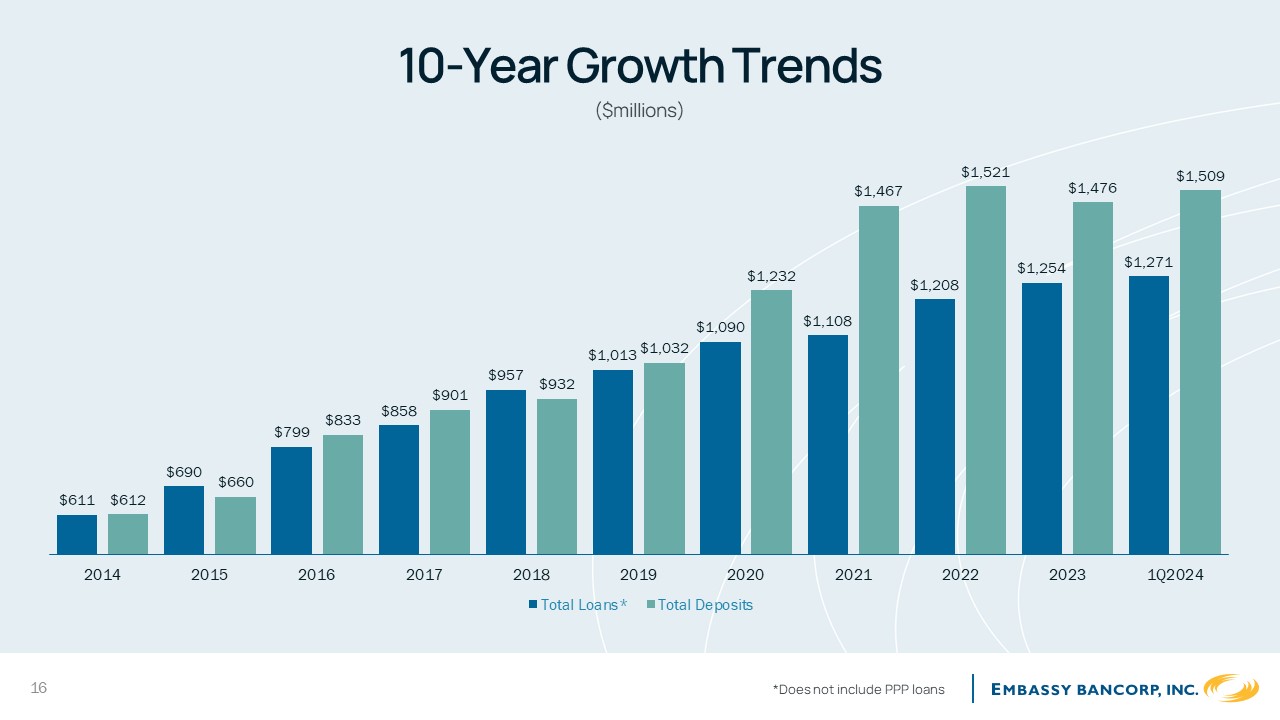

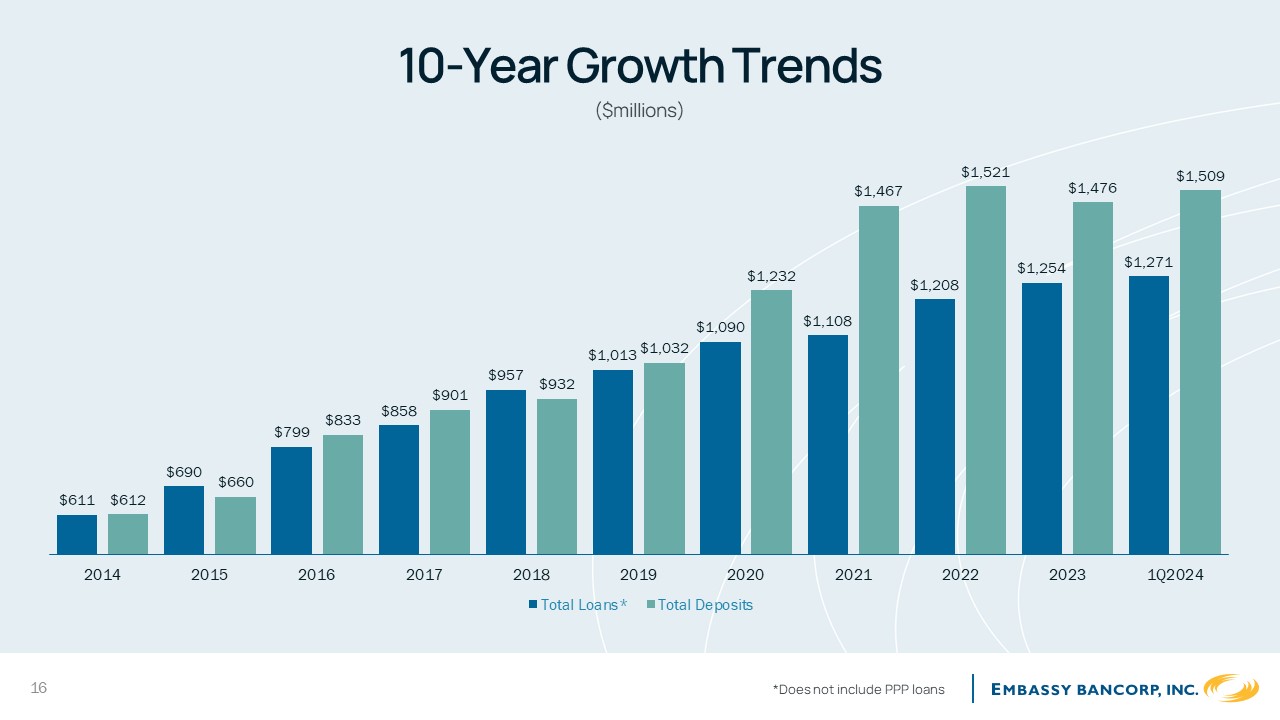

10-Year Growth Trends

($millions)

$1,521$1,509

$1,467$1,476

$611

$612$690$660$799$833$858$901$957$932$1,013 $1,032

$1,090

$1,232

$1,108

$1,254

$1,208

$1,271

20142015201620172018201920202021202220231Q2024

Total Loans*Total Deposits

16*Does not include PPP loans

Deposits Cost of Funds Market Share

- Diane Cunningham

17

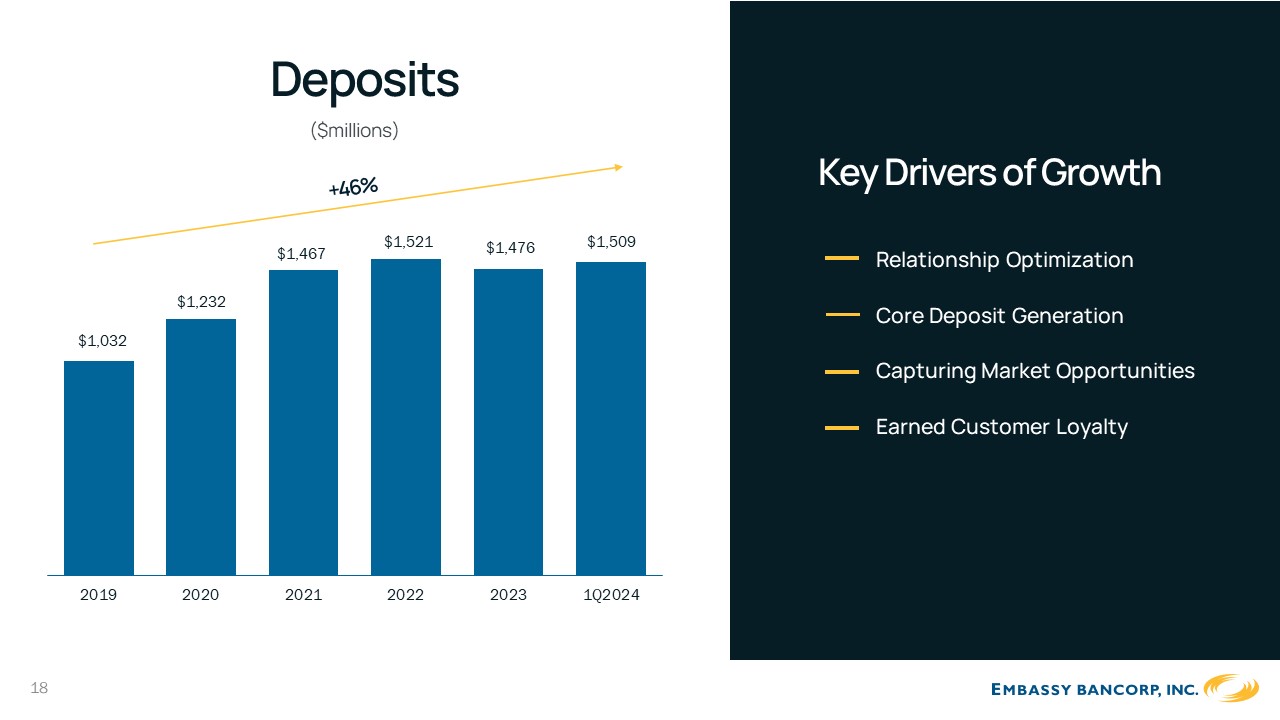

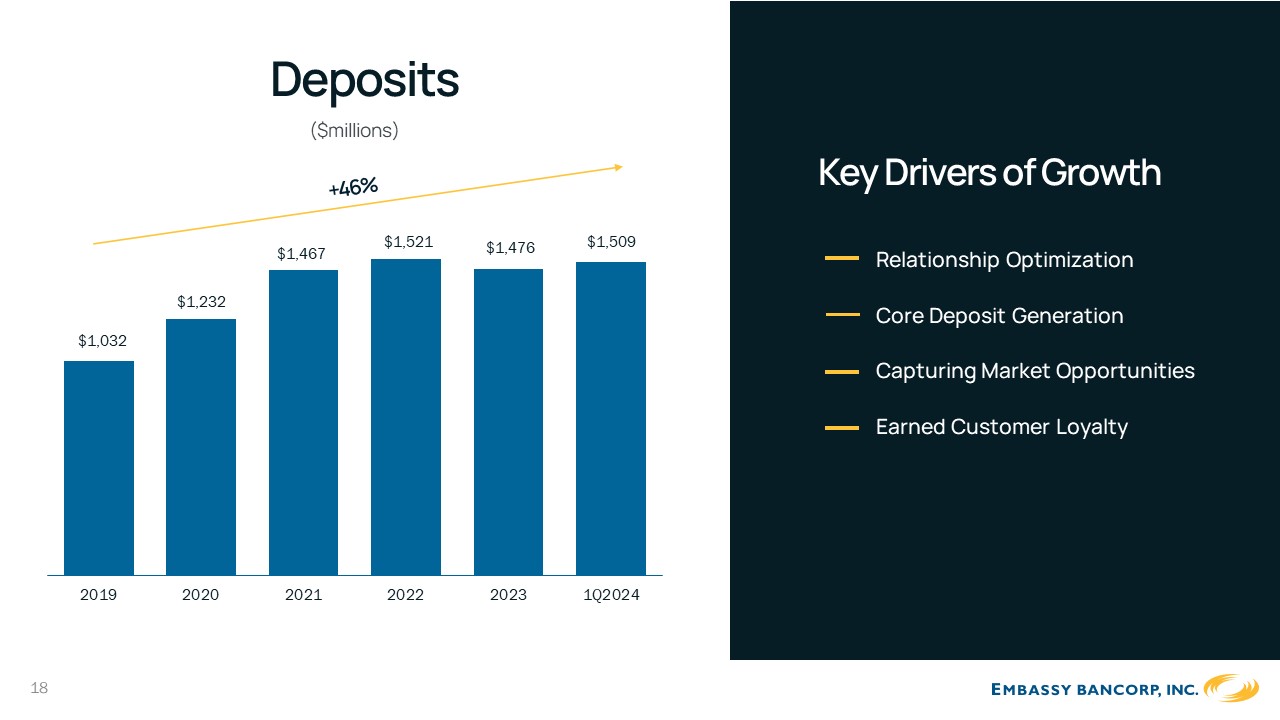

Deposits

($millions)

