- SEVN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Seven Hills Realty Trust (SEVN) PRE 14APreliminary proxy

Filed: 13 Dec 19, 5:09pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | Filed by a Party other than the Registrant |

| | Check the appropriate box: | | ||||||

| Preliminary Proxy Statement | ||||||||

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | ||||||||

| Definitive Proxy Statement | ||||||||

| Definitive Additional Materials | ||||||||

| Soliciting Material under §.240.14a-12 | ||||||||

RMR Real Estate Income Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | Payment of Filing Fee (Check the appropriate box): | | ||||||

| No fee required. | ||||||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||||

| | | | | | | | | |

| (1) Title of each class of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (2) Aggregate number of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined) : | ||||||||

| | | | | | | | | |

| (4) Proposed maximum aggregate value of transaction: | ||||||||

| | | | | | | | | |

| (5) Total fee paid: | ||||||||

| Fee paid previously with preliminary materials. | ||||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||||||

| | | | | | | | | |

| (1) Amount Previously Paid: | ||||||||

| | | | | | | | | |

| (2) Form, Schedule or Registration Statement No.: | ||||||||

| | | | | | | | | |

| (3) Filing Party: | ||||||||

| | | | | | | | | |

| (4) Date Filed: | ||||||||

Notice of Special Meeting

of Shareholders and Proxy Statement

[Day of the Week], [Calendar date], 2020 at [ ] [a.][p.]m., Eastern Time

Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458

LETTER TO OUR SHAREHOLDERS FROM OUR BOARD OF TRUSTEES

Dear Shareholder:

We invite you to a special meeting ("Special Meeting") of our shareholders in Newton, Massachusetts to consider a proposal to change our business from a registered investment company that makes equity investments in real estate companies to a real estate investment trust that will focus primarily on originating and investing in first mortgage whole loans secured by middle market and transitional commercial real estate. The enclosed Notice of Special Meeting and Proxy Statement provide you with important information about this proposal and our new business plan.

We believe that this proposal is the best path for our Company to increase shareholder value because it has the potential to increase the distributions we can pay to our shareholders in the future as well as the price at which our common shares trade relative to their net asset value.

Your support is very important. We encourage you to use telephone or internet methods, or sign and return a proxy card/voting instruction form, to authorize your proxy prior to the meeting so that your shares will be represented and voted at the meeting.

Thank you for being a shareholder and for your continued investment in our Company.

[ ], 20[19]

| Jennifer B. Clark John L. Harrington Joseph L. Morea Adam D. Portnoy Jeffrey P. Somers |

PRELIMINARY PROXY MATERIAL – SUBJECT TO COMPLETION

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

[Day of the Week], [Calendar date], 2020

[time], [a.m./p.m.], Eastern time

Two Newton Place, 255 Washington Street, Suite 100

Newton, Massachusetts 02458

ITEMS OF BUSINESS

RECORD DATE

You can vote if you were a shareholder of record as of the close of business on November 26, 2019.

PROXY VOTING

Shareholders as of the record date are invited to attend the Special Meeting. If you cannot attend in person, please vote in advance of the Special Meeting by using one of the methods described in the accompanying Proxy Statement.

[Calendar date], 20[19]

Newton, Massachusetts

By Order of the Board of Trustees,![]()

Jennifer B. Clark

Secretary

Please sign and return the proxy card or voting instruction form or use telephone or internet methods to authorize a proxy in advance of the Special Meeting. See the "Voting Information" section on page 28 for information about how to authorize a proxy by telephone or internet or how to attend the Special Meeting and vote your shares in person.

TABLE OF CONTENTS

| | Page | |||

|---|---|---|---|---|

PLEASE VOTE | 1 | |||

PROXY STATEMENT | 2 | |||

QUESTIONS & ANSWERS ABOUT THE PROXY MATERIALS AND VOTING | 3 | |||

BUSINESS CHANGE PROPOSAL | 6 | |||

Introduction | 6 | |||

Reasons for the Proposed Change | 6 | |||

Implementation of the Business Change Proposal and Related Risks | 12 | |||

Operation as a Mortgage REIT | 17 | |||

U.S. Federal Income Tax Considerations of the Company's Conversion to a REIT | 25 | |||

Taxation of the Company as a REIT | 25 | |||

AUDITOR PROPOSAL | 27 | |||

VOTING INFORMATION | 30 | |||

Required Vote | 30 | |||

Record Date | 30 | |||

Voting Methods | 30 | |||

Quorum, Abstentions and Broker Non-Votes | 31 | |||

Adjournments | 31 | |||

Revocation of Proxy | 31 | |||

SOLICITATION OF PROXIES | 32 | |||

COMMUNICATIONS WITH TRUSTEES | 32 | |||

SHAREHOLDER NOMINATIONS AND PROPOSALS | 32 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | 34 | |||

DIRECTORS AND OFFICERS OF THE ADVISOR | 35 | |||

HOUSEHOLDING OF MEETING MATERIALS | 35 | |||

OTHER MATTERS | 36 | |||

APPENDIX A: Current CRE Market and Market Opportunity | A-1 | |||

APPENDIX B: Risk Factors | B-1 | |||

APPENDIX C: Summary of Material United States Federal Income Tax Considerations | C-1 | |||

PLEASE VOTE

It is very important that you vote on the future direction of our Company. The NYSE American LLC ("NYSE American") rules do not allow a broker, bank or other nominee who holds shares on your behalf to vote on the Business Change Proposal described below without your instructions.

PROPOSALS THAT REQUIRE YOUR VOTE

| PROPOSAL | MORE INFORMATION | BOARD RECOMMENDATION | CLASS OF SHARES VOTING | |||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| 1 | Business Change Proposal | Page 6 | FOR | Common shares and preferred shares of the Company, voting together as a single class, and preferred shares of the Company, voting as a separate class | ||||

2 | Auditor Proposal | Page 25 | FOR | Common shares and preferred shares of the Company, voting together as a single class | ||||

| | | | | | | | | |

You can vote in advance in one of three ways:

via the internet  | Visitwww.proxyvote.com and enter your 16 digit control number provided in your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form before 11:59 p.m., Eastern time, on [Calendar Date], 2020 to authorize a proxyVIA THE INTERNET. | |

by phone | Call [ ] if you are a shareholder of record and [ ] if you are a beneficial owner before 11:59 p.m., Eastern time, on [Calendar Date], 2020 to authorize a proxyBY TELEPHONE. You will need the 16 digit control number provided on your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form. | |

by mail  | Sign, date and return your proxy card if you are a shareholder of record or voting instruction form if you are a beneficial owner to authorize a proxyBY MAIL. |

If the meeting is postponed or adjourned, these times will be extended to 11:59 p.m., Eastern time, on the day before the reconvened meeting.

PLEASE VISIT:www.proxyvote.com

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 1

2019 Proxy Statement 1

PRELIMINARY PROXY MATERIAL—SUBJECT TO COMPLETION

[Calendar Date], 20[19]

The Board of Trustees (the "Board") of the RMR Real Estate Income Fund, a Maryland statutory trust (the "Company," "we," "us," or "our"), is furnishing this proxy statement and accompanying proxy card (or voting instruction form) to you in connection with the solicitation of proxies by the Board for a special meeting of our shareholders. The meeting will be held at Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458, on [ ], [ ], 2020, at [ ] [a.][p.]m., Eastern time, and any adjournment or postponements thereof (the "Meeting"). We are first making these proxy materials available to shareholders on or about [Calendar date], 20[19].

Only owners of record of common shares, par value $0.001 per share, and preferred shares, par value $0.001 per share, as of the close of business on November 26, 2019 (the "Record Date") are entitled to notice of, and to vote at, the meeting and at any postponements or adjournments thereof. Holders of common shares are entitled to one vote for each common share. Holders of preferred shares are entitled to one vote for each preferred share. On November 26, 2019, there were 10,202,009 common shares and 667 preferred shares issued and outstanding.

