stakeholders, (ii) determined that the Transactions are fair, advisable and in the best interests of unaffiliated Shareholders, (iii) resolved to enter into the Transactions and (iv) resolved to recommend that the holders of the Shares approve the Reorganization and directed that the Reorganization be submitted to Cnova’s general meeting of shareholders for its approval.

Following the meeting of the Cnova Transaction Committee, (i) Cnova, Cnova Brazil and Via Varejo executed the Reorganization Agreement, (ii) Cnova released its signature to the Casino-Cnova Undertakings Letter, (iii) Casino and CBD executed the Cnova Shareholder Letter and (iv) CBD executed the CBD support letter.

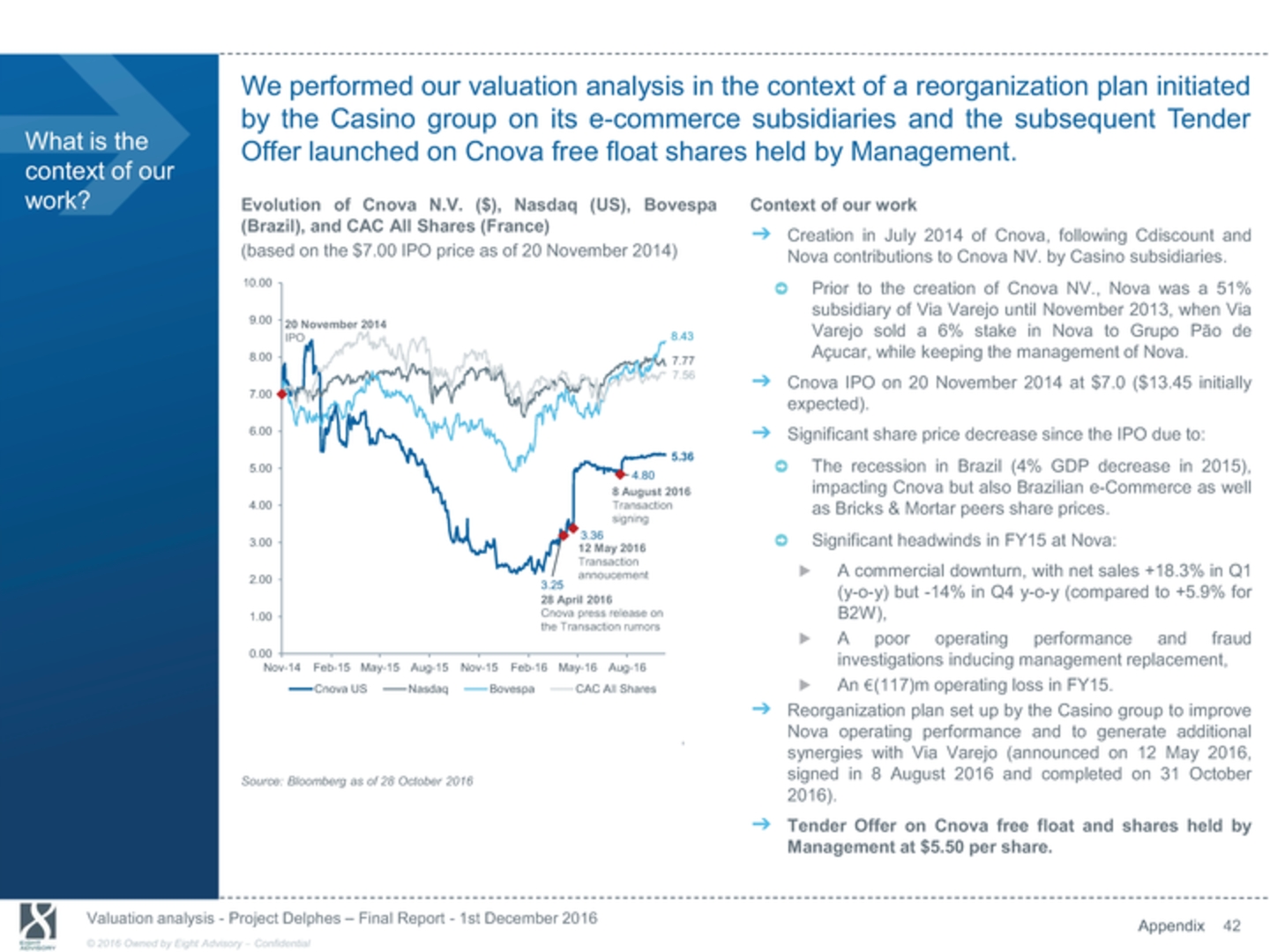

Following the close of trading on the NASDAQ of August 8, 2016, Casino, Cnova, Via Varejo and CBD issued press releases announcing the execution of the Reorganization Agreement and the Reorganization and Casino’s agreement, subject to the completion of the Reorganization, to undertake the Offers.

On September 12, 2016, Cnova convened an extraordinary general meeting of shareholders to approve the Reorganization and take certain resolutions in connection with the Transactions.

