Washington, D.C. 20549

DAVID B. PERKINS

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

Financial Statements

As of September 30, 2010 and for the period from

April 1, 2010 (commencement of operations) to September 30, 2010

(Unaudited)

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

As of September 30, 2010 and for the period from

April 1, 2010 (commencement of operations) to September 30, 2010

(Unaudited)

Table of Contents

| Schedule of Investments | 1-2 |

| Statement of Assets, Liabilities and Members’ Capital | 3 |

| Statement of Operations | 4 |

| Statement of Changes in Members’ Capital | 5 |

| Statement of Cash Flows | 6 |

| Notes to Financial Statements | 7- 15 |

| Board of Managers | 16 |

| Fund Management | 17 |

| Other Information | 18 - 20 |

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

SCHEDULE OF INVESTMENTS

September 30, 2010

(Unaudited)

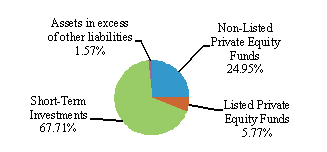

| Investments in Investment Funds (30.72%) | | Cost | | | Fair Value | |

| Investments in Non-Listed Private Equity Funds (24.95%) | |

| India (11.22%) | | | | | | |

India Business Excellence Fund I, Inc. a | | $ | 419,500 | | | $ | 604,474 | |

| United Kingdom (6.97%) | | | | | | | | |

Elysian Capital I, L.P. a | | | 370,991 | | | | 375,831 | |

| United States (6.76%) | | | | | | | | |

The Azalea Fund III L.P. a | | | 69,514 | | | | 364,373 | |

| Total Investments in Non-Listed Private Equity Funds | | | | 1,344,678 | |

| Investments in Listed Private Equity Funds (5.77%) | |

| Belgium (0.48%) | | | | | | | | |

| Gimv NV Ord | | | 25,237 | | | | 25,734 | |

| France (1.25%) | | | | | | | | |

| Eurazeo | | | 59,336 | | | | 67,114 | |

| Germany (1.26%) | | | | | | | | |

| Deutsche Beteiligung AG | | | 60,906 | | | | 68,139 | |

| Sweden (1.54%) | | | | | | | | |

| Ratos | | | 62,176 | | | | 82,893 | |

| United Kingdom (1.24%) | | | | | | | | |

| HgCapital Trust PLC | | | 61,462 | | | | 66,950 | |

| Total Investments in Listed Private Equity Funds | | | | 310,830 | |

| Total Investments in Investment Funds (Cost $1,129,122) | | | | 1,655,508 | |

| | | | | | | | | |

See notes to financial statements.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

SCHEDULE OF INVESTMENTS

September 30, 2010 (CONCLUDED)

(Unaudited)

| Short-Term Investments (67.71%) | | | | |

| | | | | | | |

Federated Prime Obligations Fund #10, 0.22% b | | $ | 3,649,469 | | | $ | 3,649,469 | |

| Total Short-Term Investments (Cost $3,649,469) | | | | 3,649,469 | |

| | | | | | |

| Total Investments (Cost $4,778,591) (98.43%) | | | | 5,304,977 | |

| | | | | | |

| Assets in excess of other liabilities (1.57%) | | | | 84,632 | |

| | | | | | |

| Members' Capital – 100.00% | | | $ | 5,389,609 | |

| | | | | | | | | |

a Investment Funds are issued in private placement transactions and as such are restricted as to resale. |

b The rate shown is the annualized 7-day yield as of September 30, 2010. |

| Total cost and fair value of restricted Investment Funds as of September 30, 2010 was $860,005 and $1,344,678, respectively. |

See notes to financial statements.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

