- SEVN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Seven Hills Realty Trust (SEVN) DEF 14ADefinitive proxy

Filed: 22 Feb 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

| RMR Real Estate Income Fund | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

RMR Real Estate Income Fund

Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, APRIL 14, 2016

To the Shareholders of RMR Real Estate Income Fund:

Notice is hereby given that the annual meeting of shareholders of RMR Real Estate Income Fund, a Delaware statutory trust (the "Fund"), will be held at the offices of the Fund, Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458, on Thursday, April 14, 2016, at 9:30 a.m. (Eastern time), and any adjournments, postponements or delays thereof (the "Annual Meeting"), for the following purposes:

THE BOARD OF TRUSTEES OF THE FUND, INCLUDING ALL OF THE INDEPENDENT TRUSTEES OF THE FUND, UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" PROPOSAL 1 AND PROPOSAL 2.

Shareholders of record as of the close of business on February 10, 2016 are entitled to notice of and to vote at the Annual Meeting and at any adjournments, postponements or delays thereof.

Securities and Exchange Commission rules allow us to furnish proxy materials to our shareholders on the Internet. You can now access proxy materials and vote at www.proxyvote.com. You may vote via the Internet or by telephone by following the instructions on that website. In order to vote via the Internet or by telephone you must have your shareholder identification number which is set forth in the Notice Regarding the Availability of Proxy Materials mailed to you. If your shares are held in the name of a brokerage firm, bank, nominee or other institution, you should provide instructions to your broker, bank, nominee or other institution on how to vote your shares. You may also request a paper proxy card to submit your vote by mail. If you attend the Annual Meeting and vote in person, that vote will revoke any proxy you previously submitted. If you hold shares in the name of a brokerage firm, bank, nominee or other institution, you must provide a legal proxy from that institution in order to vote your shares at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please read the proxy statement and complete or authorize a proxy for your shares as soon as possible. Your vote is important, no matter how many or how few shares you own.

By order of the Board of Trustees,

JENNIFER B. CLARK

Secretary

RMR Real Estate Income Fund

Newton, Massachusetts

February 22, 2016

RMR Real Estate Income Fund

Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458

PROXY STATEMENT

YOUR PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES OF

RMR REAL ESTATE INCOME FUND

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on Thursday, April 14, 2016

February 22, 2016

This proxy statement is being furnished in connection with the solicitation by the Board of Trustees (the "Board") of RMR Real Estate Income Fund, a Delaware statutory trust (the "Fund"), of proxies to be voted at the annual meeting of shareholders of the Fund to be held at the offices of the Fund, Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458, on Thursday, April 14, 2016, at 9:30 a.m. (Eastern time), and at any and all adjournments, postponements or delays thereof (the "Annual Meeting").

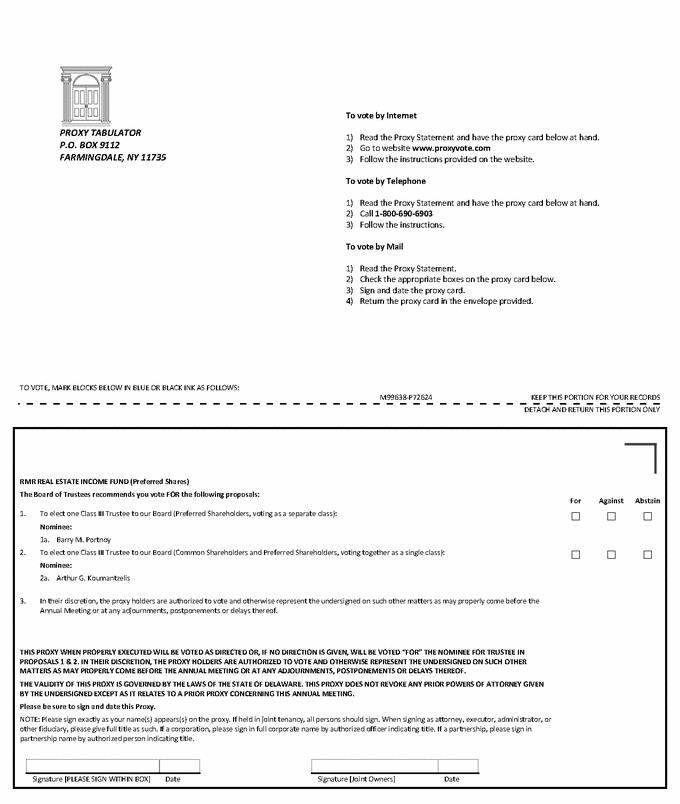

The following table indicates the proposal in respect of which votes are solicited by this proxy statement and the class of shares solicited for the proposal:

Proposal | Description | Class of Shares Voting | ||

|---|---|---|---|---|

| Proposal 1 | To elect Mr. Barry M. Portnoy as a trustee. | Preferred shares of the Fund, voting as a separate class. | ||

Proposal 2 | To elect Mr. Arthur G. Koumantzelis as a trustee. | Common shares and preferred shares of the Fund, voting together as a single class. |

This proxy statement and the related proxy cards are being first sent to shareholders on or about February 22, 2016. The Fund will furnish, without charge, a copy of its annual report and most recent semi-annual report, if any, to any shareholder upon request. Requests should be directed to the Secretary of the Fund at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 (toll free telephone number (866) 790-8165). Copies can also be obtained by visiting the Fund's website atwww.rmrfunds.com.* Copies of the Fund's annual and semi-annual reports are also available on the EDGAR Database on the Securities and Exchange Commission's (the "SEC") website atwww.sec.gov.

The record date for the Annual Meeting is February 10, 2016. Only shareholders of record as of the close of business on February 10, 2016 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments, postponements or delays thereof. As of the record date, the Fund had the following shares outstanding:

Fund | NYSE MKT Symbol+ | Number of Common Shares | Number of Preferred Shares (Series M, T, W, Th and F) | |||

|---|---|---|---|---|---|---|

RMR Real Estate Income Fund | RIF | 7,651,507 | 667 |

The principal executive office of the Fund is located at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

A quorum of shareholders is required to take action at the Annual Meeting. A majority of the shares of the Fund entitled to vote on a particular matter at the Annual Meeting, represented in person or by proxy, will constitute a quorum for voting on that particular matter or transaction of business. Common shares and preferred shares of the Fund represented by valid proxies or in person will count for the purpose of determining the presence of a quorum for the Annual Meeting. Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of election appointed for the Annual Meeting.

Broker non-votes are shares held in street name for which instructions on a particular proposal have not been received from the beneficial owners or other persons entitled to vote and for which the broker does not have discretionary voting authority. Shares represented by proxies that are marked "ABSTAIN" will be counted as shares present for purposes of determining whether a quorum is present at the Annual Meeting. Broker non-votes and abstentions will have no effect on the outcome of the vote on Proposal 1 and Proposal 2.

Failure of a quorum to be present at the Annual Meeting with respect to any particular matter may cause an adjournment of the Annual Meeting with respect to that particular matter and will subject the Fund to additional proxy solicitation expenses. The Fund's bylaws expressly authorize the chairperson of the Annual Meeting, subject to the review of the Independent Trustees (as defined below), to adjourn the Annual Meeting for any reason deemed necessary by the chairperson, including if (a) no quorum is present for the transaction of business, (b) the Board or the chairperson of the Annual Meeting determines that adjournment is necessary or appropriate to enable the shareholders to consider fully information that the Board or the chairperson of the Annual Meeting determines has not been made sufficiently or timely available to shareholders, or (c) the Board or the chairperson of the Annual Meeting determines that adjournment is otherwise in the best interests of the Fund. If the Annual Meeting is adjourned, the time and place of the adjourned meeting will be announced at the Annual Meeting.

The holders of the outstanding common and preferred shares of the Fund are entitled to one vote per share with respect to proposals of the Fund upon which such holders are entitled to vote.

Approval of Proposal 1 and Proposal 2 requires the affirmative vote of a majority of all the votes cast on Proposal 1 and Proposal 2, as applicable, at the Annual Meeting.

The individuals named as proxies on the proxy cards will vote in accordance with your directions with respect to the Fund as indicated thereon if your proxy is received properly executed. If you properly execute your proxy card and give no voting instructions, your shares will be voted "FOR"

2

Proposal 1 and Proposal 2 to the extent that your shares are entitled to be voted on those proposals. If other matters properly come before the Annual Meeting or any adjournments, postponements or delays thereof, and if discretionary authority to vote with respect thereto has been conferred by the applicable proxy card, the persons named in the proxy card will vote the proxy in accordance with their discretion on those matters.