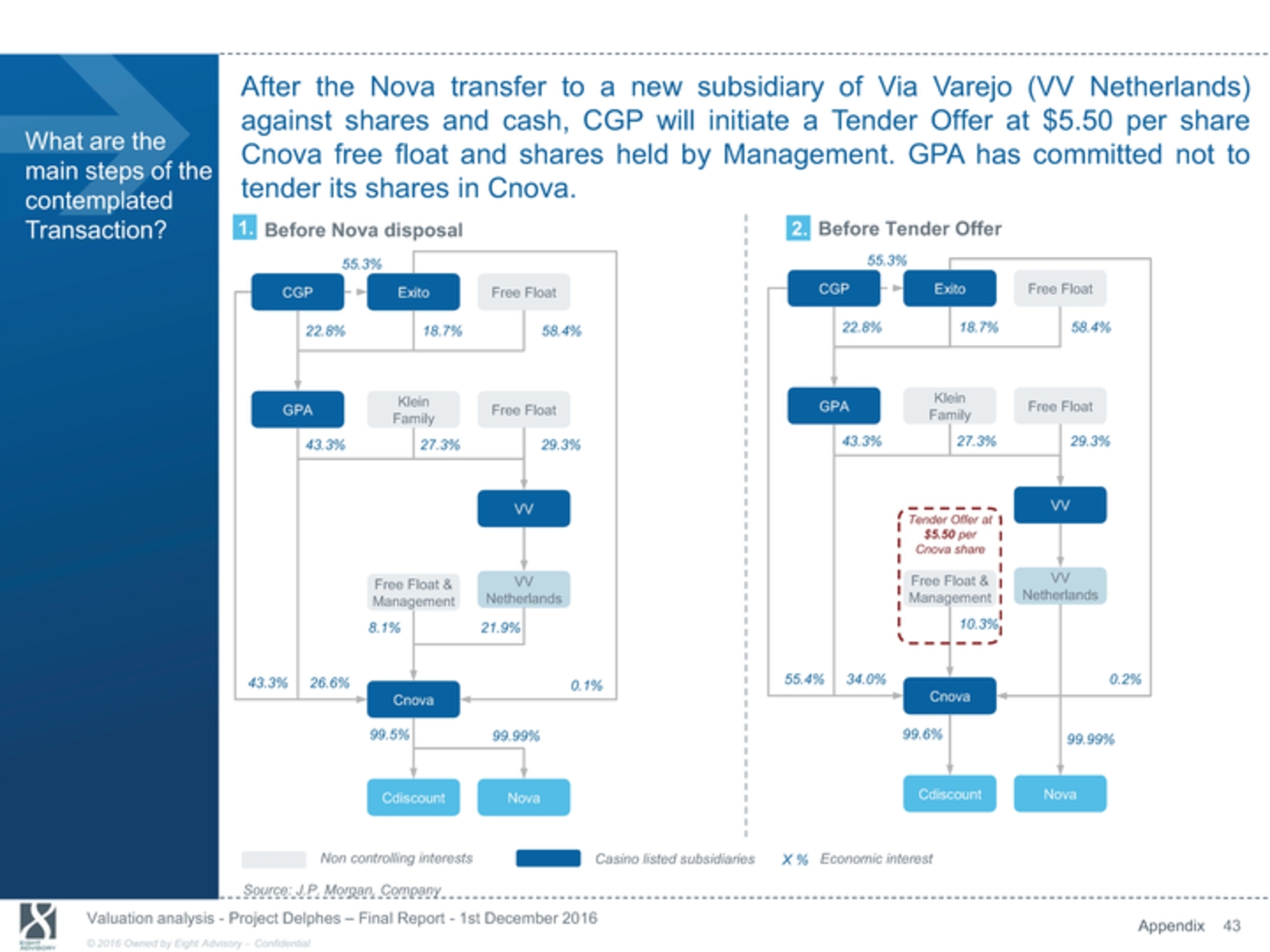

In connection with the anticipated completion of Reorganization, on October 27, 2016, the Cnova Transaction Committee (as such constituting a meeting of the Cnova Board of Directors) met to, amongst other things, discuss and approve certain documents required to be executed by Cnova in connection with the completion of the Reorganization, and furthermore reviewed and discussed the main steps to be taken by Cnova in connection with the Offers. Earlier that day, at the extraordinary general meeting of shareholders in which 96.01% of the shares were represented, the Shareholders approved the Reorganization, with 99.99% of the votes in favour of the Reorganization.

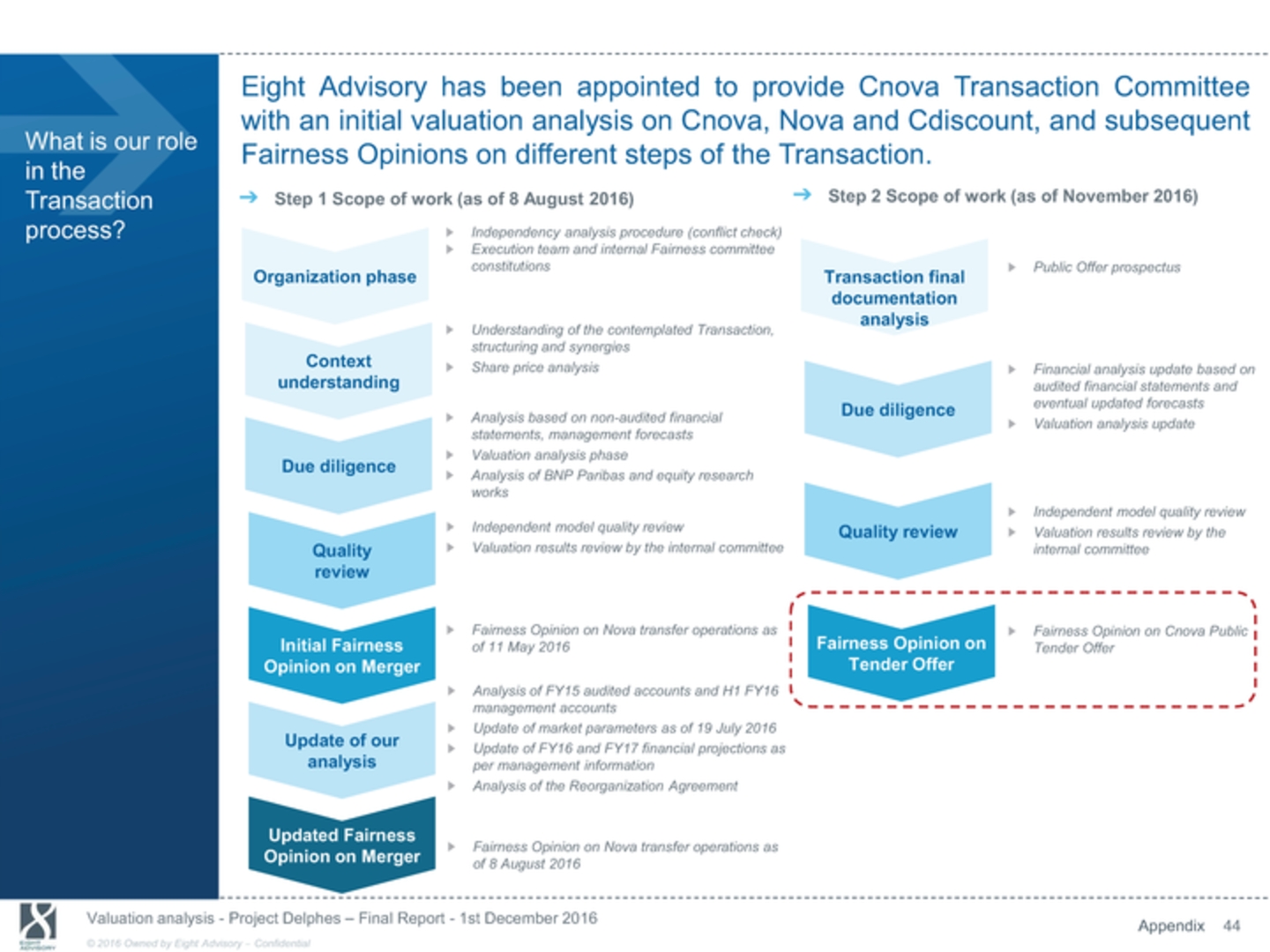

After the completion of the Reorganization on October 31, 2016, the Cnova Transaction Committee met on November 23, 2016 to discuss the conclusions of Eight Advisory, in its capacity as independent expert, as well as the status of the preparation of the Offers.

On November 23, 2016, the Cnova transaction committee met to discuss the conclusions of Eight Advisory, in its capacity as independent expert, as well as the status of the preparation of the Offers. At this meeting, the Cnova transaction committee reviewed a draft of this Position Statement.