We will furnish, without charge, a copy of our annual report and most recent semi-annual report succeeding the annual report, if any, to any shareholder upon request. Requests should be directed to the Secretary of the Company at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 (toll free telephone number (866) 790-8165). Copies can also be obtained by visiting our website at www.rmrfunds.com.1 Copies of our annual and semi-annual reports are also available on the EDGAR Database on the Securities and Exchange Commission's (the "SEC") website at www.sec.gov.

The mailing address of our principal executive offices is Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02548.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SPECIAL MEETING TO BE HELD ON [DAY OF THE WEEK], [CALENDAR DATE], 2020.

THE NOTICE OF SPECIAL MEETING AND PROXY STATEMENT ARE AVAILABLE AT: WWW.PROXYVOTE.COM.

2 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

QUESTIONS & ANSWERS ABOUT THE PROXY MATERIALS AND VOTING

1. ON WHAT PROPOSALS AM I BEING ASKED TO VOTE? |

You are being asked to consider and vote upon two proposals:

If the Business Change Proposal is approved, we will change our business from a registered investment company that invests in equity securities issued by real estate companies to a REIT that will focus primarily on originating and investing in first mortgage whole loans, generally of $50.0 million or less, secured by middle market and transitional commercial real estate ("CRE"). In connection with this change to our business, we would amend our fundamental investment objectives and restrictions regarding purchasing and selling real estate and originating loans, as well as our status as a "diversified" fund, to allow us to engage in our new business as a mortgage REIT.

2. HOW DOES THE BOARD RECOMMEND THAT I VOTE? |

The Board unanimously recommends that you vote:

3. WHY IS THE BOARD RECOMMENDING THE BUSINESS CHANGE PROPOSAL? |

The Board, including the members of the Board who are not interested persons (as defined in the Investment Company Act of 1940 (the "1940 Act")) of the Company (the "Independent Trustees"), believes that the Business Change Proposal is in the best interest of shareholders because it is the best path for our Company to increase shareholder value because it has the potential to increase the distributions we can pay to our shareholders in the future as well as the price at which our common shares trade relative to their net asset value ("NAV"). Over the course of many years, the Board has considered and implemented various strategies for increasing value for our shareholders. For a discussion of the principal considerations taken into account by the Board and a special committee (the "Special Committee") of the Board comprised of all the Independent Trustees, and a discussion of the potential risks in implementing the Business Change Proposal, see "Business Change Proposal—Reasons for the Proposed Change" and Appendix B.

4. IF THE BUSINESS CHANGE PROPOSAL IS APPROVED, WHAT WILL THE COMPANY DO TO IMPLEMENT THE PROPOSAL? |

If the Business Change Proposal is approved by shareholders, we will apply to the SEC for an order under the 1940 Act declaring that we have ceased to be a registered investment company (the "Deregistration Order"). Pending the SEC's issuance of the Deregistration Order, we intend to begin

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 3

2019 Proxy Statement 3

realigning our portfolio consistent with our new business as a mortgage REIT. We anticipate that the implementation period may last approximately two years, with full implementation not projected until approximately the beginning of 2022. This time period is an estimate and may vary depending upon the length of the deregistration process with the SEC, tax considerations and the pace at which we will be able to originate or invest in first mortgage whole loans.

5. DOES OUR ADVISOR HAVE EXPERIENCE IN MANAGING A MORTGAGE REIT? WILL THERE BE ANY CHANGES TO THE COMPANY'S INVESTMENT ADVISORY AGREEMENT IN CONNECTION WITH THE BUSINESS CHANGE PROPOSAL? |

Our investment adviser, RMR Advisors LLC (the "Advisor"), and its affiliates have significant experience and expertise in managing REITs and in investing in middle market CRE. An affiliate of our Advisor currently manages a mortgage REIT, and we expect that the same personnel that conduct the business of that mortgage REIT would conduct our business if the Business Change Proposal is approved.

After we receive the Deregistration Order, our investment advisory agreement with our Advisor would be terminated. Our existing management fee is lower than the typical management fee for mortgage REITs. As a result, we expect to receive the benefit of establishing a portfolio of mortgage loans at a cost lower than would otherwise be expected to apply to a newly established mortgage REIT.

After deregistration, the Board anticipates we would enter into a new management agreement with our Advisor or an affiliate of our Advisor, who would continue to provide the day-to-day management of our operations, subject to the oversight and direction of the Board. While management fee expenses, as well as other operating expenses, are projected to increase as the Business Change Proposal becomes fully implemented following receipt of the Deregistration Order, these expenses are projected to be offset by higher projected income, resulting in higher projected net income per common share (thus supporting a potentially higher distribution rate in the long term) than without the implementation of the Business Change Proposal.

6. WHAT WILL HAPPEN TO THE COMPANY'S DIVIDEND IF THE BUSINESS CHANGE PROPOSAL IS APPROVED? |

During the transition period before our portfolio has been fully converted to its new investment strategy, we intend to try to maintain a quarterly managed distribution rate as high as is reasonably practicable. However, at some point during the implementation of the Business Change Proposal, the Board likely will need to temporarily reduce the managed distribution rate because we expect our cash flow from earnings and the status and availability of capital gains we realize from our portfolio to decline during the transition.

The full implementation of the Business Change Proposal, however, is anticipated to have a positive impact on the sustainability and potential growth of our earnings and distribution rate over the long term. We believe that, over the long term, our new investment strategies could result in our increasing cash flow from earnings, which could result in higher distributions to shareholders compared to historical levels, enhanced coverage for our distribution rate, the potential for share price appreciation, and/or the potential for narrowing or eliminating the discount at which our common shares historically have traded relative to their NAV.

7. WHAT ARE THE TAX CONSEQUENCES OF IMPLEMENTING THE BUSINESS CHANGE PROPOSAL? |

We have elected to be treated and currently operate in a manner intended to qualify for taxation as a "regulated investment company" ("RIC") under the Internal Revenue Code of 1986, as amended (the "IRC"). Assuming we deregister as an investment company under the 1940 Act as a result of the

4 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

Business Change Proposal, our qualification for taxation as a RIC would terminate for the taxable year in which the Deregistration Order becomes effective (the "Deregistration Year") and we intend to elect to be taxed as a REIT under the IRC commencing with the Deregistration Year and in subsequent taxable years. See Appendix C for a detailed discussion of the tax consequences of implementing the Business Change Proposal.

Once the Business Change Proposal is fully implemented, we intend to make quarterly distributions to our shareholders in amounts that will, at a minimum, enable us to comply with the REIT provisions of the IRC that require annual distributions of at least 90% of our REIT taxable income (other than net capital gains). The actual amount of such distributions will be determined on a quarterly basis by the Board, taking into account the REIT tax requirements, our cash needs, our earnings, the market price of our common shares and other factors the Board considers relevant.

8. WHAT IS THE ESTIMATED COST ASSOCIATED WITH THE BUSINESS CHANGE PROPOSAL? WHO WILL BEAR THE COSTS AND EXPENSES ASSOCIATED WITH THE BUSINESS CHANGE PROPOSAL? |

We estimate that the third party costs and expenses associated with consideration and approval of the Business Change Proposal will be approximately $[ ]. All third party costs and expenses associated with the Business Change Proposal will be paid by our Advisor and not the Company.

9. WILL MY VOTE MAKE A DIFFERENCE? |

YES! Your vote is important to ensure that the proposals are adopted. We encourage all shareholders to participate in the governance of the Company.

10. WHAT WILL HAPPEN IF SHAREHOLDERS DO NOT APPROVE THE BUSINESS CHANGE PROPOSAL? |

If the Business Change Proposal is not approved, the Board may consider other options to enhance or preserve shareholder value, including continuing our current operation as a registered investment company.

