In the event that one or more Authorized Participants having substantial interests in Shares or otherwise responsible for a significant portion of the Shares’ daily trading volume on the Exchange withdraw from participation, the liquidity of the Shares will likely decrease which could adversely affect the market price of the Shares and result in your incurring a loss on your investment.

The Trust is not registered as an investment company under the Investment Company Act of 1940 and is not required to register under such act. Consequently, Shareholders do not have the regulatory protections provided to investors in investment companies. The Trust does and will not hold or trade in commodity futures contracts regulated by the CEA, as administered by the CFTC. Furthermore, the Trust is not a commodity pool for purposes of the CEA, and neither the Sponsor nor the Trustee is subject to regulation by the CFTC as a commodity pool operator or a commodity trading advisor in connection with the Shares. Consequently, Shareholders do not have the regulatory protections provided to investors in CEA-regulated instruments or commodity pools.

If the Trust is required to terminate and liquidate, such termination and liquidation could occur at a time which is disadvantageous to Shareholders, such as when silver prices are lower than the silver prices at the time when Shareholders purchased their Shares. In such a case, when the Trust’s silver is sold as part of the Trust’s liquidation, the resulting proceeds distributed to Shareholders will be less than if silver prices were higher at the time of sale.

Although Shares are listed for trading on the NYSE Arca, it cannot be assumed that an active trading market for the Shares will develop or be maintained. If an investor needs to sell Shares at a time when no active market for Shares exists, such lack of an active market will most likely adversely affect the price the investor receives for the Shares (assuming the investor is able to sell them).

As interests in an investment trust, the Shares have none of the statutory rights normally associated with the ownership of shares of a corporation (including, for example, the right to bring “oppression” or “derivative” actions). In addition, the Shares have limited voting and distribution rights (for example, Shareholders do not have the right to elect directors and do not receive dividends).

The Trust competes with other financial vehicles, including traditional debt and equity securities issued by companies in the silver industry and other securities backed by or linked to silver, direct investments in silver and investment vehicles similar to the Trust. Market and financial conditions, and other conditions beyond the Sponsor’s control, may make it more attractive to invest in other financial vehicles or to invest in silver directly, which could limit the market for the Shares and reduce the liquidity of the Shares.

To the extent existing exchange traded vehicles (“ETVs”) tracking silver markets represent a significant proportion of demand for physical silver bullion, large redemptions of the securities of these ETVs could negatively affect physical silver bullion prices and the price and NAV of the Shares.

The possibility of large-scale distress sales of silver in times of crisis may have a short-term negative impact on the price of silver and adversely affect an investment in the Shares. For example, the 2008 financial credit crisis resulted in significantly depressed prices of silver largely due to a slowdown in demand in silver for industrial use and forced sales and deleveraging from institutional investors. Crises in the future may impair silver’s price performance which would, in turn, adversely affect an investment in the Shares.

Several factors may have the effect of causing a decline in the prices of silver and a corresponding decline in the price of Shares. Among them:

A significant increase in silver hedging activity by silver producers. Should there be an increase in the level of hedge activity of silver producing companies, it could cause a decline in world silver prices, adversely affecting the price of the Shares.

A significant change in the attitude of speculators and investors towards silver. Should the speculative community take a negative view towards silver, it could cause a decline in world silver prices, negatively impacting the price of the Shares.

A widening of interest rate differentials between the cost of money and the cost of silver could negatively affect the price of silver which, in turn, could negatively affect the price of the Shares.

A combination of rising money interest rates and a continuation of the current low cost of borrowing silver could improve the economics of selling silver forward. This could result in an increase in hedging by silver mining companies and short selling by speculative interests, which would negatively affect the price of silver. Under such circumstances, the price of the Shares would be similarly affected.

The Trust’s silver may be subject to loss, damage, theft or restriction on access.

There is a risk that part or all of the Trust’s silver could be lost, damaged or stolen. Access to the Trust’s silver could also be restricted by natural events (such as an earthquake) or human actions (such as a terrorist attack). Any of these events may adversely affect the operations of the Trust and, consequently, an investment in the Shares.

The Trust’s lack of insurance protection and the Shareholders’ limited rights of legal recourse against the Trust, the Trustee, the Sponsor, the Custodian and any subcustodian exposes the Trust and its Shareholders to the risk of loss of the Trust’s silver for which no person is liable.

The Trust does not insure its silver. The Custodian maintains insurance with regard to its business on such terms and conditions as it considers appropriate in connection with its custodial obligations and is responsible for all costs, fees and expenses arising from the insurance policy or policies. The Trust is not a beneficiary of any such insurance and does not have the ability to dictate the existence, nature or amount of coverage. Therefore, Shareholders cannot be assured that the Custodian maintains adequate insurance or any insurance with respect to the silver held by the Custodian on behalf of the Trust. In addition, the Custodian and the Trustee do not require any direct or indirect subcustodians to be insured or bonded with respect to their custodial activities or in respect of the silver held by them on behalf of the Trust. Further, Shareholders’ recourse against the Trust, the Trustee and the Sponsor, under New York law, the Custodian, under English law, and any subcustodians under the law governing their custody operations is limited. Consequently, a loss may be suffered with respect to the Trust’s silver which is not covered by insurance and for which no person is liable in damages.

The Custodian’s limited liability under the Custody Agreements and English law may impair the ability of the Trust to recover losses concerning its silver and any recovery may be limited, even in the event of fraud, to the market value of the silver at the time the fraud is discovered.

The liability of the Custodian is limited under the Custody Agreements. Under the Custody Agreements between the Trustee and the Custodian which establish the Trust Unallocated Account and the Trust Allocated Account, the Custodian is only liable for losses that are the direct result of its own negligence, fraud or willful default in the performance of its duties. Any such liability is further limited, in the case of the Allocated Account Agreement, to the market value of the silver held in the Trust Allocated Account at the time such negligence, fraud or willful

17

default is discovered by the Custodian and, in the case of the Unallocated Account Agreement, to the amount of silver credited to the Trust Unallocated Account at the time such negligence, fraud or willful default is discovered by the Custodian. Under each Authorized Participant Unallocated Bullion Account Agreement (between the Custodian and an Authorized Participant), the Custodian is not contractually or otherwise liable for any losses suffered by any Authorized Participant or Shareholder that are not the direct result of its own gross negligence, fraud or willful default in the performance of its duties under such agreement, and in no event will its liability exceed the market value of the balance in the Authorized Participant Unallocated Account at the time such gross negligence, fraud or willful default is discovered by the Custodian. In addition, the Custodian will not be liable for any delay in performance or any non-performance of any of its obligations under the Allocated Account Agreement, the Unallocated Account Agreement or the Authorized Participant Unallocated Bullion Account Agreement by reason of any cause beyond its reasonable control, including acts of God, war or terrorism. As a result, the recourse of the Trustee or the investor, under English law, is limited. Furthermore, under English common law, the Custodian or any subcustodian will not be liable for any delay in the performance or any non-performance of its custodial obligations by reason of any cause beyond its reasonable control.

