UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | |||

Filed by a Party other than the Registrant o | |||

| Check the appropriate box: | |||

| o | Preliminary Proxy Statement | ||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| o | Definitive Proxy Statement | ||

| x | Definitive Additional Materials | ||

| o | Soliciting Material Pursuant to §240.14a-12 | ||

| TRANSOCEAN LTD. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| x | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Analyst Contacts: Thad Vayda News Release

+1 713-232-7551

Diane Vento

+1 713-232-8015

Media Contact: Guy A. Cantwell FOR RELEASE: April 15, 2013

+1 713-232-7647

TRANSOCEAN LTD. RELEASES INVESTOR PRESENTATION AND LAUNCHES TRANSOCEANVALUE.COM, HIGHLIGHTING STRATEGY TO MAXIMIZE SHAREHOLDER VALUE

ZUG, SWITZERLAND --Transocean Ltd. (NYSE: RIG) (SIX: RIGN) today released supplemental materials to its shareholders outlining the company's recommendations regarding certain proposals found in the proxy statement for the company's 2013 Annual General Meeting ("AGM"). The meeting will be held at 5 p.m. CEST, on May 17, 2013, in Zug, Switzerland. The company filed an investor presentation, which highlights the significant operational and financial progress it has achieved for its shareholders; provides detailed and compelling support for the company's highly qualified slate of Director nominees; and reiterates the reasons the proposed $2.24 per share dividend will maximize shareholder value.

In addition, the company has launched a website, www.transoceanvalue.com, to provide shareholders with easy access to all the relevant materials and information about its positions, recommendations and voting details. The site informs shareholders that Transocean currently has in place the correct operational improvement plan; a prudent, balanced approach to capital allocation; and the right leadership team to continue to drive long-term shareholder value. The Board and management are fully committed to acting in the best interest of the company and all its stakeholders to create value and strongly encourage shareholders to carefully review the company's plan before voting. We are confident that our strategy is the right one to best ensure Transocean's long-term well-being and competitiveness.

Shareholders are encouraged to support the Board's recommendations on three key proposals: the $2.24 per share dividend, the election of our five Director nominees, and the re-adoption of Board authority to issue shares out of the company's authorized share capital.

Please vote promptly using the company's WHITE proxy card.

April 15, 2013

Dear Transocean Shareholders:

Today we filed an investor presentation and launched a new website - www.transoceanvalue.com - that highlights the improved operational performance and financial PROGRESS the company has made, as well as the asset and operational strategies that position Transocean to continue to deliver meaningful value to shareholders. The presentation provides an update on our latest strategic initiatives and clearly illustrates our ability to EXECUTE operational improvement initiatives to drive enhanced profitability and cash flow. Additionally, our BALANCED CAPITAL ALLOCATION approach ensures the financial flexibility required to drive disciplined, high-return capital investments and sustainable distributions to our shareholders. In conjunction with this strategy, our proposed $2.24 per share dividend provides the basis for immediate return of capital to shareholders with the potential for future increases and the ability to invest in our fleet to ensure long-term competitiveness. We also emphasize the stark differences between OUR HIGHLY EXPERIENCED AND KNOWLEDGEABLE BOARD and Mr. Icahn's inexperienced slate of nominees who will focus exclusively on advancing his MISGUIDED and SHORT-TERM AGENDA.

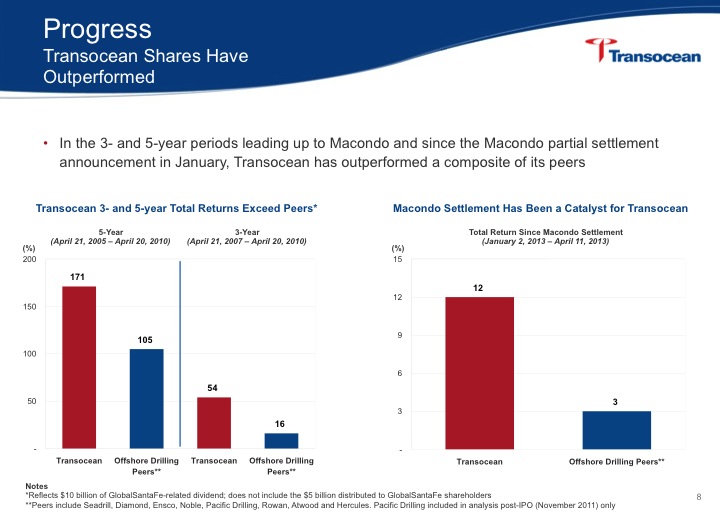

We have the right leadership team in place and remain on track to continue delivering industry-leading shareholder returns. We successfully navigated through significant uncertainties triggered by the Macondo incident and have emerged a stronger company. Revenue efficiency and utilization have improved and backlog is strong and growing. Maximizing the value of your investment in Transocean has always been and remains the central priority of Transocean's Board and its management team, and we have the plan in place to continue to deliver the value that you, our shareholders, expect and deserve.

We urge you to support the company and our successful strategy by voting the company's WHITE proxy card today.

