Subsequent to the execution of the agreement with ACG, the Company was presented with the opportunity to include the Ruby Project within the scope of an existing USCIS-approved EB-5 Regional Center, and with the goal of expediting the approval process for the Ruby Project by USCIS, the Company, together with ACG, has entered into a Memorandum of Understanding with an existing Regional Center, the Northern California Regional Center, LLC ("NCRC"). NCRC has agreed to expand the scope of its USCIS-approved designation to include mining projects in the counties of Sierra and Nevada in Northern California, and together with ACG has agreed to sponsor North Bay's application to obtain $7.5 million through the EB-5 Program for the Ruby Project in Sierra County, California.

NCRC was approved on April 22, 2010 by USCIS as a designated EB-5 Regional Center, and is currently approved to sponsor qualifying investments in such capacity within the Northern California counties of Colusa, Butte, Glenn, Sacramento, San Joaquin, Shasta, Sutter, Tehama, Yuba and Yolo. Pursuant to its regional center designation, NCRC may sponsor qualifying investments in certain industry economic sectors that do not currently include mining. The Memorandum of Understanding provides that NCRC will seek USCIS approval for an expansion of NCRC’s Regional Center Geographic Area (the “Expansion”) to include the counties of Nevada and Sierra, where the Ruby Mine is located, and for approval to include mining within its designated industry sectors (the “Mining Designation”).

The applications and all supporting documentation required by USCIS were filed by NCRC in January, 2011. In July, 2011, NCRC received formal approval by USCIS for the expansion of the Regional Center, and the inclusion of the Ruby Mine as a qualified EB-5 project.

With the approval of the Expansion and Mining Designation by USCIS, NCRC is now permitted to sponsor qualified investments in North Bay’s Ruby Project under the EB-5 Program. The Memorandum of Understanding provides that NCRC will receive a $5,000 administrative fee to be paid by each investor independent of the investor’s minimum EB-5 investment of $500,000. In addition, upon the Ruby Project receiving the aggregate sum of $7,500,000 through the EB-5 Program, NCRC shall be entitled to an undivided one and one half percent (1.5%) interest in the Ruby Project. No shares of Company stock have been or will be issued in connection with this agreement, and the entire EB-5 funding is expected to be non-dilutive to shareholders. While a new Regional Center remains a long-term goal of North Bay and ACG, the agreement to bring the Ruby Project within the scope of a pre-existing Regional Center is seen by the Company as the most efficient and expeditious way to complete funding for the Ruby Project through the EB-5 Program in the near-term. This is an arms-length agreement, and neither the Company nor any of its officers or directors has any ownership position or pre-existing relationship with NCRC.

Procedurally, once USCIS has approved the Ruby Project, regardless of whether under the auspices of NCRC’s Regional Center or a new Regional Center owned by North Bay and ACG, the Regional Center will organize a limited partnership (“LP”) that will be made up of the foreign investors, as limited partners, each of whom will subscribe to a Regulation S offering and purchase a unit in the LP at the purchase price of $500,000. Each investor will complete and deliver to the LP a subscription agreement, and will pay a minimum of $500,000 into an escrow account, which will be held in escrow until the investor’s I-526 petition filed with USCIS has been either approved or denied by USCIS. If the investor’s I-526 petition is denied by USCIS the Escrow Agent will return the investor’s funds to the investor. If the I-526 petition is approved the Escrow Agent will pay the investment to the LP. As each new investor's I-526 petition is approved by USCIS and funds are released from escrow, the LP will then loan the funds to the Ruby Project.

To facilitate receipt by the Ruby Project of EB-5 funding from the investor LP and to comply with USCIS requirements, the Ruby Project must be organized as an original business and a new enterprise under the EB-5 Program. Accordingly, North Bay and ACG have therefore jointly organized an appropriate special purpose entity as a limited liability company domiciled in California called Ruby Gold, LLC (the "JV") that will own and operate the Ruby Project. The initial ownership/membership interest in the JV will be held 60% by North Bay and 40% by ACG. Once approved by USCIS, it is expected that the EB-5 funding for the Ruby Project will then come from the investor LP in the form of a loan to the JV.

Governance of the JV shall be through a board of directors (the "JV Board"). The appointment of the members of the JV Board shall be allocated between North Bay and ACG on a pro rata basis of their ownership/membership interest in the JV, provided however, that from the date on which the JV is organized and at all times subsequent thereto, at least one member of the JV Board shall be appointed by ACG. The operating agreement of the JV shall provide that the number of members of the JV Board shall be adjusted from time to time so as to reflect North Bay's and ACG's respective ownership/membership interest in the JV. Additionally, the operating agreement of the JV shall provide that if the initial capital contributions made by the owner/members of the JV shall not be sufficient to operate the Ruby Project, then any such required or desired capital shall be satisfied by the JV borrowing such capital.

As determined by the agreement with ACG dated July 28, 2010, net income from the Ruby Project is to be distributed as follows: (a) until the first $3,000,000 of the EB-5 Financing is returned to the EB-5 investors, 80% of the net profits from the Ruby Project will be returned to the EB-5 investors and 20% will be distributed to the owners of the JV; (b) after the first $3,000,000 of the EB-5 Financing is returned to the EB-5 investors and until the entire amount of the EB-5 Financing has been returned to the EB-5 investors, 70% of the net profits from the Ruby Project will be returned to the EB-5 investors and 30% will be distributed to the owners of the JV; (c) after the entire amount of the EB-5 Financing has been returned to the EB-5 investors, 100% of the net profits from the Ruby Project will be distributed to the owners of the JV. By virtue of the loan covenant dated September 27, 2010 with Tangiers and the Memorandum of Understanding dated October 14, 2010 with NCRC, the interests of Tangiers (0.75%) and NCRC (1.5%) are included in the net profit distributions to the owners of the JV. The loan from Tangiers was satisfied and retired in the first quarter of 2011, but the profit interest agreed to and described herein remains in effect.

The Company notes that its intention to utilize EB-5 funding is a matter of economics and the success of the Ruby Project itself is not exclusively contingent on the EB-5 financing heretofore disclosed. Unless and until all of the milestones related to USCIS approvals for EB-5 are achieved and funds are received, the Company may elect to accept alternative funding should a suitable funding source be identified and acceptable terms negotiated. As of the date of this prospectus, the EB-5 funding remains pending, the Company has not received any funding through the EB-5 program, and there is no guarantee that it will be completed. Accordingly, given the length of time this process has been ongoing, as of the date of this prospectus the Company has elected to proceed on its own by funding the project through loans and stock issuances.

On December 2, 2013, the Board of Directors authorized the spinoff of RGI as a separate and independent public company by distributing shares of RGI’s common stock to North Bay shareholders based on a date and at a ratio yet to be determined. Other than the authorization for said spinoff by our Board of Directors and the Board of RGI, there are no agreements, formal or otherwise, in place between the respective companies, any affiliate of either company, or any other parties governing the spinoff, and no shareholder approvals are required. On the same date, the Board of Directors of RGI authorized the formalization of a joint-venture agreement between the Company and RGI with regard to Ruby on a 50/50 profit-sharing basis. On January 14, 2014, RGI filed a registration statement on Form 10 with the SEC to initiate said spinoff. On March 10, 2014, RGI withdrew the Form 10 after discussions with the SEC and expects to file a registration statement on Form S-1 to register 120 million shares of RGI as the stock dividend to be issued to our shareholders in the spinoff, which amounts to 40% of the issued and outstanding shares of RGI common stock currently owned by North Bay. Accordingly, as the completion of the spinoff is contingent on a registration statement by RGI becoming effective, no determination has yet been made as to whether or not the stock dividend will be tax-free, there has been no further determination as to when the spinoff and stock dividend distribution might be completed, and there is no guarantee that it will be completed.