Any proxies may be revoked at any time before they are voted at the Annual Meeting by timely filing with the Fund a written notice of revocation, by timely delivering to the Fund a duly executed proxy bearing a later date, by voting over the Internet or by telephone at a later time in the manner provided on the website indicated in the Notice of Internet Availability or by attending the Annual Meeting and voting in person. Votes provided over the Internet, by telephone or by mail must be received by 11:59 p.m. Eastern time on April 13, 2016. If you hold shares in the name of a brokerage firm, bank, nominee or other institution, you must provide a legal proxy from that institution in order to vote your shares at the Annual Meeting.

The proposals for shareholder votes and the recommendations of the Board with respect to Proposal 1 and Proposal 2 are set forth below.

INFORMATION RELATING TO TRUSTEES

The Fund's Board is divided into three classes of trustees (each trustee, a "Trustee" and, collectively, the "Trustees"). There is one Trustee (Mr. John L. Harrington) in Class I whose current term expires in 2017, there are two Trustees in Class II (Messrs. Adam D. Portnoy and Jeffrey P. Somers) whose current terms expire in 2018 and there are two Trustees in Class III (Messrs. Barry M. Portnoy and Arthur G. Koumantzelis) whose current terms expire in 2016. Messrs. Barry M. Portnoy and Arthur G. Koumantzelis are each being proposed for reelection as a Class III Trustee at the Annual Meeting. Trustees in each class are elected and hold office for a term expiring at the Fund's annual meeting held in the third year following the year of their election, with each Trustee holding office until the expiration of the term of the relevant class and the election and qualification of his or her successor, or until he or she sooner dies, resigns, retires, or is disqualified or removed from office. Pursuant to the requirements of the Investment Company Act of 1940, as amended (the "1940 Act"), and the organizational documents of the Fund, holders of preferred shares of the Fund, voting as a separate class, are entitled to elect two Trustees to the Fund's Board (Messrs. Barry M. Portnoy and Adam D. Portnoy presently represent the holders of the Fund's preferred shares), and the remaining Trustees of the Fund are elected by the holders of the common shares and preferred shares of the Fund, voting together as a single class.

A majority of the Trustees are not "interested persons" of the Fund within the meaning of the 1940 Act. Messrs. Harrington, Somers and Koumantzelis are not "interested persons" of the Fund within the meaning of the 1940 Act, and are sometimes referred to herein as "Independent Trustees."

The Board has determined that a majority of the Trustees are Independent Trustees pursuant to the Fund's declaration of trust, bylaws, applicable corporate governance standards for companies listed on the NYSE MKT and applicable laws and regulations relating to registered investment companies. In determining independence pursuant to NYSE MKT standards each year, the Fund's Board affirmatively determines whether the Independent Trustees have a direct or indirect material relationship with the Fund or its affiliates other than by reason of their service as an Independent Trustee. When assessing a Trustee's relationship with the Fund or its affiliates, the Board considers all relevant facts and circumstances, not merely from the Trustee's standpoint but also from that of the persons or organizations with which the Trustee has an affiliation. Material relationships can include commercial, banking, consulting, legal, accounting, charitable and familial relationships. The Board has determined that Messrs. Harrington, Koumantzelis and Somers currently qualify as independent under applicable Federal securities regulations, NYSE MKT rules and the Fund's declaration of trust and bylaws.

3

The Fund's Board currently consists of five Trustees. Pursuant to the Fund's bylaws, two of the five Trustees are "Managing Trustees." The "Managing Trustees" have been employees, officers or directors of the investment adviser of the Fund or involved in the day to day activities of the Fund for at least one year. Messrs. Barry and Adam Portnoy serve as the Fund's Managing Trustees.

Additional information regarding the nominees and Trustees is included in this proxy statement under the heading "Information Regarding Nominees and Trustees of the Fund."

Proposal 1: Election of Mr. Barry M. Portnoy as a Class III Trustee by the holders of preferred shares, voting as a separate class.

ELECTION OF TRUSTEE

In the Proposal, holders of preferred shares, voting as a separate class, are being asked to elect Mr. Barry M. Portnoy as a Class III Trustee of the Fund. On February 19, 2016, the Fund's Board, upon the recommendation of the Nominating Committee of the Fund, nominated Mr. Barry M. Portnoy as a Class III Trustee to stand for reelection at the Annual Meeting.

The Board, in making its nomination, and the Nominating Committee of the Fund, in making its recommendation, considered Mr. Barry M. Portnoy's qualifications for service on the Board. The Board and the Nominating Committee considered the quality of his past services as a Trustee of the Fund, his business and personal experience and reputation for integrity, intelligence, sound judgment and ability to understand complex financial issues and to make meaningful inquiries; his willingness and ability to devote sufficient time to Board business; his familiarity with the responsibilities of service on the Board of a publicly owned company; and other matters that the Board and the Nominating Committee deemed appropriate. Mr. Barry M. Portnoy is the nominee of the Board for election by its preferred shareholders, voting as a separate class, at the Annual Meeting to serve until the Fund's 2019 annual meeting, and to hold office until the expiration of the term of the Class III Trustees and the election and qualification of his successor, or until he sooner dies, resigns, retires, or is disqualified or removed from office.

It is the intention of the persons named in the proxy cards to vote the shares represented thereby "FOR" the election of Mr. Barry M. Portnoy, unless a proxy card is marked otherwise. Mr. Barry M. Portnoy has agreed to serve as Trustee of the Fund if elected. However, if Mr. Barry M. Portnoy becomes unable or unwilling to accept nomination for election to the Board, the proxies will be voted for a substitute nominee designated by the Fund's Board. The Board has no reason to believe that Mr. Barry M. Portnoy will be unable or unwilling to serve.

THE BOARD UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE "FOR" THE ELECTION OF MR. BARRY M. PORTNOY.

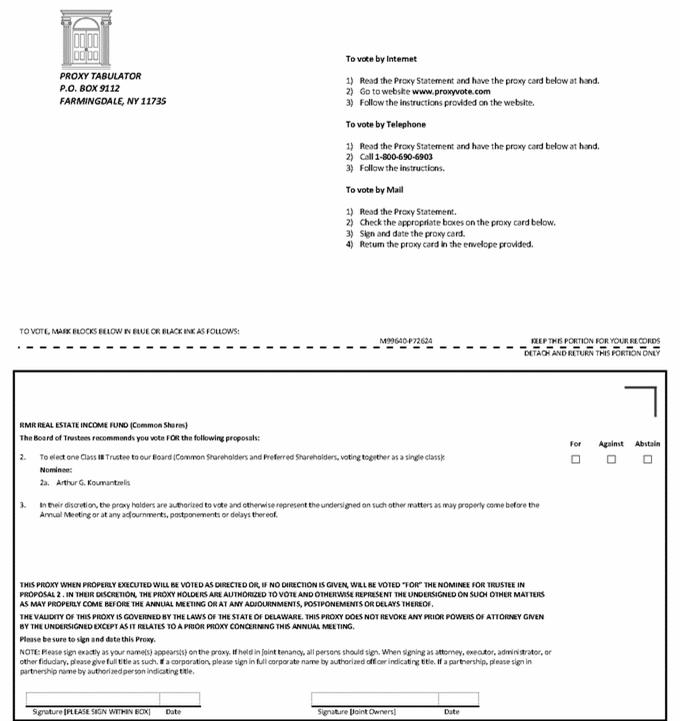

Proposal 2: Election of Mr. Arthur G. Koumantzelis as a Class III Trustee by the holders of common shares and preferred shares, voting together as a single class.

ELECTION OF TRUSTEE

In the Proposal, holders of common shares and preferred shares, voting together as a single class, are being asked to elect Mr. Arthur G. Koumantzelis as a Class III Trustee of the Fund. On February 19, 2016, the Nominating Committee of the Fund nominated Mr. Arthur G. Koumantzelis as a Class III Trustee to stand for reelection at the Annual Meeting.