The obligations of the Custodian and English subcustodians are governed by English law, which may frustrate the Trust in attempting to receive legal redress against the Custodian or any subcustodian concerning its silver.

The obligations of the Custodian under the Custody Agreements and the Authorized Participant Unallocated Bullion Account Agreement are governed by English law. The Custodian may enter into arrangements with English subcustodians, which arrangements may also be governed by English law. The Trust is a New York common law trust. Any United States, New York or other court situated in the United States may have difficulty interpreting English law (which, insofar as it relates to custody arrangements, is largely derived from court rulings rather than statute), LBMA rules or the customs and practices in the London custody market. It may be difficult or impossible for the Trust to sue a subcustodian in a United States, New York or other court situated in the United States. In addition, it may be difficult, time consuming and/or expensive for the Trust to enforce in a foreign court a judgment rendered by a United States, New York or other court situated in the United States.

The Trust may not have adequate sources of recovery if its silver is lost, damaged, stolen or destroyed.

If the Trust’s silver is lost, damaged, stolen or destroyed under circumstances rendering a party liable to the Trust, the responsible party may not have the financial resources sufficient to satisfy the Trust’s claim. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or one or more subcustodians or, to the extent identifiable, other responsible third parties (e.g., a thief or terrorist), any of which may not have the financial resources (including liability insurance coverage) to satisfy a valid claim of the Trust.

Shareholders and Authorized Participants lack the right under the Custody Agreements to assert claims directly against the Custodian and any subcustodian.

Neither the Shareholders nor any Authorized Participant have a right under the Custody Agreements to assert a claim of the Trustee against the Custodian or any subcustodian. Claims under the Custody Agreements may only be asserted by the Trustee on behalf of the Trust.

Because neither the Trustee nor the Custodian oversees or monitors the activities of subcustodians who may hold the Trust’s silver, failure by the subcustodians to exercise due care in the safekeeping of the Trust’s silver could result in a loss to the Trust.

Under the Allocated Account Agreement, the Custodian may appoint from time to time one or more subcustodians to hold the Trust’s silver on a temporary basis pending delivery to the Custodian. The subcustodians which the Custodian currently uses are LBMA market-making members that provide bullion vaulting and clearing services to third parties. The Custodian is required under the Allocated Account Agreement to use reasonable care in appointing its subcustodians, making the Custodian liable only for negligence or bad faith in the selection of such subcustodians, and has an obligation to use commercially reasonable efforts to obtain delivery of the Trust’s silver from any subcustodians appointed by the Custodian. Otherwise, the Custodian is not liable for the acts or omissions of its subcustodians. These subcustodians may in turn appoint further subcustodians, but the Custodian is not responsible for the appointment of these further subcustodians. The Custodian does not undertake to monitor the performance by subcustodians of their custody functions or their selection of further subcustodians. The Trustee

18

does not monitor the performance of the Custodian other than to review the reports provided by the Custodian pursuant to the Custody Agreements and does not undertake to monitor the performance of any subcustodian. Furthermore, the Trustee may have no right to visit the premises of any subcustodian for the purposes of examining the Trust’s silver or any records maintained by the subcustodian, and no subcustodian will be obligated to cooperate in any review the Trustee may wish to conduct of the facilities, procedures, records or creditworthiness of such subcustodian. In addition, the ability of the Trustee to monitor the performance of the Custodian may be limited because under the Allocated Account Agreement and the Unallocated Account Agreement the Trustee has only limited rights to visit the premises of the Custodian for the purpose of examining the Trust’s silver and certain related records maintained by the Custodian.

The obligations of any subcustodian of the Trust’s silver are not determined by contractual arrangements but by LBMA rules and London bullion market customs and practices, which may prevent the Trust’s recovery of damages for losses on its silver custodied with subcustodians.

There are expected to be no written contractual arrangements between subcustodians that hold the Trust’s silver and the Trustee or the Custodian because traditionally such arrangements are based on the LBMA’s rules and on the customs and practices of the London bullion market. In the event of a legal dispute with respect to or arising from such arrangements, it may be difficult to define such customs and practices. The LBMA’s rules may be subject to change outside the control of the Trust. Under English law, neither the Trustee nor the Custodian would have a supportable breach of contract claim against a subcustodian for losses relating to the safekeeping of silver. If the Trust’s silver is lost or damaged while in the custody of a subcustodian, the Trust may not be able to recover damages from the Custodian or the subcustodian. Whether a subcustodian will be liable for the failure of subcustodians appointed by it to exercise due care in the safekeeping of the Trust’s silver will depend on the facts and circumstances of the particular situation. Shareholders cannot be assured that the Trustee will be able to recover damages from subcustodians whether appointed by the Custodian or by another subcustodian for any losses relating to the safekeeping of silver by such subcustodian.

Silver bullion allocated to the Trust in connection with the creation of a Basket may not meet the London Good Delivery Standards and, if a Basket is issued against such silver, the Trust may suffer a loss.

Neither the Trustee nor the Custodian independently confirms the fineness of the silver allocated to the Trust in connection with the creation of a Basket. The silver bullion allocated to the Trust by the Custodian may be different from the reported fineness or weight required by the LBMA’s standards for silver bars delivered in settlement of a silver trade (London Good Delivery Standards), the standards required by the Trust. If the Trustee nevertheless issues a Basket against such silver, and if the Custodian fails to satisfy its obligation to credit the Trust the amount of any deficiency, the Trust may suffer a loss.

Silver held in the Trust’s unallocated silver account and any Authorized Participant’s unallocated silver account is not segregated from the Custodian’s assets. If the Custodian becomes insolvent, its assets may not be adequate to satisfy a claim by the Trust or any Authorized Participant. In addition, in the event of the Custodian’s insolvency, there may be a delay and costs incurred in identifying the bullion held in the Trust’s allocated silver account.