201920202021202220231Q2024

18

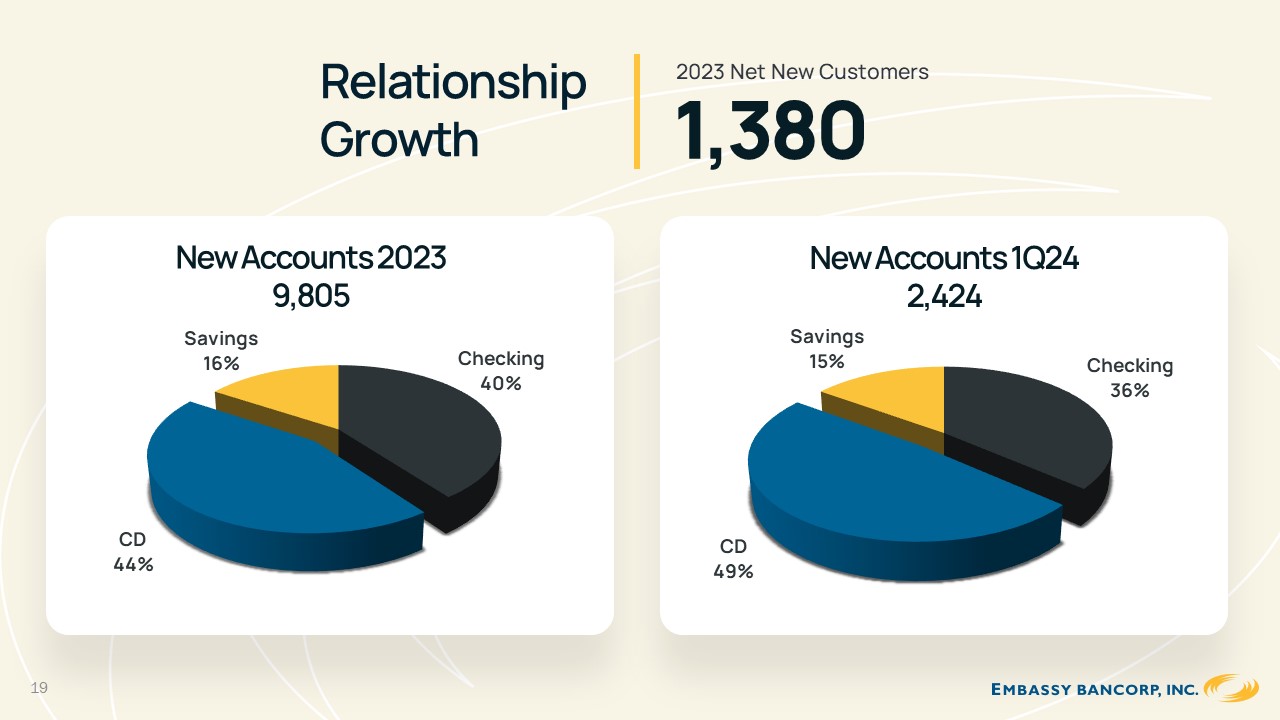

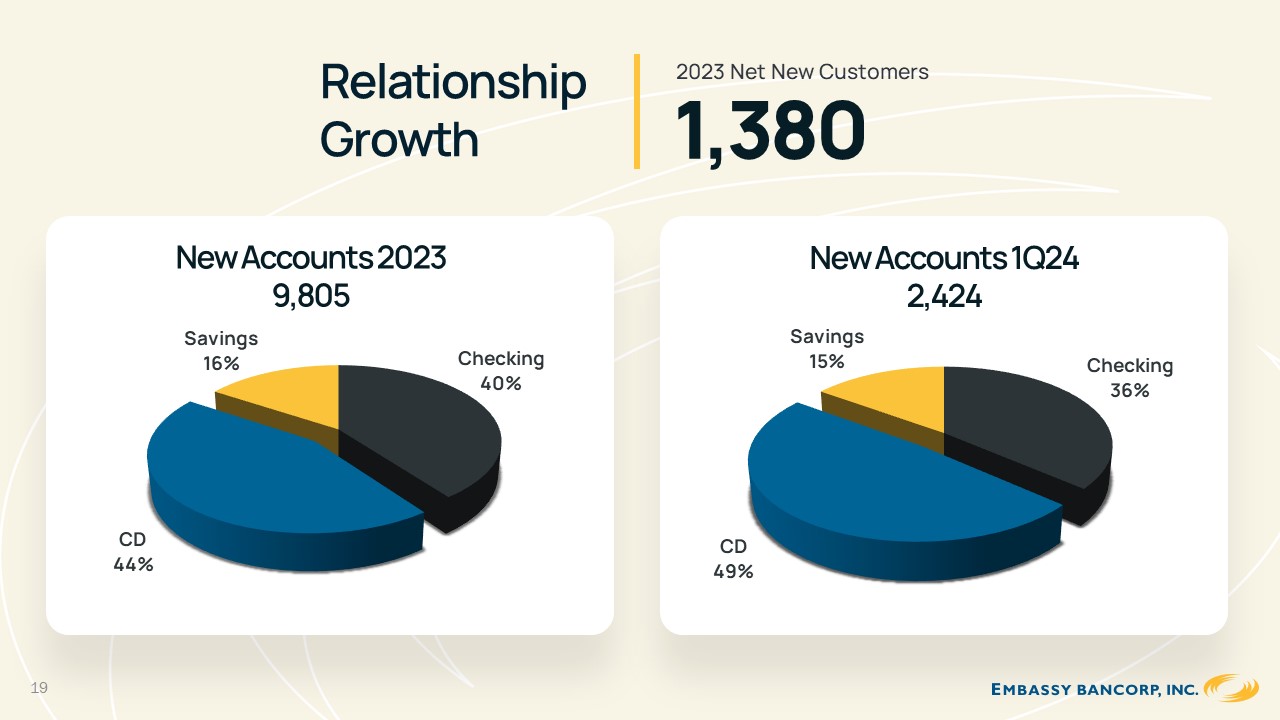

Relationship Growth

2023 Net New Customers

1,380

New Accounts 2023 9,805

Savings 16%

Checking 40%

New Accounts 1Q24 2,424

Savings

15%

Checking 36%

CD 44%

CD 49%

19

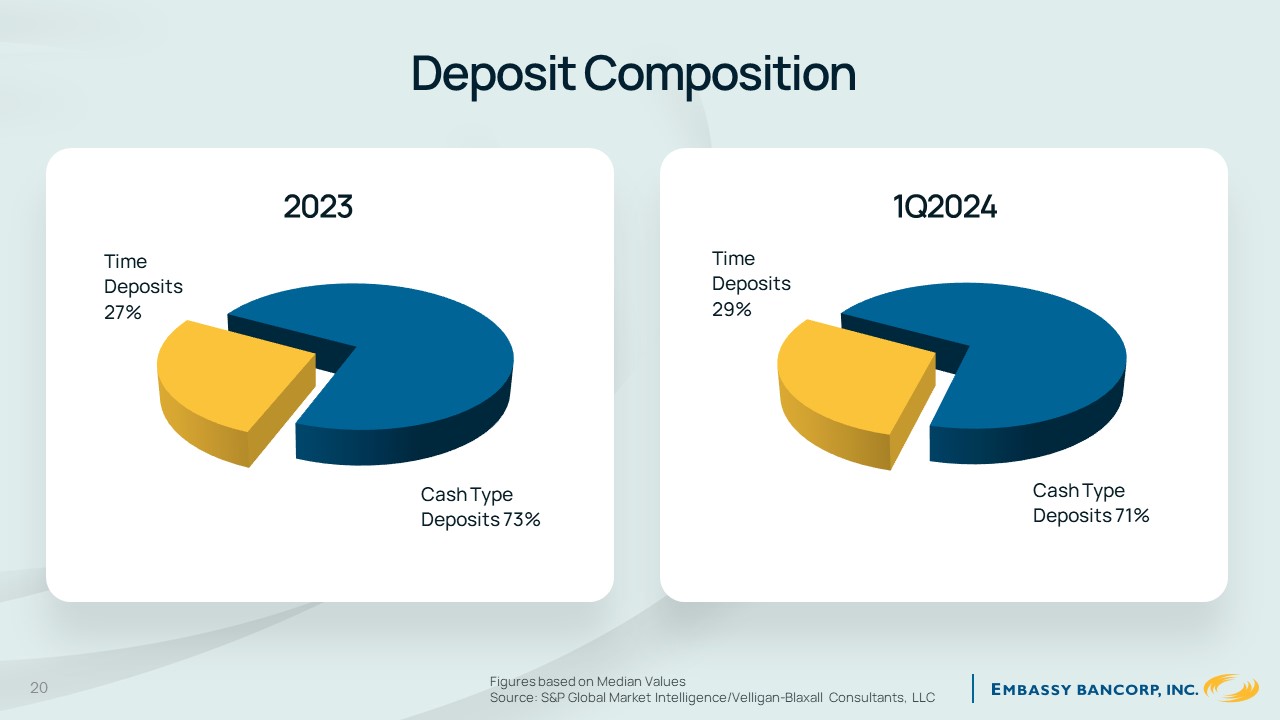

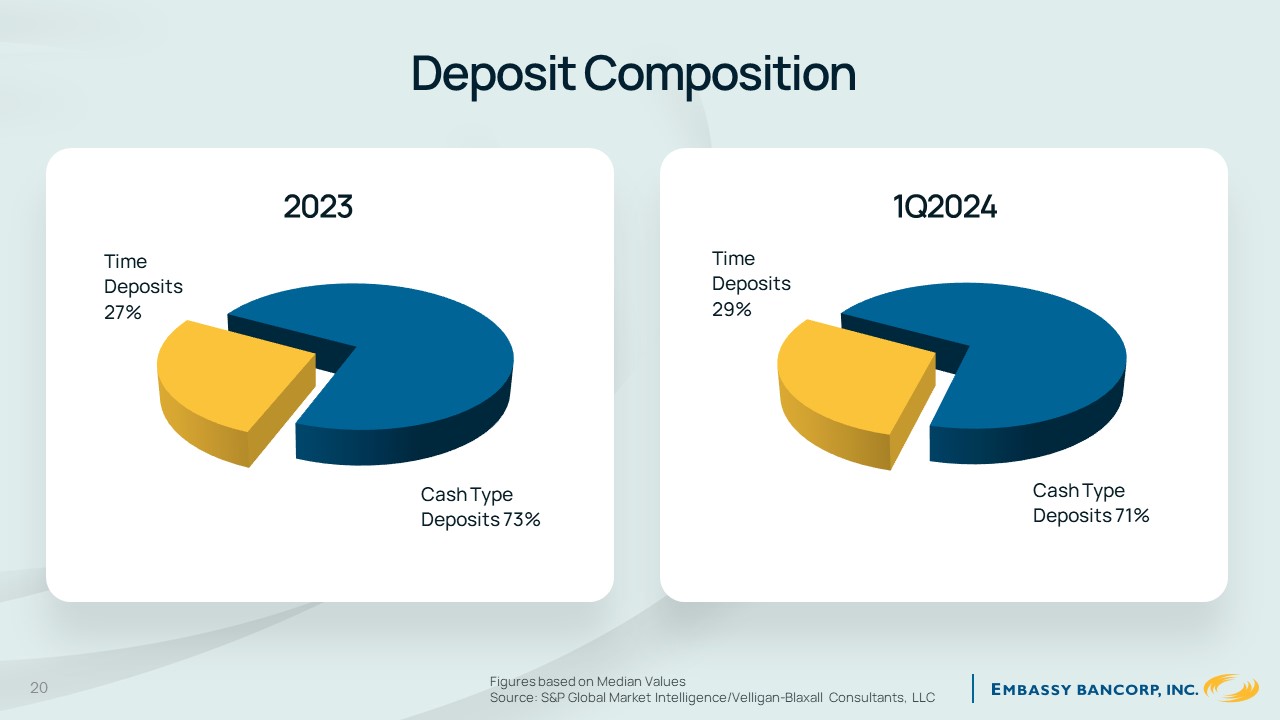

Deposit Composition

Time Deposits 27%

20231Q2024

Time Deposits 29%

Cash Type Deposits 73%

Cash Type Deposits 71%

20

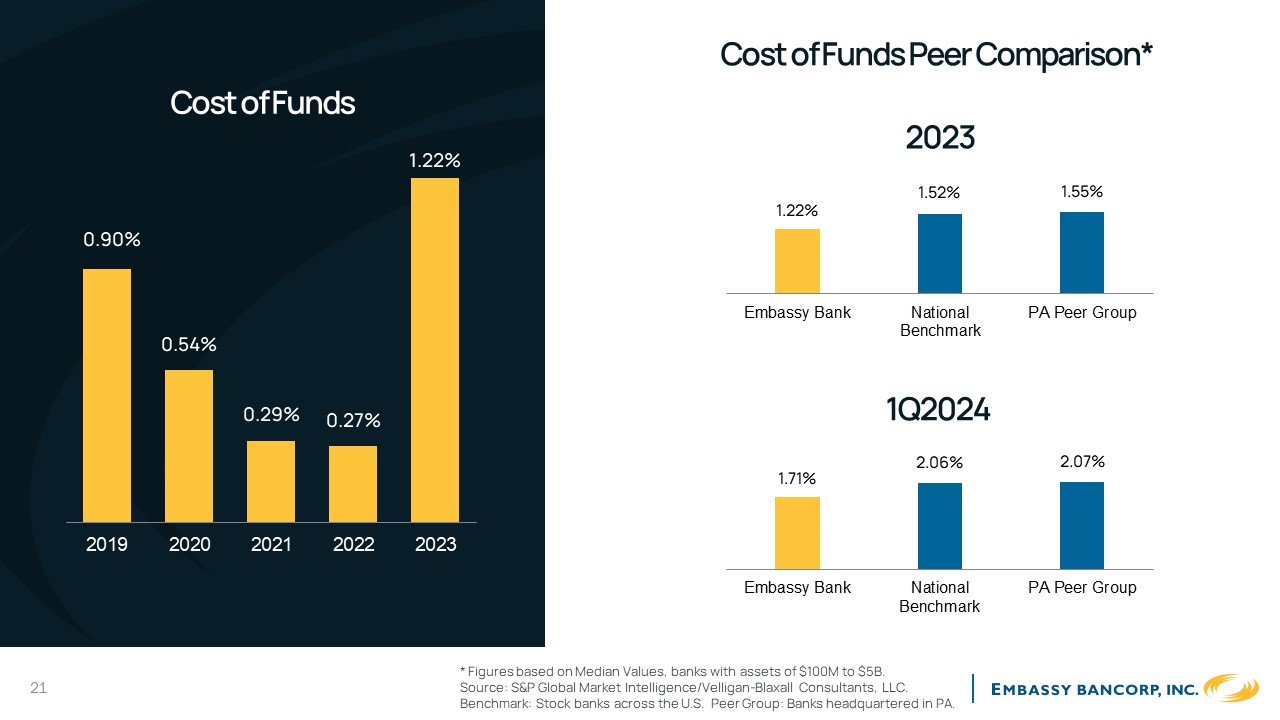

Figures based on Median Values

Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC

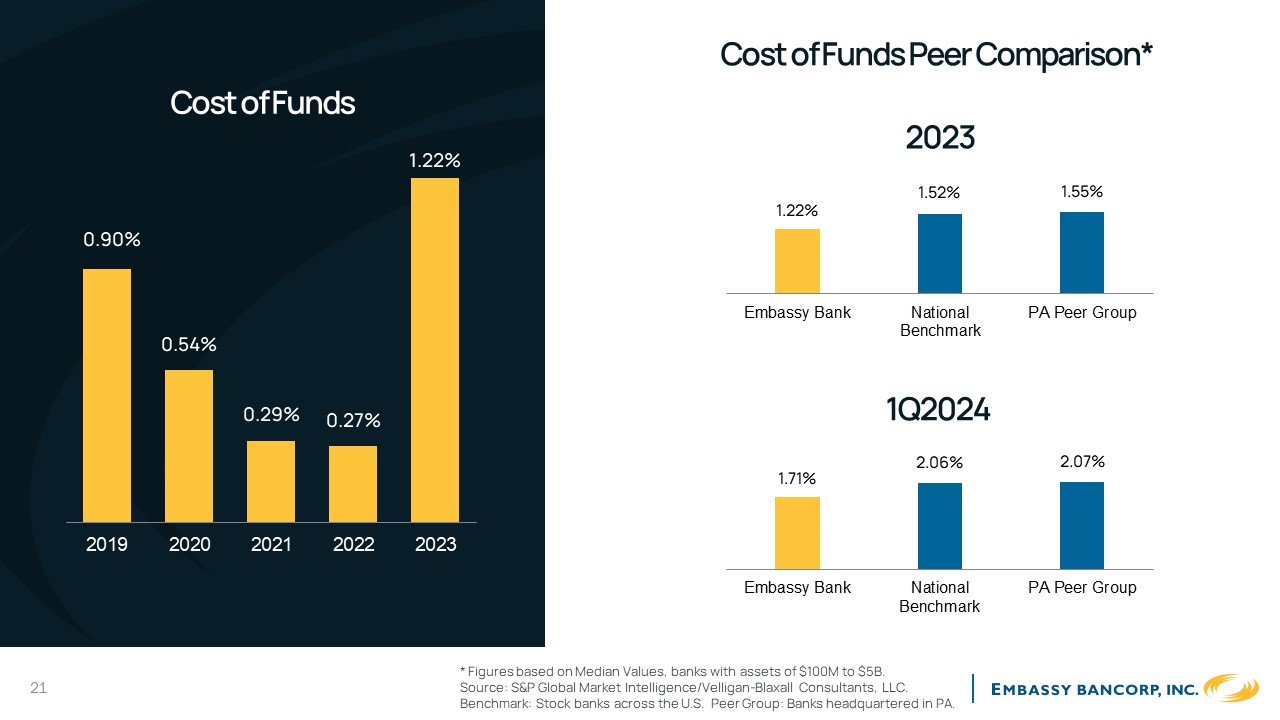

Cost of Funds Peer Comparison*

2023

1.52%1.55%

Embassy BankNational Benchmark

1Q2024

PA Peer Group

2.06%2.07%

Embassy BankNational Benchmark

PA Peer Group

* Figures based on Median Values, banks with assets of $100M to $5B.

21Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

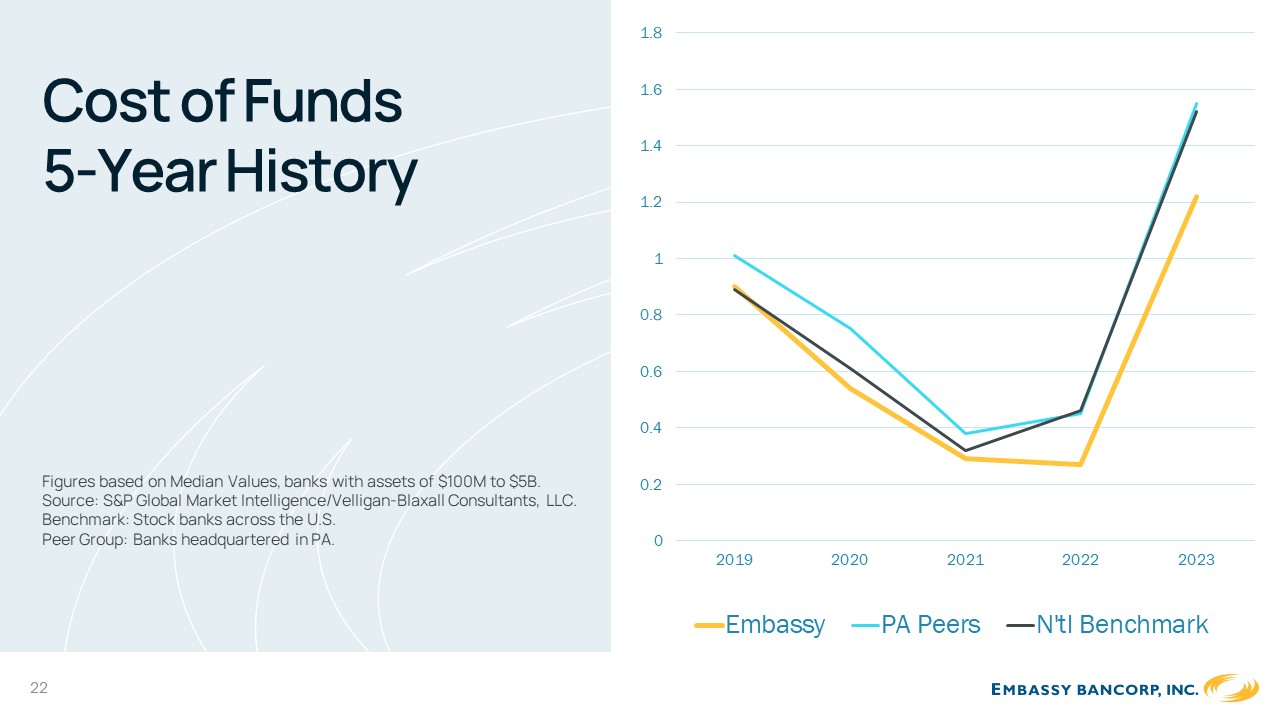

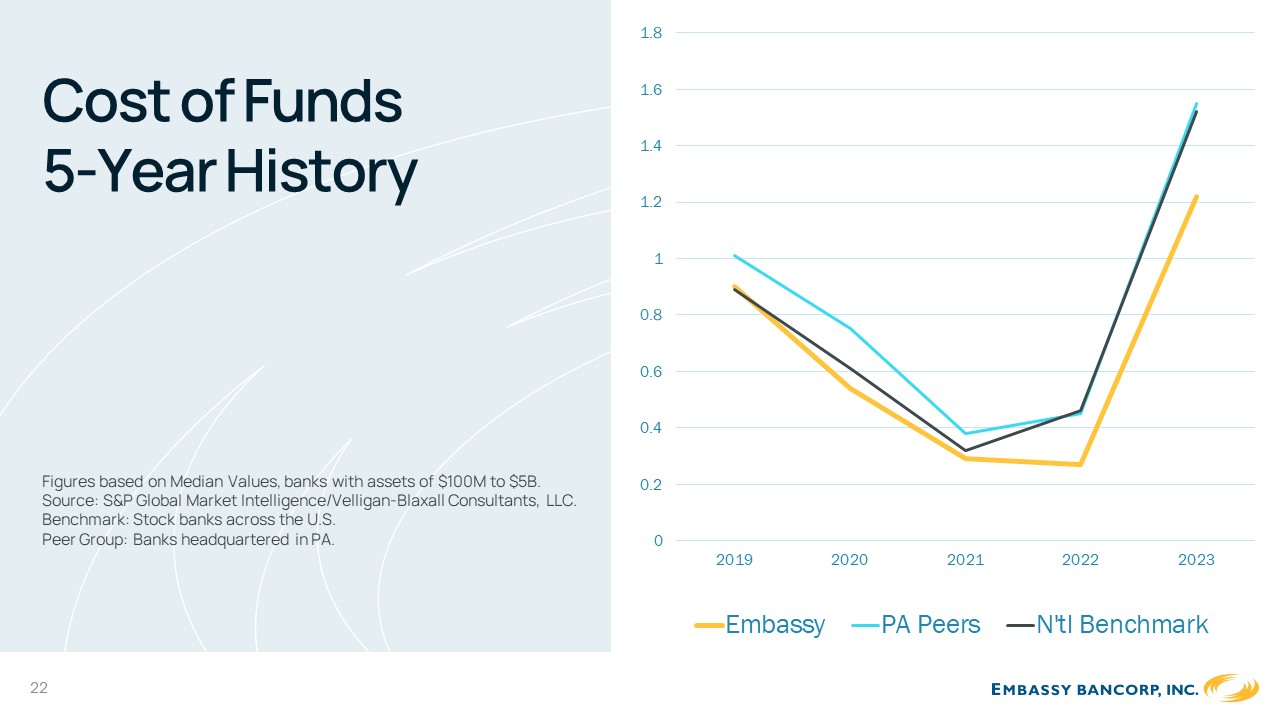

Cost of Funds 5-Year History

1.8

1.6

1.4

1.2

1

0.8

0.6

0.4

Figures based on Median Values, banks with assets of $100M to $5B. Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S.

