As filed with the Securities and Exchange Commission on April 8, 2009

File No. 333-155579

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pantheon Arizona Corp.

(Exact Name of Registrant as Specified in Its Charter)

Arizona

(State or Other Jurisdiction of Incorporation or Organization)

8000

(Primary Standard Industrial Classification Code Number)

Suite 10-64, #9 Jianguomenwai Avenue

Chaoyang District, Beijing, China

100600

01186-10-85322720

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant’s Principal Executive Offices)

Law Debenture Corporate Services Inc.

400 Madison Avenue, Ste. 4D

New York, New York 10017

212-750-6474

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

Jeffrey Maddox, Esq. Virginia M. Tam, Esq. Jones Day 29th Floor, Edinburgh Tower The Landmark 15 Queen’s Road Central Hong Kong S.A.R. (852) 3189-7318 Facsimile: (852) 2868-5871 | | Mitchell S. Nussbaum, Esq. Loeb & Loeb LLP 345 Park Avenue New York, New York 10154 (212) 407-4159 Facsimile: (212) 504-3013 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after (i) this Registration Statement becomes effective, (ii) all other conditions to the merger of Pantheon China Acquisition Corp., a Delaware corporation, into the Registrant, with the Registrant surviving and, following such merger, the conversion and continuation of the Registrant into China Cord Blood Corporation, a Cayman Islands exempted company, and (iii) all other conditions to the share exchange between China Cord Blood Corporation and the shareholders of China Cord Blood Services Corporation, a Cayman Islands exempted company, pursuant to the Agreement and Plan of Merger, Conversion and Share Exchange attached as Annex A to the Proxy Statement/Prospectus contained herein have been satisfied or, with respect to the share exchange only, waived.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, please check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | | Accelerated filer ¨ | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company x | |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this proxy statement/prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This proxy statement/prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS

SUBJECT TO COMPLETION, DATED APRIL 8, 2009

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

OF PANTHEON CHINA ACQUISITION CORP.

AND PROSPECTUS FOR ORDINARY SHARES, WARRANTS AND UNITS

OF PANTHEON CAYMAN ACQUISITION CORP.

Proxy Statement/Prospectus dated , 2009

and first mailed to stockholders and warrantholders on or about , 2009

Dear Stockholders and Warrantholders:

The stockholders of Pantheon China Acquisition Corp., or “Pantheon,” a Delaware corporation, are cordially invited to attend the special meeting of the stockholders relating to the acquisition agreement dated as of November 3, 2008, or the “Acquisition Agreement,” by and among Pantheon, Pantheon Arizona Corp., a corporation incorporated in the State of Arizona and a wholly-owned subsidiary of Pantheon, or “Pantheon Arizona,” China Cord Blood Services Corporation, an exempted company incorporated in the Cayman Islands, or “CCBS,” Golden Meditech Company Limited, an exempted company incorporated in the Cayman Islands, or “Golden Meditech,” and each shareholder of CCBS named in Schedule I thereto and indicated as a “selling shareholder” for the purposes of the Acquisition Agreement, which as of the date hereof hold 93.94% of the outstanding shares of CCBS and the other related proposals. We refer to the shareholders of CCBS listed on Schedule I of the Acquisition Agreement each as a selling shareholder and collectively the selling shareholders. The issuance of shares of Pantheon Cayman to the selling shareholders is being consummated on a private placement or offshore basis, pursuant to Section 4(2) of, or in accordance with Regulation S promulgated under, the Securities Act of 1933, as amended, as appropriate. The aggregate value of the consideration to be paid by Pantheon in the business combination is approximately $317.9 million (based on 54,345,104 shares to be issued to the selling shareholders at a market value of $5.85 per share, the closing price of Pantheon’s common stock as of March 13, 2009). The transactions contemplated under the Acquisition Agreement, including the corporate redomestication of Pantheon and the business combination with CCBS are referred to in this proxy statement/prospectus as the Acquisition.

Pantheon China Acquisition Corp. is a blank check company formed on April 10, 2006 for the purpose of acquiring, through a stock exchange, asset acquisition or other similar business combination, or control, through contractual arrangements, an operating business that has its principal operations located in the People’s Republic of China. Pantheon’s efforts in identifying a prospective target business were not limited to a particular industry.

On December 20, 2006, Pantheon consummated its initial public offering, or “IPO,” of 5,750,000 units, including 750,000 subject to an over-allotment option, with each unit consisting of one share of common stock and two warrants, each to purchase one share of common stock at an exercise price of $5.00 per share. The units were sold at an offering price of $6.00 per unit, generating total gross proceeds of $34,500,000. Simultaneously with the consummation of the IPO, Pantheon consummated the private sale of 2,083,334 warrants at a price of $0.60 per warrant, generating total proceeds of $1,250,000, to Christina Jun Mu and Kevin Kezhong Wu, each an officer and director of Pantheon, Francisco A. Garcia and Hunter S. Reisner, each a special advisor of Pantheon, Easton Capital Corp. Defined Benefit Plan, an entity of which John H. Friedman, one of Pantheon’s special advisors, is trustee, and Pantheon China Acquisition Limited, an entity owned by Mark D. Chen, the chief executive officer and president of Pantheon. After deducting the underwriting discounts and commissions and the offering expenses, the total net proceeds to Pantheon from the public offering and the private sale were approximately $33,153,914, of which $32,747,500 was deposited into a trust fund, or the “Trust Account,” and the remaining proceeds became available to be used to provide for business, legal and accounting due diligence on prospective business combinations and continuing general and administrative expenses. Included in the amount deposited into the Trust Account was $345,000 of underwriting discounts and commissions payable to the underwriters, the payment of which was deferred unless and until Pantheon completes a business combination. In addition, Pantheon is allowed and did withdraw $5.6 million to convert certain of its outstanding shares of common stock to cash and $300,000 from the Trust Account for working capital purposes. Through March 31, 2009, Pantheon has used approximately $1,050,000 of the total of the net proceeds that were not deposited into the Trust Account and amounts allowed to be withdrawn from the Trust Account to pay such conversion amounts and general and administrative expenses. As of March 31, 2009, there was $28,853,895 held in the Trust Account.

On December 10, 2008, Pantheon entered into a Put and Call Option Agreement with Modern Develop Limited (“Modern”), Mark D. Chen and YA Global Investments, L.P. (“YA Global”) and a separate Put and Call Option Agreement with Modern, Mark D. Chen, Victory Park Credit Opportunities Master Fund, Ltd (“VPCO”) and Victory Park Special Situations Master Fund, Ltd (“VPSS” and together with VPCO, “Victory Park”). Modern, YA Global and Victory Park are all independent third parties. YA Global and Victory Park acquired from several of Pantheon’s largest stockholders 4,547,399 shares of common stock of Pantheon in the aggregate through negotiated private transactions brokered by Rodman & Renshaw LLC, a financial intermediary. Under the Put and Call Option Agreements, YA Global and Victory Park agreed to grant their proxies to Pantheon’s representatives in voting for the Extension Amendment (defined below).

Pursuant to the Put and Call Option Agreements, Modern has the right to purchase an aggregate of 4,547,399 shares of common stock of Pantheon ( representing approximately 79.09% of the shares sold in the initial public offering) from YA Global and Victory Park at an exercise price of $5.97 per share. Modern’s call options have an initial term commencing on the date of the Put and Call Option Agreements and ending on June 30, 2009, and may be extended to September 30, 2009 or on the record date of a business combination if not exercised sooner. Modern paid an option fee of $2,501,070 in the aggregate for the initial term and in the event Modern elects to extend the call options it will be required to pay an additional extension option fee of $1,931,280 in the aggregate to YA Global and Victory Park, in each case pro rata to the number of shares held by the two investors.