Silver which is part of a deposit for a purchase order or part of a redemption distribution will be held for a time in the Trust’s Unallocated Account and, previously or subsequently in, the Authorized Participant Unallocated Account of the purchasing or redeeming Authorized Participant. During those times, the Trust and the Authorized Participant, as the case may be, will have no proprietary rights to any specific bars of silver held by the Custodian and will each be an unsecured creditor of the Custodian with respect to the amount of silver held in such unallocated accounts. In addition, if the Custodian fails to allocate the Trust’s silver in a timely manner, in the proper amounts or otherwise in accordance with the terms of the Unallocated Account Agreement, or if a subcustodian fails to so segregate silver held by it on behalf of the Trust, unallocated silver will not be segregated from the Custodian’s assets, and the Trust will be an unsecured creditor of the Custodian with respect to the amount so held in the event of the insolvency of the Custodian. In the event the Custodian becomes insolvent, the Custodian’s assets might not be adequate to satisfy a claim by the Trust or the Authorized Participant for the amount of silver held in their respective unallocated silver accounts.

In the case of the insolvency of the Custodian, a liquidator may seek to freeze access to the silver held in all of the accounts held by the Custodian, including the Trust’s Allocated Account. Although the Trust would be able to

19

claim ownership of properly allocated silver, the Trust could incur expenses in connection with asserting such claims, and the assertion of such a claim by the liquidator could delay creations and redemptions of Baskets.

In issuing Baskets, the Trustee relies on certain information received from the Custodian which is subject to confirmation after the Trustee has relied on the information. If such information turns out to be incorrect, Baskets may be issued in exchange for an amount of silver which is more or less than the amount of silver which is required to be deposited with the Trust.

The Custodian’s definitive records are prepared after the close of its business day. However, when issuing Baskets, the Trustee relies on information reporting the amount of silver credited to the Trust’s accounts which it receives from the Custodian during the business day and which is subject to correction during the preparation of the Custodian’s definitive records after the close of business. If the information relied upon by the Trustee is incorrect, the amount of silver actually received by the Trust may be more or less than the amount required to be deposited for the issuance of Baskets.

The sale of the Trust’s silver to pay expenses not assumed by the Sponsor at a time of low silver prices could adversely affect the value of the Shares.

The Trustee sells silver held by the Trust to pay Trust expenses not assumed by the Sponsor on an as-needed basis irrespective of then-current silver prices. The Trust is not actively managed and no attempt will be made to buy or sell silver to protect against or to take advantage of fluctuations in the price of silver. Consequently, the Trust’s silver may be sold at a time when the silver price is low, resulting in a negative effect on the value of the Shares.

The value of the Shares will be adversely affected if the Trust is required to indemnify the Sponsor or the Trustee under the Trust Agreement.

Under the Trust Agreement, each of the Sponsor and the Trustee has a right to be indemnified from the Trust for any liability or expense it incurs without gross negligence, bad faith or willful misconduct on its part. That means the Sponsor or the Trustee may require the assets of the Trust to be sold in order to cover losses or liability suffered by it. Any sale of that kind would reduce the NAV of the Trust and the value of the Shares.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Not applicable.

Item 3. Legal Proceedings

None.

Item 4. (Removed and Reserved)

20

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

a) On July 24, 2009, the Trust’s Shares commenced trading on the NYSE Arca under the symbol SIVR, and the Trust commenced operations, began accruing expenses and began the calculation of NAV. For each of the quarters during the fiscal period commencing July 24, 2009 and ending December 31, 2009 (the “Reporting Period,” the high and low sale prices of the Shares as reported for NYSE Arca transactions were as follows:

| | | | | | | |

| | Period ended December 31, 2009 | |

| | High | | Low | |

Third Quarter (commencing July 24, 2009) | | $ | 17.37 | | $ | 13.40 | |

Fourth Quarter | | $ | 19.15 | | $ | 16.20 | |

The number of Shareholders of record of the Trust as of March 26, 2010 was approximately nine.

b) Not applicable.

c) 15 Baskets (1,500,000 Shares) were redeemed during the fourth quarter of the year ended December 31, 2009.

| | | | | | | |

Period | | Total Number of Shares

Redeemed | | Average Ounces of Silver

Per Share | |

| | | | | | | |

10/01/09 to 10/31/09 | | | 0 | | | 0 | |

11/01/09 to 11/30/09 | | | 0 | | | 0 | |

12/01/09 to 12/31/09 | | | 1,500,000 | | | .99932 | |

| |

|

| |

|

| |

Total | | | 1,500,000 | | | .99932 | |

Item 6. Selected Financial Data.

The following selected financial data for the Reporting Period should be read in conjunction with the Trust’s financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| | | | |

| | December 31,

2009* | |

Total assets | | $ | 139,223,967 | |

Total gain on sales and distributions of silver | | $ | 3,870,417 | |

Net gain (loss) | | $ | 3,664,391 | |

Weighted-average shares outstanding | | | 7,648,171 | |

Net gain (loss) per share | | $ | 0.48 | |

Net cash flows | | $ | 0 | |

| |

|

|

* | For the period from July 24, 2009 to December 31, 2009. |

21

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This information should be read in conjunction with the financial statements and notes to the financial statements included with this report. The discussion and analysis that follows may contain statements that relate to future events or future performance. In some cases, such forward-looking statements can be identified by terminology such as “may,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. Neither the Sponsor, nor any other person assumes responsibility for the accuracy or completeness of forward-looking statements. Neither the Trust nor the Sponsor is under a duty to update any of the forward-looking statements to conform such statements to actual results or to a change in the Sponsor’s expectations or predictions.

Introduction.

The Trust is a common law trust, formed under the laws of the state of New York on the completion of the initial deposit of silver on July 20, 2009 (the “Date of Inception”). The Trust is not managed like a corporation or an active investment vehicle. It does not have any officers, directors, or employees and is administered by the Trustee pursuant to the Trust Agreement. The Trust is not registered as an investment company under the Investment Company Act of 1940 and is not required to register under such act. It will not hold or trade in commodity futures contracts, nor is it a commodity pool, subject to regulation as a commodity pool operator or a commodity trading adviser in connection with issuing Shares.

The Trust holds silver and is expected to issue Baskets in exchange for deposits of silver, and to distribute silver in connection with redemptions of Baskets. Shares issued by the Trust represent units of undivided beneficial interest in and ownership of the Trust. The investment objective of the Trust is for the Shares to reflect the performance of the price of silver, less the Trust’s expenses. The Sponsor believes that, for many investors, the Shares will represent a cost effective investment relative to traditional means of investing in silver.