0.2

Peer Group: Banks headquartered in PA.0

20192020202120222023

EmbassyPA PeersN'tl Benchmark

22

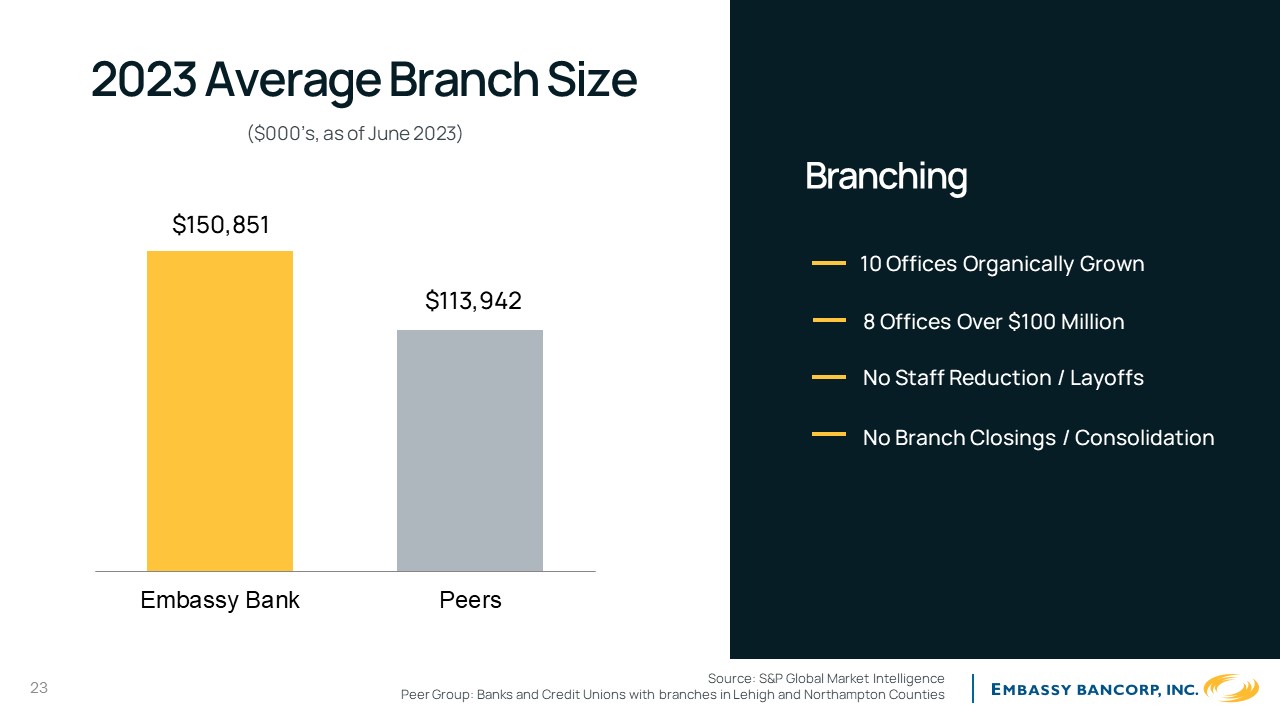

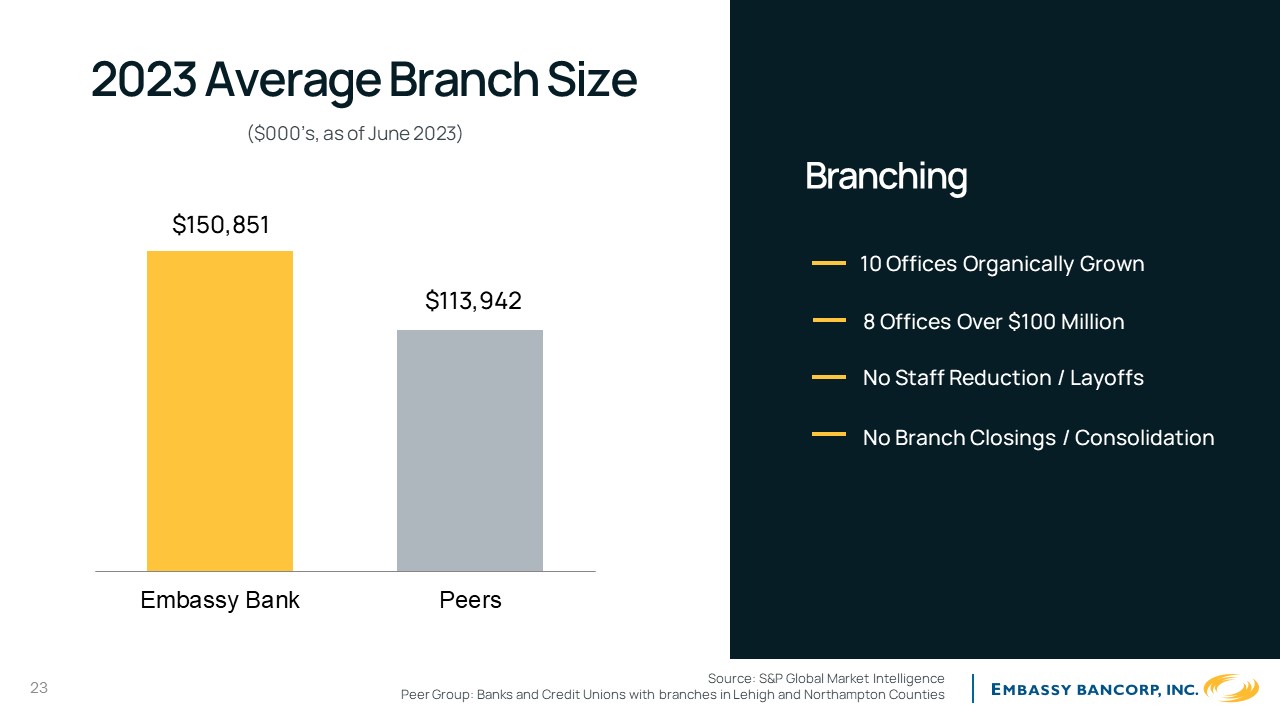

2023 Average Branch Size

($000’s, as of June 2023)

$150,851

Embassy BankPeers

Source: S&P Global Market Intelligence Peer Group: Banks and Credit Unions with branches in Lehigh and Northampton Counties

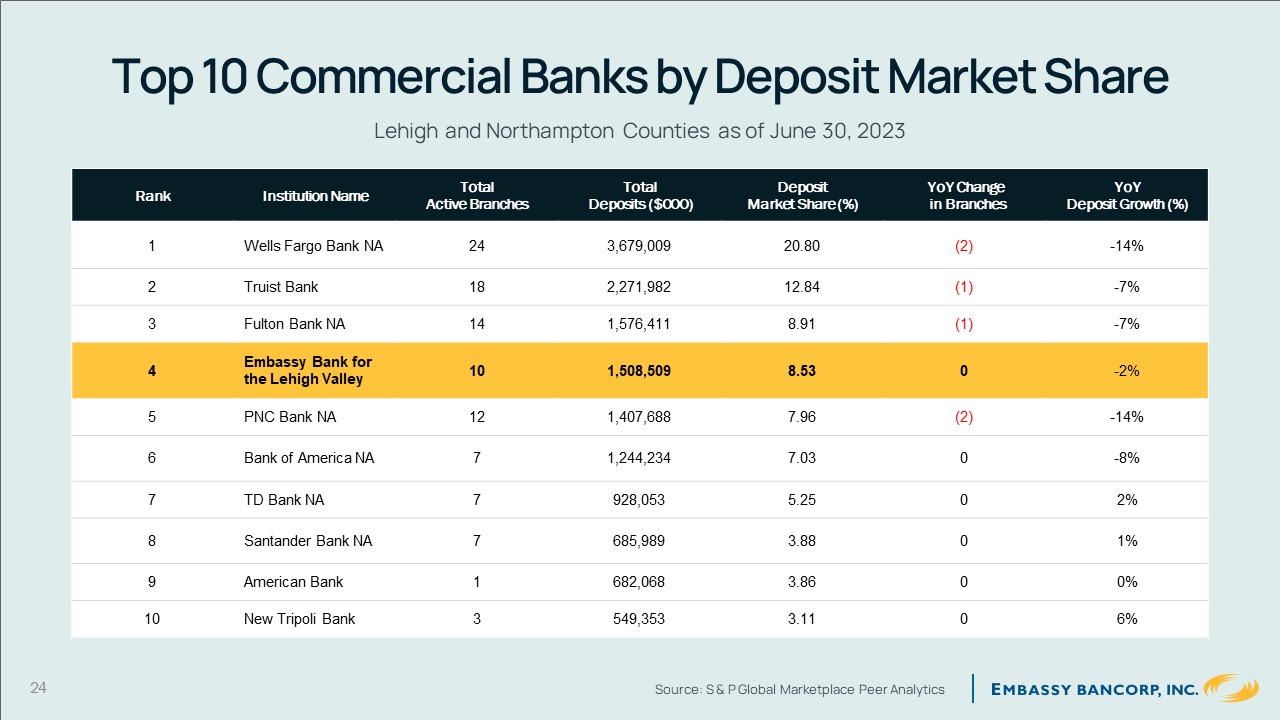

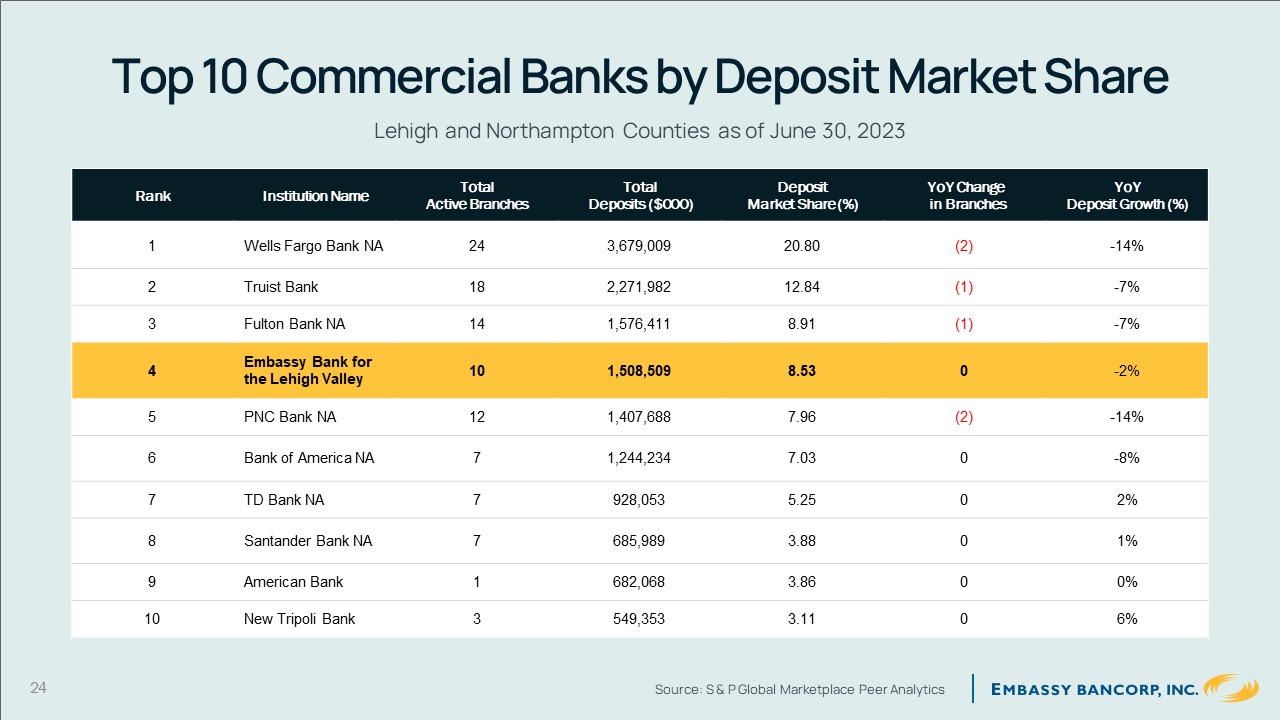

Top 10 Commercial Banks by Deposit Market Share

Lehigh and Northampton Counties as of June 30, 2023

RankInstitution NameTotalActive BranchesTotalDeposits ($000)DepositMarket Share (%)YoY Changein BranchesYoYDeposit Growth (%)1Wells Fargo Bank NA243,679,00920.80(2)-14%2Truist Bank182,271,982

12.84(1)-7%3Fulton Bank NA141,576,4118.91(1)-7%4Embassy Bank for the Lehigh Valley101,508,509

8.530-2%5PNC Bank NA121,407,6887.96(2)-14%6Bank of America NA71,244,2347.030-8%7TD Bank NA

7928,0535.2502%8Santander Bank NA7685,9893.8801%9American Bank1682,0683.8600%10New Tripoli Bank3549,3533.1106%

24Source: S & P Global Marketplace Peer Analytics

Lending Asset Quality Liquidity

- Judy Hunsicker

25

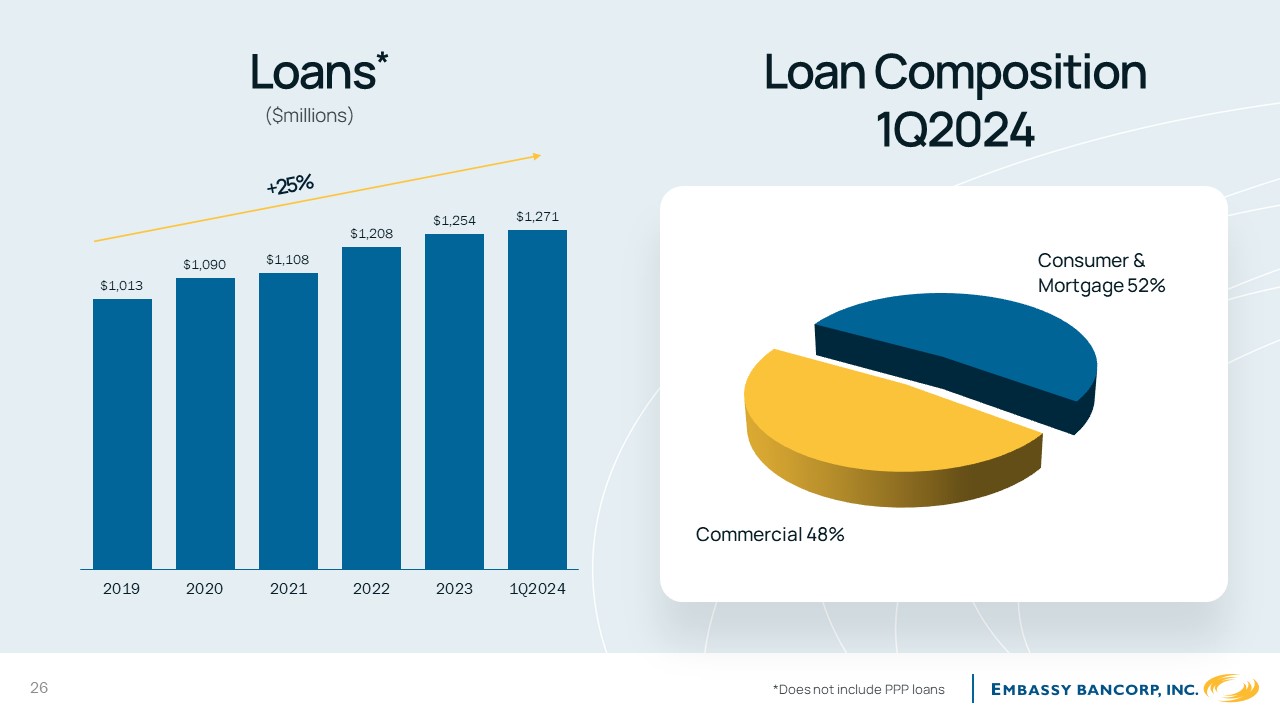

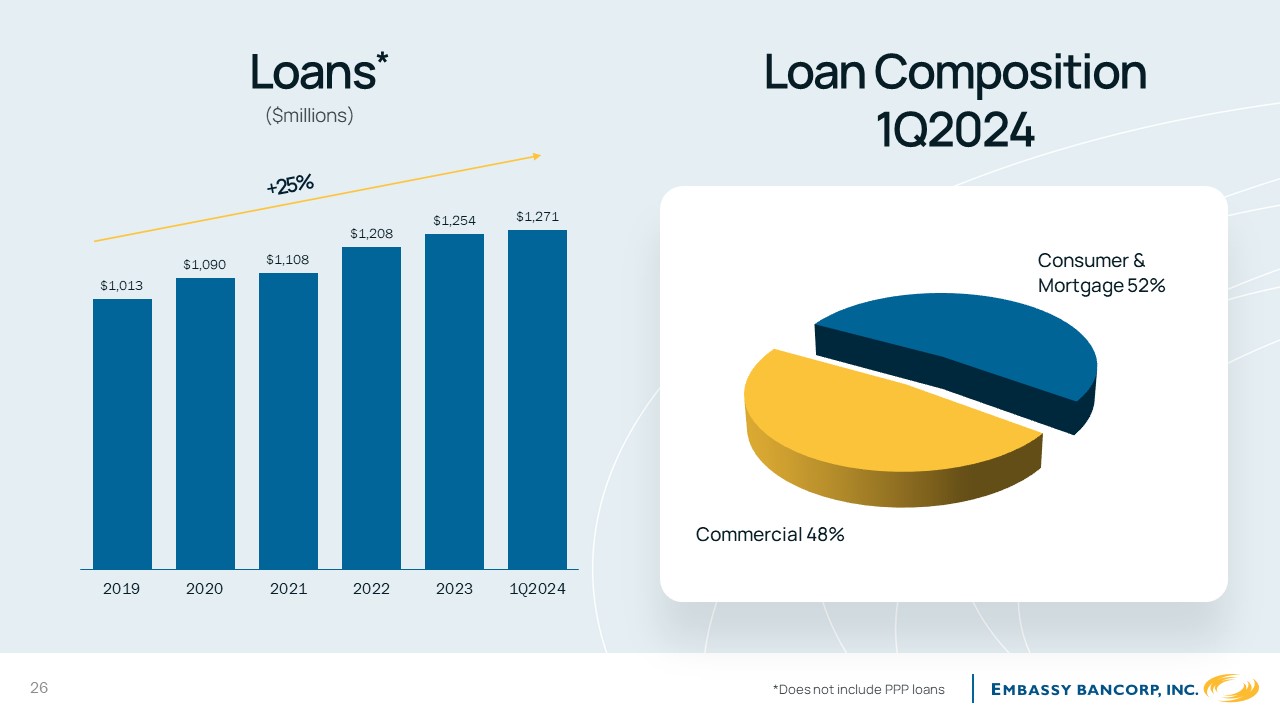

Loans*

($millions)

