The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements relies on estimates and assumptions that impact the Trust’s financial position and results of operations. These estimates and assumptions affect the Trust’s application of accounting policies. Below we describe the valuation of gold bullion, a critical accounting policy that we believe is important to understanding our results of operations and financial position. In addition, please refer to Note 2 to the Financial Statements for further discussion of our accounting policies.

Gold is held by the Custodian on behalf of the Trust and is valued, for financial statement purposes, at the lower of cost or market. The cost of gold is determined according to the average cost method and the market value is based on the London PM Fix used to determine the NAV of the Trust. Realized gains and losses on sales of gold, or gold distributed for the redemption of Shares, are calculated on a trade date basis using average cost.

Under the Custody Agreements, the Sponsor has exercised its right to visit the Custodian, in order to examine the gold and the records maintained by the Custodian. The inspection held as of December 31, 2011 by Inspectorate, a leading commodity inspection and testing company, confirmed that the Custodian’s records of gold held in the vault were accurate.

The Trust is not aware of any trends, demands, conditions or events that are reasonably likely to result in material changes to its liquidity needs. In exchange for a fee, (the “Sponsor’s Fee”) the Sponsor has agreed to assume most of the expenses incurred by the Trust. As a result, the only expense of the Trust during the period covered by this report was the Sponsor’s Fee. The Trust’s only source of liquidity is its transfers and sales of gold.

The Trustee will, at the direction of the Sponsor or in its own discretion, sell the Trust’s gold as necessary to pay the Trust’s expenses not otherwise assumed by the Sponsor. The Trustee will not sell gold to pay the Sponsor’s Fee but will pay the Sponsor’s Fee through in-kind transfers of gold to the Sponsor. At December 31, 2011 and 2010 the Trust did not have any cash balances.

Review of Financial Results

Financial Highlights

| | | | | | | | | | |

| | December 31, 2011 | | December 31, 2010 | | December 31, 2009* | |

| | | | | | | | | | |

Total gain on gold | | $ | 16,729,149 | | $ | 747,885 | | $ | 1,556,531 | |

Net gain / (loss) from operations | | $ | 10,873,288 | | $ | (1,791,997 | ) | $ | 1,273,268 | |

Net cash provided by operating activities | | $ | — | | $ | — | | $ | — | |

*Period from September 1, 2009

The year ended December 31, 2011

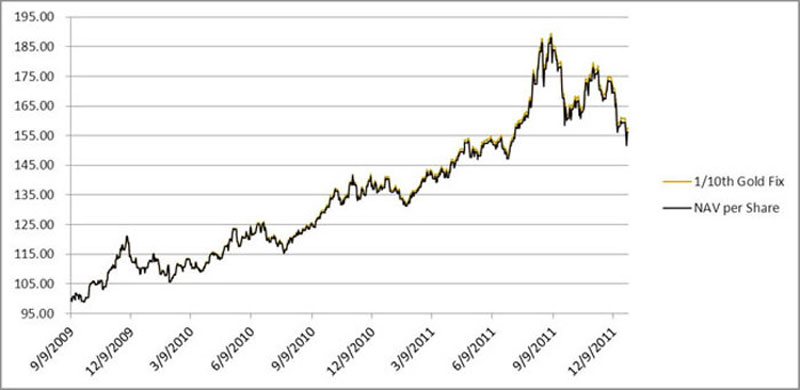

The net asset value (“NAV”) of the Trust is obtained by subtracting the Trust’s expenses and liabilities on any day from the value of the gold owned by the Trust on that day; the NAV per Share is obtained by dividing the NAV of the Trust on a given day by the number of Shares outstanding on that day.

The Trust’s NAV increased from $1,157,505,203 at December 31, 2010 to $1,677,362,792 at December 31, 2011, a 44.91% increase for the year. The increase in the Trust’s NAV resulted primarily from a increase in the price per ounce of gold, which increased 11.65% from $1,410.25 at December 31, 2010 to $1,574.50 at December 31, 2011, and a increase in outstanding Shares, which rose from 8,250,000 Shares at December 31, 2010 to 10,750,000 Shares at December 31, 2011, a result of 2,950,000 Shares (59 Baskets) being created and 450,000 Shares (9 Baskets) being redeemed during the year.

NAV per Share increased 11.21% from $140.30 at December 31, 2010 to $156.03 at December 31, 2011. The Trust’s NAV per Share rose slightly less than the price per ounce of gold on a percentage basis due to Sponsor’s Fees, which were $5,855,861 for the year, or 0.39% of the Trust’s assets on an annualized basis.

Sponsor’s Fees increased 130.56% from $2,539,882 for the year ended December 31, 2010 to $5,855,861 for the year ended December 31, 2011. This increase relates to an increase in the price per ounce of gold and an increase in the average NAV for the year.

The NAV per Share of $188.03 at September 6, 2011 was the highest during the year, compared with a low of $131.19 at January 28, 2011.

Net gain from operations for the year ended December 31, 2011 was $10,873,288, resulting from a net gain of $1,217,680 on the transfer of gold to pay expenses and a net gain of $15,511,469 on gold distributed for the redemption of Shares, offset by Sponsor’s Fees of $5,855,861. Other than the Sponsor’s Fee, the Trust had no expenses during the year ended December 31, 2011.