11. HOW CAN I AUTHORIZE A PROXY TO VOTE MY SHARES? |

Please follow the instructions included on the enclosed proxy card.

12. WHOM DO I CALL IF I HAVE QUESTIONS REGARDING THE PROXY? |

You may contact our proxy solicitor:

Morrow Sodali LLC

470 West Avenue

Stamford, Connecticut 06902

Shareholders Call Toll Free: (800) 662-5200

Banks and Brokers Call Collect: (203) 658-9400

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 5

2019 Proxy Statement 5

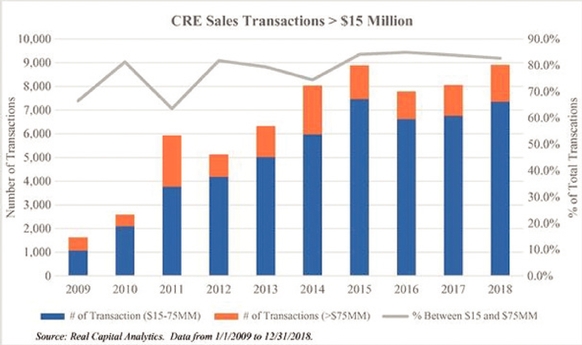

The Board, including the Independent Trustees, recommends that we change our business from a registered investment company that invests in securities issued by real estate companies to a company that will focus primarily on originating and investing in first mortgage whole loans, generally of $50.0 million or less, secured by middle market and transitional CRE. We define middle market CRE as commercial properties that have values of up to $75.0 million and transitional CRE as commercial properties subject to redevelopment or repositioning activities that are expected to increase the value of the properties. The changed business will seek to qualify for taxation as a REIT for U.S. federal income tax purposes. To permit us to engage in our new business, our fundamental investment restrictions regarding purchasing and selling real estate and originating loans, as well as our fundamental investment objectives and status as a "diversified" fund, would be amended to allow us to engage in our business as a mortgage REIT.

The Board believes that, over the long term, the Business Change Proposal would result in our increasing cash flow from earnings, which could result in higher distributions to shareholders compared to historical levels, enhanced coverage for our distribution rate, the potential for share price appreciation, and/or the potential for narrowing or eliminating the discount at which our common shares historically have traded relative to their NAV. Over the course of many years, the Board has considered and implemented various other strategies to increase shareholder value with disappointing results. For a variety of reasons discussed below, the Board believes that the Business Change Proposal is a better long term business strategy and is more likely to increase shareholder value than continuing to operate as a registered investment company.The Board has unanimously recommended that shareholders vote "FOR" the Business Change Proposal.

Set forth below is a summary of the Special Committee's and the Board's considerations in approving the Business Change Proposal.

Following preliminary discussion of the Business Change Proposal with some of the Independent Trustees, our Advisor formally presented the Business Change Proposal to the Board at a meeting on August 5, 2019. At that meeting, the Board formed the Special Committee to consider and make findings with respect to the Business Change Proposal and to report to the full Board on its deliberations, findings and recommendations. The Special Committee appointed Mr. Jeffrey Somers, Esq., to serve as its chair, given his prior experience as a 1940 Act attorney and service as special counsel to the Independent Trustees prior to becoming a member of the Board. The Special Committee and the Board reached their decision to unanimously recommend the Business Change Proposal after approximately four months of consideration, discussions and deliberations, during which the Special Committee met on eight occasions.

The Special Committee reviewed materials prepared by our Advisor relating to the Business Change Proposal, our investment objectives, strategies, and restrictions, the types of investments we intend to make if the Business Change Proposal is approved, the risk and return characteristics of those investments, projected income and expenses anticipated to be associated with implementing the Business Change Proposal and associated with operating as a mortgage REIT and related matters. These materials generally compared our business and prospects both with and without implementing the Business Change Proposal, and the Special Committee discussed these matters extensively with our Advisor. The Special Committee also engaged an independent financial consultant (the "Consultant") with experience in the investment management and REIT industries to assist the Special Committee in evaluating the Business Change Proposal. The Consultant prepared a report evaluating the commercial mortgage REIT industry and the anticipated broader impact of the implementation of the Business Change Proposal on the Company, including on our operations and performance. The Consultant's report also addressed perceived market and economic trends and their anticipated impact on the Company both with

6 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

and without the implementation of the Business Change Proposal. In the course of reviewing the report, together with information provided by our Advisor, and meeting in person with the Consultant and our Advisor, the Special Committee posed additional questions, requested additional information and financial projections from our Advisor and met separately in executive sessions to discuss the Business Change Proposal. During the course of its evaluation, the Special Committee also consulted with our Advisor and our legal counsel. At a Board meeting held on October 29, 2019, the Special Committee and the Board further discussed the Business Change Proposal and the Special Committee, after meeting in executive session, reported its findings to the full Board and unanimously recommended that the Board approve the Business Change Proposal and submit it to a vote of the Company's shareholders.

In reaching its decision to recommend the approval of the Business Change Proposal, the Special Committee, in consultation with the Consultant and our Advisor, considered various factors it deemed relevant, including, but not limited to, the following factors:

In considering the Business Change Proposal, the Special Committee noted its discussions with our Advisor and the Consultant regarding the anticipated positive impact that the implementation of the Business Change Proposal would have on the sustainability and potential growth of our earnings and distribution rate over the long term. The Special Committee in particular considered its evaluation that, over the long term, our new investment strategies could result in our increasing cash flow from earnings, which could result in higher distributions to shareholders compared to historical levels, enhanced coverage for our distribution rate, the potential for share price appreciation, and/or the potential for narrowing or eliminating the discount at which our common shares historically have traded relative to their NAV. The Special Committee also noted its view that, in light of the likely necessity of a reduction in the managed distribution rate at some point in 2020 with or without the approval of the Business Change Proposal, the Business Change Proposal would allow us to return to, or possibly exceed, the current distribution level once we have fully implemented our business plan as a mortgage REIT.

The Special Committee further considered that our Advisor has committed to pay all third party costs and expenses related to consideration and approval of the Business Change Proposal.

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 7

2019 Proxy Statement 7

The Special Committee noted that, notwithstanding these anticipated advantages, the particular nature of any economic downturns, recessions or financial crises, and issuer specific or asset class/property type specific credit risk could adversely impact the anticipated risk-return tradeoff for real estate related debt versus equity investing and lead to losses notwithstanding any perceived protection provided by investing in debt as opposed to equity.

8 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

The Special Committee noted that despite these efforts, our common shares have continued to trade at a discount to NAV.

In evaluating mortgage REITs comparable to the strategy proposed for us, the Special Committee noted that these REITs often, though not always, traded at a premium to net asset value and considered the potential for the Business Change Proposal, in the long term, to act as a catalyst for providing shareholders with an improved likelihood of being able to trade their common shares at a price closer to, or perhaps even in excess of, NAV. In addition, the Special Committee noted the precedent of another registered investment company that deregistered and became a REIT and the impact of such conversion on the trading price of that fund, though the Special Committee also noted the different facts and circumstances applicable to that situation and that there could be no assurance that converting to a mortgage REIT would have a similar impact on the market price of our common shares.