Pursuant to the Put and Call Option Agreements, Pantheon has agreed to effect a liquidation in accordance with Delaware law in the event the business combination is abandoned prior to the exercise of the call options or if Modern elects not to extend the period of the call options.

On December 14, 2008, Pantheon, following approval by its stockholders, amended its certificate of incorporation (the “Extension Amendment”), to extend the time in which it must complete a business combination before it is required to be liquidated and grant conversion rights to holders of its public common stock in connection with such vote to approve the Extension Amendment. A total of 929,613 shares (or approximately 16.2% of the shares issued in the IPO) were converted in connection with the shareholder approval of the Extension Amendment.

The shares of Pantheon’s common stock, warrants and units are traded on the Over-The-Counter Bulletin Board, or the “OTCBB,” under the symbols “PCQC,” “PCQCW” and “PCQCU,” respectively. Each of Pantheon’s units consists of one share of common stock and two warrants, each to purchase an additional share of Pantheon’s common stock for consideration of $5.00 per share. Pantheon’s units commenced to trade on the OTCBB on December 15, 2006. Pantheon’s common stock and warrants commenced to trade separately on January 17, 2007. Following consummation of the business combination, Pantheon will be reorganized into a Cayman Islands exempted company, or “Pantheon Cayman.” It is contemplated that an application will be made for the Pantheon Cayman securities to become listed on the New York Stock Exchange, or the “NYSE” or elsewhere at an appropriate time. The listing application will be made only when Pantheon Cayman has satisfied the relevant listing requirements. Such listing will be unrelated to, and is not a condition for or requirement of, the business combination or the Acquisition Agreement.

As of September 30, 2008, CCBS had an authorized share capital of $10,000,000, consisting of 1,000,000,000 ordinary shares with a par value $0.01 per share, and the issued share capital consisted of 161,898,000 ordinary shares fully paid or credited as fully paid. Of the 161,898,000 ordinary shares currently issued and outstanding as of the date hereof, CCBS has (i) 24,200,000 redeemable ordinary shares, which will be redeemable at the request of the holders in the event a qualified initial public offering implying a total market capitalization, without giving effect to the receipt of offering proceeds, of no less than $240 million does not occur by November 21, 2008; and (ii) 16,698,000 redeemable ordinary shares, which will be redeemable at the request of the holders in the event a qualified initial public offering implying a total market capitalization, without giving effect to the receipt of offering proceeds, of no less than $400 million does not occur by January 14, 2009. The selling shareholders have entered into written resolutions, acknowledging that they have waived their redemption rights with respect to CCBS’s redeemable shares, through June 30, 2009. Because all of these holders are selling shareholders in the Acquisition Agreement, the redemption rights effectively will not be exercisable if the Acquisition is completed prior to June 30, 2009.

Pantheon currently has authorized share capital of 26,000,000 shares consisting of 25,000,000 shares of common stock with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share. Pantheon Arizona currently has authorized share capital identical to that of Pantheon. Prior to the meeting of stockholders to approve the redomestication, Pantheon intends to increase the share capital of Pantheon Arizona from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 shares of common stock with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share. The increase in Pantheon Arizona’s authorized share capital is necessary to allow for sufficient authorized shares to complete the business combination following the redomestiction and to provide Pantheon Cayman the flexibility to use its share capital in the future for financing and business combinations.

As of March 31, 2009, there was approximately $28,853,895 in the Trust Account, or approximately $5.98 per outstanding share issued in the initial public offering. If the holders of 20% or more of the shares of Pantheon’s common stock issued in the initial public offering vote against the Acquisition and exercise their conversion rights, Pantheon will not complete the Acquisition. The conversion of 929,613 shares (or approximately 16.2% of the shares issued in the initial public offering) in connection with the Extension Amendment has not changed the percentage of shares that can elect conversion in connection with the business combination. On , 2009, the record date for the special meeting of stockholders, the last sale price of Pantheon’s common stock was $ .

Each stockholder’s vote is very important. Whether or not you plan to attend the Pantheon special meeting in person, please submit your proxy card without delay. Stockholders may revoke proxies at any time before they are voted at the meeting. Voting by proxy will not prevent a stockholder from voting such stockholder’s shares in person if such stockholder subsequently chooses to attend the Pantheon special meeting. The proxy statement/prospectus constitutes a proxy statement of Pantheon and a prospectus of Pantheon Cayman for the securities of Pantheon Cayman that will be issued to the securityholders of Pantheon.

Holders of Pantheon common stock will not be entitled to any appraisal rights under Delaware corporate law or dissenter rights under Arizona corporate law in connection with the Acquisition.

Unless the context indicates otherwise, all references to “CCBS” in this proxy statement/prospectus refer to China Cord Blood Services Corporation and its consolidated subsidiaries, including China Stem Cells Holdings Limited, or “CSC,” Beijing Jiachenhong Biological Technologies Co., Limited, or “Jiachenhong,” (including Beijing Cord Blood Bank it operates) and Guangzhou Municipality Tianhe Nuoya Bio-engineering Co. Ltd., or “Nuoya,” (including Guangdong Cord Blood Bank it operates). Unless the context indicates otherwise, all references to “China” refer to the People’s Republic of China. All references to “provincial-level regions” or “regions” include provinces as well as autonomous regions and directly controlled municipalities in China, which have an administrative status equal to provinces, including Beijing. Penetration rates referenced in this proxy statement/prospectus represent a measurement of the demand for cord blood banking services calculated by dividing the number of subscribers for cord blood banking services over the total number of newborns in a particular region over a given period.

All references to “Renminbi,” “RMB” or “yuan” are to the legal currency of the People’s Republic of China and all references to “U.S. dollars,” “dollars,” “$” are to the legal currency of the United States. This proxy statement/prospectus contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from Renminbi to U.S. dollars were made at the noon buying rate in The City of New York for cable transfers in Renminbi per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York, or the noon buying rate, as of September 30, 2008, which was RMB6.7899 to $1.00. We make no representation that the Renminbi or U.S. dollar amounts referred to in this proxy statement/prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On March 13, 2009, the cash buying rate announced by the People’s Bank of China was RMB6.843 to $1.00.

We encourage you to read this proxy statement/prospectus carefully. In particular, you should review the matters discussed under the caption “RISK FACTORS” beginning on page 15.

Pantheon’s board of directors unanimously recommends that Pantheon stockholders vote “FOR” approval of each of the proposals.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Acquisition or otherwise, or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

| /s/ Mark D. Chen |

Mark D. Chen Chairman of the Board of Directors of Pantheon China Acquisition Corp. |

, 2009

HOW TO OBTAIN ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates important business and financial information about Pantheon that is not included or delivered herewith. If you would like to receive additional information or if you want additional copies of this document, agreements contained in the appendices or any other documents filed by Pantheon with the Securities and Exchange Commission, such information is available without charge upon written or oral request. Please contact the following:

Pantheon China Acquisition Corp.

Suite 10-64 #9 Jianguomenwai Avenue

Chaoyang District, Beijing, China

100600

Tel: 86-10-85322720

If you would like to request documents, please do so no later than , 2009 to receive them before Pantheon’s special meeting. Please be sure to include your complete name and address in your request. Please see “Where You Can Find Additional Information” to find out where you can find more information about Pantheon and CCBS. You should rely only on the information contained in this proxy statement/prospectus in deciding how to vote on the Acquisition. Neither Pantheon nor CCBS has authorized anyone to give any information or to make any representations other than those contained in this proxy statement/prospectus. Do not rely upon any information or representations made outside of this proxy statement/prospectus. The information contained in this proxy statement/prospectus may change after the date of this proxy statement/prospectus. Do not assume after the date of this proxy statement/prospectus that the information contained in this proxy statement/prospectus is still correct.

Pantheon China Acquisition Corp.

