UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report _________________________

For the transition period from ___________ to ___________.

Commission file number: 001-34532

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

1 Shuanghu Development Zone

Xinzheng City

Zhengzhou, Henan Province

China, 451191

(Address of principal executive offices)

Mingwang Lu

1 Shuanghu Development Zone, Xinzheng City, Zhengzhou, Henan Province, China, 451191

Tel: 86-371-62568634, Fax: 86-371-67718787

Email: mingwang.lu@geruigroup.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| Ordinary Shares, no par value | | NASDAQ Global Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (December 31, 2010): 46,139,053 ordinary shares (including ordinary shares included in public units outstanding as of this date)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP x | International Financial Reporting | | Other o |

| | Standards as issued by the International | | |

| | Accounting Standards Board | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

China Gerui Advanced Materials Group Limited (the “Company”) filed its Annual Report on Form 20-F for the fiscal year ended December 31, 2010 (the “Annual Report”) with the Securities and Exchange Commission on April 19, 2011. This Amendment No. 1 to the Annual Report (the “Amendment”) is filed solely to address the following item:

| | · | to include a revised Report of Independent Registered Public Accounting Firm of UHY Vocation HK CPA Limited to state that they conducted their audits in accordance with the “standards” of the Public Company Accounting Oversight Board (United States). The original Report had referenced only “auditing standards” in this respect. Also included with the Amendment are all information required under Item 18 of Form 20-F and updated Exhibit 12 and Exhibit 13 certifications referencing the Amendment that are currently dated. |

As required by Rule 12b-15 under the Exchange Act of 1934, as amended, or the Exchange Act, updated certifications of our principal executive officer and our principal financial officer are being filed as exhibits to this Amendment. This Amendment speaks as of the date of the initial filing of the Annual Report, except for the certifications referenced above. Other than as described above, this Amendment does not, and does not purport to, amend, update or restate the information in the Annual Report or reflect any events that have occurred after the Annual Report was filed.

PART III

| ITEM 18. | FINANCIAL STATEMENTS |

The full text of our audited consolidated financial statements for the years ended December 31, 2010, 2009 and 2008 begins on page F-1 of this annual report.

| Exhibit No. | | Description |

| 1.1 | | Amended and Restated Memorandum and Articles of Association, adopted on March 17, 2009 [incorporated by reference to Exhibit 3.1 to the registrant’s Amendment No. 1 to Form 20-F filed on March 23, 2009] |

| 2.1 | | Specimen Ordinary Share Certificate [incorporated by reference to Exhibit 4.7 to the registrant’s Registration Statement on Form S-4/A filed on February 17, 2009 in commission file number 333-155312-01] |

| 2.2 | | Form of Underwriter Representative Warrant [incorporated by reference to Exhibit 4.4 of Amendment No. 3 to the registrant’s Registration Statement on Form F-1 (File No. 333-161924) filed on November 5, 2009] |

| 4.1 | | Form of Voting Agreement [incorporated by reference to Exhibit 10.15 to the registrant’s Registration Statement on Form S-4 filed on November 12, 2008 in commission file number 333-155312-01] |

| 4.2 | | English Translation of Renminbi Loan Agreement, dated July 16, 2008, between Zhengzhou Branch of China CITIC Bank and Henan Green Complex Materials Co., Ltd [incorporated by reference to Exhibit 10.17.3 to the registrant’s Amendment No. 2 to Registration Statement on Form S-4 filed on January 29, 2009 in commission file number 333-155312-01] |

| 4.3 | | English Translation of Real Estate Maximum Mortgage Agreement, dated March 26, 2007, between Zhengzhou Branch of Shanghai Pudong Development Bank and Henan Green Complex Materials Co., Ltd [incorporated by reference to Exhibit 10.17.5 to the registrant’s Amendment No. 2 to Registration Statement on Form S-4 filed on January 29, 2009 in commission file number 333-155312-01] |

| 4.4 | | English Translation of Maximum Mortgage Agreement, dated April 21, 2008, between Xiangyang Credit Union of Zhengzhou Rural Credit Cooperatives and Henan Green Complex Materials Co., Ltd [incorporated by reference to Exhibit 10.17.6 to the registrant’s Amendment No. 2 to Registration Statement on Form S-4 filed on January 29, 2009 in commission file number 333-155312-01] |

| 4.5 | | English Translation of Credit Granting Agreement, valid from July 21, 2008, between Guangdong Development Bank Zhengzhou Huanghe Road Sub-branch and Henan Green Complex Materials Co., Ltd [incorporated by reference to Exhibit 10.17.7 to the registrant’s Amendment No. 2 to Registration Statement on Form S-4 filed on January 29, 2009 in commission file number 333-155312-01] |

| Exhibit No. | | Description |

| 4.6 | | English Translation of Agreement, dated September 16, 2003, between Xinzheng City Longhu Town People’s Government and Henan Green Complex Materials Co., Ltd [incorporated by reference to Exhibit 10.17.8 to the registrant’s Amendment No. 2 to Registration Statement on Form S-4 filed on January 29, 2009 in commission file number 333-155312-01] |

| 4.7 | | English Translation of Lease Agreement for Land Use Right and Buildings, dated November 10, 2008, between Zhengzhou the Second Iron & Steel Co., Ltd. and Henan Green Complex Materials Co., Ltd [incorporated by reference to Exhibit 10.17.9 to the registrant’s Amendment No. 2 to Registration Statement on Form S-4 filed on January 29, 2009 in commission file number 333-155312-01] |

| 4.8 | | English Translation of Form of Labor Contract for all employees of Henan Green, including executive officers [incorporated by reference to Exhibit 4.15 to the registrant’s Annual Report on Form 20-F filed on July 15, 2009] |

| 4.9 | | Form of Agreement, dated as of September 15, 2009, by and among the registrant, Oasis Green Investments Limited, Plumpton Group Limited, and Honest Joy Group Limited.[incorporated by reference to Exhibit 10.16 to the registrant’s Registration Statement on Form F-1 filed on September 15, 2009 in commission file number 333-161924] |

| 4.10 | | Underwriting Agreement, dated November 9, 2009 [incorporated by reference to Exhibit 1.1 to the registrant’s Report on Form 6-K/A filed on November 10, 2009] |

| 4.11 | | Form of Registration Rights Agreement, by and among the registrant and the purchasers named therein, dated June 4, 2010 [incorporated by reference to Exhibit 4.1 to the registrant’s Report on Form 6-K filed on June 7, 2010] |

| 4.12 | | Form of Securities Purchase Agreement, by and among the registrant and the purchasers named therein, dated June 4, 2010 [incorporated by reference to Exhibit 10.1 to the registrant’s Report on Form 6-K filed on June 7, 2010] |

| 4.13 | | China Gerui Advanced Materials Group Limited 2010 Share Incentive Plan [incorporated by reference to Exhibit 10.1 to the registrant’s Report on Form 6-K filed on November 16, 2010] |

| 4.14 | | Form of Share Option Agreement for Employees relating to China Gerui Advanced Materials Group Limited 2010 Share Incentive Plan [incorporated by reference to Exhibit 10.2 to the registrant’s Report on Form 6-K filed on November 16, 2010] |

| 4.15 | | Form of Share Option Agreement for Directors relating to China Gerui Advanced Materials Group Limited 2010 Share Incentive Plan [incorporated by reference to Exhibit 10.3 to the registrant’s Report on Form 6-K filed on November 16, 2010] |

| 4.16 | | Form of Restricted Share Award Agreement relating to China Gerui Advanced Materials Group Limited 2010 Share Incentive Plan [incorporated by reference to Exhibit 10.4 to the registrant’s Report on Form 6-K filed on November 16, 2010] |

| 8.1 | | List of the registrant’s subsidiaries [incorporated by reference to Exhibit 8.1 to the registrant’s Annual Report on Form 20-F filed on July 15, 2009] |

| 11.1 | | Code of Ethics [incorporated by reference to Exhibit 14.1 to the registrant’s Annual Report on Form 20-F filed on July 15, 2009] |

| 12.1 | | CEO Certification Pursuant to Rule 13a-14(a) (17 CFR 240.13a-14(a)) or Rule 15d-1(a) (17 CFR 240.15d-14(a)) |

| 12.2 | | CFO Certification Pursuant to Rule 13a-14(a) (17 CFR 240.13a-14(a)) or Rule 15d-1(a) (17 CFR 240.15d-14(a)) |

| 13.1 | | CEO Certification Pursuant to Rule 13a-14(b) (17 CFR 240.13a-14(b)) or Rule 15d-14(b) (17 CFR 240.15d-14(b)) and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) |

| 13.2 | | CFO Certification Pursuant to Rule 13a-14(b) (17 CFR 240.13a-14(b)) or Rule 15d-14(b) (17 CFR 240.15d-14(b)) and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) |