On June 4, 2013, the Company executed a Memorandum of Understanding (the “June 2013 Agreement”) with a private US investor (the “June 2013 Investor”) for an advance sale of up to 120 ounces of specimen gold from the Ruby Mine in Sierra County, California. The price paid in advance by the June 2013 Investor shall be at a ten percent (10%) discount to the then-current spot price of gold on the day the gold is produced and made available for shipment (the “June 2013 Delivery Date”). The June 2013 Investor will acquire the right to purchase the gold at their discretion. Upon signing the June 2013 Agreement, the Company received an initial cash advance of $150,000 (the “June 2013 Advance”), which is based on a 10% discount to the current spot price of gold, for delivery of the first 120 ounces of specimen gold produced from the Ruby Mine on or before February 1, 2014. The June 2013 Advance paid will be applied to the amount due to the Company on the June 2013 Delivery Date, as determined by the then-current spot price of gold on the June 2013 Delivery Date. In the event that 120 ounces of specimen gold is not available for delivery by February 1, 2014, the June 2013 Investor will be entitled to be repaid the June 2013 Advance in cash plus 10% interest equal to $165,000 total, with an option to still purchase the same amount of gold at a discount of 10% to the then-current spot price of gold when the specimen gold becomes available for delivery at a later date As of the date of this prospectus, the Company has repaid the entire cash advance plus interest in a cash payment of $165,000. As per the terms of the agreement, the investor still retains the right to again purchase the 120 ounces of gold at a future date..

On August 2, 2013, the Company executed a Memorandum of Understanding (the “August 2013 Agreement”) with a second private US investor (the “August 2013 Investor”) for an advance sale of up to 40 ounces of specimen gold from the Ruby Mine in Sierra County, California. The price paid in advance by the August 2013 Investor shall be at a ten percent (10%) discount to the then-current spot price of gold on the day the gold is produced and made available for shipment (the “August 2013 Delivery Date”). The August 2013 Investor will acquire the right to purchase the gold at their discretion. Upon signing the Agreement, the Company received an initial cash advance of $50,000 (the “August 2013 Advance”), which is based on a 10% discount to the current spot price of gold, for delivery of 40 ounces of specimen gold produced from the Ruby Mine on or before April 2, 2014. The August 2013 Advance paid will be applied to the amount due to the Company on the August 2013 Delivery Date, as determined by the then-current spot price of gold on the Delivery Date. In the event that 40 ounces of specimen gold is not available for delivery by April 2, 2014, the August 2013 Investor will be entitled to be repaid the August 2013 Advance in cash plus 10% interest equal to $55,000 total, with an option to still purchase the same amount of gold at a discount of 10% to the then-current spot price of gold when the specimen gold becomes available for delivery at a later date

On November 1, 2011, the Company agreed to option the Taber Mine in Sierra County, California, for a period of up to nine months, during which time the Company will continue to conduct further due diligence. On July 11, 2012, the Company executed an amendment to the Taber Mine Option Agreement to extend the option for one additional year. The consideration to be paid during the term of the option is $2,000 per month. Should the Company elect to exercise the option, the parties will then enter into a definitive lease agreement, with an optional buyout provision. As of the date of this prospectus, the term of the option has expired, and the Company has elected not to renew it.

Our CEO, Mr. Perry Leopold owns 100 shares of the Company’s Series I Preferred Stock. Each outstanding share of the Series I Preferred Stock represents its proportionate share of eighty per cent (80%) of all votes entitled to be voted and which is allocated to the outstanding shares of Series I Preferred Stock and therefore Mr. Leopold is able to control the outcome of most corporate matters on which our shareholders are entitled to vote. These shares are not convertible into common stock or any commodities. The Series I Preferred Stock was issued in February 2007. These shares were issued to our Chief Executive Officer, Mr. Perry Leopold, in February 2007 as an anti-takeover measure to insure that Mr. Leopold maintains control of the Company during periods when the Company’s stock may be severely undervalued and subject to hostile takeover in the open market. As specified in the Certificate of Designation filed by the Company with the Delaware Secretary of State in February 2007, the outstanding shares of Series I Preferred Stock shall vote together with the shares of Common Stock of the Corporation as a single class and, regardless of the number of shares of Series I Preferred Stock outstanding and as long as at least one of such shares of Series I Preferred Stock is outstanding, shall represent eighty percent (80%) of all votes entitled to be voted at any annual or special meeting of shareholders of the Corporation or action by written consent of shareholders. Each outstanding share of the Series I Preferred Stock shall represent its proportionate share of the 80% which is allocated to the outstanding shares of Series I Preferred Stock”.

Our headquarters are located at 2120 Bethel Road, Lansdale, PA 19446, with a mailing address of PO Box 162, Skippack, PA 19474. Our website is located at www.northbayresources.com. Our telephone number is (215) 661-1100.

Going Concern

Our consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has generated modest revenues since inception and has never paid any dividends and is unlikely to pay dividends. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploration of economically recoverable reserves in its resource properties, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. The Company has had very little operating history to date. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

We have experienced recurring net losses from operations, which losses have caused an accumulated deficit of $15,535,153 as of December 31, 2013. In addition, we have a working capital deficit of $3,249,806 as of December 31, 2013. We had net losses of $2,059,305 and $2,119,706 for the years ended December 31, 2013 and 2012, respectively. These factors, among others, raise substantial doubt about our ability to continue as a going concern. If we are unable to generate profits and are unable to continue to obtain financing to meet our working capital requirements, we may have to curtail our business sharply or cease operations altogether. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis to retain our current financing, to obtain additional financing, and, ultimately, to attain profitability. Should any of these events not occur, we will be adversely affected and we may have to cease operations.

As of December 31, 2013 the accumulated deficit attributable to CEO stock awards, including previous management, and valued according to GAAP, totals $2,558,535 since inception in 2004. As of December 31, 2013 the accumulated deficit attributable to CEO compensation is $820,474 in deferred compensation. This reflects the total amounts unpaid as per the management agreement with The PAN Network dating back to January 2006, less any amounts actually paid or forgiven since 2006. These totals are non-cash expenses which are included in the accumulated deficit since inception. Actual CEO compensation paid in cash over the course of the seven years since 2006 consists of $10,000 in 2006, $50,764 in 2007, $23,139 in 2008, $29,979 in 2009, $21,988 in 2010, $90,000 in 2011, $116,000 in 2012, and $100,000 in 2013. These cash expenditures are also included in the accumulated deficit.

The ongoing execution of our business plan is expected to result in operating losses over the next twelve months. Management believes it will need to raise capital through loans or stock issuances in order to have enough cash to maintain its operations for the next twelve months. There are no assurances that we will be successful in achieving our goals of obtaining cash through loans, stock issuances, or increasing revenues and reaching profitability.

In view of these conditions, our ability to continue as a going concern is dependent upon our ability to meet our financing requirements, and to ultimately achieve profitable operations. Management believes that its current and future plans provide an opportunity to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that may be necessary in the event we cannot continue as a going concern.

| Securities Being Offered by Selling Stockholder | Up to 29,463,118 shares of our common stock. |

| | |

| Offering Price | The selling shareholder will sell our common stock at prevailing market prices or privately negotiated prices. |

| | |

| Terms of the Offering | The selling shareholder will determine when and how it will sell the common stock offered in this prospectus. |

| | |

| Risk Factors | The securities offered hereby involve a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors.” |

| | |

| Common Stock Outstanding before Offering | 152,531,443 shares of our common stock are issued and outstanding as of the date of this prospectus. |

| | |

Common Stock Outstanding after Offering (1) | 181,994,561shares of common stock. |

| | |

| Use of Proceeds | The selling stockholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. Accordingly, we will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive up to $883,894 in proceeds from the sale of our common stock to the selling stockholder from the shares covered herein and sold to the selling stockholder under the Securities Purchase Agreement described below. Any proceeds that we receive under the purchase agreement are expected to be used for general working capital purposes. |

| | |

| OTCQB Market Symbol | NBRI |

| | |

| (1) | Assumes the issuance to the selling stockholder of all shares being registered herein under the Securities Purchase Agreement. |

This offering relates to the resale of 29,463,118 shares of our common stock, par value of $0.001, by the selling stockholder, Tangiers Investors LP (“Tangiers”). The Company will receive proceeds from the sale of our common stock to Tangiers under the Securities Purchase Agreement entered into with the selling stockholder on October 7, 2009 and amended on July 24, 2013 (“Securities Purchase Agreement”).

