Filed pursuant to Rule 424(b)(3)

Registration StatementNo. 333-210313

FRONTIER FUNDS

(a Delaware statutory trust)

PROSPECTUS SUPPLEMENT

TO

PROSPECTUS AND DISCLOSURE DOCUMENT

DATED SEPTEMBER 25, 2017

The following information amends the disclosure in the Prospectus and Disclosure Document dated as of September 25, 2017, as supplemented from time to time (the “Prospectus”). If any statement in this supplement conflicts with a statement in the Prospectus, the statement in this supplement controls. Capitalized terms not defined herein will have the meaning ascribed to such term in the Prospectus.

Frontier Fund Management, LLC

Managing Owner

DATED January 8, 2018

FRONTIER FUNDS

FRONTIER DIVERSIFIED FUND

Supplement dated January 8, 2018 to the Prospectus dated as of September 25, 2017, as supplemented from time to time

The purpose of this Supplement is to provide you with information regarding certain changes to the Prospectus in connection with updates to the commodity trading advisor information. Please note the following changes:

| 1. | Effective January 1, 2018, Chesapeake Capital Corporation no longer serves as a commodity trading advisor to Frontier Funds. Accordingly, all references to Chesapeake Capital Corporation in the Prospectus are hereby deleted in their entirety. |

| 2. | The first two rows in the first table under the heading “Allocation of Assets among Trading Advisors and Commodity Pools” are hereby deleted in their entirety and replaced with the following: |

| | |

Advisor | | Allocation as of January 1, 2018 (expressed as a percentage of aggregate notional exposure to commodity trading programs) |

Aspect Capital Limited (accessed via Galaxy Plus Fund – Aspect Feeder Fund (532) LLC) | | 4% |

| 3. | The reference to “Aspect Capital Limited” under the heading “Major Commodity Trading Advisors, Galaxy Plus Platform Commodity Pools and/or Reference Programs:” in the section entitled “FRONTIER DIVERSIFIED FUND APPENDIX” is hereby deleted in its entirety and replaced with “Aspect Capital Limited (accessed via Galaxy Plus Fund – Aspect Feeder Fund (532) LLC)”. |

| 4. | The first table under the heading “DIVERSICATION SUMMARY—FRONTIER FUNDS—THE FRONTIER DIVERSIFIED FUND” in the section entitled “FRONTIER DIVERSIFIED FUND APPENDIX” is hereby deleted in its entirety and replaced with the following: |

1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Trading Advisors and/or

Reference Programs:

Major Advisors and/or

Reference Programs: | | Program | | Interest

Rates | | | Currencies | | | Equity

Indices | | | Metals | | | Energies | | | Agricultural

Commodities | | | Total | |

Aspect Capital Limited* | | Core Diversified Program | | | 25.0 | % | | | 25.0 | % | | | 25.0 | % | | | 10.0 | % | | | 7.5 | % | | | 7.5 | % | | | 100.0 | % |

Crabel Capital Management, LLC | | Multi-Product 1x Program | | | 25.0 | % | | | 24.0 | % | | | 33.0 | % | | | 5.0 | % | | | 9.0 | % | | | 4.0 | % | | | 100.0 | % |

Emil van Essen | | Multi-Strategy Program | | | 2.0 | % | | | 0.0 | % | | | 0.0 | % | | | 5.0 | % | | | 55.0 | % | | | 38.0 | % | | | 100.0 | % |

FORT, L.P. | | Global Contrarian | | | 44.4 | % | | | 20.3 | % | | | 22.6 | % | | | 1.0 | % | | | 11.7 | % | | | 0.0 | % | | | 100.0 | % |

H2O AM LLP | | Force 10 | | | 28.0 | % | | | 40.0 | % | | | 32.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Quantitative Investment Management, LLC | | Global | | | 25.0 | % | | | 12.0 | % | | | 49.0 | % | | | 3.0 | % | | | 11.0 | % | | | 0.0 | % | | | 100.0 | % |

QuantMetrics Capital Management LLP | | QM Futures | | | 2.0 | % | | | 2.0 | % | | | 96.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Quest Partners LLC | | Quest Tracker Index Program | | | 26.0 | % | | | 20.0 | % | | | 20.0 | % | | | 7.5 | % | | | 14.0 | % | | | 12.5 | % | | | 100.0 | % |

Welton Investment Partners LLC | | Global Program | | | 30.0 | % | | | 25.0 | % | | | 15.0 | % | | | 10.0 | % | | | 10.0 | % | | | 10.0 | % | | | 100.0 | % |

Winton Capital Management Ltd.** | | Diversified Futures Fund | | | 28.8 | % | | | 16.7 | % | | | 18.2 | % | | | 13.8 | % | | | 14.8 | % | | | 7.7 | % | | | 100.0 | % |

Non-Major Advisors and/or Reference Programs | | N/A | | | 0.7 | % | | | 1.7 | % | | | 65.1 | % | | | 0.0 | % | | | 0.3 | % | | | 32.2 | % | | | 100.0 | % |

