UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22255 | |||||||

| ||||||||

Columbia ETF Trust II | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

225 Franklin Street |

| 02110 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Christopher O. Petersen, Esq. c/o Columbia Management Investment Advisers, LLC 225 Franklin Street Boston, Massachusetts 02110

Ryan Larrenaga c/o Columbia Management Investment Advisers, LLC | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (800) 345-6611 |

| ||||||

| ||||||||

Date of fiscal year end: | March 31 |

| ||||||

| ||||||||

Date of reporting period: | March 31, 2019 |

| ||||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

March 31, 2019

COLUMBIA ETF TRUST II

Columbia Beyond BRICs ETF

Columbia EM Core ex-China ETF

Columbia EM Quality Dividend ETF

Columbia Emerging Markets Consumer ETF

Columbia India Consumer ETF

Columbia India Infrastructure ETF

Columbia India Small Cap ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds' annual and semiannual shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds' website (columbiathreadneedleus.com/etfs), and each time a report is posted you will be notified by mail and provided with a website address to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank).

You may elect to receive all future reports in paper free of charge. You can contact your financial intermediary to request that you continue receiving paper copies of your shareholder reports. Your election to receive paper reports will apply to all Columbia Funds held in your account.

TABLE OF CONTENTS

Columbia Beyond BRICs ETF | |||||||

| Fund at a Glance | 2 | ||||||

| Manager Discussion of Fund Performance | 5 | ||||||

Columbia EM Core ex-China ETF | |||||||

| Fund at a Glance | 7 | ||||||

| Manager Discussion of Fund Performance | 10 | ||||||

Columbia EM Quality Dividend ETF | |||||||

| Fund at a Glance | 12 | ||||||

| Manager Discussion of Fund Performance | 15 | ||||||

Columbia Emerging Markets Consumer ETF | |||||||

| Fund at a Glance | 17 | ||||||

| Manager Discussion of Fund Performance | 20 | ||||||

Columbia India Consumer ETF | |||||||

| Fund at a Glance | 22 | ||||||

| Manager Discussion of Fund Performance | 24 | ||||||

Columbia India Infrastructure ETF | |||||||

| Fund at a Glance | 26 | ||||||

| Manager Discussion of Fund Performance | 28 | ||||||

Columbia India Small Cap ETF | |||||||

| Fund at a Glance | 30 | ||||||

| Manager Discussion of Fund Performance | 32 | ||||||

| Understanding Your Fund's Expenses | 34 | ||||||

| Frequency Distribution of Premiums and Discounts | 35 | ||||||

| Portfolio of Investments | 37 | ||||||

| Statement of Assets and Liabilities | 62 | ||||||

| Statement of Operations | 65 | ||||||

| Statement of Changes in Net Assets | 68 | ||||||

| Financial Highlights | 72 | ||||||

| Notes to Financial Statements | 79 | ||||||

| Report of Independent Registered Public Accounting Firm | 91 | ||||||

| Federal Income Tax Information | 92 | ||||||

| Trustees and Officers | 93 | ||||||

| Additional Information | 99 | ||||||

Columbia ETF Trust II | Annual Report 2019

FUND AT A GLANCE

Columbia Beyond BRICs ETF

Investment objective

Columbia Beyond BRICs ETF (the Fund) seeks investment results that correspond (before fees and expenses) to the price and yield performance of the FTSE Beyond BRICs Net of Tax Index.

Portfolio management

Christopher Lo, CFA

Portfolio Manager

Managed Fund since 2016

The Board of Trustees of Columbia ETF Trust II, based upon the recommendation of the Investment Manager, determined to close and liquidate the Fund. The last day of trading for the Fund on the NYSE Arca Exchange is expected to be June 14, 2019. On or about June 21, 2019, the Fund will make a liquidating distribution to remaining shareholders equal to the shareholder's proportionate interest in the net assets of the Fund.

Average annual total returns (%) (for period ended March 31, 2019)

Inception | 1 Year | 5 Years | Life | ||||||||||||||||

Market Price | 08/15/12 | -10.15 | -1.43 | -0.01 | |||||||||||||||

Net Asset Value | 08/15/12 | -9.46 | -1.25 | 0.01 | |||||||||||||||

Tracked Index(1) | -9.01 | -0.02 | 1.57 | ||||||||||||||||

(1) The Tracked Index reflects the Indxx Beyond BRICs Index through October 25, 2013 and the FTSE Beyond BRICs Net of Tax Index USD thereafter.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by the Fund's former investment manager or Columbia Management Investment Advisers, LLC (Columbia Management or the Investment Manager). Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting columbiathreadneedleus.com/etfs.

Columbia Management took over portfolio management in September 2016 upon its acquisition of the Fund's previous investment manager.

The price used to calculate Market Price return is based on the midpoint of the 4:00 PM Eastern (U.S.) bid/ask spread on the NYSE and does not represent returns an investor would receive if shares were traded at other times.

The Fund's shares may trade above or below their net asset value. The net asset value of the Fund will generally fluctuate with changes in the market value of the Fund's holdings. The market prices of shares, however, will generally fluctuate in accordance with changes in net asset value as well as the relative supply of, and demand for, shares on the exchange. The trading price of shares may deviate significantly from the net asset value.

The FTSE Beyond BRICs Index is a market capitalization-weighted index designed to represent the performance of a diversified basket of 90 liquid companies in emerging and frontier markets excluding Brazil, Russia, India, China (BRIC), Taiwan and Argentina as defined by FTSE's Country Classification System. The index has 75% exposure to emerging markets and 25% to frontier markets at rebalance.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia ETF Trust II | Annual Report 2019

2

FUND AT A GLANCE (continued)

Columbia Beyond BRICs ETF

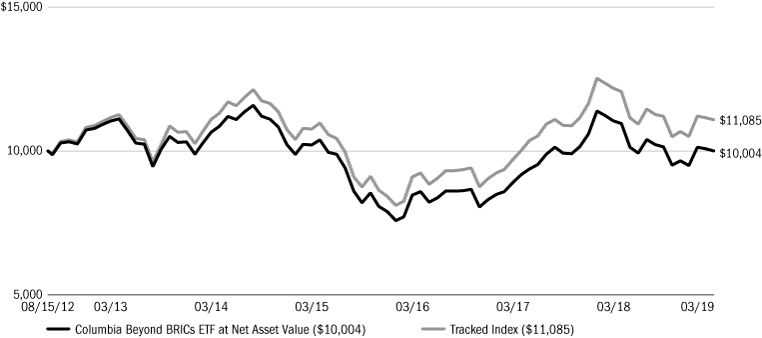

Performance of a hypothetical $10,000 investment (August 15, 2012 — March 31, 2019)

The chart above shows the change in value of a hypothetical $10,000 investment made on the Fund's inception, and does not reflect the deduction of taxes or brokerage commissions that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Top ten holdings (%) (at March 31, 2019)