SIGNATURE

The registrant hereby certifies that it meets all of the requirements for filing its annual report on Form 20-F and that it has duly caused and authorized the undersigned to sign this Amendment No. 1 to its annual report on its behalf.

| | CHINA GERUI ADVANCED MATERIALS GROUP LIMITED |

| | |

| | /s/ Mingwang Lu | |

| | Mingwang Lu |

July 11, 2011 | Chief Executive Officer |

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

TO THE BOARD OF DIRECTORS AND STOCKHOLDERS OF

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

We have audited the accompanying consolidated balance sheets of China Gerui Advanced Materials Group Limited (the “Company”) as of December 31, 2010, and 2009, and the related consolidated statements of income, changes in stockholders’ equity, and cash flows for each of the three years in the period ended December 31, 2010. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of China Gerui Advanced Materials Group Limited as of December 31, 2010 and 2009, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2010, in conformity with accounting principles generally accepted in the United States of America.

UHY VOCATION HK CPA LIMITED

Certified Public Accountants

Hong Kong, the People’s Republic of China,

April 19, 2011

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2010, 2009 AND 2008

| CONTENTS | | Pages |

| | | |

| Report of Independent Registered Public Accounting Firm | | F-1 |

| | | |

| Consolidated Balance Sheets | | F-3 |

| | | |

| Consolidated Statements of Income | | F-4 |

| | | |

| Consolidated Statements of Changes in Stockholders’ Equity | | F-5 |

| | | |

| Consolidated Statements of Cash Flows | | F-6 |

| | | |

| Notes to the Consolidated Financial Statements | | F-7 |

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

CONSOLIDATED BALANCE SHEETS

(IN US DOLLARS)

| | | December 31, 2010 | | | December 31, 2009 | |

| Assets | | | | | | |

| | | | | | | |

| Current assets | | | | | | |

| Cash | | $ | 119,477,298 | | | $ | 79,607,369 | |

| Restricted cash | | | 66,530,303 | | | | 37,498,169 | |

| Accounts receivable, net | | | 4,087,086 | | | | 4,808,184 | |

| Inventories | | | 7,002,277 | | | | 5,958,880 | |

| Prepaid expenses and other deposits | | | 28,749,680 | | | | 16,473,710 | |

| Other receivables | | | 2,068,082 | | | | 2,292,133 | |

| Total current assets | | | 227,914,726 | | | | 146,638,445 | |

| | | | | | | | | |

| Non-current assets | | | | | | | | |

| Property, plant and equipment, net | | | 85,489,849 | | | | 22,338,210 | |

| Prepaid machinery deposits | | | - | | | | 13,973,966 | |

| Land use right, net | | | 15,599,157 | | | | 1,399,026 | |

| Total non-current assets | | | 101,089,006 | | | | 37,711,202 | |

| Total assets | | $ | 329,003,732 | | | $ | 184,349,647 | |

| | | | | | | | | |

| Liabilities and stockholders' equity | | | | | | | | |

| | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable | | $ | 2,650,689 | | | $ | 7,617,953 | |

| Notes payable | | | 86,227,272 | | | | 41,013,622 | |

| Term loans | | | 44,090,909 | | | | 33,982,715 | |

| Land use right payable | | | 10,203,404 | | | | - | |

| Income tax payable | | | 4,151,665 | | | | 3,817,304 | |

| Customers deposits | | | 9,686,444 | | | | 8,146,611 | |

| Accrued liabilities and other payables | | | 4,181,347 | | | | 2,728,585 | |

| | | | | | | | | |

| Total current liabilities | | | 161,191,730 | | | | 97,306,790 | |

| | | | | | | | | |

| Total liabilities | | | 161,191,730 | | | | 97,306,790 | |

| | | | | | | | | |

| Stockholders' equity | | | | | | | | |

| | | | | | | | | |

| Common stock, | | | | | | | | |

| | | | | | | | | |

| Common stock, 100,000,000 shares authorized with no par value; 46,139,053 and 40,692,323 shares outstanding as of December 31, 2010 and December 31, 2009, respectively | | | 73,944,243 | | | | 45,261,630 | |

| | | | | | | | | |

| Additional paid-in capital | | | 6,930,944 | | | | 6,930,944 | |

| Retained earnings | | | 79,522,406 | | | | 32,438,982 | |

| Accumulated other comprehensive income | | | 7,414,409 | | | | 2,411,301 | |

| | | | | | | | | |

| Total stockholders' equity | | | 167,812,002 | | | | 87,042,857 | |

| | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 329,003,732 | | | $ | 184,349,647 | |

See notes to financial statements.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

CONSOLIDATED STATEMENTS OF INCOME

(IN US DOLLARS)

| | | For the Year Ended | |

| | | December 31, | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | |

| Revenue | | $ | 253,866,337 | | | $ | 218,902,632 | | | $ | 196,264,731 | |

| | | | | | | | | | | | | |

| Cost of revenue | | | (177,869,648 | ) | | | (153,095,354 | ) | | | (142,407,995 | ) |

| | | | | | | | | | | | | |

| Gross Profit | | | 75,996,689 | | | | 65,807,278 | | | | 53,856,736 | |

| | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | |

| General and administrative expenses | | | (7,795,722 | ) | | | (4,573,512 | ) | | | (3,431,745 | ) |

| Selling and marketing expenses | | | (1,251,091 | ) | | | (919,049 | ) | | | (831,108 | ) |

| Total operating expenses | | | (9,046,813 | ) | | | (5,492,561 | ) | | | (4,262,853 | ) |

| | | | | | | | | | | | | |

| Operating income | | | 66,949,876 | | | | 60,314,717 | | | | 49,593,883 | |

| | | | | | | | | | | | | |

| Other income and (expense): | | | | | | | | | | | | |

| Interest income | | | 1,087,178 | | | | 829,056 | | | | 1,395,121 | |

| Interest expenses | | | (5,286,727 | ) | | | (3,237,757 | ) | | | (3,769,423 | ) |

| Sundry income | | | 270,240 | | | | 293,831 | | | | 155,687 | |

| | | | | | | | | | | | | |

| Income before income taxes | | | 63,020,567 | | | | 58,199,847 | | | | 47,375,268 | |

| | | | | | | | | | | | | |

| Income tax expense | | | (15,937,143 | ) | | | (14,751,569 | ) | | | (11,869,735 | ) |

| | | | | | | | | | | | | |

| Income before minority interest | | | 47,083,424 | | | | 43,448,278 | | | | 35,505,533 | |

| | | | | | | | | | | | | |

| Net income attributable to minority interest | | | - | | | | - | | | | (13,920,944 | ) |

| | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 47,083,424 | | | $ | 43,448,278 | | | $ | 21,584,589 | |

| | | | | | | | | | | | | |

| Earnings per share | | | | | | | | | | | | |

| - Basic | | $ | 1.07 | | | $ | 1.29 | | | $ | 0.72 | |

| | | | | | | | | | | | | |

| - Diluted | | $ | 1.01 | | | $ | 1.15 | | | $ | 0.72 | |

| | | | | | | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | | | | | |

| - Basic | | | 43,891,670 | | | | 33,751,844 | | | | 30,000,000 | |

| | | | | | | | | | | | | |

| - Diluted | | | 46,655,721 | | | | 37,675,479 | | | | 30,000,000 | |

See notes to financial statements.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2010, 2009 AND 2008