Frontier Diversified Fund | | N/A | | | 21.7 | % | | | 16.8 | % | | | 37.1 | % | | | 4.7 | % | | | 11.6 | % | | | 8.1 | % | | | 100.0 | % |

| 5. | The section entitled “FRONTIER DIVERSIFIED FUND APPENDIX—CHESAPEAKE CAPITAL CORPORATION” is hereby deleted in its entirety. |

| 6. | The first table under the heading “DIVERSICATION SUMMARY—FRONTIER FUNDS—THE FRONTIER MASTERS FUND” in the section entitled “FRONTIER MASTERS FUND APPENDIX” is hereby deleted in its entirety and replaced with the following: |

| | | | | | | | | | | | | | | | | | |

Trading Advisors and/or

Reference Programs | | Program | | Interest

Rates | | Currencies | | Equity

Indices | | Metals | | Energies | | Agricultural

Commodities | | Hybrids | | Total |

Emil van Essen | | Multi-Strategy Program | | 2.0% | | 0.0% | | 0.0% | | 5.0% | | 55.0% | | 38.0% | | 0.0% | | 100.0% |

Transtrend B.V. | | Diversified Trend Program – Enhanced Risk USD | | 15.0% | | 26.0% | | 18.0% | | 5.0% | | 7.0% | | 9.0% | | 20.0% | | 100.0% |

Welton Investment Partners LLC | | Global Program | | 30.0% | | 25.0% | | 15.0% | | 10.0% | | 10.0% | | 10.0% | | 0.0% | | 100.0% |

Winton Capital Management Ltd.** | | Diversified Futures Fund | | 28.8% | | 16.7% | | 18.2% | | 13.8% | | 14.8% | | 7.7% | | 0.0% | | 100.0% |

Frontier Masters Fund | | N/A | | 19.0% | | 16.8% | | 12.8% | | 8.5% | | 21.7% | | 16.2% | | 5.0% | | 100.0% |

2

| 7. | The first table under the heading “DIVERSICATION SUMMARY—FRONTIER FUNDS—THE FRONTIER LONG/SHORT COMMODITY FUND” in the section entitled “FRONTIER LONG/SHORT COMMODITY FUND APPENDIX” is hereby deleted in its entirety and replaced with the following: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Trading Advisors and/or

Reference Programs:

Major Advisors and/or

Reference Programs: | | Program | | Grains | | | Livestock | | | Softs | | | Energies | | | Industrial

Metals | | | Precious

Metals | | | Financials | | | Total | |

Emil van Essen | | Multi-Strategy Program | | | 13.0 | % | | | 12.0 | % | | | 13.0 | % | | | 55.0 | % | | | 3.0 | % | | | 2.0 | % | | | 2.0 | % | | | 100.0 | % |

JE Moody & Company LLC | | JEM Commodity Relative Value Program | | | 15.0 | % | | | 15.0 | % | | | 15.0 | % | | | 40.0 | % | | | 15.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Red Oak Commodity Advisors | | Fundamental Trading | | | 15.0 | % | | | 1.5 | % | | | 10.0 | % | | | 15.0 | % | | | 15.0 | % | | | 10.0 | % | | | 30.0 | % | | | 100.0 | % |

Rosetta Capital Management LLC | | Rosetta Trading | | | 50.0 | % | | | 5.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Welton Investment Partners LLC | | Global Program | | | 6.40 | % | | | 1.00 | % | | | 5.50 | % | | | 5.50 | % | | | 5.50 | % | | | 1.0 | % | | | 75.1 | % | | | 100.0 | % |

Non-Major Advisors and/or Reference Programs | | N/A | | | 10.0 | % | | | 50.0 | % | | | 8.0 | % | | | 1.0 | % | | | 0.0 | % | | | 0.0 | % | | | 6.0 | % | | | 100.0 | % |

Frontier Long/Short Commodity Fund | | N/A | | | 20.5 | % | | | 19.8 | % | | | 7.8 | % | | | 21.1 | % | | | 6.0 | % | | | 2.2 | % | | | 22.6 | % | | | 100.0 | % |

| 8. | The section entitled “FUND EXPOSURE BY FUTURES STRATEGY” in the Statement of Additional Information is hereby deleted in its entirety and replaced with the following: |