In making its nomination, the Nominating Committee of the Fund considered Mr. Arthur G. Koumantzelis's qualifications for service on the Board. The Nominating Committee considered the quality of his past services as a Trustee of the Fund, his business and personal experience and reputation for integrity, intelligence, sound judgment and ability to understand complex financial issues

4

and to make meaningful inquiries; his willingness and ability to devote sufficient time to Board business; his familiarity with the responsibilities of service on the Board of a publicly owned company; his ability to qualify as an Independent Trustee under applicable Federal securities regulations, NYSE MKT rules and the Fund's declaration of trust and bylaws; and other matters that the Nominating Committee deemed appropriate. Mr. Arthur G. Koumantzelis is the nominee of the Nominating Committee of the Fund for election by its common shareholders and preferred shareholders, voting together as a single class, at the Annual Meeting to serve until the Fund's 2019 annual meeting, and to hold office until the expiration of the term of the Class III Trustees and the election and qualification of his successor, or until he sooner dies, resigns, retires, or is disqualified or removed from office.

It is the intention of the persons named in the proxy cards to vote the shares represented thereby "FOR" the election of Mr. Arthur G. Koumantzelis, unless a proxy card is marked otherwise. Mr. Arthur G. Koumantzelis has agreed to serve as Trustee of the Fund if elected. However, if Mr. Arthur G. Koumantzelis becomes unable or unwilling to accept nomination for election to the Board, the proxies will be voted for a substitute nominee designated by the Fund's Nominating Committee. The Board has no reason to believe that Mr. Arthur G. Koumantzelis will be unable or unwilling to serve.

THE BOARD UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE "FOR" THE ELECTION OF MR. ARTHUR G. KOUMANTZELIS.

The Fund will bear the cost of the solicitation of proxies, including the preparation, printing and mailing of proxy materials. In addition to the solicitation of proxies by Internet, email, telephone and mail, the Fund's Trustees, officers and other employees, and the directors, officers and other employees of RMR Advisors LLC (the "Advisor"), the Fund's investment adviser, may solicit proxies by personal interview, telephone, facsimile, email or otherwise. They will not be paid any additional compensation for such solicitation. The Fund will request banks, brokers and other custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Fund and obtain their voting instructions. The Fund will reimburse those firms for their expenses.

INFORMATION REGARDING NOMINEES AND TRUSTEES OF THE FUND

Certain information concerning the nominees and Trustees of the Fund is set forth below. Messrs. Barry M. Portnoy and Arthur G. Koumantzelis, nominees for the Fund, are currently Trustees of the Fund. The Fund is a registered closed end management investment company advised by the Advisor. The "interested persons" of the Fund (as defined by Section 2(a)(19) of the 1940 Act) who are Trustees of the Fund are noted as "Interested Trustees." The business address of the nominees and Trustees of the Fund, and of the Advisor, is Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

During 2015, the Board of the Fund held five meetings. No Trustee attended less than 75% of the meetings of the Board or Board committees on which he served. All members of the Board are encouraged, but not required, to attend the Annual Meeting. All members of the Board attended the annual meeting of shareholders held in 2015.

Biographical and other information relating to the nominees standing for election at the Annual Meeting is set forth below. Mr. Barry M. Portnoy is an Interested Trustee as a result of his indirect ownership of, and current positions with, The RMR Group LLC (the Advisor's parent company) and his ownership of, and current positions with, The RMR Group Inc. (the Advisor's ultimate parent

5

company), the Advisor and the Fund. Mr. Arthur G. Koumantzelis is an Independent Trustee and is a member of the Fund's Audit, Compensation and Nominating Committees.

Name and Year of Birth | Position held with the Fund, current term and length of time served† | Principal occupation(s) or employment in past 5 years and other public company directorships held by nominee for Trustee in past 5 years | Number of portfolios in fund complex overseen by nominee for Trustee | ||||

|---|---|---|---|---|---|---|---|

| Interested Trustee Nominee | |||||||

Barry M. Portnoy†† (1945) | Class III Managing Trustee to serve until 2016; Portfolio Manager of the Fund; since 2003 | Director and Vice President of the Advisor since 2002 and Chairman of the Advisor since 2015; Managing Director and Director of The RMR Group Inc. since 2015; Chairman of The RMR Group LLC (formerly known as Reit Management & Research LLC) ("RMR LLC") since 1998 and Director of RMR LLC from 1986 until 2015; Managing Trustee of Hospitality Properties Trust since 1995; Managing Trustee of Senior Housing Properties Trust since 1999; Managing Director of Five Star Quality Care, Inc. since 2001; Managing Director of TravelCenters of America LLC since 2006; Managing Trustee of Government Properties Income Trust since 2009; Managing Trustee of Select Income REIT since 2011; and Managing Trustee of Equity Commonwealth (formerly CommonWealth REIT) from 1986 to 2014. | 1 | ||||

Independent Trustee Nominee | |||||||

Arthur G. Koumantzelis (1930) | Class III Independent Trustee to serve until 2016; since 2003 | Independent Director of TravelCenters of America LLC since 2007; and President and Chief Executive Officer of Gainesborough Investments LLC from 1998 to 2007. | 1 |

Biographical and other information relating to the Trustees who are not standing for election or reelection at the Annual Meeting is set forth below. Mr. Adam D. Portnoy is an Interested Trustee as a result of his indirect ownership of, and current positions with, The RMR Group LLC (the Advisor's parent company) and his ownership of, and current positions with, The RMR Group Inc. (the Advisor's ultimate parent company), the Advisor and the Fund. Messrs. Harrington and Somers are Independent Trustees and are members of the Fund's Audit, Compensation and Nominating Committees.

6

Name and Year of Birth | Position held with the Fund, current term and length of time served† | Principal occupation(s) or employment in past 5 years and other public company directorships held by Trustee in past 5 years | Number of portfolios in fund complex overseen by Trustee | ||||

|---|---|---|---|---|---|---|---|

| Interested Trustees | |||||||

Adam D. Portnoy†† (1970) | Class II Managing Trustee to serve until 2018; Portfolio Manager of the Fund; since 2007 (Class II Trustee since 2009) | Director and President of the Advisor since 2007 and Chief Executive Officer of the Advisor since 2015; Managing Director, President, Chief Executive Officer and Director of The RMR Group Inc. since 2015; President and Chief Executive Officer of RMR LLC since 2005 and Director of RMR LLC from 2005 to 2015; President and Chief Executive Officer of the Fund from 2007 to 2015; Managing Trustee of Hospitality Properties Trust since 2007; Managing Trustee of Senior Housing Properties Trust since 2007; Managing Trustee of Government Properties Income Trust since 2009 (President from 2009 to 2011); Managing Trustee of Select Income REIT since 2011; and Managing Trustee of Equity Commonwealth (formerly CommonWealth REIT) from 2006 to 2014 (President from 2011 to 2014). | 1 | ||||

Independent Trustees | |||||||

John L. Harrington (1936) | Class I Independent Trustee to serve until 2017; since 2003 | Trustee of the Yawkey Foundation (a charitable trust) since 1982 (Chairman of the Board from 2002 to 2003 and since 2007) and Executive Director of the Yawkey Foundation from 1982 to 2006; Trustee of the JRY Trust (a charitable trust) from 1982 to 2009; President of Boston Trust Management Corp. from 1981 to 2006; Chief Executive Officer and General Partner of the Boston Red Sox Baseball Club from 1986 to 2002 and Vice President and Chief Financial Officer prior to that time; Principal of Bingham McCutchen Sports Consulting LLC from 2007 to 2008; Independent Trustee of Hospitality Properties Trust since 1995; Independent Trustee of Senior Housing Properties Trust since 1999; and Independent Trustee of Government Properties Income Trust since 2009. | 1 |

7

Name and Year of Birth | Position held with the Fund, current term and length of time served† | Principal occupation(s) or employment in past 5 years and other public company directorships held by Trustee in past 5 years | Number of portfolios in fund complex overseen by Trustee | ||||

|---|---|---|---|---|---|---|---|

Jeffrey P. Somers (1943) | Class II Independent Trustee to serve until 2018; since 2009 | Of Counsel, Morse, Barnes-Brown & Pendleton, PC (law firm) since 2010 (Equity Member from 1995 to 2009 and Director); Director of Cantella Management Corp. (holding company for Cantella & Co., Inc., an SEC registered broker dealer) from 2002 until January 2014, when the company was acquired by a third party; Independent Trustee of Senior Housing Properties Trust since 2009; Independent Trustee of Government Properties Income Trust since 2009; Independent Trustee of Select Income REIT since 2012; and Trustee of Pictet Funds (1995-2001). | 1 |

The Board believes that, collectively, the Trustees have balanced and diverse experiences, skills, attributes and qualifications, which allows the Board to operate effectively in governing the Fund and protecting the interests of shareholders. Among the attributes common to all Trustees is their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Advisor, other service providers, counsel and independent auditors, and to exercise effective business judgment in the performance of their duties as Trustees. Each Trustee's ability to perform his duties effectively is evidenced by his educational background or professional training; business, consulting, or public or charitable service; experience from service as a Trustee of the Fund and its predecessor funds, other investment funds, public companies, real estate investment trusts or not-for-profit entities or other organizations; ongoing commitment and participation in Board and committee meetings; or other relevant life experiences.