Naspers, Ltd. N Shares (South Africa) | 3.6 | ||||||

Qatar National Bank QPSC (Qatar) | 2.6 | ||||||

PTT PCL NVDR (Thailand) | 2.5 | ||||||

America Movil SAB de CV Series L (Mexico) | 2.3 | ||||||

Fomento Economico Mexicano SAB de CV Series UBD (Mexico) | 2.3 | ||||||

PT Bank Central Asia Tbk (Indonesia) | 2.2 | ||||||

Banca Transilvania SA (Romania) | 2.1 | ||||||

Safaricom PLC (Kenya) | 2.1 | ||||||

National Bank of Kuwait SAKP (Kuwait) | 2.1 | ||||||

Guaranty Trust Bank PLC (Nigeria) | 2.1 | ||||||

Percentages indicated are based upon total investments (excluding Money Market Funds and derivatives, if any).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Country breakdown (%) (at March 31, 2019)

Bangladesh | 5.5 | ||||||

Chile | 3.4 | ||||||

Colombia | 0.6 | ||||||

Czech Republic | 0.4 | ||||||

Hungary | 1.2 | ||||||

Indonesia | 9.4 | ||||||

Kenya | 3.4 | ||||||

Kuwait | 2.9 | ||||||

Malaysia | 8.2 | ||||||

Mexico | 11.1 | ||||||

Morocco | 3.8 | ||||||

Nigeria | 3.9 | ||||||

Philippines | 3.5 | ||||||

Qatar | 3.9 | ||||||

Romania | 2.1 | ||||||

South Africa | 14.8 | ||||||

Thailand | 12.4 | ||||||

United Arab Emirates | 3.0 | ||||||

United States(a) | 0.5 | ||||||

Vietnam | 6.0 | ||||||

Total | 100.0 | ||||||

Country Breakdown is based primarily on issuer's place of organization/incorporation. Percentages indicated are based upon total investments and excludes investments in derivatives, if any. The Fund's portfolio composition is subject to change.

(a) Includes investments in Money Market Funds.

Columbia ETF Trust II | Annual Report 2019

3

FUND AT A GLANCE (continued)

Columbia Beyond BRICs ETF

Equity sector breakdown (%) (at March 31, 2019)

Communication Services | 14.0 | ||||||

Consumer Discretionary | 5.4 | ||||||

Consumer Staples | 8.7 | ||||||

Energy | 4.8 | ||||||

Financials | 43.5 | ||||||

Health Care | 3.5 | ||||||

Industrials | 2.9 | ||||||

Materials | 9.1 | ||||||

Real Estate | 3.7 | ||||||

Utilities | 4.4 | ||||||

Total | 100.0 | ||||||

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Columbia ETF Trust II | Annual Report 2019

4

MANAGER DISCUSSION OF FUND PERFORMANCE

Columbia Beyond BRICs ETF (BBRC)

For the 12-month period that ended March 31, 2019, the Fund returned -9.46% based on net asset value (NAV) and -10.15% based on market price. The Fund's Tracked Index, the FTSE Beyond BRICS Index, returned -9.01%.

The Fund's NAV on March 31, 2018 was $19.49, and it ended the annual period on March 31, 2019 with an NAV of $16.70. The Fund's market price on March 31, 2019 was $16.66 per share.

Emerging market equities struggled amid escalating trade tensions and more

Emerging market equities underperformed both U.S. and developed market international equities during the annual period. The MSCI Emerging Markets Index (Net) returned -7.41% during the annual period, as compared to S&P 500 Index and MSCI EAFE Index (Net) returns of 9.50% and -3.71%, respectively, for the same time period.

Emerging market equities had a challenging start to the annual period, primarily because of escalating trade tensions between the U.S. and China, a hawkish U.S. Federal Reserve (Fed) and resultant currency pressures. Fed tightening, rising bond yields and a stronger U.S. dollar weighed on emerging market currencies. Emerging market equities declined in the third quarter of 2018 as well. The quarter started positively with political developments in Latin America. Brazilian equities initially rebounded, driven by strong earnings results and reduced political uncertainty. Positive trade rhetoric from the Mexican president-elect also boosted investor sentiment, as his inclination toward a re-negotiation of the North American Free Trade Agreement and maintaining fiscal prudence mitigated concerns. However, Chinese equities fell, as the U.S. heightened the trade conflict by threatening to impose tariffs on an additional $267 billion worth of Chinese imports in addition to those already announced. Further, U.S. sanctions and concerns around central bank policy in the face of rising inflation spurred a sell-off in Turkish assets.

Emerging equity markets, like most global equity markets, ended calendar year 2018 on a down note, led by the threat of slowing global economic growth and tightening liquidity. Emerging market equities remained particularly challenged, primarily around persistent U.S.-China trade tensions and the resultant concerns of a Chinese economic slowdown. The success of Jair Bolsonaro in the Brazilian elections brought some relief for markets as did a subsequent temporary truce in the U.S.-China trade war and the accommodative stance of the Chinese government, particularly toward the private sector. But the optimism was short-lived following the arrest of technology company Huawei's Chief Financial Officer. Asian equities broadly suffered, including the equity markets of China, South Korea, Taiwan and Hong Kong. Elsewhere, falling oil prices and geopolitical tensions dampened Russian equities, though Turkish equities rallied as political tensions began to fade.

Following on the heels of a trying year in 2018, emerging market equities, like global equities broadly, came roaring back in the first quarter of 2019. Much of the impetus for the strong equity recovery can be attributed to an abrupt change in monetary policy direction by the Fed, where its bias shifted from a tightening mode to a more dovish stance. Other contributing factors to the sharp market turnaround included a sizable fiscal and monetary stimulus program in China, which seems to have had a fairly immediate impact based on leading economic indicators, and progress made on trade talks between the U.S. and China.

Contributors and detractors

Constituents in the financials, materials and energy sectors detracted most from the Fund's absolute returns during the annual period. Constituents in the information technology, consumer discretionary and utilities sectors contributed most positively to the Fund's absolute returns during the annual period.

From a country perspective, constituents in South Africa, Mexico and Malaysia detracted most from the Fund's absolute returns during the annual period. Conversely, constituents in United Arab Emirates, Qatar and Indonesia contributed most positively to the Fund's absolute returns during the annual period.

Positions in South African communication services provider MTN Group, Vietnamese industrial production company Hoa Phat Group and Mexican telecommunication services provider America Movil detracted most. Each generated a double-digit negative absolute return during the annual period. Positions in United Arab Emirates bank First Abu Dhabi Bank,

Columbia ETF Trust II | Annual Report 2019

5

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Columbia Beyond BRICs ETF (BBRC)

Bangladesh utilities company United Power Generation & Distribution Company and Qatari bank Qatar National Bank contributed most positively. Each generated a double-digit absolute gain during the annual period.

The MSCI EAFE Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The index is compiled from a composite of securities markets of Europe, Australasia and the Far East and is widely recognized by investors in foreign markets as the measurement index for portfolios of non-North American securities.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure market performance of emerging markets.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

Investing involves risks, including the risk of loss of principal. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The Fund is passively managed and seeks to track the performance of an index. The Fund may not sell a poorly performing security unless it was removed from the index. There is no guarantee that the index will achieve positive returns. Risk exists that the index provider may not follow its methodology for index construction. Errors may result in a negative fund performance. The Fund's net value will generally decline when the market value of its targeted index declines. Foreign investments subject the Fund to risks, including political, economic, market, social and other risks impacting a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. These risks are enhanced for emerging or frontier market issuers. Investment in or exposure to foreign currencies subjects the Fund to currency fluctuation and risk of loss. Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. The Fund concentrates its investments in issuers of one or more particular industries to the same extent as the underlying index. Although the Fund's shares are listed on an exchange, there can be no assurance that an active, liquid or otherwise orderly trading market for shares will be established or maintained. Active market trading may increase portfolio turnover, transaction costs and tracking error to the targeted index. The Fund may have portfolio turnover, which may cause an adverse cost impact. There may be additional portfolio turnover risk as active market trading of the Fund's shares may cause more frequent creation or redemption activities that could, in certain circumstances, increase the number of portfolio transactions as well as tracking error to the Index and as high levels of transactions increase brokerage and other transaction costs and may result in increased taxable capital gains. See the Fund's prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia ETF are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia ETF. References to specific securities should not be construed as a recommendation or investment advice.