Suite 10-64, #9 Jianguomenwai Avenue

Chaoyang District, Beijing, China

100600

Notice of Special Meeting of Pantheon China Acquisition Corp. Stockholders

To Be Held on , 2009

To Pantheon Stockholders:

A special meeting of stockholders of Pantheon China Acquisition Corp., a Delaware corporation, or Pantheon, will be held at New York, New York, on , 2009, at a.m., for the following purposes:

1. The corporate reorganization of Pantheon, to be accomplished through a merger and conversion and continuation as described in the Acquisition Agreement, that would result in holders of Pantheon securities holding securities in a Cayman Islands exempted company rather than a Delaware corporation. The reorganization involves two steps. First, Pantheon, the current Delaware corporation, will effect a short-form merger, or the “merger”, pursuant to which it will merge with and into Pantheon Arizona, its wholly-owned Arizona subsidiary, with Pantheon Arizona surviving the merger. Second, after the merger, Pantheon Arizona will become a Cayman Islands exempted company, Pantheon Cayman Acquisition Corp., or “Pantheon Cayman,” pursuant to a conversion and continuation procedure, or the “conversion,” under Arizona and Cayman Islands law, following which and upon the consummation of the business combination (or defined below) Pantheon Cayman will change its name to China Cord Blood Corporation. The reorganization will change Pantheon’s place of incorporation from Delaware to the Cayman Islands. We refer to the merger and the conversion transactions as the redomestication. This proposal is called the Redomestication Proposal and consists of the merger of Pantheon into Pantheon Arizona, the authorization for the Pantheon Arizona board of directors to complete the conversion and the authorization of the Pantheon Arizona board of directors and shareholders to complete the continuation of Pantheon Arizona to the Cayman Islands as the entity Pantheon Cayman. Holders of Pantheon’s common stock as of the record date are entitled to vote on the Redomestication Proposal.

2. The authorization for the Pantheon Cayman board of directors to complete the share exchange included in the Acquisition Agreement, or the “share exchange”, which will only take place if the Redomestication Proposal is approved. We refer to the share exchange transaction as the business combination. This proposal is called the Business Combination Proposal. Holders of Pantheon’s common stock sold in the IPO as of the record date are entitled to vote on the Business Combination Proposal.

3. The adoption of the China Cord Blood Corporation 2008 Share Option Scheme, or the “Incentive Plan,” which provides for the grant of the right to purchase up to 9,062,324 ordinary shares of Pantheon Cayman, representing up to 10.3% of Pantheon Cayman’s share capital on a fully-diluted basis upon the completion of the business combination, to directors, officers, employees and/or consultants of Pantheon Cayman and its subsidiaries. In addition, in voting to approve the adoption of the Incentive Plan, a stockholder will be voting to refresh the limit of shares available for grant under the Incentive Plan, meaning that existing options held by CCBS employees will not be counted against the 9,062,324 options available for grants mentioned above. This proposal is called the Incentive Plan Proposal.

4. The adjournment of the special meeting in the event Pantheon does not receive the requisite stockholder vote to approve the business combination. This proposal is called the Adjournment Proposal.

As of March 31, 2009, there were 6,070,387 shares of Pantheon common stock with a par value of $0.0001 issued and outstanding and entitled to vote. Only Pantheon stockholders who hold shares of record as of the close of business on , 2009 are entitled to vote at the special meeting or any adjournment of the special meeting. Approval of the business combination will require the affirmative vote of the holders of a majority of the shares of Pantheon common stock issued in the IPO present and entitled to vote at the special meeting; provided, however, that if 20% or more of the shares purchased in the IPO vote against approval of the business combination and demand conversion then the Acquisition will not be completed. The conversion of 929,613 shares (or approximately 16.2% of the shares issued in the IPO) in connection with the Extension Amendment has not changed the percentage of shares that can convert in connection with the business combination. Abstentions and broker non-votes will have the same effect as a vote against the approval of the business combination, except that you will not be able to convert your shares into a pro rata portion of the Trust Account.

Pantheon currently has authorized share capital of 26,000,000 shares consisting of 25,000,000 shares of common stock with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share. Pantheon Arizona currently has authorized share capital identical to that of Pantheon. Prior to the meeting of stockholders to approve the redomestication, Pantheon intends to increase the share capital of Pantheon Arizona from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 shares of common stock with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share. The increase in Pantheon Arizona’s authorized share capital is necessary to allow for sufficient authorized shares to complete the business combination following the redomestiction and to provide Pantheon Cayman the flexibility to use its share capital in the future for financing and business combinations.

The transactions contemplated under the Acquisition Agreement, including the reorganization and the business combination, are referred to in this proxy statement/prospectus as the Acquisition. Holders of Pantheon’s common stock will not be entitled to any appraisal rights under the Delaware corporate law or dissenters rights under Arizona corporate law in connection with the Acquisition.

Whether or not you plan to attend the special meeting in person, please submit your proxy card without delay. Voting by proxy will not prevent you from voting your shares in person if you subsequently choose to attend the special meeting. If you fail to return your proxy card, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the special meeting. You may revoke a proxy at any time before it is voted at the special meeting by executing and returning a proxy card dated later than the previous one, by attending the special meeting in person and casting your vote by ballot or by submitting a written revocation to Pantheon at Suite 10-64, #9 Jianguomenwai Avenue, Chaoyang District, Beijing, China, 100600, that is received by us before we take the vote at the special meeting. If you hold your shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

Pantheon’s board of directors unanimously recommends that Pantheon stockholders vote “FOR” approval of each of the proposals.

| By order of the Board of Directors, |

| |

| /s/ Mark D. Chen |

Mark D. Chen Chairman of the Board of Directors of Pantheon China Acquisition Corp. |

, 2009

| | Page |

| | |

| QUESTIONS AND ANSWERS ABOUT THE PANTHEON SPECIAL MEETING | i |

| SUMMARY | 1 |

| CCBS SUMMARY FINANCIAL INFORMATION | 9 |

| SELECTED UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION | 11 |

| COMPARATIVE PER SHARE INFORMATION | 13 |

| MARKET PRICE INFORMATION | 14 |

| RISK FACTORS | 15 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 42 |

| DIVIDEND POLICY | 43 |

| SPECIAL MEETING OF PANTHEON STOCKHOLDERS | 44 |

| THE BUSINESS COMBINATION PROPOSAL | 50 |

| THE ACQUISITION AGREEMENT | 60 |

| THE REDOMESTICATION PROPOSAL | 65 |

| THE INCENTIVE PLAN PROPOSAL | 78 |

| THE ADJOURNMENT PROPOSAL | 81 |

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA OF CCBS | 82 |

| UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS | 84 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF CCBS | 91 |

| THE CORD BLOOD BANKING INDUSTRY | 122 |

| CCBS BUSINESS | 126 |

| PANTHEON SELECTED FINANCIAL INFORMATION | 139 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF PANTHEON | 140 |

| PANTHEON BUSINESS | 142 |

| DIRECTORS, EXECUTIVE OFFICERS, EXECUTIVE COMPENSATION AND CORPORATE GOVERNANCE | 143 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 151 |

| CERTAIN TRANSACTIONS | 153 |

| DESCRIPTION OF PANTHEON’S SECURITIES | 156 |

| COMPARISON OF PANTHEON AND PANTHEON CAYMAN STOCKHOLDER RIGHTS | 159 |

| COMPARISON OF CAYMAN ISLANDS CORPORATE LAW TO DELAWARE CORPORATE LAW | 164 |

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 169 |

| EXPERTS | 178 |

| LEGAL MATTERS | 178 |

| STOCKHOLDER PROPOSALS AND OTHER MATTERS | 178 |

| ENFORCEABILITY OF CIVIL LIABILITIES | 178 |

| INDUSTRY AND MARKET DATA | 178 |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 178 |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

