Registration Statement on Form 10

| 1. | We note your response to comment one from our letter dated September 21, 2009. We understand that, in order to earn a commission, an Affiliate must accumulate nine new orders, that those orders are placed on the Affiliate's right and left sales sides, and that a sales side must have at least three orders placed on it before a commission may be earned. However, your disclosure does not explain the purpose of dividing the nine new affiliates into two groups. Please revise your disclosure to clarify. |

We have added the following disclosure.

EFT Compensation Plan:

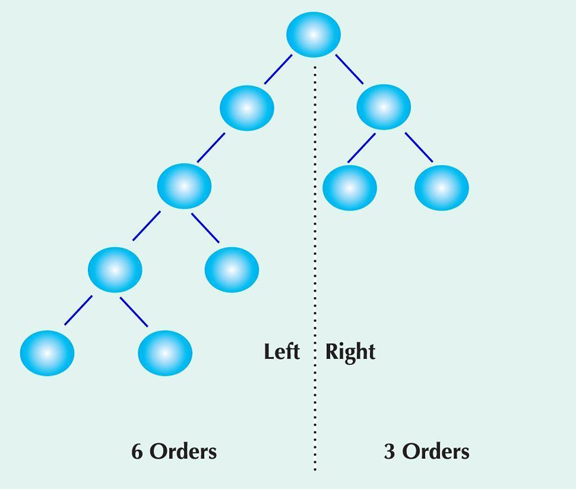

We also have a commission plan. The Company's commission plan is calculated on every nine new orders that are placed under an Affiliate’s identification number. When an Affiliate places an order, he/she is required to provide us with identification number of the Affiliate which referred him/her to us. Each Affiliate is recognized to have both a right and left sales side. The Company’s compensation plan whereby Affiliates are placed into two groups, one on the left side and one on the right side of the originating Affiliate is commonly known as a “Binary Plan.” Binary compensation plans originated in the 1990’s to the network marketing industry. As well as the simplicity of the design that the binary compensation structure offers, there are a number of advantages that make it attractive to all network marketers.

A binary plan, as the name suggests, is based around the number 2, which represents the maximum number of frontline Affiliates that the initial Affiliates can have. Any additional Affiliates must then be placed under one of the frontline Affiliates. This creates a very supportive environment for new Affiliates as the easiest way for Affiliates to earn a commission is by assisting the new Affiliates to build their network. This team approach makes the binary plan very attractive as there is a lot of support (both initial and ongoing) as all Affiliates work towards achieving a common goal. The binary plan benefits the Company because it encourages Affiliates to recruit other Affiliates and to help their weaker downline Affiliates to build their network (i.e., promoting teamwork) to achieve a better volume balance and a more consistent and higher commission check. Another benefit of a binary plan is that it allows a company to sell its products directly to the consumer by choosing to use a word of mouth approach (e.g., networking) instead of advertising through traditional streams (e.g., media).

The Company's binary compensation plan is calculated on every "nine" new orders that are placed under an Affiliate’s ID number for the purpose of selling the Company's products. Each Affiliate is recognized to have both a right and left sales side. The commissions that each Affiliate earns are calculated on the accumulation of nine new orders placed on these two sides with a minimum of three orders placed on one side in order to generate the commission. Commissions are paid on a weekly basis and are calculated on total new sales generated each week.

| 2. | We read your response to our comment four from our letter dated September 21, 2009. We note that the table showing the shares held by affiliates totals 57,000,000 shares. We also note that several times throughout your document you state that there were 75,983,205 shares outstanding and that 7,793,165 shares are held by non-affiliates and the remaining 68,190,040 shares are held by affiliates. Refer to page four, page 19, page 39, page 44, and page F-17. Please revise these disclosures in your filing to clarify the date at which non-affiliates held only 7,793,165 shares, and provide us with a detailed list showing each affiliate and the number of shares that they held at that date that supports that disclosure. In addition, please provide us with your analysis as to the identification of Greenstone Holdings as your affiliate. |

The several references to the number of shares held by non-affiliates and affiliates of the Company as June 30, 2009 mistakenly reflected the number of shares held by the Company Affiliate members. We have revised the disclosure as follows:

“As of the fiscal quarter ended June 30, 2009, there were 75,983,205 shares of Common Stock outstanding (23,583,205 were held by non-affiliates and the remaining 52,400,000 were held by affiliates).”