(IN US DOLLARS)

| | | Common Stock, with no Par Value | | | Additional | | | | | | Accumulated Other | | | | | | | | | | |

| | | Number of | | | | | | Paid-in | | | Subscription | | | Comprehensive | | | Retained | | | Total | | | Comprehensive | |

| | | Shares | | | Amount | | | Capital | | | receivable | | | Income | | | Earnings | | | Equity | | | Income | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2007 | | | 30,000,000 | | | $ | 300 | | | $ | 1,834,940 | | | $ | - | | | $ | 1,057,886 | | | $ | 14,462,559 | | | $ | 17,355,685 | | | $ | - | |

| Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 21,584,589 | | | | 21,584,589 | | | | 21,584,589 | |

| Foreign currency translation gain | | | - | | | | - | | | | - | | | | - | | | | 1,345,661 | | | | - | | | | 1,345,661 | | | | 1,345,661 | |

| Subscription for ordinary shares | | | - | | | | - | | | | 4,310,087 | | | | - | | | | - | | | | - | | | | 4,310,087 | | | | | |

| Subscription receivable | | | - | | | | - | | | | - | | | | (4,310,087 | ) | | | - | | | | - | | | | (4,310,087 | ) | | | | |

| Contribution to capital on purchase of minority interest | | | - | | | | - | | | | 785,917 | | | | - | | | | - | | | | - | | | | 785,917 | | | | | |

| Dividend declared | | | - | | | | - | | | | - | | | | - | | | | - | | | | (51,856,496 | ) | | | (51,856,496 | ) | | | | |

| Dividend allocated to minority interest | | | - | | | | - | | | | - | | | | - | | | | - | | | | 23,325,052 | | | | 23,325,052 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2008 | | | 30,000,000 | | | $ | 300 | | | $ | 6,930,944 | | | $ | (4,310,087 | ) | | $ | 2,403,547 | | | $ | 7,515,704 | | | $ | 12,540,408 | | | $ | 22,930,250 | |

| Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 43,448,278 | | | | 43,448,278 | | | | 43,448,278 | |

| Foreign currency translation gain | | | - | | | | - | | | | - | | | | - | | | | 7,754 | | | | - | | | | 7,754 | | | | 7,754 | |

| Subscription receivable settlement | | | - | | | | - | | | | - | | | | 4,310,087 | | | | - | | | | - | | | | 4,310,087 | | | | - | |

| Issuance of shares in connection with earn-out share agreement accounted for as a dividend | | | 2,850,000 | | | | 18,525,000 | | | | - | | | | - | | | | - | | | | (18,525,000 | ) | | | - | | | | - | |

| Issuance of shares for offering (net of expenses amounting to $2,914,056) | | | 4,800,000 | | | | 21,085,944 | | | | - | | | | - | | | | - | | | | - | | | | 21,085,944 | | | | - | |

| Issuance of over allotment shares (net of expenses amounting to $288,000) | | | 720,000 | | | | 3,312,000 | | | | - | | | | - | | | | - | | | | - | | | | 3,312,000 | | | | - | |

| Shares issuance for warrant conversion | | | 76,600 | | | | 383,000 | | | | - | | | | - | | | | - | | | | - | | | | 383,000 | | | | - | |

| Balance at December 31, 2009 | | | 40,692,323 | | | $ | 45,261,630 | | | $ | 6,930,944 | | | $ | - | | | $ | 2,411,301 | | | $ | 32,438,982 | | | $ | 87,042,857 | | | $ | 43,456,032 | |

| Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 47,083,424 | | | | 47,083,424 | | | | 47,083,424 | |

| Foreign currency translation gain | | | - | | | | - | | | | - | | | | - | | | | 5,003,108 | | | | - | | | | 5,003,108 | | | | 5,003,108 | |

| Shares issued for warrant conversion | | | 2,142,959 | | | | 10,714,795 | | | | - | | | | - | | | | - | | | | - | | | | 10,714,795 | | | | - | |

| Shares issued in private placement net of offering fees of $863,676 | | | 3,303,771 | | | | 17,967,818 | | | | - | | | | - | | | | - | | | | - | | | | 17,967,818 | | | | - | |

| Balance at December 31, 2010 | | | 46,139,053 | | | $ | 73,944,243 | | | $ | 6,930,944 | | | $ | - | | | $ | 7,414,409 | | | $ | 79,522,406 | | | $ | 167,812,002 | | | $ | 52,086,532 | |

See notes to financial statements

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN US DOLLARS)

| | | For the Year ended December 31 | |

| | | 2010 | | | 2009 | | | 2008 | |

| Cash flows from operating activities: | | | | | | | | | |

| Net income | | $ | 47,083,424 | | | $ | 43,448,278 | | | $ | 21,584,589 | |

| Add: Net income attributable to minority interest | | | - | | | | - | | | | 13,920,944 | |

| | | | 47,083,424 | | | | 43,448,278 | | | | 35,505,533 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | |

| Depreciation of property, plant and equipment | | | 3,149,314 | | | | 2,792,547 | | | | 2,447,626 | |

| Amortization of land use right | | | 259,438 | | | | 30,827 | | | | 30,280 | |

| Changes in assets and liabilities: | | | | | | | | | | | | |

| Accounts receivable, net | | | 721,098 | | | | 5,496,540 | | | | (128,270 | ) |

| Inventories | | | (1,043,397 | ) | | | (2,404,567 | ) | | | 5,106,310 | |

| Prepaid expenses and other deposits | | | (12,275,970 | ) | | | (5,552,655 | ) | | | (949,445 | ) |

| Other receivables | | | 224,051 | | | | (1,026,036 | ) | | | (630,379 | ) |

| Accounts payable | | | (4,967,264 | ) | | | 2,278,603 | | | | (547,173 | ) |

| Income tax payable | | | 334,361 | | | | 1,628,627 | | | | (408,010 | ) |

| Customers deposit | | | 1,539,833 | | | | (9,338,097 | ) | | | 9,035,743 | |

| Accrued liabilities and other payables | | | 1,452,762 | | | | (3,565,821 | ) | | | 1,005,235 | |

| Net cash provided by operating activities | | | 36,477,650 | | | | 33,788,246 | | | | 50,467,450 | |

| Cash flows from investing activities: | | | | | | | | | | | | |

| Capital expenditures for addition of property, plant and equipment | | | (65,063,864 | ) | | | (5,213,329 | ) | | | (6,572,185 | ) |

| Payment of purchases of land use right | | | (3,996,727 | ) | | | (14,648 | ) | | | - | |

| Changes in restricted cash | | | (29,032,134 | ) | | | (12,785,820 | ) | | | (5,485,798 | ) |

| Changes in prepaid machinery deposits | | | 13,973,966 | | | | (13,336,084 | ) | | | 25,126,394 | |

| Net cash (used in)/provided by investing activities | | | (84,118,759 | ) | | | (31,349,881 | ) | | | 13,068,411 | |

| Cash flows from financing activities: | | | | | | | | | | | | |

| Repayment of term loans | | | (45,984,848 | ) | | | (37,269,379 | ) | | | (26,662,742 | ) |

| Proceeds from term loans | | | 56,093,042 | | | | 40,574,191 | | | | 39,985,342 | |