The year ended December 31, 2010

The Trust’s NAV increased from $336,294,290 at December 31, 2009 to $1,157,505,203 at December 31, 2010, a 244.19% increase for the year. The increase in the Trust’s NAV resulted primarily from an increase in the price per ounce of gold, which rose 27.74% from $1,104.00 at December 31, 2009 to $1,410.25 at December 31, 2010, and an increase in outstanding Shares, which rose from 3,050,000 Shares at December 31, 2009 to 8,250,000 Shares at December 31, 2010, a consequence of 5,250,000 Shares (105 Baskets) being created and 50,000 Shares (1 Basket) being redeemed during the year.

NAV per Share increased 27.24% from $110.26 at December 31, 2009 to $140.30 at December 31, 2010. The increase in the Trust’s NAV per Share rose slightly less than the price per ounce of gold on a percentage basis due to Sponsor’s fees, which were $2,539,882 for the year, or 0.39% of the Trust’s assets on an annualized basis.

The NAV per Share of $141.45 at November 9, 2010 was the highest during the year, compared with a low of $105.63 at February 5, 2010.

Net loss for the year ended December 31, 2010 was $1,791,997, resulting from a net gain of $186,497 on the transfer of gold to pay expenses and a net gain of $561,388 on gold distributed for the redemption of Shares, offset by Sponsor’s Fees of $2,539,882. Other than the Sponsor’s Fees, the Trust had no expenses during the year ended December 31, 2010.

23

The fiscal period from September 9, 2009 to December 31, 2009

On September 1, 2009, the Trust was formed as a legal entity with an initial deposit of gold. On September 9, 2009, the Trust’s Shares commenced trading on the NYSE Arca under the symbol SGOL, and the Trust commenced operations, began accruing expenses and began the calculation of NAV (the “Commencement of Operations”). The assets of the Trust were $9,994,893 and the redemption value per Share was $99.95 as of commencement of operations on September 9, 2009.

The Trust’s NAV grew from $9,994,893 at September 9, 2009 to $336,294,290 at December 31, 2009, a 3,264.66% increase for the period. The increase in the Trust’s NAV resulted primarily from an increase in the price per ounce of gold, which rose 10.46% from $999.50 at September 9, 2009 to $1,104.00 at December 31, 2009 and an increase in outstanding shares, which rose from 100,000 shares at September 9, 2009 to 3,050,000 shares at December 31, 2009, a consequence of 3,200,000 shares (64 Baskets) being created and 250,000 shares (5 Baskets) being redeemed during the period.

The Trust’s NAV per Share increased 10.32% from $99.95 at September 9, 2009 to $110.26 at December 31, 2009 relates directly to the increase in the price per ounce of gold, which rose 10.46%. The Trust’s NAV per Share rose slightly less than the price per ounce of gold on a percentage basis due to Sponsor’s Fees, which were $293,263 for the period, or 0.39% of the Trust’s assets on an annualized basis.

The NAV per Share of $121.08 on December 2, 2009 was the highest during the period, compared with a low of $98.92 on September 29, 2009.

Net gain for the period ended December 31, 2009 was $1,273,268 resulting from a net gain of $20,890 on the transfer of gold to pay expenses and a net gain of $1,545,641 on gold distributed for the redemption of Shares, offset by Sponsor’s fees of $293,263. Other than the Sponsor’s fees, the Trust had no expenses during the period ended December 31, 2009.

24

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

The Trust Indenture does not authorize the Trustee to borrow for payment of the Trust’s ordinary expenses. The Trust does not engage in transactions in foreign currencies which could expose the Trust or holders of Shares to any foreign currency related market risk. The Trust invests in no derivative financial instruments and has no foreign operations or long-term debt instruments.

Item 8. Financial Statements and Supplementary Data(Unaudited)

Quarterly Income Statements

Year ended December 31, 2011

| | | | | | | | | | | | | | | | |

| | Three months ended | | Year ended | |

| | March 31 | | June 30 | | September 30 | | December 31 | | December 31 | |

| | | | | | | | | | | | | | | | |

Revenues | | | | | | | | | | | | | | | | |

Value of gold transferred to pay expenses | | $ | 1,100,821 | | $ | 1,296,347 | | $ | 1,522,072 | | $ | 1,732,571 | | $ | 5,651,811 | |

Cost of gold transferred to pay expenses | | | (946,203 | ) | | (1,052,200 | ) | | (1,154,393 | ) | | (1,281,335 | ) | | (4,434,131 | ) |

| | | | | | | | | | | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Gain on gold transferred to pay expenses | | | 154,618 | | | 244,147 | | | 367,679 | | | 451,236 | | | 1,217,680 | |

| | | | | | | | | | | | | | | | |

Gain on gold distributed for the redemption of Shares | | | 1,434,889 | | | — | | | 10,923,956 | | | 3,152,624 | | | 15,511,469 | |

| | | | | | | | | | | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | $ | 1,589,507 | | $ | 244,147 | | $ | 11,291,635 | | $ | 3,603,860 | | $ | 16,729,149 | |

| | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | |

Sponsor’s fee | | $ | 1,141,622 | | $ | 1,311,536 | | $ | 1,611,203 | | $ | 1,791,500 | | $ | 5,855,861 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total expenses | | $ | 1,141,622 | | $ | 1,311,536 | | $ | 1,611,203 | | $ | 1,791,500 | | $ | 5,855,861 | |

| | | | | | | | | | | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net gain / (loss) from operations | | $ | 447,885 | | $ | (1,067,389 | ) | $ | 9,680,432 | | $ | 1,812,360 | | $ | 10,873,288 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Net gain / (loss) per Share | | $ | 0.05 | | $ | (0.12 | ) | $ | 0.97 | | $ | 0.17 | | $ | 1.14 | |

| | | | | | | | | | | | | | | | |

Weighted average number of Shares | | | 8,564,444 | | | 9,076,374 | | | 9,945,109 | | | 10,593,478 | | | 9,551,507 | |