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 9

2019 Proxy Statement 9

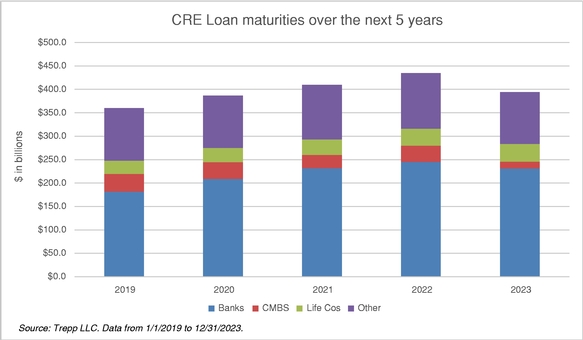

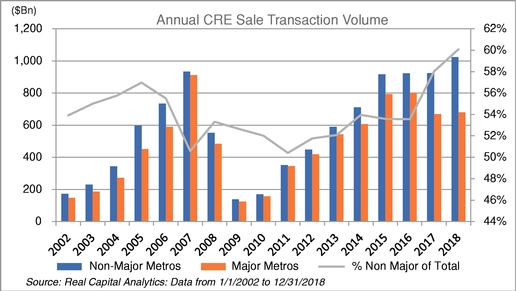

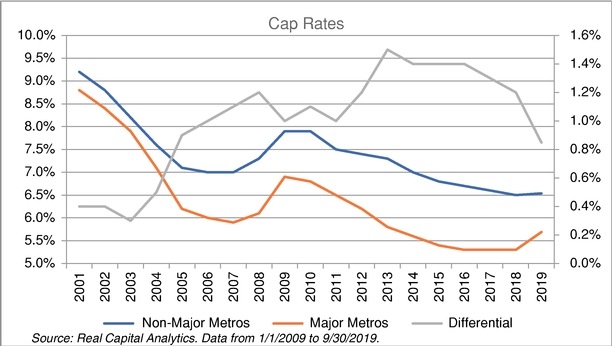

traditional CRE debt providers, especially with regard to transitional and middle market CRE debt financing. The Special Committee noted that our focus on providing debt financing for transitional and middle market CRE transactions will enable us to pursue investment opportunities that may offer superior risk adjusted investment returns as compared to more heavily regulated financial institutions and many other traditional CRE debt providers, who tend to focus on larger, more competitive markets. Our Advisor and the Special Committee also discussed the large volume of maturing CRE loans over the next five years and that the resulting need for borrowers to refinance assets is expected to provide an opportunity for originating CRE debt. A summary of the current CRE market is attached to this Proxy Statement as Appendix A.

10 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

The Special Committee recognized that if the Company is unsuccessful in implementing the Business Change Proposal, the anticipated benefits of the Business Change Proposal may not be realized. The Special Committee also recognized that, based on projections, there would be an extended implementation period for the Business Change Proposal because of the anticipated length of time to obtain the Deregistration Order and the timing of becoming a REIT which may be impacted by tax considerations. This implementation period may last approximately two years, with full implementation not projected until approximately the beginning of 2022. The Special Committee noted that this time period was an estimate and may vary depending upon the length of the deregistration process with the SEC, tax considerations and the pipeline of mortgage origination opportunities. The Special Committee considered that, during this implementation period, the anticipated benefits of the Business Change Proposal, financial and otherwise, would not be realized or would only be realized to a lesser extent, and that during this period the Board likely will need to temporarily reduce the managed distribution rate, we may not maintain a comparable level of income, expenses may increase as a percentage of net assets, our common share price may exhibit increased volatility and a greater discount to NAV and we may be more vulnerable to activist closed-end fund investor activity. The Special Committee believes that the risk of these temporary disruptions is outweighed by the potential benefits of the Business Change Proposal upon its full implementation. The Special Committee in particular noted that our Advisor has committed to pay all third party costs and expenses related to consideration and approval of the Business Change Proposal.

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 11

2019 Proxy Statement 11

In determining to approve the Business Change Proposal, the Board took into account the findings and recommendations of the Special Committee. The Board did not identify any particular factor as determinative, and each Trustee attributed different weights to the various factors. These factors were also considered by the Independent Trustees meeting separately from the full Board both with and without Company counsel. Following review and discussions with our Advisor and Company counsel, the Board, including the Independent Trustees, unanimously determined that the Business Change Proposal is advisable and in the best interests of us and our shareholders. On October 29, 2019, the Board, including the Independent Trustees, accepted the recommendations, findings and considerations of the Special Committee and unanimously approved the Business Change Proposal and directed that the Business Change Proposal be submitted for consideration by our shareholders. If shareholders do not approve the Business Change Proposal, the Board may consider other options to enhance or preserve shareholder value, including continuing our current operation as a registered investment company.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE BUSINESS CHANGE PROPOSAL.

Realignment of Portfolio and Deregistration. If the Business Change Proposal is approved by shareholders, we will begin to realign our portfolio so that we can rely on an exclusion from regulation under the 1940 Act available to companies primarily engaged in a real estate business and will apply to the SEC for a Deregistration Order. We intend to accomplish this by selling our existing investments as and when necessary to fund mortgage origination opportunities and/or by selling our existing investments and potentially temporarily holding liquid real estate assets, such as agency whole pool certificates, pending mortgage origination opportunities. We may elect to pursue one or both of these options at any given point in time depending upon a variety of factors, including the timing of receipt of the Deregistration Order, economic conditions, desired common share distribution level, and the availability of leverage facilities on acceptable terms, among others. The issuance of the Deregistration Order by the SEC is not within our control, and we anticipate that it may take a year or longer from the date of filing of the application to obtain the Deregistration Order. Until the SEC issues a Deregistration Order, we will continue to be registered as an investment company and will continue to be regulated under the 1940 Act.

Changes to Our Fundamental Investment Objectives and Restrictions. If the Business Change Proposal is approved, our fundamental investment objectives of earning and paying a high level of current income to common shareholders, with capital appreciation as a secondary objective, will be replaced with a non-fundamental primary objective to balance capital preservation with generating attractive risk adjusted returns. Additionally, if the Business Change Proposal is approved, our fundamental investment restrictions regarding purchasing and selling real estate and originating loans would be amended to permit us to engage in our new business strategy, as set forth below.

12 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

| Current Fundamental Restrictions | Fundamental Restrictions After Approval of Business Change Proposal But Before Deregistration | |

|---|---|---|

| | | |

| The Company may not purchase or sell real estate, except that the Company may invest in securities of companies that deal in real estate or are engaged in the real estate business, including REITs, and securities secured by real estate or such interests and the Company may hold and sell real estate or mortgages on real estate acquired through default, liquidation or other distributions of an interest in real estate as a result of the Company's ownership of such securities. | The Company may purchase or sell real estate, except to the extent that it would violate the 1940 Act. | |

The Company may not originate loans to other persons except by the lending of its securities, through the use of repurchase agreements and by the purchase of debt securities. | The Company may originate loans to other persons, except to the extent that it would violate the 1940 Act. | |

| | | |

Each of the amended policies would remain fundamental, as required by the 1940 Act, until we receive the Deregistration Order, at which time these policies (and other Company policies) could be changed by the Board without shareholder approval.

We currently have, and will retain until we receive the Deregistration Order, a fundamental investment policy to make investments that will result in concentration (25% or more of the value of our investments) in the securities of companies primarily engaged in the real estate industry and not in other industries; provided, however, this does not limit our investments in (i) U.S. Government obligations, or (ii) other obligations issued by governments or political subdivisions of governments. We note that for purposes of our investment policies and restrictions, we define a "real estate company" as an entity that derives at least 50% of its revenues from the ownership, leasing, management, construction, sale or financing of commercial, industrial or residential real estate, or has at least 50% of its assets in real estate, and we will consider agency whole pool certificates and other trusts that own mortgages or other interests in real estate to be real estate companies.

Changes to Our Non-Fundamental Investment Policies and Strategies. Our current non-fundamental investment policies and strategies provide that under normal market conditions, we invest:

If the Business Change Proposal is approved, the foregoing policies and strategies will be replaced with the investment strategy described under "—Operation as a Mortgage REIT—Investment Strategy."