| Proceeds received from common stock issued and warrant conversion, net | | | 28,682,613 | | | | 26,736,329 | | | | - | |

| Proceeds from notes payable | | | 45,213,650 | | | | 14,102,666 | | | | 6,430,053 | |

| Repayment of subscription receivable | | | - | | | | 4,310,087 | | | | - | |

| Land use right payable | | | - | | | | (28,521 | ) | | | (125,604 | ) |

| Due to former minority shareholders | | | - | | | | (4,310,087 | ) | | | - | |

| Due to former owner | | | - | | | | - | | | | (61,688 | ) |

| Dividends paid | | | - | | | | (9,601,549 | ) | | | (42,254,947 | ) |

| Net cash provided by/(used in) financing activities | | | 84,004,457 | | | | 34,513,737 | | | | (22,689,586 | ) |

| Net increase in cash | | | 36,363,348 | | | | 36,952,102 | | | | 40,846,275 | |

| Effect on change of exchange rates | | | 3,506,581 | | | | 32,862 | | | | 1,557,778 | |

| Cash as of January 1 | | | 79,607,369 | | | | 42,622,404 | | | | 218,351 | |

| Cash as of December 31 | | $ | 119,477,298 | | | $ | 79,607,369 | | | $ | 42,622,404 | |

| Supplemental disclosures of cash flow information: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cash paid during the year for: | | | | | | | | | | | | |

| Interest paid | | $ | 3,927,906 | | | $ | 3,27,757 | | | $ | 3,769,423 | |

| Income tax paid | | $ | 15,738,892 | | | $ | 13,122,287 | | | $ | 12,277,745 | |

| Non-cash paid during the year for: | | | | | | | | | | | | |

| Dividend paid | | $ | - | | | $ | 18,525,000 | | | $ | - | |

| Transfer of prepayments and other deposits to property, plant and equipment | | $ | - | | | $ | - | | | $ | 2,288,337 | |

| Acquisition of minority interest with subscription receivable | | $ | - | | | $ | - | | | $ | 4,310,087 | |

See notes to financial statements.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 1. | DESCRIPTION OF BUSINESS AND ORGANIZATION |

On November 30, 2009, the Board of Directors of Golden Green Enterprises Limited (“Golden Green”) authorized the Company's corporate name change to China Gerui Advanced Materials Group Limited ("the Company" or "China Gerui"), effective as of December 14, 2009.

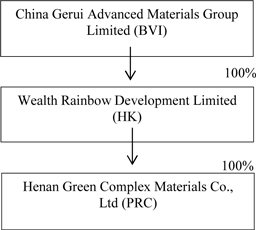

The Company was established in the British Virgin Islands ("BVI") on March 11, 2008 as a limited liability Company, for the purpose of effectuating a reorganization and merger with Wealth Rainbow Development Limited (“Wealth Rainbow”) and Henan Green Complex Materials Co., Ltd (“Henan Green”) as discussed in Note 2.

China Gerui's holdings are comprised of Wealth Rainbow, also a holding company and Henan Green, an operating company and a leading China-based specialty precision cold-rolled steel producer. Through its investment in these entities, the Company manufactures and sells specialty, high-end, high precision, ultra thin, high strength, cold-rolled, narrow strip steel products that are characterized by stringent performance and specification requirements that mandate a high degree of manufacturing and engineering expertise, and are extensively used in the manufacturing industry throughout mainland China. The Company's products are not standardized commodity products, but are tailored to customers' requirements and then incorporated into products they and end-users make for various applications. The Company sells its products to its customers in the People's Republic of China (PRC) in a diverse range of industries, including the food packaging, telecommunication, electrical appliance, and construction materials industries.

Wealth Rainbow was formed on March 1, 2007 by Lu Mingwang's family as the Company. On October 21, 2008, Wealth Rainbow acquired 100% of the outstanding shares of Henan Green pursuant to a stock transfer agreement. Subsequent to the stock transfer, Wealth Rainbow became the sole shareholder of Henan Green. The change of ownership was approved by the Chinese Government on October 21, 2008. The principal activity of Wealth Rainbow is to hold its interest in Henan Green.

On June 12, 2010, the Company's directors approved a resolution to increase the registered capital of the operating entity, Henan Green, in amount of RMB138,000,000 ($20,349,780). Henan Green received the full amount in July 2010.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 1. | DESCRIPTION OF BUSINESS AND ORGANIZATION (…/Cont’d) |

The consolidated financial statements include the financial statements of China Gerui and its subsidiaries (together referred to as the "Group"). The Company owns 100% equity interests directly and indirectly, in two subsidiaries, namely Wealth Rainbow and Henan Green. The organization chart of the Group is as follows:

| 2. | REORGANIZATION AND ACQUISITION OF NON-CONTROLLING INTEREST |

On October 21, 2008, Wealth Rainbow acquired the non-controlling interest in Henan Green for $4,310,087 with the issuance of a promissory note to the minority stockholders. This amount represented the fair value of Henan Green as determined by an independent valuation which was performed during August 2008. On the effective acquisition date, October 21, 2008, the fair value of Henan Green exceeded the agreed purchase price by $785,917. Such amount has been recorded as a contribution of capital by Henan Green during 2008.

The net assets of Henan Green were recorded by Wealth Rainbow at historical cost to the extent of the common control group’s 55.02% ownership of Henan Green. The remaining 44.98% of Henan Green shares acquired were accounted for as a purchase (fair value) of the non-controlling interest.

The common control group comprised of three direct relatives of the Lu's family which held approximately 55.02% of the shares of Henan Green on the date it was acquired by Wealth Rainbow. Wealth Rainbow was wholly owned by another direct relative of the Lu's family. Under the common control reporting rules, the control group’s 55.02% interest of Henan Green that was acquired by Wealth Rainbow constitutes an exchange of equity interests between entities under the common control.

Subsequent to the Henan Green acquisition, Wealth Rainbow entered into a reorganization and capitalization agreement with the Company during November 2008 in which all of the shares of Wealth Rainbow were exchanged with shares of the Company. As a result of these transactions, Wealth Rainbow and Henan Green became wholly owned subsidiaries of the Company. These transactions have been accounted for as a reorganization under common control with the purchase of a minority interest. On September 9, 2009, the Company fully settled the amount of $4,310,087 which was recorded as amount due to former minority shareholders.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 2. | REORGANIZATION AND ACQUISITION OF NON-CONTROLLING INTEREST (…/Cont’d) |

The consolidated financial statements of the Company have been prepared as if the existing corporate structure had been in existence throughout the periods presented and as if the reorganization had occurred as of the beginning of the earliest period presented.

During March 2009, the Company amended its memorandum of association by increasing its authorized number of ordinary shares from 50,000 with a $1 par value to 100,000,000 with no par value. Simultaneously with the amendment, the Company effected a stock split by an additional 29,999,900 shares to the current shareholders. Accordingly, immediately after the amendment and prior to the merger with China Opportunity Acquisition Corp. (“COAC”), the Company had 30,000,000 ordinary shares outstanding. On March 17, 2009, the Company consummated a merger with COAC.

In connection with the merger, the Company issued 2,245,723 shares of its ordinary shares in exchange for all the outstanding shares of COAC. The Company also granted, in connection with the merger, 17,266,667 of warrants in exchange for all the outstanding warrants of COAC. The Company is deemed to be the surviving entity and registered its shares pursuant to a registration statement filed with the U.S. Securities and Exchange Commission. Accordingly, after the merger, the former shareholders of COAC own approximately 6.5% of the Company’s ordinary shares. As of December 31, 2010, there were 2,219,559 warrants exercised.