Pursuant to the Securities Purchase Agreement, we may, at our sole discretion, periodically issue and sell to Tangiers shares of our common stock for a total aggregate purchase price of $10,000,000. We have previously registered 45,094,833 shares under this facility, of which 19,651,471 shares were issued between January 24, 2011 and April 25, 2013, at an aggregate average price per share of $0.065, and 25,365,768 shares were issued between September 11, 2013 and February 26, 2014 at an aggregate average price per share of $0.03. During the second quarter of fiscal 2013, we discovered certain shares of the 19,651,471 shares registered in 2011 were inadvertently offered and sold without registration under the Securities Act, as amended, during the period from October 24, 2011 through April 25, 2013. A more detailed discussion is included in Note 10 of the audited Financial Statements on page 117 and in the Risk Factor on page 18. We have deregistered the remaining shares from our previous registration statement by filing a post-effective amendment to the registration statement. Under this registration statement on Form S-1 (“Registration Statement”), we are only registering 29,463,118 additional shares of our common stock. We will issue additional shares to Tangiers, at our option, in order to continue to receive advances under the Securities Purchase Agreement. If additional shares are issued, they will be covered by future registration statements. The registration statement of which this Prospectus is a part of must be declared effective prior to us being able to issue those additional shares to Tangiers so that we may obtain further cash advances under the Securities Purchase Agreement.

Pursuant to the Securities Purchase Agreement, the dollar amount of each advance is based upon the average daily trading volume in dollar amount during the ten (10) trading days preceding the advance notice date (the “Base Amount”). For each share of common stock purchased under the Securities Purchase Agreement, Tangiers will pay us 90% of the lowest volume weighted average price (“VWAP”) of the Company's common stock as quoted by Bloomberg, LP on other principal market on which the Company's common stock is traded for the five days immediately following the notice date (the “Market Price”). Any advance notice that exceeds the Base Amount by up to 200% will be further discounted by 7.5% (or 82.5% of the Market Price), and any advance notice in excess of 200% and up to 300% of the Base Amount will be further discounted by an additional 7.5% (or 75% of the Market Price). The price paid by Tangiers for the Company's stock shall be determined as of the date of each individual request for an Advance under the Securities Purchase Agreement. Tangiers’ obligation to purchase shares of the Company's common stock under the Securities Purchase Agreement is subject to certain conditions, including the Company obtaining an effective registration statement for shares of the Company's common stock sold under the Securities Purchase Agreement, and is limited to a maximum of $250,000 per ten consecutive trading days after the advance notice is provided to Tangiers. The Securities Purchase Agreement shall terminate and Tangiers shall have no further obligation to make advances under the Securities Purchase Agreement at the earlier of the passing of 60 months after the date that the Securities and Exchange Commission declares the Company’s registration statement effective or the Company receives advances from Tangiers equal to $10,000,000. Upon the execution of the Securities Purchase Agreement, Tangiers received a one-time commitment fee in October 2009 equal to $85,000 of the Company's common stock divided by the lowest volume weighted average price of the Company's common stock during the 10 business days immediately following the date of the Securities Purchase Agreement, as quoted by Bloomberg, LP.

By way of example, the following table illustrates the total share issuance from a hypothetical $50,000 draw request (“Advance Notice”) where the Base Amount preceding the Advance Notice has been tabulated to be $20,000, and the VWAP during the 5 day period following the Advance Notice is determined to be $0.05. The Base Amount for this hypothetical draw request is thus $20,000, which at a 10% discount of the Market Price of $0.05 per share will set the issuance price at $0.045 and will result in 444,444 shares being issued. The amount that is more than 100% of the Base Amount but less than or equal to 200% of the Base Amount (Tier 1) is $20,000, which at a 17.5% discount of the Market Price results in an additional 484,849 shares being issued. The amount that is greater than 200% of the Base Amount (Tier 2) is $10,000, which at a 25% discount to the Market Price results in an additional 266,667 shares being issued, for a total issuance on this example $50,000 draw request of 1,195,960 shares.

| | | Draw Request | | | 10-day Avg $ Volume (Base Amount) | | | Tier Split (Base / Tier 1 / Tier 2) | | | Low VWAP During 5-day Pricing Period | | | Discount | | | Tier Price | | | Shares Issued | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Our common stock is recently trading around $0.04 per share. If this price is maintained, of which there is no assurance, our shares will be issued to Tangiers at a minimum of $0.03 (25% discount) to a maximum of 0.036 (10% discount) per share, depending on the amount of each draw request. As of the date of this prospectus, $2,041,800 has been drawn from this facility since January 24, 2011, leaving $7,958,200 remaining to be drawn if the entire $10,000,000 available to us is to be received. Therefore, assuming said minimum price and including the amount already received, we will need to register as many as 193,755,556 additional shares of our common stock in order to obtain the full $10,000,000 available to us under the Securities Purchase Agreement as of the date of this prospectus. We are only registering 29,463,118 on this Registration Statement. The total amount of 29,463,118 shares of our common stock will be issued to Tangiers in order to obtain the funds available to us under the Securities Purchase Agreement. We will be required to file other registration statements if we intend to obtain the full amount of funds available to us under the Securities Purchase Agreement. If we issue to Tangiers all 29,463,118 shares of our common stock at the current stock price we will only be able to receive approximately $883,894 in net proceeds after the minimum discount of 10% is applied and after deducting expenses related to filing this registration statement. This Registration Statement must be declared effective prior to us being able to issue those additional shares to Tangiers so that we may obtain cash advances under the Securities Purchase Agreement.

As of the date of this prospectus, the shares of common stock to be issued in order to receive advances under the Securities Purchase Agreement upon issuance would equal approximately 19.33% of our outstanding common stock.

The shares of our common stock being offered for resale by the selling security holder are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. The risks and uncertainties described below are not exclusive. Additional risks and uncertainties not presently known or that the Company currently deems immaterial may also impair operations. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. As one of our stockholders, you will be subject to the risks inherent in our business. In such case, the trading price of our common stock could decline and you may lose all or part of your investment. As of the date of this prospectus, our management is aware of the following material risks and we have included all known material risks in this section:

Risks Related To Our Business

We have been the subject of a going concern opinion by our independent auditors who have raised substantial doubt as to our ability to continue as a going concern

Our audited financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has generated modest revenues since inception and has never paid any dividends and is unlikely to pay dividends. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploration of economically recoverable reserves in its resource properties, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. The Company has had very little operating history to date. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. These factors raise substantial doubt regarding the ability of the Company to continue as a going concern.

We have experienced recurring net losses from operations, which losses have caused an accumulated deficit of $15,535,153 as of December 31, 2013. In addition, we have a working capital deficit of $3,249,806 as of December 31, 2013. We had net losses of $2,059,305 and $2,119,706 for the years ended December 31, 2013 and 2012, respectively. These factors, among others, raise substantial doubt about our ability to continue as a going concern. If we are unable to generate profits and are unable to continue to obtain financing to meet our working capital requirements, we may have to curtail our business sharply or cease operations altogether. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis to retain our current financing, to obtain additional financing, and, ultimately, to attain profitability. Should any of these events not occur, we will be adversely affected and we may have to cease operations.