The Trust issues and redeems Shares only with Authorized Participants in exchange for silver, only in aggregations of 100,000 or integral multiples thereof. A list of current Authorized Participants is available from the Sponsor or the Trustee.

Shares of the Trust trade on the NYSE Arca under the symbol “SIVR”.

Valuation of Silver and Computation of Net Asset Value.

As of the London Fix on each day that the NYSE Arca is open for regular trading or, if there is no London Fix on such day or the London Fix has not been announced by 12:00 noon New York time on such day, as of 4:00 p.m., New York time, on such day (the “Evaluation Time”), the Trustee values the silver held by the Trust and determines both the ANAV and the NAV of the Trust.

At the Evaluation Time, the Trustee values the Trust’s silver on the basis of that day’s London Fix, or, if no London Fix is made on such day or has not been announced by the Evaluation Time, the next most recent London Fix determined prior to the Evaluation Time is used, unless the Sponsor determines that such price is inappropriate as a basis for valuation. In the case this determination is made, the Sponsor will identify an alternative basis for such evaluation to be used by the Trustee.

Once the value of the silver held by the Trust has been determined, the Trustee subtracts all estimated accrued but unpaid fees and other liabilities of the Trust from the total value of the silver and all other assets of the Trust. The resulting figure is the ANAV of the Trust. The ANAV is used to compute the Sponsor’s Fee.

The Trustee then subtracts from the ANAV the amount of accrued Sponsor’s Fees computed for such day to determine the NAV of the Trust. The Trustee also determines the NAV per Share by dividing the NAV of the Trust by the number of Shares outstanding as of the close of trading on the NYSE Arca.

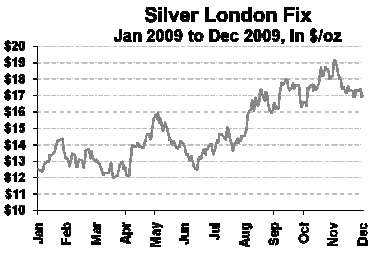

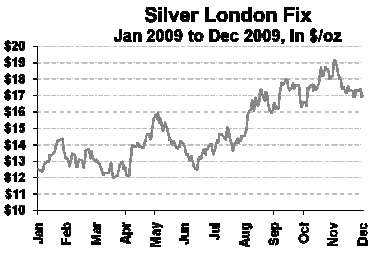

The following chart shows the daily London Fix price of silver for the Reporting Period:

22

Liquidity & Capital Resources

The Trust is not aware of any trends, demands, conditions, events or uncertainties that are reasonably likely to result in material changes to its liquidity needs. In exchange for the Sponsor’s Fee, the Sponsor has agreed to assume most of the expenses incurred by the Trust. As a result, the only expense of the Trust during the period covered by this report was the Sponsor’s Fee. The Trust’s only source of liquidity is its transfers and sales of silver.

The Trustee will, at the direction of the Sponsor or in its own discretion, sell the Trust’s silver as necessary to pay the Trust’s expenses not otherwise assumed by the Sponsor. The Trustee will not sell silver to pay the Sponsor’s Fee but will pay the Sponsor’s Fee through in-kind transfers of silver to the Sponsor. At December 31, 2009 the Trust did not have any cash balances.

Critical Accounting Estimates

The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements relies on estimates and assumptions that impact the Trust’s financial position and results of operations. These estimates and assumptions affect the Trust’s application of accounting policies. In addition, please refer to Note 2 to the financial statements for further discussion of accounting policies.

The Trust’s Cost of Silver– Realization of Gains and Losses

The Trust’s cost of silver is determined according to the average cost method and the market value is based on the London Fix used to determine the NAV of the Trust. Realized gains and losses on sales of silver, or silver distributed for the redemption of Shares, are calculated on a trade date basis using average cost.

The Trust recognizes the diminution in value of the investment in silver which arises from market declines on an interim basis. Increases in the value of the investment in silver through market price recoveries in later interim periods of the same fiscal year are recognized in the later interim period. Increases in value recognized on an interim basis may not exceed the previously recognized diminution in value.

Redeemable Capital Shares

The Shares of the Trust are classified as “Redeemable Capital Shares” for financial statement purposes, since they are subject to redemption at the option of Authorized Participants. Outstanding Shares are reflected at redemption value, which represents the maximum obligation (based on NAV per Share), with the difference from historical cost recorded as an offsetting amount to retained earnings.

The Period Ended December 31, 2009

On July 20, 2009, the Trust was formed as a legal entity with an initial deposit of silver. On July 24, 2009, the Trust’s Shares commenced trading on the NYSE Arca under the symbol SIVR, and the Trust commenced operations, began accruing expenses and began the calculation of NAV (the “Commencement of Operations”). The assets of the Trust were $1,378,000 and the redemption value per Share was $13.78 as of close of business on July 24, 2009.

The assets of the Trust at market value at December 31, 2009 were $156,066,265 representing a 1,122.80% increase from the asset level as of close of business on the Commencement of Operations. The redemption value per Share increased from $13.78 on July 24, 2009 to $16.97 on December 31, 2009 representing a 23.15% increase from the NAV as of close of business on the Commencement of Operations.

The price of silver per ounce increased from $13.78 on July 24, 2009 to $16.99 on December 31, 2009, representing a 23.29% increase during the Reporting Period. The Trust’s redemption value per Share rose slightly less than the silver spot price per ounce on a percentage basis due to the Sponsor’s Fees, a portion of which are presently being waived to reduce the Sponsor’s Fees to 0.30% for the first year of the Trust’s operations. This waiver will be in place until July 20, 2010.

23

The Sponsor received $260,026 in fees during the Reporting Period, or 0.30% of the Trust’s assets on an annualized basis.

The redemption value per Share of $19.15 on December 2, 2009, was the highest during the Reporting Period, compared with a low of $13.40 on July 30, 2009.

The number of Baskets created from the Date of Inception to December 31, 2009 was 107 (representing 10,700,000 Shares) and the number of Shareholders on record as at December 31, 2009 totaled nine. Fifteen Baskets (representing 1,500,000 Shares) were redeemed during the Reporting Period.

