Virginia K. Sourlis, Esq., MBA* | The Galleria |

Philip Magri, Esq.+ | 2 Bridge Avenue |

Joseph M. Patricola, Esq.*+# | Red Bank, New Jersey 07701 |

| | (732) 530-9007 Fax (732) 530-9008 |

| | www.SourlisLaw.com |

| * Licensed in NJ | Virginia@SourlisLaw.com |

| + Licensed in NY | |

| # Licensed in DC | |

October 19, 2009

VIA EDGAR CORRESPONDENCE

Division of Corporate Finance

U.S. Securities and Exchange Commission

Mail Stop 3561

100 F Street N.E.

Washington, D.C. 20005

Attn: H. Christopher Owings

Assistant Director

| | RE: | EFT BioTech Holdings, Inc. |

Registration Statement on Form 10

Amendment No. 4 Filed September 3, 2009

File No. 000-53730

Form 10-K/A for the Fiscal Year Ended March 31, 2009

File No. 001-34222

Dear Mr. Owings:

Below please find our responses to the Staff’s comment letter, dated September 21, 2009 (the “Comment Letter”), regarding the above-captioned matter. Per your request, our responses are keyed to the enumerated questions and comments in the Comment Letter.

Also, please be advised that the Company has filed Amendment No. 5 to the Registration Statement today. A hard copy of this response letter and Amendment No. 5, marked to show changes from Amendment No. 4, is being sent to you today via overnight mail.

Please also be advised that pursuant to Comment Letter, the Company has filed Amendment No. 2 to its Annual Report on Form 10-K for the fiscal year ended March 31, 2009 today. A marked copy of the amended Form 10-K/A Amendment No. 2 is also being sent to you today via overnight.

Please do not hesitate to contact me at (732) 610-2435 if you have any questions regarding this matter.

Very truly yours,

/s/ Philip Magri

| 1. | We note your response to comment three of our letter dated July 30, 2009. However, the purpose of dividing the nine new affiliates into two groups remains unclear. Please revise your disclosure to clarify. |

We have revised the disclosure to read as follows:

We also have a commission plan. The Company's commission plan is calculated on every nine new orders that are placed under an Affiliate’s identification number. When an Affiliate places an order, he/she is required to provide us with identification number of the Affiliate which referred him/her to us. Each Affiliate is recognized to have both a right and left sales side. The commissions that each Affiliate earns are calculated on the accumulation of nine new orders placed on these two sides with a minimum of three orders placed on one side in order to generate the commission. Commissions are paid on a weekly basis and are calculated on total new sales generated each week.

| 2. | In response to comment five of our letter dated July 30, 2009, you revised your disclosure to state that your board of directors approved a loan to Excalibur in order to facilitate Excalibur's purchase of a new shipping vessel. Please clarify whether all of the loans that have been made to Excalibur were for that purpose. If they were not, please provide a brief description of the purpose of each loan. In addition, please disclose whether Excalibur has purchased the shipping vessel; in this regard, we note your disclosure regarding the inaugural passenger voyage. |

We have revised the disclosure to state that the $17,628,283 of the July 28, 2009 loan of $19,183,000 was used by Excalibur to purchase the vessel and that all of the remaining amounts were used by Excalibur for working capital and to fund its operations.

Excalibur International Marine Corporation

Due to the recent changes in policy between Mainland China and Taiwan, an opportunity was recognized to take advantage of direct sailings for cargo and passengers through the Taiwan Strait. EFT identified Excalibur International Marina Corporation (“Excalibur”), a shipping company located in Taiwan, as a viable entity to participate with in this business opportunity. In order to expedite the purchase of a new vessel, EFT’s Board of Directors approved a non-interest bearing, unsecured loan to facilitate this purchase.

On July 28, 2008, the Registrant loaned $19,193,000 to Excalibur. The purpose of this loan was to provide Excalibur funds to purchase a vessel ($17,628,283) and working capital ($1,564,717). This loan was still outstanding with balance of $1,564,717 as of June 30, 2009. At the time of the transaction, Excalibur was not a related party nor did any of the Company or any of its officers or directors have any relationship with Excalibur or any of its officers and directors.

On September 23, 2008, the Registrant signed a loan agreement with Excalibur to lend $2,000,000 at an interest rate of 3.75% per month with a term of no more than 60 days. At the end of the 60 days term, the term of the loan was extended for six months. On December 25, 2008, the Company extended this loan to May 25, 2009. On May 25, 2009, the Company extended this loan to Excalibur for another six months and decreased the interest rate to 12.5% per annum. The loan was used to fund operations.