STATEMENT OF ASSETS, LIABILITIES AND MEMBERS’ CAPITAL

September 30, 2010

(Unaudited)

| | | |

| Investments in Investment Funds , at fair value (cost $1,129,122) | | $ | 1,655,508 | |

| Short-term investments, at fair value (cost $3,649,469) | | | 3,649,469 | |

| Interest receivable | | | 650 | |

| Prepaid assets | | | 154,978 | |

| Total assets | | $ | 5,460,605 | |

| | | | | |

| Liabilities and members’ capital | | | | |

| Accounting and administration fees payable | | $ | 31,700 | |

| Professional fees payable | | | 17,000 | |

| Offering fees payable | | | 11,950 | |

| Servicing fees payable | | | 10,233 | |

| Custodian fees payable | | | 113 | |

| Total liabilities | | $ | 70,996 | |

| | | | | |

Members’ capital | | $ | 5,389,609 | |

| Total liabilities and members’ capital | | $ | 5,460,605 | |

| | | | | |

| Components of members’ capital: | | | | |

| Capital contributions | | $ | 5,144,383 | |

| Accumulated net investment loss | | | (281,160 | ) |

| Unrealized appreciation on investments and foreign currency | | | 526,386 | |

| Members’ capital | | $ | 5,389,609 | |

| | | | | |

| Net asset value per unit | | $ | 103.99 | |

| Number of authorized units | | Unlimited | |

| Number of outstanding units | | | 51,829.638 | |

See notes to financial statements.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

STATEMENT OF OPERATIONS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010

(Unaudited)

| | | |

| Interest | | $ | 3,423 | |

| Total investment income | | $ | 3,423 | |

| | | | | |

| Operating expenses | | | | |

| Organizational fees | | $ | 151,168 | |

| Accounting and administration fees | | | 47,550 | |

| Professional fees | | | 36,659 | |

| Managers’ fees | | | 25,000 | |

| Offering fees | | | 15,250 | |

| Servicing fees | | | 10,233 | |

| Insurance expense | | | 6,640 | |

| Custodian fees | | | 2,500 | |

| Other expenses | | | 5,000 | |

| Gross operating expenses | | $ | 300,000 | |

| Reimbursement of placement agent fees | | | (15,417 | ) |

| Net operating expenses | | $ | 284,583 | |

| Net investment loss | | $ | (281,160 | ) |

| | | | | |

| Unrealized appreciation on investments and foreign currency | | | | |

| Net unrealized appreciation on investments | | $ | 499,368 | |

| Net unrealized appreciation on foreign currency | | | 27,018 | |

| Unrealized appreciation on investments and foreign currency | | $ | 526,386 | |

| Net increase in members’ capital resulting from operations | | $ | 245,226 | |

See notes to financial statements.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

STATEMENT OF CHANGES IN MEMBERS’ CAPITAL

For the period from April 1, 2010 (commencement of operations) to September 30, 2010

(Unaudited)

| | | Members’ | |

| | | Capital | |

| Members’ capital, at April 1, 2010 | | $ | - | |

| Capital contributions | | | 5,144,383 | |

| Net investment loss | | | (281,160 | ) |

| Net unrealized appreciation on private equity investments | | | 499,368 | |

| Net unrealized appreciation on foreign currency | | | 27,018 | |

| Members’ capital, at September 30, 2010 | | $ | 5,389,609 | |

See notes to financial statements.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

STATEMENT OF CASH FLOWS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010

(Unaudited)

| Cash flows from operating activities: | | | |

| Net increase in members’ capital resulting from operations | | $ | 245,226 | |

Adjustments to reconcile net increase in members’ capital resulting from operations to net cash used in operating activities: | | | | |

| Purchases of Investment Funds | | | (1,129,122 | ) |

| Net unrealized appreciation on investments | | | (499,368 | ) |

| Net unrealized appreciation on foreign currency | | | (27,018 | ) |

| Increase in interest receivable | | | (650 | ) |

| Increase in prepaid assets | | | (154,978 | ) |

| Increase in accounting and administration fees payable | | | 31,700 | |

| Increase in professional fees payable | | | 17,000 | |

| Increase in offering fees payable | | | 11,950 | |

| Increase in servicing fees payable | | | 10,233 | |

| Increase in custodian fee payable | | | 113 | |

| Net cash used in operating activities | | $ | (1,494,914 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Capital contributions | | $ | 5,144,383 | |

| Net cash provided by financing activities | | $ | 5,144,383 | |

| Net change in cash and cash equivalents | | $ | 3,649,469 | |

| | | | | |

| Cash and cash equivalents at beginning of period | | | - | |

| Cash and cash equivalents at end of period | | $ | 3,649,469 | |

See notes to financial statements.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