Appendix A - Agreement and Plan of Merger, Conversion and Share Exchange by and among Pantheon China Acquisition Corp., Pantheon Arizona Corp., China Cord Blood Services Corporation, Golden Meditech Company Limited, and the Selling Shareholders named in Schedule I thereto | A-1 |

| Appendix B - China Cord Blood Corporation 2008 Share Option Scheme | B-1 |

| Appendix C - | Form of Pantheon Cayman Memorandum and Articles of Association |

| Appendix D - | Form of Pantheon Arizona Articles of Incorporation |

| Appendix E - | Form of Pantheon Arizona Bylaws |

QUESTIONS AND ANSWERS ABOUT THE PANTHEON SPECIAL MEETING

| Q: | What is the purpose of this document? |

| A: | This document serves as Pantheon’s proxy statement and as the prospectus of Pantheon Cayman. As a proxy statement, this document is being provided to Pantheon stockholders because the Pantheon board of directors is soliciting their proxies to vote to approve, at a special meeting of stockholders, the Acquisition. |

| Q: | What is being voted on? |

| A: | You are being asked to vote on four proposals: |

| | · | The redomestication of Pantheon to the Cayman Islands by means of the merger and the conversion, resulting in it becoming Pantheon Cayman. This proposal is called the Redomestication Proposal. |

| | · | The proposed share exchange resulting in CCBS becoming a subsidiary of Pantheon Cayman. This proposal is called the Business Combination Proposal. |

| | · | The approval of the Incentive Plan. This proposal is called the Incentive Plan Proposal. |

| | · | The approval of any adjournment of the special meeting for the purpose of soliciting additional proxies. This proposal is called the Adjournment Proposal. |

| Q: | Why is Pantheon proposing the redomestication? |

| A: | Pantheon is proposing redomesticating the company under the laws of the Cayman Islands because it has concluded doing so will permit greater flexibility and possibly improved economics in structuring acquisitions as Pantheon expands. Pantheon believes that potential target shareholders would view being a shareholder in a publicly-traded Cayman Islands exempted company more favorably than being a shareholder in a U.S. corporation. See “The Redomestication Proposal” below. |

| Q: | When and where is the special meeting of Pantheon stockholders? |

| A: | The special meeting of Pantheon stockholders will take place at , New York, New York on , 2009, at a.m. |

| Q: | Who may vote at the special meeting? |

| A: | Only holders of record of shares of Pantheon common stock as of the close of business on , 2009 may vote at the special meeting. As of March 31, 2009, there were 6,070,387 shares of Pantheon common stock with a par value of $0.0001 outstanding and entitled to vote. |

| Q: | What is the quorum requirement for the special meeting? |

| A: | Stockholders representing a majority of the Pantheon common stock issued and outstanding as of the record date and entitled to vote at the special meeting must be present in person or represented by proxy in order to hold the special meeting and conduct business. This is called a quorum. Shares of Pantheon common stock will be counted for purposes of determining if there is a quorum if the stockholder (i) is present and entitled to vote at the meeting, or (ii) has properly submitted a proxy card. In the absence of a quorum, stockholders representing a majority of the votes present in person or represented by proxy at such meeting, may adjourn the meeting until a quorum is present. |

| Q: | What vote is required to approve the business combination? |

| A: | Approval of the business combination will require the affirmative vote of the holders of a majority of the shares of Pantheon common stock issued in the IPO present and entitled to vote at the special meeting; provided, however, that if 20% or more of the shares purchased in the IPO vote against approval of the business combination and demand conversion then the Acquisition will not be completed. The conversion of 929,613 shares (or approximately 16.2% of the shares issued in the IPO) in connection with the Extension Amendment has not changed the percentage of shares that can convert in connection with the business combination. Abstentions and broker non-votes will have the same effect as a vote against the approval of the business combination, except that you will not be able to convert your shares into a pro rata portion of the Trust Account. |

| Q: | Do I have conversion rights in connection with the Acquisition? |

| A: | Yes. In order to exercise conversion rights, a stockholder must vote against the Business Combination Proposal and elect to exercise conversion rights on the enclosed proxy card. If a stockholder votes against the Business Combination Proposal but fails to properly exercise conversion rights, such stockholder will not be entitled to have its shares converted to cash. Any request for conversion, once made, may be withdrawn at any time up to the date of the special meeting. The actual per share conversion price will be equal to the amount in the Trust Account (which includes $345,000 in deferred underwriting discounts and commissions) as of two business days prior to the consummation of the proposed business combination, inclusive of any interest, divided by the number of outstanding shares sold in the IPO. For illustrative purposes, based on funds in the Trust Account on March 31, 2009, the estimated per share conversion price would have been $5.98. Please see “Special Meeting of Pantheon Stockholders—Conversion Rights” for the procedures to be followed if you wish to convert your shares into cash. |

| Q: | Has the board of directors of Pantheon recommended approval of the Business Combination Proposal and the other proposals? |

| A: | Yes. Pantheon’s board of directors has unanimously recommended to its stockholders that they vote “FOR” the approval of the Business Combination Proposal, Redomestication Proposal, Incentive Plan Proposal and the other proposals at the special meeting. After careful deliberation of the terms and conditions of these proposals, Pantheon’s board of directors has unanimously determined that the Acquisition and related proposals are fair to, and in the best interests of, Pantheon and its stockholders. Pantheon’s directors have interests in the Acquisition that may be different from, or in addition to, your interests as a stockholder of Pantheon. For a description of such interests, please see “The Business Combination Proposal—Interests of Certain Persons in the Acquisition.” |

| A: | Please vote your shares of Pantheon common stock as soon as possible after carefully reading and considering the information contained in this proxy statement/prospectus. You may vote your shares prior to the special meeting by signing and returning the enclosed proxy card. If you hold your shares in “street name” (which means that you hold your shares through a bank, brokerage firm or nominee), you must vote in accordance with the instructions on the voting instruction card that your bank, brokerage firm or nominee provides to you. |

| Q: | If my shares are held in “street name” by my bank, brokerage firm or nominee, will they automatically vote my shares for me? |

| A: | No. Your bank, brokerage firm or nominee cannot vote your shares without instructions from you. You should instruct your bank, brokerage firm or nominee how to vote your shares, following the instructions contained in the voting instruction card that your bank, brokerage firm or nominee provides to you. |

| Q: | What if I abstain from voting or fail to instruct my bank, brokerage firm or nominee? |

| A: | Abstaining from voting or failing to instruct your bank, brokerage firm or nominee to vote your shares will have no effect on the outcome of the Business Combination Proposal but will be counted for purposes of determining if a quorum is present and will have the same effect as a vote “against” the other proposals. |

| Q: | Can I change my vote after I have mailed my proxy card? |

| A: | Yes. You may change your vote at any time before your proxy is voted at the special meeting. You may revoke your proxy by executing and returning a proxy card dated later than the previous one, or by attending the special meeting in person and casting your vote by ballot or by submitting a written revocation stating that you would like to revoke your proxy that we receive prior to the special meeting. If you hold your shares through a bank, brokerage firm or nominee, you should follow the instructions of your bank, brokerage firm or nominee regarding the revocation of proxies. You should send any notice of revocation or your completed new proxy card, as the case may be, to: |

Pantheon China Acquisition Corp.