On October 20, 2008, EFT Investment Co., Ltd. was formed as a wholly-owned subsidiary of EFT BioTech Holdings, Inc. EFT Investment Co., Ltd was formed in Taiwan. On October 25, 2008, EFT Investment Co., Ltd. completed the acquisition of 585,677,500 shares of common stock of Excalibur; representing approximately 49% shares of issued and outstanding shares of Excalibur, for an aggregate purchase price of USD $19,193,000. Prior to the acquisition of Excalibur, Excalibur was not a related person under Item 404 of Regulation S-K.

On November 24, 2008, the Registrant signed an additional loan agreement with Excalibur, a then related party, pursuant to which the Registrant loaned Excalibur $500,000 at the interest rate of 3.75% per month with a term of 30 days with an extension of six months. On December 25, 2008, the Company extended the loan to May 25, 2009. On May 25, 2009, the Company extended this loan for another six months and decreased the interest rate to 12.5% per annum. The loan was used to fund operations.

On May 13, 2009, the Company signed another loan agreement denominated in U.S. dollars with Excalibur to lend Excalibur $600,000 at interest rate of 12.5% per annum with a maturity date of November 13, 2009. The loan was used to fund operations.

On June 28, 2009, Excalibur completed its inaugural passenger voyage across the Taiwan Strait.

Item 1 A. Risk Factors, page 12

We are subject to laws governing our customers' personal identifiable information."

| 3. | We note the risk factor that you added in response to comment four of our letter dated July 30, 2009. It appears that this risk factor overlaps in substance with the risk factor entitled "The processing, storage and use of personal data could give rise to liabilities...." on page 16. Please revise your disclosure to make it clear how these two risk factors are different or to combine them, as appropriate. |

We have combined the two risk factors to read as follows:

We are subject to laws governing our customers’ personal identifiable information. The processing, storage and use of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements or differing views of personal privacy rights.

The collection of data and processing of transactions through our systems require us to receive and store a large volume of personally identifiable data. We are subject to various consumer protection laws relating to the collection, use, retention, security and transfer of personally identifiable information about our users, especially for financial information. In many states, there is currently great uncertainty whether or how existing laws governing issues such as property ownership, sales and other taxes, apply to the Internet and commercial online services. The interpretation and application of these laws are in a state of flux. These laws may be interpreted and applied inconsistently from country to country and our current data protection policies and practices may not be consistent with those interpretations and applications. . We might become exposed to potential liabilities with respect to the data that we collect, manage and processes, and may incur legal costs if our information security policies and procedures are not effective or if we are required to defend our respective methods of collection, processing and storage of personal data. Complying with these varying requirements could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business. Any failure, or perceived failure, by us to comply with any regulatory requirements or orders or other federal, state or international privacy or consumer protection-related laws and regulations could result in proceedings or actions against us by governmental entities or others, subject us to significant penalties and negative publicity and adversely affect us. In addition, we are subject to the possibility of security breaches, which themselves may result in a violation of these laws. Future investigations, lawsuits or adverse publicity relating to our methods of handling personal data could adversely affect our business, financial condition and results of operations due to the costs and negative market reaction relating to such developments.

Item 2. Financial Information, page 20

| 4. | We note your response to comment two from our letter dated July 20, 2009. You state that you are providing your analysis as of November 28, 2008, the last business day of your recently completed second fiscal quarter; however, November 28 is not the last business day of your recently completed second fiscal quarter. Furthermore, as this Form 10 is your initial registration statement, your calculation of public float must be made as of a date within 30 days of the date of the filing of the initial registration statement, i.e. within 30 days of December 10, 2008, to be consistent with Item 10(f)(l)(ii) of Regulation S-K. Please tell us whether you wish to use November 28, 2008 as the date within 30 days of December 10, 2008. For whatever date you use for your determination, tell us the total number of shares outstanding as of that date, and provide us with a detailed list showing each affiliate and the number of shares that they held at that date so that we can better understand how you determined that only 7.8 million shares were held by nonaffiliates. |

In compliance with Item 10(f)(1)(ii), we have determined that the Company is a “smaller reporting company” based on the fact that the non-affiliated public float was less than $75,000,000 on December 9, 2008 based on a closing price of $3.70.