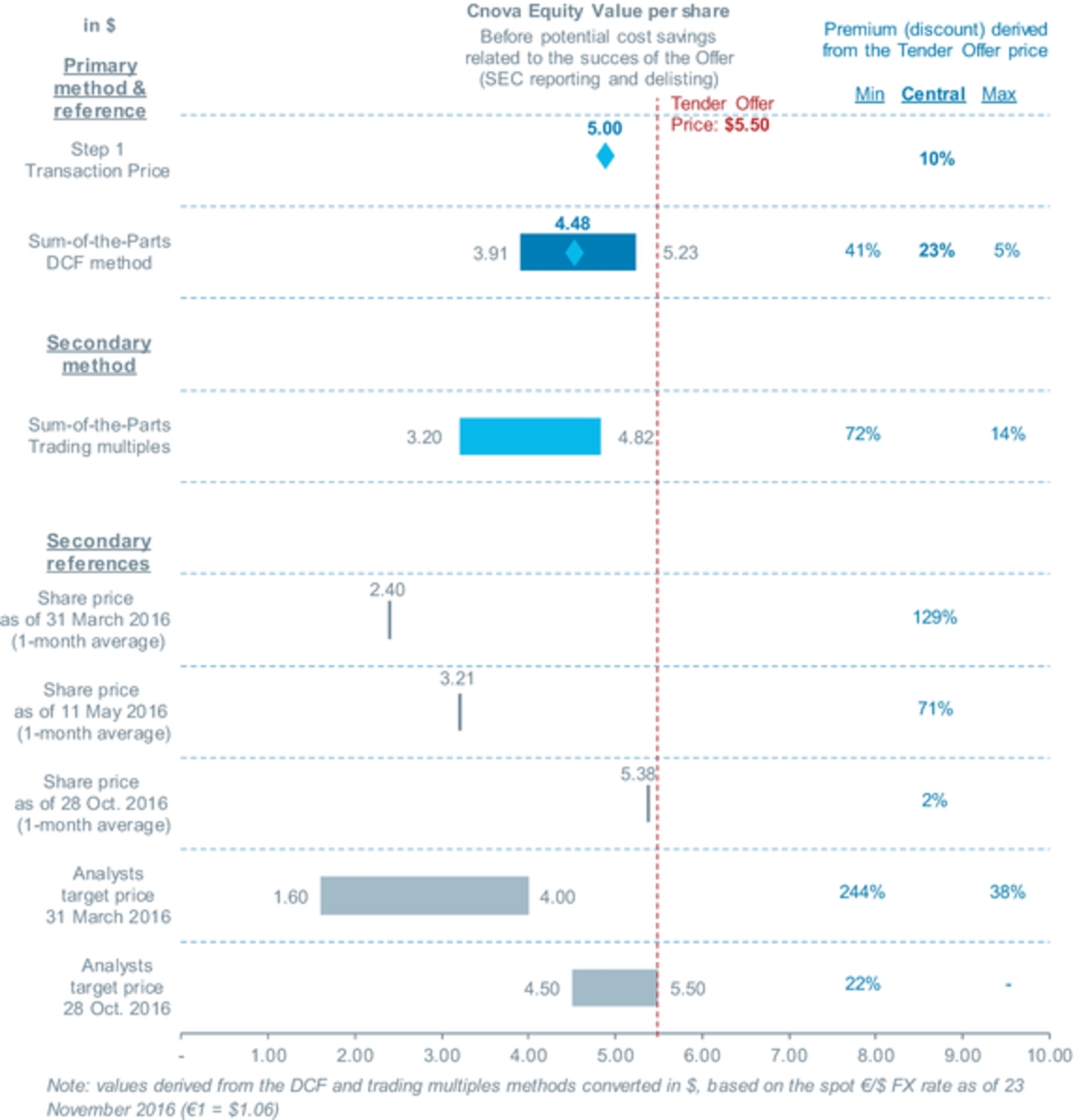

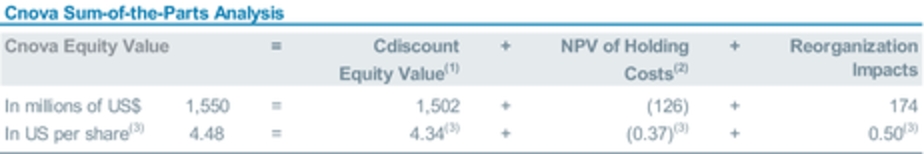

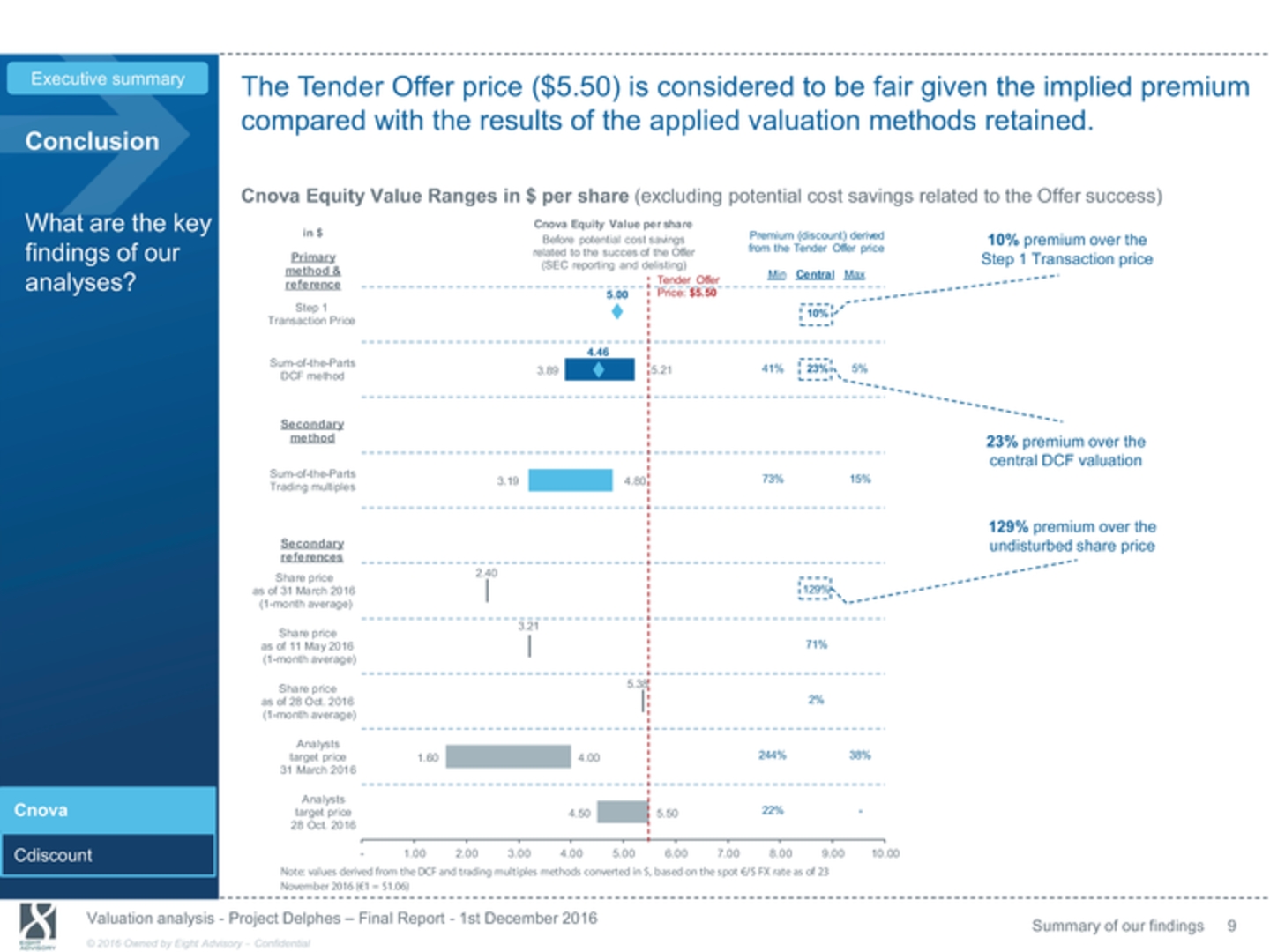

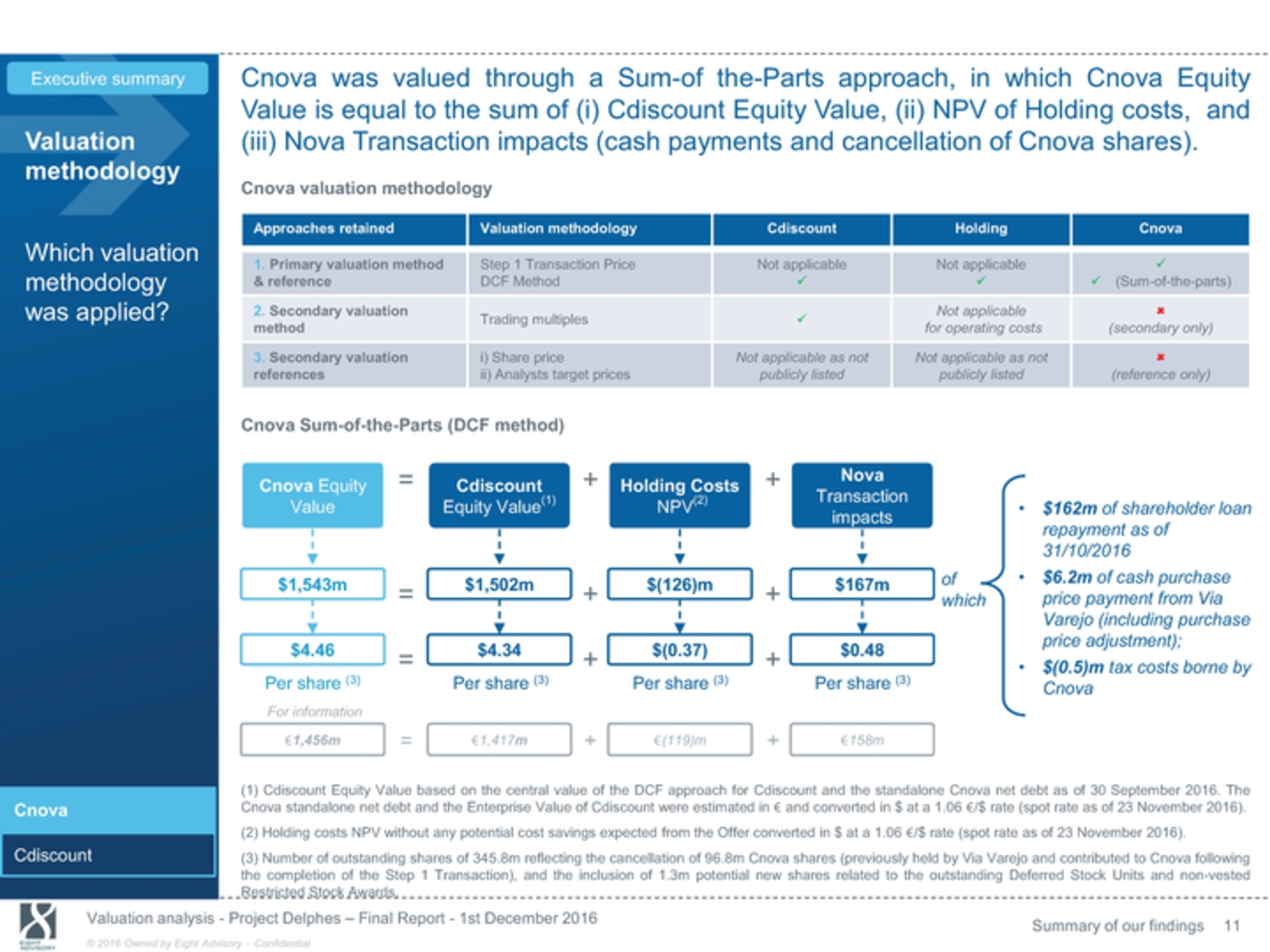

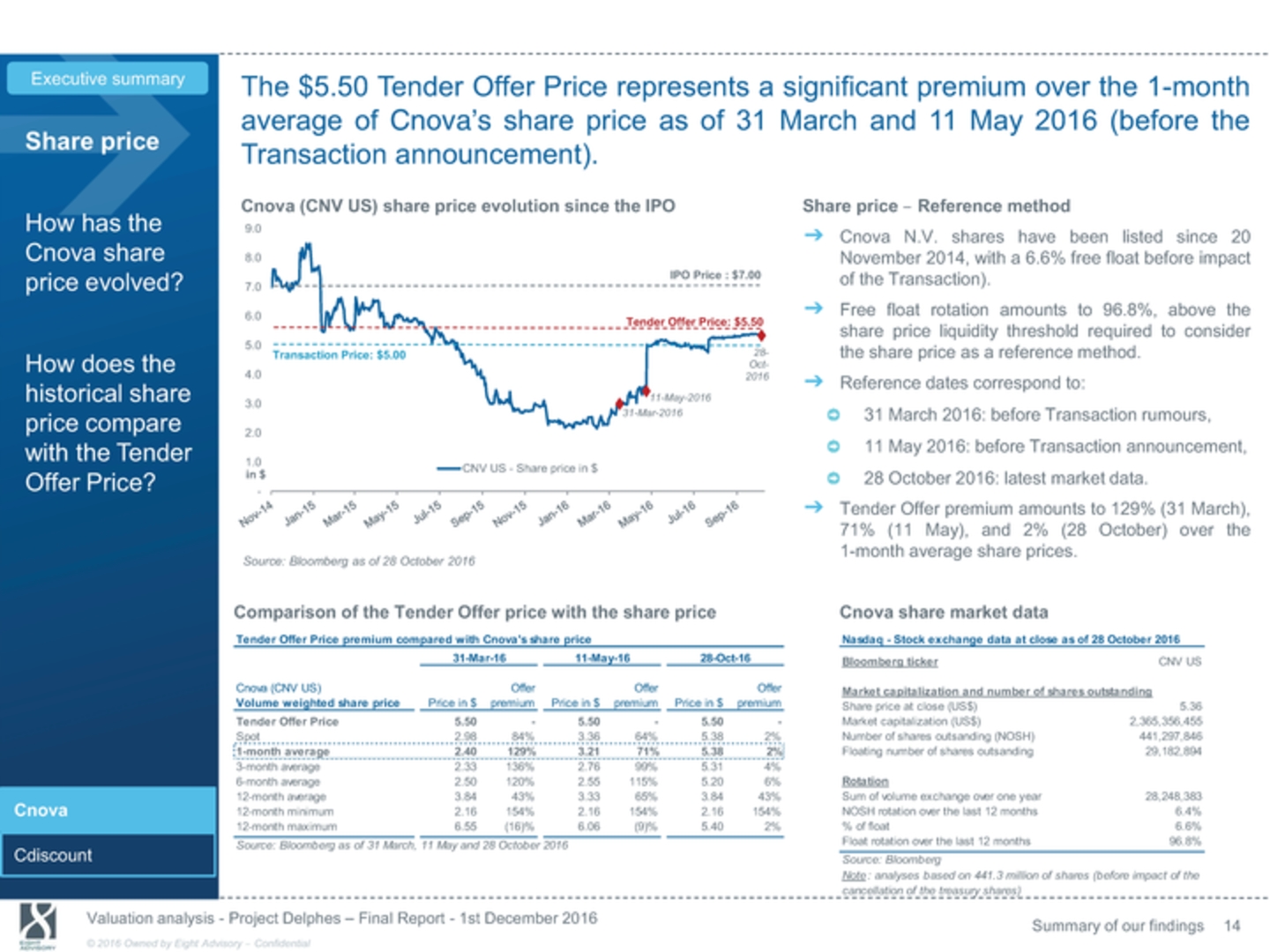

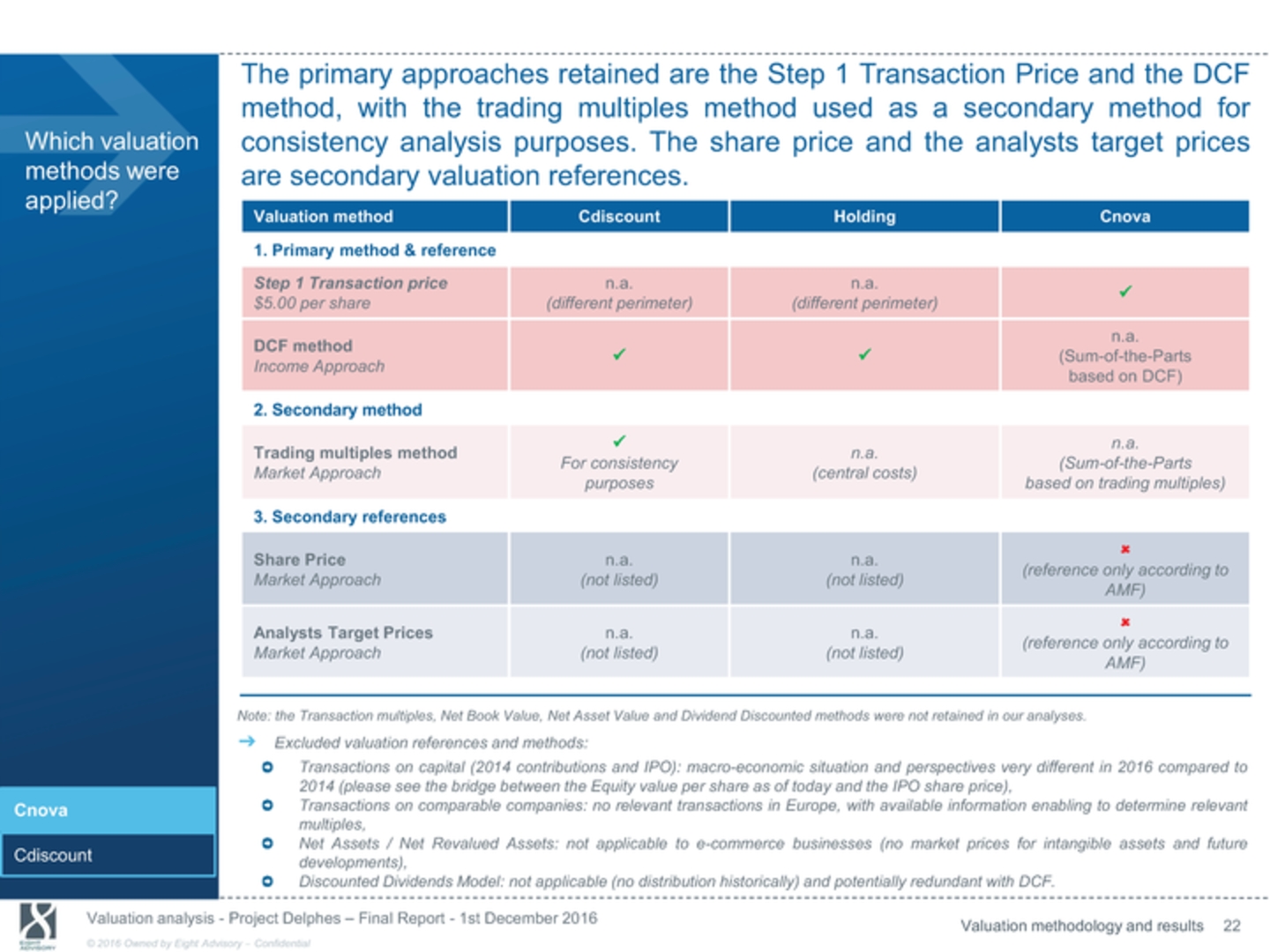

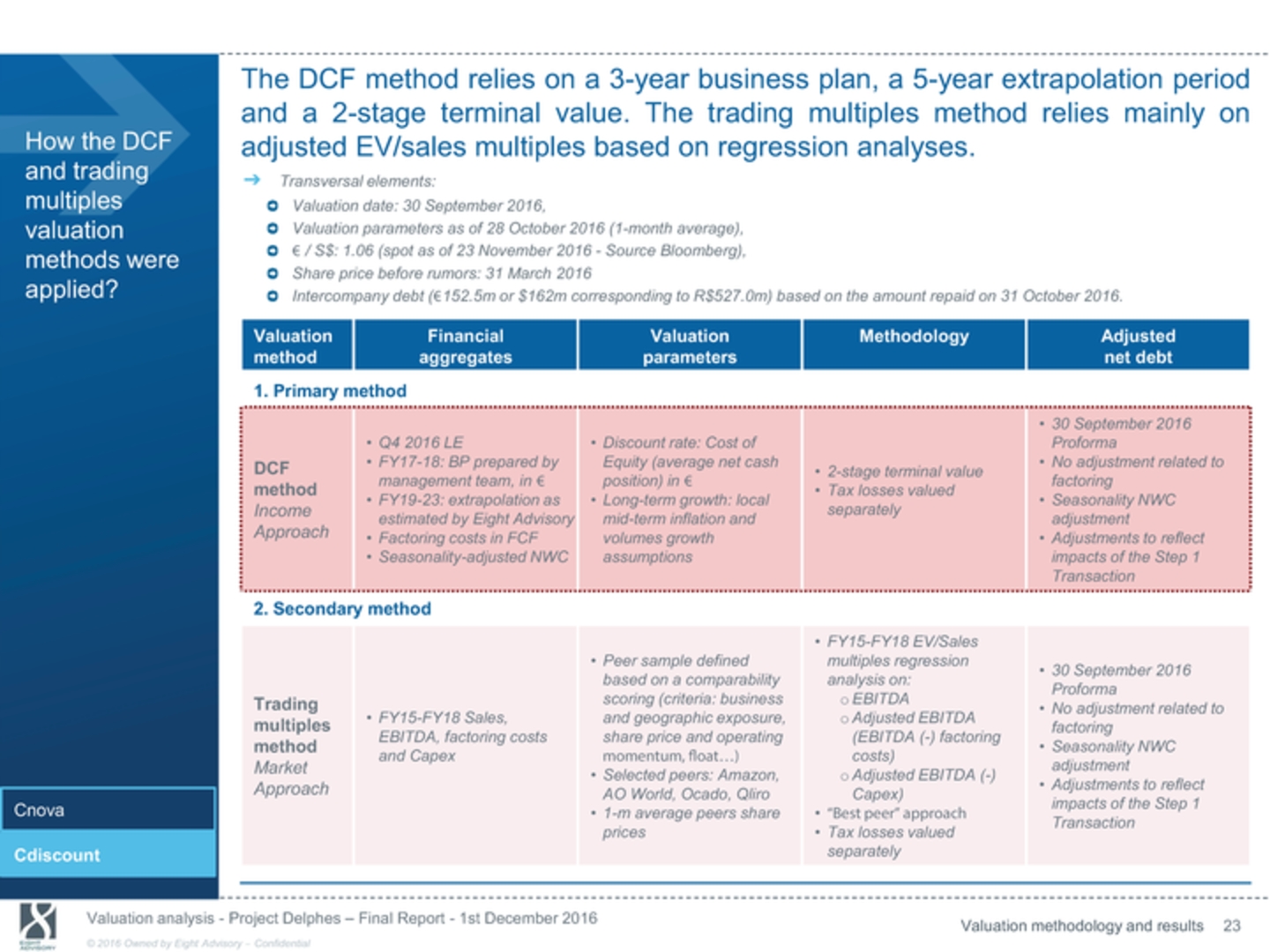

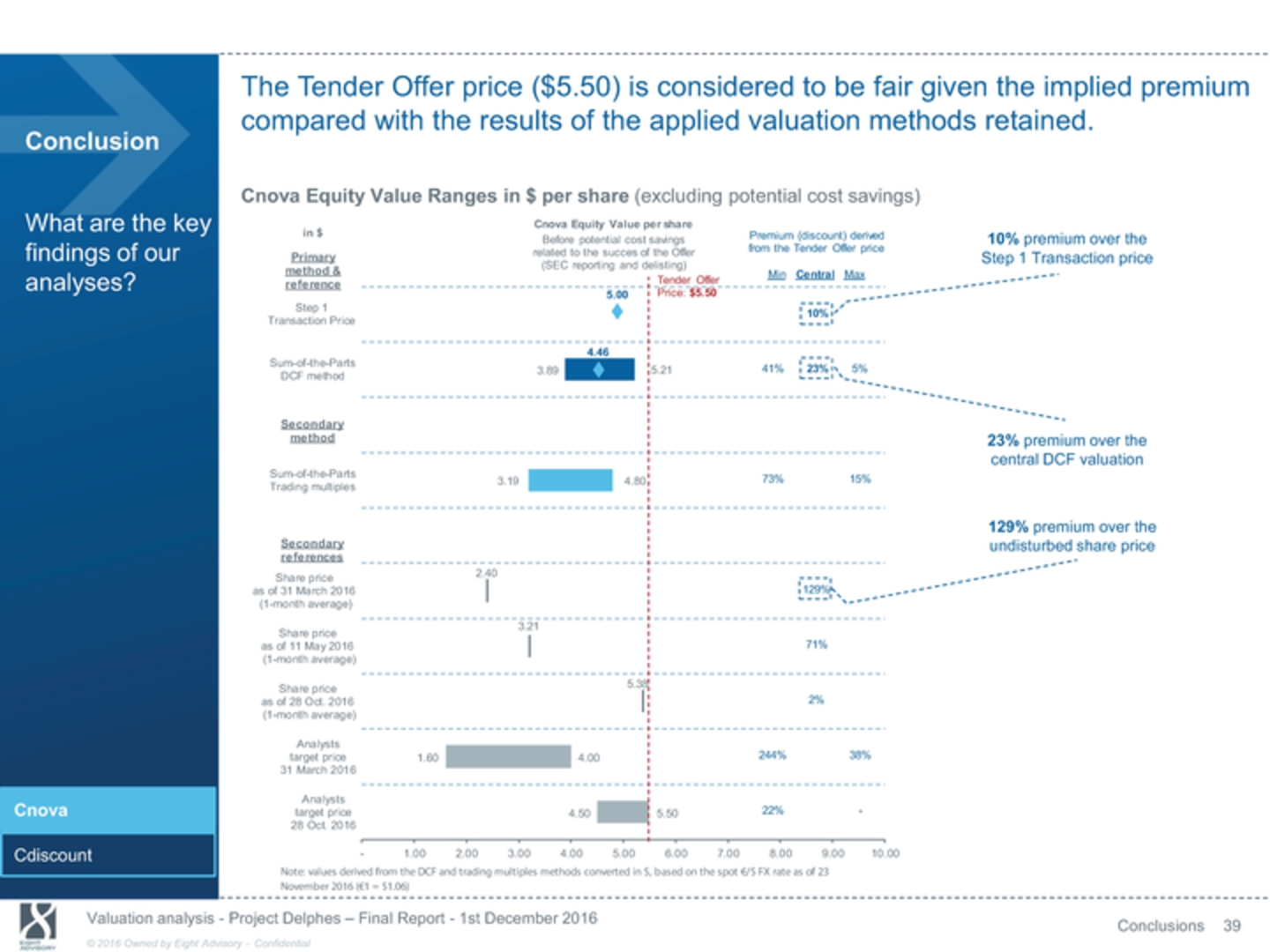

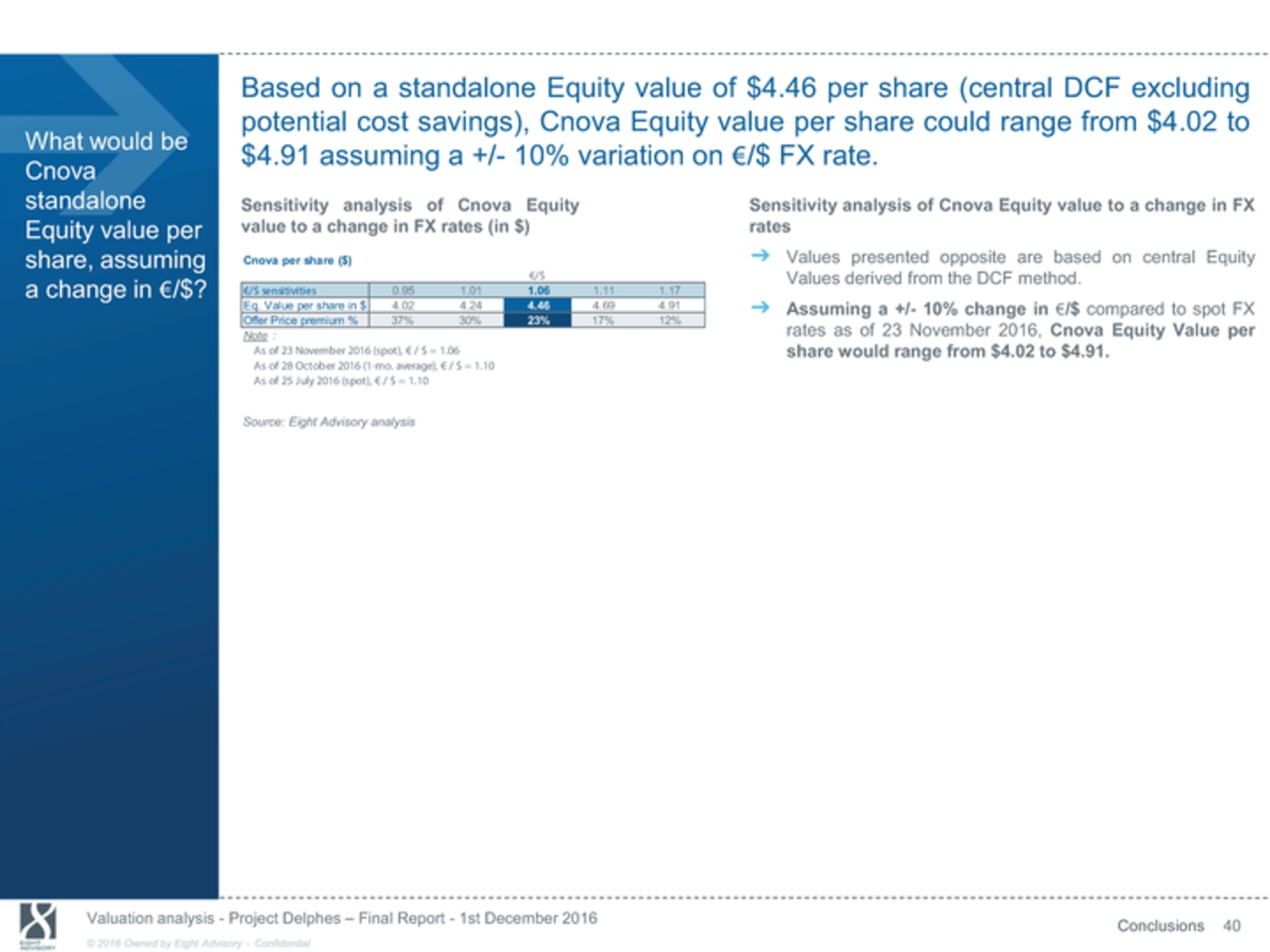

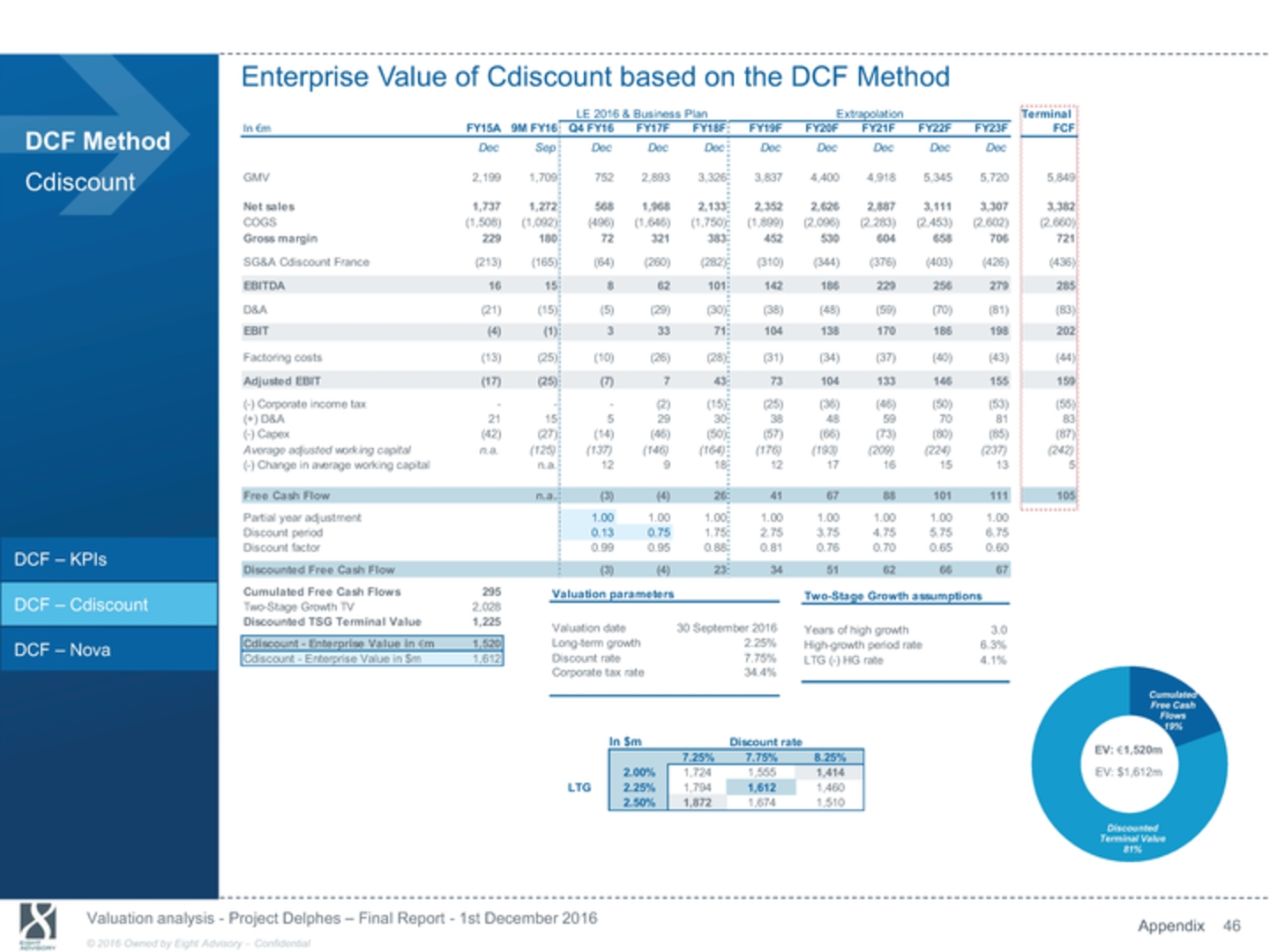

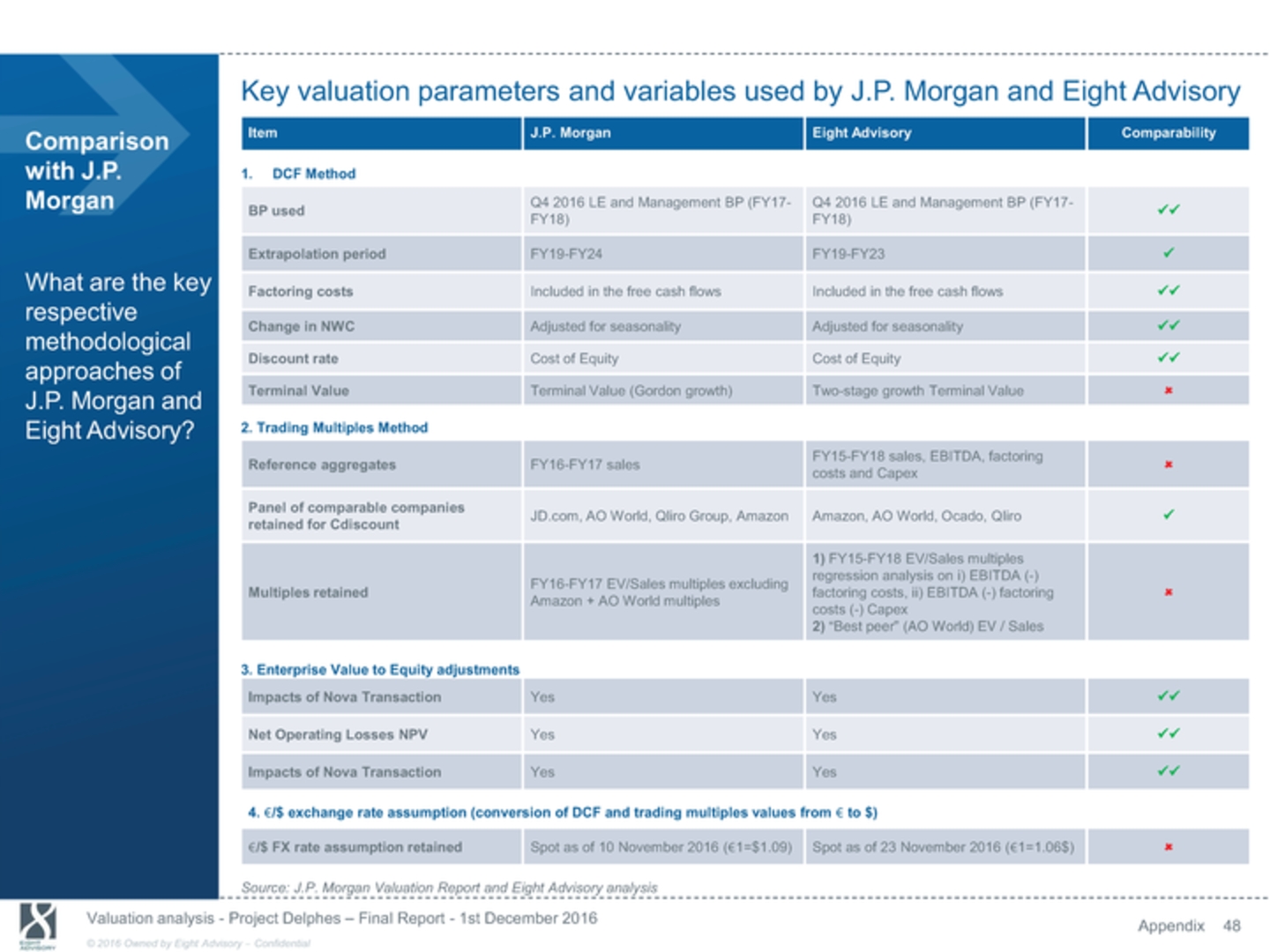