Detailed list showing each affiliate and the number of shares that they held on June 30, 2009:

Jack Jie Qin —President, Chief Executive Officer and Chairman (Principal Executive Officer) | 1,000 |

George W. Curry —Chief Marketing Director | 300,000 |

Dragon Win Management, Ltd. (6) Palm Grove Houses, P.O. Box 438 Road Town, Tortola British Virgin Islands | 52,099,000 |

| Total | 52,400,000 |

Our analysis as to the identification of Greenstone Holdings as our affiliate on December 9, 2008.

Rule 501(b) of Regulation promulgated under the Securities Act of 1933, as amended (the “Act”) defines “Affiliate” as a person that “directly, or indirectly, through one or more intermediaries, controls or is controlled by, or is under common control with, the person specified. “ Greenstone Holdings (“Greenstone”) met the definition of an Affiliate of the Company at the time the Registration Statement was filed for the following reasons.

Greenstone met with the Company’s officers and directors several times and sat in on many Board meetings to discuss and plan the Company’s future, business strategies and financing options. When the Company and Greenstone agreed that the Company would benefit from conducting a Private Placement Offering of common stock, the Board and Greenstone made the decision to engage Buckman, Buckman & Reid, Inc., a registered broker/dealer, as the placement agent for the Company’s January 2008 Regulation S Offering that ended in October 2008. Greenstone also played a vital role in directing and advising the Board to file a Registration Statement on Form 10 to become a fully-reporting company and to have Buckman, Buckman & Reid, Inc. sponsor the Company to file an application with FINRA to act as a market maker. Greenstone also assisted the Company and its Board in determining the termination and appointment of certain key executive officers and directors of the Company. Once the Company filed the Registration Statement on December 10, 2008, Greenstone’s role of advising and directing the Company and its Board ceased and Greenstone was no longer an Affiliate of the Company.

Item 13. Financial Statements and Supplementary Data, page 45

Consolidated Financial Statements for the Year Ended March 31« 2009 and March 31 > 2008

Notes to Consolidated Financial Statements

Note 8 - Investment page F-17

| 3. | We read your response to our comment eight from our letter dated September 21, 2009 and await your conclusion. |

We have included the audited financial statements for Excalibur International Marine Corporation for the fiscal year ended December 31, 2007.

Consolidated Financial Statements for the periods ended June 30.20 09 and June 30.2008

Notes to Unaudited Consolidated Financial Statements, page F-26

Note 8 - Investment, page F-34

| 4. | We read your response to our comment 11 from our letter dated September 21, 2009. We remain unclear as to how you determined the fair value of your investment in Excalibur. In this regard, your response appears to indicate that you subjectively determined that there was a loss in the value of your investment due to Excalibur's continuing losses, which does not appear consistent with the guidance in paragraph 19(h) of APB 18. Please provide us with a detailed explanation of how you calculated the amount of loss to record and how your methodology complies with APB 18. |

The Company elected to perform an assessment of the carrying value of the equity method investment of Excalibur International as of June 30, 2009. As of June 30, 2009, the Company determined the estimated fair value of its reporting unit using a discounted cash flow model and compared the value to the carrying value of its reporting unit. This assessment indicated that the Company's carrying value in its investment was impaired.

The discount rate, sales growth, profitability assumptions and perpetual growth rate are the material assumptions utilized in the discounted cash flow model used to estimate the fair value of its reporting unit. The amount of investment loss (impairment) for Excalibur was $1,080,969. In future filing the Company will continue to use the discounted cash flow model in determining the fair value of its equity method investment.

According to APB 18, para. 19(h), the current fair value of the equity method investment was less than its carrying amount which indicated a loss in value per the Company’s discounted cash flow model. The Company reports this loss as investment loss on the Statement of Operations and Other Comprehensive Income.

The Company’s share of earnings or losses of the investment are shown as a subsidiary loss on equity method investment per APB 18 paragraphs 18 and 19(c).

Form 1Q-K/A for the Fiscal Year Ended March 31.2009 filed October 19.2009

| 5. | In future periodic reports, please revise the certifications filed as Exhibit 31 so the language is identical to the language contained in Item 601(b)(31) of Regulation S-K. In this regard, we note the following: |

| | • | You refer to 4tthe Company" rather than to "the registrant"; |

| | | |

| | • | In paragraph 5(a) you refer to deficiencies and weaknesses that are "reasonable likely" rather than "reasonably likely"; and |

| | • | In paragraph 5(b) you refer to fraud that "involved management" rather than "involves management." |

In future periodic reports, the Company will revise the certifications filed as Exhibit 31 so that the language is identical to the language contained in Item 601(b)(13) of Regulation S-K.