Hatteras Global Private Equity Partners Institutional, LLC (the “Fund”) was organized as a limited liability company under the laws of the State of Delaware on November 7, 2008 and commenced operations on April 1, 2010. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. The Fund is managed by Hatteras Capital Investment Management, LLC (the “Adviser”), an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Capvent US Advisors, LLC (“Capvent”), an investment adviser registered with the SEC under the Advisers Act, serves as sub-adviser to the Fund (in such capacity, the “Sub-Adviser”). The Fund’s placement agent, an affiliate of the Adviser, is Hatteras Capital Distributors, LLC (the “Placement Agent”).

The Fund had an initial closing on April 1, 2010 (the “Initial Closing”). The Board of Managers (the “Board”) of the Fund has delegated to the officers of the Fund the responsibility to determine the dates of all subsequent closings of the Fund, including the final closing date (the “Final Closing”), provided that the final closing shall be no later than April 1, 2011. The Fund’s investment period (the “Investment Period”) is three years following the Final Closing of the Fund. The Fund will continue until the date that is ten years from the date of the Final Closing, unless terminated earlier pursuant to applicable terms of the Fund’s limited liability company agreement, as amended and restated (the “LLC Agreement”). The term may be extended for two one-year periods at the discretion of the Board.

The Board has overall responsibility for the management and supervision of the business operations of the Fund on behalf of the members of the Fund (“Members”), subject to the laws of the State of Delaware and the LLC Agreement, including authority to oversee and establish policies regarding the management, conduct and operation of the Fund’s business. The Fund’s investment objective is to seek attractive long-term capital appreciation by investing in a diversified portfolio of private equity investments. In particular, the Fund’s objective is to earn superior risk-adjusted returns by systematically overweighting the vehicles, segments and opportunities that the Adviser and Sub-Adviser believe offer the most attractive relative value at a given point in time.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

The Fund’s accounting and reporting policies conform to accounting principles generally accepted within the United States of America (“U.S. GAAP”).

Cash, if any, includes short-term interest bearing deposit accounts. At times, such deposits may be in excess of federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts.

| c. | Valuation of Portfolio Investments |

Investments held by the Fund include:

• Investments in Non-Listed Private Equity Funds—The Fund will value interests in non-listed private equity funds (“Non-Listed Funds”) at fair value, which ordinarily will be the value determined by their respective investment managers, in accordance with procedures established by the Board. Investments in Non-Listed Funds are subject to the terms of the Non-Listed Funds’ offering documents. Valuations of the Non-Listed Funds may be subject to estimates and are net of management and performance incentive fees or allocations payable to the Non-Listed Funds’ investment manager as required by the Non-Listed Funds’ offering documents. If the Adviser determines that the most recent value reported by any Non-Listed Fund does not represent fair value or if any Non-Listed Fund fails to report a value to the Fund, a fair value determination is made under procedures established by and under the general supervision of the Board. Because of the inherent uncertainty in valuation, the estimated values may differ from the values that would have been used had a ready market for the securities existed, and the differences could be material. The interests of some Non-Listed Funds may be valued less frequently than the calculation of the Fund’s net asset value. Therefore, the reported performance of the Non-Listed Fund may lag the reporting period of the Fund. The Adviser has established procedures for reviewing the effect on the Fund’s net asset value due to this lag in reported performance of the Non-Listed Funds.