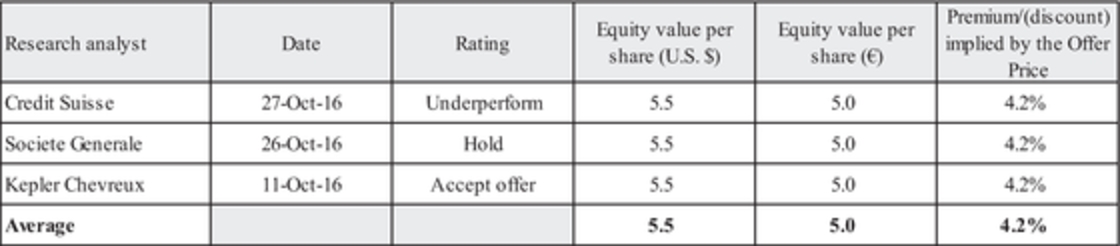

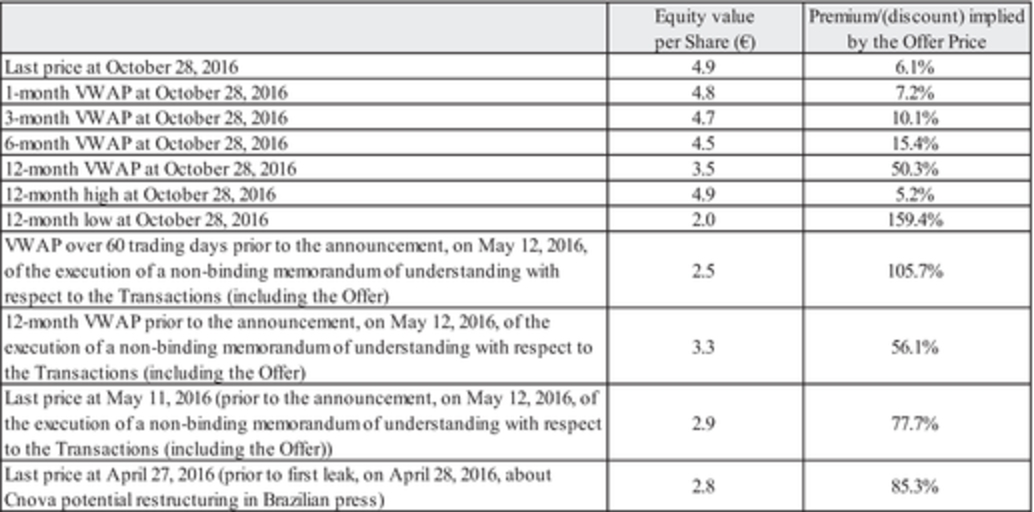

On December 1, 2016, the Cnova transaction committee met again to discuss the Offers. At this meeting, Eight Advisory delivered an opinion as to the fairness of the Offers to the Cnova transaction committee setting forth its opinion that, as of December 1, 2016, and based upon, and subject to, the factors and assumptions set forth therein, the price to be paid to