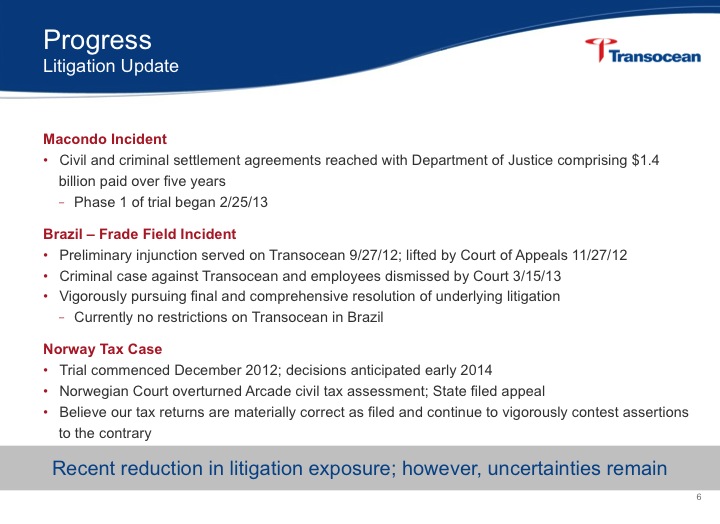

PROGRESS

Transocean has made significant and tangible progress - both operationally and financially - in the wake of the April 2010 Macondo incident. Key areas of recent success include:

• | Significant progress towards meeting our strategic objectives, resulting in strong operational and financial improvements in 2012; |

• | Meaningful reduction in Macondo litigation uncertainty; and |

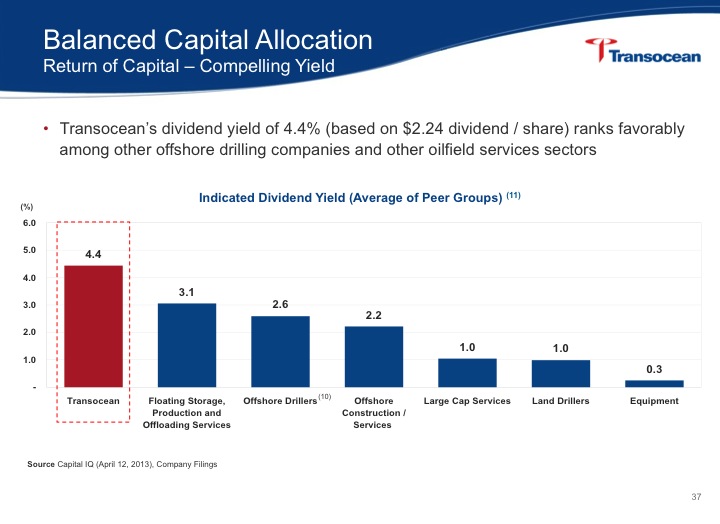

• | Proposed reinstatement of a dividend - at $2.24 per share - representing one of the industry's largest payout ratios and implied yields. |