25

Year ended December 31, 2010

| | | | | | | | | | | | | | | | |

| | Three months ended | | Year ended | |

| | March 31 | | June 30 | | September 30 | | December 31 | | December 31 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Revenues | | | | | | | | | | | | | | | | |

Value of gold transferred to pay expenses | | $ | 203,868 | | $ | 388,451 | | $ | 604,006 | | $ | 960,375 | | $ | 2,156,700 | |

Cost of gold transferred to pay expenses | | | (198,158 | ) | | (365,260 | ) | | (562,836 | ) | | (843,949 | ) | | (1,970,203 | ) |

| | | | | | | | | | | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Gain on gold transferred to pay expenses | | | 5,710 | | | 23,191 | | | 41,170 | | | 116,426 | | | 186,497 | |

| | | | | | | | | | | | | | | | |

Gain / (loss) on gold distributed for the redemption of Shares | | | — | | | 573,615 | | | — | | | (12,227 | ) | | 561,388 | |

| | | | | | | | | | | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | $ | 5,710 | | $ | 596,806 | | $ | 41,170 | | $ | 104,199 | | $ | 747,885 | |

Expenses | | | | | | | | | | | | | | | | |

Sponsor’s fee | | $ | 323,426 | | $ | 445,181 | | $ | 714,762 | | $ | 1,056,513 | | $ | 2,539,882 | |

| | | | | | | | | | | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total expenses | | $ | 323,426 | | $ | 445,181 | | $ | 714,762 | | $ | 1,056,513 | | $ | 2,539,882 | |

| | | | | | | | | | | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net (loss) / gain from operations | | $ | (317,716 | ) | $ | 151,625 | | $ | (673,592 | ) | $ | (952,314 | ) | $ | (1,791,997 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Net (loss) / gain per Share | | $ | (0.10 | ) | $ | 0.04 | | $ | (0.11 | ) | $ | (0.12 | ) | $ | (0.34 | ) |

| | | | | | | | | | | | | | | | |

Weighted average number of Shares | | | 3,171,667 | | | 3,817,033 | | | 5,905,978 | | | 7,829,891 | | | 5,195,890 | |

The financial statements required by Regulation S-X, together with the report of the Trust’s independent registered public accounting firm appear on pages F-1 to F-11 of this filing.

26

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

There have been no changes in accountants and no disagreements with accountants during the year ended December 31, 2011.

Item 9A. Controls and Procedures.

Conclusion Regarding the Effectiveness of Disclosure Controls and Procedures

The Trust maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in its Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to the Chief Executive Officer and Chief Financial Officer of the Sponsor, and to the audit committee, as appropriate, to allow timely decisions regarding required disclosure.

Under the supervision and with the participation of the Chief Executive Officer and the Chief Financial Officer of the Sponsor, the Sponsor conducted an evaluation of the Trusts disclosure controls and procedures, as defined under Exchange Act Rule 13a-15(e). Based on this evaluation, the Chief Executive Officer and the Chief Financial Officer of the Sponsor concluded that, as of December 31, 2011, the Trust’s disclosure controls and procedures were effective.

There have been no changes in the Trust’s or Sponsor’s internal control over financial reporting that occurred during the Trust’s recently completed fiscal quarter ended December 31, 2011 that have materially affected, or are reasonably likely to materially affect, the Trust’s or Sponsor’s internal control over financial reporting.

Management’s Report on Internal Control over Financial Reporting

The Sponsor’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined under Exchange Act Rules 13a-15(f) and 15d-15(f). The Trust’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States. Internal control over financial reporting includes those policies and procedures that:

(1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Trust’s assets,

(2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that the Trust’s receipts and expenditures are being made only in accordance with appropriate authorizations; and

(3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Trust’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become ineffective because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The Chief Executive Officer and Chief Financial Officer of the Sponsor assessed the effectiveness of the Trust’s internal control over financial reporting as of December 31, 2011. In making this assessment, they used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control—Integrated Framework. Their assessment included an evaluation of the design of the Trust’s internal control over financial reporting and testing of the operational effectiveness of its internal control over financial reporting. Based on their assessment and those criteria, the Chief Executive Officer and Chief Financial Officer of the Sponsor concluded that the Trust maintained effective internal control over financial reporting as of December 31, 2011.

Deloitte & Touche LLP, the independent registered public accounting firm that audited and reported on the financial statements included in this Form 10-K, as stated in their report which is included herein, issued an attestation report on the effectiveness of the Trust’s internal control over financial reporting as of December 31, 2011.

27

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Sponsor, Trustee and the Shareholders of the ETFS Gold Trust

We have audited the internal control over financial reporting of ETFS Gold Trust (the “Trust”) as of December 31, 2011, based on criteria established inInternal Control — Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission. The Trust’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Trust’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, the company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the company’s board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Trust maintained, in all material respects, effective internal control over financial reporting as of December 31, 2011, based on the criteria established inInternal Control — Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the financial statements of the Trust as of and for the year ended December 31, 2011, and our report dated February 28, 2012 expressed an unqualified opinion on those financial statements.

/s/ DELOITTE & TOUCHE LLP

New York, New York

February 28, 2012

28

Item 9B. Other Information.

Not applicable.

29

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Not applicable.

Item 11. Executive Compensation.