8

The table below discusses some of the experiences, qualifications and skills of each of the Trustees that support the conclusion that they should serve (or continue to serve) on the Board.

Trustee | Experience, Qualifications and Skills | |

|---|---|---|

| Interested Trustee Nominee: | ||

Barry M. Portnoy | The Board concluded that Mr. Portnoy should serve as one of the Fund's Managing Trustees based upon, among other things, his many years of leadership experience in real estate, administration and financial services operations and the law and his experience in and knowledge of the commercial real estate industry and real estate investment trusts. Mr. Portnoy's extensive public company director service, his professional skills and expertise in, among other things, legal and regulatory matters and his experience as chairman of a national law firm have provided him with legal expertise and executive skills valuable to the Board in dealing with and resolving complex and difficult issues. Mr. Portnoy's experience as Managing Director and Director of The RMR Group Inc., Chairman (and formerly a Director) of RMR LLC, Managing Trustee of various real estate investment trusts and Managing Director of publicly traded real estate based operating companies provides the Board with insight into the operational, financial and investment practices of real estate investment vehicles generally. The Board also benefits from Mr. Portnoy's experience as Director of the Advisor. Mr. Portnoy's long-standing service on the Board also provides him with a specific understanding of the Fund, its operations, and the business and regulatory issues facing the Fund. |

9

Trustee | Experience, Qualifications and Skills | |

|---|---|---|

| Interested Trustee: | ||

Adam D. Portnoy | The Board concluded that Mr. Portnoy should serve as one of the Fund's Managing Trustees based upon, among other things, his extensive experience in and knowledge of the commercial real estate industry and real estate investment trusts, his leadership positions with The RMR Group Inc., RMR LLC and the Advisor, his public company director service, his demonstrated management ability, his experience in investment banking and private equity, his government organization service, and his institutional knowledge earned through service on the Board, his prior service as President and Chief Executive Officer of the Fund and its predecessors, and his key leadership positions with the Advisor. The Board benefits from Mr. Portnoy's experience as Managing Director, President, Chief Executive Officer and Director of The RMR Group Inc., President and Chief Executive Officer (and formerly a Director) of RMR LLC, and Director, President and Chief Executive Officer of the Advisor and his prior experience as President and Chief Executive Officer of the Fund and its predecessors in light of his business leadership and experience. Mr. Portnoy's experiences as the Managing Trustee of various real estate investment trusts provide the Board with practical business knowledge of real estate investment trusts. Mr. Portnoy's long-standing service on the Board and his prior service as President and Chief Executive Officer of the Fund also provides him with a specific understanding of the Fund, its operations, and the business and regulatory issues facing the Fund. | |

Independent Trustee Nominee: | ||

Arthur G. Koumantzelis | The Board concluded that Mr. Koumantzelis should serve as one of the Fund's Independent Trustees because, among other things, he brings to the Board a wealth of practical business knowledge and leadership as an experienced president, chief financial officer and director/trustee of various public and private companies and accounting and financial reporting knowledge as a former partner in an international firm of independent public accountants. In particular, because of Mr. Koumantzelis's extensive service as the president of a private investment company, as a trustee of various real estate investment trusts and as a director of a real estate based operating company, he is able to provide the Board with insight regarding the management of pools of real estate related assets. Moreover, Mr. Koumantzelis has served as the chief financial officer of a company required to file periodic reports with the SEC and this, among other qualifications, qualifies Mr. Koumantzelis as the Fund's audit committee financial expert. Mr. Koumantzelis's long-standing service on the Board also provides him with a specific understanding of the Fund, its operations, and the business and regulatory issues facing the Fund. Mr. Koumantzelis's independence from the Fund and the Advisor also qualifies him to be a member of the Audit, Compensation and Nominating Committees. |

10

Trustee | Experience, Qualifications and Skills | |

|---|---|---|

| Independent Trustees: | ||

John L. Harrington | The Board concluded that Mr. Harrington should serve as one of the Fund's Independent Trustees based upon, among other things, his many years of experience as a president, chief executive officer and director/trustee of various public and private companies and charitable trusts. Mr. Harrington's experience as president of Boston Trust Management Corp., an investment management company, as a former director of Fleet Bank, N.A. and as trustee of a various real estate investment trusts provides the Board with the benefit of his experience with the management practices of financial companies generally and particular expertise with respect to real estate investment trusts. Through his many executive and finance related positions, including but not limited to responsibilities he undertook during his long tenure in management of professional baseball, Mr. Harrington developed professional skills and expertise in management, accounting, finance and risk management. Mr. Harrington is also licensed as a Certified Public Accountant and was a former assistant professor of accounting at Boston College. Mr. Harrington's long-standing service on the Board also provides him with a specific understanding of the Fund, its operations, and the business and regulatory issues facing the Fund. Mr. Harrington's independence from the Fund and the Advisor also qualifies him to serve as a member of the Audit, Compensation and Nominating Committees. | |

Jeffrey P. Somers | The Board concluded that Mr. Somers should serve as one of the Fund's Independent Trustees because, among other things, he brings to the Board broad and diverse knowledge of the legal and compliance matters pertaining to investment companies as a result of his prior experience serving on the boards of registered investment companies, his work as an SEC staff attorney and more than 30 years of business law experience, including in general corporate governance and securities matters and securities laws compliance for investment advisers and broker-dealers. Mr. Somers's experience as a trustee of three real estate investment trusts allows him to provide the Board with added insight into the management practices of real estate focused investment vehicles and expertise with respect to real estate investment trusts. Mr. Somers's leadership roles as a managing member of two law firms has provided him with management and executive experience valuable to the Board in fulfilling its oversight responsibilities. Mr. Somers's past service on the Board also provides him with a specific understanding of the Fund, its operations, and the business and regulatory issues facing the Fund. Mr. Somers's independence from the Fund and the Advisor also qualifies him for service as a member of the Audit, Compensation and Nominating Committees. |

11

Interested Trustees of the Fund receive no compensation for services as a Trustee from the Fund. The following table sets forth the compensation of the Independent Trustees from the Fund for service to the Fund for the fiscal year ended December 31, 2015. As of December 31, 2015, the Fund is the only fund in the fund complex.

Name | Aggregate Compensation from Fund | |||

|---|---|---|---|---|

Arthur G. Koumantzelis | $ | 12,500 | ||

Jeffrey P. Somers | $ | 13,000 | ||

John L. Harrington | $ | 13,500 | ||

Until changed by a vote of the Compensation Committee of the Board, the compensation payable to each Independent Trustee is as follows.

Timing and Description | Amount | |||

|---|---|---|---|---|

• At the first meeting of the Board following the Annual Meeting of shareholders, an annual retainer. | $ | 7,500 | ||

• At the first meeting of the Board following the Annual Meeting of shareholders, an annual retainer paid to the Audit Committee Chair. | $ | 1,000 | ||

• For each meeting of the Board or a Board committee which is attended, an attendance fee, per meeting, up to a maximum of $1,000 per meeting day. | $ | 500 | ||

In addition to the compensation paid to Independent Trustees, the Fund reimburses all Trustees for expenses incurred in connection with their duties as Trustees, including for approved attendance at continuing education programs.

Any shareholder of the Fund or other interested party of the Fund who desires to communicate with the Fund's Trustees, individually or as a group, may do so by visiting the Fund's website atwww.rmrfunds.com, by calling the Fund's toll free confidential message system at (866) 511-5038, or by writing to the party for whom the communication is intended, in care of the Secretary, RMR Funds, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458. Communications will be delivered to the appropriate persons.