Change from "diversified" to "non-diversified" status. We currently operate as a "diversified" fund, which means that, with respect to 75% of our total assets, securities issued by a single company may not have a value greater than 5% of our total assets and we may not own more than 10% of the outstanding voting securities of the company. If the Business Change Proposal is approved, we will begin operating as a "non-diversified" investment company, which means we will no longer need to comply with the 1940 Act's diversification requirements. A non-diversified fund may invest a significant part or all of its investments in a small number of issuers. Having a larger percentage of assets in a smaller number of issuers makes a

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 13

2019 Proxy Statement 13

non-diversified fund more susceptible to the risk that one single event or occurrence can have a significant adverse impact on the fund.

Investment Advisory Agreement. If the Business Change Proposal is approved, our current investment advisory agreement will remain in effect, including the existing investment advisory fee, until we receive the Deregistration Order. Under the terms of our investment advisory agreement, our Advisor provides us with an investment program, makes our day-to-day investment decisions and manages our business affairs in accordance with our investment objectives and policies, subject to the general supervision of the Board. As compensation for its services rendered and the related expenses borne by our Advisor, we pay our Advisor a monthly fee equal to an annual rate of 0.85% of our average daily managed assets. Our managed assets are equal to the NAV of our common shares plus the liquidation preference of our preferred shares and the principal amount of our outstanding borrowings. We may terminate the investment advisory agreement at any time without penalty by giving our Advisor sixty days' notice and paying any compensation earned prior to such termination, provided that such termination shall be directed or approved by the vote of a majority of our Trustees or by the vote of the holders of a "majority" (as defined in the 1940 Act) of our outstanding voting securities.

Following approval of the Business Change Proposal and receipt of the Deregistration Order, the Board anticipates that the existing agreement would be terminated and we would enter into a new management agreement with our Advisor or an affiliate of our Advisor, who would continue to provide for our day-to-day management, subject to the oversight and direction of our Board. See "—Operation as a Mortgage REIT—Terms of Management Agreement."

Distribution Policy. During the transition period before our portfolio has been fully converted to its new investment strategy, we intend to try to maintain a quarterly managed distribution rate as high as is reasonably practicable. However, there can be no assurance that we will not reduce our quarterly distributions during the investment strategy transition period, and the Board likely will need to temporarily reduce the managed distribution rate because we expect our cash flow from earnings and the status and availability of capital gains we realize from our portfolio to decline during the transition. This decline could result from the rotation out of existing investments, the need to establish income streams from mortgage originations, the potential for holding assets in temporary investments with lower yields such as agency whole pool certificates and the availability or unavailability of realized capital gains to distribute, among other potential variables. We anticipate distributing capital gains recognized on the sale of assets during this transition period, either as part of our quarterly distributions made pursuant to our Managed Distribution Plan, or at the end of the year in accordance with the requirements of subchapter M of the IRC.

The full implementation of the Business Change Proposal, however, is anticipated to have a positive impact on the sustainability and potential growth of our earnings and distribution rate over the long term. We believe that, over the long term, our new investment strategies could result in our increasing cash flow from earnings, which could result in higher distributions to shareholders compared to historical levels, enhanced coverage for our distribution rate, the potential for share price appreciation, and/or the potential for narrowing or eliminating the discount at which our common shares historically have traded relative to their NAV.

In the absence of the Business Change Proposal, our distribution rate would likely need to be reduced beginning in 2020 in order to make our regular quarterly distributions sustainable over the long term.

Auction Rate Preferred Shares and Credit Facility. If shareholders approve the Business Change Proposal, we intend to redeem our outstanding auction rate preferred shares and terminate our credit facility with BNP Paribas Prime Brokerage International, Ltd. We would seek to fund such redemptions and termination with a replacement credit facility designed for our new business as a mortgage REIT. See "—Operation as a Mortgage REIT—Policies and Investment Guidelines—Leverage Policies and Financing Strategy."

Change in Name. We expect to change our name to "RMR Mortgage Trust."

14 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

Effects of Deregistration. As a registered investment company, we are subject to extensive regulation under the 1940 Act. The 1940 Act, among other things,

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 15

2019 Proxy Statement 15

After we receive a Deregistration Order, we will no longer be subject to regulations under the 1940 Act. Instead, as a mortgage REIT, we would be able to, among other things:

However, we would be regulated by, among other laws, the Exchange Act, which regulates, among other things:

After we receive the Deregistration Order, we will continue to be managed by our Board and our officers. The Board will maintain substantially similar power, authority and discretion as the Board has before deregistration and be subject to the same duties under state law. Shareholders would also continue to have the benefit of the significant regulatory protections provided by the corporate governance requirements of the NYSE American or another national securities exchange, including those that require that a majority of the trustees be "independent directors" (as defined under NYSE American or other applicable exchange rules), trustee nominations and the compensation of all of our executive officers be subject to independent director approval, and that we hold an annual meeting of shareholders no later than one year after our first fiscal year following listing. In addition, consistent with the requirements of the NYSE American or another national securities exchange, we intend to adopt a code of conduct and ethics applicable to all trustees, officers and employees and retain the position of Director of Internal Audit, which is currently occupied by the individual who is also the Company's chief compliance officer.

Because the regulatory requirements specifically applicable to financial statements of registered investment companies would no longer be applicable to the Company, the financial information in our financial statements after we receive the Deregistration Order will change. For example, once we are no longer an investment company, we will no longer be required to present a schedule of portfolio of investments as part of our financial statements or report investments at fair value.

16 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

Reorganization to a Maryland REIT. As a holder of our common shares, your rights are governed by the Maryland Statutory Trust Act and our organizational documents. Because Maryland has a statutory scheme specifically designed for REITs, we expect that the Board will take the necessary steps under Maryland law to reorganize the Company as a Maryland REIT following our receipt of the Deregistration Order and make changes to the Company's governing documents in advance of or in connection with such reorganization. Any such changes and any such reorganization can be accomplished under Maryland law without shareholder approval. If we reorganize as a Maryland REIT, your rights as a holder of common shares of the Company will be governed by the Maryland REIT Law and by any amended organizational documents adopted by the Board at that time.

There are several differences between the Maryland Statutory Trust Act and the Maryland REIT Law that you should consider. The default provisions of the Maryland Statutory Trust Act may generally be altered in the declaration of trust or bylaws of a Maryland statutory trust, including provisions relating to shareholders' rights, preferences and privileges. The Maryland REIT Law is a more structured statutory framework that provides shareholders greater voting and other rights that may not be modified to the same extent as permitted under the Maryland Statutory Trust Act. For example:

See Appendix B for more information on the risks associated with the Business Change Proposal.

The following discussion assumes that, unless otherwise noted, the Business Change Proposal has been approved by shareholders and we have fully implemented the Business Change Proposal, reorganized as a mortgage REIT and received the Deregistration Order. See Appendix B for more information on the risks associated with the Business Change Proposal.

Investment Strategy

As a mortgage REIT, our primary investment objective will be to balance capital preservation with generating attractive risk adjusted returns. We will seek to achieve this objective by primarily investing in first mortgage whole loans secured by middle market and transitional CRE. The first mortgage loans in which we plan to invest will generally have the following characteristics:

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 17

2019 Proxy Statement 17

We will invest in first mortgage whole loans that provide bridge financing on transitional CRE properties. These investments will typically be secured by properties undergoing redevelopment or repositioning activities that are expected to increase the value of the properties. We will fund these loans over time as the borrowers' business plans for the properties are carried out. Our loans secured by transitional CRE will typically be bridge loans that are usually refinanced, with the proceeds from other CRE mortgage loans or property sales. We expect to receive origination fees, extension fees, modification or similar fees in connection with our bridge loans. Bridge loans may lead to future investment opportunities for us, including takeout mortgage loans with the same borrowers and properties.