Net gain for the period ended December 31, 2009 was $3,664,391 resulting from a net gain of $27,499 on the transfer of silver to pay the Sponsor’s Fee, and a net gain of $3,842,918 on silver distributed for the redemption of Baskets, which was offset by the Sponsor’s Fee of $206,026. Other than the Sponsor’s Fee, the Trust had no expenses during the period ended December 31, 2009.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Not applicable.

Item 8. Financial Statements and Supplementary Data.

Quarterly Income Statements (unaudited)

| | | | | | | | | | |

| | For the period July 20,

2009 through Sept. 30,

2009* | | Three months ended

December 31, 2009 | | For the period July 20,

2009 through Dec. 31,

2009* | |

Revenues | | $ | | | $ | | | $ | | |

Value of silver transferred to pay expenses | | | 36,294 | | | 169,732 | | | 206,026 | |

Cost of silver transferred to pay expenses | | | (34,526 | ) | | (144,001 | ) | | (178,527 | ) |

|

|

|

|

|

|

|

|

|

|

|

Gain on silver transferred to pay expenses | | | 1,768 | | | 25,731 | | | 27,499 | |

Gain on silver distributed for the redemption of shares | | | — | | | 3,842,918 | | | 3,842,918 | |

Unrealized Gain (Loss) on investment in silver | | | 1,768 | | | — | | | — | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

Total Gain (Loss) on sales and distributions of silver | | | (422,434 | ) | | 3,868,649 | | | 3,870,417 | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

Expenses | | | | | | | | | | |

Sponsor’s fees | | $ | 70,988 | | $ | 102,716 | | $ | 206,026 | |

Total expenses | | $ | 70,988 | | $ | 102,716 | | $ | 206,026 | |

Net gain (loss) from Operations | | $ | 69,220 | | $ | 3,765,933 | | $ | 3,664,391 | |

Net income (loss) per share | | $ | (0.01 | ) | $ | 0.42 | | $ | 0.48 | |

Weighted-average shares outstanding | | | 6,007,246 | | | 9,005,435 | | | 7,648,171 | |

| |

| |

* Period commenced July 24, 2009. |

The financial statements required by Regulation S-X, together with the report of the Trust’s independent registered public accounting firm, appear on pages F-1 to F-12 of this filing.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Deloitte & Touche LLP was appointed independent accountants to the Trust from the Date of Inception. There have been no disagreements with accountants during the period ended December 31, 2009.

24

Item 9A. Controls and Procedures.

The authorized officers of the Sponsor performing functions equivalent to those that a principal executive officer and principal financial officer of the Trust would perform if the Trust had any officers, and with the participation of the Trustee, have evaluated the effectiveness of the Trust’s disclosure controls and procedures, and have concluded that the disclosure controls and procedures of the Trust were effective as of December 31, 2009.

There have been no changes in the Trust’s or Sponsor’s internal control over financial reporting that occurred during the Trust’s fourth fiscal quarter that have materially affected, or are reasonably likely to materially affect, the Trust’s or Sponsor’s internal control over financial reporting. This Annual Report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of the Trust’s registered public accounting firm due to a transition period established by rules of the SEC for newly public companies.

Item 9B. Other Information.

Not applicable.

25

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Not applicable.

Item 11. Executive Compensation.

Not applicable.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Securities authorized for issuance under equity compensation plans

Not applicable.

Security Ownership of Certain Beneficial Owners

The Sponsor has no knowledge of any person being the beneficial owner of more than five percent of the Shares of the Trust or any arrangement which may subsequently result in a change in control of the Trust.

Security Ownership of Management

The Trustee does not beneficially own any of the Trust Shares.

Change In Control

Neither the Sponsor nor the Trustee knows of any arrangements which may subsequently result in a change in control of the Trust.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Not applicable.

Item 14. Principal Accounting Fees and Services.

(1) to (4) Fees for services performed by Deloitte & Touche LLP for the period ended December 31, 2009 were as follows:

| | | | |

Audit fees | | $ | 51,000 | |

Audit-related fees | | | 17,500 | |

Tax fees | | | — | |

All other fees | | | 0 | |

| | | | |

| |

|

| |

| | $ | 68,500 | |

(5) The Trust has no board of directors, and as a result, has no audit committee and no pre-approval policies or procedures with respect to fees paid to Deloitte & Touche LLP.

(6) None of the hours expended by Deloitte & Touche LLP to audit the Trust’s financial statements for the fiscal period ended December 31, 2009 were attributable to work performed by persons other than the principal accountant’s full-time, permanent employees.

26

PART IV

Item 15. Exhibits, Financial Statement Schedules

1. Financial Statements

See Index to Financial Statements on Page F-1 for a list of the financial statements being filed herein.

2. Financial Statement Schedules

Schedules have been omitted since they are either not required, not applicable, or the information has otherwise been included.

3. Exhibits

| | |

Exhibit No. | | Description |

|

|

|

4.1 | | Depositary Trust Agreement, incorporated by reference to Exhibit 4.1 filed with Registration Statement No. 333-156307 on July 21, 2009 |

| | |

4.2 | | Form of Authorized Participant Agreement, incorporated by reference to Exhibit 4.2 filed with Registration Statement No. 333-156307 on July 21, 2009 |

| | |

4.3 | | Global Certificate, incorporated by reference to Exhibit 4.3 filed with Registration Statement No. 333-15822 on July 21, 2009 |

| | |

10.1 | | Allocated Account Agreement, incorporated by reference to Exhibit 10.1 filed with Registration Statement No. 333-156307 on July 21, 2009 |

| | |

10.2 | | Unallocated Account Agreement, incorporated by reference to Exhibit 10.2 filed with Registration Statement No. 333-156307 on July 21, 2009 |

| | |

10.3 | | Depository Agreement, incorporated by reference to Exhibit 10.3 filed with Registration Statement No. 333-156307 on July 21, 2009 |

| | |

10.4 | | Marketing Agent Agreement, incorporated by reference to Exhibit 10.4 filed with Registration Statement No. 333-156307 on July 21, 2009 |

| | |

31.1 | | Chief Executive Officer’s Certificate, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

31.2 | | Chief Financial Officer’s Certificate, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

32.1 | | Chief Executive Officer’s Certificate, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| | |

32.2 | | Chief Financial Officer’s Certificate, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

27

ETFS SILVER TRUST

FINANCIAL STATEMENTS

INDEX

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Sponsor, Trustee and the Unitholders of the ETFS Silver Trust