Columbia ETF Trust II | Annual Report 2019

6

FUND AT A GLANCE

Columbia EM Core ex-China ETF

Investment objective

Columbia EM Core ex-China ETF (the Fund) seeks investment results that correspond (before fees and expenses) to the price and yield performance of the Beta Thematic Emerging Markets ex-China Index.

Portfolio management

Christopher Lo, CFA

Portfolio Manager

Managed Fund since 2016

Average annual total returns (%) (for period ended March 31, 2019)

Inception | 1 Year | Life | |||||||||||||

Market Price | 09/02/15 | -7.37 | 11.80 | ||||||||||||

Net Asset Value | 09/02/15 | -6.38 | 11.74 | ||||||||||||

MSCI Emerging Markets Index (Net) | -7.41 | 10.51 | |||||||||||||

Beta Thematic Emerging Markets ex-China Index | -8.44 | 10.19 | |||||||||||||

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by the Fund's former investment manager or Columbia Management Investment Advisors, LLC (Columbia Management or the Investment Manager). Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting columbiathreadneedleus.com/etfs.

Columbia Management took over portfolio management in September 2016 upon its acquisition of the Fund's previous investment manager.

The price used to calculate Market Price return is based on the midpoint of the 4:00 PM Eastern (U.S.) bid/ask spread on the NYSE and does not represent returns an investor would receive if shares were traded at other times.

The Fund's shares may trade above or below their net asset value. The net asset value of the Fund will generally fluctuate with changes in the market value of the Fund's holdings. The market prices of shares, however, will generally fluctuate in accordance with changes in net asset value as well as the relative supply of, and demand for, shares on the exchange. The trading price of shares may deviate significantly from the net asset value.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure market performance of emerging markets.

The Beta Thematic Emerging Markets ex-China Index is a market capitalization-weighted index designed to provide broad, core emerging markets equity exposure by measuring the stock performance of up to 700 companies, excluding those listed or domiciled in China or Hong Kong.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes (except the MSCI Emerging Markets Index (Net), which reflects reinvested dividends net of withholding taxes) or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia ETF Trust II | Annual Report 2019

7

FUND AT A GLANCE (continued)

Columbia EM Core ex-China ETF

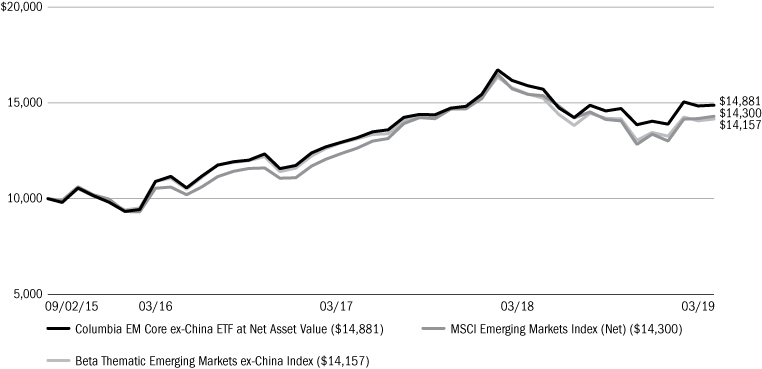

Performance of a hypothetical $10,000 investment (September 2, 2015 — March 31, 2019)

The chart above shows the change in value of a hypothetical $10,000 investment made on the Fund's inception, and does not reflect the deduction of taxes or brokerage commissions that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Top ten holdings (%) (at March 31, 2019)

Samsung Electronics Co., Ltd. (South Korea) | 6.6 | ||||||

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | 5.4 | ||||||

Infosys, Ltd. ADR (India) | 3.5 | ||||||

ICICI Bank, Ltd. ADR (India) | 3.5 | ||||||

LUKOIL PJSC ADR (Russia) | 2.9 | ||||||

Naspers, Ltd. N Shares (South Africa) | 2.7 | ||||||

Petroleo Brasileiro SA Preference Shares (Brazil) | 2.2 | ||||||

Vale SA (Brazil) | 2.0 | ||||||

Itau Unibanco Holding SA Preference Shares (Brazil) | 2.0 | ||||||

BTS Group Holdings PCL NVDR (Thailand) | 1.9 | ||||||

Percentages indicated are based upon total investments (excluding Money Market Funds and derivatives, if any).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Country breakdown (%) (at March 31, 2019)

Brazil | 9.3 | ||||||

Chile | 1.4 | ||||||

India | 13.1 | ||||||

Indonesia | 3.8 | ||||||

Malaysia | 4.0 | ||||||

Mexico | 3.5 | ||||||

Philippines | 2.3 | ||||||

Poland | 2.3 | ||||||

Russia | 5.3 | ||||||

South Africa | 10.0 | ||||||

South Korea | 16.9 | ||||||

Taiwan | 19.8 | ||||||

Thailand | 6.8 | ||||||

Turkey | 0.7 | ||||||

United Kingdom | 0.5 | ||||||

United States(a) | 0.3 | ||||||

Total | 100.0 | ||||||

Country Breakdown is based primarily on issuer's place of organization/incorporation. Percentages indicated are based upon total investments and excludes investments in derivatives, if any. The Fund's portfolio composition is subject to change.

(a) Includes investments in Money Market Funds.

Columbia ETF Trust II | Annual Report 2019

8

FUND AT A GLANCE (continued)

Columbia EM Core ex-China ETF

Equity sector breakdown (%) (at March 31, 2019)

Communication Services | 3.3 | ||||||

Consumer Discretionary | 9.0 | ||||||

Consumer Staples | 7.2 | ||||||

Energy | 9.4 | ||||||

Financials | 24.6 | ||||||

Health Care | 3.1 | ||||||

Industrials | 5.8 | ||||||

Information Technology | 22.7 | ||||||

Materials | 11.0 | ||||||

Real Estate | 1.8 | ||||||

Utilities | 2.1 | ||||||

Total | 100.0 | ||||||

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Columbia ETF Trust II | Annual Report 2019

9

MANAGER DISCUSSION OF FUND PERFORMANCE

Columbia EM Core ex-China ETF (XCEM)

For the 12-month period that ended March 31, 2019, the Fund returned -6.38% based on net asset value (NAV) and -7.37% based on market price. The MSCI Emerging Markets Index (Net) returned -7.41%, and the Beta Thematic Emerging Markets ex-China Index returned -8.44% during the same time period.

The Fund's NAV on March 31, 2018 was $28.03, and it ended the annual period on March 31, 2019 with an NAV of $25.40. The Fund's market price on March 31, 2019 was $25.51 per share.