Our Advisor and the Board believe that our mortgage investment strategy is appropriate for the current market environment. However, to capitalize on investment opportunities at different times in the economic and CRE investment cycle, we may change our investment strategy from time to time. Our Advisor and the Board believe that the flexibility of our investment strategy and the experience and resources of our Advisor and its affiliates, will allow us to take advantage of changing market conditions to preserve capital and generate attractive risk adjusted returns on its investments. The Board will be able to modify such strategies without the consent of the shareholders to the extent that the Board determines that such modification is in our best interest.

Policies and Investment Guidelines

If the Business Change Proposal is approved by shareholders, the Board will approve our operating and regulatory policies and investment guidelines. The Board currently anticipates adopting the policies and guidelines described below. The Board may, in its discretion, revise or waive such policies and guidelines from time to time in response to changes in market conditions or business opportunities without shareholder approval.

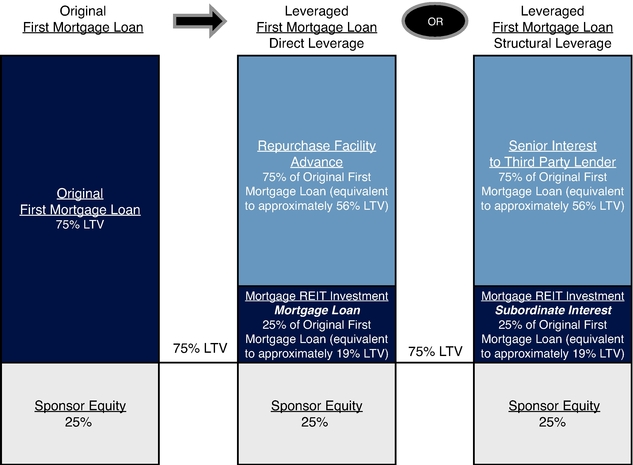

Leverage Policies and Financing Strategy. To increase the returns on our investments, after issuance of the Deregistration Order, we plan to employ both direct and structural leverage on our first mortgage loan investments, which we expect generally will not exceed, on a debt to equity basis, a ratio of 3-to-1, an increase from the ratio of 1-to-2 set by the 1940 Act.

We expect our initial direct leverage will come from repurchase facilities for which we may pledge whole first mortgage loans as collateral. Structural leverage will involve the sale of senior interests in first mortgage loans, such as A-Notes, to third parties and our retention of B-Notes and other subordinated interests in the loans. Below is an illustration of the leverage strategies we plan to use with our first mortgage loan investments.

18 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

REPRESENTATIVE CAPITAL STACK ON A FUNDED FIRST MORTGAGE LOAN

We anticipate that repurchase agreements we may enter with banks will be related to our first mortgage loan investments, and we do not currently plan to enter repurchase agreements regarding our subordinated mortgage, mezzanine loan or preferred equity investments. We believe that the relationships our Advisor and its affiliates, as well as other companies managed by our Advisor's affiliates (the "RMR managed companies"), have with commercial and investment banks and other sources of financing may be of assistance to us to arrange our financings. For example, as of November 30, 2019, the RMR managed companies had 34 banking relationships for over $4.7 billion of revolving credit facilities and term loans, and these existing relationships may provide us with introductions to these lenders and expedite their diligence of our operations.

We intend to use reasonable amounts of leverage, to the extent available, to make additional investments that may increase our potential returns. We expect that the organizational documents to be adopted by our Board after we receive the Deregistration Order will not limit the amount of leverage we may use. Although we are not required to maintain any particular leverage ratio, the amount of leverage we will use for particular investments will depend upon an assessment of a variety of factors, which may include the anticipated liquidity and price volatility of our assets, the potential for losses in our portfolio, the gap between the duration of our assets and liabilities, the availability and cost of financing our assets, the health of the U.S. economy and commercial mortgage markets, our outlook for the level, slope and volatility of future interest rates, the credit quality of our borrowers and collateral, the collateral values underlying our assets and our outlook for market lending spreads relative to the LIBOR (or other applicable benchmark interest rate index) curve.

REIT Operations. We intend to operate to ensure that we establish and maintain our qualification as a REIT for U.S. federal tax purposes and are excluded from regulation as an investment company under the 1940 Act. Before acquiring any asset, we will determine whether the asset would constitute a "real estate asset" as defined in the IRC (see Appendix C). We intend to regularly monitor the nature of our assets and the income they generate to ensure that at all times we maintain our tax qualification as a

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 19

2019 Proxy Statement 19

REIT and our exclusion from regulation under the 1940 Act. The Board currently intends to review our transactions on a periodic basis to ensure compliance with these operating policies.

Distribution Policy. We intend to make quarterly distributions to our shareholders of amounts that will, at a minimum, enable us to comply with the REIT provisions of the IRC that require annual distributions of at least 90% of our REIT taxable income (other than net capital gains). See Appendix C. The actual amount of such distributions will be determined on a quarterly basis by the Board, taking into account, in addition to the REIT tax requirements, our cash needs, the market price for our common shares and other factors our Board considers relevant.

Operating Expenses. We will enter into a new management agreement with our Advisor or one of its affiliates. Pursuant to the new management agreement, the manager will implement our business strategies subject to the oversight of the Board, including: (a) performing all of our day-to-day activities as a public company operating as a mortgage REIT; (b) sourcing, analyzing and closing our investments; (c) arranging our financings; (d) performing our asset management functions by monitoring the performance of our borrowers and the maintenance of our collateral; and (e) when necessary, enforcing our loan and security rights. Although our total operating expenses as a mortgage REIT are anticipated to be greater than our expenses as a registered investment company, if the Business Change Proposal is fully implemented, we anticipate that the increased cash flow from earnings as a result of the change to our business should in the long term more than offset any increase in expenses and, as noted above, could result in higher distributions to shareholders compared to historical levels, enhanced distribution coverage, the potential for share price appreciation, and/or the potential for narrowing or eliminating the discount at which our common shares historically have traded relative to their NAV.

Policies with Respect to Certain Other Activities. We may raise additional funds through offerings of equity or debt securities or by retaining cash flow (subject to provisions in the IRC concerning distribution requirements and the taxability of undistributed REIT taxable income) or a combination of these methods. If our Board determines to raise additional equity capital, it has the authority, without shareholder approval, to issue additional common shares or preferred shares of beneficial interest in any manner and on such terms and for such consideration as it deems appropriate, at any time.

In addition, to the extent available, we intend to borrow money to make investments that may increase our potential returns. We intend to use traditional forms of financing, including repurchase agreements, bank credit facilities (including revolving facilities and term loans), public or private debt issuances, securitizations and other sources of financing. Although we have no present intention to do so, we may also issue preferred equity which requires us to pay dividends at fixed or variable rates before we may pay distributions to our common shareholders. We expect that the Board will periodically review our investment guidelines and our portfolio and leverage strategies.

We may invest in equity or debt securities of other REITs or other entities engaged in real estate operating or financing activities, but we currently do not expect to do so for the purpose of exercising control over such entities.

Investment Guidelines. We will endeavor to meet the following investment guidelines:

20 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

We do not intend to adopt a formal portfolio turnover policy. Subject to maintaining our qualification for taxation as a REIT under the IRC for U.S. federal income tax purposes and our exemption from registration under the 1940 Act, we currently expect that we will typically hold investments that we originate for between two and 10 years. However, in order to maximize returns and manage portfolio risk while maintaining the financial capacity to undertake attractive opportunities that become available to us, we may dispose of an asset earlier than anticipated or hold an investment longer than anticipated if we determined doing so to be appropriate based upon market conditions or other factors regarding a particular investment.

Terms of Management Agreement

For purposes of this discussion, we assume that our Advisor will continue to be our manager although, as stated above, we may enter into a new management agreement with an affiliate of our Advisor, who would continue to provide for the day-to-day management of our operations, subject to the oversight and direction of the Board.