• Investments in Listed Private Equity Funds—Listed Private Equity Funds includes listed private equity vehicles, such as business development companies (including derivatives tied to the return of such vehicles) (“Listed Funds”, and together with Non-Listed Funds, “Investment Funds”). Securities of Listed Funds traded on one or more of the U.S. national securities exchanges or the OTC Bulletin Board or on foreign securities exchanges will be valued at their last sales price. Securities of Listed Funds traded on NASDAQ will be valued

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

| c. | Valuation of Portfolio Investments (CONTINUED) |

at the NASDAQ Official Closing Price (“NOCP”), at the close of trading on the exchanges or markets where such securities are traded for the business day as of which such value is being determined.

The Fund classifies its assets and liabilities into three levels based on the lowest level of input that is significant to the fair value measurement. The three-tier hierarchy distinguishes between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on measurements for disclosure purposes.

Various inputs are used in determining the value of the Fund’s investments. The inputs are summarized in the three broad levels listed below:

Valuation of Investments

| | · | Level 1 – quoted prices (unadjusted) in active markets for identical assets and liabilities |

| | · | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | · | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Non-Listed Private Equity Investments | | $ | − | | | $ | − | | | $ | 1,344,678 | | | $ | 1,344,678 | |

| Listed Private Equity Investments | | | 310,830 | | | | − | | | | − | | | | 310,830 | |

| Short-Term Investments | | | 3,649,469 | | | | − | | | | − | | | | 3,649,469 | |

Total | | $ | 3,960,299 | | | $ | − | | | $ | 1,344,678 | | | $ | 5,304,977 | |

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

| c. | Valuation of Portfolio Investments (CONTINUED) |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

Investments | | Balance as of

April 1, 2010 | | | Net Realized Gain (Loss) | | | Change in Unrealized Appreciation/ Depreciation | | | Gross Purchases | | | Gross Sales | | | Balance as of

September 30, 2010 | |

| Non-Listed Private Equity | | $ | − | | | $ | − | | | $ | 484,673 | | | $ | 860,005 | | | $ | − | | | $ | 1,344,678 | |

| Total Investments | | $ | − | | | $ | − | | | $ | 484,673 | | | $ | 860,005 | | | $ | − | | | $ | 1,344,678 | |

Interest income is recorded when earned. Disbursements received from non-listed private equity investments are accounted for as a reduction of cost. Investments in listed private equity investments are recorded on trade date basis. Investments in non-listed private equity funds are recorded on a subscription effective date basis, which is generally the first day of the calendar month in which the investment is effective. Realized gains and losses are determined on a specific identified cost basis.

Fund expenses that are specifically attributed to the Fund are charged to the Fund and recorded on an accrual basis. Expenses of the Fund include, but are not limited to, the following: all costs and expenses related to portfolio transactions; legal fees; accounting, auditing, and tax preparation fees; custodial fees; fees for data and software providers; costs of insurance; registration expenses; managers’ fees; and expenses of meetings of the Board.

The Fund is treated as a partnership for federal income tax purposes and therefore is not subject to U.S. federal income tax. For income tax purposes, the individual members will be taxed upon their distributive share of each item of the Fund’s profit and loss.

The Fund has reviewed any potential tax positions and has determined that it does not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Beginning in the 37th month after the Final Closing, or earlier at the Board’s discretion, the Fund may make distributions to Members at least annually, or more frequently, at the Fund’s discretion, as permitted by applicable laws, rules and regulations. Amounts distributed will be intended to represent the net amounts of distributions (after Fund fees and expenses) received by the Fund from Investment Funds during the period since the last distribution (or from commencement of operations in the case of the first distribution). Any distributions to Members will be made pro rata.

The preparation of financial statements in conformity with U.S. GAAP requires the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in Member’s capital from operations during the reporting period. Actual results could differ from those estimates.

| 3. | MANAGEMENT FEES AND RELATED PARTY TRANSACTIONS |

The Adviser is responsible for the management and operation of the Fund and the investment of the Fund’s assets, subject to the ultimate supervision of and subject to any policies established by the Board, pursuant to the terms of an investment management agreement with the Fund (the "Investment Management Agreement"). Under the Investment Management Agreement, the Adviser is responsible for developing, implementing and supervising the Fund's investment program. The Sub-Adviser serves as sub-adviser to the Fund pursuant to the terms of a sub-advisory agreement among the Adviser, the Sub-Adviser and the Fund.