On June 4, 2010, the Company completed a private placement in which the Company sold to certain investors 3,303,771 ordinary shares at a price per share of $5.70, for an aggregate purchase price of $18,831,495, pursuant to a securities purchase agreement dated the same date. The foregoing issuance was made in reliance upon exemptions provided by Section 4(2) of the Securities Act for the offer and sale of securities not involving a public offering and Regulation D promulgated thereunder.

| 3. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The accompanying audited consolidated financial statements and related notes have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP). The preparation of the consolidated financial statements in accordance with US GAAP requires management of the Group to make a number of estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting year. Significant items subject to such estimates and assumptions include the recoverability of the carrying amount and the estimated useful lives of long-lived assets; valuation allowances for receivables, realizable values for inventories. Actual results could differ from those estimates.

The consolidated financial statements include all accounts of the Company and its wholly-owned subsidiaries. All material inter-company balances and transactions have been eliminated.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 3. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (…/Cont’d) |

| | (b) | Foreign currency translation |

Assets and liabilities of foreign operation are translated at the rate of exchange in effect on the balance sheet date; income and expenses are translated at the average rate of exchange prevailing during the year. The year-end rates for December 31, 2010, 2009 and 2008 of Renminbi to one US dollar were 6.6000, 6.8270 and 6.8225 respectively; average rates for the year-end December 31, 2010, 2009 and 2008 were 6.7604, 6.8303 and 6.9351 respectively. The related translation adjustments are reflected in "Accumulated other comprehensive income" in the stockholder's equity section of the balance sheet. As of December 31, 2010, 2009 and 2008, the accumulated foreign currency translation gain was $7,414,409, $2,411,301 and $2,403,547 respectively. Foreign currency gains and losses resulting from transactions are included in earnings.

The year-end rates for December 31, 2010, 2009 and 2008 of Hong Kong dollar to one US dollar were 7.7810, 7.7543 and 7.7499 respectively; average rates for the year-end December 31, 2010, 2009 and 2008 were 7.7700, 7.7515 and 7.7818 respectively.

Cash represents cash in banks and cash on hand.

The Group considers all highly liquid investments with original maturities of three months or less to be cash. The Group maintains bank accounts in the PRC.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 3. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (…/Cont’d) |

Accounts receivable are recorded at the invoiced amount, net of allowances for doubtful accounts sales returns and trade discounts. The allowance for doubtful accounts is the Group’s best estimate of the amount of probable credit losses in the Group’s existing accounts receivable. Management determines the allowance based on historical write-off experience, customer specific facts and economic conditions. The Group has historically been able to collect all of its receivable balances, and accordingly, 2% allowance has been provided for doubtful accounts.

Outstanding account balances are reviewed individually for collectability. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Group does not have any off-balance-sheet credit exposure to its customers.

Inventories are stated at the lower of cost or market and consist primarily of flat rolled steel. Cost is determined using the weighted average cost method. In the case of work in process and finished goods, such costs comprise of direct materials, direct labor and an appropriate proportion of overheads.

| | (f) | Property, plant and equipment |

Property, plant and equipment are recorded at cost less accumulated depreciation. Expenditures for major additions and betterments are capitalized. Maintenance and repairs are charged to general and administrative expenses as incurred. Depreciation of property, plant and equipment is computed by the straight-line method over the assets estimated useful lives ranging from five to fifty years. Building improvements, if any, are amortized on a straight-line basis over the estimated useful life.

Upon sale or retirement of property, plant and equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in operations.

Construction in progress represents the costs of property, plant and equipment under construction or installation. Depreciation commences when the asset is placed in service. The accumulated costs are reclassified as property, plant and equipment when installation or construction is completed. Government subsidies received reduce the cost of construction.

The estimated useful lives of the assets are as follows:

| | | Estimated Life |

| Land use right | | 43 - 50 |

| Leasehold land improvement | | 46.5 |

| Buildings | | 10 - 20 |

| Machinery and equipment | | 5 - 20 |

| Vehicles | | 5 |

| Furniture fixtures and office equipment | | 5 |

Expenditures for repairs and maintenance, which do not extend the useful life of the assets, are expensed as incurred.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 3. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (…/Cont’d) |

Land use right is recorded at cost less accumulated amortization. Under FASB ASC Topic 350, “Intangible, Goodwill and Other", land use right classified as definite lived intangible assets and are amortized over its useful life. According to the laws of the PRC, the government owns all of the land in the PRC. Companies or individuals are authorized to possess and use the land only through land use rights granted by the PRC government. Land use right is amortized using the straight-line method over the lease term of 43 to 50 years.

| | (h) | Impairment of long-lived assets |

In accordance with FASB ASC Topic 360, Property Plant and Equipment, the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value. If long-lived assets are to be disposed, depreciation is discontinued, if applicable, and the assets are reclassified as held for sale at the lower of their carrying amounts or fair values less costs to sell.

Based on the Group’s assessment, no impairment was recognized as of December 31, 2010, 2009 and 2008.

| | (i) | Fair value measurements |

FASB ASC Topic 820, “Fair Value Measurement and Disclosures” defines fair value, the methods used to measure fair value and the expanded disclosures about fair value measurements. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between the buyer and the seller at the measurement date. In determining fair value, the valuation techniques consistent with the market approach, income approach and cost approach shall be used to measure fair value FASB ASC Topic 820 establishes a fair value hierarchy for inputs, which represent the assumptions used by the buyer and seller in pricing the asset or liability. These inputs are further defined as observable and unobservable inputs. Observable inputs are those that buyer and seller would use in pricing the asset or liability based on market data obtained from sources independent of the Company. Unobservable inputs reflect the Company’s assumptions about the inputs that the buyer and seller would use in pricing the asset or liability developed based on the best information available in the circumstances.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 3. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (…/Cont’d) |

| | (i) | Fair value measurements (…/Cont’d) |

The fair value hierarchy is categorized into three levels based on the inputs as follows:

| | Level 1 - | Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access. Valuation adjustments and block discounts are not being applied. Since valuations are based on quoted prices that are readily and regularly available in an active market, valuation of these securities does not entail a significant degree of judgment. |

| | Level 2 - | Valuations based on (i) quoted prices in active markets for similar assets and liabilities, (ii) quoted prices in markets that are not active for identical or similar assets, (iii) inputs other than quoted prices for the assets or liabilities, or (iv) inputs that are derived principally from or corroborated by market through correlation or other means. |

| | Level 3 - | Valuations based on inputs that are unobservable and significant to the overall fair value measurement. |

For certain of the Company’s financial instruments, none of which are held for trading purposes, including cash, accounts receivable, accounts payable and accrued expenses, the carrying amounts approximate fair value due to their short maturities.

The Group generates revenue primarily from sales of steel mill flat-rolled products.

Revenue is recognized when products have been delivered to the buyer and title and risk of ownership has passed to the buyer, the sales price is fixed and determinable and collectability is reasonably assured.

In the PRC, value added tax (“VAT”) of 17% on the invoice amount is collected in respect of the sales of goods on behalf of tax authorities. The VAT collected is not revenue of the Group; instead, the amount is recorded as a liability on the balance sheet until such VAT is paid.

The Group accounts for income taxes under FASB ASC Topic 740 "Income Taxes". Deferred income tax assets and liabilities are determined based upon differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be effective when the differences are expected to reverse.

Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statements of income in the period that includes the enactment date.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 3. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (…/Cont’d) |

| | (k) | Income taxes (…/Cont’d) |

The Group adopted FASB ASC Topic 740, "Income Taxes", which prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken in the tax return. This interpretation also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods and income tax disclosures.

| | (l) | Commitments and contingencies |

In the normal course of business, the Group is subject to contingencies, including legal proceedings and claims arising out of the normal course of businesses that relate to a wide range of matters, including among others, product liability. The Group records accruals for such contingencies based upon the assessment of the probability of occurrence and, where determinable, an estimate of the liability. Management may consider many factors in making these assessments including past history, scientific evidence and the specifics of each matter. As management has not become aware of any product liability claims arising from any incident over the year, the Group has not recognized a liability for product liability claims.