The Board anticipates that our management agreement with our Advisor will include the following terms, which remain subject to negotiation:

Base Management Fee. We anticipate that we will be required to pay our Advisor a base management fee at an annual rate equal to 1.5% of our "Equity," payable in cash quarterly (0.375% per quarter) in arrears. Under such management agreement, "Equity" would mean (a) the sum of (i) our NAV on the effective date of the management agreement, plus (ii) the net proceeds we receive from any future sale or issuance of our common shares, plus (iii) our cumulative "Core Earnings" (as defined below) for the period commencing on the effective date of the management agreement to the end of the most recent calendar quarter, less (b) (i) any distributions previously paid to holders of our shares, (ii) any incentive fee (as defined below) previously paid to our Advisor and (iii) any amount that we may have paid to repurchase our common shares. All items in the foregoing sentence (other than clause (a)(iii)) would be calculated on a daily weighted average basis.

The table below sets forth a simplified, hypothetical example of a base management fee calculation for a one-year period pursuant to the management agreement, based on the following assumptions:

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 21

2019 Proxy Statement 21

This example of the base management fee earned by our Advisor is provided for illustrative purposes only.

| | | Illustrative Amount | Calculation | |||

|---|---|---|---|---|---|---|

| | | | | | | |

| 1 | What is the NAV on the effective date of the management agreement? | $200 million | Assumed NAV on the effective date of the management agreement | |||

2 | What are Core Earnings? | $17.0 million | Assumed to be an 8.5% return on Equity | |||

3 | What are the distributions to shareholders following the effective date of the management agreement? | $17.0 million | Assumed to equal 100% of Core Earnings | |||

4 | What repurchases of our shares for cash are made following the implementation of the Business Change Proposal? | — | None | |||

5 | What is the incentive fee following the effective date of the management agreement? | $0.6 million | 20% of the amount by which Core Earnings exceeds the product of 7.0% and the Equity | |||

6 | What is our Equity? | $199.4 million | (a) the sum of (i) our NAV on the effective date of the management agreement, plus (ii) the net proceeds we receive from any future sale or issuance of our common shares, plus (iii) our cumulative Core Earnings for the period commencing on the effective date of the management agreement to the end of the most recent calendar quarter, less (b) (i) any distributions previously paid to holders of our shares, (ii) any incentive fee previously paid to our Advisor and (iii) any amount that we may have paid to repurchase our common shares | |||

7 | What is the base management fee? | $2.9 million | 1.50% times the Equity | |||

| | | | | | | |

Incentive Fee. Starting in the first full calendar quarter following the effective date of the management agreement, we may be required to pay our Advisor an incentive fee in arrears in cash equal to the difference between: (a) the product of (i) 20% and (ii) the difference between (A) our Core Earnings for the most recent 12 month period (or such lesser number of completed calendar quarters, if applicable), including the calendar quarter (or part thereof) for which the calculation of the incentive fee is being made, and (B) the product of (1) our Equity in the most recent 12 month period (or such lesser number of completed calendar quarters, if applicable), including the calendar quarter (or part thereof) for which the calculation of the incentive fee is being made, and (2) 7.0% per year and (b) the sum of any incentive fees paid to our Advisor with respect to the first three calendar quarters of the most recent 12 month period (or such lesser number of completed calendar quarters preceding the applicable period, if applicable). No incentive fee shall be payable with respect to any calendar quarter unless Core Earnings for the 12 most recently completed calendar quarters (or such lesser number of completed calendar quarters from the effective date of the management agreement) in the aggregate is greater than zero. The incentive fee may not be less than zero.

The table below sets forth a simplified, hypothetical example of an incentive fee calculation for a one year period pursuant to the management agreement using a hurdle rate (the rate of return on Equity above which our Advisor earns an incentive compensation) of 7.0% per annum and an incentive rate (the

22 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

proportion of the rate of return on Equity above the hurdle rate earned by our Advisor as an incentive fee) of 20.0%, based on the following assumptions:

This example of the incentive fee earned by our Advisor is provided for illustrative purposes only.

| | | Illustrative Amount | Calculation | |||

|---|---|---|---|---|---|---|

| | | | | | | |

| 1 | What are the Core Earnings? | $17.0 million | The assumed annual yield on Equity (8.5%) multiplied by Equity in the previous 12 month period ($200 million) | |||

2 | What is the hurdle amount? | $14.0 million | The hurdle rate (7.0% per annum) multiplied by the assumed Equity in the previous 12 month period ($200 million) | |||

3 | What is the incentive fee? | $0.6 million | The incentive fee rate (20.0%) multiplied by the excess of the Core Earnings ($17.0 million) above the hurdle amount ($14.0 million) |

For purposes of the calculation of base management fees and incentive fees payable to our Advisor, "Core Earnings" is defined as net income (or loss) attributable to our common shareholders, computed in accordance with generally accepted accounting principles in the United States ("GAAP"), including realized losses not otherwise included in GAAP net income (loss) and excluding: (a) the incentive fees earned by our Advisor; (b) depreciation and amortization (if any); (c) non-cash equity compensation expense; (d) unrealized gains, losses and other similar non-cash items that are included in net income for the period of the calculation (regardless of whether such items are included in or deducted from net income or in other comprehensive income or loss under GAAP); and (e) one-time events pursuant to changes in GAAP and certain material non-cash income or expense items, in each case after discussions between our Advisor and the Independent Trustees and approved by a majority of the Independent Trustees. Pursuant to the terms of such management agreement, the exclusion of depreciation and amortization from the calculation of Core Earnings shall only apply to owned real estate. Equity and Core Earnings as defined in the management agreement are non-GAAP financial measures and may be different than our shareholders' equity and our net income calculated according to GAAP.

Expense Reimbursement. We anticipate that our Advisor, and not us, will be responsible for the costs of its employees who provide services to us, including the cost of our Advisor's personnel who originate our loans, unless any such payment or reimbursement is specifically approved by the Independent Trustees. Generally, it is the practice of our Advisor and The RMR Group Inc. ("RMR Inc.") and its subsidiaries (collectively, "RMR") to treat individuals who spend 50% or more of their business time providing services to our Advisor as employees of our Advisor. We anticipate that we will be required to pay or to reimburse our Advisor and its affiliates for all other costs and expenses of our operations, including but not limited to, the costs of rent, utilities, office furniture, equipment, machinery and other overhead type expenses, the costs of legal, accounting, auditing, tax planning and tax return preparation, consulting services, diligence costs related to our investments, investor relations expenses and other professional services, and other costs and expenses not specifically required under the management agreement to be borne by our Advisor. We expect that some of these overhead, professional and other services will be provided by RMR pursuant to a shared services agreement between our Advisor and RMR. In addition, we will continue to pay our pro rata portion of internal audit costs incurred by RMR on behalf of us and other public companies to which RMR or its affiliates provides management services. These amounts and all other related party costs which we may reimburse, if any, will be subject to approval by the Independent Trustees at least annually.

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 23

2019 Proxy Statement 23

Termination Fee. In the event our management agreement is terminated by us without a cause event or by our Advisor for a material breach, we anticipate that we will be required to pay our Advisor a termination fee equal to (a) three times the sum of (i) the average annual base management fee and (ii) the average annual incentive fee, in each case paid or payable to our Advisor during the 24 month period immediately preceding the most recently completed calendar quarter prior to the date of termination or, if such termination occurs within 24 months of its initial commencement, the base management fee and the incentive fee will be annualized for such 24 month period based on such fees earned by our Advisor during such period, plus (b) an amount equal to costs of the Business Change Proposal paid by our Advisor. No termination fee will be payable if the management agreement is terminated by us for a cause event or by our Advisor without a material breach.

The management agreement remains subject to negotiation, review and approval by the Board.