On December 9, 2008, the Company’s stock was held by the following affiliates:

| Name/Title | | Amount of Shares | |

Jack Jie Qin -President, Chief Executive Officer and Chairman | | | 1,000 | |

Dr. Joseph B. Williams —Chief Administrative Officer, Secretary and Director | | | 300,000 | |

George W. Curry —Director | | | 300,000 | |

Jun Qin Liu —Director | | | 300,000 | |

Dragon Win Management Limited (1) Palm Grove Houses, P.O. Box 438 Road Town, Tortola British Virgin Islands | | | 52,099,000 | |

Greenstone Holdings 40 Wall Street, 11th Floor New York, NY 10005 | | | 4,000,000 | |

| Total Shares Held by Affiliates | | | 57,000,000 | |

| | (1) | Jun Qin Liu is a director of Dragon Win Management Limited. |

Based on 75,983,205 shares of common stock of the Company issued and outstanding on December 9, 2008, there were 18,983,205 shares of common stock held by non-affiliates. The non-affiliate public float on such date based on a closing price of $3.70 was $70,237,858, thereby making the Company a “smaller reporting company” pursuant to Item 10(f)(1)(ii) of Regulation S-K. Please note that the Company inadvertently omitted Greenstone Holdings from the beneficial ownership table in the Company’s originally filed Form 10 but added Greenstone to later filings. As of the date of Amendment No. 5, however, we have been advised by Greenstone that they own less than 5% of the Company’s issued and outstanding common stock and because of such, are not included in the Company’s beneficial ownership table in Amendment No. 5.

Selected Financial Data, page 20

| | 5. | Please refer to comment seven from our letter dated July 30, 2009. Despite your statement that you are not required to provide Selected Financial Data as a smaller reporting company, if you choose to present Selected Financial Data, it must agree to your audited financial statements. The amount you have titled Income from Continuing Operations is Net Operating Income on you Statement of Operations. Please note that these are defined GAAP terms and may not be used to refer to other amounts. Please revise. |

We agree with the Staff’s position on this matter. However, we have deleted the Selected Financial Data table as permitted by the rules governing smaller reporting companies.

| | 6. | Please explain to us why the amounts you show as Long-term Operating Leases do not agree to the amounts shown in your contractual obligations table. |

We agree with the Staff’s position on this matter. However, we have deleted the Selected Financial Data table as permitted by the rules governing smaller reporting companies.

Item 13. Financial Statements and Supplementary Data, page 45

Consolidated Financial Statements for the Year Ended March 31. 2009 and March 31. 2008