Emerging market equities struggled amid escalating trade tensions and more

Emerging market equities underperformed both U.S. and developed market international equities during the annual period. The MSCI Emerging Markets Index (Net) returned -7.41% during the annual period, as compared to S&P 500 Index and MSCI EAFE Index (Net) returns of 9.50% and -3.71%, respectively, for the same time period.

Emerging market equities had a challenging start to the annual period, primarily because of escalating trade tensions between the U.S. and China, a hawkish U.S. Federal Reserve (Fed) and resultant currency pressures. Fed tightening, rising bond yields and a stronger U.S. dollar weighed on emerging market currencies. Emerging market equities declined in the third quarter of 2018 as well. The quarter started positively with political developments in Latin America. Brazilian equities initially rebounded, driven by strong earnings results and reduced political uncertainty. Positive trade rhetoric from the Mexican president-elect also boosted investor sentiment, as his inclination toward a re-negotiation of the North American Free Trade Agreement and maintaining fiscal prudence mitigated concerns. However, Chinese equities fell, as the U.S. heightened the trade conflict by threatening to impose tariffs on an additional $267 billion worth of Chinese imports in addition to those already announced. Further, U.S. sanctions and concerns around central bank policy in the face of rising inflation spurred a sell-off in Turkish assets.

Emerging equity markets, like most global equity markets, ended calendar year 2018 on a down note, led by the threat of slowing global economic growth and tightening liquidity. Emerging market equities remained particularly challenged, primarily around persistent U.S.-China trade tensions and the resultant concerns of a Chinese economic slowdown. The success of Jair Bolsonaro in the Brazilian elections brought some relief for markets as did a subsequent temporary truce in the U.S.-China trade war and the accommodative stance of the Chinese government, particularly toward the private sector. But the optimism was short-lived following the arrest of technology company Huawei's Chief Financial Officer. Asian equities broadly suffered, including the equity markets of China, South Korea, Taiwan and Hong Kong. Elsewhere, falling oil prices and geopolitical tensions dampened Russian equities, though Turkish equities rallied as political tensions began to fade.

Following on the heels of a trying year in 2018, emerging market equities, like global equities broadly, came roaring back in the first quarter of 2019. Much of the impetus for the strong equity recovery can be attributed to an abrupt change in monetary policy direction by the Fed, where its bias shifted from a tightening mode to a more dovish stance. Other contributing factors to the sharp market turnaround included a sizable fiscal and monetary stimulus program in China, which seems to have had a fairly immediate impact based on leading economic indicators, and progress made on trade talks between the U.S. and China.

Contributors and detractors

Constituents in the communication services, industrials and energy sectors contributed most positively to the Fund's absolute returns during the annual period. Constituents in information technology, health care and consumer discretionary detracted most from absolute returns during the annual period.

From a country perspective, constituents in India, Thailand and Indonesia contributed most positively to the Fund's absolute returns during the annual period. Conversely, constituents in South Korea, South Africa and Turkey detracted most from absolute returns during the annual period.

Positions in India-based bank Icici Bank, India-based technology services company Infosys and Russian energy company Lukoil contributed most positively. Each generated a double-digit absolute gain during the annual period. Positions in

Columbia ETF Trust II | Annual Report 2019

10

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Columbia EM Core ex-China ETF (XCEM)

South Korea-based biotechnology firm Celltrion, India-based auto manufacturer Tata Motors and South Korea-based electronic equipment and products manufacturer Samsung Electronics detracted most. Each produced a double-digit negative absolute return during the annual period.

The MSCI EAFE Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The index is compiled from a composite of securities markets of Europe, Australasia and the Far East and is widely recognized by investors in foreign markets as the measurement index for portfolios of non-North American securities.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure market performance of emerging markets.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

Investing involves risks, including the risk of loss of principal. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The Fund is passively managed and seeks to track the performance of an index. The Fund may not sell a poorly performing security unless it was removed from the index. There is no guarantee that the index will achieve positive returns. Risk exists that the index provider may not follow its methodology for index construction. Errors may result in a negative fund performance. The Fund's net value will generally decline when the market value of its targeted index declines. Foreign investments subject the Fund to risks, including political, economic, market, social and other risks impacting a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. These risks are enhanced for emerging or frontier market issuers. Investment in or exposure to foreign currencies subjects the Fund to currency fluctuation and risk of loss. Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. The Fund concentrates its investments in issuers of one or more particular industries to the same extent as the underlying index. Although the Fund's shares are listed on an exchange, there can be no assurance that an active, liquid or otherwise orderly trading market for shares will be established or maintained. Active market trading may increase portfolio turnover, transaction costs and tracking error to the targeted index. The Fund may have portfolio turnover, which may cause an adverse cost impact. There may be additional portfolio turnover risk as active market trading of the Fund's shares may cause more frequent creation or redemption activities that could, in certain circumstances, increase the number of portfolio transactions as well as tracking error to the Index and as high levels of transactions increase brokerage and other transaction costs and may result in increased taxable capital gains. See the Fund's prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia ETF are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia ETF. References to specific securities should not be construed as a recommendation or investment advice.

Columbia ETF Trust II | Annual Report 2019

11

FUND AT A GLANCE

Columbia EM Quality Dividend ETF

Investment objective

Columbia EM Quality Dividend ETF (the Fund) seeks investment results that correspond (before fees and expenses) to the price and yield performance of the Beta Advantage® Emerging Markets Quality Dividend Index.

Portfolio management

Christopher Lo, CFA

Portfolio Manager

Managed Fund since 2016

The Board of Trustees of Columbia ETF Trust II, based upon the recommendation of the Investment Manager, determined to close and liquidate the Fund. The last day of trading for the Fund on the NYSE Arca Exchange is expected to be June 14, 2019. On or about June 21, 2019, the Fund will make a liquidating distribution to remaining shareholders equal to the shareholder's proportionate interest in the net assets of the Fund.

Average annual total returns (%) (for period ended March 31, 2019)

Inception | 1 Year | 5 Years | Life | ||||||||||||||||

Market Price | 08/04/11 | -10.44 | 0.23 | -1.20 | |||||||||||||||

Net Asset Value | 08/04/11 | -9.01 | 0.22 | -1.15 | |||||||||||||||

MSCI Emerging Markets Index (Net) | -7.41 | 3.68 | 1.85 | ||||||||||||||||

Tracked Index(1) | -7.98 | 1.96 | 0.31 | ||||||||||||||||

(1) The Tracked Index reflects the Indxx Emerging Market High Income Low Beta Index through January 31, 2014, the FTSE Emerging All Cap ex Taiwan Low Volatility Dividend Net Tax Index from February 3, 2014 through January 23, 2015, and the Beta Advantage® Emerging Markets Quality Dividend Index thereafter.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by the Fund's former investment manager or Columbia Management Investment Advisers, LLC (Columbia Management or the Investment Manager). Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting columbiathreadneedleus.com/etfs.

Columbia Management took over portfolio management in September 2016 upon its acquisition of the Fund's previous investment manager.

The price used to calculate Market Price return is based on the midpoint of the 4:00 PM Eastern (U.S.) bid/ask spread on the NYSE and does not represent returns an investor would receive if shares were traded at other times.