As of December 31, 2013 the accumulated deficit attributable to CEO stock awards, including previous management, and valued according to GAAP, totals $2,558,535 since inception in 2004. As of December 31, 2013 the accumulated deficit attributable to CEO compensation is $820,474 in deferred compensation. This reflects the total amounts unpaid as per the management agreement with The PAN Network dating back to January 2006, less any amounts actually paid or forgiven since 2006. These totals are non-cash expenses which are included in the accumulated deficit since inception. Actual CEO compensation paid in cash over the course of the seven years since 2006 consists of $10,000 in 2006, $50,764 in 2007, $23,139 in 2008, $29,979 in 2009, $21,988 in 2010, $90,000 in 2011, $116,000 in 2012, and $100,000 in 2013. These cash expenditures are also included in the accumulated deficit.

Excluding management fees, which are deferred as-needed, the Company has required approximately $7,000 (USD) per month to maintain its mineral claims in British Columbia in good standing and pay general administrative expenses. We believe these expenses can be maintained at present levels for the foreseeable future. Going forward, as a fully-reporting company, we estimate it will cost an additional $2,500 to $5,000 per month in SEC compliance fees, consisting primarily of accounting, legal, and edgarization fees. If we cannot generate enough revenue from claim sales and joint-ventures to cover these costs, we believe we can rely on loans and our equity credit line established with Tangiers to make up for any revenue shortfall once this Registration Statement is declared effective by the SEC. However, as there is no assurance that this Registration Statement or any subsequent Registration Statement will be declared effective, the equity line with Tangiers may be unavailable to us. If we cannot generate sufficient revenue or raise additional funds through equity, we may not be able to maintain our mineral claims or make timely filings with the SEC. In fiscal year 2014, our mortgage on the Ruby Mine Property (“Ruby Mine”) requires us to pay $60,000 per month through December 30, 2015. The Company believes it can rely on loans and our equity credit line established with Tangiers to make up for any revenue shortfall once this registration statement to register the Tangiers equity credit line is made effective by the SEC. However, as there is no assurance that this or any subsequent registration statement will be made effective, the equity line with Tangiers may be unavailable to us. If we cannot generate sufficient revenue or raise additional funds through loans, equity, we may not be able to maintain our mortgage on the Ruby Mine.

The ongoing execution of our business plan is expected to result in operating losses over the next twelve months. Management believes it will need to raise capital through loans and stock issuances in order to have enough cash to maintain its operations for the next twelve months. There are no assurances that we will be successful in achieving our goals of obtaining cash through loans or stock issuances, or increasing revenues and reaching profitability.

In view of these conditions, our ability to continue as a going concern is dependent upon our ability to meet its financing requirements, and to ultimately achieve profitable operations. Management believes that its current and future plans provide an opportunity to continue as a going concern. The accompanying financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that may be necessary in the event we cannot continue as a going concern.

We may not be able to engage in joint-ventures, which could have a significant negative impact on our financial condition.

We intend to increase our revenues and available cash through joint-venture opportunities. We may not have the resources required to promote our properties and attract viable joint-venture partners. If we are unable to secure additional joint-venture partners for our mining properties, we will not be able to generate enough revenue to achieve and maintain profitability or to continue our operations.

Because of our dependence on a limited number of potential partners, our failure to attract new partners for our mining properties could impair our ability to continue successful operations. The absence of a significant partnership base may impair our ability to attract new partners. Our failure to develop and sustain long-term relationships with joint-venture partners would impair our ability to continue exploration of our properties. Once secured, the failure of a joint-venture partner to obtain sufficient financing to meet their commitments to us may cause the joint-venture to fail, and our business prospects may suffer.

We may not be able to increase our revenue or effectively operate our business. To the extent we are unable to achieve revenue growth, we may continue to incur losses. We may not be successful or make progress in the growth and operation of our business. Our current and future expense levels are based on operating plans and estimates of future revenues and are subject to increase as strategies are implemented. Even if our revenues grow, we may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall.

Accordingly, any significant shortfall in revenues would likely have an immediate material adverse effect on our business, operating results and financial condition. Further, if we substantially increase our operating expenses and such expenses are not subsequently followed by increased revenues, our operating performance and results would be adversely affected and, if sustained, could have a material adverse effect on our business. To the extent we implement cost reduction efforts to align our costs with revenue, our revenue could be adversely affected.

We may face many of the challenges that a developing company in the mining industry typically encounters which may impede or prevent successful implementation of our business plan.

These challenges include, but are not limited to:

| · | Evaluation and staking of new prospects; |

| · | Maintaining claims in good standing; |

| · | Engaging and retaining the services of qualified geological, engineering and mining personnel and consultants; |

| · | Establishing and maintaining budgets, and implementing appropriate financial controls; |

| · | Identifying and securing joint-venture partners; |

| · | Establishing initial exploration plans for mining prospects; |

| · | Obtaining and verifying independent studies to validate mineralization levels on our prospects; and |

| · | Ensuring the necessary exploratory and operational permits are filed on a timely basis, the necessary permits are maintained and approved by governmental authorities and jurisdictions, and adhering to all regulatory and safety requirements. |

The failure to address one or more of these above factors may impair our ability to carry out our business plan. In that event, an investment in us would be substantially impaired.

Our business plan is dependent on continually finding new mining prospects with sufficient mineralization, grade and consistency without which it may not be practical to pursue the business plan, and investors will lose their investment.

Our business model depends on locating new prospects with commercially sufficient amounts of precious and other metal mineralization. Until feasibility studies are completed, permits issued, and actual extraction and processing begins, we will not know if our prospects are commercially viable. Even if initial reports about mineralization in a particular prospect are positive, subsequent activities may determine that the prospect is not commercially viable. Thus, at any stage in the exploration and development process, we may determine there is no business reason to continue, and at that time, our financial resources may not enable us to continue exploratory operations and will cause us to terminate our current business plan.

Our metals exploration efforts are highly speculative in nature and may be unsuccessful.

Metals exploration is highly speculative in nature, involves many risks and frequently is unsuccessful. Once mineralization is discovered, it may take a number of years from the initial phases of drilling before production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to establish proven and probable ore reserves through drilling, to determine metallurgical processes to extract the metals from the ore and, in the case of new properties, to construct mining and processing facilities. As a result of the foregoing uncertainties, no assurance can be given that our exploration programs will result in the identification, expansion, or replacement of current or future production with new proven and probable ore reserves.

Exploration projects have no operating history upon which to base estimates of proven and probable ore reserves and estimates of future cash operating costs. Such estimates are, to a large extent, based upon the interpretation of geologic data obtained from drill holes and other sampling techniques, and feasibility studies which derive estimates of cash operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of the mineral from the ore, comparable facility and equipment operating costs, anticipated climatic conditions and other factors. As a result, it is possible that actual cash operating costs and economic returns based upon development of proven and probable ore reserves may differ significantly from those originally estimated. Moreover, significant decreases in actual over expected prices may mean reserves, once found, will be uneconomical to produce. It is not unusual in new mining operations to experience unexpected problems during the start-up phase.

Other risk factors include changes in regulations, environmental concerns or restrictions, legacy rights accorded to local First Nations communities, technical issues relating to exploration, development, and extraction, such as rock falls, subsidence, flooding and weather conditions, safety requirements, and labor issues. Any of these factors individually or together could delay or halt implementation of the business plan or raise costs to levels that may make it unprofitable or impractical to pursue our business objectives.

Regulatory compliance is complex and the failure to meet all the various requirements could result in loss of a claim, fines or other limitations on our business plan.