Loan Composition 1Q2024

$1,013

$1,090$1,108

Consumer &

Mortgage 52%

Commercial 48%

201920202021202220231Q2024

26*Does not include PPP loans

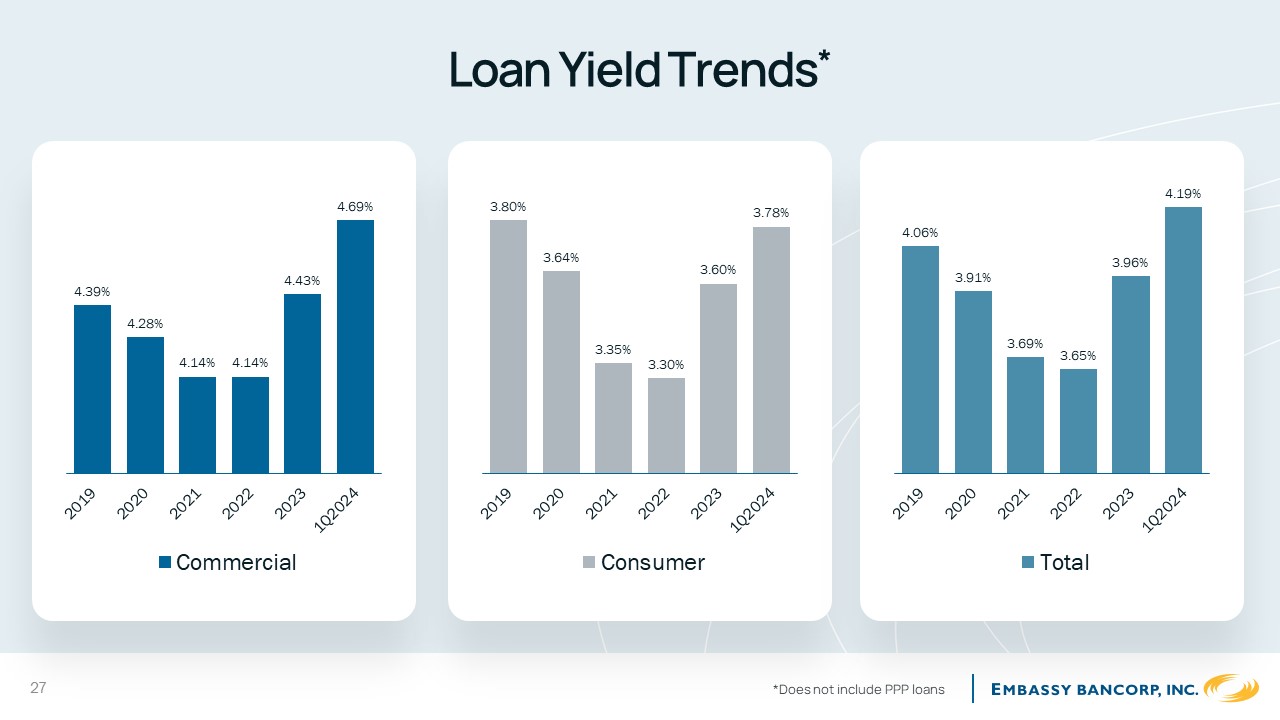

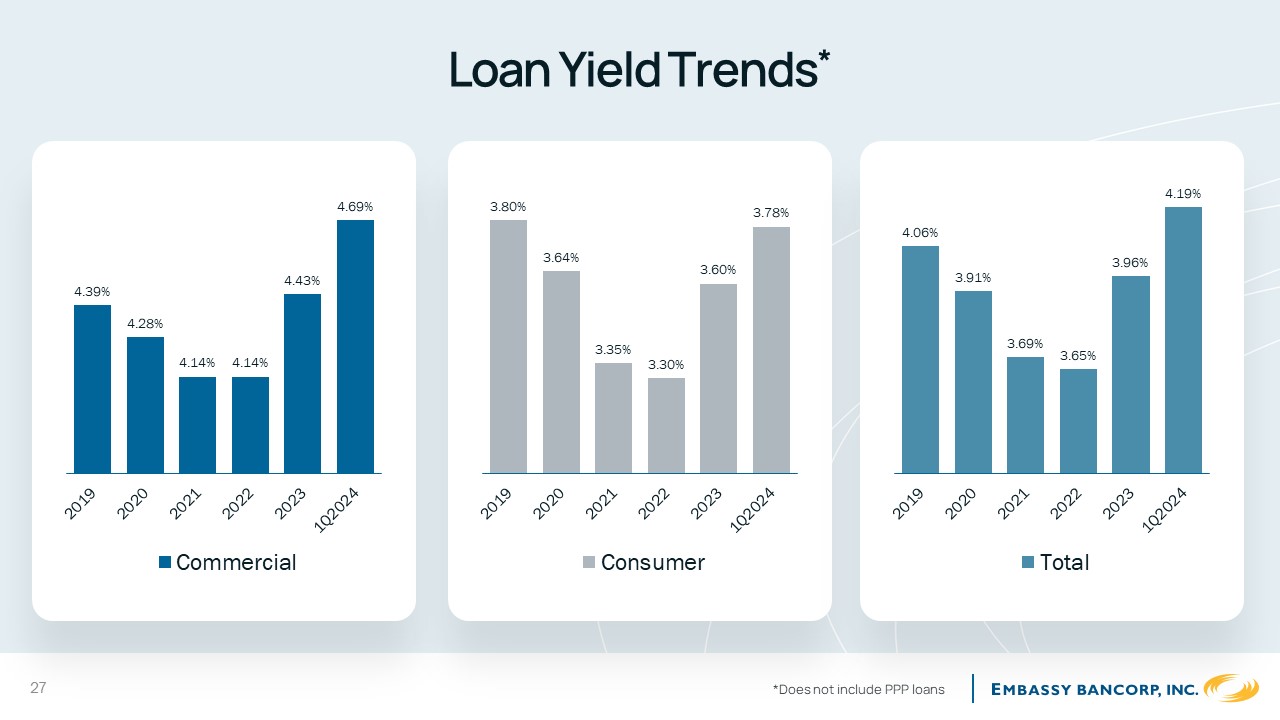

Loan Yield Trends*4.39%4.43%4.69%3.80%3.64%3.60%3.78%4.06%3.91%3.96%4.19%4.28%4.14%4.14%

3.35%3.30%3.69%3.65%CommercialConsumerTotal

27*Does not include PPP loans

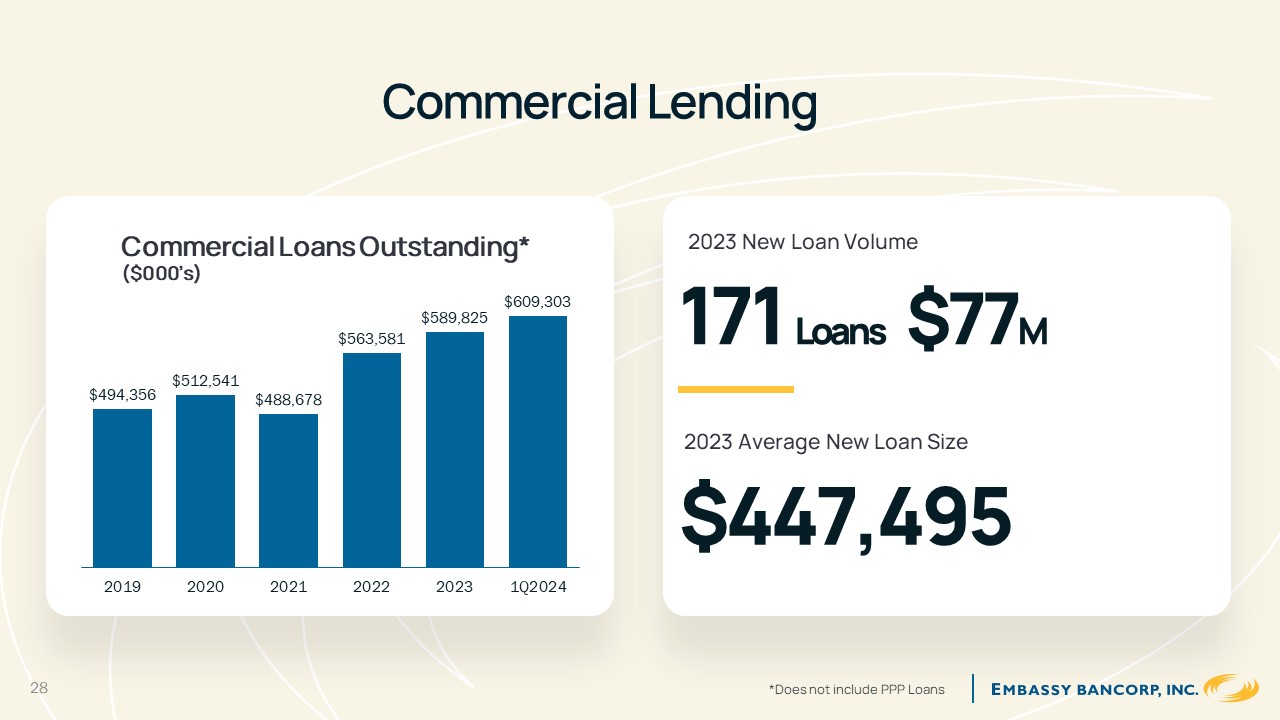

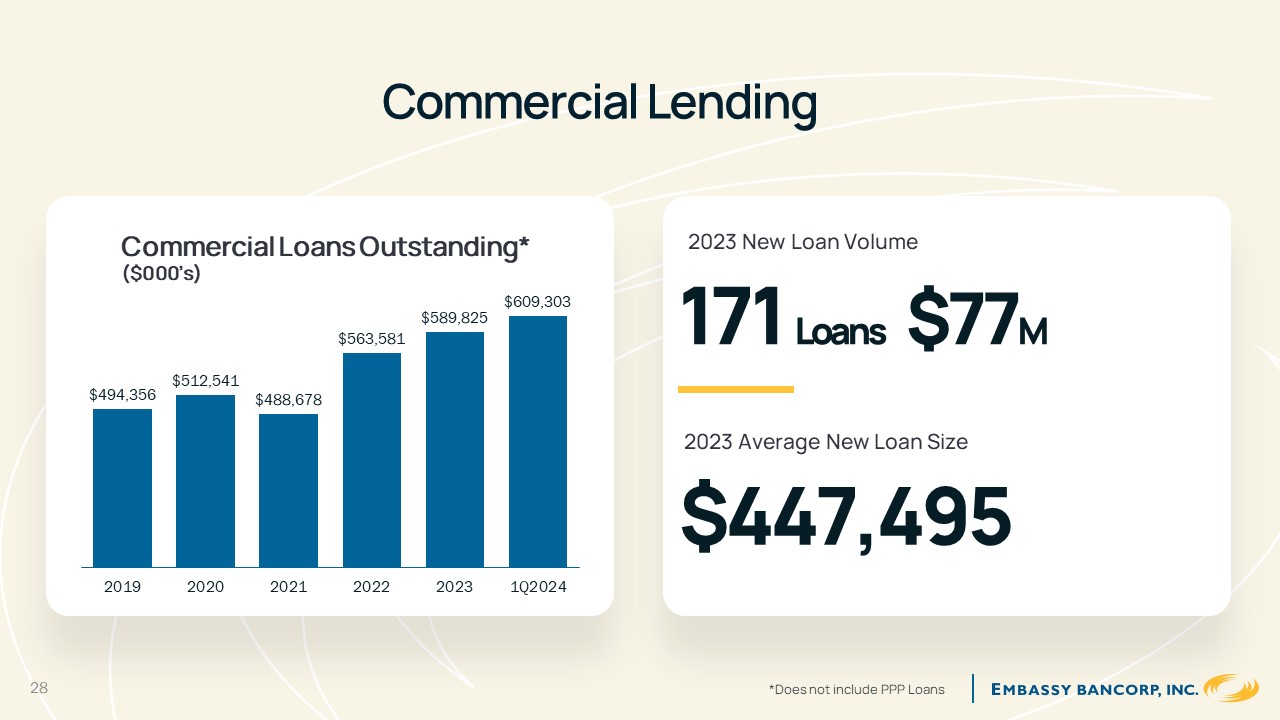

Commercial Lending

Commercial Loans Outstanding*

2023 New Loan Volume

($000’s)

$512,541

$494,356$488,678

$589,825

$563,581

$609,303

171

Loans

$77M

201920202021202220231Q2024

2023 Average New Loan Size

$447,495

28*Does not include PPP Loans

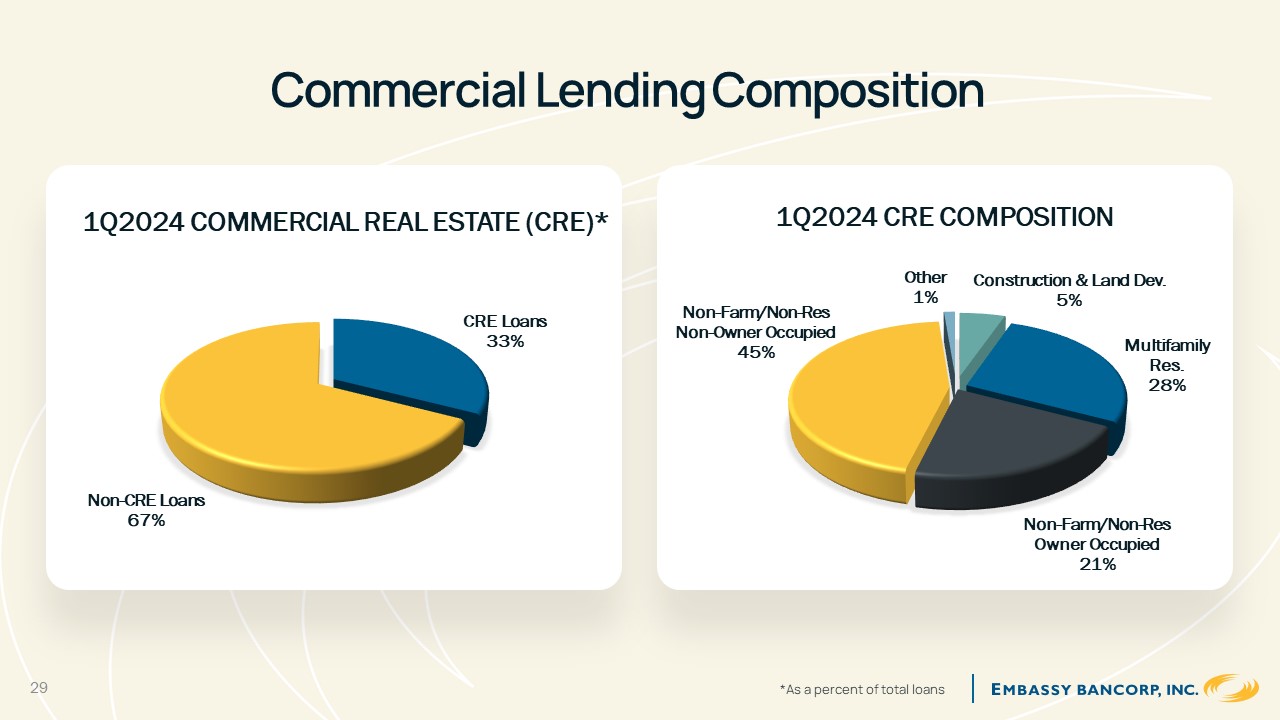

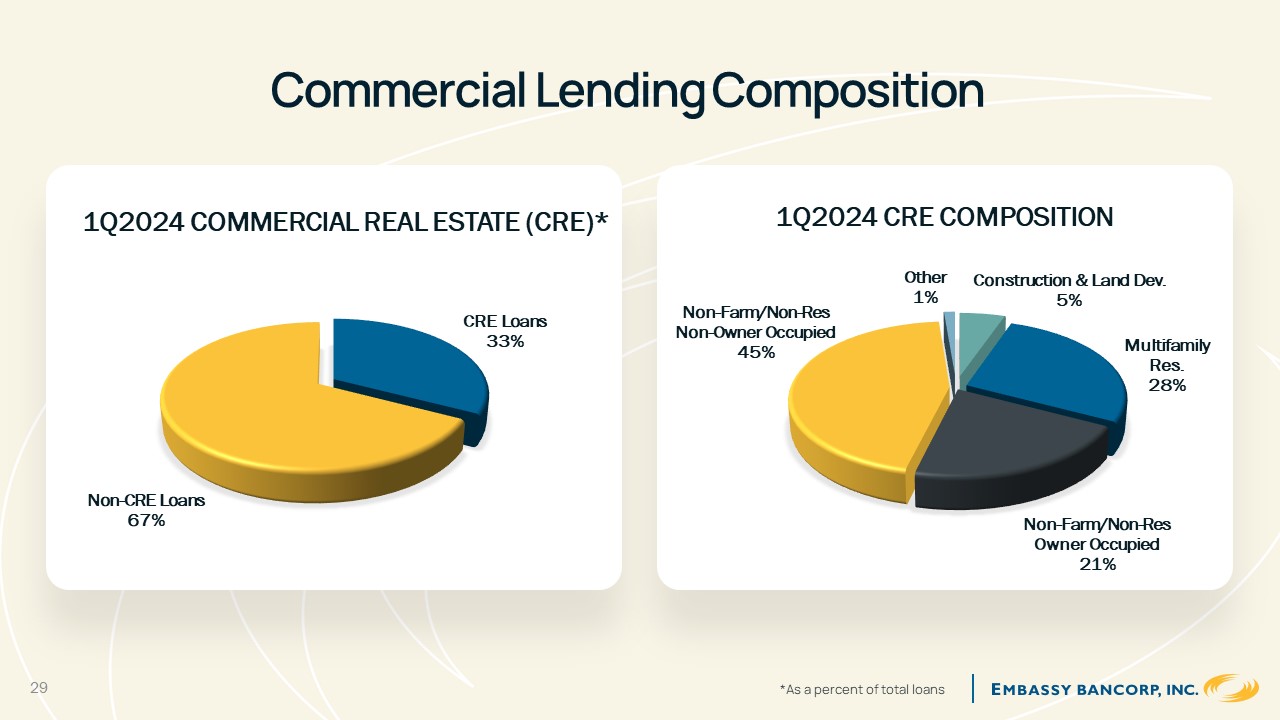

Commercial Lending Composition

1Q2024 COMMERCIAL REAL ESTATE (CRE)*

1Q2024 CRE COMPOSITION

Non-CRE Loans 67%

CRE Loans 33%

Non-Farm/Non-Res Non-Owner Occupied 45%

Other 1%

Construction & Land Dev.