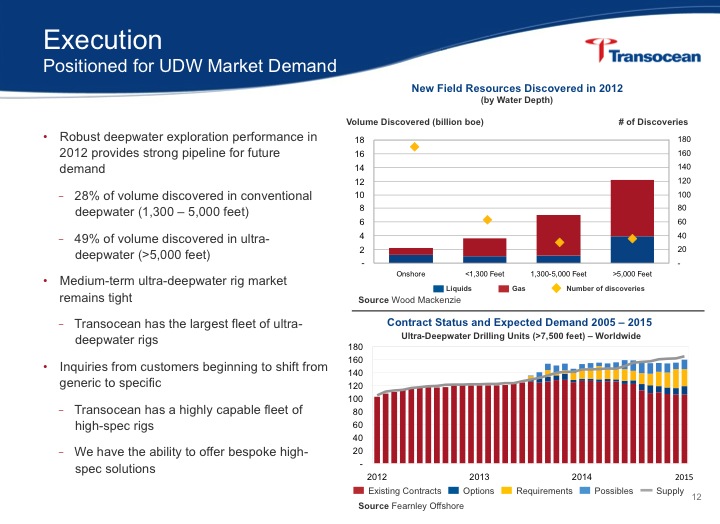

EXECUTION

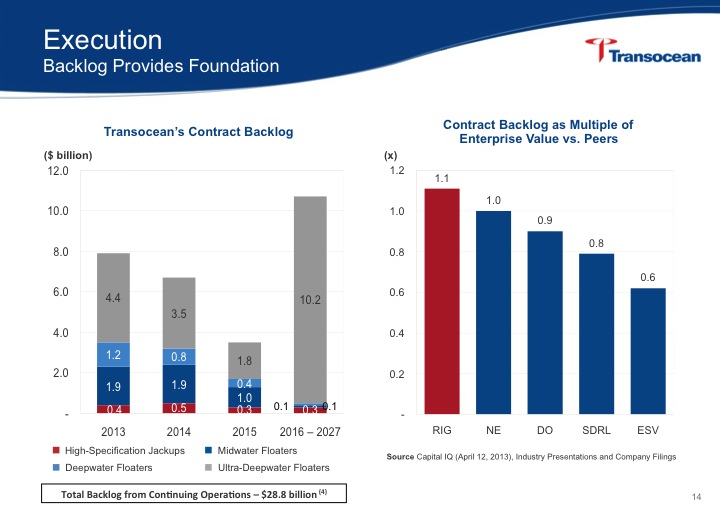

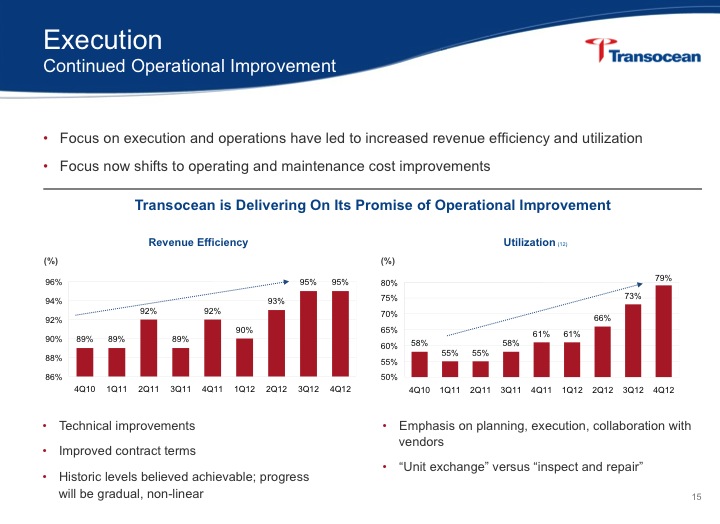

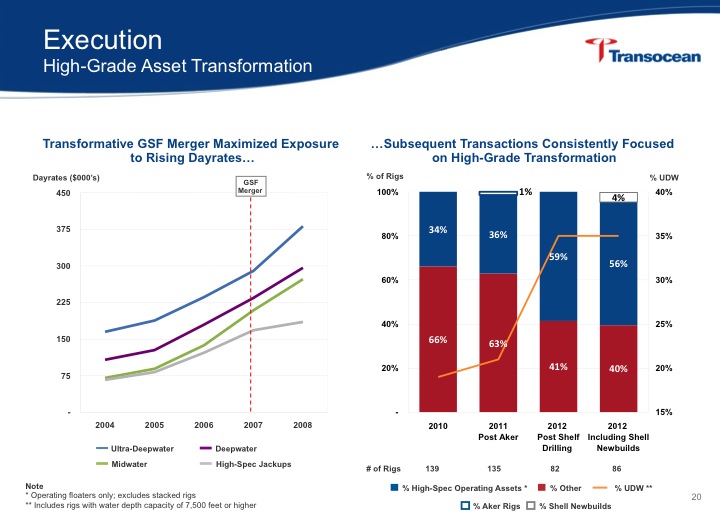

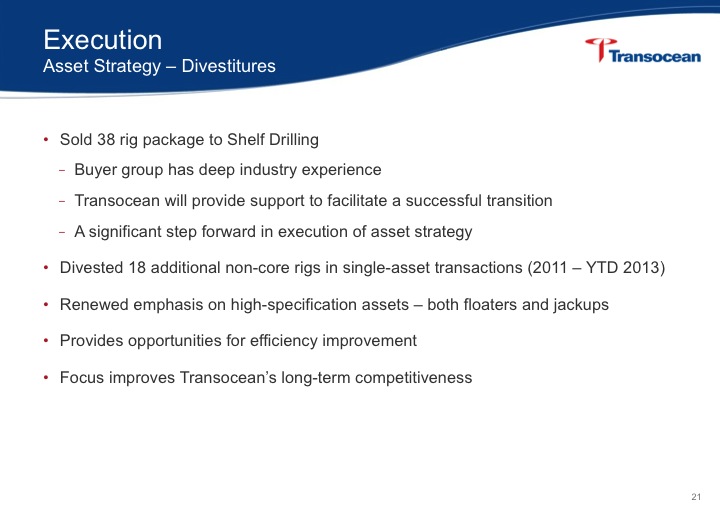

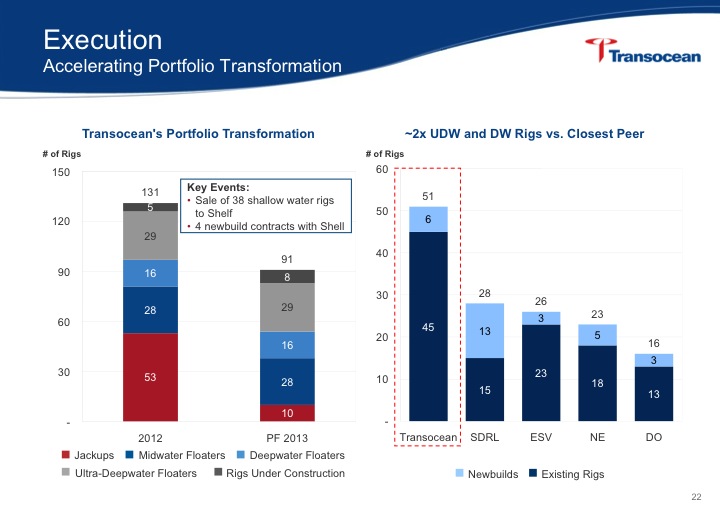

Transocean's leadership team has continued to execute its well-defined strategic plan, including through the continuous improvement of operational performance and a prudent, balanced allocation of capital that will maximize shareholder value. Our ability to execute is exemplified in the following:

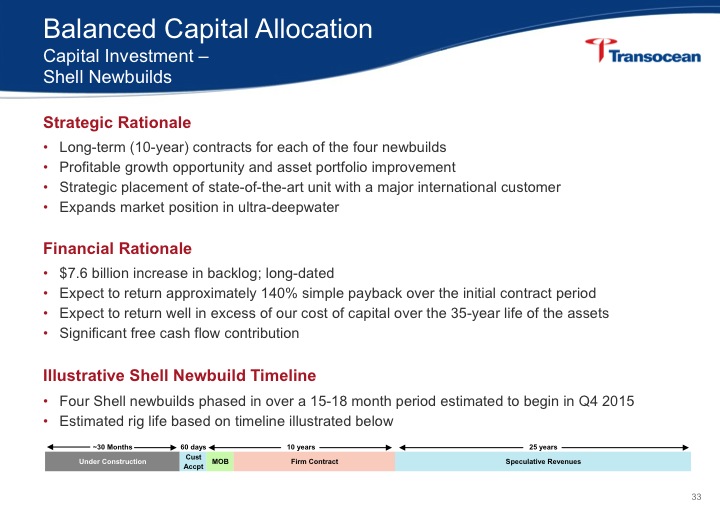

• | Significant fleet transformation resulting from the divestiture of 56 non-core assets and the addition of five high-specification assets over the past two years; |