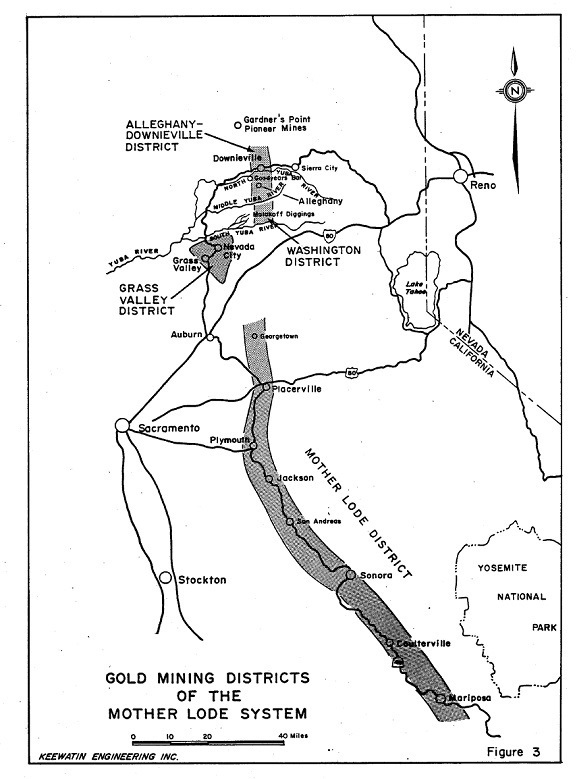

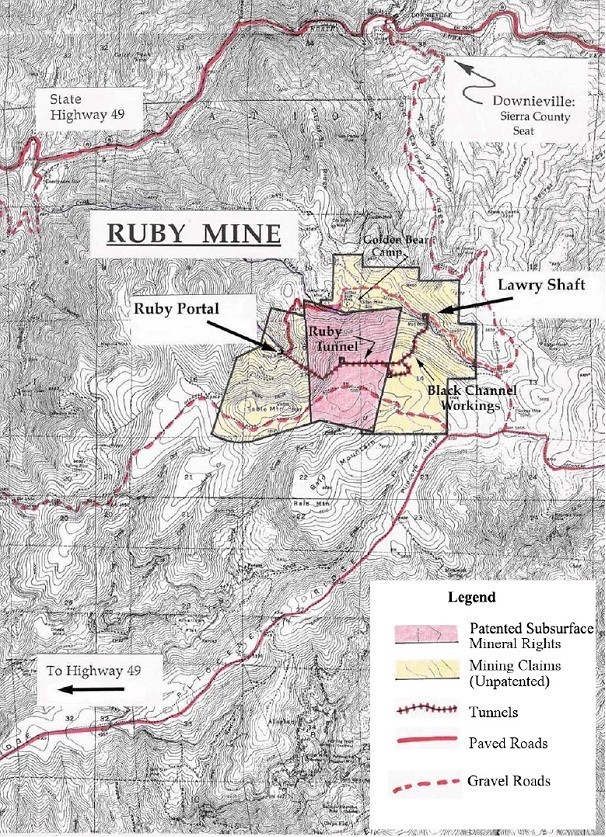

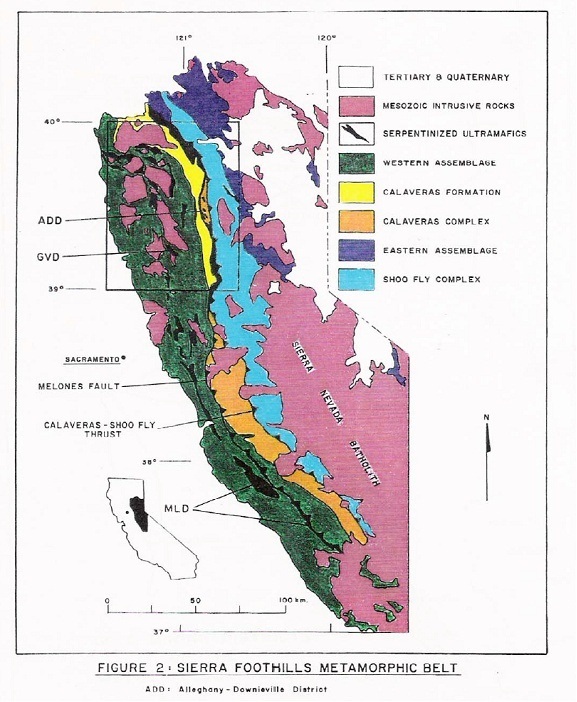

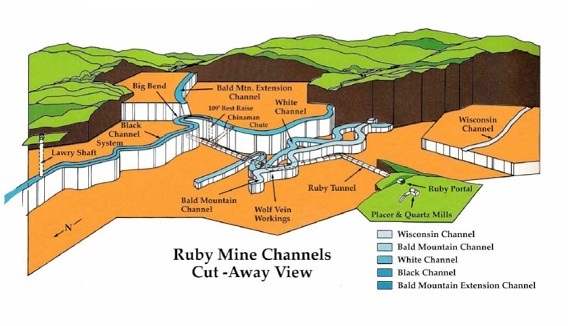

With the exception of the Ruby Mine in Sierra County, California, all of our mining claims are in British Columbia, Canada, where we are subject to regulation by numerous federal and provincial governmental authorities, but most importantly, by the British Columbia Ministry of Energy, Mines, and Petroleum Resources. Our Ruby Mine project (“Ruby Project”) in Sierra County, California, is subject to US regulation by the Federal Environmental Protection Agency, the Federal Department of the Interior, the Bureau of Land Management, the US Forestry Service, the US Department of Labor Mine Safety and Health Administration, as well as other comparable state agencies, such as the California Department of Conservation Office of Mine Reclamation, the California State Water Resources Control Board and the California Division of Occupational Safety and Health. At the Ruby, we are also subject to various federal and state statutes, such as the federal Mine Safety & Health Act of 1977, the federal Mine Improvement and New Emergency Response Act of 2006, the federal Comprehensive Environmental Response, Compensation and Liability Act, also known as the "Superfund" law, the federal Clean Air Act , the federal Resource Conservation and Recovery Act, and the California Surface Mining and Reclamation Act. Where EB-5 funding has been applied for, offered, or secured, we are subject to regulation by the US Department of Homeland Security and the United States Citizenship and Immigration Services ("USCIS"). The acquisition of a prospect in Mexico, or any other country, will be subject to similar regulatory agencies requirements by various agencies in each country. In all cases, the failure or delay in making required filings and obtaining regulatory approvals or licenses will adversely affect our ability to carry out our business plan. The failure to obtain and comply with any regulations or licenses may result in fines or other penalties, and even the loss of our rights over a prospect. We expect compliance with these regulations to be a substantial expense in terms of time and cost. Therefore, compliance with or the failure to comply with applicable regulation will affect our ability to succeed in our business plan and ultimately to generate revenues and profits. We expect that our operations will comply in all material respects with applicable laws and regulations. We believe that the existence and enforcement of such laws and regulations will have no more restrictive an effect on our operations than on other similar companies in the resource industry.

The Ruby Mine has no proven or probable reserves, and production may be less than expected, or may never begin at all.

Our current resource estimate at the Ruby Mine is inferred, or hypothetical. While past production is a good indicator, past production does not guarantee future results. If our mining efforts fail to produce a grade of gold high enough to sustain an economic enterprise, our Ruby Mine Project may fail. In the event of such a failure, our inability to repay any accumulated debt incurred from the Ruby project may cause our business to fail.

Our ability to begin mining operations at the Ruby Mine requires that we raise sufficient capital to pay off the mortgage on the Ruby Mine property and provide enough operating capital to begin as well as sustain commercial production. We have elected to avail ourselves of the federal EB-5 Program to secure funding, for which the Ruby Mine has been pre-approved by the USCIS in July 2011, but which is contingent on our ability to raise sufficient funds from foreign investors who participate in the federal EB-5 Program. As of the date of this prospectus, the EB-5 funding remains pending, the Company has not received any funding through the EB-5 program, and there is no guarantee that it will be completed. Accordingly, given the length of time this process has been ongoing, as of the date of this prospectus the Company has elected to proceed on its own by funding the project through revenue generated from claim sales and joint-ventures, and capital from loans, stock sales, and other alternative funding sources. If we fail to secure enough capital from either the EB-5 Program or any other alternative funding sources, we may have to curtail the Ruby project and forfeit the property.

