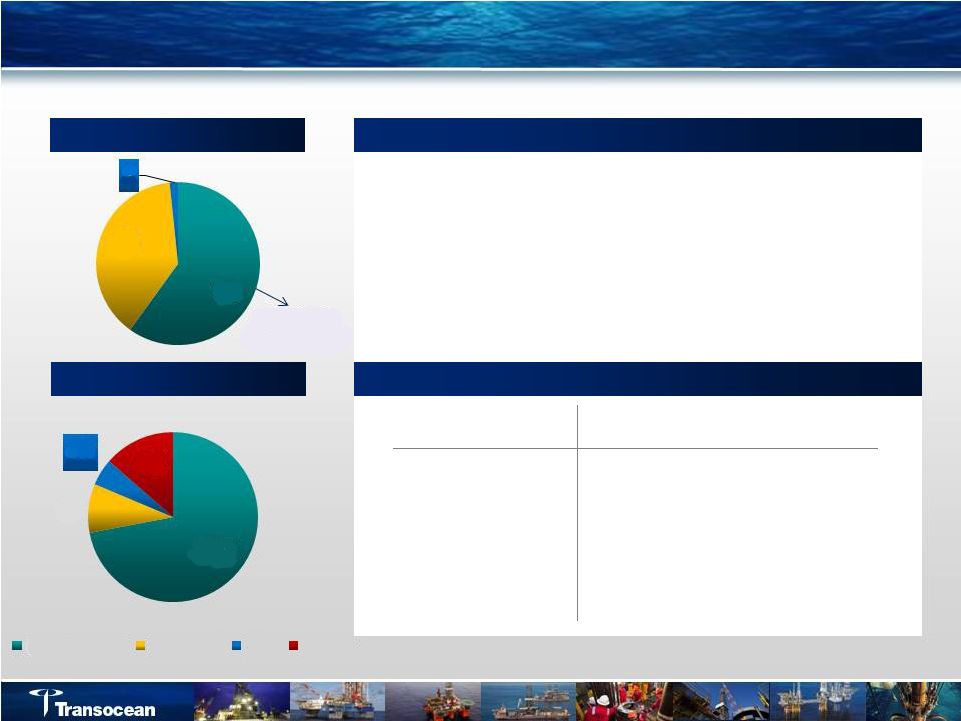

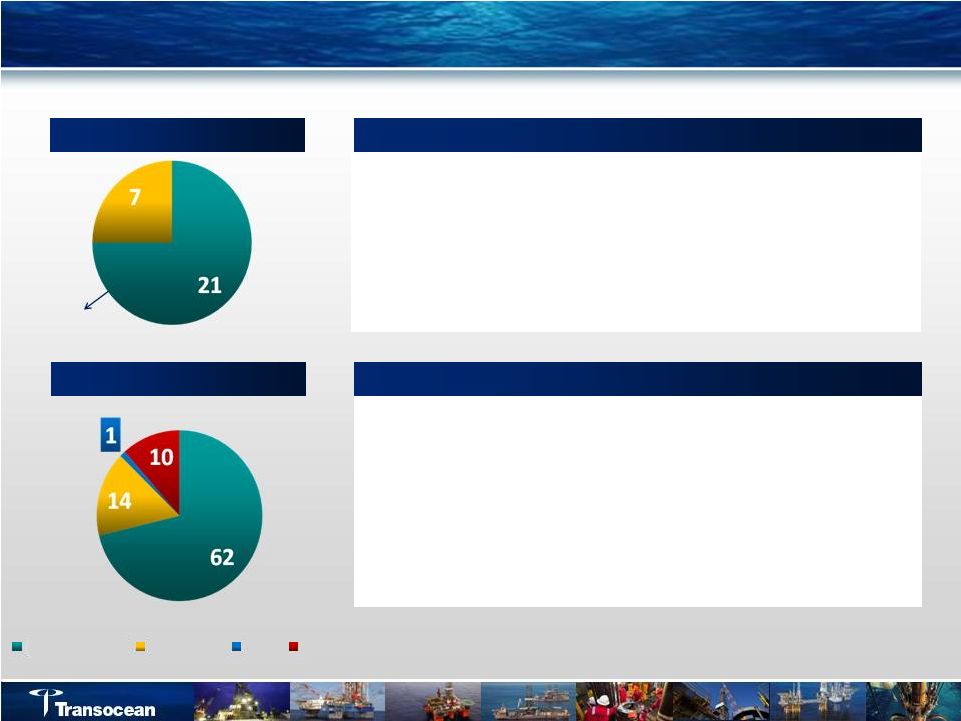

24 Footnotes Footnotes (1) Amounts have been restated to reflect the impact of discontinued operations. (2) Per Fleet Status Report issued July 13, 2011 & Fleet Update Summary issued August 17, 2011. Floaters classifications are by water depth as described in the Fleet Status Report. Harsh Environment Floaters are included in the appropriate water depth classification. “Jackups” includes High-Specification Jackups and Standard Jackups. Rig count is 134, plus 4 newbuilds, less one “other” rigs (one drilling barge). Rigs Under Construction are inclusive of rigs to be accepted by the customer subsequent to August 17, 2011. “Idle” and “Stacked” rig classifications are as described in the Fleet Status Report. (3) Excludes submersible rigs. (4) Excludes tender rigs. (5) “Jackups” includes High-Specification Jackups and Standard Jackups. (6) Calculated by multiplying the contracted operating dayrate by the firm contract period for 2011 and future periods as of the Fleet Status Report issued July 13, 2011. Firm commitments are represented by signed drilling contracts or, in some cases, by other definitive agreements awaiting contract execution. Our contract backlog is calculated by multiplying the full contractual operating dayrate by the number of days remaining in the firm contract period, excluding revenues for mobilization, demobilization and contract preparation or other incentive provisions, which are not expected to be significant to our contract drilling revenues. The contractual operating dayrate may be higher than the actual dayrate we receive or we may receive other dayrates included in the contract, such as a waiting-on-weather rate, repair rate, standby rate or force majeure rate. The contractual operating dayrate may also be higher than the actual dayrate we receive because of a number of factors, including rig downtime or suspension of operations. In certain contracts, the dayrate may be reduced to zero if, for example, repairs extend beyond a stated period of time. (7) “Free Cash Flow Backlog” is defined as revenue backlog, plus firm mobilization revenue for contracts not started, less the following: operating expenditures, overhead costs (except general and administrative costs), firm mobilization costs, cash income taxes, and firm capital expenditures based on current contract backlog from the company’s Fleet Status Report as of July 13, 2011. Includes the cash balance as of June 30, 2011. In preparing the scheduled maturities of our debt, presented as of June 30, 2011 for future periods, we assumed the noteholders exercise their options to require us to repurchase the 1.50% Series B and 1.50% Series C Convertible Senior Notes in December 2011 and 2012, respectively. (8) “Net debt” is defined as the aggregate carrying amount of debt, net of (a) cash and cash equivalents and (b) cash balances that are designated as security for certain debt instruments. At June 30, 2011, Aker’s aggregate carrying amount of debt was $2.0 billion. (9) Data from ODS-Petrodata as of August 22, 2011. Analysis by Transocean. Includes competitive rigs which have completed construction on or before August 22, 2011. Jackups are defined as independent cantilever. “Other” includes, but is not limited to, rigs which are not under contract and are en route, in port, in shipyard, out of service, undergoing acceptance testing, or on standby. (10) This presentation is unaudited. |