We have audited the accompanying statement of financial condition of ETFS Silver Trust (the “Trust”) as of December 31, 2009, and the related statement of operations, changes in shareholders’ deficit, and cash flows for the period July 20, 2009 (date of inception) to December 31, 2009. These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material respects, the financial position of ETFS Silver Trust at December 31, 2009, and the results of their operations and their cash flows for the period July 20, 2009 (date of inception) to December 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

/s/ DELOITTE & TOUCHE LLP

New York, New York

March 29, 2010

F-2

ETFS SILVER TRUST

Statement of Condition

December 31, 2009

| | | | |

| | December 31,

2009 | |

| |

| |

ASSETS | | | | |

Investment in silver (1) | | $ | 139,223,967 | |

| | | | |

| |

|

| |

Total Assets | | $ | 139,223,967 | |

| |

|

| |

| | | | |

LIABILITIES | | | | |

Accounts payable to Sponsor, net of waiver (Note 2.6) | | $ | — | |

| | | | |

| |

|

| |

Total Liabilities | | $ | — | |

| |

|

| |

| | | | |

Redeemable Shares: | | | | |

Shares at redemption value to investors (2) | | | 156,066,265 | |

| | | | |

Shareholders’ Deficit | | | (16,842,298 | ) |

| |

|

| |

Total Liabilities, Redeemable Shares & Shareholders’ Deficit | | $ | 139,223,967 | |

| |

|

| |

| |

(1) | The market value of investment in silver at December 31, 2009 is $156,066,265. |

| |

(2) | Authorized share capital is unlimited and no par value per share. Shares issued and outstanding at December 31, 2009 are 9,200,000. |

See Notes to the Financial Statements.

F-3

ETFS SILVER TRUST

Statement of Operations

For the period July 20, 2009* through December 31, 2009

| | | | |

|

|

|

|

|

| | For the period

July 20, 2009*

through

December 31, 2009 | |

| |

| |

REVENUES | | | | |

| | | | |

Value of silver transferred to pay expenses | | $ | 206,026 | |

Cost of silver transferred to pay expenses | | | (178,527 | ) |

| |

|

| |

Gain on silver transferred to pay expenses | | | 27,499 | |

| | | | |

Gain on silver distributed for the redemption of shares | | | 3,842,918 | |

| |

|

| |

| | | | |

Total Gain on silver | | $ | 3,870,417 | |

| |

|

| |

| | | | |

EXPENSES | | | | |

| | | | |

Sponsor fees, net of waiver (Note 2.6) | | $ | 206,026 | |

| |

|

| |

| | | | |

Total Expenses | | | 206,026 | |

| |

|

| |

| | | | |

Net Gain from Operations | | $ | 3,664,391 | |

| |

|

| |

| | | | |

Net Gain per share | | $ | 0.48 | |

| |

|

| |

| | | | |

Weighted average number of shares | | | 7,648,171 | |

| |

|

| |

* Date of Inception.

See Notes to the Financial Statements.

F-4

ETFS SILVER TRUST

Statement of Cash Flows

|

For the period July 20, 2009* through December 31, 2009 |

|

| | | | |

| | For the period

July 20, 2009*

through

December 31, 2009 | |

| |

|

|

|

INCREASE / (DECREASE) IN CASH FROM OPERATIONS: | | | | |

| | | | |

Cash proceeds received from transfer of silver | | $ | — | |

| | | | |

Cash expenses paid | | | — | |

|

|

|

|

|

Increase in cash resulting from operations | | | — | |

| | | | |

Cash and cash equivalents at beginning of period | | | — | |

|

|

|

|

|

Cash and cash equivalents at end of period | | $ | — | |

|

|

|

|

|

| | | | |

SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING ACTIVITIES: | | | | |

| | | | |

Value of silver received for creation of shares | | $ | 161,927,868 | |

|

|

|

|

|

Value of silver distributed for redemption of shares - at average cost | | $ | 22,525,374 | |

|

|

|

|

|

| | | | |

| | For the period

July 20, 2009*

through

December 31, 2009 | |

| |

|

|

|

RECONCILIATION OF NET GAIN/(LOSS) TO NET CASH PROVIDED BY OPERATING ACTIVITIES: | | | | |

| | | | |

Net Gain from Operations | | $ | 3,664,391 | |

Adjustments to reconcile net gain to net cash provided by (used in) operating activities | | | | |

Increase in silver assets | | | (139,223,967 | ) |

Increase/(Decrease) in redeemable shares | | | | |

Creations | | | 161,914,997 | |

Redemptions | | | (26,355,421 | ) |

| |

|

| |

Net cash provided by operating activities | | $ | — | |

| |

|

| |

| | | | |

Supplemental Disclosure of Non-Cash Item: | | | | |

Value of silver transferred to pay expenses | | $ | 206,026 | |

See Notes to the Financial Statements.

F-5

ETFS SILVER TRUST

Statement of Changes in Shareholders’ Deficit

|

For the period July 20, 2009* through December 31, 2009 |

| | | | |

| | For the period

July 20, 2009*

through

December 31, 2009 | |

| |

|

| |

| | | | |

Shareholders’ Deficit - Opening balance | | $ | — | |

Net Gain for the period | | | 3,664,391 | |

Adjustment of Redeemable Shares to redemption value | | | (20,506,689 | ) |

| |

|

| |

Shareholders’ Deficit – Closing balance | | $ | (16,842,298 | ) |

| |

|

| |

See Notes to the Financial Statements.

F-6

ETFS SILVER TRUST

| |

Notes to the Financial Statements |

|

1. | Organization |

| |

| The ETFS Silver Trust (the “Trust”) is an investment trust formed on July 20, 2009, under New York law pursuant to a depositary trust agreement (the “Trust Agreement”) executed by ETF Securities USA LLC (the “Sponsor”) and the Bank of New York Mellon (the “Trustee”) at the time of the Trust’s organization. The Trust holds silver bullion and issues ETFS Physical Silver Shares (the “Shares”) (in minimum blocks of 100,000 Shares, also referred to as “Baskets”) in exchange for deposits of silver and distributes silver in connection with redemption of Baskets. Shares represent units of fractional undivided beneficial interest in and ownership of the Trust which are issued by the Trust. The Sponsor is a Delaware limited liability company that is a wholly-owned subsidiary of ETF Securities Limited, a Jersey, Channel Islands’ based company. The Trust is governed by the Trust Agreement. |