3

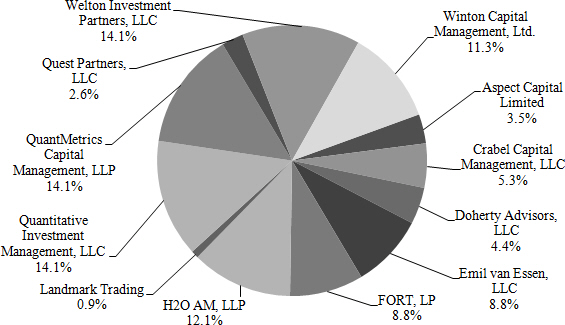

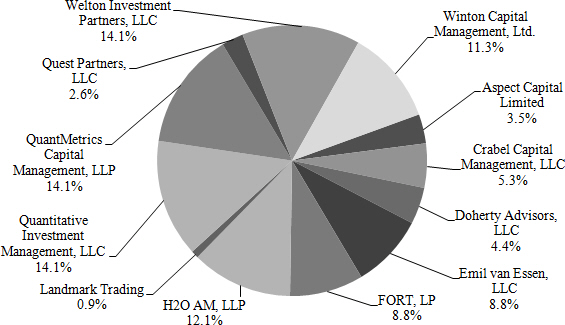

Frontier Diversified Fund, as of January 1, 2018

Portfolio holdings are as of the date stated, are subject to change, and should not be considered investment advice. The portfolio holdings do not include investments of the Frontier Funds (the “Trust”) cash management pool and the related allocation to the Quest Fixed Income Tracker-based Hedge Program (“QFIT”). QFIT is designed to produce investment returns that have a positive correlation to medium-term interest rates in the United States. Frontier Fund Management LLC is allocating to QFIT in order to hedge its cash management investments in US Treasuries. Such allocation is intended to mitigate duration risk and preserve capital in the Trust’s cash management pool, rather than generate capital appreciation as with the Trust’s other investments in CTA trading programs. The Trust’s total allocation to QFIT was $11 million, as of 12/31/2017. Such allocation is sharedpro-rata by each Fund of the Trust.

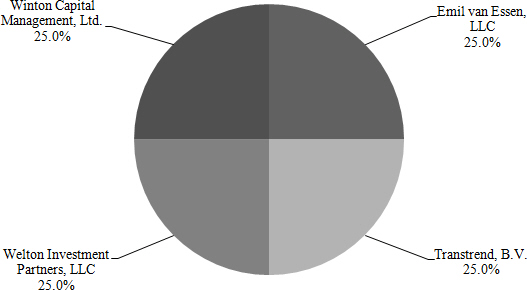

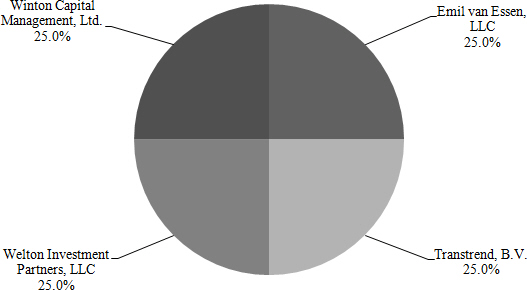

Frontier Masters Fund, as of January 1. 2018

Portfolio holdings are as of the date stated, are subject to change, and should not be considered investment advice. The portfolio holdings do not include investments of the Frontier Funds (the “Trust”) cash management pool and the related allocation to the Quest

4

Fixed Income Tracker-based Hedge Program (“QFIT”). QFIT is designed to produce investment returns that have a positive correlation to medium-term interest rates in the United States. Frontier Fund Management LLC is allocating to QFIT in order to hedge its cash management investments in US Treasuries. Such allocation is intended to mitigate duration risk and preserve capital in the Trust’s cash management pool, rather than generate capital appreciation as with the Trust’s other investments in CTA trading programs. The Trust’s total allocation to QFIT was $11 million, as of 12/31/2017. Such allocation is sharedpro-rata by each Fund of the Trust.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

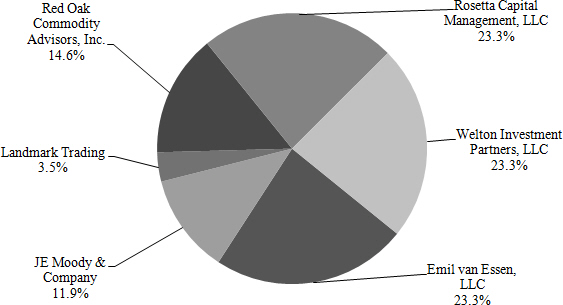

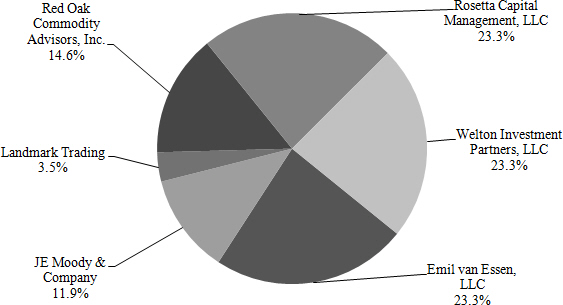

Frontier Long/Short Commodity Fund, as of January 1, 2018

Portfolio holdings are as of the date stated, are subject to change, and should not be considered investment advice. The portfolio holdings do not include investments of the Frontier Funds (the “Trust”) cash management pool and the related allocation to the Quest Fixed Income Tracker-based Hedge Program (“QFIT”). QFIT is designed to produce investment returns that have a positive correlation to medium-term interest rates in the United States. Frontier Fund Management LLC is allocating to QFIT in order to hedge its cash management investments in US Treasuries. Such allocation is intended to mitigate duration risk and preserve capital in the Trust’s cash management pool, rather than generate capital appreciation as with the Trust’s other investments in CTA trading programs. The Trust’s total allocation to QFIT was $11 million, as of 12/31/2017.Such allocation is sharedpro-rata by each Fund of the Trust.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

5