The Trust has no directors or executive officers. The only ordinary expense paid by the Trust is the Sponsor’s Fee.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Security Ownership of Certain Beneficial Owners

The following table sets forth as of December 31, 2011, information with respect to each person known to own beneficially more than 5% of the outstanding Shares of the Trust:

Under the Trust Agreement, Shareholders have no voting rights, except in limited circumstances. The Trustee may terminate the Trust upon the agreement of Shareholders owning at least 75% of the outstanding Shares.

| | | | | | | |

Name and Address | | Amount and Nature

of Beneficial

Ownership | | Percent of Class | |

| |

| |

| |

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022 | | | 2,112,871 | | | 19.65 | % |

Security Ownership of Management

The Trustee does not beneficially own any of the Trust Shares.

Change In Control

Neither the Sponsor nor the Trustee knows of any arrangements which may subsequently result in a change in control of the Trust.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

The Trust has no directors or executive officers.

Item 14. Principal Accounting Fees and Services.

Fees for services performed by Deloitte & Touche LLP for the years ended December 31, 2011 and 2010:

| | | | | | | |

| | December 31, 2011 | | December 31, 2010 | |

| | | | | | | |

Audit fees | | $ | 52,500 | | $ | 90,000 | |

Audit related fees | | | 13,750 | | | 45,000 | |

| | | | | | | |

| |

|

| |

|

| |

| | $ | 66,250 | | $ | 135,000 | |

Pre-Approved Policies and Procedures

As referenced in Item 10 above, the Trust has no board of directors, and as a result, has no pre-approval policies or procedures with respect to fees paid to Deloitte & Touche LLP. Such determinations are made by the Sponsor.

None of the hours expended by Deloitte & Touche LLP to audit the Trust’s financial statements for the fiscal period ended December 31, 2011 were attributable to work performed by persons other than the principal accountant’s full-time, permanent employees.

30

PART IV

Item 15. Exhibits, Financial Statement Schedules

1. Financial Statements

See Index to Financial Statements on Page F-1 for a list of the financial statements being filed herein.

2. Financial Statement Schedules

Schedules have been omitted since they are either not required, not applicable, or the information has otherwise been included.

3. Exhibits

| |

Exhibit No. | Description |

|

|

4.1 | Depositary Trust Agreement, incorporated by reference to Exhibit 4.1 filed with Registration Statement No. 333-158221 on September 1, 2009 |

| |

4.2 | Form of Authorized Participant Agreement, incorporated by reference to Exhibit 4.2 filed with the Trust’s Annual Report on Form 10K for the fiscal year ended December 31, 2011. |

| |

4.3 | Global Certificate, incorporated by reference to Exhibit 4.3 filed with Registration Statement No. 333-158221 on September 1, 2009 |

| |

10.1 | Allocated Account Agreement, incorporated by reference to Exhibit 10.1 filed with Registration Statement No. 333-158221 on September 1, 2009 |

| |

10.2 | Unallocated Account Agreement, incorporated by reference to Exhibit 10.2 filed with Registration Statement No. 333-158221 on September 1, 2009 |

| |

10.3 | Depository Agreement, incorporated by reference to Exhibit 10.3 filed with Registration Statement No. 333-158221 on September 1, 2009 |

| |

10.4 | Marketing Agent Agreement, incorporated by reference to Exhibit 10.4 filed with Registration Statement No. 333-158221 on September 1, 2009 |

| |

31.1 | Chief Executive Officer’s Certificate, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

31.2 | Chief Financial Officer’s Certificate, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

32.1 | Chief Executive Officer’s Certificate, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

32.2 | Chief Financial Officer’s Certificate, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

31

ETFS GOLD TRUST

FINANCIAL STATEMENTS AS OF DECEMBER 31, 2011

INDEX

| | |

| | Page |

| | |

Report of Independent Registered Public Accounting Firm | | F-2 |

| | |

Statements of Financial Condition at December 31, 2011 and December 31, 2010 | | F-3 |

| | |

Statements of Operations for the years ended December 31, 2011 and 2010 and for the period September 1, 2009 through December 31, 2009 | | F-4 |

| | |

Statements of Cash Flows for the years ended December 31, 2011 and 2010 and for the period September 1, 2009 through December 31, 2009 | | F-5 |

| | |

Statements of Changes in Shareholders’ Deficit for the years ended December 31, 2011 and 2010 and for the period September 1, 2009 through December 31, 2009 | | F-6 |

| | |

Notes to the Financial Statements | | F-7 |

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Sponsor, Trustee and the Shareholders of the ETFS Gold Trust:

We have audited the accompanying statements of financial condition of ETFS Gold Trust (the “Trust”) as of December 31, 2011 and 2010, and the related statements of operations, changes in shareholders’ deficit, and cash flows for the years ended December 31, 2011 and 2010 and the period September 1, 2009 (date of inception) to December 31, 2009. These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material respects, the financial position of ETFS Gold Trust at December 31, 2011 and 2010, and the results of its operations and its cash flows for the years ended December 31, 2011 and 2010 and the period September 1, 2009 (date of inception) to December 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Trust’s internal control over financial reporting as of December 31, 2011, based on the criteria established inInternal Control – Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 28, 2012 expressed an unqualified opinion on the Trust’s internal control over financial reporting.