BOARD LEADERSHIP STRUCTURE AND COMMITTEES

The Fund's Board is comprised of both Independent Trustees and Managing Trustees (as defined below), with a majority being Independent Trustees. The Independent Trustees are not involved in the day to day activities of the Fund, are not employees of the Advisor and are persons who qualify as independent under applicable Federal securities regulations, NYSE MKT rules and the Fund's declaration of trust and bylaws. The "Managing Trustees" have been employees, officers or directors of the Advisor or involved in the day to day activities of the Fund for at least one year. The Fund's Board is composed of three Independent Trustees and two Managing Trustees. The Fund's President and the Fund's Treasurer are not members of the Board, but each regularly attends Board meetings, as does the Fund's Chief Compliance Officer and Director of Internal Audit at the invitation of the Board. Other officers of the Advisor also sometimes attend Board meetings at the invitation of the Board.

The Audit, Compensation and Nominating Committees are comprised solely of Independent Trustees and an Independent Trustee serves as Chair of each such committee. These three standing

12

committees have responsibilities related to leadership and governance, including among other things: (i) the Fund's Audit Committee reviews financial reports, oversees accounting and financial reporting processes, selects independent accountants, determines the compensation paid to independent accountants and assists the Fund's Board with its oversight of the internal audit function and compliance with legal and regulatory requirements; (ii) the Fund's Compensation Committee annually evaluates the performance of the Fund's Chief Compliance Officer and Director of Internal Audit and approves the compensation the Fund pays to him and recommends to the Board compensation to be paid to the Fund's Independent Trustees; and (iii) the Fund's Nominating Committee considers nominees to serve on the Fund's Board and selects, or recommends that the Board select, nominees for election to the Board. The Chairs of the Audit, Compensation and Nominating Committees set the agenda for their respective committee meetings, but committee members, the Managing Trustees or members of the management may suggest agenda items to be considered by these committees.

The Fund does not have a Chairman of the Board or a lead Independent Trustee. The President, any Managing Trustee or any two Trustees then in office may call a special meeting of the Trustees. The Managing Trustees, in consultation with the President, Treasurer and the Chief Compliance Officer and Director of Internal Audit, set the agenda for the Board meetings, and any Independent Trustee may place an item on an agenda by providing notice to a Managing Trustee, the President, the Treasurer or the Chief Compliance Officer and Director of Internal Audit. Discussions at Board meetings are led by the President, Managing Trustee or Independent Trustee who is most knowledgeable on a subject. The Fund's Board is small, which facilitates informal discussions and communication from management to the Board and among Trustees. The Independent Trustees meet to consider the business of the Fund without the attendance of the Fund's Managing Trustees or officers, and they meet separately with the Fund's officers, with its Chief Compliance Officer and Director of Internal Audit and with the Fund's independent accountants. In such meetings of the Independent Trustees, the Chair of the Audit Committee presides unless the Independent Trustees determine otherwise.

The Board of the Fund seeks to combine appropriate leadership with the ability to conduct business efficiently and with appropriate care and attention given the specific characteristics and circumstances of the Fund. In particular, the Board of the Fund is small—comprised of only five members—and the Board believes that this structure facilitates informal discussions and communication from management to the Board and among Trustees. Additionally, the Fund is relatively focused in its investment approach and business, and relatively small in terms of assets under management, and the Board believes that this structure allows it to provide oversight of and be involved in the critical aspects of the Fund's management on an ongoing and cost efficient basis.

The Fund's Board oversees risk as part of its general oversight of the Fund, and oversight of risk is addressed as part of various Board and Board committee activities and through regular and special Board and Board committee meetings. The actual day to day business of the Fund is conducted by the Advisor, and the Advisor implements risk management in its activities. In discharging their oversight responsibilities, the Fund's Board and Board committees regularly review a wide range of reports provided to them by the Advisor and other service providers, including reports on market and industry conditions, operating and compliance reports, financial reports, reports on risk management activities, liquidity analyses, valuation, and regulatory and legislative updates that may impact the Fund, legal proceedings updates and reports on other business related matters, and the Trustees discuss such matters among themselves and with representatives of the Advisor, counsel and the Fund's independent accountants. The Fund's Audit Committee performs a lead role in helping the Board fulfill its responsibilities for oversight of the financial reporting, internal audit function, risk management and the compliance with legal and regulatory requirements. The Fund's Board and Audit Committee review periodic reports from an independent registered public accounting firm regarding potential risks, including risks related to the Fund's internal controls. The Fund's Audit Committee also annually

13

reviews, approves and oversees an internal audit plan developed by the Fund's Chief Compliance Officer and Director of Internal Audit with the goal of helping the Fund systematically evaluate the effectiveness of its risk management, control and governance processes, and periodically meets with the Chief Compliance Officer and Director of Internal Audit to review the results of its internal audits, and directs or recommends to the Board actions or changes it determines appropriate to enhance or improve the effectiveness of its risk management. The Fund's Compensation Committee also evaluates the performance of the Chief Compliance Officer and Director of Internal Audit.

While a number of risk management functions are performed, it is not possible to identify all of the risks that may affect the Fund or to develop processes and controls to eliminate all risks and their possible effects, and processes and controls employed to address risks may be limited in their effectiveness. Moreover, it is necessary for the Fund to bear certain risks to achieve its objectives. As a result of the foregoing and other factors, the Fund's ability to manage risk is subject to substantial limitations.

As discussed above, the Fund has an Audit Committee, a Compensation Committee and a Nominating Committee. The Board has adopted charters for each of these committees. Copies of the respective charters of the Audit Committee, Compensation Committee and Nominating Committee are available on the Fund's website atwww.rmrfunds.com. Each of these Board committees is composed of Messrs. Harrington, Koumantzelis and Somers, the Independent Trustees, who are independent under applicable NYSE MKT listing standards.

The primary function of the Audit Committee is to assist the Board's oversight of matters relating to: the integrity of financial statements; legal and regulatory compliance; the qualifications, independence, performance and fees of independent accountants; accounting, financial reporting and internal control processes; and the appointment and duties of the Director of Internal Audit. Messrs. Harrington and Somers each serve simultaneously on the audit committees of more than three public companies; however, the Board has determined that such simultaneous service does not impair the ability of Messrs. Harrington and Somers to effectively serve on the Fund's Audit Committee. The Audit Committee is responsible for the selection of independent accountants. The Board has determined that Mr. Koumantzelis is "independent" as defined by applicable laws and regulations governing registered investment companies and the rules of the NYSE MKT and, based upon his education and experience, possesses the requisite qualifications for designation, and has so designated him, as the Fund's audit committee financial expert. During 2015, the Audit Committee of the Fund held three meetings.

The primary function of the Compensation Committee is to determine and review the fees paid by the Fund to Independent Trustees and to assess the performance of, and to recommend to the Fund's Board the compensation payable to, the Chief Compliance Officer and Director of Internal Audit of the Fund. During 2015, the Compensation Committee of the Fund held two meetings.

The primary function of the Fund's Nominating Committee is to (i) identify individuals qualified to become Independent Trustees and to select Independent Trustee nominees for each annual meeting of the Fund's shareholders or when vacancies occur and (ii) consider recommendations by the Fund's shareholders of nominees for election to the Board. The Fund's Nominating Committee may also generally consider the qualifications of Managing Trustee nominees for each annual meeting of the Fund's shareholders and recommend to the Board whether the Board should nominate such persons for election by the Fund's shareholders. During 2015, the Nominating Committee of the Fund did not meet.

14

SHAREHOLDER NOMINATIONS AND PROPOSALS

The Fund's declaration of trust and bylaws require compliance with certain procedures for a Fund shareholder to properly make a nomination for election to the Board or to propose other business for the Fund. In order for a shareholder to properly propose a nominee for election to the Board or propose business outside of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the shareholder must comply, in all respects, with the advance notice and other provisions set forth in the Fund's bylaws, which currently include, among other things, requirements as to the shareholder's timely delivery of advance notice, ownership of at least a specified minimum amount of the Fund's common or preferred shares, as applicable, for a specified minimum period of time, record ownership and submission of specified information. If a shareholder who is eligible to do so under the Fund's bylaws wishes to nominate a person or persons for election to the Board or propose other business for the Fund, that shareholder must provide a written notice to the Fund's Secretary at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458. The notice must set forth detailed specified information about any proposed nominee, the shareholder making the nomination and affiliates and associates of that shareholder. As to any other business that the shareholder proposes to bring before the meeting, the Fund's bylaws provide that the notice must set forth a description of such business, the reasons for proposing such business at the meeting and any material interest in such business of the shareholder, a description of all agreements, arrangements and understandings involving the shareholder in connection with the proposal of such business and a representation that the shareholder intends to appear in person or by proxy at the meeting to bring the business before the meeting.