Basic earnings per share are computed on the basis of the weighted-average number of shares of our common stock outstanding during the period. Diluted earnings per share is computed on the basis of the weighted-average number of shares of our common stock plus the effect of dilutive potential common shares outstanding during the period using the treasury method. As of December 31, 2010, the Company had a total of 15,191,108 warrants outstanding which included 144,000 warrants granted to the underwriter which may be exercised on or after August 9, 2010 and until November 9, 2014, and 1,200,000 warrants to be exercised from one unit purchase option which were exercisable until March 19, 2011.

The following table sets forth the computation of basic and diluted net income per common share:

| | | For the Year ended | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | �� |

| Net income | | $ | 47,083,424 | | | $ | 43,448,278 | | | $ | 21,584,589 | |

| | | | | | | | | | | | | |

| Weighted average outstanding shares of common stock | | | 43,891,670 | | | | 33,751,844 | | | | 30,000,000 | |

| Dilutive effect of Warrants | | | 2,584,713 | | | | 3,659,717 | | | | - | |

| Dilutive effect of Unit Purchase Option granted to underwriters | | | 179,338 | | | | 263,918 | | | | - | |

| Diluted weighted average outstanding shares | | | 46,655,721 | | | | 37,675,479 | | | | 30,000,000 | |

| | | | | | | | | | | | | |

| Earnings per common stock: | | | | | | | | | | | | |

| Basic | | $ | 1.07 | | | $ | 1.29 | | | $ | 0.72 | |

| Diluted | | $ | 1.01 | | | $ | 1.15 | | | $ | 0.72 | |

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 3. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (…/Cont’d) |

FASB ASC Topic 280 "Segment reporting" establishes standards for reporting information on operating segments in interim and annual financial statements. The Group has only one segment, all of the Group's operations and customers are in the PRC and all income are derived from the sales of steel mill flat-rolled products. Accordingly, no geographic information is presented.

| | (o) | Economic and political risks |

The Group's operations are conducted in the PRC. Accordingly, the Group's business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC economy.

The Group's operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Group's results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances aboard, and rates and methods of taxation, among other things.

| | (p) | Recently issued accounting standards not yet adopted |

We describe below recent pronouncements that have had or may have a significant effect on our financial statements. We do not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to our financial condition, results of operations, or disclosures.

In March 2010, FASB issued authoritative guidance regarding the effect of denominating the exercise price of a share-based payment awards in the currency of the market in which the underlying equity securities trades and that currency is different from (1) entity’s functional currency, (2) functional currency of the foreign operation for which the employee provides services, and (3) payroll currency of the employee. The guidance clarifies that an employee share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades should be considered an equity award assuming all other criteria for equity classification are met. The guidance will be effective for interim and annual periods beginning on or after December 15, 2010, and will be applied prospectively. Affected entities will be required to record a cumulative catch-up adjustment for all awards outstanding as of the beginning of the annual period in which the guidance is adopted. This adoption of the authoritative guidance is not expected to have a material impact on the Group’s financial statements.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

Cash represents cash in bank and cash on hand. Cash as of December 31, 2010 and 2009 consists of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Bank balances and cash | | $ | 186,007,601 | | | $ | 117,105,538 | |

| Less: Restricted cash | | | (66,530,303 | ) | | | (37,498,169 | ) |

| | | $ | 119,477,298 | | | $ | 79,607,369 | |

Renminbi is not a freely convertible currency and the remittance of funds out of the PRC is subject to the exchange restrictions imposed by the PRC government.

As at December 31, 2010, and 2009 the Group's cash amounting to $66,530,303 and $37,498,169 respectively, were restricted and deposited in certain banks as guarantee deposits as security for notes payable granted by the banks.

The restricted cash guaranteed $86,227,272 and $41,013,622 of notes payable as of December 31, 2010 and 2009 respectively. It can only be released at the expiration date of corresponding notes payable.

The Group performs ongoing credit evaluations of its customers' financial conditions. The Group generally encourages its customers to use its products and settle the outstanding balance within credit terms. As of December 31, 2010 and 2009, the provision on accumulated allowance for doubtful accounts was $32,528 and $31,446 respectively.

Inventories as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Raw materials | | $ | 3,395,097 | | | $ | 2,152,547 | |

| Work-in-process | | | 1,404,362 | | | | 1,345,715 | |

| Finished goods | | | 2,202,818 | | | | 2,460,618 | |

| | | $ | 7,002,277 | | | $ | 5,958,880 | |

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 7. | PREPAID EXPENSES AND OTHER DEPOSITS |

Prepaid expenses and other deposits as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Prepaid purchases | | $ | 27,772,852 | | | $ | 16,411,723 | |

| Prepaid general expenses | | | 976,828 | | | | 61,987 | |

| | | $ | 28,749,680 | | | $ | 16,473,710 | |

Prepaid purchases represent amounts prepaid to suppliers for the purchases of raw materials and accessories.

Other receivables as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Advances to staff | | $ | 18,916 | | | $ | 265,402 | |

| Loan to customer | | | 106,060 | | | | 478,248 | |

| Standby guarantee fund | | | 213,876 | | | | 1,349,453 | |

| Warrant consideration receivable | | | 1,352,180 | | | | - | |

| Others | | | 377,050 | | | | 199,030 | |

| | | $ | 2,068,082 | | | $ | 2,292,133 | |

Other receivables represent advances to staff, cash retained by the Company’s warrant agent for warrants exercised and petty cash to department staff for daily expenditures. These amounts are interest free and with no fixed repayment terms.

Included in other receivables are $213,876 and $1,349,453 of funds in 2010 and 2009 held by unrelated third parties to provide a standby guarantee for Henan Green to obtain additional bank loans. There was no agreement signed with the third parties and no interest income was received.

As of December 31, 2010, other receivables include cash retained by the Company’s warrant agent in the amount of $1,352,180 for 270,436 warrants exercised.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 9. | PROPERTY, PLANT AND EQUIPMENT |

Property, plant and equipment as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Buildings | | $ | 7,902,125 | | | $ | 4,996,924 | |

| Leasehold land improvement | | | 20,864 | | | | 20,170 | |

| Plant machinery and equipment | | | 42,367,394 | | | | 23,518,194 | |

| Vehicles | | | 2,574,278 | | | | 2,306,841 | |

| Office equipment | | | 205,479 | | | | 148,652 | |

| Construction in progress | | | 49,199,036 | | | | 4,977,442 | |

| | | | 102,269,176 | | | | 35,968,223 | |

| Less: Accumulated depreciation | | | (16,779,327 | ) | | | (13,630,013 | ) |

| | | $ | 85,489,849 | | | $ | 22,338,210 | |

Depreciation expense for the years ended December 31, 2010, 2009 and 2008 was $3,149,314, $2,792,547 and $2,447,626 respectively.