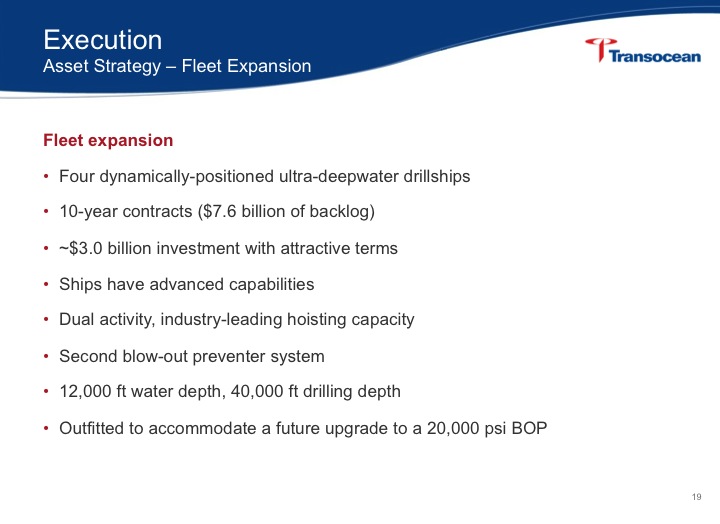

• | Winning the industry's highest contracted backlog of ~$29 billion, including the addition of an unprecedented $7.6 billion of backlog associated with four newbuild drillships; |

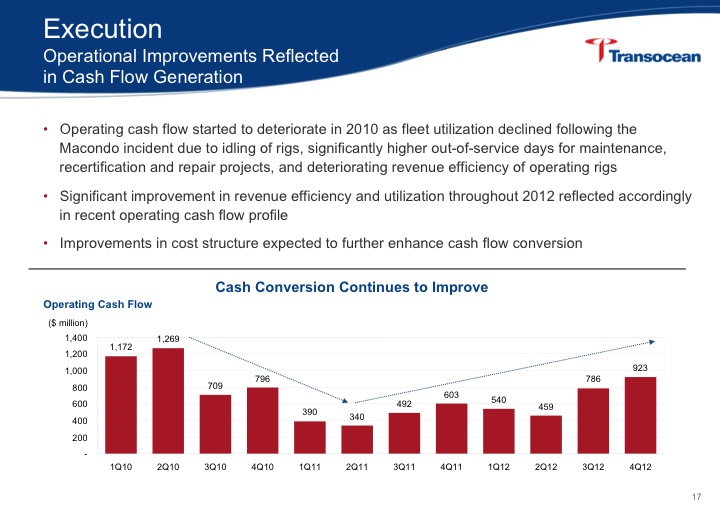

• | Material improvement in revenue efficiency and utilization resulting in improving operating cash flow; and |

• | Commitment to initiatives recently implemented to enhance operating margins and cash flow. |