The Fund's shares may trade above or below their net asset value. The net asset value of the Fund will generally fluctuate with changes in the market value of the Fund's holdings. The market prices of shares, however, will generally fluctuate in accordance with changes in net asset value as well as the relative supply of, and demand for, shares on the exchange. The trading price of shares may deviate significantly from the net asset value.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure market performance of emerging markets.

The Beta Advantage® Emerging Markets Quality Dividend Index is an equal-weighted index designed to represent a portfolio of approximately 50 companies in developing markets, which is expected to have a higher dividend yield than the average dividend yield of companies included in the developing markets universe as defined by Columbia Management.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes (except the MSCI Emerging Markets Index (Net), which reflects reinvested dividends net of withholding taxes) or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia ETF Trust II | Annual Report 2019

12

FUND AT A GLANCE (continued)

Columbia EM Quality Dividend ETF

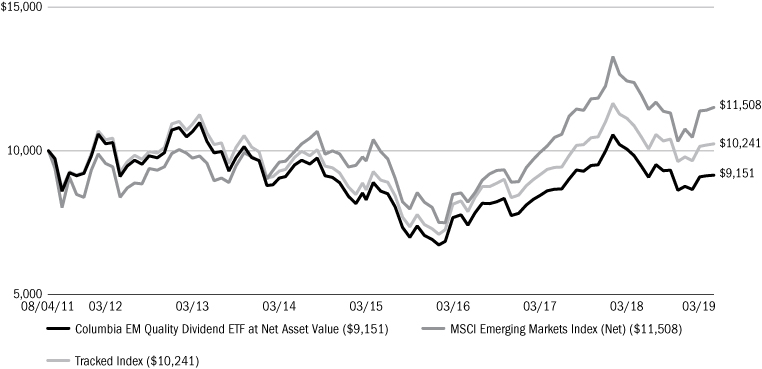

Performance of a hypothetical $10,000 investment (August 4, 2011 — March 31, 2019)

The chart above shows the change in value of a hypothetical $10,000 investment made on the Fund's inception, and does not reflect the deduction of taxes or brokerage commissions that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Top ten holdings (%) (at March 31, 2019)

Bharat Petroleum Corp., Ltd. (India) | 2.1 | ||||||

Link REIT (Hong Kong) | 2.1 | ||||||

Grupo Mexico SAB de CV Series B (Mexico) | 2.1 | ||||||

Indian Oil Corp., Ltd. (India) | 2.1 | ||||||

PT Telekomunikasi Indonesia Persero Tbk (Indonesia) | 2.1 | ||||||

Formosa Chemicals & Fibre Corp. (Taiwan) | 2.1 | ||||||

Nan Ya Plastics Corp. (Taiwan) | 2.1 | ||||||

CK Asset Holdings Ltd. (Hong Kong) | 2.1 | ||||||

Vale SA (Brazil) | 2.0 | ||||||

Formosa Plastics Corp. (Taiwan) | 2.0 | ||||||

Percentages indicated are based upon total investments (excluding Money Market Funds and derivatives, if any).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Country breakdown (%) (at March 31, 2019)

Brazil | 6.0 | ||||||

Chile | 4.1 | ||||||

China | 9.8 | ||||||

Colombia | 2.0 | ||||||

Hong Kong | 10.2 | ||||||

India | 12.2 | ||||||

Indonesia | 7.9 | ||||||

Kenya | 2.0 | ||||||

Malaysia | 11.9 | ||||||

Mexico | 4.1 | ||||||

Poland | 1.9 | ||||||

Qatar | 2.0 | ||||||

South Africa | 4.0 | ||||||

South Korea | 5.7 | ||||||

Taiwan | 12.2 | ||||||

Thailand | 2.0 | ||||||

United Arab Emirates | 2.0 | ||||||

Total | 100.0 | ||||||

Country Breakdown is based primarily on issuer's place of organization/incorporation. Percentages indicated are based upon total investments and excludes investments in derivatives, if any. The Fund's portfolio composition is subject to change.

Columbia ETF Trust II | Annual Report 2019

13

FUND AT A GLANCE (continued)

Columbia EM Quality Dividend ETF

Equity sector breakdown (%) (at March 31, 2019)

Communication Services | 9.9 | ||||||

Consumer Discretionary | 2.0 | ||||||

Consumer Staples | 10.0 | ||||||

Energy | 11.9 | ||||||

Financials | 19.9 | ||||||

Information Technology | 9.8 | ||||||

Materials | 18.4 | ||||||

Real Estate | 6.1 | ||||||

Utilities | 12.0 | ||||||

Total | 100.0 | ||||||

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Columbia ETF Trust II | Annual Report 2019

14

MANAGER DISCUSSION OF FUND PERFORMANCE

Columbia EM Quality Dividend ETF (HILO)

For the 12-month period that ended March 31, 2019, the Fund returned -9.01% based on net asset value (NAV) and -10.44% based on market price. The MSCI Emerging Markets Index (Net) returned -7.41%, and the Fund's Tracked Index, the Beta Advantage® Emerging Markets Quality Dividend Index, returned -7.98% during the same time period.

The Fund's NAV on March 31, 2018 was $16.00, and it ended the annual period on March 31, 2019 with an NAV of $14.10. The Fund's market price on March 31, 2019 was $14.04 per share.

Emerging market equities struggled amid escalating trade tensions and more

Emerging market equities underperformed both U.S. and developed market international equities during the annual period. The MSCI Emerging Markets Index (Net) returned -7.41% during the annual period, as compared to S&P 500 Index and MSCI EAFE Index (Net) returns of 9.50% and -3.71%, respectively, for the same time period.

Emerging market equities had a challenging start to the annual period, primarily because of escalating trade tensions between the U.S. and China, a hawkish U.S. Federal Reserve (Fed) and resultant currency pressures. Fed tightening, rising bond yields and a stronger U.S. dollar weighed on emerging market currencies. Emerging market equities declined in the third quarter of 2018 as well. The quarter started positively with political developments in Latin America. Brazilian equities initially rebounded, driven by strong earnings results and reduced political uncertainty. Positive trade rhetoric from the Mexican president-elect also boosted investor sentiment, as his inclination toward a re-negotiation of the North American Free Trade Agreement and maintaining fiscal prudence mitigated concerns. However, Chinese equities fell, as the U.S. heightened the trade conflict by threatening to impose tariffs on an additional $267 billion worth of Chinese imports in addition to those already announced. Further, U.S. sanctions and concerns around central bank policy in the face of rising inflation spurred a sell-off in Turkish assets.

Emerging equity markets, like most global equity markets, ended calendar year 2018 on a down note, led by the threat of slowing global economic growth and tightening liquidity. Emerging market equities remained particularly challenged, primarily around persistent U.S.-China trade tensions and the resultant concerns of a Chinese economic slowdown. The success of Jair Bolsonaro in the Brazilian elections brought some relief for markets as did a subsequent temporary truce in the U.S.-China trade war and the accommodative stance of the Chinese government, particularly toward the private sector. But the optimism was short-lived following the arrest of technology company Huawei's Chief Financial Officer. Asian equities broadly suffered, including the equity markets of China, South Korea, Taiwan and Hong Kong. Elsewhere, falling oil prices and geopolitical tensions dampened Russian equities, though Turkish equities rallied as political tensions began to fade.