In consideration for such services, the Fund pays the Adviser a quarterly investment management fee, (“Investment Management Fees”) equal to 1.25% on an annualized basis of the net assets of the Fund as of each quarter-end. However, during the period from the Initial Closing to the Final Closing, the Fund pays the Investment Management Fee to the Adviser monthly at a rate equal to 1.25% on an annualized basis of the net assets of the Fund. The Investment Management Fee is paid to the Adviser out of the Fund’s assets, and will therefore decrease the net profits or increase the net losses of the Fund. The Adviser pays the Sub-Adviser a portion of the Investment Management Fee it receives from the Fund. Investors may be charged a placement fee of up to 3.00% for purchases on the Final Closing. Purchases on the Initial Closing were not subject to a placement fee and purchases made on all subsequent closings may be charged a placement fee that increases 0.25% per month after the Initial

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

| 3. | MANAGEMENT FEES AND RELATED PARTY TRANSACTIONS (CONTINUED) |

Closing. For example, investors that purchase units of limited liability company interests (“Units”) in the Fund at a closing in July 2010, three months after the Initial Closing, may have been charged a placement fee of 0.75%. The Placement Agent has entered into an expense reduction agreement pursuant to which it will rebate to the Fund, in order to offset operating expenses, any amount it receives as a placement fee.

For the period ended September 30, 2010, total fees paid by the Fund’s investors at the time of their initial investment to the Placement Agent were $15,417, of which $15,417 was rebated to the Fund by the Placement Agent. At September 30, 2010, no amounts were receivable from the Placement Agent.

The Fund will pay the Adviser or one of its affiliates, in its capacity as the servicing agent (the “Servicing Agent”), a quarterly servicing fee (“Fund Servicing Fee”), equal to 0.50% on an annualized basis of the net assets of the Fund. However, during the period from the Initial Closing to the Final Closing, the Fund will pay the Fund Servicing Fee to the Servicing Agent monthly. The Fund Servicing Fee will be paid to the Servicing Agent out of the Fund’s assets and will decrease the net profits or increase the net losses of the Fund.

Each member of the Board who is not an “interested person” of the Fund, as defined by Section 2(a)(19) of the 1940 Act (each an “Independent Manager”), receives an annual retainer of up to $10,000 from the Fund for his services on the Board and for his services as a member of the audit committee of the Fund. All Board members are reimbursed by the Fund for all reasonable out-of-pocket expenses incurred by them in performing their duties.

| 4. | ACCOUNTING, ADMINISTRATION, AND CUSTODIAL AGREEMENT |

In consideration for accounting, administrative, and recordkeeping services, the Fund pays J.D. Clark & Company, a division of UMB Fund Services, Inc. (the “Administrator”), a quarterly administration fee based on the month-end net asset value of the Fund. The Administrator also provides regulatory administrative services, transfer agency functions, and Member services at an additional cost. For the period ended September 30, 2010, the total accounting and administration fee was $47,550, and is included in the Statement of Operations under Accounting and Administrative Fees.

UMB Bank, n.a., an affiliate of the Administrator, serves as custodian of the Fund’s assets and provides custodial services for the Fund.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

| 5. | INVESTMENT TRANSACTIONS |

Total purchases of investments for the period ended September 30, 2010 amounted to $1,129,122. There were no sales of investments for the period ended September 30, 2010. The cost of investments for U.S. federal income tax purposes is adjusted for items of taxable income allocated to the Fund from the investments. The Fund relies upon actual and estimated tax information provided by the private equity funds in which it invests as to the amounts of taxable income allocated to the Fund as of December 31, 2010.

The Fund intends to invest substantially all of its available capital in private equity investments. The non-listed private equity investments will be restricted securities that are subject to substantial holding periods or are not traded in public markets at all, so that the Fund may not be able to resell some of its securities holdings for extended periods.

Due to the timing of tax information received from the private equity investments, tax basis reporting is not available as of the balance sheet date.