Placing a mining project into production without first establishing reserves has a much higher risk of economic or technical failure.

Historically, placing a mining project into production without first establishing reserves has a much higher risk of economic or technical failure. We are not basing our production decision on a final or bankable feasibility study of mineral reserves, and intend to mine and sample simultaneously. While unorthodox by current industry practices, mining and sampling simultaneously has historically been the standard in California's drift mines such as the Ruby Mine. This approach is supported the Department of the Interior Bureau of Land Management ("BLM") Technical Bulletin 4 entitled "Placer Examination Principles and Practice". Nevertheless, the increased uncertainty inherent in this approach increases the economic and technical risks of failure associated with this type of production decision.

Competition may develop which could hinder our ability to locate, stake and explore new mining claims, or to attract new joint-venture partners.

As metal prices continue to increase and demand grows, we expect new companies to form and compete with the already numerous junior and developed mining, exploration and production companies in existence. Some of these companies may be more efficient in locating new claims, which could impede our business plan. As well, some of these companies may be better funded, or more successful in attracting joint-venture partners, and thereby diminish our ability to execute our business plan.

We could fail to attract or retain key personnel, which could be detrimental to our operations.

Our success largely depends on the efforts and abilities of our Chief Executive Officer, Perry Leopold. The loss of his services could materially harm our business because of the cost and time necessary to find his successor. Such a loss would also divert management’s attention away from operational issues. We do not presently maintain key-man life insurance policies on our Chief Executive Officer. To the extent that we are smaller than our competitors and have fewer resources, we may not be able to attract sufficient number and quality of staff.

New exploration activities require substantial capital expenditures.

New exploration activities, if done independently and without benefit of a joint-venture partner, require substantial capital expenditures for the extraction, production and processing stages and for machinery, equipment and experienced personnel. There can be no assurance that the Company will generate sufficient cash flow and/or that it will have access to sufficient external sources of funds in the form of outside investment or loans to continue exploration activities at the same or higher levels than in the past.

Our Chief Executive Officer controls another company, Speebo, Inc. (“Speebo”), that could potentially create a conflict of interest

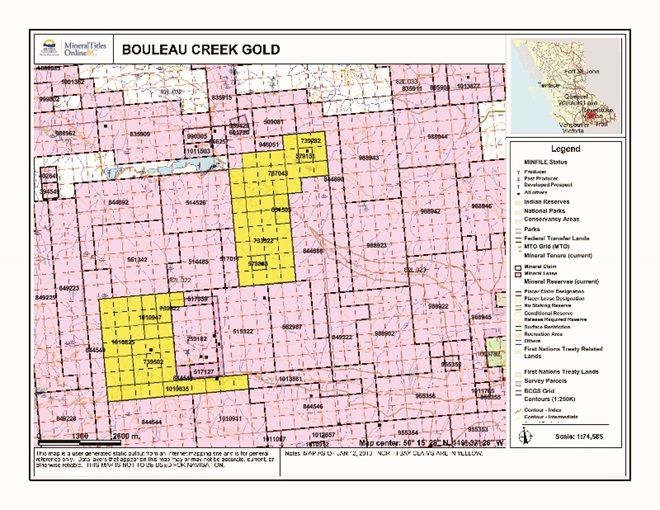

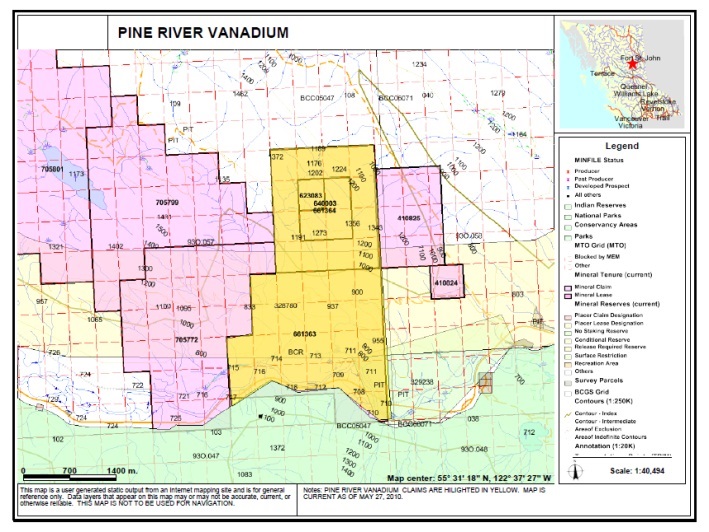

Speebo is a private exploration company founded and funded in 2006 by our Chief Executive Officer, Perry Leopold, as a proof-of-concept in the use of MTO technology as the primary methodology for the identification and acquisition of mineral properties of merit. As a result of Mr. Leopold’s success in acquiring claims in this manner and subsequently generating revenue from them, the Board of Directors of North Bay agreed with Mr. Leopold’s contention that new technology holds the key to a successful exploration enterprise in the 21st century, and in 2007 the Company adopted the Generative Business Model that incorporates MTO (as defined below) technology as the core methodology in the execution of our current business plan. Speebo continues to operate to a limited extent, and often acts for the benefit of North Bay. Two key claims currently owned by North Bay, Bouleau Creek Gold and Pine River Vanadium, were originally acquired and subsequently gifted to the Company by Speebo. To date there have never been any material related-party transactions between Speebo and North Bay for the benefit of Speebo, nor has there been any instance, material or otherwise, of Speebo ever receiving any benefit whatsoever from its affiliation as a related-party. While the potential inherently exists for a conflict-of-interest in the future, the reality of the relationship to date has been complimentary and supportive to the sole benefit of North Bay, and not competitive in any way. In the event a potential transaction in the future might convey a benefit to Speebo, it may only be done with the unanimous consent of the Board of Directors, and in full compliance with the Code of Ethics adopted by the Company in October, 2009.

A single shareholder, our Chief Executive Officer and Chairman of the Board Mr. Perry Leopold, has the ability to control our business direction.

Our Chief Executive Officer and Chairman of the Board, Mr. Perry Leopold, owns 80% of the voting shares of our stock by virtue of his ownership of 100% of the authorized Series I Preferred Shares. These shares were issued to him in February 2007 as an anti-takeover measure to insure that Mr. Leopold maintains control of the Company during periods when the Company’s stock may be severely undervalued and subject to hostile takeover in the open market. As specified in the Certificate of Designation filed by the Company with the Delaware Secretary of State in February 2007, “the outstanding shares of Series I Preferred Stock shall vote together with the shares of Common Stock of the Corporation as a single class and, regardless of the number of shares of Series I Preferred Stock outstanding and as long as at least one of such shares of Series I Preferred Stock is outstanding, shall represent eighty percent (80%) of all votes entitled to be voted at any annual or special meeting of shareholders of the Corporation or action by written consent of shareholders. Each outstanding share of the Series I Preferred Stock shall represent its proportionate share of the 80% which is allocated to the outstanding shares of Series I Preferred Stock.” These Series I Preferred Shares also supersede any other shares that Mr. Leopold may own, so that any additional shares he may acquire do not increase his 80% voting rights, and are therefore included within the 80%. Accordingly, Mr. Leopold is likely to be in a position to control the election of our Board of Directors and the selection of officers, management and consultants. He will also have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of our assets, the interests of Mr. Leopold may still differ from the interests of the other stockholders.

Our executive officers do not have any training specific to the technicalities of mineral exploration, and there is a higher risk our business will fail

Mr. Perry Leopold, our Chief Executive Officer since 2006, does not have any formal training as a geologist or a mining engineer. As a result, our management may lack certain skills that are advantageous in managing an exploration company. In addition, Mr. Leopold’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in geology and mine engineering.