5%

Multifamily Res.

28%

Non-Farm/Non-Res Owner Occupied 21%

29*As a percent of total loans

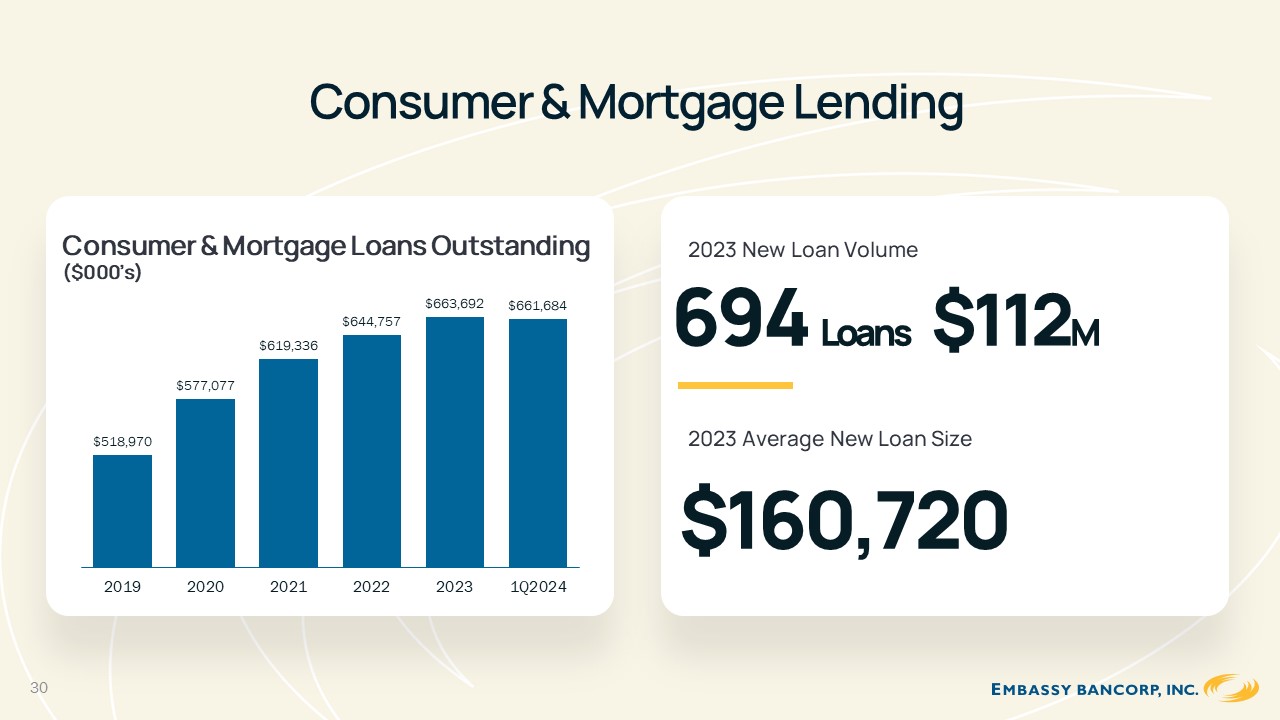

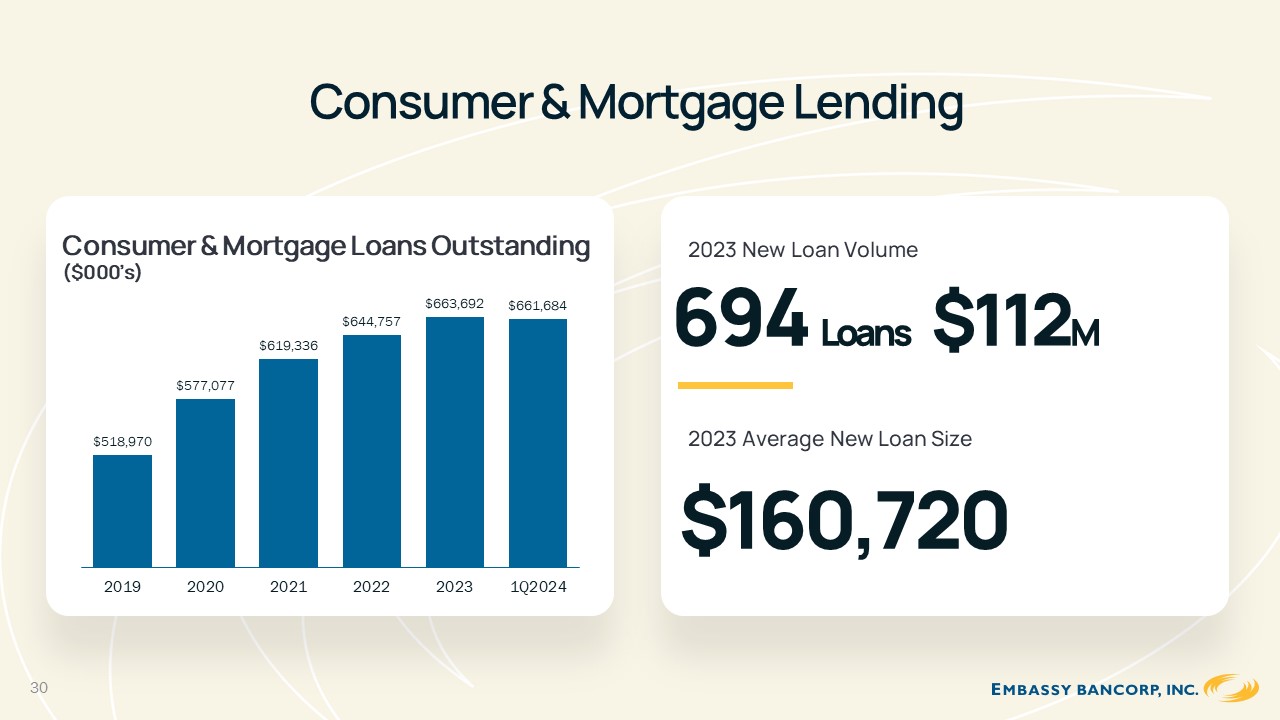

Consumer & Mortgage Lending

Consumer & Mortgage Loans Outstanding

($000’s)

2023 New Loan Volume

$663,692$661,684

$644,757

$619,336

694 Loans

$112M

$577,077

$518,970

201920202021202220231Q2024

2023 Average New Loan Size

$160,720

30

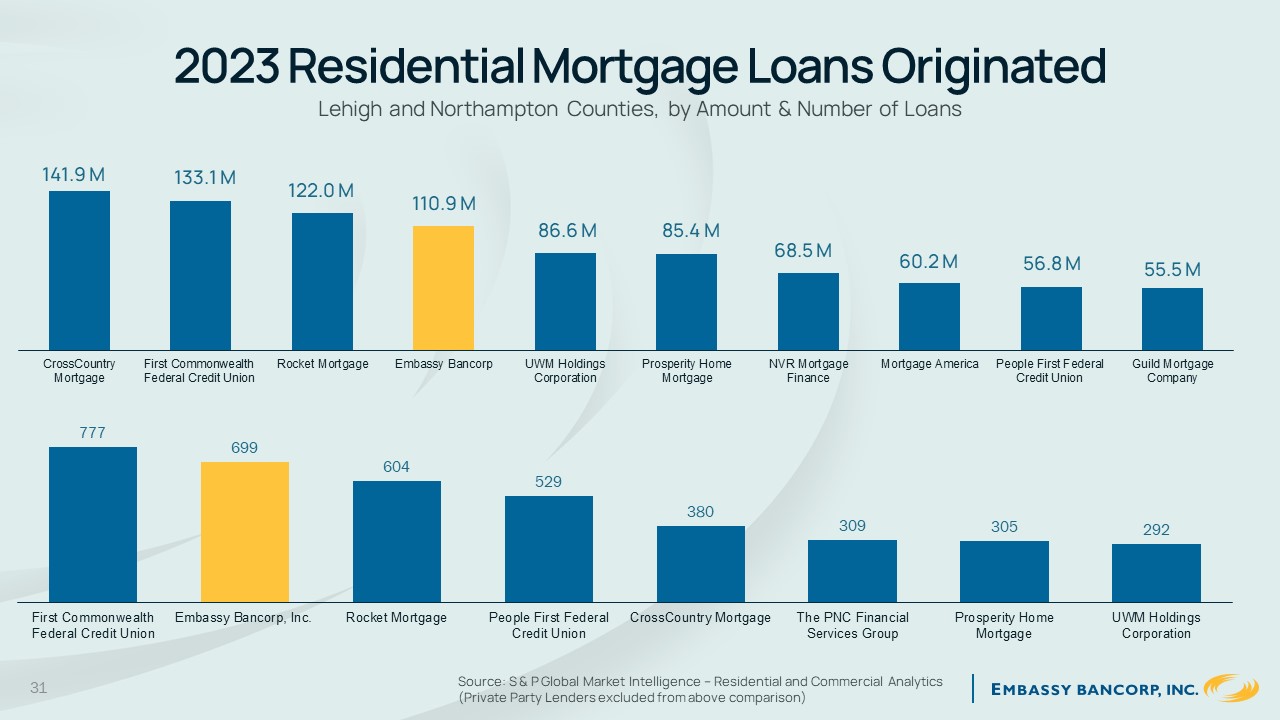

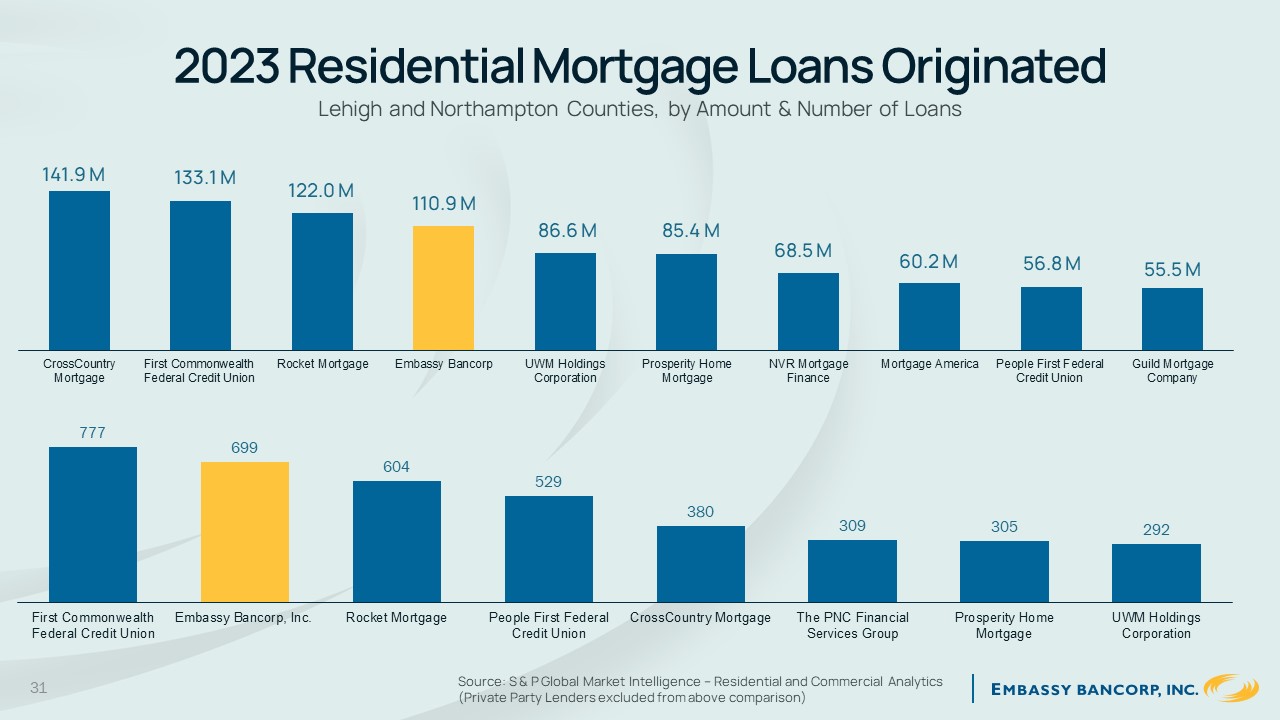

2023 Residential Mortgage Loans Originated

Lehigh and Northampton Counties, by Amount & Number of Loans

141.9 M133.1 M122.0 M110.9 M86.6 M85.4 M68.5 M60.2 M56.8 M55.5 M

CrossCountry

First Commonwealth

Rocket Mortgage

Embassy Bancorp

UWM Holdings

Prosperity Home

NVR Mortgage

Mortgage America

People First Federal

Guild Mortgage

Mortgage

Federal Credit Union

Corporation

Mortgage

FinanceCredit Union

Company777699604529380309305292

First CommonwealthEmbassy Bancorp, Inc.Rocket MortgagePeople First FederalCrossCountry MortgageThe PNC FinancialProsperity HomeUWM HoldingsFederal Credit UnionCredit UnionServices Group

Mortgage

Corporation

31Source: S & P Global Market Intelligence – Residential and Commercial Analytics

(Private Party Lenders excluded from above comparison)

Asset Quality

Non-Performing Assets to Total Assets

20231Q2024

0.41%

0.37%

0.24%

0.25%

0.13%

0.12%

Embassy BankNational BenchmarkPA Peer GroupEmbassy BankNational BenchmarkPA Peer Group

Figures based on Median Values, banks with assets of $100M to $5B.

32Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

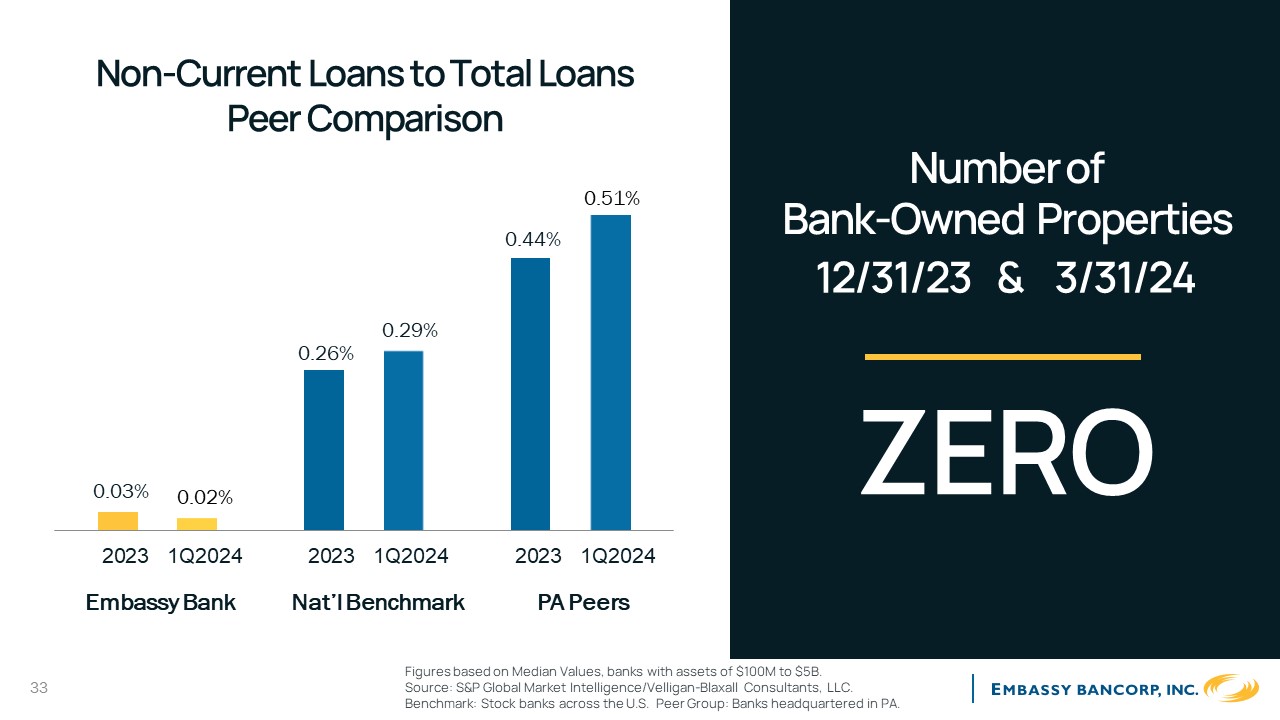

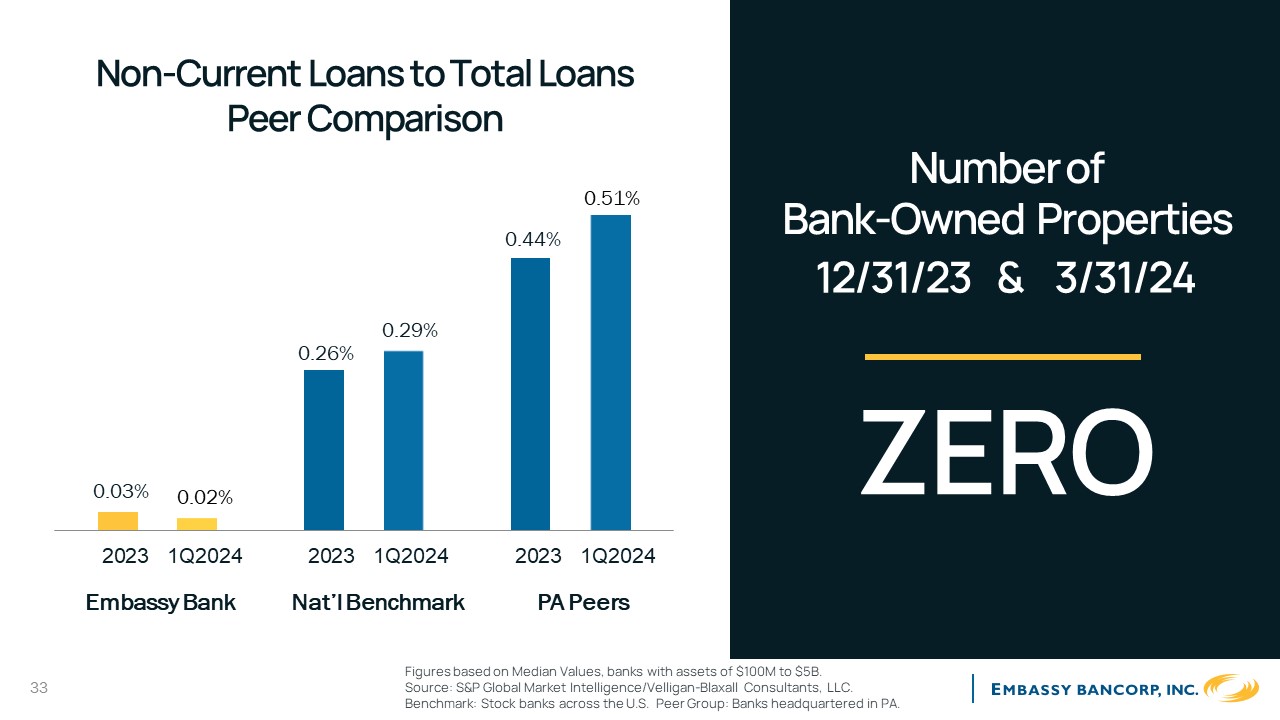

Non-Current Loans to Total Loans Peer Comparison

0.51%

20231Q202420231Q202420231Q2024

Number of

Bank-Owned Properties

12/31/23 & 3/31/24

ZERO

Embassy BankNat’l BenchmarkPA Peers

Figures based on Median Values, banks with assets of $100M to $5B.

33Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

Securities Available for Sale*Securities to Total Assets

($000’s)

2023 Peer Comparison**

$310,264 $316,992

$276,060 $266,158

17%19%20%$130,940$90,829

201920202021202220231Q2024

Embassy BankNational Benchmark

PA Peer Group

* Embassy Bancorp classifies its entire securities portfolio as available for sale.

34** Figures based on Median Values, banks with assets of $100M to $5B.

Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

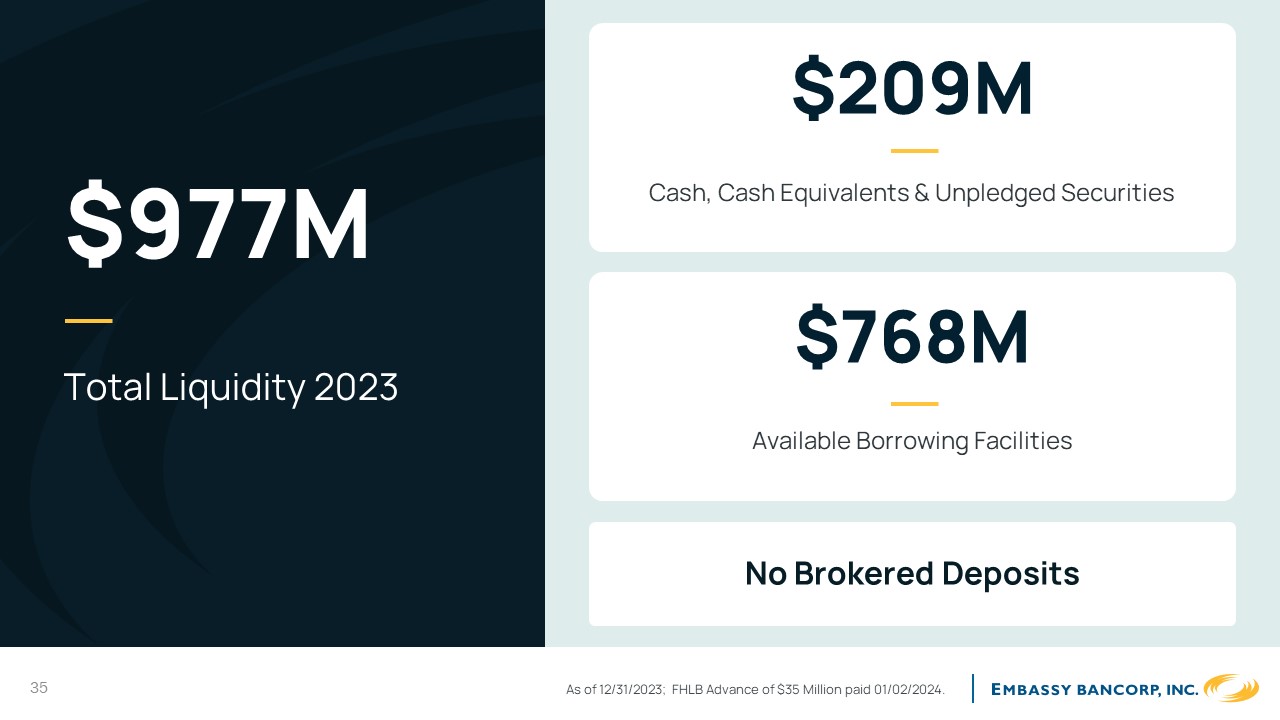

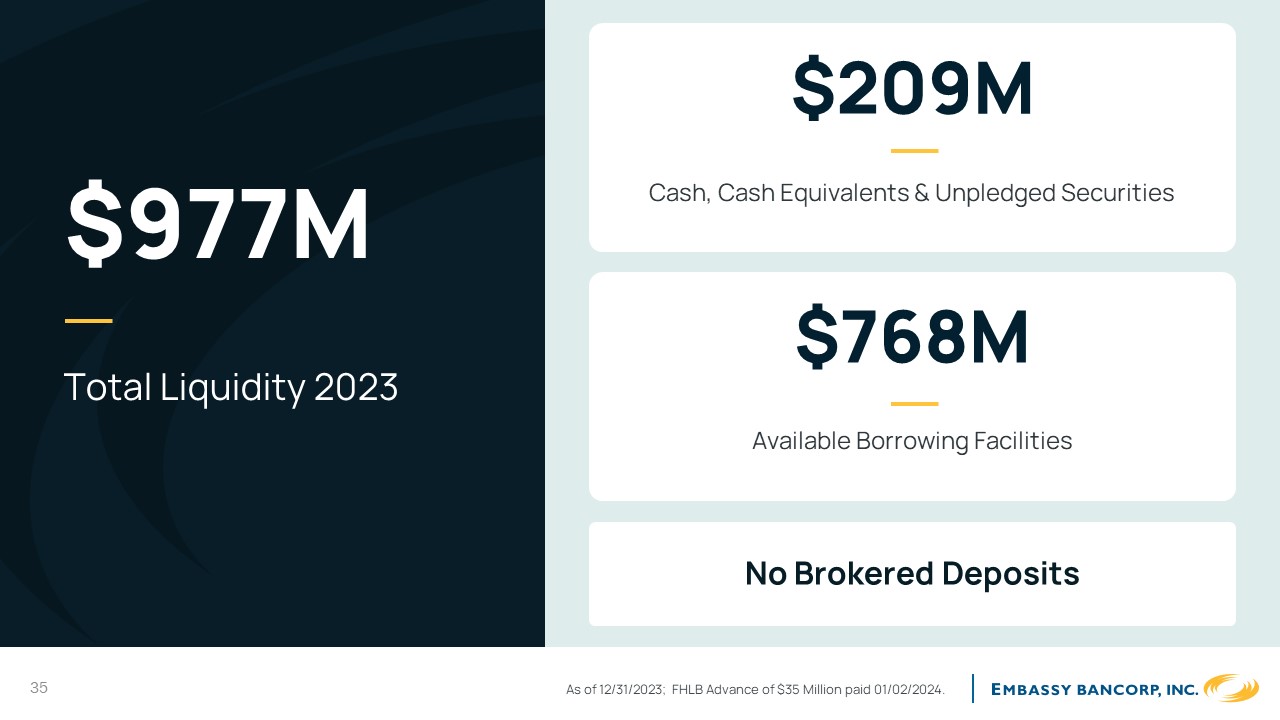

$977M total liquidity 2023 $209M Cash, Cash Equivalents & Unpledged securities $768M available borrowing facilities No brokered deposits as of 12/31/2023 FHLB Advance of $35 million paid on 01/02/2023 Embassy Bancorp, Inc.

Efficiency Income

Shareholder Value

- Dave Lobach

36

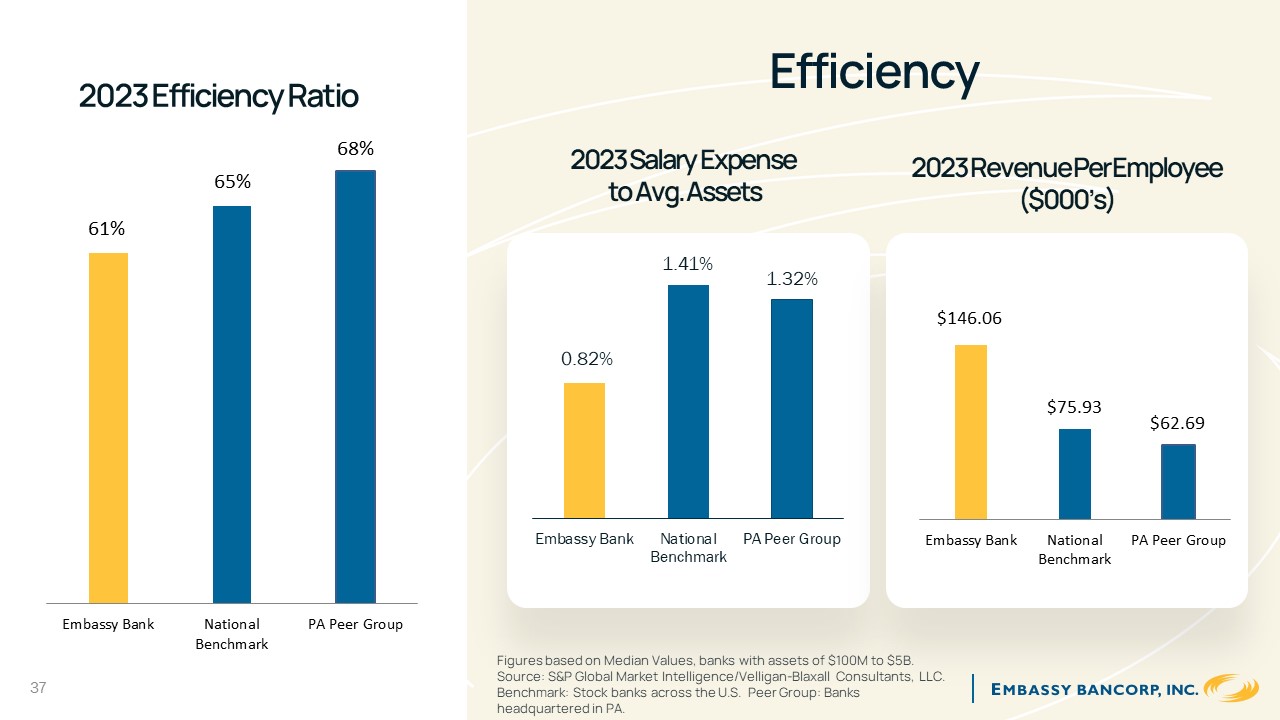

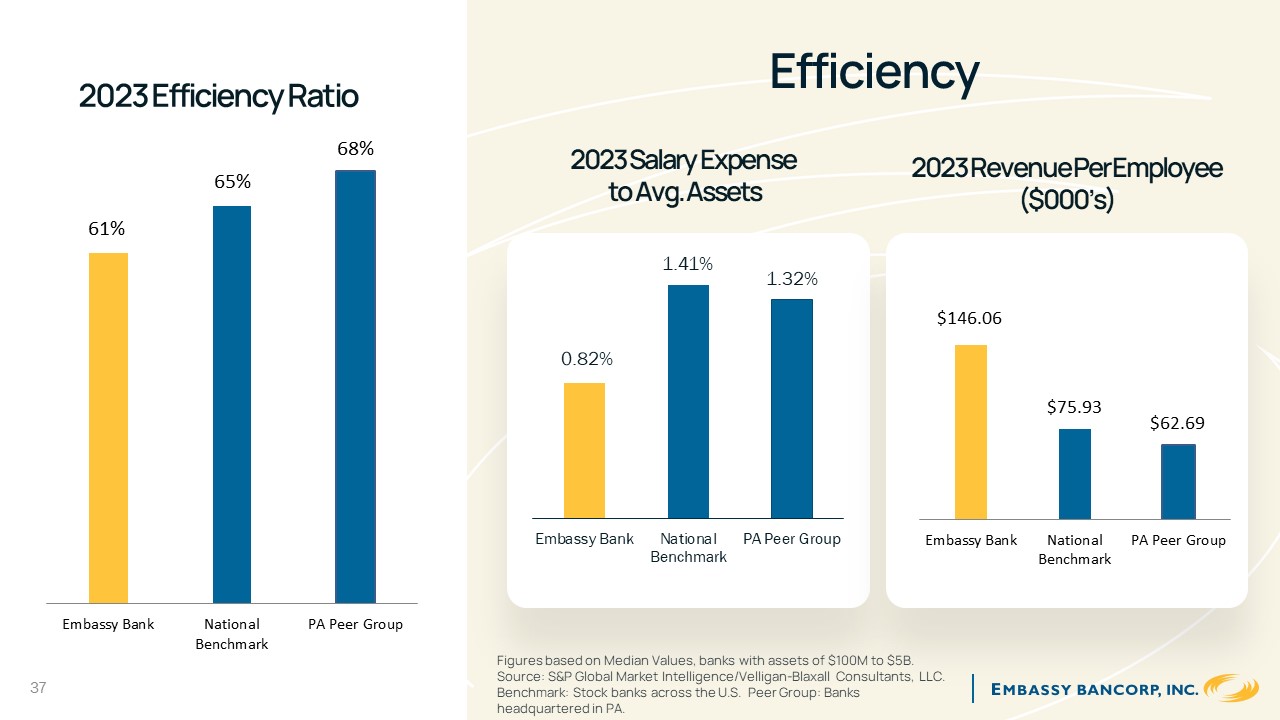

2023 Efficiency Ratio

Efficiency

61%65%68%2023SalaryExpensetoAvg.Assets1.41%2023RevenuePerEmployee($000’s)1.32%0.82%$146.06

$75.93$62.69Embassy BankNationalBenchmarkPA Peer GroupEmbassy BankNationalBenchmark

PA Peer GroupEmbassy BankNational Benchmark

37

PA Peer Group

Figures based on Median Values, banks with assets of $100M to $5B. Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