Other. In addition to the fees and expense reimbursements payable to our Advisor under the management agreement, our Advisor and its affiliates may benefit from other fees paid to it in respect of our investments. For example, if we seek to securitize some of our CRE loans, our Advisor or its affiliates may act as collateral manager. In any of these or other capacities, our Advisor and its affiliates may receive fees for their services if approved by a majority of our Independent Trustees.

Reports and Annual Meetings

We anticipate that our common shares will continue to be listed on the NYSE American or another national securities exchange. We will be required to satisfy the annual and periodic reporting requirements of the Exchange Act, including filing an Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, each of which requires the filing of financial statements and officers' certifications. Furthermore, we will be required to file a Current Report on Form 8-K whenever a reportable event occurs between the above reporting periods. Pursuant to applicable exchange rules, we will continue to hold annual meetings of shareholders.

Trustees of the Company

[Board of Trustees. After we receive the Deregistration Order, we expect that [ ] will resign from the Board and that [ ] will be elected to the Board until his or her respective successor is elected and qualified. Each other member of the current Board will continue to serve on the Board until his or her successor is duly elected and qualified. Information regarding [ ] is set forth below.

| Name and Year of Birth | Position to be Held with the Company | Principal occupation(s) or employment in past 5 years and other public company directorships held in past five (5) years | ||

|---|---|---|---|---|

| | | | | |

| [ ] | [ ] | [ ] |

The table below discusses some of the experiences, qualifications and skills of [ ] that support the conclusion that [ ] should serve on the Board of the Company.

| Name | Experience, Qualifications and Skills | |||||

|---|---|---|---|---|---|---|

| | | | | | | |

| [ ] | [ ] | | ] | |||

Committees of the Board of Trustees. We currently have an Audit Committee, a Compensation Committee and a Nominating Committee. The Audit, Compensation and Nominating Committees are currently comprised solely of Independent Trustees and an Independent Trustee serves as Chair of each such committee. After we receive the Deregistration Order, we expect that each committee of the Board will continue to be comprised entirely of Independent Trustees and that an Independent Trustee will serve as Chair of each committee.

24 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

Compensation of Trustees and Officers. Currently, we pay our Independent Trustees an annual retainer of $18,500 and pay the Audit Committee Chair an annual retainer of $1,000 and reimburse all Trustees for expenses incurred in connection with their duties as Trustees, including for approved attendance at continuing education programs. We do not pay any other remuneration to our executive officers and Trustees, and we have no bonus, pension, profit-sharing or retirement plan. Employees of our Advisor are eligible for bonuses from our Advisor and may participate in employee benefits plans offered by our Advisor.

As a mortgage REIT, we expect that the Board will adopt the following compensation structure: each Independent Trustee will receive an annual fee of $30,000 for services as a Trustee. We expect the annual fee for any new Independent Trustee to be prorated for the initial year. We expect that each Independent Trustee who served as a committee chair of the Board's Audit, Compensation or Nominating Committees will receive an additional annual fee of $7,500, $5,000 and $5,000, respectively, and that each Trustee will receive a grant of 3,000 of our common shares of beneficial interest on the date of the first Board meeting following each annual meeting of shareholders (or, for Trustees who are first elected or appointed at other times, on the day of the first Board meeting attended). We expect that Trustees will be reimbursed for travel expenses they incur in connection with their duties as Trustees and for out of pocket costs they incur in connection with their attending certain continuing education programs.

We have elected to be treated and currently operate in a manner intended to qualify as a RIC under the IRC. Assuming we deregister as an investment company under the 1940 Act as a result of the Business Change Proposal, our qualification for taxation as a RIC would terminate for the Deregistration Year. As noted above, in that event, we intend to elect to be treated and to qualify for taxation as a REIT commencing with the Deregistration Year and in subsequent taxable years.

The law firm of Sullivan & Worcester LLP has acted as our tax counsel. Following the commencement of the Deregistration Year, we would expect to receive an opinion of Sullivan & Worcester LLP to the effect that, commencing with the Deregistration Year, we have been organized in conformity with the requirements for qualification for taxation as a REIT under the IRC, and that our actual method of operation has enabled, and our proposed method of operation will enable, us to meet the requirements for qualification and taxation as a REIT. The opinion of tax counsel will be based on various assumptions relating to our organization and operation, and will be conditioned upon fact-based representations and covenants regarding our organization, assets, income, and the past, present and future conduct of our business operations. While, if the Business Change Proposal is approved, we intend to operate so that we will qualify for taxation as a REIT, given the highly complex nature of the rules governing REITs, the ongoing importance of factual determinations, and the possibility of future changes in our circumstances, no assurance can be given by tax counsel or by us that we will qualify for taxation as a REIT for any particular year. The opinion will be expressed as of the date issued, and will not cover subsequent periods. Tax counsel will have no obligation to advise us or our shareholders of any subsequent change in the matters stated, represented or assumed, or of any subsequent change in the applicable law. You should be aware that opinions of counsel are not binding on the U.S. Internal Revenue Service (the "IRS"), and no assurance can be given that the IRS will not challenge the conclusions set forth in such opinions.

Our qualification and taxation as a REIT will depend on our ability to meet, through actual operating results, distribution levels, and diversity of stock and asset ownership, various qualification requirements imposed upon REITs by the IRC, the compliance with which will not be reviewed by tax counsel. In addition, our ability to qualify for taxation as a REIT depends in part upon the operating results, organizational structure and entity classification for U.S. federal income tax purposes of certain affiliated entities, the status of which may not have been reviewed by tax counsel. Our ability to qualify for taxation

RMR Real Estate Income Fund ![]() 2019 Proxy Statement 25

2019 Proxy Statement 25

as a REIT also requires that we satisfy specified asset tests, some of which depend upon the fair market values of assets that we own directly or indirectly. Such values may not be susceptible to a precise determination. Accordingly, no assurance can be given that the actual results of our operations for any taxable year will satisfy such requirements for qualification and taxation as a REIT.

A summary of the U.S. federal income tax consequences generally expected to be applicable to us as a mortgage REIT and to an investment in our common shares from and after our conversion to a REIT is attached to this Proxy Statement as Appendix C.

26 RMR Real Estate Income Fund ![]() 2019 Proxy Statement

2019 Proxy Statement

At a meeting held on December 6, 2019, the Board, including a majority of the Independent Trustees, appointed RSM as our independent registered public accounting firm for the fiscal year ending December 31, 2020. A representative of RSM is not expected to be present at the Meeting.

Ratification of the appointment of RSM as our independent registered public accounting firm by our shareholders is not required under our governing documents. However, if shareholders do not ratify the appointment, the Audit Committee and the Board will reconsider whether or not to continue to retain RSM. Even if the appointment is ratified, the Audit Committee and the Board in their discretion may change the appointment at any time during the year if they determine that such change would be in the best interest of us and our shareholders.

Ernst & Young LLP ("Ernst & Young") served as our independent registered public accountant for 2017. Effective April 12, 2018, the Board, including a majority of the Independent Trustees, upon recommendation and approval of the Audit Committee, appointed RSM to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2018. Ernst & Young did not resign and did not decline to stand for re-election. As noted, the Board, including a majority of the Independent Trustees, has also appointed RSM as our independent registered public accounting firm for the fiscal year ending December 31, 2020, and previously appointed RSM to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2019. We know of no direct financial or material indirect financial interest of RSM in us.

Ernst & Young's report on our financial statements for the fiscal year ended December 31, 2017 did not contain an adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principle.

During the fiscal years ended December 31, 2017, and the subsequent interim period through April 12, 2018, there were no "disagreements" (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions) with Ernst & Young on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Ernst & Young, would have caused Ernst & Young to make reference to the subject matter of the disagreements in connection with their reports on our financial statements for such fiscal years.