| |

| The investment objective of the Trust is for the Shares to reflect the performance of the price of silver, less the Trust’s expenses and liabilities. The Trust is designed to provide an individual owner of beneficial interests in the Shares (a “Shareholder”) an opportunity to participate in the silver market through an investment in securities. |

| |

2. | Significant Accounting Policies |

| |

| The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires those responsible for preparing financial statements to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Trust. |

| |

2.1. | Valuation of Silver |

| |

| Silver is held by HSBC Bank USA, National Association (the “Custodian”), on behalf of the Trust and is valued, for financial statement purposes, at the lower of cost or market. The cost of silver is determined according to the average cost method and the market value is based on the London Fix used to determine the net asset value (“NAV”) of the Trust. Realized gains and losses on transfers of silver, or silver distributed for the redemption of Shares, are calculated on a trade date basis using average cost. The price for an ounce of silver is set by three market making members of the London Bullion Market Association at approximately 12:00 noon London time on each working day. |

| |

| Once the value of silver has been determined, the NAV is computed by the Trustee by deducting all accrued fees and other liabilities of the Trust, including the remuneration due to the Sponsor (the “Sponsor’s Fee”), from the fair value of the silver and all other assets held by the Trust. |

| |

| The table below summarizes the unrealized gains or losses on the Trust’s silver holdings as of December 31, 2009: |

| | | | |

|

|

| |

| | December 31,

2009 | |

|

|

|

| |

|

Investment in silver-average cost | | $ | 139,223,967 | |

Unrealized Gain on investment in silver | | | 16,842,298 | |

|

|

|

| |

Investment in silver-market value | | $ | 156,066,265 | |

|

|

|

|

|

F-7

ETFS SILVER TRUST

Notes to the Financial Statements

| |

2. | Significant Accounting Policies (continued) |

| |

2.1. | Valuation of Silver (continued) |

| |

| The Trust recognizes the diminution in value of the investment in silver which arises from market declines on an interim basis. Increases in the value of the investment in silver through market price recoveries in later interim periods of the same fiscal year are recognized in the later interim period. Increases in value recognized on an interim basis may not exceed the previously recognized diminution in value.

The per Share amount of silver exchanged for a purchase or redemption is calculated daily by the Trustee, using the London Fix to calculate the silver amount in respect of any liabilities for which covering silver sales have not yet been made, and represents the per-Share amount of silver held by the Trust, after giving effect to its liabilities, to cover expenses and liabilities and any losses that may have occurred. |

| |

2.2. | Creations and Redemptions of Shares |

| |

| The Trust expects to create and redeem Shares from time to time, but only in one or more Baskets (a Basket equals a block of 100,000 Shares). The Trust issues Shares in Baskets to Authorized Participants on an ongoing basis. Individual investors cannot purchase or redeem Shares in direct transactions with the Trust. An Authorized Participant is a person who (1) is a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) is a participant in The Depository Trust Company, (3) has entered into an Authorized Participant Agreement with the Trustee and the Sponsor and (4) has established an Authorized Participant Unallocated Account with the Custodian or another silver bullion clearing bank to effect transactions in silver bullion. An Authorized Participant Agreement is an agreement entered into by each Authorized Participant, the Sponsor and the Trustee which provides the procedures for the creation and redemption of Baskets and for the delivery of the silver required for such creations and redemptions. An Authorized Participant Unallocated Account is an unallocated silver account established with the Custodian by an Authorized Participant |

| |

| The creation and redemption of Baskets is only made in exchange for the delivery to the Trust or the distribution by the Trust of the amount of silver represented by the Baskets being created or redeemed, the amount of which is based on the combined NAV of the number of Shares included in the Baskets being created or redeemed determined on the day the order to create or redeem Baskets is properly received. |

| |

| Authorized Participants may, on any business day, place an order with the Trustee to create or redeem one or more Baskets. The typical settlement period for Shares is three business days. In the event of a trade date at period end, where a settlement is pending, a respective account receivable and/or payable will be recorded. When silver is exchanged in settlement of redemption, it is considered a sale of silver for financial statement purposes. |

| |

| The Shares of the Trust are classified as “Redeemable Capital Shares” for financial statement purposes, since they are subject to redemption at the option of Authorized Participants. Outstanding Shares are reflected at redemption value, which represents the maximum obligation (based on NAV per Share), with the difference from historical cost recorded as an offsetting amount to retained earnings. Changes in the Shares for the period from July 20, 2009 (the “Date of Inception”) through December 31, 2009 are as follows: |

F-8

ETFS SILVER TRUST

Notes to the Financial Statements

| |

2. | Significant Accounting Policies (continued) |

| |

2.2. | Creations and Redemptions of Shares (continued) |

| | | | |

| | For the period

July 20, 2009*

through

December 31, 2009 | |

|

|

|

|

|

Number of Redeemable Shares: | | | | |

Opening Balance | | | — | |

Creations | | | 10,700,000 | |

Redemptions | | | (1,500,000 | ) |

|

|

|

|

|

Closing Balance | | | 9,200,000 | |

|

|

|

|

|

| | | | |

|

|

|

|

|

| | For the period

July 20, 2009*

through

December 31, 2009 | |

|

|

|

|

|

|

Redeemable Shares: | | | | |

Opening Balance | | $ | — | |

Creations | | | 161,914,997 | |

Redemptions | | | (26,355,421 | ) |

Adjustment to redemption value | | | 20,506,689 | |

|

|

|

|

|

Closing Balance | | $ | 156,066,265 | |

|

|

|

|

|

| | | | |

Redemption Value per Share at Period End | | $ | 16.96 | |

|

|

|

|

|

| |

2.3. | Revenue Recognition Policy |

| |

| The primary expense of the Trust is the Sponsor’s Fee, which is paid by the Trust through in-kind transfers of silver to the Sponsor. With respect to expenses not otherwise assumed by the Sponsor, the Trustee will, at the direction of the Sponsor or in its own discretion, sell the Trust’s silver as necessary to pay these expenses. When selling silver to pay expenses, the Trustee will endeavor to sell the smallest amounts of silver needed to pay these expenses in order to minimize the Trust’s holdings of assets other than silver. |

| |

| Unless otherwise directed by the Sponsor, when selling silver the Trustee will endeavor to sell at the price established by the London Fix. The Trustee will place orders with dealers (which may include the Custodian) through which the Trustee expects to receive the most favorable price and execution of orders. The Custodian may be the purchaser of such silver only if the sale transaction is made at the next London Fix following the sale order. A gain or loss is recognized based on the difference between the selling price and the average cost of the silver sold. Neither the Trustee nor the Sponsor is liable for depreciation or loss incurred by reason of any sale. |

| |

2.4. | Income Taxes |

| |

| The Trust is classified as a “grantor trust” for U.S. federal income tax purposes. As a result, the Trust itself will not be subject to U.S. federal income tax. Instead, the Trust’s income and expenses will “flow through” |