Suite 10-64, #9 Jianguomenwai Avenue

Chaoyang District, Beijing, China

100600

Tel: 86-10-85322720

| Q: | Should I send in my stock certificates now? |

| A: | Yes. Pantheon shareholders who intend to have their shares converted, by electing to have those shares converted to cash on the proxy card at the same time they vote against the Business Combination Proposal, should send their certificates prior to the special meeting. Please see “Special Meeting of Pantheon Stockholders—Conversion Rights” for the procedures to be followed if you wish to convert your shares into cash. |

| Q: | When is the Acquisition expected to occur? |

| A: | Assuming the requisite stockholder approval is received, Pantheon expects that the Acquisition will occur during the second quarter of 2009. |

| Q: | May I seek statutory appraisal rights or dissenter rights with respect to my shares? |

| A: | Under applicable Delaware and Arizona corporate law, you do not have appraisal rights or dissenter rights with respect to your shares. |

| Q: | What happens if the Acquisition is not consummated? |

| A: | If Pantheon does not consummate the Acquisition by September 30, 2009 then pursuant to Article 6 of its amended and restated certificate of incorporation, Pantheon’s officers must take all actions necessary in accordance with the Delaware General Corporation Law to dissolve and liquidate Pantheon as soon as reasonably practicable. Pursuant to the Put and Call Option Agreements entered into by Pantheon, Mark D. Chen, Modern Develop Limited, an independent third party, and certain institutional investors relating to shares of its common stock that have been purchased through negotiated private transactions, Pantheon has agreed to effect a liquidation in accordance with Delaware law in the event the business combination is abandoned prior to exercise of either the put or call option or if Modern elects not to extend the period of the call options. Following dissolution, Pantheon will no longer exist as a corporation. In any liquidation, the funds held in the Trust Account, plus any interest earned thereon (net of taxes), together with any remaining out-of-trust net assets will be distributed pro-rata to holders of shares of Pantheon common stock who acquired such shares of common stock in Pantheon’s initial public offering or in the aftermarket. If the Acquisition is not effected by September 30, 2009, the warrants will expire worthless. The estimated consideration that each share of Pantheon common stock would be paid at liquidation would be $5.98 per share, based on amounts on deposit in the Trust Account as of March 31, 2009. The closing price of Pantheon’s common stock on the OTCBB on March 13, 2009 was $5.85 per share. Holders of shares issued prior to Pantheon’s initial public offering have waived any right to any liquidation distribution with respect to such shares. |

| Q: | What happens to the funds deposited in the Trust Account following the Acquisition? |

| A: | Following the closing of the Acquisition, funds in the Trust Account will be released to Pantheon. Pantheon stockholders exercising conversion rights will receive their per share conversion price. The balance of the funds will be utilized to fund the Acquisition. |

| Q: | Who will manage Pantheon Cayman after the Acquisition? |

| A: | Effective the closing date, the board of directors of Pantheon Cayman will consist of five members. The members will include Ting Zheng and Albert Chen of CCBS, Mark Chen and Jennifer Weng of Pantheon, and Dr. Ken Lu, a nominee of CCBS, of whom Mr. Mark Chen, Ms. Jennifer Weng and Dr. Ken Lu are independent non-executive directors. Simultaneously therewith, all other current directors of Pantheon will resign as directors of the Pantheon Cayman Board. |

| Q: | What is the anticipated dividend policy after the Acquisition? |

| A: | Pantheon Cayman intends to retain cash flows for reinvestment in its business. Retained cash flows may be used to fund the growth of CCBS’s current business, application for new cord blood banking licenses, acquisition of other licensed cord blood bank operators in China and for other purposes, as determined by Pantheon Cayman’s management and board of directors. Pantheon Cayman’s dividend policy reflects its judgment that by reinvesting cash flows in its business, it will be able to provide value to its shareholders by enhancing its long-term dividend paying capacity. Pantheon Cayman’s objectives are to increase distributable cash flows per share through the growth of CCBS’s current business, application for new cord blood banking licenses and acquisition of existing licensed cord blood bank operators in China. The declaration and payment of dividends are not guaranteed or assured. The board of directors will continually review its dividend policy and make adjustments that it believes appropriate. |

| Q: | Which accounting standard will Pantheon Cayman prepare its financial statements in accordance with after the Acquisition? |

| A: | Pantheon Cayman intends to continue providing its investors with financial statements prepared in accordance with generally accepted accounting principles in the United States and the relevant securities laws. |

| Q: | Will the Pantheon stockholders be taxed as a result of the merger, conversion or the share exchange? |

| A: | Generally, for U.S. federal income tax purposes, stockholders of Pantheon should not recognize any gain or loss as a result of the merger, conversion or share exchange. We urge you to consult your own tax advisors with regard to your particular tax consequences of the merger, conversion or share exchange. |

| Q: | Will Pantheon be taxed on the merger? |

| A: | Pantheon should not recognize any gain or loss for U.S. federal income tax purposes as a result of the merger. |

| Q: | Will Pantheon Arizona be taxed on the conversion? |

| A: | Pantheon Arizona should recognize gain, but not loss, for U.S. federal income tax purposes as a result of the conversion equal to the excess, if any, of the fair market value of each of its assets over such asset’s adjusted tax basis at the effective time of the conversion. For this purpose, the valuation of Pantheon Arizona’s assets at the time of conversion may take into account a variety of factors, including possibly the fair market value of Pantheon Arizona’s shares immediately prior to the conversion. Since any such gain will be determined based on the value of its assets at that time, the amount of such gain (and any U.S. federal income tax liability to Pantheon Arizona by reason of such gain) cannot be determined at this time. Any U.S. federal income tax liability incurred by Pantheon Arizona as a result of such gain should become a liability of Pantheon Cayman by reason of the conversion. |

| Q: | Will Pantheon Cayman be taxed on the share exchange? |

| A: | Pantheon Cayman should not recognize any gain or loss for U.S. federal income tax purposes as a result of the share exchange. |

SUMMARY

This summary highlights selected information from this proxy statement/prospectus but may not contain all of the information that may be important to you. Accordingly, we encourage you to read carefully this entire proxy statement/prospectus, including the Acquisition Agreement attached as Appendix A. Please read these documents carefully as they are the legal documents that govern the Acquisition and your rights in the Acquisition. Unless the context otherwise requires, references to “Pantheon,” “we,” “us” or “our” in this proxy statement/prospectus refers to Pantheon China Acquisition Corp., including its consolidated subsidiaries, before the consummation of the Acquisition and to Pantheon Cayman, including its consolidated subsidiaries, after the consummation of the Acquisition.

The Parties

Pantheon

Pantheon China Acquisition Corp.

Suite 10-64, #9 Jianguomenwai Avenue

Chaoyang District, Beijing, China

100600

Telephone: 86-10-85322720

Pantheon China Acquisition Corp. is a blank check company formed on April 10, 2006 for the purpose of acquiring, through a stock exchange, asset acquisition or other similar business combination, or control, through contractual arrangements, an operating business that has its principal operations located in the People’s Republic of China. Pantheon’s efforts in identifying a prospective target business were not limited to a particular industry.

On December 20, 2006, Pantheon consummated its initial public offering, or IPO, of 5,750,000 units, including 750,000 subject to an over-allotment option, with each unit consisting of one share of common stock and two warrants, each to purchase one share of common stock at an exercise price of $5.00 per share. The units were sold at an offering price of $6.00 per unit, generating total gross proceeds of $34,500,000. Simultaneously with the consummation of the IPO, Pantheon consummated the private sale of 2,083,334 warrants at a price of $0.60 per warrant, generating total proceeds of $1,250,000, to Christina Jun Mu and Kevin Kezhong Wu, each an officer and director of Pantheon, Francisco A. Garcia and Hunter S. Reisner, each a special advisor of Pantheon, Easton Capital Corp. Defined Benefit Plan, an entity of which John H. Friedman, one of Pantheon’s special advisors, is trustee, and Pantheon China Acquisition Limited, an entity owned by Mark D. Chen, the chief executive officer and president of Pantheon. After deducting the underwriting discounts and commissions and the offering expenses, the total net proceeds to Pantheon from the public offering and the private sale were approximately $33,153,914, of which $32,747,500 was deposited into a Trust Account and the remaining became available to be used to provide for business, legal and accounting due diligence on prospective business combinations and continuing general and administrative expenses. Included in the amount deposited into the Trust Account was $345,000 of underwriting discounts and commissions payable to the underwriters, the payment of which was deferred unless and until Pantheon completes a business combination. In addition, Pantheon is allowed and did withdraw approximately $5.6 million to convert certain of its outstanding shares of common stock to cash and $300,000 from the Trust Account for working capital purposes. Through March 31, 2009, Pantheon has used approximately $1,050,000 of the net proceeds that were not deposited into the Trust Account and amounts allowed to be withdrawn from Trust Account to pay such conversion amounts and general and administrative expenses. As of March 31, 2009, there was $28,853,895 held in the Trust Account.