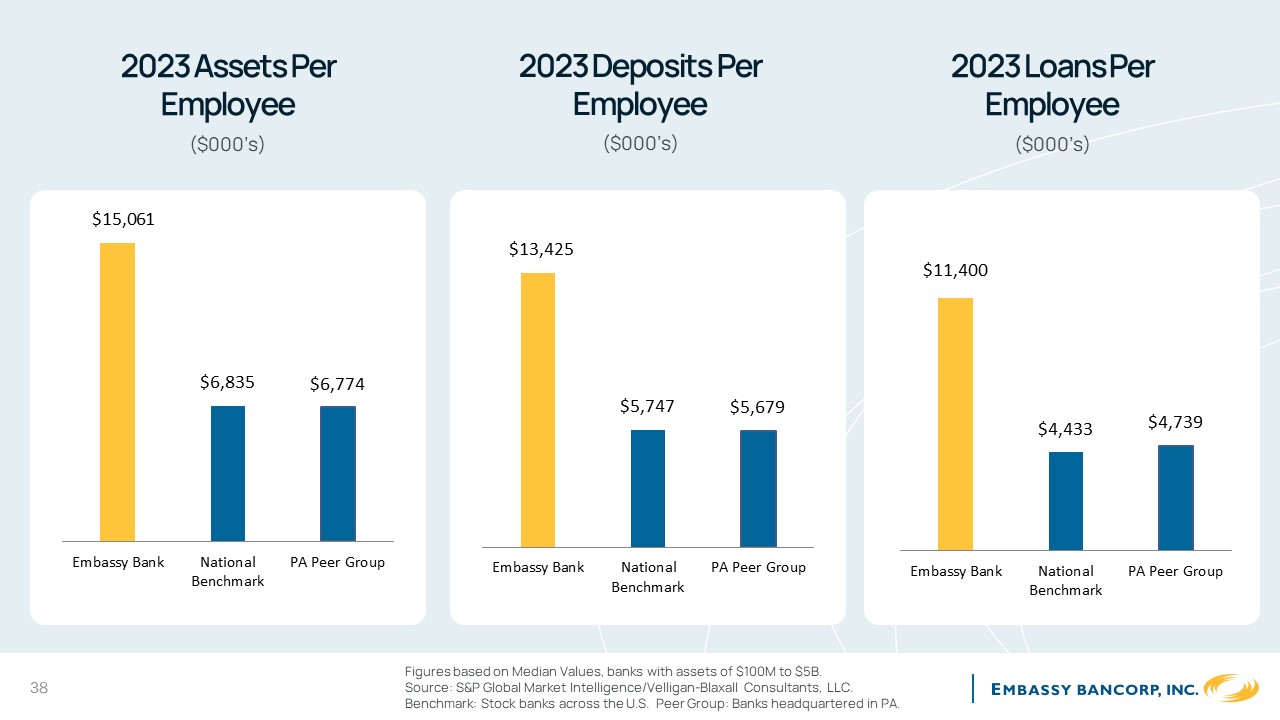

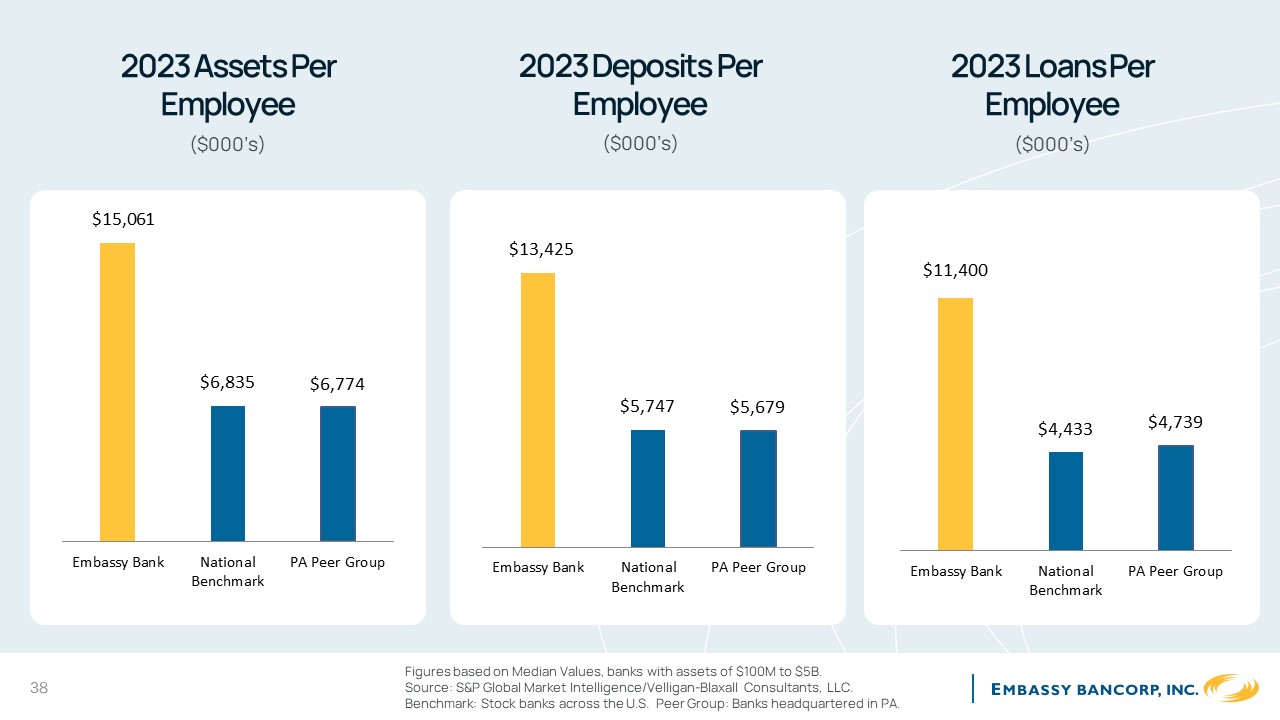

2023 Assets Per Employee

($000’s)

2023 Deposits Per Employee

($000’s)

2023 Loans Per Employee

($000’s)

$15,061$13,425$11,400$6,835$6,774$5,747$5,679$4,433$4,739

Embassy BankNationalBenchmarkPA Peer GroupEmbassy BankNationalBenchmarkPA Peer Group

Embassy BankNationalBenchmarkPA Peer Group

Figures based on Median Values, banks with assets of $100M to $5B.

38Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

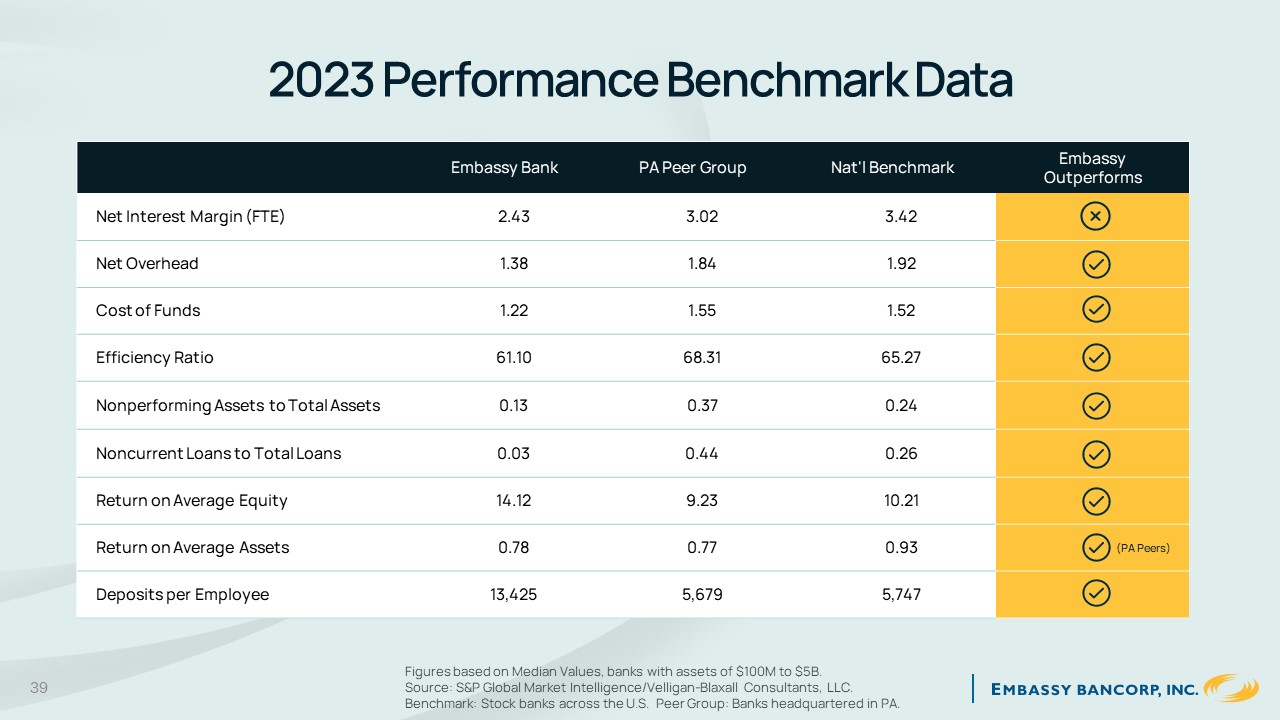

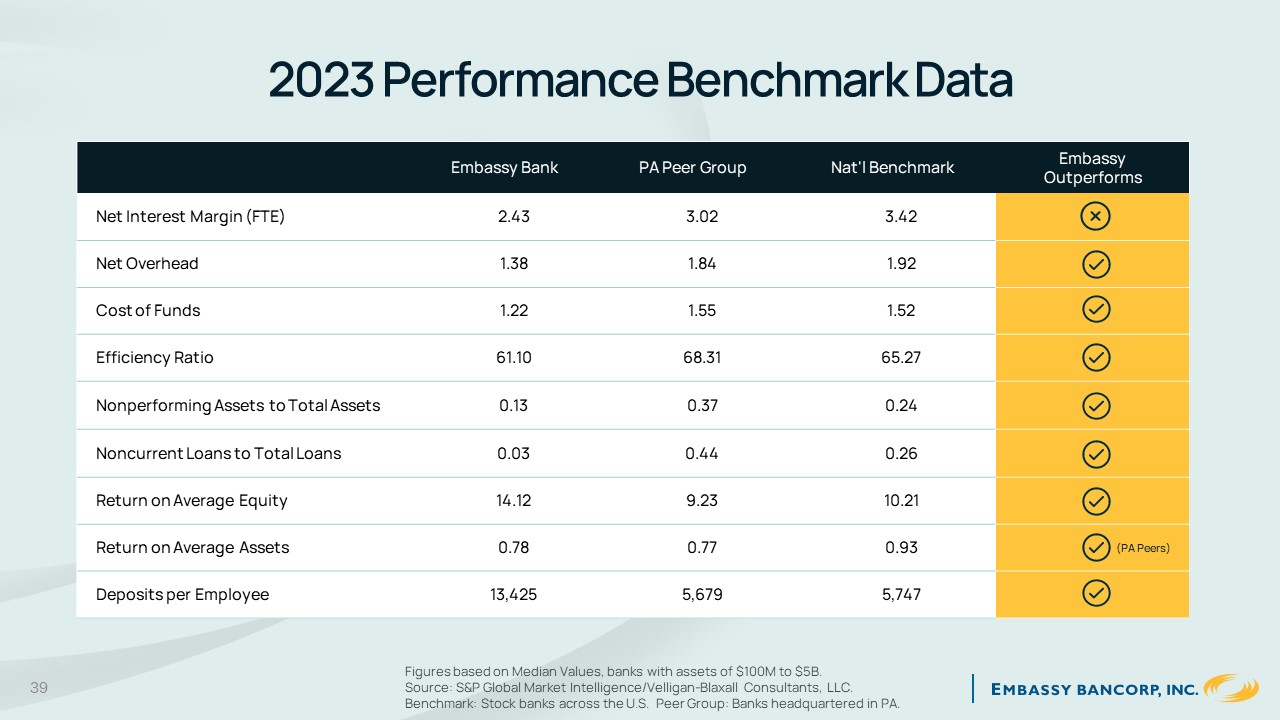

2023 Performance Benchmark Data

Embassy Bank

PA Peer Group

Nat'l Benchmark

Embassy Outperforms

Net Interest Margin (FTE)

2.43

3.02

3.42

Net Overhead

1.38

1.84

1.92

Cost of Funds

1.22

1.55

1.52

Efficiency Ratio

61.10

68.31

65.27

Nonperforming Assets to Total Assets

0.13

0.37

0.24

Noncurrent Loans to Total Loans

0.03

0.44

0.26

Return on Average Equity

14.12

9.23

10.21

Return on Average Assets

0.78

0.77

0.93

(PA Peers)

Deposits per Employee

13,425

5,679

5,747

Figures based on Median Values, banks with assets of $100M to $5B.

39Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

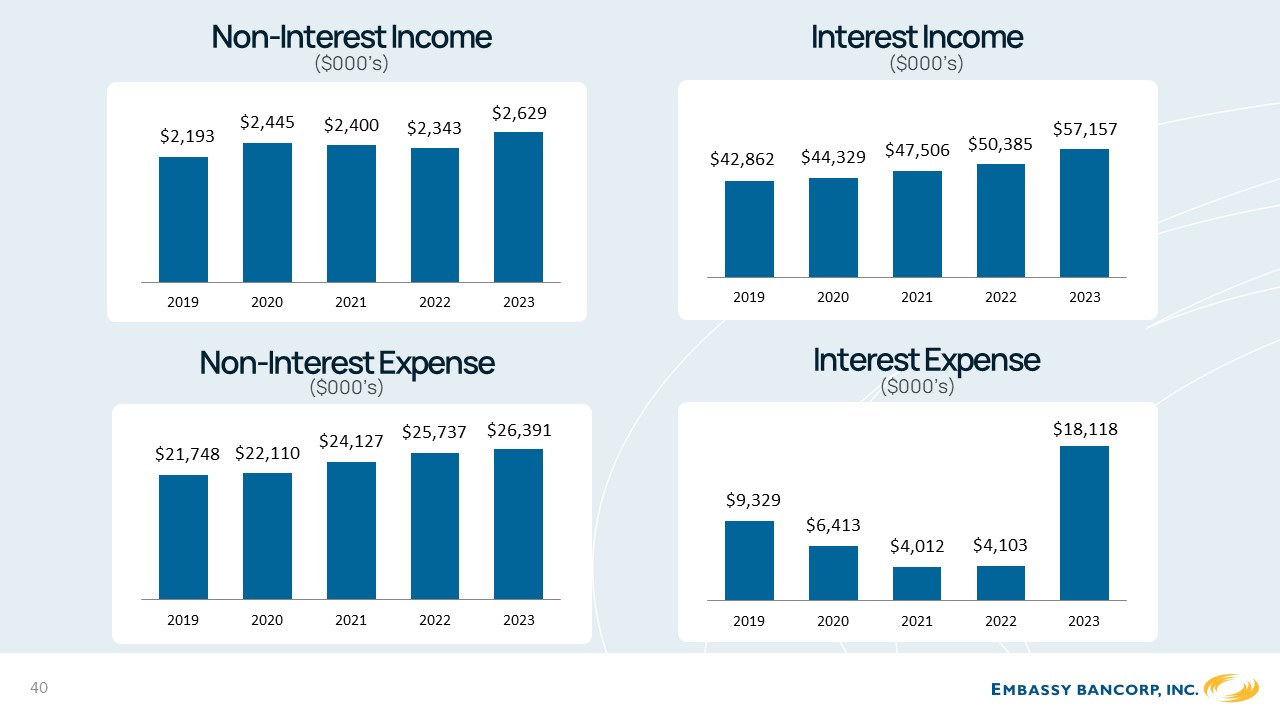

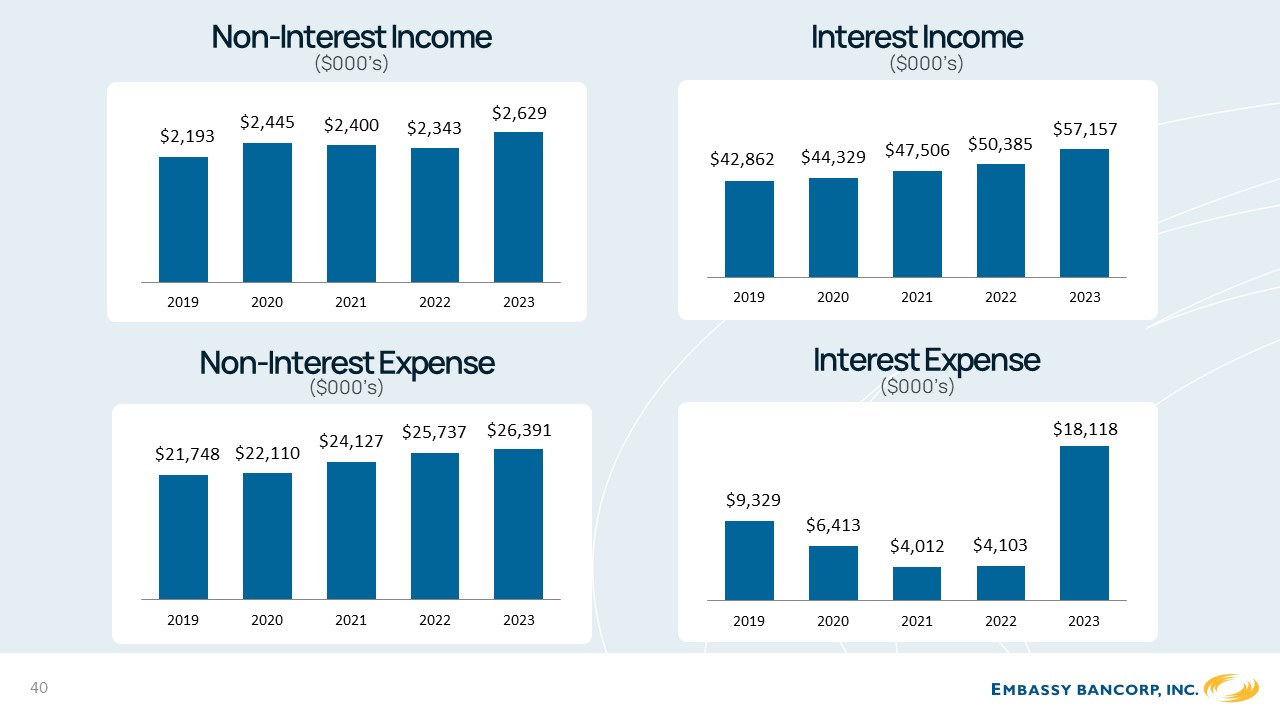

Non-Interest Income

($000’s)

$2,445$2,400$2,629

$2,193

Interest Income

($000’s)

$42,862$44,329$47,506$50,385

$57,157

20192020202120222023

Non-Interest Expense

($000’s)

$24,127$25,737$26,391

$21,748$22,110

20192020202120222023

Interest Expense

($000’s)