Consolidated Statements of Changes in Stockholders' Equity, page F-6

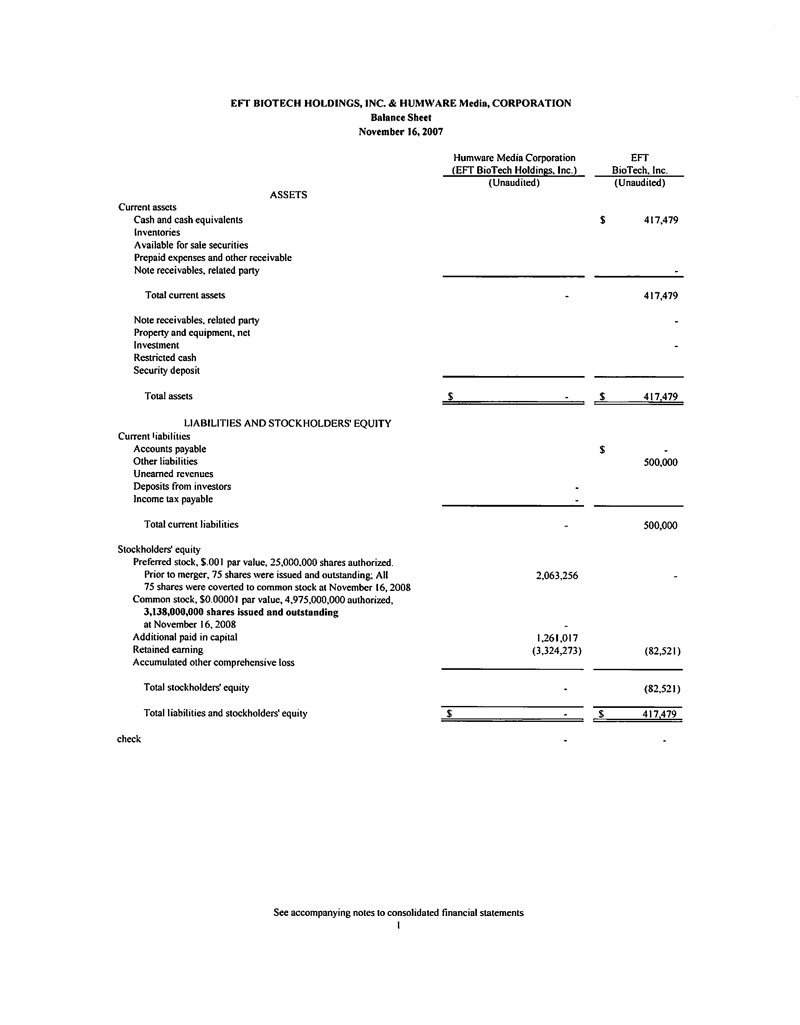

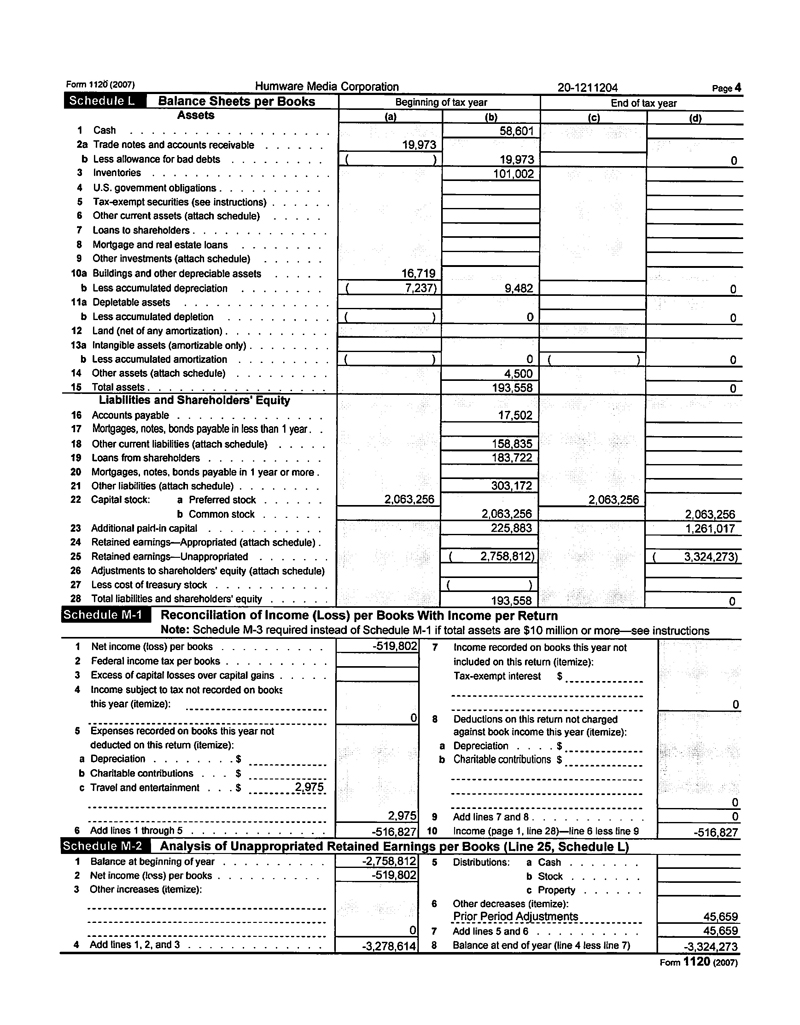

| | 7. | Your response to comment 14 from our letter dated July 30, 2009 states that the balance sheets that we requested are enclosed. However, we never received this information. As previously requested, please provide us with the balance sheet for the shell company EFT Holdings, and the consolidated balance sheet for the operating company, EFT BioTech, immediately prior to the reverse merger. Note that the consolidated balance sheet for EFT BioTech should include its operating subsidiaries. |

Please see the attached balance sheet.

Notes to Consolidated Financial Statements

Note 8 - Investment, page F-17

| | 8. | We read your response to our comment 20 from our letter dated July 30, 2009 and have the following additional comments: |

| • | Please refer to comment one above in this comment letter. If you qualify as a smaller reporting company, it still appears that audited financial statements of Excalibur may be required to be included with your annual March 31, 2009 financial statements under Rule 8-04 of Regulation S-X. Please provide us with your calculation of each of the criteria specified in Rule 8-04(b) of Regulation S-X. Please note that these calculations must be based upon the most recent audited annual financial statements of Excalibur prior to the October 2008 acquisition of your equity interest, as compared to your audited annual financial statements for the fiscal year ended March 31, 2008. |

| • | Please refer to comment one above in this comment letter. If you do not qualify as a smaller reporting company, Rule 3-09 of Regulation S-X requires you to provide separate audited financial statements for a 50 percent or less owned company that you account for on the equity method, provided that certain criteria are met. As indicated in our previous comment, since your investment in Excalibur comprises 25% of your total assets as of March 31, 2009, you have met the criteria requiring separate audited financial statements of Excalibur to be included with your annual March 31, 2009 financial statements. Also provide us with your analysis of what periods of Excalibur's audited financial statements are required under Rule 3-05 of Regulation S-X to demonstrate that these would not differ from the periods of Excalibur's audited financial statements required under Rule 3-09. |