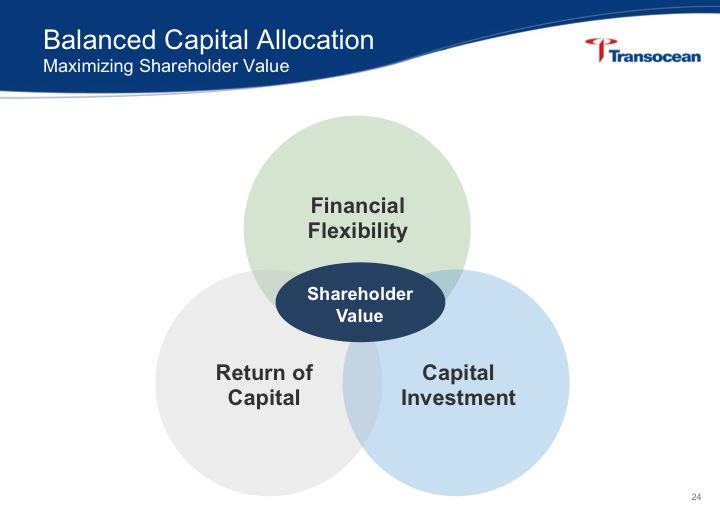

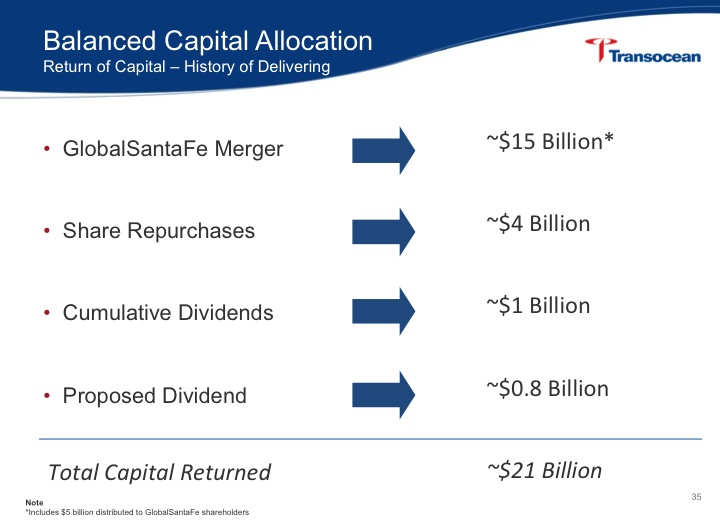

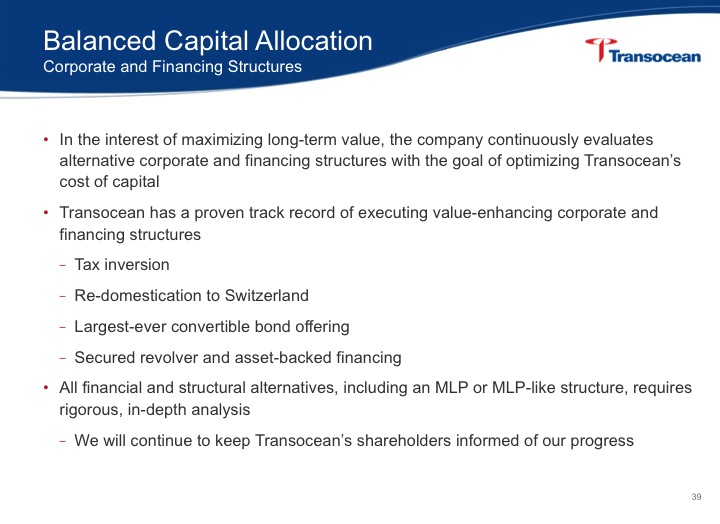

BALANCED CAPITAL ALLOCATION

Management and the Board are committed to maximizing long-term shareholder value by maintaining a strong, flexible balance sheet, characterized by an investment grade rating on the company's debt; disciplined, high-return investment in the business; and a sustainable return of capital to shareholders with the goal of future increases in distributions as business conditions warrant. Our balanced approach to capital allocation includes:

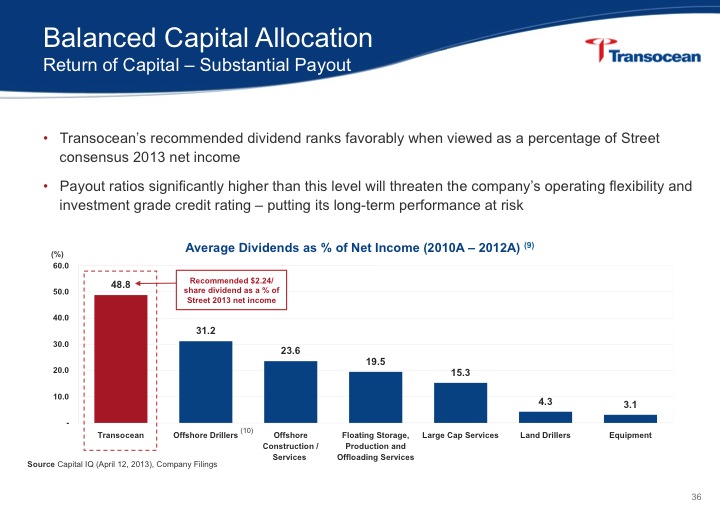

• | A proposed $2.24 per share dividend, or approximately $800 million in the aggregate - a sustainable distribution representing one of the industry's largest payout ratios and implied yields; and |

• | Accelerated retirement of approximately $1 billion of debt to facilitate continued progress towards achieving a gross debt target of $7 billion to $9 billion. |

LEADERSHIP

The offshore drilling industry is dynamic and continually presents challenges and opportunities. Reflecting the ever-changing nature of Transocean's business and the unique circumstances in which it operates, the company spends considerable time and effort evaluating the composition of its Board to ensure a panel of Directors with the experience, skills and capabilities necessary to represent the best interest of our shareholders. Our industry leading governance program includes:

• | Regularly infusing fresh perspectives into an already extraordinarily experienced and knowledgeable Board as evidenced by the addition of six new directors in the last two years; and |

• | Identifying nominees with deep, relevant experience and a history of achievement. |