F-9

ETFS SILVER TRUST

Notes to the Financial Statements

| |

2. | Significant Accounting Policies (continued) |

| |

2.4. | Income Taxes (continued) |

| |

| to the Shareholders, and the Trustee will report the Trust’s proceeds, income, deductions, gains, and losses to the Internal Revenue Service on that basis. The Trust has adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 740-10,Income Taxes (formerly FASB Interpretation Number 48,Accounting for Uncertainty in Income Taxes). FASB ASC 740-10 prescribes a recognition threshold and a measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FASB ASC 740-10 also provides guidance on the related derecognition, classification, interest and penalties, accounting for interim periods, disclosure and transition of uncertain tax positions. The Sponsor has evaluated the effects of FASB ASC 740-10 and has determined that it does not have a significant effect on the financial position or results of operations of the Trust. |

| |

2.5 | Investment in Silver |

| |

| The following represents the changes in ounces of silver and the respective values for the period from the Date of Inception through December 31, 2009: |

| |

| | | | | |

| | | For the period

July 20, 2009*

through

December 31, 2009 | |

| | |

| |

| Ounces of Silver: | | | | |

| Opening Balance | | | — | |

| Creations | | | 10,696,328.6 | |

| Redemptions | | | (1,498,198.4 | ) |

| Transfers of silver | | | (12,358.3 | ) |

|

|

|

|

|

|

| Closing Balance | | | 9,185,771.9 | |

|

|

|

|

|

|

| | | | | |

| Investment in Silver (lower of cost or market): | | | | |

| Opening Balance | | $ | — | |

| Creations | | | 161,927,868 | |

| Redemptions | | | (22,525,374 | ) |

| Transfers of silver | | | (178,527 | ) |

|

|

|

|

|

|

| Closing Balance | | $ | 139,223,967 | |

|

|

|

|

|

|

| |

* | Date of Inception. |

| |

2.6. | Expenses |

| |

| The Trust will transfer silver to the Sponsor to pay the Sponsor’s Fee that will accrue daily at an annualized rate equal to 0.45% of the adjusted daily NAV of the Trust, paid monthly in arrears. Presently, the Sponsor intends to waive a portion of its fee and reduce the Sponsor’s Fee to 0.30% for the first year of the Trust’s operations beginning on the Trust’s inception date and ending July 20, 2010. |

F-10

ETFS SILVER TRUST

Notes to the Financial Statements

| |

2. | Significant Accounting Policies (continued) |

| |

2.6. | Expenses (continued) |

| |

| The Sponsor has agreed to assume administrative and marketing expenses incurred by the Trust, including the Trustee’s monthly fee and out-of-pocket expenses, the Custodian’s fee and the reimbursement of the Custodian’s expenses, exchange listing fees, United States Securities and Exchange Commission (the “SEC”) registration fees, printing and mailing costs, audit fees and certain legal expenses. |

| |

| At December 31, 2009 there were no fees payable to the Sponsor. |

| |

2.7. | Organization Costs |

| |

| Expenses incurred in organizing the Trust and the initial offering of the Shares, including applicable SEC registration fees, of approximately $1,153,000, were borne directly by the Sponsor. The Trust will not be obligated to reimburse the Sponsor. |

| |

3. | Related Parties |

| |

| The Sponsor and the Trustee are considered to be related parties to the Trust. The Trustee’s fee is paid by the Sponsor and is not a separate expense of the Trust. The Trustee and the Custodian and their affiliates may from time to time act as Authorized Participants or purchase or sell silver or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion. |

| |

4. | Concentration of Risk |

| |

| The Trust’s sole business activity is the investment in silver, and substantially all the Trust’s assets are holdings of silver which creates a concentration risk associated with fluctuations in the price of silver. Several factors could affect the price of silver, including: (i) global silver supply and demand, which is influenced by factors such as forward selling by silver producers, purchases made by silver producers to unwind silver hedge positions, central bank purchases and sales, and production and cost levels in major silver-producing countries; (ii) investors’ expectations with respect to the rate of inflation; (iii) currency exchange rates; (iv) interest rates; (v) investment and trading activities of hedge funds and commodity funds; and (vi) global or regional political, economic or financial events and situations. In addition, there is no assurance that silver will maintain its long-term value in terms of purchasing power in the future. In the event that the price of silver declines, the Sponsor expects the value of an investment in the Shares to decline proportionately. Each of these events could have a material affect on the Trust’s financial position and results of operations. |

| |

5. | Indemnification |

| |

| Under the Trust’s organizational documents, each of the Trustee (and its directors, employees and agents) and the Sponsor (and its members, managers, directors, officers, employees, and affiliates) is indemnified by the Trust against any liability, cost or expense it incurs without gross negligence, bad faith or willful misconduct on its part and without reckless disregard on its part of its obligations and duties under the Trust’s organizational documents. |

| |

| The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. |

| |

6. | Subsequent Events |

| |

| In accordance with the provisions set forth in FASB ASC 855-10,Subsequent Events, the Trust’s management has evaluated the possibility of subsequent events existing in the Trust’s financial statements |

F-11

ETFS SILVER TRUST

Notes to the Financial Statements

| |

6. | Subsequent Events (continued) |

| |

| through the issuance date. Management has determined that there are no material events that would require adjustment to or disclosure in the Trust’s financial statements through this date. |

F-12

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

| | |

| ETF SECURITIES USA LLC | |

| Sponsor of the ETFS Silver Trust | |

| (Registrant) | |

| | |

| | |

| /s/ Graham Tuckwell | |

|

| |

| Graham Tuckwell | |

| President and Chief Executive Officer | |

| (Principal Executive Officer) | |

| | |

Date: March 30, 2010 | | |

| | |

| | |

| /s/ Greg Burgess | |

|

| |

| Greg Burgess | |

| Chief Financial Officer and Treasurer | |

| (Principal Financial Officer and Principal Accounting Officer) |

| | |

Date: March 30, 2010 | | |

* The Registrant is a trust and the persons are signing in their capacities as officers of ETF Securities USA LLC, the Sponsor of the Registrant.