/s/ DELOITTE & TOUCHE LLP

New York, New York

February 28, 2012

F-2

ETFS GOLD TRUST

Statements of Financial Condition At December 31, 2011 and December 31, 2010

| | | | | | | |

| | December 31, 2011 | | December 31, 2010 | |

ASSETS | | | | | | | |

Investment in gold (1) | | $ | 1,376,845,277 | | $ | 971,070,331 | |

| |

|

| |

|

| |

Total assets | | $ | 1,376,845,277 | | $ | 971,070,331 | |

| |

|

| |

|

| |

| | | | | | | |

LIABILITIES | | | | | | | |

Accounts payable to Sponsor | | $ | 560,620 | | $ | 382,114 | |

| |

|

| |

|

| |

Total liabilities | | | 560,620 | | | 382,114 | |

| |

|

| |

|

| |

| | | | | | | |

REDEEMABLE SHARES | | | | | | | |

Shares at redemption value to investors (2) | | | 1,677,362,792 | | | 1,157,505,203 | |

Shareholders’ deficit | | | (301,078,135 | ) | | (186,816,986 | ) |

| |

|

| |

|

| |

Total liabilities, redeemable shares & shareholders’ deficit | | $ | 1,376,845,277 | | $ | 971,070,331 | |

| |

|

| |

|

| |

| |

(1) | The market value of investment in gold at December 31, 2011 was $1,677,923,412 and as at December 31, 2010 was $1,157,887,317. |

| |

(2) | Authorized share capital is unlimited and no par value per Share. Shares issued and outstanding at December 31, 2011 were 10,750,000 and at December 31, 2010 were 8,250,000. |

See Notes to the Financial Statements.

F-3

ETFS GOLD TRUST

For the years ended December 31, 2011 and 2010 and the period September 1, 2009* through December 31, 2009

| | | | | | | | | | |

| | Year

Ended

December 31, 2011 | | Year

Ended

December 31, 2010 | | Period

September 1, 2009*

through

December 31, 2009 | |

REVENUES | | | | | | | | | | |

| | | | | | | | | | |

Value of gold transferred to pay expenses | | $ | 5,651,811 | | $ | 2,156,700 | | $ | 293,263 | |

Cost of gold transferred to pay expenses | | | (4,434,131 | ) | | (1,970,203 | ) | | (272,373 | ) |

| |

|

| |

|

| |

|

| |

Gain on gold transferred to pay expenses | | | 1,217,680 | | | 186,497 | | | 20,890 | |

| | | | | | | | | | |

Gain on gold distributed for the redemption of Shares | | | 15,511,469 | | | 561,388 | | | 1,545,641 | |

| |

|

| |

|

| |

|

| |

Total gain on gold | | | 16,729,149 | | | 747,885 | | | 1,566,531 | |

| | | | | | | | | | |

EXPENSES | | | | | | | | | | |

| | | | | | | | | | |

Sponsor’s fee | | | 5,855,861 | | | 2,539,882 | | | 293,263 | |

| |

|

| |

|

| |

|

| |

Total expenses | | | 5,855,861 | | | 2,539,882 | | | 293,263 | |

| | | | | | | | | | |

| |

|

| |

|

| |

|

| |

Net gain / (loss) from operations | | $ | 10,873,288 | | $ | (1,791,997 | ) | $ | 1,273,268 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Net gain / (loss) per Share | | $ | 1.14 | | $ | (0.34 | ) | $ | 0.66 | |

| | | | | | | | | | |

Weighted average number of Shares | | | 9,551,507 | | | 5,195,890 | | | 1,942,149 | |

| | | | | | | | | | |

* Date of Inception.

See Notes to the Financial Statements.

F-4

ETFS GOLD TRUST

For the years ended December 31, 2011 and 2010 and the period September 1, 2009* through December 31, 2009

| | | | | | | | | | |

| | Year

Ended

December 31, 2011 | | Year

Ended

December 31, 2010 | | Period

September 1, 2009*

Through

December 31, 2009 | |

INCREASE / (DECREASE) IN CASH FROM OPERATIONS: | | | | | | | | | | |

| | | | | | | | | | |

Cash proceeds received from transfer of gold | | $ | — | | $ | — | | $ | — | |

Cash expenses paid | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

Increase in cash resulting from operations | | $ | — | | $ | — | | $ | — | |

| | | | | | | | | | |

Cash and cash equivalents at beginning of period | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

Cash and cash equivalents at end of period | | $ | — | | $ | — | | $ | — | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING ACTIVITIES: | | | | | | | | | | |

| | | | | | | | | | |

Value of gold received for creation of Shares | | $ | 466,052,746 | | $ | 650,946,846 | | $ | 354,780,028 | |

| | | | | | | | | | |

Value of gold distributed for redemption of Shares - at average cost | | $ | 55,843,669 | | $ | 5,552,232 | | $ | 26,861,735 | |

| | | | | | | | | | |

RECONCILIATION OF NET GAIN / (LOSS) TO NET CASH PROVIDED BY OPERATING ACTIVITIES: | | | | | | | | | | |

| | | | | | | | | | |

Net gain / (loss) from operations | | $ | 10,873,288 | | $ | (1,791,997 | ) | $ | 1,273,268 | |

Adjustments to reconcile net gain / (loss) to net cash provided by operating activities: | | | | | | | | | | |

Increase in gold assets | | | (405,774,946 | ) | | (643,424,411 | ) | | (327,645,920 | ) |

Increase in amounts payable to Sponsor | | | 178,506 | | | 382,114 | | | — | |

Increase / (decrease) in redeemable Shares: | | | | | | | | | | |

Creations | | | 466,052,755 | | | 650,947,913 | | | 354,760,532 | |

Redemptions | | | (71,329,603 | ) | | (6,113,619 | ) | | (28,387,880 | ) |

| |

|

| |

|

| |

|

| |

Net cash provided by operating activities | | $ | — | | $ | — | | $ | — | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF NON-CASH ITEM: | | | | | | | | | | |

| | | | | | | | | | |

Value of gold transferred to pay expenses | | $ | 5,651,811 | | $ | 2,156,700 | | $ | 293,263 | |

* Date of Inception

See Notes to the Financial Statements.