To be timely, the notice must be delivered to the Fund's Secretary at the principle executive offices of the Fund not later than 5:00 p.m. (Eastern time) on the 120th day nor earlier than the 150th day prior to the first anniversary of the date of the proxy statement for the preceding year's annual meeting. If the annual meeting is called for a date that is more than 30 days earlier or later than the first anniversary of the date for the preceding year's annual meeting, notice by the shareholder, to be timely, must be so delivered not later than 5:00 p.m. (Eastern time) on the 10th day following the earlier of the day on which (i) notice of the date of the annual meeting is mailed or otherwise made available or (ii) public announcement of the date of such meeting is first made by the Fund. Neither the postponement or adjournment of an annual meeting, nor the public announcement of such postponement or adjournment, commences a new time period for the giving of a shareholder's notice as described above. Except as otherwise set forth in the Fund's bylaws, no shareholder may give a notice to nominate or propose other business, and no such notice shall be effective, unless such shareholder holds a certificate for all shares owned by such shareholder during all times described above and in the Fund's bylaws, and a copy of each such certificate held by such shareholder at the time of giving such notice accompanies such shareholder's notice.

The foregoing description of the procedures for a Fund shareholder properly to make a nomination for election to the Board or to propose other business for the Fund outside of Rule 14a-8 under the Exchange Act is only a summary and is not complete. Copies of the Fund's declaration of trust and bylaws, including the provisions which concern the requirements for shareholder nominations and proposals, and the provisions which concern the eligibility of a shareholder to make a nomination or proposal of other business, are available on the EDGAR Database on the SEC's website atwww.sec.gov. The Fund will also furnish, without charge, a copy of its declaration of trust and bylaws to a shareholder upon request, which may be requested by writing to the Fund's Secretary at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458. Any shareholder of the Fund considering making a nomination or other proposal should carefully review and comply with these provisions of the Fund's bylaws.

Shareholder proposals intended to be presented pursuant to Rule 14a-8 under the Exchange Act at the Fund's 2017 annual meeting of shareholders must be received at the Fund's principal executive

15

offices on or before October 25, 2016 in order to be considered for inclusion in the Fund's proxy statement for its 2017 annual meeting of shareholders, provided that if the Fund holds its 2017 annual meeting on a date that is more than 30 days before or after April 14, 2017, shareholders must submit proposals for inclusion in the Fund's 2017 proxy statement within a reasonable time before the Fund begins to print and send proxy materials. Under Rule 14a-8, the Fund is not required to include shareholder proposals in the proxy materials unless conditions specified in the rule are met. The Fund's bylaws require that shareholder nominations and proposals made outside of Rule 14a-8 under the Exchange Act must be submitted, in accordance with the requirements of the Fund's bylaws, not later than 5:00 p.m. (Eastern time) on October 25, 2016 (which is also the date, after which, shareholder nominations and proposals made outside of Rule 14a-8 under the Exchange Act would be considered "untimely" within the meaning of Rule 14a-4(c) under the Exchange Act) and not earlier than September 25, 2016; provided, that, if the Fund's 2017 annual meeting is called for a date that is more than 30 days earlier or later than April 14, 2017, then a shareholder's notice must be so delivered not later than 5:00 p.m. Eastern time on the 10th day following the earlier of the day on which (1) notice of the date of the Fund's 2017 annual meeting is mailed or otherwise made available or (2) public announcement of the date of the Fund's 2017 annual meeting is first made by the Fund.

SELECTION OF CANDIDATES FOR TRUSTEES

The Nominating Committee of the Fund selects, or recommends that the Board select, Trustees to be elected by the Fund's shareholders. The Nominating Committee of the Fund also selects, or recommends that the Board select, Trustees to fill vacancies which may occur from time to time.

In considering candidates to serve as Trustees, the Nominating Committee seeks individuals who have qualities which the committee believes may be effective in serving the Fund's long term best interests. Among the characteristics which the Nominating Committee considers are the following: the quality of the candidate's past services to the Fund, if any; the business and personal experience of the candidate and their relevance to the Fund's business; the reputation of the candidate for integrity; the reputation of the candidate for intelligence, sound judgment and the ability to understand complex financial issues and to make meaningful inquiries; the willingness and ability of the candidate to devote sufficient time to Board business; the familiarity of the candidate with the responsibilities of service on the Board of a publicly owned company; whether the candidate would be an Independent Trustee if elected as a Trustee; and other matters that the Nominating Committee deems appropriate. In seeking candidates for Trustee who have not previously served as a Trustee of the Fund, among other possible sources, the Nominating Committee may use the business, professional and personal contacts of its members, it may accept recommendations from other Trustees, and, if it considers it appropriate, it may engage a professional search firm. In 2015, the Fund did not pay any third party to identify or to assist in the evaluation of any candidate for election to the Board.

Another purpose of the Fund's Nominating Committee is to consider candidates for election as Trustees who are recommended by shareholders. To be considered by the Fund's Nominating Committee, a shareholder recommendation for a nominee must be made by such shareholder's written notice to the Chair of the Nominating Committee and the Secretary of the Fund, which notice should contain or be accompanied by the information and documents with respect to the recommended nominee and recommending shareholder that the recommending shareholder believes to be relevant or helpful to the Nominating Committee's deliberations. The Fund's Nominating Committee may request additional information about the shareholder recommended nominee or about the shareholder recommending the nominee. Any nominee recommended by a shareholder will be considered by the Nominating Committee in its discretion using the same criteria as other candidates considered by it.

The preceding paragraph applies only to shareholder recommendations for nominees to the Fund's Nominating Committee. A shareholder nomination must be made in accordance with the provisions of the Fund's bylaws, including the procedures discussed above, and applicable state and federal laws.

16

The table below lists the officers of the Fund, their year of birth, their term in office and their principal occupations during the last five years. The President, the Treasurer and the Secretary of the Fund are elected annually by the Board. The Director of Internal Audit is appointed by the Audit Committee at any time. Other officers of the Fund may be elected or appointed by the Board at any time. Unless otherwise indicated, the principal business address of each officer of the Fund is Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

No officer is compensated by the Fund with the exception of the Fund's Chief Compliance Officer and Director of Internal Audit. The following table sets forth the compensation of the Chief Compliance Officer and Director of Internal Audit from the Fund for service to the Fund for the fiscal year ended December 31, 2015. As of December 31, 2015, the Fund is the only fund in the fund complex.

| Name, Position | Aggregate Compensation from Fund | |||

|---|---|---|---|---|

Vern D. Larkin, Chief Compliance Officer and Director of Internal Audit | $ | 61,397 | † | |

Name and Year of Birth | Position held with the Fund and length of time served† | Other principal occupations in the past 5 years | Number of portfolios in fund complex for which position is held | |||

|---|---|---|---|---|---|---|

| Fernando Diaz (1968) | President (serves at the discretion of the Board); Senior Portfolio Manager of the Fund; since 2015 | Vice President and Portfolio Manager of the Fund from 2007 to 2015; Vice President of the Advisor since 2007; Senior REIT Analyst and Assistant Portfolio Manager, State Street Global Advisors/The Tuckerman Group from 2001 to 2006; and Senior REIT Analyst and Assistant Portfolio Manager, GID Securities, LLC from 2006 to 2007. | 1 | |||

Mark L. Kleifges (1960) | Treasurer and Chief Financial Officer (serves at the discretion of the Board); since 2003 | Treasurer and Chief Financial Officer of the Advisor since 2004; Executive Vice President of RMR LLC since 2008; Treasurer and Chief Financial Officer of Hospitality Properties Trust since 2002; and Treasurer and Chief Financial Officer of Government Properties Income Trust since 2011. | 1 |