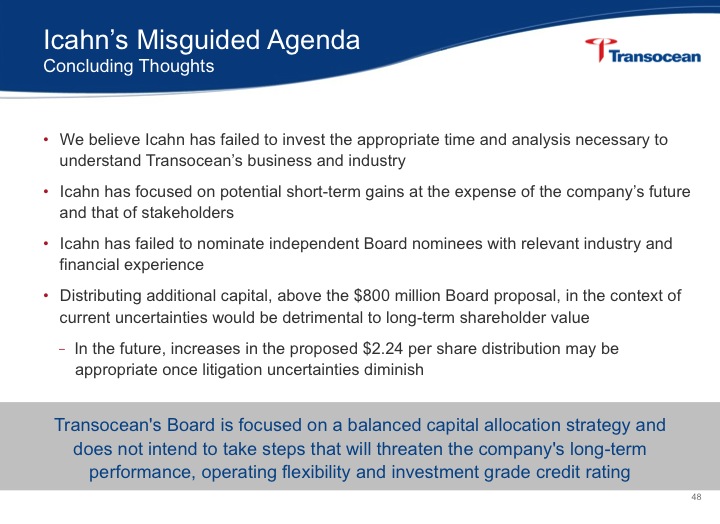

ICAHN'S MISGUIDED AGENDA

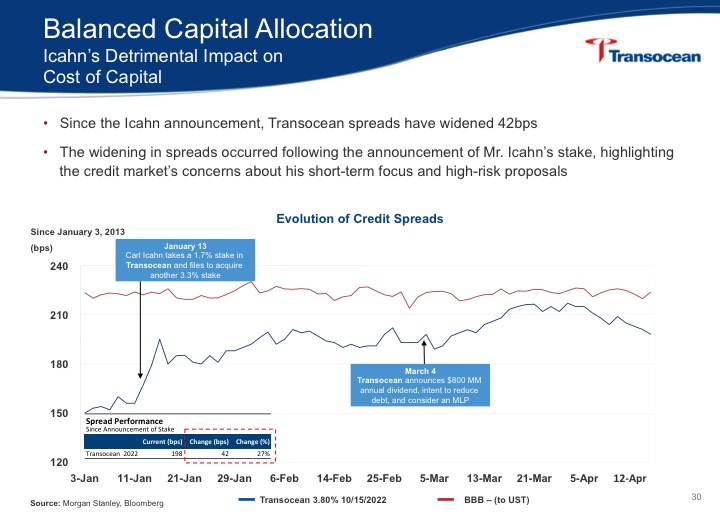

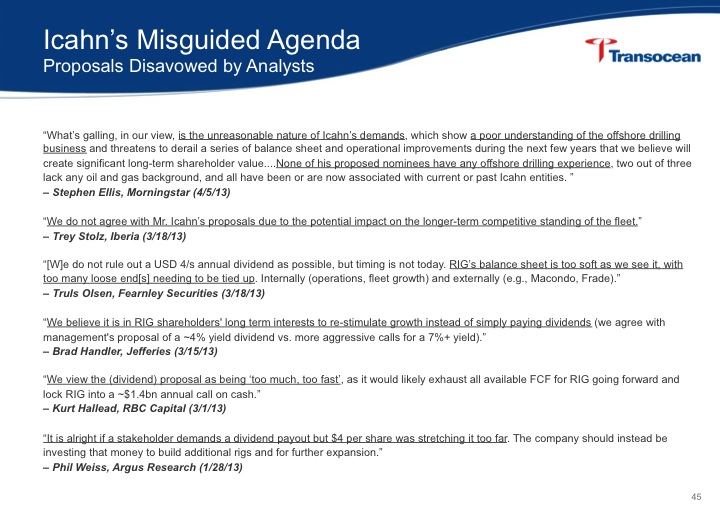

Mr. Icahn's dividend proposal is in direct conflict with Transocean's disciplined capital allocation strategy and would adversely affect the company's ability to operate and compete effectively in a cyclical and capital-intensive industry. Further, the election of Mr. Icahn's Board nominees is not in the best interest of the company and all of its stakeholders.

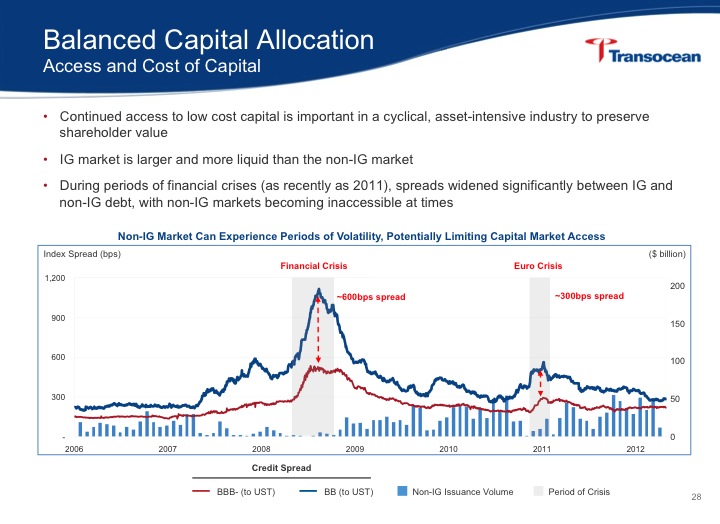

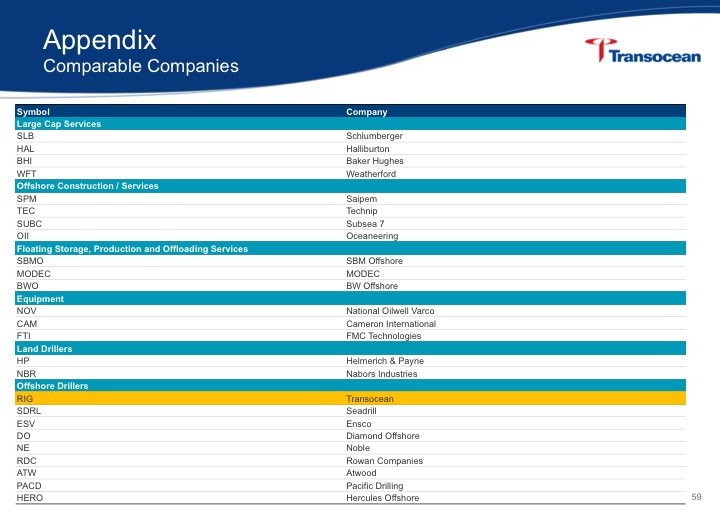

Mr. Icahn's misguided agenda highlights his lack of drilling industry expertise. His superficial analysis is evidenced by his demand for an unreasonable 85% payout ratio. This proposed level of payout completely ignores the dynamics of the cyclical offshore drilling industry and fails to recognize the distinct competitive advantage afforded by financial flexibility and an investment grade credit rating. This 85% payout ratio is clearly disconnected from any reasonable industry benchmark - Transocean's proposed dividend is already well in excess of the average implied dividend yields and payout ratios of other oilfield services companies. Mr. Icahn has dismissed investments in newbuilds - the lifeblood of a drilling contractor.