$18,118

$9,329

$6,413

$4,012$4,103

20192020202120222023

20192020202120222023

40

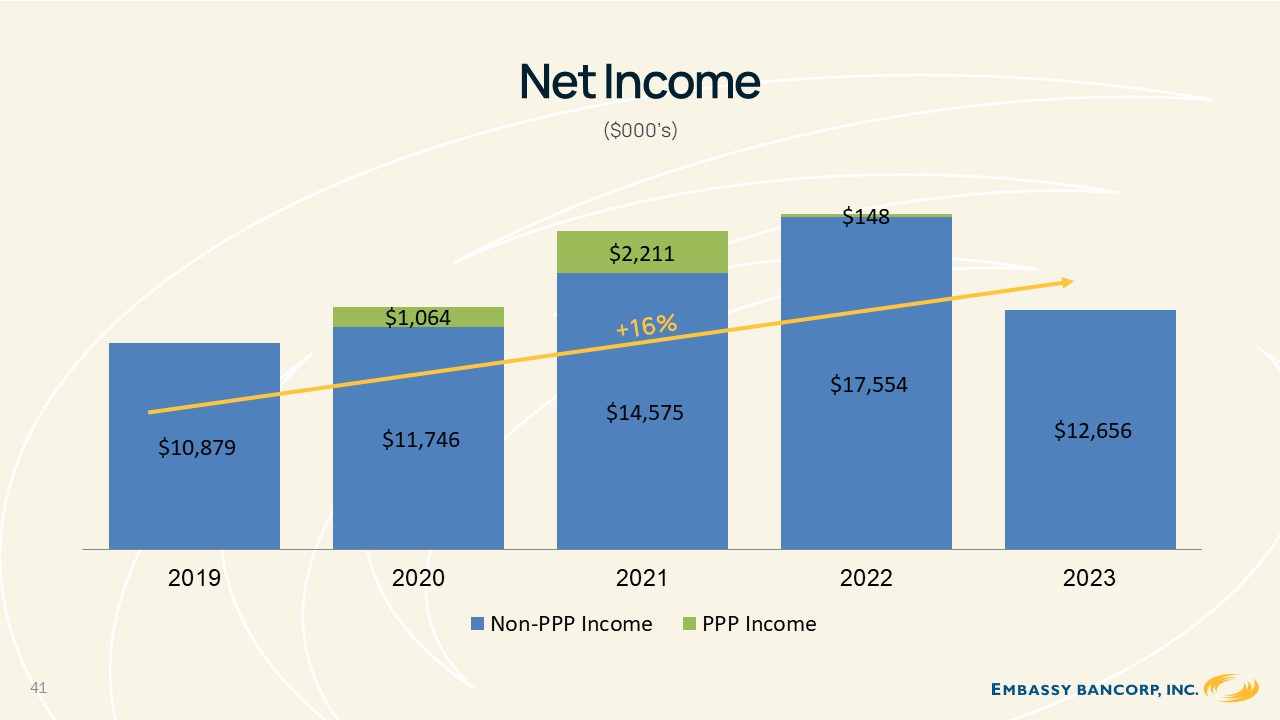

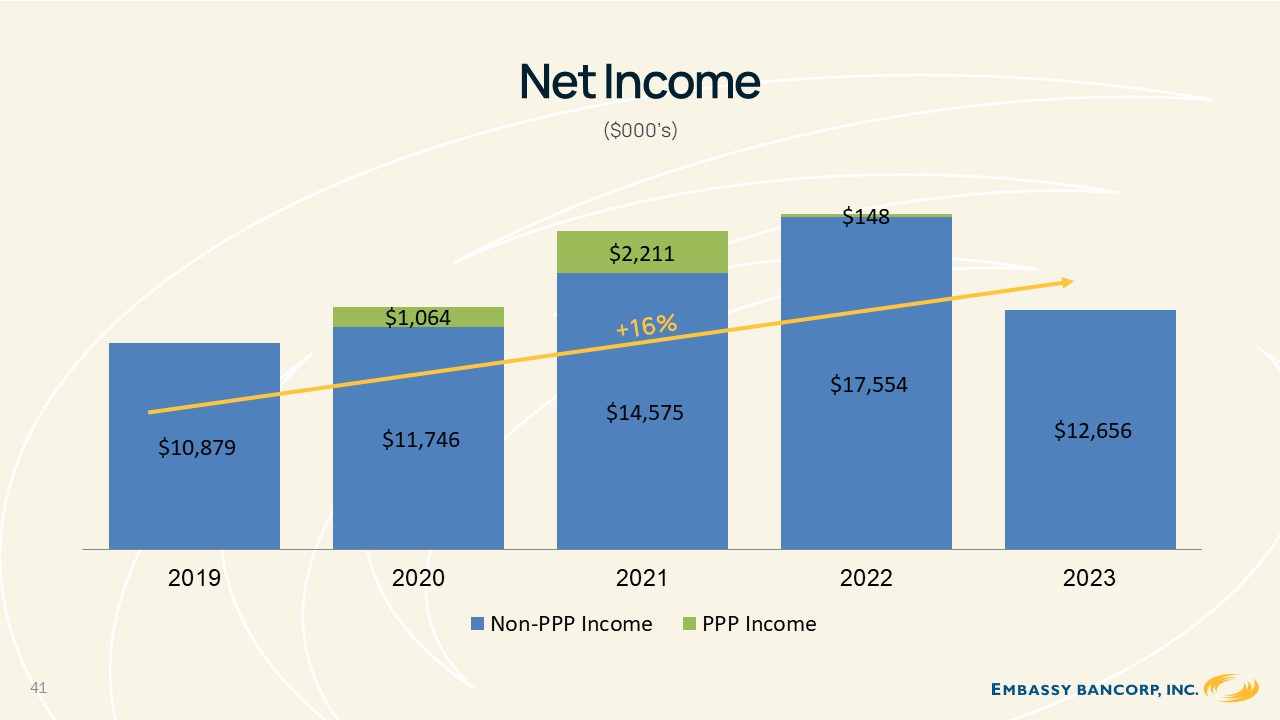

Net Income

($000’s)

20192020202120222023

Non-PPP Income PPP Income

41

Book Value per Share

12.09%

Compounded Annual Growth Rate (2002-2023)

520.55%

Overall Growth Rate (2002-2023)

42

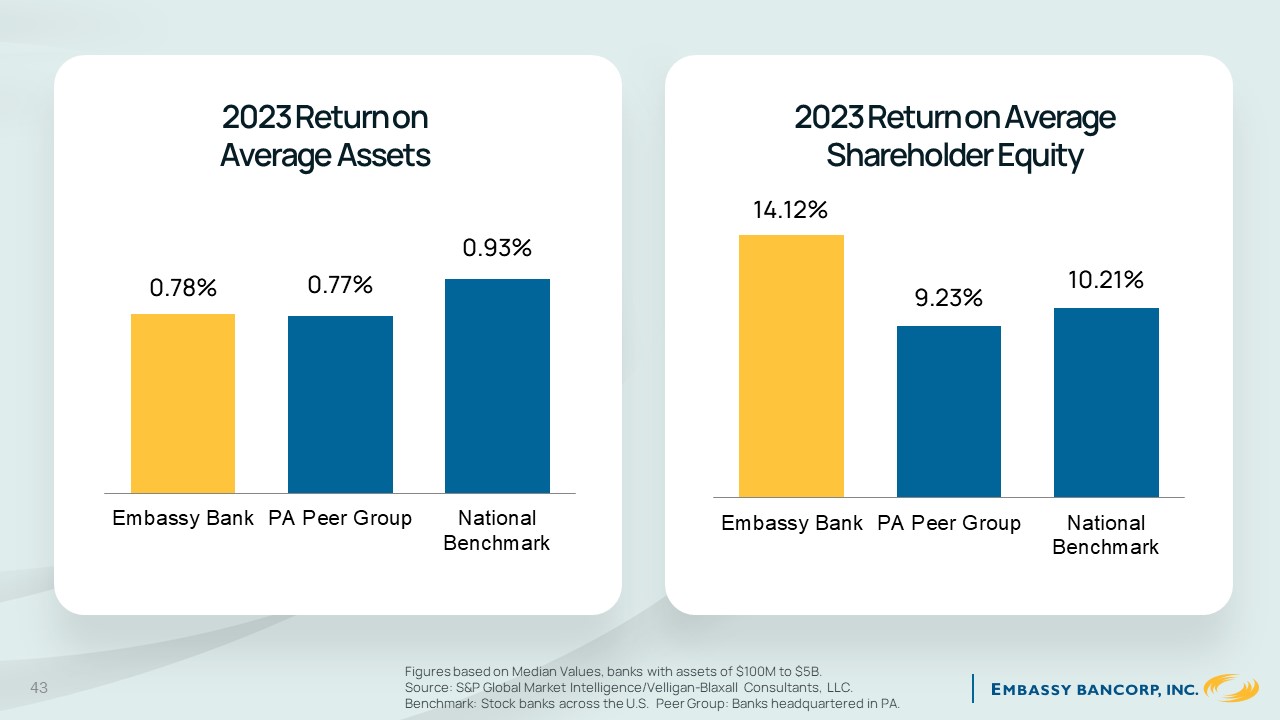

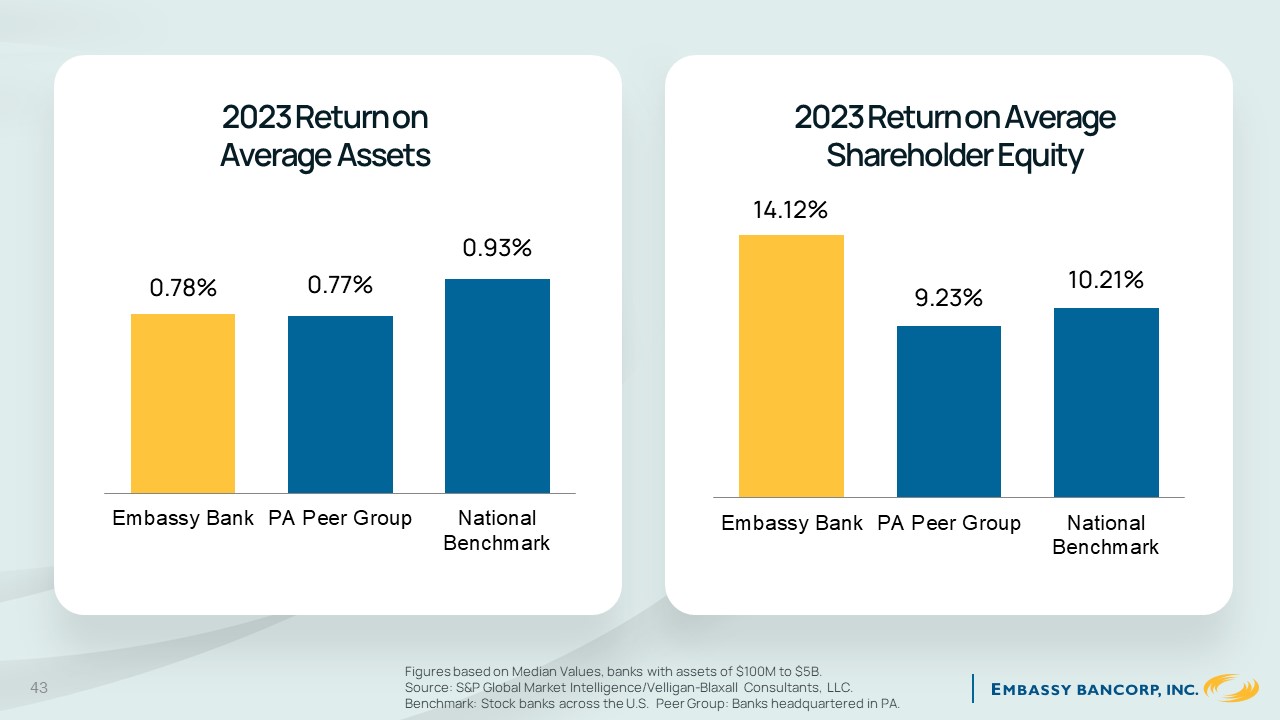

2023 Return on Average Assets

0.78%0.77%

0.93%

2023 Return on Average Shareholder Equity

14.12%

9.23%10.21%

Embassy Bank PA Peer GroupNational

Benchmark

Embassy Bank PA Peer GroupNational

Benchmark

Figures based on Median Values, banks with assets of $100M to $5B.

43Source: S&P Global Market Intelligence/Velligan-Blaxall Consultants, LLC. Benchmark: Stock banks across the U.S. Peer Group: Banks headquartered in PA.

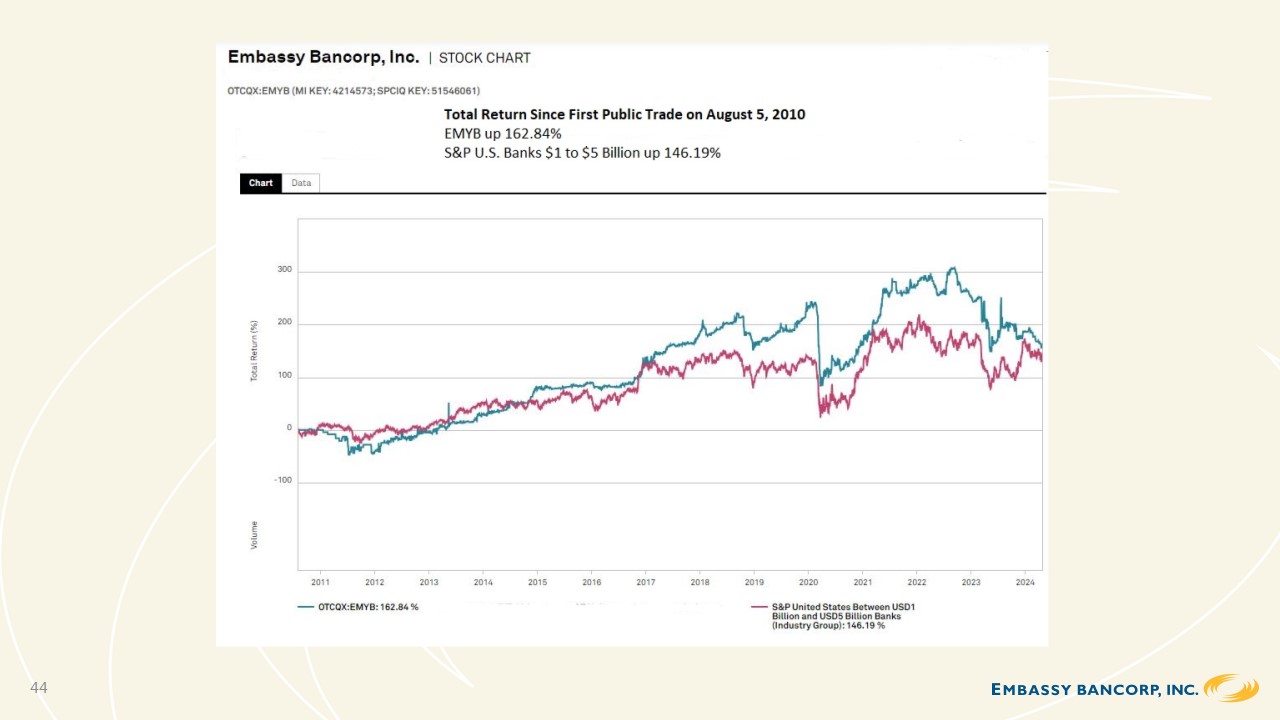

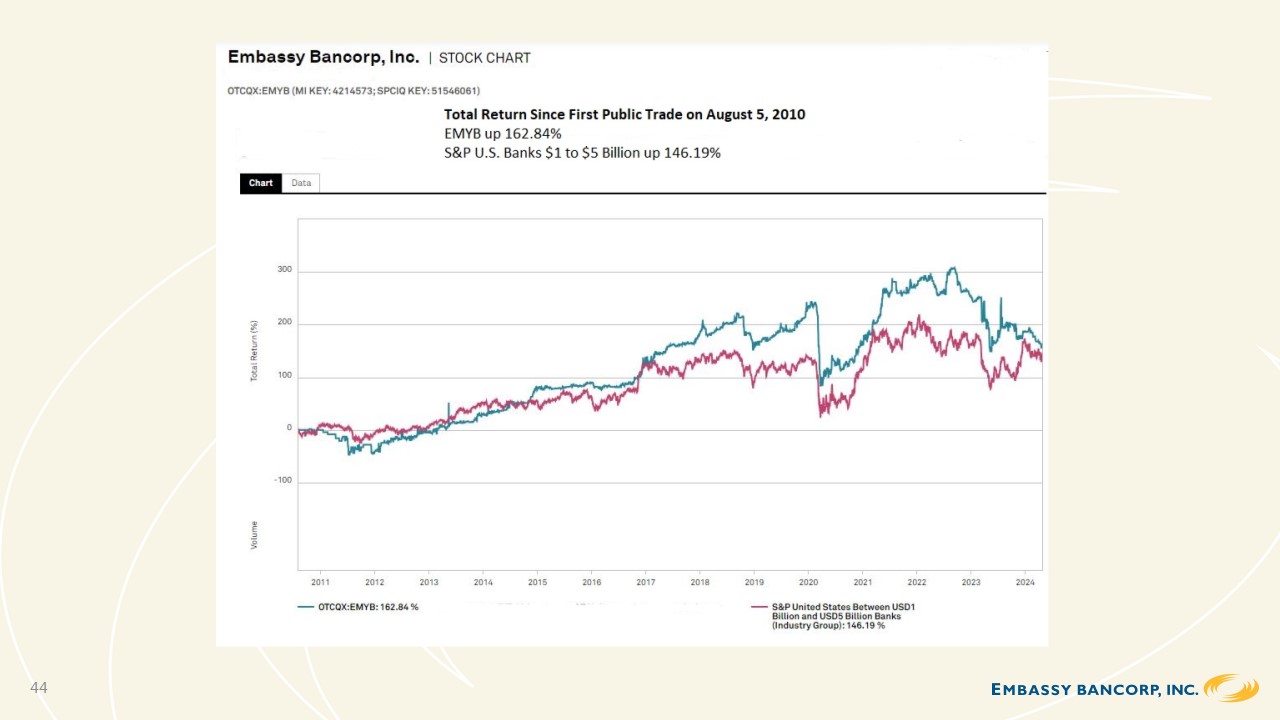

Total Return since first public trade on August 5, 2010 OTCQX EMYB 162.84% S&P U.S. Banks $1 to $5 billion up 146.19% 44

$0.14 45

Annual Dividend Announcement

$0.40

$0.35

$0.30

$0.20$0.22

$0.17

$0.42

20172018201920202021202220232024

Shareholders of record as of 06/28/2024

Payable 07/12/2024

Closing Items

Questions & Answers

Results of Voting

Conclusion of

Meeting

46

Thank You From Our

Board of Directors

47