Following on the heels of a trying year in 2018, emerging market equities, like global equities broadly, came roaring back in the first quarter of 2019. Much of the impetus for the strong equity recovery can be attributed to an abrupt change in monetary policy direction by the Fed, where its bias shifted from a tightening mode to a more dovish stance. Other contributing factors to the sharp market turnaround included a sizable fiscal and monetary stimulus program in China, which seems to have had a fairly immediate impact based on leading economic indicators, and progress made on trade talks between the U.S. and China.

Contributors and detractors

Constituents in the energy, industrials and information technology sectors detracted most from the Fund's absolute returns during the annual period. Constituents in consumer discretionary, financials and health care contributed most positively to absolute returns during the annual period.

From a country perspective, constituents in Brazil, South Africa and China detracted most from absolute returns during the annual period. Conversely, constituents in Hong Kong, Qatar and Kenya contributed most positively to the Fund's absolute returns during the annual period.

Positions in China-based acoustic components manufacturer AAC Technologies, Brazilian highway manager CCR and Brazilian energy company Ultrapar Participacoes detracted most. Each generated a double-digit negative absolute return

Columbia ETF Trust II | Annual Report 2019

15

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Columbia EM Quality Dividend ETF (HILO)

during the annual period. Positions in Qatari bank Qatar National Bank, Hong Kong-based retail real estate investment trust Link REIT and India-based technology services company Infosys contributed most positively. Each of these companies produced a double-digit absolute gain during the annual period.

The MSCI EAFE Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The index is compiled from a composite of securities markets of Europe, Australasia and the Far East and is widely recognized by investors in foreign markets as the measurement index for portfolios of non-North American securities.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure market performance of emerging markets.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

Investing involves risks, including the risk of loss of principal. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The Fund is passively managed and seeks to track the performance of an index. The Fund may not sell a poorly performing security unless it was removed from the index. There is no guarantee that the index will achieve positive returns. Risk exists that the index provider may not follow its methodology for index construction. Errors may result in a negative fund performance. The Fund's net value will generally decline when the market value of its targeted index declines. Foreign investments subject the Fund to risks, including political, economic, market, social and other risks impacting a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. These risks are enhanced for emerging or frontier market issuers. Investment in or exposure to foreign currencies subjects the Fund to currency fluctuation and risk of loss. Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. The Fund concentrates its investments in issuers of one or more particular industries to the same extent as the underlying index. Although the Fund's shares are listed on an exchange, there can be no assurance that an active, liquid or otherwise orderly trading market for shares will be established or maintained. Active market trading may increase portfolio turnover, transaction costs and tracking error to the targeted index. The Fund may have portfolio turnover, which may cause an adverse cost impact. There may be additional portfolio turnover risk as active market trading of the Fund's shares may cause more frequent creation or redemption activities that could, in certain circumstances, increase the number of portfolio transactions as well as tracking error to the Index and as high levels of transactions increase brokerage and other transaction costs and may result in increased taxable capital gains. Dividend quality is not guaranteed and the amount, if any, can vary over time. See the Fund's prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia ETF are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia ETF. References to specific securities should not be construed as a recommendation or investment advice.

Columbia ETF Trust II | Annual Report 2019

16

FUND AT A GLANCE

Columbia Emerging Markets Consumer ETF

Investment objective

Columbia Emerging Markets Consumer ETF (the Fund) seeks investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Consumer TitansTM Index.

Portfolio management

Christopher Lo, CFA

Portfolio Manager

Managed Fund since 2016

Average annual total returns (%) (for period ended March 31, 2019)

Inception | 1 Year | 5 Years | Life | ||||||||||||||||

Market Price | 09/14/10 | -13.90 | -2.33 | 2.17 | |||||||||||||||

Net Asset Value | 09/14/10 | -13.08 | -2.25 | 2.21 | |||||||||||||||

Dow Jones Emerging Markets Consumer TitansTM Index* | -12.28 | -1.20 | 3.38 | ||||||||||||||||

* As of 3/18/2019, the index name changed from Dow Jones Emerging Markets Consumer Titans 30TM Index to Dow Jones Emerging Markets Consumer TitansTM Index.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by the Fund's former investment manager or Columbia Management Investment Advisers, LLC (Columbia Management or the Investment Manager). Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting columbiathreadneedleus.com/etfs.

Columbia Management took over portfolio management in September 2016 upon its acquisition of the Fund's previous investment manager.

The price used to calculate Market Price return is based on the midpoint of the 4:00 PM Eastern (U.S.) bid/ask spread on the NYSE and does not represent returns an investor would receive if shares were traded at other times.

The Fund's shares may trade above or below their net asset value. The net asset value of the Fund will generally fluctuate with changes in the market value of the Fund's holdings. The market prices of shares, however, will generally fluctuate in accordance with changes in net asset value as well as the relative supply of, and demand for, shares on the exchange. The trading price of shares may deviate significantly from the net asset value.

The Dow Jones Emerging Markets Consumer TitansTM Index is a free-float market capitalization-weighted index that measures the performance of 60 leading emerging market companies in the Consumer Discretionary, Consumer Staples, and Communication Services sectors as defined by the S&P Dow Jones Indexes.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia ETF Trust II | Annual Report 2019

17

FUND AT A GLANCE (continued)

Columbia Emerging Markets Consumer ETF

Performance of a hypothetical $10,000 investment (September 14, 2010 — March 31, 2019)

The chart above shows the change in value of a hypothetical $10,000 investment made on the Fund's inception, and does not reflect the deduction of taxes or brokerage commissions that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Top ten holdings (%) (at March 31, 2019)

Tencent Holdings, Ltd. (China) | 5.0 | ||||||

Alibaba Group Holding, Ltd. ADR (China) | 4.9 | ||||||

China Mobile, Ltd. (China) | 4.9 | ||||||

Baidu, Inc. ADR (China) | 4.8 | ||||||

Hindustan Unilever, Ltd. (India) | 4.7 | ||||||

Chunghwa Telecom Co., Ltd. (Taiwan) | 3.9 | ||||||

Uni-President Enterprises Corp. (Taiwan) | 3.5 | ||||||

ITC, Ltd. (India) | 3.3 | ||||||

Maruti Suzuki India, Ltd. (India) | 3.1 | ||||||

JD.com, Inc. ADR (China) | 3.0 | ||||||

Percentages indicated are based upon total investments (excluding Money Market Funds and derivatives, if any).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Country breakdown (%) (at March 31, 2019)

Brazil | 7.2 | ||||||

Chile | 1.5 | ||||||

China | 42.8 | ||||||

Hong Kong | 0.4 | ||||||

India | 16.6 | ||||||

Indonesia | 3.2 | ||||||

Mexico | 3.6 | ||||||

Russia | 4.5 | ||||||

South Africa | 4.5 | ||||||

Taiwan | 10.6 | ||||||

Thailand | 3.8 | ||||||

United Arab Emirates | 0.9 | ||||||

United States(a) | 0.4 | ||||||

Total | 100.0 | ||||||

Country Breakdown is based primarily on issuer's place of organization/incorporation. Percentages indicated are based upon total investments and excludes investments in derivatives, if any. The Fund's portfolio composition is subject to change.

(a) Includes investments in Money Market Funds.