We anticipate our operating expenses will increase and we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without increasing or realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to execute on our business plan. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues from mining or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We have one employee, our Chief Executive Officer, who also has other business interests, and he may not be able to devote a sufficient amount of time to our business operations, causing our business to fail

Mr. Perry Leopold, our Chief Executive Officer, currently devotes 40 or more hours per week to our business affairs, and currently devotes less than 10 hours per week total on his other business interests, specifically, Speebo, Circular Logic, Inc., and The PAN Network. Mr. Leopold also serves as a consultant to a major consumer electronics firm on legacy technology issues related to his work with The PAN Network in aiding the development of the internet in the 1980’s, and which is done only as time permits, on an as-needed as-available basis. Currently, we do not have any other employees. If the demands of any of Mr. Leopold’s other business interests should increase in the future, it is possible that Mr. Leopold may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

A single shareholder, our Chief Executive Officer Mr. Perry Leopold, owns 100% of our outstanding convertible preferred stock, and the market price of our shares would most likely decline if he were to convert these shares to common stock and sell a substantial number of shares all at once or in large blocks.

Our Chief Executive Officer, Mr. Perry Leopold owns 4,000,000 shares of our Series A Preferred stock, which equates to 20,000,000 shares of common stock upon conversion if he so elects. Mr. Leopold will then be eligible to sell these shares publicly subject to the volume limitations in Rule 144. The offer or sale of a large number of shares at any price may cause the market price to fall. Sales of substantial amounts of common stock or the perception that such transactions could occur may materially and adversely affect prevailing markets prices for our common stock.

If First Nations land claims affect the title to our mineral claims, our ability to mine on our claims may be lost.

The Province of British Columbia and Canadian government policy at this time is to consult with all potentially affected First Nations bands and other stakeholders in the area of any potential commercial production. In the event that we encounter a situation where a First Nations person or group claims an interest in any of our mineral claims, we may be unable to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we may have in this claim. The Supreme Court of Canada has ruled that both the federal and provincial governments in Canada are now obliged to negotiate these matters in good faith with First Nations groups. If any of our mineral claims should become the subject of a dispute with First Nations groups, the costs and/or losses could be greater than our financial capacity and our business would fail.

The Province of British Columbia owns most of the land covered by our Canadian mineral claims, and our ability to conduct exploratory programs is subject to the consent of the Province of British Columbia, leading to possible ejection from or forfeiture of our mineral claims.

The land covered by most of our mineral claims in Canada is owned by the Province of British Columbia. The ability to conduct an exploratory program on any of our claims is subject to the consent of the Province of British Columbia. In order to keep our claims in good standing with the Province of British Columbia, the Province of British Columbia requires that before the expiry dates of the mineral claim that exploration work on any mineral claim valued at an amount stipulated by the government be completed together with the payment of a filing fee, or, a payment to the Province of British Columbia in lieu of completing said exploration work. In the event that these conditions are not satisfied prior to the expiry dates of the mineral claim, we will lose our interest in any mineral claim so affected, and the mineral claim then become available again to any party that wishes to stake an interest in these claims. In the event that either we are ejected from the land or our mineral claims expire, we will lose all interest that we have in the claims so affected.

Our mineral and placer rights in British Columbia are limited.

Our acquisition of any mining claim in British Columbia conveys the mineral or placer rights for mining-related purposes only, and while our rights allow us to use the surface of a claim for mining and exploration activities, our claims do not convey any other surface, residential or recreational rights to the Company. Additionally, our right to extraction is not absolute, as any mechanized extraction work on claims in British Columbia requires additional permits and possibly conversion of our claims to mining leases, the approval of which is not guaranteed. In the event a mining permit is not approved, the subject claims may become worthless to us, and we may be forced to allow them to forfeit.

Some of the land overlying our Canadian mineral claims is owned by private parties, and our ability to conduct exploratory programs is subject to their consent.

The land covered by some of our mineral claims in Canada is owned by private parties by virtue of legacy Crown Grants registered over the past century. Access and availability to conduct an exploratory program on any of these claims is subject to the consent of the private landowner. In the event any private party objects to our access and blocks our ability to conduct exploration work on these claims, these claims may become worthless to us, and we may be forced to allow them to forfeit.

Risk Factors Related to Our Planned Spinoff of Ruby Gold, Inc., Our Wholly-owned Subsidiary

We have announced our intention to spinoff our wholly-owned subsidiary, Ruby Gold, Inc. which may cause shareholders to sell their stock if the spinoff is completed, and which may cause our stock to decline.

On December 2, 2013, our Board of Directors authorized the spinoff of our wholly-owned subsidiary, Ruby Gold, Inc. (“RGI”) as a separate and independent public company. Once the spinoff is complete, the Company intends to issue a special stock dividend based on a ratio yet to be determined. Shareholders who are eligible to receive such stock dividend will be holders of common stock of North Bay as of the record date, which has yet to be set by the Board of Directors of the Company. On January 14, 2014, RGI filed a registration statement on Form 10 with the SEC to initiate said spinoff. After the RGI registration statement on Form 10 is deemed effective, the Board of Directors of the Company intends to then determine the date and ratio for the distribution of shares from the spin-off and a news release announcing the record date will be issued at that time. Other than the authorization for said spinoff by our Board of Directors and the Board of RGI, there are no agreements, formal or otherwise, in place between the respective companies, any affiliate of either company, or any other parties governing the spinoff, and no shareholder approvals are required. On March 10, 2014, RGI withdrew the Form 10 after discussions with the SEC and expects to file a registration statement on Form S-1 to register 120 million shares of RGI as the stock dividend to be issued to our shareholders in the spinoff, which amounts to 40% of the issued and outstanding shares of RGI common stock currently owned by North Bay. Accordingly, as the completion of the spinoff is contingent on a registration statement by RGI becoming effective, no determination has yet been made as to whether or not the stock dividend will be tax-free, there has been no further determination as to when the spinoff and stock dividend distribution might be completed, and there is no guarantee that it will be completed.

In the event the spinoff is completed and North Bay shareholders receive a special stock dividend of shares in RGI, it is possible that North Bay shareholders who originally invested in North Bay principally because of the Ruby Mine project might then sell their North Bay shares. Such an event could place further downward pressure on the price of our common stock.

We may be unable to achieve some or all of the benefits that we expect to achieve from the separation of RGI and our Company.

We may not be able to achieve the full strategic and financial benefits that we expect will result from the separation of RGI and our Company or such benefits may be delayed or may not occur at all. For example, analysts and investors may not regard our corporate structure to be clearer and simpler than the current corporate structure or place a greater value on our Company. As a result, in the future the aggregate market price of our Company’s common stock and RGI’s common stock as separate companies may be less than the market price per share of our common stock had the spinoff not occurred.

Risk Factors Related to Our Securities, the Securities Purchase Agreement and This Offering

We are registering herein 29,463,118 shares of common stock to be issued under the Securities Purchase Agreement. The sale of such shares could depress the market price of our common stock.

We are registering 29,463,118 shares of common stock under the registration statement of which this Prospectus forms a part for issuance pursuant to the Securities Purchase Agreement. The sale of these shares into the public market by Tangiers could depress the market price of our common stock.

Existing stockholders will experience significant dilution from our sale of shares under the Securities Purchase Agreement.

The sale of shares pursuant to the Securities Purchase Agreement will have a dilutive impact on our stockholders. As a result, the market price of our common stock could decline significantly as we sell shares pursuant to the Securities Purchase Agreement. In addition, for any particular advance, we will need to issue a greater number of shares of common stock under the Securities Purchase Agreement as our stock price declines. If our stock price is lower, then our existing stockholders would experience greater dilution.

The investor under the Securities Purchase Agreement will pay less than the then-prevailing market price of our common stock.