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund, and therefore cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

An investment in the Fund involves significant risks, including liquidity risk, non-diversification risk and economic conditions risk, that should be carefully considered prior to investing and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. For a more complete list of risk factors members should refer to their Confidential Placement Memorandum, as supplemented, and corresponding Statement of Additional Information, as supplemented. No guarantee or representations is made that the investment objective of the Fund will be met.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

Liquidity risk: Transfer of the Units is subject to significant restrictions. Because of these restrictions and the absence of a public market for the Units, a Member may be unable to liquidate his, her or its investment even though his, her or its personal financial circumstances would make liquidation advisable or desirable. The Units will not be

| 7. | RISK FACTORS (CONTINUED) |

readily acceptable as collateral for loans and the Units are not permitted to be pledged as collateral for loans. Moreover, even if a Member were able to dispose of his, her or its Units, adverse tax consequences could result.

Non-diversification risk: If there is an industry in which the Fund concentrates its investments, the Fund may be subject to greater investment risk as companies engaged in similar businesses are more likely to be similarly affected by any adverse market conditions and other adverse industry-specific factors.

The financial highlights are intended to help an investor understand the Fund’s financial performance for the past period. The total return in the table represents the rate that a typical Member would be expected to have earned or lost on an investment in the Fund.

The ratios and total return amount are calculated based on the Member group taken as a whole. An individual Member’s results may vary from those shown below due to the timing of capital transactions.

The ratios are calculated by dividing total dollars of net investment income or expenses, as applicable, by the average of total monthly Members’ capital. The ratios do not reflect the Fund’s proportionate share of income and expenses from the Fund’s private equity investments. The total return amount is calculated based on the change in the net asset value during each accounting period.

| Net Asset Value, April 1, 2010 | | $ | 100.00 | |

| Income from investment operations: | | | | |

| Net investment loss | | | (5.42 | ) |

| Net unrealized gain (loss) on investment transactions | | | 9.41 | |

| Total from investment operations | | | 3.99 | |

| Net Asset Value, September 30, 2010 | | $ | 103.99 | |

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

NOTES TO FINANCIAL STATEMENTS

For the period from April 1, 2010 (commencement of operations) to September 30, 2010 (CONTINUED)

(Unaudited)

| 8. | FINANCIAL HIGHLIGHTS (CONTINUED) |

| | | For the period from April 1, 2010 (commencement of operations) to September 30, 2010 | |

Total return (1) | | | 3.99 | % |

| Members’ capital, end of period (000’s) | | $ | 5,390 | |

Portfolio Turnover (1) | | | 0 | % |

| Net investment loss: | | | | |

Before reimbursement of placement agent fees (2) | | | (10.98 | )% |

After reimbursement of placement agent fees (2) | | | (10.19 | )% |

| Total operating expenses: | | | | |

Before reimbursement of placement agent fees (2) | | | 11.16 | % |

After reimbursement of placement agent fees (2) | | | 10.37 | % |

(1) Not annualized.

(2) Annualized except for offering fees and organizational expenses.

Management has evaluated subsequent events through the date the financial statements were issued, and determined there were no other subsequent events that required disclosure in or adjustment to the financial statements except for the following: effective October 1, 2010 and November 1, 2010, there were additional capital contributions of $197,000 and $314,400, respectively.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

BOARD OF MANAGERS

(Unaudited)

The identity of the Board members (each a “Manager”) and brief biographical information, as of September 30, 2010, is set forth below. The business address of each Manager is care of Hatteras Funds, 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615. The Fund’s Statement of Additional Information, as supplemented, includes additional information about the Managers and may be obtained without charge by calling Hatters at 1-866-388-6292.