Columbia ETF Trust II | Annual Report 2019

18

FUND AT A GLANCE (continued)

Columbia Emerging Markets Consumer ETF

Equity sector breakdown (%) (at March 31, 2019)

Communication Services | 39.2 | ||||||

Consumer Discretionary | 30.9 | ||||||

Consumer Staples | 29.9 | ||||||

Total | 100.0 | ||||||

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Columbia ETF Trust II | Annual Report 2019

19

MANAGER DISCUSSION OF FUND PERFORMANCE

Columbia Emerging Markets Consumer ETF (ECON)

Effective prior to the market open on March 18, 2019, the Fund's benchmark, the Dow Jones Emerging Markets Consumer Titans 30TM Index changed its name to the Dow Jones Emerging Markets Consumer TitansTM Index and modified its construction criteria to more effectively and comprehensively capture the emerging market consumer theme while limiting geographic and single stock concentration. The revised Dow Jones Emerging Markets Consumer TitansTM Index is designed to measure the performance of 60 leading emerging market companies classified in the GICS consumer discretionary, consumer staples and communication services sectors.

For the 12-month period that ended March 31, 2019, the Fund returned -13.08% based on net asset value (NAV) and -13.90% based on market price. The Dow Jones Emerging Markets Consumer TitansTM Index returned -12.28%, during the same time period.

The Fund's NAV on March 31, 2018 was $26.34, and it ended the annual period on March 31, 2019 with an NAV of $22.67. The Fund's market price on March 31, 2019 was $22.60 per share.

Emerging market equities struggled amid escalating trade tensions and more

Emerging market equities underperformed both U.S. and developed market international equities during the annual period. The MSCI Emerging Markets Index (Net) returned -7.41% during the annual period, as compared to S&P 500 Index and MSCI EAFE Index (Net) returns of 9.50% and -3.71%, respectively, for the same time period.

Emerging market equities had a challenging start to the annual period, primarily because of escalating trade tensions between the U.S. and China, a hawkish U.S. Federal Reserve (Fed) and resultant currency pressures. Fed tightening, rising bond yields and a stronger U.S. dollar weighed on emerging market currencies. Emerging market equities declined in the third quarter of 2018 as well. The quarter started positively with political developments in Latin America. Brazilian equities initially rebounded, driven by strong earnings results and reduced political uncertainty. Positive trade rhetoric from the Mexican president-elect also boosted investor sentiment, as his inclination toward a re-negotiation of the North American Free Trade Agreement and maintaining fiscal prudence mitigated concerns. However, Chinese equities fell, as the U.S. heightened the trade conflict by threatening to impose tariffs on an additional $267 billion worth of Chinese imports in addition to those already announced. Further, U.S. sanctions and concerns around central bank policy in the face of rising inflation spurred a sell-off in Turkish assets.

Emerging equity markets, like most global equity markets, ended calendar year 2018 on a down note, led by the threat of slowing global economic growth and tightening liquidity. Emerging market equities remained particularly challenged, primarily around persistent U.S.-China trade tensions and the resultant concerns of a Chinese economic slowdown. The success of Jair Bolsonaro in the Brazilian elections brought some relief for markets as did a subsequent temporary truce in the U.S.-China trade war and the accommodative stance of the Chinese government, particularly toward the private sector. But the optimism was short-lived following the arrest of technology company Huawei's Chief Financial Officer. Asian equities broadly suffered, including the equity markets of China, South Korea, Taiwan and Hong Kong. Elsewhere, falling oil prices and geopolitical tensions dampened Russian equities, though Turkish equities rallied as political tensions began to fade.

Following on the heels of a trying year in 2018, emerging market equities, like global equities broadly, came roaring back in the first quarter of 2019. Much of the impetus for the strong equity recovery can be attributed to an abrupt change in monetary policy direction by the Fed, where its bias shifted from a tightening mode to a more dovish stance. Other contributing factors to the sharp market turnaround included a sizable fiscal and monetary stimulus program in China, which seems to have had a fairly immediate impact based on leading economic indicators, and progress made on trade talks between the U.S. and China.

Columbia ETF Trust II | Annual Report 2019

20

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Columbia Emerging Markets Consumer ETF (ECON)

Contributors and detractors

Constituents in the consumer discretionary, consumer staples and energy sectors detracted most from the Fund's absolute returns during the annual period. Constituents in information technology, financials and health care contributed most positively to the Fund's absolute returns during the annual period.

From a country perspective, constituents in South Africa, Brazil and China detracted most from absolute returns during the annual period. Conversely, constituents in Indonesia, Taiwan and United Arab Emirates contributed most positively to the Fund's absolute returns during the annual period.

Positions in Brazilian beverage producer and distributor Ambev, India-based auto manufacturer Tata Motors and South African consumer staples retailer Shoprite Holdings detracted most. Each of these companies produced a double-digit negative absolute return during the annual period. Positions in China-based educational services provider Tal Education Group, India-based consumer products manufacturer Hindustan Unilever and India-based diversified consumer products company ITC contributed most positively. Each generated a double-digit absolute gain during the annual period.

The MSCI EAFE Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The index is compiled from a composite of securities markets of Europe, Australasia and the Far East and is widely recognized by investors in foreign markets as the measurement index for portfolios of non-North American securities.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure market performance of emerging markets.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

Investing involves risks, including the risk of loss of principal. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The Fund is passively managed and seeks to track the performance of an index. The Fund may not sell a poorly performing security unless it was removed from the index. There is no guarantee that the index will achieve positive returns. Risk exists that the index provider may not follow its methodology for index construction. Errors may result in a negative fund performance. The Fund's net value will generally decline when the market value of its targeted index declines. Foreign investments subject the Fund to risks, including political, economic, market, social and other risks impacting a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. These risks are enhanced for emerging or frontier market issuers. Investment in or exposure to foreign currencies subjects the Fund to currency fluctuation and risk of loss. Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. The Fund concentrates its investments in issuers of one or more particular industries to the same extent as the underlying index. Although the Fund's shares are listed on an exchange, there can be no assurance that an active, liquid or otherwise orderly trading market for shares will be established or maintained. Active market trading may increase portfolio turnover, transaction costs and tracking error to the targeted index. The Fund may have portfolio turnover, which may cause an adverse cost impact. There may be additional portfolio turnover risk as active market trading of the Fund's shares may cause more frequent creation or redemption activities that could, in certain circumstances, increase the number of portfolio transactions as well as tracking error to the Index and as high levels of transactions increase brokerage and other transaction costs and may result in increased taxable capital gains. See the Fund's prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia ETF are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia ETF. References to specific securities should not be construed as a recommendation or investment advice.

Columbia ETF Trust II | Annual Report 2019

21

FUND AT A GLANCE

Columbia India Consumer ETF

Investment objective

Columbia India Consumer ETF (the Fund) seeks investment results that correspond (before fees and expenses) to the price and yield performance of the Indxx India Consumer Index.

Portfolio management

Christopher Lo, CFA

Portfolio Manager

Managed Fund since 2016

Average annual total returns (%) (for period ended March 31, 2019)

Inception | 1 Year | 5 Years | Life | ||||||||||||||||

Market Price | 08/10/11 | -8.44 | 11.34 | 10.32 | |||||||||||||||

Net Asset Value | 08/10/11 | -8.03 | 11.30 | 10.27 | |||||||||||||||

Indxx India Consumer Index | -6.72 | 12.93 | 11.91 | ||||||||||||||||

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by the Fund's former investment manager or Columbia Management Investment Advisers, LLC (Columbia Management or the Investment Manager). Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting columbiathreadneedleus.com/etfs.