| • | Please apply this comment to both your Form 10 and your Form 10-K. |

Due to a top management agreement signed prior to the Company’s investment in Excalibur and resistance from Excalibur, the Company has been unable to obtain Excalibur’s audited financial statements. This resistance creates a situation where at this time the Company is unable to respond to this comment. Currently, the Company is using their best efforts to get audited financial statements from Excalibur to comply with the Rule 8-04 of Regulation S-X. To that end, the Company has sent to Taiwan (where Excalibur is located) its In-House Counsel, Senior VP and Company CEO to attempt to rectify this unfortunate situation. We will update your office when we have resolved this issue.

| | 9. | We note that you have removed Note 14 related to the restatement of your financial statements for the fiscal year ended March 31, 2008, along with the labels on the face of your financial statements indicating that the March 31, 2008 numbers are restated. As this restatement was originally reflected within your audited March 31, 2009 financial statements, and you are continuing to present those financial statements, you should continue to present the restatement to comply with SFAS 154. |

We have amended Amendment No. 5 to comply with this comment.

Consolidated Financial Statements for the periods ended June 30.2009 and June 30. 2008 Notes to Unaudited Consolidated Financial Statements, page F-26 Note 2 - Summary of Significant Accounting Policies, page F-26

| 10. | Please disclose, if true, that your interim financial statements reflect all adjustments, consisting of normal recurring adjustments, which are, in the opinion of management, necessary to a fair statement of the results for the interim periods presented. Refer to Instruction 2 to Rule 8-03 of Regulation S-X. Please ensure that this comment is also applied to all future Forms 10-Q. |

The Company has added the following disclosure in Amendment No. 5:

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions for Form 10-Q and Article 210.8-03 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. All such adjustments are of a normal recurring nature. Operating results for the six month period ended September 30, 2009, are not necessarily indicative of the results that may be expected for the fiscal year ending March 31, 2010. For further information refer to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2009.

We will add the foregoing foreclosures to future Forms 10-Q.

Note 8 - Investment, page F-34

| 11. | We read that in the quarter ended June 30, 2009, you wrote off the premium that you paid when you initially purchased your investment in Excalibur. Please explain to us in reasonable detail how you calculated the amount of impairment to record for your investment in Excalibur, including explaining how you determined the fair value of your investment. Refer to paragraph 19(h) of APB 18. In future quarterly filings, please expand your disclosures in this footnote to address the above matters. |

The excess of EFT March 31, 2009 equity investment over investee net book value includes goodwill and the license across the Taiwan Strait. However as of June 30, 2009, with a continued loss in Excalibur, the absence of an ability to recover the carrying amount which has indicated a loss in value of the investment. EFT determined to write off the premium and took the impairment.

Item 15. Financial Statements and Exhibits, page 46

| 12. | You continue to state that your audited financial statements for the years ended March 31, 2008 and 2007 and the notes thereto and the unaudited financial statements for the nine months ended December 31, 2008 and 2007 and notes thereto are included after the Signature Page of this Registration Statement on Form 10, however, they appear to have been moved and updated. Please revise your disclosure. |

We have revised the language to read as follows:

(a) Financial Statements filed as part of this Registration Statement:

The Registrant’s audited financial statements for the years ended March 31, 2009 and 2008 and the notes thereto and the unaudited financial statements for the three months ended June 30, 2009 and 2008 and notes thereto are included in Item 13 of this Registration Statement on Form 10 and are incorporated by reference herein.

| 13. | The date of the $2,000,000 loan to Excalibur appears to remain incorrect in the exhibit index. Please revise the exhibit index accordingly. In addition, please file as exhibits the two unsecured loans that were made to Yeuh-Chi Liu in July. |

Finally, we note that the exhibit index of the Form 10-K/A filed on September 3, 2009 continues to incorrectly identify the $500,000 loan to Excalibur as a $5,000,000 loan and the dates of the loan agreements. In future filings of your periodic reports, please revise the exhibit index accordingly.

We have revised the exhibit index. We have also corrected the exhibit index in the Form 10-K/A Amendment No. 2.

Form 10-K/A for the year ended March 31, 2009 filed September 3.2009 Report of Independent Registered Public Accounting Firm

| 14. | We note that you have not included a Report of Independent Registered Public Accounting Firm in your filing. Please amend your filing to include such a report covering all periods presented in your financial statements. Ensure the report complies with Rule 2-02 of Regulation S-X. |

We have included the audit report in the Form 10-K/A Amendment No. 2.