F-5

ETFS GOLD TRUST

Statements of Changes in Shareholders’ Deficit For the years ended December 31, 2011 and 2010 and the period September 1, 2009* through December 31, 2009

| | | | | | | | | | |

| | Year

Ended

December 31, 2011 | | Year

Ended

December 31, 2010 | | Period

September 1, 2009

through

December 31, 2009* | |

| | | | | | | | | | |

Shareholders’ deficit - opening balance | | $ | (186,816,986 | ) | $ | (8,648,370 | ) | $ | — | |

Net gain/(loss) for the year | | | 10,873,288 | | | (1,791,997 | ) | | 1,273,268 | |

Adjustment of redeemable Shares to redemption value | | | (125,134,437 | ) | | (176,376,619 | ) | | (9,921,638 | ) |

| |

|

| |

|

| |

|

| |

Shareholders’ deficit – closing balance | | $ | (301,078,135 | ) | $ | (186,816,986 | ) | $ | (8,648,370 | ) |

| |

|

| |

|

| |

|

| |

* Date of Inception

See Notes to the Financial Statements.

F-6

ETFS GOLD TRUST

Notes to the Financial Statements

1. Organization

The ETFS Gold Trust (the “Trust”) is an investment trust formed on September 1, 2009, under New York law pursuant to a depositary trust agreement (the “Trust Agreement”) executed by ETF Securities USA LLC (the “Sponsor”) and the Bank of New York Mellon (the “Trustee”) at the time of the Trust’s organization. The Trust holds gold bullion and issues ETFS Physical Swiss Gold Shares (the “Shares”) (in minimum blocks of 50,000 Shares, referred to as “Baskets”) in exchange for deposits of gold and distributes gold in connection with redemption of Baskets. Shares represent units of fractional undivided beneficial interest in and ownership of the Trust which are issued by the Trust. The Sponsor is a Delaware limited liability company that is a wholly-owned subsidiary of ETF Securities Limited, a Jersey, Channel Islands based company. The Trust is governed by the Trust Agreement.

The investment objective of the Trust is for the Shares to reflect the performance of the price of gold, less the Trust’s expenses and liabilities. The Trust is designed to provide an individual owner of beneficial interests in the Shares (a “Shareholder”) an opportunity to participate in the gold market through an investment in securities.

2. Significant Accounting Policies

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires those responsible for preparing financial statements to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Trust.

2.1. Valuation of Gold

Gold is held by JP Morgan Chase Bank, N.A. (the “Custodian”), on behalf of the Trust, at the Zurich, Switzerland vaulting premises of UBS A.G. (the “Zurich Sub-Custodian”) and is valued, for financial statement purposes, at the lower of cost or market. The cost of gold is determined according to the average cost method and the market value is based on the London PM Fix used to determine the net asset value (“NAV”) of the Trust. Realized gains and losses on transfers of gold to pay the Sponsor’s Fee, or gold distributed for the redemption of Shares, are calculated on a trade date basis using average cost. The price for an ounce of gold is set by five market making members of the London Bullion Market Association at approximately 3:00 PM London Time.

Once the value of gold has been determined, the NAV is computed by the Trustee by deducting all accrued fees and other liabilities of the Trust, including the remuneration due to the Sponsor (the “Sponsor’s Fee”), from the fair value of the gold and all other assets held by the Trust.

The table below summarizes the unrealized gains or losses on the Trust’s gold holdings as of December 31, 2011 and 2010:

| | | | | | | |

| | December 31, 2011 | | December 31, 2010 | |

| | | | | | | |

Investment in gold-average cost | | $ | 1,376,845,277 | | $ | 971,070,331 | |

|

Unrealized gain on investment in gold | | | 301,078,135 | | | 186,816,986 | |

| |

|

| |

|

| |

Investment in gold-market value | | $ | 1,677,923,412 | | $ | 1,157,887,317 | |

| |

|

| |

|

| |

The Trust recognizes the diminution in value of the investment in gold which arises from market declines on an interim basis. Increases in the value of the investment in gold through market price recoveries in later interim periods of the same fiscal year are recognized in the later interim period. Increases in value recognized on an interim basis may not exceed the previously recognized diminution in value.

The per Share amount of gold exchanged for a purchase or redemption is calculated daily by the Trustee, using the London PM Fix to calculate the gold amount in respect of any liabilities for which covering gold sales have not yet been made, and represents the per-Share amount of gold held by the Trust, after giving effect to its liabilities, to cover expenses and liabilities and any losses that may have occurred.