On December 10, 2008, Pantheon entered into a Put and Call Option Agreement with Modern Develop Limited (“Modern”), Mark D. Chen and YA Global Investments, L.P. (“YA Global”) and a separate Put and Call Option Agreement with Modern, Mark D. Chen, Victory Park Credit Opportunities Master Fund, Ltd (“VPCO”) and Victory Park Special Situations Master Fund, Ltd (“VPSS” and together with VPCO, “Victory Park”). Modern, YA Global and Victory Park are all independent third parties. YA Global and Victory Park acquired from several of Pantheon’s largest stockholders 4,547,399 shares of common stock of Pantheon in the aggregate through negotiated private transactions brokered by Rodman & Renshaw LLC, a financial intermediary. Under the Put and Call Option Agreements, YA Global and Victory Park agreed to grant their proxies to Pantheon’s representatives in voting for the Extension Amendment (defined below).

Pursuant to the Put and Call Option Agreements, Modern has the right to purchase an aggregate of 4,547,399 shares of common stock of Pantheon (representing approximately 79.09% of the shares sold in the initial public offering) from YA Global and Victory Park at an exercise price of $5.97 per share. Modern’s call options have an initial term commencing on the date of the Agreements and ending on June 30, 2009, and may be extended to September 30, 2009 or on the record date of a business combination if not exercised sooner. Modern paid an option fee of $2,501,070 in the aggregate for the initial term and in the event Modern elects to extend the call options it will be required to pay an additional extension option fee of $1,931,280 in the aggregate to YA Global and Victory Park, in each case pro rata to the number of shares held by the two investors.

Pursuant to the Put and Call Option Agreements, Pantheon has agreed to effect a liquidation in accordance with Delaware law in the event the business combination is abandoned prior to the exercise of the call options or if Modern elects not to extend the period of the call options.

On December 14, 2008, Pantheon, following approval by its stockholders, amended its certificate of incorporation (the “Extension Amendment”), to extend the time in which it must complete a business combination before it is required to be liquidated and grant conversion rights to holders of its public common stock in connection with such vote to approve the Extension Amendment. A total of 929,613 shares (or approximately 16.2% of the shares issued in the IPO) were converted in connection with the shareholder approval of the Extension Amendment.

CCBS

China Cord Blood Services Corporation

48th Floor, Bank of China Tower

1 Garden Road

Central

Hong Kong S.A.R.

Telephone: (852) 3605 8180

CCBS was incorporated as an exempted company with limited liability under the Companies Law (2007 Revision) of the Cayman Islands on January 17, 2008 as the holding company for its business operations in China. CCBS has two operating subsidiaries in China: Jiachenhong and Nuoya. CCBS holds an indirect 100.0% interest in Jiachenhong and an indirect 90.0% interest in Nuoya. In addition, CCBS holds an indirect 18.9% interest in CordLife, a provider of cord blood banking services with operations in Singapore, Australia, Hong Kong, India, Indonesia, the Philippines and Thailand.

CCBS is a leading provider of cord blood banking services in China. Expectant parents pay CCBS to process and store the cord blood of their children at birth for potential future use in medical treatment of the children or their family members. CCBS generates substantial upfront cash inflows from initial processing fees as well as steady continuing cash inflows from annual storage fees. CCBS enters into 18-year contracts with its subscribers and charges an initial processing fee at birth and a storage fee each year. The contracts can be terminated early by the parents or further extended, at the option of the children, after the children reach adulthood. CCBS expects annual storage fees to contribute an increasing proportion of its revenue as the number of its subscribers accumulated over the years continues to grow. In addition to its fee-based commercial services, CCBS also preserves cord blood units donated by the public and charges fees for matching units with patients in need of transplants. This revenue accounts for a small percentage of its total revenue.

The PRC government authorities have been following a “one license per region” policy, allowing each licensee, including CCBS, to operate within its own region without competition. The application process for a cord blood banking license takes several years, during which time the applicant usually incurs a substantial amount of initial investments, including constructing cord blood bank facilities to demonstrate to the government authorities that it is capable of meeting the stringent application requirements. This licensing process may deter newcomers with fewer resources and less experience from competing for licenses with established cord blood banking operators in China.

CCBS’s management team successfully pioneered the commercialization of cord blood banking services in China. Jiachenhong, its Beijing-based subsidiary with operations dating back to 2002, was the operator of the first licensed cord blood bank in China. CCBS has also developed a hospital network consisting of over 90 major hospitals in Beijing to perform cord blood collection services for its subscribers. To expand the geographic coverage of its business, CCBS acquired the right to operate in Guangdong through the acquisition of Nuoya in May 2007. The acquisition enabled CCBS to significantly increase the size of the market that it can address. CCBS believes it will be able to apply the experience it gained in its successful operation in Beijing to its more recently commenced operation in Guangdong. As of September 30, 2008, CCBS had capacity to store an additional 226,000 units, and it believes it has the ability to further expand its capacity to meet increasing market demand.

Currently, CCBS is the sole cord blood banking licensee in Beijing and Guangdong. So far, cord blood banking licenses have been issued for only six of China’s 31 regions, with another four licenses expected to be issued by 2010. CCBS expects to continue to grow its business through existing market penetration and geographical expansion. CCBS’s existing operations cover an aggregate population of approximately 110 million, including 94 million in Guangdong, which is larger than all but 12 countries in the world. According to the National Bureau of Statistics of China, there were 1.2 million newborns in Beijing and Guangdong in 2007. As the PRC government authorities issue cord blood banking licenses in more regions, CCBS believes that there will be significant growth opportunities in China. China has a population of approximately 1.3 billion. According to the National Bureau of Statistics of China, there were 15.9 million newborns in China in 2007, representing approximately 12.0% of newborns worldwide. In addition to the large number of newborns in China, we expect increased demand for CCBS’s services to be driven by a number of factors, including increasing disposable income in urban areas; greater attention to health issues as people become more financially secure; emphasis on children under China’s one-child policy; and heightened public awareness of the benefits associated with cord blood storage.

Golden Meditech, a public company traded with its shares listed on the Growth Enterprise Market of the Hong Kong Stock Exchange Company Limited, or “Hong Kong Stock Exchange GEM,” indirectly holds a 50.25% interest in CCBS through Golden Meditech Stem Cells (BVI) Company Limited, "Golden Meditech Stem Cells," a wholly-owned subsidiary of Golden Meditech, and the remaining 49.75% interest in CCBS is held by various institutional investors. As such, Golden Meditech is the parent company of CCBS and has control over its operations.

The Acquisition and the Acquisition Agreement

Redomestication to the Cayman Islands

Pursuant to the Acquisition Agreement, upon stockholder approval, Pantheon will complete a corporate reorganization that would result in holders of Pantheon securities holding securities in Pantheon Cayman, a Cayman Islands company rather than in Pantheon, a Delaware corporation. The reorganization involves two steps. First, Pantheon, the current Delaware corporation, will effect a short-form merger pursuant to Section 253 of the General Corporation Law of the State of Delaware in which it will merge with and into Pantheon Arizona, its wholly-owned Arizona subsidiary, with Pantheon Arizona surviving the merger. Second, after the merger, Pantheon Arizona will become Pantheon Cayman, a Cayman Islands company, pursuant to a conversion and continuation procedure under Arizona and Cayman Islands law. The reorganization will change Pantheon’s place of incorporation from Delaware to the Cayman Islands. We refer to the entire two-step transaction as the redomestication.