17

Name and Year of Birth | Position held with the Fund and length of time served† | Other principal occupations in the past 5 years | Number of portfolios in fund complex for which position is held | |||

|---|---|---|---|---|---|---|

| Jennifer B. Clark (1961) | Secretary and Chief Legal Officer (serves at the discretion of the Board); since 2002 | Director of the Advisor since 2015 and Secretary or Clerk and Vice President of the Advisor since 2002; Executive Vice President, General Counsel and Secretary of The RMR Group Inc. since 2015; Secretary of RMR LLC since 2015; Executive Vice President and General Counsel of RMR LLC since 2008; Secretary of Hospitality Properties Trust since 2008; Secretary of Senior Housing Properties Trust since 2008; Secretary of Five Star Quality Care, Inc. since 2012 (Assistant Secretary from 2001 to 2012); Secretary of TravelCenters of America LLC since 2007; Secretary of Government Properties Income Trust since 2009; Secretary of Select Income REIT since 2011; and Secretary of Equity Commonwealth (formerly CommonWealth REIT) from 2008 to 2014. | 1 | |||

Vern D. Larkin (1970) | Chief Compliance Officer (serves at the discretion of the Board) and Director of Internal Audit (serves at the discretion of the Audit Committee); since 2012 | Chief Compliance Officer of the Advisor since 2012; Director of Internal Audit of The RMR Group Inc. since 2015; Director of Internal Audit of Hospitality Properties Trust, Senior Housing Properties Trust, Government Properties Income Trust, Select Income REIT, Five Star Quality Care, Inc. and TravelCenters of America LLC since 2012; Vice President, General Counsel and Secretary of Five Star Quality Care, Inc. from 2011 to 2012; Senior Vice President of RMR LLC from 2011 to 2012; attorney at Skadden, Arps, Slate, Meagher & Flom LLP from 1998 to 2011; and Director of Internal Audit of Equity Commonwealth (formerly CommonWealth REIT) from 2012 to 2014. | 1 |

18

TRUSTEE BENEFICIAL OWNERSHIP OF SECURITIES

The following table sets forth, for each Trustee, the aggregate dollar range of the Fund's equity securities beneficially owned as of January 31, 2016 unless otherwise noted. The Fund is not part of a "family of investment companies" as that term is defined in the 1940 Act. The information as to beneficial ownership is based on statements furnished to the Fund by such Trustees.

| Name | Dollar range of equity securities in the Fund | |

|---|---|---|

Interested Trustees | ||

Barry M. Portnoy* | over $100,000** | |

Adam D. Portnoy | over $100,000** | |

Independent Trustees |

| |

John L. Harrington | over $100,000 | |

Jeffrey P. Somers | $10,001 - $50,000 | |

Arthur G. Koumantzelis* | $1 - $10,000 |

The Advisor is a wholly owned subsidiary of RMR LLC, an alternative asset management company which provides management services to publicly traded REITs and real estate operating companies. RMR LLC is a majority owned subsidiary of The RMR Group Inc., a public holding company that conducts substantially all of its business through RMR LLC. Messrs. Barry and Adam Portnoy control The RMR Group Inc. through their ownership of a trust which is the controlling shareholder of The RMR Group Inc. The following table sets forth for each Independent Trustee of the Fund information regarding securities beneficially owned by them of those companies that RMR LLC provides management services to.

| Name | Company | Title of Class | Value of Securities† | Percent of Class | |||||

|---|---|---|---|---|---|---|---|---|---|

| John L. Harrington | Hospitality Properties Trust | Common | $ | 619,473 | * | ||||

| John L. Harrington | Senior Housing Properties Trust | Common | $ | 354,760 | * | ||||

| John L. Harrington | Government Properties Income Trust | Common | $ | 188,788 | * | ||||

| Arthur G. Koumantzelis | Hospitality Properties Trust | Common | $ | 132,442 | * | ||||

| Arthur G. Koumantzelis | Senior Housing Properties Trust | Common | $ | 40,948 | * | ||||

| Arthur G. Koumantzelis | Five Star Quality Care, Inc. | Common | $ | 54,518 | * | ||||

| Arthur G. Koumantzelis | TravelCenters of America LLC | Common | $ | 398,859 | * | ||||

| Jeffrey P. Somers | Senior Housing Properties Trust | Common | $ | 209,960 | * | ||||

| Jeffrey P. Somers | Government Properties Income Trust | Common | $ | 154,463 | * | ||||

| Jeffrey P. Somers | Select Income REIT | Common | $ | 122,850 | * | ||||

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Unless otherwise indicated, the information set forth below is as of January 31, 2016. To the Fund's knowledge, no person beneficially owned more than 5% of the Fund's outstanding common or preferred shares, except as set forth below. To the Fund's knowledge, none of its officers or Trustees owned 1% or more of the outstanding common shares of the Fund, except as set forth below. To the Fund's knowledge, none of its officers or Trustees owned any of its preferred shares. Collectively, to the Fund's knowledge, the officers and Trustees of the Fund beneficially own, as a group, in the aggregate, 669,229 common shares (not including any fractional shares which may be beneficially owned by an officer or Trustee) of the Fund, representing approximately 8.75% of the Fund's outstanding common shares. Unless otherwise indicated below, to the Fund's knowledge, each owner named below has sole voting and dispositive power for all shares shown to be beneficially owned by that person. Share amounts listed below do not include fractional share amounts.

| Title of Share Class | | Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | See Note | | Percentage of Share Class | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Shares | | Barry M. Portnoy | | | 544,055 | | | (1)(3)(5) | | | 7.11% | | | |||

| Common Shares | | Morgan Stanley | | | 399,624 | | | (2) | | | 5.22% | | | |||

| Common Shares | | Adam D. Portnoy | | | 143,338 | | | (1)(4)(5) | | | 1.87% | | | |||

| Common Shares | | Mark L. Kleifges | | | 7,235 | | | (1) | | | * | | | |||

| Common Shares | | John L. Harrington | | | 6,548 | | | (1) | | | * | | | |||

| Common Shares | | Fernando Diaz | | | 1,007 | | | (1) | | | * | | | |||

| Common Shares | | Jeffrey P. Somers | | | 876 | | | (1) | | | * | | | |||

| Common Shares | | Arthur G. Koumantzelis | | | 405 | | | (1) | | | * | | | |||

| Preferred Shares | | Royal Bank of Canada | | | 553 | | | (6) | | | 82.91% | | | |||

20

Trust, may also be deemed to beneficially own (and have shared voting and dispositive power over) the common shares beneficially owned by ABP Trust. Voting and investment power with respect to the common shares owned by ABP Trust may be deemed to be shared by Mr. Barry Portnoy as Chairman, holder of the majority of the shares of beneficial interest in and a trustee of ABP Trust and Mr. Adam Portnoy as the President and Chief Executive Officer, a holder of shares of beneficial interest in and a trustee of ABP Trust.

The declaration of trust and bylaws of the Fund generally provide that no person or group of persons, other than an excepted person or group (as approved by the Fund's Board or as stated in the Fund's declaration of trust or bylaws), may beneficially own in excess of 9.8% of (i) any class or series of shares of the Fund, or (ii) the aggregate of all the outstanding classes and series of shares of the Fund. The Fund's Board intends to strictly enforce these provisions of the Fund's declaration of trust and bylaws by utilizing, when necessary, the remedies available in the Fund's declaration of trust and bylaws for violations of these provisions of the Fund's declaration of trust and bylaws, although in certain instances it may grant exceptions to this ownership limitation in accordance with the provisions of the Fund's declaration of trust and bylaws when it determines that doing so would be in the best interests of the Fund and its shareholders. The Fund has granted Royal Bank of Canada and its affiliates, limited exceptions to the ownership limitation with respect to their beneficial ownership of common or preferred shares (as applicable) of the Fund. For more information about these ownership limitations, please refer to the full text of the Fund's declaration of trust and bylaws, which are available by accessing the Fund's filings with the SEC on the SEC's website (www.sec.gov) or by contacting our Investor Relations Group at (866) 790-8165.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act requires that fund trustees, executive officers, and persons who own more than 10% of a registered class of a fund's equity securities, as well as a fund's investment adviser and their officers and directors, file reports of ownership and changes in ownership of securities of the fund with the SEC and NYSE MKT. A fund's executive officers, trustees, and greater than 10% shareholders, as well as a fund's investment adviser and their officers and directors, are required to furnish the fund with copies of all forms they file pursuant to Section 16(a). Based solely on a review of copies of these reports furnished to the Fund pursuant to Rule 16a-3(e) under the 1934 Act, or written representations that no such reports were required, the Fund believes that during 2015 all such filing requirements applicable to its executive officers, Trustees, and greater than 10% shareholders, as well as to the Advisor, and its officers and directors, were timely met.