F-7

ETFS GOLD TRUST

Notes to the Financial Statements

2. Significant Accounting Policies (continued)

2.2. Gold Receivable and Payable

Gold receivable or payable represents the quantity of gold covered by contractually binding orders for the creation or redemption of Shares respectively, where the gold has not yet been transferred to or from the Trust’s account. Generally, ownership of the gold is transferred within three days of trade date.

| | | | | | | |

| | December 31, 2011 | | December 31, 2010 | |

| | | | | | | |

Gold receivable | | $ | — | | $ | — | |

| |

|

| |

|

| |

| | | | | | | |

Gold payable | | $ | — | | $ | — | |

| |

|

| |

|

| |

2.3 Creations and Redemptions of Shares

The Trust expects to create and redeem Shares from time to time, but only in one or more Baskets (a Basket equals a block of 50,000 Shares). The Trust issues Shares in Baskets to Authorized Participants on an ongoing basis. Individual investors cannot purchase or redeem Shares in direct transactions with the Trust. An Authorized Participant is a person who (1) is a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) is a participant in The Depository Trust Company, (3) has entered into an Authorized Participant Agreement with the Trustee and the Sponsor, and (4) has established an Authorized Participant Unallocated Account with the Trust’s Custodian or other gold bullion clearing bank. An Authorized Participant Agreement is an agreement entered into by each Authorized Participant, the Sponsor and the Trustee which provides the procedures for the creation and redemption of Baskets and for the delivery of the gold and any cash required for such creations and redemptions. An Authorized Participant Unallocated Account is an unallocated gold account, either loco London or loco Zurich, established with the Custodian or a gold bullion clearing bank by an Authorized Participant.

The creation and redemption of Baskets is only made in exchange for the delivery to the Trust or the distribution by the Trust of the amount of gold represented by the Baskets being created or redeemed, the amount of which is based on the combined NAV of the number of Shares included in the Baskets being created or redeemed determined on the day the order to create or redeem Baskets is properly received.

Authorized Participants may, on any business day, place an order with the Trustee to create or redeem one or more Baskets. The typical settlement period for Shares is three business days. In the event of a trade date at period end, where a settlement is pending, a respective account receivable and/or payable will be recorded. When gold is exchanged in settlement of redemption, it is considered a sale of gold for financial statement purposes.

The amount of bullion represented by the Baskets created or redeemed can only be settled to the nearest 1/1000th of an ounce. As a result, the value attributed to the creation or redemption of Shares may differ from the value of bullion to be delivered or distributed by the Trust. In order to ensure that the correct metal is available at all times to back the Shares, the Sponsor accepts an adjustment to its management fees in the event of any shortfall or excess. For each transaction, this amount is not more than 1/1000th of an ounce.

The Shares of the Trust are classified as “Redeemable Capital Shares” for financial statement purposes, since they are subject to redemption at the option of Authorized Participants. Outstanding Shares are reflected at redemption value, which represents the maximum obligation (based on NAV per Share), with the difference from historical cost recorded as an offsetting amount to retained earnings.

F-8

ETFS GOLD TRUST

Notes to the Financial Statements

2. Significant Accounting Policies (continued)

2.3. Creations and Redemptions of Shares (continued)

Changes in the Shares for the years ended December 31, 2011 and 2010 and the period from September 1, 2009 (the “Date of Inception”) through December 31, 2009 are as follows:

| | | | | | | | | | |

| | Year

Ended

December 31, 2011 | | Year

Ended

December 31, 2010 | | Period

September 1, 2009*

through

December 31, 2009 | |

Number of Redeemable Shares: | | | | | | | | | | |

Opening Balance | | | 8,250,000 | | | 3,050,000 | | | — | |

Creations | | | 2,950,000 | | | 5,250,000 | | | 3,300,000 | |

Redemptions | | | (450,000 | ) | | (50,000 | ) | | (250,000 | ) |

| |

|

| |

|

| |

|

| |

Closing Balance | | | 10,750,000 | | | 8,250,000 | | | 3,050,000 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Redeemable Shares: | | | | | | | | | | |

Opening balance | | $ | 1,157,505,203 | | $ | 336,294,290 | | $ | — | |

Creations | | | 466,052,755 | | | 650,947,913 | | | 354,760,532 | |

Redemptions | | | (71,329,603 | ) | | (6,113,619 | ) | | (28,387,880 | ) |

Adjustment to redemption value | | | 125,134,437 | | | 176,376,619 | | | 9,921,638 | |

| |

|

| |

|

| |

|

| |

Closing balance | | $ | 1,677,362,792 | | $ | 1,157,505,203 | | $ | 336,294,290 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Redemption value per Share at period end | | $ | 156.03 | | $ | 140.30 | | $ | 110.26 | |

| | | | | | | | | | | |

* Date of Inception | | | | | | | | | | |

2.4. Revenue Recognition Policy

The primary expense of the Trust is the Sponsor’s Fee, which is paid by the Trust through in-kind transfers of gold to the Sponsor. With respect to expenses not otherwise assumed by the Sponsor, the Trustee will, at the direction of the Sponsor or in its own discretion, sell the Trust’s gold as necessary to pay these expenses. When selling gold to pay expenses, the Trustee will endeavor to sell the smallest amounts of gold needed to pay these expenses in order to minimize the Trust’s holdings of assets other than gold.

Unless otherwise directed by the Sponsor, when selling gold the Trustee will endeavor to sell at the price established by the London PM Fix. The Trustee will place orders with dealers (which may include the Custodian) through which the Trustee expects to receive the most favorable price and execution of orders. The Custodian may be the purchaser of such gold only if the sale transaction is made at the London PM Fix used by the Trustee to value the Trust’s gold. A gain or loss is recognized based on the difference between the selling price and the average cost of the gold sold. Neither the Trustee nor the Sponsor is liable for depreciation or loss incurred by reason of any sale.