The redomestication will result in all of Pantheon’s issued and outstanding shares of common stock immediately prior to the redomestication converting into ordinary shares of Pantheon Cayman, and all units, warrants and other rights to purchase Pantheon’s common stock immediately prior to the redomestication being exchanged for substantially equivalent securities of Pantheon Cayman. The shares of Pantheon Cayman will continue to be quoted on the OTCBB or such other public trading market on which its shares may be trading at such time. Pantheon will cease to exist and Pantheon Cayman will be the surviving corporation. In connection therewith, Pantheon Cayman will assume all the property, rights, privileges, agreements, powers and franchises, debts, liabilities, duties and obligations of Pantheon, including any and all agreements, covenants, duties and obligations of Pantheon set forth in the Acquisition Agreement.

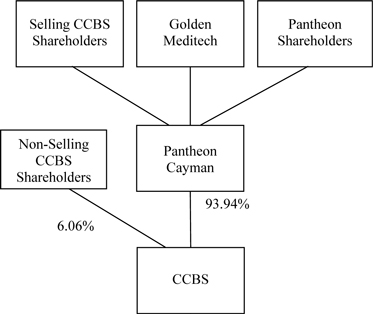

Business Combination with CCBS; Acquisition Consideration

Immediately following the redomestication, Pantheon Cayman will acquire all of the issued and outstanding ordinary shares of CCBS held by the selling shareholders in exchange for ordinary shares of Pantheon Cayman at a ratio of one ordinary share of Pantheon Cayman for approximately every 2.8 CCBS ordinary shares. The issuance of shares of Pantheon Cayman to the selling shareholders is being consummated on a private placement or offshore basis, pursuant to Section 4(2) of, or in accordance with Regulation S promulgated under the Securities Act of 1933, as amended, as appropriate. As of the date of this proxy statement/prospectus, shareholders representing 93.94% of the outstanding shares of CCBS have elected to participate in the business combination by becoming selling shareholders in the Acquisition Agreement. Accordingly, the aggregate value of the consideration to be paid by Pantheon in the business combination will be approximately $317.9 million (based on 54,345,104 shares to be issued to the selling shareholders at a market value of $5.85 per share, the closing price of Pantheon’s common stock as of March 13, 2009). Following the redomestication and upon consummation of the business combination, Pantheon Cayman will change its name to China Cord Blood Corporation.

Immediately after the business combination, all stock options of China Stem Cells Holdings Limited, an exempted company incorporated in the Cayman Islands and wholly-owned subsidiary of CCBS, or “CSC”, will be amended such that the options will become exercisable for ordinary shares of Pantheon Cayman and thereafter become substantially equivalent securities of Pantheon Cayman, with each option to purchase one share of CSC becoming an option to purchase 35.73314 ordinary shares of Pantheon Cayman. In addition, pursuant to an earn-out provision in the Acquisition Agreement, Pantheon Cayman has agreed to issue, over a period of three years, warrants exercisable for up to 9,000,000 ordinary shares of Pantheon Cayman to CCBS’s senior management based on the percentage increase in the number of new subscribers during the relevant periods. Each warrant will be exercisable for one ordinary share of Pantheon Cayman at an exercise price equal to the lower of $5.00 and the market price of a Pantheon Cayman share on the date of issuance and has a term of five years. It is expected that these will result in the recognition of share-based compensation expense for these warrants as the achievement of performance conditions becomes probable over the performance period.

Pantheon currently has authorized share capital of 26,000,000 shares consisting of 25,000,000 shares of common stock with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share. Pantheon Arizona currently has authorized share capital identical to that of Pantheon. Prior to the meeting of stockholders to approve the redomestication, Pantheon intends to increase the share capital of Pantheon Arizona from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 shares of common stock with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share. The increase in Pantheon Arizona’s authorized share capital is necessary to allow for sufficient authorized shares to complete the business combination following the redomestiction and to provide Pantheon Cayman the flexibility to use its share capital in the future for financing and business combinations.

Assuming that no additional selling shareholders will be included in the Acquisition Agreement, Pantheon will acquire only 93.94% interest in CCBS in the business combination, resulting in a total of 60,415,491 shares of Pantheon Cayman issued and outstanding. Pantheon’s current public shareholders will own approximately 8.0% of Pantheon Cayman, Pantheon’s current directors, officers and affiliates will own approximately 2.1% of Pantheon Cayman, Golden Meditech will own approximately 48.1% of Pantheon Cayman, and the selling shareholders (excluding Golden Meditech) will own approximately 41.8% of Pantheon Cayman. If Modern exercises all of its call options, or if YA Global and Victory Park exercise all of their put options, Modern will own approximately 7.5% of Pantheon Cayman. Upon the completion of the business combination, Pantheon Cayman is not expected to become a subsidiary of Golden Meditech. Immediately following the business combination, CCBS’s current directors and executive officers will become directors and executive officers of Pantheon Cayman, and the options of CSC currently held by them and other participants of the current stock option scheme of CSC will become options to purchase 3,573,314 ordinary shares of Pantheon Cayman.

Pursuant to the Acquisition Agreement, the redomestication will not be consummated unless the business combination is also approved. Similarly, the business combination will not take place unless the redomestication is also approved. Upon consummation of the business combination, Pantheon Cayman will own 93.94% of the issued and outstanding ordinary shares of CCBS (assuming no additional CCBS shareholders become selling shareholders).

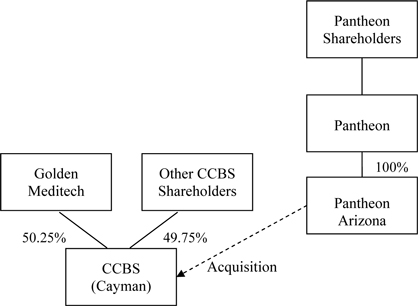

The following diagrams illustrates the corporate structure of Pantheon and CCBS immediately before and after the Acquisition:

Before the Acquisition

Conversion Rights

Pursuant to Pantheon’s Certificate of Incorporation, a holder of shares of Pantheon common stock may, if the stockholder affirmatively votes against the business combination, demand that Pantheon convert such shares into cash. Demand may be made by checking the box on the proxy card provided for that purpose and returning the proxy card in accordance with the instructions provided, and, at the same time, ensuring your bank or broker complies with the requirements identified elsewhere herein. You will only be entitled to receive cash for these shares if you continue to hold them through the closing of the business combination.

In connection with tendering your shares for conversion into cash, you must elect either to physically tender your stock certificates to Pantheon’s transfer agent prior to the special meeting or to deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, which election would likely be determined based on the manner in which you hold your shares. Traditionally, in order to perfect conversion rights in connection with a blank check company’s business combination, a holder could vote against a proposed business combination and check a box on the proxy card indicating such holder was seeking to exercise such holder’s conversion rights. After the business combination was approved, the company would contact such stockholder to arrange for it to deliver its certificate to verify ownership. As a result, the stockholder then had an “option window” after the consummation of the business combination during which it could monitor the price of the stock in the market. If the price rose above the conversion price, it could sell its shares in the open market before actually delivering its shares to the company for cancellation in consideration for the conversion price. Thus, the conversion right, to which stockholders were aware they needed to commit before the stockholder meeting, would become a “put” right surviving past the consummation of the business combination until the converting holder delivered its certificate. The requirement for physical or electronic delivery prior to the special meeting ensures that a converting holder’s election to convert is irrevocable once the business combination is approved. In furtherance of such irrevocable election, stockholders electing to convert will not be able to tender their shares at the special meeting.