Name & Date of Birth | | Position(s) Held with the Fund | | Length of Time Served | | Principal Occupation(s) During Past 5 years and Other Directorships Held by Manager | | Number of Portfolios in Fund Complex Overseen by Manager |

| INTERESTED MANAGER |

David B. Perkins* July 18, 1962 | | President and Chairman of the Board of Managers of the Fund | | Since Inception | | Mr. Perkins has been Chairman of the Board of Managers and President of the Fund since inception. Mr. Perkins is the Founder and Chairman of Hatteras and its affiliated entities. He founded the firm in September 2003. Prior to that, he was the co-founder and Managing Partner of CapFinancial Partners, LLC. | | 15 |

| INDEPENDENT MANAGERS |

H. Alexander Holmes May 4, 1942 | | Manager; Audit Committee Member of the Fund | | Since Inception | | Mr. Holmes founded Holmes Advisory Services, LLC, a financial consultation firm, in 1993. | | 15 |

Steve E. Moss February 18, 1953 | | Manager; Audit Committee Member of the Fund | | Since Inception | | Mr. Moss is a principal of Holden, Moss, Knott, Clark, Copley & Hoyle, P.A. and has been a member manager of HMKCT Properties, LLC since January 1996. | | 15 |

Gregory S. Sellers May 5, 1959 | | Manager; Audit Committee Member of the Fund | | Since Inception | | Mr. Sellers has been the Chief Financial Officer of Imagemark Business Services, Inc., a strategic communications provider of marketing and print communications solutions, since June 2009. From 2003 to June 2009, Mr. Sellers was the Chief Financial Officer and a director of Kings Plush, Inc., a fabric manufacturer. | | 15 |

Daniel K. Wilson June 22, 1948 | | Manager; Audit Committee Member of the Fund | | Since June 2009 | | Mr. Wilson was Executive Vice President and Chief Financial Officer of Parksdale Mills, Inc. from 2004 - 2008. Mr. Wilson currently is in private practice as a Certified Public Accountant. | | 9 |

*Mr. Perkins is deemed to be an “interested” Manager of the Fund because of his affiliations with the Adviser.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

FUND MANAGEMENT

(Unaudited)

Set forth below is the name, date of birth, position with the Fund, length of term of office, and the principal occupation for the last five years, as of September 30, 2010, of each of the persons currently serving as Executive Officer. The business address of each officer is care of Hatteras Funds, 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615.

Name & Date of Birth | | Position(s) Held with the Fund | | Length of Time Served | | Principal Occupation(s) During Past 5 years and Other Directorships Held by Officer | | Number of Portfolios in Fund Complex Overseen by Officer |

| OFFICERS |

J. Michael Fields July 14, 1973 | | Secretary of the Fund | | Since Inception | | Prior to becoming Secretary of each fund in the Hatteras Complex in 2008, Mr. Fields had been the Treasurer of each fund since inception. Mr. Fields is Chief Operating Officer of Hatteras and its affiliates and has been employed by the Hatteras firm since its inception in September 2003. | | N/A |

| Andrew P. Chica September 7, 1975 | | Chief Compliance Officer of the Fund | | Since Inception | | Mr. Chica joined Hatteras in November 2007 and became Chief Compliance Officer of each of the funds in the Fund Complex and the Adviser as of January 2008. Prior to joining Hatteras, Mr. Chica was the Compliance Manager for UMB Fund Services, Inc. from December 2004 to November 2007. From April 2000 to December 2004, Mr. Chica served as an Assistant Vice President and Compliance Officer with U.S. Bancorp Fund Services, LLC. | | N/A |

| Robert Lance Baker September 17, 1971 | | Treasurer of the Fund | | Since Inception | | Mr. Baker joined Hatteras in March 2008 and became Treasurer of the funds in the Hatteras Complex in December 2008. Mr. Baker serves as the Chief Financial Officer of the Adviser and its affiliates. Prior to joining Hatteras, Mr. Baker worked for Smith Breeden Associates, an investment advisor located in Durham, NC. At Smith Breeden, Mr. Baker served as Vice President of Portfolio Accounting, Performance Reporting, and Fund Administration. | | N/A |

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

OTHER INFORMATION

(Unaudited)

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and the Fund’s record of actual proxy votes cast is available at www.sec.gov and by calling 1-800-504-9070 and may be obtained at no additional charge.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available, without charge and upon request, on the SEC’s website at http://www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

OTHER INFORMATION

(CONTINUED)

(Unaudited)

Privacy Policy

Hatteras recognizes that its clients have an expectation that Hatteras and its affiliates will maintain the confidentiality of its clients' nonpublic personal information. Keeping your information confidential and secure is an important part of our responsibility to you and we take this responsibility very seriously. As such, we provide you with options about how your information may be shared within Hatteras and with others as required or permitted by law -- including those who may work with us to better serve your needs.