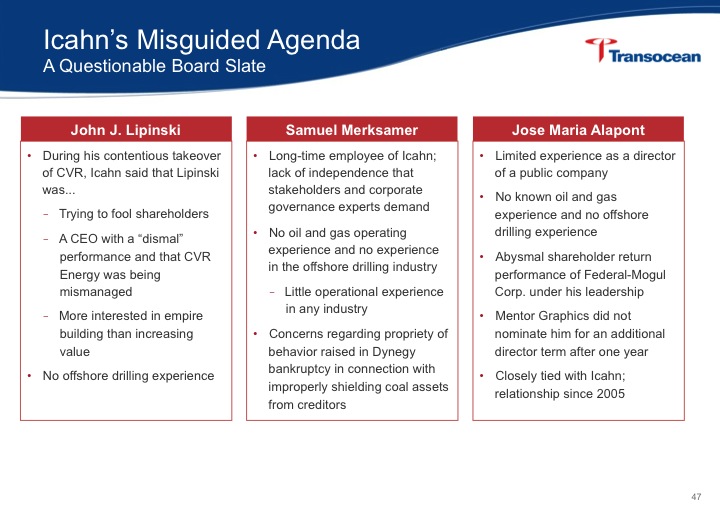

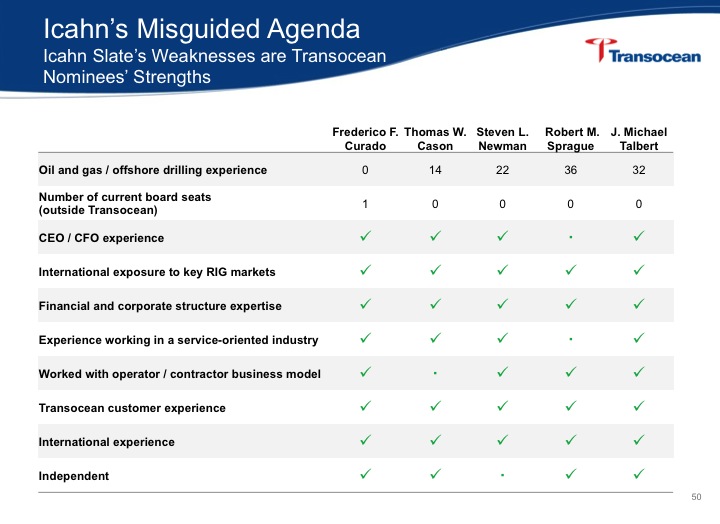

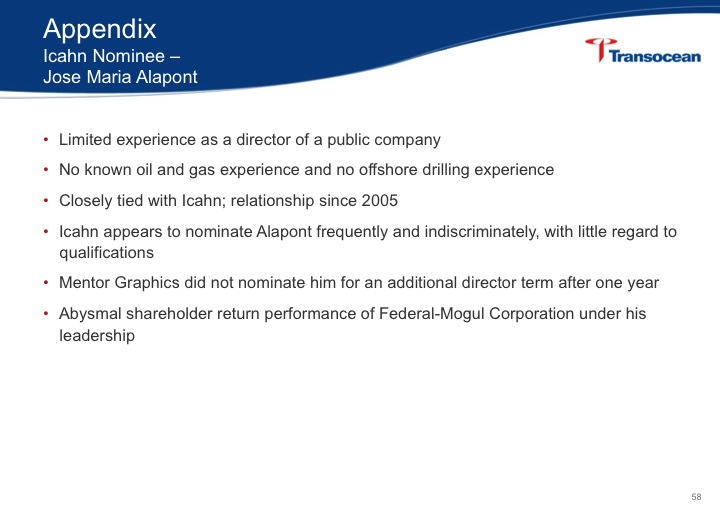

Moreover, Mr. Icahn's Board nominees would bring no value to the company. They are captive to Mr. Icahn through current and past associations and were handpicked to pursue his misguided agenda. Mr. Icahn's nominees reflect his lack of industry knowledge. Among other disqualifying weaknesses, they have limited international exposure or knowledge of the company's key growth markets; generally lack financial and corporate structuring experience; have rarely worked in a service-oriented or capital-intensive industry; possess limited knowledge of the specialized operator - contractor business model; and have little apparent experience with complex international tax treaties and networks.

PROTECT TRANSOCEAN'S FUTURE BY VOTING THE COMPANY'S WHITE PROXY CARD TODAY

We are seeking your vote FOR the company's proposed $2.24 per share dividend, which represents one of the industry's highest implied payout ratios and dividend yields. In the context of a cyclical and capital-intensive industry, the unique uncertainties associated with the remaining litigation faced by the company dictate that Transocean must maintain a prudent level of financial flexibility. Mr. Icahn's unrealistic, ill-conceived and inappropriate dividend proposal fails to recognize the nature of the offshore drilling industry.