The common stock to be issued under the Securities Purchase Agreement will be issued at 90% of the lowest daily volume weighted average price of our common stock during the five consecutive trading days immediately following the date we submit an Advance Notice to Tangiers. In the event we submit an Advance Notice in excess of the Base Amount, as determined by average daily trading volume in dollar amount during the ten (10) trading days preceding the Advance Notice, the discount on the excess shares might be as much as 25%. These discounted sales could also cause the price of our common stock to decline.

The sale of our stock under the Securities Purchase Agreement could encourage short sales by third parties, which could contribute to the further decline of our stock price.

The significant downward pressure on the price of our common stock caused by the sale of material amounts of common stock under the Securities Purchase Agreement could encourage short sales by third parties. Such an event could place further downward pressure on the price of our common stock.

We may be limited in the amount we can raise under the Securities Purchase Agreement because of concerns about selling more shares into the market than the market can absorb without a significant price adjustment.

The Company intends to exert its best efforts to avoid a significant downward pressure on the price of its common stock by refraining from placing more shares into the market than the market can absorb. This potential adverse impact on the stock price may limit our willingness to use the Securities Purchase Agreement. Until there is a greater trading volume, it seems unlikely that we will be able to access the maximum amount we can draw without an adverse impact on the stock price.

We may not be able to access sufficient funds under the Securities Purchase Agreement when needed.

Our common stock is recently trading around $0.04 per share. If this price is maintained, of which there is no assurance, our shares will be issued to Tangiers at a minimum of $0.03 to a maximum of $0.036 per share, depending on the amount of each draw request and the applicable discount applied (see “The Offering”). As of the date of this prospectus, $2,041,800 has been drawn from this facility since the original effective date of January 24, 2011, leaving $7,958,200 remaining to be drawn if the entire $10,000,000 available to us is to be received. Therefore, assuming said minimum price and including the amount already received, we will need to register as many as 193,755,556 additional shares of our common stock in order to obtain the full $10,000,000 available to us under the Securities Purchase Agreement as of the date of this prospectus. We are only registering 29,463,118 on this registration statement. The total amount of 29,463,118 shares of our common stock will be issued to Tangiers in order to obtain the funds available to us under the Securities Purchase Agreement, as amended. We will be required to file other registration statements if we intend to obtain the full amount of funds available to us under the Securities Purchase Agreement. If we issue to Tangiers all 29,463,118 shares of our common stock at the current stock price we will only be able to receive approximately $883,894 in net proceeds after a 10% discount is applied and after deducting expenses related to filing this Registration Statement. This Registration Statement must be declared effective prior to us being able to issue those additional shares to Tangiers so that we may obtain cash advances under the Securities Purchase Agreement.

Our ability to raise funds under the Securities Purchase Agreement is also limited by a number of factors, including the fact that the maximum advance amount during any 10 trading day period is capped at $250,000, as well as the fact that we are not permitted to submit any request for an advance within 10 trading days of a prior request. Also, the Company may only draw an amount up to 300% of the average daily trading volume in dollar amount during the 10 trading days preceding the advance date. As such, although sufficient funds are made available to the Company under the Securities Purchase Agreement, such funds may not be readily available when needed by the Company.

We will not be able to use the Securities Purchase Agreement if the shares to be issued in connection with an advance would result in Tangiers owning more than 9.9% of our outstanding common stock.

Under the terms of the Securities Purchase Agreement, we may not request advances if the shares to be issued in connection with such advances would result in Tangiers and its affiliates owning more than 9.9% of our outstanding common stock. We are permitted under the terms of the Securities Purchase Agreement to make limited draws on the Securities Purchase Agreement so long as Tangiers’ beneficial ownership of our common stock remains lower than 9.9%. A possibility exists that Tangiers and its affiliates may own more than 9.9% of our outstanding common stock (whether through open market purchases, retention of shares issued under the Securities Purchase Agreement, or otherwise) at a time when we would otherwise plan to obtain an advance under the Securities Purchase Agreement. As such, by operation of the provisions of the Securities Purchase Agreement, the Company may be prohibited from procuring additional funding when necessary due to these provisions discussed above.

The Securities Purchase Agreement will restrict our ability to engage in alternative financings.

The structure of transactions under the Securities Purchase Agreement will result in the Company being deemed to be involved in a near continuous indirect primary public offering of our securities. As long as we are deemed to be engaged in a public offering, our ability to engage in a private placement will be limited because of integration concerns which therefore limits our ability to obtain additional funding if necessary.

We are increasing our authorized shares, and may need to do so again in the future as we draw down on our equity line with Tangiers.

As of the date of this prospectus, we have 152,531,443 shares outstanding out of 250,000,000 shares authorized. We have also reserved 56,852,098 shares of common stock for the possible conversion, consisting of 13,302,098 shares for the possible conversion of outstanding convertible notes, 20,000,000 shares for the possible conversion of outstanding preferred stock, and 23,550,000 shares for the possible exercise of outstanding warrants. We are in the process of filing all required documents to increase the number of authorized shares to 500,000,000 to provide for our reserves, and may have to again increase the authorized shares at some point in the future if we are to obtain the full $10,000,000 available to us under the Securities Purchase Agreement.

There may not be sufficient trading volume in our common stock to permit us to generate adequate funds.

The Securities Purchase Agreement, as amended, provides that the maximum dollar amount of each advance request will be the lesser of $250,000 or no more than 300% of the average daily trading volume in dollar amount during the ten (10) trading days preceding the Advance Date. If the average daily trading volume in our common stock is too low, it is possible that it would reduce the amount of each advance or advances to amounts at each time that may not provide adequate funding for our planned operations.

Our shares are quoted on OTCQB under the symbol “NBRI”. As such, we are required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC; failure to remain current in our filings is a breach of the Securities Purchase Agreement

Because our shares are quoted on OTCQB, we are required to remain current in our filings with the SEC in order for shares of our common stock to remain eligible for quotation on OTCQB. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 or 60 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on OTCQB investors in our common stock may find it difficult to sell their shares. Furthermore, failure to remain current in our filings with the SEC is a breach of the Securities Purchase Agreement, and a cause for Tangiers to terminate said agreement.

We have offered and sold certain shares of common stock without registration under the Securities Act of 1933. Some holders of our securities may have the right to rescind their purchases. If these security holders exercise their right to rescind their purchases, our operations could be materially adversely affected.

We have inadvertently offered and sold certain shares of common stock without registration under the Securities Act of 1933 (the “Securities Act”), as amended, during the period from October 24, 2011 through April 25, 2013. Pursuant to Section 10(a)(3) of the Securities Act, by the time our prospectus had been in use for 9 months from the effective date of January 24, 2011, the balance sheet date of the audited financial statement contained in our prospectus was more than 16 months old, and had not been refreshed to present our current financial statements within said prospectus. This inadvertent failure to update our prospectus according to Rule Section 10(a)(3) of the Securities Act may have caused our prospectus to no longer be effective as of October 24, 2011, and thus may have constituted a violation of Section 5 of the Securities Act (which generally requires an effective registration of offers and sales of securities) and may give rise to liability under Section 12 of the Securities Act (which generally provides a rescission remedy for offers and sales of securities in violation of Section 5) as well as potential liability under the anti-fraud provisions of federal and state securities laws.

The Securities Act requires that any claim for rescission be brought within one year of the violation. The time periods within which claims for rescission must be brought under state securities laws vary and may be two years or more from the date of the violation. As of the date of this prospectus and within the federal statute of limitations approximately 10 million shares of our outstanding common stock are subject to rescission, with a potential liability approximating $668,000, including interest at 10% per annum.

As of the date of this prospectus management is unable to determine at this time whether any claim for rescission may be filed against us; however, there can be no assurance that claims will not be asserted. In addition, regulatory agencies could launch a formal investigation and/or institute an enforcement proceeding against us for violations of federal and state registration and qualification requirements. If any security holders exercise their right to rescind their purchases, or if a formal investigation results in an enforcement action against us, our operations could be materially adversely affected.

Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations, which may limit a stockholder’s ability to buy and sell our stock.