What Type of Personal Information Will Hatteras Collect or Receive?

Generally, Hatteras does not collect any non-public personal information about you, although certain non-public personal information about you may become available to Hatteras from various sources, including:

| | · | Information we may receive from you, such as your name, address and phone number, your social security number and your assets, income, other household information and any other information you may provide to Hatteras; |

| | · | Information about your transactions with Hatteras, our affiliates, or others, such as your account balances, transaction history, and claims you make; and |

| | · | Information from visitors to our website provided through online forms, site visitorship data, and online information collecting devices known as “cookies.” |

How Will Hatteras Use This Information?

Hatteras does not sell lists of client information, however we reserve the right to disclose the non-public personal information No personal information, regardless of the source, regarding any customer or consumer, may be disclosed except as follows:

| | · | Non-affiliated third parties that provide services necessary to effect, administer or enforce a transaction that you request or authorize. |

| | · | Credit bureaus or similar reporting agencies. |

| | · | Law enforcement officers and governmental agencies and courts as required by a subpoena, court order or law. |

| | · | Non-affiliated third parties with whom Hatteras has a contractual agreement to jointly offer, endorse, market or sponsor a financial product or service; and/or to service and maintain customer accounts including effectuating a transaction. |

| | · | Other non-affiliated financial institutions with which we have agreements. |

| | · | Others to the extent permitted or required by law. |

If you access Hatteras’ products or services through another financial intermediary, your intermediary’s policy will govern how it uses your personal information.

Your Right To Opt Out

You may direct Hatteras not to make disclosures to non-affiliated third parties, except as permitted or required by law. Those wishing to opt out of disclosures to non-affiliated third parties may call the following number: 1-866-388-6292.

Hatteras Global Private Equity Partners Institutional, LLC

(a Delaware Limited Liability Company)

OTHER INFORMATION

(concluded)

(Unaudited)

How We Keep Your Information Secure and Confidential

Hatteras restricts your personal and account information to those individuals who need to know that information to service your account. Hatteras also maintains physical, electronic and procedural safeguards to protect your information.

Disposal of Your Information Derived from a Consumer Report

In the unlikely event Hatteras obtains non-public consumer report information (as that term is defined in Regulation S-P) about you and Hatteras no longer needs such information, Hatteras will dispose of such information as follows: If such information is in paper form, Hatteras will shred any papers containing such information so that such information may not be practicably read or reconstructed. If such information is in electronic form, Hatteras will permanently erase such information from the electronic device holding such information such that it can no longer be practicably read or reconstructed.

Notifications

As required by federal law, we will notify you of our privacy policy annually. We reserve the right to modify this policy at any time, but rest assured that if we do change it, we will inform you promptly. If you have any questions, please feel free to call us at 1-866-388-6292 or visit our website at www.hatterasfunds.com.

Not applicable to semi-annual reports.

Not applicable to semi-annual reports.

Not applicable to semi-annual reports.

Not applicable to semi-annual reports.

Not applicable to semi-annual reports.

Not applicable to semi-annual reports.

Not applicable.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant's board of managers, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407 (c)(2)(iv) of Regulation S-K, or this Item.

(a) The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the 1940 Act (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the registrant's second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

By (Signature and Title)* /s/ David B. Perkins

David B. Perkins, President

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ David B. Perkins

David B. Perkins, President

By (Signature and Title)* /s/ R. Lance Baker

R. Lance Baker, Treasurer

* Print the name and title of each signing officer under his or her signature.