2.5. Income Taxes

The Trust is classified as a “grantor trust” for U.S. federal income tax purposes. As a result, the Trust itself will not be subject to U.S. federal income tax. Instead, the Trust’s income and expenses will “flow through” to the Shareholders, and the Trustee will report the Trust’s proceeds, income, deductions, gains, and losses to the Internal Revenue Service on that basis.

The Trust has adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 740-10,Income Taxes. The Sponsor have evaluated the application of ASC 740 to the Trust, to determine whether or not there are uncertain tax positions that require financial statement recognition. Based on this evaluation, the Sponsor has determined no reserves for uncertain tax positions are required to be recorded as a result of the application of ASC 740. As a result, no income tax liability or expense has been recorded in the accompanying financial statements.

F-9

ETFS GOLD TRUST

Notes to the Financial Statements

2. Significant Accounting Policies (continued)

2.6. Investment in Gold

Changes in ounces of gold and the respective values for the years ended December 31, 2011 and 2010 and for the period from September 1, 2009* through December 31, 2009 are as follows:

| | | | | | | | | | |

| | Year

Ended

December 31, 2011 | | Year

Ended

December 31, 2010 | | Period

September 1, 2009*

through

December 31, 2009 | |

Ounces of gold: | | | | | | | | | | |

Opening balance | | | 821,051.2 | | | 304,614.4 | | | — | |

Creations | | | 292,915.5 | | | 523,161.0 | | | 329,852.1 | |

Redemptions | | | (44,662.3 | ) | | (4,984.6 | ) | | (24,973.5 | ) |

Transfers of gold | | | (3,617.9 | ) | | (1,739.6 | ) | | (264.2 | ) |

| |

|

| |

|

| |

|

| |

Closing Balance | | | 1,065,686.5 | | | 821,051.2 | | | 304,614.4 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Investment in gold (lower of cost or market): | | | | | | | | | | |

Opening balance | | $ | 971,070,331 | | $ | 327,645,920 | | $ | — | |

Creations | | | 466,052,746 | | | 650,946,846 | | | 354,780,028 | |

Redemptions | | | (55,843,669 | ) | | (5,552,232 | ) | | (26,861,735 | ) |

Transfers of gold | | | (4,434,131 | ) | | (1,970,203 | ) | | (272,373 | ) |

| |

|

| |

|

| |

|

| |

Closing Balance | | $ | 1,376,845,277 | | $ | 971,070,331 | | $ | 327,645,920 | |

| |

|

| |

|

| |

|

| |

* Date of Inception | | | | | | | | | | |

2.7. Expenses

The Trust will transfer gold to the Sponsor to pay the Sponsor’s Fee that will accrue daily at an annualized rate equal to 0.39% of the adjusted daily NAV of the Trust, paid monthly in arrears.

The Sponsor has agreed to assume administrative and marketing expenses incurred by the Trust, including the Trustee’s monthly fee and out of pocket expenses, the Custodian’s fee and the reimbursement of the Custodian’s expenses, exchange listing fees, United States Securities and Exchange Commission (the “SEC”) registration fees, printing and mailing costs, audit fees and certain legal expenses.

For the year ended December 31, 2011, the Sponsor’s Fee was $5,855,861 (Year ended December 31, 2010: $2,539,882; period ended December 2009: $293,263).

At December 31, 2011 $560,620 was payable to the Sponsor (2010: $382,114).

2.8Subsequent Events

In accordance with the provisions set forth in FASB ASC 855-10,Subsequent Events, the Trust’s management has evaluated the possibility of subsequent events existing in the Trust’s financial statements through the issuance date. Management has determined that there are no material events that would require adjustment to or disclosure in the Trust’s financial statements through this date.

F-10

ETFS GOLD TRUST

Notes to the Financial Statements

3 Related Parties

The Sponsor and the Trustee are considered to be related parties to the Trust. The Trustee’s fee is paid by the Sponsor and is not a separate expense of the Trust. The Trustee and the Custodian and their affiliates may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

4 Concentration of Risk

The Trust’s sole business activity is the investment in gold, and substantially all the Trust’s assets are holdings of gold which creates a concentration risk associated with fluctuations in the price of gold. Several factors could affect the price of gold, including: (i) global gold supply and demand, which is influenced by factors such as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries; (ii) investors’ expectations with respect to the rate of inflation; (iii) currency exchange rates; (iv) interest rates; (v) investment and trading activities of hedge funds and commodity funds; and (vi) global or regional political, economic or financial events and situations. In addition, there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately. Each of these events could have a material effect on the Trust’s financial position and results of operations.

5 Indemnification

Under the Trust’s organizational documents, each of the Trustee (and its directors, employees and agents) and the Sponsor (and its members, managers, directors, officers, employees, and affiliates) is indemnified by the Trust against any liability, cost or expense it incurs without gross negligence, bad faith or willful misconduct on its part and without reckless disregard on its part of its obligations and duties under the Trust’s organizational documents.

The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

F-11

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

| |

| ETF SECURITIES USA LLC

Sponsor of the ETFS Gold Trust

(Registrant) |

| |

| /s/ Graham Tuckwell |

|

|

| Graham Tuckwell |

| President and Chief Executive Officer |

| (Principal Executive Officer) |

Date: February 29, 2012

| |

| /s/ Thomas Quigley |

|

|

| Thomas Quigley |

| Chief Financial Officer and Treasurer |

| (Principal Financial Officer and Principal Accounting Officer) |

| |

Date: February 29, 2012

* The Registrant is a trust and the persons are signing in their capacities as officers of ETF Securities USA LLC, the Sponsor of the Registrant.