Construction in progress consists of the construction of a plant and production lines on 300 acres of land. The total construction in progress as at December 31, 2010 and 2009 was $49,199,036 and $4,977,442 respectively.

| | | | | | Estimated cost | | |

| | | Balance at | | | to complete as of December 31, | | Estimated time |

| | | 2010 | | | 2010 | | to complete |

| | | | | | | | |

| Production lines | | $ | 40,857,868 | | | $ | 19,748,192 | | Before May, 2011 |

| Plant | | | 8,341,168 | | | | 143,680 | | Before May, 2011 |

| | | $ | 49,199,036 | | | $ | 19,891,872 | | |

No depreciation has been provided for construction in progress.

| 10. | PREPAID MACHINERY DEPOSITS |

Prepaid machinery deposits as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Prepaid machinery deposits | | $ | - | | | $ | 13,973,966 | |

Prepaid machinery deposit represents part of cost of machinery prepaid before delivery. The Group paid deposits for the acquisition of equipment and machinery which will be used for the expansion of production, which, according to the Company's capacity expansion planning, will double its existing production capacity of 250,000 metric tons to 500,000 metric tons by the end of 2011. As of December 31, 2010, the total prepaid machinery deposits amounted $19,240,885 were transferred to construction in progress.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

Land use right as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Land use right, net | | $ | 13,455,218 | | | $ | 1,399,026 | |

| Prepaid expenses on land use right | | | 2,143,939 | | | | - | |

| | | $ | 15,599,157 | | | $ | 1,399,026 | |

Land use right represents the value of land approved to the Company for industrial production purpose by the local government in Zhengzhou, People's Republic of China. The right will expire between June 30, 2053 to June 30, 2054 for the land with 58.6 acres (351.61 Chinese mu) and 50 acres (300 Chinese mu) respectively. Land use right payable for the 58.6 acres as of December 31, 2010 was $10,203,404.

Buildings of staff accommodation and the R & D center are located on the land with 50 acres (300 Chinese mu). Payment of the land use right for the 50 acres was fully settled in 2009.

The Company had obtained the approval to acquire the land use right of 58.6 acres (351.61 Chinese mu) in February 2010. Although there is no payment schedule to settle the outstanding amount of $10,203,404 until the Company receives notification from the local government, the Company expects to fully settle the outstanding amount within 12 months. Use of the land is planned for the Company's expansion capacity throughout 2011.

The Company’s related party, Zhengzhou No. 2 Iron and Steel Company Limited ("Zhengzhou Company") owns a land use right with total 24.94 acres (151.4 Chinese mu), the Company currently leases a part of the land use rights for 6.69 acres (40.60 Chinese mu) from Zhengzhou Company which was the former owner of Henan Green. The Company's existing production lines and warehouses are located on this parcel of land. For operation risk mitigation purpose, the Company has started the process of transferring the title of the land use right to the extent 24.94 acres (151.4 Chinese mu) from Zhengzhou Company. To facilitate Zhengzhou Company's negotiation with local regulatory authorities on the transfer and in anticipation of the upfront payments associated with the transaction, the Company prepaid as of December 31, 2010 $2,143,939 to Zhengzhou Company. Final transfer price is to be further determined based on market-based valuation of the land value and calculation of associated value-added tax.

Land use right is amortized using the straight-line method over the lease term of 43 to 50 years. The amortization expense for the years ended December 31, 2010, 2009 and 2008 were $259,438, $30,827 and $30,280 respectively. The total future amortization is as follows:

| December 31, | | | |

| 2011 | | $ | 305,046 | |

| 2012 | | | 305,046 | |

| 2013 | | | 305,046 | |

| 2014 | | | 305,046 | |

| 2015 | | | 305,046 | |

| Over 5 years | | | 11,929,988 | |

| | | $ | 13,455,218 | |

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

Notes payable as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Classified by financial institutions: | | | | | | |

| China Citic Bank | | $ | 19,696,970 | | | $ | 7,470,338 | |

| Commercial Bank of Zhengzhou | | | 3,030,303 | | | | 6,957,668 | |

| Minsheng Bank of China | | | 6,030,303 | | | | 6,152,043 | |

| Guangdong Development Bank | | | 12,121,212 | | | | 2,343,636 | |

| Shanghai Pudong Development Bank | | | 18,939,394 | | | | 13,402,666 | |

| Shanghai Pudong Development Bank | | | - | | | | 1,904,204 | |

| China Merchants Bank | | | 6,060,606 | | | | 2,783,067 | |

| China Everbright Bank | | | 13,636,364 | | | | - | |

| Bank of Luoyang | | | 5,166,666 | | | | - | |

| Bank of Xuchang | | | 1,545,454 | | | | - | |

| | | $ | 86,227,272 | | | $ | 41,013,622 | |

| Additional information: | | | | | | | | |

| Maximum balance outstanding during the year | | $ | 102,298,541 | | | $ | 48,879,449 | |

| Finance cost | | $ | 2,510,056 | | | $ | 941,644 | |

| Finance charge per contract | | | 0.050 | % | | | 0.050 | % |

| Weighted average interest rate | | | 1.43 | % | | | 2.41 | % |

All the above notes payable are secured by either 50% or 100% corresponding restricted cash. As at December 31, 2010 and 2009, the Group's cash of $66,530,303 and $37,498,169 respectively were restricted for such purpose. All the notes payable have terms of six months. Commercial Bank of Zhengzhou had imposed covenant on the Company’s subsidiary, Henan Green, that not more than 10% of the net profit could be distributed as dividend. Shanghai Pudong Development Bank imposed covenant on the Company’s subsidiary, Henan Green, that they should be notified for any transaction which is over 10% of Henan Green’s net assets. The Company was in compliance with the financial covenants at balance sheet date in the 2010.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

In order to provide working capital for operations, the Group entered into the following short term loan agreements as of December 31, 2010 and 2009:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Classified by financial institutions: | | | | | | |

| China Citic Bank | | $ | 1,515,152 | | | $ | 3,661,930 | |

| China Merchants Bank | | | 9,090,909 | | | | 4,394,317 | |

| Commercial Bank of Zhengzhou | | | 7,575,758 | | | | 7,323,861 | |

| Guangdong Development Bank | | | - | | | | 2,929,544 | |

| Minsheng Bank of China Branch | | | - | | | | 2,783,067 | |

| Shanghai Pudong Development Bank | | | 10,606,061 | | | | 5,859,089 | |

| Zhengzhou City Rural Credit Cooperative | | | 757,576 | | | | 1,171,818 | |

| Bank of Communications | | | 1,515,151 | | | | 1,464,772 | |

| Bank of Luoyang | | | 9,090,909 | | | | 4,394,317 | |

| Bank of Xuchang | | | 3,939,393 | | | | - | |

| | | $ | 44,090,909 | | | $ | 33,982,715 | |

| | | | | | | | | |

| Additional information: | | | | | | | | |

| Maximum balance outstanding during the period/year | | $ | 49,812,171 | | | $ | 37,791,123 | |

| Interest paid during the period/year | | $ | 2,434,768 | | | $ | 2,266,504 | |

| Range of interest rate | | | 0.425-0.84 | % | | | 0.531 - 0.965 | % |

| Weighted average interest rate | | | 3.02 | % | | | 3.46 | % |

All of the above terms loans are fixed term loans with a period of 12 months or less. Commercial Bank of Zhengzhou had imposed covenant on the Company’s subsidiary, Henan Green, that not more than 10% of the net profit could be distributed as dividend. Shanghai Pudong Development Bank imposed covenant on the Company’s subsidiary, Henan Green, that any transaction which is over 10% of Henan Green’s net assets they must be approved by the Bank. For those loan facilities obtained from banks, all these terms loans are either guaranteed and secured by Henan Green's fixed assets, including its machinery and land use right, or guaranteed and secured by a related party, Zhengzhou Company’s land and plant properties, or guaranteed by Henan Green’s former owners or other third parties.

| 14. | ACCRUED LIABILITIES AND OTHER PAYABLES |

Accrued liabilities and other payables as of December 31, 2010 and 2009 consist of the following:

| | | 2010 | | | 2009 | |

| | | | | | | |

| Accrued expenses | | $ | 2,963,644 | | | $ | 1,713,874 | |

| Other payables | | | 361,548 | | | | 499,046 | |

| Other tax payables | | | 856,155 | | | | 515,665 | |

| | | $ | 4,181,347 | | | $ | 2,728,585 | |

Other tax payables represent payables other than income tax which consist of value added tax and city maintenance and construction tax.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

The Company was established in the British Virgin Islands ("BVI") on March 11, 2008 as a limited liability company. Authorized common stock of the Company included 50,000 ordinary shares with a $1.00 par value. Prior to the stock split described below, the Company had 100 shares outstanding. During March 2009, the Company amended its memorandum of association by effecting a stock split resulting in the issuance of 29,999,999 shares and increasing the total authorized shares from 50,000 to 100,000,000. Accordingly, immediately after this amendment of its memorandum of association, the Company had 30,000,000 shares outstanding.