Columbia Management took over portfolio management in September 2016 upon its acquisition of the Fund's previous investment manager.

The price used to calculate Market Price return is based on the midpoint of the 4:00 PM Eastern (U.S.) bid/ask spread on the NYSE and does not represent returns an investor would receive if shares were traded at other times.

The Fund's shares may trade above or below their net asset value. The net asset value of the Fund will generally fluctuate with changes in the market value of the Fund's holdings. The market prices of shares, however, will generally fluctuate in accordance with changes in net asset value as well as the relative supply of, and demand for, shares on the exchange. The trading price of shares may deviate significantly from the net asset value.

The Indxx India Consumer Index is a maximum 30-stock free-float adjusted market capitalization weighted index designed to measure the market performance of companies in the consumer industry in India as defined by Indxx's proprietary methodology. The index consists of common stocks listed on the primary exchange of India.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia ETF Trust II | Annual Report 2019

22

FUND AT A GLANCE (continued)

Columbia India Consumer ETF

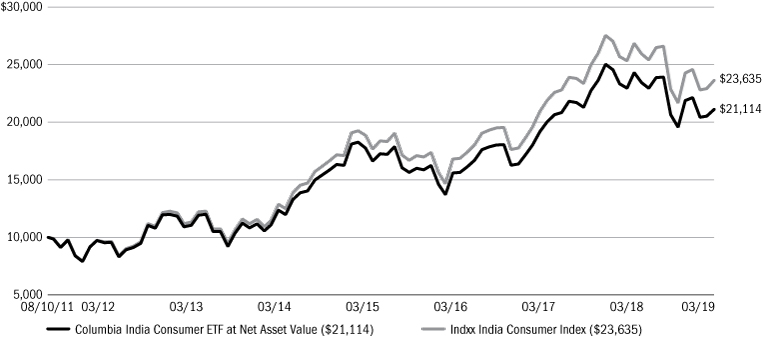

Performance of a hypothetical $10,000 investment (August 10, 2011 — March 31, 2019)

The chart above shows the change in value of a hypothetical $10,000 investment made on the Fund's inception, and does not reflect the deduction of taxes or brokerage commissions that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Top ten holdings (%) (at March 31, 2019)

Nestle India, Ltd. | 5.3 | ||||||

Titan Co., Ltd. | 5.3 | ||||||

ITC, Ltd. | 5.0 | ||||||

Britannia Industries Ltd. | 4.9 | ||||||

Mahindra & Mahindra, Ltd. | 4.9 | ||||||

Hindustan Unilever, Ltd. | 4.9 | ||||||

Bajaj Auto, Ltd. | 4.8 | ||||||

Tata Motors, Ltd. | 4.7 | ||||||

Maruti Suzuki India, Ltd. | 4.7 | ||||||

Eicher Motors, Ltd. | 4.6 | ||||||

Percentages indicated are based upon total investments (excluding Money Market Funds and derivatives, if any).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Equity sector breakdown (%) (at March 31, 2019)

Consumer Discretionary | 54.3 | ||||||

Consumer Staples | 45.7 | ||||||

Total | 100.0 | ||||||

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Columbia ETF Trust II | Annual Report 2019

23

MANAGER DISCUSSION OF FUND PERFORMANCE

Columbia India Consumer ETF (INCO)

For the 12-month period that ended March 31, 2019, the Fund returned -8.03% based on net asset value (NAV) and -8.44% based on market price. The Indxx India Consumer Index returned -6.72% during the same time period.

The Fund's NAV on March 31, 2018 was $45.81, and it ended the annual period on March 31, 2019 with an NAV of $42.08. The Fund's market price on March 31, 2019 was $42.23 per share.

Indian equities gained despite rising crude prices and financial sector concerns

The Indian equity market enjoyed solid returns during the annual period despite rising crude oil prices and financial sector concerns. The MSCI India Index returned 6.75% for the annual period, significantly outperforming the -7.41% return of the MSCI Emerging Markets Index (Net). Still, there were challenges. Brent crude oil rose to as high as $85 per barrel in October 2018, the highest level seen since November 2014. This increase was a result of the Organization of Petroleum Exporting Countries (OPEC) refusing to ramp up production, and the U.S. persuading buyers to cut down imports of Iranian oil. As the world's third largest oil importer, India faced the brunt of the rising crude oil prices, a situation exacerbated by a depreciating rupee. The annual period also saw a major liquidity issue surrounding Infrastructure Leasing and Financial Services, an Indian infrastructure development and finance company. The lender defaulted on its short-term commercial papers, which rocked the debt market. Throughout September and October 2018, the Indian equity market declined substantially on the back of non-banking financial company sector liquidity fears. Further pressuring investor sentiment was Finance Minister Arun Jaitley re-introducing a long-term capital gains tax and levying a tax on profits generated from assets such as shares and share-oriented products. On the positive side, Indian Prime Minister Narendra Modi's government released on February 1, 2019 its last budget before the April 2019 general elections. It focused on supporting farmers and those economically less privileged, while continuing its push toward better physical and social infrastructure. India's general election was scheduled to begin on April 11, 2019, and after seven phases, the results are anticipated to be reported on May 23. Campaign promises of both Modi's Bharatiya Janata Party (BJP) and Gandhi's Indian National Congress include increased spending to provide income support to the poor and to farmers. Also, BJP has pledged to spend significant monies on infrastructure. If campaign promises are implemented, such spending should help support demand in consumer-oriented sectors.

Importantly, the fundamentals for India and its economy remained strong during the annual period. Its policy-driven, largely domestic-based economic growth, in synchronization with global economic growth, provided a tailwind for its equity market performance.

Contributors and detractors

Constituents in consumer discretionary, information technology and energy detracted most from the Fund's absolute returns during the annual period. Consumer staples, materials and utilities contributed most positively to the Fund's absolute returns during the annual period.

Positions in auto manufacturer Maruti Suzuki India, motorcycle manufacturer Hero MotoCorp and auto manufacturer Tata Motors detracted most. Each generated a double-digit negative absolute return during the annual period. Positions in food products manufacturer Nestle India, diversified consumer products manufacturer Hindustan Unilever and jewelry manufacturer and retailer and perfume producer Titan contributed most positively. Each of these companies produced a double-digit absolute gain during the annual period.

The MSCI Emerging Markets Index (Net) is a free float-adjusted market capitalization index that is designed to measure market performance of emerging markets.

The MSCI India Index is designed to measure the performance of the large and mid-cap segments of the Indian market. With 79 constituents, the index covers approximately 85% of the Indian equity universe.

Investing involves risks, including the risk of loss of principal. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The Fund is passively managed and seeks to track the performance of an index. The Fund may not sell a poorly performing security unless it was removed from the index. There is no guarantee that the index will achieve positive returns. Risk exists that the index provider may not follow its methodology for index construction. Errors may result in a negative fund performance. The Fund's net value will generally decline when the market value

Columbia ETF Trust II | Annual Report 2019

24

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Columbia India Consumer ETF (INCO)