tendering Cnova shareholders pursuant to the Offers was fair, from a financial point of view, to unaffiliated Cnova shareholders.

After review of this opinion, the Cnova Transaction Committee, representing the Cnova Board of Directors, unanimously concluded that it has thoroughly considered the merits, advantages and potential disadvantages, of the Offers and unanimously (i) concluded that the price to be offered by Casino in the Offers reflects at least full and fair value for the Shares, (ii) determined that the Offers are in the best interest of Cnova, its Shareholders and all other stakeholders, (iii) determined that the Offers are fair, advisable and in the best interest of the unaffiliated Shareholders and (iv) resolved to fully support the Offers and recommend that Shareholders accept the Offers, and tender their Shares into the Offers.

| 3. | RATIONALE FOR ENTERING INTO THE TRANSACTIONS |

The Cnova Transaction Committee, representing the full Cnova Board of Directors, considered before the execution of the Reorganization Agreement the rationale for entering into the Transactions and the opportunities and risks entailed by the Transactions for Cnova, its Shareholders and stakeholders.

The Cnova Transaction Committee determined on this occasion that the Transactions were in the best interest of Cnova and its stakeholders, including its minority Shareholders and employees. The Cnova Transaction Committee’s purposes for engaging in the Transactions are described below:

| • | the Cnova Transaction Committee believes that the Reorganization obtains a fair value for Cnova Brazil and the Reorganization is expected to achieve governance, operational, and fiscal efficiencies at Cnova, thereby maximizing value for the Shareholders and furthering the interests of its other stakeholders; |