OTHER INFORMATION ABOUT THE FUND,

THE FUND'S ADVISOR AND THE FUND'S ADMINISTRATOR

The Advisor, located at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458, serves as the investment adviser, manager and administrator for the Fund. The Advisor was founded in 2002 and is a wholly owned subsidiary of The RMR Group LLC. RMR LLC is a majority owned subsidiary of The RMR Group Inc. Messrs. Barry and Adam Portnoy, both Trustees

21

of the Fund, control The RMR Group Inc. through their ownership of a trust which is the controlling shareholder of The RMR Group Inc. State Street Bank and Trust Company ("State Street"), located at Two Avenue de Lafayette, Boston, Massachusetts 02111, is the Fund's sub-administrator.

On December 13, 2011, in connection with the approval of the Fund's merger with Old RMR Real Estate Income Fund ("Old RIF"), the Fund's shareholders approved a new investment advisory agreement with the Advisor that was in effect for two years from the closing date of the Fund's merger with Old RIF, January 20, 2012, and which continues from year to year thereafter as long as such continuation is approved in the manner prescribed by the 1940 Act. The Fund's investment advisory agreement with the Advisor (the "Advisory Agreement") was most recently considered and approved by the Board and the Independent Trustees for an additional one year term, commencing on January 20, 2016, at meetings of the Board that took place on December 10, 2015 and January 19, 2016. The Advisory Agreement calls for fees to be paid to the Advisor equal to an annual rate of 0.85% of the Fund's average daily managed assets. As of December 31, 2015, the managed assets of the Fund were approximately $257 million. The Fund's managed assets are equal to the net asset value of the Fund's common shares plus the liquidation preference of the Fund's preferred shares and the principal amount of the Fund's outstanding borrowings. During 2015, advisory fees were $2,240,824 for the Fund. Neither the Advisor nor any of its affiliated companies receive compensation from the Fund other than pursuant to the advisory fees described herein and the Fund's administration agreement, which was also most recently considered and re-approved by the Fund's Board at meetings on December 10, 2015 and January 19, 2016, except the Fund reimbursed the Advisor allocated internal audit and compliance costs as described below. A discussion regarding the basis for the Fund's Board continuing the Advisory Agreement for an additional one year term will be available in the Fund's 2015 Annual Report, which will be filed with the SEC on Form N-CSR.

To date, amounts paid or payable to the Advisor under the administration agreement have been limited to (i) reimbursement of the fees charged to the Advisor for the Fund by State Street, which for 2015 totaled $78,400; and (ii) reimbursement payments to the Advisor by the Fund for compliance and internal audit services for the Fund for the twelve months ended December 31, 2015, which for 2015 totaled $125,967 and were authorized by the Fund's Compensation Committee and the Board, and separately the Independent Trustees.

Under the terms of the Advisory Agreement, the Advisor provides the Fund with an investment program, makes day-to-day investment decisions for the Fund and manages the Fund's business affairs in accordance with the Fund's investment objectives and policies, subject to the general supervision of the Board. The Advisor also provides persons satisfactory to the Board to serve as the Fund's officers. The Fund's officers, as well as its other employees and Trustees may be directors, trustees, officers or employees of the Advisor and its affiliates, including the RMR LLC and The RMR Group Inc. Generally, the Advisory Agreement may be terminated by a majority of the Fund's Trustees or by proper vote of the Fund's shareholders, at any time upon sixty days' notice and payment of compensation earned prior to such termination. The Advisory Agreement terminates automatically on its assignment (as that term is defined in the 1940 Act). Since the closing of the Fund's merger with Old RIF, Messrs. Barry Portnoy, Adam Portnoy and Fernando Diaz, portfolio managers of Old RIF, have served as the Fund's portfolio managers. The portfolio managers generally function as a team. Messrs. Barry Portnoy and Adam Portnoy provide strategic guidance to the team, while Mr. Fernando Diaz is in charge of substantially all of the day to day operations, research and trading functions.

In addition to the fee paid to the Advisor, the Fund pays all other costs and expenses of its operations, including, but not limited to, compensation of the Fund's Independent Trustees, custodian, transfer agency and distribution expenses, rating agency fees, legal fees, costs of independent auditors, allocated compliance and internal audit costs, expenses of repurchasing shares, expenses in connection with any borrowings or other capital raising activities, expenses of being listed on a stock exchange, expenses of preparing, printing and distributing shareholder reports, notices, proxy statements and reports to governmental agencies, membership in investment company organizations, expenses to maintain and administer the Fund's dividend reinvestment plan and taxes, if any.

22

DIRECTORS AND OFFICERS OF THE ADVISOR

Information as of the date of this proxy statement relating to the directors and officers of the Advisor is set forth below. Officers of the Advisor are elected and appointed by its board of directors and hold office until they resign, are removed or are otherwise disqualified to serve. The following table lists the directors and officers of the Advisor.

| Name (Year of Birth) | Position | Date position was acquired | ||

|---|---|---|---|---|

| Adam D. Portnoy (1970) | Director, President and Chief Executive Officer | May 2007 (Director and President), June 2015 (Chief Executive Officer) | ||

Barry M. Portnoy (1945) | Director, Chairman and Vice President | July 2002 (Director and Vice President), September 2015 (Chairman) | ||

Mark L. Kleifges (1960) | Treasurer and Chief Financial Officer | September 2004 | ||

Jennifer B. Clark (1961) | Director, Secretary or Clerk and Vice President | September 2015 (Director), July 2002 (Secretary or Clerk and Vice President) | ||

Fernando Diaz (1968) | Vice President | May 2007 | ||

Vern D. Larkin (1970) | Chief Compliance Officer | March 2012 |

Messrs. Barry M. Portnoy and Adam D. Portnoy are Trustees of the Fund, and Messrs. Kleifges, Diaz and Larkin and Ms. Clark are officers of the Fund. Mr. Adam Portnoy is the son of Mr. Barry Portnoy.

23

The Audit Committee of the Fund oversees the Fund's financial reporting process. The Audit Committee has: (1) reviewed and discussed with management the Fund's 2015 audited financial statements for the fiscal year ended December 31, 2015; (2) discussed with Ernst & Young LLP, the Fund's independent auditor, the matters required to be discussed under PCAOB Auditing Standard No. 16; (3) received the written disclosures or the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the Audit Committee concerning independence, and discussed with the independent accountant the independent accountant's independence; and (4) considered whether the provision of non-audit services by the auditors is compatible with maintaining their independence and concluded that it is compatible at this time. At the Audit Committee's meeting on February 19, 2016, and based on the foregoing review and discussions, the Audit Committee recommended to the Board that the Fund's audited financial statements be included in the Fund's 2015 annual report to shareholders and filed with the SEC.

| AUDIT COMMITTEE of RMR Real Estate Income Fund | ||

John L. Harrington, Chairman Arthur G. Koumantzelis Jeffrey P. Somers |

24

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee and the Board, at their respective meetings on both December 10, 2015 and January 19, 2016, considered and appointed Ernst & Young LLP as the Fund's independent registered public accountant for 2016. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting, with the opportunity to make a statement if he or she desires to do so. This representative will be available to respond to appropriate questions from shareholders who are present at the Annual Meeting.

The fees for services provided by Ernst & Young LLP for the Fund for the last two years (the Fund's fiscal year end is December 31) were as follows:

| | 2015 | |||

|---|---|---|---|---|

Audit fees | $ | 48,000 | ||

Audit related fees | — | |||

Tax fees(1) | 11,685 | |||

| | | | | |

Subtotal | 59,685 | |||

All other fees | — | |||

| | | | | |

Ernst & Young LLP total fees | $ | 59,685 | ||

| | | | | |

| | | | | |

| | | | | |

| | 2014 | |||

|---|---|---|---|---|

Audit fees | $ | 46,250 | ||

Audit related fees | — | |||

Tax fees(1) | 11,235 | |||

| | | | | |

Subtotal | 57,485 | |||

All other fees | — | |||

| | | | | |