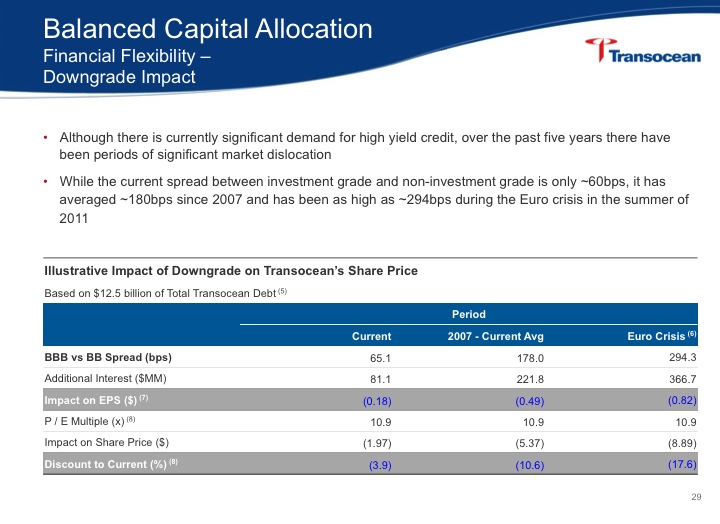

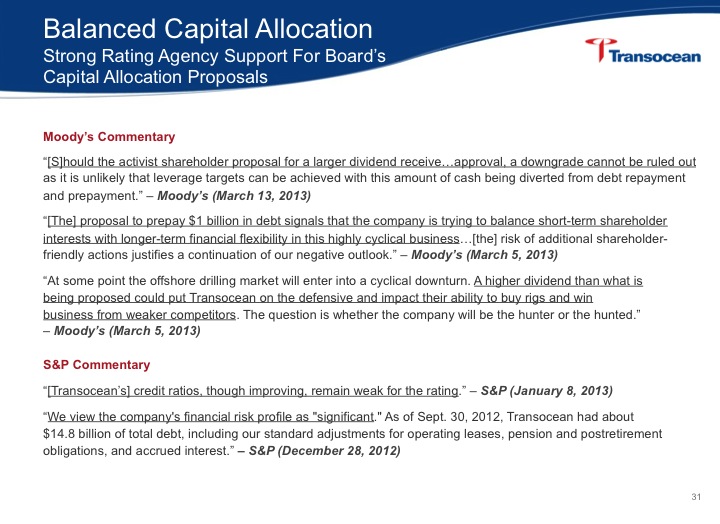

In the future, increases in Transocean's annual distributions may be appropriate once litigation uncertainties are further resolved. However, at this time, Transocean's Board firmly believes that distributing additional capital to shareholders beyond the

proposed $2.24 per share dividend would lead to a deterioration of the company's balance sheet and is also likely to result in the loss of the investment grade rating on the company's debt. Among other things, the loss of an investment grade rating would severely limit the company's access to reliable sources of capital and increase our cost of debt financing for an extended period of time. Simply stated, Mr. Icahn's proposals would have a real and profoundly harmful impact on the company's ability to create long-term shareholder value.

We are also seeking your vote FOR the five highly qualified and diverse Transocean Director nominees, including Frederico F. Curado, Thomas W. Cason, Steven L. Newman, Robert M. Sprague and J. Michael Talbert. Our nominees have deep, relevant expertise and a history of achievement. Conversely, Mr. Icahn's unqualified nominees emphasize his lack of familiarity with the industry and make apparent his disregard for the company's long-term future. Mr. Icahn's nominees bring no value to the team and, given their close affiliation with him, are unlikely to act in the best interest of all Transocean's stakeholders.

In order to provide the company with additional flexibility, we also urge you to vote FOR the Board's proposal that its authority to issue shares out of the company's authorized share capital be renewed for an additional two-year period. The Board's current authority will expire on May 13, 2013. While the Board currently has no plans to issue share capital under this authorization, extending this authority provides the company with additional flexibility to pursue value-enhancing opportunities in accordance with its disciplined capital allocation strategy.

Shareholders are encouraged to review the supplemental information provided in the investor presentation and at www.transoceanvalue.com and vote “FOR” the Board's proposals by voting promptly using the company's WHITE proxy card in order to drive long-term shareholder value and protect the company's ability to compete over the long term.

On behalf of Transocean's Board of Directors and management team, we thank you for your continued support.

Sincerely,

| J. Michael Talbert | Steven L. Newman |

| Chairman | President and Chief Executive Officer |

About Transocean

Transocean is a leading international provider of offshore contract drilling services for oil and gas wells. The company specializes in technically demanding sectors of the global offshore drilling business with a particular focus on deepwater and harsh environment drilling services, and believes that it operates one of the most versatile offshore drilling fleets in the world.

Transocean owns or has partial ownership interests in, and operates a fleet of, 83 mobile offshore drilling units consisting of 48 High-Specification Floaters (Ultra-Deepwater, Deepwater and Harsh-Environment drilling rigs), 25 Midwater Floaters and ten High-Specification Jackups. In addition, we have six Ultra-Deepwater Drillships and two High-Specification Jackups under construction.

Forward Looking Statements

The statements described in this press release and referenced website that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements which could be made include, but are not limited to, statements involving prospects for the company, expected revenues, capital expenditures, costs and results of operations, the proposed dividend, the company's capital allocation strategy, value-creating objectives, sustainability of potential future distributions and contingencies. These statements are based on currently available competitive, financial, and economic data along with our current operating plans and involve risks and uncertainties including, but not limited to, shareholder approval, market conditions, the company's results of operations, the effect and results of litigation, assessments and contingencies, and other factors, including those discussed in the company's most recent Form 10-K for the year ended December 31, 2012 and in the company's other filings with the SEC, which are available free of charge on the SEC's website at www.sec.gov. Should one or more of these risks or uncertainties materialize (or the other consequences of such a development worsen), or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or expressed or implied by such forward-looking statements. All subsequent written and oral forward-looking statements attributable to the company or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements. All non-GAAP financial measure reconciliations to the most comparative GAAP measure are displayed in quantitative schedules on the company's web site at www.deepwater.com.

This presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, and it does not constitute an offering prospectus within the meaning of article 652a or article 1156 of the Swiss Code of Obligations or a listing prospectus within the meaning of the listing rules of the SIX Swiss Exchange. Investors must rely on their own evaluation of Transocean Ltd. and its securities, including the merits and risks involved. Nothing contained herein is, or shall be relied on as, a promise or representation as to the future performance of Transocean Ltd.

For more information about Transocean, please visit the website www.deepwater.com.