In connection with the merger of COAC, on March 17, 2009, the Company issued 2,245,723 ordinary shares.

In connection with the merger between the Company and COAC, the Company is the surviving entity, up to 17,866,667 ordinary shares of the Company were reserved for issuance upon exercise of the warrants to subscribe for ordinary shares of the Company at $5.00 per share. A unit purchase option to purchase 600,000 units, each at $6.60 consisting of one share of common stock and two warrants see the table included in this note. The unit purchase option was not exercised and expired on March 21, 2011.

During the year ended December 2009, 76,600 warrants were exercised, for which the Company received proceeds of $383,000.

During the year ended of December 31, 2010, 2,142,959 warrants were exercised, for which the Company received proceeds of $10,714,795.

The Company and Oasis Green Investments Limited, Plumpton Group Limited and Honest Joy Group Limited (collectively, the “Original Shareholders”) entered into an agreement dated September 15, 2009, pursuant to which, the Company agreed to issue to the Original Shareholders an aggregate of 2,850,000 ordinary shares within ten days of entering into the agreement. The 2,850,000 shares were to be divided among the Original Shareholders in the same proportion to the amounts of the ordinary shares that they would have received under the terms of the earn-out provision of the Merger Agreement. In consideration of the issuance of the ordinary shares, the Company and the Original Shareholders agreed to a mutual release of all claims relating to the merger, the redemptions, and the earn-out provision. The issuance of such shares was recorded as a dividend since the merger was deemed to be a recapitalization.

On November 9, 2009, the Company entered into an Underwriting Agreement (the “Underwriting Agreement”) with Maxim Group LLC (the “Underwriter Representative”) to sell in a public offering 4,800,000 ordinary shares of the Company at a price of $5.00 per share for aggregate proceeds of $24,000,000. The Company netted proceeds amounting to $21,085,944 after commissions, fees and other expenses amounting to $2,914,056.

In addition, the Company granted the underwriters an option to purchase up to 720,000 additional ordinary shares to cover over-allotments and the option was exercised in full during December 2009. The gross proceeds for the over allotment were $3,600,000 which yielded $3,312,000 additional proceeds to the Company after deducting the underwriter commissions, discounts and other fees amounting $288,000.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 15. | STOCKHOLDERS’ EQUITY (…/Cont’d) |

On June 4, 2010, the Company completed a private placement in which the Company sold to certain investors 3,303,771 ordinary shares at a price per share of $5.70, for an aggregate purchase price of $18,831,494, pursuant to a securities purchase agreement dated the same date. The foregoing issuance was made in reliance upon exemptions provided by Section 4(2) of the Securities Act for the offer and sale of securities not involving a public offering and Regulation D promulgated thereunder. The Company netted proceeds amounting to $17,967,818, offering fees and other fees amounted to $863,676.

The Board of Directors and the Compensation Committee of the Company adopted the China Gerui Advanced Materials Group Limited 2010 Share Incentive Plan (the "Plan") on November 16, 2010. The Plan became effective on the date of its adoption, subject to approval by the Company’s shareholders within 12 months. At the Company’s annual shareholders meeting hold on December 8, 2010, the Company’s shareholders approved the adoption of the 2010 Plan.

Up to 3,500,000 of the Company’s ordinary shares may be issued under the Plan (subject to adjustment as described in the Plan). The Plan permits the grant of Nonqualified Share Options and Restricted Share Awards to employees, directors, and consultants of the Company and its affiliates.

In connection with the adoption of the Plan, the Board of Directors and Compensation Committee also approved forms of Share Option Agreement for employees and directors (collectively, the “-Forms of Option Agreement-”) and form of Restricted Share Award Agreement (the “-Form of Share Award Agreement-”) that will be utilized by the Company to grant options and restricted shares under the Plan.

No Options were exercisable, and no Share Awards or ordinary shares were issuable under the Plan unless and until the Plan was approved by the shareholders of the Company. In the event that the shareholders of the Company had not approved the Plan within such 12 months period, the Plan and any previously granted Option would have terminated.

The Company also granted in connection with its November 2009 public offering the Underwriter Representative (and its designees) a warrant (the “Underwriter Representative Warrant”) for the purchase of an aggregate of 144,000 ordinary shares (the “Warrant Shares”) for an aggregate purchase price of $100.00. The Underwriter Representative Warrant may be exercised in full or part to purchase Warrant Shares at an initial exercise price of $6.00 per share. The Underwriter Representative Warrant is exercisable beginning on August 9, 2010 and until November 9, 2014.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

| 15. | STOCKHOLDERS’ EQUITY (…/Cont’d) |

A summary of all warrants outstanding as of December 31, 2010 and December 2009 and actions relating thereto during the years then ended is presented below:

| | | Warrants | | | Exercise Price | | | Terms | |

| | | | | | | | | | |

| Issued on March 17, 2009 | | | 17,266,667 | | | $ | 5.00 | | | 2 years | |

| Granted | | | 144,000 | | | | 6.00 | | | 4¼ years | |

| Exercised | | | (76,000 | ) | | | 5.00 | | | 2 years | |

| | | | | | | | | | | | |

| Outstanding as of December 31, 2009 | | | 17,334,067 | | | | | | | - | |

| Exercised | | | (2,142,959 | ) | | | 5.00 | | | - | |

| Outstanding as of December 31, 2010 | | | 15,191,108 | | | | | | | | |

2,218,559 warrants were exercised in 2010 and 2009 at $5.00 each for proceeds to the Company of $11.1 million. As at December 31, 2010, 144,000 warrants granted on November 9, 2009 were still outstanding and may be exercised at $6.00 each on or after August 9, 2010 and until November 9, 2014.

Retained earnings as of December 31, 2010 and December 31, 2009 consist of the following

| | | 2010 | | | 2009 | |

| | | | | | | |

| Retained earnings | | $ | 77,939,504 | | | $ | 30,856,080 | |

| Statutory surplus reserves | | | 1,582,902 | | | | 1,582,902 | |

| | | $ | 79,522,406 | | | $ | 32,438,982 | |

In accordance with PRC Company Law, the Group is required to allocate at least 10% profit to the statutory surplus reserve. Appropriation to the statutory surplus reserve by the Group is based on profit arrived under PRC accounting standards for business enterprises for each year.

The profit arrived at must be set off against any accumulated losses sustained by the Group in prior years, before allocation is made to the statutory surplus reserve. Appropriation to the statutory surplus reserve must be made before distribution of dividends to shareholders. The appropriation is required until the statutory surplus reserve reaches 50% of the stockholder's equity. This statutory surplus reserve is not distributable in the form of cash dividends.

As the statutory surplus reserve has reached 50% of the stockholder's equity in 2005, the Group ceased to allocate.

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

All of the Company's income is generated in the PRC.

| | | For the Year ended | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | |

| Current income tax expense | | $ | 15,937,143 | | | $ | 14,751,569 | | | $ | 11,869,735 | |

The Group's income tax provision in respect of operations in PRC is calculated at the applicable tax rates on the estimated assessable profits for the year based on existing legislation, interpretations and practices in respect thereof. The standard tax rate applicable to the Group changed from 33% to 25%, effective on January 1, 2008.

A reconciliation of the expected income tax expense to the actual income tax expense for the years ended December 31, 2010, 2009 and 2008 are as follows:

| | | For the Year ended | |

| | | 2010 | | | 2009 | | | 2008 | |