Through the DWAC system, this electronic delivery process can be accomplished by the stockholder, whether or not it is a record holder or its shares are held in “street name,” by contacting the transfer agent or its broker and requesting delivery of its shares through the DWAC system. Pantheon believes that approximately 80% of its shares are currently held in “street name.” Delivering shares physically may take significantly longer. In order to obtain a physical stock certificate, a stockholder’s broker and/or clearing broker, DTC, and Pantheon’s transfer agent will need to act together to facilitate this request. There is a nominal cost associated with the above-referenced tendering process and the act of certificating the shares or delivering them through the DWAC system. The transfer agent will typically charge the tendering broker $35 and the broker would determine whether or not to pass this cost on to the converting holder. It is Pantheon’s understanding that stockholders should generally allot at least two weeks to obtain physical certificates from the transfer agent. Pantheon does not have any control over this process or over the brokers or DTC, and it may take longer than two weeks to obtain a physical stock certificate. Such stockholders will have less time to make their investment decision than those stockholders that do not elect to exercise their conversion rights. Stockholders who request physical stock certificates and wish to convert may be unable to meet the deadline for tendering their shares before exercising their conversion rights and thus will be unable to convert their shares.

Certificates that have not been tendered in accordance with these procedures by the day prior to the special meeting will not be converted to cash. In the event that a stockholder tenders its shares and decides prior to the special meeting that it does not want to convert its shares, the stockholder may withdraw the tender. In the event that a stockholder tenders shares and the business combination is not completed, these shares will not be converted to cash and the physical certificates representing these shares will be returned to the stockholder promptly following the determination that the business combination will not be consummated. Pantheon anticipates that a stockholder who tenders shares for conversion in connection with the vote to approve the business combination would receive payment of the conversion price for such shares soon after the completion of the business combination. Pantheon will hold the certificates of stockholders that elect to convert their shares into a pro rata portion of the funds available in the Trust Account until such shares are converted to cash or returned to such stockholders.

If properly demanded, Pantheon will convert each share of common stock into a pro rata portion of the funds available in the Trust Account, calculated as of two business days prior to the anticipated consummation of the business combination. As of the record date, this would amount to approximately $ per share. If you exercise your conversion rights, you will be exchanging your shares of Pantheon common stock for cash and will no longer own the shares. You will be entitled to receive cash for these shares only if you affirmatively vote against the business combination, properly demand conversion, and tender your stock certificate to Pantheon’s transfer agent prior to your vote. If the business combination is not completed, these shares will not be converted into cash. However, if Pantheon is unable to complete the business combination by September 30, 2009 (or if the CCBS business combination is abandoned prior to such date), it will be forced to liquidate and all holders of shares will receive a pro rata portion of the funds available in the Trust Account at the time of the liquidation.

The business combination will not be consummated if the holders of 20% or more of the common stock sold in the IPO (1,150,000 shares or more) exercise their conversion rights. The conversion of 929,613 shares (or approximately 16.2% of the shares issued in the IPO) in connection with the Extension Amendment has not changed the percentage of shares that can convert in connection with the business combination.

Recommendations of the Boards of Directors and Reasons for the Acquisition

After careful consideration of the terms and conditions of the Acquisition Agreement, the board of directors of Pantheon has determined that the redomestication, the business combination and the transactions contemplated thereby are fair to and in the best interests of Pantheon and its stockholders. In reaching its decision with respect to the Acquisition and the transactions contemplated thereby, the board of directors of Pantheon reviewed various industry and financial data and the due diligence and evaluation materials provided by CCBS. The board of directors did not obtain a fairness opinion on which to base its assessment. Pantheon’s board of directors recommends that Pantheon stockholders vote:

· FOR the Redomestication Proposal;

· FOR the Business Combination Proposal;

· FOR the Incentive Plan Proposal; and

· FOR the Adjournment Proposal.

Interests of Certain Persons in the Acquisition

When you consider the recommendation of Pantheon’s board of directors in favor of adoption of the Business Combination Proposal and other proposals, you should keep in mind that Pantheon’s directors and officers have interests in the Acquisition that are different from, or in addition to, your interests as a stockholder.

| | · | if the proposed Acquisition is not completed by September 30, 2009 (or if the business combination is abandoned prior to such date), Pantheon will be required to liquidate. In such event, the 1,250,000 shares of common stock held by Pantheon officers, directors and affiliates, which were acquired prior to the IPO for an aggregate purchase price of $25,000, will be worthless, as will the 2,083,334 warrants that were acquired prior to the IPO for an aggregate purchase price of $1,250,000. Such common stock and warrants had an aggregate market value of approximately $7.5 million based on the last sale price of $5.85 and $0.10, on the OTCBB on March 13 and 17, 2009, respectively. |

| | · | in connection with the IPO, Mark D. Chen agreed to indemnify Pantheon for debts and obligations to vendors that are owed money by Pantheon, but only to the extent necessary to ensure that certain liabilities do not reduce funds in the Trust Account. If the business combination is consummated, Mr. Chen will not have to perform such obligations. As of March 31, 2009, Pantheon believes that the maximum amount of the indemnity obligation of Mr. Chen was approximately $66,000, which was computed based on the amount payable to creditors, less amounts relating to creditors for which Pantheon has received a waiver of each such creditor’s right to sue the Trust Account. Pantheon does not have sufficient funds outside of the Trust Account to pay these obligations. Therefore, if the business combination is not consummated and vendors that have not signed waivers sue the Trust Account and win their cases, the Trust Account could be reduced by the amount of the claims and Mr. Chen would be required to fulfill his indemnification obligations and he may not be able to satisfy his individual obligations to indemnify Pantheon; |

| | · | warrants to purchase Pantheon common stock held by Pantheon’s officers and directors are exercisable only upon consummation of a business combination; |

| | · | all rights specified in Pantheon’s certificate of incorporation relating to the right of officers and directors to be indemnified by Pantheon, and of Pantheon’s officers and directors to be exculpated from monetary liability with respect to prior acts or omissions, will continue after the business combination. If the business combination is not approved and Pantheon liquidates, Pantheon will not be able to perform its obligations to its officers and directors under those provisions; |

| | · | if the business combination with CCBS is completed, Ting Zheng and Albert Chen will serve as executive directors of Pantheon Cayman and Mark Chen and Jennifer Weng will serve as non-executive directors of Pantheon Cayman; and |

| | · | Pantheon’s financial, legal and other advisors have rendered services for which they may not be paid if the business combination is not approved. Any recovery of such fees and expenses by these vendors will be much more difficult in the event the business combination is not approved while such recovery is not expressly contingent on the outcome of the Pantheon stockholder vote, these vendors could be viewed as having an interest in the outcome of such vote. |

In addition, the exercise of Pantheon’s directors’ and officers’ discretion in agreeing to changes or waivers in the terms of the transaction may result in a conflict of interest when determining whether such changes or waivers are appropriate and in our stockholders’ best interest.

As of March 31, 2009, there were 6,070,387 shares of Pantheon common stock issued and outstanding. Only Pantheon stockholders who hold shares of record as of the close of business on , 2009 are entitled to vote at the special meeting or any adjournment of the special meeting. Approval of the business combination will require the affirmative vote of the holders of a majority of the shares of Pantheon common stock issued in the IPO present and entitled to vote at the special meeting; provided, however, that if 20% or more of the shares purchased in the IPO vote against approval of the business combination and demand conversion then the Acquisition will not be completed. Abstentions and broker nonvotes will have the same effect as a vote against the approval of the business combination, except that holders who abstain or do not give a voting instruction to their brokers will not be able to convert their shares into a pro rata portion of the Trust Account. As of March 31, 2009, directors, executive officers and affiliates of Pantheon held 1,250,000 shares of common stock (or approximately 20.6% of the outstanding shares of Pantheon common stock).